Abstract

This article uses a French database of firms set up in 1998 to investigate the determinants of takeovers versus startups as a mode of entry. It focuses on two determinants that previous research has not fully analyzed: social capital and financial capital. Our findings suggest social capital affects the mode of entry. They show that entrepreneurs with social capital are more likely to create new firms from scratch than to take over existing firms. We confirm the effect of financial capital on the mode of entry. Bank loans are more often associated with takeovers than with startups and low initial wealth is more often associated with startups than with takeovers. These results show that finance affects the mode of entry.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

There is extensive literature focusing on the decision to become an entrepreneur, with entrepreneurship corresponding to the startup of a new venture. However, this is not the only way to go into business. Budding entrepreneurs can also take over existing firms.Footnote 1

Western European countries have a substantial supply of existing firms available for purchase. According to the European Commission (2006), one-third of European entrepreneurs are due to withdraw from their businesses within the next 10 years. Business transfers are estimated to involve up to 690,000 small and medium-sized firms and 2.8 million jobs every year. In the past, while these businesses were very largely transferred within the family, this is becoming less frequent.Footnote 2 According to the European Commission (2003), entrepreneurs have fewer children than before; wider accessibility to education has given the younger generation a broader choice of career options than continuing the family business; and a competitive environment has required greater managerial and entrepreneurial skills. Consequently, an increasing number of retiring business owners desire to hand over their enterprises to non-family members, and policy-makers and business support organizations have to cope with this new challenge. In this context, the entrepreneur’s mode of entry is of policy interest.

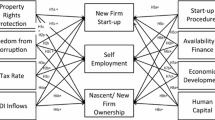

However, surprisingly few studies have focused on this question. Two articles only investigate the determinants of the entrepreneur’s mode of entry. Parker and Van Praag (2010) examined the human capital corresponding to years of schooling and to experience. Using a sample of data on Dutch entrepreneurs, they show that mode of entry depends on individual characteristics of entrepreneurs. They introduced the social background of individuals by focusing on the case of those whose parents run a family firm. Block, Thurik, and Van der Zwan (2010) studied individual and environmental determinants of the preferred mode of entry in 27 member states of the European Union. They considered business owners and nascent entrepreneurs (individuals who actively take steps to start a business) and also those individuals who actively consider setting up a business. They showed the role of human capital in the preferred entry mode and highlighted the role of other determinants. Some factors, for example attitude to risk and inventiveness, are linked to the individual. Others, for example country of residence and perceived barriers to entrepreneurship, are related to the environment.

This article analyzes the entry mode actually chosen by individuals in France in the late nineties. We focus on two determinants that previous research has not fully analyzed: social and financial capital. Our work differs from previous research in its focus and its objectives. We consider individuals with given personal characteristics in a given environment that decide to enter into entrepreneurship and must therefore choose a mode of entry: startup or takeover.

Our findings support the effect of social capital on the mode of entry, showing that the entrepreneur with a family business or/and with entrepreneurs among close relations is more likely to create a new firm from scratch. We observe that the presence of strong relationships with customers and/or suppliers has a similar effect. We also confirm the role played by financial capital in the mode of entry. Bank loans are more often associated with takeovers than with startups and low initial wealth is more often associated with startups than with takeovers.

In the next section, we discuss the role of social and financial capital in the entrepreneur’s choice of mode of entry. We then describe our data and methodology and provide some basic descriptive statistics. We then present the results of our econometrical analysis. The paper ends with a discussion of implications for policy-makers and suggestions for possible future research.

2 Previous research

2.1 Entrepreneurs, social capital, and mode of entry

Social capital refers to networks of relationships in which personal and organizational contacts are closely embedded. These relationships are viewed as the means through which actors gain access to a variety of resources held by others (Hoang and Antoncic 2003). In particular, they are likely to improve the entrepreneur’s human capital by enhancing the individual’s ability to identify opportunities, acquire new resources, and develop an entrepreneurial spirit.

Although the concept of social capital is intuitively very important, it is difficult to measure networking variables (Brüderl and Preisendörfer 1998). However, studies confirm the importance of networks in affecting the entrepreneurial process. Many articles have shown that to have a self-employed parent has a substantial positive effect on the decision to become self-employed (see, for example, Laferrère and McEntee 1995).

Parker and Van Praag (2010) have indirectly investigated the effect of social capital on mode of entry. In the case of family business transfers, they have analyzed the effect of social background on human capital and consequently on modes of entry. Belonging to a family business is indeed a source of social capitalFootnote 3 (Bulboz 2001). Using a sample of data on Dutch entrepreneurs, Parker and Van Praag (2010) have shown that entrepreneurs with business families are generally more likely to take over existing firms, not necessarily their own family business. Social capital linked to family ties would favor taking over an existing firm rather than starting up a new venture.

The reliance on networks is not limited to takeovers; it also concerns startups. Literature shows that individuals consistently use networks to gather information in order to spot entrepreneurial opportunities (Birley 1985; Smeltzer et al. 1991; Hoang and Antoncic 2003). Networks, in particular those based on family and relatives, have been shown to enable the transfer of entrepreneurial values. Belonging to an entrepreneurial network could be argued to increase risk-taking and the attraction of startups and/or innovative projects. Consequently, social capital would tend to encourage the creation of a pure new firm rather than the take-over of an existing one.

Thus, social capital is argued to significantly affect mode of entry. The direction of the effect, however, remains unclear.

2.2 Entrepreneurs, financial capital, and mode of entry

Studies have shown that financial capital matters in the decision to start a firm. Evans and Leighton (1989) and Evans and Jovanovic (1989) for the United-States, Bernhardt (1994) for Canada, and Laferrère and McEntee (1995) for France found that people with greater family wealth are more likely to become self-employed. They have also highlighted the role of personal wealth in the decision to become self-employed (for the United States, see Holtz-Eakin et al. 1994, for the United Kingdom, see Blanchflower and Oswald 1998, and for Sweden, see Lindh and Ohlsson 1996)Footnote 4 but have not analyzed in depth its effect on the mode of entry.

Previous research has mentioned the importance of financial constraints in the decision to opt for a takeover rather than start a new venture. Using the European Commission’s Flash Eurobarometer Survey on Entrepreneurship, Block, Thurik and Van der Zwan (2010) found that perceived financial constraints to entrepreneurship positively affect the preference for taking over versus starting a new venture from scratch. Using Dutch data on new entrepreneurs, Parker and Van Praag (2010) showed that when entrepreneurs operate in industries with higher capital requirements and risk, they tend to opt for takeovers.

These first empirical results can easily be justified by credit rationing theory (Stiglitz and Weiss 1981) applied to entrepreneurship. This shows how informational asymmetries on borrower’s riskFootnote 5 can imply adverse selection and moral hazard and finally lead external investors, in particular banks, to ration credit to the most opaque firms. Arguably, takeovers would be less credit-rationed than startups. Takeovers have track records that cannot be produced by new ventures. Admittedly, new ventures produce business plans for potential outside investors. However, outsiders often find these documents insufficiently credible; they do not compensate for the lack of track record. Furthermore, Stiglitz and Weiss (1981) demonstrated the existence of another financial constraint, “redlining”, or the exclusion of entire categories of firm from the credit market. Excluded firms belong to the riskiest categories of borrower for which interest rates are deemed to be higher than the critical interest rate. Thus, takeovers should be less financially constrained than pure new firms because they are less risky. Statistics on the survival of new firms show better performance for takeovers in comparison with them. In France, the survival of new firms set up in 1998 was 90% for takeovers and 84% for new firms one year after birth. After three (five) years, takeovers were still better with an exit rate of 27% (41%) compared with 39% (51%) for new firms (Cournot and Mulic 2004). For these two reasons, access to credit should be easier for takeovers than for new ventures. Finally, individuals could be expected to prefer to take over an existing firm rather than start a new venture if they are facing financial constraints. When entry requires the same level of external finance whatever the entry mode to entrepreneurship, the decision to take over an existing firm may provide a way of limiting financial constraints.

However, taking over an existing business requires 60% more investment than does a startup (European Commission 2006). On average, takeovers are more costly than new ventures, because they not only require the transfer of physical assets but also that of relationships with stakeholders and reputation. Consequently, for a given level of wealth, takeovers are generally more dependent on external finance than are startups.Footnote 6 Access to debt depends on solvency and that is linked to the financial support of firms by entrepreneurs themselves. When there is little financial support, credit constraints are more limiting and the capacity of the new entrepreneurs to access bank loans is more frequently constrained. If the availability of bank loans is limited, the solution is to choose a less costly project and this is more likely to be a startup.

Finally, relationships between financial capital and modes of entry are complex and depend not only on liquidity constraints linked to risks and informational asymmetries but also on the relative cost of projects.

3 Data and variables

3.1 Dataset

In this article, we have used data from the system of information on new enterprises (SINE) produced by the French National Institute of Statistical and Economic Studies (INSEE) every four years since 1994. This system is based on a compulsory survey that analyzes the start-up and development conditions of enterprises and their problems over their first five years. Here, we have used the cohort of new firms set up in 1998 that survived for at least one month. The 1998 SINE survey scheme consisted of selecting a set of new enterprises representative of the 160,000 new firms created in 1998 and in the scope of the survey. This cohort was designed to be representative of the entire population according to three criteria: regional location, economic sector (nine areas), and mode of entry (startup or takeover). A frequency weight variable is used to make the sample fit the total population of new firms. The weight accorded to each sample observation corresponds to the number of enterprises represented by this observation.

This study focuses on choices made by individuals. Consequently, groups are excluded from the sample. Mode of entry is the result of a choice based on preferences between startup and takeover under the constraints of finding a firm for sale and/or being sufficiently wealthy to buy an existing firm. These constraints do not affect all individuals equally. Employees of a firm for sale are easily able to find an existing firm to take over, as are family members of a family business who can, moreover, benefit from the family’s wealth and from preferential prices for business transfers. Because of this, we have excluded all cases relating to the internal business transfer market of business (takeovers by a family member or an employee of the target). Our sample comprises 20,374 firms set up or taken over in 1998.

3.2 Dependent variable: takeover versus startup

The SINE survey covers the mode of entry that newly self-employed entrepreneurs choose. We focus on the two alternative modes of entry available to new entrepreneurs: startup or takeover. Takeovers are the purchase by an individual of the whole or part of another firm’s activity and means of production. Startups are the setting up of new means of production. Our dependent variable has a value of 1 if an individual takes over an existing firm and 0 if he or she starts up a new firm.

3.3 Independent variables

3.3.1 Variables of interest: social and financial capital

Social capital can be generated by two kinds of network. The first is the entrepreneurial network. In the SINE survey, individuals are questioned about the entrepreneurial activity of their close circle. We distinguish between the presence of businessmen and women within the family (family entrepreneurial network) from the presence of businessmen and women within other close circles (close-circle entrepreneurial networks). For each type of entrepreneurial network, we have created a dummy variable equal to 1 if this network is identified and 0 otherwise. The second form of network is the professional network that corresponds to strong relationships between founders and customers and/or suppliers. In the SINE survey, individuals were questioned about the existence of such relationships and their effects on the start-up and development conditions of enterprises. In order to track the effect of this type of network, we created a dummy variable equal to 1 when the startup is favored by relationships with customers or suppliers and 0 otherwise.

To analyze the effect of financial capital on modes of entry, we have introduced three variables. The first concerns the access of new firms to bank loans for capital. There are seven dummy variables, called “loans i ” with i = 1,…,7. These variables are 1 when entrepreneurs receive a bank loan and when their financial needs belong to one of seven brackets (from €1,500 to more than € 76,000) and 0 otherwise. Choice of a specific mode of entry is not constrained for wealthy individuals. In this case, loans i will not have any effect (or any constant effect for each bracket of financial capital needed to start) on the mode of entry. An individual whose wealth is not sufficiently high faces a choice: either to enter at a smaller size or to take over an existing firm to avoid credit constraints. In the case of the latter, the loans i variable must positively affect the decision to opt for takeover even for the smallest level of capital needed. The second variable identifies the problems of cash flow that an entrepreneur expects to encounter early on. This variable serves as a proxy for the personal wealth of an individual before entry. The third variable relates to business plans that are assumed to provide information both on market research and financial forecasting. Lack of information provides a strong argument in favor of takeovers versus startups for financially-constrained creators. Business plans produced by new ventures do not convey sufficient information for the relaxation of financial constraints in comparison with the track records produced by takeovers. In the SINE survey, individuals are questioned about the existence of financial forecasting plans and market research before entry. We have created a variable business plan equal to 1 when both market research and prospective financial accounts are available and 0 in other cases.

3.3.2 Other individual determinants

Except for the variables gender (the reference is male) and nationality (French = 1, Not French = 0), the individual determinants relate to human capital.

According to Parker and Van Praag (2010), education and managerial experience can affect mode of entry. As a measure of education, four levels of diploma are used: no diploma, vocational diploma, baccalaureate, and baccalaureate plus more than 2 years’ higher education (each variable is 1 when the entrepreneur has a degree and 0 otherwise). To measure managerial experience, we have used a question relating to the development of managerial skills by the entrepreneurs during their career. The variable managerial experience is 1 when entrepreneurs state they have former professional experience in management and/or human resource management.

The acquisition of competences by individuals during past professional experiences in the same or similar activity as those developed by new firms increases the individual’s human capital. In this case, the variable activity experience is 1 (and 0 otherwise). We have introduced the specific experience associated with serial startups. The variable serial creator is 1 when an entrepreneur has already set up a firm and 0 otherwise.

3.3.3 Environmental determinants

Entrepreneurial decisions, and in particular the choice of entry mode, are not only defined at the micro level. These decisions also depend on factors at the meso level. The business environment itself drives startups. We consider the effect of three factors on modes of entry: demand, sector, and innovation.

Demand affects entrepreneurship. Since the eighties, customer demand for proximity and more flexible production has enabled greater numbers of smaller firms to survive and to expand (Piore and Sabel 1984; Acs and Audretsch 1990). This need for proximity, linked with specific activities, may affect the mode of entry chosen by entrepreneurs. The location variable takes into account this potential need for proximity between firms and customers. This variable is 1 when customers are geographically close to new firms (customers are local).

The affiliation of firms to a specific sector can favor a specific kind of entry. In some sectors, the presence of a large number of small firms facilitates takeovers of existing enterprises. Some sectors are also more innovative than others and startups are more frequent in these sectors. This variable affects mode of entry, in particular depending on the entrepreneur’s occupational possible sector-dependent qualifications. We identify nine sectors (dummy variables): trade, agribusiness, industry, building, transportation, real estate, private personal services, enterprise services, and education.

Innovation often requires flexibility, i.e. the ability of firms to change. By definition, an existing firm is less flexible than a new one. If the entrepreneur wants to innovate, in particular in a new technological process, adjustment costs are likely to incur considerable expense for an existing firm. Thus, an entrepreneur may prefer to create a new venture. Furthermore, in the case of innovative projects, specificity of assets and uncertainty are high and therefore entrepreneurs may be encouraged to enter at a small size. To control for this effect, we have introduced the variable innovation that is 1 when the entrepreneur is selling a new product or using a new production process and 0 otherwise.

4 Descriptive statistics

Of the 20,374 new firms in the SINE dataset, 12.3% are takeovers and 87.7% are startups, a proportion similar to that given by Parker and Van Praag (2010),Footnote 7 but higher than that of Block, Thurik and Van der Zwan (2010) based on individuals’ preferences; they found, in France, the new venture to be the preferred mode of entry for only 78% of nascent entrepreneurs, business owners, and those considering entrepreneurship. This spread between preferences and actions may reflect the difficulties that nascent entrepreneurs face when they wish to take over existing firms.

Table 1 reports descriptive data from the SINE dataset for both the global sample of new firms set up in 1998 and the two sub-samples constructed according to actual mode of entry, either startup or takeover. We have used these variables to test whether the differences between new ventures and takeovers are significant (test of equal proportion). We provide descriptive statistics for both the global sample and the two sub-samples, and the results of the equal proportion test.

As expected, the univariate analysis reveals significant differences for both social and financial capital according to the mode of entry. Networks, with the exception of family networks, seem to have a negative effect on takeovers.

Of the firms in the sample 27.87% use bank loansFootnote 8; of these, 22.47% are startups and 66.32% are takeovers, a substantial difference that cannot be explained by size alone. Access to bank loans is more frequent for takeovers than for startups, irrespective of the level of capital. The spread between startups and takeovers increases with financial need. Expected cash-flow problems are more frequent for startups (15.39% of startups against 11.07% of takeovers). These statistics illustrate the lack of initial wealth. Startups more often produce business plans (31.23% for startups against 28.14% for takeovers). They try to compensate for the lack of a track record with this prospective work on financial accounts.

The distribution per sector of new ventures and takeovers is very heterogeneous. Takeovers are more frequent in the private personal services sector and the trade sector. In private personal services, the restaurant and bar sectors are more subject to takeovers.Footnote 9 This may be because of the need for a license for the sale of alcoholic drinks; it is easier to buy an existing one than to obtain a new one. The trade sector may be important, because of the importance of proximity to consumers. This is confirmed by the proportion of takeovers of firms with mainly local customers (78.81% for takeovers vs. 46.65% for new ventures). Except for the transportation sector, distribution by sector seems very different for the two modes of entry. This could be partly because of different legal and economic conditions for entry.

As regards other variables, the univariate analysis corroborates previous studies. In the case of takeovers, entrepreneurs have more managerial experience and develop fewer innovative projects than for startups.

5 Empirical results

Given the nature of the dependent variable (mode of entry), logit models have been used. The probability of a takeover is estimated. Table 2 presents the results and displays the odds ratio.Footnote 10 We are interested here in the choice of mode of entry and think of entrepreneurship in a broad sense—any individual who creates a new venture or buys an existing firm. Nevertheless, the concept of entrepreneurship is frequently associated with innovation. The motivations and characteristics of these entrepreneurs are not the same as for those who create their own job or manage a company. These differences can cause significant heterogeneity in the sample that cannot be corrected by the introduction of the innovation dummy variable. To take into account innovation, regressions have been estimated not only for the global sample but also for the sub-sample of firms where a new product or a new process is planned.

5.1 Social capital

Social capital affects the choice by nascent entrepreneurs of mode of entry into entrepreneurship. We show that an entrepreneur with a family business or a close-circle entrepreneurial network is less likely to buy an existing firm. Strong relationships with customers and/or suppliers, that is, professional networks, have exactly the same effect.

Parker and Van Praag (2010), working only on family network, did not find the same results in a sample of new Dutch firms. Entrepreneurs from business families were found to be generally more likely to take over existing firms, not necessarily their own family business, than to start up new firms. They show that entrepreneurs from family businesses have a network of this kind, whereas the remainder benefit from no other form of network. In this article, we do not limit social network to family networks. Rather, we have introduced another kind of entrepreneurial network linked to close relationships, the close-circle network, in addition to the professional network. When we remove the distinction between family network and close-circle network, our result is more in line with that of Parker and Van Praag (2010) as the entrepreneurial network no longer affects mode of entry.Footnote 11 A difference still remains. It can be explained by intergenerational transfers within family businesses. Parents can indeed transfer to children an entrepreneurial spirit, and in particular the taste for risk. This attitude toward risk may explain why people with a large entrepreneurial network are more likely to start up a new firm. This is partially confirmed in the case of innovative projects.

Professional networks make it less likely for an entrepreneur to take over an existing firm. Entrepreneurs with high social capital have greater knowledge of the business transfer market and perhaps better knowledge also of the opportunities for startups. Ucbasaran, Westead and Wright (2008) have addressed this issue but their empirical study does not confirm it. Better knowledge of business transfers and better identification of new opportunities have opposite effects when it comes to creating a new venture as opposed to taking over an existing firm. We have found the identification of opportunities to create new ventures to be the dominant effect.

5.2 Financial capital

Financial capital also affects modes of entry. Results are significant for all the exogenous variables introduced to represent financial capital.

There is a positive relationship between access to debt and takeovers. Takeovers are predictably more often financed by bank loans. This is confirmed for all levels of financial need at birth. Bank loans are more often associated with takeovers, irrespective of the level of initial capital. This result can be explained by a lack of initial personal wealth that leads entrepreneurs to seek external capital such as bank loans. As takeovers are, ceteris paribus, less risky and less opaque than startups, they are less credit-constrained. For a given amount of capital, less wealthy individuals tend to choose takeovers insofar as they need to ask for external finance. Our results show that the effect of bank loans on decision to takeover a business is particularly high for the largest amounts of capital required (more than €38,000). This can be explained by the high frequency of leveraged buyout transactions when we consider the largest amounts of capital.

Surprisingly, the same positive effect of bank debt on the choice of takeovers as mode of entry can be seen when we focus on the subsample of innovative projects. This result was unexpected because, in our view, a takeover is not the most appropriate mode of entry when entrepreneurs want to develop innovative projects. The need for flexibility associated with innovations and the uncertainty intrinsically linked with them should encourage entrepreneurs to favor startups. The results for the innovation variable in Table 2 confirm this. Innovation has a negative effect on the decision to opt for takeover. It can be argued that the need for finance, along with a lack of private equity for new French firms, may have led individuals to choose an inappropriate mode of entry in order to relax financial constraints.Footnote 12

Second, we observe a negative relationship between the decision of nascent entrepreneurs to opt for takeovers versus startups and expected cash flow problems. These problems, that reveal a lack of initial wealth, are more often associated with startups irrespective of the innovative profile of the project. This may demonstrate a lack of initial wealth, which might oblige nascent entrepreneurs to opt for startup rather than for takeover as mode of entry. This could partially explain the spread between preference for and choice of mode of entry in France. Block, Thurik and Van der Zwan (2010) use the Flash Eurobarometer survey on entrepreneurship to show that takeover is the preferred mode of entry for 22% of nascent entrepreneurs, business owners and those considering entrepreneurship. Our statistics reveal a lower level of actual takeovers as they only affected 15% of firms set up in 1998.Footnote 13 This can be explained by limited initial wealth and access to external finance that leads new entrepreneurs to choose smaller and less expensive projects. These characteristics correspond more closely to startups than to takeovers.

Finally, business plans are predictably more frequently used by startups than by takeovers. This is the case for the total sample and for the sub-sample of innovative new ventures. Startups use a business plan to provide information about the quality of the firm; this prospective analysis is less frequently produced by takeovers as they are able to show track records. We also confirm indirectly the low credence attributed to this document by bankers as we earlier emphasized the negative relationship between access to loans and startups.

5.3 Other results

Some control variables gave interesting results. We can confirm the results of Parker and Van Praag (2010) for a Dutch sample concerning the effect of experience on the mode of entry chosen by entrepreneurs. We observed that the possession of managerial skills did increase the likelihood of purchase of an existing firm.

The nature of the activity also affects mode of entry. Local activity makes business takeovers more likely. Activities that need proximity between firms and customers favor business takeovers in all sectors. This may be because of the effect of reputation in this kind of activity. Reputation exists from the start in the case of takeovers but must be built up from scratch in the case of startups.

Finally, sector affects mode of entry. Sectors seem to significantly affect the likelihood of takeover compared with the base sector. Takeovers are less frequent in industry, building, transportation, real estate, and services to enterprises and more frequent in agribusiness and education than in the trade sector. At this level of detail, these findings are difficult to interpret and require further empirical investigation.

5.4 Robustness checks and limitations

Our descriptive statistics have shown that modes of entry are heterogeneous depending on sector. Regardless of individual choice, some sector or activity-dependent characteristics can constrain the mode of entry that entrepreneurs would hypothetically choose. The need to own a license in some activities is a good example of this constraint as it is difficult for startups to obtain licenses. To limit this sector-dependency, models have been estimated for each sector separately. These demonstrate the stability of our results. Results for the effect of loans and expected cash flow problems are never reversed and in the worst case they are merely insignificant. Results for the effect of networks are also broadly stable; they tend to remain the same and sometimes they become insignificant with only two exceptions for which there are opposing results. These exceptions concern the effects of professional networks in the building sector and the effect of family networks in the enterprise service sector.

In this study, we do not directly control for the potential endogeneity of schooling that Block et al. (2011, in press) analyzed. The choice of level of schooling and that of mode of entry can indeed be determined by both common and unobservable factors (e.g. taste for risk) that can be linked to our interest variable. Our database does not allow us to identify “good” instrumental variables for dealing with the problem of endogeneity. To partially take this problem into account, a model has been produced for each level of diploma. The results for financial variables and professional network remain qualitatively the same as they do in the global model. The effect of entrepreneurial networks is also broadly the same but only in the case of the lowest levels of education. There are differences when the diploma is higher than the Baccalaureate. In this case, results for family networks are insignificant whereas those for other close-circle networks become insignificant only for entrepreneurs who have at least the Baccalaureate. It may be that the most educated entrepreneurs do not need to belong to personal networks in order to identify market opportunities for startups or “good” targets for takeovers.

6 Conclusion

Modes of entry into entrepreneurship are under-researched. Parker and Van Praag (2010) analyzed the effect of human capital, and above all the number of schooling years, on the choice between family business transfers, outside takeovers, and startups. Their paper focuses on transfers within family businesses, which, in the Netherlands, accounted for 27% of takeovers at the turn of the twentieth century (European Commission 2002). Block, Thurik and Van der Zwan (2010) highlighted the importance of other factors, for example difficult access to finance and socioeconomic determinants, in 27 European countries. Using the European Flash Barometer, they consider prospective entrepreneurs and not those who have effectively begun to take entrepreneurial action. This article studies the choice of French nascent entrepreneurs either to take over an existing firm or to start a new venture from scratch. This study is the first to analyze empirically the effect of social capital in the contexts of non-family business transfers and financial variables.

We show how social capital affects choice of mode of entry into entrepreneurship. We do not limit the concept of social capital to relationships within the family. We also introduce ties with close relationships and relationships with customers and/or suppliers. Finally, we distinguish between entrepreneurial social capital (family entrepreneurial social networks or close-circle entrepreneurial social networks) and professional social networks (close relationships with customers and/or suppliers). Our French data show that when entrepreneurs belong to a network, irrespective of its nature they are more likely to choose to start up a new venture than to take over an existing firm. We argue that the fact of belonging to a network may indeed lead to the transfer of entrepreneurial values, in particular the transfer of an attitude in favor of risk that encourages startups rather than takeovers.

Interestingly, financial capital is also an important factor in defining the mode of entry into entrepreneurship. We have shown that takeovers are predictably more often financed by bank loans than are startups. We argue that this is because of the better conditions in terms of risk and informational systems of takeovers in comparison with startups. Banks would rather finance takeovers than startups and this is confirmed, irrespective of the level of capital needed to start or the innovative profile of the project. We argue that financial constraints on startups may be so severe that nascent entrepreneurs may choose an inappropriate mode of entry. Nascent entrepreneurs with innovative projects choose to take over an existing firm rather than to create a new venture if they need external finance whereas innovative projects ought to be developed by startups rather than by takeovers. We argue that financial constraints may be responsible for the inadequate mode of entry chosen by some innovative entrepreneurs. Initial lack of wealth may lead nascent entrepreneurs to choose to start up a smaller new firm than to take over an existing firm, which is more costly. All this shows that finance matters to entrepreneurship. These results show the need to provide all the instruments and institutions necessary to finance both startups and business transfers. While tools for financing takeovers are well developed in France, there is a regrettable lack of financial instruments and institutions for financing startups. This capital gap may be responsible for inappropriate forms of entrepreneurial endeavor that may limit the growth of firms and increase the risk of bankruptcy. Finally, more generally, this study stresses the need for academic research and also for policy makers and practitioners to give equal attention to startups and transfers and to do so in a much more coordinated way.

Notes

Entrepreneurship can occur within an existing organization (Casson 1982; Shane and Venkataraman 2000) and takeovers of existing firms can be a way for individuals to become entrepreneurs. The entrepreneurial process consists indeed of distinct activities, for example opportunity identification, resource mobilization, and the creation of an organization (Shane and Venkataraman 2000) which does not exclusively correspond to a startup.

In the mid-nineties, transfers of this kind only accounted for 14% of takeovers in France compared with 27% in the Netherlands, 42% in Germany, and 68% in Italy (European Commission 2003).

Coleman (1988) considered the relationships among family members to be the ideal environment for the creation of social capital.

All these articles are formally based on the key idea that entrepreneurs face liquidity constraints and that one of the strongest impediments to entrepreneurship is the lack of financial capital. However, Cressy (1996, 2000), Hurst and Lisardi (2004), Moore (2004) and Kim et al. (2006) have questioned the interpretation of the relationship between wealth and self-employment as evidence of liquidity constraints. Cressy (2000) argued that reducing absolute risk aversion can explain the positive relationship between wealth and entrepreneurship. Hurst and Lisardi (2004) showed that the propensity to start a business is non-linear in wealth. Moore (2004) provided evidence that the relationship between wealth and entering entrepreneurship is only significant for high-wealth households and that liquidity constraints do not seem binding for most new entrepreneurs.

In their model, the individual characteristics of entrepreneurs are private information and very imperfectly shared with outside investors. The latter are only aware of the distribution of entrepreneurs’ characteristics. Consequently, the risk of projects cannot be easily or accurately accessed. They study a continuum of borrower types with projects with identical expected internal rates of return and with non-observable riskiness.

This is why specific financial transactions, called leveraged buyouts, based on a high proportion of unsecured debts, have been developed since the eighties first in US and later in Europe. The financial structure of buyouts typically consists of 60–80% of debt, as opposed to debt ratios of 20–30% in public firms (Rajan and Zingales 1995).

Note that their sample includes family business transfers.

This result is obtained by adding the percentage of each “loans i ” variable.

61.10% of takeovers in private personal services are accounted for by restaurants and 17.64% bars against 38.13% and 7.40% respectively for new ventures.

The odds ratio shows the strength of association between a predictor and the response of interest. It is the factor by which the odds (equal to the probability of takeover divided by the probability of new venture) change for a unit increase in the corresponding independent variable. The odds ratio is a convenient concept for dummy variables, because a unit change means having the characteristic versus not having. If the odds ratio is unity, there is no association. Odds ratios greater (smaller) than unity indicate that for the predictor concerned takeover (pure creation) is more likely.

In other regressions, we consider only two modalities of entrepreneurial networks: family networks versus other networks.

The small difference between the results regarding the effect of debt on modes of entry is also surprising. Williamson (1988) showed that the financial structure of innovative firms tends to be very different from that of non-innovative ones and, consequently, we might have expected different results in terms of relationships between modes of entry and debt for innovative firms in comparison with the global sample.

References

Acs, Z., & Audretsch, D. (1990). The economics of small firms: A European challenge. Dordrecht/Boston/London: Kluwer Academic Publishers.

Bernhardt, I. (1994). Comparative advantage in self-employment and paid work. Canadian Journal of Economics, 27(2), 273–289.

Birley, S. (1985). The role of networks in the entrepreneurial process. Journal of Business Venturing, 1(1), 107–117.

Blanchflower, D., & Oswald, A. J. (1998). What makes an entrepreneur? Journal of Labor Economics, 16(1), 26–60.

Block, J., Hoogerheide, L., & Thurik R. (2011). Education and entrepreneurial choice: An instrumental variables analysis. International Small Business Journal. http://isb.sagepub.com/content/early/2011/05/30/0266242611400470. Published online 1 June 2011.

Block, J., Thurik, A., & Van der Zwan, P. (2010). Business takeover or new venture? Individual and environmental determinants from a cross-country study. Research paper. Research Institute of Management. http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1703303. Accessed Aug 28 2011.

Brüderl, J., & Preisendörfer, P. (1998). Network support and the success of newly founded businesses. Small Business Economics, 10(3), 213–225.

Bulboz, M. (2001). Family as source, user, and builder of social capital. Journal of Socio-Economics, 30(2), 129–131.

Casson, M. C. (1982). The entrepreneur: An economic theory. Oxford: Martin Robertson.

Coleman, J. (1988). Social capital in the creation of human capital. American Journal of Sociology, 94, 95–120.

Cournot, S., & Mulic, S. (2004) Le rôle économique des repreneurs d’entreprise. INSEE Première, juillet, n 275, 1–4.

Cressy, R. (1996). Are business start-ups debt-rationed? Economic Journal, 106(438), 1253–1270.

Cressy, R. (2000). Credit rationing or entrepreneurial risk aversion? An alternative explanation for the Evans and Jovanovic finding. Economics Letters, 66(2), 235–240.

European Commission. (2002). Rapport final du groupe d’experts sur la transmission des petites et moyennes enterprises. May. Brussels: European Commission.

European Commission. (2003). A good practice guide of measures for supporting the transfer of businesses to new ownership. January. Brussels: European Commission.

European Commission. (2006). Transfer of businesses: Continuity through a new beginning. 14 March. Brussels: European Commission.

Evans, D., & Jovanovic, B. (1989). An estimated model of entrepreneurial choice under liquidity constraints. Journal of Political Economy, 97(4), 808–827.

Evans, D., & Leighton, L. S. (1989). Some empirical aspects of entrepreneurship. American Economic Review, 79(3), 519–535.

Hoang, H., & Antoncic, B. (2003). Network-based research in entrepreneurship: a critical review. Journal of Business Venturing, 18(2), 165–187.

Holtz-Eakin, D., Joulfaian, D., & Rosen, H. (1994). Entrepreneurial decisions and liquidity constraints. RAND Journal of Economics, 25(2), 334–347.

Hurst, E., & Lisardi, A. (2004). Liquidity constraints, household wealth, and entrepreneurship. Journal of Political Economy, 112(2), 319–347.

Kim, P., Aldrich, H., & Keister, L. (2006). Access (not) denied: The impact of financial, human, and cultural capital on entrepreneurial entry in the United States. Small Business Economics, 27(1), 5–22.

Laferrère, A., & McEntee, P. (1995). Self-employment and intergenerational transfers of physical and human capital: An empirical analysis of French data. Economic and Social Review, 27(1), 43–54.

Lindh, T., & Ohlsson, H. (1996). Self-employment and windfall gains: Evidence from the Swedish Lottery. Economic Journal, 106(439), 1515–1526.

Moore, K. (2004). Do liquidity constraints matter for new entrepreneurs? Federal reserve system, finance and economic discussion series, No. 2004–42. http://www.federalreserve.gov/pubs/feds/2004/200442/200442pap.pdf. Accessed 15 Sept 2011.

Parker, S., & Van Praag, M. (2010). The entrepreneur’s mode of entry: Business takeover or new venture start? Journal of Business Venturing, 16pp. http://www.sciencedirect.com/science/article/pii/S088390261000073X. Available online 18 Oct 2010.

Piore, M., & Sabel, Ch. (1984). The second industrial divide: Possibilities for prosperity. New York: Basic Books.

Rajan, R., & Zingales, L. (1995). What do we know about capital structure? Some evidence from international data. Journal of Finance, 50(5), 1421–1460.

Shane, S., & Venkataraman, S. (2000). The promise of entrepreneurship as a field of research. Academy of Management Review, 25(1), 217–226.

Smeltzer, L., Van Hook, H., & Hutt, R. (1991). Analysis of the use of advisors as information sources in venture startups. Journal of Small Business Management, 29(3), 10–20.

Stiglitz, J., & Weiss, A. (1981). Credit rationing in markets with imperfect information. American Economic Review, 71(3), 349–410.

Ucbasaran, D., Westead, P., & Wright, M. (2008). Opportunity identification and pursuit: Does an entrepreneur’s human capital matter? Small Business Economics, 30(2), 153–173.

Williamson, O. (1988). Corporate finance and corporate governance. Journal of Finance, 43(3), 567–591.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Bastié, F., Cieply, S. & Cussy, P. The entrepreneur’s mode of entry: the effect of social and financial capital. Small Bus Econ 40, 865–877 (2013). https://doi.org/10.1007/s11187-011-9391-y

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11187-011-9391-y