Abstract

This study extends Xu and Reuf (Strateg Organ 2:331–355, 2004) by exploring the strategic and non-strategic risk-taking propensity perceptions of nascent entrepreneurs as it relates to the subsequent likelihood of venture formation success. In addition, the moderating influences of perceptions of environmental uncertainty and venture growth aspirations are also examined. Findings from an analysis of data from the Panel Study of Entrepreneurial Dynamics (PSED) I indicate that an entrepreneur’s risk-taking propensity has no relationship to the likelihood of successfully starting a business. Perceptions of environmental uncertainty and venture growth aspirations were positively related to non-strategic risk-taking propensity, yet none of these variables (strategic and non-strategic risk-taking propensity, environmental uncertainty and growth aspirations) had a significant effect on venture creation success. We suggest that risk-taking propensity, as measured in this study, does not play a significant role in differentiating between nascent entrepreneurs or others, or between those that are successful or unsuccessful at starting businesses.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

This article is an extension of a study by Xu and Reuf (2004). They theorized two forms of risk tolerance that might influence individuals to take entrepreneurial action: strategic and non-strategic. Strategic risks focus on the perceptions of specific risks associated with the development of a new business while non-strategic risks focus on the perceptions of risks associated with business situations endemic to all individuals (e.g., perceptions of the likelihood that a new business, in general, will succeed; estimates of the size that new businesses, in general, might grow to in 5 years).

Risk-taking is defined as the willingness to take action based on the perception of possible future gains or losses (Jackson 1994). An individual with a propensity for high levels of risk would be willing to accept high levels of variability in the gains or losses of future choices. A low risk-taking propensity would signal a willingness to accept low levels of variability in the gains or losses of future choices. An example of the difference between high and low variability in gains or losses: high variability might be taking a chance to earn either one million dollars or zero dollars; and low variability might be taking a chance to earn either $600,000 or $400,000. Both decisions have the same average outcome: $500,000. Yet the choice of one million dollars or zero dollars would be perceived as more risky compared to the $600,000 or $400,000 choice since the variation in the outcomes is greater.

Using data from the Panel Study of Entrepreneurial Dynamics (PSED) I, Xu and Reuf (2004) found that nascent entrepreneurs were more risk-adverse than the sample representing the U.S. population for both strategic and non-strategic risks. More specifically, they found that nascent entrepreneurs were less likely to select pursuing business opportunities that had higher variations in potential outcomes compared to the control group. And they found that nascent entrepreneurs were more likely to estimate that new businesses had higher chances of failing and if started, would have lower levels of growth, compared to the responses of the control group. What was not explored in their study was whether the risk-taking propensity (strategic and non-strategic) of these nascent entrepreneurs had any effect on the likelihood of actually starting businesses. For example, Zhao et al. (2010) found that the risk-taking propensity of nascent entrepreneurs was higher than others in comparison samples yet they found no difference in risk-taking propensity scores between those nascent entrepreneurs who started businesses versus those that did not. This finding differs from Xu and Reuf’s (2004) study about nascent entrepreneurs having different risk propensity scores compared to others, so, in the spirit of continuing this contrast, an exploration of the risk propensity measures used by Xu and Reuf (2004) might indicate differences between successful and unsuccessful nascent entrepreneurs. As will be noted later, given the variety of findings that either support or disconfirm the importance of risk-propensity as a differentiating factor, we will argue that the risk-propensity construct will not play a significant role in contrasting successful from unsuccessful entrepreneurs.

In addition, we explore whether a nascent entrepreneur’s strategic and non-strategic risk taking propensity is influenced by their views of environmental uncertainty and their aspirations for venture growth, and whether these constructs (risk, uncertainty, and aspirations) affect the likelihood that these nascent entrepreneurs will succeed at starting an on-going business. The measure of uncertainty would tap into perceptions of the situation each entrepreneur faced. We would assume that individuals who perceived high levels of uncertainty would perceive higher levels of risk as well. And, the aspiration measure would tap into the entrepreneur’s desire to pursue larger or smaller opportunities. We would assume that individuals who desired to pursue opportunities that resulted in larger ventures might be willing to bear higher levels of risk to achieve those goals.

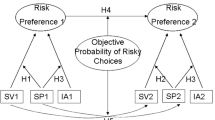

Specifically, we set out to test whether nascent entrepreneurs with a high risk-taking propensity are: (1) more likely to perceive high levels of uncertainty during the venture creation process, (2) more likely to aspire to create high growth ventures, and (3) are more likely to successfully start on-going new businesses (see Fig. 1). We will also be able to identify certain situations (with specific interactions between risk, uncertainty, aspirations and cognitive bias), where nascent entrepreneurs with a high risk-taking propensity might be more likely to start businesses.

2 Literature review and hypotheses

The idea of risk-taking is in the genesis of many early conceptions about the nature of entrepreneurship. One of the first individuals to use the term “entrepreneur,” Richard Cantillon (1755/2001) viewed the process of entrepreneurship as that of undertaking the risks inherent in buying and selling in the marketplace where prices were uncertain. Individuals who were willing to bear this marketplace uncertainty were also the ones who would reap the benefits (or loses) from this risk taking. Say (1880/1971) espoused a similar view: entrepreneurs were individuals who were willing to accept the risks involved with assembling the resources required to produce goods that would be sold in the marketplace. Those surpluses of funds gained from sales over costs were labeled as entrepreneurial rents that accrued to these entrepreneurs. Frank Knight (1921), who first made the distinction between risk (the probabilities of future outcomes are known) and uncertainty (the probabilities of future outcomes are not known), saw the entrepreneur as willing to assume uncertainty for the likelihood of future profit. Implicit, then, in a view of entrepreneurs as individuals who take risks to start businesses is a sense that these individuals are also prone to taking risks. If starting a business is perceived as a risky endeavor, then, one might assume that individuals who start businesses are also “risk-takers,” that is, they are more likely to make risky choices compared to others.

Overall, the culmination of scholarly research on the relationship of perceptions of risk to differences between entrepreneurial individuals compared to others has led to mixed results. For example, the two major meta-analyses of research studies comparing risk-taking propensities of entrepreneurs to others generated conflicting findings. Stewart and Roth (2001) analyzed 12 studies that used, primarily, the risk-taking scale in the Jackson Personality Inventory (1976). Their findings indicated that entrepreneurs who were “growth-oriented founders” were more likely to have higher levels of risk-taking propensity than “income-oriented” entrepreneurs, who were more likely to have higher levels of risk-taking propensity than managers. In contrast, Miner and Raju (2004) analyzed 14 studies that primarily used the Risk Avoidance subscale of the Miner Sentence Completion Scale—Form T (Miner 1986) a projective measure of risk-proneness, and they found that entrepreneurs were less likely to be prone to taking risks compared to managers.

Subsequently, meta-analyses of a combination of all of the studies in Stewart and Roth (2001) and Miner and Raju (2004), produced additional conflicting findings. Miner and Raju (2004) found that entrepreneurs and managers had similar risk propensities, while Stewart and Roth’s (2004) reanalysis of these studies suggested that entrepreneurs had higher risk propensities than managers. The authors of these opposing findings suggested that the reasons for the differences between their results was due to the selection of specific studies that reliably measure risk propensity, and, represent “valid” samples of entrepreneurs. Neither side could agree on which specific studies of risk taking propensity should be the correct ones to include for analyses. So, combining different studies produced different results.

These meta-analyses suggest that, at a more fundamental level, a critical issue in the comparison of the risk-taking propensities of individuals involves the criteria by which persons are categorized into such groups as “entrepreneurs” or “managers.” The samples of “entrepreneurs” used for studies of risk-taking propensity typically include founders of businesses that started their companies long ago. Therefore, one must assume that an individual’s propensity for risk does not change over time, so that the risk taking propensity score that an individual had as a founder would be similar to the risk taking propensity score that the individual had later as the owner of an on-going firm. Rarely did any of the studies in these meta-analyses control for the length of time between when the founder started the business and when the founder participated in the risk propensity survey. The time between these events could be years or decades. In addition, these studies provided few details about the characteristics of the “managers” used to compare to the entrepreneurs. It was often assumed that individuals with managerial responsibilities would be similar, in terms of their activities and other characteristics, to the entrepreneurs, except that the entrepreneurs were founders and owners of independent businesses. The primary difference, then, between these two groups would therefore be assumed to be only in the choice of occupation, of which, by implication, the occupation of entrepreneur was assumed to be more risky than that of manager (Wu and Knott 2006).

It should also be noted in reviewing previous risk-taking propensity studies that various measures of risk-taking propensity have been used, and, that differences among these measures could generate conflicting findings. As will be discussed later, while the general idea of “risk” may be assumed to have an agreed upon meaning (which is a problematic assumption), how “risk” is specifically measured can have widely varying operationalizations, which, on face-value, are likely to measure different perceptions of what “risk” means for particular individuals in particular situations.

This struggle with both conceptualizing and then measuring the nature of risk has continued in recent entrepreneurship scholarship. For example, in a meta-analysis undertaken by Zhao et al. (2010), risk-taking propensity was positively related to intentions to start a business, but not related to actually getting into business. Their results were similar to those found in Stewart and Roth (2004) about differences between nascent entrepreneurs intending to start businesses compared to others since both meta-analyses used only studies that used the Jackson Personality Inventory as well as studies with samples similar to Stewart and Roth (2004). The finding in Zhao et al. (2010) that successful entrepreneurs were similar to unsuccessful entrepreneurs on their risk propensity scores may reflect the wide variation in types of individuals involved in entrepreneurship in which different motives, skills and interests confound ways to ferret out the influence of risk perceptions on successful entrepreneurial efforts.

As described earlier, Xu and Reuf (2004) posit that risk-taking propensity may be considered as comprising two different perspectives: strategic and non-strategic. Strategic risks would be risks associated with perceptions about the likelihood of success or failure in regards to specific opportunities considered by individuals. Non-strategic risks would be perceptions of risks of success or failure in regards to entrepreneurial activities, in general. In both instances, arguments can be offered that entrepreneurs would have biases that may affect their propensity for risk differentially compared to others. Given the contrasting findings from previous research studies on risk-taking propensity, we will, conservatively, suggest the following:

H1

Strategic risk propensity will not differentiate between entrepreneurs who are more likely to start a new business compared to those that do not start a business.

H2

Non-strategic risk propensity will not differentiate between entrepreneurs who are more likely to start an on-going new business compared to those that do not.

H3

The interaction effect between strategic and non-strategic risk propensity will not differentiate between entrepreneurs who are more likely to start an on-going new business compared to those that do not.

2.1 Environmental uncertainty

In a review of the literature and research on environmental uncertainty, Milliken (1987) developed a general definition of environmental uncertainty as “an individual’s perceived inability to predict (an organization’s environment) accurately because of a ‘lack… of information’ or ‘an inability to discriminate between relevant and irrelevant data’ ” (p. 136). In previous studies (Gartner and Liao 2007; Liao and Gartner 2006) we found that perceptions of environmental uncertainty played an important role in differentiating between nascent entrepreneurs who were more likely to engage in pre-venture planning, or not. Based on those findings, we surmised that differences in perceptions of environmental uncertainty would likely influence differences in risk perceptions among nascent entrepreneurs, as well.

H4

Entrepreneurs who perceive high levels of environmental uncertainty will have higher strategic risk propensity scores.

H5

Entrepreneurs who perceive high levels of environmental uncertainty will have higher non-strategic risk propensity scores.

2.2 Venture growth aspirations

Entrepreneurs pursue opportunities to create new businesses for a variety of reasons (Carter et al. 2003; Gatewood et al. 1995). One reason of primary interest to entrepreneurship scholars has been the intention to grow a business (Acs 2008; Autio 2007; Baum et al. 2001; Reynolds et al. 2002; Wicklund and Shepherd 2003). These studies suggest that individuals who intend to grow businesses are likely to start businesses that grow, and that such growth businesses are an important factor in overall economic growth. As growth oriented businesses require more resources than non-growth businesses to both start and expand, it would seem likely that individuals who aspire to create growth businesses would likely perceive the risks involved in such efforts as being higher than the risks associated with starting a low growth business.

H6

Entrepreneurs with high growth aspirations will have higher strategic risk propensity scores.

H7

Entrepreneurs with high growth aspirations will have higher non-strategic risk propensity scores.

3 Research methods

3.1 Sample

There are few research samples that have sought to study individuals in the actual process of starting businesses. Assuming that one would want to look at the risk-taking perceptions of entrepreneurs while they were actually in the process of starting businesses (thereby having an opportunity to control for characteristics of their situation, as well), such research samples would solve many of the problems of samples biased towards studying entrepreneurs long after their startup efforts. Such a longitudinal sample of individuals in the process of starting businesses exists: The PSED (Gartner 2008). The PSED is a longitudinal data set of individuals in the process of starting businesses who were identified from a random digit dialing telephone survey of 64,622 adults in the United States (Reynolds and Curtin 2004). Nascent entrepreneurs were identified for inclusion in this study during surveys that occurred between July 1998 and November 1999. To qualify as “nascent entrepreneurs”, that is, individuals who were in the process of starting a business, respondents answered “yes” to the following two questions: (1) Are you, alone or with others, now trying to start a new business? (2) Are you, alone or with others, now starting a new business or new venture for your employer? Is the effort a part of your job assignment? The following procedures were used to generate our final sample using data from the PSED. First, we eliminated non-independent ventures such as those emerging venture efforts that were: purchased, the takeover of an existing business, a franchise, or a startup sponsored by existing business. Based on these criteria (Q190), there were 695 cases for analysis. We only chose the independent startups for data analysis.

3.2 Measures

Here is how we defined the various measures used for evaluating whether an entrepreneur started a business, perceived strategic and non-strategic risk, aspired to grow a business, and perceived uncertainty in their entrepreneurial situation.

3.2.1 Venture formation

The PSED follow-up survey provides the opportunity to investigate whether these nascent entrepreneurs had successfully launched a business. There are three follow-up rounds of data collection, namely R, S and T, which were conducted approximately 1-, 3-, and 5 years after the initial interview. For each round, the status of the nascent venture was asked. There are five categories of venture status: (1) operating, (2) still active in the start-up process, (3) not active in the start-up process, (4) terminated the start-up process, and (5) something else. We consider “operating” as a successful venture formation, which is coded as “1” and the rest were coded as category “0” for “unsuccessful venture formation.”

Measures of risk-taking are consistent with Xu and Reuf (2004) who measured risk in two ways: risk associated with choices to invest in a specific business (strategic) and risk associated with perceptions of the likelihood of business success, in general (non-strategic). For strategic risk taking propensity, nascent entrepreneurs were asked about their preferences among three ventures which have the same expected payout—the probability of success times the profit (QH1). The three options were: a profit of $5,000,000 with a 20% chance of success; a profit of $2,000,000 with a 50% of success; and a profit of $1,250,000 with an 80% chance of success. These three options were subsequently coded as 3, 2 and 1, respectively. For non-strategic risk taking behavior, nascent entrepreneurs were asked two related questions. The first question asked: “Considering all the new businesses that will be started in the US this year, what percentage do you expect to close within 5 years? (QN1)”. The second question asks: “Of all new business starts, what percent will eventually be worth $0 to 499,999, $500,000 to 999,999, $1,000,000 to 4,999,999, $5,000,000 to 9,999,999, and $10,000,000 or more, respectively? (QN2a–QN2e)”. We first calculated the expected entrepreneurial profit by summing the cross product of the median of each category and the estimated corresponding percentage, multiplied by the probability of success which equals 1 subtracting the probability of failure rate estimated in the first question. Similarly to Xu and Reuf (2004), the measures were standardized in $1,000s for subsequent analysis.

To ascertain perceptions of environmental uncertainty (QD1a–QD1k), we used an 11-item measure from the PSED mailing survey (Matthews and Human 2004). These items are related to nascent entrepreneurs’ perceptions of their ability to understand or to predict the state of various environmental conditions due to lack of information or uncertainty about that environment. A factor analysis of the 11 items generated three interpretable factors: financial uncertainty, competitive uncertainty and operational uncertainty, which have Cronbach alphas of 7.1, 6.3 and 6.1, respectively. Due to the low reliability of the competitive and operational uncertainty scores, and also considering the very early stage of venture formation, we chose financial uncertainty as a key uncertainty measure, and a composite score of these measures was also created for subsequent analysis.

Growth aspiration was measured by the question: “Describe your preference for the future size of this business: (1) I want the business to be as large as possible, or (2) I want a size I can manage myself or with a few key employees?” The first option is coded as ‘2’ and the second option is coded as ‘1’.

We also control for the entrepreneur’s startup experience (Q200), whether the effort involved a startup team (Q116), the entrepreneur’s industry experience (Q340), the entrepreneur’s managerial experience (Q341), the type of industry the startup effort was in (Q301), the level of education of the entrepreneur (Q343), and whether the entrepreneur engaged in business planning as part of the startup effort (Q111).

3.3 Models

We used two multiple regression models and two logistic regression models to test the direct effects posited in hypotheses H1–H7. Models 1 and 2 test hypotheses 1 and 2, and the interactive hypothesis 3 after including the control variables. Models 3 and 4 examine hypotheses 4–7 by regressing strategic and non-strategic risk propensity on the environmental uncertainty and growth aspiration measures. Models 5 and 6 test the mediating effect of risk taking propensity, following the recommendation of Baron and Kenny (1986).

4 Results of the study

Table 1 provides descriptive statistics and a correlation table for the controls, independent variables and dependent variables.

Table 2 reports on the results obtained from the various regression models. As indicated in Table 2, model 1 includes the control variables that may be directly related to the probability of venture formation, plus the strategic risk taking propensity and non-strategic risk taking propensity measures. Our base model for the control variables indicates startup knowledge related variables such as management experience and venturing experience are not statistically significant, contradictory to findings by Lee and Tsang (2002) and Sapienza et al. (2006). In addition, our results failed to yield a significant finding for the impact of business plan development on the probability of venture formation, lending no support for findings found in previous studies by Delmar and Shane (2003) and Liao and Gartner (2006).

Hypothesis 1 and hypothesis 2 predict that strategic risk-taking propensity and non-strategic risk taking propensity do not influence the likelihood of venture formation. The coefficient for strategic risk propensity is positive (β = 0.170), but not statistically significant, lending support for hypothesis 1. The coefficient for non-strategic risk taking propensity (β = −0.129) is negative and not statistically significant, therefore, hypothesis 2 is also supported. As a main effect, then, the results from model 1 show no relationship between risk taking propensity (strategic or non-strategic) and the probability of venture formation.

Hypothesis 3 predicts the interactive effect of strategic and non-strategic risk on the probability of venture formation. The coefficient is reported as insignificant in model 2 (β = −0.428), therefore providing support for hypothesis 3.

Model 3 examines the impact of perceived environmental uncertainty and growth aspiration on strategic risk taking propensity. The coefficients for environmental uncertainty and growth aspiration are 0.012 and 0.086, respectively, and are not statistically significant. Hypotheses 4 and 6 are not supported.

Hypotheses 5 and 7 predict a positive impact on perceptions of environmental uncertainty and the entrepreneur’s growth aspirations on non-strategic risk taking propensity. As indicated in model 4, the regression coefficient for environmental uncertainty is 0.112, which is consistent with the predicted direction and statistically significant, lending support for hypothesis 5. Entrepreneurs who have higher perceptions of environmental uncertainty also score higher on perceptions of non-strategic risk taking. The regression coefficient for growth aspiration is statistically significant (β = 0.316, p < 0.01), providing strong support for hypothesis 7. Entrepreneurs who seek to start larger businesses also score higher on perceptions of non-strategic risk taking. Collectively, our results indicate differential effects of environmental uncertainty and growth aspiration—both have strong and positive effects on non-strategic risk taking propensity but not on strategic risk taking propensity.

To further examine the potential mediating effects of risking taking propensity on the relationship between uncertainty (a perceived environmental condition), growth aspiration (an individual attribute) and the probability of venture formation, we created a base model (model 5) to include the control variables as well as the uncertainty and growth aspiration variables. We then created a full model (model 6) to further include the risk taking propensity variables (strategic and non-strategic). A comparison of model 6 and model 5 suggests that the addition of the strategic and non-strategic risk taking variables failed to change the relationship between uncertainty, growth aspiration and the probability of creating a new business. Therefore, our results failed to indicate any mediating effect from entrepreneurial risk taking propensity (strategic and non-strategic).

5 Discussion

According to the findings of this study, an entrepreneur’s risk propensity has no relationship to the likelihood of successfully starting a business. In other words, whether an entrepreneur has a high or low propensity for risk (either strategic or non-strategic) the likelihood of successfully starting a business is not affected. Entrepreneurs with high scores are no more likely to start a business than the risk averse. Coupled with the findings from Xu and Reuf (2004), the strategic and non-strategic risk measures suggest that perceptions of risk do not differentiate between entrepreneurs and others, or between successful and unsuccessful entrepreneurs.

A number of concerns might be offered about the measures and sample used in this study. The measures of risk taking propensity are single-item variables, and, therefore, may not capture, in a robust fashion, the nature of each nascent entrepreneur’s perception of risk. Xu and Reuf (2004) offer compelling arguments for the face- and theoretical-validity of these measures. Concerns might be raised about the heterogeneity of the sample of nascent entrepreneurs. As the PSED sampling frame provides a generalizable sample of all efforts to engage in business startup activity in the United States, there might be issues raised as to the value of recognizing such a breadth of kinds of individuals who engage in entrepreneurship. Given that a majority of these emerging efforts might be considered as relatively mundane efforts with little potential for employment or sales growth, then, to study such inconsequential entrepreneurial efforts might provide few insights into the forces that drive the creation of high growth businesses. Because this study controls for a variety of variables that might play a role in spurring high growth entrepreneurship (i.e., education, industry and managerial experience, type of industry and business), such insights into the differences between the relatively few high growth businesses versus the predominance of small and mundane businesses can be identified. Be-that-as-it-may, there are ways that future studies on the risk propensity of nascent entrepreneurs could be improved.

More attention needs to be placed on the kinds of risks that nascent entrepreneurs perceive, themselves. That is, research on entrepreneurial risk tends to begin with the creation, by academics, of questions that query nascent entrepreneurs on the various trade-offs that these individuals might make across a set of financial decisions that would generate variation in financial gains and losses. Nascent entrepreneurs might not actually think that way, or actually be concerned with the kinds of financial choices that academics find interesting and can analyze. Sarasvathy’s (2008) studies of expert entrepreneurs using open-ended verbal protocols to elicit insights into the ways these individuals actually think, has shown that they perceive the risks of venture creation in entirely different ways than do individuals who have chosen different kinds of jobs. The idea, then, of assuming that individuals have similar conceptions of how they actually perceive risks in their day-to-day decisions, might be worth exploring.

Wu and Knott (2006) have offered theory and evidence that entrepreneurs face two kinds of risks: demand uncertainty (risks concerned with the potential value of a particular opportunity) and ability uncertainty (risks concerns with marshalling the skills and resources to actualize an opportunity). From this perspective, how entrepreneurs perceive their own skills and abilities (McGee et al. 2009) as well as how entrepreneurs actually engage in specific activities to pursue opportunities, might lend insights into the kinds of risks that entrepreneurs believe they face. In addition, entrepreneurial activity occurs over time, and, therefore, entrepreneurs can both learn from their mistakes and successes, become aware of alternative ways to achieve their goals, and make changes to their plans as circumstances unfold. The specific risks (perceived or actual) that impact nascent entrepreneurs are likely to change over time.

6 Conclusions

Based on the findings of this study, we believe that thinking about individuals in terms of their perceptions of risk does not lead to a meaningful way to grasp the nature of the entrepreneur (Gartner 1985). Now, this is not to say that there is no variation in the risk profiles of entrepreneurs, overall, or of the general population, overall. Some entrepreneurs do have higher propensities for strategic and non-strategic risk compared to others. Some individuals in the general population have higher propensities for strategic and non-strategic risk compared to others. What the results of Xu and Reuf (2004) do indicate is that, in general, for entrepreneurs as a group, their scores on the strategic and non-strategic risk propensity measures are not statistically different from scores from the sample of the general population. And, our study suggests that the risk scores of entrepreneurs don’t seem to affect the likelihood that they will successfully start a firm. We challenge the assumption that an individual’s risk taking propensity has some relationship to whether they will be more likely to act entrepreneurially, or be more likely to succeed as an entrepreneur. We believe that engaging in entrepreneurship does not, inherently, stem from a personal characteristic. While entrepreneurs do take risks, they are not more likely to be “risk takers” as a characteristic of their personality, than any one else.

References

Acs, Z. J. (2008). Foundations of high impact entrepreneurship. Foundations and Trends in Entrepreneurship, 4(6), 535–620.

Autio, E. (2007). Global entrepreneurship monitor 2007 global report on high-growth entrepreneurship. London: London Business School; Babson Park, MA: Babson College.

Baron, R. M., & Kenny, D. A. (1986). The moderator-mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. Journal of Personality and Social Psychology, 51, 1173–1182.

Baum, R., Locke, E., & Smith, K. (2001). Multidimensional model of venture growth. Academy of Management Journal, 44(2), 292–303.

Cantillon, R. (1755/2001). Essay on the nature of commerce in general. New Brunswick, NJ: Transaction Publishers.

Carter, N. M., Gartner, W. B., Shaver, K. G., & Gatewood, E. J. (2003). The career reasons of nascent entrepreneurs. Journal of Business Venturing, 18(1), 13–39.

Delmar, F., & Shane, S. (2003). Does business planning facilitate the development of new ventures? Strategic Management Journal, 24(12), 1165–1185.

Gartner, W. B. (1985). A framework for describing and classifying the phenomenon of new venture creation. Academy of Management Review, 10(4), 696–706.

Gartner, W. B. (2008). Variations in entrepreneurship. Small Business Economics, 31, 351–361.

Gartner, W. B., & Liao, J. (2007). Pre-venture planning. In C. Moutray (Ed.), The small business economy for data year 2006: Report to the President (pp. 212–264). Washington, DC: U. S. Small Business Administration Office of Advocacy.

Gatewood, E. J., Shaver, K. G., & Gartner, W. B. (1995). A longitudinal study of cognitive factors influencing start-up behaviors and success at venture creation. Journal of Business Venturing, 10(5), 371–391.

Jackson, D. N. (1976). Personality inventory manual. Goshen, NY: Research Psychologists Press.

Jackson, D. B. (1994). Jackson personality inventory: Revised manual. Port Huron, MI: Sigma Assessment Systems.

Knight, F. H. (1921). Risk, uncertainty and profit. Boston, MA: Houghton Mifflin Company.

Lee, D. Y., & Tsang, E. W. K. (2002). The effects of entrepreneurial personality, background and network activities on venture growth. Journal of Management Studies, 38(4), 583–602.

Liao, J., & Gartner, W. B. (2006). The effects of pre-venture plan timing and perceived environmental uncertainty on the persistence of emerging firms. Small Business Economics, 27(1), 23–40.

Matthews, C. H., & Human, S. E. (2004). The economic and community context for entrepreneurship: Perceived environmental uncertainty. In W. B. Gartner, K. G. Shaver, N. M. Carter, & P. D. Reynolds (Eds.), Handbook of Entrepreneurial Dynamics (pp. 421–429). Thousand Oaks, CA: Sage Publications.

McGee, J. E., Peterson, M., Mueller, S. L., & Sequeira, J. M. (2009). Entrepreneurial self-efficacy: Refining the measure. Entrepreneurship Theory and Practice, 33(4), 965–988.

Milliken, F. (1987). Three types of uncertainty about environment: State, effect and response uncertainty. Academy of Management Review, 12, 133–143.

Miner, J. B. (1986). Scoring guide for the miner sentence completion scale—form T. Eugene, OR: Organizational Measurement Systems Press.

Miner, J. B., & Raju, N. S. (2004). Rick propensity differences between managers and entrepreneurs and between low- and high-growth entrepreneurs: A reply in a more conservative vein. Journal of Applied Psychology, 89(1), 3–13.

Reynolds, P., & Curtin, R. (2004). Appendix A. Data collection. In W. B. Gartner, K. G. Shaver, N. M. Carter, & P. D. Reynolds (Eds.), Handbook of Entrepreneurial Dynamics (pp. 453–476). Thousand Oaks, CA: Sage Publications.

Reynolds, P. D., Bygrave, W. D., Autio, E., Cox, L. W., & Hay, M. (2002). Global entrepreneurship monitor, 2002 executive report. Babson Park, MA: Babson College.

Sapienza, H. J., Autio, E., George, G., & Zahra, S. A. (2006). A capacities perspective on the effects of early internationalization on firm survival and growth. Academy of Management Review, 31(4), 914–933.

Sarasvathy, S. D. (2008). Effectuation: Elements of entrepreneurial expertise. Cheltenham: Edward Elgar.

Say, J. (1880/1971). A treatise on political economy: Or the production, distribution and consumption of wealth (C. R. Prinsep & C. C. Biddle, Trans.). New York, NY: Augustus M. Kelley.

Stewart, W. H., & Roth, P. L. (2001). Risk propensity differences between entrepreneurs and managers: A meta-analytic review. Journal of Applied Psychology, 86(1), 145–153.

Stewart, W. H., & Roth, P. L. (2004). Data quality affects meta-analytic conclusions: A response to Miner and Raju (2004) concerning entrepreneurial risk propensity. Journal of Applied Psychology, 89(1), 14–21.

Wicklund, J., & Shepherd, D. (2003). Aspiring for, and achieving growth: The moderating role of resources and opportunities. Journal of Management Studies, 40(8), 1919–1941.

Wu, B., & Knott, A. M. (2006). Entrepreneurial risk and market entry. Management Science, 52(9), 1315–1330.

Xu, H., & Reuf, M. (2004). The myth of the risk-tolerant entrepreneur. Strategic Organization, 2(4), 331–355.

Zhao, H., Seibert, S. E., & Lumpkin, G. T. (2010). The relationship of personality to entrepreneurial intentions and performance: A meta-analytic review. Journal of Management, 36(2), 381–404.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Gartner, W., Liao, J. The effects of perceptions of risk, environmental uncertainty, and growth aspirations on new venture creation success. Small Bus Econ 39, 703–712 (2012). https://doi.org/10.1007/s11187-011-9356-1

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11187-011-9356-1