Abstract

We examine causes of black/white gaps in self-employment entry rates in the United States by recognizing that industry context heavily shapes impacts of owner resource endowments on the likelihood of successful entry. Barriers to entry, briefly stated, are high in some lines of business and low in others. We therefore proceed by explaining self-employment entry into separate subgroups of high- and low-barrier industries. Higher entry rates typifying whites, relative to African Americans, are traditionally interpreted as reflections of the former group’s greater personal wealth and human-capital resources. This consensus view, however, is simplistic: personal wealth holdings have no positive explanatory power for predicting entry into low-barrier lines of business. Our findings demonstrate, furthermore, that high educational attainment is a strong, positive predictor of entry into high-barrier fields, but not into low-barrier industries. Because industry context indeed shapes entry patterns, “one-size-fits-all” econometric models commonly used to predict entry into self-employment fall short.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

A large body of literature indicates that the people most likely to enter self-employment and small business ownership in the United States have higher personal net worth and stronger human-capital credentials than non-entrants. Similarly, increased success and survival odds typify well-capitalized small businesses run by owners having the human capital (education, experience, expertise) appropriate for operating viable ventures (see, e.g., Fairlie and Robb 2007, 2008; Parker 2009; Dunn and Holtz-Eakin 2000; Bruderl et al. 1992; Hout and Rosen 2000). Regarding African Americans specifically, the stronger human- and financial-capital characteristics of potential nonminority entrepreneurs are often viewed as important explanations of the lower entry rates of blacks (Fairlie 1999).

While relatively low rates of self-employment among African Americans have prevailed throughout the twentieth century (Fairlie and Meyer 2000), an apparent paradox has been noted by studies exploring racial differences in nascent entrepreneurship rates. Among blacks 18–64 years of age, these rates are “about 50% higher than (corresponding rates) for whites and the difference is statistically significant” (Reynolds et al. 2004). Global Entrepreneurship Monitor (GEM) project data indicate that whites are less likely to engage in business start-up activities (6.2%) than blacks (11.1%). Indeed, Kollinger and Minniti find that blacks are “1.79 times more likely to be nascent entrepreneurs than whites with an identical socio-economic background” (2006, p. 16). Particularly among black Americans with college degrees (and those with graduate training), prevalence rates of nascent entrepreneurship recorded in the Panel Study of Entrepreneurial Dynamics (PSED) data are roughly twice as high as rates typifying similarly educated white adults. How then does one reconcile the higher incidence of firm start-up activities among blacks, relative to whites in the U.S., with their much lower rates of actual self-employment entry?

This study analyzes data drawn from the Survey of Income and Program Participation (SIPP), conducted by the U.S. Bureau of the Census, to track self-employment entry patterns among blacks and nonminority whites from 1996 to 2004. The concept of high- and low-barrier industry subgroups is developed to explain self-employment dynamics. Key elements underlying viable new-business creation include: (1) involvement of capable entrepreneurs possessing appropriate human capital for operating a successful venture; (2) assembly of sufficient financial capital to launch the venture; and (3) access to markets for selling the products of the enterprise. The uniqueness of minority entrepreneurship is rooted in the higher barriers owners encounter when they attempt to pull together these basic building blocks of successful venture creation. The whole entry process is more difficult for minorities generally—and African Americans specifically—than for whites because they must contend with higher entry barriers (Bates 1997; Waldinger et al. 2006). These barriers must be surmounted if self-employment entry is to proceed.

Applicable entry barriers, in this context, are overcome in part by the human- and financial-capital resources that self-employment entrants bring into their new ventures. Yet, entry barriers are not homogeneous across industry groups. In capital-intensive fields like manufacturing, for example, aspiring owners must create a venture of sufficient size to capture operating efficiencies rooted in scale economies. Because efficient scale is commonly achieved by investing substantial sums in equipment, inventories, and the like, manufacturing is a high-barrier line of business, in contrast to low-barrier fields like personal services, where capital intensity is typically low and scale economies are modest. Entry barriers in skill-intensive fields like professional services, in contrast, are commonly overcome by the aspiring entrepreneurs possessing educational credentials earned through graduate and professional studies.

Utilizing a framework thus defined by entry barriers, we demonstrate that determinants of self-employment entry patterns differ sharply across the high- and low-barrier industry sectors. This approach allows us to measure directly the extent to which black/white differences in self-employment entry rates are explained by the educational attainment and personal net worth levels possessed by potential entrants. In fact, controlling for these human- and financial-capital resource endowments does not fully explain gaps in entry rates, so the paradox of lower entry rates and higher nascent rates of entrepreneurship among African Americans, relative to whites, remains. Our findings are consistent with the presence of higher barriers facing aspiring black entrants, irrespective of their net worth holdings or educational backgrounds, and this pattern of higher barriers appears to be particularly pronounced in low-barrier lines of business.

2 Barriers to business entry: literature overview

The fact that owner endowments of appropriate human- and financial-capital resources are prerequisites for successful venture creation and operation is rarely disputed (Fairlie and Robb 2008; Bates 1997; Parker 2009; Evans and Jovanovic 1989). The fact that aspiring African American entrepreneurs commonly have less access to financial capital than whites is similarly well established. The evidence documenting low personal-wealth levels and limited borrowing power among black Americans is overwhelming. Bradford (2003) utilized PSID data to measure median net asset holdings of black families headed by employees ($10,679) as opposed to white families with employee heads ($67,449). These nationwide data further indicated that families headed by black business owners held median net assets of $67,449 in 1994, about one-third of the corresponding holdings among whites ($202,348) (Bradford 2003).

More recent data from the U.S. Bureau of the Census, cited by Fairlie and Robb (2008), indicate overall median wealth levels of $6,166 for black households, less than one tenth the corresponding $67,000 median figure reported by whites. Whether invested directly into small businesses or used as collateral to obtain loans, such huge wealth differences translate into startup capital disparities for African American entrepreneurs. “Racial differences in asset levels play an important role in explaining the racial gap in the entry rate” (Fairlie 1999, p. 97).

Lending practices of financial institutions exacerbate black–white differences in access to financial capital. For both startups and existing businesses, bankers are the primary source of debt capital, and this capital is more accessible to white entrepreneurs than to similarly situated blacks (Blanchflower et al. 2003; Cavalluzzo and Wolken 2005). The fact that most African American owners of small businesses reside in black residential areas appears to contribute to their limited access to bank credit (Bates 1989). Information asymmetries characteristic of such areas are linked to credit rationing, according to the classic “redlining” analysis put forth by Stiglitz and Weiss (1981). Restricted access to capital, of course, shapes the scale and industry distribution of planned businesses, thus reducing financial capital demand among black-owned firms (Bates 1997; Fairlie and Robb 2007). Black business owners—more so than whites—indicate that expectation of loan denial often causes firms in need of credit not to seek bank loans (Blanchflower et al. 2003).

This conventional wisdom is not without its skeptics. According to Light and Rosenstein (1995), the notion that financial-capital barriers retard startup and operation of minority-owned business is a myth. Citing data from the U.S. Bureau of the Census Characteristics of Business Owners (CBO) database, Meyer (1990) observed that 78% of black-business owners required less than $5,000 to start their firms. Examining self-employment entry among all racially-defined groups, Hurst and Lusardi (2004) found that the relationship between wealth and entry into self-employment “is essentially flat over the majority of the wealth distribution” (p. 319). They concluded that wealth and borrowing constraints do not deter most small business formations: “This may simply reflect the fact that the starting capital required for most businesses is sufficiently small” (p. 321).

Yet in those specific lines of business where startup capital needs are not small, constraints may nonetheless be binding. Where borrowing opportunities are limited and firm startup capital requirements are large, low net-worth potential entrepreneurs may nonetheless be handicapped. Bates (1995) identified the small firm subgroups with the highest mean startup levels of capital investment—manufacturing and wholesaling. Utilizing SIPP data, he proceeded to delineate entrants into manufacture and wholesale self-employment from non-entrants, incorporating wealth, human capital, and demographic traits as explanatory variables. “Wealth”, defined as a series of categorical variables, was related to entry only at the higher end of the distribution, broadly consistent with Hurst and Lusardi’s (2004) findings.

Following Hurst and Lusardi’s convention of segmenting industries by the amount of capital needed to start a business, we identify subsets of high-barrier and low-barrier small firm startups. Financial capital investment is certainly not the only, or even the dominant, factor likely to shape small firm entry. “Those transitioning into entrepreneurship were more likely to be white, male, married, and to have high education and high income” (Hurst and Lusardi 2004, p. 323). Recognizing the importance of the human-capital element, measured by educational attainment, we use both this factor and equity-capital investments of firm owners to define low-barrier and high-barrier subsets of small firms.

While most scholars agree on the key role played by financial-capital constraints in shaping self-employment entry, human capital’s role is a more contentious topic. Educational attainment and work experience measures of potential owners have been erratic determinants of self-employment entry (Evans and Leighton 1989; Parker 2009). Dunn and Holtz-Eakin (2000) highlighted the role of intergenerational links: having a self-employed parent had a strong, positive effect on the probability of transitioning to self-employment. Focusing specifically upon black entry, Fairlie (1999) found that graduating from college—relative to dropping out of high school—did not increase the probability of entry for blacks. “Overall, the size of the coefficient estimates and their statistical significance suggests that the relationship between education and entry into self-employment is weak” (p. 40).

Fairlie’s conclusion about self-employment entry patterns among black Americans and the minimal relevance of educational background, however, simply highlights the paradox noted by studies of nascent entrepreneurship. Why are black men and women with graduate training “two to three times more likely to be involved in a firm startup” (Reynolds et al. 2004, p. 274) if indeed members of this highly educated group are in fact no more likely actually to enter into self-employment than those never attending college? PSED data cited by Reynolds and his co-authors (2004, table 8) document nascent entrepreneurship rates of 4.3% among black women with high school degrees only, as opposed to 15.6% for those with graduate experience; a similarly large differential describes similarly educated black men. In light of their strong inclination toward small business ownership, those least constrained by human-capital deficiencies should logically be entering into self-employment at rates at least as high as those typifying similarly educated whites. Traditional resource-constraint explanations for the low self-employment entry rates describing black Americans simply lack credibility when applied to highly educated elite subgroups.

The erratic track record of education background in predicting self-employment entry may reflect the practice of inappropriate aggregation across diverse business types. The practice of placing entrepreneurs into overly broad industry groups, we hypothesize, increases the imprecision of research findings. Use of high- and low-barrier industry groupings is pursued in our analyses of SIPP data precisely because the nature of financial- and human-capital constraints is expected to vary substantially across small business sectors.

The consensus view that nonminority whites achieve higher entry rates than African Americans because they are relatively wealthier and better educated, we hypothesize, is simplistic. The self-employed are indisputably an unusually diverse group, ranging from casual laborers at one end of the spectrum to highly educated and specialized professionals at the other. The human- and financial-capital requirements facilitating successful entry are not homogeneous across industry types. Rather, the determinants of entry vary across industries requiring little in the way of advanced academic credentials and/or large investments of financial capital, as opposed to fields where potential entrepreneurs need substantial endowments of such traits. Simply stated, entry barriers are higher in some industries than in others. In low-barrier lines of business, higher wealth and education levels may not predict higher rates of entry. One’s personal net worth amount is not necessarily associated positively with low-barrier entry. Those with the strongest educational credentials, furthermore, may avoid self-employment in low-barrier fields because of opportunity-cost considerations. The relevance of human- and financial-capital resource endowments, we believe, applies largely to explaining entry patterns in the high-barrier lines of business. African American self-employment, however, is concentrated in low-barrier fields.

Self-employment entry, in summary, has been most often examined empirically in one-size-fits-all econometric models, but this approach cannot capture key small firm dynamics. Our fundamental hypothesis is that industry context heavily shapes the impacts of owner resource endowments on small firm entry patterns. More formally stated, resource requirements facilitating successful entry into self-employment and small business ownership are not homogeneous across industry types. Characteristics of potential and actual owners, furthermore, draw entrepreneurs toward some types of ventures and away from others. Finally, racial differences in the types of industries potential owners most often enter are important factors for understanding observed racial differences in self-employment rates.

3 Data and models

Utilizing data from the 1996 and 2001 SIPP panels, we identified potential entrants, defined as persons who did not report owning a business in the relevant survey period. Our sample was restricted to African American and non-Hispanic white adults between the ages of 20 and 64, all of whom reported household wealth information. No work restrictions were imposed upon the entrant sample because a significant portion of business entries came from non-employment. The restrictions yielded 147,923 potential entrants (initially not self-employed): African Americans accounted for 20,839 of the observations in the sample; whites made up the remaining 127,084 observations.

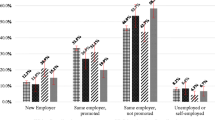

The 1996 and 2001 SIPP surveys are rotating panels made up of 12 and 9 waves of data, respectively. Surveys (waves) were conducted every 4 months, tracking the same individuals/households throughout the panel. Because low-income households were oversampled, sampling weights are used throughout our analysis, making the data nationally representative. Each SIPP respondent was asked about business ownership and his/her labor force status in the current month. Using this information, we define an individual as self-employed if he or she reported both owning a business in the sample month and working at least 15 h per week in that business.Footnote 1 In our empirical models, we utilize information on the potential entrant’s labor force status. The other recorded states include part-time self-employment, part-time paid employment, unemployment, welfare recipient status, and “not in the labor force”. Full-time workers are defined as working at least 15 h per week; part-timers work less than 15 h per week. Individuals defined as unemployed experienced at least 1 week of unemployment during the survey month and did not satisfy the criteria for being classified as self-employed or paid employed. Those defined as “welfare recipient” received Supplemental Security Income (SSI), Aid to Families with Dependent Children (AFDC)/Temporary Assistance for Needy Families (TANF) payments, or food stamps—and did not satisfy the definition criteria for self-employment, paid employment or unemployment.

Table 1 reports summary statistics for four subgroups of potential entrants into self-employment. Those entering over a 1-year period are compared to those who did not enter, and the entrant/no entry subgroups are broken down into black/white subsets. We also provide estimates of the black–white mean gap in the observable characteristics. Within these racially-defined subsets, entrants stand out as more likely to be college graduates and less likely to be high-school dropouts, relative to nonentrants. Substantial household wealth differentials also delineate entrants from nonentrants: black entrants reported mean net assets 40% greater than black nonentrants, but less than one fifth of the roughly $300,000 average wealth amount describing white entrants (Table 1). Two dominant patterns apparent in Table 1 statistics are (1) the lower average wealth of potential black entrants and their weaker educational backgrounds, relative to whites, and (2) conditional upon race, the higher mean wealth and educational credentials of entrants relative to nonentrants.

Table 2 reports self-employment entry rates for blacks and whites, where “entry rate” reflects the probability of becoming self-employed during a 1-year period, conditional upon not being self-employed at the beginning of the year. Whites exhibit a substantially higher rate of entry—1.78%—than blacks (1.17%). Although no clear theoretical basis exists for disaggregating small firms into high- and low-barrier subgroups (Hurst and Lusardi 2004), the major industries cluster conveniently into high and low human capital/financial capital subgroups. At the high-barrier end are manufacture, wholesale, professional services, business services, finance, insurance, and real estate, and entertainment. Low-barrier fields are personal services, repair services, construction, transportation, retail, and miscellaneous services. High-barrier fields are those in which average financial capital investments are highest and/or mean owner years of formal schooling are highest: average owner equity-capital investment in high-barrier fields is in the top one-third, relative to all small business subgroups, and/or owner average years of education is in the top one-third. Summary statistics of average years of schooling and owner equity investment among the self-employed, by industries, are shown in Appendix Table 5.

The robustness of our high/low barrier classifications was explored using U.S. Bureau of the Census CBO data to classify industry subgroups, using mean owner equity investment at startup, as well as average years of schooling. Retail thus emerged as a high-barrier industry; retail exhibited the highest owner equity and education traits observed in low-barrier fields when SIPP data were used to define cutoffs. Retail is the borderline case, not clearly high- or low-barrier. Analyses reported throughout this study were replicated in all cases, with retail included in the high-barrier grouping, to test the consistency of econometric findings to alternative high/low barrier specifications. It is noteworthy that industries meeting high-barrier cutoff values for financial capital investment most commonly also met cutoff values for high owner human capital: most high-barrier fields report both owner human- and financial-capital mean values exceeding cutoff values.

Most entrants described in Table 2 were operating businesses in low-barrier fields, with blacks exhibiting more concentration than whites in industries where low financial- and human-capital levels were the norm. Overall, 41.8% of African American entrants were in high-barrier lines of business, along with 47.6% of whites (Table 2). Our guiding hypothesis—that industry context heavily shapes the impacts of owner resource endowments on self-employment entry—suggests that substantial differences in owner human- and financial-capital resources in high- and low-barrier industry entrant subgroups reflect differences in barriers to entry across industries. Indeed, potential entrepreneurs with lower educational attainment and net worth holdings do tend to enter industries where lower owner human- and financial-capital wealth endowments are consistent with business viability, and vice versa.

Utilizing multinomial logistic regression models to investigate determinants of black–white gaps in self-employment entry rates, explanatory variables include demographic, financial- and human-capital traits of adults who were not initially self-employed. We treat self-employment and industry choices as simultaneous: the three choices are no entry, entry into a low-barrier field, and entry into a high-barrier line of business. Entry is a process shaped by traits and resources of potential entrepreneurs as they interact with business-specific barriers to entry in high- and low-barrier fields. Applicable barriers are hypothesized to vary substantially across small business sectors, affecting not only the decision to enter but also the type of business entered.

4 Findings

Entrepreneur educational background and household net assets predict entry in the logistic regression model (Table 3) in profoundly different ways, depending upon whether entry is into a low- or high-barrier type of firm. The college graduate variable coefficient is strongly positive for high-barrier fields, yet the exact opposite outcome describes low-barrier industry entry (Table 3). The weak and inconsistent explanatory power of education in predicting self-employment entry—observed by Evans and Leighton (1989) for whites and Fairlie (1999) for blacks—appears to be the result of over-aggregation of diverse industry types: advanced education, properly understood, positively predicts entry into some lines of small business, while negatively predicting entry into others.

Household net worth amount positively predicts entry into high-barrier small businesses in the Table 3 logit exercise, while exhibiting a negative relationship to low-barrier firm entry. The clear implication is that low net-worth holdings do not limit one’s entry into business fields where low average capitalization levels prevail. Most self-employed African Americans work in low-barrier fields; this finding conflicts with the conventional wisdom that black presence is thwarted by capital constraints, including lending discrimination.

If low net-worth households—white or black—face borrowing constraints and are thus unable to finance small firm startups, it follows that small firm formation rates will rise as household wealth goes up. Higher wealth levels, after all, serve both as a direct source of startup equity capital, as well as collateral for enhancing one’s borrowing power (Bates 1997). Higher wealth alleviates the capital-constraint problem. Failure to observe a positive relationship between household wealth and entry (Table 3) implies the absence of both equity capital and borrowing constraints in the low-barrier lines of business that account for 58.2% of black (and 52.4% of white) entrants.

Beyond educational background and household wealth, demographic traits—race and gender—predict entry into self-employment in consistent directions but differing magnitudes. The racial trait negatively predicts entry into both high- and low-barrier fields, albeit insignificantly for high-barrier, while being female negatively predicts entry (Table 3). Yet, coefficient values suggest that being black, other factors constant, is less of a constraint than being female.

We next test the sensitivity of our findings and conclusions. An alternative strategy to the multinomial logit approach (Table 3), in which self-employment entry is modeled as a simultaneous decision between starting up a business and the industry group (here, low- or high-barrier), is to view the observed outcome as a result of two sequential decisions about entry. The latter lends itself to a two-step model, where the first decision is whether to enter self-employment and the second decisions, conditional on entry, is the industry group in which to start the business. A practical issue with the latter approach is how to identify separately the relevant parameters in the entry and industry choice models (i.e., to find a valid exclusion restriction). In our robustness test, we assume that an individual’s labor market state of the previous year is a determinant of the decision of whether to enter self-employment or not but is not a relevant factor in the low- versus high-barrier outcome. We assume normal distributions for both outcomes and jointly estimate the models as a two-step probit model.

The two-step results, shown in Appendix Table 6, reveal that our entry findings are robust in this alternative framework. The two-step estimates reveal that, once differences in observable characteristics are controlled for, the differences in self-employment entry between nonminority whites and African Americans are concentrated in low-barrier industries. The results confirm the strong positive relationship between education level and high-barrier industry entry. Household wealth, once again, predicts high-barrier start-up, conditional on entry. In sum, the two-step approach supports our claim that the one-size-fits-all self-employment entry model is too simplistic and provides estimates leading to the same conclusions as our Table 3 multinomial logit outcomes.

Lastly, we extend our analysis of entry to investigate the possibility that the human- and financial-capital endowments of potential entrants play different roles for African Americans, compared to their white counterparts. To do so, we include interactions between our education and household net worth variables and the African American indicator variable. The results, shown in Appendix Table 7, reveal certain race differences in the role of education. The estimates point consistently towards a more positive, or less negative, relationship between human capital and business start-up among blacks than whites, particularly for low-barrier entry. Nonetheless, the estimates indicate a general negative relationship between education and low-barrier entry among African Americans. One exception is blacks with post-graduate degrees are somewhat more likely to enter low-barrier self-employment, compared to an otherwise observationally similar African American lacking a high school diploma. We also find that household wealth plays a slightly greater role for high-barrier start-ups among African Americans than it does among otherwise observationally similar whites. This may be related to differential treatment between blacks and whites with respect to the small business lending market (Blanchflower et al. 2003; Cavalluzzo and Wolken 2005).

5 Role of differences in endowments—high-barrier entry rate gap

It is clear (Table 3) that our set of observable characteristics, including education and household wealth, explains very little of the low-barrier entry rate gap between blacks and whites. However, the differences in endowments explain 70% of the high-barrier gap. To address the role of specific characteristics in explaining this gap (the observed one percentage point high-barrier industry gap), we first estimate a parsimonious model, including only education controls, shown as Model 1 in Table 3. Results indicate that the high-barrier entry rate gap drops to 0.14 percentage points, suggesting that the difference in educational attainment alone between blacks and whites explains roughly 60% of this gap. If we instead include controls for household net worth only (Model 2), the high-barrier entry rate gap is reduced to 0.22 percentage points, implying that differences in net worth alone explain roughly 35% of the gap. However, since education and net worth are positively correlated, the contribution of wealth in explaining the gap may capture the impact of education.

To investigate the combined contribution of education and net worth, we estimate a specification that includes both types of controls. The results (not reported in Table 3) indicate that the estimated entry rate gap is −0.10%, suggesting that slightly more than 70% of the gap is explained by differences in educational attainment and wealth alone. Our interpretation is that differences in educational attainment between blacks and whites explain roughly 60% of the high-barrier entry rate gap. Adding net worth explains an additional 10% of the gap. It should be pointed out that once we control for both education and net worth, the estimated black–white high barrier entry gap is not statistically significant at a 5% significance level (the p value is 0.096). As the Model 3 results show (Table 3), additional controls reduce the estimated high-barrier entry gap to a statistically insignificant 0.02%. The low-barrier entry gap, however, remains at a significant 0.16 percentage points, suggesting that slightly more than 1/3 of the gap is due to black–white differences in our observable factors.

As a robustness test, we reclassified retail as a high-barrier line of business and re-estimated Table 3 multinomial logit exercises. Treating this borderline subgroup as a high- as opposed to a low-barrier industry produced no changes in the degree to which black–white gaps were explained, nor did it appreciably alter any of our findings or conclusions. We also investigated whether the results are sensitive to separately reclassifying the relatively low human- and financial-capital-intensive “other” industries category as low-barrier and found no appreciable change in the results.

Hurst and Lusardi (2004) concluded from their analysis of PSID data that household net worth was positively related to self-employment entry only toward the top of the wealth distribution, a result that conflicts somewhat with our Table 3 (Models 2 and 3) analyses of entry patterns. As a direct test of this difference in findings, we use categorical wealth variables in our multinomial logit model, specifically identifying potential entrants at different points (quintiles) in the net worth distribution.Footnote 2 The results (Model 3, Table 3) indicate that that household wealth levels and entry are not positively related in the case of low-barrier industries but are in high-barrier fields.

6 Fitting the pieces together

Our econometric findings suggest a clear resolution to one prominent issue raised by previous studies of entry patterns: educational attainment measures, properly understood, are not erratic determinants of self-employment entry, as past studies have suggested. They are, in fact, powerful predictors of entry into self-employment, and this is particularly true among college graduate potential entrants and those with additional graduate-level educational credentials. While higher levels of educational attainment are strong predictors of entry patterns, the impacts of this human-capital endowment operate quite differently in high- as opposed to low-barrier fields (Table 3). The greater one’s level of educational attainment, the higher the attraction to high-barrier fields like professional services, where one’s human capital can be effectively employed, and the stronger the aversion to low-barrier fields offering prospects of low returns (Table 4). Consistent with opportunity cost considerations, our findings indicate that well-educated potential entrepreneurs tend strongly toward entry into higher remuneration fields, while avoiding the less remunerative low-barrier lines of business. We conclude that the lingering uncertainty in the entrepreneurship literature regarding impacts of educational background upon the self-employment entry decisions of potential entrepreneurs can be clarified by recognizing that industry context shapes entry patterns.

“Relatively low levels of education, assets, and parental self-employment” typify black American workers, partially explaining why 3.8% of them are “self-employed business owners, compared to 11.6% of white workers” (Fairlie and Robb 2007, p. 289). While our analysis of SIPP data provides some support for Fairlie’s explanation of low self-employment rates among African Americans, important qualifications are in order. First, an equalization of black–white household net worth holdings, by itself, would indeed tend to increase somewhat the self-employment entry rate among African Americans, but most of the black–white entry rate gap would remain. Equalization of educational attainment would have a much greater impact, substantially increasing the rate at which black Americans enter into self-employment and small business ownership in high-barrier fields. Our findings suggest that differences in net worth and educational attainment alone account for over 70% of the black–white gap in high-barrier industry entry rates, and that advances in educational attainment offer an effective strategy for further reducing this gap.

The majority of blacks and whites entering into self-employment choose low-barrier lines of business. Because entry into this sector, according to our findings, is not positively related to household wealth levels (Table 3), a relaxing of financial constraints in the form of either higher household wealth levels or greater access to bank credit is unlikely to increase black entry into low-barrier fields. A higher incidence of black college graduates in the general population, furthermore, might actually depress entry into low-barrier lines of business, tending to widen the racial gap, other factors constant, because such education credentials generally predict lower rates of entry. The low earnings associated with owning a low-barrier line of business (Table 4) are unlikely to be attractive to highly educated entrepreneurs because of opportunity–cost considerations. Our conclusion regarding low-barrier lines of business is that the racial gap in self-employment entry rates (Table 2) cannot be explained adequately by owner net worth and education measures. Sources of this gap are most likely to be found elsewhere.

The fact that black American adults lacking college educations enter self-employment at lower rates, yet pursue nascent entrepreneurship at higher rates, than similarly educated whites (Reynolds et al. 2004) suggests, once again, that they face higher entry barriers. As Kollinger and Minniti (2006, p. 71) have observed: “a lack of participation in business ownership among blacks is not due to a lack of entrepreneurial propensity but, rather, to the existence of uneven barriers to entry across races…”. Yet, the black–white gap in rates of entry into low-barrier lines of business, according to our findings, is poorly explained by the observable demographic, labor force status, human-capital, financial-capital, and other traits analyzed in our analysis of entry patterns (Table 3). Ruling out the educational backgrounds of potential entrepreneurs and applicable financial constraints as predominant explanations for this racial gap in entry rates, what are the likely causes? What are the most relevant barriers and how do they operate? The research agenda going forward is to identify those barriers most responsible for holding down black entry rates into low-barrier lines of business.

Past studies of discriminatory behaviors limiting entry into fields like retailing have often stressed barriers limiting black-owned businesses seeking to sell their products in mainstream markets. White consumer aversion to purchasing products from minority-owned firms, according to Borjas and Bronars (1989), limits opportunities for creation and successful operation of black-owned retail and consumer services ventures catering to white clients. This explanation of heightened barriers is refined by Leiberson’s theory of ethnic stratification, postulating that racial discrimination impacts black and Asian entrepreneurs differently. Differing white perceptions of various minority groups—particularly regarding the “threatening versus servile” behavioral dimension—caused whites to prefer to avoid black-owned ventures; patronizing establishments owned by Asians was less objectionable (Lieberson 1980).

Regarding access to mainstream product markets, discriminatory patterns reducing the ability of black entrepreneurs to compete on a level playing field, we believe, limit their ability to turn their strong entrepreneurial propensities into high levels of successful firm creation and operation in fields like retailing. Entrenched business networks resistant to minority business entrants similarly complicate market penetration in fields, particularly construction (Granovetter and Tilly 1988). Old-boy networks parceling out work to in-group members limit the range of opportunities accessible to network outsiders generally, and black-owned construction firms specifically, limiting their participation to the smaller, less attractive construction jobs (Bates and Howell 1998). Studies probing how such barriers operate to limit entrepreneurial opportunities among minorities have historically been frustrated by data insufficiency (Bates 1997), but database advances are lessening this constraint (Bates and Robb 2008). Scholarly inquiry into issues of market accessibility is likely, we believe, to illuminate causes of the enduring racial gaps in low-barrier industry entry rates.

Notes

In an earlier version of this paper (IZA Discussion Paper No 3156), we defined an individual as self-employed if he/she reported owning a business and earning at least $333 in self-employment earnings in the sample wave (the equivalent of $1,000 per year). The conclusions reached in this paper are not sensitive to the self-employment definition.

We find similar results using a flexible quadratic functional net-worth form combined with dummy variables with cutoffs at (1) $50,000–150,000, (2) $150,000–350,000, and (3) $350,000 plus.

References

Bates, T. (1989). Small business viability in the urban ghetto. Journal of Regional Science, 29(4), 625–643.

Bates, T. (1995). Self-employment entry across industries. Journal of Business Venturing, 10(6), 143–156.

Bates, T. (1997). Race, self-employment and upward mobility. Baltimore: Johns Hopkins University Press.

Bates, T., & Howell, D. (1998). The declining status of African American men in the New York construction industry. Economic Development Quarterly, 12, 88–100.

Bates, T., & Robb, A. (2008). Analysis of young firms serving urban minority clients. Journal of Economics and Business, 60(1), 139–148.

Blanchflower, D., Levine, P., & Zimmerman, D. (2003). Discrimination in the small business credit market. Review of Economics and Statistics, 85(4), 930–943.

Borjas, G., & Bronars, S. (1989). Consumer discrimination and self-employment. Journal of Political Economy, 97(2), 581–605.

Bradford, W. (2003). The wealth dynamics of entrepreneurship for black and white families in the U.S. Review of Income and Wealth, 49(1), 89–115.

Bruderl, J., Preisendorfer, P., & Ziegler, R. (1992). Survival chances of newly founded organizations. American Sociological Review, 57(2), 227–242.

Cavalluzzo, K., & Wolken, J. (2005). Small business loan turndowns, personal wealth and discrimination. Journal of Business, 78, 2153–2178.

Dunn, T., & Holtz-Eakin, D. (2000). Financial capital, human capital, and the transition to self-employment: Evidence from intergenerational links. Journal of Labor Economics, 18(2), 282–305.

Evans, D., & Jovanovic, B. (1989). An estimated model of entrepreneurial choice under liquidity constraints. Journal of Political Economy, 97(4), 808–827.

Evans, D., & Leighton, L. (1989). Some empirical aspects of entrepreneurship. American Economic Review, 79(3), 519–535.

Fairlie, R. (1999). The absence of the African-American owned business: An analysis of the dynamics of self-employment. Journal of Labor Economics, 17(1), 80–108.

Fairlie, R., & Meyer, B. (2000). Trends in self-employment among black and white men: 1910–1990. Journal of Human Resources, 35(4), 643–669.

Fairlie, R., & Robb, A. (2007). Why are black-owned businesses less successful than white-owned businesses: The role of families, inheritances, and business human capital. Journal of Labor Economics, 25(2), 289–324.

Fairlie, R., & Robb, A. (2008). Race families, and human capital. Cambridge: MIT Press.

Granovetter, M., & Tilly, C. (1988). Inequality and the labor process. In N. Smelser (Ed.), Handbook of sociology. Newberry Park, CA: Sage.

Hout, M., & Rosen, H. (2000). self-employment, family background, and race. Journal of Human Resources, 35(4), 670–692.

Hurst, E., & Lusardi, A. (2004). Liquidity constraints, household wealth, and entrepreneurship. Journal of Political Economy, 112(2), 319–347.

Kollinger, P., & Minniti, M. (2006). Not for lack of trying: American entrepreneurship in black and white. Small Business Economics, 27, 59–79.

Lieberson, S. (1980). A piece of the pie. Berkeley: University of California Press.

Light, I., & Rosenstein, C. (1995). Race ethnicity and entrepreneurship in urban America. New York: Aldine de Gruyter.

Meyer, B. (1990). Why are there so few black entrepreneurs? National Bureau of Economic Research Working Paper #3537.

Parker, S. (2009). The economics of entrepreneurship. Cambridge: Cambridge University Press.

Reynolds, P., Carter, N., Gartner, W., & Greene, P. (2004). The prevalence of nascent entrepreneurs in the United States: Evidence from the panel study of entrepreneurial dynamics. Small Business Economics, 23(4), 263–284.

Stiglitz, J., & Weiss, A. (1981). Credit rationing in markets with imperfect information. American Economic Review, 71(3), 393–410.

Waldinger, R., Aldrich, H., & Ward, R. (2006). Ethnic entrepreneurs: Immigrant business in industrial societies. Newbury Park, CA: Sage.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

Rights and permissions

About this article

Cite this article

Lofstrom, M., Bates, T. African Americans’ pursuit of self-employment. Small Bus Econ 40, 73–86 (2013). https://doi.org/10.1007/s11187-011-9347-2

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11187-011-9347-2