Abstract

This paper investigates the impact of in-house R&D and innovation management practices on innovation success in small and medium-sized firms (SMEs). While there is little doubt about the significance of technology competence for generating successful innovations, in-house R&D activities may be a particular challenge for SMEs due to high risk exposure, high fixed costs, high minimum investment and severe financial constraints. SMEs may thus opt for refraining from R&D and relying more on innovation management tools in order to achieve innovation success. We analyse whether such a strategy can pay off. Based on data from the German CIS, we find that R&D activities are a main driver for innovation success if combined with external R&D, using external innovation sources or by entering into co-operation agreements. SMEs without in-house R&D can yield a similar innovation success if they effectively apply human resource management tools or team work to facilitate innovation processes.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The ability to generate new knowledge by research and development (R&D) is generally regarded as a key driver for innovation success of firms. R&D findings are likely to result in superior product characteristics or a significant increase in production efficiency, which can be transferred into higher market success of new products or new processes. Empirical research could show a positive impact of in-house R&D on innovation success in terms of sales of new products or the degree of novelty (see Cassiman and Veugelers 2002; Becker and Dietz 2000). High investment in R&D by SMEs was also found to increase patent outcome and total factor productivity (see Cohen et al. 1987; Rogers 2004; Lee and Sung 2005; Plehn-Dujowich 2007; Kim et al. 2004; Van Dijk et al. 1997). At the same time, R&D is a costly and risky activity that demands a minimum amount of resources and time in order to achieve results. SMEs may face particular barriers while investing in in-house R&D, which add to the general constraint for private R&D investment resulting from knowledge spillovers. High fixed costs and a high minimum size of R&D projects demand a high financial commitment, put pressure on profits and imply high risk on firm survival in case an R&D project fails to deliver. Financing R&D is particularly challenging for SMEs as loans are rarely available due to high risk exposure (i.e. not bankable risk) and lack of collaterals, while both loan and equity financing are hampered by information asymmetries as well as high management costs on the side of the financer in order to evaluate and monitor investment into SMEs (see Hall 2002). Given these constraints, SMEs may refrain from continuous R&D activities. In order to still benefit from the opportunities of innovation, they could try to invest in less risky and costly activities to generate innovations, particularly by putting more emphasis on managing innovation processes and fully exploiting their innovative potentials by appropriate management techniques, including the use of external knowledge.

The aim of this paper is to empirically analyse whether such a strategy pays off. For this purpose we distinguish among technological competence, organisational skills for managing innovation and network competence as driving forces for innovation success (see Ritter and Gemünden 2004). While technological competence is closely related to in-house R&D, organisational skills refer to practices for smoothly organising innovation processes, including intra-firm communication and incentives for employees to actively contribute to innovation efforts (see Tidd et al. 2005; Hidalgo and Albors 2008). Network competence relates to a firm’s ability to use external sources of innovation and incorporate them into the internal innovation processes. In practice, a firm will have to combine all three fields of competence to successfully innovate. In this paper, we are particularly interested in whether SMEs that decide not to engage in in-house R&D can compensate for the resulting deficiency in technological competence by investing more into organisational skills and network competence. From this reasoning, three research questions emerge:

-

(1)

Are SMEs that invest into in-house R&D more successful in their innovative efforts than innovating SMEs without in-house R&D?

-

(2)

Are there innovation management strategies that allow non-R&D performing SMEs to achieve similar innovation success compared to SMEs with in-house R&D?

-

(3)

What elements do successful innovation management consist of?

These questions are relevant to innovation policy targeting small businesses. Since policy attempts to support successful innovation as a means to increase wealth, it is pertinent to know what barriers prevent firms from successful innovation, and what type of public support is needed to maximise innovation success. Innovation policy in most industrialised countries assumes that supporting R&D is critical in this respect, both in small and large firms. This policy approach may be challenged in case the link between R&D and innovation success is weak in SMEs, and innovation success is actually driven by sophisticated innovation management.

In the next section, we discuss the role of R&D and innovation management in SMEs with a particular focus on the likely constraints SMEs may face when engaging in R&D. Section 3 discusses our approach to measuring innovation success in SMEs and Sect. 4 presents our empirical model. The data used are described in Sect. 5, while Sect. 6 summarises the model estimation results and discusses main findings. Section 7 concludes this paper.

2 R&D and innovation management in SMEs

R&D is by no doubt a major ingredient in innovation. Exploring new ways of solving technical problems, employing new technologies to meet user demand, and developing new technologies to produce and deliver goods and services will help firms to generate innovations that outperform competitors and help innovators to gain market shares and increase profitability. Yet, investing into R&D is associated with high costs and risk. Any firm will thus have to balance between the expected benefits from successful R&D and the costs and probability of failure when engaging in R&D. There are several features of R&D that are likely to result in systematic differences between small and large firms with respect to conducting in-house R&D:

-

R&D is subject to minimum project sizes in order to generate useful results due to technical indivisibilities. SMEs will thus have to invest a higher share of their resources to R&D than large firms, limiting their ability to invest in other business areas such as marketing. Minimum costs may even be as high to prevent SMEs from any R&D investment (see Galbraith 1952, p. 92).

-

R&D is associated with high entry costs, i.e. specific investment into laboratory equipment and human capital. Given that R&D is subject to technical indivisibilities, SMEs will have to invest a high share of their total sales to set up R&D. In case of stopping R&D, this investment is likely to be sunk costs.

-

R&D costs are largely fixed costs. SMEs have to spread these fixed costs over a smaller sales base more than large firms, militating either profitability or price competitiveness and restricting available cash flow to finance R&D in the future (see Cohen and Klepper 1996).

-

R&D activities are highly idiosyncratic. Outsiders such as external financers will find it difficult to evaluate the prospects of a firm’s R&D efforts in terms of risk and technical and economic potential without a firm-specific history of success and failure over a larger number of projects. SMEs, and especially young firms, are less able to provide such a track record and may suffer restricted access to external finance.

-

Most R&D is investment, i.e. returns, if any, are generated in later periods than expenditures occur. While R&D demands pre-financing, most R&D is current expenditures for staff and material and does not qualify as collaterals for debt financing. Lack of collaterals and information asymmetries on R&D project perspectives raise costs of external funding (see Freel 2000; Czarnitzki 2006; Tiwari et al. 2007). Financing in-house R&D thus strongly rests on internal funding sources. Their availability tends to be more restricted in SMEs due to a smaller cash flow.

-

R&D is risky, and many R&D projects fail. While large firms are able to spread risk by running a portfolio of different R&D projects at the same time, SMEs will have to focus on one or a few projects only. Failure of a single R&D project may increase the risk exposure of the firm as a whole substantially. This is particularly relevant when SMEs finance R&D through debt using non-R&D assets as collateral. Liquidating these assets in case of failure of R&D projects may jeopardise the entire business.

These features of R&D typically result in a lower propensity of SMEs to conduct R&D. This is regularly revealed by data from innovation surveys which cover a random sample of firms from various size classes (see Kleinknecht 1989; Santarelli and Sterlacchini 1990). Current data from the German Innovation Survey conducted in 2007 (see Table 1) show that across a large set of manufacturing and service sectors, the share of firms with in-house R&D activity on a permanent basis increases steadily by size class, from 8.2% (firms with five to nine employees) to 52.3% (500 and more employees). The same holds true when the sector coverage is restricted to sectors where competition is particularly based on research, innovation and new knowledge. “Permanent R&D” refers to R&D activities that are performed continuously and independently from actual demand for developing or improving technology. Permanent R&D activities typically imply a certain number of staff which is solely assigned to R&D, and investment into dedicated laboratory equipment.

While most SMEs refrain from conducting R&D permanently, a large share of SMEs still conducts innovation activities since this may help them to compensate for various other liabilities of smallness (see Brüderl and Preisendörfer 1998). About a third of innovative firms with no permanent in-house R&D perform R&D on an occasional basis. They devote resources to R&D only in case there is a direct demand from other business functions such as production or marketing. This strategy reduces fixed costs of R&D and limits funding requirements. A main drawback may be less sophisticated R&D outputs in terms of technological advancement and novelty since occasional R&D restricts the resources to continuously monitor relevant technology trends and reduces the capacity to absorb external knowledge.

The majority of innovative firms without permanent in-house R&D refrain from any kind of R&D activity. These firms may rest on technology and knowledge inputs from external sources such as suppliers or consultants. But they may also have found ways other than R&D to exploit internal innovation potentials and access external sources for innovation. In particular, sophisticated innovation management methods could help firms to achieve similar results with innovations and market success as R&D performing firms do. Innovation management covers a broad set of tools and techniques (see Nijssen and Frambach 2000; Hidalgo and Albors 2008). We use the term here to denote all activities of firms targeted at organising the innovation process in a way to maximise the outcome in terms of market success with new products and new processes. Innovation management includes measures to facilitate both internal processes and external links. Facilitating internal processes include organisational skills for identifying innovation ideas, providing incentives to managers and improving co-operation among business units and departments. Monitoring R&D and innovation projects with a particular focus on identifying a project’s prospects (and stopping those that will not deliver) is another key element of innovation management.

Improving external links requires network competence such as techniques to identifying innovation impulses from customers, leveraging suppliers as source of innovation or absorbing knowledge from other organisations, including competitors and public research. Entering into R&D co-operations, research joint ventures or other forms of partnerships are popular ways to access knowledge available at other organisations. Identifying, accessing and absorbing external knowledge requires certain capabilities often associated with conducting in-house R&D (Cohen and Levinthal 1989, 1990; Rosenberg 1990). Balancing between internal R&D efforts and external knowledge acquisition is thus another major concern of innovation management (see Arora and Gambardella 1994; Cassiman and Veugelers 2002). In recent years, the notion of “open innovation” (Chesbrough 2003; Roper et al. 2007) has directed attention to the management of various external links in innovation, including human capital and finance.

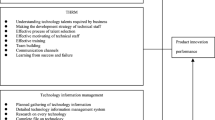

While innovation management activities of firms may be categorised in many different ways (see Tidd et al. 2005; Adams et al. 2008), we distinguish four areas of innovation management practice through which firms may improve their innovative performance, the first two are related to organisational skills, the latter two to network competence:

-

Human resource management (HRM) aims at increasing incentives for managers and employees to engage in innovation activities and develop skills needed for effective innovation efforts. In particular, HRM needs to motivate and enable individuals to experiment with new ideas (Shipton et al. 2005). Management practices include recruiting methods to identify the right people for promoting innovation within an organisation, training for handling innovation challenges, as well as reward systems, performance management systems and career development tools that help in the formation of innovative ideas of employees.

-

Team working is intended to facilitate knowledge sharing, develop mutual trust and help overcoming organisational barriers. The role of teams for increasing performance has first been shown for production (Levine 1995) and quality management (see Högl and Gemünden 2001). With regard to innovation, creating cross-functional teams has been identified as particularly important for accelerating innovation processes from R&D to marketing (see Zeller 2002) and smoothing information flows among different business units (Allen 1983). The importance of cross-functional co-operation for innovation success was shown by Cooper and Kleinschmidt (1995), Love et al. (2006), Love and Roper (2004) and Song et al. (1997). Management tools range from joint workshops, knowledge information systems for open cross-functional communication and innovation circles to initiate a temporary exchange of personnel across units.

-

Searching external sources of innovation aims at identifying valuable impulses from customers, suppliers, competitors or universities and other public research organisations in order to orient innovation efforts (see Katila and Ahuja 2002; Laursen and Salter 2006). Key management issues refer to methods of identifing key innovation sources such as lead customers or lead markets (see von Hippel 1988; Beise 2004), to assess the value of external sources and to develop in-house capacities to incorporate these impulses into the innovation processes.

-

Co-operation in innovation and other forms of partnering and external knowledge acquisition should provide access to complementary knowledge (see Baumol 2002) and can help sharing the costs and the risk of innovative activities (Hagedoorn 2002). Co-operations typically rest on formal agreements. Managing intellectual property issues and the distribution of costs and returns of joint innovative efforts are key management issues of this type of innovation practice.

Results from the German Innovation Survey in 2003, which contained a large set of questions on innovation management practices, show that each of the four above-mentioned areas is widely used (see Table 2).Footnote 1 72% of innovative firms in Germany effectively use team work, i.e. these practices were assessed as highly important for facilitating innovation processes. A similar share effectively employs searching for external innovation sources, i.e. they were able to identify these sources and transfer external impulses into new products or processes. HRM is effectively used by 57% of all innovative firms, and 48% engage in co-operation agreements for developing innovations.

While large innovative firms show the highest shares for all four areas, size differences in the effective use of innovation management practices within the group of SMEs are marginal. This suggests that there are few if any size-related barriers to apply innovation management techniques successfully. What is more, innovation management practices are widespread in all sectors. Firms in research and knowledge intensive sectors do not show a significantly stronger use of any of the four practices. This pattern is in stark contrast to the finding for permanent in-house R&D.

3 Innovation success in SMEs

The key purpose of our analysis is to compare the level of innovation success among innovative SMEs with varying in-house R&D activities and innovation management practices. A proper measure of innovation success has to respond to three challenges. First, the measure must represent both product and process innovation success, since R&D and innovation management activities can target both types of innovations. Secondly, the measure should distinguish between more and less successful innovators. Thirdly, the measure has to be neutral to firm size.

Measures of innovative output such as patents or sales with new products, which are typically used in empirical studies on innovation success (see Kleinknecht et al. 2002), do not fully meet these requirements. While patents are clearly a valid measure for the success of R&D efforts (see Griliches 1984; Hall et al. 1986, 2001), output of other types of innovative activity may be incompletely captured by this indicator. What is more, smaller firms may be reluctant to use patents due to high patenting costs and a lack of experience in successfully defending their intellectual property rights against offense (see Soete 1979; Acs and Audretsch 1988, 1991; Licht and Zoz 2000). Another drawback of patents as an indicator of success is the lack of market evaluation since patents give no indication whether the new technological knowledge protected by patents was transferred into market success.

Studies based on innovation survey data most often use the share of sales generated by new products as a success indicator (see Crépon et al. 1998; Belderbos et al. 2004; Lööf and Heshmati 2002; Janz et al. 2004; Griffith et al. 2006; Parisi et al. 2006; Roper et al. 2007), sometimes distinguishing between new-to-the-market and new-to-the-firm products (see de Jong and Vermeulen 2006). The main drawback of this indicator is its sole focus on product innovation success. Some authors argue that most process innovation is related in some way to product innovation (Mohnen and Röller 2005), but there are clearly many successful process innovations that are not related to product innovation success, particularly with regard to cost saving process innovation.

In this study, we propose an alternative measure of the level of innovation success in innovative SMEs that meets all three requirements. We focus on an SME’s ability to introduce “challenging” innovations, i.e. innovations that demand particular efforts and are likely to alter an SME’s market position very significantly. We furthermore suppose that a firm which is able to introduce more “challenging” innovations at the same time is more successful than one introducing less.

For product innovation, we propose that innovation success in terms of an innovation effects on a firm’s market position basically depends on the degree of novelty. A high degree of novelty will result in a more pronounced product differentiation vis-à-vis competitors, is more likely to gain new customers and will allow a firm to realise higher mark-ups. A high degree of novelty is especially relevant for SMEs in order to distinguish themselves from larger competitors and compensate for liabilities of smallness such as a lack of reputation and less resources for marketing new products. There are two types of novelty to be distinguished: A market novelty is a new product that has not been supplied in the same or a similar form on a firm’s market yet. Market novelties need not be the world’s first necessarily since a firm’s market may be restricted to a certain region or group of customers. Another type of novelty refers to a firm’s range of products. “Product line novelties” are new products that have no predecessor product within the firm. They allow firms to enter a new market or market segment. While a product line novelty may either be a market novelty or an imitation of products offered by other firms in the respective market (segment), it challenges a firm’s management as it may demand new ways of production, distribution and marketing. Introducing both market and product line novelties at the same time means that SMEs will have to cope with new market environments and will have to convince their customers of new product features their are not familiar with yet. Yet, a new product may be a market novelty and a product line novelty at the same time in case a firm enters a new market by offering a product that has not been offered at that market by any other firm before. In this case, a firm is taking particularly high risk which may be compensated by particularly high gains in market shares and profits. If having introduced such an innovation successfully it is fair to consider this firm as being more successful with introducing challenging innovation than a firm with a market novelty or a product line novelty only.

For process innovation, we argue that a successful introduction of new processes can basically yield to two types of outputs: a decrease in unit costs of production and an increase in the quality of production processes. A new process that reduces unit costs may be called “efficiency innovation” and is likely to increase price competitiveness of firms, resulting in higher profits or higher market shares (see Peters 2008). Quality improving process innovation (“quality innovation”) may allow for product differentiation, which could have a positive impact on a firm’s competitiveness. While efficiency innovations often focus on automation, simplifying procedures and realising synergies, quality innovations are likely to demand more precise and sometimes more time consuming and costly production processes. Quality innovations constitute a separate output dimension since they aim at increasing product and service quality (of both new and old products), resulting in higher sales either through an increase in demand or through higher product prices. Quality innovations are particularly relevant in services since many service innovations rest on reshaping processes in a way to better respond to new customer needs (see Miles 2005). Combining both outcomes of process innovation indicates a particularly challenging type of process innovation activity.

All four types of innovation success may be measured through qualitative and quantitative indicators. Qualitative indicators simply indicate whether a firm has introduced a certain type of innovation during a given period of time. Quantitative indicators capture the significance of these innovations in a firm’s total activities. We use the sales share of market novelties and product line novelties as well as the share of unit costs reduced by efficiency innovations and the increase in sales due to quality innovations as indicators of quantitative innovation success. In order to obtain a single success measure, we construct a simple index following Bresnahan et al. (2002) by applying a z-transformation to each indicator (i.e. an indicator’s mean over the whole sample is subtract from a firm’s value of this indicator, divided by the standard deviation) and summing up the transformed values.

A main drawback of this indicator is its size dependence. When looking at the group of firms that have successfully introduced a certain type of innovation, quantitative innovation success is systematically higher for very small firms compared to medium-sized or large firms (see Table 4). One may argue that very small firms are particularly successful innovators and much more capable to generate high sales shares, cost reductions and sales growth from innovations than large firms. We rather believe that the result shown in Table 3 reflects effects of small numbers which makes it more likely for very small firms to obtain high indicator values due to small base values (i.e. a low volume of sales or a low amount of total costs).

One may response to this problem by either calculating size class specific success indicators or by controlling for size class effects in econometric modelling. There is still another drawback, however, which refers to effects of a firm’s number of different products and processes on the level of innovation success as measured by the above mentioned indicators. Suppose an SME that just offers one product which is replaced by a new product which is new to the firm’s market. If this new product is successfully introduced, it will generate a sales share of 100%. In contrast, a firm which offers two products (each generating half to total sales) and which replaces one of its products by a market novelty successfully will report a sales share with market novelties of 50%. One may argue, however, that both have obtained a similar degree of innovation success since both were able to develop a market novelty and introducing it to the market. A similar argument can be made with respect to sales growth due to quality innovations and the magnitude of cost savings from efficiency innovations which are also likely to be higher the lower the number of different processes a firm applies.

Since our data do not contain information on a firm’s number of different products and processes we are not able to control for a resulting bias in the innovation success indicator. We thus refrain from applying a quantitative indicator but instead use a count variable which counts the number of different challenging innovations (market novelties, product line novelties, efficiency innovation, quality innovation) introduced within a certain period of time. We argue that an SME that was able to introduce both market and product line novelties and at the same time implement new process technologies that yield to both cost savings and quality improvements is obviously successful in reshaping its market position substantially through innovation, both in terms of product differentiation, entering new markets and improving price competitiveness. While the immediate quantitative impact of these innovations in terms of sales shares, cost savings or sales growth may vary considerable among individual firms, these differences do not adequately reflect the likely long term effects of such innovations. On the other hand, firms having introduced innovations that were neither market novelties nor product line novelties, efficiency innovations or quality innovations will obtain significantly smaller returns from their innovative activity. These firms did introduce product imitations (i.e. new products in their established market which were offered by competitors already before) or process innovations that did not yield any significant changes in costs or quality. For firms with one to three different types of “challenging” innovation, we assume that innovation success always increases when another type of innovation is successfully introduced, regardless of the type. While one may argue that some of the four types innovations are more valuable than others, particularly with regard to market novelties (which may give a firm temporary monopoly), we stress the strategic importance for an SME being able to compete on several dimensions of innovations. It clearly increases a firm’s ability to response to changing market environments and competitive strategies of competitors, and it reduces an SME’s dependence from one particular innovation. We thus treat our innovation success indicator as a categorical variable which reflects the degree of complex innovation an SME is capable to introduce at the same time.

Results from the most recent innovation survey in Germany show that out of all firms with product or process innovations within a 3-year period, 29% introduced market novelties, 30% product line novelties, 38% efficiency innovations and 41% quality innovations (see Table 4). While large firms show the highest shares throughout, size effects seem to be more prevalent for product line novelties and less for efficiency and quality innovations. Only 5% of all innovators were able to succeed with all four types. Ten percent could introduce three different types within a 3-year period. About a quarter of all innovators introduced none of the four types, i.e. they either introduced mere imitations or new processes that did not result in lower unit costs or higher product quality.

4 Empirical model

For investigating our research questions, we analyse the effects of conducting R&D and using various types of innovation management tools on an SME’s success in introducing complex innovations. We start from a base-line model that links innovation success SUC (i.e. the index described above) to R&D input, innovation management efforts and a set of k control variables (CTR). R&D input in SMEs can relate to in-house R&D and external R&D (i.e. contracting out R&D to other firms or universities). Following Cassiman and Veugelers (2006), we allow that combining in-house and external R&D may have different effects than doing only in-house or only external R&D. A firm’s i R&D input is thus measured by three dummy variables: in-house R&D conducted on a permanent base (RI), external R&D (RE) and an interaction term (RI*RE).Footnote 2

Since SUC can be observed for innovating firms only, one has to take into account a potential selection bias. When analysing SUC we perform regressions conditional on the fact that the firm is an innovator. If innovating and SUC are correlated, the estimates using only innovators would be biased. Hence, we apply a sample selection model where we first model the decision to be innovative and second analyse SUC. As SUC is an ordinal variable we cannot apply the well-known sample selection model by Heckman (1979). Due to the non-linearity of the Ordered Probit model, we have to estimate the two equations jointly by Full Information Maximum Likelihood (FIML) where we allow error term correlations across the two equations. Thus, a selection equation estimates the probability that firm i introduced an innovation INN depending on a set of explanatory variables (EXV), while a success equation models the effects of R&D input and a set of control variables CTR on the level of innovation success of an innovating firm (SUC). The baseline model thus reads:

where we observe INN = 1 if INN* > 0 and INN = 0 otherwise. SUC is only observed if INN = 1, and takes values from 0 to 4. Assuming a joint normal distribution of the two error terms allows us to estimate the model by familiar FIML techniques. For technical details, see Miranda and Rabe-Hesketh (2006).

Following the literature on a firm’s propensity to innovate (see Crépon et al. 1998; Cohen 1995; Acs and Audretsch 1988; Bhattacharya and Bloch 2004), we use firm size, firm age, a firm’s ability to absorb knowledge (measured by the share of skilled labour), the market environment (captured by the significance of export markets for a firm’s total sales) and whether a firm belongs to an enterprise group as explanatory variables EXV in (1a). The control variables CTR in (1b) include size and age (the latter controlling for likely effects of market and technology experience), the financial input devoted to innovative activities (as a share in total sales), receipt of public subsidies for innovation (which is likely to increase the available funds for innovation at almost zero costs and should thus enable the firm to devote larger efforts to developing and successfully introducing challenging innovations) and lagged export intensity (as a proxy for the competitive environment, assuming stronger competitive pressure on firms substantially engaged in foreign markets). Furthermore, we control for sector affiliation and region.

In a further step, we add a firm’s innovation management practice to (1b), the selection Eq. 1a remaining unchanged. Dummy variables capture whether a firm effectively uses human resource management (HRM), team work and cross-functional co-operation within the firm (TMW), searching for external sources of innovation (SEA), and co-operation with external partners to develop innovations (COP).

We assume that engaging in in-house R&D activity is a basic decision any innovative SME will have to make. Since SMEs are faced with specific constraints to enter into this activity, some SMEs will opt to not perform R&D. In order to identify whether these firms can achieve similar innovation success through focusing on innovation management, we interact RI and the four variables of innovation management, thus distinguishing between firms conducting both in-house R&D and applying certain innovation management practices at the same time, and those using innovation management without in-house R&D:

By keeping RI as a separate variable in the model, we can test whether conducting in-house R&D adds to innovation success when controlled for interaction effects between R&D and innovation management. A positive and statistically significant value for β1 in (3) suggests that R&D performing firms have an advantage in generating complex innovations over non-R&D performing firms which cannot be fully compensated through innovation management. Equation 3 can also be used to apply a simple test of substitution effects between in-house R&D and the four innovation management practices on innovation success. Substitution is present if

that is, the combined effect of conducting in-house R&D jointly with a certain innovation management practice m is statistically not significantly higher than the effect of applying innovation management practice m without in-house R&D.

Aside from a potential substitution of R&D by innovation management practices, we are also interested in exploring the most successful ways of managing innovation processes in SMEs. For this purpose, we construct a dummy variable for different “innovation management practices” (IMP) for all 16 combinations n of HRM, TMW, SEA and COP. Innovation management practice is multiplied by RI and (1 − RI) in order to separate practices in R&D and non-R&D performing firms.

For each combination of innovation management practices, we can then test whether internal R&D plus a certain management practice combination leads to a higher output compared to the situation where a firm applies this practice without conducting permanent R&D. Furthermore, the test for substitution effects (4) can be applied accordingly.

5 Data

The study rests on data from the German Innovation Survey, which is the German contribution to the EU’s Community Innovation Survey (CIS). While the German Innovation Survey fully complies with the methodological recommendations for CIS surveys and adopts the standard CIS questions, it goes beyond the CIS design in three important respects (see Janz et al. 2001, for a more detailed discussion). First, the German Innovation Survey is designed as a panel survey and is conducted every year. Every year the same gross sample of firms is surveyed, refreshed biannually to compensate for panel mortality. The Survey is conducted by the Centre for European Economic Research (ZEW) located in Mannheim, thus also known as the Mannheim Innovation Panel (MIP). Secondly, the MIP contains a significantly larger number of questions compared to the harmonised CIS questionnaire, which allows for a much more in depth analysis of relations between firms’ innovation activities, their market environment and their economic performance. Thirdly, the MIP has a somewhat broader sector and size coverage than the CIS standard, including firms with five to nine employees and covering a larger set of service sectors.

This paper uses data from the survey wave 2003. In this year, the questionnaire contained a number of special questions related, among others, to the use of external innovation sources and innovation management practices in the areas of human resource management and cross-functional teams. The gross sample of the survey was 25,791 firms, from which 3,272 were classified as neutral losses due to firm closure, mergers and acquisitions or other events. 4,583 firms responded to the survey, which equals 20.2% of the gross sample corrected for neutral losses. The low response rate, which is in line with that of other survey years, is a common phenomenon of voluntary firm surveys in Germany. It reflects the very large number of firm surveys that target the same firm population. As a result, firms are rather reluctant to participate in voluntary surveys, causing a low response rate for all of these surveys. Since a low response rate may cause a bias in the net sample with respect to key variables such as the share of innovating firms, a comprehensive non-response survey (NRS) was performed. Out of non-responding firms, a stratified random sample was drawn and firms were contacted by telephone and questioned on a few key innovation variables (product and process innovations, R&D activities). The response rate of the NRS was about 85%, and the net size 4,120. Taking the net sample and the NRS together, the total response rate was 38.4%. While 53.2% of all firms in the net sample reported to having introduced innovations during 2000 and 2002, this share was 59.8% in the NRS. When controlling for differences in the size and sector structure of both samples, there were no statistical differences in the propensity to innovate between the net sample and the NRS.

We restrict our analysis to firms with less than 250 employees, following the standard definition of small and medium-sized enterprises (SMEs) as used by the European Commission. 3,602 firms of the net sample (=79.4%) are SMEs, of which 1,715 (=47.6% of all SMEs) introduced either product or process innovations during 2000 to 2002. Since not all firms provided full information on all model variables, the number of SMEs available for model estimations reduces to 2,841, of which 1,049 are innovators. These firms constitute the empirical base of this study. The number of innovators is reduced stronger than that of non-innovators since we require more information from innovators, particularly on their innovation management practice and their innovation success. The size and sector structure of innovators without full information is not statistically different from the one of innovators with full information (see Table 8).

All variables related to innovation activities, including the dependent variable, R&D input and innovation management practices refer to a 3-year reference period (2000–2002), complying with CIS survey methodology. This standard practice in innovation surveys may imply an endogeneity problem in case the events measured through the success variable took place prior to R&D activities or the use of certain innovation management practices. To limit this problem, we consider market novelties, product line novelties, efficiency innovations and quality innovations for construction the dependent variable SUC only in case a firm reported positive economic results with the respective type of innovation in 2002 (i.e. positive sales, positive cost savings or a growth of sales).

Innovation success is measured as a count variable that sums up the occurrence of successfully introducing market novelties, product line novelties, efficiency innovations and quality innovations. We tested alternative indices, for example by adding an extra unit to the index in case of market novelties or if both product and process innovations were introduced. We also tested a variant of SUC by merging categories 2 and 3 into one category, i.e. distinguishing between firms with no “challenging” innovations, with only one, with two to three, and with all four. Using these alternative measures did not alter any of the main estimation results. We therefore proceeded with the simplest variant of the index. Table 8 in the Appendix shows the number of observations by combination of innovation type that form our innovation success index. The additional regression and test results can be found in Tables 9 and 10.

Variables on R&D are directly taken from the corresponding questions in the questionnaire. Each of the four innovation management variables combines a set of separate questionnaire items. The survey contained a set of nine items on different human resource management instruments which are frequently used in businesses to support innovationFootnote 3: (1) innovation output as part of goal agreements with managers, (2) identifying, promoting and committing individuals who drive innovation processes, (3) recruitment and training of skilled personnel needed for innovation, (4) delegating decision making of innovation managers, (5) financial incentives for innovation managers, (6) non-financial incentives for innovation managers, (7) incentives for employees to develop and report innovation ideas, (8) organisational measures for a more efficient use of human capital such as innovation circles and (9) engaging employee representatives in implementing innovations. Firms had to assess the contribution of each instrument to support innovation in their firm on a 3-point Likert scale. Firms had the option to add further HRM practices as free text. Since the items refer to different firm environments, not all of them are equally relevant to a specific firm, i.e. some may only be applied in larger firms. We assume that a firm that uses at least one instrument (including the one stated as free text) with a highly important contribution to in-house innovation has an effective human resource management of innovation in place. This procedure seems to be supported by the fact that all nine items on HRM are highly correlated.

Team working is measured through seven items: (1) supporting informal contacts, (2) joint development of innovation strategies, (3) open communication of innovation ideas, (4) mutual support for coping with innovation challenges, (5) regular meetings of heads of business units to discuss innovation-related issues, (6) temporary exchange of personnel in the context of innovation projects and (7) cross-functional innovation workshops. We construct the TMW variable in the same way as for HRM, i.e. a firm applying at least one highly important team work instrument is regarded as having effective cross-functional co-operation in innovation.

Information on firms’ success in searching for external sources of innovation is taken from an extensive question on the significance of different innovation sources and their impact on innovation (see Sofka 2008; Beise-Zee and Rammer 2006, for more details on this question). Essentially, firms were asked for five external sources (customers, suppliers, competitors, universities/other public research organisations, regulation) which have triggered innovation, i.e. provided innovation impulses that were essential to successfully introduce an innovation. The significance of each source was surveyed separately for product and process innovation. We construct a dummy variable taking one, if at least one source, out of customers, suppliers, competitors, universities/other public research organisations was decisive for introducing a product and process innovation in 2000–2002. We do not consider regulations here since regulation-led innovation need not coincide with search strategies.

The presence of co-operation agreements in innovation is measured by combining three questions. Firms with product and process innovation had to indicate whether these innovations were predominantly developed in-house, in co-operation with external partners or by others. All firms reporting a predominantly co-operative development of either product innovations or process innovations are regarded as having an effective co-operation practice. Since there may still be innovations based on co-operation in firms that predominantly develop innovations in-house, we also consider firms stating that they were engaged in innovation co-operation agreements with external partners.

Most control variables were taken directly from corresponding questions in the questionnaire (the full questionnaire can be found in Rammer et al. 2005). Firm age was calculated using firm formation data from the Creditreform data base (the largest credit rating agency in Germany), which also serves as sampling pool for the MIP. Table 5 reports definitions and descriptive statistics for all model variables. The median firm in the sample for model estimations has 35 employees and is 12 years old. Mean size (61 employees) and age (15.4 years) are somewhat higher.

With respect to our key variables, 51% of all innovating firms conduct in-house R&D on a permanent basis, and 35% of all firms contract out R&D. HRM as an innovation management tool is used effectively by 55%. Seventy-four percent of innovating firms report that team work and other methods of cross-functional co-operation are highly important for supporting innovation. Seventy-one percent of innovating firms have successfully searched for external sources of innovation, and 54% were engaged in co-operation agreements or have developed innovations in a co-operative way with external partners. Correlation coefficients among model variables can be obtained from the authors upon request.

6 Model estimation results

The results for the selection equation on INN* > 0 are similar for all four models estimated. As expected, the propensity to innovate increases with firm size. This is also the case for the share of highly skilled employees (HUC). Firms competing internationally, i.e. firms reporting export activity, are also more likely to innovate, which is possibly due to higher competitive pressure on international markets. Firms located in Eastern Germany innovate less than Western Germany companies, and younger firms are more likely to introduce new processes or products to the market (see also Huergo and Jaumandreu 2004). Finally, as one would expect, there are also significant differences in innovation propensity across industries.

When it comes to correlations across the innovation input and output equations, we only find weak selection effects. Only in models 2 and 3, the correlation of error terms, RHO, is significant at the 10% level. That points to the fact that our second stage equation describes the innovation outcome in a satisfactory way, and that one does not have to worry too much about an omitted variable bias (which is captured through selection correction). However, as the selection term is significant in two models, we prefer to report the full models rather than results of models ignoring potential selectivity.

With regard to the second equation on innovation outcome the baseline model (see Table 6, model 1) shows that both internal R&D and external R&D matter for generating complex innovations in SMEs. However, we do not find significant interaction effects of internal and external R&D. This may be due to the fact that we only consider SMEs which may not be able to realise as significant economics of scope in their R&D as large firms would possibly do. If R&D projects in SMEs are significantly smaller or less complex than in large firms, and SMEs have less projects in total, the cross-fertilisation among projects and different sources of knowledge is thus limited.

When we add the innovation management variables (see model 2), the results concerning R&D remain robust, and we see an additional positive effect on innovation outcome of human resource management, successfully searching for external sources of innovation, and co-operation agreements. Teamwork has no effect, though.

The results are somewhat different when controlling for interaction effects of permanent R&D and innovation management (model 3). For in-house R&D performers, searching for external sources of innovation and co-operation agreements do matter while for non-R&D performers, applying each of the four types of innovation management practices increase innovation success. Effects are stronger for human resource management and team work than for searching external sources and co-operating in innovation. This result points to different effects of innovation management in R&D performers and non-R&D performers.

As certain management practices may not only substitute R&D, but are also substitutes among each other, we turn to the results of our model 4. As a “summary” result from the combination of significant interaction terms, it turns out that searching for external knowledge dominates the positive impact of the management practices for R&D performers. For non-R&D performers, results are more mixed. Strong effects on innovation success are observed for all practices that combine three or all four innovation management tools as well as for combining HRM and team work, team work and searching, as well as searching and co-operating. Non-R&D performers can also yield higher innovation success when applying only HRM and only team work tools.

In order to investigate the main research question “can non-R&D performers obtain similar innovation output as R&D performers through a sensible mix of management practices” further, we conducted Wald tests on whether the coefficient of R&D plus a certain management practice combination is significantly larger for R&D performers than the output obtained by non-R&D performers using the same combination of management tools. As can be seen from Table 7, R&D performers achieve a higher index on the dependent variable than non-R&D performers for the vast majority of management tool combinations, except in two cases. However, in most cases the difference between the two types of firms is not statistically significant. We only find that R&D in combination with searching for external innovation sources outperforms the non-R&D performers significantly, which is in line with the open innovation paradigm. All three differences that are statistically significant involve searching for external sources. If, however, an R&D performing firm does not use external sources, there is no combination of management practices that makes an R&D performer better off than an innovating firm that decided not to conduct own internal R&D.

With regard to the control variables in the regression models, only few variables affect innovation success. Young firms are more likely to introduce complex innovations. This finding adds to Huergo and Jaumandreu’s (2004) result on a higher innovation propensity of young firms. There are no size effects,Footnote 4 and only weak sector effects in models 2 and 3. Surprisingly, the share of innovation expenditure in total sales does not affect the innovation success of innovating SMEs in terms of complex innovations. The same is true for public subsidies. SMEs having received public money to conduct innovation activities do not show a higher innovation success (if at all, the variable is negative and marginally significant in models 3 and 4). Note that this does not question a general positive effect of R&D subsidies on innovation in the economy. This is already captured by the covariates on R&D irrespective of subsidised or not. Our result just shows that the subsidised R&D does not lead to more complex innovations than privately financed R&D.

7 Conclusion

This paper explores the impact of in-house R&D and innovation management on innovation success in SMEs. Earlier studies have found that in-house R&D, particularly when combined with the acquisition of external R&D, is a main driver of innovation success. In this study, we analyse whether SMEs that refrain from in-house R&D can substitute R&D by certain innovation management practices in order to achieve a similar innovation success, and which management tools (and their combination) generates the best results. Innovation success is measured through a categorical variable that captures the extent to which an SME has successfully introduced “challenging” product and/or process innovations, i.e. innovations that significantly change the firm’s market position.

Our findings show that continuous R&D activities are a main driver of innovation success in SMEs, especially when linked to external knowledge sourcing. External sources can be tapped through different ways, including acquiring external knowledge by contract R&D, using external innovation sources such as customer, suppliers and universities, or entering into co-operation agreements with external partners. But firms without in-house R&D activities can yield a similar innovation success as R&D performers as long as they apply the right strategy. On the one hand, relying on external R&D seems to be a promising approach, while occasional R&D—that is to start R&D activities only in case a certain technological problem has to be solved—is no successful strategy. On the other hand, human resource management and team work are innovation management tools that can help non-R&D performing SMEs to gain similar innovation success as R&D performers, especially when combined with each other or combined with external knowledge sourcing or formal co-operations with external partners. Combining all four types of innovation management tools by non-R&D performers is no promising way, however. Focusing on searching external sources of innovation without in-house R&D is also a less successful strategy.

The results can be viewed from an innovation economics and innovation management point of view. If SMEs want to generate complex innovations that substantially improve their competitive position, conducting in-house R&D, i.e. developing technology competence, is important. For fully exploiting their own technology competence, acquiring external knowledge through contracting out R&D is particularly helpful. Since SMEs are highly restricted in the scope of developing new knowledge on their own, complementing their own technology resources with external knowledge widens their opportunities to successfully transfer R&D results into products and processes. External R&D also allows SMEs to limit their own risk, better control costs or R&D and specialising on those technology competences for which they have the best resources. Interestingly, SMEs without in-house R&D are not likely to catch-up to R&D performers when using external sources for innovation. It seems that only in-house R&D creates the necessary absorptive capacity to utilize outside information.

Another main finding is that applying comprehensive innovation management practices pays off when it comes to other tools than sourcing external knowledge. SMEs that are able to apply a large set of innovation management tools effectively, including human resource management, cross-functional team work, and co-operation agreements, yield similar innovation success as R&D performers. It suggests that comprehensive innovation management is a type of intangible investment which gives firms a competitive advantage. In contrast to R&D, spillovers, risk exposure and funding needs are low for this type of investment and can be handled rather flexibly, making it particularly attractive to SMEs.

Our results have some relevance for innovation policy. First, the strong focus on promoting in-house R&D often to be found in innovation policy is not fully supported by our study when it comes to SMEs. First, in-house R&D seems to be particularly effective only if combined with external knowledge sourcing. Policy initiatives should thus attempt to combine financial R&D support to SMEs with strengthening the capacities of SMEs to co-operate with other partners, including links to customers and suppliers. Secondly, innovation policy should also acknowledge the key role of external R&D in SMEs and also offer financial support to this type of R&D activity.

Since innovation management can compensate for in-house R&D if applied in the right way, policy may try to identify likely barriers in SMEs preventing them from effectively using innovation management practices, particularly human resource management and team working. Measures to make SMEs familiar with such management tools, for example, through best practice diffusion, may be another helpful policy approach.

Notes

Definition and measurement of the four areas of management practice are described in Sect. 4.

In Sect. 2, we argued that conducting in-house R&D occasionally is another type of R&D input which may be preferred by SMEs since it involves less investment, less financial resources and bears less risk. As this paper is about whether SMEs need to invest into R&D as a permanent activity in order to achieve high innovation success or whether they can substitute R&D by some type of innovation management, we refrain from considering occasional R&D in the remainder of the paper. Estimation results of extended models that also included a term for occasional R&D and an interaction term for occasional and external R&D showed that neither of the both terms was statistically significant, indicating that occasional R&D does not support innovation success in SMEs in our empirical set-up.

The authors would like to thank Norbert Janz and Hans-Georg Gemünden for their conceptual contribution in the design of this question as well as the one on team work and cross-functional co-operation.

This also holds true when using the log of the number of employees instead of size class dummies, and there are also no non-linear effects of size.

References

Acs, Z. J., & Audretsch, D. B. (1988). Innovation in large and small firms. American Economic Review, 78, 678–690.

Acs, Z. J., & Audretsch, D. B. (1991). R&D, firm size, and innovative activity. In Z. J. Acs & D. B. Audretsch (Eds.), Innovation and technological change: An international comparison. New York: Harvester Wheatsheaf.

Adams, R., Bessant, J., & Phelps, R. (2008). Innovation management measurement: A review. International Journal of Management Reviews, 8, 21–47.

Allen, R. C. (1983). Collective invention. Journal of Economic Behaviour and Organization, 4, 1–24.

Amara, N., & Landry, R. (2005). Sources of information as determinants of novelty of innovation in Canadian manufacturing firms: Evidence from the 1999 statistics Canada innovation survey. Technovation, 25, 245–259.

Arora, A., & Gambardella, A. (1994). Evaluating technological information and utilizing it: Scientific knowledge, technological capability and external linkages in biotechnology. Journal of Economic Behaviour and Organisation, 24, 91–114.

Baumol, W. J. (2002). The free-market innovation machine. Princeton: Princeton University Press.

Becker, W., & Dietz, J. (2000). R&D cooperation and innovation activities of firms—evidence for the German manufacturing industry. Research Policy, 33, 209–223.

Beise, M. (2004). Lead markets: Country-specific drivers of the global diffusion of innovations. Research Policy, 33, 997–1018.

Beise-Zee, M., & Rammer, C. (2006). Local user-producer interaction in innovation and export performance of firms. Small Business Economics, 27, 207–222.

Belderbos, R., Carree, M., Diederen, B., Lokshin, B., & Veugelers, R. (2004). Heterogeneity in R&D cooperation strategies. International Journal of Industrial Organization, 22, 1237–1263.

Bhattacharya, M., & Bloch, H. (2004). Determinants of innovation. Small Business Economics, 22(2), 155–162.

Bresnahan, T., Brynjolfsson, E., & Hitt, L. (2002). Information technology, workplace organization and the demand for skilled labor: Firm-level evidence. Quarterly Journal of Economics, 117, 339–376.

Brüderl, J., & Preisendörfer, P. (1998). Network support and the success of newly founded business. Small Business Economics, 10, 213–225.

Cassiman, B., & Veugelers, R. (2002). R&D co-operation and spillovers: Some empirical evidence from Belgium. American Economic Review, 92, 1169–1184.

Cassiman, B., & Veugelers, R. (2006). In search of complementarity in the innovation strategy: Internal R&D and external knowledge acquisition. Management Science, 92, 1169–1184.

Chesbrough, H. (2003). Open innovation: The new imperative for creating and profiting from technology. Cambridge: Harvard Business School Press.

Cohen, W. M. (1995). Empirical studies of innovative activity. In P. Stonemann (Ed.), Handbook of the economics of innovation and technical change (pp. 182–264). Oxford, UK: Blackwell.

Cohen, W. M., & Klepper, S. (1996). Firm size and the nature of innovation within industries: The case of process and product R&D. The Review of Economics and Statistics, 78, 232–243.

Cohen, W. M., & Levinthal, D. A. (1989). Innovation and learning: The two faces of R&D. The Economic Journal, 99, 569–596.

Cohen, W. M., Levin, R. C., & Mowery, D. (1987). Firm size and R&D intensity: A re-examination. Journal of Industrial Economics, 35, 543–563.

Cohen, W. M., & Levinthal, D. A. (1990). Absorptive capacity: A new perspective on learning and innovation. Administrative Science Quarterly, 35, 128–152.

Cooper, R. G., & Kleinschmidt, E. J. (1995). Benchmarking the Firm’s critical success factors in new product development. Journal of Product Innovation Management, 12, 374–391.

Crépon, B., Duguet, E., & Mairesse, J. (1998). Research, innovation, and productivity: An econometric analysis at the firm level. Economics of Innovation and New Technology, 7, 115–158.

Czarnitzki, D. (2006). Research and development in small and medium-sized enterprises: The role of financial constraints and public funding. Scottish Journal of Political Economy, 53, 257–335.

De Jong, J. P. J., & Vermeulen, P. A. M. (2006). Determinants of product innovation in small firms: A comparison across industries. International Small Business Journal, 24, 587–609.

Freel, M. S. (2000). Do small innovating firms outperform non-innovators? Small Business Economics, 14, 195–210.

Galbraith, J. K. (1952). American capitalism. The concept of countervailing power. Boston: Houghton Mifflin.

Griffith, R., Huergo, E., Mairesse, J., & Peters, B. (2006). Innovation and productivity across four European countries. Oxford Review of Economic Policy, 22, 483–498.

Griliches, Z. (Ed.) (1984). R and D, patents, and productivity. Chicago: University of Chicago Press.

Hagedoorn, J. (2002). Inter-firm R&D partnerships—an overview of major trends and patterns since 1960. Research Policy, 31, 477–492.

Hall, B. H. (2002). The financing of research and development. Oxford Review of Economic Policy, 18, 35–51.

Hall, B. H., Griliches, Z., & Hausman, J. A. (1986). Patents and R and D: Is there a lag? International Economic Review, 27, 265–283.

Hall, B. H., Jaffe, A., & Trajtenberg, M. (2001). Market value and patent citations. RAND Journal of Economics, 36, 16–38.

Heckman, J. J. (1979). Sample selection bias as a specification error. Econometrica, 47(1), 153–162.

Hidalgo, A., & Albors, J. (2008). Innovation management techniques and tools: A review from theory and practice. R&D Management, 38, 113–127.

Högl, M., & Gemünden, H. G. (2001). Teamwork quality and the success of innovative projects: A theoretical concept and empirical evidence. Organization Science, 12, 435–449.

Huergo, E., & Jaumandreu, J. (2004). How does probability of innovation change with firm age? Small Business Economics, 22, 193–207.

Janz, N., Ebling, G., Gottschalk, S., & Niggemann, H. (2001). The Mannheim innovation panels (MIP and MIP-S) of the Centre for European Economic Research (ZEW). Schmollers Jahrbuch—Zeitschrift für Wirtschafts-und Sozialwissenschaften, 121, 123–129.

Janz, N., Lööf, H., & Peters, B. (2004). Firm level innovation and productivity—is there a common story across countries? Problems and Perspectives in Management, 2, 184–204.

Katila, R., & Ahuja, G. (2002). Something old, something new: A longitudinal study of search behavior and new product introduction. Academy of Management Journal, 45(6), 1183–1194.

Kim, J., Lee, S. J., & Marschke, G. (2004). Relation of firm size to R&D productivity, mimeo. Buffalo: The State University of New York.

Kleinknecht, A. (1989). Firm size and innovation. Observations in Dutch manufacturing industries. Small Business Economics, 1, 215–222.

Kleinknecht, A., van Montfort, K., & Brouwer, E. (2002). The non-trivial choice between innovation indicators. Economics of Innovation and New Technology, 11, 109–121.

Laursen, K., & Salter, A. (2006). Open for innovation: The role of openness in explaining innovation performance among U.K. manufacturing firms. Strategic Management Journal, 14, 95–112.

Lee, C.-Y., & Sung, T. (2005). Schumpeter’s legacy: A new perspective on the relationship between firm size and R&D. Research Policy, 34, 914–931.

Levine, D. (1995). Re-inventing the workplace. Washington: Brookings Institute.

Licht, G., & Zoz, K. (2000). Patents and R&D. An econometric investigation using applications for German, European and US patents by German companies. In D. Encaoua, B. H. Hall, F. Laisney, & J. Mairesse (Eds.), The Economics and Econometrics of Innovation (pp. 307–338). Dordrecht: Kluwer.

Lööf, H., & Heshmati, A. (2002). Knowledge capital and performance heterogeneity: A firm level innovation study. International Journal of Production Economics, 76, 61–85.

Love, J. H., & Roper, S. (2004). The organisation of innovation: Collaboration, cooperation and multifunctional groups in UK and German manufacturing. Cambridge Journal of Economics, 28, 379–395.

Love, J. H., Roper, S., Mangiarotti, G. (2006). Organizing innovation: Complementarities between cross-functional teams. DRUID Working Paper No. 06-27, Copenhagen.

Miles, I. D. (2005). Innovation in services. In J. Fagerberg, D. Mowery, & R. Nelson (Eds.), The Oxford handbook of innovation (pp. 433–458). Oxford: Oxford University Press.

Miranda, A., & Rabe-Hesketh, S. (2006). Maximum likelihood estimation of endogenous switching and sample selection models for binary, ordinal, and count variables. The Stata Journal, 6(3), 285–308.

Mohnen, P., & Röller, L. -H. (2005). Complementarities in innovation policy. European Economic Review, 49, 1431–1450.

Nijssen, E. J., & Frambach, R. T. (2000). Determinants of the adoption of new product development tools by industrial firms. Industrial Marketing Management, 29, 121–131.

Parisi, M. L., Schiantarelli, F., & Sembenelli, A. (2006). Productivity, innovation and R&D: Micro evidence for Italy. European Economic Review, 50, 2037–2061.

Peters, B. (2008). Innovation and firm performance. An empirical investigation for German firms, ZEW Economic Studies (Vol. 38). Heidelberg: Physica.

Plehn-Dujowich, J. (2007). Innovation, firm size, and RD search. Economics Bulletin, 12, 1–8.

Rammer, C., Peters, B., Schmidt, T., Aschhoff, B., Doherr, T., & Niggemann, H. (2005). Innovationen in Deutschland–Ergebnisse der Innovationserhebung 2003 in der deutschen Wirtschaft, ZEW Wirtschaftsanalysen (Vol. 78). Baden-Baden: Nomos.

Ritter, T., & Gemünden, H. G. (2004). The impact of a company’s business strategy on its technological competence, network competence and innovation success. Journal of Business Research, 57, 548–556.

Rogers, M. (2004). Networks, firm size and innovation. Small Business Economics, 22, 141–153.

Roper, S., Love, J. H., Du, J. (2007). The limits of open innovation: Openness and (quasi-)markets in the organization of innovation. Aston Business School Research Paper 0713, Birmingham.

Rosenberg, N. (1990). Why do firms do basic research (with their own money)? Research Policy, 19, 165–174.

Santarelli, E., & Sterlacchini, A. (1990). Innovation, formal vs. informal R&D, and firm size: some evidence from italian manufacturing firms. Small Business Economics, 2, 223–228.

Shipton, H., Fay, D., West, M. A., Patterson, M., & Birdi, K. (2005). Managing people to promote innovation. Creativity and Innovation Management, 14, 118–128.

Soete, L. (1979). Firm size and inventive activity. The evidence reconsidered. European Economic Review, 12, 319–340.

Sofka, W. (2008). Globalizing domestic absorptive capacities. Management International Review, 48, 769–792.

Song, X. M., Montoya-Weiss, M. M., & Schmidt, J. B. (1997). Antecedents and consequences of cross functional co-operation: A comparison of R&D, manufacturing and marketing perspectives. Journal of Product Innovation Management, 14, 35–47.

Tidd, J., Bessant, J., & Pavitt, K. (2005). Managing innovation. Integrating technological, market and organizational change (3rd ed.). Chichester: Wiley.

Tiwari, A. K., Mohnen, P., Palm, F. C., Schim van der Loeff, S. (2007). Financial constraint and R&D investment: Evidence from CIS, UNU-MERIT Working Paper 2007–011, Maastricht.

Van Dijk, B., Den Hertog, R., Menkveld, B., & Thurik, R. (1997). Some new evidence on the determinants of large- and small-firm innovation. Small Business Economics, 9, 335–343.

Von Hippel, E. (1988). The sources of innovation. New York: Oxford University Press.

Zeller, C. (2002). Project teams as means of restructuring research the pharmaceutical industry. Regional Studies, 36, 275–289.

Acknowledgements

The authors would like to thank Marco Vivarelli, Roy Thurik, Jacques Mairesse and the other participants of the workshop „Drivers and Impacts of Corporate R&D in SMEs”, held at the JRC-IPTS in Seville, September 19th, 2008 as well as Bettina Peters for helpful comments. The usual disclaimer applies.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

Rights and permissions

About this article

Cite this article

Rammer, C., Czarnitzki, D. & Spielkamp, A. Innovation success of non-R&D-performers: substituting technology by management in SMEs. Small Bus Econ 33, 35–58 (2009). https://doi.org/10.1007/s11187-009-9185-7

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11187-009-9185-7