Abstract

Our research clarifies the conceptual linkages among willingness to pay for additional safety, willingness to accept less safety, and the value of a statistical life (VSL). We present econometric estimates using panel data to analyze the VSL levels associated with job changes that may affect the worker’s exposure to fatal injury risks. Our baseline VSL estimates are $7.7 million and $8.3 million (Y$2001). There is no statistically significant divergence between willingness-to-accept VSL estimates associated with wage increases for greater risks and willingness-to-pay VSL estimates as reflected in wage changes for decreases in risk. Our focal result contrasts with the literature documenting a considerable asymmetry in tradeoff rates for increases and decreases in risk. An important implication for policy is that it is reasonable to use labor market estimates of VSL as a measure of the willingness to pay for additional safety.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

The fundamental principle for valuing the benefits of government policies is society’s willingness to pay for the policy effects. In the case of regulations and other government policies that reduce fatal injury risks, the policy impact to be valued is the expected number of lives that will be saved by the policy. The standard measure of the willingness-to-pay value is the tradeoff rate between money and fatal injury risks, or what is known as the value of a statistical life (VSL). Here we examine the connections between VSL as willingness to pay for additional safety or willingness to accept less safety. The estimates we present show that there is no economic or statistically significant divergence between willingness to accept and willingness to pay in the important case of worker decisions concerning their exposure to fatal injury risks.

The practice throughout the U.S. federal government for estimating the VSL to be used in benefit assessments is to rely principally on labor market estimates of VSL based on workers’ wage-risk tradeoffs.Footnote 1 Labor market estimates capture the compensating differential that workers require to incur job risks as compared to a risk-free job. Consequently, from the vantage point of a model in which workers are comparing a hypothetical baseline risk-free job with a risky job, the estimated wage-risk tradeoffs are not estimates of willingness to pay (WTP) for a decrease in risk but rather are measures of willingness to accept (WTA) for the increase in risk associated with taking the hazardous job compared to the safe alternative. Given the assumptions of standard hedonic labor market models, the local rates of tradeoff for WTA and WTP are identical for very small changes in risk. Consequently, the use of labor market estimates of VSL as a WTP measure in policy applications is reasonable.

Various models of the rationality of individual choice have hypothesized that there may, however, be important status quo effects that can generate a spread between WTA and WTP values (Knetsch and Tang 2006). In the Kahneman and Tversky (1979) prospect theory model, utility levels are based on changes in wealth rather than on levels of wealth, and people are assumed to be much more averse to a loss in money than would be indicated by their valuation of an increase in money. Thus, there is a kink in utility functions associated with a shift in marginal utility values at the current wealth level. Numerous other models have incorporated similar kinds of reference point effects in which the tradeoff rate for a decrease in some attribute is quite different than for a comparable increase.

A wide body of literature involving economic experiments and stated preference studies has documented a substantial discrepancy between WTA and WTP values for the same commodity. The meta-analysis by Horowitz and McConnell (2002) reviewed a large set of studies over a wide range of commodities, including environmental outcomes and real goods, and found an average of the mean values of WTA/WTP of 7.2. If VSL estimates are viewed as WTA values rather than WTP, and also are characterized by a similar WTA/WTP ratio, then meta-analysis estimates of the median labor market estimates of VSL of $7 million in Y$2000 (Viscusi and Aldy 2003) should be reduced to $1 million in order to reflect the value of WTP rather than WTA. Such a change in VSL levels would have a profound effect on benefit estimates for government regulations and on which policies pass a benefit-cost test. However, no studies to date have explored the discrepancy between WTA and WTP values in the risky job choice situation.

The WTA/WTP gap for labor market decisions may be different than that identified in experimental studies. First, job choices involve repeated decisions for which the individual is able to acquire information such as that provided by hazard warnings, observations of various workplace signals of injury risks such as lax safety standards, and personal experience with whether or not the job poses a risk of injury. The WTA/WTP gap is related to the family of influences associated with endowment effects. Evidence for endowment effects indicates that experience with a good may affect the existence and strength of the asymmetry between buying and selling prices (List 2003). Second, while some experimental studies use actual commodities rather than hypothetical payoffs, the stakes involved in life-or-death risky job decisions are much greater. Even on an expected value basis, the magnitude of the typical VSL estimate multiplied by the average job fatal injury risk is roughly two orders of magnitude larger than the stakes in any related experiments dealing with reference dependence effects. Whether greater stakes increase or decrease the WTA/WTP discrepancy based on theory is unclear, but the importance of the decision and the incentives to think carefully about one’s choices are greater for repeated exposures to fatal injury risks.Footnote 2 Third, risks of death on the job differ from commodities in most of the previous literature in that life and health affect utility functions in a manner that cannot be treated as a monetary equivalent.

How one should characterize a situation of compensating differentials depends on the reference point so that treating labor market estimates of VSL as always being a WTA value is not correct. Categorizing labor market estimates as a WTA amount based on an economic model in which workers face a hypothetical choice between a risk-free job and a risky job is overly simplistic, because in the standard hedonic wage model the worker is choosing from a set of jobs on the market opportunities locus. A principal assumption of the hedonic analysis is that for both the worker and the firm, the local rates of tradeoff for small changes in risk are the same for changes in risk in each direction. However, even if a worker is located at a point on the market opportunities locus, the standard hedonic wage model does not estimate the slope of the worker’s utility function but rather estimates the average rates of wage-risk tradeoff across the labor market. If utility functions are subject to reference point effects that introduce kinks in the utility mapping, we will show that the market tradeoff rates may not necessarily equal the local rate of tradeoff for the worker utility function.

In what follows we examine the validity of the assumption that workers’ local rates of tradeoff are the same for increases and decreases in risk. Rather than estimating a hedonic wage equation, we examine the core assumption of the hedonic wage model by analyzing wage-risk tradeoffs for job changers. Our research framework takes into account the shifting nature of the worker’s reference point in actual job choice situations. The status quo for the worker is being continuously redefined as the worker changes jobs over a lifetime. If the worker accepts the compensating differential to move from the current job to a higher risk job, the estimated wage-risk tradeoff rate is a WTA measure of VSL. However, if the worker moves from a riskier job to a lower risk job with a decreased risk differential, then the wage-risk tradeoff rate is a WTP measure even though the new job is not risk-free and will generate a compensating differential compared to a zero risk job.

Using panel data makes it possible to examine such job changes, which in turn will provide insight into whether there is a discrepancy between WTA and WTP values for job fatality rates. With a few exceptions (Brown 1980; Villanueva 2007; Schaffner and Spengler 2010; Kniesner et al. 2012) that have used panel data to examine VSL, all labor market estimates have focused on cross-sectional evidence. More importantly, no panel study to date has examined whether there is any difference in tradeoff rates in the WTA and WTP situations. Here we use data from the Panel Study of Income Dynamics (PSID) in conjunction with very refined measures of fatal injury risk to explore possible asymmetries in VSL based on whether the job change should be viewed as a WTA or WTP situation.

To summarize our research, first we provide a theoretical framework in which there are reference point effects whereby workers can be particularly averse to changes on dimensions that make them worse off. There could be a reference point effect associated with either a decrease in wages or an increase in the fatal injury risk. The models incorporate the several possible reference point effects in a compensating differentials framework and show that the ratio WTA/WTP will exceed 1.0 if either of the reference point effects is influential. An estimated WTA/WTP>1 violates the standard assumption of the hedonic wage model that a worker’s constant expected utility locus is of the form that the local rate of tradeoff is the same in each direction at the point of tangency of the market offer curve and the worker’s constant expected utility locus. To test whether the identical local tradeoff assumption is violated, we depart empirically from the hedonic framework and examine job changers using the PSID. Standard estimates of a hedonic wage equation would not illuminate whether there are reference point effects, but by focusing on job changers, we are able to distinguish situations that should be reflective of the WTA and WTP situations. We find no statistically significant difference in VSL across the two groups based on the tradeoffs implied by the wage-risk combinations involved in the job change. Though the point estimates of VSL are sometimes higher for risk increases than for risk decreases, as predicted by the reference point models, the WTA and WTP values for labor market estimates of VSL are not significantly different.

1 Compensating differentials with reference point effects

The starting point of our analysis is to examine the implications of incorporating reference point effects into a standard model of compensating differentials.

1.1 Wage-risk tradeoffs

Let the worker’s baseline job be characterized by a fatal injury risk p0 and a wage w0. Theoretical models of compensating differentials often assume that the baseline job is a zero risk or low risk job. The worker has an indirect utility function u(w), where u′ > 0 and u″ ≤ 0. Levels of wealth and other income are subsumed in the functional form of u(w). If the worker is killed on the job, the utility level is zero. The expected utility v(p0, w0) of the base case job situation is given by

Let the worker compare the baseline job to a position with a fatal injury rate p1 and wage w1. For the alternative position to be desirable compared to the initial job the worker’s reservation wage for the new job must satisfy

where v(p *0 , w0) equals some constant value. If there are no reference point effects involving the wage or the fatal injury risk, whether the job change involves an increase in risk for more pay or a decrease in risk for less pay does not enter the expected utility calculation.

By implicit differentiation of v(p1, w1), one can calculate the reservation wage-risk tradeoff rate for the new job, or

where this expression is defined as the VSL. In the case of a new job involving a higher wage rate for greater risk, ∂w1/∂p1 is a willingness-to-accept measure. In the standard situation with no reference point effects,

so that

1.2 Wage reference points

The starting point for reference point effects is Kahneman and Tversky’s (1979) prospect theory model in which financial losses loom larger than comparable gains. In the labor market context, these losses will be in terms of a decrease in wages (see below for probability reference points). For concreteness we assume that all wage and risk reference points are with respect to the baseline reference position. The comparison job has a wage w1 < w0 and an associated initial risk p1 ≤ p0. Here the worker is incurring a lower wage to buy greater safety.

To model the reference dependence effect with respect to wages, we adopt a gain-loss model similar to the type of structure used in other reference dependent contexts in the literature.Footnote 3 In particular, for a drop in wages from w0 to w1 there is an additional utility decrease of λ[u(w0) – u(w1)] associated with the difference. The expected utility of the comparison job is given by

As before, v(p1, w1, λ) must equal v(p *0 , w0) to make the jobs equally attractive in the compensating differentials model.

The wage-risk tradeoff rate for the comparison job is

The reference wage effect serves to lower the value of WTP as incurring a wage cut for greater safety is less attractive. Because the wage reference effect influences the value of WTP but not WTA, the ratio

The ratio of WTA to WTP′ exceeds 1 because WTP has been reduced by the reference wage effect, while WTA is unaffected.

1.3 Probability reference points

Suppose that the reference point of consequence is not with respect to wages but rather with respect to the unattractiveness of a job with greater objective risk value p1 > p0. To model the risk reference point case, we assume a reference utility loss of μ(p1 – p0) associated with increases in the worker’s objective risk level. The expected utility of the new job is consequently

Assessment of the wage-risk tradeoff yields the result that

In calculating the ratio of willingness to accept to willingness to pay, it is WTP that is the pertinent value rather than WTP′ because the wage rate is not declining here. As a result, for comparison jobs involving more pay for greater risk,

1.4 Empirical implications of monetary and probability reference points

Any different job that is as equally attractive as the worker’s baseline position will trigger at most only one reference point effect even if both potentially may be influential. For p1 < p0 and w1 < w0, there will be a wage reference effect making WTP′ < WTP. For p1 > p0 and w1 > w0, there is a probability reference effect leading to WTA′ > WTA. Both reference point effects will not result from the same job change. Irrespective of whether it is the wage reference point or fatal injury risk reference point or both reference points that come into play, willingness to accept will exceed willingness to pay.

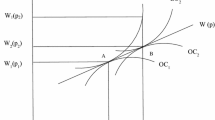

The implication of such reference points for worker utility functions is that there will be kinks in an otherwise smooth constant expected utility locus. Figure 1 illustrates a constant expected utility locus uu. For a worker whose wage-risk combination is at point A, the slope of uu at A would represent both the WTA and WTP for standard models, where WTA would equal WTP for small changes in risk. Consider the situation of an increase in risk from point A for a worker with a risk probability reference point effect. The constant expected utility locus with such reference point effects is given by AB because the worker requires a higher wage to accept an increase in risk than that along uu. The AB curve is steeper than the constant expected utility locus uu to the right of point A, implying a higher WTA. Similarly, if the worker has a reference point effect with respect to decreases in wages, that worker will be willing to accept less of a wage reduction to achieve a reduction in risk than along uu, as the worker’s constant expected utility locus for risk reductions is AE. Thus, with both reference dependent effects, the local slope of uu at point A corresponds to neither the WTA nor the WTP, and WTA ≠ WTP, as in the standard model.

Our empirical focus is on job changers. Although people do not switch jobs in the standard hedonic model, information acquisition over time may generate the incentive to switch jobs. The first type of learning is on-the-job learning about the worker’s current position, as in Viscusi (1979). If the worker’s experiences on the job are favorable, the position becomes increasingly attractive relative to other positions, and there is no incentive for the worker to quit. If the worker has an unfavorable experience, such as observing risky job conditions, the posterior probability of a fatal accident is p *0 > p0.Footnote 4 Thus, the worker with an adverse experience may believe that the job is more dangerous than given by the average objective risk value. Alternatively, the information acquisition may be with respect to other market opportunities. In particular, as shown by Altonji and Paxson (1988), with the presence of search costs workers are not necessarily selecting from jobs along a market opportunities locus as in the hedonic model but instead are confronting a dispersion of wage offers. Whether the information acquisition is with respect to the worker’s current job or market alternatives, there may be a potential rationale for changing jobs.

Figure 1 illustrates a situation in which a worker at point A is considering a job that poses greater risk but pays a higher wage. The job at point C would be an attractive alternative in the absence of reference dependent effects, but with risk reference effects it would not be desirable. However, jobs on or to the northwest of AB, such as the job at point D, would be attractive. Because job changes involving a risk increase may lie on or above AB, the effect of worker sorting is that the tradeoff rates for workers who incur an increase in risk provide an upper bound on WTA values. Villanueva (2007) makes a similar observation for job changes when there are no reference point effects where the upper bound arises from the censoring of tradeoff rates, not reference dependence effects. For job changes that involve a decrease in risk, the tradeoff rates for job changers provide a lower bound on WTP values for analogous reasons. Our empirical exploration of job changers below will distinguish the tradeoff rates for both increases and decreases in risk and test for possible differences in tradeoff values.

2 Data and regression variables

When examining whether labor market decisions display WTA = WTP our primary data source is the 1993–2001 waves of the Panel Study of Income Dynamics (PSID), which provides worker-level data on wages, industry, occupation, and key personal characteristics. The particular PSID data that we use are from the random Survey Research Center sample of male heads of households ages 18–65 who (a) worked for an hourly or salary pay during the previous calendar year, (b) were not permanently disabled or institutionalized, (c) were not in agriculture or the armed forces, (d) had a real hourly wage greater than $2 and less than $100, and (e) had no missing data on wages, education, region, industry, and occupation.

Beginning in 1997 the PSID changed to interviewing every other year. To have consistently spaced survey responses we use data from the 1993, 1995, 1997, 1999, and 2001 waves. We do not require workers to be present for the entire sample period; we have an unbalanced panel where we take missing values as random events.Footnote 5 Our sample inclusion conditions resulted in 2,036 men and 6,625 person years. About 40% of the men appear on all five waves (covering nine years) and another 25% are present for four waves.

The dependent variable in our regressions is based on the worker’s hourly wage rate. We deflate the nominal wage by the personal consumption expenditure deflator for the 2001 base year. We then take the natural log of the real wage rate to downplay the influence of outliers as well as for ease of comparison with others’ estimates.

The focal regressor in our research is the fatal injury rate of the worker’s two-digit industry by one-digit occupation group, which we denote as \( \widehat{p} \). We created the 720 industry-occupation groups as the intersections of 72 two-digit Standard Industrial Classification (SIC) code industries and the 10 one-digit occupational groups. We constructed our workers’ fatal injury risk variable using proprietary U.S. Bureau of Labor Statistics data from the Census of Fatal Occupational Injuries (CFOI) for 1992–2002.Footnote 6 The CFOI provides the most comprehensive and accurate inventory available of all work-related fatalities in a given year (Viscusi 2013).

It is important to emphasize that we construct two measures of fatal risk. The first uses the number of fatalities in each industry-occupation cell in survey year t divided by the number of employees for that industry-occupation cell in survey year t. The second measure uses a 3-year average of fatalities surrounding each PSID survey year (1992–1994 for the 1993 wave, 1994–1996 for the 1995 wave, and so on), divided by a similar 3-year average of employment. Both of our measures of the fatal injury risk vary over time because of changes in the numerator and the denominator.

We expect there may be less measurement error in the 3-year average fatal injury rates relative to the annual rate because of the averaging process, which will reduce the influence of random fluctuations in fatalities as well as mitigate the small sample problems that arise from many narrowly defined job categories. Alternatively, the annual measure should be a more pertinent measure of the risk in that particular survey year.

Kniesner et al. (2012) show that the main source of variation identifying compensating differentials for fatal injury risk comes from workers who switch industry-occupation cells over time. That is, some changes in fatal injury risk occur because of within industry-occupation cell changes and others occur because workers switch industry-occupation cells. Kniesner et al. find that the within-group variation is 8 times higher for job changers than job stayers, and thus job changers are key to identifying wage-risk tradeoffs. Thus, in our empirical models below we focus on two types of job changers—those who ever switch industry/occupation over the sample period, and those who switch in any given year. The latter group is a subset of the former. Appendix A lists the means for both the annual and 3-year fatal injury risk measures for the samples of workers that ever change jobs or when they change jobs. The sample in Appendix A is for those used in our first-difference regression models described below. The sample mean risks for the annual measures for the two samples are 6.31/100,000 and 6.21/100,000, respectively. As expected the variation in the annual measure exceeds that of the 3-year average.

3 Econometric estimates of WTA and WTP

For ease of presentation and discussion we suppress the coefficients other than those involving fatal risk. Every regression model controls for a quadratic in age; years of schooling; and indicators for marital status, union status, race, one-digit occupation, two-digit industry, region, state, and year. The occupation and industry dummies account for the substantial heterogeneity of jobs in different occupations and industries. Because there might also be unmeasured differences in labor markets across states and regions that do not vary over time, we include the full set of state and region (nine Census divisions) fixed effects. Year dummies control for common macroeconomic shocks. The standard errors we report are clustered by industry and occupation and are also robust to the relevant heteroskedasticity. Note that the first-difference baseline specifications automatically net out the influence of workers’ compensation, industry, and other job and personal characteristics that do not change over time. Appendix A provides means of the regression variables for the three samples used in estimation.

3.1 Baseline wage change equation estimates

As we emphasize in Kniesner et al. (2012), it is crucial to control for latent worker heterogeneity when estimating the compensating wage differentials. Moreover, Lillard and Weiss (1979) demonstrate that wage functions may have not only idiosyncratic differences in levels but also idiosyncratic differences in wage growth, and this is likely to be particularly important among job changers. Thus, as our baseline preferred specification to correct for wages that may not be difference stationary, we estimate the double-differenced model

where Δ2 = Δ t − Δ t − 1, and is commonly known as the difference-in-differences operator. The estimates from Eq. (12) address systematically both latent heterogeneity and possibly trended regressors, but force WTA = WTP. Our focal estimates are expressed as VSLs for ease of discussion of economic and policy relevance and are constructed as \( VSL=\left[\left(\left(\widehat{\partial w}/\partial \widehat{p}\right)=\widehat{\alpha}\times w\right)\times h\times 100,000\right], \) where we evaluate VSL at the mean wage and sample mean hours from Appendix A.

The baseline estimates of VSL in Tables 1 and 2 with WTA = WTP imposed are $7.7 million and $8.3 million, based on the annual fatal injury rate coefficient.Footnote 7 Given such VSL magnitudes, any influence of income effects on the WTA-WTP gap is negligible.Footnote 8 Possible (random) measurement errors in workplace hazard rates will attenuate the coefficient estimate; the measurement error effect from models with 3-year average fatal injury rates should be mitigated by permitting the fatal injury rate to capture a wider time interval. Compared to VSLs for the annual risk measure the estimated VSLs in Tables 1 and 2 are about 50–60% larger when fatal injury risk is a 3-year average.

3.2 Estimates allowing asymmetry

For the job changers in our sample about 51% switched into lower fatal injury risk jobs, and about 46% switched into higher fatal injury risk jobs so that there was apparently some effort to sort into safer employment. In the year of a job switch the mean fatal injury rate among those entering a lower risk job was 3.38 per 100,000, while among those entering a higher risk job the mean rate was 8.68 per 100,000 workers (the estimates for 3-year averages are 3.07 and 8.19). The balance in changes in risk is what permits us to examine workers’ WTA (VSL+) versus WTP (VSL−).

Our first econometric estimates that permit asymmetry whereby WTA ≠ WTP and in turn VSL+ ≠ VSL− are based on the spline-type regression specification

The dummy indicator variable d t = 1 when \( \varDelta \widehat{p}>0 \) with the associated null hypothesis test that \( {\widehat{\alpha}}_2=0 \) being our test for symmetry or WTA = WTP.

The results in column (2) of Tables 1 and 2 labeled “Asymmetry” cannot reject the null hypothesis that the fatal injury rate effect is similar for changes to more dangerous jobs versus changes to equally or less dangerous jobs.Footnote 9 When asymmetry of responses is permitted, the average VSL over all job changes is little different from the baseline because there is no substantive or statistical evidence of asymmetry. Thus, our second econometric specification that permits differences in WTA and WTP is to estimate the regression functions separately for when \( \varDelta \widehat{p}>0 \) (labeled “Increases in Fatal Risk” in Tables 1 and 2) versus \( \varDelta \widehat{p}\le 0 \) (labeled “Decreases in Fatal Risk” in Tables 1 and 2). The model now relaxes the econometric restriction in Eq. (12) that the only difference in wage processes determining WTA and WTP comes from the fatal risk coefficient, while the theoretical discussion around Eqs. (8) and (11) considers more broadly differences in utility functions. In columns (3) and (4) of Tables 1 and 2 we cannot reject the null hypothesis that WTA and WTP are statistically the same. The 95% confidence interval for the ratio WTA/WTP rules out a WTA/WTP ratio of 3 (3.4) for the annual rate in Table 1 (2), and rejects a ratio of 2 for the 3-year fatality rate models in both Tables 1 and 2.

3.3 Estimates from more restrictive models allowing asymmetry and selection effects

To test whether it is important to allow unrestricted growth heterogeneity as we do in the double difference model of Eq. (12), we consider two more familiar, but restrictive specifications. The first is the standard first-difference estimates based on the model

The estimates for those who ever change jobs and in the year of a job change are presented in Tables 3 and 4, respectively. Once again we do not reject the null hypothesis that the asymmetry effects are zero, but when we estimate separate models for increases and decreases in fatality risk, we cannot rule out ratios of WTA/WTP of 5 or 6 in the annual models (closer to a ratio of 3 in 3-year models).

The second approach comes from an underappreciated paper by Solon (1986) where he develops the reference point effect result as a statistical argument involving heterogeneity of preferences among job changers in a panel data regression model correcting for latent time-invariant heterogeneity. In particular, suppose that workers who switch to more dangerous jobs require a large wage increase to accept a new job that is more dangerous, but workers who seek a safer job do not accept a safer job if it is accompanied by much of a wage cut. The result in a panel data set that is driven by worker selection effects will produce the result WTA > WTP. Consequently, in our empirical work we also attempt to control for worker-specific selection effects in estimating WTA versus WTP based on labor market pairings of risk and wages.

Possible selection effects just discussed lead us to develop an interactive factor model as described in Bai (2009), which for wage levels here is

where λ i is the inverse Mills ratio of the probability of ever changing jobs. Given our specification of the conditional mean function in (18) where λ i is a time-invariant factor loading, we focus our discussion now on the larger subsample of those workers ever changing a job.Footnote 10 Expressed as our first-differenced model, the estimating equation for the selection bias corrected panel data regression estimated on the subsample who ever changed jobs is

Results for an asymmetric VSL model in the presence of selection bias corrections for non-random worker mobility appear in Table 5. The first stage probit model for constructing the inverse Mills ratio regresses whether the worker ever changes a job on the time-means of the variables used in the wage equation. Because the time means are not included in the regression, the effect of the inverse Mills ratio is identified both by exclusion restrictions and by nonlinearities. The pseudo R-squared for the probit model is a respectable 0.2.

In Table 5 we once again have the focal result of our research appearing. We cannot reject the null hypothesis of symmetry whereby WTA = WTP with the attendant implication that VSL+ = VSL−. The selection bias results in Table 5 also show the familiar result that the VSL is higher when based on the estimates from the 3-year fatal injury risk average, which we have argued should be comparatively freer of attenuation bias due to measurement error in job safety plaguing the concurrent fatal injury risk regressor. In columns (3) and (4) of Table 5 we estimate the models separately for increases versus decreases in fatal injury risk, and obtain the qualitatively expected result that WTA > WTP, but continue to fail to reject the null hypothesis that they are statistically the same. Again, like the first-difference estimates of Tables 3 and 4, a ratio of WTA/WTP = 5 cannot be ruled out with selection effects, underscoring the importance of allowing for more unrestricted growth heterogeneity in wages, as in our baseline double-difference model of Tables 1 and 2, to pin down the WTA-WTP relationship.

4 Discussion

We emphasize that a key difference between our empirical research, which cannot reject equality of WTA and WTP, and the extant estimated WTA > WTP literature is that the job changers we study are moving either up or down from a job posing some quite small probability of death to a job posing some other very small probability of death. We could in turn reasonably hypothesize that the reference point effect-endowment effect type influence is less pronounced in such situations where the baseline is both probabilistic and involves probabilities on the order of 1/25,000 to 2/25,000. By comparison, the effects may be more pronounced when the probabilities involved are either 0 or 1. In Viscusi et al. (1987) there was a much greater effect when the risk level became zero—a certainty premium, which is a possibility that does not arise for safety risks. All of the experiments with discrete goods such as mugs, soda, candy bars, and pens take the probability of owning the good from 1 to 0. In situations where the probability of ownership starts at 1, we might expect there to be more attachment to the good and a stronger endowment effect than if the initial probability of ownership is very small.

Continuing with the link to the experimental literature, our results also can be interpreted as consistent with the findings of Plott and Zeiler (2005), who ran experiments with lotteries and mugs and found no divergence between WTA and WTP. They have several conjectures for their findings that apply to our situation. Plott and Zeiler note that their subjects’ misperceptions regarding the task can produce a WTA-WTP gap, which can be eliminated by extensively training and instructing the subjects. Our workers deal with their decisions regularly so that they do not misperceive the task. Second, in the experimental setting of Plott and Zeiler, people could both buy and sell so that they became less attached to the good than in most endowment effects experiments. Our workers too have the option of moving up or down in terms of risk so that they are in effect buyers or sellers. Finally, the decision process in experimental settings is unfamiliar to respondents, which can cause a WTA-WTP difference, whereas the workers in our research are in familiar job-choice contexts, which further makes sensible the core empirical result we present here that the estimated WTA = WTP in the labor market concerning job-related risk of severe injury.

Our assessment of the role of VSL measures in estimating the WTP for fatal job injury risk reductions does not rule out the potential importance of a WTA/WTP gap in other choice situations. Moreover, as shown by Knetsch et al. (2012), there may be policy contexts in which the appropriate benefits measure is conceptually linked to WTA rather than WTP. As a result, the potential presence of a WTA/WTP gap looms as a real empirical possibility of substantial policy relevance. The task for the policy analyst is to determine whether such a discrepancy should be reflected in benefit values.

Despite the absence of a statistically significant difference between WTA and WTP, in seven of the ten comparisons the WTA value exceeded the WTP amount as predicted. The average WTA amount is about 17% higher than the average WTP amount. However, even if such discrepancies were to represent real differences, they would lead to only minor refinements in the VSL that are well within the bounds of error. The more pressing concern stimulated by the current literature is that the labor market estimate of the VSL might seriously overstate the pertinent WTP amount for benefit assessments by almost an order of magnitude. It is clear based on our results that there is no serious discrepancy between VSL and WTP for labor market estimates of the VSL.

Notes

See U.S. Office of Management and Budget Circular A-4, Regulatory Analysis (Sept. 17, 2003), which is available at http://www.whitehouse.gov/omb/circulars_a004_a-4 (Last accessed July 24, 2013); Memorandum to Secretarial Officers Modal Administrators from Polly Trottenberg, Under Secretary for Policy and Robert S. Rivkin, General Counsel, Guidance on Treatment of the Economic Value of a Statistical Life in U.S. Department of Transportation Analyses, Office of the Secretary of Transportation, U.S. Department of Transportation, 2013. Available at http://www.dot.gov/office-policy/transportation-policy/guidance-treatment-economic-value-statistical-life (Last accessed July 24, 2013); and U.S. Environmental Protection Agency, “Valuing Mortality Risk Reductions for Environmental Policy: A White Paper,” SAB Review Draft, 2010.

For minor health effects that do not reduce the marginal utility of income, Chilton et al. (2012) report stated preference evidence indicating a narrowing of the WTA/WTP gap for more minor health effects.

If workers have a beta distribution of assessed fatal injury risks where γ is the informational content of the prior and p0 reflects the probability of an adverse outcome, the posterior probability of p *0 that prevails after observing information equivalent to one unfavorable trial outcome is (γp0 + 1)/(γ +1) > p0.

When there is time-invariant non-random attrition, the differenced data models we use will remove it along with other latent time-invariant factors (Ziliak and Kniesner 1998).

In Kniesner et al. (2012) the estimated VSL from the pooled model that included job stayers is $6.6 million. Although this is statistically the same as the pooled VSLs reported in Tables 1 and 2 here, the qualitatively lower point estimate results from dampened variation in industry/occupation fatal risk among job stayers.

A worker moving to a riskier job that poses an additional 5/100,000 risk will receive an added wage premium of $350, which is 0.7% of average annual income. Based on estimates of the income elasticity of VSL (Viscusi and Aldy 2003), the effect of such income changes on the VSL will be under 0.5%.

As part of specification checks we ran regressions similar to those in Table 1 for persons who did not change jobs. In all cases estimated VSL was either insignificant or negative. Additionally, results similar to those in Table 1 (symmetry of estimated VSL) appear when we include a dummy variable for positive change in fatal injury rate so the linear segments need not join at a common point. For more discussion of the general econometric issue see Hamermesh (1999).

Note that the subsample of “when change jobs” might involve more complicated time-varying effects, as we discuss below.

References

Altonji, J. H., & Paxson, C. H. (1988). Labor supply preferences, hours constraints, and hours-wage trade-offs. Journal of Labor Economics, 6(2), 254–276.

Bai, J. (2009). Panel data models with interactive fixed effects. Econometrica, 77(4), 1229–1279.

Brown, C. (1980). Equalizing differences in the labor market. Quarterly Journal of Economics, 94(1), 113–134.

Chilton, S., Jones-Lee, M., McDonald, R., & Metcalf, H. (2012). Does the WTA/WTP ratio diminish as the severity of a health complaint is reduced? Testing for smoothness of the underlying utility of wealth function. Journal of Risk and Uncertainty, 45(1), 1–24.

Hamermesh, D. S. (1999). The art of labormetrics. NBER Working Paper 6927.

Horowitz, J. K., & McConnell, K. E. (2002). A review of WTA/WTP studies. Journal of Environmental Economics and Management, 44(3), 426–447.

Kahneman, D., & Tversky, A. (1979). Prospect theory: an analysis of decision under risk. Econometrica, 47(2), 263–291.

Knetsch, J. L., & Tang, F.-F. (2006). The context, or reference, dependence of economic values. In M. Altman (Ed.), Handbook of contemporary behavioral economics: Foundations and developments (pp. 423–440). New York: M.E. Sharpe, Inc.

Knetsch, J. L., Riyanto, Y. E., & Zong, J. (2012). Gain and loss domains and the choice of welfare measure of positive and negative changes. Journal of Benefit-Cost Analysis, 3(4). doi:10.1515/2152-2812.1084.

Kniesner, T. J., Viscusi, W. K., Woock, C., & Ziliak, J. P. (2012). The value of statistical life: Evidence from panel data. Review of Economics and Statistics, 94(1), 74–87.

Kőszegi, B., & Rabin, M. (2006). A model of reference-dependent preferences. Quarterly Journal of Economics, 121(4), 1133–1165.

Lillard, L. A., & Weiss, Y. (1979). Components of variation in panel earnings data: American scientists 1960–70. Econometrica, 47(2), 437–454.

List, J. (2003). Does market experience eliminate market anomalies? Quarterly Journal of Economics, 118(1), 41–71.

Plott, C. R., & Zeiler, K. (2005). The willingness to pay-willingness to accept gap, the “endowment effect”, subject misperceptions, and experimental procedures for eliciting valuations. American Economic Review, 95(3), 530–545.

Schaffner, S., & Spengler, H. (2010). Using job changes to evaluate the bias of value of statistical life estimates. Resource and Energy Economics, 32(1), 15–27.

Solon, G. (1986). Bias in longitudinal estimation of wage gaps. NBER Working Paper 58.

Villanueva, E. (2007). Estimating compensating wage differentials using voluntary job changes: evidence from Germany. Industrial & Labor Relations Review, 60(4), 544–561.

Viscusi, W. K. (1979). Employment hazards: An investigation of market performance. Cambridge: Harvard University Press.

Viscusi, W. K. (2004). The value of life: estimates with risks by occupation and industry. Economic Inquiry, 42(1), 29–48.

Viscusi, W. K. (2013). Using data from the Census of Fatal Occupational Injuries to estimate the “value of a statistical life”. Monthly Labor Review, 1–17.

Viscusi, W. K., & Aldy, J. E. (2003). The value of a statistical life: a critical review of market estimates throughout the world. Journal of Risk and Uncertainty, 27(1), 5–76.

Viscusi, W. K., & Huber, J. (2012). Reference-dependent valuations of risk: why willingness-to-accept exceeds willingness-to-pay. Journal of Risk and Uncertainty, 44(1), 19–44.

Viscusi, W. K., Magat, W., & Huber, J. (1987). An investigation of the rationality of consumer valuations of multiple health risks. RAND Journal of Economics, 18(4), 465–479.

Ziliak, J. P., & Kniesner, T. J. (1998). The importance of sample attrition in life-cycle labor supply estimation. Journal of Human Resources, 33(2), 507–530.

Author information

Authors and Affiliations

Corresponding author

Additional information

Jack Knetsch provided insightful suggestions. This research was conducted with restricted access to BLS data. The views expressed here do not necessarily reflect the views of the BLS

Appendix A

Appendix A

Rights and permissions

About this article

Cite this article

Kniesner, T.J., Viscusi, W.K. & Ziliak, J.P. Willingness to accept equals willingness to pay for labor market estimates of the value of a statistical life. J Risk Uncertain 48, 187–205 (2014). https://doi.org/10.1007/s11166-014-9192-1

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11166-014-9192-1