Abstract

The choice of the proper discount rate is important in the analysis of projects whose costs and benefits extend into the future, a particularly striking feature of policies directed at climate change. Much of the literature, including prominent work by Arrow et al. (1996), Stern (2007, 2008), and Dasgupta (2008), employs a reduced-form approach that conflates social value judgments and individuals’ risk preferences, the latter raising an empirical question about choices under uncertainty rather than a matter for ethical reflection. This article offers a simple, explicit decomposition that clarifies the distinction, reveals unappreciated difficulties with the reduced-form approach, and relates them to the literature. In addition, it explores how significant uncertainty about future consumption, another central factor in climate policy assessment, raises further complications regarding the relationship between social judgments and individuals’ risk preferences.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

The standard welfare economic framework for policy assessment holds that social welfare, W, is some function of the utilities, U, of all individuals in society, which in turn are (under a common simplification) a function of individuals’ levels of consumption, c. How consumption affects utility, including, in particular, the rate at which marginal utility falls with consumption, is, of course, an empirical question, the answer to which is derived from individuals’ behavior under uncertainty (Vickrey 1945). By contrast, how utility affects social welfare is a normative question, that is, a social judgment that is made by an outside observer.

In the context of climate change assessments, however, these two distinct concepts are frequently conflated, typically in discussions of the choice of a social discount rate to be applied to postulated streams of consumption over time. Instead of separately specifying the social welfare function W and individuals’ utility functions U, analysts use a single, reduced-form representation, Z(c), under which social welfare is taken to be a direct function of consumption. In this article, we identify a number of problems with this practice.

In Section 1, we show how conceptual confusion arises because Z(c) has both empirical and ethical components that are not clearly distinguished. As we will explain, analysts sometimes confound pertinent empirical evidence on risk preferences and normative arguments, with the result that understanding is undermined rather than advanced. For example, in this Journal, Dasgupta (2008) presents “a fairly complete account of the idea of social discount rates as applied to public policy analysis” in which his analogue to Z(c) is at some points viewed as a representative individual’s utility function and at others as a concave function of utility reflecting an outside observer’s social judgment. In so doing, he is in excellent company, joined, for example, by Stern (the Stern Review 2007, and his Ely Lecture published in the American Economic Review 2008) and by Arrow, Cline, Maler, Munasinghe, Squitieri, and Stiglitz (1996). Muddling the analysis of the social discount rate is highly consequential since the choice of this rate is potentially decisive concerning whether present efforts to control greenhouse gas emissions should be aggressive or modest. Compare, for example, Nordhaus (2007, 2008), Stern (2007, 2008), and Weitzman (2007).

Moreover, attempts to sort out the questions formally are inhibited by the use of this reduced form. It might appear that such a composite representation is unproblematic; after all, W is a function of individuals’ U’s, which in turn are functions of their c’s. However, analysis often focuses on a single parameter, η, for the curvature (elasticity) of Z(c), which is mistakenly assumed to be a simple combination of the corresponding curvature parameters for U(c), that is, risk aversion, and W(U), aversion to inequality in utilities. Denoting these curvature parameters by α and β respectively and considering a simple special case that most closely corresponds to the functional forms used in the literature, we have η = 1−(1−α)(1−β). Furthermore, the implied social welfare function that most directly rationalizes existing practice has problematic features, including that it can violate the Pareto principle.

One way to summarize the implications of Section 1’s analysis is to say that, relative to current practice, the social discount rate should in most cases be based more on empirical evidence of individuals’ risk preferences than on ethical reflection. That is, debates about the correct discount rate should attend more to the economics of decision-making under uncertainty.

This perspective is reinforced in Section 2 where we explicitly incorporate uncertainty about the future consumption path, a signal feature in climate policy assessment where there is significant doubt about the magnitude of climate change for given emissions, the economic impact of a given degree of climate change, the rate at which future emissions control costs will fall, and other matters. Although this subject has also received prior attention in the literature, once again difficulties arise from the failure to separate concavity in individuals’ utility functions, reflecting risk preferences, and concavity in the social welfare function, reflecting ethical judgments. We examine the interaction of uncertainty in future consumption with strict concavity of the social welfare function and identify yet another (qualitatively different) source of conflict with the Pareto principle.

Zeckhauser and Viscusi (2008, p. 95) have remarked on “the intertwined problems of time and uncertainty” that arise with regard to discounting. The present investigation suggests that there are more connections than meet the eye and that the failure to disentangle them makes the analysis of a challenging set of problems even more difficult.

1 Individuals’ risk preferences versus social judgments

1.1 Formulation in climate change analysis

We adopt a number of simplifications that are standard in the literature and largely orthogonal to our main points. Specifically, we suppose that there is only a single individual in each generation—perhaps a representative individual or one of many identical individuals, with a constant population size over time—a problematic restriction that we partially relax in Section 2.Footnote 1 The individual’s utility U is a function (only) of available consumption c in the pertinent time period. In this section, we focus on the problem of choosing among feasible, certain consumption paths over time, c(t), each corresponding to different policies, so as to maximize social welfare. (In Section 2, we examine the choice among uncertain consumption paths.) It is convenient to employ the continuous time representation, in which case the expression for social welfare SW is

In this expression, δ is taken to be a pure social rate of time preference, one that some analysts argue should equal 0, reflecting a view that all generations should be weighted equally, or some low level that reflects the likelihood that humanity will become extinct. Although there is important debate about the choice of δ, we set the issue to the side. We instead focus on the term W(U(c)), where we often suppress the t, focusing on some arbitrarily chosen generation.

In place of expression (1), it is common to find (in addition or instead) the following variant, which then becomes the focus of analysis:

At this point, a further simplification (also tangential to our purposes) is sometimes introduced, namely that consumption c has a constant growth rate of g (also denoted \( \mathop{c}\limits^{ \cdot } /c \)). An additional common assumption, which we will explore further momentarily, is that the function relating a generation’s level of consumption to its contribution to social welfare has the form \( Z(c) = {{{{c^{{1 - \eta }}}}} \left/ {{1 - \eta }} \right.} \). Given all this, one can show that the social rate at which the stream of consumption should be discounted is the constant rate

For concrete illustrations of the differing implications, one might roughly follow some of the Stern Review’s (Stern 2007) parameters, η = 1, g = 1.3, and δ = 0.1, yielding ρ = 1.4. By contrast, using Nordhaus’s (2008, p. 61) choices of η = 2 and δ = 1.5 and employing the growth path implicit in his simulation, the result is ρ = 5.5. When discounting over periods of 50 or 100 years (or more), the differences are staggering.

Our focus is on how the value of η should be determined and interpreted. As is clear from the foregoing, η is a property of Z(c). But that function is a reduced form. The motivation for such a function, usually unelaborated, is that it is a composite of W(U) and U(c). Accordingly, we wish to know how η relates to the curvature of the underlying welfare and utility functions.Footnote 2 This decomposition is critical even to formulating what questions to ask since the properties of W are a matter of ethical debate whereas those of U are empirical; specifically, the curvature of U depends on preferences concerning decisions under uncertainty. We wish to know whether the choice of η in the literature is a normative question, an empirical question to be resolved by the literature on risk preferences, or some combination. And what combination?

1.2 Decomposition

To begin, we introduce notation for the Arrow-Pratt relative risk aversion parameter and analogues thereto for each of our three functions of interest:

Single and double primes denote first and second derivatives with respect to the function’s direct argument; in particular, W′ and W″ denote the corresponding derivatives of W with respect to U (and not with respect to c).

The core of our analysis involves taking seriously the notion that the reduced form Z(c) is really the composite function W(U(c)). Specifically, we assume that the widespread use of the reduced-form Z(c) function is implicitly motivated by—and really has to be grounded in—a welfare economic framework under which social welfare depends in some justifiable fashion on individuals’ utilities in each generation that, in turn, in the models at hand, depend on consumption in each generation.

To pursue this course, one can take the first and second derivatives of the composite function W(U(c)) with respect to c, which with some rearrangement yields

Multiplying the second term by U(c)/U(c), letting ε U denote the elasticity of utility with respect to consumption (equivalently, the ratio of the marginal utility of consumption, U′(c), to the average utility of consumption, U(c)/c), and making substitutions using the notation from expressions (4) and (5), this expression can be rewritten as

Expression (8) indicates how to determine the relevant curvature of the Z(c) function when that function is taken to be a composite of the welfare function W and the utility function U (rather than some arbitrary reduced form that is chosen without regard to the underlying social welfare function and utility function). Of interest is the fact that the curvature of Z is not a simple sum of the curvatures of U and W. The latter is weighted by ε U . Note that this factor can be quite low in wealthy societies (as mentioned, it equals the ratio of the marginal to the average utility of consumption), so in that setting, the curvature of U is relatively more (perhaps much more) important (assuming that the curvature of W is not extreme, as with a Rawlsian maximin social welfare function).Footnote 3

To make the foregoing more concrete, it is useful to consider (as is common in the literature) the case in which the R’s are constant.Footnote 4 Specifically, for U and W, suppose that

Using these functional forms and continuing to suppose that Z(c) = W(U(c)), we have

where γ = 1−(1−α)(1−β).Footnote 5

1.3 Discussion

These expressions for Z(c) are not what one might have expected from typical discussions, where, as mentioned, the standard reduced form is \( Z(c) = {{{{c^{{1 - \eta }}}}} \left/ {{1 - \eta }} \right.} \). There is the additional leading term in (11) and (12). Perhaps more surprising is the manner in which the curvature parameter for the reduced form (γ in our expression 12, η in the standard representation) relates to those for the underlying utility and welfare functions. Pursuing the latter, the familiar expression (3) for the overall social discount rate can be rewritten as follows:

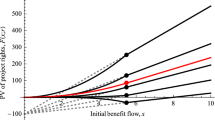

First, consider the functional relationship depicted in this expression. Taking the plausible case in which α > 1, we see that a higher curvature parameter β for the social welfare function implies a lower rather than a higher discount rate—even though g > 0, so that future generations are richer. Likewise, the sign of the effects for both α and β reverse when the other parameter crosses the value 1.0. Hence, familiar intuitions translating such curvature parameters for the U and W functions into overall curvature (γ in expression 12 or η in expression 3) fail.Footnote 6

Second, reflecting on the decomposition more broadly, we find (as Section 1.4 elaborates in the climate change context) that some explications of the curvature parameter η are confusing and potentially misleading because of the failure to separate the two conceptually distinct sources of curvature. Determination of the curvature of individuals’ utility functions, α in our constant-relative-risk-aversion special case in expression (9), presents an empirical question that is usually addressed by examining individuals’ choices under uncertainty (Vickrey 1945). Granted, its magnitude is subject to serious dispute. The literature has generated a wide range of estimates, and there are concerns about whether the behavior on which such estimates are based is fully informed and rational. See, for example, Barsky et al. (1997), Campbell (1996), Chetty (2006), Choi and Menezes (1992), Kocherlakota (1996), and Zeckhauser and Viscusi (2008). Nevertheless, the existence of debate about empirical evidence on risk preferences does not justify analysts substituting their own values.

By contrast, the curvature of the social welfare function, β in our expression (10), is a normative judgment subject to a quite different sort of analysis. See, for example, the conflicting views represented in Sen and Williams (1982). It is interesting to consider the case of a utilitarian social welfare function, which has received some endorsement, most famously from Harsanyi (1953, 1955), and seems to be accepted by many economists.Footnote 7 (See also our further discussion in Section 2.) In that case, β in expression (10) is zero, and the Z(c) function is coincident with the U(c) function. The difficulties with expression (13) become moot, and the reduced-form parameter η simply equals α. In this case, the question of the proper value for η is entirely an empirical one since, as explained, α is a property of individuals’ utility functions that is ordinarily taken to be revealed by behavior under uncertainty. On the other hand, for a nonutilitarian social welfare function, explicit justification would have to be offered for the parameter β.

Relatedly, it is problematic, but common, to advocate the use of particular values for η without regard to specifications of the underlying U and W functions, the values of α and β in our special case. Consider, for example, the belief that η should be taken to equal 2. If it turned out that, empirically, individuals were nearly risk neutral, this would entail the view that a utilitarian social welfare function was insufficiently egalitarian. However, if evidence revealed instead that individuals were quite risk averse, with α > 2, then one would have to switch one’s ethical position to the view that utilitarianism is too egalitarian. Coherent normative principles for assessment cannot be contingent on empirical facts. Accordingly, when performing sensitivity analysis on an empirical parameter, it is expected that changing the parameter will change the results, but it is not appropriate for the social welfare function to be simultaneously changed as different values for the empirical parameter are considered. Put another way, optimal decisions depend on the particular circumstances, but the proper decision-making criterion should not.

Third, we turn to an important and neglected question concerning the reduced-form approach: What social welfare function (if any) is implied by this methodology? Specifically, suppose one wishes to generate the standard reduced-form Z(c) function, \( Z(c) = {{{{c^{{1 - \eta }}}}} \left/ {{1 - \eta }} \right.} \), starting from the familiar constant-relative-risk-aversion utility function U(c) in expression (9), where again the curvature parameter η in the reduced-form Z(c) function is taken to equal 1−(1−α)(1−β). We are inquiring into the implied welfare function W(U). One might have thought it would be the function given by expression (10), but it is not. It is straightforward to show that the implied social welfare function is

Expression (14) works in the mathematical sense just described, and it appears to be similar to expression (10). However, the result is normatively problematic.Footnote 8 Although it may not be immediately apparent, the stated form is not an individualistic social welfare function. To restate a basic point in welfare economics: Under an individualistic social welfare function, social welfare is taken to be a function only of individuals’ utilities and not, importantly, of any aspect of how those utilities were produced. Formally, this means that one can write W(U(x)), where x is a complete description of a state of the world. This functional form contrasts with W(U(x),x), which means that social welfare, in addition to depending on individuals’ utilities, can also depend directly on some trait of the state of the world. That is, some aspect of the world may affect social welfare even if it affects no one’s utility. Or, more relevant for our purposes, it can affect social welfare independently of (or different from) how it affects individuals’ utilities.

Consider the manner in which expression (14) deviates from the more familiar individualistic social welfare function. In addition to the appearance of β, which is a parameter of the welfare function and therefore not problematic, there is also α, which of course is a parameter of individuals’ utility functions, which appears other than through the utility function. The direct implication is that different individuals (here, generations) would count more or less depending on the curvature of their utility functions (even if, say, they have the same utility level). This property is inconsistent with the standard normative framework. Indeed, it seems bizarre. It is as if two generations had different tastes, one preferring chocolate and the other vanilla, and both achieved the same utility; perhaps chocolate and vanilla are each produced at the same cost and each generation chooses more of the flavor it prefers. Nevertheless, the social welfare function depends directly on preferences for chocolate versus vanilla and thus weights one of the two generations more than the other on that account.

The problem actually is worse, for it can be shown that this feature implies that the social welfare function (14) can favor choices that violate the Pareto principle. To demonstrate this point, suppose that there are two social states, each producing precisely the same utility levels for all individuals (in our setting, for individuals in all generations), but one involves a different value for α. (To give a possible motivation, a different climate path may affect how consumption is transformed into individual utility, but there might also be a different consumption path as well, one that produces an offsetting effect on utility such that the utility level in each generation is the same.) Under the social welfare function (14), these identical utility profiles, produced by two different regimes, will have different values for social welfare because the α’s in the leading term will differ. This difference implies that, starting with the regime yielding lower social welfare, we might imagine that there exists a small policy adjustment that would raise utility in each generation slightly. This modified regime would still have lower social welfare according to expression (14)—assuming that the change is sufficiently small—even though it yields higher utility for all generations. Hence, the social welfare function (14) sometimes instructs society to choose policies that reduce everyone’s well-being.Footnote 9

1.4 Application

The analysis thus far casts discussion of the social discount rate in economic policy analysis in a different light. This claim can be illustrated by work on climate change. We begin with Dasgupta’s (2008) extensive treatment in this Journal and follow with Arrow et al. (1996) and Stern (2007, 2008). As will be seen, the problems we identify are not particular to certain authors or papers but are widespread and have a common pattern.

Dasgupta (2008):

Dasgupta’s framework is fairly typical of much of the literature, which is not surprising since the article is an interpretative survey designed to have this feature. Converting his main expression for social welfare (Dasgupta 2008, expression 2) to the continuous time analogue, he has

On its face, it is hard to know whether this welfare function is comparable to expression (1) or to expression (2) above. It is equivalent to both if the social welfare function is utilitarian. As mentioned, in that case W(U) = U, and Z(c) = W(U(c)) = U(c). However, Dasgupta is explicit in not limiting himself to the (formally) utilitarian case (e.g., allowing that “U [may be] not felicity, but an increasing, concave function of felicity” [p. 147]).Footnote 10 And, as will be discussed, he clearly envisions that the curvature is to be chosen by a social observer rather than determined empirically.Footnote 11 In short, the U function in Dasgupta is emphatically not a utility function—making his choice of notation unfortunate. Similarly, he regularly uses the term “felicity” (with no adjective “social”) and occasionally “well-being” (again with no preceding adjective) to refer to social welfare, not individuals’ well-being (although some usages earlier in the article do refer to individuals’ utility, rather than social welfare).

Dasgupta’s U(c) must, in our notation, be a Z(c) function, meaning that the proper analogue to expression (15), Dasgupta’s social welfare function, is expression (2), not expression (1). In that case, the problematic nature of working directly with a reduced-form Z(c) function is fully applicable to Dasgupta’s analysis and to that of those whom he is following in this regard. Indeed, Dasgupta focuses on the functional form \( U(c) = {{{{c^{{1 - \eta }}}}} \left/ {{1 - \eta }} \right.} \) and derives an expression for the social discount rate for consumption corresponding to expression (3) above (Dasgupta 2008, expression 4a).

To illustrate the difficulties, Dasgupta (2008, p. 147) begins a key part of his discussion by posing the question: “How should the social evaluator choose U.” Since this function is chosen by a social evaluator rather than reflecting individuals’ choices under uncertainty, as measured by an empiricist, he is taking the question of the proper value of η to be entirely a question of ethics. This approach would make sense if he was implicitly assuming that α is zero (i.e., individuals are risk neutral), so that the decomposed η simply equals β, but this stance would be contrary to the evidence. He elaborates that many would infer the parameter from choices people make, but he states that he is taking the view of those who adopt a philosophical approach. Moreover, he criticizes others, including Stern, for inconsistency because they chose “η on the basis of estimates obtained from consumer behaviour, but ignored consumer behavior entirely when it came to the choice of δ and sought the advice of moral philosophers instead. This is neither good economics nor good philosophy” (p. 159). However, under a utilitarian social welfare function, this is precisely the correct economics and philosophy since η is a parameter of individuals’ utility functions and δ is entirely an aspect of the social welfare function. On the other hand, Dasgupta’s analysis—under which individuals’ utility functions, as reflected in their choices under uncertainty, are wholly ignored in choosing η despite what is apparent in expression (8)—is difficult to rationalize.

Another issue in Dasgupta’s exposition—again mirroring some other prominent work—concerns how he believes a social observer should choose η. At various points, he endorses the use of thought experiments in which one backs out parameter values, taking as primitives what one deems to be reasonable policy conclusions (such as on how high of an optimal savings rate is plausible). That is, one first determines correct policy conclusions in certain settings—based on what seem to be sensible, rather than absurd, outcomes—and then asks what ethical parameter is consistent with that conclusion. The problem is that this process reverses normative analysis. The method would be appropriate if one were attempting to determine what normative parameter is implicit in some actual society’s policy choices. For example, in the optimal income tax problem, one can back out a polity’s social welfare function from its policies (and empirical parameter estimates). Note that if, in Dasgupta’s example, a high savings rate is rejected, this may well reflect that society does not care that much about future generations. (He instead takes as a given that they value far distant generations equally with themselves and infers that they therefore must be highly inequality averse and hence will not make significant sacrifices for even astronomically large benefits for those in the far future.)Footnote 12 In any case, his analysis fails to reflect that, even if one adopts a social welfare function that is strictly concave in individuals’ utilities, expression (8) makes clear that the empirical question of the curvature of individuals’ utilities—their risk preferences—will be an important (and possibly the much larger) component of the proper value for aggregate curvature, the η in Dasgupta’s analysis.

Arrow et al. (1996):

The well-known treatment of the social discount rate in Arrow et al. (1996) is much the same. Their social welfare function (expression 4A.1) isFootnote 13

(This expression is immediately followed with a version of our expression 3, their 4A.2.) This formulation again raises the question: Is the social welfare function in (16) properly compared to expression (1) or expression (2) above? Closely related, is their function W(c) a utility function, a social welfare function, or a reduced-form composite?

They tell us that their W is “welfare,” which might suggest social welfare, but immediately thereafter they refer to their analogue to η as “the elasticity of marginal well-being, or marginal utility” and then follow by presenting a “convenient form of W [as] one giving a constant elasticity of marginal utility” (p. 134). Just as one is about to conclude that their W is a utility function, meaning that the social welfare function in expression (16) is implicitly utilitarian, they state: “A higher value of [η] means greater emphasis on intergenerational equity. As [η]→∞, the well-being function in (4A.1) resembles more and more the Rawlsian max-min principle; in the limit, optimal growth is zero” (p. 135). Hence, in the end, their W(c) function has to be understood as the analogue to our reduced-form Z(c) function.

Accordingly, the foregoing analysis is fully applicable to their treatment as well. To illustrate the potential for confusion, consider the following statement that appears under the heading “Diminishing marginal utility,” immediately after a discussion of utility that unmistakably refers to individuals’ actual utility functions as revealed by their behavior: “Just as the choice of the rate of pure time preference ([δ]) has important implications for intergenerational equity, as discussed above, so does the choice of the elasticity of marginal utility. The more weight the society gives to equity between generations, the higher the value of [η]” (p. 136, emphasis added).

Stern (2007, 2008):

Begin with the Stern Review (Stern 2007). On one hand, the presentation seems to eschew the reduced-form approach. It states (p. 44) that one can think of “overall welfare, W, calculated across households (and generations) as a function of the welfare of these households.” The social welfare function for the simple case (Stern’s expression 3) is stated to be

Although this is identical to expression (15), suggesting that U should be understood as a reduced-form welfare function, this function is introduced by informing the reader that it presents “a very special additive form of W.” Hence, the interpretation is that U is indeed a utility function and expression (17) should be understood as a utilitarian social welfare function. Furthermore, attention is focused (Stern’s expression 6) on the case in which

leading to the interpretation that his η corresponds to our α, the coefficient of relative risk aversion, an empirical parameter of individuals’ utility functions reflecting their choices under uncertainty. Stern then presents his analogue to our expression (3) (his expression 8).

However, this interpretation turns out to be incorrect, or at least misleading. Stern states (p. 44) that “[t]he joint specification of W and [U] constitutes a set of value judgments which will guide the assessment of consequences.” One might have expected him to have said that the specification of W constitutes a value judgment, whereas the specification of U does not, but rather involves an empirical assessment of individuals’ risk preferences. All ambiguity is eliminated in his discussion of his version of expression (17), which had been described explicitly as a utility function (recalling that he purports to be using a utilitarian social welfare function): “η which is the elasticity of the marginal utility of consumption…is essentially a value judgment” (p. 46). As we have discussed, however, it is hard to understand how the proper choice of an empirical parameter constitutes a value judgment.

This subject is elaborated further in Stern (2008). He discusses how one “can interpret η as the parameter of relative risk aversion in the context of an expected utility model of individual behavior” (p. 17). After noting familiar behavioral anomalies, he claims that “there is very little to guide us.” From that, he somehow concludes that “we must address the ethics directly.” For example, he argues that “direct ethical discussion…suggests a broad range for η, although the consequences for simple transfers suggest that many would regard η in excess of 2 as unacceptably egalitarian.”Footnote 14 We find it difficult to understand how an actual, empirically grounded parameter of a utility function could be objected to on normative grounds.

There appear to be two ways to interpret Stern’s discussions. One is that he adopts a social welfare function that is utilitarian (additive) in functional form but rejects a subjectivist view of utility, instead deeming individuals’ utility functions for evaluative purposes to be something to be chosen by the social observer, with the curvature parameter being based on ethical views concerning the distribution of consumption (without regard to how consumption actually influences individuals’ utilities).Footnote 15 The other is that he is following the fairly common approach of viewing U(c) as really a reduced-form social welfare function of sorts, tantamount to our Z(c). In any case, the distinct conceptual roles of the W and U functions, and the distinct types of arguments and evidence pertinent to each, are obscured.Footnote 16

2 Extension: Uncertain future consumption

As mentioned in the introduction, uncertainty is one of the most striking features of the climate change problem; actually, it is an important element of any policy analysis pertaining to the distant future. For analytical purposes, we will simplify by supposing that all pertinent uncertainty—whether pertaining to climate change itself, its impacts on the economy, costs of emissions reductions in the future, or unrelated phenomena—can be summarized by its effects on the consumption path, which we now denote by c(t,θ), where θ indicates the state of the world (each θ corresponding to an entire consumption path). We further assume that θ has density function f(θ) and is distributed on the unit interval [0,1].

It is now possible to express expected social welfare (which we continue to denote by SW) as follows:

Given the time-separable form of our social welfare function, we can reverse the order of integration.

Focusing on the contribution to social welfare in each period (the inner integral, abstracting from the pure social rate of time preference), we note the familiar property that, for any t (and assuming strict concavity of U and that f(θ) is not degenerate):

In other words, the expected social welfare associated with any period is reduced on account of uncertainty relative to what it would be if consumption instead were certain at its expected value, which for later convenience we will denote by \( \bar{c}(t) \).

Consider the case in which uncertainty is greater at more distant time periods.Footnote 17 In this case, the contribution of the future to aggregate social welfare will be diminishing over time, again, relative to the case in which the consumption path took on its mean value with certainty. Now, to assess policies involving different consumption paths, we want to examine the effect of marginal changes in consumption on social welfare. Focus initially on the utility function U, which would be appropriate if the social welfare function were utilitarian, as in Gollier (2008).Footnote 18 Although this function is strictly concave, marginal utility is strictly convex for standard functional forms of utility; that is, U′′′ > 0.Footnote 19 This property suggests that the effects of changes in consumption in the future can be relatively more consequential on account of uncertainty. To illustrate this point, consider a policy that raises consumption at time t by a common increment in all possible states θ. Comparing the marginal contribution to social welfare in period t between the uncertainty and certainty cases, we note that

The greater the degree of uncertainty about outcomes in period t, the greater is the marginal gain from such a project.

The foregoing illustration supposes that we are considering a policy that raises consumption in period t by the same increment regardless of the state θ. More generally, policies implemented today will have different effects on consumption in a given period in different states. Of particular value are policies that, ceteris paribus, raise consumption most in the lowest-consumption states (the standard premium favoring negative covariance projects). With climate policy, for example, the worst states might correspond to those in which the degree of climate change for given emissions is the most severe; moreover, due to nonlinearities, incremental mitigation may well have the greatest payoff in those situations. In such a case, the expected utility gain from the future consumption benefit would be larger on two counts related to uncertainty: uncertainty itself amplifies the marginal gain, and the benefit would be concentrated in the lowest-consumption and hence highest-marginal-utility states, which further augments the increase in expected utility.

This too, of course, is just a hypothetical example. Nevertheless, this brief sketch indicates the potentially great importance of taking into account that future consumption streams are uncertain. Related, failing to attend to the fact that policies may have different effects in different states could also lead to significant misassessments of policies’ social value. Summarizing a policy’s effects in terms of a single, mean influence on the consumption path, c(t), is therefore quite problematic. Likewise, because of possible correlations among uncertain elements, such as the impact of a project and the prevailing state of nature, as in the preceding example, one cannot properly substitute certainty equivalents, component by component, which is sometimes done to simplify analysis.Footnote 20

Until now, we have considered only the implications of the curvature of U. If W is not utilitarian but instead is strictly concave, one’s intuition might be that the aforementioned phenomenon would be magnified. This view, however, is incomplete in two respects. First, Section 1 explored in detail the difficulties in drawing simple interpretations regarding the composite function W(U(c)), and these problems persist in the present context. For example, if one were trying to take certainty equivalents, one would have to reinterpret them to reflect the concavity of W in addition to that of U. Perhaps not surprisingly, the literature’s treatment of uncertain consumption paths largely mirrors its analysis of the certainty case and thus does not avoid any of the problems. For example, the Stern Review (Stern 2007, p. 49) uses the same construction and notation that we examined and found wanting in subsection 1.4 when it turns to uncertainty over the growth path of consumption.

Second, the problems with failing to properly distinguish between the W and U functions are greater when we introduce uncertainty over consumption paths because now we are interested in the curvature of the marginal impact on social welfare. In this case, just as we had to specify the sign of U′′′, with a strictly concave W function we also need to know the sign of W′′′(U(c)). Specifically, if one takes the third derivative of W(U(c)) with respect to c, there are four terms: three are unambiguously positive given our assumptions about U and with W strictly concave, and a fourth takes the sign of W′′′(U(c)). The shape of W is a normative matter, as we emphasize in Section 1. To our knowledge, the question of its appropriate third derivative has not been a subject of analysis or reflection (except implicitly for the utilitarian social welfare function, where the third derivative is zero).

To elaborate further on both the utility and social welfare functions, it is worth observing that all of the notation and expressions in this section for the case of uncertainty are formally equivalent to what one would employ to represent the certainty case but with an unequal distribution of consumption within each generation. Compare Rothschild and Stiglitz (1973). Instead of indexing states, θ would index individuals. Accordingly, instead of different levels of consumption in different states, we would have different levels of consumption for different individuals. The density of a given state would correspond to the density of individuals with the designated level of consumption. Expressions (19) and (20), for expected social welfare for the case where there is only a single (representative) individual in each generation, would now indicate social welfare for heterogeneous individuals in each generation, but now in the case of certain consumption paths. Expression (21) would indicate that social welfare is lower on account of inequality (holding average consumption constant) and expression (22) that a uniform increase in everyone’s consumption raises welfare more when the preexisting distribution of consumption is unequal.

One also could combine intragenerational inequality and consumption path uncertainty by focusing on the combination of the two phenomena in terms of the likelihood that an individual would experience a given level of consumption in a particular generation. More precisely, for each given state of nature there would be associated with it not a single level of consumption in generation t, but some distribution of consumption across individuals in that generation. Therefore, for each level of possible consumption in a generation, there would be a weight (density) indicating the aggregate likelihood that some individual would experience that level of consumption. At this point, we could, as with the inner integral in expression (20), integrate over that density to obtain the contribution to social welfare associated with that generation. Given the importance of intragenerational inequality (mentioned previously in note 1) and the magnitude of uncertainty about future consumption, the sorts of adjustments described here could be quite important to policy assessment.

Introducing uncertainty about future consumption when one employs a strictly concave social welfare function raises additional issues that have received little attention. These relate to some normative work on the choice of the social welfare function that shows how nonutilitarian social welfare functions can conflict with the Pareto principle and raise further problems.Footnote 21 To explore the former in the present context, consider again the inner integral in expression (20) or, equivalently, the left side of expression (21). They denote E[W(U(c))], the expected value of welfare as a function of utility (in a given generation). Sticking with the representative individual interpretation, compare this to the W(E[U(c)]), social welfare as a function of expected utility. When W is strictly concave, we have

The expression in large parentheses on the right side of (23) is the expected utility (not expected social welfare) for the representative individual in generation t. (Note also that this term differs from that on the right side of (21), where the expectation is over c and not U(c).)

If the representative individual in generation t were behind the veil, so to speak, at time 0, that individual would wish to maximize the expected value of U(c), suggesting that U(c) should be the social maximand and not W(U(c)).Footnote 22 One way to see the argument is to compare two policies that hold constant the situation of individuals in all other generations but provide different outcomes for generation t, as follows: the first policy yields slightly higher expected utility than does the second policy, but it produces a sufficiently higher variation in utility levels that the integral on the left side of expression (23) is lower than that for the second policy. (Such a situation is possible whenever W is strictly concave.) The individual in generation t would prefer the policy with the greater expected utility but society would prefer the other due to its lower variance in utility levels. For this one-individual society, a strictly concave W therefore leads to a violation of the Pareto principle. Moreover, one could replicate this formulation for all t, which would generate a strict Pareto violation: all generations would be worse off under the policy deemed best by the strictly concave social welfare function W.Footnote 23

Stepping back from the immediately preceding point to the observation that the uncertainty case is isomorphic to intragenerational inequality, we can see from yet another perspective how the curvature of an evaluation function influences assessments under uncertainty and also other sorts of evaluation. In Section 1, we explored how curvature (of both W and U) influences not only decisions under uncertainty but also allocations over time, a point that is familiar from individual utility maximization: greater concavity of U makes consumption smoothing more valuable. In this section, we have focused instead on uncertainty about future consumption. In all instances, risk preferences dictate the assessment of outcomes that might be unequal, whether with certainty or due to uncertainty. The behind-the-veil perspective suggests that this deep connection applies to thinking about the social welfare function as well as contemplation of individuals’ utility functions.

3 Conclusion

Much of the literature on discount rates, and particularly that addressed to assessing climate change policies, uses a reduced-form approach under which consumption flows over time are discounted. A key component of the overall social discount rate (and the main or only component for those who hold egalitarian views toward individuals in different generations) is captured by a single parameter reflecting the curvature of a reduced-form function of consumption.

In principle, this parameter needs to be derived from the underlying social welfare function and individuals’ utility functions. We have made this decomposition explicit. Doing so reveals a number of anomalies in the standard approach and many respects in which leading discussions of the issues are in some respects confused and potentially misleading. The central problem concerns the conflation of social judgments, an entirely normative matter, and estimates of individuals’ utility functions, specifically, their risk preferences, a purely empirical question. Viewed properly, empirical evidence on the curvature of individuals’ utility as a function of consumption is a central factor, and the only one under a utilitarian social welfare function. Ethical argumentation is entirely appropriate (indeed, necessary) regarding the choice of the social welfare function, but it is inapposite when measuring individuals’ risk preferences. In reviewing the climate change literature, we find that authors often invoke ethical views when they should be attending much more to empirical evidence on individuals’ decision-making under uncertainty.

When we address uncertainty in future consumption paths, a striking feature of climate policy assessment, we show that the same difficulties of conflating curvature due to individuals’ risk preferences and that attributable to social judgments are manifest. Indeed, the implications of a strictly concave social welfare function (in contrast to individuals’ utility functions exhibiting risk aversion) have received little attention in this context, and we identify some significant problems that have not previously been recognized.

At one level, some of these points are familiar, even elementary. On the other hand, they are often forgotten or confused, even in the leading expositions on the subject. And the explicit analysis of uncertainty introduces conceptual challenges that are not appreciated. This article seeks to advance understanding through a clear, distinct formulation and also to elaborate the specific ways in which analysis can go awry when familiar reduced-form representations are substituted for explicit decomposition that distinguishes curvature due to individuals’ risk preferences from that attributable to social judgments.

Notes

When there is heterogeneity within generations—which is enormous across the world’s population—the summary for a generation is itself properly understood as a composite of a social welfare function and individuals’ utilities, rather than simply a utility function, so it too would need to be decomposed to do the analysis correctly. Indeed, even with a utilitarian social welfare function that merely sums all individuals’ utilities within the generation, the manner in which total utility depends on aggregate consumption in the generation, and changes thereto along different policy paths, generally cannot be summarized simply as some individual’s utility function, although the summary function for the generation will obviously depend directly on individuals’ utility functions, as well as on how consumption is distributed.

This question is examined in the intragenerational context with regard to the optimal income taxation literature in Kaplow (2010), which provides the basis for the analytical approach in this section.

Throughout, if the pertinent constant equals 1, the natural log functional form should be employed instead.

The right side can be reduced to α+(1−α)β, which shows the correspondence with expression (8), noting that, for this functional form for U, ε U = 1−α.

The situation is not as bad as may first appear when one realizes that, for α > 1, expression (9) for utility is negative. Accordingly, if one employs negative values for β rather than positive ones and considers higher magnitudes for β (which correspond to lower, negative values) to represent greater social aversion to inequality in utility levels, the familiar relationships are restored. See Kaplow (2010, p. 34).

Interestingly, Mirrlees (1982, p. 77 n. 21) takes the occasion of his essay in the Sen and Williams volume to clarify that, in his seminal optimal income taxation paper, Mirrlees (1971), he meant to represent a utilitarian social welfare function, so his curvature parameter needs to be interpreted as a possible value for the curvature of individuals’ actual utility functions, not as the degree of social inequality aversion, which depends on the social observer’s ethical preferences.

This conclusion follows from Kaplow and Shavell’s (2001) demonstration that any nonindividualistic social welfare function violates the Pareto principle.

In his note 4, Dasgupta might be understood to adopt a utilitarian view as he explicitly rejects the prioritarian approach. Yet he states that a “utilitarian” can “assign” a lower “social” value to increases in consumption of the rich versus the poor, and his later statements, some mentioned below, embrace what many refer to using the language of prioritarianism.

To take another example, Heal’s (2005, pp. 1110, 1121–22) prominent survey employs a social welfare function like that in expression (15), explicitly adopts a utilitarian view, and hence appears to avoid the problems we raise. Nevertheless, when elaborating in other writing on how one determines the curvature of utility, he takes the same position as Dasgupta and others: “Of course the choice of the form for the utility function, and therefore the value of [η], is also an ethical choice [like the choice of δ].” (Heal 2009, p. 281.)

Consider the case in which a thought experiment is conducted and it turns out that most would be unwilling to undertake a cost-beneficial medical research project at a cost of $50 billion, but rather would pay only $1 billion. Should one conclude that if, say, saving lives were the benefit, it must be that the proper social value on life is, say, only $100,000 rather than $5,000,000, despite revealed preference evidence favoring the latter figure? Or that the proper social welfare function places a tiny weight on the affected group (individuals who happen to contract the particular disease)? Or that respondents implicitly disbelieve the estimates of expected benefits? Or—our preferred interpretation—that our intuitions about plausible amounts to spend on medical research are way off the mark (which is part of why we undertake explicit cost-benefit analysis, after first determining our value of life and what we believe to be the proper social welfare function)?

There is a typographical error in the original, the omission of the variable of integration t from the exponent of e.

Later, Stern (2008, p. 23), in summarizing his discussion, refers to choosing a higher value for η, such as η = 2, as “taking on board the positions of two commentators on the Review—Weitzman (2007a, b) argued for greater emphasis on risk and uncertainty, and Dasgupta (2007) for more egalitarian values than those captured by η = 1,” suggesting the mixed role Stern associates with the single parameter of his reduced-form representation.

In discourse in moral philosophy, this is sometimes referred to as an objectivist view of well-being or a perfectionist ethical stance.

Keep in mind that this statement is as viewed from the present, time 0. Uncertainty regarding climate change may well fall over time as more is learned, but present policy decisions need to be based on current information. The prospect of learning does, of course, introduce an important option value element to optimal policy determination. See Gollier and Treich (2003) and Summers and Zeckhauser (2008).

Gollier (2008) uses this framework to explore the term structure of discount rates under various assumptions about the structure of uncertainty (specifically, regarding the possible nonconstancy of volatility) whereas we focus, as in Section 1, on the interrelationship between the curvatures of U and W.

This condition is often termed “prudence,” referring to an individual’s inclination to save more when uncertainty about future consumption increases. See Gollier (2008) and Kimball (1990). Decreasing absolute risk aversion is a stronger, sufficient condition; an even stronger sufficient condition is constant relative risk aversion (as in expression 9).

Consider, for example, the statement of Arrow et al. (1996, p. 130, emphasis omitted): “Most economists believe that considerations of risk can be treated by converting outcomes into certainty equivalents, amounts that reflect the degree of risk in an investment, and discounting these certainty equivalents. There is general agreement that in evaluating competing projects, all spending, including investment, is to be converted into consumption equivalents first, then discounted.… Environmental impacts may be incorporated by converting them to consumption equivalents, then discounting.” One might justify examining each component separately if, in computing the certainty equivalent, one took account of the covariance of that component with overall consumption (in the one-factor model we are considering) and if, moreover, each component was small. In the climate policy context, however, the latter assumption is not regarded to hold.

There is another, quite different sort of problem that may arise: double counting of the costs of uncertainty. For example, in the IPCC Fourth Assessment Report (2007, p. 137), it recommends “transformation of the random benefit into its certainty equivalent for each maturity” and then “[i]n a second step, the flow of certainty-equivalent cash flows is discounted at the rates recommended above.” However, to the extent that those recommended rates are ones that are already adjusted downward on account of the interaction of uncertainty in future consumption flows with curvature in individuals’ utility functions, this certainty equivalent adjustment would be incorrect.

Pareto conflicts, time inconsistency, and other matters are examined, for example, by Kaplow (1995) and the literature discussed therein. Note that the Pareto conflict considered here is qualitatively different from that explored in Section 1: there, the problem arises from the social welfare function depending directly on an empirical parameter rather than being solely a function of individuals’ utilities; here, we are assuming that social welfare depends only on individuals’ utility functions but addressing how nonlinearity of the social welfare function can produce Pareto violations in the presence of uncertainty.

One could attempt to avoid this difficulty by adhering to the strictly concave W but insist that it operate on expected utility rather than on realized utility. This alternative formulation, however, raises other difficulties. Notably, it requires a particular categorization of different sources of uncertainty: behind the veil, uncertainty regarding identity is treated qualitatively differently from uncertainty regarding outcomes associated with each identity. (Suppose there are two individuals behind the veil, who will each, with 50% likelihood, be actual persons A and B; moreover, there are two outcomes, High and Low. If A receives High for sure and B receives Low for sure, we use the strictly concave W to assess the regime. But if whether A rather than B gets High or Low depends on a single coin flip, we do not use the strictly concave W but just the U functions. In a sense, all the difference depends on whether the identity-determining coin is flipped before or after the coin indicating the linkage of identities to particular outcomes.)

References

Arrow, K. J., Cline, W. R., Maler, K.-G., Munasinghe, M., Squitieri, R., & Stiglitz, J. E. (1996). Intertemporal equity, discounting, and economic efficiency. In J. P. Bruce, H. Lee, & E. F. Haites (Eds.), Climate change 1995: Economic and social dimensions of climate change. Cambridge: Cambridge University Press.

Barsky, R. B., Juster, F. T., Kimball, M. S., & Shapiro, M. D. (1997). Preference parameters and behavioral heterogeneity: an experimental approach in the Health and Retirement Study. Quarterly Journal of Economics, 112, 537–579.

Campbell, J. Y. (1996). Understanding risk and return. Journal of Political Economy, 104, 298–345.

Chetty, R. (2006). A new method of estimating risk aversion. American Economic Review, 96, 1821–1834.

Choi, E. K., & Menezes, C. F. (1992). Is relative risk aversion greater than one? International Review of Economics and Finance, 1, 43–54.

Dasgupta, P. (2008). Discounting climate change. Journal of Risk and Uncertainty, 37, 141–169.

Gollier, C. (2008). Discounting with fat-tailed economic growth. Journal of Risk and Uncertainty, 37, 171–186.

Gollier, C., & Treich, N. (2003). Decision-making under scientific uncertainty: the economics of the precautionary principle. Journal of Risk and Uncertainty, 27, 77–103.

Harsanyi, J. C. (1953). Cardinal utility in welfare economics and in the theory of risk-taking. Journal of Political Economy, 61, 434–435.

Harsanyi, J. C. (1955). Cardinal welfare, individualistic ethics, and interpersonal comparisons of utility. Journal of Political Economy, 63, 309–321.

Heal, G. (2005). Intertemporal welfare economics and the environment. In K.-G. Mäler & J. R. Vincent (Eds.), Handbook of environmental economics, vol. 3. Amsterdam: Elsevier.

Heal, G. (2009). The economics of climate change: a post-Stern perspective. Climatic Change, 96, 275–297.

International Panel on Climate Change, Working Group III. (2007). Climate change 2007: Mitigation of climate change. Cambridge: Cambridge University Press.

Kaplow, L. (1995). A fundamental objection to tax equity norms: a call for utilitarianism. National Tax Journal, 48, 497–514.

Kaplow, L. (2005). The value of a statistical life and the coefficient of relative risk aversion. Journal of Risk and Uncertainty, 31, 23–34.

Kaplow, L. (2010). Concavity of utility, concavity of welfare, and redistribution of income. International Tax and Public Finance, 17, 25–42.

Kaplow, L., & Shavell, S. (2001). Any non-welfarist method of policy assessment violates the Pareto principle. Journal of Political Economy, 109, 281–286.

Kimball, M. S. (1990). Precautionary saving in the small and in the large. Econometrica, 58, 53–73.

Kocherlakota, N. R. (1996). The equity premium: it’s still a puzzle. Journal of Economic Literature, 34, 42–71.

Mirrlees, J. A. (1971). An exploration in the theory of optimal income taxation. Review of Economic Studies, 38, 175–208.

Mirrlees, J. A. (1982). The economic uses of utilitarianism. In A. Sen & B. Williams (Eds.), Utilitarianism and beyond. Cambridge: Cambridge University Press.

Nordhaus, W. D. (2007). The Stern Review on the economics of climate change. Journal of Economic Literature, 45, 686–702.

Nordhaus, W. D. (2008). A question of balance: Weighing the options on global warming policies. New Haven: Yale University Press.

Rothschild, M., & Stiglitz, J. E. (1973). Some further results on the measurement of inequality. Journal of Economic Theory, 6, 188–204.

Sen, A., & Williams, B. (1982). Utilitarianism and beyond. Cambridge: Cambridge University Press.

Stern, N. H. (1976). On the specification of models of optimum income taxation. Journal of Public Economics, 6, 123–162.

Stern, N. H. (2007). The economics of climate change: The Stern Review. Cambridge: Cambridge University Press.

Stern, N. H. (2008). The economics of climate change. American Economic Review: Papers and Proceedings, 98(2), 1–37.

Summers, L., & Zeckhauser, R. (2008). Policymaking for posterity. Journal of Risk and Uncertainty, 37, 115–140.

Vickrey, W. (1945). Measuring marginal utility by reactions to risk. Econometrica, 13, 319–333.

Weitzman, M. L. (2007). The Stern Review of the economics of climate change. Journal of Economic Literature, 45, 703–724.

Zeckhauser, R. J., & Viscusi, W. K. (2008). Discounting dilemmas: editors’ introduction. Journal of Risk and Uncertainty, 37, 95–106.

Acknowledgement

We thank the editor and referee for comments and Harvard’s John M. Olin Center for Law, Economics, and Business, the Daniel and Gloria Kearney Fund, the Walter J. Blum Faculty Research Fund, and the Walter J. Blum Professorship in Law for financial support.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Kaplow, L., Weisbach, D. Discount rates, social judgments, individuals’ risk preferences, and uncertainty. J Risk Uncertain 42, 125–143 (2011). https://doi.org/10.1007/s11166-010-9108-7

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11166-010-9108-7