Abstract

Using data from two freshmen cohorts at a public research university (N = 3730), this study examines the relationship between loan aid and second-year enrollment persistence. Applying a counterfactual analytical framework that relies on propensity score (PS) weighting and matching to address selection bias associated with treatment status, the study estimates that loan aid exerts a significant negative effect on persistence for students from low-income background (i.e., Pell eligible), and those taking up high amounts of loans in order to meet total cost of attendance, including students who exhausted the available amount of subsidized loan aid. However, no significant incremental effect associated with unsubsidized loan aid, net of subsidized loan aid, could be detected. The estimated effect of loan aid on persistence controls for first-year academic experience and takes into account 26 factors related to loan selection and persistence in order to match students with loan aid to a counterfactual case in covariate adjusted regression. Comparison with results from non-matched-sample analysis suggests selection bias may mask the negative effect of loans detected with matched-sample estimation. Validity of covariates determining the loan selection process and criteria for acceptable balance in the matched data are discussed, and implications for future research are addressed.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Between 2004 and 2014 the average amount of debt for U.S. college graduates to finance their studies rose by 56%—more than twice the rate of inflation (25%) during that time period—and the total outstanding federal student loan balance over the last 12 years has more than quadrupled to over $1.3 trillion (Kane 2016; Institute for College Access & Success 2015; Looney and Yannelis 2015). While the rapid rise in student loan financing is incontrovertible, its effect on student enrollment persistence is less clear. Reviewing the research between 1991 and 2008, Hossler et al. (2009, p. 410) found “mixed” effects of loans on student enrollment persistence, a finding echoed by Pascarella and Terenzini (2005, p. 411) after they examined scholarly studies published since the 1980s. Since close to 20% of college dropouts accumulate substantial loan debt (AASCU 2006), a better understanding of the loan burden-dropout nexus is imperative in order to improve college completion.

More recent reviews on the impact of aid largely corroborate previous findings and highlight that incongruities in results likely stem from differences in methodology, data sources, scope of the analysis, type of aid covered, and how aid is measured (Welbeck et al. 2014; Chen and Zerquera 2011; Hossler et al. 2009). The cumulative evidence from these studies show that the influence of aid on student enrollment persistence is mediated by a complex web of interrelated factors: including the timing, type, and amount of aid and how they correlate with persistence in the presence of other student attributes. Moreover, as Hossler et al. caution, “because of the complex interplay of privilege, opportunity, and conditioned action in society, the question of endogeneity bias becomes an inherent controversy in the study of financial aid and persistence in college (Hossler et al. 2009, p. 401). Finally, recent studies show that the likelihood of loan selection to finance college is significantly associated with parental contributions to cover educational expenses and the amount of remaining (or unmet) need students face after taking into account all types of aid received (Cho et al. 2015; Brown et al. 2014; Elliot and Nam 2013; Cadena and Keys 2013).

Mindful of the insights gained from previous research on student loan aid, this study focuses on the relationship between loan aid and enrollment persistence of first-year students, and specifically addresses the influence of student/parent ability to pay, the level of unmet financial need net of all types of awarded aid, and the potential selection bias when estimating the impact of loan aid. To this end, the study gauges the effect of federal loans on enrollment persistence for first-year students who completed the Free Application for Federal Student Aid (FAFSA) at a public research university. The study focuses specifically on students with different levels of estimated financial (family/student) contribution (EFC) to meet the cost of college attendance, and students with distinctly different levels of unmet financial need. Thus, the study is guided by the following research questions:

-

1.

Are there significant differences in enrollment persistence between first-year students with loans and students with no loans?

-

2.

Are differences in persistence between students with loan aid and no loan aid associated with level of EFC and level of unmet financial need?

-

3.

Since some students rely on both federally subsidized and unsubsidized loan aid, is there a significant marginal effect associated with unsubsidized loan aid net of subsidized loan aid?

-

4.

Since the amount of federal loan money is capped for both subsidized and unsubsidized loans, are first-year students who receive the maximum amount less likely to persist?

The following sections review the pertinent literature, examine the factors that are associated with loan selection, and describe the method used here to address selection bias when estimating the effect of student loans. Subsequent sections present the analytical framework and the study findings.

Prior Research

In their review of the research corpus that accumulated since 1991, Hossler et al. (2009) concentrated on 32 “highly relevant, high-quality studies” that shaped their conclusions about the effect of financial aid on student persistence (p. 394). They found that few studies examined the effect of the amount of debt on enrollment persistence, and most studies failed to include robust indicators of student academic and social integration, and only a paucity of studies addressed selection bias in cross-sectional analysis of aid and persistence. These limitations, the authors argue, may well account for the inconsistent findings on the relationship between loan aid and enrollment persistence. Also, they found that a dichotomous indicator for loan status was more likely associated with negative or nonsignificant effects, while studies capturing the amount of loan aid yielded mostly positive effects on student persistence (pp. 410–411).

In a more recent review of the financial aid research, Welbeck et al. (2014) single out ten studies that employed randomized control trials (RCTs) and quasi-experimental designs (e.g., regression discontinuity) to estimate the causal link between aid and academic success. Though none of these studies isolated student loans as the focal interest, they showed a consistent pattern of positive effects of need-based grant aid on credits earned and enrollment persistence. To further improve our understanding of the aid impact, the authors called for more research that disaggregates results by different levels of unmet need that students face (p. 7).

Using propensity score matching to address selection bias, McKinney and Backschneider Burridge (2015) found a positive effect on persistence into the second year for community college students on loans based on data from the Beginning Postsecondary Student (BPS:04/09) survey, but that effect turned negative 3 and 6 years after initial enrollment. In a similar study on community college students that did not attempt to control for selection bias, Dowd and Coury (2006) observed a negative effect of loans (measured dichotomously and amount of dollars) on persistence to the second year, though loans did not exert a significant influence on degree attainment, and there was no association with low-income and dependency status of the student.

Jackson and Reynolds (2013) estimated the impact of loans on persistence of black and white first-year students at 4-year institutions captured by the 1996–2001 Beginning Postsecondary Student (BPS:96/01) survey. While loans appeared to enhance persistence and degree completion for both black and white students, black students were more likely to take on larger loan amounts. Using the BPS:96/01 survey data in conjunction with the National Postsecondary Student Aid Study (NPSAS:96) data, Chen and DesJardins (2010) found that subsidized loans had on average a positive effect on enrollment persistence, while unsubsidized loans exerted no significant influence. Though their study did not address the potential selection bias associated with loan status, their findings control for the timing of loan receipt during 6 years of undergraduate enrollment. In a similar study that focused on identifying variations of aid effects across student income background, Chen and DesJardins (2008) noticed the positive effect of Pell grant on persistence of low-income students, but they found no significant variation in the effect of loans on students from different income background. This finding corroborated an earlier study by Dowd (2004), using a nationally representative sample of first-year students, which also showed no variation in loan effect by student income background. In contrast, Kim (2007), who also used the BPS:96/01 survey data, found that loan debt for first-year students from low-income background is negatively correlated with their chance for degree completion. However, the amount of loan debt may not have a linear negative effect on student persistence, as Robb et al. (2011–2012) discovered from a large-scale survey of students at two major universities. Their finding suggests that the negative effect of loan amount on persistence increases up to a point after which it declines, indicating that student perception of loan burden exerts some influence on enrollment persistence. The perceived loan burden also varied with academic performance and class standing, with high-GPA students feeling less burdened and first-year students feeling more burdened.

Relying on matched samples of first-year students at two public research universities, Gross et al. (2015) discovered that greater reliance on loans as part of the student’s total aid package was linked to higher enrollment persistence, although their analysis did not examine if that finding was consistent across income background or if it varied between subsidized and unsubsidized loans. In a similar study at a large public research institution, Jones-White et al. (2014) found that $1000 in first-year load aid reduced the chance of graduation from that institution by over 7% net of the effect of other types of aid. In contrast, Bresciani and Carson (2002) noticed no significant association between the proportion of loan aid in total first-year assistance and enrollment persistence, while Braunstein et al. (2001) found no significant effect of loan aid on persistence of first-year students. Omission to distinguish between subsidized and unsubsidized loans has been identified as one likely reason for the mixed findings on loan effects (Chen 2008; Singell 2002; DesJardins et al. 2002). And since student persistence is strongly correlated with features of the institution attended (Pascarella and Terenzini 2005), Gross et al. (2015) call for more research on financial aid effects at individual campuses.

The discrepant and incongruous findings from the cumulative research on the effects of student loans has prompted greater attention on the interrelationship between aid eligibility and loan status on the one hand and enrollment persistence on the other hand. Only a few studies have highlighted the need to address self-selection bias associated with student motivation and educational goal, and endogeneity bias associated with student attributes and background characteristics (Hossler et al. 2009; Dowd 2008; Alon 2005). The methodological challenge is to render loan status independent of other student features that influence whether or not one qualifies for and selects loan aid. “This problem of the inherent endogeneity of aid eligibility—and the related one of self-selection—can mask the true effect of aid on student persistence” (Hossler et al. 2009, p. 400). To address this problem, one needs to understand the factors that govern a student’s probability for loan selection in order to model loan status as an external (exogenous) predictor of student persistence. Moreover, there is a paucity of research on the effect of loans for students from different income background, with different levels of ability to pay, and with varying levels of unmet need.

Loan Selection

Loans are typically a ‘last resort’ source of aid for students after merit-based scholarships and need-based grants are exhausted (Ziskin et al. 2014). Students who qualify for subsidized loans may select to rely on unsubsidized loans if the former are considered insufficient. In contrast to scholarship and need-based grant aid that are available (and thus selected) based on academic merit and income background, selection of loan aid is more directly tied to perceived need, which is a function of the actual remaining need after taking into account all other aid received (Cadena and Keys 2013; Brown et al. 2014). A student’s eligibility for need-based federal financial aid is determined by the student’s ability to pay and the cost of attendance at the selected school. Specifically, information on assets and income of the student and parents collected through the FAFSA are compared to the cost of attendance to determine the EFC from the parent and/or student. Students whose cost of attendance surpasses their EFC typically qualify for some type of need-based aid, including subsidized and unsubsidized loans.

Unlike scholarship and grant aid, which typically offer little discretion for the student to select and accept or reject—amounts are usually set, eligibility is clear cut—students have greater discretion whether or not to take out a loan and for what amount. If qualified, these loans are listed in an award letter sent to the student, with the default choice indicating acceptance. To receive a loan, first-time borrowers are required to sign a promissory note and attend loan counseling, which can be completed online. (For details on the FAFSA award process, see Cadena and Keys 2013). Thus, the presence of selection bias is more plausible with loans compared to scholarships and grants, a point highlighted in Hossler et al. (2009, p. 413) in their review of the research: “Because loans have to be repaid, the possibility of self-selection bias influencing any analysis of the impact of student loans is great.”

In a review of the determinants of loan selection Cho et al. (2015) highlight the importance of family and parental contributions to cover student educational expenses. Brown et al. (2014) found that the degree of unmet expected family support is associated with demand for financial aid, while Elliot and Nam (2013) reported that students with college savings accounts are less likely to seek financial aid. Data from the 1999–2000 and 2003–2004 waves of the National Postsecondary Student Aid Study (NPSAS) confirm that students with the highest unmet need are most likely to take up loans (Cadena and Keys 2013). Student proclivity to rely on loans is also associated with past behavior, consideration of parental views, gender, and support for future goals in life (Chudry et al. 2011). Students with higher educational goals (e.g., expecting to earn a graduate-level degree) were found to be more tolerant to take on debt (Trent et al. 2006). Parent disposition to debt, ethnic/racial background, and social agents in the educational environment (e.g., counselors, peers) may also influence loan selection (Dowd 2008; Luna De La Rosa 2006; Stanton-Salazar 1997). In contrast, access to financial aid information does not appear to affect the likelihood of loan take-up based on findings from a randomized field experiment (Booij et al. 2012). However, assistance with filling out and processing the FAFSA, which covers subsidized and unsubsidized student loans, does increase the rate of aid application (Bettinger et al. 2009). Thus, cognitive constraints may influence whether or not a student applies for loan aid.

As the research indicates, students’ preference for the types of financial aid available is conditioned by a host of factors, many of which relate to socio-demographic background (parent education, ethnicity/race, peers), economic resources (income and family support), the actual and perceived need to meet educational expenses, and educational goal and expectations. Many of these factors can be measured with institutional student matriculation and FAFSA-sourced financial aid data, and such data can be complemented with student survey data (Caison 2007). However, the loan selection process may also be influenced by student self-concept and other affective dispositions that are difficult to capture (Dowd 2008).

Estimating the Effect of Student Loans on Enrollment Persistence

Conceptual Framework

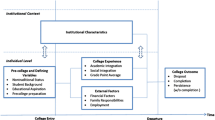

Development of the analytical model and its variable specification follows Chen’s (2008) multidimensional approach and Astin’s (1993) longitudinal input–environment–output (I–E–O) model. In addition to the seminal theories that are anchored in the psychological, sociological, organizational, and interactionalist perspectives (Tinto 1993, 1982; Bean 1980, 1983), Chen’s multidimensional, or heterogeneous, approach is steeped in human capital theory and supply and demand theory, and it incorporates the assumption that students from different economic background respond differently to financial aid, in part due to varying levels of debt aversion (pp. 221–223). Specifically, Chen posits that mounting levels of debt lowers persistence of students from low-income background, thus the effect of loan take-up by these students translates into greater dropout risk compared to higher-income students. Chen’s conceptual attention to loan propensity by income background is therefore well suited to gauge the effect of loans for students with distinctly different levels of EFC and unmet financial need.

Astin’s I–E–O model offers a suitable framework to examine the influence of financial aid while controlling for the influence of student attributes and background (inputs), and campus social and academic experience variables—referred to by Astin as environmental “involvement measures”—that may mediate the relationship between aid and persistence (Astin 1993, pp. 77–82). Campus involvement measures include student use of academic and social support offices, and on-campus employment. Core courses (math, English) and academic performance in terms of grades attained (GPA) and credits earned have consistently emerged as key correlates of student persistence and should be incorporated when estimating the effect of loans (Pascarella and Terenzini 2005; Adelman 2006; Astin 1993). Selection of other covariate controls to estimate the discrete effect of loans on persistence is guided by Chen’s (2008, pp. 223–228) major variable clusters, including student socio-demographic attributes (gender, age, ethnicity/race, parental education), residency background, educational aspiration, academic preparation, financial aid factors, and college cost of attendance. These variables complement those specifically informed by our understanding of the loan selection process and are listed and statistically summarized in Table 1.

The Propensity Score and Counterfactual Inference Model

To address the potential selection bias associated with estimating the effect of student loans on enrollment persistence, the study relies on propensity score (PS) matching in two-stage regression models. Like regression discontinuity and instrumental variable (IV) methods, the PS method offers a way to address selection bias and to establish control groups as benchmarks to gauge the effect of student loans on enrollment persistence (Bowman and Herzog 2014; Murnane and Willett 2010; Alon 2005; Angrist 2003). Use of the PS in observational studies was popularized by Rosenbaum and Rubin (1983, 1984) and is closely linked to the counterfactual analytical framework that emerged in statistics and econometrics (Holland 1986; Rosenbaum 2002; Rubin 2006; Heckman 2000). The counterfactual model seeks an answer to the “what if” question. In the context of this study, what is the potential enrollment outcome for a student who took up loan aid to pay for college had that student not chosen to rely on loan aid? The ability to create a counterfactual case—the comparable untreated (no loan) student that substitutes for the unobserved outcome of the treated (with loan) student—is at the core of causal inference estimation after controlling for treatment selection (i.e., selection bias).

Rosenbaum and Rubin (1983) showed that matching a treated case with an untreated case on a single probability (propensity) score that adequately captures the linear combination of factors that predict treatment selection offers a way to reduce selection bias. Formally, the propensity score

measures the probability (Pr) of selecting into treatment D conditional on observable predictors (covariates X) for each case (i). Assuming the treatment can be measured dichotomously (D = 1 or 0), the average treatment effect (ATE) conditional on X is formalized as

where E(∆i|Xi = x) is the expected difference in the outcome Yi between the treated (Di = 1) and untreated (Di = 0), controlling for observable factors (Xi = x) that predict treatment (D) selection. Since financial aid evaluation in education is focused typically on intervention or support for those students who need the aid, the counterfactual centers on the student with a loan—i.e. had that student not selected loan aid—and thus the average treatment effect on the treated (ATT) is defined as

or the difference in outcome under treatment and non-treatment for those students who actually did select loan aid.

PS Methods

The PS is estimated with a logit regression model for a binary treatment (i.e., selecting loan aid or not) that takes the following function

where P i denotes the likelihood of student i to select loan aid, X i is the vector of student attributes listed in Table 1, and e i captures a random error term. The study then estimates the effect of loan aid on enrollment persistence by matching students with loans to those without loans on their PS, by inverse probability of treatment weighting (IPTW) using the PS, and by including the PS and loan status in covariate adjusted regression (see Austin 2011; Murnane and Willett 2010), specified as

where Pi is the likelihood of student i enrollment persistence, Xi is the propensity to select loan aid (PS), Yi indicates loan status (yes/no), Zi is a vector of first-year college experiences (as listed in Table 1), and ɛi is the random error term. To address the need for measuring the influence of loans for students from different income background and different levels of ability to pay, the study runs separate PS-matching and estimation models for students with a low EFC (i.e., Pell eligible) versus students with a high EFC (i.e., upper half of Pell non-eligible students), and for students with no remaining financial need versus students with high remaining need (i.e., upper half of those with remaining need). The latter include students whose remaining need is equivalent to at least half of the cost of attendance for in-state residence students with on-campus living arrangements.

Results of each PS method are estimates of the ATT—i.e., the effect on students with loans had they not taken out loan aid—and are compared to unmatched-data regression with the same set of covariates. Data were matched using the nearest neighbor and full matching functions in the MatchIt R program (Ho et al. 2011), and genetic matching using the Matching program in R by Sekhon (2011). These algorithms yielded the best covariate balance among several others in a PS evaluation study and thus are relied upon here (Herzog 2014).

Results from PS-matched data are compared with unmatched-data regression and with weighted-case regression using IPTW. With IPTW, treated cases receive a weight of 1, while all control cases are weighted on

where P i (X) is the PS of the control case, thereby magnifying untreated cases that resemble more closely the treated cases (for more on IPTW, see Reynolds and DesJardins 2010).

Data Source and Variables

Data are drawn from a moderately selective public research university (average freshman SAT of 1080, ACT of 23; Carnegie classification: R2) with a population of about 21,000 mostly full-time students. The data capture the profile and academic experience of 3730 new first-year undergraduate students that enrolled full-time in the fall semester of 2011 and 2012. Fifty-six percent of those were female; 25% identified as either Hispanic, Black, Native American, or Pacific Islander; and 52% lived on campus. Twenty percent qualified for reduced out-of-state tuition under the Western Undergraduate Exchange (WUE) program, 7% paid the full-rate non-resident tuition, and 37% received the federal Pell grant. Only 1.6% (N = 60) of cohort students were financially independent based on the FAFSA filing. The average cost of attendance for first-year, in-state students living on campus during that time was $20,147. The average cost of attendance increase between 2011 and 2012 was compensated for with an almost commensurate rise in average grant and scholarship aid support in order to produce a largely unchanged average net cost of attendance between 2011 and 2012. Part-time students with less than 12 attempted semester credits were excluded from the analysis. They make up 4.7% of the first-time enrolled students, and they do not qualify for most institutional scholarships that require full-time enrollment. There were 163 students who filed a FAFSA but did not complete the process or submitted documentation that could not be fully verified, and thus were excluded.

The PS for loan status (0 = no, 1 = yes) is estimated first for all types of loans—subsidized and unsubsidized—and subsequently for only unsubsidized loans. The latter offers the opportunity to estimate the incremental effect of unsubsidized loans after factoring in subsidized loan aid, which is a covariate (predictor) in the PS estimation. This distinction is important, since students that are eligible for subsidized loans are likely to exhaust that source before selecting unsubsidized loans (Ziskin et al. 2014). Of the 37% of students that relied on federally subsidized loans, 88% borrowed the first-year maximum allowable ($3500); and 76% of those who reached the maximum also borrowed unsubsidized loans. Of the 63% of students who did not receive subsidized loans, 17% received the first-year maximum allowable amount ($5500) of unsubsidized loans. Of all the students with loans, 97% relied on federal government loan programs (almost all Stafford Loans, 3% with Perkins Loans and 5% with PLUS Loans), while the remainder took out private loans administered through the institutional financial aid office.

Selection of the covariates to estimate the PS (as listed in Table 1) is governed by several criteria. First, they mirror the variable clusters in Chen’s multidimensional model and reflect student socio-demographic background, residency status, academic preparation, financial aid profile, and cost of attendance. Second, they are all baseline characteristics that exist prior to student selection of loan aid and may be related to both selection of loan aid and enrollment persistence. While the most important covariates are those related to selection of loan aid, both theoretical and empirical research show that PS estimation with a large set of covariates (at least ten or more), including covariates indirectly related to the outcome, yields better PS balance between treatment and control groups (Stuart and Rubin 2008). Third, most of the covariates selected here have been used extensively in prior research to understand student academic success and enrollment persistence (Jones-White et al. 2014; Chen 2008; Haynes 2008; Pascarella and Terenzini 2005; Astin 1993).

Table 1 lists the 26 covariates to estimate the PS with logistic regression using loan status as the dependent variable. Remaining need, estimated family/student contribution (EFC), and whether or not a student had scholarship aid or a Pell Grant are student financial attributes to estimate the PS for loan selection. These variables in combination with matriculation-system data that track on-campus living status, participation in a living-and-learning community, out-of-state residency status, and student work plans (taken from entry survey) emerged as the strongest predictors of student loan selection (Wald > 30). Not surprisingly, most of these variables determine a student’s cost of attendance and are sourced directly from the student’s FAFSA information (Cadena and Keys 2013). The inclusion of a continuous metric for remaining need—the amount outstanding after accounting for the EFC and all types of grant, scholarship, and loan aid received—allows testing of the impact of loan aid across different levels of remaining need and thus takes the analysis a step beyond previous studies that examined average impact of load aid (Jones-White et al. 2014; Bresciani and Carson 2002; Mortenson 1999). Specifically, it allows a comparison of students who elected, or were eligible, to receive sufficient aid to cover their cost of attendance versus students who still had outstanding need. Similarly, incorporation of the EFC offers an opportunity to examine the influence of loan aid as a function of the ability to pay for college, rather than merely income level, which fails to reflect the estimated expense burden facing a student.

The remaining covariates capture a student’s socio-demographic background (being age 19 or older, male, non-Asian ethnic minority, father has 4-year college degree, mother has 4-year college degree), academic preparation (high school GPA-ACT/SAT index score, high school class rank percentile, advanced standing at entry, undeclared major, math-intensive major), and academic motivation and aspiration (delayed college entry by 6 months or more, months elapsed since ACT/SAT test date, selected the institution as first choice, and plans to attend graduate school). Except for the academic preparation index (composed of high school GPA and test scores), the high school percentile rank, months elapsed since the test date, remaining financial need and EFC (both $ amounts), all covariates are dummy coded (no = 0, yes = 1). The test date is a continuous metric that measures the months elapsed between the first time the student took the ACT/SAT test and the start of college. Advanced standing indicates if a student earned college credit in high school, while math-intensive major identifies students who chose an academic program that requires advanced math in the first year of study. Test date and delayed entry are proxy indicators for student commitment and motivation, following a previous study that used admission date for that purpose (Pike et al. 2011). Identifying students with a math-intensive major takes into account that math courses dominate the list of courses undergraduate students are most likely to fail or drop without completion (Adelman 2004).

In addition, the study gauges the impact of loan aid with and without a set of first-year experience variables due to the significant influence of first-year academic experience on student persistence in documented research (Pascarella and Terenzini 2005; Astin 1993). Following Astin’s I–E–O model, the study explores whether or not first-year college exposure mediates the relationship between student loan status and enrollment persistence by comparing results from the baseline model without first-year experience variables to the covariate adjusted model that controls for first-year experience. The covariate adjusted model that regresses the outcome (persistence) on the PS and loan status also controls for whether or not a student took math or English, or enrolled in an online distance education course; used any of the on-campus tutoring centers; visited the on-campus student diversity center; worked on campus (all coded as dummy variables); and academic success. The latter is measured with a momentum index composed equally of cumulative grades (GPA) and number of course credits completed. The use of academic momentum indices to gauge student success goes back to the work of Adelman (2004, 2006), and offers the advantage of estimation model parsimony (i.e., reducing statistical degrees of freedom). Also, the collapsing of first-year grades and credits into an academic momentum score has shown strong association with degree completion beyond pre-college preparation and socio-demographic background (Jones-White et al. 2014; Attewell et al. 2012). These variables may mitigate bias in the estimated outcome, as found in other PS-based studies that included post-treatment measures (Austin 2011; Titus 2007). This method assumes that the covariance between the PS and the outcome is correctly modeled, and that variables exhibit tolerable collinearity. The variance inflation factor (VIF) for the combined set of pre- and post-treatment variables remained well below 2.5, the recommended upper limit (Allison 2012).

All data originated with the institution’s matriculation system, except for several student self-reported data elements that were recorded as part of the mandatory start-of-first-year orientation survey. They include measures of parent level of education, intent to attend graduate school, plans to work full-time or plans to not work while in college (plans to work half-time being the reference category), and having selected the institution as first choice among colleges considered by the student. Combining selected variables from the freshmen entry survey with data from the institutional matriculation system has been shown to produce a more parsimonious and more accurate persistence prediction model compared to Pascarella and Terenzini’s (1980) institutional integration survey scale (Caison 2007).

Limitations

Inferences from the findings of this study are limited to the focal institution and may not extend to other higher education institutions with distinctly different first-year students in terms of academic preparation, socio-demographic background, and educational aspirations (as described in the previous section). Second, the analysis is restricted to the 80% of students who filed and completed the federal aid application (FAFSA), a proportion that mirrors the national average (80%) of FAFSA filers for 2011 (Ipsos and SallieMae 2012). While the persistence rate of non-filers in the sampled cohorts is the same as for FAFSA-filers (t = .498, α = 0.62), it is conceivable that exposure to private loan aid could have affected the persistence of non-filers in a different way. However, the number of such students in our cohorts is likely to be very small. National data for public 4-year institutions show that only 7% of students had private education loans in 2011, and a mere 1% of those who did not complete the FAFSA borrowed on average only $168 in private loan aid in 2011 (The Institute for College Access & Success 2016; Ipsos and SallieMae 2012). Third, the study omits a separate analysis for the small number of independent students (as identified in the FAFSA), which produced an unstable coefficient in the model estimation due to data sparseness across all covariates. Also, close examination of the aid package for dependent students showed that parental support had a small impact on the amount of loans for these students, with PLUS loans making up a mere 7% of the average total loan amount. Fourth, while the captured financial aid data encompasses all financial support processed by the institution’s student aid office (e.g., state-sponsored and institutional scholarships and grants), it does not include private sources of financing. However, as national data for 2011 show, such financing—including private loans, home equity loans, credit cards, and retirement accounts—met on average only 4% of the total cost attendance for FAFSA-filers (Ipsos and SallieMae 2012).

Lastly, while the study estimates the presence of selection bias in the statistical estimator with propensity score matching, it acknowledges the potential for omitted variable bias in the PS estimation to mimic the probability of loan selection. Similarly, even though the statistical estimation accounts for a wide range of factors associated with loan selection and enrollment persistence, one cannot be entirely sure that the loan status of a given student exerts no influence on enrollment persistence of other students given the limits of observational data.

Descriptive Statistics and Balance Verification

Table 2 shows that students with an EFC level between $5200 and $20,000 are most likely to rely on loans, both subsidized and unsubsidized. These students are in the bottom half of those that do not qualify for the federal Pell Grant. The upper half, those with an EFC above $20,000, are less likely to rely on loans, especially subsidized loans for which few would qualify. Students with a low EFC level—i.e., those eligible for the Pell Grant—are slightly less likely to rely on loans compared to mid-level EFC students, but more likely to have loans compared to high-level EFC students. Looking at the academic momentum of these students, Table 3 suggests that students on unsubsidized loans barely differ in their academic success from those with only subsidized loans, regardless of the level of EFC. Since unsubsidized loans accrue interest that is capitalized (i.e., added to the principal) if not paid during enrollment, one may expect students carrying unsubsidized loans to be at an academic disadvantage if employment to service interest payments competes with academic obligations.

Tables 4 and 5 indicate that students who received enough aid to cover the cost of attendance (and thus face no remaining need), as well as students with high remaining need are mostly from high EFC background. Expectedly, students with high remaining need are less likely to have a low EFC level, which allows students to qualify for more need-based aid such as the Pell Grant. Still, over a fifth of students with high remaining need (i.e., over $10,000) are Pell-eligible. These students make up 27% of all Pell-eligible students (Table 6). In contrast, students with a high EFC level (i.e., over $20,000) are twice as likely to have high remaining need compared to Pell-eligible students (57%, Table 7). While these distributions convey some sense of the financial burden faced by freshmen, they do not reveal how reliance on loans may impact enrollment persistence given a student’s level of ability to pay for college or the level of unmet financial need that has not be covered by the aid received.

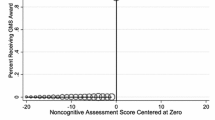

Before proceeding with an interpretation of the results from the statistical regression, one must verify that the resampled data from PS matching resulted in suitable control groups to establish a counterfactual analytical framework. Figure 1 depicts the PS distribution for the treated (loan aid) and control (no loan aid) groups before and after matching (using full sub-classification). The histograms before matching (left side) are distinctly different in shape, showing a sharp decline in the number of students with no loans (raw control) who exhibit a high propensity for loan selection; conversely, students with loans (raw treated) are mostly clustered at the high end of the propensity scale, as one would expect. In contrast, the histograms after matching (right side) look very similar, confirming that no-loan students in the control group largely resemble students with loan aid across the PS distribution. Figure 2 shows a great improvement in the PS distribution between students with unsubsidized loans and those without such loans, rendering both groups highly comparable based on the covariates included. Similar improvements in the PS and covariate balance occurred after applying nearest neighbor matching, as summarized in Table 8. Overall balance as well as balance for covariates that are strongly related to the loan selection process (EFC, remaining need, aid received, out of state tuition, and living on campus) are well within ±0.25, a threshold range recommended for reliable regression adjustment (Stuart 2010; Rubin 2001).

Results

Descriptive statistics in Table 9 indicate that students with loans are less likely to persist than students without loans. The average seven percentage point difference grows to 10 percentage points when the comparison is limited to students with high remaining need, suggesting that high remaining need in conjunction with loan aid may put those students at an added disadvantage. Without considering other factors, however, one may scarcely conclude that loans are a key determinant in student persistence, much less a cause that may explain the lower rate for students with loans.

The influence of loan aid in the presence of all the factors used to estimate the PS are listed in Table 10 under the ‘Null Model’, first listed for all students and then broken out by both EFC and remaining need levels. The table compares results for students with low versus high EFC levels, and students with no (zero) remaining need versus those with high remaining need. Estimation of the influence of loan aid after controlling for first-year experience are listed under the ‘Post-treatment Model’. The estimated impact of unsubsidized loan aid, net of subsidized loan aid, is furnished in Table 11. Standard errors for nearest neighbor matched samples (NNR:1) are based on Lechner’s (1999) variance approximation:

where N 1 is the number of matched treated cases and W i is the number of repeat uses of a control case when matching with replacement in order to account for potential bias in bootstrapped standard errors introduced with multiple use of the same case (Caliendo and Kopeinig 2008).

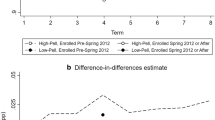

Results from the logit coefficients show that, on average, loan aid exerts a negative influence on persistence both before and after accounting for first-year experience (Table 10, top panel, ‘all students’). However, that effect reaches statistical significance only with PS-weighted (IPTW) and matched sample data (NNR:1). Regression with unmatched data (first column) produces no significant effect after accounting for first-year experience. When separating the analysis by EFC and remaining need levels (Table 10, lower panels), the only significant effects net of first-year experience emerge from data using full sub-classification matching. Accordingly, students with a low EFC level (i.e., Pell eligible) and students with no remaining need are estimated to be negatively affected by loan aid. The estimated negative effect for students with no remaining need is slightly larger if the student received the maximum amount ($3500) of subsidized loans (logit coefficient −.567 vs −.479). In either case, results based on unmatched data (first column Table 10) show no significant effect for students with no remaining need.

Estimates of the effect of unsubsidized loans net of subsidized loans (i.e., after controlling for whether or not a student received subsidized loans) are listed in Table 11. Results suggest that unsubsidized loans exert no significant effect on student persistence after taking into account the first-year college experience (i.e., coefficients associated with the ‘post-treatment’ models). This finding is consistent between unmatched and matched-data models and holds irrespective of the level of EFC or level of remaining need. Students with high remaining need and those with a high EFC appear to be negatively impacted by unsubsidized loans, but only prior to factoring in their first-year experience. Similarly, the study finds a slightly higher negative effect for high need students who received the maximum amount of subsidized loans prior to factoring in their first-year experience (logit coefficient −.410 vs −.306), but no significant effect emerged after controlling for first-year experience. Thus, first-year experience factors included in the analysis mediate the effect of loans on student persistence and render that relationship statistically insignificant.

Using the significant coefficients from matched data based on full sub-classification, Table 12 translates the estimated effect on enrollment persistence as the percentage change associated with loan aid vis-à-vis the baseline reference category, students without loan aid, applying Cruce’s (2009) corrected Delta-p statistic. A comparison of results between regression with unmatched data versus covariate adjusted regression using PS-matched data suggests that the former would fail to detect the negative effect of loan aid on persistence for students with low EFC and those with no remaining need. For students with high need, the effect size of unsubsidized loan aid prior to factoring in first-year experience is estimated to be lower with matched data compared to regression with unmatched data. Data for the PS-matched samples that show significant loan effects are well balanced (i.e., within the threshold range of ±0.25 standardized mean difference) between students with loan aid and those without loan aid across all key covariates that strongly predict loan selection, as listed in Table 13.

Discussion of Findings

Results from the series of regression models that separate students by EFC and remaining need levels produce several key findings. Loans exert a negative influence on enrollment persistence of Pell-eligible students, namely those with an EFC no larger than $5200, as determined by the FAFSA data. Loans also seem to negatively affect persistence of students with no remaining financial need after factoring in their EFC and all types of aid received. And for those who received the maximum amount of subsidized loans ($3500), the negative effect of loans on enrollment persistence is slightly larger compared to those students who did not reach the maximum limit. In contrast, there is no significant incremental effect associated with unsubsidized loans after factoring in whether a student took out subsidized loans. These estimates take into account all the factors used in the calculation of a student’s propensity to select loan aid, whether or not they received the maximum amount of subsidized loans, as well as their first-year college experience (including their GPA and number of completed course credits). Moreover, the results control for a range of student socio-demographic attributes, pre-college preparation, academic motivation, and campus integration factors deemed important in college persistence research (Jones-White et al. 2014; Chen 2008; Caison 2007; Adelman 2006; Pascarella and Terenzini 2005; Astin 1993).

Gauging the effect of loans both before and after controlling for the first-year experience reveals that the impact of loan aid is significantly diminished by the college experience for students with high remaining need (Table 10), even if they carry unsubsidized loans (Table 11). The same finding applies to high-EFC students with unsubsidized loans. Controlling for both receipt of subsidized loans and whether or not the student reached the maximum limit, unsubsidized loans exert no negative influence on students with low EFC (Pell eligible) and those with no remaining need, regardless of a student’s first-year experience (Table 11).

These differences in results suggest that average estimated effects mask both the magnitude and nature of the influence of loan aid on students from different income background and with varied levels of unmet financial need. This supports the conclusion by Welbeck et al. (2014, pp. 16, 18) in their review of the research on aid that level of unmet need and student ability to afford cost of attendance are key factors in gauging the influence of aid on student success.

In their survey of the research since 1991, Hossler et al. (2009, p. 394) identified 32 “high quality” studies on the impact of financial aid, but few (if any) of these studies examined aid while taking into account both student ability to pay (EFC) and unmet need. Similarly, only a few of the covered studies offer evidence of how campus social integration, student motivation, and academic success interact with financial aid. Lack of statistical control over these factors may also limit the finding in a more recent study linking receipt of need-based aid (including subsidized loans) to higher student dropout (Gross et al. 2015).

In addition to the finding that the effect of loans varies with ability to pay (EFC) and remaining need, the results here add to the already substantial evidence in the cumulative research that academic performance is the key predictor of enrollment persistence for most students (Adelman 2006; Pascarella and Terenzini 2005; Astin 1993). Moreover, the findings here corroborate those from a previous study on students at the same institution (Herzog 2008), showing that academic success in the first year exerts a greater effect on persistence of low-income students compared to high-income students net of all other factors (including financial aid, socio-demographics, motivation, and educational goal). As Table 14 shows, first-year academic momentum is a far more significant factor for Pell-eligible students compared to students with a high EFC, a difference consistent across all tested regression models.

The analytical framework in this study also addresses the challenge of selection bias associated with observational data and tests the counterfactual hypothesis, what would be the rate of persistence of students with loan aid had they not selected loans to finance college? As listed in Table 10, there is a significant effect associated with loans net of first-year experience for Pell-eligible students with low EFC and students with no remaining financial need whose total aid package covered the cost of attendance. Had these students not relied on loan aid—most of it subsidized—their estimated persistence rate would have been 4 and 7 percentage points higher, respectively. And for students with no remaining need who exhausted the available federal subsidized loan aid, their estimated persistence would have been 8 percentage points higher (Table 12). These negative effects would not have been detected with unmatched sample data, nor could one estimate the influence of loan aid in the counterfactual context. Being able to answer the ‘what if’ question in the counterfactual framework yields an estimate of what would have happened to students with loan aid had they not chosen that type of financing option. Moreover, results show that, net of subsidized loans and first-year experience, unsubsidized loans exert on average a significant negative influence on enrollment persistence, but that effect disappears for both low-EFC and high-EFC students and students with no remaining need (Table 11). Therefore, the incremental effect of unsubsidized loans, beyond that which may occur with subsidized loan aid, varies with income background and level of remaining financial need.

Whether the difference to an analysis with unmatched data can be attributed to reduced selection bias with the PS-matched data depends on how well the observable characteristics (covariates) included in the PS estimator capture the process of loan selection by students. Recent research confirms that student loan selection is largely governed by both perceived and actual credit constraints, which derive from the combination of income background, cost of attendance, and willingness (or aversion) to take on debt (Ziskin et al. 2014; Cadena and Keys 2013; Avery and Turner 2012). Ziskin et al. (2014) document that loan aid is indeed a ‘last resort’ financing option that students typically rely on after maximizing all other aid options. The sequence of offered, accepted, and self-selected aid is well documented with the FAFSA data. Results from the PS estimation show that the FAFSA-derived metrics for EFC and remaining need in combination with indicators for variation in cost of attendance (i.e., residency status, on-campus living cost) together emerged as the most significant predictors of loan aid (Wald > 30). The balance of these covariates and the PS in the matched group data is well within the threshold range for reliable regression adjustment (Stuart 2010; see Table 13).

Thus, the selection of covariates for PS estimation and the degree of balance in the matched data together render the conditional independence assumption (i.e., a strongly ignorable treatment assignment) plausible, if not highly likely, assuming the absence of significant omitted variables that are related to loan selection and persistence, and that are uncorrelated with those included here. Under that assumption, balance in the chosen covariates to estimate the PS are sufficient to render the likelihood of loan selection uncorrelated with enrollment persistence for students with no loan aid. Therefore, one may assume that results from the corresponding analysis with unmatched data may mask the significant negative effect associated with loan aid for Pell-eligible students and students with no remaining need as detected by the PS-matched sample analysis. Also, these estimated effects draw on counterfactuals that are matched with the entire sample of students with loans. None of the PS matching methods forced deletion of treated cases (i.e., students with actual loan aid) from the analysis due to lack of common support. As a result, the findings are more likely to hold in general for first-year students with loans.

Do Student Loans Help or Hurt?

The answer to that question is, it depends. Without addressing the presence of potential selection bias, loan aid—either in subsidized or unsubsidized form—appears to exert no significant influence on enrollment persistence. This finding holds even after a student’s academic performance in terms of grades and course credits completed is factored in. However, when testing the counterfactual hypothesis with matched data that compare students with no loan aid and highly similar disposition for selecting such aid to students that actually carry loan aid, the findings indicate that Pell-eligible students and students with no remaining need (i.e., whose aid package covers the cost of college attendance) would persist at a higher rate without loan aid than with loan aid. The estimated effect is slightly larger for students who exhausted the available annual amount of federally subsidized loan aid.

Hossler et al. (2009) concluded that loans are more likely to have a negative effect on persistence if the metric is based on a dichotomized indicator for loan aid. Examining studies that used national databases (e.g., NPSAS), Hossler et al. (2009) report no effect associated with loan aid if measured on a continuous scale (i.e., amount received) once cost of attendance and living are included in the estimation. In contrast, Jones-White et al. (2014) found a negative effect associated with loan amount for first-year students. However, the studies from which these findings are drawn did not attempt to control for selection bias associated with receipt of loan aid. The one study covered in the review by Hossler et al. that did address selection bias (with an instrumental variable probit model) found a negative effect of loan aid on a student’s chance of graduation (Alon 2005). The expansion of state-based and other large-scale grant programs to promote college enrollment of low-income high school graduates has prompted a growing number of evaluation studies that incorporate mechanisms to address selection bias, but none of these studies isolate the effect of loan aid (Angrist et al. 2014; Welbeck et al. 2014).

The finding that the negative impact of loan aid is limited to low-income students and students who receive enough aid to end up with no remaining need offers evidence of the importance to apply an analytical framework in the study of aid that differentiates by ability to pay, as reflected in the EFC, and by the amount of unmet need net of all aid received. The evidence here partly corroborates results from a previous study on students at the same institution that shows a negative influence of loan aid on first-year student persistence (Herzog 2005). However, that study did not gauge the effect of loans separately by EFC level, nor did it explore the interaction effect between loan status and a student’s ability to pay (as reflected in the EFC amount), nor did it address selection bias in the statistical estimator. Though a direct comparison between results in that study and this study is of limited value, given the difference in covariate controls, it is reasonable to assume that an analytical approach focused on selection bias and testing of the counterfactual hypothesis may produce a more accurate estimate of the causal effect of loan aid.

Like the negative effect of loan aid on graduation that Alon (2005) found after separating the effect of aid eligibility from the impact of aid received, the negative effect of loan aid detected here emerged only after addressing selection bias with PS-matched data. Accordingly, had Pell-eligible students with loan aid not selected such aid, their persistence would have been 4 percentage points higher; the persistence rate of those receiving and selecting enough aid to cover the cost of attendance (and thus facing no unmet need) would have been 7–8 percentage points higher (Table 12). Given the proportion of Pell-eligible students in the cohorts examined, the overall freshmen persistence rate at the institution would increase by 1 percentage point had the Pell-eligible not relied on loans; a similar increase in overall freshmen persistence would result if students with no remaining need would have refrained from accepting loans.

Such estimates assume that the financial need covered by loans could be addressed with other sources of aid (or cost discounts) that do not produce a negative effect on persistence. Johnson (2013) found that for academically average students augmenting tuition subsidies (e.g. with grants or discounts) would mitigate the dropout risk and increase degree completion. Both Gross et al. (2015) and DesJardins et al. (2002) concluded that greater reliance on loans as part of the total aid received elevated the dropout risk for students. Consistent with the finding in this study, Kim (2007), using national data from the Beginning Postsecondary Student (BPS) survey, produced evidence that loan aid during the first-year lowered degree completion odds for low-income students. In contrast, Marx and Turner (2015) observed mixed effects on degree attainment after replacing loans with Pell Grant aid. Since the results here are limited to first-year students, the observed negative effect of loan aid may not endure as students in the examined cohorts academically progress. Those advancing are on average academically more successful and may feel more comfortable with rising loan debt.

As Table 15 shows, loans constitute about the same proportion of total aid received for students with no remaining need as it does for those with remaining need of up to $10,000. However, the former receive on average loans that are 60% larger than the latter group, or more than double the size of loans taken up by students with high remaining need (i.e. over $10,000). The higher loan amounts for students with no remaining need is likely associated with the higher cost of on-campus living—on average they are 35% more likely to live on campus—and echoes the finding in Cadena and Keys (2013) that on-campus students are more likely to take up loans. Thus, these students are more likely to end up with no outstanding need as loan aid is directly applied to on-campus room and board expenses. This pattern is consistent across the different student affordability levels (EFC ranges) and shows that the confluence of low affordability (Pell eligible) and higher loan amount reduces enrollment persistence. Low-EFC students with no remaining need take up loans more than twice as large as Low-EFC students with high remaining need (over $10,000, see Table 15).

The substantial difference in average loan amount across remaining need levels combined with the finding that unsubsidized loans do not elevate the dropout risk (net of subsidized loans) suggests that the level of debt may exert a negative psychological effect separate from the economic effect associated with a financial payback obligation and accumulating interest payments. This may also explain the slightly higher estimated dropout risk for students who exhausted the available amount of subsidized loans in order to meet the full cost of attendance (i.e., students with no remaining need). If so, it may corroborate results in Cadena and Keys (2013) that self-control among some students leads to debt-aversion and thus lower loan take-up rates, at least for students with alternate funding sources or those seeking to avoid excessive consumption while in college. The data also show that Low-EFC students who are academically more challenged are least likely to live on campus and hence incur the lowest loan debt in the first year (see Table 15). However, the low academic success and persistence of these students suggests that other factors are at work not captured here. While the estimation model controls for on-campus employment and takes into account student plans to work while in college, data on actual off-campus work hours was not available. Recent findings show that reduced work hours enhance academic success for some students (Scott-Clayton and Minaya 2016). Since low-income students with credit constraints are more likely to work longer hours while in college (Soria et al. 2014), which may heighten their dropout risk (Mendoza 2012), it is plausible that Low-EFC students with high remaining need eschew larger loan debt in favor of off-campus employment while in college, thereby engaging in a trade-off that seemingly compromises their academic success and progress.

Conclusion

The estimated effect of loan aid on student persistence varies with ability to pay for college as well as with the amount of loan aid and associated remaining financial need. Accordingly, Pell Grant-eligible students with loans and students who take-up higher amounts of loan aid to meet college costs are at an elevated risk of departure after the first year of college. Moreover, students who borrowed the maximum annual amount of subsidized loan aid to meet college costs face an even higher risk. However, unsubsidized loans exert no significant impact on enrollment persistence beyond the estimated effect of interest-free subsidized government loans. The observed significant effects emerged only after addressing selection bias associated with loan status. Thus, this study confirms the importance of taking into account student discretion in selecting loan aid when gauging the impact of this type of financing on student outcomes. Having chosen a counterfactual analytical framework to estimate the effect of student loans, this study seeks to respond to the call for more rigorous research to understand the role of financial aid in college success (Murnane and Willett 2010; Hossler et al. 2009; Chen 2008).

Though the findings here are drawn from data at one institution, with inference possibly limited to that campus, the insight gained by Gross et al. (2015, p. 244) from the large-scale NPSAS data shows that “student departure is strongly influenced by the unique experiences of students on individual campuses,” prompting the authors to encourage more research in this area at individual institutions. At the same time, the results here are based on the experience of first-year students and may not extrapolate to students progressing to the second year and beyond. Also, the estimated effects may still be biased to the extent that unobserved factors governing student selection of loan aid are uncorrelated with those included in the selection estimation, as well as possibly significant omitted factors related to first-year student persistence.

The finding that loan aid for some students reduces the institution’s overall freshmen retention rate by at least 1% may offer the institution the opportunity to tweak its student aid policy in order to move the needle on a key performance indicator widely used in assessment, program review, accreditation, and college survey rankings. Results indicate that estimation of the effect of loan aid on student outcomes can tangibly support policy decisions at the senior management level if the analysis accounts for student ability to pay (EFC), amount of borrowed loans, and the remaining financial need a student faces after considering all aid received. Since the observed negative effect of loan aid is limited to students least likely to afford college (Pell-eligible) and those relying on large amounts of loans to meet college expenses, the institution should explore alternate funding or discount options for these students. Such effort should also consider enhanced academic support (e.g. tutoring and counseling), given that academic performance has a greater impact on the persistence of low-income students compared to students less challenged to pay for college.

References

AASCU. (2006, August). Student debt burden. Policy Matters, 3(8). Retrieved January 15, 2017, from http://www.aascu.org/uploadedFiles/AASCU/Content/Root/PolicyAndAdvocacy/PolicyPublications/StudentDebtBurden.pdf.

Adelman, C. (2004). Principal indicators of student academic histories in postsecondary education, 1972-2000. Washington, DC: U.S. Department of Education.

Adelman, C. (2006). The toolbox revisited: Paths to degree completion from high school through college. Washington, DC: U.S. Department of Education.

Alon, S. (2005). Model mis-specification in assessing the impact of financial aid on academic outcomes. Research in Higher Education, 46(1), 109–125.

Allison, P. (2012). When can you safely ignore multicollinearity? Statistical Horizons. Retrieved February 12, 2017 from https://statisticalhorizons.com/multicollinearity.

Angrist, J. D. (2003). Randomized trials and quasi-experiments in education research. NBER reporter no. 4. Cambridge, MA: National Bureau of Economic Research.

Angrist, J., Autor, D., Hudson, S., & Pallais, A. (2014, December). Leveling up: Early results from a randomized evaluation of post-secondary aid. NBER Working Paper 20800. Cambridge, MA: National Bureau of Economic Research.

Astin, A. W. (1993). What matters in college? Four critical years revisited. San Francisco: Jossey-Bass.

Attewell, P., Heil, S., & Reisel, L. (2012). What is academic momentum? And does it matter? Educational Evaluation and Policy Analysis, 34, 27–44.

Austin, P. C. (2011). An introduction to propensity score methods for reducing the effects of confounding in observational studies. Multivariate Behavioral Research, 46, 399–424.

Avery, C., & Turner, S. (2012). Student loans: Do college students borrow too much—Or not enough? The Journal of Economic Perspectives, 26(1), 165–192.

Bean, J. P. (1980). Dropouts and turnover: The synthesis and test of a casual model of student attrition. Research in Higher Education, 12(2), 155–187.

Bean, J. P. (1983). The application of a model of turnover in work organization to the student attrition process. Review of Higher Education, 6(2), 129–148.

Bettinger, E. P., Long, B. T., Oreopoulos, P., & Sanbonmatsu, L. (2009, September). The role of simplification and information in college decisions: Results from the H&R Block FAFSA experiment. NBER working paper 15361. Cambridge, MA: National Bureau of Economic Research.

Booij, A. S., Leuven, E., & Oosterbeek, H. (2012). The role of information in the take-up of student loans. Economics of Education Review, 31, 33–44.

Bowman, N. A., & Herzog, S. (eds.) (2014). Methodological Advances and Issues in Studying College Impact. New Directions for Institutional Research no. 161, San Francisco: Jossey-Bass.

Braunstein, A., McGrath, M., & Pescatrice, D. (2001). Measuring the impact of financial factors on college persistence. Journal of College Student Retention, 2, 191–203.

Bresciani, M. J., & Carson, L. (2002). A study of undergraduate persistence by unmet need and percentage of gift aid. NASAP Journal, 40, 104–123.

Brown, M., Haughwout, A., Lee, D., Scally, J., & van der Klaaw, W. (2014, April). Measuring student debt and its performance. Staff Report No. 668. New York: Federal Reserve Bank of New York.

Cadena, B. C., & Keys, B. J. (2013). Can self-control explain avoiding free money? Evidence from interest-free student loans. The Review of Economics and Statistics, 95(4), 1117–1129.

Caison, A. L. (2007). Analysis of institutionally specific retention research: A comparison between survey and institutional database methods. Research in Higher Education, 48, 435–451.

Caliendo, M., & Kopeinig, S. (2008). Some practical guidance for the implementation of propensity score matching. Journal of Economic Surveys, 22, 31–72.

Chen, R. (2008). Financial aid and student dropout in higher education: A heterogeneous research approach. In J. C. Smart (Ed.), Higher education: Handbook of theory and research (pp. 209–239). New York: Springer.

Chen, R., & DesJardins, S. L. (2008). Exploring the effects of financial aid on the gap in student dropout risks by income level. Research in Higher Education, 49, 1–18.

Chen, R., & DesJardins, S. L. (2010). Investigating the impact of financial aid on student dropout risks: Racial and ethnic differences. The Journal of Higher Education, 81, 179–208.

Chen, J., & Zerquera, D. (2011). “A methodological review of studies on effects of financial aid on college student success. Paper prepared for the 36th annual conference of the Association for Education Finance and Policy.

Cho, S. H., Xu, Y., & Kiss, D. E. (2015). Understanding student loan decisions: A literature review. Family and Consumer Sciences Research Journal, 43, 229–243.

Chudry, F., Foxall, G., & Pallister, J. (2011). Exploring attitudes and predicting intentions: Profiling student debtors using an extended theory of planned behavior. Journal of Applied Social Psychology, 41, 119–149.

Cruce, T. M. (2009). A note on the calculation and interpretation of the Delta-p statistic for categorical independent variables. Research in Higher Education, 50, 608–622.

DesJardins, S. L., Ahlburg, D. A., & McCall, B. P. (2002). Simulating the longitudinal effects of changes in financial aid on student departure from college. Journal of Human Resources, 37, 653–679.

Dowd, A. C. (2004, May 12). Income and financial aid effects on persistence and degree attainment in public college. Education Policy Analysis Archives, 12(21). Retrieved March 18, 2005 from http://epaa.asu.edu/epaa/v12n21/.

Dowd, A. C. (2008). Dynamic interactions and intersubjectivity: Challenges to causal modeling in studies of college student debt. Review of Educational Research, 78, 232–259.

Dowd, A. C., & Coury, T. (2006). The effects of loans on the persistence and attainment of community college students. Research in Higher Education, 47, 33–62.

Elliot, W., & Nam, I. (2013). Reducing student loan debt through parents’ college savings (Vol. 49, pp. 265–286). St Louis, MO: Center for Social Development at Washington University.

Gross, J. P., Hossler, D., Ziskin, M., & Berry, M. S. (2015). Institutional merit-based aid and student departure: A longitudinal analysis. The Review of Higher Education, 38, 221–250.

Haynes, R. M. (2008). The impact of financial aid on postsecondary persistence: A review of the literature. NASFAA Journal of Student Financial Aid, 37, 30–35.

Heckman, J. J. (2000). Causal parameters and policy analysis in economics: A twentieth century retrospective. The Quarterly Journal of Economics, 115, 45–97.

Herzog, S. (2005). Measuring determinants of student return vs. dropout/stopout vs. transfer: A first-to-second year analysis of new freshmen. Research in Higher Education, 46(8), 883–928.

Herzog, S. (2008, January). Estimating the influence of financial aid on student retention. Education working paper archive. Fayetteville, AR: University of Arkansas, Department of Education Reform.

Herzog, S. (2014). The propensity score analytical framework: An overview and institutional research example. In. N.A. Bowman & S. Herzog (Eds.), Methodological advances and issues in studying college impact. New Directions for Institutional Research no. 161. San Francisco: Jossey-Bass.

Ho, D. E., Imai, K., King, G., & Stuart, E. (2011). MatchIt: Nonparametric preprocessing for parametric causal inference. Journal of Statistical Software, 42(8), 1–28.

Holland, P. W. (1986). Statistics and causal inference. Journal of the American Statistical Association, 81, 945–960.

Hossler, D., Ziskin, M., Gross, J., Kim, S., & Cekic, O. (2009). Student aid and its role in encouraging persistence. In J. C. Smart (Ed.), Higher education: Handbook of theory and research (pp. 389–425). New York: Springer.

Institute for College Access & Success. (2015, October). Student debt and the class of 2014: The project on student debt. 10th annual report. Washington, DC: Institute for College Access & Success.

Ipsos & Sallie Mae. (2012). How America pays for college 2012. Retrieved Feb 12, 2017 from http://news.salliemae.com/sites/salliemae.newshq.businesswire.com/files/publication/file/HowAmericaPays2012.pdf.

Jackson, B. A., & Reynolds, J. R. (2013). The price of opportunity: Race, student loan debt, and college achievement. Sociological Inquiry, 83, 335–368.

Johnson, M. T. (2013). Borrowing constraints, college enrollment, and delayed entry. Journal of Labor Economics, 31, 669–725.

Jones-White, D. R., Radcliffe, P. M., Lorenz, L. M., & Soria, K. M. (2014). Priced out? The influence of financial aid on the educational trajectories of first-year students starting college at a large research university. Research in Higher Education, 55, 329–350.

Kane, L. (2016, January 12). Student loan debt in the US has topped $1.3 trillion. Business Insider. Retrieved May 19, 2016 from http://www.businessinsider.com/student-loan-debt-state-of-the-union-2016-1.

Kim, D. (2007). The effect of loans on students’ degree attainment: Differences by student and institutional characteristics. Harvard Educational Review, 77, 64–100.

Lechner, M. (1999, December). Identification and estimation of causal effects of multiple treatments under the conditional independence assumption. Discussion paper no. 91. Bonn, Germany: Institute for the Study of Labor (IZA).

Looney, A., & Yannelis, C. (2015, September). A crisis in student loans? How changes in the characteristics of borrowers and in the institutions they attend contributed to rising loan defaults. Brookings papers on economic activity. Washington, DC: The Brookings Institution.

Luna De La Rosa, M. (2006). Is opportunity knocking? Low income students’ perceptions of college and financial aid. American Behavioral Scientist, 49(12), 1670–1686.

Marx, B. M., & Turner, L. J. (2015, January). Borrowing trouble? Student loans, the cost of borrowing, and implications for the effectiveness of need-based grant aid. NBER working paper 20850. Cambridge, MA: National Bureau of Economic Research.

McKinney, L., & Backschneider Burridge, A. (2015). Helping or hindering? The effects of loans on community college student persistence. Research in Higher Education, 56, 299–324.

Mendoza, P. (2012). Should I work or should I borrow? A counterfactual analysis on the effect of working while in enrolled and debt on baccalaureate completion. Journal of Student Financial Aid, 42, 25–59.

Mortenson, T. (1999, October). Unmet and overmet financial need of undergraduate students. Postsecondary Education Opportunity, 88, 1–10.

Murnane, R. J., & Willett, J. B. (2010). Methods matter: Improving causal inference in educational and social science research. New York: Oxford University Press.

Pascarella, E. T., & Terenzini, P. T. (1980). Predicting freshman persistence and voluntary dropout decisions from a theoretical model. Journal of Higher Education, 51(1), 60–75.

Pascarella, E. T., & Terenzini, P. T. (2005). How college affects students: A third decade of research. San Francisco: Jossey-Bass.

Pike, G. R., Hansen, M. J., & Lin, C. (2011). Using instrument variables to account for selection effects in research on first-year programs. Research in Higher Education, 52, 194–214.

Reynolds, C. L., & DesJardins, S. L. (2010). The use of matching methods in higher education research. In J. C. Smart (Ed.), Higher education: Handbook of theory and research (Vol. 24, pp. 47–104). New York: Springer.

Robb, C. A., Moody, B., & Adbel-Ghany, M. (2011–2012). College student persistence to degree: The burden of debt. Journal of College Student Retention, 13, 431–456.

Rosenbaum, P. R. (2002). Observational studies. New York: Springer.

Rosenbaum, P. R., & Rubin, D. B. (1983). The central role of the propensity score in observational studies for causal effects. Biometrika, 70, 41–55.

Rosenbaum, P. R., & Rubin, D. B. (1984). Reducing bias in observational studies using subclassification on the propensity score. Journal of the American Statistical Association, 79, 516–524.

Rubin, D. B. (2001). Using propensity scores to help design observational studies: Application to the tobacco litigation. Health Services and Outcomes Research Methodology, 2, 169–188.

Rubin, D. B. (2006). Matched sampling for causal inference. New York: Cambridge University Press.

Scott-Clayton, J., & Minaya, V. (2016). Should student employment be subsidized? Conditional counterfactuals and the outcomes of work-study participation. Economics of Education Review, 52, 1–18.

Sekhon, J. S. (2011). Multivariate and propensity score matching software with automated balance optimization: The matching package for R. Journal of Statistical Software, 42(7), 1–22.

Singell, L. D., Jr. (2002). Merit, need, and student self selection: Is there discretion in the packaging of aid at a large public university? Economics of Education Review, 21(5), 445–454.

Soria, K. M., Weiner, B., & Lu, E. C. (2014). Financial decisions among undergraduate students from low-income and working-class social backgrounds. Journal of Student Financial Aid, 44, 2–23.