Abstract

This study uses fixed-effects panel data techniques to estimate the elasticity of community college enrollment demand relative to local unemployment rates. The findings suggest that community college enrollment demand is counter-cyclical to changes in the labor market, as enrollments rise during periods of weak economic conditions. Using national data for the years 1990 through 2009, we find that a one percentage-point change in unemployment is associated with 1.1–3.3 % increases in enrollment demand. We disaggregate the analysis by total full-time and part-time enrollment, concluding that high levels of unemployment are also associated with greater demand for full-time attendance. Additionally, enrollments are slightly more responsive to unemployment in metropolitan (rather than micropolitan) areas. Informed by enrollment demand theory, our analysis provides an update to the “unemployment elasticity” literature and could aid in current enrollment planning, economic development, and public policy efforts to educate students on the margin between college and work.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

During the recent Great Recession, community colleges across the United States experienced record enrollment growth. According to the American Association of Community Colleges, this recession created such rapid expansion that many campuses maximized or (in some cases) exceeded their service capacity (Mullin and Phillippe 2009). Enrollment surges are not unique to the current economic downturn, as recessions have historically driven people into community colleges (Betts and McFarland 1995). When individuals face such labor market uncertainties as unemployment, loss of income, or layoffs, they may be more inclined to participate in formal postsecondary training programs in order to “retool” for the new economy. Even among the employed, these labor market uncertainties may be enough to encourage some individuals to opt for investing in education (Kane and Rouse 1999). Taken together, periods of weak economic conditions are expected to put upward pressure on community colleges enrollment demand.

While all sectors of higher education experienced enrollment growth during the most recent recession (Dadashova, Hossler and Shapiro 2011), community colleges are of particular interest in this study. Community colleges have become an increasingly desirable educational destination for many students, as they provide a lower-priced alternative to four-year institutions and they offer credentials that can be completed in a shorter period of time. Additionally, one of the missions of the American community college is to respond to local economic conditions, so we should expect educational leaders in this sector to be particularly interested in the role local unemployment rates play in shaping enrollment demand (Cohen and Brawer 2008). When community college enrollment levels surged by more than 15 % during the Great Recession, it highlighted the role these institutions play in terms of responding to labor market conditions since community colleges accounted for the majority of the nation’s enrollment growth during this most recent recession (Mullin and Phillippe 2009; U.S. Department of Education 2011).

When shifting our attention to the higher education and labor economics literature, the volume of recent research is surprisingly limited, leaving a gap in what we know about the elasticity of community college enrollment demand relative to local labor market conditions. Accordingly, the following study updates this literature by asking, “to what extent does public community college enrollment demand change relative to changes in local unemployment rates?” Drawing upon enrollment demand theory, we design a fixed-effects panel data model to estimate how community college enrollments change relative to changes in local unemployment rates, controlling for such factors as the pool of recent high school graduates, tuition levels, manufacturing employment, institutional enrollment profiles, and per-capita income levels. We find that community college enrollment runs counter-cyclical to the business cycle, where periods of economic decline are associated with greater demand for community college education. More specifically, full-time and part-time enrollment demand responds differently to changes in local unemployment rates, while variations also exist across metropolitan and micropolitan regions. Our findings may inform public policymaking and enrollment planning efforts to address community colleges’ responsiveness to local labor market conditions.

Enrollment Demand Theory and the Cyclicality of Schooling

Enrollment Demand Theory

Since at least the 1960s, scholars have been interested in understanding the factors associated with student participation in higher education. Economists studying this topic often draw upon demand theory, positing that enrollment decisions are a function of such pecuniary and non-pecuniary factors as: a college’s price, the price of alternative educational opportunities, population changes, current wages and income levels, anticipated future earnings, and labor market conditions (Becker 1990; Clotfelter 1992; Leslie and Brinkman 1987). The majority of enrollment demand research focuses on how students respond to changes in price. When a college increases its tuition rate, then the institution should expect enrollment demand to decline; alternatively, enrollments should increase if a nearby institution increases its tuition price. Researchers have consistently found that a $100 increase in an institution’s own price generally corresponds with a 0.5–1.0 percentage-point decline in enrollment (Feldman and Hoenack 1969; Jackson and Weathersby 1975; Hoenack and Weiler 1979; Manski and Wise 1983; Leslie and Brinkman 1987; Becker 1990; Clotfelter 1992; Heller 1997; Hemelt and Marcotte 2011).

However, the literature on “non-price” factors of enrollment demand, such as opportunity costs, demographic changes, and labor market conditions is less extensive by comparison (Betts and McFarland 1995; Kienzl, Alfonso and Melguizo 2007). Local wages and income levels can be incorporated into demand models to account for the opportunity costs associated with pursuing education. If an individual can earn high wages or income levels without additional schooling, then demand for a community college education may be low in higher income areas. Similarly, population changes can factor into enrollment demand studies because colleges in areas that are experiencing population growth (decline) should expect to have greater (less) demand for their educational services. Rising unemployment levels can also send “non-price” market signals to individuals who are unemployed and to those who are currently employed but considering their future employment options (Kane and Rouse 1999). These market signals can be incentives for individuals to invest in human capital in order to prepare for changes in the labor market.

Cyclicality of Schooling

When labor market conditions weaken, employment levels fall and the opportunity cost of attending college should decline; as a result, more individuals will invest in greater levels of education (Becker 1990, 1993; Clotfelter 1992). To the extent that enrollment levels respond to non-price signals such as unemployment rates, we should expect enrollments to run counter-cyclical to the business cycle where spikes in unemployment are associated with greater levels of college participation. In addition to experiencing greater enrollment demand during periods of high unemployment, more students will choose to enroll full-time (rather than part-time) due to reductions in opportunity costs. If individuals have fewer options for full-time work, or if they have no work at all, then they may be inclined to enroll in college full-time.

To the extent that we can anticipate a long period of anemic economic recovery, public policymakers and community college leaders may expect sustained levels of high community college demand (Katz 2010). While recent economic conditions have driven more individuals to college, community colleges have experienced steady enrollment growth for several decades. In the late 1960s, ~1.9 million undergraduates enrolled in this sector; by 2009, this figure had risen to more than 7 million, outpacing the growth of public and private four-year colleges and universities (U.S. Department of Education 2011). Community colleges now enroll ~35 % of all undergraduate students. Within the public sector, nearly one in every two students enrolls in a community college and many states are encouraging greater expansion of the two-year sector (Cohen and Brawer 2008). While there are many reasons that may explain the growth of community college enrollment demand, local economic conditions are an increasingly significant source of this growth.

Regional Variations in Unemployment and Enrollment

Since we are most interested in the relationship between unemployment rates and community college enrollment demand, we design an analysis that takes into account the unique labor market conditions of the local region each community college serves by measuring unemployment rates at the metropolitan and micropolitan statistical areas. In other demand studies, researchers aggregate unemployment rates to the state-level, which likely introduces a degree of aggregation bias into the analysis (Dellas and Sakellaris, 2003; Fitzpatrick and Turner 2007; Kane and Rouse 1999; Stratton, O’Toole and Wetzel 2004). By way of example, the Elkhart-Goshen metropolitan area is one of Indiana’s largest manufacturing regions. While the state’s average unemployment rate was ~8 % throughout the Great Recession, the Elkhart-Goshen metropolitan region suffered significantly higher unemployment levels surpassing 20 % after several manufacturing plants closed in 2007 and 2008 (U.S. Bureau of Labor Statistics 2012). While state unemployment trends demonstrate one measure of labor market conditions, recessions often impact local regions within states differently, particularly those that rely heavily on manufacturing industries, as illustrated in the Indiana/Elkhart-Goshen example (Elsby, Hobijn and Sahin 2010).

To address this measurement concern, we define “local regions” based upon each community college’s micro- and metropolitan statistical area, commonly referred to as a “Core Based Statistical Area” (CBSA). CBSA’s are determined by an area’s population density and the commuter patterns of the area’s core urban center, where micropolitan areas have urban cores with 10,000–50,000 people, while metropolitan areas are larger than 50,000. Each metro or micro area includes one or more counties that have a high degree of social and economic integration with the urban core (U.S. Census Bureau 2012). For the purposes of building our model, we believe that examining the most local data is not only practical for community college administrators, but it also improves our research design by avoid aggregation bias.

Literature Review

In one of the more-often cited unemployment elasticity studies, Betts and McFarland (1995) analyze institution-level community college enrollment data between the years 1969 and 1985,Footnote 1finding that a one percentage-point increase in regional unemployment rates is associated with ~4 percentage-point increases in full-time community college attendance. Using panel data techniques, this study offers one of the more comprehensive treatments of the relationship non-price factors plays in shaping student enrollment demand. In a similar analysis, Nutting (2008) uses institution-level records from 27 community colleges in the SUNY (State University of New York) system, finding that a one percentage-point increase in unemployment rates associate with a 3.5–6 percentage-point changes in enrollment demand between the years 1990 and 1997. These two examples demonstrate one of the variations in analytical techniques found within the unemployment elasticity literature. That is, some studies may use institutional records for only one system of colleges (i.e. Nutting 2008) while others take advantage of national datasets that include all institutions (i.e. Betts and McFarland 1995).

Other scholars have examined the topic by using students as the primary unit of analysis, thus national surveys have been used to estimate unemployment elasticity. Using data from the U.S. Department of Education’s Beginning Postsecondary Students survey, Stratton, O’Toole, and Wetzel (2004) estimate how enrollment intensity (full-time versus part-time) varies according to state unemployment rates, finding a positive relationship between full-time enrollment demand and state unemployment rates. Using a different national survey, the U.S. Census Bureau’s Current Population Survey, Dellas and Sakellaris (2003) find similar patterns as the previously mentioned study, where full-time enrollment rises at larger rates than part-time enrollment during periods of high unemployment. In this study, enrollment demand increased by ~2 % for every one percentage-point increase in the state unemployment rate, ceteris paribus. Similarly, Fitzpatrick and Turner (2007) use the same Census survey (but for the years 1977 through 2002) to estimate how recent high school graduates and young workers’ college enrollment demand changes relative to state unemployment rates. They also find a counter-cyclical relationship, where high unemployment is associated with higher levels of enrollment demand. Several other studies have utilized Census survey data to estimate unemployment elasticity, finding positive relationships between state unemployment rates and college enrollment demand (Black and Sufi 2002; Corazzini, Dugan and Grabowski 1972; Clotfelter 1992; Kane 1994; Rouse 1994).

Interestingly, these studies tend to focus exclusively on recent high school graduates (18–24 years olds) and they examine periods of time that are prior to the two most recent (2001 and 2007) recessions. Furthermore, they often include state-level (rather than local) unemployment rates to control for labor market conditions (Dellas and Sakellaris 2003; Fitzpatrick and Turner 2007; Stratton, O’Toole and Wetzel 2004). However, Kienzl, Alfonso and Melguizo (2007) and Bozick (2009) note that these unemployment elasticity studies may suffer from aggregation bias since they do not fully account for the labor market heterogeneity that exists within local community college regions. Aggregating to the state-level may also introduce a limitation in terms of practical utility, as campus leaders may view state-level trends as having little utility in terms of campus-based planning efforts (Rusk, Leslie and Brinkman 1982). Accordingly, we believe metro/micropolitan unemployment rates will be a more suitable alternative to Census region or state-level unemployment rates.

In summary, the unemployment elasticity literature provides strong evidence of the counter-cyclical nature of community college enrollment demand; the research evidence points to a positive relationship with enrollments, as anticipated in demand theory models. Each of these studies utilizes demand theory to support their research design and variable choice, where one must account for pecuniary and non-pecuniary factors associated with tuition prices, and regional demographic and labor market patterns. Unfortunately, much of what we currently know about the business cycle of community college enrollments is based on studies that were conducted prior to the two most recent recessions. Additionally, much of this research focuses on 18–24 year-olds’ responsiveness to state-level unemployment rates. As the next section outlines, our study contributes to previous enrollment demand research by taking advantage of data from the most recent economic recessions, while also including unemployment elasticity estimates for full-time and part-time enrollment according to local (CBSA) service regions.

Data Sources

We developed a unique institution-level panel dataset for the years 1990–2009Footnote 2, which merges data from the U.S. Department of Education Integrated Postsecondary Education Data Systems (IPEDS) with federal datasets from the Bureau of Labor Statistics (BLS) and Bureau of Economic Analysis (BEA). Since the service region of a community college is not constrained to the county in which it is located, we aggregate county-level BLS and BEA data to each institution’s CBSA using County Federal Information Processing Standard (FIPS) codes.

To measure community college enrollment levels, we utilize the fall total, full-time, and part-time degree-seeking enrollment levels from IPEDS. The key predictor variable of interest, local area unemployment rates, is collected from the BLS Local Area Unemployment Statistics (LAUS). In addition to unemployment data, we incorporate data that measures other local factors that are expected to relate to community college enrollment demand. We use BEA Regional Economic Accounts data to measure the proportion of jobs that are in the manufacturing sector since the shift away from manufacturing is a market signal that puts upward pressure on enrollment demand (Goldin and Katz 2008). Similarly, we utilize BEA data to control for local per-capita income levels that are expected to be associated with enrollment demand (Kane 1999). We also utilize the U.S. Department of Education’s Common Core of Data measure the total number of high school completers within each CBSA. Finally, we include tuition levels reported in IPEDS to measure each institution’s own tuition and the regional average tuition (i.e. cross-price elasticity) to serve as our price elasticity controls.

Analytical Techniques

To estimate the elasticity of enrollment demand relative to local unemployment rates, we implement a semi-log fixed-effects panel data model. The log transformation technique improves the model fit by reducing outliers and allows us to interpret our results in terms of elasticities. Our outcomes of interest, community college enrollment levels, are transformed to their natural log. And since the key independent variable of interest (unemployment rate) is already expressed as a percentage value, we have chosen to leave this in its original form as described by Wooldridge (2009, p. 191). This allows us to estimate how a one percentage-point change in the unemployment rate is associated with percentage changes in community college enrollments. For example, if our regression coefficient for the unemployment variable is 2.5, then this is associated with a 2.5 percentage-point increase in enrollments.

Enrollment demand theory posits that the number of degree-seeking students enrolled (Y) at a public community college (i) during the fall of a given year (t) is a function of institution’s local unemployment rate for the given year (U it ). The theory also gives reason to believe that enrollment trends will vary according to two important factors that have not been fully explored in the enrollment demand literature. First, we suspect that full-time enrollments will be impacted at a greater magnitude than part-time enrollments; accordingly, we disaggregate our analysis by total, full-time, and part-time enrollment status. Second, we suspect enrollment patterns will vary according to micro- and metropolitan regional differences, where individuals may have more educational opportunities in metropolitan areas than in micropolitan areas. Similarly, the local labor markets of metropolitan areas differ from micropolitan areas, so we disaggregate our analysis by micro- and metropolitan regions areas. To our knowledge, the enrollment demand literature has not yet fully explored how demand differs by these characteristics for community colleges, so we hope to contribute to this body of literature by disaggregating our results according to these two dimensions.

Community college enrollments are also expected to vary according to area demographics, so we include a measure for the size of the local pool of recent high school completers (H it ) in the CBSA for each year. Local labor market conditions, measured by the share jobs in manufacturing (M it ) and per-capita income level (I it ), are also expected to be related to community college enrollment demand. Similarly, each community college’s own price of tuition (T it ) and the cross-price of other institutions in the CBSA (C it ) are added as our price elasticity controls. This model is expressed in the following equation:

where βk are parameters to be estimated, η is the unobserved institutional (i) fixed-effects and δ is the year fixed-effects (t).

Estimation Strategy

One of the most significant challenges in conducting social science research rests with the issue of omitted variable bias. Enrollment demand theory posits that several measurable factors (i.e. price, labor market conditions, etc.) can predict enrollment decisions; however, it is possible that other sources of unobserved variation could also explain why students choose to enroll in community college. A community’s cultural norms and customs, for example, may be associated with local demand for community college education yet these concepts are difficult to measure. Due to this unobserved heterogeneity, we specify our model using institution fixed effects. Fixed-effects techniques account for the unobserved institutional heterogeneity that exists among community colleges and is relatively stable over time, such as cultural norms and customs as well as other similar factors. This estimation strategy allows us to capture the net effect of observed and unobserved time-invariant predictors on enrollment demand.Footnote 3By estimating our models with fixed effects, we aim to produce unbiased parameter estimates that account for unobserved factors that could impact enrollment demand (Allison 2009).

Since the model includes repeated time series, it is possible that the error in one year is serially correlated with error in the immediately prior year, violating the assumption of independence of errors [E(ε it = ε it + ε it−1) ≠ 0]. As a consequence of this violation, standard errors, t tests, and confidence intervals may be imprecise. To test for the presence of this problem, we implement a Wooldridge test (Drukker 2003), which reveals the presence of serial correlation. Accordingly, we estimate our fixed-effects models with a first-order autoregressive covariance structure (AR(1)) via the Cochrane–Orcutt transformation. This transformation takes the first difference of each dependent and predictor variable, and then it multiplies these values by rho. The tradeoff of improving our model’s efficiency via this estimation strategy is that it requires us to drop the first year of observations; however, since we have a large sample of several years and observations, this should still yield reliable parameter estimates (Pindyck and Rubinfeld 1997).

Limitations

Our study is limited in the following ways. First, enrollment demand theory posits that enrollment demand is partially driven by individuals’ anticipated future earnings; we do not measure this in our model because the data is unavailable at the county or CBSA level. Betts and McFarland (1995) utilize data aggregated to the Census region to account (to some degree) for this factor. Since our overarching goal is to reduce aggregation bias in our study, and given the data limitations, we do not include a local indicator for “potential future earnings.” While we do account for local income levels, we suspect there is a degree of unobserved variation in terms of earnings potential that may not be fully captured even with our fixed effects estimates.

Secondly, unemployment elasticity might vary considerably by students age, gender, or ethnicity and we do not disaggregate our enrollment outcome according to these three characteristics. Unemployment rates by gender, ethnicity, and age are available (Black and Sufi 2002; Rivkin 1995), but these data are not available at the county or CBSA level. Since unemployment statistics by gender, ethnicity, or age are not disaggregated at these levels, we did not disaggregate enrollments by these characteristics. Further research could examine how enrollment patterns differ according to these groupings, so long as the researcher has access to unemployment rates that are disaggregated in these ways.

Although we account for differences in micro- and metropolitan areas, a third limitation arises when a community college serves an area that is not incorporated into one of these two classifications. For example, Northwest State Community College (located in Fulton County, Ohio) serves a rural region in the northwest part of the state. Since Fulton County is not affiliated with a micro- or metropolitan statistical area, it is excluded from our analysis. Of the 1,095 community colleges listed in IPEDS for 2009, 137 were unaffiliated with a CBSA; perhaps further research could explore the unemployment elasticity of rural institutions. Additionally, some new colleges began during our period of analysis, which resulted in an unbalanced panel. We ran the analysis with a balanced panel (excluding institutions with missing data), only to yield similar results as our unbalanced model. Despite these limitations, we believe our analysis makes an important contribution to the enrollment demand literature as we offer an update to the literature exploring “unemployment elasticity” and our analysis takes advantage of county and CBSA unemployment data, which should offer a more accurate estimation of the extent to which community colleges respond to local economic forces.

Results and Discussion

Descriptive Statistics

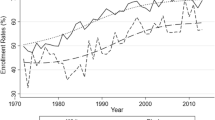

While the literature suggests several price and non-price indicators should be associated with community college enrollment demand, we are primarily interested in the role local unemployment rates play in this relationship. Figure 1 displays the counter-cyclical relationship between local (CBSA) unemployment and enrollment, where we see periods of weak economic conditions (i.e. high unemployment) follow similar community college enrollment patterns. When examining Fig. 1, we can see that the years prior to the 2001 recession experienced slow growth in unemployment rates, reaching a peak in 2001. During this period, community college enrollment experienced a similar pattern, where enrollment grew in the years leading up to the 2001 recession and then weakened in the years that followed. A similar, though sharper, pattern emerges when looking at the Great Recession (2007–2009). This period experienced significant climbs in unemployment rates, which were associated with similar climbs in community college enrollments. In both of examples, it appears that rising unemployment rates send market signals to potential students, where individuals opt for investing in human capital as the economy begins to slow.

The unemployment rate during the period of 1990–2009 averaged 5.8 % for all metropolitan and micropolitan regions. When disaggregating between micro- and metropolitan regions, as seen in Table 1, this rate changes from 5.6 to 6.2, respectively, indicating that micropolitan regions had slightly higher (though quite similar) unemployment rates when compared to metropolitan regions.

By definition, metropolitan and micropolitan regions vary by population size. Not surprisingly, the average total enrollment for a metropolitan community (7,167 students) is larger than a micropolitan community college (2,375 students). In addition, the mix of full-time and part-time students differs according to region. Metropolitan community colleges enroll a larger share of part-time students than micropolitan students, perhaps reflecting the nature of metropolitan campuses that tend to serve commuters and more full-time workers (Cohen and Brawer 2008). In micropolitan areas, community colleges tend to enroll nearly as many full-time students as part-time, suggesting less heterogeneity in terms of the students’ enrollment preferences.

Shifting to the price indicators, community colleges charge ~$1,800 in tuition and fees, with little variation between micropolitan and metropolitan regions. Cross-prices are accentuated in metropolitan areas, where the price of alternative educational opportunities is greater (perhaps to having more alternatives) than in micropolitan areas. Regional differences also exist with regard to non-price indicators, where metropolitan areas have larger per-capita incomes, smaller shares of manufacturing employment, and larger pools of recent high school completers.

Regression Results

In terms of the key variable of interest, unemployment rates, our models estimates that a one percentage-point change in unemployment is associated with between 1.1 to 3.3 percentage-point increases in community college enrollment demand. In Table 2, full-time enrollment demand is expected to increase by ~3.3 percentage-points for each one percentage-point increase in local unemployment. The parameter estimate for part-time enrollment (1.05) is still positive, but the smaller magnitude suggests that unemployment may impact full-time enrollments to a greater extent than part-time enrollments. Total enrollments are expected to increase by ~2.4 %, though this estimate varies according to metro and micro areas. Notably, the R 2 values range between 0.398 and 0.491 for the total enrollment and full-time enrollment models, while this range is smaller (0.087–0.188) for part-time enrollment. We speculate that the goodness of fit is lower for our part-time enrollment models because of omitted variables that are unavailable in our dataset. For example, we do not have data for “potential future earnings” and our unemployment variable is not disaggregated by age. Adding these variables (and others) would improve model fit, as seen in Betts and McFarland (1995) where the R 2 for part-time enrollment is ~0.300. Nevertheless, we find several consistent patterns between unemployment and community college enrollment, as described below.

In the metropolitan areas (Table 3), total enrollments are expected to increase by 2.6 percentage-points for a one percentage-point change in unemployment. Similar to the first model, full-time enrollments are expected to rise at greater levels than part-time enrollments when unemployment rates rise, when holding other variables in the model constant. In contrast, micropolitan areas (Table 4) experience slightly smaller parameter estimates, suggesting that the unemployment elasticity is slightly smaller in micropolitan areas than metropolitan areas. Our models estimate that each one percentage-point increase in micropolitan unemployment rates is associated with a 1.6 and 3.2 percentage-point increase in total and full-time enrollments, respectively. Part-time enrollments failed to produce a systematic pattern between unemployment and enrollment demand.

By using three different enrollment measurements and data on local economic characteristics, our findings provide additional evidence that community college enrollment demand runs counter-cyclical to business cycles. Building upon the extant “unemployment elasticity” literature, we estimate that community college enrollment demand increases by ~1.1–3.3 percentage-points for a 1 % increase in unemployment rates, when holding other variables in the model constant. These estimates vary according to part-time and full-time status, as well as metro and micropolitan statistical areas.

Conclusions and Discussion

This study utilizes institution-level enrollment data and local economic indicators for the years 1990–2009, to examine the extent to which community college enrollment demand changes relative to changes in local unemployment rates. We find that part-time and full-time enrollment demand responds to unemployment rates at different magnitudes, as a 1 % change in unemployment rates is associated with ~3.3 % increase in full-time enrollment demand while part-time enrollment changes by ~1.1–1.6 percentage-points. We also find evidence of variations across micro- and metropolitan statistical areas, where demand for community college tends to be more responsive to unemployment rates in metro areas. Our study suggests that community college enrollment demand runs counter-cyclical to the business cycle, where periods of weak economic times are associated with greater demand for education. Behaving well with economic theory, our results suggest that when opportunity costs decline during recession, people are more inclined to invest in this form of human capital.

Building upon enrollment demand theory and the cyclicality of schooling literature, our results suggests that individuals on the margins between college and work will pursue community college education at greater rates during periods of higher unemployment. Given the economic challenges that have emerged from the more recent recession, we suspect that community colleges will continue to face high levels of enrollment demand. The Great Recession officially ended in June of 2009, yet the national unemployment rate has settled at a persistently high 8.3 % (U.S. Bureau of Labor Statistics 2012). Due to the depth and length of the 2007 recession and the magnitude of job losses that communities have faced, economists project a long period of economic recovery. The Congressional Budget Office estimates that unemployment rates will not reach their pre-recession levels of 5 % until 2016 or later, and chances of a double-dip recession may still loom (Levine 2011).

With this context in mind, further research should continue to examine the interactions between labor market conditions and community college enrollment patterns. Further research could probe deeper into questions that we did not address in this study. For example, how does unemployment elasticity differ for rural (i.e. those not affiliated with a CBSA) community colleges? If enrollment at these institutions is less responsive to unemployment, then why might this be the case? Our study focuses on micro- and metropolitan areas, so we would be curious to see if similar patterns hold for rural colleges. Similarly, some scholars may be interested in examining how demand varies according to students’ age, gender, race, or socio-economic status. Our study examines broad enrollment patterns and does not investigate the socio-cultural variation that may exist within each institution, though this could be a fruitful line of inquiry for research, policy, and practice. And finally, too few studies disaggregate between full- and part-time enrollment with part-time enrollment rarely discussed in much detail. Given the relatively low predictive value of the model for part-time enrollment in micropolitan areas, additional inquiry into the factors that contribute to part-time enrollment and how it responds to changes in local unemployment rates.

Because of their missions to serve local labor markets, ongoing public policy debates have highlighted the role community colleges play in regional, state, and national economic recovery efforts (Katz 2010; Levin 2007; Summers 2010). Public policymakers try to capitalize on this relationship by encouraging displaced and under-employed workers to attend community colleges as a tool for economic recovery (Leigh and Gill 2007; Lewin 2012; Schultz 2010). Do these policy interventions work? If they do, are they cost-effective and scalable for other communities to implement? When framing these policy interventions in terms of enrollment demand theory, it may be tempting to speculate that investing in community colleges during recessionary periods will result in even higher enrollment levels since the opportunity costs are low. However, these questions are beyond the scope of our analysis and further research on the impact of these employment interventions could be a helpful line of inquiry for gaining a better understanding of the relationship between labor market conditions and community college enrollment patterns. With a better understanding of the counter-cyclical nature of community colleges enrollments, campus leaders and state policymakers can weigh the merits of alternative policy solutions for responding to this demand.

Notes

.This period of time incorporates four recessions. For a full list of U.S. recession periods, see National Bureau of Economic Research (2012).

These years represent the earliest and latest available data periods.

We conducted a Hausman specification test, rejecting the null hypothesis that the random effects are orthogonal to the regressors. As a result, the fixed-effects method is preferred.

References

Allison, P. D. (2009). Fixed effects regression models. Sage series on quantitative applications in the Social Sciences.

Becker, W. (1990). The demand for higher education. In S. Hoenack & E. Collins (Eds.), The economics of American universities: management, operations, and fiscal environment (pp. 155–188). New York: SUNY.

Becker, G. S. (1993). Human capital: a theoretical and empirical analysis, with special reference to education. Chicago: University of Chicago Press.

Betts, J. R., & McFarland, L. L. (1995). Safe port in a storm: the impact of labor market conditions on community college enrollments. The Journal of Human Resources, 30(4), 741–765.

Black, S. E., & Sufi, A. (2002). Who goes to college? differential enrollment by race and family background. Cambridge: National Bureau of Economic Research.

Bozick, R. (2009). Job opportunities, economic resources, and the postsecondary destinations of American youth. Demography, 46(3), 493–512.

Clotfelter, C. T. (1992). Explaining the demand. In C. Clotfelter, R. Ehrenberg, M. Getz, & J. Siegfried (Eds.), Economic challenges in higher education (pp. 59–88). Chicago: University of Chicago Press.

Cohen, A., & Brawer, F. (2008). The American community college (5th ed.). Hoboken: Wiley.

Corazzini, A. J., Dugan, D. J., & Grabowski, H. G. (1972). Determinants and distributional aspects of enrollment in US higher education. Journal of Human Resources, 7, 39–59.

Dadashova, A., Hossler, D., & Shapiro, D. (2011). National postsecondary enrollment trends: before, during, and after the great recession. Herndon: National Student Clearinghouse.

Dellas, H., & Sakellaris, P. (2003). On the cyclicality of schooling: theory and evidence. Oxford Economic Papers, 55(1), 148.

Drukker, D. (2003). Testing for serial correlation in linear panel-data models. The Stata Journal, 3(2), 168–177.

Elsby, M., Hobijn, B., & Sahin, A. (2010). The labor market in the great recession. Brookings papers on economic activity. Washington, D.C.: Spring.

Feldman, P., & Hoenack, S. (1969). Private demand for higher education in the United States. The economics and financing of Higher Education in the United States, 375–95.

Fitzpatrick, M., & Turner, S. (2007). Blurring the boundary: changes in the transition from college participation to adulthood (pp. 107–137). The Price of Independence: The Economics of Early Adulthood.

Goldin, C. D., & Katz, L. F. (2008). The race between education and technology. Cambridge: Belknap.

Heller, D. E. (1997). Student price response in higher education. The Journal of Higher Education, 68(6), 624–659.

Hemelt, S. W., & Marcotte, D. E. (2011). The impact of tuition increases on enrollment at public colleges and universities. Educational Evaluation and Policy Analysis, 33, 435–457.

Hoenack, S. A., & Weiler, W. C. (1979). The demand for higher education and institutional enrollment forecasting. Economic Inquiry, 17(1), 89–113.

Jackson, G. A., & Weathersby, G. B. (1975). Individual demand for higher education: a review and analysis of recent empirical studies. The Journal of Higher Education, 46, 623–652.

Kane, T. J. (1994). College entry by blacks since 1970: the role of college costs, family background, and the returns to education. Journal of Political Economy, 102, 878–911.

Kane, T. J. (1999). The price of admission: rethinking how Americans pay for college. Washington, D.C.: Brookings Institution.

Kane, T. J., & Rouse, C. (1999). The community college: educating students at the margin between college and work. The Journal of Economic Perspectives, 13(1), 63–84.

Katz, L. (2010). Long-term unemployment in the great recession. Testimony for the joint economic committee of the US Congress hearing on “Long-Term Unemployment: Causes, Consequences and Solutions”(April 29, 2010).

Kienzl, G., Alfonso, M., & Melguizo, T. (2007). The effect of local labor market conditions in the 1990s on the likelihood of community college students’ persistence and attainment. Research in Higher Education, 48(7), 751–774. doi:10.1007/s11162-007-9050-y.

Leigh, D. E., & Gill, A. M. (2007). Do community colleges respond to local needs?: evidence from California. Kalamazoo: W.E. Upjohn Institute.

Leslie, L. L., & Brinkman, P. T. (1987). Student price response in higher education: the student demand studies. The Journal of Higher Education, 58, 181–204.

Levin, J. (2007). Nontraditional students and community colleges: the conflict of justice and neoliberalism. Basingstoke: Palgrave Macmillan.

Levine, L. (2011). Economic growth and the unemployment rate. Congressional Research Service, 7–75700, Washington, D.C.

Lewin, T. (2012). Obama budget seeks job training at community colleges. The New York Times. http://www.nytimes.com/2012/02/14/education/obama-to-propose-community-college-aid.html. Accessed 18 Feb 2012.

Manski, C. F., & Wise, D. A. (1983). College choice in America. Cambridge: Harvard University Press.

Mullin, C., & Phillippe, K. (2009). Community college enrollment surge. AACC policy brief series. Washington, D.C.: American Association of Community Colleges.

National Bureau of Economic Research (2012). U.S. Business cycle expansion and contractions. NBER. http://www.nber.org/cycles.html. Accessed 24 Jan 2012.

Nutting, A. W. (2008). Costs of attendance and the educational programs of first-time community college students. Economics of Education Review, 27(4), 450–459.

Pindyck, R., & Rubinfeld, D. (1997). Econometric models and economic forecasts (4th ed.). Columbus: McGraw-Hill/Irwin.

Rivkin, S. G. (1995). Black/white differences in schooling and employment. The Journal of Human Resources, 30, 826–852.

Rouse, C. E. (1994). What to do after high school: The two-year versus four-year college enrollment decision (pp. 59–88). Choices and consequences: Contemporary policy issues in education.

Rusk, J. J., Leslie, L. L., & Brinkman, P. T. (1982). The increasing impact of economic conditions upon higher education enrollments. Economics of Education Review, 2(1), 25–48.

Schultz, M. (2010). Federal funding cuts will limit no worker left behind. The Detroit News. http://www.detroitnews.com/article/20100630/BIZ/6300356. Accessed 3 Feb 2012.

Stratton, L. S., O’Toole, D. M., & Wetzel, J. N. (2004). Factors affecting initial enrollment intensity: part-time versus full-time enrollment. Economics of Education Review, 23(2), 167–175. doi:10.1016/j.econedurev.2003.06.002.

Summers, L. H. (2010). Principles for economic recovery and renewal. Business Economics, 45(1), 3–7.

U.S. Bureau of Labor Statistics (2012). Employment situation summary. http://www.bls.gov/news.release/empsit.nr0.htm. Accessed 27 Feb 2012.

U.S. Census Bureau (2012). Metropolitan and micropolitan, metropolitan and micropolitan statistical areas. http://www.census.gov/population/metro/. Accessed 9 Feb 2012.

U.S. Department of Education (2011). Digest of education statistics, 2010. Digest of education statistics. http://nces.ed.gov/programs/digest/d10/tables/dt10_34.asp. Accessed 3 Nov 2011.

Wooldridge, J. M. (2009). Introductory econometrics: a modern approach. Belmont: Cengage Learning.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Hillman, N.W., Orians, E.L. Community Colleges and Labor Market Conditions: How Does Enrollment Demand Change Relative to Local Unemployment Rates?. Res High Educ 54, 765–780 (2013). https://doi.org/10.1007/s11162-013-9294-7

Received:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11162-013-9294-7