Abstract

The aim of this paper is to examine the association between accounting-based earnings management and real activities manipulation in a weaker regulatory environment. We measure accruals-based earnings management by modified Jones model. Real earnings management is identified through sales manipulation and discretionary expenditures. The relationship between accruals-based earnings management and real earnings management is examined by using simultaneous equation systems estimated with panel data. Based on a sample of Tunisian public offering firms, our findings support not only a complementary relationship between sales manipulation and accruals-based earnings management, but also a substitutive interaction between discretionary expenditures and accruals management. Tunisian firms do not face greater scrutiny from regulators and jointly use the two alternatives of earnings management. However, when income taxation becomes the main incentive for earnings management, Tunisian firms prefer real earnings management to discretionary accrual. It implies that accounting earnings management is jointly used with some real earnings management tools and serves as substitutes for other real activities manipulations. Contrary to results of previous studies, managers can use the two earnings management alternatives as substitutes and complementary tools at the same time.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Most prior studies of the universal phenomenon of earnings management applied a single strategy: accounting-based earnings management or real activities manipulation. Accounting-based earnings management consists of the use of judgments by managers in financial reporting to alter the level of accruals and earnings as a consequence. Real earnings management affects the level of cash flow through deviation from normal business practices (operational, investment and financing transactions) in order to affect earnings (Roychowdhury 2006).

Recently, research provided evidence that firms use both two alternative ways to obtain the desired level of earnings (Baker et al. 2018; Cohen et al. 2008; Cohen and Zarowin 2010). Indeed, examining either type of strategy in isolation cannot explain the overall impact of earnings management activities and perhaps leads to incorrect conclusions (Zang 2012).

Evidence from Barton (2001), Pincus and Rajgopal (2002), Cohen et al. (2008) or Zang (2012) indicates that both strategies are used as substitutes. Substitution implies that adopting real earnings management strategy decreases the use of accounting earnings management and vice versa.

Only a few studies showed that the relationship between real earnings management and accounting earnings management is complementary (Matsuura 2008; Chen et al. 2012). By complementary relationship, we intend that managers jointly select the two policies over the same period. Therefore, managers can determine both real and accrual manipulation simultaneously. They can also use the two techniques sequentially by determining accounting earnings management after real earnings activities. Indeed, the sequential nature of this decision implies that real activities must be taken early in the year while the effect of accruals management is decided at year closing.

In this context, our paper presents a new approach to analyze earnings management strategies. Since accounting and real earnings management as being jointly determined, our approach is based on a simultaneous equations model. Despite the increasing interest of these two earnings management strategies, prior research has failed to evaluate their interaction through the study of each real activity tool separately. Indeed, the major studies to be investigated in this field measure real earnings management as a whole. In addition, prior literature does not develop incentives that can influence the choice between complementary and substitution relationship. We try to fill these gaps in the literature by analysing the different relationships between accounting and real earnings management measured by each real activity tool separately. The most important advantage of this way is that it can demonstrate if managers use all real earnings management techniques in the same fashion or differently. The additional advantage of using this method is that it results in identifying the conflictual incentives that condition a firm’s decision to adopt either strategies or a single one. This investigation is useful to understand the firm’s behavior in different contexts.

Tunisia provides a particularly interesting context which is different from American and European ones. Indeed, Tunisia is an emerging country that is known for its lack of transparency, weaker investor protection, lower voluntary disclosure level, and developing capital market (Ben Othman and Zeghal 2008; Kolsi 2012; Chakroun 2013). These specificities in terms of flexibility accounting standards, effectiveness corporate governance, and ownership structure may explain the link between accounting and real earnings management.

Studies of accruals-based earnings management in this context are numerous. (e.g., Ben Othman et al. 2007; Ben Amar and Abaoub 2010) However, those using real activity manipulation are quite limited (Zgarni et al. 2012; Elleuch Hamza and Bannouri 2015). Moreover, there is no investigation or empirical evidence on how Tunisian managers choose between accounting and real earnings management.

To our knowledge, our study is the first one to investigate the relationship between these two forms of earnings management by focusing on the Tunisian specificities, which remained unexplored. Our purpose is then to examine the association between accounting-based earnings management and real activities manipulation of Tunisian public offering firms. We also extend the literature by including the effects of the corporate tax on earnings management activities in this country that has less closely aligned book and taxable incomes.

Using simultaneous equation systems, our findings support a complementary relationship between sales manipulation and accruals-based earnings management. This indicates that the institutional environmental weaknesses and the smaller capital market reduce both real and accounting earnings management costs and motivate managers to engage in the two forms simultaneously. Our findings also reveal a substitutive interaction between discretionary expenditures and accruals management. Income taxes represent a high cost that affects this interaction. The use of the earnings management in more than one strategy at the same time depends on managers’ earnings management incentives. Contrary to previous studies which only confirm one of the two opposing views (substitution versus complementary hypothesis), our study supports the two views at the same time.

These findings are significant for researchers, investors and regulatory authorities. Researchers should be conscious that the total earnings management may not be as prominent as expected. The multiple interactions in different directions between accounting and real earnings management tools require further analysis and thinking over.

Furthermore, our results demonstrate that investors need to recognize the modern manipulation in accounting and the influence of a weaker regulatory environment on the entire earnings management tools in order to take a better investment decision. In particular, due to the low costs related to both accounting and real earnings management in such an environment, investors should be aware that loss firms actually hide bigger losses. They should also know that due to tax considerations, suspect firms manage their earnings in the opposite directions by using different earnings management instruments, even those having negative future consequences. Taken together, investors cannot correctly interpret the magnitude and the direction of earnings management if they do not identify the use of either technique. Therefore, they cannot understand the true consequences of earnings management strategies before investing in a firm.

For regulators, our findings suggest that reducing accounting flexibility or enhancing scrutiny over accounting discretion may not eliminate earnings management activities. It is also necessary for regulators in relatively weak governance environments to increase scrutiny and greater disclosure over the discretionary behavior of real activities manipulation. Thus, Tunisian regulators should impose numerous restrictions including taxation rules in order to reduce discretionary expenditures and improve the effectiveness of managers’ real decisions. Such implications can bridge between theory and practice because real earnings management must be reported so that investors are not misled.

The remainder of this study is organized as follows: the next section summarises the prior literature that examines the relationship between accounting and real earnings management around the world. Section 3 describes the main economic and regulatory environments that characterize the Tunisian public offering firms which condition our hypotheses and methodology. Section 4 is devoted to the empirical results and the implications of our evidence. The last section offers concluding remarks.

2 Relationship between accounting and real earnings management: benefits of a simultaneous estimation

According to Zang (2012), the relationship between accounting and real earnings management depends on the relative costs and constraints of using earnings management tools. She argues that if the costs of using discretionary accruals are higher than real activity manipulation, managers choose real earnings management tools. This occurs when the risk of auditors’ and regulators’ scrutiny or litigation penalties are higher. Conversely, real earnings management tool is considered costlier in the long run than accruals manipulation, specifically if future cash flows are negatively affected by the use of this instrument.

Based on the relative cost–benefit advantages, managers will select the tool with a relatively lower cost and make use of it rather than other multiple costlier instruments. The relative cost–benefit hypothesis is conditioned on the regulatory environment, reporting and litigation costs. These conditions play a major role in explaining the substitutive interaction between the two forms of earnings management. The trade-off decision is then dependent upon their relative costliness.

In contrast, under the low cost of the two forms of earnings manipulation, managers have more incentives to use them as coordination means. These incentives dominate the relative cost–benefit hypothesis (Chen et al. 2012). Following this complementarity hypothesis, managers inflate earnings and meet earnings goals via a coordinated approach.

To sum up, the literature appreciates the cost aspect of the two earnings management forms, and the trade-off decision supports the two rival hypotheses. Based on this development, we discuss the benefits of a simultaneous estimation and how this improves inferences regarding the earnings management process.

2.1 Substitution hypothesis

The substitution relationship is a function of the relative costs of the two manipulation strategies. Many authors underline that the shifting from real activities manipulation to discretionary accounting practices is a consequence of higher cost associated with real earnings management. Indeed, Barton (2001) found that firms which use derivatives support a higher cost than those managing accruals. For this reason, managers reduce their use of real earnings management tool and substitute it by abnormal accruals. Pincus and Rajgopal (2002) completed the study of Barton (2001) by choosing “hedging with derivatives” as real financing activities techniques. Their results are similar to those of Barton (2001).

However, real activities manipulation is relatively applied more than accruals discretion when his cost is lower compared with the cost of accounting earnings management. Indeed, in a tightened regulatory environment, real earnings management substitutes accrual manipulation. Libby and Seybert (2009) refer to regulatory environment as accounting, financial reporting, auditing, and other corporate governance regulations. The purpose of such regulation is to improve financial reporting quality. Indeed, a tightened accounting standards and auditors’ scrutiny increase the costs of applying accounting earnings management and so limit its use.

Empirically, Ewert and Wagenhofer (2005) investigated the impact of strict financial reporting regulation on the costs of earnings management and showed that tighter accounting rules constrain accounting manipulation in favor of real activities. In this case, manipulation through accruals discretion becomes costlier compared to real earnings management.

Moreover, Ge and Kim (2014) and Cohen et al. (2008) underlined that the adoption of Sarbanes–Oxley Act (SOX), which increases audit and other corporate governance scrutiny, decreases accruals-based earnings management, and induces executives to resort to real transactions one. They so confirmed the substitution effect among different earnings management strategies.

In particular, Chan et al. (2015) examined the effect of regulatory clawbacksFootnote 1 introduced by the Sarbanes–Oxley Act on the choice of the earnings management forms. Their results indicate that clawback adoption leads to a reduction in abnormal accruals in order to avoid scrutiny from the SEC and to eliminate thereby the risk of accounting restatements. However, authors found that managers tend to switch from accounting management to real transactions one by cutting back on discretionary expenses. The substitution effect is then in line with Cohen et al.’s (2008) findings.

Furthermore, Chi et al. (2011) provided the evidence that improved audit regulation and monitoring systems influence the choice of the earnings management alternatives. When audit quality is higher, managers prefer real earnings management to discretionary accrual because managing real activities cannot influence auditors’ opinions and consequently becomes less costly. The authors documented that the two forms of earnings management function as substitutes.

Additionally, Jungeun et al. (2012) analysed the effect of economic shock on earnings management practices by examining the behavior of Korean business group (chaebol firms) in pre-and post-financial crisis periods. The Asian financial crisis forced these firms to undertake a series of reforms affecting the legal environment in order to impede accounting earnings management practices and improve their financial reporting transparency. Authors found that after the Asian financial crisis, chaebol firms have switched earnings management strategies from artificial to real manipulation. They consider that the change in the business environment in Korea led chaebol firms to seek other financing sources from external capital markets by improving the transparency of financial information. Consequently, manipulation through abnormal operating decisions becomes more appealing.

However, the study of Matsuura (2008) proves otherwise. Matsuura (2008) was the only author who highlighted a complementarity relationship in the Japanese context. Indeed, despite recent tightening accounting rules that should constrain discretionary accruals, such as “Impairment” and “Financial instrument” accounting standards, Japanese managers continue to use it jointly with real earnings management.

Not only the level of regulation influences the choice of earnings management practices. The country’s institutional structures, the tax rate environment, and the degree of investor protection are other factors that determine the substitutive relationship between the two forms of earnings management.

The most international empirical results suggest that firms in countries with strong investor rights, transparent reporting environment, and developed equity markets engage in less accounting earnings management and shift to real activities manipulation.

Indeed, Nnadi et al. (2015) examined the effect of regulatory environment on earnings management practices by comparing Chinese firms with Hong Kongese ones. Firms operating in China are characterized with concentrated ownership structures and are highly regulated by the state. Conversely, Hong Kong firms operate in a strong equity capital market and a transparent reporting environment. The results of their studies indicate that Hong Kong firms tolerate real earnings management practices such as sales manipulation and discretionary expenditures whilst experience less accounting earning management. On the contrary, Chinese firms are more likely to engage in accounting discretion than in real earnings management activities.

Furthermore, the international comparative studies on the choice between the alternative ways of earnings management showed that investor protectionFootnote 2 is an important factor in explaining international differences in corporate earnings management policies. Contrary to civil law systems, common law countries are characterized by high investor protection because government interventions are limited, individual and private property rights are protected, a quality of legal enforcement is enhanced, and capital markets are larger (La Porta et al. 1998).

According to these authors, a stronger system of legal enforcement protects investors’ rights by conferring on them powers to discipline managers and to reduce the possibility of private benefits. The most recent studies supported that a stronger investor protection laws constrain the use of accounting earnings management (e.g., Enomoto et al. 2015). In countries with higher investor protection rights, the real earnings management is then preferred over accruals discretion. Indeed, Enomoto et al. (2015) highlight the substitutive trade-off across 38 countries. In particular, they underlined that Anglo-American countries are more likely to engage in real earnings management than in Asia and Continental Europe. These latter rather employ accounting earnings management tools than real activities manipulation.

Additionally, Lee and Swenson (2011) pointed out that the choice between the two practices also depends on tax considerations. Marginal tax rates vary by country and the higher tax rates have significant effects in explaining the relationship between discretionary accruals and real earnings management. In particular, firms with higher tax rates reduce earnings and taxes by accelerating expenses. Authors found a negative relationship between discretionary accruals and discretionary expenditures supporting the substitution hypothesis. Such tax effect is significant for American and Canadian firms which face higher tax rates. However, this doesn’t apply to East Asian firms which experience lower marginal rates.

2.2 Complementarity hypothesis

Compared to a tightened regulatory environment, firms operating in a weaker regulatory environment are more likely to manipulate earnings. Indeed, earnings management is more pervasive in countries with weaker investor protection, more concentrated ownership, and less developed stock markets because of fewer regulators’ scrutiny and legal punishment (Leuz et al. 2003). Managers enjoy greater private control benefits and can mislead investors easier. So, the financial reporting and litigation costs in countries operating in such an environment are considered as low. For these reasons, firms are more inclined towards earnings management through not only the accounting strategy but also the managers’ real decisions.

Initially, empirical results support the relevance of firms’ incentives to manage earnings through accruals in countries with weaker investor protection and law enforcement. La Porta et al. (1998) specified that these countries generally belong to the civil-law tradition.

Indeed, a positive association is identified in the French context, a code-law country characterized by weak investor protection. Sellami (2016) found that French firms use real activities manipulation and abnormal accruals as complementary practices after the mandatory IFRS adoption.

Recently, few studies provide evidence of the use of real earnings management in countries with low legal protection (Wang 2014). In such an environment, there are higher opportunities for risk-taking, which motivate firms to engage in more real earnings management activities. Wang (2014) adds that “the more corruption and large unofficial economy” of these countries encourage managers to make abnormal operating decisions for opportunistic reasons.

Moreover, studies conducted in emerging Asian countries support this conclusion. In fact, Chen et al. (2012), who confirmed the complementary relationship in the Taiwan context, indicated that Taiwan is an emerging country where investor protection is weak and disclosure requirements are low. The reporting and litigation costs are thus relatively lower than those in developed countries. These specific characteristics encourage Taiwanese firms to use the two strategies simultaneously. The findings of Sanjaya and Saragih (2012) also show that Indonesian managers’ real decisions positively influence accounting earnings management.

Africa and Middle East samples are another area characterized by low enforcement of reporting standards and supervisory rules. Few studies examined the type of association between accounting and real earnings management in this context. We only identify the study of Hashemi and Rabiee (2011), conducted on firms listed on the Tehran Stock Exchange, which sustains a complementary relationship.

2.3 Benefits of the simultaneous estimation

Accrual manipulation is generally conducted in the end of the fiscal year and before financial reporting. Real activities manipulation is conducted during the fourth fiscal quarter when managers have more information about the optimal level of earnings management needed to achieve earnings targets (Francis et al. 2016). We can so assume that the total amount of earnings management is the sum of these two types of manipulation plus their disturbance terms (ŭ and ĕ):

EM: earnings management; RM: real earnings management; AM: accounting earnings management.

The amount of real earnings management is not exogenous and affects, in part, accounting management because managers take decision about the RM before the accounting choices. Similarly, the level of accounting management is adjusted according to the level of real activities manipulation already realized. The trade-off decision is influenced by the relative costliness of earnings management activities. When the costs associated with real (accounting) earnings management are high, firms diminish the use of real activities (accounting) manipulation and increase the accounting (real activities) manipulation. Inversely, the low (high) cost of both accruals discretion and real activities tools pushes managers to increase (reduce) the two alternatives. Thus, the manipulation of accruals and the real activities can be considered as a result from a joint decision to manage earnings. In other terms, we can argue that discretionary accruals are endogenously related to real earnings management tools.

To address endogeneity of the earnings management activities, we believe that a simultaneous equations model is the best estimation method where the two endogenous variables are accounting and real earnings management.

To estimate this model, we also need more than one exogenous variable for each endogenous variable. The literature suggests that managers have multiple incentives for a strategical management of earnings. Thus, there are several exogenous variables which are correlated with managers’ earnings management decisions.

Highly levered firms can reduce real earnings management in favor of discretionary accruals. Indeed, firms frequently resort to the bank loans for financing and so must convince their creditors about their solvency. Consequently, they avoid real manipulation activities which have a direct cash-flows effect and generate a negative long-term performance impact, as opposed to accounting earnings management. Therefore, we expect that leverage is positively (negatively) associated with accrual (real) earnings management.

Besides, Zang (2012) indicated that firms enjoying better performance engage in a higher level of real earnings management due to their healthy financial condition. In contrast, firms with poor financial health find real activities manipulation costly and are more likely to manage earnings with accrual components. Firm performance is negatively (positively) associated with accrual (real) earnings management.

Moreover, accrual reversal is an important accounting earnings management constraint for future reporting. This lack of flexibility incites managers to manipulate earnings through real activities (Zang 2012). Firms with lower levels of accounting flexibility have been switching to real earnings management. We then assume that flexibility is positively (negatively) associated with accrual (real) earnings management.

In addition, firms with higher marginal tax rates perceive accounting earnings management as inefficient. Indeed, due to the book-tax differences, manipulation via discretionary accruals can reduce book income without tax consequences. However, real earnings management is likely to reduce book and taxable income at the same time. For this reason, we suppose that marginal tax rate is positively (negatively) associated with real (accrual) earnings management.

As identified by the literature, larger firms also have more effective monitoring mechanisms comparing to smaller firms. They then support more pressure by auditors and other external monitoring systems and exhibit less accounting earnings management consequently (Klein 2002). Recent studies showed that larger firms have more flexibility to deviate from optimal business decisions to achieve their corporate goals (Chen et al. 2012; Zang 2012). So, we predict that firm size is negatively (positively) associated with accrual (real) earnings management.

Finally, firms with growth opportunities are more likely to engage in earnings management because managers’ actions in such firms are not readily observable to shareholders and it is more difficult to monitor the managerial activities (Skinner 1993). Moreover, growth firms experience more stock market pressure to meet earnings thresholds and push managers to manipulate earnings (Skinner and Sloan 2002). Therefore, we suggest that discretionary accruals and real activities manipulation are higher in growth firms.

Based on these developments, our simultaneous equations model contains two endogenous variables and six exogenous variables. The causal model diagram of our model can be presented by the Fig. 1. This diagram displays how endogenous and exogenous variables are related to one another with respect to the theoretical model. Figure 1 is non-recursive due to the reciprocal paths between accounting and real earnings management.

The causal model diagram. Endogenous variables: Accounting earnings management is measured by discretionary accruals. Real earnings management is measured by two proxies: abnormal operating cash flow and abnormal level of discretionary expenses. Exogenous variables: Leverage: leverage level of a firm is measured as the ratio of debt divided by total assets. Performance: firm performance is measured as pretax income scaled by total assets. Flexibility: accounting flexibility is measured by net operating assets of a firm (shareholders’ equity plus total debt less cash and marketable securities scaled by lagged sales). Taxes: marginal tax rate is measured as tax expense of a firm scaled by pretax income. Size: firm size is measured by the logarithm of the total assets. Growth: growth opportunities are measured as sales growth firms in the year t divided by the sales of previous year, minus one

3 Hypotheses formulation and research design

3.1 Hypotheses development

Based on the theoretical framework developed above, it appears that the nature of the relationship between real activities versus accruals-based earnings management is contingent upon the strength of a country’s regulatory environment, a transparent reporting environment, and a developed equity markets. Real earnings management and discretionary accruals play mutually complementary roles in countries with relatively weaker regulatory environments. However, substitutive interaction is more prevalent in countries with stronger investor protection laws.

Tunisia inherited its legal system, civil law, from French colonizers. Despite the improvement in a number of key areas which are considered in “high compliance” with relevant international standards, Tunisia suffers from inefficient legal and institutional environment weaknesses. Indeed, the results of EBRDFootnote 3’s 2013 assessment of the corporate governance framework in Tunisia identify a number of weaknesses in the legal regime. In practice, several areas relating transparency, disclosure and the rights of minority shareholders need to be strengthened.

Like all emerging economies, information sources in Tunisia are mostly limited to annual reports. Indeed, Chakroun (2013) showed a low level of voluntary disclosure, compared with that requested by Tunisian financial analysts. The author even mentioned that any Tunisian public offering firm was legally punished when it does not disseminate the mandatory information required by the Financial Market Council (FMC). Despite some improvement with reference to non-financial disclosure, minor shareholders cannot access to corporate information timely and at a reasonable cost (Ben Othman and Zeghal 2008; EBRD’s 2013).

Furthermore, the Tunisian banking sector plays a predominant role in financing public offering firms compared with financial market despite any growth in its capital market. This latter is considered as embryonic with 77 listed non-financial firms in 2015. The majority of these firms are characterized with concentrated ownership structures with familiar characteristics and this can limit the protection of the shareholders’ rights (Kolsi 2012).

If we consider them all together, we can assume that Tunisian firms operate in an environment with weaker investor protection and law enforcement. Thus, there is little cost to adopt multiple instruments to manage earnings regardless to their forms. From the cost side perspective, we support the complementarity hypothesis. We then assume that accruals earnings management positively influences real activities manipulation.

However, Tunisia is also characterized by a higher tax effect. Indeed, the tax rate reaches 35%, which is considered relatively high compared with other countries. In addition, the adoption of the Tunisian accounting system since 1996 created more independence between accounting and taxation rules (Dridi and Boubaker 2015). These book tax differences imply that the use of accounting earnings management for tax purposes is not efficient. Such tax environment might create strong incentives to manage earnings and taxes downwards by increasing discretionary expenditures rather than by accounting manipulation. A substitutive relationship between discretionary expenditures and accruals is consequently predicted.

We support the complementarity hypothesis for the other real earnings management tools as sales manipulation, overproduction or selling assets. Due to unavailability of overproduction data and the no effect of the sale of assets or investment on earnings management behavior of Tunisian firms (Elleuch Hamza and Bannouri 2015), we test the complementarity hypothesis using sales manipulation as real earnings management tool.

From the aforesaid discussions, we would expect that:

H 1

There is a complementary relationship between accounting earnings management and sales manipulation practiced by Tunisian public offering firms.

H 2

There is a substitutive relationship between accounting earnings management and discretionary expenditures practiced by Tunisian public offering firms.

3.2 Data and methodology

3.2.1 Sample collection and data sources

In order to test our hypotheses, we initially select all Tunisian public offering companies (181 firms) tabulated from the Financial Market Council (FMC). We restrict our sample to non-financial institutions due to the accounting specificities of financial firms (70 financial firms). We also exclude the cases of unavailability of data (33 firms). Moreover, we eliminate “Syphax” firm because of its financial problems. Table 1 summarises the final sample selection.

The final sample of 77 firms includes 43 industrial companies and 34 commercial ones. We note that the majority of firms are private (85%) and only 15% of all sample represent public firms.Footnote 4 Moreover, 47 firms are listed on Stock Exchange (See Table 2). Companies that are not listed on a stock exchange do not meet the exchange’s requirements. They offer stock or bonds to the public in order to increase their capitals or investments. Certainly, their incentives for earnings management are different from listed firms. As revealed by Elleuch Hamza (2012), unlisted Tunisian firms manipulate earnings to reduce taxable income. Whereas, listed companies avoid losses or smooth earnings. In all cases, the author found that the two types of firms engage in significant earnings management by using both accrual and real manipulations.

The study period covers data over a 10-year period (2005–2014). In reality, financial statements are published in the FMC site well before 2005. However, we only note 40 financial statements published in both 2003 and 2004 years. Due to the unavailability of data, we eliminate these 2 years from our study period. The list of these firms is available on: http://www.cmf.org.tn/ accessed 16 April 2015 (Official Bulletin No 150416).

Data was manually collected from the individual financial statements available on the website of the FMC and annual reports available on Tunisian Stock Exchange website (http://www.bvmt.com.tn) as well as on companies’ websites. We do not choose the consolidated accounts because Tunisian investors do not mainly use them since taxable profits and dividends of Tunisian firms are determined on the basis of individual statements.

3.2.2 Definition and measurement of variables

3.2.2.1 Definition and measurement of endogenous variables

The two endogenous variables, which are supposed to be linked, are “accounting earnings management” and “real earnings management”.

Accounting earnings management is measured by discretionary accruals. We use the modified Jones model for this purpose. As described by Dechow et al. (1995), this model is a firm-specific measure based on cross-sectional estimation. According to this model, total accruals are affected by the change in sales, level of property, plant, and equipment:

where ACCi,t = total accruals for firm i in year t, measured as net income less operating cash flows; Δsalesi,t = change in sales measured by sales in year t less sales in year t − 1 for firm i; PPEi,t = gross property, plant and equipment for firm i in year t; ΔRECi,t = change in trade receivables measured by trade receivables in year t less trade receivables in year t − 1 for firm i; and TAi,t−1 = total assets for firm i in year t − 1. All variables are deflated by beginning total assets to avoid heteroscedasticity; α0,1,2,3 = coefficients estimated for two sectors (commercial and industrial) separately to reflect economic conditions for each industry and every year of the assessment period (2004–2013).

Discretionary accruals of the firm i (DAi,t) correspond to the difference between the total accruals observed for year (t) of the study period (2005–2014) and the non-discretionary accruals estimated by the above model in year (t − 1):

In order to test the first hypothesis, real earnings management is measured through sales manipulation. Offering discounts and more lenient credit terms increases current sales resulting in more positive earnings. However, cash flows from operating activities are reduced relative to sales. Roychowdhury (2006) so developed a model linking cash flow from operating activities to sales as:

where CFOi,t: cash flow from operating activities for firm i in year t; Salesi,t = sales for firm I in year t; ΔSalesi,t: change in sales measured by sales in year t less sales in year t − 1 for firm i; and TAi,t−1 = total assets for firm i in year t − 1. γ0,1,2,3 = coefficients estimated cross-sectionally for each sector-year as above models.

Then, the abnormal operating cash flow (ABNCFOi,t) is calculated as the difference between the actual operating cash flow and the estimated one for every firm (i) and year (t) of the study period (2005–2014):

The second hypothesis is related to discretionary expenditures. The latter involves Advertising, Selling, General, and Administrative (ASG&A) expenses as well as Research and Development (R&D) expenditures. By reducing or cutting these expenditures, current period earnings are increased. In the Tunisian context, companies do not frequently invest in R&D and are reluctant to voluntarily disclose such information in their annual reports (Chakroun 2013). Thereby, obtaining data about investment in R&D is not obvious. In accordance with Roychowdhury (2006), we set the value of the R&D to zero when these data are missing. In this case, discretionary expenditures are solely the sum of Advertising expenses and Selling, General and Administrative Expenses (ASG&A).

Roychowdhury (2006) assumes a linear relation between discretionary expenses and sales. A normal level of discretionary expenditures is then estimated as follows:

where DISEXi,t: discretionary expenditures for firm i in year t measured by the sum of Advertising expenses, Research and Development expenses (R&D) and Selling, General and Administrative expenses (ASG&A); Salesi,t−1 = sales for firm i in year t; and TAi,t−1 = total assets for firm i in year t − 1. δ0,1,2 = coefficients estimated cross-sectionally for each sector-year as above models.

Similar to the previous estimation models, abnormal level of discretionary expenses (ABNDISEXi,t) are measured as deviations from the predicted values from the estimation model:

3.2.2.2 Measurement of exogenous variables

As discussing above, six exogenous variables influence both endogenous variables. We measure them following prior research (Cohen and Zarowin 2010; Chen et al. 2012). The first exogenous variable is the leverage level of the firm. We proxy for leverage with the debt divided by total assets (Ohlson 1980). The second exogenous variable is the firm performance which is usually measured by the Return On Assets (ROA). The third exogenous variable is the accounting flexibility. According to Barton and Simko (2002), Net Operating Assets (NOA) scaled by Sales can capture the accumulated effect of accounting choice in past earnings. Indeed, due to the articulation between balance sheet and income statement, accruals are reflected in both earnings and net assets. So, if NOA level is large, accrual level is also high and accounting flexibility is thereby reduced. The fourth exogenous variable is the taxes. As Dyreng et al. (2008), we measure marginal tax rate as “Tax expense” scaled by “Pretax income”. The fifth exogenous variable is the firm size which is usually measured by the logarithm of the total assets. The last exogenous variable is the growth opportunities. Unlike Skinner and Sloan (2002), we cannot proxy for growth opportunities with the market-to-book ratio because not all sample firms are listed on Stock Exchange. For this reason and following Mortal and Reisel (2013), we use sales growth as an alternative proxy for growth opportunities. It is calculated as the sales of a given year divided by the sales of the previous year, minus one.

3.2.3 Presentation of model

To test our hypotheses, we follow Barton (2001) and Zang (2012) by applying the simultaneous equations model since accounting earnings management and real earnings manipulation are two interrelated variables. A simultaneous equations model is usually developed to solve the endogeneity problem between the two types of earnings management. Our model also takes into account the effect of all exogenous variables on earnings management strategies.

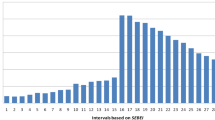

As Zang (2012), we include the “Suspect firm” variable to correct for potential selection bias. Since previous studies sustained that Tunisian firms are suspected of having managed their earnings to meet/beat the zero earnings target, we identify them as firms reporting small annual profits (Elleuch Hamza and Bannouri 2015). Empirically, we adopt the approach proposed by Degeorge et al. (1999) which results in a discontinuity in the histogram used to detect such manipulation practices. The interval width is determined mathematically using earnings dispersions and the number of observations:

“IQR” is the sample interquartile range of earnings variable and “n” is the number of observations.

Firms located in the interval to the immediate right of zero engage in earnings management activities and are called ‘Suspect firms’.

In addition, the trend (year variable) is retained in our model as an additional instrument since the study period covers data over a large period and earnings management decisions can consequently vary across time.

where DAi,t = discretionary accruals for firm i in year t, measured by modified Jones Model; REMi,t = real earnings management for firm i in year t, measured by two proxies: ABNCFOit = abnormal operating cash flow for firm i in year t; ABNDISEXi,t = abnormal level of discretionary expenses for firm i in year t. LEVi,t = leverage for firm i in year t, measured as the ratio of debt divided by total assets. ROAi,t = return on assets for firm i in year t, measured as pretax income scaled by total assets. NOAi,t = net operating assets for firm i at the beginning of the year t, measured as (shareholders’ equity plus total debt less cash and marketable securities) scaled by lagged sales. TAXi,t = marginal tax rate for firm i in year t, measured as tax expense scaled by pretax income. SIZEi,t = size for firm i in year t, measured by the logarithm of the total assets. GROWTHi,t = sales growth firms i in year t, measured as the year t divided by the sales of previous year, minus one. SUSPECTi,t = dummy variable which equals one if the firm-year just beats or meets zero earnings threshold, and zero otherwise. Suspect firms are identified using Degeorge et al. (1999) approach. YEAR = trend variable.

If the endogeneity problem occurs, the ordinary least squares (OLS) estimators become inconsistent. The relationship between accounting and real earnings management is then tested by using two-stage least squares (2SLS). In the first-stage model, accounting and real earnings management are regressed using exogenous variables to estimate predicted values of endogenous variables. In the second-stage model, these predicted values are used instead of the actual values to estimate simultaneous equations.

The 2SLS procedure accounts the correlation of endogenous explanatory variables with error term. The 2SLS estimator yields unbiased estimates even in the presence of collinearity problems between regressors (Kennedy 2003). In the absence of residual correlation or heteroscedasticity, 2SLS estimator is the most efficient instrument variable one (Greene 2008). In the presence of such autocorrelation or error heteroscedasticity, 3SLS may be preferred to 2SLS.

The coefficients of simultaneous equations models are estimated with panel data which improves estimation efficiency through variability over time and across firms (Wooldridge 2002). Sample size affects our choice of the appropriate estimation method. Since our sample size is small, the coefficient estimates can vary widely across firms. In this case, efficiency can be loosed due to “the additional parameters and the resulting lower degrees of freedom”. For this reason, we report “T-Student” and “F-Fisher” statistics instead of “Z” and “χ2” statistics. This approach is valid in samples of small size and in the absence of asymptotic convergence of probability distributions.

To test the complementarity hypothesis, we are initially interested in the magnitude and not the direction of accounting and real earnings management. For this reason, our analysis is based on the absolute value of the two proxies. If both accruals and abnormal operating decisions are jointly used, both Ɵ1 and Ʋ1 are expected to be positive. The significant negative coefficients provide evidence for the trade-off decision.

After investigating the magnitude, we analyse the direction of earnings management. It is enough to examine the sign of the coefficients {Ɵ1, Ʋ1} and its significance without using the absolute value. Significant negative coefficients confirm a complementary association between accounting and real earnings management. Indeed, higher positive values of discretionary accruals indicate positive accounting earnings management. However, larger negative amounts of abnormal CFO or abnormal of discretionary expenditures imply positive real activities manipulation. Alternatively, significant positive coefficients reveal a substitution relationship between earnings management tools. Otherwise, no significant relationship is identified between the two strategies.

4 Empirical results and interpretations

4.1 Results of descriptive statistics

Table 3 provides descriptive statistics of quantitative variables used in the simultaneous equations model. As reported in this table, the absolute values of both abnormal accruals measures and sales manipulation exceed on average 10% of the total assets, which is considered as an important rate. However, abnormal discretionary expenditures only achieve 2.70% of lagged total assets.

Table 3 also indicates that discretionary accruals measured by modified Jones model are on average (median) positive. Indeed, this model shows an increase of 0.18% on average. Whereas, abnormal CFO and abnormal discretionary expenditures are on average (median) negative, exceeding − 0.47% (− 0.57%). These results indicate that Tunisian public offering firms enhance their earnings by using both accounting and real earnings management. Descriptive statistics then show that Tunisian managers use the two alternatives as complementary tools.

With regard to leverage, it appears that Tunisian firms are highly leveraged. Indeed, the ratio of debt divided by total assets exceeds on average the half of total assets (mean = 53.16%). However, the minimum and maximum values of this ratio indicate a wide variation within the sample. For example, the highest ratio is 2.64 and the lowest is 0 with a standard deviation of 33.64%.

Moreover, Table 3 indicates that the mean and the median of NOA are higher (respectively 1.96 and 1.25) and the firm’s accounting flexibility is so lower. However, the extreme values varied from 15.67 to 2648.73%. These results suggest that for some firms, lower accounting flexibility is costly and can limit the use of accounting earnings management. The mean effective tax rate is 11.4% which may support that the sample firms are less profitable. Indeed, on average (median), the pretax benefit only achieves 5.7% (4.8%) of the firm’s total asset. Our sample includes both small and large firms and both low and high growth firms since the minima and maxima of the two variables present a wide difference.

4.2 Results of univariate analysis

The results of univariate regressions are indicated in Table 4. As seen in this table, many factors are associated with the magnitudes of discretionary accruals and real earnings management tools. Particularly, larger firms and firms with lower accounting flexibility are less likely to involve in accounting earnings management than the smaller firms (negative accrual coefficient of 1.1%, significant at the 5% level) or firms with higher accounting flexibility (negative accrual coefficient of 0.8%, significant at the 1% level). Moreover, the coefficient of 4% on marginal tax rate is positive and significant at the 1% indicating that firms with higher marginal tax rates increase their discretionary expenditures.

When we reran univariate equations without absolute values, the results show that firm performance is also a determinant factor which influences executive’s decisions to manage earnings. Indeed, Table 4 indicates that firms with high earnings performance have greater incentives to manage earnings downward using the artificial and sales manipulation (negative accruals coefficient of 12%, significant at the 5% level and positive sales coefficient of 53%, significant at the 1% level).

It seems that firms that experience a better performance decrease their discretionary accruals and increase their cash-flows, reducing thereby their earnings. However, they are in contradiction with those obtained by modified Jones model which its corresponding coefficient displays a significant positive sign at the 1% level. The discretionary expenditures model does not show any relationship between these two variables. Since firm performance is related to the endogenous variables (both accounting earnings management and sales manipulation), we do not introduce it in our simultaneous equations.

Table 4 also shows that firms with high leverage resort to sales manipulation as earnings management techniques (negative sales coefficient of 10.69%, significant at the 1% level). This result reveals that leverage is positively associated with real earnings management. In addition, firms with lower accounting flexibility have a higher level of discretionary expenditures (coefficient of 0.1%, significant at the 5% level).

Before providing the results of simultaneous equations, we present the correlation matrix in Table 5. As reported in this Table, we do not observe a strong correlation between the independent variables except for firm performance and leverage. Indeed, ROA is positively correlated with both marginal tax rate and growth (Spearman coefficients of 0.43 and 0.23 respectively) and negatively correlated with leverage (Spearman coefficient of − 0.48). Moreover, leverage is correlated with both marginal tax rate and accounting flexibility since the Spearman coefficients, that display values of − 0.179 and − 0.24 respectively, are statistically significant at 1% level. In short, the independent variables present a mean of the VIF equal to 1.1, which does not indicate a serious problem of multicollinearity.

4.3 Regression results for simultaneous equations

Following Chen et al. (2012) and Zang (2012), we check the endogeneity between real and accounting earnings management by referring to the Hausman test. All values of this test are significant at the 5% and 10% levels. This implies that the Hausman test rejects the exogeneity of accounting and real management equations and the 2SLS method provides better estimators than the ordinary least squares one (OLS).

The results of Hausman test, presented in Tables 6 and 7, also show that simultaneous equations between sales manipulation and accounting earnings management measures are generally obtained through estimates based on the fixed effect model. However, coefficients on the interaction terms of discretionary expenditures and accounting earnings management measures are estimated with the random effect model.

Tables 6 and 7 report the same findings. In fact, the empirical results of Table 6 reveal that absolute value of real activities manipulation is positively associated with absolute value of accounting earnings management (significant at the 1% level) suggesting that Tunisian firms use the two approaches jointly. Thus, the test of the magnitude of accounting and real earnings management supports our first hypothesis. The results for exogenous variables are also consistent with our expectations. As predicted, firm’s accounting flexibility, taxes, and size firms are the most important factors in determining earnings management activities. Indeed, the positive coefficients on NOA in the sales manipulation model (significant at the 5% and 1% levels) show that firms with lower accounting flexibility are more likely to involve in real earnings management than firms with the higher accounting flexibility. Besides, the negative coefficients on taxes in the accounting management models (e.g., coefficient of − 0.50, significant at the 5% level) indicate that firms with higher marginal tax rates do not engage in accounting earnings management.

These results are consistent with those examining the effect of directional earnings management on managers reporting decision. In fact, Table 7 provides further insight into how Tunisian firms combine earnings management strategies in the direction way to achieve their goals. Table 7 shows a negative and significant relationship at the 1% level between sales manipulation and discretionary accruals. Indeed, the coefficient on sales manipulation in the accounting management equation, measured by modified Jones model, is negative (coefficient of − 1.49) and significant at the 1% level. At the same time, the coefficient on discretionary accruals in the sales manipulation equation is negative (coefficient = − 1.39) and significant at the 1% level. So, Tunisian public offering firms use accounting management and sales manipulation as a complementary tool to increase earnings reporting. This additional evidence, again, supports our initial findings and confirms our first hypothesis.

This finding supports those released in Asian and French contexts. The weak protection of Tunisian investors, the lack of dynamism in the financial market, and the lower disclosure requirements make decrease the impact of litigation risks. Thereby, Tunisian managers are encouraged to use both techniques in a complementary way without incurring high costs. These results are at odds with those found in American context and the majority of European countries, which are characterized by a higher investor protection.

The complementary role between accounting and real earnings management is not yet confirmed when we adopt the discretionary expenditures model to measure real earnings management. As shown in Table 7, results from the simultaneous equations between discretionary accruals, estimated by modified Jones model, and discretionary expenditures reveal a positive and significant coefficient at the 1% level (coefficients of 6.72 and 2.62 respectively). A positive coefficient of accounting management means a substitutive relationship between accrual and real earnings management. In fact, it suggests that when accrual management is used to inflate earnings, increasing discretionary expenditures are used to deflate earnings. Thus, the accrual and real earnings management are substitutive. These results, which confirm our second hypothesis, are in line with those of Lee and Swenson (2011).

In light of these results, it seems that accounting earnings management is not accompanied by discretionary expenditures. However, it is accompanied with sales manipulation in order to enhance the level of earnings. The substitutive relationship between accounting and real earnings management can be explained by the effect of corporate tax on earnings management decisions. Indeed, the results presented in Table 7 report that taxes influence the amount of discretionary expenditures positively since the coefficients on taxes are positive and significant at the 5% level (coefficient equal to 0.22). Our results reveal that firms with higher marginal tax rates are more likely to accelerate discretionary expenditures and this decision, which has income-reducing effects, manages taxes downward. These firms do not choose accounting alternatives because accruals management usually does not affect taxable income due to the low levels of book-tax conformity in the Tunisian setting. They prefer real manipulations that have a direct impact on the amount of taxable income.

To sum up, our findings underline that the tradeoff between two strategies is based on complementarity hypothesis because Tunisian firms operate in a weaker regulatory environment characterized by relatively low litigation costs and disclosure requirements. However, the tax cost effect pushes Tunisian managers to substitute the discretionary expenditures for accounting manipulation. The relatively cost–benefit hypothesis becomes then prominent.

Moreover, the results reveal that the coefficient on NOA is negative for the most accounting management equations and significant at the 1%, 5% and 10% levels, which is in accordance with our prediction that accounting flexibility constrains the use of accrual-based earnings management. Firms with lower accounting flexibility are oriented towards real operational activities. Indeed, the negative and significant coefficient of NOA in sales manipulation equation proves that sales manipulation leads to a lower cash flow, resulting in a positive benefit (negative coefficient of 1.7%, statistically significant at the 1% level). These findings are consistent with our previous predictions.

In addition, the results indicate that the tendency to manage earnings through sales manipulation is increased over the sample period (negative coefficient of 0.6%, statistically significant at the 5% level). Specifically, they provide evidence on the trend in real activities manipulation of suspect firms. Indeed, Table 9 documents a negative coefficient of 0.3%, statistically significant at the 1% level. However significant decrease is observed in accounting earnings management over time. The tendency to avoid losses through discretionary accruals diminishes over the sample period (negative coefficient of 0.2%, statistically significant at the 1% level).

On the contrary, high-growth firms are associated with more accounting earnings management (positive coefficient of 5.1%), statistically significant at the 5% level. These firms, which are characterized by weak internal control environment, have more incentives to use accruals-based earnings management. However, there is weak evidence that growth opportunities have an impact on real activities manipulation since corresponding coefficients are only significant at the 10% level.

Together, our findings add value to the body of the literature since prior studies examine the interaction between real and accounting earnings management by proposing a synthesis measure of real earnings manipulation. Their results confirm either complementary or substitutive relationship. However, by using each of these measures separately, our findings reveal that managers can resort to earnings management instruments in the opposite direction to accomplish conflicting earnings goals. Interestingly, further examinations are added to analyse the interaction between all these instruments.

4.4 Additional examinations

Previous studies found evidence that firms are more likely to strategically use accounting and/or real earnings management as there is an incentive to avoid losses (Roychowdhury 2006; Zang 2012). Firms with extremely bad earnings news may also engage in earnings management upward to limit the amount of losses (Chen et al. 2012) or downward to take a “Big bath” (Healy 1985). Even profit firms have greater incentives to manage their earnings in the two directions. They may reduce their benefits to create reserves for future periods or increase their profits for smoothing purposes.

According to this analysis, it is interesting to exam the relationship between the two earnings management tools across earnings levels. For this reason, we divide our sample into three sub-groups. The first one focuses on all loss firm-year observations with negative earnings. The suspect firm-years form the second sub-group. This class encompasses all firm-years that report little profits and are located in the first interval to the right of earnings-zero targets. The last sub-group includes the other firm-year observations that realize high benefits. Our initial model is therefore modified by changing the endogenous variables with interaction variables. Thus, we attribute the corresponding value of accounting and real earnings management of loss firms and zero otherwise for the first sub-group. We rerun the equations for the other sub-groups in the same way. The results are presented in Panels A, B and C of Table 8.

The complementary role between accounting earnings management and sales manipulation is again brought into light regardless of sub-groups. However, the substitution role between accounting earnings management and discretionary expenditures is not supported in the negative income sub-group. Indeed, Panel A shows that the coefficient of the discretionary accruals variable is − 1.59 in the abnormal discretionary expenditures model. Besides, the coefficient of the abnormal discretionary expenditures variable is − 59.24 in the discretionary accruals model. Both of them are negative and statistically significant at the 5% level. Firms with negative earnings so use all earnings management tools at the same time. Only suspect firms (Panel B) and income-increasing sub-group (Panel C) use discretionary accruals and expenditures in the substitution process.

Our results shed light on the importance of earnings levels on the interaction between real and accounting earnings management. Investors must know that loss firms, that do not have tax concerns, hide bigger losses by using all alternatives. Suspect firms also resort to accountings and real instruments in order to beat zero earnings threshold. But, for tax purposes, they diminish their earnings through increasing the discretionary expenditures. To provide more confirmatory results to support these findings, we analyse the association between the two real activities management models across earnings levels. The results reported in Table 9 reveal that loss firms use abnormal cash flows and discretionary expenditures jointly. Indeed, Panel A of Table 9 shows both positive coefficients (60.29 and 2.39, respectively). But only coefficient on abnormal discretionary expenditures is statistically significant at the 5% level.

Suspect firms use the two real activities manipulation as substitute tools since the corresponding coefficients are negative (− 13.78 and − 2.00) and statistically significant at the 5% and 1% levels. In particular, Panel B of Table 8 underlines that suspect firms with higher marginal tax rates do not increase their income through accruals (negative coefficient of 6.6%, statistically significant at the 1% level). However, they do that through sales manipulation (negative coefficient of 11.1%, statistically significant at the 1% level) in order to report small profits instead of negative earnings. At the same time, they reduce their earnings through discretionary expenditures (positive coefficient of 16%, statistically significant at the 1% level) for tax considerations.

Finally, there is weak evidence about the interaction between the two real activities management models from the income-increasing sub-group since corresponding coefficients are not significant.

5 Discussion and conclusion

This study investigates the relationship between real and accounting earnings management in the Tunisian context. Contrary to previous literature, which aggregated the real activities manipulation measures into one proxy, our measure does not adopt their sum. We analyse the relationship between earnings management alternatives by focusing on real activities manipulation tools separately. Using simultaneous equations model, our results indicate a complementary relationship between discretionary accruals and sales manipulation. Tunisian firms do not face greater scrutiny from regulators and jointly use the two alternatives of earnings management.

It so appears that Tunisian context, which belongs to the Middle East and North Africa (MENA) region, is similar to the Asian context. Firm size and accounting flexibility are the principal factors influencing managers’ earnings management decisions. Tunisian small firms engage in more accounting earnings management than larger companies. The more effective corporate governance of larger firms constrains accruals-based earnings management. The latter are oriented towards real management tools via sales manipulation. Moreover, accrual management is coerced by firms’ accounting flexibility. Consisting with the findings of Chen et al. (2012) and Zang (2012), reducing accounting flexibility compels Tunisian firms to use sales manipulation in order to increase earnings levels.

Apart from loss firms, our findings also document a substitutive interaction between discretionary accruals and expenditures. Contrary to previous literature (Roychowdhury 2006; Cohen et al. 2008; Cohen and Zarowin 2010), which indicated that firms cut discretionary expenditures to enhance the earnings level, Tunisian firms accelerate discretionary expenditures for tax considerations. Since managing earnings through accruals is not influenced by taxes, Tunisian firms are more likely to choose real earnings management tools. As suggested by Lee and Swenson (2011), managing R&D or advertising is a relevant real earnings management tool since such costs and expenses are deductible for tax purposes. However, many components of the accruals are partially or not deductible.

By examining the real activities manipulation tools separately, we find that managers of suspect and profit firms jointly use accruals management with sales manipulation and trade off discretionary expenditures and accrual-based earnings management. Unlike previous studies, our results reveal that managers combine the two opposing views to achieve different earnings targets at same time.

Like all studies, our research has a number of limitations. Firstly, our research only focuses on two real earnings management tools and does not involve overproduction or sales investments and assets techniques. Such techniques should be incorporated in further research to improve our study findings.

Secondly, our study investigates the trend in earnings management over time but does not analyse if exogenous events can contribute to changes in this tendency. In particular, it is interesting to investigate how Tunisian revolution and the economic crisis accompanied this event affect the interaction between accounting and real earnings management. Future studies should compare this relationship before and after the revolution. Thirdly, our sample is only limited to Tunisian context but can be generalized to MENA region by extending such studies to the other MENA countries.

Notes

Clawback is a mechanism that authorizes the board of directors to recoup bonuses paid to managers if they are engaged in any misconduct when restating financial reports.

Investor protection is defined by La Porta et al. (2002) as “the power to prevent manager from expropriating minority shareholders and creditors within the constraints imposed by law”.

EBRD: European Bank for Reconstruction and Development.

The list of public firms is available on the Presidency of the Government Portal of the Republic of Tunisia from: http://www.pm.gov.tn/pm/entreprise/listetablissement.php?lang=fr&URLref_gouvernorat=&URLref_domaine=&Keyword=&FormlistKeyword_Page=&URL_ref_etab_parent=&URL_ref_sous_type_etablissement=&FormlistKeyword_Sorting=1&FormlistKeyword_Sorted=1&.

References

Baker TA, Lopez TJ, Reitenga AL, Ruch GW (2018) The influence of CEO and CFO power on accruals and real earnings management. Rev Quant Finance Account, published online: 21 February 2018

Barton J (2001) Does the use of financial derivatives affect earnings management decisions. Account Rev 76(1):1–26

Barton J, Simko P (2002) The balance sheet as an earnings management constraint. Account Rev 77(1):1–27

Ben Amar A, Abaoub E (2010) Earnings management thresholds: the case in Tunisia. Asian Acad Manag J Account Finance 6(2):35–56

Ben Othman H, Zeghal D (2008) A study of corporate governance disclosure and its country-level determinants in the emerging markets. Res Account Emerg Econ 8:125–155

Ben Othman H, El Younsi B, Zeghal D (2007) Analyse des déterminants de la gestion des résultats: cas des firmes tunisiennes, françaises et canadiennes. Repères Perspect Manag Dév 10(July):21–47

Chakroun R (2013) Relation entre l’étendue de la divulgation volontaire et les mécanismes internes de gouvernance substitution ou complémentarité. Revue Maroc Compta Contrôle Audit 1(April):89–126

Chan LH, Chen KC, Chen TY, Yu Y (2015) Substitution between real and accruals-based earnings management after voluntary adoption of compensation clawback provisions. Account Rev 90(1):147–174

Chen C-L, Huang S-H, Fan H-S (2012) Complementary association between real activities and accruals-based manipulation in earnings reporting. J Econ Policy Ref 15(2):93–108

Chi W, Lisic L, Pevzner M (2011) Is enhanced audit quality associated with greater real earnings management. Account Horiz 25(2):315–335

Cohen D, Zarowin P (2010) Accrual-based and real earnings management activities around seasoned equity offerings. J Account Econ 50(1):2–19

Cohen DA, Dey A, Lys TZ (2008) Real and accrual-based earnings management in the pre- and post-Sarbanes-Oxley periods. Account Rev 83(3):757–787

Dechow P, Sloan R, Sweeney A (1995) Detecting earnings management. Account Rev 70(2):193–225

Degeorge F, Patel J, Zeckhauser R (1999) Earnings management to exceed thresholds. J Bus 72(1):1–33

Dridi W, Boubaker A (2015) An assessment of the linkage between financial reporting and taxation in Tunisia. Int Bus Res 8(4):168–179

Dyreng S, Hanlon M, Maydew E (2008) Long run corporate tax avoidance. Account Rev 83(1):61–82

EBRD (2013) Commercial laws of Tunisia: an assessment by the EBRD. Document available at: https://www.ebrd.com/documents/strategy-and-policy-coordination/read-the-ebrds-tunisia-country-law-assessment.pdf

Elleuch Hamza S (2012) Les spécificités de la gestion des résultats des entreprises tunisiennes à travers une démarche par entretiens. Rev Compta Contrôle Audit 18(1):39–65

Elleuch Hamza S, Bannouri S (2015) The detection of real earnings management in MENA countries: the case of Tunisia. Afro Asian J Finance Account 5(2):135–159

Enomoto N, Kimura F, Yamaguchi T (2015) Accrual-based and real earnings management: an international comparison for investor protection. J Contemp Account Econ 11(3):183–198

Ewert R, Wagenhofer A (2005) Economic effects of tightening accounting standards to restrict earnings management. Account Rev 80(4):1101–1125

Francis B, Hasan I, Li L (2016) Abnormal real operations, real earnings management, and subsequent crashes in stock prices. Rev Quant Finance Account 46(2):217–260

Ge W, Kim JB (2014) Boards, takeover protection, and real earnings management. Rev Quant Finance Account 43(4):651–682

Greene WH (2008) Econometric analysis, 6th edn. Prentice Hall, Upper Saddle River, p 802

Hashemi SA, Rabiee H (2011) The relation between real earnings management and accounting earnings management: evidence from Iran. Bus Manag Rev 1(8):25–33

Healy P (1985) The effect of bonus schemes on accounting decisions. J Account Econ 7:85–107

Jungeun C, Jaimin G, Jaehong L (2012) Chaebol firms’ real and accrual-based earnings management in the pre-and post-asian financial crisis periods. J Mod Account Audit 8(7):915–931

Kennedy P (2003) A guide to econometrics, 4th edn. MIT Press, Cambridge

Klein A (2002) Economic determinants behind variations in audit committee independence. Account Rev 77(2):435–452

Kolsi MC (2012) The determinants of corporate voluntary disclosure: evidence from the Tunisian capital market. IUP J Account Res Audit Pract 9(4):49–68

Kothari S, Leone A, Wasley C (2005) Performance matched discretionary accrual measures. J Account Econ 39(1):163–197

La Porta R, Lopez-de-Silanes F, Shleifer A, Vishny R (1998) Law and finance. J Polit Econ 106(6):1113–1155

La Porta R, Lopez-De-Silanes F, Shleifer A, Vishny R (2002) Investor protection and corporate valuation. J Finance 57(3):1147–1170

Lee N, Swenson C (2011) Earnings management through discretionary expenditures in the U.S., Canada, and Asia. Int Bus Res 4(2):257–266

Leuz C, Nanda D, Wysocki PD (2003) Earnings management and investor protection: an international comparison. J Finance Econ 69(3):505–527

Libby R, Seybert N (2009) Behavioral studies of the effects of regulation on earnings management and accounting choice. Accounting, organizations, and institutions: essays for Anthony Hopwood. Oxford University Press, Oxford

Matsuura S (2008) On the relation between real earnings management and accounting earnings management: income smoothing perspective. J Int Bus Res 7(S3):63–77

Mortal S, Reisel N (2013) Capital allocation by public and private firms. J Financ Quant Anal 48(1):77–103

Nnadi M, Omoteso K, Yu Y (2015) Does regulatory environment affect earnings management in transitional economies? An empirical examination of the financial reporting quality of cross-listed firms of China and Hong Kong. Int Financ Rev 16:245–276

Ohlson JA (1980) Financial ratios and the probabilistic prediction of bankruptcy. J Account Res 18(Spring):109–131

Pincus M, Rajgopal G (2002) The interaction between accruals management and hedging: evidence from oil and gas firms. Account Rev 77(1):127–160

Roychowdhury S (2006) Earnings management through real activities manipulation. J Account Econ 42(3):335–370

Sanjaya IPS, Saragih FM (2012) The effect of real activities manipulation on accrual earnings management: the case in Indonesia Stock Exchange (IDX). J Mod Account Audit 9(8):1291–1300

Sellami M (2016) The interaction between real and accrual-based earnings management: analysis based on the mandatory IFRS adoption. Int J Account Econ Stud 4(1):24–31

Skinner D (1993) The investment opportunity set and accounting procedure choice. J Account Econ 16:407–445

Skinner DJ, Sloan RG (2002) Earnings surprises, growth expectations and stock returns or don’t let an earnings torpedo sink your portfolio. Rev Account Stud 7:289–312

Wang X (2014) New evidence on real earnings management: An international investigation. A thesis submitted to Auckland University of Technology available from: http://aut.researchgateway.ac.nz/bitstream/handle/10292/8863/PhD%20thesis%20Xuejun%20Wang.pdf?sequence=1, Accessed 15 Apr 2016

Wooldridge JM (2002) Econometric analysis of cross section and panel data. MIT Press, Cambridge, p 735

Zang AZ (2012) Evidence on the trade-off between real activities manipulation and accrual-based earnings management. Account Rev 87(2):675–703

Zgarni I, Hlioui K, Zehri F (2012) The effect of audit committee characteristics on real activities manipulation in the Tunisian context. Int J Multidiscip Res 2(2):1–15

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Elleuch Hamza, S., Kortas, N. The interaction between accounting and real earnings management using simultaneous equation model with panel data. Rev Quant Finan Acc 53, 1195–1227 (2019). https://doi.org/10.1007/s11156-018-0779-5

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11156-018-0779-5

Keywords

- Accruals-based earnings management

- Real earnings management

- Complementary relationship

- Substitutive interaction

- Simultaneous equations model