Abstract

This paper examines the factors associated with the length of time that a firm’s market value is below its book value. From 1990 to 2010, approximately 19 % of firm quarter observations have a market value below their book value, and 46 % experience a market value below its below book value for more than 1 year. I investigate firm characteristics—accounting aggressiveness, asset liquidity, debt covenants, and cash flows; firm actions—merger, liquidation or an internal adaptation of resources; and accounting rules and their association with the length of time a firm’s book-to-market (BTM) ratio is greater than one. This paper extends the research on the adaptation option and also brings to light the unusual sample of observations that persist with a BTM ratio greater than one.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

This paper examines firms with a book value greater than their market value. Specifically, I explore both firm characteristic variables, such as accounting aggressiveness, asset liquidity, debt covenants, and cash flows, and firm actions, such as a merger, a liquidation, or an internal adaptation, that are associated with the length of time a firm continues with a book value that is greater than its market value. I also explore the association between FASB’s rules regarding asset write-downs and liability recognition and the length of time a firm’s book-to-market (BTM) ratio is greater than one.

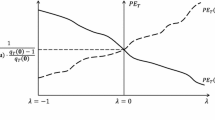

In theory, when a firm’s book value is higher than its market value, it can adapt the firm resources (represented by the book value) to another higher value use (see Aleksanyan and Karim 2013; Burgstahler and Dichev 1997; Berger et al. 1996; Barth et al. 1998; Collins et al. 1999). This suggests that the equity value of a firm is a convex function, similar to a call option, conditional on the relative values of discounted earnings and book value, with the book value acting as the strike price on that option (see Fig. 1). Intuitively, the adaptation option arises from the fact that assets generally have multiple uses (see Jensen and Ruback 1983; Hayn 1995).Footnote 1 If a firm’s expected earnings are low, management can redeploy the assets internally for other uses, sell the whole company to outside investors, or declare bankruptcy and liquidate the assets. The implication of the adaptation option theory is that firm value should, at worst, be equal to the book value (implying a BTM ratio equal to one) because management could simply exercise the adaptation option (Hayn 1995).

The relationship between adaptation value, recursion value, and the ratio of the market value to the book value (see Burgstahler and Dichev 1997). The dashed portion of the recursion value line represents value from the current use of the assets that is below the adaptation strike price. A firm should not operate in this region

Whereas the adaptation option restricts firms to, at worst, a BTM ratio equal to one, conservatism biases the BTM ratio below one. Under US GAAP, accounting information receives asymmetric treatment where increases in assets require a higher level of validation than decreases, leading to lower BTM ratios (Basu 1997). In spite of these two mechanisms (the adaptation option and conservatism) forcing a BTM equal to or below one, from 1990 to the end of 2010 there are 97,700 firm-quarter observations (or 19 %) where the BTM ratio is greater than one. Although some firm ratios recover quickly, 46 % occur after a firm has already had a BTM ratio greater than one for at least 1 year.Footnote 2 This conflict between theory and empirical evidence provides this paper with a rich research setting to examine factors that are associated with these firms that continue with high BTM ratios.

To investigate this phenomenon, I perform a firm-level examination of the length of time a firm continues with a BTM ratio greater than one with firm type characteristics (aggressive accounting, asset liquidity, debt covenants, and cash flows), on firm actions (internal and external adaptation—including both mergers and liquidation), and on accounting standards. Results are consistent with firms with more aggressive accounting practices maintaining a BTM ratio greater than one for longer periods of time. This is consistent with managers not utilizing the adaptation option because the book value of equity is overstated, and thus the true “strike price” is not “in the money.” In addition to aggressive accounting, I also find that observations with more specialized (less liquid) assets tend to have a BTM ratio greater than one for longer periods of time. I find that firms that are close to debt covenant violations are less likely to persist with a BTM ratio greater than one, but firms with higher cash flows are likely to persist longer with a BTM ratio greater than one.

Regarding firm actions, evidence is consistent with firms that utilize an external adaption option by liquidation tending to have a BTM ratio greater than one for a longer period of time, but not if the firm is purchased by another. Internal adaptations appear to significantly reduce the length of time the firm’s BTM ratio is greater than one if the adaptation occurs within the first year, but not if it occurs later than 1 year. Lastly, I find evidence that the FASB’s efforts at reducing overstatement have only been partially effective.

This anomaly, the persistence of firms with a BTM ratio above one, is interesting to study because, although prior research has identified firms with a BTM ratio greater than one, this is the first study to provide evidence that this situation can persist for extended periods of time, as opposed to simply recovering within a few quarters. For example, both Danielson and Press (2003) and Beaver and Ryan (2000) provide descriptive statistics showing that a portion of the general population has a BTM greater than one. However, neither study recognizes that firms persist with book values greater than market values. This finding is important because the adaptation option theory suggests that this situation should not exit. Therefore, this paper extends the body of research on the adaptation option (Berger et al. 1996; Burgstahler and Dichev 1997; Barth et al. 1998; Collins et al. 1999). The option is a critical assumption in other research, most notably for firm valuation. According to Hayn (1995), a firm’s resources can be reallocated or adapted when the current earnings are low, leading to a greater portion of firm value being a function of the assets instead of earnings. However, my findings suggest that the use of the adaptation option is not by fiat.

My study also adds to the body of literature on conservatism. Many studies focus on conservatism and how it affects accounting information (for example, Basu 1997; Ball et al. 2000; Givoly and Hayn 2000). However, I consider a sample of firms that are aggressive in their accounting practices; specifically, they have recognized assets (or not recognized liabilities) that are not recognized by the market (see Ohlson 1995; Beaver and Ryan 2000). Danielson and Press (2003) suggest that, because of conservatism, firms should not have a BTM ratio greater than one, and if they do, the situation should not persist for very long. This paper provides evidence that observations with a high BTM ratio do persist and helps explain what factors are associated with the length of time it persists.

My findings should also be of interest to standard setters. I find that firms with a BTM greater than one, on average, are under financial distress and have a higher likelihood of bankruptcy than other firms (the mean Altman Z-score, Altman 1968, is 4.8 for high BTM observations compared to 6.5 for low BTM observations, see Table 1). The evidence presented in this paper is consistent with firms being aggressive with their accounting practices when investors are likely to be more concerned with the cash flows from liquidating the firm than under normal circumstances.

There are two important caveats regarding this paper. First, to make this paper tractable, I focus on the correlation between firm characteristics, firm actions, accounting standards, and the length of time a firm’s BTM ratio is greater than one. This does not imply that these are the exclusive reasons for a firm’s BTM remaining above one. For example, a firm may have a BTM greater than one because of the high cost of manager removal. I do not consider this relation between agency costs and a BTM ratio remaining above one; however, this issue is examined in Oler (2011).

Second, the main research question of this paper is why do firms with a BTM ratio greater than one persist, which is fundamentally different from the question as to why firms obtain a BTM ratio greater than one (see Beaver and Ryan 2000). While the latter is an interesting question in its own right, it deals more with the question of innovation and obsolescence, whereas the former question addresses why managers are not using the adaptation option to correct a BTM ratio that is greater than one in a timely manner. However, how firms obtain a BTM ratio greater than one is an interesting question that I leave for future research.

In the following section, I provide background and develop my hypotheses for which variables are associated with the length of time a firm will continue with a BTM ratio greater than one. Section 3 describes the main research design and discusses the necessary data requirements, and Sect. 4 describes the data. Section 5 contains the research findings and Sect. 6 provides some suggested future research and concludes.

2 Hypothesis development

A simple way to understand the relationship between firm value and the adaptation option is to begin with the Ohlson model (Ohlson 1995), which shows that the price of a firm can be modeled by:

where P is the price of the firm, bv is the book (adaptation) value of the firm, and \(\tilde{x}^{a}\) represents future abnormal earnings (recursion value), defined as total earnings less the firm’s cost of capital. In an information-perfect world without agency costs, if the firm is expected to earn negative future abnormal earnings from current operations, i.e.

then equity value is maximized by the cessation of those operations and adapting firm resources (i.e. assets) to an alternative use. If the firm does not have an alternative use for the assets, the manager can sell the assets, ensuring that a firm’s equity market value will not be below equity book value.

In general, the adaptation value is closely related to book value by design. Book value is a cost-based measure of the value of the firm’s resources and adaptation value is the value of the firm’s resources independent of use. At acquisition, book value is equal to the adaptation value because the historical cost (book value) is the same as the current market value of the assets. Subsequent to acquisition, the two may diverge due to accounting conventions (such as depreciation) or changes in adaptation values—such as unforeseen obsolescence, but in general track each other (see Burgstahler and Dichev 1997). Prior research, both theoretical (Beaver and Landsman 1983) and empirical (Perfect and Wiles 1994), finds that book value and adaptation value tend to correlate.

Conservatism also plays an important role in the book value of equity. Under US GAAP, if there is a shock in the economic environment (for example, obsolescence) that causes a decrease in the value of an asset, the conservatism convention requires that management write-down the asset to its economic value. Conversely, if there is an economic increase in asset value, the asset book value remains unchanged. Due to this asymmetric treatment of gains and losses, book values will be necessarily understated, thus causing the BTM ratio to be biased downward below one.

The implication of the adaptation option theory is that the firm value payoff pattern follows that of a call option, as depicted in Fig. 1, where the kink at the horizontal point indicates zero abnormal earnings. Empirically, extant literature (Collins et al. 1999) provides evidence that is consistent with the adaptation option theory that firm value is a function of both earnings (Collins and Kothari 1989; Barth et al. 1992) and balance sheet measures of assets and liabilities (Landsman 1986; Barth 1991; Shevlin 1991).

In spite of this theory, empirical support, and accounting conventions, there are many observations where the firm’s equity value is less than the book equity value (see Fig. 2; Table 1). As mentioned above, under normal circumstances, book values are expected to be biased downwards. However, Hirshleifer et al. (2004) provide evidence consistent with managers using accruals to increase earnings, which in turn causes firm equity value to become overstated. If managers are aggressive with their accounting practices and the book value of firm equity becomes overstated, the BTM ratio will be greater than one because the assets are overvalued (or liabilities undervalued) on the financial statements and are therefore not a good indicator of adaptation value.Footnote 3 Thus, my first firm characteristic hypothesis is that the length of time a firm has a BTM greater than one is decreasing in the firm’s degree of conservatism. The formal hypothesis is specified below (in the alternative form):

H 1

The length of time a firm has a BTM ratio greater than one is decreasing in the firm’s degree of conservatism.

My second firm characteristic hypothesis regards the adaptability of the assets. The adaptability of assets is a continuum with cash, which is fully fungible, on one end of the spectrum and specialized assets on the other. If the assets are harder to adapt, then the length of time a firm has a BTM above one will increase relative to those that are easier to adapt. This line of reasoning is consistent with the findings of Schlingemann et al. (2002) that asset adaptability plays an important role in divestments. Specifically, assets with more specific uses require more unique contracts and specialized consultants, which leads to higher transaction costs and extended periods before adaptation. Thus, I expect firms with assets that are more specialized (illiquid) and, therefore, more difficult to adapt to have a BTM ratio greater than one for a longer period of time. Formally, I predict (alternative):

H 2

The length of time a firm has a BTM ratio greater than one is increasing in the specialization of the firm’s assets.

Although prior research has shown that there is a relationship between a firm’s debt covenants and accounting choice (see Fields et al. 2001), the type of relationship is not certain. According to the debt covenant hypothesis (see Watts and Zimmerman 1986), firms with debt will purposefully utilize aggressive accounting practices to avoid debt covenant violations since such violations will, at a minimum, increase the cost of capital to the company. On the other hand, research has shown that the correlation between conservatism and debt covenants can also be positive. For example, Nikolaev (2010) (also see Beatty et al. 2008) finds that firms with public debt are more conservative. Nikolaev attributes this finding to firms adopting more conservative accounting practices as a means to attract better debt contracts, consistent with Watts’ (2003) conjecture on conservatism and bonding. The implication is that firms that are closer to violating debt covenants will have a short time period with a BTM ratio greater than one. Because of the conflicting theories, I am unable to make a directional hypothesis and instead predict that the closeness of a firm to debt covenant violation is correlated with the length of time that the BTM ratio is above one (in the alternative form):

H 3

The length of time a firm has a BTM ratio greater than one is correlated with how close the firm is to a debt covenant violation.

One factor that will affect the length of time a firm’s BTM is above one is the firm’s ability to stave off bankruptcy and avoid market discipline (i.e., outside investors providing cash but conditional on management making changes within the firm). A firm with low (negative) cash flows is more likely to become insolvent, discontinue operations and, therefore, drop out of the sample. On the other hand, firms with high cash flows from operations will be more likely to continue operating with a BTM ratio above one. Therefore, I predict that firms with higher cash flows will persist longer with a BTM ratio above one than firms with lower cash flows (alternative):

H 4

The length of time a firm has a BTM ratio greater than one is increasing in cash flows.

Whereas the above hypotheses relate to firm characteristics, the next two hypotheses are related to the firm actions once the BTM rises above one. When the recursion value is truly below the book value, the firm can adapt its current resources to a better use. Both Burgstahler and Dichev (1997) and Hayn (1995) predict that as a firm’s value from the current earnings-process approaches zero, the likelihood that the firm will utilize its resources in a different manner increases, consistent with an internal adaptation. Therefore, there should be a negative relation between an internal adaptation and the length of time a firm has a BTM above one. This leads to my fifth hypothesis regarding the adaptation option (alternative):

H 5

The length of time a firm has a BTM ratio greater than one is decreasing with the use of an internal asset adaptation.

Similar to an internal adaptation, an external adaptation, when the firm is sold or liquidated, will cause the BTM ratio to fall below one quickly, but only once it is utilized. However, unlike an internal adaptation which a manager has an incentive to immediately exercise, there are incentives for a manager to delay the use of an external adaptation. An external adaptation is extreme in nature, more likely to take longer to procure, is irreversible, and is likely to be viewed as an option of last resort (see Oler and Smith 2012). Because of the negative incentives for management to utilize an external adaptation, I predict that an external adaptation is associated with the length of time that a firm has a BTM greater than one (alternative):

H 6

The length of time a firm has a BTM ratio greater than one is increasing with the use of an external asset adaptation.

For my last hypothesis, I consider the association between FASB’s attempts at enforcing greater conservatism and the length of time a firm has a BTM ratio greater than one. A key attribute of accounting information is flexibility so that managers can signal firm performance (see Dye and Sridhar 2008). For example, managers can signal greater than expected useful lives of equipment by extending depreciation periods. However, this flexibility also affords managers the ability to be aggressive, leading to more firms with a BTM ratio above one. From time to time, accounting standard setters have enacted rules that restrict this flexibility and force certain accounting treatments, such as increased asset write-downs. I hypothesize that after these standards are imposed, firms will continue with a BTM ratio greater than one for a shorter period of time. Formally (alternative):

H 7

The length of time a firm continues with a BTM ratio greater than one decreases after the imposition of rules enforcing greater conservatism.

3 Research design

3.1 Hypothesis tests

I use the following Tobit model to test whether the length of time a firm’s BTM ratio is greater than one is associated with aggressive accounting (H 1 ), asset specialization (H 2 ), debt covenant violation (H 3 ), cash flows (H 4 ), internal adaptation (H 5 ), external adaptation (H 6 ), and standards that increase conservatism (H 7 ).

where COUNT i = the number of consecutive quarters observation i has a BTM ratio greater than one; AAC i = conservatism measure (accumulated accruals) for observation i; BEGPPE i = beginning property, plant, and equipment, scaled by total assets, measured in the first quarter observation i’s BTM ratio is greater than one; BEGINTAN i = beginning intangible assets, scaled by total assets, measured in the first quarter observation i’s BTM ratio is greater than one; DEBTEQUITY i = beginning total debt to equity ratio measured in the first quarter observation i’s BTM ratio is greater than one; ACFO i = average quarterly net operating cash flow, scaled by total assets, measured over the same period as COUNT for observation i; INTERNALADAPT i = indicator variable equal to 1 if observation i has restructuring costs while the BTM is above one, and 0 otherwise; LIQUIDATED i = indicator variable equal to 1 if observation i is liquidated and 0 otherwise; MERG i = indicator variable equal to 1 if observation i is purchased and 0 otherwise; D106 t = indicator variable equal to 1 if observation i is after 12/15/1992, and 0 otherwise; D121 t = indicator variable equal to 1 if observation i is after 12/15/1995, and 0 otherwise; D142 t = indicator variable equal to 1 if observation i is after 12/15/2001, and 0 otherwise; BEGSALES i = beginning quarterly sales, scaled by total assets, measured in the first quarter observation i’s BTM ratio is greater than one; CAGR i = geometric mean growth rate in sales measured over the prior three years before observations i’s BTM ratio is greater than one; WRITEDOWN i = indicator variable equal to one if observation i writes-down its assets, including goodwill, while its BTM ratio is greater than one; BEGQTREWR t = equal weighted returns measured in the first quarter observation i’s BTM ratio is greater than one; AQTREWR t = average equal weighted returns measured over the period observation i’s BTM ratio is greater than one; ENDQTREWR t = equal weighted returns measured in the last quarter observation i’s BTM ratio is greater than one; and ABOVE2 i = indicator variable equal to one if observation i’s BTM ratio is greater than one for the second time within 4 quarters.Footnote 4

Because the independent variable COUNT (the number of consecutive quarters a firm has a BTM ratio greater than one) is truncated, the ordinary least squares assumption of normality is violated. This type of violation leads to biased estimators (specifically inconsistent, see Breen 1996) and therefore they are not reliable. To control for this bias, I utilize a Tobit model because it takes into account the truncation of the dependent variable and provides unbiased estimators.Footnote 5

To test whether the degree of aggressive accounting is associated with the length of time a firm’s BTM ratio is greater than one, I focus on the coefficient on AAC. I use accumulated accruals, as suggested by Givoly and Hayn (2000) (also see Kwon et al. 2006), for my proxy for the degree of aggressive accounting.Footnote 6 They argue that conservatism is a selection criterion among accounting principles that result in the minimization of the cumulative earnings due to slower revenue recognition, faster expense recognition, lower asset valuation, and higher liability valuation. Thus, the firms with the highest (lowest) degree of accumulated accruals are the least (most) conservative. Accumulated accruals are especially appealing for this paper because they are unconditional, they measure management’s underlying policy towards conservatism in more than one period, and they are firm specific.

In general form, the measure is defined as the difference between earnings and cash flows. Because I measure total firm conservatism, I define accumulated accruals in the broadest sense possible—as the difference between net income and cash flows from operations (scaled by total assets):

where ATA is defined as the average total assets from period k − 1 to k, NI is net income, and CFO is cash flow from operations. I use the 3 years prior to the time the firm’s BTM ratio goes above one because firm managers may adjust (accelerate) the firm’s accounting policies when the BTM ratio is above one, and the variable is to proxy for the overall degree of conservatism for the firm. To be consistent with Givoly and Hayn (2000), I also measure accumulated accruals as earnings before depreciation less cash flows from operations, operating accruals, nonoperating accruals (defined as the difference between total accruals before depreciation expense and operating accruals) and depreciation and amortization expense.

The objective of this test is to determine whether a firm with more aggressive accounting policies is likely to persist with a BTM ratio greater than one for a longer period of time than a firm with less aggressive accounting policies. Because a more conservative firm will have a lower (more negative) AAC, a positive coefficient is consistent with the hypothesis that firms with a lower degree of conservatism will have their BTM ratios remain above one for a longer period of time.

I use two proxies to test whether asset specialization is associated with the length of time an observation’s BTM is above one. The first proxy is total property, plant and equipment (scaled by total assets), measured at the beginning of the first quarter that the firm’s BTM ratio rises above one (BEGPPE). The underlying assumption is that a firm with a greater proportion of fixed assets will have a harder time adapting all of its resources than a firm with a greater proportion of current assets. A positive coefficient is consistent with firms with a higher ratio of hard to adapt assets to total assets having a BTM ratio greater than one for a longer period of time.

The second proxy for asset adaptability is intangible assets (BEGINTAN), including goodwill, also measured at the beginning of the first quarter that the firm’s BTM ratio rises above one and scaled by total assets. Intangible assets and goodwill are important parts of a firm’s balance sheet. Although they are valued differently than tangible assets (Henning et al. 2000), they similarly have lower liquidity. Because of the lower liquidity, I predict a positive relationship between intangible assets and the length of time an observation’s BTM is greater than one.

My third hypothesis considers the relation between debt covenants and the length of time a firm’s BTM ratio is above one. I use the total debt to equity ratio, measured in the first quarter the observation’s BTM ratio is above one as my proxy. Duke and Hunt (1990) conclude that the debt to equity ratio is a good measure of the closeness to some debt covenants, namely retained earnings and tangible assets. This is of particular importance in this study since these are the covenants that can be most easily avoided by aggressive accounting.

The fourth hypothesis considers the relation between cash flows and the length of time the BTM is greater than one. I use ACFO, the average cash flows from operations, measured over the period the firm’s BTM ratio is greater than one and scaled by total assets. A positive coefficient on ACFO, indicating that firms with higher cash flows persist longer with a BTM ratio above one than firms with lower cash flows, is consistent with the fourth hypothesis.

To test for internal adaptations, I use an indicator variable equal to one if the firm recognizes restructuring costs while the BTM ratio is above one. I use an indicator variable instead of a continuous variable since my hypothesis does not consider the magnitude of the adaptation, only whether the firm utilizes the option, and to account for likely non-linearities. A negative coefficient would be consistent with my hypothesis.

Since a firm can externally adapt its resources by either liquidating (LIQUIDATED) or being purchased (MERG), I use two indicator variables to test for external adaptations. Unlike an internal adaptation, I predict the sign on the coefficients will be positive since managers will avoid the external adaptation option until other avenues have been explored first.

To test whether rules enforcing greater conservatism reduce the length of time a firm continues with a BTM ratio greater than one, I consider three FASB standards.Footnote 7 The first standard, SFAS 106 Employers’ Accounting for Postretirement Benefits Other Than Pension, effective for years ending after 12/15/1992, requires firms to recognize other future pension benefit obligations, predominately health care costs, on an accrual basis. The next standard, SFAS 121 Accounting for the Impairment of Long-Lived Assets and for Long-Lived Assets to be Disposed Of, effective 12/15/1995, requires managers to measure asset values against cumulative undiscounted cash flows on an annual basis for impairment (although SFAS 121 was replaced by SFAS 144, the rules regarding long lived asset impairments remained largely unchanged). The last standard is SFAS 142 (replacing APB 17 and parts of SFAS 121), Goodwill and Other Intangible Assets. This standard, effective on December 15, 2001, specifically requires firm managers to assess goodwill on an annual basis for impairments and recognize an impairment loss if the book value exceeds the fair market value.

To measure the effects of these standards on the length of time an observation’s BTM is greater than one, I include three dummy variables: D106, D121, and D142, each corresponding to their respective FASB standard and are coded with a one if the observation takes place after the effective date of that standard. For example, if an observation’s BTM is greater than one starting in January 1997, then both D106 and D121 will be coded as one, while D142 will be coded as zero. A negative coefficient is consistent with the hypothesis that after the effective date of the standard, the length of time an observation’s BTM ratio is greater than one is shorter.

3.2 Control variables

In this section I discuss the control variables used in addition to the variables of interest discussed above. BEGSALES (scaled by total assets), measured in the quarter when the BTM ratio rises above one, is a proxy for firm size. Larger firms are subject to more regulatory scrutiny, are more difficult to integrate, and have fewer potential buyers making them less likely to be purchased; therefore, I predict a positive coefficient on BEGSALES, indicating that larger firms will have a BTM above one for longer lengths of time.

I include the sales growth rate (CAGR) to control for the growth rate of the firm. The variable is the geometric mean growth rate measured over the prior 3 years before the BTM climbs above one. Because growth is positively related to market values (the denominator), I predict a negative coefficient (see Ramirez and Hachiya 2008).

Because internal adaptations are often in conjunction with an asset impairment, a negative coefficient could be the result of the write-down and not the adaptation. To isolate the effects of the internal adaptation, I include a dummy variable, WRITEDOWN, which is equal to one if the firm writes down any assets while the BTM ratio is above one. Because a write-down naturally decreases the numerator in the BTM ratio, I predict a negative coefficient.

Because the market value of a firm’s equity (the denominator in the BTM ratio) is associated with the overall market environment, I control for its effect on the length of time an observation’s BTM ratio is above one. To do so, I include equal weighted market returns measured over the first quarter the BTM is greater than one, average equal weighted market returns during the period the BTM ratio is greater than one, and equal weighted market returns after the firm’s BTM ratio rises above one (BEGQTREWR, AQTREWR, and ENDQTREWR respectively).

I do not make a prediction on the association between market performance and the length of time an observation’s BTM ratio is above one. On the one hand, as market performance decreases (approaches a recession) the future expected cash flows decrease, causing more observations to have a BTM ratio greater than one for a longer period of time. On the other hand when the market performance is poor, the weak observations are more likely to be dropped from the sample due to bankruptcy, which would then indicate a negative relation. Therefore, the effect that these control variables have on the dependent variable is an empirical question.

I include ABOVE2 as a control for firms that have their BTM ratios rise above one multiple times per year. Given that a firm can enter into the sample multiple times, I need to control for the serial correlation that is likely caused by observations from the same firm and are, therefore, not independent of each other. I do not make a prediction on the sign of the coefficient. Lastly, I include industry fixed effects to control for differences between industries (suppressed).

4 Data description

Because of data availability, the sample for the analysis includes the BTM ratio for firms from 1990–2010. 1990 is the earliest date that enough cash flow data is available to calculate the lagged accumulated accrual variable. Firm data are sourced from the quarterly Compustat fundamentals file, and pricing information is from monthly CRSP (both adjusted for stock-splits). Consistent with prior studies (Burgstahler and Dichev 1997), the BTM ratio is determined by dividing the beginning of the quarter book value of common equity per common share outstanding by the market value per share.

To better understand the magnitude and historical context of the number of firms with a BTM ratio greater than one and their characteristics, I first provide some descriptive statistics on the observations with a BTM ratio greater than one and compare them against observations with a BTM ratio less than one. From 1990 to 2010, there are 97,700 out of 520,056, or 19 % of quarterly observations in which a firm’s BTM ratio is greater than one. On an average annual basis, there are 4,885 observations per year with a BTM ratio above one. The largest number of observations is in 2009 at 6,299 (32.8 % of all observations in that year), and the smallest is in 2006 at 1,216 (5.9 %). There does not appear to be a general trend in the number of observations, but the years from 2004 through 2007 are markedly smaller (average of 1,453 observations per year) than from 1990 to 2003 (4,538 observations per year).

Table 1 provides descriptive statistics on the whole sample of observations with a BTM ratio greater than one and compares these observations against all other observations with a BTM less than one (note that the table contains all observations of firm-quarters with a BTM ratio greater than one—as opposed to the other tables where one observation is the number of consecutive quarters an observation’s BTM ratio is greater than one). On average, the BTM greater-than-one observations tend to have lower sales ($1,057 million vs. $2,117 million), lower net income (−$0.25 million vs. $135 million), lower total assets ($5,474 million vs. $5,629 million) lower cash flows from operations ($144 million vs. $269 million), and lower Altman Z-Scores (4.8 vs. 6.5). Overall, the observations with a BTM ratio greater than one are smaller, perform more poorly, and are closer to bankruptcy than the other observations. AAC is as predicted, with the BTM ratio greater-than-one observations having a higher level of accumulated accruals than BTM ratio less-than-one observations (−0.14 vs. −0.19 respectively).

Of the 97,700 observations where the BTM ratio is above one, 45,285 remain above one for more than four consecutive quarters, representing 3,790 unique firms. Observations are grouped into bins based on the number of consecutive quarters the BTM ratio is above one, generating 17,941 exclusive cumulative-quarter observations. Bins range up to 55 and correspond with the dependent variable COUNT.

Figure 2 shows the proportion of firm-quarter observations with a BTM ratio above one to the total firm-quarter observations (the solid bars) and the market wide returns for a given year (the dotted bars). The figure provides a better understanding of the relationship between market performance and whether a firm has a BTM ratio above one. There does not appear to be a discernable pattern or relationship between the two bars, and the correlation coefficient between the samples is statistically insignificant, although the lag of returns is marginally significant (−0.41, p = 0.07). The arrows represent recessions over the time period. Although the ratio of firms with a BTM greater than one to all firms is higher in periods of recession, it does not completely track. For example, although there is a recession in 1991, the ratio is higher in 1990.

Histogram of the ratio of firms with a BTM ratio greater than one over the total number of firms for the given year (solid bars) and also the annual equally weighted market returns from all major exchanges (dotted bars). The years following the FASB statements effective dates are 1993, 1995, and 2002. Recession years are labeled by arrows (1991, 2001, 2007, and 2008)

The sample selection begins with restricting the observations to only those with a COUNT greater than 4, leaving a sample of 5,400 observations. The 4-quarter cut-off ensures that my sample is taken after the firm has had a year to react to the BTM ratio rising above one and, therefore, can take any corrective impairments. For example, a firm is required to conduct a fair value test under SFAS 142 on (at least) an annual basis. It would be difficult to argue that the accounting is aggressive if I include firms that have not yet had time to write-off assets, i.e. within 1 year. In fact, one could argue that, for these firms that do make the appropriate impairments, the accounting system is working exactly as it should. A second reason for the cut-off is to also help control for market anomalies and imperfections. Although a semi-strong capital market is assumed, there is evidence of market anomalies existing (Sloan 1996; Frankel and Lee 1998). By using at least 1 year cut-off, market anomalies are less likely to be driving the results.Footnote 8

Because of missing cash flow data items and different reporting and incentives, I exclude financial institutions and utilities, reducing the sample by 1,616 observations.Footnote 9 The sample is further reduced by another 2,072 observations due to missing data, the majority of which is used to calculate the accumulated accruals (AAC) measure, giving a final sample of 1,712 observations representing a total of 1,380 firms.Footnote 10

Figure 3 is a histogram of the cumulative quarter observations. Notice the monotonic decrease in observations as COUNT increases, which is expected as observations drop out of the sample. The sample ranges from over 359 observations with a COUNT of 5 up to 1 observation with a COUNT of 55 (over 13 years). Given that the dataset is censored at 5, the histogram is obviously skewed.

Below is a histogram of the 1,712 cumulative quarterly observations where the BTM ratio for a given firm is above one and corresponds with the variable COUNT. Each observation is unique to its respective bin; for example, a firm in the 8-quarter bin does not appear in any other bin, thus observations are not double counted. Observations range from 359 in quarter 5 to 1 in quarter 55

Table 2 provides the observations broken down by industry. The largest concentration is in Manufacturing (51.5 %), followed by Services (16.3 %), and Retail (10.4 %). The far right column provides a comparison of the Compustat universe to my sample. In general, my sample composition tracks the Compustat universe. A Chi squared test of distributions between the general population (Compustat) and my final sample is unable to reject the null of no difference between the distributions at conventional levels (p = 0.25).

Table 3 Panel A contains descriptive statistics on the final sample (greater than 1 year) as well as for other distinct time periods: one, two, three, four and greater than 4 years. The mean COUNT, the number of consecutive quarters a firm’s BTM ratio is greater than one, is 9.4, which is just over 2 years. The mean BTM ratio is 1.61. On average, these firms are not profitable (mean of −$44.1 million), although the median is slightly above zero ($0.22 million, untabulated). An unexpected finding is that the mean cash flows from operations (scaled) is positive. One would expect that firms in distress, such as these, would have negative cash flows. A testable explanation is that this is a result of a survivorship bias. Firms that have negative cash flows are unable to continue operating and shut down before the minimum 1 year, whereas those with positive cash flows are able to continue. A positive coefficient on ACFO is consistent with this prediction.

The second column of Table 3 contains observations with a BTM ratio greater than one for 1 year or less. The average length of time is 1.8 quarters, suggesting the sample is full of observations that see their BTM rising above one and then fall down again shortly thereafter. Observations with a BTM greater than one for more than 1 year (first column) tend to be smaller ($1,391 million vs. $1,886 million in total assets, p = 0.04) and have a higher BTM ratio (1.61 vs. 1.27, p < 0.01). The net income for firms with a BTM greater than one for 1 year is similar to those greater than 1 year (−$44.1 million vs. −$44.2 million, p = 0.99). Columns 3–6 likewise provide descriptive statistics for the samples based upon the number of years (2, 3, 4, and greater than 4) the BTM is greater than one.

Panel B is a partition of the sample based on whether the observation’s BTM ratio remains above one between 1 and 2 years (Group 1), and greater than 2 years (Group 2). This is to help identify different firm characteristics that change as the firm’s BTM ratio stays above one for longer periods of time. Mean AAC significantly increases (recall that the more aggressive observations have a higher or less negative AAC) between the two groups (p < 0.01).Footnote 11 Group 1 observations tend to have lower scaled PP&E (BEGPPE, p < 0.01), higher scaled intangible assets (BEGINTAN, p = 0.06), lower scaled cash flows (ACFO, p < 0.01), lower scaled sales (BEGSALES, p = 0.09), higher total assets (p < 0.01), lower net income (p = 0.06), and higher total debt (p < 0.01). Also, beginning market performance is significantly worse for firms with a BTM ratio greater than one for less than 2 years relative to those with BTM greater than one for more than 2 years (BEGQTREWR, p < 0.01 and AQTREWR, p = 0.06).

Because of the large differences between means and medians, I also include a test of median differences. The differences between the two tests are small, with only ACFO, total debt, and BTM providing different insights from the test of mean differences.

An interesting result is that the observations in Group 1 tend to have higher levels of intangible assets than Group 2 (p = 0.06). What is interesting is that even though Group 2 has smaller intangible assets on average, its observations maintain a BTM ratio for more than 2 years, inconsistent with intangible assets driving the higher book values.

Figure 4 is a graph comparing the average equity book values against average market values, both scaled by shares outstanding, on the vertical axis over the last year the observation’s BTM is greater than one and the quarter of its recovery on the horizontal axis. The purpose of the graph is to provide insight into how the relation between book and market values changes while the BTM ratio is greater than one. The graph shows that firms tend to recover by both decreasing book values and increasing market values, although the change in the market values tend to be larger. In untabulated results, on average a firm loses 13.3 % of its book equity value from the time the BTM ratio falls below one to the month it recovers, while losing 9.1 % of the market value. The majority of the changes come in the quarter just before recovering, with market values increasing by 31.5 % (suggesting a more U-shaped pattern in market values) and book values decreasing by 8.8 %.

Above is a graph of the sample of 1,712 observations comparing the average book values against average market values, both scaled by shares outstanding, on the vertical axis over the last year the observation’s BTM is greater than one (3–0) and the first quarter following its recovery (−1) on the horizontal axis

Table 4 provides a correlation matrix, with Spearman correlations in the upper triangle and Pearson correlations in the lower triangle. COUNT is positively correlated with AAC, which is consistent with the hypothesis that firms with more aggressive accounting tend to have BTM ratios above one for a longer period of time. Most of the other variables are positively correlated using the Spearman correlations (exception being DEBTEQUITY, ENDQTREWR, and CAGR). Using the Pearson specification, only AAC, BEGPPE, DEBTEQUITY, ACFO, BEGINTAN, and BEGQTREWR, are significant.

5 Results

Table 5 Panels A–C provide the results on the association between the length of time the observation’s BTM ratio is greater than one and firm characteristics: aggressive accounting (AAC), PP&E (BEGPPE) and intangible assets (BEGINTAN), leverage (DEBTEQUITY), and cash flows (ACFO); firm actions: restructuring (INTERNALADAPT), liquidation (LIQUIDATED), and firm sale (MERG); and changes in accounting standards: SFAS 106, 121, and 142 (D106, D121 and D142). The first column in Panel A contains the main case where the BTM ratio remains above one for over four consecutive quarters. I also provide the results for more extreme cases by allowing the ratio to rise above 1.5 and 2.0. In Panel B, I present the results using different definitions of accumulated accruals (operating vs. nonoperating, both before depreciation and amortization). Lastly, Panel C contains the results using all observations, including those with a BTM greater than one for less than 1 year.

In Panel A, the coefficient on AAC (0.200, p < 0.01) is positive and significant, consistent with the hypothesis that firms with a lower degree of conservatism tend to have a BTM ratio greater than one for a longer period of time. This result holds when increasing the BTM ratio cut-off level from 1.0 to 1.5, but becomes insignificant with firms that have a BTM ratio greater than 2.0. The fact that the coefficient becomes insignificant if the BTM ratio is greater than 2.0 suggests that the relationship between a firm’s level of conservatism and the time it spends with a BTM ratio greater than one is not linear. Using earnings before depreciation instead of raw earnings in the accumulated accrual measure (Givoly and Hayn 2000) leaves the results largely unchanged (untabulated).

Referring to Table 5 Panel B, only the coefficient on nonoperating accruals (NONOPERATINGAAC) is significant, and operating accruals (OPERATINGAAC) is not significant (both measured before depreciation and amortization). This result is consistent with literature (see Marquardt and Wiedman 2004; Krull 2004; Petroni 1992, among others) that finds that nonoperating and specific accruals are often used to manage earnings. Depreciation and amortization is negative. This is not surprising given that depreciation and amortization expense will always reduce total equity, and therefore reduce the length of time an observation’s BTM ratio is greater than one.

The results regarding the liquidity of the assets are consistent for BEGPPE and somewhat consistent for BEGINTAN. The coefficient on BEGPPE is positive across all specifications, consistent with the second hypothesis that firms with more illiquid assets will remain with a BTM ratio greater than one for a longer period of time. However, the coefficient on BEGINTAN is not consistently significant. In the main specification (Table 5 Panel A, first column), the coefficient is not significant, but is significant and positive when the BTM is greater than 1.5, and marginally significant when the BTM is greater than 2. BEGINTAN is not significant under any specification in Panel B, but is significant in Panel C.

The coefficient on DEBTEQUITY is negative and significant under all specifications. This is consistent with Watts (2003) and Nikolaev’s (2010) conjectures that firms will bond themselves with conservatism. However, an alternative explanation is that these firms are being forced to adapt to more conservative accounting practices by the debt holders. The difference between the two explanations is slight, and can be pursued in future research.

ACFO, average cash flows from operations, is generally consistent with the expectation that firms with higher cash flows are able to continue longer with a BTM ratio above one. The only exception being when the BTM ratio cut-off is increased to 1.5.

The coefficient on INTERNALADAPT is insignificant under most specifications, inconsistent with my hypothesis. Because I require a firm to have a BTM ratio above one for more than 1 year before it is included in the sample (so that observations will be subject to impairment tests), firms that restructure quickly could also be removed from the sample. When using all observations with a BTM ratio greater than one, as opposed to truncating the sample at 1 year (Panel C), INTERNALADAPT is negative as predicted, consistent with the hypothesis above.

LIQUIDATED, but not MERG, is positively correlated with COUNT under most specifications. This is consistent with firm managers viewing liquidation as a last resort. This could also be indicative of weak corporate governance since managers could be delaying the option for self-interested reasons—a topic pursued by Oler (2011).

Regarding the three indicator variables, D106, D121, and D142, only D142 is reliably negative and significant, consistent with FASB’s attempts at enforcing conservatism. The coefficient on D106 is only significant and negative under the specification using the BTM ratio cut-off at 1.5. D121 is positive and significant under the specifications in Panels A and B, suggesting that firms are less likely to write-down long-lived assets. This result is consistent with Riedl (2004) who finds that SFAS 121 write-downs are more likely due to reporting than economic reasons.Footnote 12

BEGSALES, to control for firm size, is not positive under any specification—and is negative across most specifications, opposite to my prediction. CAGR is negative and significant across most specifications as expected. The exceptions being when the BTM is above two and when using all observations. WRITEDOWN is also negative across all specifications.

Market returns, (BEGQTREWR, AQTREWR, and ENDQTREWR) are all positive and significant when an observation has a BTM ratio above one, but AQTREWR is insignificant when the BTM is greater than 1.5, and both AQTREWR and ENDQTREWR are insignificant when the BTM is greater than two. AQTREWR largely swamps the other coefficients when it is significant (for example, under the first column on Panel A it is 3.83, p < 0.01). Lastly, ABOVE2 is positive under the BTM > 1.5 (Panel A) and when using all observations (Panel C) specifications.

Additional sensitivity tests that include change in book equity value, BTM ratio, average growth while BTM is greater than one, growth after the BTM falls below one, and cumulative buy and hold returns over the period the observation’s BTM ratio is above one do not largely affect the results. Lastly, I also run the analysis using firm-months to build the dependent variable COUNT instead of firm-quarters. The results do not demonstratively change.

6 Summary

In conclusion, the purpose of this study is to consider which firm characteristics, firm actions, and accounting rules are associated with a firm continuing with a BTM greater than one. If firms are conservative, then a BTM ratio greater than one should be a rare occurrence because managers can utilize the adaptation option. However, from 1990 to 2010, an average of 19 % of firm-quarter observations have a BTM ratio above one. Results are largely consistent with the hypothesis that firms that are aggressive in their accounting practices are associated with their book value of equity being overstated, which in turn is overstating the BTM ratio. Further results are consistent with asset specialization (but not with intangible assets) increasing the length of time a firm’s BTM ratio is above one and leverage decreasing the length of time the BTM ratio is above one. Cash flows are also positively correlated with the length of time the BTM ratio is above one.

The results are largely consistent with observations that use the external adaptation option, specifically liquidation, being associated with an increase in the length of time the observation’s BTM is greater than one. The results also indicate that restructuring is associated with a shorter period the BTM is greater than one, but only when using all observations, including those that have a BTM greater than one for less than 1 year. This is consistent with restructuring being effective if utilized quickly, but not so when delayed past 1 year.

Regarding the rules that increase conservatism, only SFAS 142 is reliably associated with a decrease in the length of time the firm’s BTM is greater than one, consistent with it being effective in mandating a greater level of conservatism. SFAS 121 is associated with an increase in the length of time the firm’s BTM is greater than one under some specifications, and SFAS 106 is largely insignificant.

Because this paper is the first to show that firms tend to persist with a BTM ratio remaining above one, my examination is certainly not complete and there are several avenues to further extend this research. The main prediction in this study is that managers do not use the adaptation option because the “true” BTM ratio is less than one. However, it is possible that managers are not using the adaptation option because they do not wish to. For example, if the manager’s payoff from continuing without adaptation is higher than if they do adapt, they have an incentive to not use the option (presumably because they would lose their current position). This research question is pursued by Oler (2011) by comparing entrenchment measures against the length of time a firm has an exit-to-market ratio greater than one.

Although this study considers the factors that allow a firm to continue with a BTM greater than one for an extended period of time, it does not fully explore the reasons why a firm will not correct its BTM ratio immediately. Evidence shows that the correction is not gradual; for example, the mean change in book equity value is negative 8.8 % in the quarter before the firm’s BTM ratio falls below one again. The simple question is why the sudden change? Further research to discover reasons for the change would also cut across financial and managerial disciplines.

Another potential avenue of research is to consider whether there are behavioral reasons why managers do not write-off assets so that the BTM ratio falls below one. Given that the market appears to see through the equity overvaluation—it seems inconsistent for managers to inflate earnings to “trick” the market. However, perhaps managers are overconfident in their ability to utilize their (overvalued) assets or to lead the firm to higher profitability. This level of hubris could also affect the value in use estimates by management for impairments, indicating possible auditor independence questions since they review these estimates for reasonableness.

Lastly, what are the implications of a firm with a BTM ratio greater than one? For example, are the earnings attributes for firms with a BTM ratio greater than one different from the general sample? If, according to Hayn (1995), the earnings response coefficient attenuates because earnings becomes less important as the adaptation options nears exercise, then these firms should not see such an attenuation. In conclusion, the identification of this unique sample poses several additional questions for future research to explore and exploit.

Notes

To be consistent with Burgstahler and Dichev (1997), I use the term adaptation for internal redeployments of resources as well as external adaptations, which include sell-offs, spin-offs, divestitures, and liquidations.

Although somewhat higher, this result is consistent with Danielson and Press’s (2003) finding that from 1992 to 2000, 13 % of all firms have a BTM ratio greater than one.

For brevity, when I refer to asset overvaluation I include liability undervaluation as well.

The subscript i indicates firm observation and t is time.

A poisson regression is not appropriate due to the rigid condition in a poisson distribution that the conditional mean of the dependent variable is equal to its conditional variable (see Rock et al. 2001).

Two other proxies for conservatism include the BTM ratio and asymmetric timeliness. The BTM raio, suggested by Ohlson (Ohlson 1995, also see Beaver and Ryan 2000), is rejected due to the potential mechanical relation between the BTM ratio and the dependent variable. The second, provided by Basu (1997), considers the relation between economic events and earnings, hypothesizing that negative returns have a stronger relation with earnings than positive returns. Ball and Shivakumar (2005) argue that asymmetric timeliness is a conditional measure of conservatism, but because the hypothesis compares total conservatism, a more aggregate measure is appropriate. Also, the asymmetric timeliness measure is not well suited for firm-specific tests.

I have conducted an examination of all of the FASB standards from 1990 through 2010 and determined that the three selected standards predominate FASB’s attempt to enforce conservatism.

Table 5, Panel D shows the regression results using all observations.

Of the 1,616 observations from the financial and utility industries, 1,504 are financial. This large number of financial observations is surprising, given the regulatory environment of the industry, as well as the greater propensity for assets to be closer to fair market value. I encourage future research from those acquainted with the financial industry on this finding.

A firm can have more than one observation with a BTM ratio greater than one in the sample. On average, a firm has 1.2 observations in the sample of 1,712.

I assume unequal variances between the two groups. A test of variances easily rejects the null of equal variances between the two groups in almost all cases.

This analysis treats all observations as time independent. However, if an observation has a string of months with a BTM greater than one that begins before a particular standard but ends after, then this assumption is violated. To ensure that this is not driving results, I perform the analysis allowing the indicator variables D106, D121, and D142, to vary with time. The results are of the same tenor with this change.

References

Aleksanyan M, Karim K (2013) Searching for value relevance of book value and earnings: a case of premium versus discount firms. Rev Quant Financ Acc 41(3):489–511

Altman E (1968) Financial ratios, discriminant analysis and the prediction of corporate bankruptcy. J Financ 23(4):589–609

Ball R, Shivakumar L (2005) Earnings quality in UK private firms: comparative loss recognition timeliness. J Account Econ 39(1):83–128

Ball R, Kothari SP, Robin A (2000) The effect of international institutional factors on properties of accounting earnings. J Account Econ 29(1):1–51

Barth E (1991) Relative measurement errors among alternative pension asset and liability measures. Account Rev 66(3):433–463

Barth E, Beaver W, Landsman W (1992) The market valuation implications of net periodic pension cost components. J Account Econ 15(1):27–62

Barth E, Beaver W, Landsman W (1998) Relative valuation roles of equity book value and net income as a function of financial health. J Account Econ 25(1):1–34

Basu S (1997) The conservatism principle and the asymmetric timeliness of earnings. J Account Econ 24(1):3–37

Beatty A, Weber J, Yu J (2008) Conservatism and debt. J Account Econ 45(2/3):154–174

Beaver W, Landsman W (1983) Incremental information content of Statement 33 disclosures. FASB, Stamford

Beaver W, Ryan S (2000) Biases and lags in book value and their effects on the ability of the book-to-market ratio to predict book return on equity. J Account Res 38(1):127–148

Berger P, Ofek E, Swary I (1996) Investor valuation of the abandonment option. J Financ Econ 42(1):1–31

Breen R (1996) Regression models: censored, sample selected, or truncated data, series: quantitative applications in the social sciences. Sage, Beverly Hills

Burgstahler D, Dichev I (1997) Earnings, adaption, and equity value. Account Rev 72(2):187–215

Collins D, Kothari SP (1989) An analysis of intertemporal and cross-sectional determinants of earnings response coefficients. J Account Res 11(2/3):143–181

Collins D, Pincus M, Xie H (1999) Equity valuation and negative earnings: the role of book value of equity. Account Rev 74(1):29–61

Danielson M, Press E (2003) Accounting returns revisited: evidence of their usefulness in estimating economic returns. Rev Account Stud 8(4):493–530

Duke J, Hunt H (1990) An empirical examination of debt covenant restrictions and accounting-related debt proxies. J Account Econ 12(1):45–63

Dye R, Sridhar S (2008) A positive theory of flexibility in accounting standards. J Account Econ 46(2/3):312–333

Fields T, Lys T, Vincent L (2001) Empirical research on accounting choice. J Account Econ 31(1–3):255–307

Frankel R, Lee C (1998) Accounting valuation, market expectation, and cross-sectional stock returns. J Account Econ 25(3):283–319

Givoly D, Hayn C (2000) The changing time-series properties of earnings, cash flows and accruals: has financial reporting become more conservative? J Account Econ 29(3):287–320

Hayn C (1995) The information content of losses. J Account Econ 20(2):125–153

Henning S, Lewis B, Shaw W (2000) Valuation of the components of purchased goodwill. J Account Res 38(2):375–386

Hirshleifer D, Hou K, Teoh S, Zang Y (2004) Do investors overvalue firms with bloated balance sheets? J Account Econ 38:297–331

Jensen M, Ruback R (1983) The market for corporate control: the scientific evidence. J Financ Econ 11(1):5–50

Krull L (2004) Permanently reinvested foreign earnings, taxes, and earnings management. Account Rev 79(3):745–767

Kwon S, Yin Q, Han J (2006) The effect of differential accounting conservatism on the “over-valuation” of high-tech firms relative to low-tech firms. Rev Quant Financ Acc 27(2):143–173

Landsman W (1986) An empirical investigation of pension fund property rights. Account Rev 61(4):662–691

Marquardt C, Wiedman C (2004) How are earnings managed? An examination of specific accruals. Contemp Account Res 21(2):461–491

Nikolaev V (2010) Debt covenants and accounting conservatism. J Account Res 48(1):51–89

Ohlson J (1995) Earnings, book values, and dividends in equity valuation. Contemp Account Res 11(2):661–687

Oler M (2011) Entrenched management and the adaptation option. Working paper, Virginia Tech University

Oler D, Smith K (2012) The characteristics and fate of firms that publicly seek to be acquired. Investment analysis and portfolio management, vol 6. Elsevier, Amsterdam

Perfect SB, Wiles KW (1994) Alternative constructions of Tobin’s q: an empirical comparison. J Empir Financ 1(3/4):313–341

Petroni K (1992) Optimistic reporting within the property–casualty insurance industry. J Account Econ 15(4):485–508

Ramirez P, Hachiya T (2008) Measuring the contribution of intangibles to productivity growth: a disaggregate analysis of Japanese firms. Rev Pac Basin Financ Mark Policies 11(2):151–186

Riedl E (2004) An examination of long-lived asset impairments. Account Rev 79(3):823–852

Rock S, Sedo S, Willenborg M (2001) Analyst following and count-data econometrics. J Account Econ 30(3):351–373

Schlingemann F, Stulz R, Walkling R (2002) Divestitures and the liquidity of the market for corporate assets. J Financ Econ 64(1):117–144

Shevlin T (1991) The valuation of R&D firms with R&D limited partnerships. Account Rev 66(1):1–21

Sloan R (1996) Do stock prices fully reflect information in accruals and cash flows about future earnings? Account Rev 71(3):289–315

Watts R (2003) Conservatism in accounting part I: explanations and implications. Account Horiz 17(3):207–221

Watts R, Zimmerman J (1986) Positive accounting theory. Pretince-Hall Inc, New Jersey

Acknowledgments

I appreciate the helpful comments and suggestions from my dissertation committee, David Burgstahler, Jarrad Harford, and Terry Shevlin, as well as those from Long Chen, Bowe Hansen, Derek Oler, Shiva Rajgopal, D. Shores, and workshop participants at the University of Washington, the BYU Accounting Consortium, the University of Alberta, Texas Tech University, George Mason University, the 2009 Annual American Accounting Association Meeting, and the 2011 Virginia Accounting Research Conference, and from the anonymous reviewer. I am also grateful to Lew Thorson for his programming assistance.

Author information

Authors and Affiliations

Corresponding author

Additional information

This paper is based on the author’s dissertation at the University of Washington.

Rights and permissions

About this article

Cite this article

Oler, M. Determinants of the length of time a firm’s book-to-market ratio is greater than one. Rev Quant Finan Acc 45, 509–539 (2015). https://doi.org/10.1007/s11156-014-0445-5

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11156-014-0445-5