Abstract

This paper investigates price discovery between control shares (the superior voting class) and public shares (the inferior voting class) issued by 62 dual-class firms around 148 quarterly earnings announcements from January 2002 to June 2008. We document substantial informed trading in both control and public shares. The average price discovery of control shares is 46.6 % for positive events and 40.5 % for negative events during the event periods. In addition, before the earnings announcements, abnormal trading volume and price discovery increase significantly in control shares relative to public shares. We find price discovery of control shares increases with relative volume of control shares to public shares and relative bid-ask spread but decreases with relative institutional ownership and relative volatility. Our results suggest that publicly traded superior voting class contributes to price discovery substantially, especially before earnings announcements when the information asymmetry is high. The listing of control shares not only enhances price efficiency, but also provides opportunities for outside sophisticated investors to get voting rights and engage in monitoring. Our study sheds new light on the issues of price discovery and corporate governance of dual-class firms.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

This study investigates price discovery between two different classes of common stocks for dual-class firms around quarterly earnings announcements. Price discovery is arguably one of the most important functions of financial markets. When one security or similar assets are traded in multiple markets, it is particularly of interest to determine where the price discovery occurs (Stoll and Whaley 1990b; Harris et al. 1995; Hasbrouck 1995; Fleming et al. 1996; Amin and Lee 1997; Blume and Goldstein 1997; Heaney et al. 1999; Tse 1999; Cao et al. 2000; Barclay and Hendershott 2003; Eun and Sabherwal 2003; Kadapakkam et al. 2003; Hasbrouck 2003; Chakravarty et al. 2004; Chou and Chung 2006; Choy and Zhang 2010; Bohl et al. 2011; Moshirian et al. 2012). Dual-class firms issue two different classes of common stocks, control shares (the superior voting class) and public shares (the inferior voting class).Footnote 1 Due to different liquidities and voting rights between the two shares, a particular class may attract more sophisticated investors than the other. The existence of two public-traded classes of common stock may foster efficient market if other market participants can glean more information quickly from the class preferred by the sophisticated investors. The special characteristics of dual-class ownership structure motivates our study on whether both classes of stocks contribute to price discovery and how information is incorporated into control shares and public shares.

The important dual class study by Schultz and Shive (2010) is the first to examine the microstructure of arbitrage opportunity between dual classes of shares issued by the same company that differ in votes but have identical cash flow rights. They show that a simple arbitrage strategy of shorting the expensive shares and buying shares in the cheap class earns abnormal profits after transaction costs. They find that the more liquid share class is usually responsible for the price discrepancies and the non-voting share class often responds more quickly to information than does the voting class. Our study differs from Schultz and Shive (2010) in a number of important aspects. First, to the best of our knowledge, our paper is the first to measure directly the percentage of price discovery between two classes of common stocks for dual-class firms around earnings announcements, and to provide direct evidence of price discovery in this regard. Second, we examine whether the relative rate of price discovery in the two classes is a function of firm characteristics that can be identified in a cross-sectional investigation. Finally, while Schultz and Shive (2010) discard from their sample those dual-class stocks with different classes having unequal cash flow rights, our study include all dual-class stocks with both equal and unequal cash flow rights in our sample.

Dual-class ownership structure is an extreme form of corporate governance. Firms create two classes of common stocks, control shares and public shares, to separate voting rights and cash flow rights. Under the dual-class ownership structure, control shares give their holders superior voting rights (e.g. ten votes per share), while public shares have inferior voting rights (e.g. one vote per share). The control shares are usually owned by corporate insiders (managers and directors), which allows them to maintain a majority of votes but only possess a minority of firm’s economic value. This divergence between insider voting and cash flow rights exacerbates agency problems between managers and shareholders (Berle and Means 1932; Jensen and Meckling 1976). While control shareholders are more capable of taking actions to deter any foreseeable changes in corporate control that might put at stake their private benefits and continued employment at the company, they bear a disproportionately smaller portion of the financial outcomes of their decisions. Consistently, Claessens et al. (2002), Lemmon and Lins (2003), Lins (2003), Harvey et al. (2004), and Gompers et al. (2010) provide evidence that as corporate insiders control more voting rights relative to cash flow rights, firm value and stock returns decrease. In addition, many studies document that the dual-class firms are usually associated with lower earnings informativeness (Francis et al. (2005), lower level of voluntary disclosure (Tinaikar 2009), higher level of information asymmetry (Li et al. 2012; Kim et al. 2007), more pervasiveness of earnings management (Leuz et al. (2003)], and less possibility of cross-border listing in countries with high disclosure requirements (Doidge 2004; Tinaikar 2009; Doidge et al. 2009). Further, Masulis et al. (2009) find that the dual-class ownership structure is accompanied with lower value of cash holdings for outside shareholders, higher CEO compensation, higher likelihood of value-destroying acquisitions by managers, and capital expenditures contributing less to shareholder value.

The prevalent information asymmetry and the different characteristics of the two share classes make the investigation of price discovery between the public-traded control shares and public shares particularly interesting. The high information asymmetry of dual-class firms increases the expected profits of active information gathering. We focus on earnings announcements periods when sophisticated investors gather private information and trade based on it most actively. When one security is traded in two different markets, informed traders prefer the market with higher liquidity in order to hide their informed trading, and uninformed traders also prefer trading with other uninformed investors to avoid losses from trading with the informed. Admati and Pfleiderer (1998) suggest that in equilibrium there is a tendency for trading to be concentrated because both informed traders and liquidity traders trade during the period when liquidity trading is concentrated. Easley and O’Hara (1992) also demonstrate that in the market that has greater depth, the adjustment of prices is slower and it is more difficult for the market makers to detect the informed trading. Because public shares are usually more liquid than control shares, if there is no other difference between the two share classes, both informed and uninformed traders have a tendency to trade public shares. Control shares, however, differ from public shares in that shareholders of control shares get superior voting rights. Given that the expected return of buying control shares is usually lower due to higher prices, larger transaction costs, and lower liquidity than public shares, people who trade control shares tend to be long-term investors who desire voting rights. They may be either investors or insiders who are interested in getting private benefits of control or sophisticated investors who gather private information and engage in monitoring the management of dual-class firms. The price discovery of control shares depends on which group of people dominates on the market of control shares.

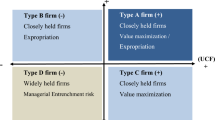

In this paper, we develop two competing hypotheses for the price discovery between control shares and public shares. The entrenchment hypothesis suggests that traders of control shares focus on the pecuniary and non-pecuniary benefits of control. Examples of pecuniary benefits include direct monetary compensation transferred from shareholders, and expenditures on perquisites such as airplanes etc., while examples of non-pecuniary benefits include power, recognition, and a nice office etc. These investors trade based on their desire to obtain the private benefits of control and thus the information content of their trades may not be high. Because informed investors who do not want voting rights trade public shares, in this case the price discovery should take place more often from trades of public shares than from control shares. An increase in trading volume of control shares is not necessarily associated with increasing price discovery of control shares. As shown in our analysis, the price of control shares also adjusts to new information more slowly than that of public shares. The superior information hypothesis suggests that traders of control shares are usually sophisticated investors who gather corporate information and monitor the performance of the dual-class firms. They possess superior information about future performance and trade based on their private information. Therefore, the trading volume of control shares affects the price discovery of control shares positively. Because there are still informed traders who prefer to trade liquid public shares, the price discovery of control shares depends on whether the number of informed traders focusing on the liquidity is larger than that focusing on the voting rights. The speed of price reaction to new information for one class is determined by the price discovery of that class.

Examining 148 earnings announcements made by 62 dual-class firms from January 2002 to June 2008, we find evidence supporting the superior information hypothesis. First, there are substantial informed investors trading both control shares and public shares. In the period [−10, 10] around the announcements, the average price discovery of control shares is 46.6 % for positive events and 40.5 % for negative events. Although the price discovery of control shares is lower than that of public shares, a price discovery of 40.5 % still suggests that substantial price discovery occurs on the market of control shares. Second, before earnings announcements there are more sophisticated investors trading control shares for both positive and negative events, which results in increasing price discovery and rising trading volume for control shares. Third, for positive events, the price discovery of control shares is even higher than 50 % during the period [−6, −2] and the price reaction of control shares to the announcements seems to be slightly faster than that of public shares during the same period. For negative events, because the price discovery of control shares is always lower than 50 %, we do not find a faster reaction for control shares than for public shares. Finally, we find the price discovery of control shares increases with relative volume of control shares to public shares and relative bid-ask spread but decreases with relative institutional ownership and relative volatility. Altogether, the changes of price discovery and volume/price reactions to new information prior to earnings announcements are consistent with the superior information hypothesis but inconsistent with the entrenchment hypothesis.

This paper adds to the existing literature on the price discovery and corporate governance of dual-class firms. Literature of dual-class firms has investigated many aspects of the dual-class ownership structure such as premium of control shares over public shares, long-term performance, firm value, announcement effect of the recapitalization, and unification. It has largely ignored the effects of issuing two classes of stocks publicly on the price discovery and public monitoring. Gompers et al. (2010) document that about 6 % of publicly-traded firms are dual-class firms, among which about 85 % have at least one untraded class of common stock. The ownership structure is one of many corporate governance variables that are endogenously determined (Demsetz and Lehn 1985). Dual-class firms are usually associated with high information asymmetry and they are virtually immune to a hostile takeover. Issuing control shares publicly can mitigate problems associated with the above two issues to some extent through improving price efficiency and allowing public monitoring by outside sophisticated investors who desire voting rights. Our study provides analysis on how information is incorporated into control shares and suggests a possible benefit of a secondary market of control shares, which sheds new lights on price discovery and corporate governance of dual-class firms.

The paper is organized as follows. Section 2 develops the empirical predictions based on literature. Section 3 describes data, sample selection, and research method used in the study. In Sects. 4 and 5, we present the characteristics of our sample dual-class firms and empirical results, respectively. Concluding remarks are provided in Sect. 5.

2 Empirical predictions

2.1 Price discovery around quarterly earnings announcements

This paper studies the price discovery during the quarterly earnings announcements period. Quarterly earnings announcements are scheduled events. Anticipating upcoming announcements, sophisticated investors engage in gathering private information and seek to make profits from information trading [See Kim and Verrecchia (1991), McNichols and Trueman (1994)]. The empirical studies (Lee et al. 1993; Krinsky and Lee 1996; Graham et al. 2006) find an increase in information asymmetry before the announcements. The information asymmetry increases due to the increasing information trading, which makes earnings announcements a great period for the investigation of information trading and price discovery.

The price discovery of a dual-class firm occurs from two sources, the market of control shares and the market of public shares. Unlike single-class firms, dual-class firms with two publicly-traded classes of common stocks allow investors to choose between control shares and public shares. Control shares differ from public shares in terms of liquidity and voting rights. Control shares are usually less liquid than public shares but they give their holders superior voting rights. Due to the differences, control shares are usually traded at larger transaction costs and higher prices, which decreases investors’ expected returns. Both liquidity traders and informed traders who do not value voting rights prefer public shares. Therefore, those who trade control shares must desire voting rights. They may be either investors or insiders who are interested in getting private benefits of control or sophisticated investors who gather private information and engage in monitoring the management of dual-class firms. The price discovery between control shares and pubic shares depends on which group of people dominates on the market of control shares.

In this paper, we develop two competing hypothesis explanation the price discovery between control shares and public shares. Prior studies (DeAngelo and DeAngelo 1985; Grossman and Hart 1988; Harris and Raviv 1988; Gompers et al. 2010) argue that Dual-class ownership structure is an extreme form of corporate governance which allows corporate insiders to retain their control through entrenchment. The managerial entrenchment brings insiders private benefits of control. The benefits range from the non-pecuniary (such as power, recognition, and a nice office) to the cash value of a guaranteed salary (DeAngelo and DeAngelo 1985; Cox and Roden 2002). The dual-class ownership structure provides insiders both means and incentives to take actions to increase their private benefits of control at the expense of outside shareholders, as documented in Masulis et al. (2009). Our entrenchment hypothesis suggests that traders of control shares trade based on their desire to get the private benefits of control, not based on private information. This predicts that the price discovery of control shares is lower than that of public shares and it does not increase with the trading volume of control shares.

Cox and Roden (2002) argue that while insiders clearly have incentive to trade control shares, they are unlikely to be active traders of their company’s stock after they have secured their position, as evidenced by Elliott et al. (1984), Givoly and Palmon (1985), Bettis et al. (2000), Ke et al. (2003) and Ke and Petroni (2004). The active traders of control shares are more likely to be outside shareholders (mutual fund managers or coalition of individual investors) who are willing to pay a premium for the opportunities to have a voice in how business is run and exert pressure on management to boost performance (Dimitrov and Jain 2006). Our superior information hypothesis suggests that traders of control shares are sophisticated investors who gather corporate information and monitor the performance of the dual-class firms. This predicts that price discovery of control shares increases with the trading volume of control shares, and that the price discovery between control shares and public shares depends on whether the number of the informed traders valuing the voting rights exceeds the number of informed traders valuing liquidity and short-term profits.

2.2 Trading volume

Market microstructure literature suggests that trading volume of a security prior to anticipated events (e.g. earnings announcements) depends on both the aggressiveness of informed traders and the avoidance of the liquidity traders. Informed traders usually act aggressively to execute profitable trades because their private information becomes valueless after the news releases (Kim and Verrecchia 1991). However, liquidity traders hesitate to trade to avoid being exploited by the informed investors, as discussed in Milgrom and Stokey (1982), Black (1986), Admati and Pfleiderer (1998), and Chae (2005).Footnote 2

Based on the above literature, we make different predictions on volume reactions to earnings announcements for control shares and public shares. Our entrenchment hypothesis suggests that informed traders prefer liquid public shares and investors who trade control shares are mainly for private benefits of control. As a result, the price discovery of control shares may decrease with the trading volume of control shares. Our superior information hypothesis suggests that investors who trade control shares are those who actively gather information and engage in corporate monitoring. The information content of their trades is high. Because their private information is useless after the announcements, they need to trade aggressively before the announcements.

2.3 Price reactions to earnings announcements

Price reactions to earnings announcements are closely related to price discovery. The class with higher price discovery is more likely to incorporate new information into prices faster and reacts to the earnings announcements more quickly than the other class. Our entrenchment hypothesis suggests that the reactions of public shares are faster than that of control shares. Informed investors prefer liquid public shares to illiquid control shares prior to earnings announcements. Those who trade control shares are usually based on their desire of getting private benefits of control. They may not trade based on private information. Therefore, before quarterly earnings announcements, public shares lead to control shares in terms of price reactions. Our superior information hypothesis suggests that one class of common shares may not always lead to the other. The hypothesis argues that the price discovery depends on the number of sophisticated investors who are interested in voting rights relative to the number of informed traders who prefer liquidity. Because the price discovery of one class of common stocks is not necessarily always higher than that of the other class, which class of common stocks react faster to new information is not conclusive.

3 Research method

3.1 Measures of price discovery

In this paper, we use two measures to evaluate price discovery, information share proposed by Hasbrouck (1995) and common factor weight suggested by Harris et al. (2002). Hasbrouck (1995) develops a model of price discovery for different markets where same securities are traded. His model suggests that price discovery can be measured by the innovations in the efficient price and a market’s contribution to price discovery is its information share, the proportion of the efficient price innovation variance that can be attributed to that market. A market with a higher information shares contributes more to price discovery. Similarly, Harris et al. (2002) also propose a measure of price discovery, common factor weights. The common factor weight of a market is defined as the proportion of the permanent component of stock price adjustments attributable to that market. When the common factor weight of a market is higher, price discovery occurs in that market more often because trades there move stock price permanently more frequently.

The information share and common factor weight complement each other. Both measures are defined in terms of the reduced form forecasting errors of individual markets from an empirical vector error correction model. They are closely related and usually lead to similar results. However, prior studies also suggest that these two measures can be different in some cases. Baillie et al. (2002) indicate that if there is a substantive correlation between the two markets, the two measures can lead to different results. Jong (2002) and Yan and Zivot (2010) suggest that between the two measures, only the information share can evaluate the relative informativeness of individual markets. They argue that although both measures account for the relative avoidance of noise trading and liquidity shocks, only information shares provide information on whether a market incorporates more new information and/or impounds less liquidity shocks. However, the information share may be distorted by transitory frictions for high frequency trading data because it only accounts for the immediate responses of prices to the news innovation. Due to the above differences, using the two measures at the same time disentangles the impacts of permanent and transitory shocks and enables robust analysis of price discovery.

3.2 Price and volume reactions to earnings announcements

The price and volume reactions for both control shares and public shares are measured by abnormal returns and abnormal volume. We calculate the market-adjusted return by subtracting the return on the CRSP equally weighted index from the daily stock return. The empirical results are essentially the same when we use risk-adjusted returns, which is consistent with Brown and Warner (1985). For brevity purpose, our analysis is based on market-adjusted returns.

Following Irvine et al. (2007), the tests of significance for the abnormal return are calculated using the non-event periods [−60, −11] and [11, 60]. Specifically, the market-adjusted returns, defined as the mean market-adjusted returns for all events on each day during the non-event periods, are calculated first. The normal return is the time-series average of the daily mean market-adjusted returns during the non-event periods. The abnormal return equals to the daily cross-sectional market-adjusted return during the event period [−10, 10] minus the normal return during the non-event period. Then the variance of daily mean market-adjusted returns during the non-event period is used to test for the significance of abnormal returns during the event periods. The abnormal volume is defined as the ratio of actual trading volume each day during the event period to normal trading volume minus 1. The calculations of normal trading volume and test of significance for abnormal trading volume are similar to those for abnormal return.

3.3 Determinants of price discovery

In this study, we further construct a regression to find the determinants of price discovery across dual-class shares. Specifically, we examine whether the differences between control shares and public shares affect the price discovery of control shares over a [−20, 20] window around earnings announcements. The regression model is:

where PrcDisc is the information share of control shares based on Hasbrouck (1995) or the common factor weight using Harris et al. (2002) methods. The explanatory variables are defined as follows:

-

1.

PIN Ratio is the ratio of probability of informed trading (Easley et al. 1996) over [−20, 20] event window of control shares to that of public shares. A higher PIN ratio of a stock means a higher probability of informed trading for control shares of that stock than for public shares. This indicates a positive relation between PIN ratio and price discovery of control shares.

-

2.

Volume Ratio is the ratio of daily trading volume of control shares to that of public shares. As mentioned in Sect. 2.3, informed traders usually prefer to trade at the market with high liquidity in order to hide their transactions, which suggests that the informed trading increases with trading volume. Therefore, we predict that when the volume ratio of a stock is higher, informed traders choose control shares more often. Thus the price discovery of control shares should increase with the volume ratio.

-

3.

Spread Ratio is the ratio of daily percentage bid-ask spread of control shares to that of public shares. Many theoretical microstructure papers [e.g. Glosten and Milgrom (1985) and Copeland and Galai (1983)] suggest that when information asymmetry increases, market makers increase the bid-ask spread in order to compensate the increasing loss from trades with informed traders. This positive relation between information asymmetry and bid-ask spread is supported by many empirical evidences (Chiang and Venkatesh 1988; Lee et al. 1993; Welker 1995; Krinsky and Lee 1996; Chung and Charoenwong 1998; Mishra et al. 2009). Therefore, the bid-ask spread can be used as a measure of information asymmetry. A higher spread ratio of a stock may indicates a larger number of informed traders for control shares of that stock than for public shares, which suggests a positive relation between spread ratio and price discovery of control shares.

-

4.

Institutional Ownership Ratio is the ratio of institutional ownership of control shares to that of public shares at the beginning of the earnings announcement quarter. Literature suggests that institutional investors help disseminate information and decrease the mispricing [e.g. Chiang and Venkatesh (1988), El-Gazzar (1997), Jiambalvo et al. (2002), Ayers and Freeman (2003), O’Neill and Swisher (2003), Ali et al. (2008), Boehmer and Kelley (2009)]. A higher institutional ownership is associated with a higher informational efficiency of transaction prices and a lower degree of informed trading. In the case of dual-class firms, the institutional ownership of control shares is particularly important because it can reduce the information asymmetry more than the institutional ownership of public shares. Shareholders who own voting rights can have more access to corporate information and affect the disclosure policy. The information asymmetry decreases if the institutional ownership of control shares enhances the amount and quality of information available to the public. In this case, there are fewer sophisticated investors gathering private information and trading control shares due to the decreasing expected profits. Therefore, we predict that the price discovery of control shares decreases with the institutional ownership ratio.

-

5.

Volatility Ratio is the ratio of daily realized volatility of control shares to that of public shares, where daily realized volatility is the summation of squared 5-min returns on that day. Prior researchers suggest that volatility can result from public information, private information, or noisy trading and document mixed empirical results. The theoretical papers [e.g. Admati and Pfleiderer (1998), Kyle (1985)] usually posit that private information revealed through trades and results in volatility. Comparing the volatilities during trading hours versus non-trading hours, the empirical results are mixed. French and Roll (1986), Barclay et al. (1990), Stoll and Whaley (1990a) suggest that the volatility results from private information; while Jones et al. (1994), Chan et al. (1996), and Fleming et al. (2006) argue that public information contributes to the price volatility. Because the control shares and public shares are issued by the same firm, the difference of public information available between control shares and public shares is less likely to cause the changes of the volatility ratio. Therefore, we predict that the price discovery of control shares is positively associated with the volatility ratio if the volatility ratio changes due to the relative change of trading based on private information between control shares and public shares. On the contrary, if the change of the volatility ratio mainly reflects the relative change of noisy trading between the two shares, we should observe a negative relation between the volatility ratio and price discovery of control shares.

-

6.

Market Capitalization Ratio is the ratio of the natural logarithm of daily market value ($) of control shares to that of public shares. On the one hand, a higher market capitalization ratio may suggest a larger insider ownership. Demsetz (1986) and Chiang and Venkatesh (1988) argue that insider ownership boosts the profit potential from insider trading and increases the information asymmetry due to the managerial entrenchment. The high information asymmetry motivates sophisticated investors to gather private information actively and trade control shares due to the high expected profit. The increasing informed trading of control shares (either by insiders or by sophisticated investors who gather private information) contribute to price discovery of control shares. Therefore, the price discovery of control shares increases with market capitalization ratio.

On the other hand, because the price of control shares is usually very close to that of public shares, a higher market capitalization ratio may suggest more number of control shares available to public investors. Because the control shares are also listed on exchanges, outside investors can trade control shares. In Table 2, we find the average institutional ownership of control shares is 43 %, which suggests that there are still substantial outside investors holding control shares. Sophisticated outside investors who buy control shares can get the opportunity to exert pressure that improves performance and thus reduce the information asymmetry. In this case, the price discovery of control shares decreases with the market capitalization ratio.

-

7.

Cumulative Abnormal Return Ratio is the ratio of cumulative abnormal return over [−1, 1] event window of control shares to that of public shares. The cumulative abnormal return ratio reflects the relative magnitude of price reactions to earning announcements between control shares and public shares. A high cumulative abnormal return ratio suggests that the price reaction of control shares, relative to public shares, is high during the 3-day announcement period. If the high ratio is due to faster reaction of control shares than public shares, the price discovery of control shares should increase with the cumulative abnormal return ratio. On the contrary, if the high ratio results from less reaction of control shares than public shares prior to the announcement (i.e. during the period of [−10, −2]), the price discovery of control shares should decrease with the cumulative abnormal return.

4 Data, sample selection, and characteristics of sample

4.1 Data and sample selection

This study uses information from four major sources. The daily stock prices, trading volume, numbers of shares outstanding, and market capitalizations are obtained from the Center for Research in Security Prices (CRSP). The information about bid-ask spreads, numbers of trades, trade sizes is from the NYSE’s Trade and Quote (TAQ) databases. The earnings announcement dates and institutional ownership are collected from Compustat database and Thompson 13-F filling data, respectively.

In this study, we investigate the earnings announcements made by dual class firms from January 2002 to June 2008. The sample period is selected with an eye toward several events that may have affected the stock market reaction to new information during the past decade. The end of our study, June 2008, is chosen to avoid the period of the financial crisis. In the late 2008, the common stocks began the precipitous price decline. The economic and financial turmoil may have temporarily affected the way markets adjust to new information. The beginning year of 2002 is selected to exclude the impacts of adopting regulation fair disclosure (Reg FD) and decimalization in the early 2000s. On August 10, 2000, the US Securities and Exchange Commission (SEC) approved Reg FD which prohibits selective disclosure of information and requires publicly traded companies to disclose material information to all investors simultaneously. In 2000 the SEC also ordered the stock exchanges to phase in decimal pricing for listed stocks starting and mandated that all securities actually be priced in decimals no later than April 9, 2001. The adoptions of these two new rules may have affected the reactions of stock prices, trading volume, and price volatilities to the quarterly earnings announcements. For example, Bailey et al. (2003) and others report that the reaction of trading volume to earnings announcements increased after Reg FD, and that the volatility of returns following earnings announcements decreased due to the smaller tick size after decimalization. To avoid the above possible confounding events, we choose a sample period from January 2002 to June 2008.

Examining CRSP, TAQ, and SEC filings, we identity 62 firms which have two or more classes of common stocks outstanding during our sample period. We first review CRSP data for the years 2002–2008 and identify potential dual class corporations which have two or more common stock issues with the same first six-digit CUSIP numbers but different two-digit extensions. This procedure provides an initial sample of 434 two or more classes of common stock outstanding. We next discard issues of common stock for which no TAQ data are reported, which leaves us with 309 possible dual class corporations. Then we examine SEC filings for each of these corporations to determine whether or not it is indeed a dual class firm. This step identifies a sample of 88 dual class firms, including one firm with three classes of stock outstanding. On average, 56 % of the sample firms traded on the NYSE during 2002–2008, 33 % on NASDAQ, and 11 % on the AMEX. Among the 88 firms, the voting ratios of public shares to control share are higher than 1/10th for 21 firms, equal to 1/10th for 20 firms, and lower than 1/10th for 47 firms.

We obtain the dates of quarterly earnings announcements by the 88 firms from the Compustat database. If a company is not listed in Compustat, we check its earnings announcement dates from LexisNexis. Because sophisticated investors have incentives to gather private information and trade based on it only when they expect the profits are high enough to cover information costs and transaction costs, we may not observe active trading from these investors during earnings announcements periods if the announcements do not convey new information. Therefore, to examine sophisticated traders’ preference between public shares and control shares, we focus on the earnings announcements which convey new information to the public.

We define that an earnings announcement contains new information if one or both of the control shares and public shares have significantly market-adjusted returns during the 3-day event period from day −1 to day +1 at the 5 % significance level. Altogether our sample includes 148 quarterly earnings announcements (90 positive announcements and 58 negative announcements) that convey new information made by 62 dual class firms during the 25 quarters from January, 2002 through June, 2008.

Table 1 shows the market-adjusted return of earnings announcements that convey new information. For the announcements which convey positive news, the 3-day cumulative market adjusted return is 8.69 % for the control shares and 8.85 % for the public shares. The 3-day cumulative market-adjusted return for negative announcements is −10.24 % for control shares and −10.44 % for the public shares. In both positive and negative announcements, the price adjustments of control shares during the 3-day period are very close to those of public shares. The price adjustments in the 3-day period for both positive and negative events are very large, which suggests that the information asymmetry before these announcements is very high. Although sophisticated investors may not exactly identify firms with large announcement effects in advance, on average firms with higher information asymmetry attract more sophisticated investors due to the high potential profits of information gathering. Focusing on the announcements which convey new information, we can observe these investors’ choices between control shares and public shares more clearly.

4.2 Characteristics of the dual class firms

The characteristics of the 62 dual-class firms are presented in Table 2. For brevity purpose, we discuss the average characteristics of our sample. The analyses of medians are similar.Footnote 3 Panel A of Table 2 shows the sample excluding BRK. The sample contains 282 firm-year observations. The number of firms each year varies due to the IPOs of new dual-class firms, merger and acquisitions in which dual class firms are bought by another firms, and recapitalizations which combine different classes of a common stock into one. Consistent with prior studies, we find that control shares tend to have lower numbers of shares outstanding (86 vs. 184 million shares), smaller market capitalizations ($2,215 vs. $4,507 million), and slightly higher stock prices ($27.73 vs. $27.33) than public shares. The higher price of control share indicates that investors pay for voting rights. However, the mean and median share prices for the control shares and public shares are very close in most cases. An exception is Security Capital Group (SCZ), an REIT that was in the sample for the first 4½ months of 2002, and was acquired by GE Capital in May, 2002. One control share of SCZ equaled 50 public shares, so the price of a control share was $1,200 when the price of a public share was $25. Therefore, the large difference in the market value of the two classes of stock is mainly due to the difference of number of shares outstanding.

Panel A of table 2 also reveals that the control shares are less liquid than the public shares on a variety of dimensions. Control shares have higher bid-ask spreads, lower trading volume, lower annual turnover, fewer trades per year, and smaller trade size than public shares. The mean bid-ask spread for the control shares (1.2 %) is more than twice as large as the spared of the public shares (0.50 %). The average trading volume per year for control shares (128 million shares) is about half of the average volume of public shares (244 million shares). The average annual turnover is approximately 0.81 times per year for control shares, compared to the turnover of 1.75 times per year for public shares. The average number of trades per year is about 322 thousands for control shares with an average trade size of 366 shares, compared to 407 thousand trades per year with an average size of 513 shares for public shares. The result suggests that investors who trade control shares take more liquidity risk than those who trade public shares.

The percentage institutional ownership of the public shares is much higher than that of control shares. On average, the percentage of the public shares owned by institutions is about 74 %, compared to only 43 % for the control shares. Apparently institutional investors who invest in dual class corporations are more interested in the liquidity of the market for the public shares than in the greater voting power of the control shares. However, the institutional ownership of 43 % for control shares also suggest that although corporate insiders may hold the majority of control shares, there are still a substantial number of sophisticated investors investing in control shares.

5 Empirical results

5.1 Price discovery between control shares and public shares during the earnings announcements period

The changes of price discovery between control shares and public shares around quarterly earnings announcements are reported in Table 3. Because the results of price discovery evaluated by common factor weights are very similar to those evaluated by information shares, for brevity purpose we focus on the analysis of information shares. We find two interesting results. First, although the annual trading volume of control shares is just about 50 % of that of public shares, the control shares still play an important role in price discovery. For positive events, the average information share is 46.6 % (ranging from 41 to 53.8 %) for control shares and 53.4 % (ranging from 46.2 to 59 %) for public shares during the period [−10, 10]. The low trading volume associated with the substantial information share for control shares suggest that the information content per control share traded may be higher than that per public share traded. For negative events, on average 40.5 % (varying from 31.1 to 47.8 %) of the price discovery occurs from transactions of control shares; while 59.5 % (varying from 52.2 to 68.9 %) occurs from trades of public shares.

Second, we find that the information share of control shares increases prior to the announcements for both events. The trend can be observed clearly from Figs. 1 and 2 which depict the information shares graphically during the period [−10, 10] for positive events and negative events, respectively. For positive events, the information share of control shares increases on day −7 and decreases on day −1. During the period [−6, −2], the information shares of control shares are larger than public shares (i.e. higher than 50 %), although the differences between control shares and public shares are not significant. For negative events, the information share of control shares increases on day −7 and decreases on day 3. The information shares of control shares are significantly lower than those of public shares on most days during the period [−10, −8] and [4, 10]. However, during the period [−7, 3], the differences between two share classes are insignificant. The results in Table 3 suggest that which suggests that before the earnings announcements there is increasing number of sophisticated investors trading control shares based on private information for both positive and negative events.

Information share around significantly positive announcements. This figure plots the midpoints of the upper and lower bounds of information shares of both control shares and public shares classes around earnings announcements for significantly positive and negative events for the 62 dual-class sample firms between January 1, 2002 and June 30, 2008. We use ask quotes sampled at one-second interval to calculate information share based on Hasbrouck (1995). Control shares are the superior voting class and public shares are the inferior voting class. Significantly positive events are earnings announcements for which either both control shares and public shares have significantly negative cumulative market-adjusted returns during [−1, 1] announcement period or the announcement period return is significant for one voting class but is insignificant for the other voting class. Significance is evaluated at the 5 % level

Information share around significantly negative announcements. This figure plots the midpoints of the upper and lower bounds of information shares of both control shares and public shares classes around earnings announcements for significantly negative events for the 62 dual-class sample firms between January 1, 2002 and June 30, 2008. We use ask quotes sampled at one-second interval to calculate information share based on Hasbrouck (1995). Control shares are the superior voting class and public shares are the inferior voting class. Significantly negative events are earnings announcements for which either both control shares and public shares have significantly negative cumulative market-adjusted returns during [−1, 1] announcement period or the announcement period return is significant for one voting class but is insignificant for the other voting class. Significance is evaluated at the 5 % level

5.2 Trading volume reaction to new information

The trading volume reactions to new information are provided in Table 4, Figs. 3 and 4. Panel A of Table 4 and Fig. 3 show the volume adjustments to positive announcements. During the period [−10, 10], the cumulative abnormal volume increases more for control shares than for public shares. The cumulative abnormal volume by day −1 is 1.094 for control shares and only −0.731 for public shares. During the period [0, 1] the cumulative abnormal volume increases to 4.292 for control shares and to 2.331 for public shares. After day 1, the cumulative abnormal volume keeps increasing for both control shares (to 6.373) and public shares (to 4.296). The results indicate that after the earnings announcements, the cumulative abnormal volume increases by similar amount for both control shares and public shares, However, before the announcements, the control shares demonstrate positive cumulative abnormal volume; while the public shares show negative cumulative abnormal volume. The positive cumulative abnormal volume of control shares suggests that the increase of informed trades is larger than the decrease if liquidity trades. Our results provide evidence that before earnings announcements when liquidity traders withdraw or postpone their trades due to high information asymmetry, informed traders trade actively for control shares, but not for public shares.

Cumulative abnormal trading volumes for significantly positive events. This figure plots cumulative abnormal trading volumes of control shares and public shares for significantly positive earnings announcements from event day −10 to event day 10. Control shares are the superior voting class and public shares are the inferior voting class. We measure daily abnormal trading volume as the ratio of actual trading volume on that day to normal trading volume minus 1, where normal trading volume is the average daily trading volume for the stock during the [−60, −11] and [11, 60] non-announcement periods. Significantly positive announcements are earnings announcements for which either both control shares and public shares have significantly positive cumulative market-adjusted returns during [−1, 1] announcement period or the announcement period returns are significantly positive for one voting class but insignificant for the other. Significance is evaluated at the 5 % level. There are 90 significantly positive earnings announcements for the 62 dual-class sample firms between January 1, 2002 and June 30, 2008

Cumulative abnormal trading volumes for significantly negative events. This figure plots cumulative abnormal trading volumes of control shares and public shares for significantly negative earnings announcements from event day −10 to event day 10. Control shares are the superior voting class and public shares are the inferior voting class. We measure daily abnormal trading volume as the ratio of actual trading volume on that day to normal trading volume minus 1, where normal trading volume is the average daily trading volume for the stock during the [−60, −11] and [11, 60] non-announcement periods. Significantly negative announcements are earnings announcements for which either both control shares and public shares have significantly negative cumulative market-adjusted returns during [−1, 1] announcement period or the announcement period returns are significantly negative for one voting class but insignificant for the other. Significance is evaluated at the 5 % level. There are 58 significantly negative earnings announcements for the 62 dual-class sample firms between January 1, 2002 and June 30, 2008

Panel B of Table 4 presents the volume reaction to negative announcements and Fig. 4 is its graphic depiction. By day −1, the cumulative abnormal volume of control shares is higher than that of public shares (−0.206 vs. −1.183). From day 0 to day 1, the cumulative abnormal volume increases to 3.121 for control shares and to 2.537 shares. During the period [2, 10], the cumulative abnormal volume increases to 4.917 for control shares and to 7.081 for public shares. Unlike the volume adjustments prior to good events, the volume reactions before bad events are negative for both control and public shares. The decrease in volume before negative events suggests that the withdrawal of liquidity traders outweighs the emergence of informed traders for both share classes. However, we still find that the cumulative abnormal trading volume of control shares is higher than that of public shares before the announcement (that is, the decrease in volume is smaller for control shares than for public shares). The higher cumulative abnormal volume of control shares prior to the announcements indicate that there are still more informed traders emerging for control shares than for public shares. After the announcement, the abnormal volume of public shares increases much more than that of control shares, especially during the period [4, 10].

The large increase in volume of public shares during this period may be driven by large shareholders who are restricted to trade before this period. Investors with stakes of 10 % or more are considered as insiders. Based on this definition, institutional investors who hold more than 10 % of public shares can also be considered as insiders. Bettis et al. (2000) find that over 92 % of firms have policies restricting the trading by corporate insiders. These corporate insider trading policies often prohibit insiders from trading until several days after earnings announcements (e.g. 10 day period starting at 3 days after earnings announcements). The increasing informed trading of control shares is consistent with the increasing price discovery of control shares presented in Table 3.

5.3 Stock price reaction to new information

The stock price reactions to new information during the earnings announcements period for different classes of stocks are summarized in Table 5. Figures 5 and 6 are the graphic depictions of the daily cumulative abnormal returns for positive and negative announcements, respectively. We find although the price reaction of control shares is very close to that of public shares for both positive and negative events, control shares seem to lead public shares prior to positive events. Panel A of Table 5 and Fig. 5 indicate that for positive announcements, control shares react to upcoming event more than public shares by day −2 (−0.797 vs. −1.08 %). At the end of day +1, 89.42 % of the total price adjustment over the 21-day event period [−10, 10] for control shares (7.89 % out of 8.83 %) and 85.87 % of the total price adjustment for public shares (7.77 % out of 9.05 %) have taken place, which suggests that control shares experience a faster price adjustment than public shares. After day +1, the cumulative abnormal returns of control shares and public shares increase with similar speeds.

Cumulative abnormal returns for significantly positive events. This figure plots cumulative abnormal returns of control shares and public shares for significantly positive earnings announcements from event day −10 to event day 10. Control shares are the superior voting class and public shares are the inferior voting class. Significantly positive announcements are earnings announcements for which either both control shares and public shares have significantly positive cumulative market-adjusted returns during [−1, 1] announcement period or the announcement period returns are significantly positive for one voting class but insignificant for the other. Significance is evaluated at the 5 % level. There are 90 significantly positive earnings announcements for the 62 dual-class sample firms between January 1, 2002 and June 30, 2008. We measure market adjusted return by subtracting the return on the CRSP equally weighted index from the daily stock return on the same day. We calculate mean market adjusted return for all event firms on each day during the [−60, −11] and [11, 60] non-announcement periods. We then use the time series mean and variance of market adjusted return in the non-announcement periods to test for abnormal market adjusted return around earnings announcements

Cumulative abnormal returns for significantly negative events. This figure plots cumulative abnormal returns of control shares and public shares for significantly negative earnings announcements from event day −10 to event day 10. Control shares are the superior voting class and public shares are the inferior voting class. Significantly negative announcements are earnings announcements for which either both control shares and public shares have significantly negative cumulative market-adjusted returns during [−1, 1] announcement period or the announcement period returns are significantly negative for one voting class but insignificant for the other. Significance is evaluated at the 5 % level. There are 58 significantly negative earnings announcements for the 62 dual-class sample firms between January 1, 2002 and June 30, 2008. We measure market adjusted return by subtracting the return on the CRSP equally weighted index from the daily stock return on the same day. We calculate mean market adjusted return for all event firms on each day during the [−60, −11] and [11, 60] non-announcement periods. We then use the time series mean and variance of market adjusted return in the non-announcement periods to test for abnormal market adjusted return around earnings announcements

On the contrary, for the announcements which convey negative news, the control shares do not react faster than that of public shares. Panel B of Table 5 and Fig. 6 suggest that by day −2, the market-adjusted return decreases by 1.15 % for control shares and by 1.36 % for public shares. At the end of day +1, 98.17 % of the total price adjustment for control shares (−11.39 % out of −11.60 %) and 99.37 % of the total price adjustment for public shares (−11.80 % out of −11.88 %) have occurred. During the period [2, 10], the cumulative abnormal market-adjusted return of control shares decreases by 0.21 %, compared to a decrease of 0.08 % for public shares. We find during the period [−10, 10], the price reaction of control shares is smaller (and may be slower) than that of public shares, although the differences between two share classes are small. Our results for negative events are not necessarily contradictory to the findings in Tables 3 and 4 which show increasing informed trading for control shares before earnings announcements.

We provide two possible explanations. First, although the price discovery of control shares increases during the period [−7, 3], the information share of control shares is still lower than that of public shares (e.g. 42 vs. 58 %). This suggests that price discovery still occurs more frequently for public shares than for control shares. Therefore, even though the informed trading of control shares increases more than that of public shares, the price reaction of public shares may be still faster than that of control shares. Second, the difference of stock prices between control shares and public shares is also affected by the value of voting rights. Easterbrook and Fischel (1983) argue that the premium of voting over nonvoting shares represents the opportunity of those with votes to improve the performance of the corporation. The value of voting rights may change over time. Cox and Roden (2002) suggest that even though there is no direct threat of a takeover, voting rights should have value if they provide outside shareholders (e.g. mutual fund managers or coalitions of individual investors) opportunities to exert pressure on management to boost performance. They further find evidence that the premium of voting over nonvoting shares decreases with firm performance (measured by ROA and ROE). Therefore, for negative events, the smaller total price reaction of control shares to bad events may be partially driven by the increase in value of voting rights. Short sales constraints may be another explanation for smaller price reaction to negative news for control shares because control shares are usually subject to more short sales constraints than public shares. However, given the average institutional ownership of 43 % for control shares, we think a mispricing lasting for days due to short-sales constraints may not be very possible.

Altogether, Tables 3, 4, and 5 support the superior information hypothesis. Although the price discovery of control shares is lower than that of public shares, there is still substantial price discovery that occurs in the market of control shares (46.6 % for positive events and 40.5 % for negative events). For positive events, the price discovery of control shares increases before the earnings announcements periods when the cumulative abnormal trading volume of control shares rises (relative to that of pubic shares). The price discovery of control shares is higher than public shares during the period [−6, −2] when the abnormal return of control shares is slightly higher than that of public shares. For negative events, we still find the price discovery of control shares increases when control shares experience more abnormal trading volume than public shares. The results suggest that there are still increasing informed traders trading control shares before bad news. However, due to the smaller price discovery of control shares than public shares and/or possible changes in value of voting rights, we do not find that the control shares lead public shares. The evidence suggests that there are an increasing number of sophisticated informed traders who possess superior information trading control shares, resulting in increasing price discovery and rising abnormal volume (and possible faster price adjustments just for positive events). Our results support the superior information hypothesis but not the entrenchment hypothesis.

5.4 Factors affecting price discovery of control shares

The determinants of price discovery of control shares are reported in Table 6. We still focus on the analysis of information shares. The analyses of common factor weight are similar. Consistent with our predictions, we find the price discovery of control shares increases significantly with volume ratio and spread ratio. When the PIN ratio, volume ratio, and spread ratio increase by 1 %, the information share of control shares increases by 0.002, 0.254 and 0.003 %, respectively. The results suggest that higher probability of informed trading ratio, higher trading volume ratio, and higher bid-ask spread ratio of control shares relative to public shares contribute positively to the price discovery of control shares. We also find that the price discovery decreases with the institutional ownership ratio. An increase of 1 % in institutional ownership ratio decreases the information share of control shares by 0.156 %. This suggests that the institutional ownership reduces the information asymmetry and improves the price efficiency. A high institutional ownership of control shares relative to public shares increases the price efficiency and thus reduces informed trading of control shares. The volatility ratio is insignificantly and negatively related to price discovery of control shares. This finding indicates that the changes of volatility ratio may result from noisy trading, instead of trading based on private information. The significantly negative relation between market capitalization ratio and price discovery of control shares suggests that when there are many control shares available to outside investors (relative to public shares), the information asymmetry decreases and price efficiency of control shares improves. An increase of 1 % in relative market capitalization decreases the information share of control shares by 0.466 %. Finally, we don’t find a significant coefficient for cumulative abnormal return ratio. The insignificant result may be due to the very small difference of cumulative abnormal returns between public shares and control shares across all firms around three-day event period [−1, 1].

6 Concluding remarks

This paper investigates the price discovery between control shares (the superior voting class) and public shares (the inferior voting class) issued by dual-class firms around quarterly earnings announcements periods. Theoretical market microstructure papers suggest that when there are multiple markets for one asset, both informed and uninformed traders prefer to trade in the place where other uninformed investors prevail, which suggests that both informed and uninformed traders prefer liquid public shares if voting rights are not considered. Due to the high prices, large transaction costs, and low liquidity associated with control shares, investors who buy control shares desire voting rights. They may be people who seek private benefits of control or sophisticated investors who want to engage in monitoring the management. The entrenchment hypothesis posits that traders of control shares focus on the private benefits of control and do not trade based on private information. The hypothesis suggests that the price discovery occurs mainly in the market of public shares. Prices of public shares react to new information faster than those of control shares. An increase in trading volume of control shares is not necessarily associated with increasing price discovery of control shares. The superior information hypothesis suggests that traders of control shares are sophisticated investors who own superior information and trade based on it. This hypothesis suggests that where price discovery occurs depends on the relative number of informed investors trading two classes. The price discovery of control shares increases with the trading volume of control shares and the speed of price reaction to new information for one class depends on the price discovery of that class.

Examining 148 earnings announcements made by 62 dual-class firms from January 2002 to June 2008, we find evidences supporting the superior information hypothesis. There are substantial informed investors trading both control shares and public shares. The average price discovery of control shares is 46.6 % for positive events and 40.5 % for negative events during the periods [−10, 10]. Before the earnings announcements, the price discovery and abnormal trading volume of control shares increase together which indicates more sophisticated investors who possess superior information trading control shares. From a regression model, we further find that the price discovery of control shares increases with relative volume of control shares to public shares and relative bid-ask spread but decreases with relative institutional ownership and relative volatility. Our results suggest that superior voting class which is traded publicly contributes to price discovery substantially, especially before quarterly earnings announcements when the information asymmetry is high. The increasing price discovery is mainly from sophisticated investors who gather private information and want to monitor the performance of the dual-class companies. Therefore, a secondary market of control shares not only fosters the price efficiency, but also enhances public monitoring on the corporate management. Our study sheds new light on the issues of price discovery and corporate governance of dual-class firms.

Our study raises some interesting questions related to dual-class firms which issue two classes of common stocks publicly. Gompers et al. (2010) document that about 6 % of publicly-traded firms are dual class firms, among which about 85 % have at least one untraded class of common stock which is almost always the superior voting class. What affects the listing decision of control shares, whether there are differences of IPO underpricing/long-term performance among dual-class firms which issue both classes publicly, dual-class firms which have untraded control, and single-class firms, and whether listing control shares can mitigate agency problem and reduce managerial extraction of private benefits of control require future research. In future work, It would also be interesting to extend our current analysis in the special setting of Chinese A and B shares as analyzed in Heaney et al. (1999).

Notes

References

Admati AR, Pfleiderer P (1998) A theory of intraday patterns: volume and price variability. Rev Financ Stud 1:3–40

Ali A, Klasa S, Li OZ (2008) Institutional stakeholdings and better-control traders at earnings announcements. J Account Econ 46:47–61

Amin KI, Lee CMC (1997) Option trading, price discovery, and earnings news dissemination. Contemp Account Res 14:153–192

Ayers BC, Freeman RN (2003) Evidence that analyst following and institutional ownership accelerate the pricing of future earnings. Rev Acc Stud 8:47–67

Bailey W, Li H, Mao C, Zhong R (2003) Regulation fair disclosure and earnings information: market, analyst, and corporate responses. J Financ 58:2487–2514

Baillie RT, Booth GG, Tse Y, Zabotina T (2002) Price discovery and common factor models. J Financ Mark 5:309–321

Bamber LS, Barron OE, Stevens DE (2011) Trading volume around earnings announcements and other financial reports: theory, research design, empirical evidence, and directions for future research. Contemp Account Res 28:431–471

Barclay MJ, Hendershott T (2003) Price discovery and trading after hours. Rev Financ Stud 16:1041–1073

Barclay MJ, Litzenberger RH, Warner JB (1990) Private information, trading volume, and stock-return variances. Rev Financ Stud 3:233–253

Berle AA, Means GC (1932) The modern corporation and private property. Macmillan, New York

Bettis JC, Coles JL, Lemmon ML (2000) Corporate policies restricting trading by insiders. J Financ Econ 57:191–220

Black F (1986) Noise. J Financ 41:529–543

Blume ME, Goldstein MA (1997) Quotes, order flow, and price discovery. J Financ 52:221–244

Boehmer E, Kelley EK (2009) Institutional investors and the informational efficiency of prices. Rev Financ Stud 22:3563–3594

Bohl MT, Salm CA, Schuppli M (2011) Price discovery and investor structure in stock index futures. J Futures Mark 31:282–306

Brown SJ, Warner JB (1985) Using daily stock returns: the case of event studies. J Financ Econ 14:3–31

Cao C, Ghysels E, Hatheway F (2000) Price discovery without trading: evidence from the Nasdaq preopening. J Financ 55:1339–1365

Chae J (2005) Timing information, information asymmetry, and trading volume. J Financ 60:413–442

Chakravarty S, Gulen H, Mayhew S (2004) Informed trading in stock and option markets. J Financ 59:1235–1257

Chan KC, Fong W, Kho B, Stulz R (1996) Information, trading, and stock return: lessons from dual-listed securities. J Bank Financ 20:1161–1187

Chiang R, Venkatesh PC (1988) Insider holdings and perceptions of information asymmetry: a note. J Financ 43:1041–1048

Chou RK, Chung H (2006) Decimalization, trading costs, and information transmission between ETFs and index futures. J Futures Mark 26:131–151

Choy SK, Zhang H (2010) Trading costs and price discovery. Rev Quant Financ Acc 34:37–57

Chung KH, Charoenwong C (1998) Insider trading and the bid-ask spread. Financ Rev 33:1–20

Claessens S, Djankov S, Fan JPH, Lang LHP (2002) Disentangling the incentive and entrenchment effects of large shareholdings. J Financ 58:81–112

Copeland T, Galai D (1983) Information effects on the bid-ask spread. J Financ 38:1457–1469

Cox SR, Roden DM (2002) The source of value of voting rights and related dividend promises. J Corp Financ 8:337–351

DeAngelo H, DeAngelo L (1985) Managerial ownership of voting rights: a study of public corporations with dual-classes of common stock. J Financ Econ 14:33–69

Demsetz H (1986) Corporate control, insider trading, and rates of return. Am Econ Rev 76:313–316

Demsetz H, Lehn K (1985) The structure of corporate ownership: causes and consequences. J Polit Econ 93:1155–1177

Dimitrov V, Jain PC (2006) Recapitalization of one class of common stock into dual-class: growth and long-run stock returns. J Corp Financ 12:342–366

Doidge C (2004) US cross-listings and the private benefit of control: evidence from dual-class firms. J Financ Econ 72:519–553

Doidge C, Karolyi GA, Lins K, Miller DP, Stulz RM (2009) Private benefits of control, ownership, and the cross-listing decision. J Financ 64:425–466

Easley D, O’Hara M (1992) Time and the process of security price adjustment. J Financ 47:577–605

Easley D, Kiefer N, O’Hara M, Paperman J (1996) Liquidity, information, and infrequently traded stocks. J Financ 51:1405–1436

Easterbrook FH, Fischel DR (1983) Voting in corporate law. J Law Econ 26:395–427

El-Gazzar SM (1997) Predisclosure information and institutional ownership: a cross-sectional examination of market revaluations during earnings announcement periods. Account Rev 73:119–129

Elliott J, Morse D, Richardson G (1984) The association between insider trading and information announcements. RAND J Econ 15:521–536

Eun CS, Sabherwal S (2003) Cross-border listings and price discovery: evidence from US-listed Canadian stocks. J Financ 58:549–576

Fleming J, Ostdiek B, Whaley RE (1996) Trading costs and the relative rates of price discovery in stock, futures, and option markets. J Futures Mark 16:353–387

Fleming J, Kirby C, Ostdiek B (2006) Information, trading, and volatility: evidence from weather-sensitive markets. J Financ 61:2899–2930

Francis J, Schipper K, Vincent L (2005) Earnings and dividend informativeness when cash flow rights are separated from voting rights. J Account Econ 39:329–360

French KR, Roll R (1986) Stock return variances: the arrival of information and the reaction of traders. J Financ Econ 17:5–26

Givoly D, Palmon D (1985) Insider trading and the exploitation of inside information: some empirical evidence. J Bus 58:69–87

Glosten LR, Milgrom PR (1985) Bid, ask and transaction prices in a specialist market with heterogeneously informed traders. J Financ Econ 14:71–100

Gompers PA, Ishii J, Metrick A (2010) Extreme governance: an analysis of dual-class firms in the United States. Rev Financ Stud 23:1051–1088

Graham JR, Koski JL, Loewenstein U (2006) Information flow and liquidity around anticipated and unanticipated dividend announcements. J Bus 79:2301–2336

Grossman SJ, Hart OD (1988) One share-one vote and the market for corporate control. J Financ Econ 20:175–202

Harris M, Raviv A (1988) Corporate governance: voting rights and majority rules. J Financ 20:203–235

Harris FH, McInish TH, Shoesmith G, Wood RA (1995) Cointegration, error correction and price discovery on informationally-linked security markets. J Financ Quant Anal 30:563–579

Harris FH, McInish TH, Wood RA (2002) Security price adjustment across exchanges: an investigation of common factor components for Dow stocks. J Financ Mark 5:277–308

Harvey CR, Lins KV, Roper AH (2004) The effect of capital structure when expected agency costs are extreme. J Financ Econ 74:3–30

Hasbrouck J (1995) One security, many markets: determining the contributions to price discovery. J Financ 50:1175–1199

Hasbrouck J (2003) Intraday price formation in US equity index markets. J Financ 58:2375–2399

Heaney RA, Powell JG, Shi J (1999) Share return seasonalities and price linkages of Chinese A and B shares. Rev Pac Basin Financ Mark Polic 02:205–229

Irvine P, Lipson M, Puckett A (2007) Tipping. Rev Financ Stud 20:741–768

Jensen MC, Meckling WH (1976) Theory of the firm: managerial behavior, agency costs, and ownership structure. J Financ Econ 3:305–360

Jiambalvo J, Rajgopal S, Venkatachalam M (2002) Institutional ownership and the extent to which stock prices reflect future earnings. Contemp Account Res 19:117–145

Jones CM, Kaul G, Lipson M (1994) Transactions, volume, and volatility. Rev Financ Stud 4:631–651

Jong FD (2002) Measures of contributions to price discovery: a comparison. J Financ Mark 5:323–327

Kadapakkam PR, Misra L, Tse Y (2003) International price discovery for emerging market stocks: evidence from Indian GDRs. Rev Quant Financ Acc 21:179–199

Ke B, Petroni K (2004) How informed are actively trading institutional investors? Evidence from their trading behavior before a break in a string of consecutive earnings increases. J Acc Res 42:895–927

Ke B, Huddart S, Petroni K (2003) What insiders know about future earnings and how they use it? Evidence from insider trades. J Account Econ 35:315–346

Kim O, Verrecchia R (1991) Market reaction to anticipated announcements. J Financ Econ 30:273–309

Kim J, Lin J, Singh A, Yu W (2007) Dual-class splits and stock liquidity. Working paper, Louisiana State University

Krinsky I, Lee J (1996) Earnings announcements and the components of the bid-ask spread. J Financ 51:1523–1535

Kyle AS (1985) Continuous auctions and insider trading. Econometrica 53:1315–1335

Lee CMC, Mucklow B, Ready MJ (1993) Spreads, depths, and the impact of earnings information: an intraday analysis. Rev Financ Stud 6:345–374

Lemmon ML, Lins KV (2003) Ownership structure, corporate governance, and firm value: evidence from the East Asian financial crisis. J Financ 58:1445–1468

Leuz C, Nanda D, Wysocki PD (2003) Earnings management and investor protection: an international comparison. J Financ Econ 69:505–527

Li T, Ng L, Zaiats N, Zhang B (2012) Information environment, earnings management and dual-class firms: a cross-country analysis. Working paper, University of Wisconsin-Milwaukee

Lins K (2003) Equity ownership and firm value in emerging markets. J Financ Quant Anal 38:159–184

Masulis RW, Wang C, Xie F (2009) Agency problems at dual-class companies. J Financ 64:1697–1727

McNichols M, Trueman B (1994) Public disclosure, private information collection, and short-term trading. J Account Econ 17:69–94

Milgrom P, Stokey N (1982) Information, trade and common knowledge. J Econ Theor 26:17–27

Mishra S, Rowe W, Prakash A, Ghosh DK (2009) Spread behavior around board meetings for firms with concentrated insider ownership. J Financ Mark 12:592–610

Moshirian F, Nguyen HG, Pham PK (2012) Overnight public information, order placement, and price discovery during the pre-opening period. J Bank Financ 36:2837–2851

O’Neill M, Swisher J (2003) Institutional investors and information asymmetry: an event study of self-tender offers. Financ Rev 38:197–211

Schultz P, Shive S (2010) Mispricing of dual class shares: profit opportunities, arbitrage, and trading. J Financ Econ 98:524–549

Stoll HR, Whaley RE (1990a) Stock market structure and volatility. Rev Financ Stud 3:37–71

Stoll HR, Whaley RE (1990b) The dynamics of stock index and stock index futures returns. J Financ Quant Anal 25:441–468

Tinaikar S (2009) Executive compensation disclosure and private control benefits: a comparison of US and Canadian dual class firms. Working paper, University of Florida

Tse Y (1999) Price discovery and volatility spillovers in the DJIA index and futures markets. J Futures Mark 19:911–931

Welker M (1995) Disclosure policy, information asymmetry, and liquidity in equity market. Contemp Account Res 11:801–827

Yan B, Zivot E (2010) A structural analysis of price discovery measures. J Financ Mark 13:1–19

Acknowledgments

We thank the Editor, Cheng-Few Lee, and two anonymous referees for helpful comments and suggestions. We also thank Edward Dyl for his valuable inputs in the paper. The usual disclaimer applies.

Author information

Authors and Affiliations

Corresponding author

Appendix: Characteristics of Berkshire Hathaway

Appendix: Characteristics of Berkshire Hathaway

The summary statistics of Berkshire Hathaway is shown in Panel B of Table 2. BRK is different from other dual class firms in many ways due to its unique background of creating its Class B shares. Most dual class ownership arrangements occur when firms raise money from outside investors in their IPOs. On the contrary, BRK’s dual class ownership was developed about 20 years after its IPO in 1976. The average stock price of BRK increased from $67 in 1976 to over $33,000 per share in 1995, with an annual return of a stunning 38.6 %. Although a large number of individual investors would have liked to invest in BRK to benefit from Mr. Buffet’s investment prowess, they were deterred by BRK’s high stock price until an investment firm announced its intention to create a trust whose portfolio would consist entirely of BRK shares. The investment trust allowed individual investors to buy its shares for as little as $1,000. Warren Buffet and BRK’s board of directors adamantly opposed the creation of the Berkshire-only investment trusts. Having BRK go a secondary equity offering (SEO) of Class B stock with a much lower share price was Warren Buffet’s way of preempting the market for these investment trust shares.