Abstract

We examine bulk discounts, which are claimed to explain the Deaton and Paxson puzzle about household size and food demand, and which may matter to household behavior studied in other literatures. Most previous studies use unit values, which are subject to several biases and reflect economizing choices made by households, so may not reliably estimate the bulk discount schedule. Instead, individual transaction records in household expenditure diaries are used, which report expenditure, quantity, brand, unit size and number purchased per transaction. The bulk discount schedule is estimated for four foods (rice, canned meat, canned fish and chicken) that make up one-third of the total food budget in a survey in urban Papua New Guinea. For each food we use the dominant brand(s) so there is no quality variation and the estimated price schedule only reflects discounts due to variations in purchase quantity. All foods have precisely measured but small elasticities of unit price with respect to quantity purchased.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

An enduring puzzle about household behavior, particularly in poor countries, concerns the relationship between household size and the demand for food. The puzzle is that the budget share for food falls (especially for the poor) as household size rises at constant per capita consumption (Deaton and Paxson 1998). Larger households should have higher food demand, from an effective income increase from the sharing of public goods. Hence, food budget shares should rise with household size, especially for poor people whose income elasticity of food demand is highest.

In this paper we study a mechanism—bulk buying discounts—that Abdulai (2003) claims can explain the Deaton and Paxson puzzle. The idea is that these discounts let larger households spend less on food even as they consume more. In terms of evidence, Abdulai finds lower food unit values (expenditures over quantities) for bigger households and claims that this shows that they use bulk discounts to lower their food costs, resulting in a lower food budget share. Our focus on this mechanism is not because it is more plausible than the other mechanisms proposed as solutions for the puzzle.Footnote 1 In fact, we find that bulk discounts are far too small to generate much difference between large and small households in the price paid for food. Moreover, unit values are an unreliable basis for estimating the bulk discount schedule, as we show below.

We study bulk discounts because they may matter to household behaviour related to several literatures, including the Deaton and Paxson puzzle. One of these literatures is about whether the poor pay more for food. For example, Rao (2000) claims that the poor in rural India are liquidity constrained and so have to buy small quantities on each purchase occasion and end up paying more for food than do the rich; adjusting for this effect, the Gini coefficient for real income is 12–23 percent higher than for nominal income. Similarly, in Colombia the unit values for rice, beans and carrots are up to 27 percent higher when households purchase the smaller units typically used by the poor (Attanasio and Frayne 2006). Bulk discounts also may matter to price index calculation, even for studies that are not necessarily concerned with differences in the cost of living for the poor compared to other households (Griffith et al. 2009).

A problem with evidence on bulk discounts from poor countries is the use of unit values, which represent combined effects of several consumer choices, so it is hard to identify a single effect, like bulk discounting. For example, it has long been known that poorer households have lower unit values because they buy lower quality items (Prais and Houthakker 1955; Deaton 1988), so unit values will reflect combined effects of quality choice and any inability to capture bulk discounts. It is less widely recognized that buying in bulk alters the relative price of quality, in the same way that adding a fixed transport cost alters the price of quality (Alchian and Allen 1967). Since the costs that a seller incurs for small quantity sales, such as repackaging costs, should be the same per unit weight for high quality and low quality items, the relative price of high quality items will be cheaper in small packages than in larger ones.Footnote 2 Perhaps because of the complex set of consumer choices that influence unit values, when they are used as a proxy for prices they tend to provide a different answer than when surveys of prices in stores and markets are used, as has been found in studies of ‘do the poor pay more’ (Kaufman et al. 1997; Gibson and Kim 2013).

Another problem is that unit values aggregate over purchase occasions during the reference period of a survey, obscuring how much was bought in each transaction, but it is at transaction level that bulk discounts occur. Another problem for methods using unit values is that attempts to identify the price schedule by instrumenting for demand face the problem that some of the commonly used instruments, like family size and composition, also affect the opportunity cost of shopping more frequently to search for lower prices (McKenzie and Schargrodsky 2011).

A largely neglected source of data on bulk discounts is the record of individual transactions in expenditure diaries. These diaries are used in surveys in many poor countries and typically ask respondents to record expenditure and quantity for each transaction but also the brand (if available), unit size and the number of units purchased on each occasion. Transaction-level data allow quality to be held constant by restricting attention to the same brand and specification, and are the right level of aggregation for estimating bulk discount schedules, which depend on the amount purchased on each occasion rather than the total amount purchased over some period. In contrast, unit values from recall surveys treat a single ten kilogram purchase that may attract a bulk discount as identical to buying one kilogram per day for 10 days, which should not give any bulk discount.

Our empirical results use individual transactions from a diary-keeping survey in urban Papua New Guinea to estimate the bulk discount schedule for four foods that make up one-third of the total food budget (rice, chicken, canned meat and canned fish). The regressions for each food only use data for the dominant brand(s) so no quality variation confounds the results.Footnote 3 All four foods have precisely measured but small elasticities of unit price with respect to quantity purchased. It is also true that the poor, on average, buy smaller quantities in each transaction. Thus, the overall effect is that they face slightly higher prices; doubling household income would reduce the unit price paid for these four foods by one percent. The bulk discount schedule is also fairly flat with respect to household size; it would take a doubling of household size to get a 1.2 percent fall in average food prices paid. This very modest effect of household size suggests that bulk discounts cannot provide an explanation for the Deaton and Paxson puzzle.

These transaction-level estimates are contrasted with estimates obtained by applying approaches used elsewhere with unit values. The unit value methods give inaccurate estimates of the bulk discount schedule, either for estimating whether the poor pay more for food or for estimating how household size affects pecuniary economies of scale. Moreover, we show that poor people often buy more than one of a small-sized unit in the same transaction, which suggests that they had enough cash on hand to buy a single larger unit at a cheaper price per unit weight if they had so desired. Hence, liquidity constraints may not be the only explanation for why the poor buy smaller sized units. We suggest a behavioral explanation based on self-control issues in settings where reciprocal obligations require households to feed all who come to their table.

Our approach is unusual, in using transaction-level data from diaries, but a few other studies use similar data. Beatty (2010) uses transactions from the British Expenditure and Food Survey diaries and finds bulk discounts for some foods. These foods are more important in the budgets of the poor, so the poor pay less than average for food, contrary to the literature that the ‘poor pay more’. In the results below, a similar instrumental variables specification to Beatty (2010) gives imprecise estimates, perhaps due to demographic variables used as instruments not satisfying exclusion restrictions since they also affect the ability of households to search for lower prices.

Another closely related paper is Dillon et al. (2016), who use transactions from diaries in Tanzania and calculate that one-quarter of households could reduce expenditures by over ten percent without reducing quantity purchased, by exploiting the bulk discount schedule these authors estimate. However, there is reason to doubt the estimated schedule because only one of the 22 categories of goods they study is restricted to a specific brand, while most are unbranded local foods and so give no easy way to control for quality of what is bought, unlike here. Moreover, many of the items are reported in non-metric units such as bunches and heaps, with metric quantity estimated ex post from locally established conversion factors while we have exact measures of quantity because we work with packaged foods. Despite these differences, the Tanzania study also suggests that liquidity constraints are not a major cause of the pattern of purchasing behavior, with explanations rooted in self-control problems and social taxation advanced as more fruitful avenues for understanding why households may neglect to exploit apparent bulk discounts.

Of course, the key feature of these papers, and our own, is not the use of diaries per se but rather that transaction level information is gathered. A related type of data comes from consumer panels who use scanners for all barcoded purchases. Griffith et al. (2009) use such data for the United Kingdom and examine the savings from purchasing items on sale, bulk buying, buying store brands, and choosing outlets. On average, households could save an equivalent of about six percent of annual food spending from sales, and from using store brands, and about 16 percent from buying the largest package sizes, when each effect is considered in isolation. Poorer households save more from bulk buying, which is consistent with what Beatty (2010) finds using diaries. It is not clear how these findings apply to poor countries since the consumers who save the most by bulk buying tend to shop by car and shop infrequently (once a month), which is less feasible in a poor country. The persistence of traditional marketing channels in poor countries may limit what foods can be studied with scanners, since many will tend not to be barcoded.Footnote 4 However, other technologies may be feasible, such as using smart phones to take pictures of items that are part of a transaction and then uploading these (geo-tagged) pictures along with price information to a survey agency.

2 Previous literature

We are interested in bulk discounts because they may relate to the Deaton and Paxson puzzle, to whether the poor pay more, and to estimation of price indexes more generally. We do not review the literature on the Deaton and Paxson puzzle beyond what is in footnote 1. The issue of whether the poor pay more is scattered through various strands of the literature and so we do briefly review that here. Most of our focus, however, is on previous attempts to measure bulk discount schedules.

2.1 Do the poor pay more?

Whether the poor pay more for food has been debated in economics and economic geography for more than four decades. In this time, two broad approaches have been used; outlet surveys that compare the prices of identical goods in rich and poor neighborhoods, and household surveys that compare unit values (the ratio of expenditure to quantity) across rich and poor households. Outlet surveys can ensure like is compared with like by choosing a representative brand, package size and so on for each selected food. However the characteristics of purchasers are not known, and have to be proxied by neighborhood characteristics such as the share of poor households in the community. Household surveys capture buyer characteristics but lack the fine detail on purchases needed to compare like with like, as Prais and Houthakker (1955, p. 110) first noted:

An item of expenditure in a family-budget schedule is to be regarded as the sum of a number of varieties of the commodity each of different quality and sold at a different price.

Outlet surveys from rich countries find prices vary with store type (supermarkets cheaper than convenience stores) and location (suburbs cheaper than rural and central city areas). However, prices do not vary with neighborhood income, given location (Hall 1983; MacDonald and Nelson 1991). Across locations and store types, the gradients are sufficiently flat that prices facing poor households for the same food items are likely to be less than one percent more than those facing non-poor households (Kaufman et al. 1997, p. 8). Similar conclusions about no difference in prices facing rich and poor are reached from the two outlet survey studies from developing countries: Musgrove and Galindo (1988) for foods in Northeast Brazil and Gibson and Kim (2013) for foods in urban Vietnam. The study from Brazil also found that, contrary to claims about bulk discounts, for all products except soybean oil, sales for part-units were charged at the same price per gram as the standard package. The study from Vietnam found that unit values gathered from a household survey fielded in the same areas at the same time showed a very different pattern of prices paid by rich and poor compared with almost no income-related price variation in the outlet survey.

The price paid by the poor depends not only on the same-item prices they face but also on various economizing choices they make. These include buying lower quality and unbranded varieties, buying larger package sizes, and using coupons and shopping for sale items. The combined effect of these strategies sees low-income households in the United States pay only 90% of the cost per unit of the average household (Kaufman et al. 1997). In Argentina during the 2002 economic crisis, consumers downgraded the quality of their purchases and also increased shopping frequency to search for lower prices (McKenzie and Schargrodsky 2011). A greater shopping frequency of the poor was also found for the United States by Kunreuther (1973).Footnote 5

2.2 Models of the price-quantity schedule

Despite minor price differences by income strata in outlet surveys, studies using household surveys claim bulk discounts yield large differences in prices between households (Rao 2000; Attanasio and Frayne 2006; Beatty 2010). Before discussing these studies in turn, it is worth considering a quotation that highlights the difficulty in using unit values to compare food prices:

[F]or purposes of food-cost comparisons, household surveys are not designed to obtain the level of item detail available in store surveys—typically aggregating to less than 100 relatively broad food groupings. Food groups in a household survey may contain a wide range of food items and quality variations having significant unit-cost differences. Consequently, per-unit food costs may vary widely across households depending on the set of brands and package sizes that a household purchases in a food category as well as price differences for similar items.

Kaufman et al. (1997, p. 1).

The aim of the recent literature using unit values is to identify the quantity-specific unit price schedule that sellers offer to buyers. This schedule for price per unit weight, p it depends on the quantity of specific food i purchased in a specific transaction t, q it and other supply shifters \(Z_{it}^s\)

The gradient of the price schedule, θ, will be less than zero in the presence of bulk discounts.

However, neither p it nor q it is observed by household surveys, which show expenditure and total quantity over the reference period for a food group, \({Q_i} = \mathop {\sum}\nolimits_{t \in T} {{Q_{it}}}\) where the \({Q_{it}}\) aggregate over various brands or qualities (\({q_{it}}\)). The ratio of group total expenditures to total quantity—the unit value—varies both with prices and with the quality of the items chosen within the group. Hence, unit values, \({v_i},\) can be written as: \(\ln ({v_i}) = \ln ({p_i}) + \ln ({\pi _i}),\) where \({\pi _i}\) is a measure of quality.

The approach used by Rao (2000) was to estimate:

where μ k is a set of village-level fixed effects, which proxy for the supply shifters \(Z_{it}^s\). Both OLS and instrumental variables were used, with the latter to overcome the well-known simultaneity bias and trace out a demand curve from the equilibrium points. But neither method solves the problem that Eq. (2) equals Eq. (1), and hence \(\theta ' = \theta ,\) only if \({\pi _i} = 1\) and \({Q_i} = {q_{it}}\).

Attanasio and Frayne 2006 use the same approach as Rao in arguing that one can identify θ by regressing unit values on several controls for supply conditions and the quantity purchased, which is instrumented by demographic variables. This again neglects the fact that bulk discounts depend on the quantity of a specific food i in a specific transaction, \({q_{it}}\) rather than on the total quantity of a food group over the duration of the survey, \({Q_i}\). Attanasio and Frayne (henceforth AF) follow an approach introduced by Deaton (1988) in modeling the unobservable quality, \({\pi _i}\) as a function of observable household total expenditure, x and quality demand shifters, Z i q

The resulting equation models unit values as depending on total quantity and total expenditures (both of which are endogenous) and the exogenous supply and quality demand shifters:

Household composition and the log of expected household income are used as instruments and no quality effects are allowed in the commodities they consider (beans, carrots, and rice).Footnote 6 Even if this were true, there is a further, unlikely, assumption that \({Q_i} = {q_{it}}\)in order for \(\theta '' = \theta .\)

In contrast, Beatty (2010) uses data on transaction quantities rather than on total quantities over the survey reference period. However, since brands are not separately distinguished the price and quantity data are still not for a specific item, i of a given quality. Instead, they are for what Beatty (2010) calls “food aggregates”, and even though these are finely grained, with 231 different aggregates considered, his approach is still somewhat like using \({Q_{it}}\) and its corresponding unit value \({v_{it}}\) because of the mixing together of different brands, varieties and quality grades. Using the Deaton (1988) approach to control \({\pi _{it}}\) in \({v_{it}}\), Beatty’s specification is

Beatty uses household size and demographic composition, household income and the number of meals at restaurants as the instruments. A common weakness in these models is the assumption that demographics are a valid instrument for quantity demanded. If there is a distribution of prices in the market, household members may spend time searching for the best bargains, as McKenzie and Schargrodsky (2011) show, and so household size and demographic structure have a direct influence on prices paid and will not satisfy the exclusion restrictions.

A factor ignored by previous approaches is that the relative price of quality changes with variation in unit size. For sellers to offer a smaller unit quantity they may need to pass on a per unit transactions cost to the buyer, such as a repackaging cost. Alchian and Allen (1967) note that such costs lower the relative price of, and raise the demand for, high-quality goods. In other words, for some transformation cost t, such as for repacking or transport:

where p h is the price of the high quality variety, which exceeds that of the low quality variety, p l. Demand for small packages will be more for the high quality variety than is the demand for large packages, given the lower relative price of high quality in smaller packages. Any method that does not control for quality, such as methods that use unit values, will mix up the effect of sliding down the quality ladder with a bulk discount schedule.

To overcome these drawbacks of unit values, we instead use information on transaction level prices. These data let us remove quality effects by restricting attention to the same brands, while working at the right level of aggregation for estimating bulk discount schedules according to Eq. (1).

3 Data

The data are from the Papua New Guinea Urban Household Survey (UHS), carried out in the late 1980s in a variety of towns, urban villages and squatter settlements ranging in population from 200,000 down to a few hundred. Each adult in the household kept an income and expenditure diary for two weeks, and for each item of expenditure the total value, quantity, brand, package size, and number of units was recorded. These urban households had an average of six people, with typically three adults keeping diaries and spending of other household members, including dependent children, covered in these diaries as well.

Figure 1 gives an example of the sort of information available in the expenditure diaries. After being completed by the respondents the details on each transaction in the diaries were assigned to a four digit commodity code. The extract shown here relates to Group 126 “canned meat”. The main specification within this group is “canned corned meat” (code 1261) where the dominant brand is “Ox and Palm” which is sold predominantly in 340 gram cans. If attention is restricted to this dominant brand and specification, there is no quality variation of the sort that potentially interferes with the use of unit values as a proxy for market price. Because these reports of the prices paid for each transaction are coming from volunteer households rather than trained price surveyors, it is likely that there will be reporting error that causes some outliers (e.g. 14 g for ‘Maling’ rather than 140 g). So the records are trimmed by removing the lowest and highest one percent of unit prices, and median regressions are also used to provide results that may be more robust to outliers.

In the analysis that follows attention is restricted to detailed specifications of each food, to be certain that it is purchase size and not quality differences that influence the unit price. The first item is “Trukai” brand short-grain rice. This is available in pack sizes of 0.5, 1, 2, 5, 10, 25 kg and a bale of 20 bags that are each 1 kg. Rice accounts for 13 percent of the average urban household’s food budget, and the market share for the “Trukai” brand was over 95 percent. The second item is “Ox and Palm” brand canned, corned beef, available in can sizes of 200 and 340 g, and also in cartons of 24 cans. Canned meat accounts for eight percent of the average food budget, and “Ox and Palm” brand had a market share of approximately 75 percent. The third item is “777” brand canned mackerel in oil, available in can sizes of 155, 200, and 425 g, and also in cartons of 24 cans. Canned fish accounts for seven percent of the average household’s food budget, and “777” brand mackerel had a market share of approximately two-thirds. The last item is frozen whole chickens, which are sold in 12 weight ranges, of 0.1 kg increments from 0.7 to 1.8 kg (with the packaging noting that the chicken is ‘size 7’ for 0.7 kg, ‘size 8’ for 0.8 kg and so on). Unlike the other foods, no one brand dominates the frozen chicken market so all three major brands are included and brand dummy variables are included in the regression of chicken unit prices on purchase quantities. Chicken products took seven percent of the average food budget, with about three-quarters of this allocated to whole, frozen chickens.

In addition to these finely detailed product specifications we consider four food groups at a slightly broader (3-digit) level: Rice, Canned Meat, Canned Fish, and Chicken. These are more typical of the aggregation level used with unit values and provide the data used for comparing with the results estimated from transaction-level prices. Descriptive statistics for these four food groups are reported in Table 1. It is clear that buyers have scope to vary both the unit quantity and the number of units purchased in each transaction. The variation in unit quantity is greatest for Rice, with a coefficient of variation of 1.71. The number of units purchased in each transaction ranges from 1.4 for Canned Meat to 1.8 for Rice. It is also clear that multiple purchase occasions occur during the 14 day diary-keeping period, ranging from 2.5 for Chicken through to 4.6 for Canned Fish.

The final point of note in Table 1 is that even before restricting attention to the finely detailed representative brands described above, these four food groups are fairly homogenous commodities by the standards of the previous literature. Specifically, the coefficient of variation (c.o.v.) of the unit values ranges from 0.16 (Canned Meat) to 0.28 (Chicken) and averages 0.22. In contrast, the foods used by AF appear to have c.o.v. ranging from 6.2 to 12.2 (which undermines their claim of no quality variation). Thus the current data should be more favorable to unit value methods than is the case in some of the settings where these methods have been applied.

4 Specification and results

We start by estimating price-quantity schedules from the transactions-level data. We then turn to unit values, using specifications that match as closely as possible with those of prior studies.

4.1 Estimated price-quantity schedules

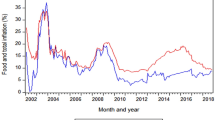

The elasticities of unit price with respect to purchase quantity from the transaction-level data are estimated with a double log specification. We use this specification because Fig. 2 shows that a plot of unit prices for rice (at the 25th, 50th, and 75th percentile) against package size is approximately linear in logs (in other words, the bulk discount schedule is non-linear in the levels).

The elasticities reported in Table 2 are from regressions that use a variety of other control variables, although the choice of these does not make much difference and nor does the use of instrumental variables rather than OLS (three of the IV estimates are so imprecise as to be statistically insignificant). Using medians rather than means makes some difference, especially for 777 brand canned mackerel, suggesting the possible influence of outliers even after the highest and lowest one percent of unit prices have been trimmed from the sample. The gradient of the price schedule for bulk purchases is rather flat. The elasticities are only −0.03 and −0.06 for canned corned beef and rice, and −0.10 and −0.14 for frozen chicken and canned mackerel.Footnote 7 Each of these elasticities is precisely estimated, so they are all statistically significant even if their economic significance may be muted. Taking a budget share weighted average, the elasticity of unit price with respect to transaction quantity is −0.076 at the mean and −0.050 at the median.

These elasticities can be combined with the elasticity of transaction quantity with respect to income (measured by per capita expenditure) to see how much more the poor pay. The elasticities of average purchase size with respect to per capita household total expenditure are 0.06 for rice, 0.07 for chicken, and from 0.16 to 0.18 for the canned foods. The two sets of elasticities can be multiplied together to give the elasticity of unit price with respect to household income. The two-stage method used to estimate this elasticity ensures that it is due only to bulk discounts and not to any quality differences in the food purchases made by large and small households. For rice, the income-price elasticity is −0.004; for canned corned beef it is −0.005; for canned mackerel it is −0.021; and for frozen chickens it is −0.007. The budget share weighted average of these elasticities is −0.008, so a doubling of household income would, on average, reduce the unit price paid for these four foods by 0.8 percent.

Similarly, the Table 2 elasticities can be combined with elasticities of transaction quantity with respect to household size, which are 0.30 for rice, 0.07 for chicken, 0.12 for canned corned beef, and 0.15 for canned mackerel. When the two sets of elasticities are multiplied together to give the elasticity of unit price with respect to household size, one obtains −0.019 for rice, −0.003 for canned corned beef, −0.020 for canned mackerel, and −0.007 for frozen chickens. The budget share weighted average of these elasticities is −0.012. Thus, a doubling of household size would, on average, reduce the unit price paid for these foods by 1.2 percent.

The results are rather different when the various unit value methods are used to estimate the gradient of the bulk discount schedule. Our summary of the specifications used in prior studies of bulk discounts with unit values, and the way we implement those specifications on the current sample is shown in Appendix Table 5. While it is not possible to match all control and instrumental variables with the same definition used in the original study, the exercise of comparing results using the transactions-level data with those using unit values should still be broadly informative. While some unit value methods do a reasonable job for Rice and Chicken, all of the methods do a poor (and imprecise) job of estimating the gradients for Canned Meat and Canned Fish (Table 3). The worst results are from the specification used by Beatty (Eq. (5)). These estimates greatly overstate the bulk discount schedule for chicken, and give imprecise estimates for the other three foods. The AF specifications are better, especially when total expenditure is not included as an explanatory variable (this may reflect the fact that the food groups here are relatively homogenous and so less is added by controlling for income-related quality choice).

4.2 Do the poor pay more?

The results show that minor bulk discounts exist for all four goods at the transaction level. Next, we turn to the behavioural question of whether these bulk discounts are exploited by the poor. We investigate this for each food and the basket as a whole. Specifically, we form an expensiveness index following Aguiar and Hurst (2007) and Beatty (2010). The expensiveness index for a specific food i purchased by household j is defined as the ratio of the actual expenditure during the survey reference period (T) relative to the expected cost of the food at the average unit price paid by all households (J) in the sample. The actual expenditure on food i by household j is

Next, we calculate the average unit price over all transactions, for all households, as in

where \({\overline q _i} = \mathop {\sum}\nolimits_{j \in J,t \in T} {q_{it}^j}\) is the total quantity of food i purchased during the survey period by all households in the sample. With this average unit price, the expected average cost of food i by household j is constructed as:

The expensiveness index for food i purchased by household j is defined as the ratio of these two expressions as in

We normalize the index so that a value above one implies that the household pays more than the average. If the index is higher for the poor, it suggests that the poor pay more due to buying small quantities in each transaction.

The results of regressing the log of the expensiveness index on log per capita income are reported in Table 4. Based on transaction-level unit prices, poorer households pay slightly more for the food basket as a whole, although the effect is statistically significant only for rice and canned fish. Conversely, results based on household-level and transaction-level unit values suggest that poorer households seem to pay less for food and for the whole food basket. Since the unit value results are not able to match the results using the appropriate transaction-level prices, it suggests that existing findings in the literature that rely on unit values may be unreliable.

4.3 Liquidity constraints or self-control device?

Our data have transaction level details on how many units of each particular size are bought on each purchase occasion. This provides direct evidence on a lack of liquidity constraints, by examining demand within a purchase occasion, where there is a choice between buying either more smaller units or fewer larger units. This evidence is clearest for rice, which has the largest variety of package sizes (0.5, 1, 2, 5, 10, 25 kg and a bale of 20 1 kg packs).

Despite a small bulk discount from buying a single large bag of rice, consumers seem to prefer buying multiple smaller bags in the same purchase occasion (Table 5). Clearly many buyers had sufficient liquidity to buy the larger bag at the cheaper unit price, since the cost of two (or more) of the smaller bags exceeds the cost of a single larger bag. So liquidity constraints do not seem to be a binding influence on purchasing behaviour for rice. This purchasing pattern occurs throughout the income distribution (Table 5). Thus the tendency of the poor to buy small and pay (slightly) more per unit weight for doing so may reflect factors other than liquidity constraints.

Our focus group surveys with urban Papua New Guineans suggest behavioral reasons for this purchasing pattern. This is a setting with strong social norms about sharing food between people, especially within clan groups, and is also a place with widespread under-nutrition.Footnote 8 Hence, many households will cook a one kilogram bag of rice per meal, regardless of how many people come to eat – if more guests come everyone has a smaller meal and if fewer come there are slightly more generous helpings and perhaps leftovers for the next meal. This ‘rule of thumb’ cooking helps act as a disciplining device so that households with food are not overrun by those without.

Furthermore, rule of thumb cooking lets the senior female, who controls the household budget, exert her authority even when she is out of the dwelling. Much of the cooking is done by teenage girls, in preparation for their bride price and moving into the household of their future husband, and also because gender bias in schooling and the labour market means that girls are otherwise likely to be unemployed.Footnote 9 While teenage girls would not have the social standing to resist requests from elderly relatives to cook more food, if they invoke the rule of their mother/aunt/grandmother that no more than one bag of rice is to be cooked for the meal, it transfers the authority of the household manager onto them. Indeed, many households resort to shopping every day in the local tradestores rather than buying in bulk on fortnightly pay day to ensure that their food is rationed out until the next pay day rather than all eaten too early in the pay cycle.

We further investigate this self-control hypothesis by considering what would happen if the buyers who bought multiple smaller bags on a purchase occasion had taken the bulk discount from buying the larger bag at the cheaper unit price. We construct this hypothetical expensiveness index for rice and regress it on log per capita income with the same set of covariates used in Table 4:

Compared to the results in Table 4, the sign of the coefficient of log per capita income has changed from negative (the poor pay more) to positive (the poor pay less). The difference between the Table 4 coefficient of −0.015 and the coefficient of 0.004 stemming from the hypothetical exploitation of bulk discounts is highly significant (the p-value for no difference is 0.008). Thus, the very slight cost of living penalty for the poor shown in Table 4 is unlikely to be due to liquidity constraints since the poor could have overcome this penalty by taking the money used to buy multiple units in the same purchase occasion and using it to buy a single larger unit at a slightly cheaper unit price.

A further test of the self-control hypothesis is to see what happens when we add direct controls for the pressure that visitors and guests may place upon a household’s table. We use the roster of the number of person-meals over the two-week diary period to compare with the person-meals expected, given the number of residents in the household. With direct control for visitor pressure (aka free-eaters) there is no significant difference between results using the expensiveness index for rice that is calculated from actual purchase behavior and the results based on the hypothetical index where purchasing multiple units on the same occasion is replaced with buying a single larger unit (the p-value for no difference is 0.133). We take this as indirect evidence that the strategy of buying small bags of rice is to help with the self-control problem of reducing social taxation that would result from the guests who might be attracted when they observe a large sack of rice being bought into the house.Footnote 10

5 Conclusions

This research has examined bulk discounts, which have been suggested as a solution to the Deaton and Paxson puzzle, and which also may matter to household behavior studied in other literatures. A neglected source of data—transaction-level records from the expenditure diaries used in household budget surveys—was used to estimate the bulk discount schedule for four foods in urban Papua New Guinea. There is a small discount for buying in bulk, which when combined with the propensity of richer households to buy larger quantities in each transaction, gives an elasticity of food prices with respect to household income of minus one percent. The similarly small elasticity with respect to household size provides no explanation for the Deaton and Paxson puzzle.

This bulk discount schedule would be mis-measured if unit values were used instead of transaction-level unit prices. The overstatement occurs even when using the methods recently developed by Rao (2000), Attanasio and Frayne 2006 and Beatty (2010) for estimating bulk discount schedules from unit values and food aggregates. It would be a useful development for more studies of household behavior to use transaction-level data so as to better understand the constraints facing poor consumers.

Notes

Other proposed solutions are: the two-good model generating the predictions is too restrictive (Horowitz 2002) but a multi-good model of Deaton and Paxson (2003) does not resolve the puzzle; scale economies in food preparation (Gan and Vernon 2003) but these deepen the puzzle because a reduction in per capita preparation costs should allow increased food expenditures per head; and, consumption measurement errors correlated with household size (Gibson and Kim 2007) but evidence from a comprehensive survey experiment with eight different survey designs randomly assigned to poor households finds no support for this hypothesis (Gibson et al. 2015).

The use of branded food products should not limit the applicability of the results to other developing countries. The share of packaged foods is already over one-third in countries like Indonesia, Malaysia and Thailand and is being driven by the rapid rise in supermarkets. For example, over 60 percent of retail food sales in Latin America are now through supermarkets, versus only 10–20% prior to 1980 (Reardon et al. 2003). Growth of the supermarket sector is even more rapid in East and Southeast Asia and is not limited to major cities and to the rich and middle class, but instead is penetrating deeply into the food markets of the poor.

An example of the analyses that are possible in a middle-income country (Mexico) with a consumer panel that uses scanners to study weekly purchases of almost 60,000 barcoded products is provided by Aguilar et al. (2016).

Frankel and Gould (2001) argue that search gives a U-shaped relationship between food prices and neighborhood income levels in the United States. The rich spend less time searching because of the opportunity cost of their time, while the poor lack the means to search. Local inequality is used to proxy for this effect in results reported below.

This assumption is unlikely to be true, with varying qualities of these foods available. In another low-income setting, Gibson and Kim (2015) show a 40% price difference between low quality and high quality rice.

These elasticities are largely the same across five of the specifications in Table 2 and only differ when Census Division (equivalent to a census tract) fixed effects are used, which increase the magnitude of the elasticities for rice and corned beef and reduce them for canned fish and frozen chicken.

Gibson and Rozelle (2002) report that the poorest quartile of the urban population consumes only 70 percent of energy requirements. Calories for the second quartile are also below requirement. Gibson and Rozelle also show one form of food sharing—from poorer people visiting their richer kin at meal times—because the survey kept a roster of the number of diners at the main meal each day. This guest effect added ten percent to the calorie demand of the richest quartile of households. In the capital city, where rice is the main staple, the average household has seven people, so with the guest effect there would be eight or more people at the main meal.

For example, Gibson and Fatai (2006) show that women in urban PNG have 2 years less schooling than men, and the wage workforce is 80 percent male. One could think of bride price as a capitalized value of what Grossbard (2015) calls work-in-household (WiHo), so that someone more experienced in cooking and household management attracts a higher price. This is especially because the main bride price payment is made several years after a woman has moved into her husband’s household, so she has had time to reveal her productivity in WiHo activities. Moreover, studies in other settings, that are like PNG in having both matrilineal and patrilineal descent traditions, suggest that when descent traditions may limit outside marriage market options, married women may use domestic labor as a tool to incentivize husbands (Walther 2017). While there are no similar time-use data for PNG to examine the same outcomes, variation between patrilineal and matrilineal customs in PNG are associated with differences in gender bias against girls (Gibson and Rozelle 2004), according to the ‘adult goods’ method of Deaton (1989), which is consistent with the general argument that inheritance traditions can affect intra-household bargaining. However, the interpretation of bride price values in PNG is also complicated by the role of social competition between the families of grooms, and by the fact that the bride price payments are redistributed throughout the community according to various reciprocal obligations, and so the amount paid for a particular bride may say more about the family of the groom than about the productivity-related characteristics of the bride.

Many urban dwellings are in close proximity to others, including being built over the sea on stilts so that people have to walk along jetties past their neighbors carrying their shopping. Thus it is difficult to disguise having food.

References

Abdulai, A. (2003). Economies of scale and the demand for food in Switzerland: Parametric and non‐parametric analysis. Journal of Agricultural Economics, 54(2), 247–267.

Aguiar, M., & Hurst, E. (2007). Lifecycle prices and production. American Economic Review, 97(5), 1533–1559.

Aguilar, A. Gutierrez E., & Seira, E. Taxing to reduce obesity. 2016. Mimeo downloaded from http://www.enriqueseira.com/uploads/3/1/5/9/31599787/taxing_obesity_submited_aer.pdf on 14 July 2017.

Alchian, A., & Allen, W. (1967). University Economics (2nd ed.). Belmont, California: Wadsworth Publishing Company.

Attanasio, O., & Frayne, C. (2006) Do the poor pay more? Paper presented at the Eighth BREAD Conference, Cornell University, May 2006.

Borcherding, T. E., & Silberberg, E. (1978). Shipping the goods apples out: The Alchian and Allen Theorem reconsidered. Journal of Political Economy, 86(1), 131–138.

Beatty, T. (2010). Do the poor pay more for food? Evidence from the United Kingdom. American Journal of Agricultural Economics, 92(3), 608–621.

Deaton, A. (1988). Quality, quantity, and spatial variation of price. American Economic Review, 78(3), 418–430.

Deaton, A. (1989). Looking for boy-girl discrimination in household expenditure data. The World Bank Economic Review, 3(1), 1–15.

Deaton, A., & Paxson, C. (1998). Economies of scale, household size, and the demand for food. Journal of Political Economy, 106(5), 897–930.

Deaton, A., & Paxson, C. (2003). Engel’s what? A response to Gan and Vernon. Journal of Political Economy, 111(6), 1378–1381.

Dillon, B., De Weerdt, J., & O’Donoghue, T. (2016) Paying more for less: Why don’t households in Tanzania take advantage of bulk discounts? Mimeo, Evans School of Public Policy, Seattle: University of Washington.

Frankel, D., & Gould, E. (2001). The retail price of inequality. Journal of Urban Economics, 49(2), 219–239.

Gan, L., & Vernon, V. (2003). Testing the Barten model of economies of scale in household consumption: Toward resolving a paradox of Deaton and Paxson. Journal of Political Economy, 111(6), 1361–1377.

Gibson, J., & Fatai, O. (2006). Subsidies, selectivity and the returns to education in urban Papua New Guinea. Economics of Education Review, 25(2), 133–146.

Gibson, J., & Kim, B. (2007). Measurement error in recall surveys and the relationship between household size and food demand. American Journal of Agricultural Economics, 89(2), 473–489.

Gibson, J., & Kim, B. (2013). Do the urban poor face higher food prices? Evidence from Vietnam. Food Policy, 41(1), 193–203.

Gibson, J., & Kim, B. (2015). Hicksian separability does not hold over space: Implications for the design of household surveys and price questionnaires. Journal of Development Economics, 114(1), 34–40.

Gibson, J., Beegle, K., De Weerdt, J., & Friedman, J. (2015). What does variation in survey design reveal about the nature of measurement errors in household consumption? Oxford Bulletin of Economics and Statistics, 77(3), 466–474.

Gibson, J., & Rozelle, S. (2002). How elastic is calorie demand? Parametric, nonparametric and semiparametric results for urban Papua New Guinea. Journal of Development Studies, 38(6), 23–46.

Gibson, J., & Rozelle, S. (2004). Is it better to be a boy? A disaggregated outlay equivalent analysis of gender bias in Papua New Guinea. Journal of Development Studies, 40(4), 115–136.

Griffith, R., Leibtag, E., Leicester, A., & Nevo, A. (2009). Consumer shopping behavior: How much do consumers save? Journal of Economic Perspectives, 23(2), 99–120.

Grossbard, S. (2015). The Marriage Motive: A Price Theory of Marriage: How Marriage Markets Affect Employment, Consumption, and Savings. New York, NY: Springer.

Hall, B. (1983). Neighborhood differences in retail food stores: Income versus race and age of population. Economic Geography, 59(3), 282–295.

Horowitz, A. (2002) Household size and the demand for food: A puzzle resolved? Paper presented at the Northeast Universities Development Consortium Conference, Williams College, October, 2002.

Kaufman, P., MacDonald, J., Lutz, S., & Smallwood, D. (1997) Do the poor pay more for food? Item selection and price differences affect low-income household food costs Agricultural Economic Report No. 759, Economic Research Service, United States Department of Agriculture.

Kunreuther, H. (1973). Why the poor may pay more for food: Theoretical and empirical evidence. Journal of Business, 46(4), 368–383.

MacDonald, J., & Nelson, P. (1991). Do the poor still pay more? Food price variations in large metropolitan areas. Journal of Urban Economics, 30(3), 344–359.

McKenzie, D., & Schargrodsky, E. (2011). Buying less but shopping more: Changes in consumption patterns during a crisis. Economia, 11(2), 1–43.

Musgrove, P., & Galindo, O. (1988). Do the poor pay more? Retail food prices in northeast Brazil. Economic Development and Cultural Change, 37(1), 91–109.

Prais, S., & Houthakker, H. (1955). The Analysis of Family Budgets. New York, NY: Cambridge University Press.

Rao, V. (2000). Price heterogeneity and ‘real’ inequality: A case-study of prices and poverty in rural South India. Review of Income and Wealth, 46(2), 201–211.

Reardon, T., Timmer, P., Barrett, C., & Berdegué, J. (2003). The rise of supermarkets in Africa, Asia, and Latin America. American Journal of Agricultural Economics, 85(5), 1140–1146.

Walther, S. (2017). Moral hazard in marriage: The use of domestic labor as an incentive device. Review of Economics of the Household, 15(2), 357–382.

Acknowledgements

We are grateful to the guest editor and editor and two anonymous reviewers for helpful comments. All remaining errors are the responsibility of the authors. This work was supported by the National Research Foundation of Korea Grant funded by the Korean Government (NRF-2014S1A3A2044637).

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no competing interests.

Electronic supplementary material

Rights and permissions

About this article

Cite this article

Gibson, J., Kim, B. Economies of scale, bulk discounts, and liquidity constraints: comparing unit value and transaction level evidence in a poor country. Rev Econ Household 16, 21–39 (2018). https://doi.org/10.1007/s11150-017-9388-7

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11150-017-9388-7