Abstract

This paper examines the effect of excessive mortgage indebtedness on health among homeowners using nine waves of the Health and Retirement Study from 1992 to 2008. Health status is measured by subjective well-being, number of depressive symptoms, and incidence of hypertension. Using average annual state-level home prices as an instrument, we attempt to identify the causal effect in an panel IV framework. Results from the panel IV estimations suggest that having a high mortgage loan to home value (LTV), defined as LTV at or above 80 %, leads to more depressive symptoms and a higher incidence of hypertension, but has no effect on subjective well-being. Since the results from panel estimations did not show that debt affects health, whether the panel IV results demonstrate a causal relationship depends critically on the exclusion assumption.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Owner-occupied housing is a major asset on U.S. households’ balance sheet, accounting for over a third of total assets (Poterba and Samwick 2001). U.S. policy has promoted homeownership as it is thought to have many social benefits.Footnote 1 Homeowners have an incentive to improve housing structures and are more likely to participate in political and social activities in the community. Though they bear the cost of capital investments and community engagement, neighboring homeowners benefit as well through higher home valuations (Dietz and Haurin 2003; Glaeser and Shapiro 2003). Homeownership also lengthens housing tenure which is correlated with family stability and better child outcomes. Moreover, longer housing tenure is correlated with better self-rated health (Dietz and Haurin 2003; Pollack et al. 2004).

As a home constitutes the largest share of a household’s assets, a mortgage similarly constitutes the largest share of a household’s liabilities. This is because home purchases require a great deal more capital than households have available. As well, the policies that promote homeownership do so by subsidizing mortgage financing which encourages the use of leverage over equity in home purchases and greater consumption of housing than households would have chosen if these subsidies did not exist (Glaeser and Shapiro 2003). The prevalence of house financing is also affected by the interaction between policy and economic conditions. During periods of mortgage credit expansion, riskier home buyers can also qualify for mortgages, thereby increasing the prevalence of mortgage finance in home sales (Mian and Sufi 2009; Keys et al. 2010).

Though prior studies have shown that homeownership is associated with better health, few have examined the health consequences of the concomitant debt. Prompted by the sub-prime mortgage crisis in 2007 and 2008, researchers have only recently begun to investigate the relationship between debt and health. The objective of this paper is to provide empirical evidence on whether excessive mortgage indebtedness adversely affects the health of homeowners.

We use Grossman’s health capital model, where health is a stock variable which depreciates over time but can be augmented by combining time, income, and medical care in a health production function, to illustrate how excessive mortgage indebtedness affects health (Grossman 1972a, b; Anderson and Grossman 2009). We hypothesize direct and indirect paths through which excessive debt leads to poorer health. The direct path posits that excessive mortgage indebtedness is a source of stress and stress has been shown to increase the risk of certain illnesses, such as cardiovascular disease (Dorian and Taylor 1984; Calcagni and Elenkov 2006; Contrada and Baum 2009) and development of unhealthy behaviors such as drinking, smoking, or substance abuse, or may cause sleep problems and eating disorders (Neil Schneiderman 2008). So greater debt causes stress which in turn impairs health. The indirect path posits that greater debt reduces household net worth which leads to fewer health investments. It is important to better understand the relationship between mortgage debt and health because if the burden of mortgage debt causes poorer health, then policies that promote homeownership through financing may have an unintended health consequence.

This study improves on existing ones in several ways. Most of the literature has focused on the health consequences of foreclosures. A criticism of these studies is that a foreclosure event actually provides financial relief to the household by forgiving the debt burden. Indeed, for a household with negative home equity, a foreclosure increases its net worth. Implicit in these studies then is that foreclosures affect health through stress, not through a decline in household net worth. By contrast, our study uses the ratio of the mortgage loan amount to the home value, or loan-to-value ratio (LTV), as a measure of the degree of mortgage indebtedness. An increase in LTV corresponds to a decrease in home equity and, if the LTV is excessive to begin with, increases the risk of foreclosure. With LTV, we allow for excessive mortgage indebtedness to affect health both directly and indirectly.

Another limitation is that while the number of foreclosures is at unprecedented levels, it is small when compared to the number of homeowners who have experienced a substantial decline in home equity. For example, Alley et al. (2011), using only the HRS 2008 participants eligible to be asked mortgage-delinquency questions, reported a mortgage delinquency rate of 3 % whereas, using the complete HRS 2008 wave, 13 % of mortgagors had LTV greater than 80 %. Moreover, the foreclosure crisis was limited to a handful of states (Alley et al. 2011) but homeowners in all states have experienced declines in home equity. Using LTV as opposed to foreclosure, we can examine the health consequences of mortgage indebtedness on a broader segment of U.S. homeowners.

Households with high LTV are more likely to perceive themselves to be in a precarious financial situation and therefore are more likely to experience financial stress, even in the absence of a foreclosure. As shown in Table 1, individuals with high LTV are more likely to report being financially dissatisfied, having difficulty meeting monthly payments, and not having control of the financial situation. However, the share that report greater than a 50 % chance of falling behind on future mortgage payments, while relatively low for both groups, is not statistical different between those with and without high LTV. This suggests that financial stress manifests even when the perceived risk of foreclosure is remote and that our LTV measure is a more general indicator of financial stress.

A key challenge in this work is identifying the direction of causation. Some studies have documented that a substantial share of bankruptcies are the result of either income loss due to illness or indebtedness due to medical expenses (Himmelstein et al. 2005, 2009; Pollack and Lynch 2009). This suggests that a decline in health leads to excessive debt and inability to repay debt. However, other studies have argued that excessive debt leads to poorer health (Currie and Tekin 2011; Alley et al. 2011; Taylor et al. 2006; Nettleton and Burrows 1998). Because of limitations inherent in the empirical strategies used thus far, the direction of causation remains uncertain.

Our identification strategy is a panel data instrumental variables estimation. We first eliminate unobserved time-invariant individual heterogeneity using panel data transformation and estimate the causal effect of excessive mortgage indebtedness on health using pooled two-stage least squares estimation on the transformed data with fully adjusted standard errors for inference. We use state-level home prices as an instrument to estimate the causal effect of having excessive mortgage indebtedness on the likelihood of reporting fair/poor health, number of depressive symptoms, and incidence of hypertension. The premise is that changes in home prices will arbitrarily shift some homeowners into having high LTV. If so, then the estimated coefficient on the predicted probability of having high LTV, predicted with home prices, should represent an unbiased estimate of the effect of mortgage indebtedness on health. We use home prices at the state-level because home prices at the individual level are endogenous. Individuals choose their homes and by extension the price of the home. Because no single individual can affect the average home price in the state, state-level home prices are arguably more exogenous.

The paper proceeds as follows. Section 2 briefly reviews existing literature. Section 3 outlines our identification strategy, provides information on the data sources, and details the data processing. Section 4 discusses the results as well as robustness checks and Sect. 5 concludes.

2 Related work

The rise in foreclosures since 2008 has prompted research on the impact of foreclosures on health. Pollack and Lynch (2009) compared the health of individuals, recruited through a mortgage counseling agency, undergoing foreclosure with that of a community sample from the 2008 Southeastern Pennsylvania Household Health Survey. They found that the foreclosed sample were significantly more likely to have hypertension, heart disease, and a clinically diagnosed psychiatric condition compared to a representative sample of the local population used as a “control” group. The foreclosed also reported greater consumption of smoking and drinking in the past month. In a broader study covering four states—Arizona, California, Florida, and New Jersey—Currie and Tekin (2011) show that zip codes with a greater number of foreclosures also experienced a greater rise in emergency room visits and hospitalizations for stress related conditions, adjusting for county-specific, time-varying factors such as labor market conditions. Furthermore, the effect was greater for conditions that are typically avoidable with preventive care.

Prior to default, borrowers who have missed two or more consecutive repayments on the mortgage loan are considered delinquent. Some studies have examined the effect of mortgage debt delinquency on health. Alley et al. (2011), using the 2006 and 2008 waves of the Health and Retirement Study (HRS), compared the health outcomes of mortgagors who had been more than two months delinquent on their mortgage payments in the past two years to those who are current on their mortgage payments. They found that delinquent respondents were significantly more likely to have depressive symptoms and to have less access to health relevant resources. These results are qualitatively consistent with similar studies in the U.K. Taylor et al. (2006), using the British Household Panel Survey (BHPS) from 1991 to 2003, a period that covers the recession in the early nineties, found that being past due on mortgage debt is associated with a negative psychological effect among men, controlling for financial conditions and other personal traits. Nettleton and Burrows (1998), using the Survey of English HousingFootnote 2 from 1991–1992 and 1994–1995, found that difficulty meeting mortgage payments is associated with a decline in mental well-being.

Existing studies have also investigated the health effects of credit card debt. Drentea and Lavrakas (2000), using a sample of adults in Ohio, found that greater credit card debt-to-income is associated with a greater likelihood of physical health impairment. In a follow up study, Drentea (2000) found that greater credit card debt-to-income is associated with a greater likelihood of having mental anxiety. Similarly, Brown et al. (2005), using the 1995 and 2000 waves of the British Household Panel Survey (BHPS), found that greater unsecured household debt is associated with the likelihood of having poor mental health. More recently, Averett and Smith (2012) using the National Survey of Adolescent Health (Add Health) tested whether having credit card debt affects body weight using OLS and Propensity Score Matching to determine if credit card indebtedness causes obesity. They found a strong positive correlation between debt and weight for women which appears to be driven largely by unobservables. In contrast, there is no correlation between debt and weight for men.

Probably the study that most closely resembles this one is Keese and Schmitz (2013). They used the German Socioeconomic Panel (GSOEP) from 1999–2009 to estimate the effect of total household debt on mental health and incidence of obesity using a fixed effects model. Their findings suggest that greater indebtedness is associated with poorer mental health and that mortgage debt, in particular, negatively affects mental health. However, indebtedness did not appear have a statistically significantly effect the incidence of obesity. Keese and Schmitz (2013) did not report separate results by gender but this might explain the inconsistency with Averett and Smith (2012) for obesity. debt and health Sweet et al. (2013) using AddHealth

While these studies all demonstrate that debt is associated with poorer health, particularly mental health, the direction of causality remains unknown. A few of these studies have attempted to deal with the endogeneity problem using fixed effects at the individual-level (Keese and Schmitz 2013) or zip code-level (Currie and Tekin 2011) but none have employed an instrumental variable technique.

3 Methodology

We use the framework of Grossman’s health capital model to derive a relationship between excessive mortgage indebtedness and health. Homeowners derive utility from health, \(H\), and housing consumption, \(V\) given by

but are subject to the wealth constraint given by

where \(W\) is household net wealth as a function of money income, \(I\) such that \(W_{I}>0\), and mortgage indebtedness, \(LTV\) such that \(W_{LTV}<0,\,p_M\) is the price of medical care, \(p_V\) is the imputed price of housing. Health is produced with medical care, \(M\), but is depleted from financial stress of excessive mortgage indebtedness as given by

where \(H_{M}>0\) and \(H_{LTV}<0\). Utility maximization subject to health production and wealth constraints yield a reduced-form demand for health as a function of mortgage indebtedness, prices, and money income given by

In this framework, an increase in mortgage indebtedness affects health directly through health production, \(H_{LTV}<0\), and indirectly through diminished net wealth which reduces medical care, \(H_{M}M_{W}W_{LTV}<0\).

The reduced-form model given by Eq. 4 is estimated as

where \(H_{it}\) is a measure of health for individual \(i\) in year \(t,\,{\mathbf {x}}_\mathbf{it}\) is a vector of exogenous explanatory variables, \(LTV_{it}\) is a indicator for excessive mortgage indebtedness or high LTV, \(\epsilon _{it}\) is the error term, and \(t=1992,\ldots ,2008\). Our parameter of interest, \(\alpha\), is estimated with bias if omitted variables are present in the error term. In particular, unobserved individual-specific and time-invariant factors, e.g. initial health endowment, risk tolerance, or time preference, might be correlated with both having a high LTV mortgage and the error term. Explicitly recasting the error term in Eq. 5 as the sum of an unobserved effect and an idiosyncratic error, our model becomes

where \(c_i\) is the unobserved effect and \(u_{it}\) are the idiosyncratic errors. Although panel data estimation can address \(c_i\), the issue of simultaneity, that medical expenses due to poor health accumulate as greater debt, remains. If health in the previous period is the omitted variable, then instrumenting should result in overestimate of the true effect, \(\alpha\). This is because (poorer) health in the previous period is positively correlated with (poorer) health in the current period and positively correlated with high LTV in the current period due to reverse causality. Income is another time-varying omitted variable that simultaneously affects health and high LTV since income determines the amount of mortgage a homeowner would qualify for. Income in the previous period is positively correlated with high LTV in the current period and negatively correlated (poorer) health in the current period. In this case, omitting income would underestimate the true effect. We conclude then that there may be multiple omitted variables such that the direction of bias cannot be a priori determined.

Our identification strategy is to eliminate \(c_i\) from Eq. 6 using either a fixed effects (FE) or first differences (FD) transformation and then to estimate \(\alpha\) using pooled two-stage least squares (2SLS) estimation on the transformed data. The choice between FE and FD depends on our assumptions about the idiosyncratic errors, \(u_{it}\).Footnote 3 We refrain from making an assumption and estimate the model both ways as a conservative approach.

The instrument is the mean-deviation in average annual state-level home prices normalized to 100 in year 2000 for the FEIV estimation and the change in average annual state-level home prices for the FDIV estimations. The premise is that mean-deviations and changes in home prices will arbitrarily shift some homeowners into having excessive mortgage debt. We use home prices at the state level because home prices at the individual level are endogenous since individuals choose their homes and by extension the price of the home. Because no single individual can affect the average home price in the state, state-level home prices are arguably more exogenous. For comparison, we also used average annual home prices aggregated at the Metropolitan Statistical Area (MSA) level to instrument for high LTV. MSA-level home prices are less likely to be correlated with unobservables at the state-level that affect health.

To ensure that the excluded instruments are not correlated with the idiosyncratic error term, we add state and year fixed effects as included instruments to remove time trends and time-invariant state characteristics. We are also concerned that the excluded instrument is correlated with the idiosyncratic error term through local labor markets conditions. For this reason, annual average county-level unemployment rates were also added as included instruments.

3.1 Data

Individual level data on demographics, health, and housing-related items such as homeownership, housing structure, home purchase price, current house price, and housing debt outstanding were obtained from the University of Michigan Health and Retirement Study. The HRS is a nationally representative survey of adults born between 1931 and 1941 and their spouses who could be of any age conducted every two years. The HRS is well-suited for this study since older adults are most likely to be homeowners.Footnote 4

The primary health outcomes of interest are subjective well-being and number of depressive symptoms. Subjective well-being is measured in the HRS using the survey question “Would you say your health is excellent, very good, good, fair, or poor?”. Using this measure, we constructed a dichotomous variable equal to one if the respondent reported being in fair or poor health and zero otherwise. Depressive symptoms are measured as a modified version of the Center for Epidemiological Studies Depression (CESD) scale. A CESD score is calculated as the sum of six indicators for the presence of depressive symptoms (depression, everything is an effort, sleep is restless, felt alone, felt sad, and could not get going) minus the sum of two indicators for the presence of non-depressive symptoms (felt happy and enjoyed life). We used this measure of mental health as a continuous variable equal to the CESD score ranging from 1 to 8, with 8 representing those exhibiting the most depressive symptoms.

In addition to well-being and depressive symptoms, we would like to demonstrate that indebtedness affects health specifically through stress. One possibility is to use presence of hypertension also known as high blood pressure. While there is no evidence that stress directly causes chronic high blood pressure, studies have shown that high blood pressure is associated with unhealthy behaviors such as sedentary lifestyle, smoking, drinking, and poor diet which are triggered by stress. Therefore, we examine whether having high LTV leads to hypertension, keeping in mind that the underlying mechanism is through unhealthy behaviors. Responses to the question “Has a doctor ever told you that you have high blood pressure or hypertension?” were used to constructed a dichotomous variable equal to one if the respondent reported having hypertension and zero otherwise.

As a falsification test, we use cancer as a health outcome for which there is no evidence of a link to stressFootnote 5 (McGee 1999). Responses to the survey question “Has a doctor ever told you that you have cancer or a malignant tumor, excluding minor skin cancer?” were used to constructed a dichotomous variable equal to one if the respondent reports having the condition and zero otherwise.

Our measure of mortgage indebtedness is the loan-to-value (LTV) ratio defined as the total amount of mortgage loan outstanding divided by the value of the primary home. The housing module of the HRS asks whether the respondent owns his/her primary residence and if so, the value of it. The question on house value is phrased as “What is its present value? I mean, what would it bring if it were sold today?” This self-reported home value is used as the denominator in the LTV variable. Similarly, the housing module of the HRS also asked respondents whether there is a mortgage on this property and if so, the amount owed. The question on amount owed is phrased as “How much is still owed on this loan?”. This self-reported mortgage loan amount is used as the numerator in the LTV variable.

All else equal, LTV declines over time given the amortizing nature of conventional mortgage loans and when the mortgage is paid off, the LTV equals zero. However, if the value of the home declines, then the LTV will rise. Though loan requirements can vary depending on the lender, to qualify for a conventional mortgage loan, home buyers must pay at least 20 % of the appraised home value at the time of purchase. Therefore, a homeowner with a LTV above 80 % would not qualify for a conventional mortgage loan under current market conditions. We define excessive mortgage indebtedness, or high LTV, as homeowners with a LTV >80 %. A dichotomous variable for high LTV was constructed as equal to one if LTV is greater than or equal to 0.8 and zero otherwise.

To demonstrate the relationship between high LTV and financial situation, we merged the HRS 2008 wave to the HRS 2009 Internet based survey of a sub-sample of the HRS participants which asked respondents a series of financial questions.Footnote 6 The combined dataset yielded 3,452 individuals for which the 2008 LTV and 2009 financial situation were both observed. Respondents were asked “How satisfied are you with...Your present financial situation?” with possible responses “Completely Satisfied”, “Very Satisfied”, “Somewhat Satisfied”, “Not Very Satisfied”, and “Not at All Satisfied”. A dichotomous variable was constructed as equal to one if the response was “Not Very Satisfied” or “Not at All Satisfied” and zero otherwise. Individuals were also asked “How difficult is it for you and your family to meet monthly payments on your family’s bills?” with possible responses “Not at all difficult”, “Not very difficult”, “Somewhat difficult”, “Very difficult”, and “Completely difficult”. A dichotomous variable was constructed as equal to one if the response was “Somewhat difficult”, “Very difficult”, or “Completely difficult” and zero otherwise. Individuals were asked “Again, think about a 0–10 scale where “0” means “no control at all” and “10” means “very much control”. How would you rate the amount of control you have these days over your financial situation?”. Responses were captured as a dichotomous variable equal to one if less than five and zero otherwise. Lastly, individuals were asked “On a scale from 0 to 100, what are the chances that you will fall behind in your mortgage payments during the next year?”. A dichotomous variable was constructed as equal to one if the response was greater than 50 and zero otherwise. For individuals that we were able to matched the 2009 Internet-based to the 2008 HRS panel, we cross-tabulated the responses to each of the three question with whether the individual reported having high LTV. These summary statistics are reported in Table 1.

A limited number of individual characteristics were used since only time-varying regressors can be included the estimation model. In the main specification, continuous variables for age and age-squared and a dichotomous variable for marital status were included as exogenous regressors. In Sect. 4.1, we report results using specifications that include dichotomous variables for employment and labor force status and continuous variables for total household income and total non-housing assets as additional regressors to determine whether including endogenous variables changes the estimated parameter on high LTV.

The analytical data set was constructed using the RAND-HRS data file, version L, including RAND imputed asset values for nine waves spanning years 1992–2008.Footnote 7 The complete RAND-HRS file contains 30,548 individuals across all waves. From this sample, individuals who reported having lived in a retirement home, assisted living home, nursing home, farm, rooming house, or boarding house in any wave were excluded. Individuals who resided in more than one state in the period of analysis were also excluded. Observations with missing values for state or county of residence, homeownership status, age, marital status, or LTV were dropped. Analyses were performed on the sample of homeowners and the subsample of mortgagors or homeowners who have mortgage debt. We expect the estimated effects to be similar for both samples. That is, having low LTV and having no LTV should not negatively impact health, only having high LTV negatively impacts health.

To obtain the sample of homeowners, only observations where the individual reported owning a single-family, two-family, or townhouse in that wave were kept. To obtain the sample of mortgagors, homeowners who have no mortgage debt were excluded from the homeowner sample. Since each health outcome contains a different number of missing values, we retain four separate samples corresponding to the four dependent variables. In addition, samples sizes also differ by the type of estimation. Pooled OLS treats each panel as a separate cross-section and retains the most observations. From the pooled OLS sample, homeowners who are observed for only one wave were dropped to obtain the FE sample. From the pooled OLS sample, the first observation for each homeowner was dropped upon first differencing in the FD sample. Therefore, the total number of samples used in this study is 24 (=2 groups \(\times\) 4 outcomes \(\times\) 3 estimations).

Table 2 shows the descriptive statistics for each sample grouped by outcome. The descriptive statistics show that mortgagors on average are in slightly better health than the sample of homeowners, which most likely corresponds to their being on average approximately four years younger. The descriptive statistics across the samples by outcome are not materially different. Among homeowners, the share that has high LTV is 5 % and among mortgagors, it is 10 %.

House price index data were obtained from Freddie Mac which publishes the Freddie Mac House price index (FMHPI).Footnote 8 The FMHPI provides a measure of typical monthly price inflation for houses within the U.S. The FMHPI is constructed using repeat transactions on single-family detached or townhouse properties which serve as collateral for mortgage loans purchased by either Freddie Mac or Fannie Mae. The FMHPI closely tracks other constant-quality home prices indexes such as Standard and Poor’s Case-Shiller Index. The FMHPI was inflation-adjusted using the Bureau of Labor Statistics (BLS) All Urban Consumers Price Index (CPI), an average of all U.S. cities, with year 2008 as the base.Footnote 9 The inflation-adjusted FMHPI was merged to the HRS data by year and state.

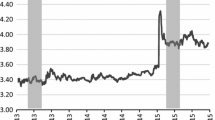

Unemployment data were obtained from the Local Area Unemployment Statistics (LAUS) program of the Bureau of Labor Statistics (BLS).Footnote 10 County-level annual average unemployment rates were merged to the HRS data by year and the individual’s county of residence. The unemployment rate is calculated as the ratio of unemployed to the civilian labor force expressed as a percent. Figure 1 shows the time series plots for the Freddie Mac House price index and BLS county-level annual average unemployment rates in the period of analysis.

4 Results

We begin by treating the each wave of the HRS as a pooled cross-section and estimating Eq. 5 using OLS for the four outcomes—fair/poor self-rated health, CESD score, hypertension, and cancer. Each estimation includes covariates for age, age-squared, marital status, as well as annual average unemployment rates in the county of residence to capture health effects due to labor market trends, year dummies to capture time trends and state dummies to capture persistent health differences across states. The estimated correlation coefficients are shown in the first column of Table 3 for the sample of homeowners and in the sixth column for the sample of mortgagors. Consistent with the literature, high LTV is associated with a greater likelihood of reporting fair/poor health, poorer mental well-being, and greater likelihood of having hypertension. Interestingly, high LTV is associated with a lower likelihood of having cancer. The estimates for homeowners and mortgagors are similar which suggests that homeowners with no mortgage have similar health relative to homeowners with a low LTV.

The FE estimation results are shown in the second and seventh columns of Table 3 and the FD estimation results are shown in the third and eighth columns, for homeowners and mortgagors, respectively. The panel model estimates are smaller in magnitude compared to the pooled OLS estimates for each outcome. This suggests that the unobserved individual-specific factors over-estimated the effect of high LTV in the pooled OLS model. Smaller magnitudes for the panel model estimates are consistent with an “ability”-like bias where higher “ability” individuals are less likely to have high LTV and less likely to be in poor health. Again, the estimates for homeowners and mortgagors are similar which suggests that the correlation between mean-deviations or changes in high LTV and mean-deviations or changes in health are similar between homeowners with no mortgage and homeowners with a low LTV. But unlike pooled OLS estimates, the FE and FD estimates are not statistically significantly different from zero, except in the case of FD estimates for fair/poor health and presence of cancer. Since the standard errors are similar between pooled OLS and FE/FD, the loss of statistical significance is due to the smaller magnitude of the estimates.

Lastly, we estimated 2SLS using demeaned and first differenced home price index as the instrumental variables, respectively. The FEIV estimation results are shown in the fourth and ninth columns of Table 3 and the FDIV estimation results are shown in the fifth and tenth columns, for homeowners and mortgagors, respectively. Adjusting for endogeneity yields estimates with larger magnitudes than that for panel estimations. This suggests that the omitted variable bias is not likely to be health in the previous period but more likely to be income or wealth.

The FEIV and FDIV results using the homeowner sample show that having high LTV increases the likelihood of reporting fair/poor health by 18.8–34.8 % points. Although the latter estimate is statistically significant at the 10 % level, we view it as an anomaly since it is not corroborated by the FEIV results. The estimates for fair/poor health using the mortgagor sample show that the effect of high LTV is 11.4–12.6 % points but are not statistically significant. For the other three outcomes, the magnitudes of the IV estimates are similar between FE and FD as well as between the samples for homeowners and mortgagors. However, in each regression the standard errors are much bigger in the homeowner sample. We suspect the predicted values for high LTV in the second stage are noisier in the homeowner sample due to the inclusion of homeowners with no mortgages. The mortgagor sample, in which homeowners with no mortgages are excluded, yields more precise IV estimates. The IV estimates using the mortgagor sample show that having high LTV increases the likelihood of having hypertension by 20.6–21.8 % points, significant at the 10 and 5 % levels, respectively. Mortgagors with high LTV also report 0.79–1.18 more depressive symptoms, significant at the 5 and 1 % levels, respectively. In the FD estimations, the estimated effect of high LTV on presence of cancer becomes statistically insignificant after IV, even when restricted to the sample of mortgagors with reduced standard errors.

The first stage corresponding to the IV estimations are reported in Table 4 for homeowners and mortgagors. Comparing the estimated parameters on the excluded instrument for the two samples, the estimates for homeowners are an order of magnitude smaller due to the inclusion of homeowners with no mortgage as mentioned and explains the less precise estimates in the main findings for homeowners. There is not much difference in the estimated parameters on the excluded instrument if we compare within the homeowner sample or within the mortgage sample. Among mortgagors, a 1 unit increase in the home price index is correlated with a 0.129–0.137 % point decline in the likelihood of having high LTV which has the expected sign and is plausible in magnitude given that the inflation-adjusted house price index averaged across states ranges from 90 to 130 units in the period of analysis. The associated F-statistics on the excluded instrument, which range from 33.68 to 121.48 depending on the regression, are all comfortably above the recommended threshold.Footnote 11

The difference in magnitudes between the OLS and FE/FD estimates suggests that unobserved time-invariant individual-level factors contributes to a bias away from zero such that OLS overestimates the effect. In contrast, the difference between FE/FD and FEIV/FDIV suggests that unobserved time-varying factors contributes to a bias towards zero such that FE/FD underestimates the effect. Since there is no reason to believe that unobservables are confined to individual heterogeneity, we must give credence to the FEIV/FDIV estimates.

4.1 Robustness

One concern is that home prices at the state level are correlated with unobservables at the state level that affect health. If true, this would invalidate the assumption that the instrument operates by randomly shifting individuals into having high LTV. For example, since health care programs are governed at the state level, it is possible that home prices are correlated with changes in access to health care and consequently health outcomes. To investigate this possibility, we repeated the estimations using MSA-level home prices as the excluded instrument and MSA fixed effects as additional included instruments. The results are shown in Table 5 and the first stage results are reported in Table 6. Among mortgagors, the FEIV and FDIV estimates for reporting fair/poor health are 0.077 and 0.20, respectively, and not statistically significant. The FEIV and FDIV estimates for the CESD score are 0.956 and 1.719 and significant at the 10 and 5 % levels. For hypertension, the estimates are 0.202 and 0.242 and significant at the 10 and 5 % levels. These estimates are not materially different from those using state-level home prices as the instrument.

Additionally, we examine the robustness of the results to high LTV thresholds at 70 and at 90 %. These results are reported only for mortgagors since the effects are estimated more precisely with this sample. As shown in Table 7, the higher the threshold, the greater the magnitude of the estimated effect possibly demonstrating that the health impact increases with debt burden. The first stage statistics reported in Table 8 shows that the strength of the instrument depends on the threshold as well. For the FEIV estimations, the instrument appears to be most relevant for the LTV threshold at 80 % whereas for the FDIV estimations, the LTV threshold at 70 yields the highest F-statistic. In summary, none of the instruments appears weak and the estimates parameters in the second stage remain statistically significant at the higher and lower thresholds so our main findings are robust to changing the threshold for high LTV.

As yet another robustness check, we repeated the estimations with additional covariates for employment, labor force status, total household income and total non-housing assets changes the results. Since these covariates are likely endogenous, these regressors served as their own instruments in the first stage in the panel IV estimations. As shown in Table 9, including additional covariates did not materially change the estimated parameters on high LTV nor did it materially change the first stage regressions (Table 10).

5 Discussion

This study presents empirical findings related to the direction of causality in the relationship between mortgage debt and health. Results from pooled OLS estimations show that excessive indebtedness is associated with reporting fair/poor health, a greater number of depressive symptoms, and incidence of hypertension. After adjusting for individual-level heterogeneity using panel estimation, these associations become statistically insignificantly different from zero. Using state-level home prices as an instrument variable in a panel IV framework, results show that having high LTV leads to one additional depressive symptom and a 20 % points increase in the likelihood of hypertension, but no effect on subjective well-being among mortgagors. The results also show that having high LTV is not statistically associated with likelihood of cancer, an outcome for which we would not expect a causal relationship.

The estimated effect between high LTV and hypertension is interesting as there is no evidence that stress, financial or otherwise, causes chronic hypertension. However, it is true that blood pressure increases temporarily in stressful situations. Specifically, in stressful situations, the body releases stress hormones, adrenaline and cortisol, into the blood. Known as “fight or flight response”, these hormones increase the heart rate and constrict blood vessels raising the blood pressure. Response to situational stress is typically short-lived and symptoms disappear after the stressful even is over (Mustacchi 1990; Zimmerman and Frohlich 1990; Boone 1991; Kario et al. 2003). However, if individuals cope with situational stress by adopting unhealthy eating habits or using tobacco or alcohol, then the risk of hypertension increases substantially. Indeed, there is evidence that unhealthy behaviors increase (Dave and Kelly 2012; Xu 2013) and that healthy behaviors decrease (Ásgeirsdóttir et al. 2014) during recessions when individuals must cope with uncertainty in the labor markets.

The results presented should be weighed against the limitations in the empirical approach. Since the HRS only surveys individuals age 50 and over, the estimated effects is not generalizable to the U.S. population. Also, aside from mortgage debt, households have access to many other forms of borrowing including credit cards, auto loans, and student loans. None of these are considered in this study. While this is a limitation, it also reflects a deliberate focus on homeowners, a more homogeneous sample with access to mortgage debt. And since mortgage debt is by far the largest component of household debt and constitutes more than half of a household’s liabilities, the amount of wealth at stake is larger and more likely to be a source of stress.

This study relies on self-reported measures for health, home values, and mortgage debt provided by homeowner respondents. The limitation of self-reported measures varies depending on the measure. Studies have found that individuals tend to under report the amount of debt owed (Gross and Souleles 2002; Karlan and Zinman 2008; Zinman 2009) while homeowners tend to overestimate the value of their homes (Kiel and Zabel 1999; Agarwal 2007; Benítez-Silva et al. 2010). This optimistic tendency suggests that the observed LTV is systematically lower than the true LTV. In the case of self-rated health measures, despite the potential for perception bias, studies have shown that, on average, self-rated health measures are strong predictors of mortality though the relationship may be modified by certain sociodemographic factors (Idler and Benyamini 1997; Franks et al. 2003). If the individual bias of self-reported measures are time-invariant, they would be eliminated by the panel data transformation. Therefore, a limitation of this study is that the individual bias of self-reported measures are assumed to be time-invariant in the panel estimations.

A remaining concern is that the results from the panel estimations and that from the panel IV estimations are surprisingly different. Assuming that the instrument works as intended, the panel IV results should be interpreted as a local average treatment effect which is driven by those on the margin of high LTV threshold. By design, homeowners that are shifted by the instrument are also those that are in the upper range of the LTV distribution in the sample. Therefore, the estimated effect is for older homeowners who are on the margin of high LTV, a group that is almost surely not representative of all homeowners. On the other hand, if the instrument is not a source of random assignment but is itself correlated with unobserved factors that affect health, then the panel IV estimations are unreliable and we are left with the panel estimations which do not suggest that excessive indebtedness leads to poorer health. Given the rise in foreclosures and the increasing share of the population with mortgage debt at older ages, more evidence on the direction of causality between debt and health is needed.

Notes

The cost of borrowing to purchase a home is subsidized by allowing interest paid on mortgages to be deducted from income and through government guarantees which reduce the credit risk of mortgage loans, essentially lowering the interest rate (Rosen 1985).

The Survey of English Housing is a supplemental survey to the British Household Panel Survey (BHPS) consisting of households headed by younger individuals, single parents, single male parents, divorced and separated, divorced and inactive.

See page 284 Wooldridge (2002).

The participation rate of homeownership stabilizes at around 70 % after age 45 (Poterba and Samwick 2001).

We follow Currie and Tekin (2011) who used cancer-related hospitalizations in a falsification test.

See HRS Internet Survey Data Description document for more information about this survey. http://hrsonline.isr.umich.edu/modules/meta/2009/internet/desc/net09_dd.

The RAND HRS Data file is a longitudinal data set based on the HRS data. It was developed at RAND with funding from the National Institute on Aging and the Social Security Administration (St Clair et al. 2011).

The FMHPI data can be downloaded from http://www.freddiemac.com/finance/fmhpi/. Data is available at three levels of geographical aggregation: Metropolitan Statistical Area (MSA), state, and national. All series begin in January, 1975.

The CPI data is available from ftp://ftp.bls.gov/pub/special.requests/cpi/cpiai.txt.

Unemployment data can be downloaded from http://www.bls.gov/lau/home.htm. Data is available at the county level of aggregation since 1990.

See Stock et al. (2002).

References

Agarwal, S. (2007). The impact of homeowners’ housing wealth misestimation on consumption and saving decisions. Real Estate Economics, 35(2), 135–154.

Alley, D. E., Lloyd, J., Pagán, J. A., Pollack, C. E., Shardell, M., & Cannuscio, C. (2011). Mortgage delinquency and changes in access to health resources and depressive symptoms in a nationally representative cohort of americans older than 50 years. American Journal of Public Health, 101(12), 2293–2298.

Anderson, R., & Grossman, M. (2009). Health and the household. Review of Economics of the Household, 7(3), 219–226. doi:10.1007/s11150-009-9058-5.

Ásgeirsdóttir, T. L., Corman, H., Noonan, K., Ólafsdóttir, T., & Reichman, N. E. (2014). Was the economic crisis of 2008 good for icelanders? Impact on health behaviors. Economics & Human Biology, 13, 1–19. doi:10.1016/j.ehb.2013.03.005.

Averett, S. L., & Smith, J. K. (2012). Indebted and overweight: The link between weight and household debt. Institute for the Study of Labor (IZA) Discussion Papers No. 6898.

Benítez-Silva, H., Eren, S., Heiland, F., & Jiménez-Martín, S. (2010). Using the health and retirement study to analyze housing decisions, housing values, and housing prices. Cityscape, 12(2), 149–159.

Boone, J. L. (1991). Stress and hypertension. Primary Care, 18(3), 623–649. PMID: 1946791.

Brown, S., Taylor, K., & Price, S. W. (2005). Debt and distress: Evaluating the psychological cost of credit. Journal of Economic Psychology, 26(5), 642–663.

Calcagni, E., & Elenkov, I. (2006). Stress system activity, innate and t helper cytokines, and susceptibility to immune-related diseases. Annals of the New York Academy of Sciences, 1069(1), 62–76.

Contrada, R. J., & Baum, A. (2009). The handbook of stress science: Biology, psychology, and health. Berlin: Springer.

Currie, J., & Tekin, E. (2011). Is there a link between foreclosure and health? National Bureau of Economic Research (NBER) Working Paper No. 12171.

Dave, D. M., & Kelly, I. R. (2012). How does the business cycle affect eating habits? Social Science & Medicine, 74(2), 254262.

Dietz, R. D., & Haurin, D. R. (2003). The social and private micro-level consequences of homeownership. Journal of Urban Economics, 54(3), 401–450.

Dorian, B., & Taylor, C. B. (1984). Stress factors in the development of coronary artery disease. Journal of Occupational and Environmental Medicine, 26(10), 747–756.

Drentea, P. (2000). Age, debt and anxiety. Journal of Health and Social Behavior, 41(4), 437–450.

Drentea, P., & Lavrakas, P. J. (2000). Over the limit: The association among health, race and debt. Social Science and Medicine, 50(4), 517–529.

Franks, P., Gold, M. R., & Fiscella, K. (2003). Sociodemographics, self-rated health, and mortality in the US. Social Science & Medicine, 56(12), 2505–2514.

Glaeser, E. L., & Shapiro, J. M. (2003). The benefits of the home mortgage interest deduction, tax policy and the economy (Vol. 17). Cambridge: MIT Press.

Gross, D. B., & Souleles, N. S. (2002). An empirical analysis of personal bankruptcy and delinquency. Review of Financial Studies, 15(1), 319–347.

Grossman, M. (1972a). The demand for health: A theoretical and empirical investigation. New York: Columbia University Press for the National Bureau of Economic Research.

Grossman, M. (1972b). On the concept of health capital and the demand for health. Journal of Political Economy, 80(2), 223–255.

Himmelstein, D. U., Warren, E., Thorne, D., & Woolhandler, S. (2005). Illness and injury as contributors to bankruptcy. Health affairs (Project Hope) Suppl Web Exclusives:W5-63–W5-73. doi:10.1377/hlthaff.w5.63, PMID: 15689369.

Himmelstein, D. U., Thorne, D., Warren, E., & Woolhandler, S. (2009). Medical bankruptcy in the united states, 2007: Results of a national study. The American Journal of Medicine, 122(8), 741–746. doi:10.1016/j.amjmed.2009.04.012.

Idler, E. L., & Benyamini, Y. (1997). Self-rated health and mortality: A review of twenty-seven community studies. Journal of Health and Social Behavior, 38(3), 21–37.

Kario, K., McEwen, B. S., & Pickering, T. G. (2003). Disasters and the heart: A review of the effects of earthquake-induced stress on cardiovascular disease. Hypertension Research: Official Journal of the Japanese Society of Hypertension, 26(5), 355–367. PMID: 12887126.

Karlan, D., & Zinman, J. (2008). Lying about borrowing. Journal of the European Economic Association, 6(2–3), 510–521.

Keese, M., & Schmitz, H. (2013). Broke, ill, and obese: Is there an effect of household debt on health? Broke, ill, and obese. Review of Income and Wealth pp n/a-n/a. doi:10.1111/roiw.12002.

Keys, B. J., Mukherjee, T., Seru, A., & Vig, V. (2010). Did securitization lead to lax screening? Evidence from subprime loans. The Quarterly Journal of Economics, 125(1), 307–362.

Kiel, K. A., & Zabel, J. E. (1999). The accuracy of owner-provided house values: The 1978–1991 american housing survey. Real Estate Economics, 27(2), 263–298.

McGee, R. (1999). Does stress cause cancer? There’s no good evidence of a relation between stressful events and cancer. BMJ. British Medical Journal, 319(7216), 1015.

Mian, A., & Sufi, A. (2009). The consequences of mortgage credit expansion: Evidence from the u.s. mortgage default crisis. The Quarterly Journal of Economics, 124(4), 1449–1496.

Mustacchi, P. (1990). Stress and hypertension. The Western Journal of Medicine, 153(2), 180–185. PMID: 2219875.

Neil Schneiderman, S. D., & Ironson, Gail. (2008). Stress and health: Psychological, behavioral, and biological determinants. Annual Review of Clinical Psychology, 1, 607–628.

Nettleton, S., & Burrows, R. (1998). Mortgage debt, insecure home ownership and health: An exploratory analysis. Sociology of health and illness, 20(5), 731–753.

Pollack, C. E., & Lynch, J. (2009). Health status of people undergoing foreclosure in the philadelphia region. American Journal of Public Health, 99(10), 1833–1839.

Pollack, C. E., von dem Knesebeck, O., & Siegrist, J. (2004). Housing and health in germany. Journal of Epidemiology and Community Health, 58(3), 216–222.

Poterba, J. M., & Samwick, A. (2001). Household Portfolio Allocation Over the Life Cycle. University of Chicago Press, pp. 65–104. Aging Issues in the United States and Japan.

Rosen, H. S. (1985). Housing subsidies: Effects on housing decisions, efficiency, and equity. Handbook of Public Economics, Chapter 7 (Vol. 1). New York: Elsevier.

St Clair, P., Bugliari, D., Chien, S., Hayden, O., Hurd, M., Miu, A., et al. (2011). RAND HRS data documentation, version l. Labor & Population Program, RAND Center for the Study of Aging.

Stock, J. H., Wright, J. H., & Yogo, M. (2002). A survey of weak instruments and weak identification in generalized method of moments. Journal of Business & Economic Statistics, 20(4), 518–529. doi:10.1198/073500102288618658.

Sweet, E., Nandi, A., Adam, E. K., & McDade, T. W. (2013). The high price of debt: Household financial debt and its impact on mental and physical health. Social Science & Medicine, 91, 94–100. doi:10.1016/j.socscimed.2013.05.009.

Taylor, M. P., Pevalin, D. J., & Todd, J. (2006). The psychological costs of unsustainable housing commitments. Institute for Social and Economic Research (ISER) Working Paper Series.

Wooldridge, J. (2002). Econometric analysis of cross section and panel data. Cambridge: MIT Press.

Xu, X. (2013). The business cycle and health behaviors. Social Science & Medicine, 77(1), 126–136.

Zimmerman, R. S., & Frohlich, E. D. (1990). Stress and hypertension. Journal of Hypertension Supplement: Official Journal of the International Society of Hypertension, 8(4), S103–107. PMID: 2258776.

Zinman, J. (2009). Where is the missing credit card debt? Clues and implications. Review of Income and Wealth, 55(2), 249–265.

Acknowledgments

We thank our Editor Michael Grossman and two anonymous reviewers for helpful comments and suggestions. We also thank David A. Jaeger, Ted Joyce, Shailender Swaminathan, Amal Trivedi, and participants at the City University of New York Graduate Center Health Economics Seminar and Brown University Center for Gerontology and Health Care Research Brown Bag Presentation for constructive feedback. We are grateful to Purvi Sevak, Partha Deb, and Hunter College CUNY for facilitating our access to restricted HRS data. All errors are our own.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Leung, L.A., Lau, C. Effect of mortgage indebtedness on health of U.S. homeowners. Rev Econ Household 15, 239–264 (2017). https://doi.org/10.1007/s11150-014-9250-0

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11150-014-9250-0