Abstract

Two games from experimental economics are paired to test household models. These experimental techniques can be helpful for informing policy that assigns welfare transfers, especially in the context of endogenous relationships or when impoverished families are omitted from income separability tests due to a lack of non-labor income, which is required for demand analysis of intrahousehold models. A trust game tests for Pareto efficiency, and a newly developed game tests for bargaining by determining if willingness-to-pay for a product changes based on endowment ownership. These games are applied in Salvador, Brazil, to a population not yet studied in the economic intrahousehold literature: adolescent mothers who live with their mothers. Their relationship is key for the welfare of adolescents’ children. The game outcomes reject Pareto efficiency but little evidence of bargaining is found. Qualitative survey questions confirm a cooperative relationship.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

This study began as an inquiry on relationships in the household in light of Bolsa Familia, Brazil’s conditional cash transfer for child health and education. Since the transfer is deposited into the mother’s bank account, one would suspect that power dynamics between spouses have shifted for the recipients. In the Northeast of the country, however, family structure is often not the nuclear model; the prevalence of single motherhood makes the question of bargaining power between spouses irrelevant for many families. Still, as extended families live together, there are plenty of intrahousehold relationships that remain to be analyzed. Of interest is that of teenage mothers who live with their mothers, a family structure not yet covered within the economic literature. Locals report that historically a teen mother would marry, but now the single teen mother is more socially acceptable and she often does not move from her own mother’s house. Understanding the families of teen mothers is important because of their prevalence and vulnerability. While Brazil’s teen birth rate is not much different than in previous decades, total fertility for the population as a whole has fallen below replacement (Cavenaghi and Diniz Alvez 2011), causing births to adolescents (19 and younger) as a percent of total births to rise from 12 % in 1986 to over 20 % in the last decade (Gupta and da Costa Leite 1999). Only 25 % of 16- and 17-year-old girls with children remain in school compared to 80 % of the rest of the population (Pesquisa Nacional por Amostra de Domicilios 2006) suggesting that these young mothers will not be earning as much as mothers who postpone childbearing. This, in turn, puts the welfare of their children at risk as the women face lower lifelong earnings. In addition, adolescent girls who live in poverty are almost twice as likely to become teen mothers.

One tool for preventing intergenerational poverty transmission is the conditional cash transfer, which provides financial support conditional on young children receiving vaccines and health check-ups and older children attending school. Brazil developed the first program of this kind and currently Bolsa Familia reaches more than 11 million families. The Bolsa Familia transfer is always given to the household matriarch, but she may not be the best target when considering her grandchild’s welfare. Biologically, we would suspect the teen to be most invested in the baby’s welfare as the closest blood relative in the household. Yet with the teen having engaged in ‘deviant’ behavior by becoming pregnant, it is quite possible that her mother does not trust her. Thus the same questions regarding family decision making and its impact on child welfare usually posed to husband and wife also apply in this context. In this paper I address the standard intrahousehold questions applied to this family structure: which household model best approximates the behavior in these families, and does the teen or her mother have more interest in the teen’s child’s well-being? I use economic games to answer this question, as standard methodology cannot be applied in this case. In a game testing the unitary model, on average these individuals do not change their valuation of a product when income ownership changes hands, and they tend toward cooperation in a trust game, though they are not full surplus maximizers. In light of these relatively harmonious findings, I suggest that the current targeting is efficient.

The contribution of this research to the intrahousehold literature is twofold. First, I use the tools of experimental economics to develop a new game to mimic the income separability test. This game reveals if there is evidence of bargaining power in the relationship. Paired with a trust game, these two games together allow for a characterization of the parent–child relationship into unitary, cooperative, non-Pareto-optimal, or other. This is an alternative methodology to the standard consumption analysis of demand modeling, and it can be applied when not all the requirements are met for determining income separability of demand such as when the nature of the family relationship is particularly endogenous (as in the parent–child relationship) or when there is a lack of exogenous income. Thus these new tools provide flexibility for the researcher, allowing for economic insights in situations that otherwise would be impossible using the standard demand method.

The second contribution of this work is insight into the relationship of teen mothers and their mothers, one that has not been widely studied within economics. This relationship impacts the welfare of the teen’s child, and can have important implications for government programs that attempt to influence the child’s well-being. Sociologists have addressed this relationship between adolescent mothers and their mothers in the United States. Apfel and Seitz (1991) report that in the majority of the inner-city black families surveyed, the grandmother assisted the teen in her parenting; much less frequently was the teenager the sole care-giver or did the grandmother take over all the parenting duties. A grandmother may be limiting her support strategically, as Hotz et al. (2005) show that parents of teen mothers give less in financial transfers to adolescents who have a younger sister than to those who do not have a younger sister to discourage the younger sister from repeating the event. This restraint, however, brings up concern for the infants’ well-being. Emotional support from grandparents is correlated with teen mothers being more nurturing toward their children whereas teen mothers without that support behave less so (Oyserman et al. 1994). This positive effect on behavior is important because, in the United States at least, teenage mothers are less nurturing than their elder counterparts. Perhaps for this reason, children of teenage mothers fare worse than others academically and tend to repeat the fertility trends of their parents (Card 1981); a grandparent’s presence may help to temper these unfortunate results. Echoing some of these findings, a Brazilian grandmother revealed that she faced inner tensions between wanting to help her daughter and grandchild and wanting to teach responsibility and allow her daughter to face the consequences for her actions. These concerns lead to questions about which recipient would be best for a transfer intended to benefit the child.

This family context requires an alternative approach to intrahousehold analysis. Income pooling cannot be tested if there is no exogenous income to pool; as will be explained later, these families are quite poor and their unearned transfers may be related to selection bias. Furthermore, the parent–child relationship, with the parent influencing the child as she is raised, will eliminate the possibility of almost any sort of income as being exogenous. Exogenous expansion of conditional cash transfers is an exception, but when this study was implemented, Bolsa Familia had been in existence for 4 years, and was preceded by a similar program; selection bias would be a concern. Applying the games within this context reveals important insights for conditional cash transfer targeting in Brazil. Facing a high teen pregnancy rate closely correlated with poverty, it is urgent to address the needs of the adolescents’ children. Potential misalignment of preferences between mother and daughter raises the question regarding whose preferences best favor the teen’s child. While current policy assigns the welfare transfer to the grandmother, the family matriarch, perhaps the teen has a closer biological interest in her child’s well-being. The results of the games indicate that this is not a concern among the families in this study so there would likely be no extra benefit for the child in changing the targeting. The families were recruited from a grass-roots organization in Salvador, Brazil, so they are not representative of the population as a whole, but their characteristics are well-aligned with those of the general population; their participation in such an organization indicates their social connectivity so they indeed may be the type of family that actively seeks to enroll in a conditional cash transfer program. The outcome of these games paints a picture of a family that is fairly harmonious but not perfectly so. The bargaining game that parallels the test of income separability failed to reject the unitary model, but an additional test reveals the teen to have more influence over the joint valuation when she owns the endowment. In the trust game, Pareto optimality was rejected, yet a high degree of trust was still evident. The additional information from qualitative survey questions supports this conclusion. This is somewhat comforting, as the reassignment of the stipend to the teen would raise additional concerns about incentivizing teen motherhood.

I test the three household models most widely found in the intrahousehold literature. The unitary model considers a household to be a single consumer, with harmonized preferences or one individual making the decisions for the family (Becker 1981). With respect to policy, this result implies that the targeting of the transfer to any specific individual in the household would not change the outcome. The unitary model is rejected if income separability is found: demand differs depending on who is receiving the income (Browning et al. 1994). Bargaining models can also be categorized based on efficiency. By definition, households are collective (cooperative) if efficiency is realized. Non-cooperative (inefficient) families still hold potential for an increase in utility without making anyone any worse off (Lundberg and Pollak 1993; Carter and Katz 1997).

Though the intrahousehold models were originally developed within an inter-“genderational” context, with little adaptation they can be conceived as intergenerational; it is simple enough to conceive the collective and non-cooperative models with parents and children as family members. Since we are dealing with parents and children, it is safe to assume that at one point in time the parent was making the decisions for the family as in the unitary model. This model still holds true if the parent remains in this dictatorial role now that the teen is grown, or if teen and parent are in such agreement that preferences are in consensus. Though not dictatorial, the rotten-kid theorem also results in a unitary outcome. With a self-interested child, the parent is making final decisions regarding income distribution for the household; income distributed to the child rises as total family income rises. Therefore the child still finds it in his best interest to maximize total family income, achieving Pareto efficiency.Footnote 1 A parent–child relationship characterized by the rotten-kid theorem would fall under the unitary model, and bargaining models would apply as a child becomes more independent, with proverbial teen rebellion having a non-efficient outcome.

Typically, consumption data is used to test income separability and Pareto efficiency, but the analysis is credible only if the income is exogenous. For this study, using unearned income is not feasible. The parent–child relationship, with the parent influencing the child as they are raised, will eliminate the possibility of almost any income as being exogenous. Many analyses take advantage of conditional cash transfer programs as exogenous shocks impacting consumption: Mexico’s Progresa (Bobonis 2009), Bolsa Familia (Braido et al. 2012), Romanian (Sahn and Gerstle 2004) and British (Lundberg et al. 1997) child allowances, among others. Unfortunately, the timing of my study occurred 4 years after Bolsa Familia had been established; selection bias would be a concern. Alternatively Pareto efficiency can be tested using distribution factors (power variables influencing how decisions are made) instead of income (Bourguignon et al. 2009). Yet distribution factors are not necessarily exogenous, especially in the case of parent and child; parental decisions in raising the child will affect the child’s bargaining power as she grows older. Udry (1996) takes another approach entirely by using supply side data; the Pareto efficiency of husbands and wives is tested by examining marginal yields of gender-specific crops considering different inputs. We could not measure the Pareto efficiency of parenting, though, since all family members contribute to child well-being.

Thus I turn to experimental economics. Experimental games have long helped economists better understand family dynamics. One of the first studies to examine the economic relationship between husband and wife in the laboratory finds couples’ behavior to be cooperative in decision-making (Corfman and Lehmann 1987); preference intensity is a stronger predictor of the decision made than bargaining power. Bateman and Munro (2005) also performed an experiment on household behavior, finding that individual lottery preferences are similar to the couple’s joint lottery preferences. In the field Hoffman (2009) staged an experiment in Uganda discovering that usage of mosquito nets varies based on the gender of the recipient in the family. Ashraf (2009) looks at husband and wife banking in the Philippines to find that expenditure choices differ when made public or kept private. In Zambia, choices about injectable contraception change when the decision is made by the woman alone or if the husband is present (Ashraf et al. 2010). In Brazil, Bursztyn and Coffman (2012) also find an inefficient outcome in that parents choose a lower-valued conditional cash transfer that requires their children’s schooling attendance over a higher-valued unconditional transfer. Berry (2011) finds evidence that Indian children’s educational attainment differs whether incentives are offered to the child or the parents.

Several studies have used trust games to evaluate cooperation between family members. Most find some degree of inefficiency. Iversen et al. (2011) use the dictator and trust games with variations in payoffs in Uganda to test intrahousehold bargaining models between husbands and wives and they reject any one model as dominant. They find that spouses in Uganda frequently do not maximize surplus, with an average contribution rate of 79 % for both women and men. In a similar study between spouses in Ethiopia, Kebede et al. (2011) find contribution rates are much lower with an overall average contribution rate of 56 %. Mani (2011) also finds Pareto inefficiency between married couples in rural India. Given an “investment” opportunity, when the individual had less control over the gains, on average only 70 % of the contribution would be to the high return investment which went to the spouse. The other 30 % was retained in a low return investment for the self. In the parent–child context in the US, Peters et al. (2004) test the rotten kid theorem in a common pool game. When participating with family, children (averaging age 11) give 56 % of their endowment, while parents contribute 84 %. Children give 5 % less than when contributing to a common pool shared with strangers while parents give 12 % less. However parents consistently give over 20 % more than children, whether paired with their own children or strangers’ children. This literature largely points toward an expectation of Pareto inefficiency and bargaining in the household.

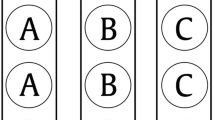

I use two complementary experimental games that help characterize populations and households into the different models of household decision-making. A bargaining game parallels the aforementioned demand analysis on a small scale by comparing a participant’s willingness to pay for a product (as elicited using the Becker–DeGroot–Marschak mechanism) when the participant is given a transfer as opposed to when the other player receives a transfer. The presence of a single utility function for the family can be rejected if these willingnesses-to-pay differ with endowment ownership. Using a child development toy as the product allows for insight into which family member places a higher value on the child’s welfare. Additionally, a trust game tests for Pareto efficiency in income maximization; results from this game provide information on cooperation and efficiency that is not available in most standard demand analyses. Teen and mother play these two games, each of which tests a separate aspect of intrahousehold interactions, and each game has two main outcomes. In the trust game, surplus maximization can be rejected or accepted and the bargaining game tests the unitary model. The total four possible outcomes align with characteristics of different household models as illustrated in the table below (Table 1).

The experimental results indicate that this population of teen mothers and their mothers falls into the “other” category, which does not have a clear corresponding model, as an over-arching model has not been proposed to account for the other possibilities these principal models do not cover. On aggregate, these families exhibit no evidence of bargaining, and while the sample does not achieve surplus maximization, they still exhibit a high level of trust with almost all being contributed in the trust game. The findings suggest that the current targeting of Bolsa Familia policy is efficient, implying that changing the recipient of the stipend from household matriarch to the teen would not result in a better outcome for the teen’s child.

2 Experimental design and estimation strategy

In this section, I present the basic framework of the two games played with the two family members and the estimation strategy associated with each.Footnote 2 Though the trust game is a standard economic game, the bargaining game is new to the literature developed especially for this intrahousehold analysis. To avoid confusion around the term ‘mother’, henceforth I shall refer to the teen mother as ‘teen’ and her mother as ‘grandmother,’ as she is the grandmother of the teen’s child.

Each family played the trust game twice and the bargaining game once. Payouts were randomized across the three games. A survey was administered prior to revealing the winnings to each player. In the bargaining game, one participant was given R$9 which was used during play.Footnote 3 The other was given an unconditional R$3 so as not to lose the goodwill of the participant. In the trust game each player was given R$2.50 which could double during the game. The enumerators also “played” so a Pareto efficient family had expected winnings of R$15. In 2008 the monthly Bolsa Familia transfer accruing to one child was R$22, so most families’ winnings were greater than half a month’s transfer.

2.1 The bargaining game

The bargaining game mimics the income separability test by comparing willingness to pay for a product when different family members are given money. In this game a cognitive development toy is introduced and the participants are told that they have the opportunity to purchase it, although the price is currently unknown. As an example of bargaining, consider the following scenario: If the teen owns the money, the grandmother may jack up her valuation of the item in question since her daughter will pocket any extra change. Worried that this cash could be spent on flippant purchases, the grandmother prefers the money to be spent on the toy, which is guaranteed to benefit the child. When the grandmother is given the endowment, the concerns regarding the change vanish; her valuation of the toy is lower because she will have complete control over the change and how it is spent. Thus the valuation is not an exact measure of the toy’s utility, since the decision may be made considering how the money left over will be divided. A family with a sharing rule in favor of the endowment holder will have the teenager inflating her valuation of the developmental toy when the grandmother holds the endowment. Each dollar left over after the purchase will not give the teen much utility; she will find it preferable to spend on the toy rather than receive a small fraction of the cash from her mother. When she makes the choice using her own money, the opportunity cost of purchasing the toy becomes purchasing more private goods for herself. The change provides her with less utility when it is in her mother’s pocket rather than in her own; unless preferences are aligned, we would expect valuations to shift with income ownership if bargaining happens in the family.

Theoretically any such product could be used to test bargaining, but since we are interested in child welfare, a developmental toy—a counting book—was chosen and produced especially for this experiment. This product was novel so participants did not have a reference for its value. Not only are children’s books a small market aimed at middle class Brazilians, they are much too expensive for the impoverished. Few and far between, those books cost at least R$20, more than the minimum wage for day laborers. Only 10.6 % of families in the study had baby books. The counting book I designed was created in the favela, silk-screened and sewn locally with potential to be much more affordable. Being made of strong cloth also makes it much more durable for babies than cardboard books on the market. The book can be washed, an advantage in dusty environments of unpaved roads. Finally, it is of developmental value since it can be used to teach counting as well as to familiarize children with books. The delight of the leaders of the NGO I worked with indicates the book’s novelty and their appreciation of its educational potential. This value may have been recognized by the grandmothers, though no findings suggest the same for the teen: a small positive correlation (0.1503, p value 0.0985) is found between the grandmother’s individual valuation of the baby book and positive response to the question, “Would you like to return to school someday?”Footnote 4

To start the game, the teen is given a monetary endowment. The individual must send a fictional messenger to a fictional store with the money and a valuation indicating her willingness-to-pay. As in the Becker-deGroot-Marschak mechanism (Friedman and Sunder 1994), the price is revealed, randomly selected between zero and the endowment, and the messenger purchases the item if the price is less than or equal to the willingness-to-pay; any money leftover after the purchase returns to the teen. If the price of the product is higher than the willingness-to-pay, no purchase occurs and the entire endowment is returned. In summary, this mechanism is truth-revealing, for the participant has no incentive to name a higher price and risk paying more than she would like for the good. Nor would the participant choose a price lower than her true willingness to pay since between these two prices she finds the value of the good higher than its price and would actually prefer to own the good. However, before the messenger makes it to the store, he “forgets” the teen’s willingness-to-pay and asks for a new willingness to pay from the grandma. This new player is reminded that the money with which the product will be purchased is not hers, and any change from the purchase (or the entire endowment if there is no purchase) will return to the teen. After this new willingness-to-pay is given, once more, the messenger “forgets” and a final willingness-to-pay is obtained, this time through a joint decision involving both individuals; again they are reminded that the teen owns the money. Armed with the three willingnesses-to-pay, the “messenger” randomly selects one at the “store,” which also generates a random price. The product is purchased (or not) as described, and the product along with the change (or the entire endowment if the selected willingness-to-pay is lower than the price) is awarded to the teen. In another treatment the roles are reversed; the grandmother is assigned the endowment.Footnote 5

There are three tests that can be done with this game. They are essentially a comparison of means, but in the results I also regress socioeconomic variables. Though these should not be considered causal, the significant covariates may provide some insight into the workings of these families.

First the unitary model is tested by comparing average valuations across treatments. The teens’ average valuation when they own the endowment is compared to their average valuation when the grandmothers own the endowment. Likewise the grandmothers’ valuations are compared to each other under the different endowment ownership treatments. Finally, the valuations elicited jointly are similarly analyzed. More formally, let v mN represent the valuation of person N (G for grandmother, T for teenager, and J for joint) when m is the owner of the endowment (g for grandmother and t for teen). Thus v tG is the grandmother’s valuation when the teen owns the endowment. The unitary model is rejected if v gN ≠ v tN for any N.

A second test of bargaining examines whether teen or grandmother has more influence over the joint valuation, holding endowment ownership constant. Regressing the joint valuation on individual valuations, we look for a difference in coefficients that would indicate that one has more influence than the other. Additionally we can interact these terms with endowment ownership testing if one has more influence when the money is one’s own. D t = 1 when the teen owns the endowment, comparing to the case of the grandmother owning the endowment.

Rejecting the equality of coefficients β G and β T would indicate that the individual corresponding to the larger coefficient has more influence in determining the joint valuation when the grandmother owns the endowment. β G + γ G compared to β T + γ T indicates relative bargaining power when the teen has the endowment. Finally, comparing β G to β T + γ T compares relative bargaining power when each has the endowment.

For policy purposes, we would want to give a transfer to the person who has a higher preference for child welfare when they own the endowment. I proxy this by testing who has the larger valuation, indicating she is willing to spend more on the child. A simple regression on dummy variables for ownership of endowment and source of valuation allows us to make this comparison of means. Now D T and D G will be dummies indicating who made the valuation; the joint valuation is omitted.

D t + D T + D t D T + constant is the teen’s valuation when she owns the endowment and D G + constant is the grandmother’s valuation when she owns the endowment. Comparing these indicates who is willing to spend more on the baby book when she receives the transfer. I also consider the sign of D t , which indicates if the family, when arriving at a joint decision, values the baby book more or less when the money is in the teen’s pocket compared to the grandmother’s pocket. If the family is fairly united, the joint spending decision could reflect how money is spent as a family.

2.2 The trust game

The other game used to evaluate models of the household is a standard trust game, which tests Pareto efficiency in surplus maximization, a measure of cooperation in the household. The participants are introduced to a “magic” hat of which they will become owner. The hat doubles in value anything that is put into it.Footnote 6 The participants then are given five vouchers each valued at R$.50 that will be redeemed for groceries at a local convenience store. One individual is the designated owner of the hat, but both are informed that the game will be played another time with the other as owner, and again the same amount of money will be distributed afresh. Both players are informed that everyone, including the enumerators (whose contribution is determined randomly), will have an opportunity to place all, some, or none of the bills in the hat. Anything in the hat is doubled in value and will be given to the owner, but not until after the game is played a second time with the other individual owning the hat. This delay avoids retribution should the first owner perceive unjustly small winnings. I take measures to ensure that this would only be a speculative conclusion. The placement of contributions is done secretly so no one will see a contribution or lack thereof. Furthermore, the enumerators’ contribution introduces noise so that the owner of the hat will not be able to calculate the contribution of the other.

The typical structure of this game has a final step where the owner of the hat redistributes her winnings after all contributions have been made and doubled; this gives the non-owner incentive to contribute and the owner an opportunity to reward the contribution. However, in this application participants are not strangers—in fact they are members of the same household with plenty of interaction for a later redistribution—so this step is not included. Furthermore, any responses to questions regarding redistribution are not necessarily truthful. A mother may pretend to give a portion of her winnings to her daughter but after the enumerators leave, snatch it back. Leaving this step implicit does not affect our analysis, which is to determine if the family is behaving in a Pareto efficient manner: do both participants place all bills in the hat when they do not own the hat?

Let c mN be the contribution person N (T or G) makes when person m (t or g) owns the hat. We are only interested in c gG and c tT insomuch as it indicates to us if the individual understood the game; both should be equal to the entire holdings. Our test of Pareto Optimality in the remaining families where both individuals understood is

Rejecting this hypothesis means we reject the unitary and collective models. In the unitary case, as long as the teens’s consumption is a normal good, she will help the grandmother maximize income and contribute all to the hat. The grandmother will do the same, too. For collective models, theory indicates that once the amount spent on the public good is decided upon, the rest of the income is divided according to a sharing rule (Browning et al. 1994). The sharing rule allows each member to maximize her own utility subject to the individual budget constraint to determine individual consumption. For the purposes of this trust game, if the sharing rule is unrelated to the final distribution of income, the result is Pareto Optimal as income maximization is always preferred for both players.Footnote 7 We can also examine who is more generous to the other by comparing c tG –c gT .

3 Context and data

In Brazil, the relationship between teen and grandmother is likely the most influential on the teen’s baby’s welfare. Locals reported that though a teen pregnancy would traditionally result in the daughter leaving her family to live with the baby’s father, nowadays teen pregnancy is more accepted and their mothers allow the daughters to live at home. This is not too surprising as Northeast Brazil is a matrilocal society. Thirty-one percent of Brazilian families are headed by single women (Pesquisa Nacional por Amostra de Domicilios 2006), and in my sample this figure is almost double: 72 % of the grandmothers head the household, in spite of the fact that some still live with their husbands.Footnote 8 Within my sample, 46 % of households have no spousal presence for either teen or grandmother. Furthermore, in only 4 % of homes are both the teen’s father and the baby’s father both present. These statistics indicate that this long-lasting relationship between grandmother and teen is most appropriate for intrahousehold analysis. (See Table 2 for further breakdown.)

Data was collected in the port city of Salvador, presently the third largest city in Brazil and the country’s first capital. Located in the impoverished Northeast, Salvador is noted for hosting the largest street carnival in the world. It’s historical roots of slavery to support sugar production make it the center of Afro–Brazilian culture, but also leaves it impoverished with the highest unemployment rate of the larger cities (Pesquisa Nacional por Amostra de Domicilios 2006).

The 153 families in the study were recruited from the community organization Pastoral da Criança. This is not a representative sample of teenage mothers who live with their mothers, but given bureaucratic and financial limitations, this population allowed the study to be feasible, a starting point for applying the games. This decentralized organization targets poor families with children 6 years or younger to improve their health and nutrition; pregnant women are also served. Every month the local volunteer leaders visit the families to provide guidance and support. Also occurring monthly is a community weighing, usually at the neighborhood church. In spite of being a Catholic sponsored organization, people of all religions participate, as the unifying force is love for children. The local leaders weigh the children, play games, and hand out snacks. Underweight children are targeted with special attention in the coming months. Established in 1983, this organization is highly respected in Brazil, and has expanded internationally to twenty other countries including a few in Africa and Asia. It is sponsored by UNICEF and has been nominated for a Nobel Peace Prize.

The Pastoral in Salvador is organized into three regions. The first region runs along the Atlantic coast, where the prime real estate is located. The second region runs along the bay, and the third covers the center of the city and a bit of the periphery. We surveyed in the second and third regions, those with a higher concentration of poorer communities and therefore likely a higher concentration of teenage mothers. Since the focus of the organization is on children and pregnant women, the Pastoral collects data mainly on the children. Therefore only the leader who worked with the mother knew the age of the mother. While we did not take data on those who were not in our profile, my enumerators estimate that more than 75 % of teenage mothers fit into our profile. With the help of 46 parochial coordinators and a plethora of community coordinators (all volunteers) we were able to consult with most local leaders. Around a hundred of these presently worked with a teenage mother who lived with her mother, grandmother (six families), or mother-in-law (17 families), and had been participating in the organization in the year 2008. This time lag was to prevent selection bias, in case anyone would join the organization just to participate for remuneration.

We were unable to interview eighteen families. Four suspicious grandmothers did not wish to let their daughters participate. One could not take time off from work. Three moved and these we did not attempt to track down due to the safety of entering unknown neighborhoods without introduction. Two declined after our logistical errors. Four families belonging to one leader could not be interviewed since the leader could not leave her sick father. The final four were in districts where the leaders did not venture themselves. Our census of teen mothers in the Pastoral who live with their mothers may also be incomplete from a leader’s oversight. Occasionally a leader from 2008 would have left and been replaced with another. We did our best to track down everyone, even from the several communities that closed in 2008. However, these closings were due to lack of volunteers anyway, so it is not likely that there were many mothers registered in the first place. Without the data on the ages of the mothers of all the children served by the Pastoral, it is impossible to know the percentage of children that are born to teen mothers, but from our census and some back-of-the-envelope calculations, it seems that the teen mothers in the pastoral are responsible for around 15 % of children in the organization, whereas the national average is twenty percent. I suspect this discrepancy comes from the limited coverage of the Pastoral, which serves just below ten percent of poor children in Salvador.

In most cases, the leader introduced us to the teenager and the enumerators scheduled a time to return when both she and her mother would be present. The leader would accompany the enumerators to the house and stay only if the neighborhood was dangerous enough to warrant; whenever possible we asked the leader to leave so the participant would not be influenced by her presence. Afterward, in return for her assistance, the leader received the remaining supermarket vouchersFootnote 9 that the family did not win, though most leaders seemed as though they would have helped without this benefit: they liked the topic of study and were glad to give the mothers they helped a chance to win some support for participation.

Comparing some statistics from the survey to comparisons in Brazil suggests that this population of children born to teen mothers is more at risk than the average child. According to Pastoral statistics,Footnote 10 within the second and third regions in Salvador 5 % of children had diarrhea in the last month, as reported by their mothers. In this population of only teen mothers, we find 35.5 %.Footnote 11,Footnote 12 Finally, within the Pastoral 87.15 % of children have complete vaccinations for their age while I find that of the 150 children of teens for whom vaccination information is available, 71.3 % have not completed the vaccinations within 2 months of the schedule. Within 1 year and 2 months of the schedule, 85.3 % of children of teenagers do complete the regimen. The World Health Organization reports that in 2008 vaccine coverage in the entire country was 96 % (World Health Organization 2009) The World Health Organization recommends that babies not be weaned until 2 years old and breast fed exclusively for 6 months (Kramer and Kakuma 2002). Of the 114 children under 2 years of age, only 67.5 % are still breastfed. Of the 47 infants in my sample 6 months or younger, 31.9 % are exclusively breastfeed and of the 41 infants 4 months or younger, 34.1 % are exclusively breastfed.Footnote 13

Comparisons to national level statistics also indicate that this is a vulnerable population. Descriptive statistics of the participants are presented in Table 3. Of these families 61 % are below Brazil’s poverty line of R$140 per capita income per month,Footnote 14 as confirmed by a majority of families receiving Bolsa Familia, Brazil’s welfare program. We do have some wealthy outliers; one grandfather who worked for an oil company refused to state his income.

To confirm the necessity of an experimental approach, let us examine the variables that would be used under a traditional econometric approach. Recall that this methodology requires demand curves to be analyzed to determine if demand shifts occur based on the recipient of exogenous income shocks. While private goods are not required to determine this, the argument is intuitively cleaner and the audience more easily convinced if an effect is shown for private goods. Usually items like women’s clothing and men’s clothing can be analyzed when looking at husband and wife. However, since this population is composed of two women, clothing may not be an appropriate category. Even consumption goods like feminine products cannot be used as private goods since many of the grandmothers are still menstruating; there are cases where mother and daughter both have babes in arms.

I included potentially private goods in the survey, asking each individually how much they spent on these in the last 3 months. I also asked if they were truly private, or if they were shared.Footnote 15 From Table 4, the high level of sharing does not make these satisfactory private goods, and the two categories that remain, leisure and salon, have few people spending. This again emphasizes the poverty of the population; without much disposable income, private goods become infrequently purchased luxuries. When all of these categories are considered simultaneously, only 63 teenagers and 47 grandmothers in a total of 82 families have private good expenditure; there is no observation of private expenditure for 46 % of the population. The correlation of the variables ‘amount of private good expenditure per family’ and ‘per capita yearly consumption’ is significantly positive (0.1622, p value 0.0451), as is the correlation with value of family’s assets (0.2786, p value 0.0005). These correlations suggest that if we were to analyze demand for private goods, there would be a systematic lack of information about the behavior of the poorest families. We do find grandmothers’ income correlated with individual private expenditures (0.3094, p value 0.0017) but teenagers’ private expenditures is not significantly correlated with their income nor with the grandmothers’ income. Average individual expenditure conditional on having spent is R$72 for grandmothers mothers and R$71 teenagers, though teens have a higher standard deviation (123 vs. 82). What is even a more serious constraint to the demand analysis, however, is that while there are sources of unearned income (shown in Table 5) all of these are endogenous, making conclusions of household behavior using tests of pooling invalid. Bolsa Familia, implemented in 2003, brings concerns of selection bias since it requires families to apply. Personality factors may affect teenagers’ reception of child support from the infants’ fathers; more forceful teens may extract higher payments. In 17 % of families neither teen nor grandmother has a source of unearned income.

4 Results

Scripts incorporated comprehension questions to check for understanding. Participants seemed to better grasp the bargaining game, likely since this game was less abstract and more aligned with an every-day scenario. We did have one family who clearly did not understand as they reported valuations of R$0.50, but were supposed to only use whole numbers. They are excluded from the analysis (as were the two other families for which doubt about their treatment arose). Another concern is that some may have fixated on the possibility of winning the book for free, though we tried to emphasize that if they put down zero as their valuation, the probability of getting the book was slim. While 40 individuals selected a valuation of zero, of these only two were in the group that did not understand the trust game, the more abstract of the two games.

4.1 The bargaining game

In Table 6 we find the sample balanced. Table 7 reports the average valuations (which could range from 0 to 9) for each individual within each treatment and tests for significant differences across our two variations. These results fail to reject the unitary model. The first three columns of Table 8 include additional covariates. While these should not have a causal interpretation, their inclusion also does not change the significance of the coefficient on teen endowment, the variable of interest for identifying bargaining power. There are some interesting correlations, such as a positive correlation between the teen’s valuation of the baby book and her private income. The grandmother’s valuation is positively correlated with her education but negatively correlated with per capita income. Additionally, grandmothers in households where men are not present value the baby book less. Since per capita income is already included as a covariate, I interpret this as relating to preferences rather than to a budget constraint. More importantly, however, the magnitude of this negative correlation is completely overcome when we look at the interaction between being in a Bolsa Familia recipient family and a women-only household. If we do indeed consider that the baby book is an accurate proxy for child welfare, then the lack of significance on the Bolsa Familia covariate on its own suggests a lack of a selection bias related to families with a higher preference for child welfare receiving Bolsa Familia. Yet we find this potential selection bias among families in which there are only women, with those more concerned about child welfare more likely to be receiving the stipend. Of course, this causality could be reversed: among women-only households, those receiving the stipend are more likely to value their children more. Alternatively, perhaps those who received the stipend and cared more about child welfare decided to leave their husbands, selecting into women-only households. This intriguing observation brings up many more questions about intrahousehold relationships and conditional cash transfers that can be addressed in future research.

In columns four and five of Table 8, we see that the most important factor in determining the joint valuation is the teen and grandmother’s individual valuations, which is not surprising. We use these coefficients to test bargaining power in a different way: examining whose valuation—teen’s or grandmother’s—has a larger influence on the joint valuation. Testing the equality of the coefficients for teen valuation and grandma valuation determines who has more influence when the grandmother has the endowment. These are not statistically different (p value 0.849). When the interactions are added in to analyze bargaining power when the teen has the endowment, however, the teen has more bargaining power (p value 0.048).

On its own this result is not a sufficient argument to influence a change in targeting policy; we must consider who values the baby book more. Table 9 stacks all valuations, giving a dummy variable equal to one representing its source; the base case is the joint valuation with the grandmother receiving the endowment. Comparing the coefficients on teen valuation and grandma valuation, in both columns the difference is statistically insignificant (p value 0.828) as is when we add the interaction terms to these (p value 0.342). Thus without indication that either teen or mother is valuing the baby book more than the other, we find no evidence that would suggest a change in targeting would be necessar for the Bolsa Familia program.

4.2 The trust game

The trust game had a built-in understanding test in addition to the comprehension questions incorporated in the instructions. I check that the participants understood the game by confirming self-interested behavior: when the participants are owners of the hat, they should place the entire R$2.50 in the hat.Footnote 16 There were nineteen teenage mothers and twenty-two grandmothers whose behavior failed to match this criteria, with a total of thirty-nine families that could not be included in the analysis of family bargaining due to at least one of the members not comprehending the activity. The multiplication concept seemed to challenge the participants, perhaps due to low education levels. Misunderstanding—or at least the expression of suboptimal behavior—is not unheard of in the trust game. In a similar test of individual surplus-maximization in rural India, Mani (2011) finds that when the optimal strategy to contribute all to a certain “investment,” on average only 90 % of the money is contributed.

Results reject Pareto efficiency in the trust game in that the average sum of contributions is R$4.50, less than the maximum R$5.00 (p value 0.000). However, this is more efficient than any of the families mentioned in the literature review of other trust games, with contributions among relatives ranging only from 56 to 84 %. Individual valuations are presented regressed with covariates in Table 10. We see the grandmother’s contribution to her daughter is correlated with how much she likes her daughter, but the daughter’s opinion of her mother is not correlated with her contribution. Also of interest, teens do contribute more if their mother is the household head while grandmothers contribute more if their daughter gave birth at an older age. Again, we cannot attribute causality to these relationships, but they are interesting indicators that trust may be related to perceived responsibility.

Though we are interested in family structure, this game also reveals individual preferences. Were an individual purely interested in monetary gain, the decision of how much to place in the hat would be straightforward: one only places if she expects to get more back than she puts in. With this logic, we expect an all-or-nothing approach with contributions dichotomized between 2.50 or 0. There are, in fact, many intermediate values chosen; though overall surplus maximization is rejected, still much generosity is revealed. To better understand how non-Pareto optimal families behaved, Table 11 contains the distribution of pairs of gifts. It is interesting to note that not a single person kept all to herself; there was always a contribution. In most cases, this tended toward R$2.50 rather than zero. With respect to Bolsa Familia policy, this result is heartening, again indicating trust in these families.

5 External validity and conclusions

The results of these games characterize these families as fairly cooperative but not to the extent of achieving complete surplus maximization. Does this finding echo other interactions in the family, supporting the external validity of the games? We turn to qualitative survey questions to amplify the picture of household dynamics. In separate rooms both adolescent mother and grandmother responded individually to inquiries about household decision making. In 74 % of families, both teen and grandmother were in agreement that the teen took the child to the health care center when ill. However, in 46 % of families there was disagreement regarding who was the impetus behind that decision. In most cases, each was claiming responsibility rather than acquiescence to another. A similar response structure occurred for buying baby clothes and products and deciding that the baby needed clothes and products. On the other hand, overall responsibility for the child clearly falls to the teen when considering time allocation. While teens spend only slightly more time with the child than grandmothers (14.56 waking hours as opposed to the grandmother’s 10.33 waking hours), the teenagers claim many more of these hours as hours that they are principally responsible for the baby. Grandmothers on average claimed 5.49 hours while teenagers claimed 13.67 hours. Ultimately, however, the grandmother is the head of the household. In 60 % of families there was agreement that it is the grandmother who grants the teen permission to go out without the baby and in 95 % of families there was agreement that the grandmother decides for herself that she can go out without the baby. The parent–child hierarchy remains in place.

In spite of the disagreements found and potential conflicts that could arise within this hierarchical structure, the disagreements stem from mutual interest in the baby’s well-being as both claim to be responsible for decisions about the baby. This ‘conflict’ is not one that drives families apart. In more than half the families both members would like to live together even when very rich; cooperation in the games is not a surprising result. Considering the experimental outcomes in light of the qualitative inquiry, the findings are consistent and complementary. The bargaining game failed to reject the unitary model when tested as the income separability model, but in an additional test we find the teen to have more influence over the joint valuation when she owns the endowment, echoing her power in her realm of responsibility for the child. In the trust game, Pareto optimality was rejected, yet most of the surplus was achieved. Looking back at Table 1, examining the results of these games through the lens of standard models places these households place these families of teenage mothers who live with their mothers in the “other” category. The additional information from the qualitative survey supports a picture of a hierarchical family that is fairly harmonious but not perfectly so.

What is not addressed in this paper and remains a fruitful area for research is the observation of former households that have split, where teen has left with her child. Future efforts can reunite separated teen and grandmother to observe how their behavior differs from families that stay together. Additional participants such as boyfriends and husbands could be included in the games as well; following decisions over time as teens and grandmothers change partners could prove quite interesting. These games are a flexible tool for economically modeling family interactions; without the stringent exogenous income requirement, studies can encompass many more populations.

This study offers valuable insight regarding the targeting of Brazil’s conditional cash transfer program Bolsa Familia. Although the sample is not randomly sampled from the general population, the demographics are reasonably aligned. Even though the sample does not include families with teens who live apart from their mothers, most of those young women under age 18 would not be eligible to receive the stipend anyway. In the face of a high teen pregnancy rate closely correlated with poverty, concern that a teen’s deviant behavior may indicate a misalignment of preferences between mother and daughter raises the question regarding whose preferences best favor the teen’s child. While in Brazil current policy assigns the welfare transfer to the grandmother, the family matriarch, perhaps the teen has a closer biological interest in her child’s well-being. The results of the games, confirmed by qualitative inquiry, indicate that this is not a concern among the families in this study; in fact this population behaves more cooperatively than others studied using similar techniques. With respect to this question of intrahousehold allocation of the targeting of a welfare transfer to teen or grandmother, the status quo is satisfactory.

Notes

Bergstrom (1989) finds a class of utility functions for which this does not hold and the child would not maximize income. Without transferable utility, a child can manipulate the utility possibilities frontier in his favor. However, I do not include these with my definition of the unitary model, as the result falls well outside of the spirit of being “unitary.”

Game instructions available in Electronic supplementary material.

R$1 ≈ US$0.50.

Only 2 of the 58 teens not enrolled in school did not wish to return, so a comparable statistic for teens contains little information. A correlation (0.1528, p value 0.0637) is also found between grandmother’s valuation and the number of baby books owned, though this disappears when owning baby books considered as a dummy variable. Education level is not correlated with the valuations elicited during the game for either teen or grandmother.

In addition to varying the owner of the endowment, I also vary the order in which the valuations are reported. No significant impact is found from this source of variation. Especially considering that there is no policy recommendation that results from a finding based on eliciting a joint valuation first, I do not include these results; I pool the treatments and only consider the variation in endowment ownership.

Other options besides doubling could be used: any term >1 would has a Pareto efficient strategy of placing all money into the hat.

Yet if the sharing rule is determined by ex-post income distribution there is a possibility that the result is not Pareto Optimal. If, say, the sharing rule is based entirely on the fraction of income after the game is played, then if person one contributes all to person two, person one is left with no bargaining power at all. If person two does not sufficiently care about person one, person one may prefer to keep the money for herself. Even though this model is technically collective, the non-Pareto optimal outcome and the perceived unfairness of this sharing rule allow us to consider it to be an uncooperative model; certainly the spirit of cooperation does not hold.

This figure is 2.5 % points higher (though not significantly different) when the question who has the most authority in the household is asked. However, the “family head” question is more formal and likely to reflect an official stance to outsiders, whereas household authority may have to do more with internal politics.

Participants were paid in vouchers for a neighborhood convenience store or grocery. Money was originally proposed for remuneration but the leaders in the Pastoral were concerned about spending on drugs and the enumerators were concerned for their safety. Vouchers resolved these concerns but still allowed the participants a wide span of purchasing choices.

These statistics are aggregated from leaders’ records taken from the visits with mothers noted in the leader’s chart of indicators for each child. While in any month some small number of visits may not have been completed, the quality of the data reported is high as the leaders are well trained. To become a leader, one must undergo multi-day training, studying a 250-page handbook on pregnancy, child development, and interaction with families.

The age of the baby is positively correlated with diarrhea reporting (0.24); thus these numbers are probably not skewed by new mothers incorrectly identifying infant feces as diarrhea.

All statistics in this paragraph from my data are significantly different from the comparison reference with 99 % confidence.

In the Pastoral 62.2 % (region two) and 53.4 % (region three) of 6-month-olds are exclusively breast fed and 59.3 % (region two) and 87.5 % (region three) of 4-month-olds are exclusively breast fed (Pastoral da Criança Internacional 2009).

I adjusted the wages up R$50 of 10 formal sector salaried workers interviewed before February 1st, 2009, to correspond to the minimum wage change on that date.

If one person said they were shared, even if the other did not, I counted them as shared.

Placing <$2.50 could be rational if the owner of the hat knew that the other would appropriate all gains after the game was over. Then out of maliciousness, not irrationality, might money be withheld from the hat. Unlikely this is the case here, since I found no significant difference in rational players and “irrational” players responses to a question on how strongly would they prefer to live with the other.

References

Apfel, N. H., & Seitz, V. (1991). Four models of adolescent mother–grandmother relationships in black inner-city families. Family Relations, 40(4), 421–429.

Ashraf, N. (2009). Spousal control and intra-household decision making: An experimental study in the Philippines. American Economic Review, 99(4), 1245–1277.

Ashraf, N., Field, E., & Lee, J. (2010). Household bargaining and excess fertility: An experimental study in Zambia. Mimeo (unpublished).

Bateman, I. J., & Munro, A. (2005). An experiment on risky choice amongst households. Economic Journal, 115(502), C176–C189.

Becker, G. S. (1981). A treatise on the family. Cambridge, MA: Harvard University Press.

Bergstrom, T. C. (1989). A fresh look at the rotten kid theorem—And other household mysteries. The Journal of Political Economy, 97(5), 1138–1159.

Berry, J. (2011). Child control in education decisions: An evaluation of targeted incentives to learn in India. Mimeo (unpublished).

Bobonis, G. J. (2009). Is the allocation of resources within the household efficient? New evidence from a randomized experiment. Journal of Political Economy, 117(3), 453–503.

Bourguignon, F., Browning, M., & Chiappori, P. A. (2009). Efficient intra-household allocations and distribution factors: Implications and identification. Review of Economic Studies, 76(2), 503–528.

Braido, L. H. B., Olinto, P., & Perrones, H. (2012). Gender bias in intrahousehold allocation: Evidence from an unintentional experiment. Review of Economics and Statistics, 94(2), 552–565.

Browning, M., Bourguignon, F., Chiappori, P., & Lechene, V. (1994). Income and outcomes: A structural model of intrahousehold allocation. Journal of Political Economy, 102(6), 1067–1096.

Bursztyn, L., & Coffman, L. C. (2012). The schooling decision: Family preferences, intergenerational conflict, and moral hazard in the Brazilian favelas. Journal of Political Economy, 120(3), 359–397.

Card, J. J. (1981). Long-term consequences for children of teenage parents. Demography, 18(2), 137–156.

Carter, M., & Katz, E. (1997). Separate spheres and the conjugal contract: Understanding the impact of gender-biased development. In L. Haddad, J. Hoddinott, & H. Alderman (Eds.), Intrahousehold resource allocation in developing countries: Models, methods, and policy (pp. 95–111). Baltimore, MD: Johns Hopkins University Press for the International Food Policy Research Institute.

Cavenaghi, S., & Diniz Alvez, J. (2011). Diversity of childbearing behavior in the context of below-replacement fertility in Brazil. United Nations Population Division Expert Paper No. 2011/8, New York.

Corfman, K. P., & Lehmann, D. R. (1987). Models of cooperative group decision-making and relative influence: An experimental investigation of family purchase decisions. The Journal of Consumer Research, 14(1), 1–13.

Friedman, D., & Sunder, S. (1994). Experimental methods: A primer for economists. Cambridge: Cambridge University Press.

Gupta, N., & da Costa Leite, I. (1999). Adolescent fertility behavior: Trends and determinants in Northeastern Brazil. International Family Planning Perspectives, 25(3), 125–130.

Hoffman, V. (2009). Demand, retention, and the intrahousehold allocation of free and purchased mosquito nets. American Economic Review, 99(2), 236–241.

Hotz, V. J., McElroy, S. W., & Sanders, S. G. (2005). Teenage childbearing and its life cycle consequences: Exploiting a natural experiment. Journal of Human Resources, 40(3), 683–715.

Iversen, V., Jackson, C., Kebede, B., Munro, A., & Verschoor, A. (2011). Do spouses realise cooperative gains? Experimental evidence from rural Uganda. World Development, 39(4), 569–578.

Kebede, B., Tarazona, M., Munro, A., & Verschoor, A. (2011). Intra-household efficiency: An experimental study from Ethiopia. CSAE Working Paper Series.

Kramer, M. S., & Kakuma, R. (2002). Optimal duration of exclusive breastfeeding: A systematic review. whqlibdoc.who.int/hq/2001/WHO_NHD_01.08.pdf.

Lundberg, S. J., Pollak, R. A., & Wales, T. J. (1997). Do husbands and wives pool their resources? Evidence from the United Kingdom child benefit. Journal of Human Resources, 32(3), 463–480.

Lundberg, S., & Pollak, R. A. (1993). Separate spheres bargaining and the marriage market. The Journal of Political Economy, 101(6), 988–1010.

Mani, A. (2011). Mine, yours or ours? The efficiency of household investment decisions: An experimental approach. CAGE Online Working Paper Series.

Oyserman, D., Radin, N., & Saltz, E. (1994). Predictors of nurturant parenting in teen mothers living in three generational families. Child Psychiatry and Human Development, 24(4), 215–230.

Pastoral da Criança Internacional. (2009). Sistema de Informação. http://www.pci.org.br.

Pesquisa Nacional por Amostra de Domicilios. (2006). Sistema IBGE de recuperação automática. http://www.sidra.ibge.gov.br.

Peters, H. E., Unur, A. S., Clark, J., & Schulze, W. D. (2004). Free-riding and the provision of public goods in the family: A laboratory experiment. International Economic Review, 45(1), 283–299.

Sahn, D. E., & Gerstle, A. (2004). Child allowances and allocative decisions in Romanian households. Applied Economics, 36(14), 1513–1521.

Udry, C. (1996). Gender, agricultural production, and the theory of the household. Journal of Political Economy, 104(5), 1010–1046.

World Health Organization. (2009). WHO vaccine-preventable diseases: Monitoring system 2009 global summary—Country profile: Brazil. apps.who.int/immunization_monitoring.

Acknowledgments

Generous funding was provided by the Social Science Research Council and Cornell University’s Einaudi and Latin American Studies Centers. I am indebted to Dr. José Guilherme Lara Resende of the Universidade de Brasilia for academic sponsorship within Brazil. I thank Elisalda de Lima Costa and Diego Corrêa for research assistance. Dan Benjamin, Kaushik Basu, Lourdes Beneria, David Sahn, Gina Reynolds, Evan Variano and participants in the UC Berkeley development and demography lunches provided helpful comments, as did two anonymous reviewers. Many thanks to my gracious hosts Associação Criança e Familia and the leaders of the Pastoral da Criança for their generosity and wisdom.

Author information

Authors and Affiliations

Corresponding author

Electronic supplementary material

Below is the link to the electronic supplementary material.

Electronic supplementary material

Rights and permissions

About this article

Cite this article

Reynolds, S.A. Behavioral games and intrahousehold allocation: teenage mothers and their mothers in Brazil. Rev Econ Household 13, 901–927 (2015). https://doi.org/10.1007/s11150-013-9213-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11150-013-9213-x