Abstract

By examining the data on 13,663 newly established FDI firms and the environmental regulation reforms between 2000 and 2010, this paper studies whether foreign investors in China exhibit pollution haven behavior. Our analyses indicate that fewer FDI firms locate in provinces with more stringent environmental regulations (i.e., with higher pollution levy rates). Consistent results are found when we examine the individual firm’s location choice decision. We further find that firms’ location patterns respond to the changes in environmental regulations. In particular, their pollution haven behavior becomes more significant when the changes bring greater inter-provincial differences in environmental stringency.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The Chinese economy has grown rapidly over the past three decades, and foreign direct investment (FDI) has contributed considerably to this trend. China has been one of the most attractive destinations for FDI, and FDI has become an indispensable component of China’s economic system. However, associated with rapid economic growth, the environment is increasingly adversely affected. With the gradual but profound effect of environmental pollution problems and the continuous expansion of the scale of FDI, one topic of debate concerns whether there are pollution haven behaviors by foreign investors in China.

The pollution haven hypothesis (PHH) states that stringent environmental regulations in industrial countries lead to the relocation of dirty industries away from developed countries toward developing countries. Numerous studies and debates on the PHH have been disseminated. Taylor (2005), for instance, states that the influence of environmental regulations on FDI as outlined in the PHH has been one of the most contentious topics examined by the international economics research community. Most of the empirical literature on this subject fails to find convincing evidence on the correlation between the location decision of FDI firms and the environmental standards of host countries.Footnote 1 Alternatively, some studies look for pollution haven effects within a country. For instance, List and Co (2000), Keller and Levinson (2002), and List et al. (2004) all find that heterogeneous environmental regulatory stringencies affect the inflows of FDI across the U.S. states. These studies also argue that the lack of convincing and supportive evidence for pollution haven effects in the cross-country study may be due to the failure to account for endogeneity and measurement errors.

In the case of China, recent empirical studies show pollution haven effects under some circumstances. For instance, Ljungwall and Linde-Rahr (2005) find that environmental regulations have not significantly influenced FDI patterns on a national scale, but they have negatively influenced foreign capital inflows in the western and central regions to a considerable degree. Di (2007) shows that FDI firms in polluting industries tend to locate in provinces with higher potential abatement cost savings. Dean et al. (2009) find that the FDI firms in highly polluting industries funded through Hong Kong, Macau and Taiwan are attracted by weak environmental standards, but that is not true for the firms funded from ethnically non-Chinese sources. Lan et al. (2012) find that the pollution haven hypothesis holds in provinces with low human capital.

By examining the data on newly established FDI firms and the environmental policy reforms in the first decade of the twenty-first century, this paper tests for evidence of pollution haven behaviors by foreign investors in China. Since 2000, environmental regulations in China have been significantly amended twice. In 2003, the pollution levy system was substantially amended, when levy rates were sharply increased and progressive levy rates were introduced for both water and air pollutants. In 2006, an emission reduction plan was launched for the period of the 11th Five-Year Plan (2006–2010). According to the emission reduction plan, a national pollution quantity control target was set for major pollutants. To be specific, the target was to reduce chemical oxygen demand (COD) and SO\(_{2}\) emissions by 10 % from the 2005 levels by the end of 2010. The national pollution quantity control target was further decomposed to the provincial levels. The reforms in 2003 and 2006 not only brought more stringent regulations throughout the country, but also led to greater provincial variance in stringency.

We investigate FDI firms’ pollution haven behaviors from both the provincial and the individual firm’s perspectives. Our analyses indicate that fewer FDI firms locate in the provinces with higher pollution levy rates. This result is confirmed when we look at the individual firm’s location choice. We find that firms, especially the high-polluting ones, are less likely to locate in provinces where environmental regulations are more stringent. Furthermore, we find that their location patterns respond to the changes in environmental regulations. In particular, FDI firms’ pollution haven behaviors become more significant under the post-2003 levy system than those under the pre-2003 system because there are greater inter-provincial differences in levy rates under the post-2003 levy system. This finding also explains why pollution haven effects are very significant in the east and inland regions but insignificant in the west region.

Our paper contributes to the existing literature in three ways:

First, our analysis integrates the exogenous changes in environmental regulations, which helps us address the potential endogeneity problem and therefore allows us to identify and estimate pollution haven behaviors more precisely. Though it is often criticized in the pollution haven empirical literature, the endogeneity problem seems somewhat inevitable.

There are three sources of endogeneity: simultaneity (or two-way causality), omitted variable and measurement error. The use of a lag on endogenous variables (i.e., pollution levies) is typically adopted by most relevant studies to address the two-way causality problem, such as Di (2007) and Dean et al. (2009). Dean et al. (2009) also discuss the problem of omitted variables. They illustrate that the corruption and income at the local level are omitted in their analyses but may affect FDI firms’ location choices. They further argue that biases may not necessarily arise even if these variables are omitted. For instance, corruption may imply lower environmental levies but may also imply a less attractive location in which to invest. Dean et al. (2009) further discuss the possible measurement error in the proxy for environmental stringency. They point out that the average collected levy per ton wastewater discharged that is commonly used in literature might not reflect the real cost of pollutant discharged, since it does not take pollutant effluent intensity into account (e.g., COD concentration in wastewater discharged). However, that is in fact a key parameter in China’s pollution levy formula for wastewater. To fix this problem, they control for the provincial average COD effluent intensity in addition to the average collected levy.

In our study, with the exogenous changes in environmental regulations, the endogeneity problem can be better addressed. For instance, causality is identified if the dependent variable (i.e., FDI firms’ location choice patterns) is significantly affected by the exogenous regulation changes, and obviously this effect should not be caused by the omitted variables. In addition, with the exogenous changes, the regulation variables might not be correlated with the error terms, and therefore the measurement error might not exist anymore.

Second, we construct the measures of environmental stringency by adopting the regulation formulas, and the measures are calculated directly with respect to specific pollutants (i.e., average levies paid per kg COD and SO\(_{2}\) emission). Compared to the pollution abatement costs (Di 2007) and the average levies paid per ton of wastewater (Dean et al. 2009), our measures are more direct and comprehensive. In addition, our measures not only capture the provincial difference in stringency but also reflect the changes in regulation stringency over time. For instance, the post-2003 levy system requires firms to pay levies as long as they emit pollutants, but the pre-2003 levy system only requires firms to pay above-standard levies. To compare the stringency between the two systems, we unify pollution measurements by using the post-2003 formula.Footnote 2

Third, in our study we adopt a novel data set that involves 13,663 FDI firms established between 2000 and 2010. Taking advantage of the large data set, we estimate the pollution haven effects using two different types of models. At the provincial level, we derive a model to investigate how the number of newly established FDI firms in a province responds to the changes in environmental stringency over years. We estimate the model using Poisson and negative binomial. At the individual firm level, we derive a model of FDI firm location choice in the presence of inter-provincial differences in environmental stringency. We estimate this model using conditional logit. Meanwhile, we observe each firm’s location, capital source structure and the sector it belongs to. These data enable us to examine differences in location patterns by pollution intensity.

The rest of the paper is structured as follows. In Sect. 2, we present China’s environmental regulations in detail. In Sect. 3, we present and describe our data set. Section 4 provides the empirical models. In Sect. 5, results and analyses are presented. Section 6 concludes.

2 China’s environmental regulations

Since the late 1970s, Chinese national environmental regulations have been designed to reduce industrial pollution and improve environmental quality. The Environmental Protection Law (EPL) was first enacted in 1979. Article 18 of the EPL states that “the levy should be imposed on pollution discharges which exceed national pollution discharge standards, based on quantity and concentration of discharges and levy fee schedules established by the State Council.” By the end of 1981, 27 of China’s 29 provinces, autonomous regions, and municipalities had begun to adopt the levy system. Since then, the levy system has been amended several times. The most recent amendment took place in 2003, when levy rates were largely increased and progressive rates were introduced. In 2006, China initiated the nationwide pollution quantity control. A pollution quantity control plan was launched and implemented during the 11th Five-Year Plan Period (2006–2010). In general, environmental regulations in China are becoming more stringent.

2.1 China’s levy system

Given that our data set is based on FDI firms’ locations from 2000 to 2010, we focus on the comparison between the pre-2003 and post-2003 pollution levy systems.

2.1.1 The pre-2003 levy system

The pre-2003 wastewater levy system is a two-tier charge system, with uniform rates for within-standard emissions and higher but de-escalating rates for above-standard emissions. If a firm’s emission of each water pollutant falls within the corresponding standard, the firm pays a within-standard levy for the total amount of wastewater discharged;Footnote 3 otherwise, it must pay the above-standard levy. Accordingly, firms are classified as compliant and non-compliant.

The above-standard levy is calculated with respect to those pollutants emitted above their corresponding standards. The above-standard levy for wastewater discharged is calculated as follows:

where \(\hbox {L}_\mathrm{i} \) is the potential levy to be paid on pollutant i;\(\hbox {P}_\mathrm{i}\) is the discharge factor of pollutant i calculated as \(\hbox {W}\frac{\hbox {C}_\mathrm{i}-\hbox {C}_\mathrm{i}^{*}}{\hbox {C}_\mathrm{i}^{*} }\), where \(\hbox {W}\) is the total amount of wastewater discharged (i.e., tons of wastewater discharged), \(\hbox {C}_\mathrm{i} \) is the concentration of pollutant i in wastewater discharged and \({\hbox {C}}_\mathrm{i}^{*} \) is the corresponding legal standard (i.e., milligrams of pollutant i per liter wastewater discharged); \(\hbox {T}_\mathrm{i}\) is the threshold factor that determinates the levy rate adopted; \(\hbox {R}_{2\mathrm{i}} \) is the levy rate applied when the discharge factor \(\hbox {P}_\mathrm{i}\) is below the threshold, while the levy rate \(\hbox {R}_{1\hbox {i}} \), with \(\hbox {R}_{1\mathrm{i}}<\hbox {R}_{2\mathrm{i}} ,\) is applied when the discharge factor \(\hbox {P}_\mathrm{i} \) is above the threshold; \(\hbox {L}_{0\mathrm{i}} =\left[ {\hbox {R}_{2\mathrm{i}} -\hbox {R}_{1\mathrm{i}}} \right] \hbox {T}_\mathrm{i}\) is a fixed payment that makes the levy function continuous. The potential levy \(\hbox {L}_\mathrm{i}\) is calculated for each pollutant i; the actual levy L is the largest of the potential levies. For instance, if a firm emits M water-related pollutants which exceed the corresponding standards, its above-standard levy is then:

The levy function takes into account both the concentration of the hazardous pollutant and the volume of discharged wastewater as it calculates the discharge factor (\(\hbox {P}_\mathrm{i} )\) based on both the total wastewater discharge and the degree to which the pollutant concentration \((\hbox {C}_\mathrm{i} )\) exceeds the standard \((\hbox {C}_\mathrm{i}^{*} )\). The standard is set by local governments, and it differs by industry and the location where the wastewater is discharged. Both the levy rates (\(\hbox {R}_{1\mathrm{i}}\) and \(\hbox {R}_{2\mathrm{i}}\)) and the threshold factor \((\hbox {T}_\mathrm{i} )\) are set by the central government and vary by pollutant, but do not vary by industry or region. The above-standard levy formula for air pollution is similar but much simpler than that for water pollution.Footnote 4

The pre-2003 levy system received much criticism for its lack of incentives. As a matter of fact, due to the decreasing block levy rates for water pollutants and the air pollution levy not being applicable to compliant firms, coupled with time-invariant levy rates (the real value in the later years was substantially lower than that in the earlier years), the system even brought disincentives to pollution control and abatement and was thus radically revised in 2003.

2.1.2 The post-2003 levy system

Under the new system, firms pay pollution levies according to three major pollutants instead of one major pollutant. There are two steps for the pollution levy calculation. The first step is to convert discharge into either COD equivalent for water pollutants or SO\(_{2}\) equivalent for air pollutants. Taking water pollutants as examples, we have:

where \(\hbox {WC}_\mathrm{i} \) is actually the amount of water pollutant i discharged; the regulatory conversion parameter for pollutant i is denoted by \(\hbox {e}_\mathrm{i} \) for water pollution. The conversion parameter takes the value of 1 for COD, which is the reason why \(\hbox {E}_\mathrm{i} \) is called the pollutant i’s COD equivalent. The levy formula suggests that both compliant and non-compliant firms need to pay for their pollution discharge. The pollutants that are more likely to cause environmental damage are assigned with a smaller conversion parameter but have larger equivalents. The equivalent is calculated for all water pollutants, but only the top three pollutants with the largest equivalents matter when calculating the levy amount. The second step is to calculate the levy, that is:

where the levy rate R equals ¥0.7 per kilogram of COD equivalent for the within-standard discharge, but the rates are doubled for the above-standard discharge, i.e., ¥1.4. All polluting firms, whether compliant or non-compliant, need to pay the levy. The calculation of air pollution levies follows the same steps.

To illustrate the differences between the pre- and post-2003 levy systems, we assume there are two firms, one compliant and the other non-compliant. As shown in Table 1, each emits a total of 500,000 tons of wastewater with three particular pollutants, COD, BOD and TSS. The levy for the compliant firm under the post-2003 levy regime totals up to ¥35,875, increasing from the pre-2003 level of ¥25,000 by 43.5 %. For the non-compliant firm, the levy under the post-2003 system is almost six times the levy under the pre-2003 system, changing from ¥36,000 to ¥207,625. The numerical comparisons show that the post-2003 levy system charges both compliant and non-compliant firms more than the pre-2003 system does, and charges non-compliant firms substantially more. The post-2003 levy system largely increases pollution charges. According to the economic census data in 2004, the average levy charge per industrial firm amounts to 37 % of its profit, and for highly polluting firms, the figure is 48 %.

Although both the pre- and post-2003 levy systems are formulated at the national level, provincial governments are able to set pollutant concentration standards according to local economic development and environmental challenges, which leads to provincial heterogeneity in the actual levy burden. The levy system reform in 2003 does not involve the changes of provincial local pollutant concentration standards. However, since the rates are doubled for the above-standard pollutant discharge in the post-2003 levy formula, the provinces with stricter standards are actually bearing higher levies after the 2003 reform. Obviously, the inter-provincial levy difference becomes greater after the reform in 2003.

2.2 National plan for total emissions control of major pollutants

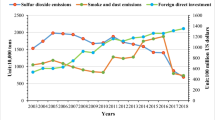

In 2006, a pollution quantity control plan (called the National Plan for Total Emissions Control of Major Pollutants) was launched and implemented. The goal was to reduce major pollutant discharges (COD and SO\(_{2}\)) by 10 % from the 2005 levels by 2010, the end of the 11th Five-Year Plan Period (2006–2010). In other words, the target was to reduce China’s emission of COD from 14.14 million tons in 2005 to 12.73 million tons in 2010, while SO\(_{2}\) emissions would also be cut from 25.49 to 22.94 million tons during the period.

The national reduction target was further decomposed to the provincial level. As shown in Fig. 1, Hebei, Jiangsu and Zhejiang needed to make the greatest reduction in COD emissions, more than 15 % of their 2005 levels, whereas Beijing, Shanghai and Shandong had the most challenging task in SO\(_{2}\) emission reduction, more than 20 % of their 2005 levels. Hainan, Qinghai and Xinjiang provinces were not required to cut down their COD and SO\(_{2}\) emissions, so they could maintain their 2005 levels. In general, the east region had more arduous reduction targets than the inland and west regions.Footnote 5

In the decomposition of pollution control targets, the central and local governments both focused on high-polluting industries. For example, the plan stressed that in high-polluting industries such as electricity, metallurgy, building materials, chemicals, paper, textiles and food brewing, clean production should be vigorously promoted to reduce pollution. Provinces with tougher reduction targets (such as Zhejiang and Jiangsu)Footnote 6 required investors in these pollution-intensive sectors to adopt cleaner production standards.

3 Data description

To study FDI firms’ pollution haven behaviors, we collect three categories of data: environmental regulation data, FDI firms’ data, and data on provincial characteristics.

3.1 Measures of environmental regulations

We construct measures of environmental regulations with respect to the levy system and quantity control plan: the effective levy rate and the pollution quantity control index.

From China Environmental Statistical Yearbook (2000–2005), we collect data on the amounts of each kind of water and air pollutants dischargedFootnote 7 and the total water and air pollution levies collected in each province. To calculate the effective levy rate, we need first to unify the multi-dimensional pollutant discharged data with the one-dimensional levy data. The post-2003 formula provides a good way to convert the multi-dimensional pollution data to one-dimensional measurement of total water (air) pollution, where COD (SO\(_{2}\)) in fact is the numeraire for water (air) pollutants. Detailed calculations are carried out as follows. We first convert the quantities of each water (air) pollutant discharged into COD (SO\(_{2}\)) equivalents following the conversion parameters and method outlined by the post-2003 levy system for each province, and then add them up to obtain the total COD (SO\(_{2}\)) equivalents that measure the provincial total water (air) pollutants discharged. We finally divide the provincial collected water (air) pollution levies by the total COD (SO\(_{2}\)) equivalents and obtain the effective levy rate, namely, the average levy per kilogram COD (SO\(_{2}\)) equivalents discharged. We calculate the effective levy rate for the years before and after 2003 by uniformly adopting the post-2003 levy formula, through which we are able to obtain the levy rate measure that well reflects the levy stringency variation introduced by the levy system reform in 2003.Footnote 8

Here is an example to illustrate how the effective levy rates are calculated. In Beijing in 2000, the aggregate emission levels of SO\(_{2}\), TSP-smoke and TSP-dust are 146,431, 51,842 and 93,681 tons respectively, and the corresponding aggregate air pollution levies collected are ¥8,452,300. Following the Eq. (3), we first convert the discharged amounts of the three kinds of air pollutants into SO\(_{2}\) equivalents, namely, divide the amounts of each pollutant discharged by the corresponding conversion parameters. The conversion parameters are 1.05 for SO\(_{2}\), 0.46 for TSP-smoke and 0.25 for TSP-dust. We therefore obtain the corresponding SO\(_{2}\) equivalents: 153,753 tons for SO\(_{2}\) emissions, 23,847 tons for TSP-smoke emissions and 23,420 tons for TSP-dust emissions. We sum them together and get the aggregate amounts of pollutants measured by SO\(_{2}\) equivalents: 201,020 tons (201,020,000 kg). To obtain the effective air pollution levy rate, we then divide the aggregate collected air pollution levies by the aggregate amounts of SO\(_{2}\) equivalents, namely, reshape the Eq. (4). The effective air pollution levy rate in Beijing in 2000 is therefore approximately ¥0.042 per kilogram of SO\(_{2}\) equivalent discharged.

Figure 2 illustrates the average and variance of provincial effective levy rates over time. After the 2003 reform, both the average and variance markedly increase, especially for the air pollution levy rate. Before 2003, the air pollution levy rate remains stable at 0.035 CNY and varies little among provinces, whereas after 2003, the figure goes up dramatically (about six times higher), and the differences between provinces widen.

As for the COD and SO\(_{2}\) quantity control plan during the “Eleventh Five-Year Plan” Period (2006–2010), we need to find a way to decompose the five-year control targets into annual control targets to be consistent with the FDI firm data. We construct the annual quantity control index as follows. We define the annual COD and SO\(_{2}\) quantity control index as the unfinished control targets by the end of the last year divided by the number of remaining years until 2010. For example, Beijing was required to decrease SO\(_{2}\) emissions by 20.4 % from 2006 to 2010; when Beijing achieved 7.84 % in 2006, the quantity control index for Beijing at the end of 2006 became the remaining target, which is 12.56 % divided by the number of years left until 2010 (4 years)—i.e., 3.14 %. For the case where the total quantity control targets were achieved in advance, the quantity control index is simply zero. Some provinces did not make efforts to control pollution at the beginning, and their reduction pressure increased as the deadline drew closer. Some provinces accomplished their five-year control targets in the first three years, thus facing no reduction pressure in the remaining two years. The annual quantity control index we have constructed measures these cases well.

3.2 Newly established FDI firm data

We collect data on 13,663 newly established FDI firms from the Annual Industrial Survey Database (2000–2010)Footnote 9 of the Chinese National Bureau of Statistics (NBS). For each firm, we observe its year of establishment, location, capital source structure, and the sector it belongs to.

Approximately 33 % of firms in the sample belong to water (COD) and air (SO\(_{2}\)) pollution intensive sectors, including beverages, textile, paper and paper products, chemical industry, coal, mining, petroleum, building materials, iron and steel, metallurgy and thermal power.Footnote 10 Moreover, the regional distribution of foreign investment is off-balance in China. Figure 3 shows the regional distribution of both high- and low-polluting FDI firms. Both concentrate in the east region, followed by the central inland region and the west region.

3.3 Other data

Besides the measures of environmental regulations, FDI firms may take other factors into account when they make location choices. For instance, when firms make investment decisions, they may evaluate local enforcement of regulations. Higher compliance costs, caused by stricter enforcement, might deter firms’ entry. Dean et al. (2009) raise this issue, but they argue that the environmental regulation variable itself should correctly signal de facto stringency, due to tighter regulations, better enforcement or both. However, as Lin (2013) shows, better enforcement makes firms report more pollution, which accordingly increases collected levies. Therefore, the regulation variable (i.e., total collected levies divided by total amount of pollution) could not capture the effect such as heavier total levy burdens caused by stricter enforcement. In addition, certain effects, for instance, non-compliant firms are more likely to be fined and warned with stricter enforcement,Footnote 11 is not captured and reflected by the regulation variables (i.e., the effective levy rate and the pollution quantity control index) either. For this reason, we calculate the average provincial number of regulators per firm (i.e., the number of environmental regulators divided by the number of industrial firms) as a proxy for the provincial stringency of enforcement.Footnote 12

Other factors that might affect firms’ location choices include the local labor market conditions (e.g., average wage, average education level, unemployment rate), the local infrastructure (e.g., highway mileage, land size), the local market structure (e.g., the number of existing firms, cumulative FDI) and the local market potential (e.g., the local population size).Footnote 13

Environmental impact assessments (EIAs) might affect firms’ location choice as well. However, we believe that EIAs’ effects are limited to the choice among neighborhoods, but among territories as large as provinces the EIAs’ effects are very marginal. In addition, although an EIA is required prior to the construction of a firm in China, even if an investor completely ignores this requirement and builds a firm without submitting an EIA statement in advance, the only penalty is to do a make-up assessment (Sun et al. 2005; Wang 2007). Moreover, lack of transparency and public participation has severely limited the effectiveness of EIAs (Chi et al. 2014; Tang et al. 2005; Wang 2010). Finally, most safety standards adopted by EIAs are formulated by Ministry of Health and unified nationwide. Therefore, we do not think EIAs in China would affect firms’ location choice among provinces.

Specific definitions and the sources of data we adopt here are provided in Appendix 2. In the next section, we present the empirical models.

4 The empirical models

We examine the location choice of newly established FDI firms both at the provincial level and the firm level.Footnote 14 Although both are based on the same data set, the provincial level analysis furthermore captures the intra-province variation on the number of newly established FDI firms due to the changes of regulations over time while the firm location choice model focuses on firms’ one-shot location choice decisions among province alternatives. Therefore, they are complementary.

At the provincial level, we estimate the impact of heterogeneity in provincial environmental stringency on the number of new FDI firms. We have the following equation:

where \(\hbox {N}_\mathrm{{j,t}} \) is the number of new FDI firms in province j in year \(t;\hbox {S}_\mathrm{{j,{t-1}}} \) represents the environmental regulations, namely, the effective water and air pollutant levy rates for province j in year \(t-1\) or the pollution quantity control index for province j at the end of the year \(t-1; \hbox {X}_\mathrm{{j,{t-1}}}\) denotes other factors that may affect location choice, including enforcement, wage, unemployment rate, education level, number of industrial firms, road mileage, population, land area and cumulative FDI in province j in year \(t-1\); R is a vector of region dummies that captures regional fixed effects,Footnote 15 and \({\upvarepsilon }_\mathrm{{j,t}}\) is the error term.

One-year lag with respect to the variable of interest \((\hbox {S})\) and the control variables (X) is used, since there would be a time lag between a location decision being made and the new firm being actually established. Given the feature of the dependent variable, we estimate this equation by adopting Poisson and negative binomial models, the two most common count models. Time fixed effects that take the form of year dummies are involved in both models and the error term is clustered by province.

At the firm level, we examine how an FDI firm makes its location choice given heterogeneity in provincial environmental stringency. Following Bartik (1988) and others in the area, we assume that the expected profits for firm i in province j can be written as:

where \({\uppi }_\mathrm{{i,j}}\) is the expected profits for firm i if it is located in province \(j; \hbox {S}_\mathrm{j}\) represents the environmental regulations of province j in the previous year; \(\hbox {X}_\mathrm{j}\) again denotes the enforcement, wage, unemployment rate, education level, number of industrial firms, road mileage, population, land area and cumulative FDI of province j in the previous year; R again captures regional fixed effects and \({\upvarepsilon }_\mathrm{{i,j}}\) is the error term.

If profit-maximizing firm managers consider a number of provinces and choose the province in which the firm’s profits would be the highest and the error term \({\upvarepsilon }_\mathrm{{i,j}}\) follows a Weibull distribution, the location choice can be estimated by using the conditional logit model. The probability that firm i chooses province k is then:

where J represents the total number of possible provinces. The parameter \({{\upalpha }'}\) is estimated by using the maximum likelihood method.

5 Results and analyses

In this section, we estimate the aforementioned models. Since Poisson model assumes that the mean and variance of the expected counts (i.e., the expected numbers of new FDI firms) are equal but this assumption is not met in our data,Footnote 16 we therefore only report estimation results from the Negative Binomial model where the assumption of equal mean and variance is relaxed.

Tables 2 and 3 report the estimation results of Eq. (5) using data from the years 2000–2005 and 2006–2010 respectively.Footnote 17

There are two sets of estimation results in each table, corresponding to the results obtained by using the full sample of firms and the sample of firms belonging to the high-polluting sectors. Table 2 shows that both the effective water and air pollutant levy rates have negative impacts on the number of newly established FDI firms. The coefficients on effective air pollutant levy are particularly statistically significant. To be specific, a 1% increase in a province’s effective air pollutant levy rate reduces the likelihood of locating there by 0.71 % for foreign investors (column 1) and by 0.82 % for foreign investors in high-polluting sectors (column 2). The air pollutant levy rate generally has a stronger impact than the levy rate of water pollutant, which may be attributed to the fact that the level (measured by mean) and inter-provincial differences (measured by the variance) of the air pollutant levy rate were increased by a larger degree than the water pollutant levy rate in the 2003 levy reform (see Fig. 2). Furthermore, the negative impacts of levy rates are stronger when we focus on the sample of polluting firms (i.e., the firms belonging to polluting sectors).

We also note that the coefficients on enforcement are negative and statistically significant in both columns of results. For instance, the estimations indicate that a 1 % increase in a province’s enforcement stringency (i.e., the average number of regulators per firm) significantly decreases the likelihood of locating there by 0.85 % for all foreign investors and by 0.70 % for the foreign investors in high-polluting sectors. In contrast to pollutant levy rates, the effects of enforcement are greater when we consider all the firms in our sample than when we only focus on the high-polluting firms. The reason is probably that the high-polluting firms are subject to less stricter pollutant discharge standards than the other firms (e.g., the COD discharge standard is 200 mg/L for pulp and paper manufacturing firms but 50 mg/L for low-polluting firms)Footnote 18, and hence high-polluting firms are not especially sensitive or even less sensitive to the enforcement stringency compared to low-polluting firms.

The local labor market conditions, namely, wage, unemployment rate and education level, do not have the expected effects. For example, wage is supposed to have a negative impact since more input costs associated with higher wages might deter the entry of foreign investors. However, the coefficients of wage turn out to be significantly positive. A probable reason is that the areas with higher wages will induce inflow of labor and therefore have relatively adequate labor supplies, and hence attract foreign investment. Likewise, the areas where the unemployment rates are high might have adequate labor supplies and hence attract foreign investment, but on the other hand lower income levels associated with high unemployment rates might deter the entry of foreign investment; skill intensive industries (such as computer integrated manufacturing and machine tool industry) might have a greater demand for skilled labors (i.e., higher education level), but labor intensive industries (such as clothing and textile industry) might have a relatively higher demand for unskilled labors (e.g., lower education level). Hence, the estimation results for the local labor market conditions are inconsistent (see also Dean et al. 2009).Footnote 19

The coefficients on the number of industrial firms,Footnote 20 road mileage and land area are insignificant. The coefficients on population and cumulative FDI are positive and statistically significant, which is consistent with what we expected. That is, foreign investment is attracted by a large population and tends to cluster together. In addition, the east region attracts more foreign investment than the west region.

Table 3 shows that neither COD nor SO\(_{2}\) quantity control indexes have significant negative impacts on the number of newly established FDI firms. A possible reason is that the pollution quantity control is a command and control instrument that is imposed upon firms on a case by case basis, but in contrast the pollution levy system is one of the market-based regulation instruments. In addition, reduction targets are undertaken by very few sectors which emit the most COD and/or SO\(_{2}\). For instance, about 60 % of the SO2\(_{2}\) reduction target is undertaken by one sector (i.e., the thermal power sector)Footnote 21 but there are only 54 newly established foreign-invested thermal power firms during 2006–2010 in our sample.

From the individual firm’s perspective, we estimate the impact of environmental regulation on a firm’s location choice as described in Eq. (7). Environmental explanatory variables and other control variables are all lagged one year here, since there would be a time lag between a location decision being made and the new firm being actually established. The results are reported in Table 4. There are three sets of results in the table, corresponding to the pre-2003 levy system (2000–2002), the post-2003 levy system (2004–2005), and the COD and SO quantity control plan during the “Eleventh Five-Year Plan” Period (2006–2010), respectively.Footnote 22 The estimation results are generally consistent with those of provincial level analyses: compared with low-polluting firms, high-polluting firms have a stronger and clearer intention to avoid locating in the provinces with higher levy rates; quantity control indexes do not have significant impacts; the coefficients on enforcement are negative and statistically significant in all sets of results. In particular, the air pollutant levy rate is significantly negative only in the post-2003 system as a result of the rather low air pollutant rate which varies little among provinces in the pre-2003 system (see Fig. 2). This provides clear evidence that FDI firms’ location patterns respond to the reform of pollution levy systems.

Notably, China has very unbalanced growth and development among regions. As noted by Dean et al. (2009), in China foreign investors first select the region for their investment and then select a province within that region. FDI firms show a strong regional preference for location. More than 80 % of FDI firms in our sample concentrate in the east region (see Fig. 3). It is therefore of interest to study whether there are pollution haven behaviors when we limit the sample within a region. We then estimate Eqs. (5) and (7) again by using the sample of the east, inland and west regions, respectively, and the results are reported in Tables 5 and 6.

Table 5 shows that there exist pollution haven behaviors in the east and inland regions, but not in the west region. Specifically, in the east region both water and air pollutant levy rates have negative and significant impacts on the entry of foreign investment into polluting industry. The effects are persistent if we split the sample of high-polluting firms into specific water and air pollution intensive firms (see columns 2 and 3). As for the inland region, only the coefficients on the air pollutant levy rates are shown to be negative and statistically significant. Similar results are found in Table 6. In both the east and inland regions, FDI firms do exhibit pollution haven behaviors. Such behaviors are especially sensitive to the post-2003 air pollutant levy rate. Why do FDI firms’ pollution haven behaviors differ among regions and differ before and after 2003? We further check the inter-provincial variance in effective levy rates, and find that the variances of post-2003 water and air pollutant levy rates in the east region are much greater than those in the inland and west regions (See Fig. 4(2)). Such levy rate disparity explains why pollution haven behaviors are generally found in the east region. In addition, as shown in Fig. 4(1) and (2), the 2003 levy reform largely increases the within-region variance of air pollutant levy rate, especially for the east and inland regions. This is the reason why pollution haven behaviors are found in east and inland regions with respect to post-2003 air pollutant rate. These observations provide additional evidence that FDI firms’ location patterns respond to the reform of pollution levy systems.

Our results complement the existing literature in two ways: first, we find clear support for pollution haven effects in our full sample, but the existing literature finds evidence of pollution haven effects only in some subsets of sample. For instance, Di (2007) provides evidence of pollution haven effects only for foreign investors in a few highly-polluting industries; Dean et al. (2009) show that only the equity joint ventures in highly-polluting industries funded through Hong Kong, Macau, and Taiwan sources are significantly attracted by weak environmental regulations. The reason is probably that our measures of environmental stringency (i.e., average levies paid per kg COD and SO equivalent emission discharged) are more direct and precise, compared to the pollution abatement costs (Di 2007) and the average levies paid per ton of wastewater (Dean et al. 2009). Second, our study integrates the changes in environmental regulation and our results indicate that pollution haven effects are sensitive to these changes. Specifically, we find significant pollution haven effects with respect to pollution levies but not to the pollution quantity control. The reason is probably that pollution quantity control is imposed upon firms case by case and lack of transparency. We further find that pollution haven behaviors become more significant when the inter-provincial differences in pollution levy burdens become greater. This finding provides very strong and convincing evidence for pollution haven effects in the case of China.

6 Conclusions

Using a novel and unique dataset on FDI firms established between 2000 and 2010, we study whether foreign investors in China exhibit pollution haven behaviors given the presence of inter-provincial differences in environmental stringency. The 2003 pollution levy system reform and the pollution quantity control plan during the 11th Five-Year Plan Period (2006–2010) bring exogenous shocks to environmental regulations and therefore inter-provincial differences in environmental stringency, allowing us to better identify and more precisely estimate the pollution haven behaviors.

We find significant pollution haven behaviors of FDI firms with respect to emission charges from both the provincial and individual firm’s perspectives. In particular, high-polluting firms are more likely attracted by provinces with lower pollution levy rates. In addition, FDI firms’ location choice pattern responds to the 2003 change in pollution levy system. Specifically, inter-provincial differences in the stringency of environmental regulations play a key role in explaining why significant pollution haven behaviors exist in certain cases; when the inter-provincial differences are large, such as the air pollutant levy rate after the 2003 reform and the regulations in the east region, FDI firms’ pollution haven behaviors become notable. Our results also imply that policy makers should not allow a large inter-provincial disparity when formulating environmental regulations, which could lead to pollution hotspots.

Notes

See Sect. 3.1 for details.

The standard fee for within-standard wastewater discharges is 0.05 CNY per ton.

See the details in Appendix 1.

The regional classification of provinces is based on geography and different levels of economic development, which is commonly used.

Water pollutants include COD, petroleum, phenol, cyanide and so on, ten kinds of pollutants in total. Air pollutants include SO\(_{2}\) and total suspended particulate (TSP). According to different diameters of particulates, TSP is divided into two categories: TSP-smoke if the diameters are less than one micron and TSP-dust otherwise. These pollutants are the most common and primary water and air pollutants.

However, a question which might arise here is that whether the effective levy rate calculated by the post-2003 levy formula appropriately reflects the actual levy burdens before 2003 when the pre-2003 levy formula was applied. In particular, is it reasonable to adopt the conversion parameters given by the post-2003 to convert the quantities of water (air) pollutants discharged into COD (SO\(_{2}\)) equivalents? We note that although the post-2003 formula in fact increased overall levy rates, it maintained the relative levy rates as those of the pre-2003 formula. The pollutants that are more likely to cause environmental damage are assigned greater levy rates in the pre-2003 formula and correspondingly greater conversion parameters in the post-2003 formula, and vice versa. As a result, the conversion parameters given by the post-2003 formula are consistent with the relative levy rates obtained from the pre-2003 formula. Hence, the effective levy rates calculated with the conversion parameters given by the post-2003 levy formula would not distort actual levy burdens in the years before 2003.

The database surveys above-scale industrial firms (namely, firms whose annual sale revenues exceed 5 million CNY) for their business performance.

According to the pollution quantity control plan (State Council 2007), the COD-intensive sectors, based on the 2-digit industrial classification codes for national economic activities, include 15 (manufacture of beverages), 17 (manufacture of textile), 22 (manufacture of paper and paper products), 26 (manufacture of raw chemical materials and chemical products), 27 (manufacture of medicines), 28 (manufacture of chemical fibers), 29 (manufacture of rubber) and 30 (manufacture of plastics); the SO\(_{2}\)-intensive sectors include 6 (mining and washing of coal), 7 (extraction of petroleum and natural gas), 8 (mining and processing of ferrous metal ores), 9 (mining and processing of non-ferrous metal), 10 (mining and processing of nonmetal ores), 25 (processing of petroleum), 26 (manufacture of raw chemical materials and chemical products), 27 (manufacture of medicines), 28 (manufacture of chemical fibers), 29 (manufacture of rubber), 30 (manufacture of plastics), 31 (manufacture of non-metallic mineral products), 32 (smelting and pressing of ferrous metals), 33 (smelting and pressing of non-ferrous metals) and 44 (production and supply of electric power).

For instance, if plants’ false reporting is caught by environmental authorities, they are liable to penalties, where they are required to pay between 100 and 300 % extra of evaded levies; other penalties include revoking discharge licenses and shutting down facilities (see Administrative Regulations on Levy and Use of Pollutant Discharge Fee, The State Council Decree of PRC No.369).

Wang and Wheeler (2005) also adopt the average number of regulators per firm as a proxy of enforcement stringency. The number of regulators is gathered from China Environmental Statistical Yearbook (2000–2010) and the provincial number of industrial firms is gathered from China Statistical Yearbook (2000–2010).

The data were drawn from the China Statistical Yearbook (2000–2010).

As we indicated earlier, there is a great imbalance in FDI firms’ regional distribution.

We conduct the over-dispersion test and the null hypothesis of the presence of greater variability cannot be rejected.

The reasons for splitting sample into 2000–2005 and 2006–2010 are as follows. The quantity control plan was implemented during 2006–2010. It is then difficult to measure the stringency of quantity control plan for the years 2000–2005. If we simply use the dummy variable (namely, assign zero to the quantity control indexes for the years 2000–2005), it may lead to measurement error since the zero index also means that quantity control targets have been achieved and the emission levels should be maintained. In addition, the use of dummy variable may also lead to collinearity since we have controlled for time fixed effects.

See Ministry of Environmental Protection (2008).

The estimation results on the variables of interest would not change if we exclude the variables of local labor market conditions on the right-hand side of Eq. (6).

The number of industrial firms is somehow correlated with enforcement variable that is given by the number of environmental regulators divided by the number of industrial firms. Enforcement has similar effects if we exclude the number of industrial firms on the right-hand side of Eq. (6).

See China Federation of Electric Power Enterprises (2008).

We do not include 2003 in the estimation because the 2003 reform was enacted on July 1, 2003.

References

Bartik, T. J. (1988). Evaluating the benefits of non-marginal reductions in pollution using information on defensive expenditures. Journal of Environmental Economics and Management, 15(1), 111–127.

China Federation of Electric Power Enterprises. (2008). The electric power industry energy saving and emission reduction policy reviews and regulation selections. Beijing: China Electric Power Press.

Chi, C., Xu, J., & Xue, L. (2014). Public participation in environmental impact assessment for public projects: A case of non-participation. Journal of Environmental Planning and Management, 57(9), 1422–1440.

Copeland, B. R., & Taylor, M. S. (2005). Trade and the environment: Theory and evidence. Princeton: Princeton University Press.

Dean, J. M., Lovely, M. E., & Wang, H. (2009). Are foreign investors attracted to weak environmental regulations? Evaluating the evidence from China. Journal of Development Economics, 90(1), 1–13.

Di, W. (2007). Pollution abatement cost savings and FDI inflows to polluting sectors in China. Environment and Development Economics, 12(6), 775–798.

Jiangsu Provincial Government. (2008). Environmental protection and ecological construction planning in Jiangsu province during the 11th Five-Year Plan. No: Jiangsu Provincial Government Notice. 26.

Keller, W., & Levinson, A. (2002). Pollution abatement costs and foreign direct investment inflows to US states. Review of Economics and Statistics, 84(4), 691–703.

Levinson, A. (1996). Environmental regulations and manufacturers’ location choices: Evidence from the census of manufactures. Journal of Public Economics, 62(1), 5–29.

Lan, J., Kakinaka, M., & Huang, X. (2012). Foreign direct investment, human capital and environmental pollution in China. Environmental and Resource Economics, 51(2), 255–275.

Lin, L. (2013). Enforcement of pollution levies in China. Journal of Public Economics, 98(1), 32–43.

List, J. A., & Co, C. Y. (2000). The effects of environmental regulations on foreign direct investment. Journal of Environmental Economics and Management, 40(1), 1–20.

List, J., Millimet, D., & McHone, W. (2004). The unintended disincentive in the clean air act. Advances in Economic Analysis and Policy, 4(2), 1–26.

Ljungwall, C., & Linde-Rahr, M. (2005). Environmental policy and the location of foreign direct investment in China (No. 22020). East Asian Bureau of Economic Research.

Ministry of Environmental Protection. (2008). Discharge standard of water pollutants for pulp and paper industry. The Ministry of Environmental Protection PRC, GB3544-2008.

State Council. (2007). National environmental protection planning during the 11th Five-Year Plan. The State Council Notice of PRC, No. 37.

Sun, Y., Chen, X., Bao, Y., Peng, X., & Gao, C. (2005). Planning environmental impact assessment orienting sustainable development: Opportunities and challenges. Chinese Journal of Population, Resources and Environment, 3(4), 31–37.

Tang, S., Tang, C., & Lo, Car. (2005). Public participation and environmental impact assessment in mainland China and Taiwan: Political foundations of environmental management. Journal of Development Studies, 41(1), 1–32.

Taylor, M. S. (2005). Unbundling the pollution haven hypothesis. The BE Journal of Economic Analysis & Policy, 4(2), 1–26.

Wang, A. (2007). The role of law in environmental protection in China: Recent developments. Vermont Journal of Environmental Law, 8, 2006–2007.

Wang, H., & Jin, Y. (2006). Industrial ownership and environmental performance: Evidence from China. Environmental and Resource Economics, 36(3), 255–273.

Wang, H., & Wheeler, D. (2005). Financial incentives and endogenous enforcement in China’s pollution levy system. Journal of Environmental Economics and Management, 49(1), 174–196.

Wang, X. (2010). Public participation in environmental impact assessment (EIA) in China. Proceedings of symposium from cross-strait environment & resources and 2nd representative conference of Chinese environmental resources & ecological conservation society, 132–135.

Xu, X. (1999). Do stringent environmental regulations reduce the international competitiveness of environmentally sensitive goods? A global perspective. World Development, 27(7), 1215–1226.

Zarsky, L. (1999). Havens, halos, and spaghetti: Untangling the evidence about foreign direct investment and the environment. In Foreign Direct Investment and the Environment. Paris: OECD.

Zhejiang Provincial Government. (2007). Environmental protection planning in Zhejiang province during the 11th Five-Year Plan. No: Zhejiang Provincial Government Notice. 25.

Acknowledgments

The authors thank the anonymous referees and the editor for their comments and suggestions, which improved the paper. Financial support from EEPSEA, the Key Laboratory of Mathematical Economics (SUFE), and the Innovation Program of Shanghai Municipal Education Commission is also gratefully acknowledged.

Author information

Authors and Affiliations

Corresponding authors

Appendices

Appendix 1: The pre-2003 levy for air pollution

For instance, if a firm emits M air-related above-standard pollutants, the levy of air pollution for the firm is calculated as:

where \(\hbox {R}_\mathrm{i} \) is the levy rate of pollutant i; V is the total discharge of air pollution measured in cubic meters; and \(\hbox {C}_\mathrm{i} \) and \(\hbox {C}_\mathrm{i}^{*}\) again are the pollutant i concentration and corresponding concentration standard, respectively. Unlike the water pollution levy, the air pollution levy is assessed on the absolute, rather than percentage, deviation from the concentration standard. Firms need not pay air pollution levies if their discharges fall within the corresponding concentration standard (namely, \(\hbox {C}_\mathrm{i} <C_\mathrm{i}^{*}\) for all i).

Appendix 2: Data definitions and sources

See Table 7.

Rights and permissions

About this article

Cite this article

Lin, L., Sun, W. Location choice of FDI firms and environmental regulation reforms in China. J Regul Econ 50, 207–232 (2016). https://doi.org/10.1007/s11149-016-9303-9

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11149-016-9303-9