Abstract

We study the existence and international transmission of housing market bubbles, using quarterly information of twenty OECD countries for the period comprised between 1970 and 2015. We find that housing bubbles are present in all the countries included in our sample. Multiple bubbles are found in all but two of those countries. We find five episodes of transmission. All of them had origin in the US housing bubble preceding the subprime crisis. Most transmissions were to European countries. Notably, the Spanish housing bubble was not a direct consequence of the US housing bubble. Its origin must be found in other causes.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Housing markets have generally been viewed as local markets, in the sense that various local structural factors, such as land availability, local taxes, and institutional factors that are particular to a city or country, play a role in determining supply and demand. However, the development and burst of multiple housing bubbles around the recent global financial crisis has raised questions of possible international transmission of housing shocks across countries.

The US subprime financial crisis of 2007–2008, that led to the global financial crisis, renewed interest in the linkages amongst the financial sector, housing prices and the macroeconomy, as well as in the implications of these linkages for policymakers. Interest has been gained also in in studying the transmission of financial shocks, and credit and housing bubbles in an international context.

Contrasting with the literature that considers them local markets, there is a growing body of literature that analyzes the importance of various shocks in driving national and global housing prices. Recent studies have reported evidence supporting the hypothesis of international housing price synchronization (Terrones and Otrok 2004; Bandt et al. 2010; Cesa-Bianchi 2011).

In this paper we contribute to this literature by studying the international transmission of housing market bubbles. Following the center-periphery literature, we consider international transmissions originated in a bubble occurring either in the US or in the UK. We use housing price data for a set of twenty OECD countries for a period comprised between 1970 and 2015, and find evidence of five episodes of bubble transmission. All of these episodes originated in the US and lie around the upshot of the subprime financial crisis. Moreover, using a recently developed method, we study the dynamics of bubble contagion, and find a diversified behavior of intensities. In some cases, as for France and New Zealand, an inverted U-shape relation is encountered, with maximum values located around the beginning of the subprime financial crisis.

These results agree with the notion that the development and burst of the US housing bubble influenced the creation and rupture of property bubbles in other developed and emerging countries. Our results shed light on the increasingly importance of international financial linkages and their relation with worldwide financial fragility. In this sense, our results are relevant for the literature on financial cross-border spillovers.

Our main focus is to establish a statistical association of the housing bubble migration among the twenty OECD countries included in our sample. However, it is worthy to briefly mention some possible transmission channels. All migrations were originated in the US housing bubble that gave start to the subprime financial crisis. Several studies have highlighted the role of extremely low mortgage interest rates, low short-term interest rates, relaxed standards for mortgage loans, and irrational exuberance, in the formation of the US housing bubble (see, for instance, Holt 2009).

All together these facts led to abundant liquidity in international financial markets and a search for yield of international investors, motivating important increases in international capital flows to other developed economies and to emerging markets. With many investors taking positions in housing markets and central banks maintaining low interest rates for avoiding the appreciation of their currencies with respect to the US dollar, the conditions for the formation of housing bubbles in many countries were set. The recent international financial crisis clearly showed that financial cross-border spillovers are a side-effect of increasing international financial markets integration.

Our results have important policy implications. On the one hand, whenever national policies have relevant cross-border effects, then international policy coordination is a must. For instance, if national policies tending to stimulate the housing market in some developed economies have effects on other countries, then housing policies should be coordinated in international forums.

On the other hand, our results highlight the importance of developing macro-prudential policies for diminishing the potentially harmful effects of shocks originated in international financial markets. Of particular relevance, small open economies should consider the implementation of temporary capital controls for limiting the noxious effects that capital flow cycles may have, as the development of housing bubbles.

Brief Literature Review

In this section we present a brief literature review of papers related to this study. We focus in recent papers on two strands of the literature. First, we review studies dealing with the transmission and international synchronization of housing prices. Second, we briefly describe the main results obtained by papers that have used methodologies similar to ours for detecting and date stamping bubbles. In this review we include the only two papers that, up to our knowledge, have tested for financial bubble transmissions.

Recent Studies on the Transmission and International Synchronization of Housing Prices

Recent papers studying the effect of interest rates on house prices show that these effects are quite modest (Kuttner 2012). This fact has motivated a growing literature that suggests the interdependence between national and global housing prices. The majority of these studies use Factor Augmented Vector Autoregressive (FAVAR) or Global Vector Autoregressive (GVAR) models to analyze the transmission and synchronization of housing prices across countries or regions.

Studies using GVAR models show there is evidence of international transmission of housing shocks. For instance, Vansteenkiste (2007) shows that house price shocks in California are an important factor driving prices in other US states. Hiebert and Vansteenkiste (2009) conclude that house price shocks play a modest role in explaining house price spillovers in the euro area. And, Cesa-Bianchi (2011) reports evidence that house price shocks originating in the US significantly affect global housing prices. However, critics to the GVAR approach have pointed-out that this methodology does not allow for a structural identification of shocks. Hence, the economic interpretation of housing shocks is rather intricate in these studies.

Studies following FAVAR methodologies have obtained similar results. Terrones and Otrok (2004) find evidence of a global housing cycle, suggesting that housing prices tend to co-move. And, de Bandt et al. (2010) find that house prices in the United States lead movements in house prices in other OECD countries.

Several papers have encountered a clear-cut nexus between abnormal credit growth, asset price bubbles and financial crisis. To mention only a few, Borio and Lowe (2002) and Borio (2009) show that excessive credit growth is the main leading indicator of a financial crisis in a 12-month horizon. Jorda et al. (2011), and Schularik and Taylor provide evidence that episodes of rapid credit growth lead to the development of real state bubbles and to increases in the probability of banking crisis. Papers studying this nexus for emerging market economies have furthered encountered that international capital flows play an important role, as they fuel-up the building of financial imbalances through rapid loan growth (Tenjo and Lopez 2010; Amador et al. 2013). Furthermore, other studies have documented a close relation between international capital-flow cycles and housing-price cycles in open economies (in 't Veld et al. 2014).

In a recent contribution, Martin and Ventura (2015) develop a theoretical model of international credit bubble migrations. They find that financial globalization and low interest rates create an environment that is conducive to credit bubbles, and to the international migration of these bubbles among countries. This finding, together with the strong empirical evidence linking credit bubbles with housing bubbles provides a solid grounding for considering the international transmission of real estate bubbles. During times of low interest rates and large international capital flows, credit bubbles are likely to develop in different countries. Central bank coordination may also play a role in fueling these bubbles (Taylor 2013). And, the development of credit bubbles increases the likelihood of the appearance of simultaneous housing bubbles in different countries.

Housing Bubbles Identification and Transmission

The existence of bubbles has been widely studied in the literature. The most commonly used detection methods follow the present value model under the assumption of rational bubbles. Under this setting, bubbles can emerge if assets are infinitely-lived and the bubble’s growth rate equals the economy’s discount rate. Under full rationality, bubbles can also exist in a finitely-lived economy if informational asymmetries exist and short-sale constraints are binding (Allen et al. 1993).

Early proposals include Shiller’s variance bound test (Shiller 1981), and West’s two step test (West 1987). Campbell and Shiller (1988) and Diba and Grossman (1988) introduced the most commonly used methods for detecting asset price bubbles in the literature, namely the right-tailed unit root test and the cointegration test.

These two frequently used methods, however, suffer from the so-called Evan’s critique. Evans (1991) shows that these tests are not able to detect the existence of explosive bubbles when the sample data includes periodically collapsing bubbles. Phillips et al. (2015) propose an identification test that overcomes Evan’s critique. This test improves power significantly with respect to the conventional unit root and cointegration tests (see Taipalus 2012), and has the advantage of allowing the date-stamping of bubbles.

The methodology proposed by Phillips et al. (2015) has been used extensively for identifying asset price bubbles in different countries and markets. Applications include bond, stock, exchange rate and housing markets. Housing market applications have been successful in identifying bubbles in countries and periods in which there was ample agreement of the presence of a bubble, but other testing procedures had been unable to find evidence confirming the bubble hypothesis. See, for instance Yiu et al. (2013) for the case of Hong Kong and Gomez-Gonzalez et al. (2015b) for the case of Colombia.

Phillips and Yu (2011) study the case of the US and report evidence of exuberant behavior in this country’s housing market between May 2002 and December 2007. Other country studies include Jiang et al. (2015), who study the residential property market of Singapore and find evidence of a bubble between the second quarter of 2006 and the first quarter of 2008. Of special relevance, the authors find evidence of explosive behavior arising two quarters earlier than in previous studies.

Shi et al. (2015) find housing price bubbles in all major Australian capital cities during the early 2000s. Greenaway-McGrevy and Phillips (2016) document evidence of episodic bubbles in the New Zealand property market over the past two decades.

Some multi-country studies have also appeared in the literature recently. Pavlidis et al. (2016) study housing prices in a set of developed countries including the US, the UK and Spain. Their results suggest that the three countries experienced periods of price exuberance between 1999 and 2007.

Engsted et al. (2016) perform an econometric analysis of bubbles in housing markets in the OECD area, using quarterly OECD data for 18 countries from 1970 to 2013. They find evidence of explosiveness in many housing markets, supporting the bubble hypothesis.

Several recent theoretical studies have shown that bubbles in housing markets may be contagious (see, for instance, Riddel 2011). In other words, bubbles in the housing market may migrate from a central location to the periphery. Some empirical papers have tested this hypothesis, using data for cities in a particular country and different econometric techniques than those used in this paper. For instance, Teng et al. (2016) show evidence supporting the hypothesis that housing bubbles migrate from Taipei City (city center) to New Taipei City (suburbs).

However, up to our knowledge only two papers have used the methodology developed by Phillips and Yu (2011) for testing transmission. The first one is Phillips and Yu (2011) itself. In their empirical application they encounter bubble transmission among the housing market, the crude oil market and the bond market. The second is Gómez-González et al. (2015a), who apply the test for detecting transmission of asset price bubbles in the housing, currency and stock markets of seven countries. However, they only study transmission of bubbles within a country. Specifically, they test for bubble transmissions among these three markets for each individual country. International bubble transmissions are not studied.

Greenaway-McGrevy and Phillips (2016) present a new method for studying bubble transmission allowing for time varying transitional effects in the contagion, and apply it to different geographical regions in New Zealand. Specifically, their formulation allows the contagion effect from the originating region to another one to change smoothly over time. Their method appears to be more suitable than methods in which the contagion effects are constant over time for studying heterogeneous markets, such as the housing market, in which location-specific effects prevail. In this study, we follow their method, and study the potentially time-varying effects of housing bubbles transmission in an international context.

This paper is the first to study the international transmission of bubbles. Following the center-periphery literature, we consider international transmissions originated in a bubble occurring either in the US or in the UK. We use housing data for a set of twenty OECD countries for a period comprised between 1970 and 2015 and find evidence of multiple bubbles for all the countries included in our sample. Moreover, we identify five episodes of bubble transmission, all of them originating in the US around the upshot of the subprime financial crisis. We show how these contagion effects vary over time.

We do not formally test for causality in this paper. Bubbles are usually short-lived and hence traditional time series causality tests, such as the Granger test, present important limitations in this context. We instead follow the center-periphery literature and recent papers suggesting that the development of the US housing bubble during the 2000s influenced several asset prices in an international context. For instance, Pavlidis et al. (2016) find considerable synchronization between housing bubbles of different countries during the early 2000s. They encounter that propagation is characterized by widespread and synchronized episodes of exuberance across very different housing markets during that period.

Baseline Model and Econometric Methods

Consider a standard asset-pricing model with a constant discount factor:

The after-dividend price of the asset at time t is P t , the payoff (dividend) received from the asset at time t + 1 is D t + 1, E t represents the expectations operator with information until period t, and r f stands for the constant is the risk-free interest rate.

Equation (1) is a linear first order differential equation. Solving this equation recursively we obtain an expression for the price of the asset as a function of the expected flow of future payoffs:

Defining the fundamental price of the asset as the discounted sum of expected future payoffs, i.e., \( {P}_t^F={\sum}_{i=0}^{\infty }{{\left(\frac{1}{1+{r}_f}\right)}^i E}_t\left({D}_{t+ i}\right) \). The bubble component can be defined from Eq. (2) as \( {B}_t={P}_t-{P}_t^F \). In other words, a bubble is related to a behavior of the price of the asset which is unrelated to its fundamentals.

Diba and Grossman (1988) show that this bubble component has an explosive behavior:

It is important to note that in this context bubbles can arise even under rational expectations, which differs greatly with behavioral economics and behavioral finance approaches that consider alternative definitions.Footnote 1

For empirically testing the presence of rational bubbles, Phillips et al. (2015) suggest applying econometric tests to the price-dividend ratio, \( \frac{P_t}{D_t} \), which cannot behave explosively in the absence of bubbles (see Gürkaynak 2008).

Most studies of house price bubbles use the price-to-rent ratio (see, for instance, Phillips and Yu (2011); Yiu et al. 2013; and, Gomez-Gonzalez et al. 2015a). In these papers, explosive behavior in this ratio is considered a sufficient condition for the existence of a bubble. In a recent paper, Ambrose et al. (2013) provide a rationale for justifying this way of measuring house price bubbles. Using 355 years of evidence they find that house prices and rents are cointegrated, indicating that the same underlying fundamentals likely influence both. Hence, an explosive behavior in this ratio is clearly conducted by aspects unrelated to housing market fundamentals.

It is important to note that the asset pricing model in which we base our bubble tests imposes some restrictions on the statistical characteristics of the price-rent ratio. Relaxations of the model can change the statistical characteristics of the price process. For instance, the existence of a time-varying discount factor may generate a mildly explosive behavior of this ratio for a while, even if rational bubbles are ruled-out. Taipalus (2012) and other studies have either used or identified approximations of the present-value formula that incorporate the possibility of time-variation in the discount rate. Therefore, the same econometric techniques applied here are amenable, if data permits, to a richer exploration that incorporates the behavior of interest rates in the prices of assets. However, we leave this issue for future research.

In this paper we detect periods of exuberance of a significant duration of at least twenty-four quarters and study the patters of transmission from the US and the UK to other OECD countries.

The econometric implementation is based in the augmented Dickey-Fuller (ADF) unit root test, performed by using the following linear regressionFootnote 2:

Where p t stands for the price-dividend ratio, ε t is an i.i.d. error term and μ represents a constant deterministic component. The null hypothesis is the existence of a unit root and the alternative hypothesis is the existence of an explosive behavior in the price-dividend ratio. The methodology we follow consists in calculating this test in multiple recursive regressions which vary in both the number of observations and the starting date of the estimation.

The GSADF statistic is the sup sup of the ADF tests, or in other words the supremum of the set of all ADF tests corresponding to different stating dates and window sizes. The GSADF statistic is used for testing the existence of at least one bubble in the whole sample. In order to estimate the origination and collapse dates of every bubble, a sup ADF (BSADF) statistic with respect to the number of observations is computed for each alternative last observation in every regression. The resulting series of ADF statistics is then compared with an appropriate series of critical values.

We calculate our GSADF and BSADF statistics following Phillips et al. (2015). We use a minimum window size of twenty-four quarters and calculate critical values for each test performing Monte Carlo simulations. We performed 10,000 replications in each case.

For analyzing pairwise housing bubble transmissions from the US and the UK to other OECD countries, we follow two complementary approaches. We use both the method proposed by Phillips and Yu (2011) and the extension presented in Greenaway-McGrevy and Phillips (2016). In Phillips and Yu (2011), the coefficient measuring the transmission of bubbles is time-invariant. This fact is not desirable for markets in which heterogeneity and time-variation of transmission intensities are present. Greenaway-McGrevy and Phillips (2016) develop an extension in which the contagion effects vary over time. This time-varying coefficient allows capturing persistent changes that occurred during periods of bubble formation and collapse. For ease of exposition, and considering that the former is a particular case of the latter, we briefly present only the method proposed by Greenaway-McGrevy and Phillips (2016) in this section.

Let \( {\widehat{\beta}}_{i, s} \) be the slope coefficient estimate of Eq. (4), for country i at an ending date of the subsample s (for s = S,…T). We fit the following funtional regression:

where S represents the initial date. In this paper j = {US, UK}, while i represents any other country different from these two. In this setting, d stands for the number of lags included in the regression of Eq. (5). We use different integer values for d, ranging from zero to 4 quarters, and report results for the value of d that generates the largest R 2 value in non-linear least squares regressions, for each case. Following Greenaway-McGrevy and Phillips (2016) we use the fixed window subsample method, which focuses more on the immediate data point than the expanding data scheme. For practical issues we chose a fixed window sample size of S = 24.Footnote 3

The primary coefficient of our functional regression (Eq. (5)), γ i , is time varying. Hence, the transmission effect from the originating country to the country of reception varies over time. This specification has the advantage of capturing potential changes in the strength of international bubble transmissions. It is reasonable to expect that the intensity of transmission increases for a period of time, during which the two bubbles are developing, and then decreases (generating an inverted U-shape).

Data

In this paper we study international housing bubble transmissions. Following center-periphery models, we focus on transmissions originating either in the US or the UK, and test for contagion to other OECD countries. For doing so, we use housing market data, i.e., house price indexes and rent price indexes, for a set of 20 countries. The rent price index is used as a proxy for the dividend in this market, as it is usually assumed in the related literature (see, for instance, Greenaway-McGrevy and Phillips 2016; Engsted et al. 2016; and Gómez-González et al. 2015a).

We use quarterly data for each series and each country, obtained from the OECD housing market data. Table 1 describes the time series used in this paper. Note that for most countries data comprises the period 1970Q1 to 2015Q2. However, the data for some countries begins in a later date.

It is noteworthy to mention that measuring the fundamentals in housing markets is a difficult task. Ideally rents and prices should be calculated separately for groups of identical, or at least homogeneous, houses. Even in the case in which disaggregated information on housing units is available, some problems must be solved. While rents and prices for rented units may be observed, it is hard to determine implied rents for owner-occupied houses. However, in our study (and in most studies of this market) we only count with aggregated data. One partial fix to this issue would be using price indices for different types of houses (i.e., luxury vs. mass segment houses). However, we do not have access to prices nor rents discriminated in this way for our period of study. Therefore, we use the ratio of the two indices for the whole market, following what is conventional in this literature.

Results

Bubble Detection and Date-Stamping

We applied the bubble detection test described in Baseline Model and Econometric Methods Section for each of the twenty OECD countries considered in this study. Using recursive unit root tests with a minimum window size of 24 observations (quarters), we found at least one episode of housing price exuberance in each country, according to the GSADF statistics depicted in Table 2. Our results go in line with those obtained by Engsted et al. (2016) who perform a similar analysis for a group of fiveeen OECD countries.

Results in Table 2 show that test statistics are significantly larger than critical values even at the 99% significance level for all countries. Values of the test statistics are particularly large for six countries, namely the US, Germany, Italy, France, Spain and Ireland. For these six countries bubbles would be detected even at extremely high confidence levels.

Table 3 shows periods for which housing price bubbles were encountered in each country. For all but two countries (Canada and Greece, for which only one bubble was found), multiple bubbles were identified in the sample period. Most housing bubbles evolved during the early 2000s, beginning before the subprime financial crisis. Interestingly, bubbles around this episode were also longer than bubbles occurring in other periods of time, such as the 1980s and early 1990s. While bubbles occurring around the time of the subprime financial crisis had on average duration of thirteen quarters, bubbles happening in other decades had a duration of only seven quarters.

Like any other detection test, the bubble detection test used in this study presents some limitations. One of them consists in the detection of very short-lived bubbles. This may not always make sense, when very short-lived episodes or a rapid succession of episodes one after the other are detected. For overcoming this problem, we consider and report only bubbles of a duration of at least three quarters. This minimum duration requirement was determined by imposing a condition that for a bubble to exist its duration must exceed the quantitylog(T), where T represents the number of observations. For most countries the resulting number was near 2.1, so we decided to impose a minimum duration of three quarters for all cases. We performed estimations using other requirements for the minimum duration of bubbles, such as four and five quarters, but results were qualitatively identical.

Additionally, the fact that the bubble term is explosive has implications for empirical studies. If economic fundamentals follow an integrated process of order less or equal than 1, which is typically assumed in the literature, then an explosive behavior in the price-to-rent ratio is indicative of the existence of rational bubbles. Given that, this type of bubbles can be identified by applying right-tailed unit root tests as done in this study. However, the results of such tests must be interpreted with caution as factors other than bubbles can also give rise to explosive dynamics in house prices; for instance, time-varying discount factors. For the sake of robustness, we checked for the stability of our results under several different specifications. For instance, we tried with different minimum window sizes (between 12 and 24 quarters), different lags, and different critical values. Results are very similar under these different specifications.

However, even when our results are robust to several different specifications, they must be interpreted with caution since they are only indicative, not conclusive. For example, a bubble is detected in Japan for the final part of the sample period. However, this episode of house price increases seems to be more a recovery than a bubble. Hence, we did not consider it when studying migrations.

Norway, France, and the Netherlands are the countries for which more bubbles were encountered with a total of five each. We also found evidence of four bubbles in Switzerland and Germany. The rest of the countries included in this study register at most three housing bubbles. Interestingly, only two bubbles were detected for the US, but bubbles in this country tend to be longer than those observed in the other countries in our sample.

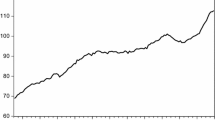

Figure 1 graphically depicts the periods in which housing bubbles were identified in each country. Both the price-rent ratio time series and the BASDF time series are shown in this figure. Notice that bubbles can be either positive or negative. Positive bubbles correspond to time periods in which the price-rent ratio grows explosively. Negative bubbles correspond to periods in which this ratio decreases at an increasing speed.

Positive bubbles are more frequent than negative bubbles and have a longer duration. In fact, in our sample only six negative bubbles were identified: Greece, between 2011Q3 and 2013Q3; France, between 1991Q2 and 1992Q3; Germany, between 2000Q2 and 2002Q1, and between 2006Q3 and 2009Q1; Italy, between 2006Q4 and 2009Q4; and, Norway, between, 1989Q2 and 1991Q1. These negative bubbles are labeled in Table 3 as “negative”.

Bubble Transmission

The emphasis of this paper is on studying housing bubble transmissions. Initially, many transmissions may be studied. However, following the literature on center-periphery, and the evidence of the recent international financial crisis, we focus on potential transmissions originating in a bubble either in the US or the UK. For instance, Pavlidis et al. (2016) find considerable synchronization between housing bubbles of different countries during the early 2000s. They encounter that propagation is characterized by widespread and synchronized episodes of exuberance across very different housing markets during that period, and suggest that the origin of several international housing bubbles may be found in the US housing bubble.

We perform two types of tests, one in which the estimated coefficient, \( {\widehat{\gamma}}_i \) in Eq. (5), is time-invariant and another in which this coefficient is allowed to vary over time. As an initial exploration, we use the test proposed by Phillips and Yu (2011) to restrict our attention to a smaller set of potential transmission episodes. Then we use the extension proposed by Greenaway-McGrevy and Phillips (2016) in order to study the time-varying nature of contagion intensities.

Various episodes of possible transmission were selected and formally tested. Out of those, five episodes were confirmed under both methods. All of these transmissions had origin in the US housing bubble preceding the subprime crisis. According to our results, there were no transmissions from the UK housing bubble to any other country in our sample. In other words, the UK housing bubble had no direct influence in the formation of housing bubbles in other OECD countries, according to our results. Table 4 shows these results.

Table 4 shows the country to which the US housing bubble migrated and the period of time for which transmission was encountered. For example, the US housing bubble that gave origin to the subprime financial crisis propagated to Denmark between 1998Q2 and 2002Q4. Notice that most transmissions were to European countries. Notably, the Spanish housing bubble was not a direct consequence of the US housing bubble. Its origin must be found in other causes.

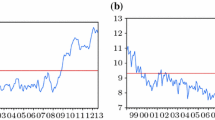

Bubble transmission intensities potentially vary over time. For testing for time-variation, we estimated the slope coefficient of Eq. (5) by local Kernel regression, using a Gaussian Kernel, for each of the five episodes of migration reported above. Figure 2 illustrates the main results. Different responses from the receptor country to the core country (the US) the can be observed. For instance, the response of France follows an inverted U-shape, with maximum values around 2007. The sensitivity increases between 1999 and 2007, and then monotonically declines. Notice that the decline corresponds to the moment in which the housing bubble in the US starts to collapse.

The graph for New Zealand’s sensitivity over time follows a similar pattern. However, the values of sensitivity are lower than those encountered for France. Importantly, the maximum values occur around 2007 too. In the case of Sweden, sensitivities are greater around 1998, and then decline, becoming mildly negative after the second half of 2012.

Sensitivities for Denmark exhibit a U-shape. They monotonically decline between 1996 and 2006, and then start to increase. Finally, in the case of Canada sensitivities are negative but increasing during most of the sample period, and during the first half of 2007 they become positive. Hence, the burst of the US housing bubble appears to have fueled the emergence of the housing bubble in Canada.

In this study we do not seek to identify the causes of bubble transmission. However, it is worthy to mention some hypotheses about its possible causes. All transmissions were originated in the US housing bubble that gave start to the subprime financial crisis. Many authors have proposed that the main cause of the US housing bubble were the persistence of extremely low mortgage interest rates, low short-term interest rates, relaxed standards for mortgage loans, and irrational exuberance (see, for instance, Holt 2009).

These four facts led to the existence of abundant liquidity in international financial markets and a search for yield of international investors. Capital flows to other developed economies and to emerging markets increased considerably before the beginning of the subprime financial crisis. With many investors taking positions in housing markets and central banks maintaining low interest rates for avoiding the appreciation of their currencies with respect to the US dollar, the conditions for the formation of housing bubbles in many countries were set.

The international financial crisis of 2007–09 clearly showed that financial cross-border spillovers are a side-effect of increasing international financial markets integration. Therefore, our results have important policy implications. First, whenever national policies have relevant cross-border effects, then international policy coordination is a must. For instance, if national policies tending to stimulate the housing market in some developed economies have effects on other countries, then housing policies should be coordinated in international forums.

Second, our results highlight the importance of developing macro-prudential policies for diminishing the potentially harmful effects of shocks originated in international financial markets. Of particular relevance, small open economies should consider the implementation of temporary capital controls for limiting the noxious effects that capital flow cycles may have, as the development of housing bubbles. Other macroprudential policies for limiting housing markets exuberance have also been suggested in the literature and implemented in practice; for instance, the establishment of caps to debt-to-income or loan-to-value ratios (e.g., Igan and Kang 2011).

Conclusions

In this paper we study the existence and international transmission of housing market bubbles. We use quarterly information of twenty OECD countries for the period comprised between 1970 and 2015, and test for the existence of bubbles following the methodology proposed by Phillips et al. (2015).

We find that housing bubbles are present in all the countries included in our sample. In fact, we were able to identify multiple bubbles in all but two of the countries included in our sample, namely Canada and Greece. We found that most of the bubbles are encountered during the late 1990s and early 2000s. This period of time also characterizes for being the one in which the longest bubbles developed.

While positive and negative bubbles exist, the first types of bubbles predominate. Interestingly, their duration is also higher than the duration of negative bubbles.

After identifying and date stamping bubbles for our set of OECD countries, we tested for possible international bubble transmissions following Phillips and Yu (2011). Following the center-periphery literature, we consider only international transmissions originated in a bubble occurring either in the US or in the UK.

Various episodes of potential transmission were selected and formally tested. We found five episodes of transmission. All of them had origin in the US housing bubble preceding the subprime crisis. Most transmissions were to European countries. Notably, the Spanish housing bubble was not a direct consequence of the US housing bubbles. Its origin must be found in other causes. Bubble transmission intensities exhibit interesting patterns of time-variation. Some present an inverted U-shape with a maximum value around the beginning of the subprime financial crisis (France and New Zealand), while others exhibit different patterns.

According to our results, there were no transmissions from UK housing bubbles to any other country in our sample. In other words, the UK housing bubble had no direct influence in the formation of housing bubbles in other OECD countries.

Our results have relevant policy implications. Whenever national policies have important cross-border effects, then there is a case for international policy coordination. In the case of housing markets, if national policies tending to stimulate these markets in some developed economies have effect on other countries, then housing policies should be discussed in international forums.

Our results highlight the importance of developing macro-prudential policies for diminishing the potentially harmful effects of shocks originated in international financial markets.

Notes

In behavioral bubble models at least some of the agents are not rational, and bubbles appear from difference of opinions between bounded-rational agents or from behavioral rules, such as feedback-trading, that some non-rational agents might follow. For example, in Scheinkman and Xiong (2003), bubbles emerge due to the combined effect of finitely supplied assets being traded by agents that are bounded rational and a market with short-selling restrictions.

The number of lags for each regression was selected following traditional information criteria, i.e., the Bayesian Information Criterion and the Akaike Information Criterion.

Our results, however, are robust to different reasonable fixed window sizes.

References

Allen, F., Morris, S., & Postlewaite, A. (1993). Finite bubbles with short sale constraints and asymmetric information. Journal of Economic Theory, 61(2), 206–229.

Amador, J., Gomez-Gonzalez, J. E., & Pabon, A. M. (2013). Loan growth and bank risk. Financial Markets and Portfolio Management, 27(4), 365–379.

Ambrose, B. W., Eichholtz, P., & Lindenthal, T. (2013). House prices and fundamentals: 355 years of evidence. Journal of Money, Credit and Banking, 45(2–3), 477–491.

Bandt, O., Barhoumi K., & Bruneau C. (2010). The international transmission of house price shocks. In O. de Bandt, T. Knetsch, J. Pealosa and F. Zollino (Eds.), Housing markets in Europe (129–158). Heidelberg: Springer.

Borio, C., Lowe, P. (2002). Asset prices, financial and monetary stability: exploring the nexus. Bank for International Settlements working paper # 114.

Borio, C. (2009). Ten propositions about liquidity crises. Bank for International Settlements

Campbell, J. Y., & Shiller, R. J. (1988). The dividend-price ratio and expectations of future dividends and discount factors. Review of Financial Studies, 1(3), 195–228.

Cesa-Bianchi, A. 2011. Housing cycles in the global economy. Working Paper, IDB. http://www.webmeets.com/files/papers/SAEe/2011/480/CesaBianchi_JPM.pdf

Diba, B. T., & Grossman, H. I. (1988). Explosive rational bubbles in stock prices? The American Economic Review, 78(3), 520–530.

Engsted, T., Hviid, S. J., & Pedersen, T. Q. (2016). Explosive bubbles in house prices? Evidence from the OECD countries. Journal of International Financial Markets, Institutions and Money, 40(C), 14–25.

Evans, G. W. (1991). Pitfalls in testing for explosive bubbles in asset prices. The American Economic Review, 81(4), 922–930.

Gomez-Gonzalez, J. E., Ojeda-Joya, J. N., Franco, J. P., & Torres, J. E. (2015a). Asset price bubbles: existence, persistence and transmission. South African Journal of Economics. doi:10.1111/saje.12108.

Gomez-Gonzalez, J. E., Ojeda-Joya, J. N., Rey-Guerra, C., & Sicard, N. (2015b). Testing for bubbles in the Colombian housing market: A new approach. Desarrollo y Sociedad, 75, 197–222.

Greenaway-McGrevy, R., & Phillips, P. C. (2016). Hot property in New Zealand: Empirical evidence of housing bubbles in the metropolitan centres. New Zealand Economic Papers, 50(1), 88–113.

Gürkaynak, R. S. (2008). Econometric tests of asset price bubbles: Taking stock. Journal of Economic Surveys, 22(1), 166–186.

Hiebert, P. & Vansteenkiste, I. (2009). Do house price developments spill over across Euro area countries? Evidence from a Global VAR. Working Paper Series 1026, ECB. http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1341598

Holt, J. (2009). A summary of the primary causes of the housing bubble and the resulting credit crisis: A non-technical paper. The Journal of Business Inquiry, 8(1), 120–129.

Igan, D. & Kang, H. (2011). Do loan-to-value and debt-to-income limits work? Evidence from Korea. IMF Working Paper # WP/11/297. https://www.imf.org/external/pubs/ft/wp/2011/wp11297.pdf

in 't Veld, J., Kollmann, R., Pataracchia, B., Ratto, M., & Roeger, W. (2014). International capital flows and the boom-bust cycle in Spain. Journal of International Money and Finance, 48(PB), 314–335.

Jiang, L., Phillips, P. C. B., & Yu, J. (2015). New methodology for constructing real estate price indices applied to the Singapore residential market. Journal of Banking and Finance, 61(Supplement 2), S121–S131.

Jorda, O., Schularick, M., & Taylor, A. (2011). Financial crises, credit booms, and external imbalances: 140 years of lessons. IMF Economic Review, 59, 340–378.

Kuttner, K. N. (2012). Low interest rates and housing bubbles: Still no smoking gun. Williams College: Mimeo http://web.williams.edu/Economics/wp/Kuttner-smoking-gun.pdf.

Martin, A., & Ventura, J. (2015). The international transmission of credit bubbles: Theory and policy. Journal of Monetary Economics, 76(S), S37–S56.

Pavlidis, E., Yusupova, A., Paya, I., Peel, D., Martinez-Garcia, E., Mack, A., & Grossman, V. (2016). Episodes of exuberance in housing markets: In search of the smoking gun. The Journal of Real Estate Finance and Economics, 53(4), 419–449.

Phillips, P. C., Shi, S., & Yu, J. (2015). Testing for multiple bubbles: Historical episodes of exuberance and collapse in the S&P 500. International Economic Review, 56(4), 1043–1078.

Phillips, P. C., & Yu, J. (2011). Dating the timeline of financial bubbles during the subprime crisis. Quantitative Economics, 2(3), 455–491.

Riddel, M. (2011). Are housing bubbles contagious? A case study of Las Vegas and Los Angeles home prices. Land Economics, 87(1), 126–144.

Scheinkman, J. A., & Xiong, W. (2003). Overconfidence and speculative bubbles. Journal of Political Economy, 111(6), 1183–1220.

Shi, S.-P., Smyth, R., & Valadkhani, A. (2015). Dating the timeline of house price bubbles in Australian capital cities. Monash Business School Discussion Paper No. 54/15. http://business.monash.edu/economics/research/publications/eco/5415timelinehousepriceshivaladkhanismythvahid.pdf

Shiller, R. J. (1981). The use of volatility measures in assessing market efficiency. The Journal of Finance, 36(2), 291–304.

Taipalus, K. (2012). Detecting asset price bubbles with time-series methods. Mimeo. http://urn.fi/URN:NBN:fi:bof-201408071681

Taylor, J.B. (2013). International monetary coordination and the great deviation. Journal of Policy Modeling, 35(3), 463–472.

Teng, H. J., Chang, C. O., & Chen, M. C. (2016). Housing bubble contagion from city Centre to suburbs. Urban Studies, 1, 19.

Tenjo, F., & López M. (2010). Early warning indicators for Latin America. Ensayos Sobre Política Económica, 28(63), 232–259.

Terrones, M. E., & Otrok, C. (2004). The global house price boom (pp. 71–89). September: World Economic Outlook.

Vansteenkiste, I. (2007). Regional housing market spillovers in the US - lessons from regional divergences in a common monetary policy setting. Working Paper Series 708, ECB. https://www.ecb.europa.eu/pub/pdf/scpwps/ecbwp708.pdf?3af4def8201a7ebadacb578d4cb96e8d

West, K. D. (1987). A specification test for speculative bubbles. Quarterly Journal of Economics, 102, 553–580.

Yiu, M. S., Yu, J., & Jin, L. (2013). Detecting bubbles in Hong Kong residential property market. Journal of Asian Economics, 28, 115–124.

Acknowledgements

The errors and omissions are the sole responsibility of the authors. The opinions expressed here are those of the authors and do not necessarily represent those of Banco de la República or its Board of Directors. We want to thank C.F. Sirmans, Caterina Di Tommaso, Nezih Guner, Wilmer Ferrer, Jair Ojeda, Mauricio Villamizar, conference participants at the 25th MBF International Rome Conference on Money, Banking and Finance, and anonymous referees for useful comments and discussions on earlier versions of this paper.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Gomez-Gonzalez, J.E., Gamboa-Arbeláez, J., Hirs-Garzón, J. et al. When Bubble Meets Bubble: Contagion in OECD Countries. J Real Estate Finan Econ 56, 546–566 (2018). https://doi.org/10.1007/s11146-017-9605-4

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11146-017-9605-4

Keywords

- Housing bubbles

- International transmission of bubbles

- Recursive right-tailed unit root tests

- OECD countries