Abstract

George Akerlof’s asymmetric information theory explains why lemons are rarely, if at all, transacted. We extend his theory to explain liquidity in the second-hand real estate market. The idea is to decompose real estate into two components: land and the building structure. While sellers may know more about the quality of their structures than buyers, information on land, predominantly its locational attributes, is much more transparent. Without assuming any credit constraints or loss aversion behaviour, our information asymmetry model shows that: 1) the liquidity of real estate increases with the share of its land value; 2) there is a positive relationship between real estate prices and turnover rates when land supply is more inelastic than the supply of structures; 3) the positive relationship is stronger when the land value component gets smaller; and 4) while the availability of first-hand real estate may divert demand away from the second-hand market, such a substitution effect is weaker when the land value component is large. These four implications were confirmed with panel data analysis using Hong Kong’s housing transactions from 1992 to 2008 across 50 districts.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Information asymmetry is a kind of friction that deters buyers and sellers from making mutually beneficial trades in a free market. Akerlof’s (1970) seminal paper pointed out that information asymmetry is widespread in second-hand markets—sellers who have owned or used their goods for a period of time are better informed about the state of their product than buyers. Since buyers usually cannot observe a product’s true quality, unscrupulous sellers have an incentive to sell them for the price of good products. But buyers who are aware that they could be cheated would not pay a price as high as that of good products, and this would make sellers of good products less willing to sell. Eventually only bad products (lemons) would be available for trade, leading to an outcome known as adverse selection.

In principle, information asymmetry also applies to first-hand markets, in which sellers know more about the quality of their goods than buyers. Yet, adverse selection is often less an issue for new goods because the cost of counteracting information asymmetry, such as using warranties and brand names, is often lower. Akerlof (1970), therefore, argued that products depreciate in value not just due to deterioration and obsolescence, but also due to the increasing cost of counteracting information asymmetry such as signalling (Spence 1974) and screening (Rothschild and Stiglitz 1976).

This study seeks to extend the “lemons” theory to the real estate market and test its temporal and cross-sectional implications on the liquidity of second-hand homes in Hong Kong. The durable nature of real estate means that the supply of used, second-hand stock is much larger than the new stock supplied by developers. Most used real estate, especially housing, is traded by individual buyers and sellers without warranties, brand names, or certification.Footnote 1 A broker is normally appointed to search for information about a property and negotiate the deal, but unlike a car dealer, he would not guarantee its quality.Footnote 2 Buyers only have access to superficial quality information based on a visual inspection of a property’s condition, while latent problems may not be discovered until after the property has been bought and occupied for some time. Without the usual signalling and screening devices, buyers appear to face much quality information uncertainty when shopping for second-hand homes. Yet, people do trade second-hand homes, and such trade is highly active in some markets. In Hong Kong, an average flat (condo unit) changes hands quite frequently. From 1991 to 2003, 10% of the private flats in the city were traded, of which at least 23% were repeat sales (Chau et al. 2005). Such a high trade frequency is unlikely to be explained solely by the contention that all transacted flats are of low quality or that buyers consistently value flats more than sellers.

To solve this puzzle, this study postulates that housing quality information is not fully asymmetric, as some property attributes are more transparent than others. In particular, land (mainly locational) attributes are, in our Hong Kong case below, more easily verified than the quality of building structures, so implications of the postulate can be empirically tested by examining how housing market liquidity varies with the relative contribution of the land and building components across locations and over time. Ideally, liquidity should be measured as the ease of selling a property such as time-on-market (TOM). The calculation of TOM requires listing information, which is, unfortunately, not publicly available in Hong Kong. Instead, turnover rates are taken as a proxy of liquidity in this study. When a long TOM is needed to sell a property, trading becomes less frequent and the ex post turnover rates should be low. This is in line with Stein’s (1995) “fishing” hypothesis, which states that TOM is negatively related to trading volume in the presence of non-movers listing their houses for sale.

Which property attribute suffers more from information asymmetry depends mainly on legal requirements and the cost of signalling or screening. In Hong Kong, the doctrine of caveat emptor dictates that property is sold “as is”. Sellers only have a duty to disclose the existence of any illegal structure and prove good title. Once the sales agreement is signed, the buyer has to proceed with the purchase even if he subsequently finds any problems in the property. In the housing market, information asymmetry is primarily related to the quality of a building’s structure, which homebuyers cannot easily verify before possession. Common examples of hidden building problems are:

-

Water seepage through windows and leaking pipes

-

Cracks behind plaster or furniture, or even latent defects

-

Blockage of drains

-

Unclean water supply

-

Noise from water running through pipes

-

Hidden costs in maintaining common areas such as lifts, electricity supply, HVAC, external walls, and slopes

Many important land attributes, on the other hand, are easily verified by buyers. Location, accessibility, and views can be identified through site inspections or even from a map. Land contamination and flooding are highly unusual in Hong Kong. Title deeds are centrally recorded by the government and are checked and cleared by solicitors before purchase. Land use restrictions are public information available from government leases and town plans. Future changes in the locality are uncertain to buyers as well as sellers—no asymmetry arises. As a result, quality information about land is much more symmetric than that about building structures.

The above institutional settings make Hong Kong’s second-hand housing market a natural laboratory for exploring the main idea of this paper: other things being equal, condos with a larger symmetric part should be traded more frequently. Our empirical analysis, as described below, is based on Hong Kong’s case where land value determines the size of the symmetric part. But in other places, the situation could reverse. For example, in some parts of the US, building inspections are a common practice and could provide reliable assessments of building quality, while local conditions are costly to obtain (Garmaise and Moskowitz 2004). In this case, our main idea remains unchanged, but the symmetric part will become different.

Based on the distinction between land and building structures, we used a panel dataset of 50 districts over 68 quarters to test the effect of information asymmetry on housing turnover rates. Variations of information asymmetry across districts and over time provide two dimensions to rigorously test the implications of the lemons theory. In particular, we provide a new perspective on the pattern of price-volume co-movements commonly found in the real estate literature. Many studies supported a positive relationship between trading volume and property prices as a result of market imperfections: credit constraints (Stein 1995; Genesove and Mayer 1997; Ortalo-Magne and Rady 2006), search frictions (Berkovec and Goodman 1996; Krainer 2001), behaviour limitations (Genesove and Mayer 2001; Engelhardt 2003), and transaction cost (Qian 2009). Different from the existing literature, we advance, in the next section, a lemons-based explanation for the price-volume relationship over time and across locations. This explanation provides a new set of implications that were not tested in the past: we show that land prices, as a proxy of the size of the symmetric component, determine 1) how strong the relationship is between trading volume and property prices and 2) how strong the substitution effect is between first and second-hand sales.

This paper is arranged into five sections. Section “Development of Hypotheses” develops a set of test implications from a model based on information asymmetry in product quality. Section “Empirical Models” describes the empirical strategies to identify the symmetric component and test the hypotheses on liquidity. Section “Data” introduces the home sales data in the Hong Kong condo market. The test results are discussed in Section “Results” and the last section is the Conclusion.

Development of Hypotheses

A necessary condition for a transaction to occur is that a buyer values a product more than its seller. Assume that the probability of this occurring per unit time is:

where V B and V S are the private values of the product to the buyer and seller, respectively. In a world where both parties are equally informed about a product’s quality, valuation differences could still exist for such reasons as imperfect information and heterogeneous agents. These imperfections and heterogeneities make the probability of sale greater than zero. A higher P implies, in a statistical sense, more trades per unit time, and hence, a more liquid market. For simplicity’s sake, in case of complete information symmetry (I S ), let this probability be P S :

where P H and P L are the sales probabilities of high and low quality products, respectively, and w is the share of high quality products.Footnote 3

The problem with asymmetric information is that the buyer knows much less about a product’s quality than the seller. According to Akerlof (1970), uninformed buyers are only willing to buy products of uncertain quality at average prices, which drives sellers of high quality products out of the market. The extreme consequence is that the whole market contracts with only low quality products offered. Let the probability of a sale in the case of complete information asymmetry (I A ) be P A :

From Eqs. 2 and 3, P A is smaller than P S .

As explained in the introduction, real estate is considered a hybrid product. Its value can be decomposed into two parts: 1) a symmetric part (e.g. land), L%, observable by everybody and 2) an asymmetric part (e.g. building structure), 1-L%, observable by the seller only. Then, the sale probability of real estate, P RE , is:

The underlying assumptions are that both the symmetric and asymmetric parts must be sold together as a bundle and the information on the symmetric part does not help infer the quality of the asymmetric part. These seem to be reasonable assumptions for a variety of hybrid products or at least for the real estate we examine here.

Equation 4 is a generalization of (2) and (3). When L% = 0, Eq. 4 collapses into a completely asymmetrical case. When L% = 1, it becomes a completely symmetrical case. More generally, Eq. 4 implies that a higher share of the symmetric part will give rise to a higher probability of sale. This becomes our first testable hypothesis:

Hypothesis 1

Real estate with a high land value relative to its building value is more liquid, holding other factors constant.

Equation 4 also has non-trivial implications on the temporal relationship between prices and volume. A number of studies have shown that property prices (or returns) should be positively related to trading volume (or its changes) due to credit constraints (Stein 1995) and demand shocks (Berkovec and Goodman 1996). Our argument over the hybrid nature of real estate adds that the relationship between prices and volume is also connected to the source of property price changes—whether it comes more from a change in the land or building values.

Here is the logic: property value (PV) is the sum of the land value (LV) and the building value (BV) and L% is LV/PV. If property value grows by the same percentage as land value and building value, there would be no change in both L% and the probability of sale in Eq. 4. This scenario, however, is unlikely because land supply is much more inelastic than the supply of structures, making land value more sensitive to demand shocks. A more plausible assumption is that when a demand shock arrives, a change in property value is accompanied by a larger change in land value and a smaller change in the building value such that ∂LV/∂PV > 1. In this case, a growth in PV sufficiently implies a growth in L%, as shown below:

Taking this result back to Eq. 4, a percentage increase in PV induces a growth in L%, which, in turn, raises the probability of sale. Therefore, partial information asymmetry provides another reason for a positive relationship between property value and trading volume. This becomes our second hypothesis:

Hypothesis 2

Property value and trading volume are positively correlated.

It can be further deduced from Eq. 5 that the sensitivity of trading volume to property value depends on the share of land value, L%. When a large portion of property value comes from land (i.e., L% is high), a percentage increase in PV brings only a small increase in L%, and hence, the probability of sale. On the other hand, with the same percentage increase in PV, the probability of sale would be much improved when a larger portion of the property value comes from its structure (i.e. L% is low). This motivates our third hypothesis:

Hypothesis 3

The smaller the land value portion, the stronger is the positive relationship between property value and trading volume.

This is a new implication on the price-volume relationship that is not shared by other competing theories. This implication can be best tested with panel data that have the price and liquidity of real estate in the time dimension and different shares of the land value in the cross-section.

Empirical Models

To test the implications drawn from above, we need to specify an empirical model. A direct way to verify Hypothesis 1 is to express Eq. 4 as a cross-section model:

where the volume of secondary sales per housing stock in district k, VS k , is a proxy of the sale probability of real estate; Z k denotes other district-specific factors that potentially affect sales volume; b and a are coefficients representing P S -P A and P A .; and ε is the error term. Of particular importance is the variable L% k . In some countries, L% k is readily available, as the land and structure values are regularly assessed by local tax authorities. This, however, is not the case in our sample. Without such information, we estimated a hedonic-based location price gradient, LPG k , as a proxy of the share of the land value in district k. The construction of LPG k will be explained later in the “Data” section. For the time being, one only needs to recognize that LPG k measures the relative land value of different districts.Footnote 4 It can adequately capture cross-sectional variations in L% in our sample because: 1) the replacement cost is more or less the same across districts and 2) the land value is much higher than the building value in all our districts such that variations in depreciation patterns become less important than variations in land value.

Hypothesis 1 is confirmed if b is shown to be positive. But the problem with Eq. 6a is that Z k was not identified—there could be a lot of unknown, omitted district-specific factors affecting real estate liquidity. It is almost impossible to list these factors exhaustively, let alone quantify them. Nevertheless, an important one that should strongly affect trading activities and can be indirectly quantified is transaction costs. These costs, including brokers’ commissions and legal fees, are generally charged at a percentage of the transaction price. Moreover, in some places ike Hong Kong, a progressive transaction tax, called stamp duty, is levied on every property transaction, while a higher tax rate is applied to more expensive properties.Footnote 5 These transaction costs act as an opposing force against trading at the upper end of the property price (hence, LPG k ) spectrum, resulting in a diminishing effect on VS k . Thus, LPG k and VS k may bear a non-linear relationship:

where b 1 and b 2 are expected to be positive and negative, respectively.

While the test of Hypothesis 1 is subject to omitted variable bias, it is possible, with the help of panel data, to avoid this problem when testing the other two hypotheses. The first step is to add a time dimension to Eq. 6a:

Note that L% kt now varies across districts and through time such that LPG k alone no longer serves as a sufficient proxy for L% kt . Measuring temporal changes in land prices is an uneasy task because a land price index is generally not available. Even if it exists, it is not as reliably measured as a property price index. A simple way to get around this issue is to make use of the elastic response of land prices to a unit change in property prices, as derived in “Development of Hypotheses”. From Eq. 5, L% kt always increases with property prices, but at a decreasing rate as L% kt becomes larger. A possible specification of the relationship between L% kt and property prices is shown below:

where PPI t is the property price index at time t and c 1 and c 2 are coefficients that should carry positive and negative signs, respectively. In other words, the positive effect in the first term should be offset partly by a negative effect in the second term. There should be a third term, LPG k , to account for cross-sectional differences in land value, but we deliberately omitted it (and its squares) because it will be absorbed by the district-specific effect below. The construction of PPI t is based on the repeat-sales method and will be explained later in the “Data” section.

Combining Eqs. 7a and 7b gives:

where d 1 = b*c 1 should be positive if Hypothesis 2 is correct and d 2 = b*c 2 should be negative if Hypothesis 3 is correct.

Before estimating Eq. 8a, the omitted variable, Z kt , has to be eliminated. This can be achieved by assuming that Z kt is separable into a linear time trend (d 3 t) and a district-specific effect (Z k ): Footnote 6

Substituting Eq. 8b into (8a) and taking first difference, our empirical model becomes:

where ∆(.) is the log difference operator. Equation 9 can be estimated using the ordinary least squares (OLS) technique or the feasible generalized least squares (FGLS) technique. The latter is more flexible because it allows the residuals to be both cross-sectionally heteroskedastic and contemporaneously correlated (Parks 1967).

One can further add that the sales of new developments, or so-called pre-sales, may affect the liquidity of the second-hand housing market. If this is the case, two more terms can be added to Eq. 9:

where VP kt is the number of presales occurred in district k at time t. The sign of the first term, ∆(VP kt ), cannot be determined a priori. If presales compete with the second-hand market, d 4 should be negative. But an opposite sign may result if an actively transacted presale market indeed stimulates more second-hand sales by changing the market sentiment. This is an empirical question that does not concern us here.

What concerns us is the second interaction term which serves as a further test of the asymmetric information theory. Other things being equal, the presales market should be more symmetric in quality information than the second-hand market because: (1) the developer generally guarantees the quality of the structure, and thus, mitigates the potential information asymmetry problems and (2) both buyers and sellers cannot inspect the building in case of a re-sale of the presale units. These information advantages should make presales more active than second-hand sales. But when the share of land value goes up, quality information about second-hand real estate becomes more symmetric, thereby reducing the information disadvantage of the second-hand market. This leads us our final hypothesis:

Hypothesis 4

The larger the land value portion, the weaker (stronger) is the substitution (complementary) effect between first and second-hand sales.

If Hypothesis 4 is correct, the sign of d 5 should be positive.

Data

The empirical models in above section are tested with Hong Kong’s housing transactions data. Hong Kong is a developed city with a high population density that reaches 6,460 people per square kilometre on average and 51,600 people per square kilometre in the most densely populated district in mid-2008 (Hong Kong Government 2009Footnote 7). Housing developments are dominantly high-rise condos of about 20–50 storeys.

With such a large population and limited land supply, it is commonly recognized that a large portion of housing prices in Hong Kong is attributed to the land value. For example, in January 2009, the average property price per square metre of a medium-to-large flat (100 to 160 m2) on Hong Kong Island was HK$106,691 (US$13,678).Footnote 8 Yet, the average unit construction cost for a luxury housing unit per square metre was only about HK$14,335 (US$1,838). In other words, the construction cost accounted for less than 13% of the property price, while the remaining 87% was the land value. This was a result of a much larger growth in property prices than in construction costs: property prices in Hong Kong have grown by 100 times over the past 40 years, but construction costs have only grown 14 times.Footnote 9

Table 1 shows a summary of the variables, with their data sources, to be used in the empirical test. The data has a panel structure covering 50 districts in Hong Kong over 68 quarters from 1992Q1 through 2008Q4. The descriptive statistics are shown in Table 2: Panel A gives the cross-section statistics (together with the number of households) and Panel B gives the panel statistics. The panel dataset is unbalanced because not all data were available in every district and time period.

While the calculation of the turnover variables is straightforward, the location price gradient and property price index warrant further discussion.

The location price gradient was estimated from about 980,000 property transactions in 50 districts through a hedonic pricing model:

where RP i is the real sales price of property i; H(.) is a log-linear hedonic function; X i is a vector of hedonic attributes, including building age, floor level, and flat size (and their square terms); D k is a vector of 49 dummies that are set to 1 if property i is in district k and to 0 if otherwise; and ε i is any idiosyncratic element in each transaction. With X i as a control for building and unit-specific attributes, the coefficient of D k captures all the district-specific effects that are shared by all the transacted properties within district k. We assigned a normalized value of 1 to an arbitrary district (Aberdeen). An exponentiation of the coefficient of D k then becomes the location price index or gradient, LPG k , which can be interpreted as the ratio of the location price in district k to that in Aberdeen.

The property price index was estimated from about 560,000 pairs of transactions from 1992Q1 to 2008Q4 through a repeat-sales model:

where NP it is the nominal sales price of property i at time t; D it is a vector of 67 quarterly dummies that are set to take the value −1 if t = t 1 , +1 if t = t 2 , and zero if otherwise; α t is the coefficient of D it ; and ε i is any idiosyncratic element in each pair of sales. With 2000Q1 arbitrarily set to 100, an exponentiation of α t becomes the property price index, PPI t .

Since PPI t and the volume variables have a time dimension, it is necessary to check their stationarity before carrying out further analysis. The results of various unit root tests are reported in Table 3. They show that VS kt and VP kt are stationary at level; PPI t is non-stationary at level, but stationary after taking the first difference. This supports the use of differenced, rather than level, variables in Eq. 9.

Results

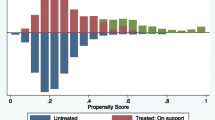

Table 4 shows the results of the cross section model (eq. 6b) for the 50 districts. As expected, the coefficients b 1 and b 2 are positive and negative, respectively, and statistically significant at the 5% level in the full period sample. This means that second-hand home sales initially grow with the land price gradient—a proxy of the share of the land value—but when the land price gradient reaches a certain point, any further increase in the land value actually reduces second-hand home sales. As explained, this non-linear effect is probably due to the higher transaction costs levied on more expensive housing units.

To further verify the effect of transaction costs, the sample is divided into two sub-periods: pre-1999 and post-1999. The year 1999 was chosen as the cutting point because at that time, the Hong Kong Government significantly increased the stamp duty for trading high-valued properties.Footnote 10 If transaction cost is an important deterrent of trades, the quadratic term in Eq. 6b should have a stronger role in the post-1999 sample than in the pre-1999 sample. The sub-period results in Table 4 agree with this. The square term of LPG k is not significant before 1999, but is significant at the 5% level thereafter.

Therefore, after controlling for transaction cost, the results in Table 4 tend to support Hypothesis 1. Further study is needed to assess how the omission of other potential variables may distort the current results.

Next, Hypotheses 2 and 3 were tested with panel data using Eq. 9. Their results are presented on the left column of Table 5. The positive, significant effect (d 1 ) of a percentage change in property prices, ∆(PPI t ), on a percentage change in turnover rates, ∆(VS kt ), agrees with the prediction of our lemons model, as well as other theories asserting a positive price-volume relationship. The coefficient of the interaction term between ∆(PPI t ) and LPG k (d 2 ) helps test the unique implication from our model: it is negative and significant at the 1% level, confirming that turnover rates are less (more) sensitive to property price changes in a district with a higher (lower) share of land value. The intuition is that, with land supply being more inelastic than the supply of structures, the same percentage increase in property prices requires a more substantial increase in the symmetric information portion in a less land-intensive district.

The next column in Table 5 reports the test of Hypothesis 4 using Eq. 10. It involved far fewer observations because presales seldom occur in every period for each district, rendering their period-to-period changes undefined. In this smaller dataset, the presales effects were insignificant, although the previous results for Hypotheses 2 and 3 were still upheld.

It is possible to avoid “division by zero” by transforming the turnover variables first before differencing. One way is to use mean deviations, as defined in VSD kt and VPD kt in Table 1. These two variables express trading volume at time t in district k as its percentage deviation from the long term average trading volume in the same district. The advantage of this method is that the ranking of the data is effectively preserved, while the denominator would not become zero as long as there are some sales in a district.

The last two columns of Table 5 show the results of re-estimating Eqs. 9 and 10 using mean deviations instead of log difference. The signs and significance of d 1 and d 2 remain the same as before. Furthermore, d 4 and d 5 are also statistically significant at the 1% level. The negative d 4 suggests that presales and second-hand homes are not two segmented markets: second-hand sales are negatively affected by the supply of new goods in the same district. Both presales and second-hand homes are considered substitutes that compete for the same pool of buyers. Yet, the strength of the substitution effect depends on the share of the land value. Confirming Hypothesis 4, our results show that districts with a higher share of land value have a weaker substitution effect between presales and second-hand sales because quality information about second-hand homes becomes more symmetric.

Conclusion

To explain why a used goods market does not shut down, we suggested that the quality information on used goods is not necessarily fully asymmetric, with the size of the symmetric portion driving the liquidity of the used goods market. Based on a decomposition of real estate into symmetric and asymmetric components, we derived several hypotheses that explain changes in the liquidity of second-hand real estate markets across districts and over time, including the commonly-asserted positive price-volume relationship. Different from previous attempts, our model drew new empirical implications that are not shared by the existing literature. Four hypotheses were tested using housing transaction data in Hong Kong. The results showed that real estate with a high land value relative to its building value is more liquid, holding other factors constant, and that the sensitivity of trading volume to real estate prices depends on the share of the land value. Moreover, while sales of new developments may draw demand away from second-hand real estate, such a substitution effect is weaker when the share of land value is high. Our lemons model could be further tested in other used goods markets where the product quality is partly symmetric and partly asymmetric.

Notes

In Hong Kong, professional inspection or certification is not common in the condo market because the cost involved is very high. Apart from professional fees, many building problems (e.g. the testing of water seepage) have to be inspected from outside a condo unit, and prior permission has to be sought from neighbours and tenants (if any).

Levitt and Syverson (2008) examined a principal-agent problem, in which brokers distorted information to induce their clients to sell their houses quickly, but at a lower price. The current study examines asymmetric quality information between buyers and sellers. Brokers may have a good sense of market sentiment and individual preferences, but they do not necessarily know more about the quality of individual properties.

Here we assume that there are only two types of product: high and low quality. Their shares (w and 1-w) are always larger than zero.

As LPGk is a sample estimate from another regression, it may measure %L with a sampling error. The consequence is that the coefficients of the regressions in Eqs. 6a and 6b are still consistent, but their standard errors are incorrect (Murphy and Topel 1985). Correcting for the standard errors, however, does not appear to change our results in any significant way. This is because LPGk was estimated from a huge sample (see the “Data” section) that substantially reduces the problem of sampling error.

These expensive properties are mostly located in high land value districts (hence, high LPG k ) as a result of the high land-to-building value ratio in Hong Kong (see also an illustration in the “Data” section).

An alternative to first differencing is a fixed or random effects model. Neither model, however, was employed because some variables, notably the property price index, were not stationary in level terms.

The housing price index of one of the largest housing estates (Mei Foo) showed a 100-fold increase from 1969 to 2008, while the tender price index grew from 100 in 1970 to only 140 in 2008 (see http://www.dlsqs.com/).

References

Akerlof, G. A. (1970). The market for “Lemons”: quality uncertainty and the market mechanism. Quarterly Journal of Economics, 84, 488–500.

Berkovec, J., & Goodman, J. (1996). Turnover as a measure of demand for existing homes. Real Estate Economics, 24, 421–440.

Breitung, J. (2000). The local power of some unit root tests for panel data. In B. H. Baltagi (Ed.), Advances in Econometrics, Volume 15: Nonstationary Panels, Panel Cointegration, and Dynamic Panels (pp. 161–178). Amsterdam: JAY Press.

Chau, K. W., Wong, S. K., Yiu, C. Y., & Leung, H. F. (2005). Real estate price indices in Hong Kong. Journal of Real Estate Literature, 13(3), 337–356.

Engelhardt, G. V. (2003). Nominal loss aversion, housing equity constraints, and household mobility: evidence from the United States. Journal of Urban Economics, 53(1), 171–195.

Garmaise, M. J., & Moskowitz, T. J. (2004). Confronting information asymmetries: evidence from real estate markets. Review of Financial Studies, 17(2), 405–437.

Genesove, D., & Mayer, C. (1997). Equity and time to sale in the real estate market. The American Economic Review, 87(3), 255–269.

Genesove, D., & Mayer, C. (2001). Loss aversion and seller behavior: evidence from the housing market. Quarterly Journal of Economics, 116(4), 1233–1260.

Im, K. S., Pesaran, M. H., & Shin, Y. (2003). Testing for unit roots in heterogeneous panels. Journal of Econometrics, 115, 53–74.

Krainer, J. (2001). A theory of liquidity in residential real estate markets. Journal of Urban Economics, 49(1), 32–53.

Levitt, S. D., & Syverson, C. (2008). Market distortions when agents are better informed: the value of information in real estate transactions. The Review of Economics and Statistics, 90(4), 599–611.

Levin, A., Lin, C. F., & Chu, C. (2002). Unit root tests in panel data: asymptotic and finite-sample properties. Journal of Econometrics, 108, 1–24.

Murphy, K. M., & Topel, R. H. (1985). Estimation and inference in two-step econometric models. Journal of Business & Economics Statistics, 3(4), 370–379.

Ortalo-Magne, F., & Rady, S. (2006). Housing market dynamics: on the contribution of income shocks and credit constraints. The Review of Economic Studies, 73, 459–485.

Parks, R. W. (1967). Efficient estimation of a system of regression equations when disturbances are both serially and contemporaneously correlated. Journal of the American Statistical Association, 62, 500–509.

Qian, W. (2009). Heterogeneous agents and housing market dynamics, Working Paper, Available at SSRN.

Rothschild, M., & Stiglitz, J. (1976). Equilibrium in competitive insurance markets: an essay on the economics of imperfect information. Quarterly Journal of Economics, 90(4), 629–649.

Spence, M. (1974). Market Signaling. Cambridge: Harvard University Press.

Stein, J. (1995). Prices and trading volume in the housing market: a model with downpayment effects. Quarterly Journal of Economics, 110, 379–405.

Acknowledgements

This project was financially supported by the General Research Fund (Project Reference: HKU 755210). We are grateful for the comments from participants at the Building and Real Estate Workshop at Hong Kong Polytechnic University and the Asia Pacific Real Estate Research Symposium at the University of Southern California.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Wong, S.K., Yiu, C.Y. & Chau, K.W. Liquidity and Information Asymmetry in the Real Estate Market. J Real Estate Finan Econ 45, 49–62 (2012). https://doi.org/10.1007/s11146-011-9326-z

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11146-011-9326-z