Abstract

This paper empirically tests auction theory by examining how the stock market evaluates the outcome of open-bid English auctions of rights to develop residential real estate projects in Hong Kong. To do so, we deconstruct the complexity surrounding actual auction events, and empirically isolate the influence of conflicting auction theory predictions using data from expert opinion around auction events, actual auction event and outcome data, and stock market data. The empirical findings include (1) with increasing uncertainty bidders reduce bids, thus confirming predictions following the winner’s curse thesis; (2) joint bidding does not lead to increased bids based on pooled (“better”) information, but instead leads to reduced competition; while increased competition leads to increased prices at auction, as expected; (3) the market interprets auction outcomes as information events which function to signal developers’ expectations about future market prospects; but if the winning bid is considered too high, this interpretation is revised to that of the winner’s curse; (4) with joint bidding and winning, the market’s response to joint winners is better explained by concern for winner’s curse (despite supposed better informed bids) than the acquisition of a below cost development project following reduced competition at auction; and (5) the market interprets increased competition at auction as indicator of the future direction of property price movements in the secondary market—the more intense the competition, the more positive the future prospect of the property market are seen to be.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Since Riley and Samuelson’s (1981) seminal article on optimal auctions, much research has been conducted on auction theory and its empirical testing in various markets including works of art, real estate, oil leases, failed banks, Treasury issues, wine, corporate takeovers, initial public offerings, corporate governance, and more. In one asset market, real estate, it is probably correct to observe that a majority of transactions, including private treaty sales and public and private auctions, all exhibit some characteristics of auctions (see Quan 1994 for a survey of auction types commonly employed in real estate transactions). In Hong Kong, the leasehold land tenure system periodically generates a significant number of prime (re)development sites for purchase by private sector developers, and as in many other jurisdictions with sale of publicly controlled assets, mechanisms for alienating this land is by private treaty, grant, or more typically by public auction. The Hong Kong Government thus regularly conducts English auctions and first-price sealed bid auctions to sell long leases over prime development land, as it has done for decades. Most participants in these auctions are large, well-capitalised, integrated real estate development companies publicly traded in the Hong Kong Stock Exchange. Several of these companies are Hang Seng Index constituents and could be considered barometer stocks for Hong Kong, given the real estate sector’s significance in the overall HKSE capitalisation (it has varied between thirty and fifty per cent over the last decade). As could thus be expected, the whole sector is very keenly watched by the financial and mainstream media, investors and traders, as are individual companies and their fortunes.

The well-developed institutions governing the conduct of land auctions in Hong Kong, their open nature and extensive media interest provide ideal circumstances for investigation of reactions in the stock market to competition between real estate developers for profitable projects and the role of open-bid English auctions in the competitive process, as well as the manner in which new information is interpreted and incorporated in stock prices. In observing land auctions, we argue that the stock price of a publicly traded real estate company that wins a land auction is subject to at least two (possibly contradictory) influences. On the one hand, success in acquiring a site at auction implies that the company has secured a potential positive net present value project. The stock market is expected to view such an acquisition favourably and the stock price of the winner should rise immediately following the successful acquisition (Pruitt et al. 1997). On the other hand, bidding at auctions for development land is typically based on the developer’s estimate of project-specific cost and margins, which may be identical for all developers ex post. One prediction of auction theory under these circumstances is that successful bidders may be victims of the “winner’s curse”: if all developers have similar margins ex post, the winner must have the lowest cost estimate; or if all have similar cost estimates, the winner must have the highest estimate for profit margins. In open-bid English auctions for development sites, it may thus be that the success at auction falls to the bidder that has either underestimated cost or overestimated profit most. If this is the case, the stock market is expected to perceive this outcome negatively and discount the winner’s stock price as a consequence of the “winner’s curse”.

Real-life land auctions of course exhibit many more complex characteristics. At least two further dynamics of such auctions are of interest, namely the impact of joint bidding on auction outcomes, and the possibility that auction outcomes may contain wider information about expected future market conditions. Firstly, theory predicts that as uncertainty about the intrinsic value of the land at auction increases, so bidders will adjust bids downward to reduce risk. Bidders may also respond to such uncertainty by bidding jointly, a fairly common phenomenon in Hong Kong, which would facilitate potentially more accurate bidding from pooling information and more keen bidding. Joint bidding also reduces the number of competitors at auction, however, and theory predicts that reduced competition will reduce prices achieved. With respect to the information content of auction outcomes, in Hong Kong the multiple of the winning bid over the opening bid is often used as an indicator of how successful an auction was, and is also often construed as reflective of developers’ optimism about future prospects for the real estate market. Indeed, prices in the spot market often move in the same direction as the change in size of the multiple following land auctions—auction outcomes may have much wider implications than a closed single event theoretical view may suggest. Altogether, the presence at auctions of the winner’s curse and positive NPV contradiction; the presence of joint bidding and potentially more accurate bidding at auctions through information pooling, or the reduction of competition at auctions from joint bidding and its potential negative influence on auction outcomes; and the possibility of auction outcomes treated as information events all indicate how complex real life auctions are.

The overall aim of this study is to test selected auction theory predictions against a large dataset of open-bid English auctions for (re)development sites in Hong Kong. In particular, we have three objectives. Firstly, using internal auction event-only generated data (“internal” data), we test empirically for two possible bidder responses to the winner’s curse phenomenon in the presence of uncertainty about the intrinsic value of the sites; namely relatively lower bids, and information pooling through joint bidding and thus potentially higher bids. Secondly, using event study methodology and market data, we test if the stock market interprets success at auction as “winner’s cursed”; or if it considers auction outcomes as acquisitions of positive NPV projects; and alternatively if the market interprets auction outcomes as a signal about perceived future market prospects. Thirdly, also using event study methodology and market data, we test if joint bidding and joint winning influences stock market interpretation of auction outcomes, which may be analysed from the perspective of better informed bidding from pooled information, or from the perspective of reducing competition at auction. In summary, we found that with increasing uncertainty bidders reduce bids, thus confirming predictions following the winner’s curse thesis. We also found that joint bidding does not lead to increased bids based on pooled (“better”) information, but instead leads to reduced competition; while increased competition leads to increased prices at auction, as expected. Further, we found support for the supposition that the market interprets auction outcomes as information events which function to signal developers’ expectations about future market prospects, but if the winning bid is considered too high, this interpretation is revised to that of the winner’s curse. With joint bidding and winning, we found that the market’s response to joint winners is better explained by concern for the winner’s curse (despite supposed better informed bids) than by acquisition of a below cost development opportunity following reduced competition. We also found that the market interprets increased competition at auction as indicator of the future direction of property price movements in the secondary market—the more intense the competition, the more positive the future prospect of the property market are seen to be. Overall, the contribution of the study is that we manage to deconstruct usefully the complexity surrounding actual auction events, and empirically isolate the influence of conflicting auction theory predictions using data from expert opinion around auction events, actual auction event and outcome data, and stock market data.

Our study is organised into six sections. “Introduction” examines selected auction theory principles and research relevant to our study, while “Auction Theory: Selected Literature” explains data requirements for our empirical investigation. “Methodology and Data Requirements” presents the methodology and results of empirical tests for two possible bidder responses to the winner’s curse phenomenon in the presence of uncertainty about the intrinsic value of the sites: firstly, relatively lower bids; and secondly, information pooling through joint bidding and thus potentially higher bids. “Valuation Uncertainty and Joint Bidding” explains methodology for and tests of whether the stock market interprets success at auction as “winner’s cursed”; or if it considers auction outcomes as acquisitions of positive NPV projects; or alternatively if the market interprets auction outcomes as a signal about perceived future market prospects. “Winners Curse, Signalling of Expectations and Stock Market Responses” further tests if joint bidding and joint winning influences stock market interpretation of auction outcomes, analysed from the perspective of better informed bidding from pooled information or reduced competition at auction. “Joint Auction Winners and Stock Market Response: more Accurate Valuation” summarises findings and concludes the paper.

Auction Theory: Selected Literature

Auctions are typically classified into two (largely simplified) categories: common value auctions and private value auctions. In an auction where bidders’ estimates of the reservation value of an asset or commodity is based on a common information set (“common value” auctions), the phenomenon known as the “winner’s curse” becomes an important concern for bidders (see McAfee and McMillan 1987; and Thaler 1988). Since the “true” value of an asset or commodity is unknown to a prospective bidder, bids based on an overestimate of value are more likely to be successful at auction. Thus a successful bidder at common value auctions is expected to pay more than necessary to secure the transaction, or there is at least doubt about the extent of benefits obtained from the transaction. Such common value auctions include auctions of offshore oil leases, contracts to provide public infrastructure and services, in financial markets it includes auctions of public debt securities and initial public offerings of equities, and it typically also includes auctions for alienation of publicly controlled land for private sector real estate development projects. In contrast, with “private value” auctions, such as that of paintings or other works of art, where private reserve values are independent among bidders and where each bidder knows her own reserve price only, the winner’s curse is irrelevant. It may be argued that for certain assets where some information is common and some private, sealed-bid auctions also do display some characteristics of private value auctions, and thus that auction format is not entirely irrelevant. Nevertheless, success in common value auctions is an informative event, and failure to incorporate conditional information into bidding may invite a winner’s curse. In this respect, Wilson (1977) has shown that optimizing behavior requires that bidders compensate for potential bias, by taking into account the expected strategies of other bidders to avoid the winner’s curse. Accordingly, rational bidders thus take the winner’s curse into account by adjusting bids downwards when there is uncertainty about other bidders’ strategies. Also, the theory predicts that lower bids should be accompanied by a larger number of competing bidders.

The theoretical implications of auction theory have been quite extensively examined in laboratory experiments, and evidence suggest that those who bid for commodities with uncertain value do fall victim to the winner’s curse (see Davis and Holt 1993). Empirical tests using actual observations have been scarce, however, mainly due to the lack of appropriate data, and also provide mixed evidence on the winner’s curse. For example, Hendricks et al. (1987) report no evidence of the winner’s curse in research into sealed-bid auctions for offshore oil leases. Thiel (1988) further provides evidence that the winner’s curse is not a significant problem in sealed bidding for highway construction contracts, but concludes that bidders seem to “shave” their bids in order to avoid the winner’s curse and also that the underlying auction model fits the data reasonably well. On the other hand, Gilberto and Varaiya (1989) investigated acquisitions of failed banks in USA Federal Deposit Insurance Corporation (FDIC) purchase and assumption (P&A) auctions, and found evidence in sealed-bid auctions that bid levels for all bidders (winners and losers) increased with increased competition, which is consistent with bidders failing to adjust for the winner’s curse. According to auction theory, an increase in the number of competitive bidders increases the level of optimal bids in private value auctions but decreases it in common value auctions. While it is difficult to classify unambiguously real world auctions into common or private value auctions a priori, Gilberto and Varaiya (1989) attempted to distinguish empirically between the categories, and found that the number of competitive bidders positively affected the winning bid of both auction categories. This is inconsistent with attempts to avoid winner’s curse, and in the absence of further empirical evidence this result remains somewhat controversial.

In general, however, empirical findings seem to support other predictions of auction theory. For example, Simon (1994) finds that the quantity risk is at least as important as the winner’s curse in auctions of US treasury securities. Quantity risk is particularly important for dealers who face the risk of not winning the desired quantity of securities at auction, as dealers who bid at these auctions typically have large short positions to cover. Further, using data from the USA Federal Offshore Oil and Gas Drainage lease sales, Hendricks and Porter (1988) test if it is possible to identify bidding agents with superior information at auctions, and also if the information available to them and to other, relatively less informed agents, could be quantified. They found that “neighbour” firms (those firms that own rights to tracts adjacent to those on which a deposit has been discovered) are better informed about the value of a lease than non-neighbour firms; and that neighbour firms exploit this advantage by shaving their bids substantially below their expectation value of the tract. Non-neighbours compensate for their disadvantage by bidding conservatively. As a consequence, neither appears to suffer from the winner’s curse.

More recently, a number of papers have reported specifically on real estate auction research, broadly related in nature but different in institutional context and detail to what we propose in this study. Informed researchers know that free entry is not a de facto condition of Hong Kong’s real estate development market, which led Ching and Fu (2003) to study contestability. They conduct an event study of Hong Kong land auctions, and find that when a development site is acquired at “below fair market value”, the acquiring company’s stock price exhibits a positive abnormal return (the positive net present value response); and further that this seems to increase with the size of the land parcel at auction—an indication that larger developers are further advantaged. Ooi and Sirmans (2004) set about to examine the effect of acquisition of development land at auction on the stock price of a set of public real estate development companies in Singapore, following the expectation that success at auction may indicate a positive NPV project with a resulting positive effect on the acquiring company’s share price. Different to Ching and Fu, though, they use a sealed-bid dataset, and explore if there are industry effects that influence positively an individual company’s performance, including (amongst other things) previous success with complex development projects over a longer term (an “experience effect”). Also using event study methodology, they show that there are positive gains to success at auctions, and that abnormal returns appear to accrue to experienced and focused private sector developers, as opposed to conglomerate and/or public-sector controlled bidders. Ooi et al. (2006) report further results of research into first-price sealed bid land auctions in Singapore. They draw on the modern land use economics expectation that competitive bidding amongst atomistic agents drives profits from projects to zero, and then set about to investigate the circumstance where the number of bidding agents is finite—the small numbers condition. In this respect, there is some similarity with the contestability nature of Ching and Fu’s (2003) Hong Kong research. They then develop a sealed-bid auction model (which appears rather liberal, given the typically highly prescriptive nature of development rules attached to public land at auction in Singapore). Using hedonic price methodology, they show that public companies tend to submit higher bids than private companies, which suggests that private companies are expected to create more shareholder wealth from auction outcomes; but also that neither experience nor joint venture structures influences bid prices, contrary to expectations.

Our study differs from Ching and Fu (2003), Ooi and Sirmans (2004) and Ooi et al. (2006) in several ways. It differs from Ching and Fu (2003) in that we are not concerned with industry economics and contestability, and accept that real estate development in Hong Kong is a highly concentrated (some argue ologopolistic) industry where incumbents are believed to have at least some pricing power. We further accept that the size of land parcels offered at government land auctions often function as entry barriers that exclude small- and medium-sized developers, because it greatly increases particularly the scale of finance required to acquire land at auction. Joint bidding is thus viewed as an imminently practical response to overcoming this barrier to entry, and so also allow developers to reduce their exposure and risk. Apart from the positive NPV/winner’s curse contradiction, we are thus also interested to observe how joint bidding at auctions affects market perceptions and company returns. Further, we are interested in deconstructing this effect, as the stock market response to joint auction winners may be conflicted. To facilitate this, we construct an information set with significant detail of circumstances surrounding open-bid auction events, including market speculation preceding, during and immediately after the event, and information about bidding behaviour during the auction event itself. Against this background, our study examines the winner’s curse and the effect that different market conditions and bidding behaviour may have on the winner’s curse in open-bid auctions. We expect that the difference in dynamics between open-bid English auctions and first-price sealed bid auctions could yield different outcomes to the Ooi and Sirmans (2004) and Ooi et al. (2006) studies.

Methodology and Data Requirements

As pointed out by Thiel (1988), one of the difficulties in testing for the presence of winner’s curse is that the winner is cursed relative to the true value of the asset or item at auction; while estimating the true value of the asset, of course, is probably even more difficult for econometricians than for bidders. Thiel overcomes the problem by developing a model of optimal bidding in which the winner’s curse is measured in terms of parameters that are independent of the true cost of the project. Other studies of the winner’s curse often use regression studies, for example Gilberto and Varaiya (1989), to test for the winner’s curse indirectly by regressing the bids on various variables suggested from theory. However, a common finding in such studies is that since the true value of the auctioned item is difficult to estimate, it is thus similarly difficult to assess the actual economic impact of the winner’s curse. Instead of following these approaches, or attempting to estimate the “true” value of the item at auction and thus directly estimating the value of the winner’s curse, we plan to extract information from financial market prices in which relevant information of the auctioned good is believed to be impounded. To this end, we employ methodology comparable to that used by James (1987) where he investigates the impact of the acquisition of FDIC failed banks at auction on the stock market price of the acquiring banks using event study methodology in order to determine whether there were wealth transfers from the FDIC to the acquiring banks.

Our objectives require the construction of a data set that contains successful land auction prices and additional auction-related transaction information (such as number of bidders) for publicly auctioned properties in Hong Kong, as well as event-study related stock exchange data for successful real estate developer-bidders around the time of the auctions. While we appreciate that corporate circumstances may have influenced financial market perceptions about bidders and auction outcomes at any one time, we have not attempted to incorporate the potential effect of individual corporate circumstances into our dataset. Our data time frame extends from 1993 to 2002, and data were obtained from transaction records of the Land Registry (Lands Office) of the Hong Kong Government, the Hong Kong Stock Exchange, and from different print media sources. The sites offered at auction were all well-known and their auctions keenly anticipated by the development community. In addition, whenever a significant site is offered at auction, the financial and general media interest prior to the auction is intense, and the event extensively covered, particularly before 1998 (see observations below).

As these are public properties offered at auction, it is important to add that site characteristics, the institutional conditions governing development allowed and other information on the properties is widely available and dispersed. The land use (and mix), scale, and other planning and development variables are all rigidly prescribed and defined for each property at auction and is part of the common information set. There is little practical scope for flexible interpretation of prescribed constraints that could influence bidding other than at the margin. Also, all these constraints on the use of the land are clearly defined and made available to the public and experts. Together with a substantially fixed development envelope and practically optimized standardized layouts (across developers), a characteristic of the industry in Hong Kong, the scale of most of these development opportunities is such that developers that do not aim to maximize gross development revenue are highly unlikely to participate in an auction with any reasonable chance of success, unless motivated by non-commercial reasons. Further, high density developments result in very high residual values for land, also for the land at our auctions. The result is that construction cost constitutes only a relatively small component of the total development cost (on average around 30–40%), and with a highly efficient and competitive construction industry costs are also predictable within a very narrow range. Thus costs, physical development characteristics, and/or site characteristics that otherwise may influence bids may be considered negligible. This leaves expected market conditions and prices as the most critical variables in the economics of the developments, which also explains high public interest in the auctions.

From 1993, major newspapers also began to conduct expert opinion surveys of market value appraisals of the development sites to be auctioned, usually within two weeks before the auction date. Since different newspapers typically surveyed different appraisers, we constructed a set of pre-auction market opinions from newspaper sources.Footnote 1 The number of opinions varied between four and twelve for each site, with an average of seven. The day after the auction, most newspapers also reported details of auction outcomes. Other than opinions about market values, we also extracted observations on (1) opening bid, (2) bid size, (3) change in bid size and the price level at which bid size changed, (4) the number of bidders, (5) the winning bid, and (6) the winner. Table 1 presents a sample of a pre-auction survey of market opinions on the intrinsic value of two sites to be auctioned on February 20, 2001, showing the location of sites, land use, site area, and plot ratio along with market opinions. Figure 1 represents graphically a typical open-bid land auction event as reported in one of the newspapers. It can safely be said that all developers would have been extremely well-informed about the exact potential of the sites. The main characteristics of our sample therefore lead us to conclude that the assets at auction are substantively common value assets, and given that there was very little discretion left for developers to vary development scale, scope, density, or timing of development—these details are typically prescribed conditions of purchase.Footnote 2 Intuitively, with a constrained and prescribed project, it strengthens the winner’s curse thesis, and we return to this in later Sections.

A typical land auction in Hong Kong. Notes: Asterisk (*) denotes companies not listed in the HKSE. Source: Details abstracted from auction reports in Oriental Daily News on March 26, 1997. The land auction commenced at 2:30 pm. The auctioneer announced HK$6.3 billion as the opening bid and bid size of HK$0.1 billion. After 18 bids, Chinachem Group stopped bidding at HK$8.1 billion, and when the price was bid up to HK$8.3 billion, Cheung Kong stopped bidding as well. The bidding continued until the price reached HK$9.1 billion after 29 bids from the start of the auction. The auctioneer then reduced the bid size by half to HK$50 million. The auction continued with Paliburg Holdings dropping out at HK$10 billion, followed by Citic Pacific at HK$10.05 billion, and Henderson Land at HK$ 10.85 billion. At HK$11.15 billion, the auctioneer further reduced the bid size from HK$50 million to HK$10 million. New World Development/Sun Hung Kai dropped out at HK$11.29 billion. At this point only two bidders remained in the auction. One of them was a joint bidder comprising Lai Sun Development, HK Parkview, Wei De Group, and Guoco Group. The other one was Sino Land. After 53 more bids between these two bidders, the Lai Sun group dropped out at HK$11.81 billion. Sino Land won with a winning bid of HK$11.82 billion. Following the auction, the stock price of Sino Land fell by 5.325% over the next two trading days (from HK$8.45 to HK$ 8)

Our dataset thus covers the same time period as Ching and Fu (2003), and some market observation is further informative to appreciate the influence of context. The residential real estate market in Hong Kong peaked in 1993 and 1994, but following anti-speculative measures adopted by the Government in June 1994 prices began to fall and declined by as much as 20% by end 1995. In 1996, a rebound began as a result of generally optimistic sentiments for the Hong Kong economy after return of sovereignty to China on July 1, 1997. In October 1997, the Asian Financial Crisis intervened and the real estate market, together with the overall economy, began to decline and continued to do so well into 2002. During the period from 1993 through 2002, the HKSAR Government sold 233 sites for industrial, residential, and commercial use by public auctions and tender offers. Of the 233 sites sold, 123 were for residential use sold by public auction. In order to examine the stock market response to these auction outcomes, our sample was censored to include only auction winners that were also listed on the HKSE. 83 government sites zoned for residential real estate development auctioned between January 1993 and December 2002 met this requirement. 73 of these were auctioned between January 1993 and April 1998 and 10 between May 1998 and December 2002. Twelve of the 83 sites were acquired by joint bidders, and thus altogether 91 auction winner companies were listed on the HKSE.

Between May 1998 and October 2002 the adverse effects of the Asian Financial Crisis began to take hold in Hong Kong, and macroeconomic conditions deteriorated rapidly with rising unemployment, asset deflation and falling real estate and other asset prices. A total of 55 government sites for residential development were auctioned during this period. Developers were not optimistic about future prices and hence not very active at land auctions, and most auctions during this period ended at a price level close to the opening bid. Meanwhile, newspapers stopped reporting land auctions in detail, and as a result, only 10 land auctions during this period had reported information useful to our analysis. Table 2 provides summary of land auctions used in our analysis. Daily stock return series for the auction winners were obtained from DATASTREAM.

Valuation Uncertainty and Joint Bidding

Any number of circumstances may influence individual bidders’ strategies at auctions, and at open-bid land auctions similar to those in our sample there are at least two prominent concerns common to all bidders. These are uncertainty about the intrinsic value of the development sites, and the extent of competition among prospective bidders for the right to develop the site. While the intrinsic value of the site reflects the present value of expected future sales generated by the development, the expected extent of competition (or cooperation) between auction participants also may affect auction outcomes. In this section we present the methodology and test empirically the influence on auction outcomes of two possible bidder responses to the winner’s curse phenomenon in the presence of valuation uncertainty—firstly, relatively lower bids; and secondly information pooling through joint bidding and thus potentially higher bids. We conduct these tests based on internal auction event-only generated data (“internal” auction data). In “Valuation Uncertainty and Joint Bidding” we broaden the analysis and consider external investor interpretation of auction outcomes through stock market responses.

Uncertainty about intrinsic site value is seen to induce two possible effects on optimal bids. Firstly, the winner’s curse thesis suggests that developers should aim to bid less relative to their estimate of intrinsic value as the degree of uncertainty about value increases, as shown in (Riley and Samuelson (1981). Alternatively, uncertainty may lead to joint bidding which would lead to reduced exposure with success. However, joint bidding reduces the number of competitors and is expected thus to reduce auction revenue, because there is less competition and bidders are expected to submit lower optimal joint bids than individual bids. While this seems intuitive, and Riley and Samuelson (1981) also demonstrate that in general the expected winning bid increases with the number of bidders, DeBrock and Smith (1983) argue that cooperation allows bidders to pool their private information, and hence generate more accurate estimates of asset value. If auctions are effectively contested, this change in the distribution of information could enable cooperative bids to be more aggressive, and, as a result, the price fetched at auction should not be significantly reduced. In Table 3 we summarize the contradictory hypotheses generated by auction theory under joint bidding circumstances.

The rest of this section explains methodology and reports results of empirical tests of the effects of valuation uncertainty, joint bidding, and competition on auction outcomes. To commence, we assume that the winning bid in our auctions reflects the influence of valuation uncertainty and winner’s curse, and/or competition and joint bidding. We thus propose that the winning bid allows us to test, from information contained in the deviation of the winning bid from a reference price, which factor(s) influenced bidding and the auction outcome. The deviation of the winning bid from a reference price, (B jt ), is determined as follows:

where p jt is the corresponding winning bid offered by the j-th bidder for the t-th site and p mt is the reference price for the t-th site.

In order to ensure robust results, we deploy three measures of reference price in our analysis. The first measure is the announced opening bid at the beginning of the auction, also taken to be the seller’s reserve price. According to Riley and Samuelson (1981), the seller can set an optimal opening bid in such a way as to extract higher rent from bidders. In Hong Kong, the multiple of the winning bid over the opening bid is often used as an indicator of how successful the auction was, the higher the multiple, the more successful the land auction was deemed to be. Further, the multiple is also often construed as reflective of developers’ optimism about future prospects for the real estate market—thus the higher the price paid at auction, the more optimistic developers are seen to be about future sale prices. Indeed, prices in the real estate market often move in the same direction as the change in size of the multiple following land auctions.Footnote 3 While it is thus often also suggested that developers bid aggressively at auctions in order to influence the price level at which they wish to dispose of their current inventory of properties, we do not support this supposition because the secondary market provides adequate opportunity for substitution if market manipulation was suspected. As argued in “Valuation Uncertainty and Joint Bidding”, we however do consider it as a mechanism to signal developer sentiment about future market prospects (albeit possibly an expensive one).

The second measure used for reference price P mt is the average of pre-auction expert opinions offered by real estate appraisers on the values of sites at auction. The excess of the winning bid over the consensus fair market valuation of the site at auction is assumed to reflect the premium the developer is willing to pay in order to acquire the site, and it serves to gauge how confident the winner is about the future price level. Expert market opinions however reflect only the intrinsic value of the sites, and ignore the effect bidding behaviour might have on the winning bid. More often than not, of course, auction outcomes deviate from the market consensus. The size of the premium is seen to depend on the reservation value of developers, the number of competing bidders in the auction and uncertainty about the market value of the site. It is insightful to add a note about the choice of expert opinion as a measure, rather than perhaps deploying a hedonic price model. Whilst containing common conditions, the leases offered for sale also contain unique prescribed conditions and/or covenants for each site, and thus would be very difficult to incorporate into a hedonic model used to estimate land value. We are however comfortable with the assumption that experts are able to incorporate (implicitly, if not explicitly) all site characteristics, current market conditions and all constrains defined in the conditions of sale when deriving their estimates.

We offer a third measure as a reference price, in order to explore further the influence of factors described into perceived auction outcomes. This measure is expected auction revenue, deploying further expert market opinion and drawing on the expression developed by Riley and Samuelson (1981):

where b 0 is the opening bid price announced by the auctioneer, v is the reservation value of the bidders, v m is the maximum price the bidders are willing to pay, n is the number of bidders, and F(v) is the probability that a competing developer-bidder draws a reservation value less than v. The expected revenue thus depends closely on the number of bidders in the auction and the dispersion of the valuation distribution among the different bidders. As the number of competing bidders increases, the bidder will bid closer to her reservation value and the expected sales revenue increases. If there are fewer bidders, bidders will bid less. As the valuation dispersion among the bidders increases, the optimal bids will decrease, which leads to lower auction revenue. When determining the expected auction revenue, we use the reported expert market opinions of site value as proxy for the reservation value of bidders. Since the number of expert opinions for each site to be auctioned is small, we assume for simplicity that F(v) follows a uniform distribution over some minimum (m) and maximum (M) market opinion. The expected revenue thus becomes

We use the method of moments to estimate the minimum and maximum market opinions. Assume the reservation values of the bidders follow a uniform distribution over the interval [m, M]. Then,

for v ∈ [m, M]. The expected auction revenue to the seller is obtained as follows:

where b 0 is the opening bid, n is the number of bidders, and v is the reservation value of the bidder. In our analysis, we take v as the average market opinion of the value of the site. In order to apply the expected revenue formula, we need to estimate the minimum (m) and the maximum (M) of the pre-auction market opinions of the value of each site to be auctioned. Let xi (i = 1…nj) be the pre-auction market opinions for the j-th site to be auctioned. Following the method of moments, the estimates for m and M are obtained as follows:

where s is the sample standard deviation of the market opinions.

As an illustration of the calculation of the deviation of the winning bid from the reference price, consider the auction of land site (Lot ST 318) on February 12, 1998. Five days before the auction, the different market value opinions as reported in three newspapers were as follows:

Market Opinions of Appraisers / Surveyors (in HK$ million) Footnote 4 | ||||||||||

100 | 58 | 59 | 60 | 95 | 48 | 65 | 68 | 71 | 92 | 80 |

The average market opinion is HK$72.36 million and the standard deviation of market opinions is HK$ 17.107 million. The estimates for the minimum and maximum opinions under a uniform distribution are:

On the day of the auction, the number of bidders (n) was tenFootnote 5, and the opening bid (b 0 ) announced by the auctioneer was HK$38 million. Using the expected sales revenue expression derived from Riley and Samuelson (1981), we predict the auction outcome as follows:

The predicted auction outcome was HK$91.22m while the actual winning bid was HK$90, very close to the prediction. The three measures of the deviation of the winning bid from the reference price are then calculated as follows:

Calculation of B jt (=ln(p jt / p mt )) with p jt = 90 | ||

Measure 1: p mt = Opening Bid | Measure 2: p mt = Average Market Opinion | Measure 3: p mt = Expected Auction Revenue |

ln(90/38) = 86.2% | ln(90/72.36) = 21.8% | ln(90/91.22) = −1.33% |

Table 4 presents the frequency distribution of the winning bids in our sample relative to opening bids, average market opinion, and expected auction sales revenue.

As mentioned, the excess of the winning bid over the opening bid (first measure) is generally regarded as one of the factors that reflect market sentiment in the Hong Kong property market, and market belief is that the size of the premium may have a positive impact on the direction of price movements in future real estate market transactions. From Table 4, we can see that the average premium as a percentage of the opening bid is 44.1%, the minimum is 0% and the maximum is 138.6%. The t-value of the average premium indicates that the premium is highly significant at 1% level. Turning to the second measure, it seems while market opinion of the intrinsic value is generally treated by the media as a forecast for the land auction outcome, the distribution in Table 4 shows that in the neighbourhood of (+/−) 10% from the winning bid, the average market opinion over-predicted the winning bid 9 times and under-predicted it by 58 times out of 83 auctions in our sample.Footnote 6 The average deviation of winning bid over average market opinion is 17.5%. The corresponding t-value of 7.53 implies that the average deviation is significantly different from zero at 1% level. The results indicate that the average market opinion reported by the media was generally not a good predictor of auction outcomes, and that it generally under-predicted outcomes by as much as 17.5%. From Table 4, the third measure, excess of winning bid over the expected revenue, averages 1.7%. The t-value of 0.77 of the average indicates that the excess bid over the expected revenue is insignificant. The result can be regarded as a simple test of how well Riley and Samuelson’s (1981) theory predicts auction outcomes.

In order to extract information about factors that influenced bidding and auction outcomes, we proceed as follows. First, we consider the range of expert market opinion to reflect valuation uncertainty, and measure valuation uncertainty (U) by the coefficient of variation, measured as the ratio of standard deviation to the mean of market opinions. The coefficient of variation is often regarded as a superior proxy for uncertainty than variance of the distribution (see Asquith 1983). To measure the degree of joint bidding (J), we use the number of joint bidders in the winning bid. To measure competition (C), we use two proxies: the first direct proxy is the number of bidders in the auction, while the second proxy is the average number of bids per bidder that an auction takes to reach the winning bid from the announced opening bid. The average number of bids per bidder is then simply taken as the number of bids from the beginning to the end of the auction, divided by the number of participating bidders. Table 5 presents the characteristics of the data on valuation uncertainty, degree of joint bidding, and competition in terms of average, standard deviation, maximum, and minimum values. The data on competition shows that the average number of bidders in the 83 auctions is 5.6, the maximum is 11 and the minimum is 1. The average number of bids an auction takes from beginning to end is 28.9. This implies that on average a bidder bids about 4.9 times for an auction to come to end. If one more bidder participates in the auction, then the number of bids will increase on average by 5.6 for the auction to come to end.

Recall our proxy to reflect the influence of various factors on bidding behaviour and auction outcomes is taken as the deviation of the winning bid from a reference price (B). To examine the relationship between auction outcome and valuation uncertainty (U), joint bidding (J), and competition (C), we estimate the following regression equation:

The subscript t denotes the t th auction. To control for the possibility that bidding strategy might be affected by the overall project scale, the total project gross floor area (A) (i.e. land area combined with allowed plot ratio in square meters) is also incorporated into the regression analysis. Three regression equations were estimated for the three different measures of reference price (B), namely announced opening bid, average market opinion, and expected auction revenue based on Riley and Samuelson (1981).

Table 6 presents the empirical findings of the effect of valuation uncertainty, joint bidding, and competition on bidding outcomes. Panel A presents the results with the Competition variable (C) proxied by the average number of bids per bidder, and Panel B presents the results with C proxied by the number of bidders.

The results are very interesting. Firstly, consider the results in Panel A. For estimates of uncertainty, only γ 1 based on announced opening bid is significant at 1% level, whereas the estimates based on average market opinion and expected revenue are not statistically significant. The signs however are consistently negative, which suggests that bidders do reduce bids with increasing uncertainty, and thus offers qualified support for the winner’s curse hypothesis. Estimates of the coefficient of joint bidding, γ 2 , are all consistently negative, and all are significant at 10% and better. The results imply that an increase of one more joint bidder will reduce the ultimate winning bid by as much as 1.6% relative to the opening bid and 2.1% relative to the average market opinion. This supports hypothesis 2(b) in Table 3, and leads to the interesting observation that although both information pooling and reduction in competition are possible effects of joint bidding, the latter appears to influence bidding decisions more and may lead to lower auction revenue. The estimates of γ 3 , the coefficient of competition, are all positive and significant at 1% level. The result offers strong empirical support for hypothesis 3 that competition drives up optimal bids and hence will lead to an increase in auction revenue. On average, an increase of one more competing bidder will increase the winning bid by 6.4% over the expected revenue and by 17.1% over the opening bid. Comparable results are reported in Panel B.

Winners Curse, Signalling of Expectations and Stock Market Responses

The next stage in the study is to consider external response to auctions by examining the stock market’s interpretation of auction outcomes. In this section we assess if the stock market interprets success at auction as “winner’s cursed”, by selling the winner’s stock down; or if it considers auction outcomes as acquisition of a positive NPV project with commensurate positive stock returns. We also assess if the market interprets auction outcomes as a signal about perceived future market prospects, such that a lower (higher) than expected price fetched at auction may reflect a negative (positive) signal about expected future market conditions, and thus lead to negative (positive) pressure on auction winners’ stock prices (and returns). In order to achieve this, we examine the behavior of cumulative average excess returns (CAR) of the winning bidder around the auction date, based on event-study methodology developed by Mikkelson and Partch (1988).Footnote 7 If a developer’s winning bid does not fully account for the winner’s curse, the winning bid, on average, overstates the true value of the development opportunity won in the auction; and the average excess rate of return over normal for winning developers is expected to be negative.

Table 7 shows stock price behavior 5 days before and 5 days after auction dates and documents the daily abnormal return, the cumulative abnormal return, and the associated daily abnormal return test statistics for winning bidders. We use 2-day, 3-day, and 4-day cumulative abnormal returns, inclusive of the auction day, rather than just the event date abnormal returns, because very often the land auctions only come to end after the close of the stock market and therefore the effect of land auction outcomes can only be reflected in the stock price the next day and after. The proportion of firms with positive abnormal return is almost equally divided up until day 0. The proportion however increases to 60.44% and 59.34% in day 1 and day 2, both significant at a 5 and 10% level respectively. The mean abnormal return for day 0, day 1, and day 2 are respectively −0.109%, 0.261%, and 0.218%. It then falls to 0.009% in day 3. None of the mean abnormal returns from day 0 to 4 is significant, which indicates that the reaction of the stock market to auction outcomes is mixed with both positive and negative responses. The response is positive if the stock market agrees that the outcome reflects good future prospects, but the response is negative when the stock market believes the price the winner paid at auction was too high. Footnote 8

We pointed out in “Methodology and Data Reequirements” that in Hong Kong it is often considered that auction outcomes convey developers’ opinions about expected future market conditions. Given the mixed results suggested by studying CAR’s reported in Table 7, we examine further if auctions function as events that signal expected future prospects for the real estate market, based on the supposition that the stock market may read auction outcomes differently from that suggested by a strict interpretation of the winner’s curse. To restate, stock market agents may construe the outcome of a land auction as a signal from the winner about future prospects for sales to be achieved from the development opportunity acquired at auction. Low winning bids may imply that developers, well informed about the future prospect of the real estate markets, are pessimistic about future property prices, which in turn may immediately affect negatively current prices in the market. Under these circumstances developers who have inventory for sale at the time of the auction would expect also to sell it at lower prices and thus lower profits. In short, the stock market may react negatively to lower than expected prices at land auctions.

How auction outcomes is interpreted by the market depends on the interplay of the winner’s curse with signalling of expectations. To examine how these two phenomena are interpreted by the market, we perform the following regression:

where CAR jt is the cumulative abnormal return for the j-th winner from day −5 to day +5 around the t-th auction.Footnote 9 To control for the potential impact of the underlying property market performance and prevailing market sentiment on cumulative abnormal returns, we follow Ooi and Sirmans (2004) and Wong et al. (2006) by incorporating into Eq. (5) a return variable R pt derived from the Hong Kong Private Residential Price Index, a sales-based index produced by the Rating and Valuation Department of the HKSAR Government. To allow for the possibility that a single estimation window includes more than one auction, we follow Ching and Fu (2003) and estimate the abnormal return needed for the computation of CAR using

where R t is the daily return of an auction winner, R mt is the daily return on the market portfolio, α and β are coefficients of the market model, ε t is the noise term, D ak is a dummy variable equal to one on the a th day of the k th auction window and zero otherwise.Footnote 10 The coefficient γ ak is the corresponding abnormal return estimate obtained from the single-factor market model.Footnote 11

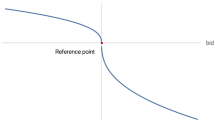

If the winner’s curse dominates the positive NPV effect of the acquired site on the company, the excess of the successful bid over the market consensus forecast should be reflected in the stock market response, and hence β 1 should be negative. On the other hand, β 1 should be positive if signalling is the dominant factor because investors would regard a high winning bid as a positive signal to the real estate market and therefore respond favourably to the winning developer. If the response is non-linear, however, it may be interpreted that the winner’s curse is of concern to the market as well. To test for non-linearity, we introduce a second order term in Eq. (5) to capture this effect. If the winner’s curse is indeed also a concern to the stock market, β 2 should be negative. These hypotheses are summarised in Table 8.

Table 9 presents the empirical results of tests on the winner’s curse effect versus the signalling effect. In this case, two regression equations were estimated using the opening bid and average market opinion measures as reference price.Footnote 12 The results are slightly mixed but also very interesting. First of all, the estimates of β 1 based on opening bid and average market opinion as the reference price are respectively 0.071 and 0.0182, significant at 5 and 10% level. The results offer support for the notion that the stock market tinterprets auction outcomes as a signal from developers about their views on future prospects of the real estate market. In this case, a 10% increase in winning bid over the announced opening bid increases the cumulative abnormal return by as much as 0.71%, whereas a 10% increase in the winning bid over the average market opinion will increase the cumulative abnormal return of the winner by 0.18%. However, the relationship between the cumulative abnormal return and the excess of winning bid over the reference price is by no means linearly positive. This is evidenced by the estimates of β 2 which are both negative; in the case of the opening bid measure it is −0.0531 and is significant at 10% level, while in the case of average market opinion it is −0.022. This result indicates that when the winning bid exceeds the opening bid beyond a certain level, the cumulative abnormal return to the winner will become negative. It implies that winner’s curse will affect the winner’s stock return whenever the winning bid exceeds the opening bid by 95%, or the average market opinion by 51%.Footnote 13

Joint Auction Winners and Stock Market Response: More Accurate Valuation or Winner’s Curse?

We return now to the question explored in “Methodology and Data Requirements”, namely the possibility of contradictory interpretations of auction outcomes. Whereas in “Methodology and Data Requirements” the analyses conducted were confined to internal auction event-only generated data, we similarly consider it reasonable to expect that joint bidding and joint winning could influence stock market opinions, which may also be analysed from the perspectives of pooling of information and reduced competition. In this section we consider the stock market’s response to joint auction winners, and analyse three phenomena.

Firstly, in the presence of uncertain valuations (U), we aim to identify if winner’s curse or signalling of market expectations dominates the stock market’s interpretation of joint bidding success at auctions. Recall that increased valuation uncertainty is expected to induce developers to bid less relative to their estimates of project value, for fear of the winner’s curse; while the signalling argument suggests that a lower than expected winning bid may send a negative signal to the property market about future profitability (and vice versa). With valuation uncertainty, which effect dominates?

Secondly, with joint bidding (J), we aim to identify if the market’s response to joint winning is interpreted as reflecting the acquisition of a project at below fair value through reduced competition; or if it is interpreted as reflecting more accurate bids as a consequence of information pooling—in which case we also know that more accurate bids from information pooling may result in more keen bidding, and so expose joint winners to the winner’s curse. Which effect dominates?

Thirdly, we aim to identify how the market interprets auction outcomes, given the extent of competition (C) at the auction and given that the outcome was a joint winner. Recall that increased competition at auction is expected to induce bidders to bid more than they would otherwise, and thus invoke the winner’s curse. (This would be exacerbated by the argument that information pooling implies more accurate estimates and more keen bidding, similarly exposing joint winners to the winner’s curse.) Thus, in sum, the winner’s curse argument implies that the stock market should interpret aggressive bids negatively as developers would likely have overbid in joint bidding. If we assume that no signalling about expectations is present, the market is expected to react negatively to increased competition among bidders; alternatively, if a signalling effect exists, we would expect the stock market to respond positively to increased competition.

Table 10 summarizes the testable relationships following this analysis.

To investigate how the market may interpret valuation uncertainty, joint bidding, and competition, we perform the following regression:

The subscripts j and t denote respectively the j th winner–bidder and the t th auction. Table 11 presents empirical findings on how valuation uncertainty, joint bidding, and competition affect the stock market’s response to the winners in the land auctions. Again, Panel A presents the results with the Competition variable (C) proxied by the average number of bids per bidder and Panel B reports the results with C proxied by the number of bidders.

As before, we use 2-day, 3-day, and 4-day cumulative abnormal returns, inclusive of the auction day. As can be observed in Table 11, the three sets of results are consistent, without switching in signs of the coefficients. The estimates of valuation uncertainty are all negative in both Panel A and Panel B. Consider the results in Panel A. The uncertainty estimates from 2-day CARs (φ 1 = −3.64*10−2) and from 3-day CARs (φ 1 = −1.6*10−3) are significant at 10%. The estimate of φ 1 provides strong support for the existence of a signalling effect in the way the stock market reacts to auction outcomes, whereas it would appear that the winner’s curse is less of a concern.

The estimates of φ 2 , the coefficient of joint bidding, are all negative in both Panels. For example in Panel B the estimated φ 2 using 2-day and 3-day CAR are respectively −8.0*10−4 and −8.83*10−4; both are significant at a 10% level. The estimated φ 2 using 4-day CAR is negative although not significantly different from zero. The results in Panel A are comparable. This empirical finding indicates that information pooling combined with the winner’s curse may explain better the response of the stock market to the auction outcome with joint bidding.

The estimates of φ 3 , the coefficient of competition, are all positive and significant at 10 and 5% level. In Panel A for example, the estimated φ 3 using 2-day CAR is 1.18*10−2 is significant at a 10% level, the one using 3-day and 4-day CAR are respectively 2.4*10−3 and 9.5*10−3 and are significant at a 5% and 1% level respectively. The signs of all three estimates are positive. This offers support for the signalling argument. The market thus interprets increased competition in land auctions as an indicator of the future direction of property price movements in the secondary market—the more intense the competition, the more positive the future prospect of the property market are seen to be.

Conclusion

In this study we examined the effects of valuation uncertainty, joint bidding, and competition on bidding behaviour at land auctions in Hong Kong, as well as how the stock market responds to the auction outcomes relative to pre-auction market forecasts. Substantial detail in our dataset about the dynamics of open-bid auctions allowed the empirical results of our study to provide important insights into the complexity of real world auctions and the interpretation of their outcomes. Firstly, using internal auction event-only generated data and expert market valuations, we found qualified support for the expectation that with increasing uncertainty bidders reduce bids, thus confirming predictions following the winner’s curse thesis. This provides a counterpoint to insights offered by Ching and Fu (2003), who found positive market response to acquisition of land at Hong Kong auctions at below “fair value”, seen as support for the existence of market power from developer industry structure, and thus limited contestability and underbidding. Also, while Ooi and Sirmans (2004) found that developer excess returns following auction outcomes is related positively to the historical ability of successful bidders to create value, and that the magnitude of excess gains is positively related to the level of uncertainty; we found instead from pre-auction market forecasts that abnormal returns following auction outcomes is negatively related to valuation uncertainty, also a counterpoint. Further, we found that joint bidding does not lead to increased bids based on pooled (“better”) information, but leads instead to reduced competition at auction and so results in lower auction revenue. The results imply that an increase of one more joint bidder will reduce the ultimate winning bid by as much as 1.6% relative to the opening bid and 2.1% relative to the average market opinion. Moreover, we further found evidence supporting the expectation that increased competition leads to increased auction revenue, as expected following Riley and Samuelson (1981). We found for example that on average an increase of one more competing bidder will increase the winning bid by 6.4% over the expected revenue and by 17.1% over the opening bid.

Secondly, using event study methodology and stock market data we found empirical support for the supposition that the market interprets auction outcomes as information events which function to signal developers’ expectations about future market prospects. However, we also found that the market is disciplined in this respect: while the empirical results support the notion that signalling plays a crucial role in the way stock market sentiment develops following land auction outcomes, there is a limit to the signalling effect and that the winner’s curse is not ignored. We find empirically that if the winning bid exceeds the opening bid by 95%, or exceeds the average market opinion by 51%, the market will tend to respond negatively to the auction outcome and interpret it as “winner’s cursed”. This result thus also supports the notion that fear of the winner’s curse should induce developers to bid less aggressively, as theory predicts. Further, market response to valuation uncertainty was expected to be negative, and the empirical results show this to be the case. An increase in valuation uncertainty leads to a negative stock market response to auction outcomes, which supports the signalling argument for valuation uncertainty. Although the market appears to ascribe less importance to the winner’s curse compared to the signalling effect, it does seem to be a critical factor in the market’s interpretation of auction outcomes in the Hong Kong sample over the study period.

Thirdly, using event study methodology and stock market data we found strong support in market responses to joint winners that these are information events that convey signals about developers’ future market expectations, with comparatively less support for market concern for winner’s curse. We found that the market interprets increased competition at auction as indicator of the future direction of property price movements in the secondary market—the more intense the competition, the more positive the future prospects of the property market are seen to be. Somewhat surprisingly, we found that the market’s response to joint winners is better explained by concern for winner’s curse (despite supposed better informed bids) than the acquisition of a below cost asset from reduced competition.

Overall, for our dataset the empirical results lead us to believe that auctions in Hong Kong broadly conform to auction theory predictions, in particular that there is qualified support for the winner’s curse and that increased uncertainty does lead to lower bids. But we did also find that joint bidding does not seem to lead to improved bidding accuracy and higher bids, however. We find very interesting the confirmation that the market interprets auction outcomes as information events which function to signal developers’ expectations about future market prospects, but most intriguing that there is a differentiation in this signalling effect—if the winning bid is considered too high, the signalling interpretation is revised to that of the winner’s curse. These results provide some insights into the extreme economic complexity of real world auctions and the interpretation of their outcomes.

Notes

The local newspapers from which we extracted details of the Hong Kong Government land auctions are Singtao Daily, Ming Pao, Apple Daily News, Oriental Daily News, Hong Kong Economic Times and Hong Kong Economic Journal.

The modern view of acquiring a development site is that it represents a call option with the developed property as the underlying asset, (see Titman 1985; Capozza and Helsley 1989). This view disaggregates the “value” of development land into two components, the “intrinsic” value of the completed development, plus the value of the option to time optimally the bringing to market of the development and possibly also selecting an optimally mixed and scaled development (Quigg 1993). In our case there is technically no expected option value, because the scope, scale and timing of the development are all prescribed conditions in the auction purchase agreement. There is no right to delay commencement of development, if allowed it is at the Lands Department's discretion. If allowed this is not a de facto option, because the same circumstance may also lead to discretionary repossession instead. In this respect our constraints differs from Ooi et al. (2006) in that they assume that developers do have some discretion.

Newspapers in Hong Kong frequently surveyed real estate agencies on asking prices of properties listed for sale immediately after land auctions. For example, on February 20, 2001, two residential sites, one in Ma On Shan and one in Sai Kung, were auctioned with the outcome price exceeding the opening bid by 24.44% and 47% respectively. Apple Daily News reported on February 21, 2001 that the auction outcome improved market sentiment and that some property owners in major residential estates in the secondary market immediately revised the listed asking prices for their properties upward by an average of 5.2%.

The market opinions are obtained by combining the survey results reported in Singtao Daily, Mingpao, and Oriental Daily News.

As reported by Oriental Daily News.

The reference price over-predicts the auction outcome whenever ln(winning bid/reference price) is less than zero and it under-predicts when ln(winning bid/reference price) is positive.

The estimation period is −100 through −6 trading days prior to auction date (day 0). Changes in the winner’s stock returns associated with each auction date, net of the market-wide influence of changes in all equity returns as proxied by changes in the Hang Seng Index returns, are calculated over an 11-day window (t = −5…+5) surrounding the auction date. This window is deemed to be sufficient to allow for both pre- and post-auction investor anticipation effects.

An example of the process at work could function to illustrate the finding. For example, Henderson Land acquired the land site at Shuen Wan (Lot TPTL 161) with the winning bid of HK$5.6 billion in the land auction on Oct 14, 1997. The opening bid was HK$3.5 billion. The premium over the opening bid is 60%. According to Table 4, this premium is the 24th highest premium in the 83 land auctions. The stock price of Henderson Land fell by 4.02% the next day. The response of the stock market did not seem to agree with the land auction outcome.

We use cumulative abnormal return from 5 days before the auction date in order to capture the potential effect of stock market speculation about auction outcomes.

The Hang Seng Index is used as the market portfolio in the calculation of the CAR. As pointed out by Ching and Fu (2003), during the sample period of from 1992 to the first quarter of 1998, no single bidder accounts for more than ten percent of the market capitalization of the index, and hence the bias of the resulting abnormal return estimates towards zero is insignificant. After the first quarter of 1998, property values began to fall due to the Asian financial crisis, market capitalization of the bidders as a percentage of the total market capitalization of the Hang Seng Index reduced, and hence the bias became even more insignificant.

The single-factor market model is Rt = α + βRmt + γD + εt, where R is the daily return of winner, Rm is the daily return of the market portfolio, α and β are coefficients of the market model, D is a dummy variable equal to one on the auction day and zero otherwise, and γ is the abnormal return on the event day.

For interest we also conducted an analysis based on the third measure, which could be viewed as a joint test of our propositions and the Riley and Samuelson (1981) auction revenue model. The results were statistically weak and are not included.

From Eq. (5), the first order condition (dCAR/dB = 0) based on opening bid implies that the maximum turning point for CAR is when B [=In(winning bid/opening bid)] is equal to −(estimated β 1 )/(2*estimated β 2 ) = 0.6698, that is the winning bid is equal to 1.95 times (= e0.6698) the opening bid. Similarly, the first order condition based on average market opinion indicates that the winner’s curse effect is likely to affect the stock return of the winner if the winning bid is 1.51 times the average market opinion or more.

References

Asquith, P. (1983). Merger bids, uncertainty and stockholder returns. Journal of Financial Economics, 11(1–4), 51–83.

Capozza, D. R., & Helsley, W. R. (1989). The fundamentals of land prices and urban growth. Journal of Urban Economics, 26(3), 295–306.

Ching, S., & Fu, Y. (2003). Contestability of the urban land market: an event study of Hong Kong land auctions. Regional Science and Urban Economics, 33(6), 695–720. doi:10.1016/S0166-0462(03)00005-X.

Davis, D. D., & Holt, C. A. (1993). Experimental economics. Princeton: Princeton University Press.

DeBrock, L. M., & Smith, J. L. (1983). Joint bidding, information pooling, and the performance of petroleum lease auctions. Bell Journal of Economics, 14(2), 395–404.

Gilberto, S. M., & Varaiya, N. P. (1989). The winner’s curse and bidder competitions in acquisitions: evidence from failed bank auctions. Journal of Finance, 44(1), 59–75.

Hendricks, K., & Porter, R. H. (1988). An empirical study of auction with asymmetric information. American Economic Review, 78(5), 865–883.

Hendricks, K., Porter, R. H., & Boudreau, B. (1987). Information, returns and bidding behavior in OCS auctions: 1954–1969. Journal of Industrial Economics, 35(4), 517–42.

James, C. (1987). An analysis of FDIC failed bank auctions. Journal of Monetary Economics, 20(1), 141–153.

McAfee, R. P., & McMillan, J. (1987). Auctions and bidding. Journal of Economic Literature, 25(2), 699–738.

Mikkelson, W., & Partch, M. (1988). Withdrawn security offerings. Journal of Financial and Quantitative Analysis, 23(2), 119–133.

Ooi, J. T. L., & Sirmans, C. F. (2004). The wealth effects of land acquisition. Journal of Real Estate Finance and Economics, 29(3), 277–294.

Ooi, J. T. L., Sirmans, C. F., & Turnbull, G. K. (2006). Price formation under small numbers competition: evidence from land auction in Singapore. Real Estate Economics, 34(1), 51–76.

Pruitt, S. W., Hoffer, G. E., & Tse, K. S. M. (1997). The United States international air route award process: shareholder wealth effects and policy implications. Journal of Regulatory Economics, 12(2), 197–217.

Quan, D. C. (1994). Real estate auctions: a survey of theory and practice. Journal of Real Estate Finance and Economics, 9(1), 23–49.

Quigg, L. (1993). Empirical testing of real option pricing models. Journal of Finance, 48(2), 621–640.

Riley, J. G., & Samuelson, W. F. (1981). Optimal auctions. American Economic Review, 71(3), 381–392.

Simon, D. P. (1994). Markups, quantity risk, and bidding strategies at treasury coupon auctions. Journal of Financial Economics, 35(1), 43–62.

Thaler, R. (1988). The winner’s curse. Journal of Economic Perspectives, 2(1), 191–202.

Thiel, S. E. (1988). Some evidence on the winner’s curse. American Economic Review, 78(5), 884–895.

Titman, S. (1985). Urban land prices under uncertainty. American Economic Review, 75(3), 505–514.

Wilson, R. (1977). A bidding model of perfect competition. Review of Economic Studies, 44(3), 511–518.

Wong, S. K., Yiu, C. Y., Tse, M. K. S., & Chau, K. W. (2006). Do the forward sales of real estate stabilize spot prices? Journal of Real Estate Finance and Economics, 32(3), 289–304.

Acknowledgement

We gratefully acknowledge the financial support provided by the Research Grant Council of the Hong Kong Special Administrative Region (RGC Reference Number: HKU 7112/05E) and a grant from the University Grants Committee of the Hong Kong Special Administrative Region, China (Project No. AoE/H-05/99).

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Tse, M.K.S., Pretorius, F.I.H. & Chau, K.W. Market Sentiments, Winner’s Curse and Bidding Outcome in Land Auctions. J Real Estate Finan Econ 42, 247–274 (2011). https://doi.org/10.1007/s11146-009-9211-1

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11146-009-9211-1