Abstract

This paper investigates the relationship between capital flows, turnover and returns for the UK private real estate market. We examine a number of possible implications of capital flows and turnover on capital returns testing for evidence of a price pressure effect, ‘return chasing’ behaviour and information revelation. The main tool of analysis is a panel vector autoregressive (VAR) regression model in which institutional capital flows, turnover and returns are specified as endogenous variables in a two equation system in which we also control for macro-economic variables. Data on flows, turnover and returns are obtained for the ten market segments covering the main UK commercial real estate sectors. Our results do not support the widely-held belief among practitioners that capital flows have a ‘price pressure’ effect on property prices. However, we do find a significant positive relationship between lagged turnover and contemporaneous capital returns, suggesting that asset turnover provides increased price revelation which, in turn, reduces investment risk and increases property values.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Although the Efficient Market Hypothesis implies a flat demand curve for asset prices, it is conventional wisdom among real estate practitioners that a surge in capital flows produced a ‘price pressure’ effect that was a key driver of the rise in global commercial real estate prices during the 2002 to 2007 period.Footnote 1 Within the finance literature, the capital flow-return relationship is linked to a range of research issues such as sentiment in market pricing, trading strategies, market volatility and efficiency, liquidity, and the causes of asset price bubbles inter alia. While the relationship between capital flows, trading volume and returns in stock and bond markets has been the subject of substantial investigation, the empirical research in commercial real estate markets is much less developed.

Although capital flows may affect prices, a priori, a number of possible causal relationships between flows and asset price returns has been suggested in previous studies including: a price pressure effect (changes in fund flows affect future returns); return chasing behaviour (changes in returns affect future fund flows); joint dependency (on common exogenous variables producing contemporaneous changes) and the presence of information cascades (self-reinforcing feedback relationships between flows and returns). It is also possible that elements of all of the above may at times be present in observed relationships between asset prices and capital flows.

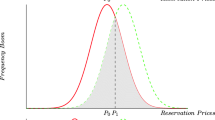

A further issue is that capital flows and trading volume may produce additional information effects in private, illiquid markets. In such markets, transactions provide a price revelation function. Arguably, the more thinly traded the market, the more likely it is that the price information provided by transactions will affect subsequent returns. The effect will be linked to the direction of market change and the volume of transactions, rather than net capital flows. For example, in a bull market we should expect a positive relationship between trading volume and prices; conversely, in a bear market a negative relationship should be observed.

Our goal in this paper is to investigate the empirical relationship among capital flows, turnover and asset prices in the UK private commercial real estate market. For frequencies ranging from daily to monthly, previous research in equity markets provides evidence of a contemporaneous correlation between transaction activity and property prices. This is commonly assumed to be due to joint dependency on common drivers. Although most studies find evidence of ‘return chasing’ behaviour in stock markets, few find evidence to support the ‘price pressure’ hypothesis. However, commercial real estate markets differ significantly from liquid and informationally efficient equity markets. Because of the short-run inelasticity of supply and the inability to short sell, the (price pressure) effects of exogenous investor demand shocks may be amplified in private real estate markets. In addition, real estate return estimates in private markets are based largely on appraisals. Appraisals, in turn, rely upon transactions to generate price signals in a market characterised by thin trading and heterogeneous assets. Trading volume, therefore, may have important information effects in addition to pure price pressure effects. An important qualification is that the interaction of low liquidity and lengthy settlement delay in private commercial real estate markets raises issues in interpreting whether observed short-term linkages are real rather than data artefacts.

Our main tool of analysis is a panel vector autoregressive (VAR) regression model, which is used to examine the dynamic relationship between capital appreciation in commercial real estate markets and three measures of transaction activity: net capital flows, turnover, and change in turnover. Data on flows, turnover, and capital appreciation are obtained for the ten main UK commercial real estate market segments. Both transaction activity and appreciation returns are specified as endogenous variables in a two equation simultaneous system. We also include other exogenous variables in an attempt to purge the capital flow and appreciation equations of any relationship that may exist because of their mutual relation to these exogenous variables and risk factors.

Our primary results can be summarized as follows. First, a simple univariate analysis reveals that capital appreciation is positively and significantly correlated with contemporaneous capital flows, percentage capital flows, and asset turnover. A significant positive relationship with changes in economic output also indicates a joint dependency of capital appreciation and economic activity. Capital appreciation is also positively correlated with lagged capital flows and turnover, suggesting a positive relation between capital appreciation and transaction activity in the prior quarter. The correlations also reveal a strong positive relation between lagged returns and current levels of transaction activity. These results are consistent with return chasing behaviour on the part of investors in private real estate markets.

The conditional covariation results from our panel VAR estimation using capital appreciation and percentage capital flows as endogenous variables do not support the widely-held belief among practitioners that capital flows are a prime determinant of price movements. Moreover, we observe a complicated empirical relationship between transaction activity and capital gains in prior quarters. However, we do find a significant positive relationship between lagged turnover and contemporaneous capital returns, suggesting that asset turnover provides increased price revelation which, in turn, reduces investment risk and increases property values.

The remainder of the paper proceeds as follows. In the next section, we review the relevant literature. In “VAR Methodology”, we discuss the VAR methodology employed to examine the conditional covariation of institutional assets prices and three measures of transaction activity. We then discuss our data sources and provide a discussion of descriptive statistics and correlations. In the following section, we present our panel VAR results. Our conclusions are presented in the final section.

Previous Research

There is a large body of empirical capital market research that examines the Wall Street maxim that “it takes trading volume to make prices move.” Although a positive contemporaneous correlation between the absolute value of stock price changes and volume is a stylized empirical fact (see Gallant et al. 1992), there is less evidence to support the existence of a causal relationship. In a cross-country analysis of the relationship between daily stock returns and volume, Chen et al. (2001) use Granger causality tests to investigate the dynamic relationship between the two variables. They find strong evidence that returns Granger cause trading volume and weaker evidence that trading volume Granger causes returns. Chen et al. (2001) conclude there is a feedback system in a number of markets. Looking at individual security returns, Gervais et al. (2001, 877) find evidence of a “high volume return premium.” That is, high levels of trading activity associated with increased returns in the subsequent month.

There has been substantial research on the relationship between mutual fund flows and returns in securities markets using different data sets, time periods, and statistical techniques. Although findings and conclusions vary, researchers have generally identified a significant positive contemporaneous relationship between monthly mutual fund flows and equity returns (see Warther 1995; Santini and Aber 1998; Mosebach and Najand 1999; Fant 1999; Edelen and Warner 2001; Goetzmann and Massa 2003). This contemporaneous positive relationship is consistent with the view that flows and returns are jointly dependent on common economic variables.

It is notable that the existing body of research is not supportive of the hypothesis that there is a causal relationship between lagged mutual fund flows, measured on a monthly basis, and future stock returns. Consistent with previous studies (see Edwards and Zhang 1998, for a review), Cha and Lee (2001) do not find evidence that lagged fund flows affect aggregate stock prices. One exception is Fortune (1998) who, using a VAR framework, finds some evidence of causation from fund flows to security returns. The evidence is similarly mixed on whether fund investors tend to exhibit ‘return chasing’ behaviour. Numerous papers have also investigated the relationship between lagged returns and future fund flows. Warther (1995, 1998) and Remolona et al. (1997) find no relation between mutual fund returns and subsequent flows. In contrast, Edwards and Zhang (1998); Fortune (1998); Cha and Lee (2001); Karceski (2002); and Edelen and Warner (2001) conclude that aggregate mutual fund returns do affect subsequent fund flows into the sector.

Although there are clear connections, the existing capital flows literature rarely considers the linkages with behavioural issues that are implicit in this topic. Investors’ behavioural traits (such as the disposition effect, herding, biased self attribution inter alia) and investment styles (e.g. momentum trading, positive feedback trading, contrarian strategies) can interact to affect capital flows and trading activity. For example, using investment data from U.S. financial institutions Mei and Saunders (1997) find evidence that real estate investments made by U.S. commercial banks and savings and loans institutions have been largely driven by ex post real estate returns. Both Stein (1995) and Cauley and Pavlov (2002) focus on the relationship between price changes and trading volume in US housing markets. They investigate the stylized fact that trading volumes tend to fall when house prices are falling and that rising prices tend to be associated with increases in transaction activity. Both papers suggest a contemporaneous and self reinforcing relationship between prices and trading volume generated by exogenous demand shocks. In particular, Cauley and Pavlov’s (2002) option pricing approach suggests that in falling markets, the value of the option of waiting to sell exceeds the net carrying costs.

However, it may be simplistic to characterise all investors as engaging in similar behavior or strategies. For example, when looking at the investment styles of different investor categories in Finnish equity markets, Grinblatt and Keloharju (2000) find that local institutions exhibited contrarian investment behaviour; i.e., a tendency to buy past losers and sell past winners. In contrast, foreign institutional investors tend to exhibit momentum trading; that is, buying past winners and selling past losers (see also Marcato and Key 2005, for momentum strategies in private real estate portfolios). Kim and Wei (2002) also find that foreign investors in Korea are more likely to engage in positive feedback trading relative to domestic investors. These studies are interesting from a real estate perspective because cross-border capital flows in real estate have increased in the last decade. These cross-border capital flows, in turn, may quickly alter who the marginal investor is at any point in time, with obvious pricing implications.

Building on the work on capital flow-return relationships in the mutual fund sector, Ling and Naranjo (2003) investigate similar questions for publicly traded real estate investments; namely, US REITs. Using quarterly data and a range of models, they find that REIT equity flows are positively related to prior returns with a two-quarter lag. However, they uncover no evidence that lagged REIT flows significantly influence future REIT returns. In further work, Ling and Naranjo (2006) examine the interrelationships and short and long-run dynamics between capital flows to REIT mutual funds and aggregate REIT returns. They find consistent evidence that REIT mutual fund flows exhibit return-chasing behaviour; that is, mutual fund flows are positively and significantly related to lagged REIT returns. However, similar to their earlier study, they find no evidence that mutual fund flows are associated with subsequent REIT returns. Thus, their work does not support the ‘price pressure’ or signalling hypotheses.

Although the conventional wisdom ‘in the market’ may be that transaction activity and the ‘weight of money’ affect commercial real estate prices, it is notable there is a large body of academic work on the determinants of capitalization rates which is largely silent on the effect of capital flows (see Sivitanidou and Sivitanides 1999; Ambrose and Nourse 1993; Chen et al. 2004). Two recent papers on capitalization rate determination include trading volume or fund flows as explanatory variables in their model specification. Hendershott and MacGregor (2005) find that the share of real estate in institutional portfolios is negatively associated with capitalization rates, i.e. increased fund flows from institutional investors are associated with increased capital returns. In a recent study of the US market, Clayton et al. (2009) use capital flows as an input into a composite investor sentiment index. Using a VECM approach, they find no consistent role for sentiment in explaining the time series variation of capitalization rates during the period 1996–2007.

Fisher et al. (2009) investigate the short- and long-run dynamics among institutional capital flows and returns in private commercial real estate markets. More specifically, they examine whether net capital flows from institutional to non-institutional investors impact asset prices and returns in a cross-section of U.S. property sectors and geographic markets. Simultaneously, they examine whether the returns earned by institutional investors impact their subsequent net acquisitions and dispositions. At the aggregate U.S. level, where net institutional capital flows reflect additional capital inflows from the non-institutional sector, they find evidence that institutional capital flows have a statistically and economically significant influence on subsequent returns. However, when disaggregating by property type at the national level, they find mixed results. Fisher et al. (2009) detect no evidence of return-chasing behaviour.

It is clear from the literature on the relationship between capital flows, transaction activity and returns that there are a number of hypotheses linked to the trading behaviour and strategies of investors. A potential complication is that a range of trading behaviours may be manifested at any given time. In particular, differently informed investor categories may be executing different strategies. As a result, the identity of the marginal investor is central. This, in turn, makes the expectations of relationships contingent upon the quality and comprehensiveness of the data available on flows. A subsequent section addresses these data issues in more depth and outlines the nature of the data used in this study. However, whatever the difficulties of interpreting flows, it is clear that information is being provided by changes in transaction activity. Where returns have been positive over the sample period, we should expect that changes in transaction activity will be positively associated with subsequent returns.

VAR Methodology

In its simplest form, a vector autoregression (VAR) model is composed of a system of equations in which a set of dependent variables are expressed as linear functions of their own and each other’s lagged values, and possibly some other exogenous control variables. We employ VAR methods to examine the dynamic relationship between capital appreciation in commercial real estate markets and three measures of transaction activity: net capital flows, dollar turnover, and change in turnover. In particular, we seek to answer two primary questions: first, is the level of transaction activity predictive of capital gains over and above the predictions of lagged capital gains?; second, are capital gains predictive of transaction activity levels over and above the predictions of lagged transaction activity? That is, do investors in private commercial real estate markets appear to chase returns?Footnote 2

The impact of capital flows on returns is likely to be conditional on the size of the market (see, for example, Froot et al. 2001; and Ling and Naranjo 2003, 2006). Therefore, we use percentage capital flows, PFLOWS, in our regression analysis, defined as the raw net quarterly capital flow in a market segment as a percentage of the total market value of IPD properties in that segment at the beginning of the quarter. Data on capital gains and our three measures of transaction activity are available from IPD for ten UK property segments: Standard Retail South East, Standard Retail Rest of UK, Shopping Centres, Retail Warehouses, London Office, West-End and Midtown Office, Office-Rest of Southeast, Office-Rest of UK, Industrial Southeast, and Industrial Rest of UK. These ten property segments are first used to estimate the following panel VAR regression:

where CAPAPP t is the quarterly capital gain in property segment s at time t and PFLOW t is percentage capital flows in segment s at time t.

To control for other potential sources of variation in capital gains and transaction activity, we include lagged values of three macroeconomic variables: the change over the prior quarter in the Treasury Bill rate; the slope of the interest rate term structure, defined as the difference between the 10-year and 1-month Treasury yield; and economic output. The latter is measured as total retail sales in the four retail property segments, total business and financial output in the four office segments, and industrial production for the two industrial property segments. All else equal, increases in interest rates, and therefore the cost of capital, are expected to decrease property prices and transaction frequency, at least in the short run. In contrast, increases in economic output are expected to increase the demand for commercial real estate space. This increase in tenant demand should put upward pressure on property prices, all else equal, and may also lead to increased transaction activity.

The use of lagged income returns as an additional control variable in our analysis is motivated by the work of Bekaert and Harvey (2003), who argue that, in a rational pricing model, current (dividend) yields will be decreasing in the growth rate of dividends and increasing in the discount rate. Therefore, dividend yields may be useful in capturing permanent price effects induced by a change in a sector’s cost of capital. Ghysels et al. (2007) provide empirical evidence that the income return (yield) is related to future commercial real estate returns. Finally, because publicly traded real estate stocks are a substitute for private market real estate investments, we also include as an explanatory variable the total return on FTSE real estate index lagged one quarter.

We first estimate the unconstrained panel VAR system with capital appreciation and percentage capital flows without location (i.e., segment) fixed effects, as represented by Eqs. 1 and 2. We subsequently add segment fixed effects to the VAR specification. We estimate each system using a maximum of four lags based on five different criteria: sequential modified LR test statistic, final prediction error, Akaike information criterion (AIC), Schwarz information criterion, and Hannan-Quinn information criterion. It is important to note that lagged capital gains in the CAPAPP equation control for the well-documented autoregressive nature of IPD capital appreciation and total returns (i.e., the smoothing bias). Thus, the estimated coefficients on lagged capital flows capture the desired marginal effects of capital flows on capital appreciation.

Once the analysis is completed using percentage capital flows as our proxy for transaction activity, a second set of panel regressions is estimated in which the turnover rate (TURN) is used in place of PFLOWS is both Eqs. 1 and 2. TURN is defined as the total value of purchases plus sales in segment s during quarter t, divided by the total market value of the segment at the beginning of the quarter. Finally, a third set of panel regressions is estimated using the change in turnover (CHTURN) as our proxy for the level of transaction activity in each market segment.

Data

Our return and transaction activity data are provided by IPD, an independent research company providing benchmarking services and return indices. The UK IPD Index measures returns on direct investments in commercial real estate. The index data are compiled from valuation and management records for individual buildings. IPD requires that all valuations be conducted by external appraisers working to global International Valuation Standards. The IPD Index excludes any properties bought, sold, under development, or subject to major refurbishment. Our returns are taken from the IPD UK Monthly Index which tracks the performance of standing investments, defined as properties held from one monthly valuation to the next. The sample period runs from the first quarter of 1987 through the fourth quarter of 2007.

The data contributors to the IPD Monthly Index are primarily pooled investment vehicles, typically large open-ended funds, which are required by regulation to have their properties appraised on a monthly basis. The IPD Monthly Index therefore provides a measure of the investment activity and returns of a sub-sample of UK investors. An interesting feature of the monthly IPD database is its relatively high turnover rate. We therefore are able to examine price and transaction activity dynamics in the portion of the private UK commercial real estate market where transactions happen most frequently.Footnote 3

An important complication in the measurement of net capital flows concerns the proportion of total flows captured by our IPD database of institutional capital flows. In a closed ‘system’ in which the domestic institutions and investors tracked by IPD own all properties in all market segments, net IPD capital flows would be zero because each IPD buyer would be matched by an IPD seller. In practice, the domestic institutional investment captured by our IPD data represents only a proportion of total capital flows in a market segment. Thus, observed net flows from a database of domestic institutional investors reflect purchases by institutions of new stock and, in addition, institutional purchases from, and sales to, domestic non-institutional investors and foreign institutional and non-institutional investors.

In market segments where domestic institutions are not the marginal investor, it may be difficult to interpret the relationship between institutional capital flows and returns. The scope for fund flows within the institutional market and to investors outside this market is illustrated in Fig. 1. We identify three main categories of flows:

-

Capital flows to and from the private real estate market and the wider investment universe (Arrow 1)

-

Capital flows within the private real estate markets between domestic institutions and other foreign and domestic investors (Arrow 2)

-

Capital flows within the institutional real estate market between domestic institutional investors (Arrow 3)

Within an open ‘system’ where sales and acquisitions are recorded for a sub-group of investors who trade with investors outside the sub-group, it can be difficult to form expectations about the relationship between net capital flows and investment performance when data are available only for the sub-group. Relatively few transactions could result in, say, large net institutional capital flows if institutional investors are selling to or buying from non-institutional investors. However, such transactions do not add capital to the overall market because other investor types (e.g. private investors, international institutions) may be taking the other side of the transaction. Shiller (1998) identifies this as a problem inherent in studies that examine the empirical relation between capital flows and stock prices. Zheng (1998) also argues that the existence of a seller for every purchase of a security means that a flow of funds analysis is actually a means to identify which group or sector moves market prices.

There is an additional problem associated with measuring the impact of capital flows on returns in private real estate markets. It is acknowledged within the research community that there is disparity between actual returns and recorded returns in private commercial real estate markets. Although the existence of appraisal smoothing is not universally accepted, it is commonly argued that appraisal-based return series tend to lag actual market returns, underestimate return volatility and display high levels of serial correlationFootnote 4. Part of the explanation for appraisal smoothing is that the transaction execution time prevents market participants from reacting to new information. In order to address this problem, a number of de-smoothing procedures have been developed that attempt to recover the actual underlying return series.

There is also a timing issue associated with reported capital flows. Flows tend to be recorded when funds are transferred from the buyer to the seller. However, the decision to commit funds may have taken place much earlier. In this paper, we do not de-smooth the return series and assume that the appraisal smoothing lag and fund flow lag are generated by similar causes. However, it is likely that transaction information generated by flows is released to market participants through informal channels and affects appraisals before the flow is formally recorded. Although capital flows may be recorded with a settlement lag, they are accurate. This suggests that any observed short-term relationships between capital flows and returns may not imply causation. For example, it is difficult for investors to engage in return-chasing behaviour with a one quarter lag.

Table 1 summarizes the composition of the monthly IPD index. As of December 2007, the monthly index tracked returns on 4,190 properties valued at nearly 51 billion pounds. These 4,190 properties are held in 75 separate portfolios and include 1,739 retail properties, 1,121 office properties, and 1,057 industrial properties. The retail properties accounted for 46% of total capital value. Office, industrial, and other property types accounted for 33%, 17%, and 3%, respectively, of total capital value. It is important to note, however, that the property composition of the IPD Databank changes as investment funds join, or leave, the Databank and as data contributing funds buy and sell property. However, all historical data are retained in the database and Index.Footnote 5

The IPD Index is compiled from the monthly returns of individual properties before the deduction of portfolio-level management fees, but inclusive of property-level management fees. To be included in the Monthly IPD Index, the property must be an existing property held for the entire period (i.e. 1 month) and directly owned (either 100% or partially) by the investor. Finally, IPD return measures reflect the unlevered performance of a private real estate investor. In fact, should properties be held through Joint Ventures, the value of the ownership is recorded as with reference to the private real estate asset (according to the percentage of ownership), as opposed to the value of the joint venture (as the latter would lead to the calculation of a levered return).

Monthly capital appreciation is computed on standing investment properties by IPD as follows:

where CV t is the total capital value of segment s in month t and Capex t is equal to total capital expenditures on properties in segment s during month t. Quarterly capital gains and total returns are computed by compounding monthly returns.

Percentage capital flows in quarter t (PFLOW t ) is defined as the difference between purchases and sales during the measurement period, relative to the segment’s total capital value at the beginning of the month (CV t−1 ):

The turnover rate (TURN), in contrast, is computed as the sum of purchases and sales throughout the quarter, relative to the total capital value of the segment at the beginning of the quarter:

It may be that a typical or expected amount of property turnover is not predictive of subsequent capital gains or losses. Rather, increases or decreases in turnover rates may be more predictive of future capital appreciation. We therefore also estimate a third set of panel regressions that use the change in turnover in quarter t, TURN t −TURN t−1 , as our proxy for transaction activity.

Aggregate U.K. Summary Statistics

Descriptive statistics for our aggregate UK dataset are displayed in Table 2. The mean and standard deviation of our quarterly data are presented in the first two columns followed by minimum and maximum values for each variable.

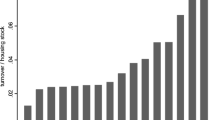

The market value of the aggregate IPD Monthly Index averaged ₤12.7 billion (in 2007:4 lb) over the 1987:1 to 2007:4 sample period, ranging from a low of ₤2.0 billion to a high of ₤56.5 billion. This increase in aggregate market value over the sample period was largely driven by an increase in data contributing owners and constituent properties.

Total quarterly returns, TOTRET, averaged 2.6% over the sample period, ranging from a low of −8.8% to a high of 8.4%. Variations in total returns are largely driven by capital appreciation, which averaged 0.9% per quarter with a standard deviation of 2.6%. The income component of total return, INCRET, averaged 1.7% per quarter, or 67% of the average total return. With a standard deviation of just 0.3%, however, the income component has exhibited significantly less volatility than capital appreciation.

Turning to our measures of transaction activity, quarterly IPD capital flows for all ten IPD market segments (FLOWS) averaged ₤0.27 billion (in 2007:4 lb) with substantial variation over the 21 year sample period. Percentage capital flows (PFLOWS) averaged 1.4% per quarter and also displays substantial volatility, ranging from a low of −4.0% to a high of 9.1% over the study period. TURN averaged 7.1% per quarter, or over 28% per year, indicating a high level of turnover among IPD properties in the monthly index. Notably, TURN displays substantial variation, ranging from a low of 2.5% per quarter to a high of 13.4%. As expected, the average change in turnover (0.3%) is not distinguishable from zero. However, CHTURN displays substantial volatility, as well as negative autocorrelation over time.

The remainder of Table 2 contains summary statistics for the remaining control variables used in our regression analysis. The yield on 10-year Treasury securities (TRYLD) averaged 7.0% over the sample period, ranging from 3.5% to 14.6%. The slope of the term structure (TERMST) averaged 51 basis points. The change in industrial output (OUTI) averaged 0.3% per quarter with a standard deviation of 1.0%. The changes in total retail sales (OUTR) and financial services output (OUTF) both averaged 1.7% per quarter, although retail sales are significantly more volatile than financial output. Finally, the total return on publicly-traded real estate companies (PUBRE) averaged 2.8% per quarter, ranging from a low of −26.9% to a high of 42.8%. Clearly, returns on publicly traded U.K. real estate companies have displayed significant volatility.

Contemporaneous Correlations

Table 3 contains contemporaneous correlations among the aggregate UK variables used in our regression analysis, with “*” indicating significance at the 5% level or greater. The third row of Table 3 reveals that aggregate quarterly IPD capital appreciation (CAPAPP) is positively and significantly correlated with contemporaneous capital flows (ρ = 0.38), percentage capital flows (ρ = 0.50) and turnover (ρ = 0.66), as well as industrial and financial services output. Clearly, this univariate evidence is consistent with the widely held belief among practitioners that capital appreciation and total returns are associated with transaction activity. In addition, quarterly capital appreciation is negatively and significantly correlated with Treasury yields (ρ = −0.22).

As expected, FLOWS and PFLOWS are highly correlated (ρ = 0.64). In addition, percentage flows are positively correlated with TURN (ρ = 0.40). Finally, both FLOWS and PFLOWS are negatively and significantly correlated with contemporaneous changes in the 10-year Treasury yield.

Table 4 documents evidence of simple univariate relations among contemporaneous and lagged values of our return and transaction activity variables. Capital appreciation is highly correlated with capital appreciation in the prior quarter (ρ = 0.82). The high degree of autocorrelation is attributable, at least in part, to the temporal lag bias (i.e., “smoothing”) associated with IPD returns, which we control for in our conditional regression analysis. Interestingly, CAPAPP is also positively correlated with lagged PFLOWS (ρ = 0.31) and lagged TURN (ρ = 0.55), suggesting a positive relation between capital appreciation and transaction activity in the prior quarter. Again, this is consistent with the view that transaction activity drives subsequent price movements. Our regression analysis below reveals whether this positive relation exists after controlling for the effects of other variables on capital appreciation.

Also of significant interest is the relation between contemporaneous measures of transaction activity and lagged return measures, i.e. is there any univariate evidence that returns are associated with subsequent capital flows or turnover? The correlations presented in rows four through six of Table 4 reveal a strong positive relation between lagged returns and current levels of transaction activity. For example, the correlation between PFLOWS and CAPAPP(−1) is 0.48 and the correlation between TURN and CAPAPP(−1) is 0.63. Although these univariate results are consistent with return chasing behaviour on the part of private market investors, they may also be attributed to settlement delays in private real estate markets.

Panel VAR Results

In this section, we first examine the conditional covariation results from our panel VAR estimation using segment-level capital appreciation and percentage capital flows as endogenous variables. These results are reported in Table 5. We subsequently repeat the analysis substituting turnover, and then change in turnover, for capital flows as our measure of transaction activity (see Tables 6 and 7). In each analysis, we first estimate the panel VAR system without segment fixed effects, as represented by Eq. 1 and 2. These coefficient estimates are reported in columns 1 and 2 of Tables 5, 6, and 7. Asterisks denote statistical significance at the 0.01(***), 0.05(**), and 0.10(*)-level, respectively. In columns three and four of each table, we report results from a panel estimation that contains fixed effects for nine of our location segments, with Standard Retail South East as the omitted market segment.

Turning first to the CAPAPP equation without segment fixed effects (column 1 of Table 5), we find that capital appreciation is positively and significantly influenced by appreciation in the previous two quarters. Given the widely documented autocorrelation (i.e., “smoothing”) in appraisal-based return series such as IPD, this positive association was expected. However, the estimated coefficient on CAPAPP(−3) is negative and highly significant, indicating a partial reversal of the positive effects of capital growth after three quarters. The sum of the four lagged coefficients on CAPAPP is 0.90. We also formally test the joint significance of the four lagged capital appreciation coefficients in the CAPAPP equation. The Wald Chi-square statistic for this test is 0.00 (see second row from the bottom of Table 5), indicating the four lags of CAPAPP in the capital growth regression are jointly significant.

Controlling for the smoothed nature of IPD returns, lagged percentage capital flows in quarters t−1 to t−3 have no impact on current capital appreciation. Thus, these results do not support the widely-held belief among practitioners that capital flows are a prime determinant of future price movements. Interestingly, the estimated coefficient on PFLOWS(−4) is negative and highly significant, even though the coefficients on the first three lags of capital flows are not significant. The Wald Chi-square statistic for the test of the joint significance of lagged capital flows in the CAPAPP equation is 0.00, indicating the four lags of PFLOWS in the capital growth regression are jointly significant. However, this result appears to be driven by the negative and significant coefficient on PFLOWS(−4).

The panel regression specification also contains five control variables: the segment’s income return in the prior quarter [INCRET(−1)]; the change over the prior quarter in the Treasury Bill rate [CHTYLD(−1)]; the slope of the interest rate term structure in the prior quarter [TERMSP(−1)]; the change in economic output in the sector (industrial, retail, or office) over the prior quarter [CHOUT(−1)]; and the total return on FTSE real estate index lagged one quarter [PUBRE(−1)]. The estimated coefficients on INCRET(−1), CHOUT(−1), and PUBRE(−1) in the CAPAPP equation without segment fixed effects are positive and highly significant, suggesting that lagged income returns and lagged changes in economic output and public real estate returns predict capital appreciation, all else equal. As expected, the estimated coefficient on CH-TYLD(−1) is negative and significant. Overall, our CAPAPP equation without segment fixed effects is able to explain 71% of the variation in quarterly capital appreciation.

The addition of segment fixed-effects to the CAPAPP-PFLOWS model (column 3 in Table 5) alters little the coefficient estimates and significance levels reported in column 1. Moreover, the coefficients on only two of the industrial segment dummy variables are statistically significant. The lack of incremental explanatory power associated with the segment fixed effects is also evident in the model’s adjusted R2 of 0.71, which is equal to the explanatory power of the CAPAPP equation without segment fixed effects. The lack of explanatory power associated with the segment indicator variables is somewhat surprising given the differences in these geographic and property type segments.

We now turn to the capital flow equations estimated simultaneously with the capital appreciation equations. In the PFLOWS equation without segment fixed effects (column 2), the estimated coefficient on CAPAPP(−1) is positive and significant, which in more liquid markets would provide evidence of return chasing behaviour. However, the estimated coefficient on CAPAPP(−4) is negative and significant. The Wald Chi-square statistic for the test of the joint significance of lagged capital appreciation in the PFLOWS equation is 0.00, indicating the joint significance of the four quarterly lags of capital appreciation in the PFLOWS equation.

The estimated coefficients on both PFLOWS(−1) and PFLOWS(−2) in the PFLOWS equation are positive and significant. This indicates that capital flows predict subsequent capital flows, up to a lag of two quarters. The Wald Chi-square statistic for the test of the joint significance of lagged capital flows in the PFLOWS equation also strongly indicates joint significance.

Similar to the results for the CAPAPP equation, the estimated coefficients on INCRET(−1), CHOUT(−1), and PUBRE(−1) in the PFLOWS equation are positive and highly significant, indicating that lagged income returns and lagged changes in economic output and public real estate returns predict capital flows, all else equal. Although changes in Treasury yields impact capital appreciation, we detect no evidence that Treasury yields predict capital flows. In contrast to the CAPAPP equation, the estimated coefficient on TERMSP(−1) is negative and highly significant in the PFLOWS estimation. Overall, our PFLOWS equation without segment fixed effects is able to explain 22% of the variation in quarterly percentage capital flows.

Similar to the estimation of the CAPAPP equations, the addition of segment fixed-effects to our PFLOWS equation (column 4 in Table 5) has a negligible effect on coefficient estimates and significance levels. Moreover, none of the estimated coefficients on our segment dummy variables are statistically significant. In fact, the addition of segment fixed effects to the specification actually lowers the adjusted R2 of the PFLOWS equation to 0.21 from 0.22.

We now turn to the results from our panel VAR estimations in which we employ turnover as our proxy for transaction activity in place of capital flows. These CAPAPP-TURN model results are reported in Table 6. The estimated coefficients on CAPAPP(−1), CAPAPP(−2), and CAPAPP(−3) in the CAPAPP equation without fixed effects (column 1) are nearly identical to the corresponding coefficients reported in Table 5. That is, we find that current quarter capital appreciation is positively and significantly influenced by appreciation in the previous two quarters, with a partial reversal in quarter t−3. The fourth quarterly lag of capital appreciation is not significant.

Controlling for lagged capital appreciation, the estimated coefficient on TURN(−1) is positive and significant, indicating a positive relation between current quarter capital appreciation and property turnover in the prior quarter. This is supportive of an information effect. The estimated coefficients on INCRET(−1), CHOUT(−1), and PUBRE(−1) in the CAPAPP equation are also positive and highly significant, and nearly identical to the corresponding coefficient estimates reported in column 1 of Table 5. Overall, our simultaneous CAPAPP-TURN model without segment fixed effects is able to explain 70% of the variation in quarterly capital appreciation.

The addition of segment fixed effects to the model (column 3) affects only marginally the coefficient estimates and significance levels of the variables in the CAPAPP equation. Lagged capital appreciation continues to predict current capital gains, with a partial reversal in quarter t−3. The estimated coefficient on TURN(−1) remains positive and significant. However, the Wald Chi-square statistic of 0.13 for the test of the joint significance of lagged turnover rates in the CAPAPP equation indicates only weak joint significance of turnover rates. Capital appreciation is positively associated with lagged income returns and changes in national output and public real estate returns. The estimated coefficients on four of the segment dummy variables are negative and significant, indicating less capital appreciation in the four markets relative to Standard Retail South East, the omitted market segment. Overall, however, the addition of segment fixed-effects leaves the adjusted R2 of the CAPAPP equation unchanged at 0.70.

Columns 2 and 4 in Table 6 contain results for the turnover equations in our CAPAPP-TURN model. Without segment fixed effects (column 2), the positive and highly significant coefficients on both CAPAPP(−1) and CAPAPP(−2) provide evidence that increased capital appreciation in quarters t−1 and t−2 predict higher turnover rates. However, the relation between TURN and CAPAPP(−3) is negative and highly significant. Thus, we again observe a complicated empirical relationship between transaction activity and capital gains in prior quarters. Similar to our results using capital flows as a proxy for transaction activity, turnover rates in the prior two quarters predict current turnover; longer lags are not significant. Relative to the corresponding results in Table 5, however, fewer control variables have estimated coefficients that are statistically significant. The adjusted R2 of the TURN equation without segment fixed effects is 0.21. Consistent with prior results, the addition of segment fixed effects does little to alter the magnitude or significance of the other coefficient estimates. However, their addition reduces the adjusted R2 of the TURN model to 0.15 from 0.21. Overall, the use of turnover rates as a proxy for transaction activity produces results broadly consistent with those obtained using PFLOWS as our measure of transaction activity.

To further examine the robustness of our results with respect to variation in our chosen metric of transaction activity, we re-estimate our panel VAR, represented by Eqs. 1 and 2 using the change in turnover as our proxy. These CAPAPP-CHTURN model results are reported in Table 7. Consistent with the two prior estimations, we find that current capital appreciation is positively and significantly influenced by appreciation in the previous two quarters, with a partial reversal in quarter t−3. This holds true both with and without the introduction of segment fixed effects. The Wald Chi-square statistics clearly reveal that the four lags of capital appreciation are jointly significant in the CAPAPP equations.

The results reported in Tables 5 and 6 provided only limited evidence of a role for individual quarterly lags of capital flows and turnover in explaining the variation of capital appreciation rates, notwithstanding the fact that the four quarterly lags of our transaction activity variables have been found to be jointly significant. However, in our CAPAPP-CHTURN model, the estimated coefficients on CHTURN(−1), CHTURN(−2), and CHTURN(−4) in the CAPAPP equations are all positive and significant. That is, lagged changes in turnover rates are highly predictive of future capital gains. This is strongly indicative of an information effect on property prices.

Consistent with the results reported in Tables 5 and 6, the estimated coefficients on INCRET(−1), CHOUT(−1), and PUBRE(−1) in the CAPAPP equations are positive and highly significant. Moreover, the estimated coefficient on CHTYLD(−1) is negative and highly significant, both with and without segment fixed effects. Both of our two CAPAPP-CHTURN models are able to explain 72% of the variation in quarterly capital appreciation.

Finally, columns 2 and 4 in Table 7 contain results from estimation of the change in turnover equation jointly with capital appreciation. Consistent with the results presented in Table 6, the estimated coefficients on CAPAPP(−1) and CAPAPP(−2) in the CHTURN equations are positive, while the relation between changing turnover rates and capital appreciation in quarter t−3 and t−4 are negative and significant. These results hold both with and without segment fixed effects. Perhaps the most striking result reported in Table 7 is the negative and significant coefficient on all four lags of changes in turnover in the CHTURN equations (columns 2 and 4). Clearly, the negative effect of changes in turnover rates on subsequent rates is highly persistent over time. Somewhat surprisingly, our CAPAPP-CHTURN VAR models are able to explain 37% to 38% of the variation in CHTURN. This explanatory power exceeds that which is observed when PFLOWS and TURN are used as proxies for transaction activity.

Conclusion

Given the widespread presumption among real estate professionals that capital flows and transaction volume matter for asset prices, it is surprising that they have received little attention in the real estate literature. Indeed, it is expected that the effects of exogenous demand shocks will be intensified in private real estate markets given the well-documented attributes of inelastic supply and short sale constraints. In addition, trading activity provides important pricing information in a market characterised by thin trading and heterogeneous assets where performance measurement is based upon appraisals rather than transaction prices. For timescales varying from daily to monthly, previous research in equity markets suggests that contemporaneous correlation between volume, flows and returns. This is commonly assumed to be due to joint dependency on common drivers. Whilst most studies find evidence of ‘return chasing’ behaviour, few find evidence to support the price pressure hypothesis.

This paper employs a vector autoregressive (VAR) panel regression model to examine the dynamics among institutional capital flows, turnover, and capital appreciation in the UK private real estate market. Both institutional capital flows and capital appreciation are specified as endogenous variables in a two equation simultaneous system. We also include other exogenous variables in an attempt to purge the capital flow and appreciation equations of any relationship that may exist because of their mutual relation to these exogenous variables and risk factors.

There are significant data issues related to the measurement of capital flows in commercial real estate markets. In particular, studies that have used institutional capital flows may have limitations if, at times, the marginal investor is non-institutional and not included in the data set. Additionally, it is clear there are problems in determining the precise timing of capital flows and price changes in commercial real estate markets due to appraisal smoothing and lengthy settlement delay. The latter, in particular, may mean that observed short-term lag relationships may, in fact, be actually contemporaneous.

In our univariate correlations, we find evidence that capital appreciation and transaction activity are jointly dependent on common exogenous factors. More specifically, there is positive correlation between capital appreciation and contemporaneous capital flows, percentage capital flows, and turnover. The significant positive correlation with changes in economic output also suggests joint dependency on this variable. In addition, capital appreciation is positively correlated with lagged capital flows and turnover, suggesting a positive relation between capital appreciation and transaction activity in the prior quarter. The correlations also reveal a strong positive relation between lagged returns and current levels of transaction activity.

The conditional covariation results from our panel VAR estimation using capital appreciation and percentage capital flows as endogenous variables do not support the widely-held belief among practitioners that capital flows have a ‘price pressure’ effect. Turning to the relationship between lagged capital appreciation and contemporaneous capital flows, whilst there is evidence of return chasing in the first quarter, this finding may be due to the delayed recording of flows relative to returns given the difficulties of market entry with a one quarter lag.

Finally, looking at the relationship between turnover rates and returns, we find evidence of an information effect, i.e. we find a positive relationship between lagged turnover and contemporaneous capital returns. This suggests that asset turnover provides increased price revelation which, in turn, reduces investment risk and increases property values. At lags of one and two quarters, we also find a positive relationship between lagged capital appreciation and contemporaneous turnover. This may be due to increased ability to trade in bull markets.

Notes

See, for example, Downs (2007).

For more detail on the estimation of VARs in this context, see Fisher et al. (2009) and the references contained therein.

The monthly database has an annual turnover rate between 20% and 45%, whilst the annual turnover rate using the annual database would be between 4% and 10%.

The latter phenomenon, in particular, will mean that contemporaneous returns will be positively linked to lagged returns.

Detailed information on IPD and the monthly IPD index is available at www.ipdindex.co.uk.

References

Ambrose, B., & Nourse, H. (1993). Factors influencing capitalization rates. Journal of Real Estate Research, 8(2), 221–237.

Bekaert, G., & Harvey, C. R. (2003). Emerging markets finance. Journal of Empirical Finance, 10(1–2), 3–56. doi:10.1016/S0927-5398(02)00054-3.

Cauley, S., & Pavlov, A. (2002). Rational delays: The case of real estate. Journal of Real Estate Finance and Economics, 24, 1–2. 143–165. doi:10.1023/A:1013990523388.

Cha, H. S., & Lee, B. (2001). The market demand curve for common stocks: Evidence from Equity mutual fund flows. Journal of Financial and Quantitative Analysis, 36(2), 195–220. doi:10.2307/2676271.

Chen, G., Firth, M., & Rui, O. (2001). The dynamic relation between stock returns, trading volume, and volatility. The Financial Review, 36(3), 153–174. doi:10.1111/j.1540-6288.2001.tb00024.x.

Chen, J., Hudson-Wilson, S., & Nordby, H. (2004). Real estate pricing: Spreads and sensibilities: Why real estate pricing is rational. Journal of Real Estate Portfolio Management, 10(1), 1–22.

Clayton, J., Ling, D. C., & Naranjo, A. (2009). Commercial Real Estate Valuation: Fundamentals versus Investor Sentiment. Journal of Real Estate Finance and Economics, 38(1), 5–37.

Downs, A. (2007). Credit crisis: The sky is not falling, The Brookings Institution, http://www.brookings.edu/papers/2007/10_mortgage_industry_downs.aspx.

Edelen, R. M., & Warner, J. B. (2001). Aggregate price effects of institutional trading: A study of mutual fund flow data and market returns. Journal of Financial Economics, 59(2), 195–220. doi:10.1016/S0304-405X(00) 00085-4.

Edwards, F., & Zhang, X. (1998). Mutual funds and stock and bond market stability. Journal of Financial Services Research, 13(3), 257–282. doi:10.1023/A:1008084311260.

Fant, L. (1999). Investment behaviour of mutual fund shareholders: The evidence from aggregate fund flows. Journal of Financial Research, 2(4), 391–402.

Fisher, J., Ling, D. C., & Naranjo, A. (2009). Institutional Capital Flows and Return Dynamics in Private Commercial Real Estate Markets. Real Estate Economics, 37(1), 85–116.

Fortune, P. (1998). Mutual funds, Part II: Fund flows and security returns, New England Economic Review, Federal Reserve Bank of Boston, Jan/Feb: 3–22.

Froot, K. A., O'Connell, P. G. J., & Seasholes, M. S. (2001). The Portfolio Flows of International Investors. Journal of Financial Economics, 59(2), 151–193.

Gallant, A., Rossi, P., & Tauchen, G. (1992). Stock prices and volume. The Review of Financial Studies, 5(2), 199–242. doi:10.1093/rfs/5.2.199.

Gervais, S., Kaniel, R., & Mingelgrin, D. (2001). The High Volume Return Premium. J Finance, 56(3), 877–919. doi:10.1111/0022-1082.00349.

Ghysels, E., Plazzi A., & Valkanov. R. (2007). Valuation in the US Commercial Real Estate. European Financial Management, 13, 472–497.

Goetzmann, W., & Massa, M. (2003). Index funds and stock market growth. Journal of Business, 76(1), 1–5422. doi:10.1086/344111.

Grinblatt, M., & Keloharju, M. (2000). The investment behavior and performance of various investor types: A study of Finland’s unique data set. Journal of Financial Economics, 55, 43–67. doi:10.1016/S0304-405X(99) 00044-6.

Hendershott, P., & MacGregor, B. (2005). Investor rationality: Evidence from UK capitalization rates. Real Estate Economics, 33, 299–322. doi:10.1111/j.1540-6229.2005.00120.x.

Karceski, J. (2002). Returns-chasing behavior, mutual funds, and beta’s death. Journal of Financial and Quantitative Analysis, 37(3), 559–599. doi:10.2307/3595012.

Kim, W., & Wei, S. (2002). Foreign portfolio investors before and during a crisis. Journal of International Economics, 56, 77–96. doi:10.1016/S0022-1996(01) 00109-X.

Ling, D. C., & Naranjo, A. (2003). The dynamics of REIT capital flows and returns. Real Estate Economics, 31(3), 405–436. doi:10.1111/1540-6229.00071.

Ling, D. C., & Naranjo, A. (2006). Dedicated REIT Mutual Fund Flows and REIT Performance. Journal of Real Estate Finance and Economics, 32(4), doi:10.1007/s11146-006-6960-y.

Marcato, G., & Key, T. (2005). Direct investment in real estate: Momentum profits and their robustness to trading costs. Journal of Portfolio Management, 31, 55–69.

Mei, J., & Saunders, A. (1997). Have U.S. financial institutions’ real estate investments exhibited “trend-chasing” behavior? Review of Economics and Statistics, 79(2), 248–258. doi:10.1162/003465397556601.

Mosebach, M., & Najand, M. (1999). Are the structural changes in mutual funds investing driving the U.S. Stock market to its current levels? Journal of Financial Research, 22(3), 317–329.

Remolona, E. M., Kleiman, P., & Gruenstein, D. (1997). Market returns and mutual fund flows. Federal Reserve Bank of New York Policy Review, 3(2), 33–52.

Santini, D., & Aber, J. (1998). Determinants of net new money flows into mutual funds. Journal of Economics and Business, 50(5), 419–429. doi:10.1016/S0148-6195(98)00011-3.

Shiller, R. (1998). Comment on Vincent Warther, “Has the rise of mutual funds increased market instability?” Brooking-Wharton Papers.

Sivitanidou, R., & Sivitanides, C. (1999). Office Capitalization Rates: Real Estate and Capital Market Influences. Journal of Real Estate Finance and Economics, 18(3), 297–322.

Stein, J. (1995). Prices and trading volume in the housing market: A model with down payment effects. Quarterly Journal of Economics, 110(2), 379–406. doi:10.2307/2118444.

Warther, V. A. (1995). Aggregate mutual fund flows and security returns. Journal of Financial Economics, 39, 209–235. doi:10.1016/0304405X(95)00827-2.

Zheng, L. (1998). Who moves the market? Working Paper, University of Michigan Business School.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Ling, D.C., Marcato, G. & McAllister, P. Dynamics of Asset Prices and Transaction Activity in Illiquid Markets: the Case of Private Commercial Real Estate. J Real Estate Finan Econ 39, 359–383 (2009). https://doi.org/10.1007/s11146-009-9182-2

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11146-009-9182-2