Abstract

The accounting literature has used the midpoint of range forecasts in various research settings, assuming that the midpoint is the best proxy for managers’ earnings expectations revealed in range forecasts. We argue that given managers’ asymmetric loss functions regarding earnings surprises, managers are unlikely to place their true earnings expectations at the midpoint of range forecasts. We predict that managers’ true expectations are close to the upper bound of range forecasts. We find evidence consistent with these predictions in 1996–2010, especially in the recent decade. Despite their role as sophisticated information intermediaries, analysts barely unravel the pessimistic bias that managers embed in range forecasts. Furthermore, we find that the upper bound rather than the midpoint better represents investors’ interpretation of managers’ expectations in recent times. Our study cautions researchers to refine their research designs that use management range forecasts and sheds light on the role of financial analysts in the earnings expectations game.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

In this study we examine whether the midpoint of range earnings forecasts represents managers’ expectations in recent years and how analysts and investors interpret range forecasts. Management earnings forecasts play a large role in the capital markets. For example, Beyer et al. (2010) conclude that in the past decade management earnings forecasts accounted for about 55 % of the accounting information used by investors. Management earnings forecasts have been examined or used in various research settings, including management behavior (e.g., earnings news, forecast error, and forecast bias), analyst revisions, market reaction, and the relation between voluntary and mandatory disclosures.Footnote 1 In these settings, researchers need to determine managers’ earnings expectations. The task is ambiguous when forecasts are issued in a range form—managers provide the lower and upper bounds of their estimates.

Range forecasts are the most predominant form of management earnings forecasts and account for about 80 % of all forecasts issued in the past decade. Prior studies uniformly use the midpoint of range forecasts for managers’ expectations in their research designs. This choice is, of course, naturally appealing and consistent with the conclusion of Baginski et al. (1993).Footnote 2 , Footnote 3 Their conclusion, however, was drawn from 1983 to 1986 when managers’ strategic incentives to meet market expectations played a minimal role.

If managers are similarly penalized for overestimating and underestimating future earnings, the midpoint might well be managers’ true expected earnings. However, in recent years managers’ loss functions when announced earnings deviate from expected earnings have become increasingly asymmetric. In addition to reacting to the earnings performance itself, investors assign a premium to firms that meet or beat the analyst consensus at the earnings announcement (hereafter MBE) (Bartov et al. 2002). Since 1996, MBE has been the most important earnings goal for managers (Brown and Caylor 2005). A failure may result in severe penalties such as a plummeting stock price, reduced management compensation, and increased likelihood of being fired.Footnote 4 Given the asymmetric loss functions, managers are unlikely to place their true earnings expectations at the midpoint of range forecasts, leaving their fortunes to chance. Instead, managers have incentives to set the midpoint below their true expectation, hoping that others will follow heuristic rules and use the midpoint and thus embed a pessimistic bias in range forecasts (hereafter “managers’ strategic use of range forecasts”). Therefore we predict that the midpoint is a poor proxy for management expectations after 1996.

The midpoint may be a worse proxy for management expectations in the recent decade than in the period before it for two reasons. First, before Regulation Fair Disclosure (Reg. FD), managers could influence analyst earnings forecasts by private communication. The private channel has been stifled after Reg. FD, and public guidance has become the only legal option for managers to communicate with analysts. Thus managers’ strategic use of range forecasts is likely to increase after Reg. FD. Second, the accounting scandals of Enron and WorldCom in 2001–2002 have raised investor skepticism over managerial intervention in the financial reporting and disclosure process. The ambiguity of range forecasts offers managers a more subtle and flexible channel to manage market expectations. That is, managers can embed a bias, give analysts room to maneuver, and avoid embarrassment when actual earnings differ from the midpoint or even outside the range. Not surprisingly, range forecasts have become increasingly popular since 2002. We predict that, following Reg. FD and the corporate scandals, managers increase their strategic use of range forecasts in 2002–2010 from 1996–2001, and therefore the midpoint is a worse proxy for management expectations in the more recent period.

Furthermore, we predict that managers’ true earnings expectations are close to the upper bound of range forecasts. Firms operate under uncertainty; ex ante managers do not know what the earnings realization will be. The more managers push the midpoint below the true expectation, the more likely they will influence analyst expectations downward and meet or beat these expectations subsequently. There is, however, a limit to this strategy, and there are two scenarios in which a balance can be reached. In the first scenario, managers prefer actual earnings to fall within the range of the forecast to maintain a perception of competence because they do not want to be viewed as out of touch with their business. Consequently, managers place their true expectations close to the upper bound but still within the range. In the second scenario, managers prefer to MBE easily while minimizing their forecast errors and therefore construct the range so that the upper bound is just below their true expectation (and they can then narrowly beat the range of estimates). Either scenario would lead to our prediction that managers’ true earnings expectations are close to the upper bound.

In our empirical tests, we use management earnings forecasts for fiscal quarters in 1996–2010 covered by First Call’s Company Issued Guidelines (CIG) database.Footnote 5 We observe 46.9 % of management forecasts in range form for the earlier period 1996–2001 and 80.5 % for the later period 2002–2010. For the full sample, actual earnings fall above the upper bound for 41.4 % of the forecasts, at the upper bound for 16.2 % of the forecasts, and below the upper bound for 42.4 % of the forecasts. In other words, the upper bound rather than the midpoint appears to be the central location of the distribution of actual earnings. We create a measure, ACT_DIS, gauging where actual earnings fall with respect to the range forecast and scale the measure to be 1 if actual earnings fall at the upper bound, 0 at the midpoint, and –1 at the lower bound. The median of this measure is 1 for the full sample period, suggesting that the upper bound rather than the midpoint is the best proxy for managers’ expectations. Using the midpoint would underestimate managers’ expectations. Moreover, we find that the median of ACT_DIS is 0 for the earlier sample period and 1 for the later period, suggesting that the best representation of managers’ expectations is the midpoint in the earlier period but the upper bound in the later period. Thus the midpoint is a worse proxy for managers’ expectations in the later period.

We conduct two tests to better understand the above findings. First, we retain firm-quarters with at least two range forecasts and expect managers to become more strategic with the last forecast than with the first forecast as managers’ pressure to manage expectations downward intensifies near the earnings announcement date. For the earlier sample period, we find many actual earnings fall below the lower bound of the first forecast but many actual earnings fall above the upper bound of the last forecast, suggesting a switch from optimism to pessimism within the same fiscal period. This switch perhaps explains why actual earnings fall symmetrically on both sides of the midpoint for all forecasts as a whole in this sample period. For the later sample period, we find many actual earnings fall above the midpoint of the first forecast and substantially more so for the last forecast, suggesting increased pessimism in range forecasts within the same fiscal period. These results suggest that our primary findings are unlikely due to earnings management or managers’ cognitive biases because reported earnings are the same for the first and last forecasts and intrinsic cognitive biases are not expected to change within a quarter. Second, we partition the sample by firm characteristics associated with management incentives to MBE, such as growth prospects and firm size. As predicted, we find that high-growth and large firms are more likely to use range forecasts strategically than low-growth and small firms. These results reinforce the idea that the documented data patterns are due to managers’ strategic use of range forecasts.Footnote 6

After analyzing managers’ use of range forecasts, we examine analyst responses to range forecasts. On the one hand, analysts are sophisticated users of financial information and therefore should anticipate managers’ strategic use of range forecasts and undo any bias embedded by managers. On the other hand, analysts have incentives to curry favor with managers for future information access and investment banking business. These incentives may lead analysts to be willingly misguided by managers. We create a measure, AF_DIS, gauging where the analyst consensus estimate (using analyst estimates after the management forecast) falls with respect to the range forecast and scale the measure to be 1 if the analyst consensus falls at the upper bound, 0 at the midpoint, and –1 at the lower bound. This measure is constructed similarly to ACT_DIS, which captures where actual earnings fall with respect to the range forecast. Suppose managers’ true earnings expectations are at the upper bound; then ACT_DIS is 1. If analysts unravel this bias, their estimates would be at the upper bound, and AF_DIS should be 1, no different from ACT_DIS. If analysts behave naively, taking the midpoint as managers’ expectations, AF_DIS should be 0, very different from ACT_DIS. Interestingly, we find that AF_DIS is no different from ACT_DIS in the earlier sample period (when range forecasts as a whole are unbiased) but is close to 0 even though ACT_DIS is near 1 during the later period. Our tests suggest that in the later period when managers aggressively set the midpoint of range forecasts below their earnings expectations, analysts barely unravel this bias, resulting in more beatable analyst expectations at the expense of larger analyst forecast errors.

Finally, we examine how investors interpret management range forecasts. We find that earnings news calculated with the midpoint as the proxy for managers’ expected earnings no longer provides the best explanatory power for investors’ price reaction at the management forecast date. Instead, the best explanatory power is obtained when managers’ true earnings expectations are set to be at the upper bound of range forecasts. This result is different from Baginski et al. (1993) but is consistent with our previous finding that actual earnings typically fall at the upper bound of range forecasts in recent times. To corroborate this result, we group observations by management earnings news and find that stock returns are not clearly negative unless the upper bound of range forecasts falls below the prevailing analyst consensus compiled before the management forecast. These results suggest that investors do not view the midpoint as managers’ true expectation but instead infer a value close to the upper bound.

Our study makes three contributions to the accounting literature. First, our findings question the conventional practice of using the midpoint of range forecasts as managers’ expectations in recent times. In the mid-1990s, investors started to closely monitor whether firms meet or beat analyst expectations due to increased analyst coverage and media attention (Brown and Caylor 2005). The close market scrutiny gives managers incentives to influence analyst expectations downward before the earnings announcement. Managers appear to use range forecasts strategically; this strategic behavior makes the midpoint a poor proxy for managers’ expectations in academic research. Our study cautions researchers to consider this strategic aspect of management range forecasts in their research designs and choose appropriate proxies for management expectations. For example, our results suggest that the upper bound is more appropriate than the midpoint.

Second, we answer the calls for examining aspects of management forecast forms. Hirst et al. (2008) identify a gap in the literature regarding the form of forecasts. The need to fill this gap is even greater after the drastic increase in range forecasts in recent years. Libby et al. (2006) call for researchers to study the multifaceted effects of range forecasts. While they find a precision effect of range forecasts in an experimental setting, we document an implicit bias embedded in management range forecasts if users simply take the midpoint as managers’ expected earnings.

Last, our study contributes to the expectations management literature by examining how expectations are managed. Prior research examines whether expectations management exists and its consequences. Recent studies find that in the post-Enron era managers rely less on earnings management and more on expectations management (Koh et al. 2008; Athanasakou et al. 2011). Consistent with increased incidences of expectations management, we observe increased popularity of range forecasts and find evidence of managers’ strategic use of such forecasts. Our findings that investors appear to unravel management’s bias more completely than analysts suggest that analysts assist managers in the expectations game.

The rest of the paper is as follows. Section 2 discusses the background and develops the hypotheses. Section 3 introduces the data. We examine management behavior in Sect. 4, analyst responses to range forecasts in Sect. 5, and investor interpretation of range forecasts in Sect. 6. Section 7 discusses the implications of our study and concludes.

2 Background and hypothesis development

Managers may issue earnings forecasts in four forms: (1) point estimates; (2) range estimates with a lower bound and an upper bound; (3) minimum estimates, which are often good news, or maximum estimates, which are often bad news; and (4) qualitative guidance. The popularity of range forecasts has increased substantially over time.Footnote 7 Despite its immense popularity, little academic research exists on how range forecasts are used by managers and interpreted by analysts and investors.

Prior research has predominately focused on the precision aspect of range forecasts. Baginski and Hassell (1997) examine the factors associated with managers’ decisions to provide range forecasts versus point forecasts (which are more precise) and minimum/maximum forecasts (which are less precise). Du et al. (2011) find that the use of range as opposed to point forecasts generally increases with firms’ operating uncertainty and that range widens when operating uncertainty grows. Management forecast precision affects investors’ confidence in the earnings estimate (Hirst et al. 1999; Libby et al. 2006), and more precise forecasts lead to greater analyst forecast revisions (Baginski et al. 2011). Whether forecast precision affects investors’ price responses is inconclusive (Pownall et al. 1993; Baginski et al. 1993). All these studies assume that range reflects managers’ uncertainty in their private signals. We instead examine the strategic aspect of range forecasts.

Users often need a number to summarize a range of estimates; the midpoint may be the most convenient rule of thumb (Tversky and Kahneman 1982). Not surprisingly, accounting researchers have used the midpoint in settings other than management earnings forecasts, for example, in inventory valuation (Oliver 1972) and contingent environmental liability estimation (Kennedy et al. 1998). As long as the loss function for over and underestimation is symmetric, the midpoint is a reasonable proxy for managers’ expectations because managers have no incentive to bias their estimates. Using samples drawn from the 1980s, McNichols (1989) finds that management earnings forecasts were unbiased, and Baginski et al. (1993) conclude that investors used the midpoint in interpreting management forecast news.Footnote 8

The information environment has changed since the mid-1990s, creating incentives for managers to issue biased forecasts. Controlling for news about fundamentals, researchers find that investors reward (penalize) firms for meeting or beating (missing) analyst earnings expectations (Bartov et al. 2002; Skinner and Sloan 2002). Due to managers’ large stock holdings and stock options and their fear of job security, avoiding earnings surprises has become the most important earnings goal for managers (Dechow et al. 2003; Graham et al. 2005; Brown and Caylor 2005). Given this asymmetric loss function, managers who operate under uncertainty will be unlikely to construct a range forecast with their true expectation at the midpoint, leaving their personal wealth and job security to chance. Managers’ private earnings signal (true expectation) is unobservable. We assume that managers have unbiased expectations of future earnings such that on average actual earnings proxy for this signal as long as managers do not manipulate reported earnings.Footnote 9 Therefore we predict:

H1

Actual earnings do not equal the midpoint of range forecasts.

We expect managers’ strategic use of range forecasts to increase after Reg. FD and the corporate scandals in the early 2000s. Reg. FD has blocked managers’ channels to privately guide analysts. Any influence that managers want to exercise has to be through public guidance. Consistent with this speculation, Kim and Park (2012) find that after Reg. FD managers have increased the use of management earnings forecasts to manage expectations. After the corporate scandals, the public is leery of outright manipulations. This may explain the findings of less earnings management and more expectations management in the post-scandal era (Koh et al. 2008; Athanasakou et al. 2011). An implicit bias embedded in range forecasts may cause less damage than either an explicit bias in point forecasts or earnings management. Range forecasts convey a level of uncertainty and give managers flexibility to justify the deviation of actual earnings from the range forecast. Moreover, range forecasts are reasonably ambiguous. Given the range of estimates, it is up to users to interpret where precisely a manager’s true expectation is at the time of the forecast and managers neither confirm nor refute the conventional practice of using the midpoint. Therefore we expect increased strategic use of range forecasts after Reg. FD and the corporate scandals and predict:

H2

Actual earnings are less likely to equal the midpoint of range forecasts in 2002–2010 than in 1996–2001.

After predicting that actual earnings are unlikely to fall at the midpoint, we now predict where actual earnings may fall. Firms operate under uncertainty, so ex ante managers do not know precisely where actual earnings will fall even though they have better information about the forthcoming earnings than outsiders. The more managers set the midpoint below their true expectation, the more likely they will influence analyst expectations downward and MBE subsequently. How far do managers go with this strategy? In one scenario, managers may desire to keep actual earnings within the forecast range to avoid appearing incompetent and out-of-touch with their business and therefore place their true expectations close to the upper bound but still within the range. In the other scenario, risk-averse managers may prefer to MBE handily without committing unnecessary forecast errors by setting the upper bound just below managers’ true expectations, hoping that users will treat the range forecast bounds as expectation boundaries. In either case, managers’ expectations are close to the upper bound. Thus we predict:

H3

Actual earnings are close to the upper bound of range forecasts.

There are two competing views about how analysts respond to managers’ strategic behavior. In the unraveling view, analysts, who are trained information professionals, may fully anticipate managerial incentives of managing expectations through range forecasts and unravel any bias embedded by managers. In the accommodating view, analysts have incentives to maintain a friendly relationship with managers. In the annual surveys of Institutional Investor magazine in the past decade, institutional investors highly value an analyst’s ability to provide timely and useful advice, whereas forecast accuracy is ranked in the bottom third of the attributes that they value. An analyst’s ability to serve clients depends to a large extent on the analyst’s access to information from management. Research has inferred that analysts are willing to issue biased forecasts to curry favor with managers for better access to future information (Lim 2001; Ke and Yu 2006). Even after Reg. FD, managers still use other legal tools to return favor to accommodating analysts (Mayew 2008). As a result, analysts may be willingly misguided by managers and issue forecasts to help managers in the MBE game.Footnote 10 We do not have a clear prediction between these two views and state the hypothesis consistent with the second explanation:

H4

After management forecasts, analysts revise their earnings estimates as if they anchor on the midpoint of range forecasts.

Mainstream economists have long assumed that investors have perfect capacity to collect and process information at no costs (Muth 1961; Sheffrin 1996). Perfectly rational investors should be able to foresee managers’ strategic use of range forecasts and undo managers’ bias. The assumption of perfect rationality, however, has been questioned first by Simon (1955, 1959) and then by numerous accounting and finance scholars (De Bondt and Thaler 1985; Bernard and Thomas 1989; Lee 2001). Instead, these scholars argue that investors are bounded-rational—they make optimal decisions within the constraints of limited resources, including attention span, information acquisition, and information processing. Facing these limitations investors may resort to functional heuristics and decision rules. Using the midpoint to summarize information in a range forecast would be a good rule of thumb. We do not have a prediction and state the hypothesis in the latter:

H5

Stock prices react to management range guidance as if investors update their beliefs by treating the midpoint of range forecasts as managers’ expectations.

3 Sample

We use the CIG database to obtain management forecasts of quarterly earnings per share (EPS) for fiscal periods ending in 1996–2010 by U.S. firms. We drop duplicate forecasts, forecasts without a Cusip-Permno link, and forecasts issued more than 180 days before the end of the fiscal period or more than 110 days after the end of the fiscal period.Footnote 11 We require forecasts to have necessary data from Compustat, CRSP, and IBES.Footnote 12 We exclude observations where the stock price 2 days before the management forecast is <$1. Our final sample consists of 42,110 management forecasts, including 11,303 during 1996–2001 and 30,807 during 2002–2010.

We classify forecasts into four forms: point, range, minimum or maximum, and qualitative.Footnote 13 Figure 1 and Table 1 show the frequency of forecast forms over time. Point and range make up the majority of forecasts in our sample.Footnote 14 We observe a shift in the frequency of point and range forecasts over the sample period. Point forecasts dwindle steadily from 30.0 % in 1996 to 11.3 % in 2010. Conversely, range forecasts increase progressively throughout the period from 38.2 % in 1996 to 87.5 % in 2010. Our test sample includes 30,106 range forecasts, including 5,300 during 1996–2001 and 24,806 during 2002–2010.

This figure plots the percentages of forecast forms in each year over the sample period. The forecasts are management estimates of quarterly earnings for the forecasted fiscal period ending in 1996–2010. We classify forecasts into four forms: point, range, minimum or maximum (min/max), and qualitative

4 Empirical analysis of management behavior

4.1 Primary analysis

We use five symmetric (around the midpoint) “actual hit” categories to classify range forecasts, where actual earnings, ACTUAL, are obtained from IBES. The indicator variable ACT_HIT is –2 if actual earnings hit below the lower bound (L) of the range forecast, –1 if actual earnings are greater than or equal to the lower bound but less than the midpoint, 0 if actual earnings equal the midpoint (M), 1 if actual earnings are greater than the midpoint but less than or equal to the upper bound, and 2 if actual earnings hit above the upper bound (H). Thus ACT_HIT places forecasts into five buckets depending on whether actual earnings pass the two explicit thresholds of a range forecast (L and H) and the implicit threshold (M).

Table 2 reports the distribution of forecasts in the actual-hit categories. For the full sample period, actual earnings are above the upper bound for 41.4 % of the forecasts, at the upper bound for 16.2 % (untabulated), and below the upper bound for 42.4 % of the forecasts, indicating that the upper bound rather than the midpoint is approximately the central location of the distribution. The distributions for the subperiods differ. In the earlier period, actual earnings are at the midpoint for 11.6 % of the forecasts, above it for 49.9 %, and below it for 38.5 % of the forecasts. So the central location of the distribution is slightly above the midpoint. In the later period, actual earnings are above the upper bound for 45.7 % of the forecasts, at it for 15.9 % (untabulated), and below it for 38.4 % of the forecasts. The central location of the distribution is slightly above the upper bound. Therefore the full-sample results are driven by the later period.Footnote 15

Our main measure, ACT_DIS, captures not only where actual earnings fall but also how far they fall from the thresholds of range forecasts. ACT_DIS is defined as (ACTUAL − M)/(0.5*(H–L)). By definition, ACT_DIS is 0 if actual earnings equal the midpoint of the range, –1 if actual earnings equal the lower bound, and 1 if actual earnings equal the upper bound. The measure takes into account the width of the range, which signals the level of earnings uncertainty, and can thus be compared across firms. To reduce the influence of outliers, we winsorize ACT_DIS at the 1st and 99th percentiles.

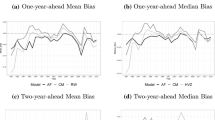

Figure 2 shows the mean and median of ACT_DIS in each year. The median is flat at 0 in the earlier sample period and climbs to 1 during 2002–2008. This pattern is consistent with a structural change occurring in 2001/2002. The increase in the median to 2 during 2009–2010 is perhaps due to the financial crisis: managers might have expected the economy to be worse than what it actually turned out to be and the ex post pessimistic forecast bias might be largely unintentional. The mean of ACT_DIS is negative between 0 and –1 in the earlier sample years and is around 1 in the later sample years.

This figure plots the mean and median of ACT_DIS of 30,106 management range forecasts of quarterly earnings for the forecasted fiscal period ending in 1996–2010. ACT_DIS is defined as (ACTUAL − M)/(0.5 * (H–L)), where ACTUAL is the realized earnings recorded in IBES and L is the lower bound, M is the midpoint, and H is the upper bound of the range forecast. By definition, ACT_DIS equals –1 when actual earnings fall on the lower bound, equals 0 when actual earnings fall on the midpoint, and equals 1 when actual earnings fall on the upper bound. We winsorize ACT_DIS at the 1st and 99th percentiles to reduce the influence of outliers

In Fig. 3 we show the histogram of ACT_DIS for the earlier and later sample periods. There is an obvious spike at the upper bound in both periods, but in the earlier sample period substantially higher frequencies are observed near the lower bound and midpoint than above the upper bound, whereas in the later sample period the distributions on both sides of the upper bound are fairly symmetric.

The figures show the distribution of ACT_DIS of management range forecasts of quarterly earnings for the forecasted fiscal period ending in 1996–2001 and 2002–2010. ACT_DIS is defined as (ACTUAL − M)/(0.5 * (H–L)), where ACTUAL is the realized earnings recorded in IBES and L is the lower bound, M is the midpoint, and H is the upper bound of the range forecast. By definition, ACT_DIS equals –1 when actual earnings fall on the lower bound, equals 0 when actual earnings fall on the midpoint, and equals 1 when actual earnings fall on the upper bound. We winsorize ACT_DIS at the 1st and 99th percentiles to reduce the influence of outliers. The distributions shown are the 5th to 95th percentile of ACT_DIS. a Earlier sample period 1996–2001. b Later sample period 2002–2010

We test whether the mean and median of ACT_DIS are significantly different from 0.Footnote 16 For the full sample, the mean of ACT_DIS is 0.93, and its median is 1.00, both significantly different from 0, indicating that actual earnings do not fall at the midpoint, consistent with our H1. For the earlier sample period, the mean of ACT_DIS is –0.37, significantly different from 0, but its median of 0.00 is indistinguishable from 0, suggesting the measure is left skewed.Footnote 17 The magnitude of ACT_DIS is quite close to 0, indicating that the midpoint represents the central location of the distribution of actual earnings. Our additional analysis in the subsequent section will help explain this result. For the later sample period, ACT_DIS has a mean of 1.20 and median of 1.00, both significantly different from 0, indicating that actual earnings fall well above the midpoint. Moreover, ACT_DIS in the later sample period is significantly higher than that in the earlier sample period (p value = 0.00), consistent with our H2.

Furthermore, we test whether actual earnings fall near the upper bound. For the full sample, the mean of 0.93 and median of 1.00 are both insignificantly different from 1 (p = 0.18 and p = 1.00). These results indicate that actual earnings are insignificantly different from the upper bound, consistent with our H3. For the earlier sample period, both the mean and median of ACT_DIS are significantly below 1 (p = 0.00). For the later sample period, the mean of 1.20 is significantly above 1 (p = 0.00), but the median of 1.00 is insignificantly different from 1 (p = 1.00). These results suggest that the phenomenon of managers’ setting their true expectations near the upper bound is prominent in the later sample period and that the full sample results are driven by the later period.

4.2 Subsample with multiple range forecasts

To provide further evidence of managers’ strategic use of range forecasts and better understand our primary findings, we examine a subset of firm-quarters for which firms issued more than one range forecast. We expect managers’ MBE pressure to be higher later in the fiscal quarter than earlier in the quarter. Therefore we expect stronger evidence of managers’ strategic use of range forecasts later in the quarter.

We retain 4,093 firm-quarters with at least two range forecasts.Footnote 18 Figure 4 illustrates the distributions of observations in the ACT_HIT categories with the left chart showing the first forecast and the right chart showing the last forecast. The obvious change is the drop of the “<Low” (below the lower bound) group and the surge of the “Mid–High” (above the midpoint but below or equal to the upper bound) group. In untabulated analysis, we find that more forecasts migrate from the “<Low” group to the “Mid–High” group than any other movements (including staying put). About 35 % of the initial forecasts in the “Low–Mid” (below the midpoint but above or equal to the lower bound) group migrate to group “Mid–High” or “>High” (above the upper bound) for the last forecast. On the other hand, initial forecasts in the “Mid–High” and “>High” groups rarely move down to the “Low–Mid” and “<Low” groups. These patterns suggest that managers increase their strategic use of range forecasts within the same fiscal period as the earnings announcement date approaches. Panel A of Table 3 tabulates the observations in the ACT_HIT categories by the first and last forecasts. The distributions for the first and last forecasts are significantly different with a Chi square statistic of 256.54 and 968.22 for the earlier and later sample periods, respectively.

The figures show where actual earnings fall with respect to range forecasts for the 4,093 firm-quarters (455 from 1996 to2001; 3,638 from 2002 to 2010) that have multiple range forecasts for the same fiscal quarter. We use five actual-hit categories, symmetric at the midpoint, to classify the forecasts. A forecast is classified as “<Low” if actual earnings are below the lower bound, “Low–Mid” if actual earnings are greater than or equal to the lower bound but less than the midpoint, “Mid” if actual earnings equal the midpoint, “Mid–High” if actual earnings are greater than the midpoint but less than or equal to the upper bound, and “>High” if actual earnings are greater than the upper bound. The categories are the same as those defined for ACT_HIT in Table 2. We use descriptive rather than numerical labels in the figures. a Earlier sample period 1996–2001. b Later sample period 2002–2010

Panel B of Table 3 compares forecast horizon, forecast range, and ACT_DIS between the first and last forecasts. On average, the first forecast is issued about 110 days before the earnings announcement and the last forecast is issued about 45 days before the announcement. The width of forecast range decreases significantly from the first to the last forecast, consistent with our expectation that managers’ private signals become more precise as their operations unfold. In the earlier sample period, ACT_DIS increases significantly from the first to the last forecast according to the tests of means and medians. Moreover, ACT_DIS is significantly negative for the first forecast, suggesting that managers are initially optimistic. This observation is consistent with management optimism in initial forecasts documented by Rogers and Stocken (2005), Gong et al. (2009, 2011). However, optimism is replaced by pessimism later in the fiscal period, consistent with managers’ walking down analyst expectations—an inference indirectly made in the literature from analyst forecast patterns (Matsumoto 2002; Richardson et al. 2004; Cotter et al. 2006). The switch from optimism to pessimism may explain why we find in Table 2 that actual earnings fall close to the midpoint for all forecasts as a whole in the earlier sample period.

In the later sample period, the means and medians of ACT_DIS are above the midpoint for the first and last forecasts. Although the changes in the median of ACT_DIS is statistically insignificant, the means increase significantly from the first to the last forecast, suggesting some firms more aggressively embed management bias in their range forecasts as the fiscal quarter progresses.

The comparisons of firms’ first and last range forecasts reinforce our expectation that managers use range forecasts strategically. In developing H1 we assume that on average actual earnings proxy for managers’ private signal as long as managers do not manipulate reported earnings or exhibit systematic cognitive biases. Our primary finding that actual earnings do not fall at the midpoint but instead close to the upper bound is subject to three explanations: (1) managers embed a pessimistic bias in range forecasts to increase their chances to MBE; (2) managers manipulate reported earnings upward to deliver or exceed a previously issued truthful forecast; and (3) managers are inherently pessimistic. Our comparisons between first and last forecasts reinforce the strategic use explanation. The earnings management explanation is unlikely because actual earnings are the same number for the first and last forecasts. The cognitive bias explanation is weak because an inherent cognitive bias is unlikely to change periodically from early in the quarter to late in the quarter.

4.3 Partitioning the sample by the level of management incentives

If the finding of actual earnings falling well above the midpoint and often around the upper bound is due to managers’ strategic behavior, we expect the result to be stronger for firms with higher management incentives and use growth and firm size to capture these incentives. We expect high-growth firms to experience greater pressure to manage expectations than low-growth firms for two reasons. First, high-growth firms would experience a torpedo effect if they fail to live up to lofty market expectations (Skinner and Sloan 2002). Second, high-growth firms have a large need for external capital; maintaining the growth trajectory and high-growth image could help raise external funds. We expect large firms to be under greater MBE pressure than small firms because of the enormous attention paid to large firms by the media and analysts. We measure firm growth prospects by the market-to-book ratio, calculated as the market value of equity divided by the book value of equity measured at the beginning of the fiscal quarter; a higher ratio indicates higher growth expectations. We measure firm size by the market value of equity at the beginning of the fiscal quarter. Each year, firms are partitioned into three equal-sized groups according to firm growth and size separately. We pool the forecasts of high-growth groups and do the same for the low-growth, large, and small firms.

Panel A of Table 4 reports the comparison of forecasts by high- vs. low-growth firms. In both the earlier and later sample periods, the percentage of forecasts with actual earnings above the upper bound is greater for high-growth firms than for low-growth firms; the pattern reverses for actual earnings below the lower bound. The tests of ACT_HIT and ACT_DIS indicate that forecasts by high-growth firms are more pessimistic than those by low-growth firms. Partitioning the sample by firm size, we find that firm size does not matter in the earlier sample period but that large firms are more aggressive in embedding a pessimistic bias than small firms in the later sample period. Overall, the tests in this section corroborate our primary findings.Footnote 19 , Footnote 20

4.4 Street earnings vs. GAAP earnings

Management earnings forecasts have been a voluntary disclosure practice in the U.S. for over four decades (Daily 1971; McDonald 1973). Managers provided predictions of GAAP earnings in the first two to three decades of the practice. As the consensus of analysts, who typically forecast recurring earnings (referred to as street earnings), became a key benchmark for managers to beat (Bradshaw and Sloan 2002), it has become unclear whether managers forecast GAAP earnings, street earnings, or both. Christensen et al. (2011) provide indirect evidence that managers use forecasts to influence the process through which street earnings are determined but do not examine the extent to which GAAP or street earnings guidance is issued. Ajinkya et al. (2005, p. 354) assume that managers forecast street earnings because “management guidance is intended to influence analysts’ forecasts and market expectations.” Almost all other recent studies are silent about the construct of management earnings forecasts with some comparing forecasts with street earnings, implicitly assuming that managers forecast street earnings (e.g., Rogers and Stocken 2005; Baik and Jiang 2006; Choi et al. 2010; Gong et al. 2011) and others not specifying the sources of actual earnings numbers (e.g., Gong et al. 2009; Feng and Koch 2010; Kim and Park 2012).

We conjecture that managers tend to forecast street earnings in recent times because investors react to street earnings more strongly than to GAAP earnings (Bradshaw and Sloan 2002) and because corporate forecasts are a primary tool for expectations management (Kim and Park 2012). We validate this conjecture by checking 100 randomly selected quantitative management earnings forecasts from firms whose realized street earnings differ from GAAP earnings and with coverage in the Factiva news database.Footnote 21 We observe that 55 % of the forecasts are clearly street earnings, 6 % are clearly GAAP earnings, 18 % include both street and GAAP earnings, and 21 % are unclear.Footnote 22 We compare the management forecast numbers in the news with the number recorded in CIG and find that 69 % of the time the CIG record is the street forecast, 7 % of the time the CIG record is the GAAP forecast, and 24 % of the time the numbers cannot be reconciled mostly because the classification of the management forecast is unclear. Furthermore, among the 18 cases where both street and GAAP forecasts are provided, the CIG record equals the street forecast 89 % of the time and the GAAP forecast only 11 % of the time. These observations confirm that our assumption of managers forecasting street earnings is reasonable and suggest that management forecasts collected in the CIG database should be compared with street earnings not GAAP earnings.Footnote 23

If the construct of management earnings forecasts in recent times is street earnings instead of GAAP earnings, in cases of different GAAP and street earnings numbers we expect to find evidence of managers’ strategic use of range forecasts when street earnings are used as the realized earnings number but do not expect to find evidence when GAAP earnings are used. To confirm this conjecture, we partition the sample by whether the two realized earnings differ and identify 15,927 range forecasts (52.9 %) issued by firms with different GAAP and street earnings and 14,179 range forecasts (47.1 %) issued by firms with the same GAAP and street earnings.

We replicate Table 2 on the subsample of different GAAP and street earnings, using street earnings as the realized earnings in Panel A of Table 5 and GAAP earnings as the realized earnings in Panel B. The results in Panel A are similar to those in Table 2, consistent with our expectations. The results in Panel B are drastically different: GAAP earnings fall outside and below the forecast range 58.5 % of the time. This means that managers could not be strategically using range forecasts to beat GAAP earnings because GAAP earnings cannot even clear the lower bound of managers’ own forecasts most of the time. The fact that GAAP earnings fall outside the range 82.4 % of the time suggests a mismatch between management forecasts and GAAP earnings. These results increase our confidence in the assumption that managers tend to predict street earnings not GAAP earnings.

In the primary tests, we find increased forecast pessimism over the sample period. This result could be due to increased analyst exclusions of negative special items from street earnings. We replicate Table 2 on the subsample of management earnings forecasts with the same GAAP and street earnings and report the results in Panel C of Table 5. The results are similar to our primary findings, alleviating the concern that the increased forecast pessimism in the later sample period is due to changes in analyst exclusion behavior, because this subsample contains no exclusions.

5 Empirical analysis of analyst responses to range forecasts

We construct two variables to gauge analyst responses to range forecasts. First, similar to the actual-hit distance measure ACT_DIS, we create AF_DIS to capture the location of analyst consensus after the management forecast relative to the range forecast. AF_DIS is defined as (AF_POST − M)/(0.5 * (H–L)), where AF_POST is the median analyst estimates issued in the 30 days after the management forecast. By definition, AF_DIS is –1 if the new analyst consensus equals the lower bound of the range forecast, 0 if the consensus equals the midpoint, and 1 if the consensus equals the upper bound. If analysts fully undo any bias that managers embed in the range forecast, AF_DIS should be the same as ACT_DIS. To illustrate, assume that a manager’s true earnings expectation is at the upper bound; therefore ACT_DIS is 1. If analysts fully unravel this bias, AF_POST is at the upper bound, and AF_DIS should be 1 as well. If analysts behave naively and anchor on the midpoint, AF_DIS should be 0. The second variable we construct captures ex post analyst forecast error, AF_ERROR = (AF_POST − ACTUAL)/(0.5 * (H–L)). Here, we use the same scalar for analyst forecast error as for ACT_DIS and AF_DIS so that we can compare the three measures. Like ACT_DIS, we winsorize AF_DIS and AF_ERROR at the 1st and 99th percentiles to reduce the influence of outliers.

Panel A of Table 6 reports mean AF_DIS for each year in the earlier and later sample periods. For convenience, we list ACT_DIS next to AF_DIS before comparing them in the third column. In the earlier sample period, AF_DIS and ACT_DIS are significantly negative and not statistically different from each other, meaning that management forecasts are optimistic and analysts undo this bias.Footnote 24 The last column reports AF_ERROR. Not surprisingly, analyst forecast error for the earlier sample period is not significantly different from 0.

In the later sample period, while the mean of ACT_DIS is 1.204, the mean of AF_DIS is only 0.110. This result means that while managers aggressively set the midpoint of range forecasts well below their true expectations, which are close to the upper bound, analysts issue new earnings estimates at only slightly above the midpoint. The ratio of 0.110 over 1.204 is 0.091, suggesting that analysts roughly undo only 9.1 % of the bias embedded by managers. The analyst forecast error is significantly negative at –1.173, indicating that the analyst consensus after the management forecast is pessimistic and inaccurate. These results suggest that in the recent decade analysts are either unwilling or unable to undo the large magnitude of pessimistic bias that managers build into the range forecasts. Figure 5 illustrates the above results.

This figure plots (1) analyst consensus after management range forecast with respect to the range of the management forecast, (2) actual earnings with respect to the range, and (3) forecast error of analyst consensus. The sample includes 30,106 management range forecasts of quarterly earnings for the forecasted fiscal period ending in 1996–2010. ACT_DIS is defined as (ACTUAL − M)/(0.5 * (H–L)), where Actual is the realized earnings recorded in IBES and L is the lower bound, M is the midpoint, and H is the upper bound of the range forecast. By definition, ACT_DIS equals –1 when actual earnings fall on the lower bound, equals 0 when actual earnings fall on the midpoint, and equals 1 when actual earnings fall on the upper bound. AF_DIS is defined as (AF_POST − M)/(0.5 * (H–L)), where AF_POST is the analyst consensus in the 30 days after the management forecast. By definition, AF_DIS equals –1 if analyst consensus is on the lower bound, equals 0 if analyst consensus is on the midpoint, and equals 1 if analyst consensus is on the upper bound. For example, if managers embed a pessimistic bias by placing their true earnings expectation at the upper bound, ACT_DIS is 1. If analysts fully unravel this bias, their consensus is at the upper bound, and AF_DIS is 1—there is no difference between AF_DIS and ACT_DIS. If analysts naively anchor on the midpoint of the range forecast, AF_DIS is 0. Significant differences between AF_DIS and ACT_DIS would suggest that analysts fail to unravel managers’ bias. AF_ERROR is defined as (AF_POST − ACTUAL)/(0.5 * (H–L)). We winsorize the variables at the 1st and 99th percentiles to reduce the influence of outliers

To better understand the above finding, we examine in Panel B of Table 6 unscaled analyst forecast errors and firms’ MBE likelihood before and after range forecasts. We categorize forecasts by management news, which is determined by comparing the range forecast with the analyst consensus (using estimates in the 30 days) before the management forecast (AF_PRE). We focus on the last two categories. For the “Mid–High” group (where the midpoint-to-upper bound portion of the range forecast contains AF_PRE), AF_PRE would have resulted in a forecast error, AFE_PRE, of –0.004, but the analyst consensus after the management forecast (AF_POST) leads to a more pessimistic forecast error, AFE_POST, of –0.014. The larger forecast error corresponds to higher MBE chances: 76.3 % with AF_POST (i.e., MBE_POST) versus 64.4 % with AF_PRE (i.e., MBE_PRE). For the “>High” group (where even the upper bound of the range forecast trails AF_PRE), AF_PRE would have resulted in an optimistic forecast error of 0.089, but AF_POST leads to a pessimistic forecast error of −0.007, and MBE chances increase from 18.7 % with AF_PRE to 72.1 % with AF_POST. These results suggest that firms’ benefit of a higher MBE likelihood comes at the cost of more pessimistic analyst responses and a greater magnitude of analyst forecast errors.

6 Empirical analysis of investor interpretation of range forecasts

We conduct two tests to examine how investors respond to range forecasts. First, we determine whether investors react to management earnings forecast news as if they interpret the lower bound, midpoint, or upper bound as managers’ expected earnings. Second, we examine the mean stock returns at the management forecast event by calibrating the range forecast to AF_PRE. This test helps us understand what management news is considered by investors as good news and bad news.

6.1 Returns regression at the management forecast event

Our first test uses the empirical model in the appendix of Baginski et al. (1993):

CAR_MF is the three-day market-adjusted return at the management forecast event. NEWS is management expectation minus AF_PRE, where we alternatively use the lower bound, midpoint, and upper bound as the proxy for management expectation, scaled by the stock price 2 days before the earnings announcement. As Anilowski et al. (2007) and Tucker (2010) show, many management forecasts are issued at an earnings announcement. To avoid confounding news, we exclude management forecasts issued within 2 days of an earnings announcement.

Panel A of Table 7 presents the R2 of the regression estimations. For both the earlier and later sample periods, the highest R2 is when the upper bound is used as managers’ expectation in calculating NEWS. This result is different from the finding of Baginski et al. (1993) that the R2 is the highest when the midpoint is used. This difference indicates that, while the midpoint was used by investors as managers’ expectations in the 1980s, the upper bound is used by investors in recent times, aligning well with our finding in Sect. 4 that the upper bound appears to be a better proxy for managers’ expectations than the midpoint.Footnote 25

6.2 Investor reaction at the management forecast event by management news categories

Our second test provides an alternative way of examining how investors interpret management forecast news. We sort the observations used in the return regression into five groups by management news. (They are the same categories as in Panel B of Table 6.) A forecast belongs to the “<Low” group if even the lower bound is above the analyst consensus before the management forecast; this is clearly good news to investors. A forecast belongs to the “>High” group if even the upper bound is below the consensus; this is clearly bad news to investors. A forecast belongs to the “Mid” group if the midpoint equals the consensus. The remaining forecasts belong to the “Low–Mid” group if the lower bound-to-midpoint portion of the range contains the consensus and the “Mid–High” group if the midpoint-to-upper bound portion of the range contains the consensus.

Panel B of Table 7 presents the number of forecasts, percentage of forecasts, mean CAR_MF, and p value for testing whether CAR_MF differs from 0. Given our primary findings in Sect. 4, it is not surprising to observe predominantly more forecasts in the “clearly bad news” group than in any other group. As expected, the mean return for the “clearly bad news” group is significantly negative and the mean stock return for the “clearly good news” group is significantly positive for both sample periods. What is intriguing is that the mean return of the “Mid–High” group is insignificantly different from 0 in both periods. If investors view the midpoint as managers’ true expectation, this group should represent bad news because the midpoint is below the consensus. The fact that the returns are nonnegative suggests that investors perceive managers’ expectations to be higher than the midpoint.

7 Discussion and conclusion

We argue that in recent years managers have incentives to influence market expectations downward and therefore the conventional wisdom of using the midpoint of range forecasts for management expectations may no longer hold. Using a sample of management quarterly earnings forecasts from 1996–2010, we find that actual earnings do not fall at the midpoint but instead fall close to the upper bound and that this strategic use increases in 2002–2010 from 1996 to 2001. Over a fiscal quarter, the width of forecast range becomes smaller as uncertainty decreases, but forecasts turn from being optimistic earlier in the quarter to pessimistic later in the quarter during 1996–2001 and from being slightly pessimistic earlier in the quarter to very pessimistic later in the quarter during 2002–2010. These patterns are unlikely due to earnings management and managers’ cognitive biases. We find that investors appear to interpret managers’ earnings expectations at the upper bound rather than the midpoint of range forecasts, whereas analysts behave rather naively, resulting in firms’ increased likelihood of meeting/beating analyst expectations and large analyst forecast errors.

Our study fills a gap in the management earnings forecast literature by documenting the strategic element of managers’ use of a major form of forecasts. We contribute to the expectations management literature by documenting that presumably sophisticated analysts are misguided by managers, suggesting that analysts assist managers in the earnings game.

Equally important, our study has implications for research in various settings that examines or uses management range forecasts, such as management forecast behavior, analyst/investor reaction, and the relation between voluntary disclosure and financial reporting properties. If researchers use the midpoint of the forecast as managers’ expectations when in fact the expectations are near the upper bound, they would be committing measurement errors. Figure 6 illustrates measurement errors in two cases: management forecast error (i.e., managers’ expectations minus actual earnings) and management forecast news (i.e., managers’ expectation minus market expectation). In each case, the magnitude and direction of measurement errors vary for different types of firms. For example, in Case 1 of management forecast error, the forecast error is correctly identified as positive, but its magnitude is overstated for firms with actual earnings above the upper bound (A1 firms). For firms with actual earnings between the midpoint and the upper bound (B1 firms), the forecast error is measured as positive when it should be negative. For firms with actual earnings below the midpoint (C1 firms), the forecast error is correctly identified as negative, but its magnitude is understated.

Case 1 shows the types of firms with ACTUAL falling in the illustrated regions, and the table next to it summarizes the measurement error problems. Actual earnings are at least as high as the upper bound of the range forecast for Type A1 firms, at least as high as the midpoint but below the upper bound for Type B1 firms, and below the midpoint for Type C1 firms. Case 2 shows the type of firms with PREVAILING ANALYST CONSENSUS falling in the illustrated regions, and the table next to it summarizes the measurement error problems. The prevailing analyst consensus before the management forecast is at least as high as the upper bound of the range forecast for Type A2 firms, at least as high as the midpoint but below the upper bound for Type B2 firms, and below the midpoint for Type C2 firms

These measurement errors could subject research to an omitted-correlated-variable problem and have two types of effects on research. The first effect occurs when management forecast errors and forecast news are used as the dependent variable: researchers may mistakenly attribute the average effects to some firm characteristics (e.g., growth) when in fact the dependent variable is incorrectly measured for these firms. The second effect occurs when management forecast errors and forecast news are used as explanatory variables: their effects on inferences would depend on their relationships with the other factors considered in the research, including good vs. bad news and cross-sectional variations in managers’ incentives to manage expectations. Researchers should use caution in using range forecasts, identify the types of firms with strong incentives for strategic behavior, and analyze whether the measurement errors would bias for or against their empirical findings to avoid incorrect conclusions in the former and low test power in the latter. In the minimum, researchers could use the upper bound as managers’ expectations to survey the boundaries of their findings, especially when range forecasts are sampled from recent years and later in a fiscal period.

Notes

The midpoint assumption is so appealing that it is sometimes explicitly used by information intermediaries and the press. For example, in a Wall Street Journal article by Maxwell Murphy on Nov. 2, 2011, “CFO Journal: The big number,” the author compares corporate guidance with analyst consensus and writes, “Where companies have issued a range of earnings expectations, Fac[t]Set uses the midpoint of the guidance range for comparison with the Wall Street consensus.” Here, FactSet is a financial data service provider to investment professionals.

Baginski et al. (1993) conduct validity checks of this assumption in their appendix and use a parametric sign test for robustness checks of their measurement of management forecast news.

We choose quarterly data over annual data because the MBE pressure is quarterly, and when annual earnings are finally reported, three quarters of the performance have already been public for months. In untabulated analysis, we find that the results from annual data are qualitatively similar but noisier.

We discuss in Sect. 4.4 that in recent times managers tend to predict street earnings instead of GAAP earnings and that managers’ strategic use of range forecasts is motivated by street earnings rather than GAAP earnings beating market expectations.

For example, range forecasts account for only 6.8 % of the earnings forecasts during 1979–1987 collected by Pownall et al. (1993) and 20–24 % of the forecasts during 1983–1986 collected by Baginski et al. (1993) and Baginski and Hassell (1997) and during 1981–1991 collected by Bamber and Cheon (1998). The percentage of range forecasts increases to 40 % in 2000 and 82 % in 2004 (Choi et al. 2010).

Hirst et al. (1999) and Libby et al. (2006) specifically examine range forecasts in an experimental setting. They construct all range forecasts with the midpoint coinciding with the point forecasts and inform the subjects that past forecast errors are unbiased. These research designs do not allow intentional bias to exist in their experiments.

We perform additional analyses that help mitigate the concern that this assumption may not hold. Prior research has used actual earnings as a proxy for managers’ private expectations. For example, Cotter et al. (2006) compare the prevailing analyst consensus with actual earnings to determine whether managers perceive analyst forecasts to be optimistic.

The phenomenon of whisper forecasts attests to this conjecture. Analysts issue earnings forecasts to be included in the analyst consensus but whisper to their clients forecasts that are much higher than their official forecasts (Bagnoli et al. 1999).

The tenor of the results remains largely unchanged if we examine forecasts issued between the date of the first analyst revision after the prior quarter’s earnings announcement and the current quarter’s earnings announcement.

The management earnings forecast data are not split-adjusted. Analyst forecasts and actuals are from the IBES non-split-adjusted database. We adjust management forecasts, analyst forecasts, and actual earnings by the split factor in CRSP when necessary as recommended by Robinson and Glushkov (2006).

Forecasts are “point” if the CIG CODE is A, B, F, G, H, I, O, or Z and EST_1 contains a numerical estimate and EST_2 is missing or EST_1 and EST_2 have the same numerical estimates. Forecasts are “range” if the CIG CODE is B, F, G, H, O or Z and EST_1 and EST_2 contain different numerical estimates. Forecasts are “min” if the CIG CODE is 3, 5, 7, C, E, M, P, V, or Y and EST_1 contains a numerical estimate. Forecasts are “max” if the CIG CODE is 1, 2, 4, 6, 8, D, J, K, L, U, W, or X and EST_1 contains a numerical estimate. Forecasts are “qualitative” if the CIG CODE is N, Q, R, S, or T or EST_1 and EST_2 do not contain numerical estimates.

Maximum, minimum, and qualitative forecasts are far less common in recent years than in the 1970s and 1980s. Pownall et al. (1993) report that 69.4 % of quantitative management earnings forecasts in 1979–1987 are maximums or minimums. From hand-collected data in 2006–2007, Lansford et al. (2012) observe that 1.9 % are maximum or minimum, 5.2 % are qualitative, and 4.3 % are ambiguous (e.g., “We expect earnings growth to be in the single digits”).

In untabulated analysis, we observe that point forecasts also show evidence of a pessimistic bias versus actual earnings, but the percentage of actual earnings being higher or equal to the point forecast is fairly constant during our sample period. Because point forecasts have decreased to only 10 % of management forecasts, we do not examine bias of point forecasts in this study.

Throughout the paper, we conduct mean tests in regressions with a constant and use robust standard errors clustered by firm. We conduct median tests in median regressions with a constant.

This result is consistent with the reported summary statistics of Baik and Jiang (2006) for their sample period of 1995–2002, when they calculate management forecast bias using the midpoint for range forecasts.

We observe stickiness in the use of range forecasts from quarter to quarter (89 %) as well as within the same quarter (84 %).

In an untabulated multivariate analysis, we regress ACT_DIS on several variables related to incentives for managers’ strategic behavior. We continue to find large firm size and high growth to be associated with forecast pessimism. After controlling for the width of forecast range, high earnings uncertainty is associated with increased forecast pessimism, consistent with managers erring on the side of caution in an uncertain environment given their asymmetric loss functions.

In untabulated analyses, we partition the sample by the width of forecast range (“wide” for the top quartile, “medium” for the middle two quartiles, and “narrow” for the bottom quartile) and find that our primary findings hold for each partition, although the results are least strong for the “wide” partition perhaps because larger width tends to be used earlier in the fiscal period when managers’ strategic incentives are weakest. We identify an unambiguously good-news sample (forecasts with the lower bound above the prevailing analyst consensus) and an unambiguously bad-news sample (forecasts with the upper bound below the prevailing analyst consensus) and find that our primary findings hold for each sample and that the good-news sample exhibits a larger pessimistic bias than the bad-news sample in the past decade, consistent with managers preferring to conservatively raise analyst expectations.

The primary sources of the management earnings forecasts are Business Wire, PR Newswire, and FD Wire.

A forecast is classified as “street earnings forecast” if the company explicitly excludes certain earnings items from the forecast or uses terms such as “adjusted earnings,” “operating earnings,” and “EBIDA.” A forecast is classified as “GAAP earnings forecast” if the company uses terms such as “reported earnings” and “GAAP earnings” or if exclusions are absent. The classification is unclear when on the one hand the company’s press release does not mention any earnings exclusions or use any specific earnings terms but on the other hand the press article immediately discussing the forecast compares it with the analyst consensus.

Our validation check does not rule out the possibility that managers’ and analysts’ definitions of street earnings may differ.

In Table 2 ACT_DIS is left skewed, and its median is close to 0 for this period, indicating that only some management forecasts are very optimistic.

The finding that in the earlier sample period management news calculated from the upper bound better explains stock returns than that from the midpoint is inconsistent with our finding in Sect. 4 that actual earnings largely fall near the midpoint in this period. The inconsistency could be due to investors’ interpreting range forecasts rather optimistically in the booming economic period or to different forecast samples used in the two sections.

References

Ajinkya, B. B., Bhojraj, S., & Sengupta, P. (2005). The association between outside directors, institutional investors, and the properties of management earnings forecasts. Journal of Accounting Research, 43, 343–376.

Anilowski, C., Feng, M., & Skinner, D. (2007). Does earnings guidance affect market returns? The nature and information content of aggregate earnings guidance. Journal of Accounting and Economics, 44, 36–63.

Athanasakou, V., Strong, N. C., & Walker, M. (2011). The market reward for achieving analyst earnings expectations: Does managing expectations or earnings matter? Journal of Business Finance and Accounting, 38, 58–94.

Baginski, S. P., Conrad, E. J., & Hassell, J. M. (1993). The effects of management forecast precision on equity pricing and on the assessment of earnings uncertainty. The Accounting Review, 68, 913–927.

Baginski, S. P., & Hassell, J. M. (1997). Determinants of management forecast precision. The Accounting Review, 72, 303–312.

Baginski, S. P., Hassell, J. M., & Wieland, M. M. (2011). An examination of the effects of management earnings forecast form and explanations on financial analyst forecast revisions. Advances in Accounting, Incorporating Advances in International Accounting, 27, 17–25.

Bagnoli, M., Beneish, M. D., & Watts, S. (1999). Whisper forecasts of quarterly earnings per share. Journal of Accounting and Economics, 28, 27–50.

Baik, B., & Jiang, G. (2006). The use of management forecasts to dampen analysts’ expectations. Journal of Accounting and Public Policy, 25, 531–553.

Bamber, L., & Cheon, S. (1998). Discretionary management earnings forecast disclosures: Antecedents and outcomes. Journal of Accounting Research, 36, 167–190.

Bartov, E., Givoly, D., & Hayn, C. (2002). The rewards to meeting or beating earnings expectations. Journal of Accounting and Economics, 33, 173–204.

Bernard, V. L., & Thomas, J. K. (1989). Post-earnings announcement drift: Delayed price response or risk premium? Journal of Accounting Research, 27, 1–36.

Beyer, A., Cohen, D., Lys, T., & Walther, B. (2010). The financial reporting environment: Review of the recent literature. Journal of Accounting and Economics, 50, 296–343.

Bradshaw, M. T., & Sloan, R. (2002). GAAP versus the street: An empirical assessment of two alternative definitions to earnings. Journal of Accounting Research, 40, 41–66.

Brown, L. D., & Caylor, M. L. (2005). A temporal analysis of quarterly earnings thresholds: Propensities and valuation consequences. The Accounting Review, 80, 423–440.

Choi, J., Myers, L. A., Zang, Y., & Ziebart, D. A. (2010). The roles that forecast surprise and forecast error play in determining management forecast precision. Accounting Horizons, 24, 165–188.

Christensen, T. E., Merkley, K. J., Tucker, J. W., & Venkataraman, S. (2011). Do managers use earnings guidance to influence street earnings exclusions? Review of Accounting Studies, 16, 501–527.

Cotter, J., Tuna, I., & Wysocki, P. (2006). Expectations management and beatable targets; How do analysts react to explicit earnings guidance? Contemporary Accounting Research, 23, 593–624.

Daily, R. A. (1971). The feasibility of reporting forecasted information. The Accounting Review, 46, 686–692.

De Bondt, W., & Thaler, R. (1985). Does the stock market overreact? Journal of Finance, 40, 793–805.

Dechow, P., Richardson, S., & Tuna, I. (2003). Why are earnings kinky? An examination of the earnings management explanation. Review of Accounting Studies, 8, 354–384.

Du, N., Budescu, D., Shelly, M. K., & Omer, T. C. (2011). The appeal of vague financial forecasts. Organizational Behavior and Human Decision Processes, 14, 179–189.

Feng, M., & Koch, A. (2010). Once bitten, twice shy: The relation between outcomes of earnings guidance and management guidance strategy. The Accounting Review, 85, 1951–1984.

Gong, G., Li, L. Y., & Wang, J. J. (2011). Serial correlation in management earnings forecast errors. Journal of Accounting Research, 49, 677–720.

Gong, G., Li, L. Y., & Xie, H. (2009). The association between management earnings forecast errors and accruals. The Accounting Review, 84, 497–530.

Graham, J. R., Harvey, C., & Rajgopal, S. (2005). The economic implications of corporate financial reporting. Journal of Accounting and Economics, 40, 3–73.

Hirst, D. E., Koonce, L., & Miller, J. (1999). The joint effect of management’s prior forecast accuracy and the form of its financial forecasts on investor judgment. Journal of Accounting Research, 37, 101–124.

Hirst, D. E., Koonce, L., & Venkataraman, S. (2008). Management earnings forecasts: A review and framework. Accounting Horizons, 22, 315–338.

Hui, K. W., Matsunaga, S., & Morse, D. (2009). The impact of conservatism on management earnings forecasts. Journal of Accounting Economics, 47, 191–207.

Ke, B., & Yu, Y. (2006). The effect of issuing biased earnings forecasts on analysts’ access to management and survival. Journal of Accounting Research, 44, 965–999.

Kennedy, J., Mitchell, T., & Sefcik, S. (1998). Disclosure of contingent environmental liabilities: Some unintended consequences. Journal of Accounting Research, 36, 257–278.

Kim, Y., & Park, M. S. (2012). Are all management earnings forecasts created equal? Expectations management versus communication. Review of Accounting Studies, 17, 807–847.

Koh, K., Matsumoto, D. A., & Rajgopal, S. (2008). Meeting or beating analyst expectations in the post-scandals world: Changes in stock market rewards and managerial actions. Contemporary Accounting Research, 25, 1–39.

Lansford, B., Lev, B., & Tucker, J. (2012). Causes and consequences of disaggregating earnings guidance. Journal of Business, Finance and Accounting, 40, 26–54.

Lee, C. M. (2001). Market efficiency and accounting research: A discussion of ‘capital market research in accounting’ by S.P. Kothari. Journal of Accounting and Economics, 31, 233–253.

Libby, R., Tan, H., & Hunton, J. E. (2006). Does the form of management’s earnings guidance affect analysts’ earnings forecasts? The Accounting Review, 81, 207–225.

Lim, T. (2001). Rationality and analysts’ forecast bias. Journal of Finance, 56, 369–385.

Matsumoto, D. A. (2002). Management’s incentives to avoid negative earnings surprises. The Accounting Review, 77, 483–514.

Matsunaga, S., & Park, C. (2001). The effect of missing a quarterly earnings benchmark on the CEO’s annual bonus. The Accounting Review, 76, 313–332.

Mayew, W. J. (2008). Evidence of management discrimination among analysts during earnings conference calls. Journal of Accounting Research, 46, 627–659.

McDonald, C. L. (1973). An empirical examination of the reliability of published predictions of future earnings. The Accounting Review, 48, 502–510.

McNichols, M. (1989). Evidence of informational asymmetries from management earnings forecasts and stock returns. The Accounting Review, 64, 1–27.

Mergenthaler, R., Rajgopal, S., & Srinvasan, S. (2011). CEO and CFO career penalties to missing quarterly analyst forecasts. Working paper, Emory University.

Muth, J. F. (1961). Rational expectations and the theory of price movements. Econometrica, 29, 315–335.

Ng, J., Tuna, I., & Verdi, R. (2013). Management forecast credibility and underreaction to news. Review of Accounting Studies, 18, 956–986.

Oliver, B. (1972). A study of confidence interval financial statements. Journal of Accounting Research, 10, 154–166.

Pownall, G., Walsley, C., & Waymire, G. (1993). The stock price effects of alternative types of management earnings forecasts. The Accounting Review, 68, 896–912.

Richardson, S., Teoh, S. H., & Wysocki, P. (2004). The walk-down to beatable analyst forecasts: The role of equity issuance and insider trading incentives. Contemporary Accounting Research, 21, 885–924.

Robinson, D., & Glushkov, D. (2006). A note on IBES unadjusted data. Working paper, Wharton Research Data Services.

Rogers, J. L., & Stocken, P. C. (2005). Credibility of management forecasts. The Accounting Review, 80, 1233–1260.

Sheffrin, S. M. (1996). Rational expectations. New York, NY: Cambridge University Press.

Simon, H. A. (1955). A behavioral model of rational choice. The Quarterly Journal of Economics, 69, 69–118.

Simon, H. A. (1959). Theories of decision-making in economics and behavioral science. The American Economic Review, 49, 253–283.

Skinner, D. J., & Sloan, R. G. (2002). Earnings surprises, growth expectations, and stock returns or don’t let an earnings torpedo sink your portfolio. Review of Accounting Studies, 7, 289–312.

Soffer, L. C., Thiagarajan, S. R., & Walther, B. R. (2000). Earnings preannouncement strategies. Review of Accounting Studies, 5, 5–26.

Tucker, J. W. (2010). Is silence golden? Earnings warnings and change in subsequent analyst following. Journal of Accounting, Auditing & Finance, 25, 431–456.

Tversky, A., & Kahneman, D. (1982). Judgment under uncertainty: Heuristics and biases. New York, NY: Cambridge University Press.

Williams, P. (1996). The relation between prior earnings forecasts by management and analyst response to a current management. The Accounting Review, 71, 103–115.

Acknowledgments

We thank Rajiv Banker, Larry Brown, Dmitri Byzalow, Michael Drake, David Folsom, Joost Impink, Stephen Penman (editor), Kathy Rupar, Michael Tang, Angie Wang, an anonymous referee, and the participants at the 2012 AAA Annual Meeting, the University of Florida Accounting Brown Bag, and the University of Temple Accounting Workshop. Marcus Kirk thanks the Luciano Prida Professorship Foundation, and Jennifer Tucker thanks the J. Michael Cook/Deloitte Professorship Foundation for financial support.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Ciconte, W., Kirk, M. & Tucker, J.W. Does the midpoint of range earnings forecasts represent managers’ expectations?. Rev Account Stud 19, 628–660 (2014). https://doi.org/10.1007/s11142-013-9259-2

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11142-013-9259-2