Abstract

A large body of literature demonstrates that acquisitions are on average value destroying for the acquirer. We investigate whether the change in the acquirer’s information uncertainty contributes to acquirer wealth losses. Information uncertainty affects the discount rate (the cost of capital), which in turn influences stock price. Our results indicate that acquisitions lead to increases in information uncertainty, as proxied by analysts’ earnings forecast dispersion. We also find that the change in information uncertainty is negatively related to acquirer long-term stock performance, after controlling for the acquirer’s fundamentals. Taken together, this evidence is consistent with the conclusion that increases in information uncertainty resulting from acquisitions contribute to acquirer post-acquisition wealth losses

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Prior research on mergers and acquisitions (M&As) documents large positive returns to targets but finds that acquiring firms usually realize zero or negative announcement-period returns and, on average, negative long-term post-acquisition returns. The latter results indicate that acquisitions are often ex post value destroying for the acquirer (Loughran and Vijh 1997; Moeller et al. 2005). While there is some consensus that acquisitions are on average value destroying for the acquirer, the factors causing the wealth destruction are not fully understood. Prior research has proposed a number of explanations for the acquiring firm’s post-acquisition performance, such as overinvestment (for example, Rau and Vermaelen 1998; Oler 2008), managerial incentives (for example, Mueller 1969; Harford and Li 2007), and overvalued stock (for example, Shleifer and Vishny 2003). A common theme of these explanations is that the market misprices acquirer fundamentals.

In this paper, we examine the possibility that the change in the acquiring firm’s information uncertainty is a factor contributing to acquiring firms’ long-term post-acquisition stock underperformance. By information uncertainty, we mean investors’ perceived uncertainty about a firm’s fundamentals, which captures the second moment of fundamentals. Prior literature focuses on the first moment of acquirer fundamentals. Uncertainty affects the discount rate (the cost of capital), which in turn influences stock price. Our discount rate theory offers an alternative explanation to the market’s mispricing of the acquirers’ fundamentals as a source of acquirers’ long-term underperformance. As suggested by standard finance theory, stock price responds to changes in either fundamentals or the discount rate. The prolonged integration process of M&As and complicated financial reporting issues are not fully anticipated and are likely to increase the uncertainty of the combined entity. An increase in acquirer’s uncertainty causes investors to demand a higher premium (higher cost of capital) to compensate for the rise in uncertainty/risk, which in turn results in acquirer stock price declines.Footnote 1

Investors’ perceived uncertainty about a firm’s fundamentals (e.g., cash flows and earnings) is likely to come from two sources: fundamental volatility and information precision/asymmetry (for example, Krishnaswami and Subramaniam 1999; Gilson et al. 2001; Zhang 2006).Footnote 2 In the M&A setting, the former is the result of combining two separate streams of fundamentals (i.e., acquirer and target) in the acquisition and the uncertainty associated with the integration process. The latter is related to uncertainty associated with information disclosure and the expected information loss resulting from the disappearance of the target. These factors aggravate information asymmetry and raise uncertainty in the post-merger period for the combined entity. While some prior studies (for example, Krishnaswami and Subramaniam 1999) use the term “information asymmetry,” we use the term “information uncertainty” because it captures both the volatility of a firm’s fundamentals, such as earning streams, and the information asymmetry between managers and outsiders.

Prior research has documented the effect of change in information uncertainty on a firm’s value in a non-acquisition context. Specifically, Krishnaswami and Subramaniam (1999) examine the effect of spin-offs on a firm’s information uncertainty. They suggest that information uncertainty leads to undervaluation of the firm and, thus, a reduction in information uncertainty resulting from a spin-off will reduce such undervaluation. Acquisitions are the inverse of spin-offs. If spin-offs reduce information uncertainty, we would expect that on average acquisitions will increase information uncertainty. As discussed above, the expected increase in information uncertainty is likely to increase the acquirer’s cost of capital, which in turn has a negative effect on the acquirer’s stock performance.

To investigate the association between acquirer stock performance and changes in information uncertainty resulting from acquisitions, we use the dispersion in analysts’ forecasts as a proxy for information uncertainty. For a sample of 1,915 acquisitions announced from 1985 to 2003, we find that on average, acquisitions lead to an increase in information uncertainty for acquirers. Specifically, we find that analyst earnings forecast dispersion increases by about 15 percent on average in the post-acquisition period. We also find that, after controlling for fundamental news such as firm’s performance (e.g., cash flows), growth, etc., the change in information uncertainty is negatively related to the acquirer’s post-acquisition stock performance. An inter-quartile increase in the change in information uncertainty corresponds to a 19.6 percent decrease in stock returns in the 36-month period after the acquisition. In addition, when the sample is partitioned based on whether there is an increase or decrease in information uncertainty after the acquisition, post-acquisition stock returns are positive for acquirers with a decrease in information uncertainty and negative for acquirers with an increase in information uncertainty.

Because our objective is to investigate an additional explanation for the previously observed acquirer post-acquisition stock performance, it is important to ensure that our information uncertainty measure does not capture a firm’s post-acquisition fundamentals (e.g., cash flows). We include a number of ex post fundamental variables (e.g., change in return on equity) in our model to control for ex post operating performance. In addition, dispersion, which represents the second moment of firm fundamentals, is unlikely to be correlated with the first moment. However, to alleviate concerns that our dispersion measure is capturing changes in fundamental performance, we also conduct a matched-design test. Specifically, for each acquirer, we select a matched non-acquiring firm with the closest size and analyst forecast dispersion within the same industry. Then we assign the acquirer’s event date as the pseudo event date for the matched firm. For the matched firms, we do not find that information uncertainty increases after the pseudo event. Moreover, for the matched sample firms, we do not find a negative relation between changes in information uncertainty and post-event stock returns. The matched-design test results, taken together with the statistically significant relationship between the post-acquisition change in information uncertainty and acquirer’s post-acquisition stock performance, support the conclusion that a portion of previously observed acquirer wealth losses are associated with the change in the acquirer’s cost of capital.

Our paper complements Moeller et al. (2007) with different theories, hypotheses, and research designs. Moeller et al. follow the theory of diversity of opinion (e.g., Miller 1977) and focus on the level of analyst dispersion and the acquirer’s announcement returns. They find that the level of analyst dispersion is negatively related to acquirers’ announcement returns. In contrast, we focus on the channel of information uncertainty affecting a firm’s stock price via the discount rate. We are interested in whether information uncertainty changes after the acquisition and whether this change affects the acquirer’s post-acquisition returns. We find that the post-acquisition change in analyst earnings forecast dispersion is negatively related to acquirers’ post-acquisition stock returns.

This paper makes two significant contributions to the literature. First, we propose and test an economics-based theory predicting that acquirers’ post-acquisition stock returns are related to a cost of capital (discount rate) effect. Similar to prior studies of changes in fundamentals post-acquisition, this study analyzes acquirer discount rate changes resulting from M&As. Simply put, the acquirer is not the same company after a large acquisition. (The deal’s value must be equivalent to at least 10% of the acquirer’s pre-deal market value to be in our sample.) Two key features of this discount rate explanation distinguish this study from prior research: (1) we provide evidence on the discount rate as an alternative explanation for the well-documented acquirer long-term stock underperformance, and (2) our theory accommodates market rationality, as opposed to the irrationality suggested by mispricing in the literature. As acquisition related uncertainty becomes apparent gradually over time in the post acquisition period, our analyses also explain why acquirer underperformance persists long after acquisitions.

Second, the evidence in the paper has important implications for the broader asset pricing literature. Information uncertainty is often modeled as the critical component of the cost of capital (e.g., Verrecchia 2001) or estimation risk (e.g., Barry and Brown 1985), but empirical results have provided mixed evidence on the pricing of uncertainty by the market. Acquisitions potentially have a pronounced effect on information uncertainty due to the magnitude of the transaction. The magnitude of the shift in information uncertainty in this institutional setting is significant enough to allow a more powerful test of the pricing effect of information uncertainty. Furthermore, changes in information uncertainty and the cost of capital are easier to isolate and analyze around significant corporate events than in a steady state.Footnote 3

Because we use ex post dispersion measures in our research design, our test is an ex post analysis of the role of information uncertainty in explaining post-acquisition stock performance. Our analysis and results neither suggest an implementable trading strategy, nor speak to market efficiency.

The remainder of the paper is organized as follows. Section 2 discusses related prior literature on mergers and acquisitions and develops hypotheses. Section 3 describes the sample selection process and presents descriptive statistics. Section 4 discusses results, and Sect. 5 summarizes and concludes.

2 Prior literature and hypothesis development

A vast and growing literature examines the wealth effects of mergers and acquisitions. Early studies focused on the abnormal returns to the target and acquirer during the announcement period, and those studies typically documented large positive announcement returns to targets and zero to negative announcement returns to acquirers (see Roll 1986; Jensen and Ruback 1983, and papers cited therein). More recent studies also examine long-term stock returns in the post-acquisition period and typically find that acquirer returns are negative over a period of three to 5 years following the acquisition (for example, Agrawal et al. 1992). In sum, the evidence suggests that acquisitions are often value destroying for the acquirer (Loughran and Vijh 1997; Rau and Vermaelen 1998; Moeller et al. 2005).

While the evidence suggests that the acquirer’s long-term stock performance is negative in the post-acquisition period, the factors contributing to this negative performance are not well understood. The literature has proposed a number of explanations, with a common theme being market mispricing of the acquirer’s fundamentals.Footnote 4 The free cash flow theory, for example, suggests that acquirers with an excess of free cash flow tend to squander it on wasteful investments, including takeovers (for example, Jensen 1986; Oler 2008). The managerial incentives story suggests that managers have their own incentives for engaging in mergers, such as increasing CEO compensation or empire-building, rather than maximizing shareholders’ welfare (for example, Harford and Li 2007; Mueller 1969). The overvalued stock story argues that the acquirer’s stock is overvalued and that managers opportunistically acquire the target using that overvalued stock (Shleifer and Vishny 2003). The earnings management story suggests that the market is fooled by earnings management by acquirers (Louis 2004).

Most of these explanations suggest that the market fails to fully incorporate the signal associated with the acquisition upon announcement. As a result, the acquirer’s post-acquisition fundamental performance (cash flows) is below market expectations, leading to acquirer stock underperformance. But an examination of accounting-based performance for the combined company (acquirer and target) in the post-acquisition period produces mixed results (for example, Healy et al. 1992; Kaplan and Weisbach 1992; Schoar 2002; Ravenscraft and Scherer 1987).

In this paper, we examine acquirer wealth effects from the cost of capital perspective. The finance and accounting literatures propose that cost of capital captures both fundamental volatility (e.g., cash flow volatility) and information asymmetry/precision (e.g., precision in public and private information). In general, risk-averse investors dislike uncertainty and thus require a premium to hold high-uncertainty stocks. From the fundamental volatility perspective, standard finance theory suggests that risk measures the uncertainty of a firm’s economic performance. In this spirit, the standard deviation of stock returns (return volatility) is widely used as a measure of risk. For example, the most commonly used reward-to-risk ratio in academics and industry, the Sharpe ratio, uses standard deviation of return as the measure of risk. Merton (1987) shows that even idiosyncratic volatility is priced in the market when information is incomplete. Wang (1993) also demonstrates that, when there is greater uncertainty in a firm’s future cash flows, less informed investors demand a higher risk premium to hold the stock.

From the information perspective, Diamond and Verrecchia (1991) show that disclosure reduces the cost of capital by improving future liquidity of a firm’s securities. Easley and O’Hara (2004) and Verrecchia (2001) show that information asymmetry affects the cost of capital. Botosan et al. (2004) find that the equity cost of capital is associated with the precision of analysts’ public and private information. Lambert et al. (2009) suggest that information precision determines a firm’s cost of capital and that such an information precision effect is unlikely to be diversified away when cash flows co-vary across firms. In this paper, we use information uncertainty to capture both fundamental volatility and information asymmetry/precision. We conjecture that information uncertainty increases after M&As, resulting in a higher cost of capital, which in turn contributes to the post-acquisition stock underperformance of acquirers.

Acquisitions are expected to have a significant impact on fundamental volatility and information collection and monitoring by market participants (e.g. financial analysts) due to the change in economic flows (e.g., cash flows) and the supply and demand of information. Conceptually, we classify operation-based uncertainty as fundamental volatility and financial reporting and information disclosure-based uncertainty as information precision/asymmetry. Nonetheless, since financial reporting is designed to capture a firm’s economic outcomes, there is obviously some relation between these two notions.

From the operational perspective, combining two entities and the uncertainty associated with the integration process are likely to increase the volatility of fundamentals. At a minimum, the acquirer’s earnings stream is altered as a result of the inclusion of the target within the combined entity. After a merger, the acquirer may shed some of its own operations that overlap with those of the target or may sell parts of the target for the same or other reasons. It is difficult for analysts and the market to anticipate the results of such downsizing actions with precision, and thus this strategic/economic action can affect the merged firm’s reported numbers. Similarly, any kind of restructuring of the combined entity, whether it be geographic relocation, changes in location of production/distribution, or such similar operational actions can have real effects on the firm’s performance (cash flows, profitability, etc.). Finally, at the time of a merger, or even in the periods after the merger, there is great uncertainty concerning the potential success of the integration of the target into the acquirer and the effect of that process on the firm’s reported results. Many reports in the financial press have documented transactions in which actual results are worse than expected due to difficulties in integration of the target and other unforeseen problems (e.g., the AOL/Time Warner merger). Nonetheless, there are also occasions in which the integration proceeds much more smoothly than anticipated and results are better than expected. Regardless, factors relating to operating decisions after acquisitions, in unison or in isolation, are expected to increase uncertainty in a firm’s economic performance.

From the financial reporting and information perspective, the accounting for acquisitions is one of the most complex areas of financial accounting, and there are a variety of elements to this accounting that can create uncertainty about a firm’s reported results. During the period in question, acquirers could account for the acquisition using one of two methods—purchase accounting or pooling of interests accounting. The two methods produced different reported results of operations, and the pooling of interests method was ultimately eliminated due in part to the perceived ability of firms to manipulate the results of operations with pooling. Members of the APB noted, in their dissent to APB No. 16—Business Combinations, such problems with the pooling method.Footnote 5

In purchase accounting transactions, many firms completed post-acquisition write-offs, and there was discretion associated with such write offs. Predicting the degree of such write-offs and the effect on reported results was difficult. Furthermore, the deferred tax consequences of an acquisition can create complexity and uncertainty with respect to a firm’s results of operations, particularly when considered in conjunction with restructuring and downsizing of the target (e.g., asset sales post merger). In addition, there were a variety of acquisition-related issues considered by the Financial Accounting Standards Board during the period.Footnote 6 Pending and actual changes in acquisition-related accounting standards highlight unpredictability in the results of operations for merged firms.

Finally, one source of uncertainty associated with financial reporting of merged firms relates to accounting policy choices and assumptions about accounting procedures. For example, if the acquirer uses accounting policies that differ from those of the target (e.g., for inventory, depreciation, or revenue recognition) or uses different factual assumptions (e.g., rates used in various pension computations, salvage values, useful lives, necessity of valuation allowances, etc.), and the target’s methods are switched to the acquirers’ method(s) for some or all of these divergent policies, the corresponding effects on the combined entity’s results are difficult to predict and could create volatility in the firm’s reported results. For an illustration of this type of phenomenon in the context of pension accounting, see for example, Bergstresser et al. (2006).

In sum, there are a variety of operational factors that could affect the merged firm’s reported results. In addition, there are numerous technical accounting policy issues, such as accounting procedure choice and estimates that affect accounting figures such as pension expense, that could create volatility and uncertainty in the merged firm’s financial reporting. Such uncertainty naturally prompts investors and analysts to acquire different pieces of private information and to interpret public information in different ways, giving rise to uncertainty and disagreement among market participants about the merged firm’s economic performance. We operationalize such uncertainty in the form of analyst earnings forecast dispersion. These factors lead to the following hypothesis.

Hypothesis 1

Acquiring firms experience an increase in information uncertainty after acquisitions.

As discussed earlier, information uncertainty affects a firm’s cost of capital (for example, Merton 1987; Diamond and Verrecchia 1991; Lambert et al. 2009). Therefore, the post-acquisition wealth effects of acquisitions may be associated with increases in information uncertainty resulting from the acquisition. If increases in information uncertainty reduce firm value because investors require a higher premium to hold the stock, we would expect to observe a negative association between increases in information uncertainty and acquirers’ post-acquisition returns. In other words, information uncertainty increases after an acquisition, suggesting a higher cost of capital. An increase in the cost of capital (the discount rate) results in a lower post-acquisition stock return. This reasoning gives rise to the following prediction.

Hypothesis 2

The change in information uncertainty after acquisitions is negatively related to the acquirer’s stock performance.

To test our hypotheses, we need an empirical proxy for uncertainty. One set of proxies includes beta (if CAPM holds), stock volatility, earnings volatility, and cash flow volatility. However, these variables are typically estimated over an extended period, such as 5 years, over which the cost of capital is assumed to be stationary. The acquisition and the integration process affect uncertainty and the cost of capital. Therefore, the assumption that the cost of capital remains stationary is likely violated.

As an alternative measure of uncertainty, we use analyst earnings forecast dispersion.Footnote 7 Forecast dispersion is an appealing proxy because we can estimate it at various points in time. To the extent that analyst forecasts serve as a good proxy for market expectations, forecast dispersion measures uncertainty in market expectations of a firm’s economic performance. Not surprisingly, in prior literature, analyst earnings forecast dispersion is widely used to proxy for the uncertainty about future earnings or the degree of consensus among analysts or market participants (e.g., Givoly and Lakonishok 1984; Barron et al. 1998; Barron and Stuerke 1998; Diether et al. 2002; Imhoff and Lobo 1992; Zhang 2006). For example, Givoly and Lakonishok (1984) argue that the level of dispersion in earnings forecasts is perceived by investors as valuable information about the level of uncertainty concerning firms’ future economic performance. Theoretical papers (Barry and Jennings 1992; Abarbanell et al. 1995; Barron et al. 1998) suggest that analyst forecast dispersion reflects both uncertainty and lack of consensus among market participants about future economic events. Motivated by the argument in some studies that forecast dispersion is likely to reflect factors other than uncertainty about future cash flows, Barron and Stuerke (1998) show that analyst forecast dispersion serves as a good indicator of uncertainty about firms’ future economic performance.

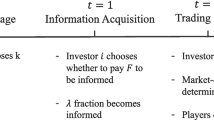

3 Sample data and variable definitions

We collect a sample of acquisitions from the Securities Data Corporation database. A transaction is included in our sample when it meets the following criteria.Footnote 8 First, the transaction was announced between 1985 and 2003. Second, both the acquirer and the target are U.S. firms. Third, the acquirer’s market value of equity is at least $200 million and the deal value of the transaction is at least 10% of acquirer market value (Harford and Li 2007). Fourth, the acquirer obtains 100% of the target. Finally, the acquirer has at least 2 years’ of actual earnings and analyst forecast data in both the pre- and post-acquisition periods. We obtain analysts’ earnings forecasts and corresponding actual earnings from I/B/E/S. The final sample has 1,915 observations with non-missing dispersion and return data.

Table 1 presents descriptive sample statistics. Results in Panel A show that the mean (median) deal value is $1.333 billion ($250 million). Compared with the mean (median) pre-acquisition acquirer market value of $3.116 billion ($803 million), the deal value represents an average (median) of about 39% (23.1%) of the acquirer’s pre-acquisition market value. About 33% of the targets in the sample are covered by I/B/E/S. The median target covered by I/B/E/S is about four times the size of the median target not covered by I/B/E/S.

Panel B reports the distribution of acquisitions by year. Acquisitions are distributed across the sample period but show some time-series clustering in the late 1990s, a period that coincides with the latest merger wave. As a result of the clustering of M&As, we include year fixed effects in our research design. Panel C provides an industry breakdown (2-digit SIC code in parentheses). The top three industries with the largest number of acquisitions are Business Services (73), Commercial Machinery, and Computers (35), and Industrial, Communications (48).

We define analyst forecast dispersion (DISP) as the standard deviation of analysts’ earnings forecasts scaled by prior year-end stock price, where analysts’ forecasts are made 8 months prior to a firm’s fiscal year-end. We take analysts’ forecasts 8 months before the fiscal year-end to ensure that analysts have access to the prior year’s annual report and SEC filings. The definition of DISP is relatively straightforward in the post-acquisition period because the target disappears after the acquisition. In the pre-acquisition period, the DISP measure is based on the acquirer only if the target is not covered by I/B/E/S. If the target is covered by I/B/E/S, we define DISP as followsFootnote 9:

where A_stdev (T_stdev) is the standard deviation of analysts’ earnings forecasts for the acquirer (target); A_shares (T_shares) is the number of acquirer (target) shares outstanding; A_price (T_price) is the acquirer’s (target’s) share price.Footnote 10

The change in information uncertainty (ΔDISP) is measured as the difference in DISP between the average uncertainty value in pre-acquisition periods (years t − 2 and t − 1) and post-acquisition periods (years t + 1 and t + 2).Footnote 11 To measure post-acquisition stock performance and following prior literature, we use the 36-month (ARET i+1, i+36) acquirer abnormal stock returns starting from the first month following the completion of the acquisition.Footnote 12 We also use 60-month stock returns (ARET i+1, i+60) as a robustness check. Abnormal stock returns (ARET i+1, i+36 and ARET i+1, i+60) are calculated as raw returns minus the returns of the benchmark portfolio, where the benchmark portfolios are 25 portfolios formed on size and book-to-market (5*5) based on NYSE breakpoints (for example, Mitchell and Stafford 2000).

Table 2 presents descriptive statistics for our sample. The mean ΔDISP is 0.13%, with a standard deviation of 1.12%. Like prior research, we find that our sample acquirers on average experience wealth losses post-acquisition. Acquirers have an average abnormal stock return of −13.11% (−10.50%) over the 36-month (60-month) period after the acquisition. The median abnormal acquirer returns are −37.10 and −22.75% for the 36- and 60-months post-acquisition periods, respectively.

Panel B of Table 2 presents the correlation matrix for both Pearson and Spearman correlations. ΔDISP is negatively correlated with post-acquisition returns (ARET i+1, i+36), with Pearson and Spearman correlations of −0.21 and −0.25, respectively, both of which are statistically significant at the 1% level. ARET i+1, i+36 is also negatively correlated with the acquirer’s cash level (CASH) and the all-stock dummy variable (ALLSTOCK), consistent with the findings in Oler (2008) and Loughran and Vijh (1997). ARET i+1, i+36 is positively correlated with proxies for unexpected fundamental news, such as changes in ROE (ΔROE), changes in sales growth (ΔSGR), and analyst forecast errors (FE t+1), indicating that the acquirer’s post-acquisition stock performance is associated with fundamental ex post operating performance.

4 Empirical results

4.1 The change in information uncertainty after acquisitions

Panel A of Table 3 presents the time-series pattern of DISP for the period surrounding the acquisitions for the overall sample. In each post-acquisition period, in years t + 1 and t + 2 where t is the year in which the acquisition transaction takes place, DISP is compared with the value in the pre-acquisition year t − 1 to determine whether a significant change in information uncertainty occurs after the acquisition. We observe an increase in information uncertainty in the post-acquisition periods. For example, the mean DISP increases from 0.61% in year t − 1 to 0.70% in year t + 1 and 0.76% in year t + 2. The median DISP also exhibits a similar pattern with increases from 0.30% in year t − 1 to 0.33% in year t + 1 and 0.34% in year t + 2, respectively. Such an increase in DISP for year t + 1 or t + 2 is significant at the 1% level for means and at the 5% level for medians. The increases in DISP in the post-acquisition periods are also economically significant. For example, relative to year t − 1, mean DISP increases by about 15% in year t + 1 and increases by about 18% in year t + 2.

Panel B of Table 3 shows the distribution of DISP t−1 and DISP t+1 by year.Footnote 13 Two patterns are evident. First, DISP tends to slightly decrease over time, a result that works against Hypothesis 1, as we predict an increase in DISP after the acquisition. Second, DISP t+1 is larger than DISP t−1 in most years, suggesting that an increase in uncertainty after the acquisition is not driven by a specific time period. In summary, our results show that the dispersion in analysts’ forecasts increases substantially after the acquisition, which is consistent with the conclusion that acquisitions increase information uncertainty.

4.2 The link between the change in information uncertainty and the acquirer’s stock performance

If increases in information uncertainty contribute to acquirer wealth losses, acquirer stock returns should be negatively associated with the change in information uncertainty. Because we focus on changes from pre-acquisition to post-acquisition periods, an advantage of our research design is that we essentially use difference regressions (the difference between post- and pre-acquisition, such as ΔDISP) and thus implicitly control for many unobserved firm characteristics that could affect the level of information uncertainty or stock price.

4.2.1 Regression analysis

To test whether the change in information uncertainty contributes to an acquirer’s subsequent stock performance, we employ the following regression model:

where the dependent variable (ARET) takes the form of ARET i+1,i+36 or ARET i+1,i+60. ΔDISP is our proxy for change in information uncertainty. To avoid the effect of outliers, the actual values of the change in information uncertainty (ΔDISP) are converted into decile rankings and then converted into values between 0 and 1.Footnote 14 We obtain decile rankings by ranking observations and assigning them in equal numbers to ten portfolios. We include five sets of controls in the model.

-

The first set of controls is related to acquisition characteristics (DEAL/MV and COVERED). DEAL/MV is relative deal size and is defined as the deal value divided by the market value of equity of the acquirer prior to the acquisition. COVERED is an indicator variable, which takes the value of 1 if analyst forecast data for the target are available on I/B/E/S and 0 otherwise.

-

The second set of controls is related to firm characteristics (SIZE and BM). SIZE is the logarithm of the market value of equity for the acquirer at the end of year t − 1. BM is the book-to-market ratio for the acquirer at the end of year t − 1.

-

The third set of controls includes proxies for unexpected changes in fundamentals. Specifically, we include the change in return on equity (ΔROE), the change in sales growth (ΔSGR), the change in analysts’ forecasts of long-term earnings growth (ΔGROWTH), and analyst forecast errors (FE t+1, FE t+2, FE t+3).Footnote 15ΔROE, ΔSGR, and ΔGROWTH are measured similarly to ΔDISP by taking the difference in average value between the pre- and post-acquisition periods. In the pre-acquisition period, these variables are based on combined target and acquirer data.Footnote 16 FE t+1, FE t+2, FE t+3 are actual earnings minus the analyst consensus earnings forecast from the I/B/E/S monthly file, where forecasts are issued immediately after the acquisition date, scaled by stock price at the forecast date for fiscal years t + 1, t + 2, and t + 3, respectively. Mergers could create value for the acquirer via synergies (e.g., Devos et al. 2009), and firms often emphasize potential synergies when announcing M&As. To the extent that analysts incorporate such information when making 1-, 2-, and 3-year-out earnings forecasts after the acquisition date, analyst forecast errors (FE t+1, FE t+2, FE t+3) capture potential synergies that did not materialize.

-

The fourth set of controls includes variables that prior literature finds are related to post-acquisition returns. Specifically, we include a proxy for earnings management (ABCA, Louis 2004), acquirer cash level (denoted as CASH, Oler 2008), and a dummy variable for 100% stock acquisitions (denoted as ALLSTOCK, Loughran and Vijh 1997). Following Louis (2004), ABCA is abnormal current accruals in the calendar quarter immediately prior to the acquisition announcement date—the difference between the unexplained current accruals (UECA) of an acquirer and the average UECA of a portfolio matched on 2-digit SIC industry and return on assets four quarters prior to the estimation quarter. UECA is the residual of the following regression:\( CA_{i} = \sum\nolimits_{j = 1}^{4} {\alpha_{j} Q_{j} } + \sum\nolimits_{t = 1985}^{2003} {\beta_{t} Y_{t} + \lambda_{1} (\Updelta SALES_{i} - \Updelta AR_{i} ) + \varepsilon_{i} } \), where CA is current accrual (changes in noncash current assets minus changes in nondebt current liabilities) Q is a dummy variable taking the value of 1 in quarter j and 0 otherwise; Y is a dummy variable taking the value of 1 in year t and 0 otherwise; ΔSALES is the quarterly change in sales; ΔAR is the quarterly change in accounts receivable. All variables in the regression (including dummies) are scaled by assets at the beginning of the quarter.

-

Finally, we include year dummy variables to control for any period effects, such as merger waves.

There are at least two issues when estimating Regression (2). First, mergers and acquisitions are not evenly distributed across years in our sample period. To address data clustering and potential time period effects, we cluster standard errors by year. Second, the regression model includes a large number of independent variables and some variables, such as three-year-out forecast errors (FE t+3), often have missing values in the dataset. To avoid overly restricting our dataset, we only require ΔDISP and RET i+1, i+36 to have nonmissing values in the regression. For other variables, if the value is missing for a particular observation, we assign the mean value of nonmissing observations to that observation. In this way, we preserve the large sample size, but the coefficient estimates are essentially based only on observations with nonmissing values.

The main variable of interest is ΔDISP, and we expect a negative coefficient on ΔDISP if acquirer wealth losses are associated with increases in information uncertainty. We include DEAL/MV to control for relative deal size. We do not make a prediction about the sign of the coefficient on DEAL/MV. COVERED controls for targets that were covered by analysts pre-acquisition relative to those targets that were not. We do not make a prediction about the sign of the coefficient on COVERED. SIZE and BM are designed to control for a firm’s fundamentals that could affect stock returns. Because we use abnormal returns as the dependent variable, we do not make a prediction about the sign of the coefficients on SIZE and BM. The coefficients on proxies for fundamental news are expected to be positive, because stock returns and unexpected fundamentals should be positively correlated.Footnote 17

Table 4 presents the regression results. The coefficient estimates on ΔDISP are negative and statistically significant in Models (1) and (2), indicating that an increase in information uncertainty is associated with acquirer wealth losses in the post-acquisition period.Footnote 18 The coefficient estimates are also economically significant. Because the raw measures of information uncertainty were converted into decile rankings, the economic significance of the coefficient can be interpreted by multiplying the coefficient estimate by the relative change in decile rankings. For example, a coefficient estimate of −0.392 on ΔDISP in Model (1) implies that stock returns would be 3.92% higher in the post-acquisition 36-month period if we move ΔDISP one decile lower. Similarly, the inter-quartile difference in ΔDISP corresponds to a 19.6% (= 0.392*0.5) decrease in stock returns in the 36-month period after the acquisition.Footnote 19

The coefficients on DEAL/MV are close to zero across all models. The coefficient on COVERED is negative but not statistically significant, suggesting a slightly more negative effect on shareholder welfare if the target is a public firm with analyst coverage. The coverage of targets by I/B/E/S may provide more information to allow the market to assess the negative effect of the acquisition on the acquirer. COVERED and DEAL/MV are positively correlated, which may affect inferences on the individual variables, although neither variable is significant.Footnote 20 We find insignificant coefficients on firm size and book-to-market, suggesting that we effectively control for these two variables when calculating abnormal returns. The coefficients on ΔROE, ΔSGR, FE t+2, and FE t+3 are positive and significant in Models (1) and (2), an expected result consistent with a positive association between post-acquisition financial performance and post-acquisition stock performance. The coefficients on ΔGROWTH and FE t+1 are insignificant, a result mainly due to the positive correlations with other fundamental variables (the coefficients on ΔGROWTH and FE t+1 are significant in univariate regressions). Untabulated results show that the correlation between FE t+1 and FE t+2 is about 50%, confirming the multicollinearity issue discussed previously. A positive coefficient on ABCA is different from Louis (2004), possibly due to our control of ex post performance measures and due to sample differences—Louis focuses on stock-for-stock mergers, and we include all types of acquisitions in our sample. The coefficients on CASH are negative consistent with Oler (2008), although statistical significance is lower than that in Oler (2008).Footnote 21 Unlike some prior research, we find that ALLSTOCK is insignificant. This result may be due to differences in samples relative to prior research. For example, during the late 1990s, the frequency of stock financed acquisitions increased significantly (Shleifer and Vishny 2003), and our sample period is centered during this period.

4.2.2 Portfolio analysis

To further evaluate the relationship between the change in information uncertainty and the acquirer’s stock performance, we conduct the following portfolio analyses. Compared with the regression analysis, the portfolio approach offers several advantages. It allows nonlinearity in variables of interest and, therefore, offers a clearer picture of the relationship between returns and the variables of interest. Moreover, portfolio analysis mitigates the effect of outliers because it averages stock returns rather than minimizing squared errors as is done in a regression analysis. Following prior literature, we use abnormal or adjusted returns in the portfolio analysis.

To control for the effect of post-acquisition financial performance, we adopt a two-way conditional sorting technique to sort the sample into five quintiles based on the change in uncertainty after controlling for ΔROE.Footnote 22 Specifically, we first sort firms into five quintiles based on ΔROE. Then within each ΔROE quintile, we further sort the observations into five groups based on ΔDISP (groups 1–5). Finally, we pool all five groups 1 together into one portfolio, all groups 2 together into another portfolio, and so on. In this way, we sort the sample into five equal-sized portfolios, which have substantial variation of ΔDISP but nearly the same level of ΔROE. Results (not tabulated) indicate that ΔROE is similar across five quintiles under this approach, suggesting that the portfolio approach of controlling for ΔROE is rather effective.

Table 5 reports post-acquisition stock returns (ARET i+1,i+36) for the five uncertainty quintiles. In Panel A, post-acquisition stock returns decrease from Q1 to Q5. In the first two quintiles (Q1 and Q2), acquirers experience a reduction in information uncertainty, and the average post-acquisition stock returns in those quintiles are positive (9.23 and 6.91% for Q1 and Q2, respectively). For the last two quintiles (Q4 and Q5), acquirers experience a significant increase in information uncertainty and the average post-acquisition stock returns are reliably negative (−13.35 and −36.36% for Q4 and Q5, respectively).

Portfolio results in Panel A do not control for any period effects. As a robustness check, we conduct the Fama–French three-factor and four-factor models on the five conditional ΔDISP portfolios in Panel A. Specifically, we assign each acquirer’s 36 monthly returns (from month t + 1 to t + 36) into one of five ΔDISP portfolios and then calculate the average monthly return for each ΔDISP portfolio. Finally, we estimate the following three- and four-factor models for monthly returns on each ΔDISP quintile:

where \( R_{Mt} - R_{ft} \), SMB, and HML are as defined in Fama and French (1996), and MOM is the momentum factor defined in Carhart (1997). The four-factor data are from Kenneth French’s website. The intercept (a) provides an estimate of the monthly abnormal returns earned by each ΔDISP quintile, after controlling for these three or four factors.

Panel B of Table 5 presents the parameter estimates for the three-factor model. The intercept decreases monotonically from 0.356 percent (t = 2.01) for Q1 to −0.892 percent (t = −4.01) for Q5. Consistent with the results in Panel A, the three-factor alphas are reliably positive for Q1 and Q2 and significantly negative for Q4 and Q5. The SMB factor loadings exhibit a “U” shape, suggesting that firms with extreme (both negative and positive) changes in dispersion are more likely to be small firms. The HML loadings are uniformly positive across five ΔDISP quintiles, suggesting that value firms are more likely to make large acquisitions. The last row of Table 5 reports the four-factor alphas after adding the momentum factor to the Fama–French three-factor model. Overall, results are very similar except that alpha becomes insignificant for Q4.

In summary, we find that the change in information uncertainty is negatively related to the acquirer’s stock performance. Furthermore, the patterns of information uncertainty and stock returns are consistent across different measures of stock performance and analyses. In general, an increase in information uncertainty is associated with negative post-acquisition abnormal returns, and a decrease in information uncertainty is associated with positive post-acquisition abnormal returns. These results are consistent with the conclusion that the information consequences of an acquisition affect the acquirer’s post-acquisition returns.

4.3 The relation between the change in information uncertainty and stock returns for the matched sample

The previous sections provide evidence that the change in information uncertainty is negatively related to the acquirer’s stock returns. Although we use a number of variables to capture unexpected fundamental news in the regression model, ΔDISP may still capture some fundamental news that is related to stock returns. We perform the following analyses to address the potential spurious relation between ΔDISP and stock returns due to other fundamental news.

We investigate the DISP pattern around a pseudo event for matched firms that do not have an acquisition. We match acquirer sample firms to a sample of non-acquirers by industry, firm size, and analyst forecast dispersion. Specifically, for each acquisition observation in our final sample, we first select all firms with a market value of equity between 70 and 130% of the acquirer in the same 2-digit SIC industry that do not have any major mergers and acquisition (relative deal value about 10%) in the 5-year (t − 2, t + 2) period. From this set of firms, we match the acquirer with the firm that has the closest forecast dispersion. Then, we assign the acquirer’s acquisition date as the pseudo event date for the matched firm. In this way, we have a matched sample of firms with similar industry/firm characteristics that do not have a major acquisition. Finally, we examine the DISP pattern around the pseudo event date and its correlation with subsequent stock returns for these matched firms.

We report the results for the matched sample in Table 6. Panel A of Table 6 shows the time-series pattern of DISP around the pseudo acquisition dates. In contrast to the results reported in Table 3, we do not observe a significant increase in information uncertainty after the pseudo acquisition date. For example, the mean DISPs are 0.61 and 0.59% in years t + 1 and t + 2, compared with 0.60 and 0.58% in years t − 2 and t − 1, respectively. The medians are also relatively stable around pseudo acquisition events. The relatively stable DISP around the pseudo acquisition date is consistent with the lack of fluctuation in information uncertainty in the absence of a major corporate restructuring event.

Panel B of Table 6 reports the results of Regression (2) for the matched sample. In contrast to the significantly negative relation between forecast dispersion and returns that we observe for acquirers, we find an insignificant relation across both models for the matched sample in Table 6. These matched sample results also support our main findings that the change in information uncertainty resulting from an acquisition is negatively associated with post-acquisition stock returns.

4.4 Additional robustness checks and discussions

4.4.1 Within- versus across-industry mergers and acquisitions

The diversification discount literature (e.g., Lang and Stulz 1994, Berger and Ofek 1995) suggests that between- and within-industry acquisitions may have different economic consequences. No change is expected in industry focus for within-industry acquisitions. However, if the target is in a line of business different from that of the acquirer (across-industry acquisition), the acquirer’s industry focus is likely to decrease. To ensure that our results are not driven by systematic differences between within- and across-industry acquisitions, we examine the association between the change in uncertainty and stock performance in two sub-samples. Table 7 reports the results using the within- and across-industry acquisition sub-samples, where industries are based on 2-digit SIC codes.Footnote 23 Overall, the results in these panels are very similar, suggesting that our main results are independent of the diversifying nature of the acquisition.

4.4.2 Alternative forecast horizons of analysts’ earnings forecasts

In the main analysis, we use analysts’ forecasts made 8 months prior to a firm’s fiscal year-end. As a robustness check, we repeat our analyses using alternative forecast horizons, such as four-month-ahead or last-month forecasts. These alternative forecast horizons yield qualitatively similar results (not tabulated).

4.4.3 Alternative measures of the change in information uncertainty

In the main analysis, we measure the change in information uncertainty as the difference in the 2-year average of uncertainty, pre- versus post-acquisition. As a robustness check, we use three-, four-, and five-year averages of information uncertainty in the post-acquisition period.Footnote 24 Results (not tabulated) are insensitive to these alternative measures.

4.4.4 Serial versus non-serial acquisitions

Because an acquirer could make multiple acquisitions in a short period of time, our measures of stock returns and changes in information uncertainty may be confounded by the effect of such serial acquisitions. We make no prediction on whether the change in information uncertainty should be stronger for serial acquirers. On one hand, an additional acquisition occurring during the pre-acquisition period tends to increase analyst forecast dispersion of earnings forecasts versus the post-acquisition forecast dispersion, making ΔDISP smaller. On the other hand, one could argue that serial acquirers are more likely to do non-synergy/business-related acquisitions, resulting in greater uncertainty. Additionally, multiple acquisitions by a company may also represent a form of growth strategy that increases the difficulty of forecasting, suggesting a higher ΔDISP.

To investigate the effect of serial acquisitions, we partition our sample into two groups on the basis on whether a sample firm made only one acquisition or more than one acquisition during the sample period. Separate analysis is done for each group. We find stronger results for serial acquisitions, but the negative relation between forecast dispersion and stock returns holds for each group. For example, the coefficient on ΔDISP is −0.316 (t = −2.68) in Model (1) of Table 4 for the group of acquirers making only one acquisition during the sample period, compared with −0.435 (t = −5.08) for the group with more than one acquisition. If we include only a firm’s first acquisition in our sample, the coefficient on ΔDISP in Model (1) of Table 4 is −0.287 (t = −3.33). Overall, the results are robust to both serial and non-serial acquisitions.

5 Conclusions and limitations

We examine the effect of information uncertainty on an acquirer’s post-acquisition stock returns. We find that acquisitions lead to a substantial increase in information uncertainty for acquirers, as measured by the dispersion in analysts’ earnings forecasts. Moreover, the change in information uncertainty is negatively related to the acquirer’s long-term post-acquisition stock performance. When the sample is partitioned on the basis of whether an increase in information uncertainty occurs, results indicate that that the average long-term stock returns are negative for acquirers experiencing an increase in information uncertainty and positive for acquirers experiencing a decrease in information uncertainty. In sum, we find evidence consistent with the view that increases in information uncertainty resulting from an acquisition affect the acquirer’s cost of capital, which in turn contribute to acquirer post-acquisition wealth losses.

While the collection of results point toward information uncertainty having an important influence on acquirers’ long-term stock returns, this study is also subject to some caveats. First, our measure of changes in information uncertainty is ex post in nature. The paper provides an ex post explanation to acquirers’ wealth loss, but we do not predict which acquirers will realize negative post-acquisition returns. Moreover, our evidence does not speak to market efficiency. Second, we control for a variety of proxies for firm fundamentals and adopt a matched-design test in our research design. We are reasonably comfortable that our proxy for information uncertainty captures investors’ perceived uncertainty of a firm’s fundamentals but not fundamentals themselves. Nevertheless, we cannot rule out the possibility that our proxy for information uncertainty may still be correlated with some unidentified fundamentals.

Notes

Although uncertainty affects the stock price via the cost of capital channel, we do not estimate the cost of capital directly in this paper for two reasons. First, uncertainty is a determinant of the cost of capital. Second, the cost of capital is not stationary around M&As and thus should not be proxied by subsequent ex post returns. Estimation techniques based on valuation models (e.g., Frankel and Lee 1998) suffer a similar problem because long-term growth forecasts are not updated frequently and thus are not aligned with earnings forecasts when the cost of capital changes around M&As.

Theoretically, an observed signal (s) is characterized as a firm’s fundamental value (v) plus a noise term (e), that is, s = v + e. For example, analyst earnings forecast (s) = firms’ underlying true earnings (v) + noise (e). The variance of the signal measures uncertainty: var(s) = var(v) + var(e) + 2*cov(v,e), where var(v) is a firm’s underlying fundamental volatility, var(e) reflects the quality of information, and cov(v,e) captures the interaction (if any) between fundamentals and noise. We do not distinguish a firm’s underlying fundamental volatility from information quality because both effects contribute to the uncertainty of a firm’s value and because it is hard to empirically disentangle one from the other as observed empirical constructs capture both effects.

To illustrate this point, suppose that we model information uncertainty as a component of the cost of capital. Assume two firms have the same constant free cash flow to shareholders of FCF and the cost of equity of r. Then each firm’s stock price equals to FCF/r. Now assume that one firm’s r increases from 10 to 11% as a result of an increase in uncertainty and that the other firm’s r is unchanged. Holding free cash flow constant, the first firm’s stock return is negative 9.09% [=(FCF/11% − FCF/10%)/(FCF/10%)], as compared with 0% for the other firm.

To our knowledge, the only rational story proposed in the literature is the diversification or coinsurance effect (Lewellen 1971; Scott 1977; Louis 2004). As two unrelated firms merge, the possibility of declaring bankruptcy declines. As a result, diversification leads to lower risk and thus lower expected returns. The diversification story differs from our uncertainty story in two important ways. First, the diversification story works via the cash flow channel. The strong entity’s cash flows can be used to offset the weak entity’s cash flow, making the combined entity less likely to go bankrupt. Second, the diversification story suggests that future stock returns should be lower forever because of lower risk. In contrast, the uncertainty story suggests returns are lower when uncertainty increases. Once uncertainty stops increasing, returns should not be lower. Previous findings (e.g., Mitchell and Stafford 2000) that the post-acquisition underperformance is mainly concentrated in the first 3 years are more consistent with the uncertainty story.

See discussion of dissenting opinions about APB No. 16. “Messrs. Davidson, Horngren, and Seidman dissent to the Opinion because it seeks to patch up some of the abuses of pooling. The real abuse is pooling itself. On that, the only answer is to eliminate pooling. Paragraphs 35–41 set forth some of the defects of pooling. The fundamental one is that pooling ignores the asset values on which the parties have traded, and substitutes a wholly irrelevant figure—the amount on the seller's books. Such nonaccounting for bargained acquisition values permits the reporting of profits upon subsequent disposition of such assets when there really may be less profit or perhaps a loss.” (emphasis added).

For example, the Emerging Issues Task Force of the FASB issued the following pronouncements.

-

93-7–Uncertainties Related to Income Taxes in a Purchase Business Combination.

-

98-11–Accounting for Acquired Temporary Differences in Certain Purchase Transactions That Are Not Accounted for as Business Combinations.

-

95-21–Accounting for Assets to Be Disposed Of Acquired in a Purchase Business Combination.

-

98-1–Valuation of Debt Assumed in a Purchase Business Combination.

-

Prior literature has debated on whether analyst forecast dispersion captures risk. Diether et al. (2002) find an inverse relation between forecast dispersion and subsequent stock returns, suggesting that dispersion does not proxy for risk. In contrast Johnson (2004) finds that this inverse relation is related to risky debt and concludes that dispersion proxies for unpriced information risk arising when asset values are unobservable. Zhang (2006) finds that the relation between dispersion and subsequent returns is negative following bad news and positive following good news. The bad news case dominates the good news one, resulting in an inverse relation as observed in Diether et al. (2002). However, the opposite results between good and bad news suggest that subsequent returns are a result of a delayed cash flow effect (good or bad news announced earlier), not an ex ante cost of capital effect. Information uncertainty simply slows the absorption of new information into the stock prices. In contrast, this paper focuses on the cost of capital channel. Standard finance theory suggests that stock price is equivalent to discounted future cash flows. When the discount rate increases due to an increase in information uncertainty after an acquisition, stock price should fall, suggesting a negative correlation between changes in information uncertainty and contemporaneous stock returns.

Some prior studies (e.g., Louis 2004) exclude financial firms from their sample. We include financial firms because we do not have a strong reason to exclude them in our research design. Louis (2004) excludes financial firms because accruals do not apply to financial firms. We do not have this issue as we focus on analyst forecast dispersion. We conduct a robustness check by excluding financial firms (SIC 6000–6999) and find similar results.

The rationale of including the target’s forecast characteristics is that the combined company has more complex business fundamentals than two separate entities due to the integration issues. An alternative approach is to focus on the acquirer only. As a robustness check, we define DISP based on the acquirers’ data only and find very similar results (not tabulated).

Weighting by outstanding shares transforms EPS into total earnings. That is true because EPS between the acquirer and target are not additive. To illustrate this point, consider the situation when the target does not exist (T_shares=0). Equation 1 then simplifies into DISP = A_stdev/A_price, which is equivalent to the standard definition of analyst forecast dispersion scaled by price in the literature. As a robustness check, we define DISP as the market value-weighted average of dispersion between the acquirer and target. The results are again very similar. For example, for models 1-2 in Table 4, the coefficients on ΔDISP are −0.381 (t = −4.77) and −0.413 (t = −3.21) under this alternative specification.

Our results are robust to the following alternative specifications: (1) The uncertainty value in year t+1 minus the value in year t−1 and (2) the uncertainty value in year t+2 minus the value in year t−1.

Our return window choice is somewhat arbitrary. We adopt the three-year return window as our main focus and the five-year window as a robustness check because the literature on M&A shows that the acquirer typically underperforms in the three-year (e.g., Rau and Vermaelen 1998; Mitchell and Stafford 2000) or five-year window after the acquisition (−.g., Agrawal et al. 1992; Loughran and Vijh 1997). Also, it often takes several years for a firm to fully digest and integrate major acquisitions. To ensure that the results are not sensitive to the choice of the three-year return window, we do robustness checks with different windows such as 1 or 2 years, and the results are similar.

The distribution of DISP t+2 is similar to that of DISP t+1. Thus, it is omitted from the table.

The results are robust if we use the actual values of ΔDISP. For example, the coefficient on ΔDISP is −8.81 (t = −5.19) for Model (1) in Table 4 when we use the actual values of ΔDISP.

To address the omitted variable problem, we consider the following additional fundamental variables in robustness checks: net profit margin (net income scaled by beginning total assets), operating margin (earnings before interest, tax, depreciation, and amortization expense scaled by beginning total assets), cash flows (cash flows from operations scaled by beginning total assets), and asset turnover (sales over beginning total assets). We consider both the level and change of the above fundamental variables and find that the tenor of the paper is unchanged.

As a robustness check, we measure ΔROE, ΔSGR, and ΔGROWTH based on the acquirer only in the pre-acquisition period. The results (not tabulated) are similar.

Because we include a number of fundamental variables, which are likely to be correlated to each other, there is a potential collinearity problem among these variables. Collinearity may render the coefficients on some fundamental variables insignificant or even negative, but it should not affect the coefficient on our main variable of interests (ΔDISP).

There appears to be a downward trend in DISP over our sample period (Panel B of Table 3). The drop in DISP might be caused by the decline in the number of analysts over time. To address the possibility that changes in DISP are due to changes in analyst coverage, we add changes in analyst coverage in the regression as an additional control variable and find the results are virtually unchanged. For example, the coefficient on ΔDISP is −0.390 (t = −5.09) when we add changes in analyst coverage as an additional control variable, compared to −0.392 (t = −5.13) in model (1) of Table 4.

After the acquirer integrates the target into its business operations, analysts and investors will gradually learn the combined business. As a result, uncertainty should eventually decrease, suggesting higher stock returns after time elapses. Empirically, it is difficult to identify the period in which the uncertainty from the acquisition decreases because the post-acquisition resolution of uncertainty does not occur in a predictable manner. As a result, stock returns do not uniformly increase at a pre-specified point of time (e.g., 3 years after acquisition).

Untabulated results show that the variance inflation factors are below 2 for both COVERED and DEAL/MV, suggesting that multicollinearity is not an issue.

The statistical significance on CASH is lower than that in Oler (2008) because we have numerous ex post fundamental variables in the regression. Oler (2008) shows that high-cash acquirers tend to have lower future profitability in the post-acquisition period. Controlling for future profitability in our tests naturally reduces the power of CASH in our return regressions. In untabulated analysis, consistent with Oler (2008), we find that the coefficient on CASH is significantly negative (coeff = −0.695, t = −2.33) once we exclude ex post variables from Model (1) of Table 4. The reported CASH results are similar (coeff = −0.250, t = −2.15) if we use a dummy variable version of CASH, which takes the value of 1 for top 20% CASH level acquirers and 0 otherwise.

We choose to control for ΔROE in the portfolio analysis because the coefficient on ΔROE is highly significant in Table 4 and ΔROE is available for most observations. The results are similar if we control for FE t+2, FE t+3, or other fundamentals in the portfolio analysis.

We find similar results using 4-digit SIC industry codes.

Because post-acquisition underperformance is typically documented using the three- or five-year return window, for comparability we do not use a post-acquisition period longer than 5 years.

References

Abarbanell, J., Lanen, W., & Verrecchia, R. (1995). Analysts’ forecasts as proxies for investor beliefs in empirical research. Journal of Accounting and Economics, 20, 31–60.

Agrawal, A., Jaffe, J., & Mandelker, G. (1992). The post-merger performance of acquiring firms: A re-examination of an anomaly. Journal of Finance, 47, 1605–1621.

Barron, O., Kim, O., Lim, S., & Stevens, D. (1998). Using analysts’ forecasts to measure properties of analysts’ information environment. The Accounting Review, 73, 421–433.

Barron, Orie., & Stuerke, Pamela. (1998). Dispersion in analyst’s earnings forecasts as a measure of uncertainty. Journal of Accounting, Auditing, and Finance, 13, 243–268.

Barry, C., & Brown, S. (1985). Differential information and security market equilibrium. Journal of Financial and Quantitative Analysis, 20, 407–422.

Barry, C., & Jennings, R. (1992). Information and diversity of analyst opinion. Journal of Financial and Quantitative Analysis, 27, 169–183.

Berger, P., & Ofek, E. (1995). Diversification’s effect on firm value. Journal of Financial Economics, 37, 39–65.

Bergstresser, D., Desai, M., & Rauh, J. (2006). Earnings manipulation, pension assumptions, and managerial investment decisions. Quarterly Journal of Economics, 121, 157–195.

Botosan, C., Plumlee, M., & Xie, Y. (2004). The role of information precision in determining the cost of equity capital. Review of Accounting Studies, 9, 233–259.

Carhart, M. (1997). On persistence in mutual fund performance. Journal of Finance, 52, 57–82.

Devos, E., Kadapakkam, P., & Krishnamurthy, S. (2009). How do mergers create value? A comparison of taxes, market power, and efficiency improvements as explanations for synergies. Review of Financial Studies, 22, 1179–1211.

Diamond, D. W., & Verrecchia, R. E. (1991). Disclosure, liquidity, and the cost of capital. The Journal of Finance, 46(4), 1325–1359.

Diether, K. B., Malloy, C. J., & Scherbina, A. (2002). Difference of opinion and the cross section of stock returns. The Journal of Finance, 57, 2113–2141.

Easley, D., & O’Hara, M. (2004). Information and the cost of capital. The Journal of Finance, 59(4), 1553–1583.

Fama, E., & French, K. (1996). Multifactor explanations of asset pricing anomalies. Journal of Finance, 51, 55–84.

Frankel, R., & Lee, C. (1998). Accounting valuation, market expectation, and cross-sectional stock returns. Journal of Accounting and Economics, 25, 283–319.

Gilson, S., Healy, P., Noe, C., & Palepu, K. (2001). Analyst specialization and conglomerate stock breakups. Journal of Accounting Research, 39(3), 565–582.

Givoly, D., & Lakonishok, J. (1984). Properties of analysts’ forecasts of earnings: A review and analysis of the research. Journal of Accounting Literature, 3, 117–152.

Harford, J., & Li, K. (2007). Decoupling CEO wealth and firm performance: The case of acquiring CEOs. Journal of Finance, 62, 917–949.

Healy, P., Palepu, K. G., & Ruback, R. (1992). Does corporate performance improve after mergers? Journal of Financial Economics, 31, 135–175.

Imhoff, E., & Lobo, G. (1992). The effect of ex ante earnings uncertainty on earnings response coefficients. The Accounting Review, 67, 427–439.

Jensen, M. C. (1986). Agency costs of free cash flow, corporate finance, and takeovers. The American Economic Review, 76(2), 323–329.

Jensen, M. C., & Ruback, R. S. (1983). The market for corporate control: The scientific evidence. Journal of Financial Economics, 11, 5–50.

Kaplan, S., & Weisbach, M. (1992). The success of acquisitions: Evidence from divestures. Journal of Finance, 57, 107–138.

Krishnaswami, S., & Subramaniam, V. (1999). Information asymmetry, valuation, and the corporate spin-off decision. Journal of Financial Economics, 53, 73–112.

Lambert, R., Leuz, C., & Verrecchia, R. E. (2009). Information asymmetry, information precision, and the cost of capital. SSRN eLibrary.

Lang, L., & Stulz, R. (1994). Tobin’s q, corporate diversification, and firm performance. Journal of Political Economy, 102, 1248–1280.

Lewellen, W. G. (1971). A pure financial rationale for the conglomerate merger. The Journal of Finance, 26(2), 521–537.

Loughran, T., & Vijh, A. (1997). Do long-term shareholders benefit from corporate acquisitions? Journal of Finance, 52, 1765–1790.

Louis, H. (2004). Earnings management and the market performance of acquiring firms. Journal of Financial Economics, 74, 121–148.

Merton, R. C. (1987). A simple model of capital market equilibrium with incomplete information. The Journal of Finance, 42(3), 483–510.

Miller, E. M. (1977). Risk, uncertainty, and divergence of opinion. Journal of Finance, 32, 1151–1168.

Mitchell, M., & Stafford, E. (2000). Managerial decisions and long-term stock price performance. Journal of Business, 73(3), 287–329.

Moeller, S., Schlingemann, F., & Stulz, R. (2005). Wealth destruction on a massive scale: A study of acquiring firm returns in the merger wave of the late 1990’s. Journal of Finance, 60, 757–782.

Moeller, S., Schlingemann, F., & Stulz, R. (2007). How do diversity of opinion and information asymmetry affect acquirer returns? The Review of Financial Studies, 20, 2047–2078.

Mueller, D. C. (1969). A theory of conglomerate mergers. The Quarterly Journal of Economics, 83(4), 643–659.

Oler, D. (2008). Does acquirer cash level predict post-acquisition returns? Review of Accounting Studies, 13(4), 479–511.

Rau, R., & Vermaelen, T. (1998). Glamour, value and the post-acquisition performance of acquiring firms. Journal of Financial Economics, 49, 223–253.

Ravenscraft, D., & Scherer, F. (1987). Life after takeover. Journal of Industrial Economics, 36, 147–156.

Roll, R. (1986). The hubris hypothesis of corporate takeovers. Journal of Business, 59, 197–216.

Schoar, A. (2002). Effects on corporate diversification on firm productivity. Journal of Finance, 57, 2379–2403.

Scott, J. H., Jr. (1977). On the theory of conglomerate mergers. The Journal of Finance, 32(4), 1235–1250.

Shleifer, A., & Vishny, R. W. (2003). Stock market driven acquisitions. Journal of Financial Economics, 70(3), 295–311.

Verrecchia, R. (2001). Essays on disclosure. Journal of Accounting and Economics, 32, 97–180.

Wang, J. (1993). A model of intertemporal asset prices under asymmetric information. The Review of Economic Studies, 60(2), 249–282.

Zhang, X. F. (2006). Information uncertainty and stock returns. Journal of Finance, 61(1), 105–137.

Acknowledgments

We received many helpful comments from Xia Chen, Henock Louis, Shane Heitzman, Jake Thomas, and seminar participants at Fudan University and Yale University. We also thank Thomson Financial Services for the I/B/E/S data provided as part of a broad academic program to encourage earnings expectation research.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Erickson, M., Wang, SW. & Zhang, X.F. The change in information uncertainty and acquirer wealth losses. Rev Account Stud 17, 913–943 (2012). https://doi.org/10.1007/s11142-012-9184-9

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11142-012-9184-9