Abstract

We explored the mechanisms of, and relationships between, modern Chinese urbanization and industrial upgrading. To these ends, we used a panel-data, vector autoregression model, a coupling, co-ordination degree model, and a panel threshold model incorporating data from 2003 to 2017. The empirical results suggest that modern urbanization and industrial upgrading are bidirectional in nature, and that the effect of the latter is greater than that of the former. Although the extent of coupling co-ordination has increased annually, significant spatial differences are apparent. The interrelationship between urbanization and industrial structure is complicated, being affected by regional economic levels, material and human capital, market environments, technological progress, foreign direct investment, financial support, and the extent of openness. All factors exhibited threshold effects. Our findings shed new light on the co-ordinated development of modern urbanization and industrial upgrading, and have implications for China’s economic development in the new normality.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Historically, urbanization is closely linked to industrial upgrading (Moir 1976). Urbanization is the objective result of human social development, and industrial upgrading is an inevitable requirement of socioeconomic development. In fact, industrial upgrading promotes urbanization which, in turn, facilitates further upgrading (Wu and Shen 2013). As countries develop, people move from rural/agricultural areas to urban centers, where they work in manufacturing and service industries exhibiting high productivity growth and agglomeration effects; changes in the consumption structure of urban residents, in turn, adjusts the industrial structure (Glaeser et al. 1992; Duranton 2008; Glaeser and Gottlieb 2009). Therefore, how to match the industrial structure coordinated with urbanization is the key to promote economic growth. China is no exception to this rule.

China’s macroeconomic policy framework has been determined to ensure steady growth, adjust the industrial structure, and advance the socioeconomic reforms in recent years, and urbanization is supposed to be one of the most important socioeconomic reform directions (Bertinelli and Black 2004; Zhang et al. 2014). The National Bureau of Statistics reports that investment-driven, export-led, low-cost manufacturing support has rapidly increased urbanization from 17.92% in 1978–59.58% in 2018 (average annual growth 4.08%). However, it has caused a series of social and economic problems, such as energy consumption, environmental pollution, low urban service level, and large numbers of peasants whose land has been expropriated (Sun et al. 2016). This is mainly due to the important factors such as urban functions have not been fully considered in the process of urbanization in China (Wang et al. 2012). Against this background, China’s modern urbanization development concept has emerged, and it not only pays attention to the scale of urban, but also focuses on the improvement of urbanization quality. Also, urbanization often lacks matching industries (Gollin et al. 2016). The proportions of primary, secondary and tertiary industries in China were 27.69, 47.71, and 24.60% in 1978 but 7.20, 40.70, and 52.20% in 2018. However, high-end services such as information technology and finance remain poorer than those of developed countries. Also, the industrial, production value structure and employment are imbalanced. China’s transformation has entered a critical stage.

At present, urbanization and industrial upgrading are poorly co-ordinated, and both under- and over-urbanization widespread. Nevertheless, studies on the influential factors and mechanisms between China’s urbanization and industrial structure are absent in large parts of previous research, and one-dimensional indicators are often used to explore the relationship between urbanization and single industries. Urban functionality and industrial comprehensiveness are ignored. Country level data are used for empirical research, resulting in a lack of comparison of provincial differences. No consensus on the relationship between modern urbanization and industrial upgrading has emerged; the two are even completely separated on occasion. This prohibits interactive co-ordinated development of urbanization and industrial upgrading and the formulation of relevant policies.

The aim of this paper is to explore the mechanisms of, and relationships between, modern urbanization and industrial upgrading; is the latter a one- or two-way process? Which one influences the other? Which one has more influence? Is development matched to urbanization? What factors affect this relationship? How do the factors act? We use a panel-data vector autoregression (VAR) model, a coupling, co-ordination degree model, and a panel threshold model to evaluate panel data from 30 Chinese provinces. Our key contributions are: We first build indicators of modern urbanization (MU) using population, economic, spatial, environmental, societal, and urban–rural co-ordination data. We construct indicators of industrial upgrading from the perspectives of rationalization and sophistication. This breaks through the disadvantage of traditional single index and is more in line with the needs of realistic development. Second, we employ panel data collected from 2003 to 2017 in 30 Chinese provinces; these reflect the regional characteristics of the relationship between MU and industrial upgrading. The factors in play vary regionally. This overcomes the shortcomings of using country level data. Third, after identifying the interrelationships, we explore the mechanisms in play and factors influencing such mechanisms, which are relatively lacking in the existing research, and this study is going to fill in this gap. The urbanization patterns of many developing countries differ from those of developed countries; a study thereof may shed light on China’s unique situation. What economic laws control co-ordinated development? We create effective policy recommendations for those who must ensure that MU and industrial upgrading interact well. We seek to relieve unemployment, avoid overcapacity, and ensure stable economic growth.

2 Literature review

Urbanization and industrial upgrading are two major themes of economic development; their interrelationship has attracted a great deal of scholarly attention from three principal perspectives.

Scholars disagree on the one-way impacts of urbanization on industrial upgrading. Most scholars believe that urbanization promotes such upgrading. First, urbanization accelerates specialization and industrial agglomeration, providing labor and capital and enhancing regional productivity (Alkay and Hewings 2012; Ian 2013; Wei and Hu 2017; Li et al. 2019). The ensuing technological innovations synergistically enhance emerging service and other industries (Michaels et al. 2012; Barufi et al. 2016; Li and Hu 2016). Enhanced accessibility and lower transportation costs increase the extent and regional distribution of the economic benefits (Holmgren and Merkel 2017). Urban infrastructure is excellent. Information moves rapidly and transportation is convenient, promoting the free flow of resources and inter-industry cooperation, reducing transaction costs, and creating a market demand for industrial upgrading (Zhao and Xu 2015; Wetwitoo and Kato 2017; Wu 2017; Sun and Cui 2018; Wang and Hu 2018). The demonstration and bandwagon effects of consumption cause residents to change their lifestyles and consumption patterns, also enhancing industrial upgrading (Hong and Cheng 2016; Zhang and Wang 2016; Wang et al. 2017). However, most developing countries are at the bottom of the global industrial chain, and it is too easy to develop an economic development model centered on traditional manufacturing. This retards the development of new industries and inhibits innovation. A few scholars believe that urbanization hinders industrial upgrading (Hope 1998; Farhana et al. 2012). As a developing country, China’s current market is imperfect and it is difficult to allocate resources effectively. Also, policy barriers to migration exist, of which the household registration system is the most important. Thus, urbanization and industrial upgrading are not synchronized (Yang and Jiang 2013; Zheng and Wei 2013; Chen and Kohlhase 2017; Fan 2019).

Most scholars believe that industrial upgrading promotes urbanization; millions move from the country to cities in a search of better living conditions and development opportunities. The impacts of primary, secondary, and tertiary industries on urbanization differ (Henderson 2010; Li and Wang 2016). Agricultural modernization originally drove urbanization, but industry then took over because the associated agglomeration rapidly changed the employment profile. Modern service industries injected new vitality, thus sustaining urbanization (Phelps and Ozawa 2003; Davis and Henderson 2004). Successful cities are the economic, technical, cultural, and commercial centers of any country. Urbanization is driven by the development of tertiary industries requiring high-level technologies (Huang and Qiu 2017; Lu et al. 2018). The effects of industrial upgrading on urbanization differ between developed and developing countries. Developed countries promote urbanization by fostering service industries that improve urban function and service quality. Developing countries use industrialization to drive urbanization; the numbers and sizes of cities increase (Black and Henderson 2003). In China, the urban village phenomenon of socio-spatial segregation is rooted in a deeply institutionalized, urban–rural administrative dualism (Liu et al. 2010; Wu et al. 2013; Wong et al. 2018). Spatially, China’s economic structure is extremely uncoordinated. The eastern coastal areas (where industries are concentrated) fully enjoy the spillover effects of the specialized division of labor. In western China, the industrial clusters are weak and the capacity of cities to absorb more people poor. Therefore, increased urbanization caused by industrial upgrading is much less significant in the west than in the center and east (He and Wu 2016).

In European and Neo-European countries that have undergone significant urbanization (to over 50%) such urbanization accompanied industrialization; the factories came to the cities (Mori 2017; Schafran et al. 2018). Spatial co-ordination of industrial agglomerations greatly affects city size (Murakami 2015). However, many developing countries exhibit high rates of urbanization but little industry. In China, most cities have weak industrial foundations and lack of supporting functions for industrial development (Wang 2014). Affected by factors such as brain drain, low ratio of land utility, and new mother town with insufficient interaction, urbanization and industrial upgrading are not yet interdependent (Shen 2013; Guo et al. 2018; Yuan and Wang 2019). Towns of different sizes focus on diverse forms of industrial development.

In previous studies, one-dimensional indicators are often used to explore the relationship between urbanization and single industries, which could hardly reflect their comprehensiveness. We build indicators of modern urbanization (MU) using population, economic, spatial, environmental, societal, and urban–rural co-ordination data, and construct indicators of industrial upgrading from the perspectives of rationalization and sophistication, which are more in line with the needs of realistic development. When studying the relationship between China’s urbanization and industrial upgrading, it is too macro to use country level data for empirical research. We employ panel data collected from 2003 to 2017 in 30 Chinese provinces, which can reflect the provincial differences. In addition, previous studies focus on the relationship between urbanization and industrial upgrading, we further identify the mechanisms in play and the relevant factors.

3 Data sources and variables

Research of this paper is not straightforward, as data is not always readily available, especially there is the problem of missing data existing in some provinces. Therefore, we collected high-quality data on 30 Chinese provinces from 2003 to 2017 from the website of the National Bureau of Statistics of China.

3.1 Modern urbanization (MU)

When studying MU, we considered population, economic, spatial, environmental, and societal data; and urban–rural co-ordination. We also evaluated city size, construction quality, and services; we did not use traditional single indicators such as population or land-use data. We entropy-weightedFootnote 1 each indicator to minimize errors caused by subjective factors (Lan and Chen 2013; Cui et al. 2018). See Table 1.

3.2 Industrial upgrading (IU)

IU embraces industrial rationalization and sophistication. We measured rationalization using the Theil indexFootnote 2 that considers both industrial weight and the relationship between the output value and employment structures. Industrial sophistication is the ratio of the values added by tertiary and secondary industries. The larger the ratio, the more developed the tertiary industry and the higher the industrial structure; the more backward the tertiary industry profile, the lower the industrial structure (Sun and Fang 2015; Che et al. 2019). See Table 1.

3.3 Other factors

We included the regional economic level (REL), material capital (MC), the market environment (ME), human capital (HC), technological progress (TP), foreign direct investment (FDI), financial support (FS) and the degree of openness (DO). Regional economic level is the regional per-capita GDP; material capital: the investment in social fixed assets; market environment: the ratio of the number of employees in state-owned enterprises to the total number of employees; human capital the average educational attainment (number of people with primary education × 6 + number of people with junior high school education × 9 + number of people with high school education × 12 + number of people with college degree or above × 16)/total population); technological progress: the number of grants obtained from regional patent applications; foreign direct investment: the ratio of foreign capital that is in fact used to contribute to regional GDP; financial support: the GDP of the regional financial industry; and the degree of openness: the ratio of total regional foreign trade to regional GDP (Halvorsen 2012; Ge and Zhang 2018; Wu and Zhao 2019). These data allow of empirical analysis.

4 Modeling

4.1 The panel VAR model

We use the panel VAR model of Love and Ziccino (2006) to explore the long-term interaction between MU and industrial upgrading. All variables are endogenous and provincial heterogeneity is considered. The first-order model is:

where Xit is a vector featuring two endogenous variables (MU and industrial upgrading), fi a fixed effect, and dp,t a province-specific time dummy. When applying the VAR to panel data, the underlying structure of all cross-sectional units must be identical. In practical terms, we allow “individual heterogeneity” by introducing fixed effects (fi). The conventional mean-difference approach to removal of fixed effects biases the coefficients; we use the Helmert transformation to overcome this problem (Zirek et al. 2016). Homoscedasticity is preserved and no serial correlation is induced. The system can be estimated using a general mixed model (Arellano and Bover 1995; Boubtane et al. 2013). Next, impulse response functions (IRFs) and variance decompositions are computed. IRFs describe the temporal responses of endogenous variables to shocks of other variables; variance decompositions measure the contributions of each shock to the forecast error variance of each endogenous variable. The standard errors of the IRFs and the confidence intervals are generated via 1000 Monte Carlo simulations. We use Cholesky decomposition to compute the IRFs; the more exogenous variables are ordered early in the VAR because earlier series impact the other variables contemporaneously but later series impact earlier variables only after a lag.

4.2 The coupling co-ordination degree model

We use the coupling co-ordination degree model to explore whether MU matches industrial upgrading; the model exploits the capacitive coupling coefficient of physics and has been increasingly applied to urban studies (Li et al. 2012; Guo et al. 2015; You 2016). The formulae are:

where D is the extent of coupling co-ordination (D ∈ [0,1]) (Gao et al. 2013). The closer the value to 1, the better the co-ordination. C is the extent of coupling; C ∈ [0,1]. When C is 0, the coupling of MU and IU is extremely low. When C is 1, the coupling of MU and IU is maximal (benign); MU and IU form a new ordered structure via interaction. T is the overall level of MU and IU and α and β the relative contributions. Here, MU and IU are equally important; α = β = 0.5 (Tang 2015).

4.3 Panel threshold model

Some scholars have reported non-linear relationships between MU and industrial upgrading (Xie and Liu 2018a, b). We use threshold variables to investigate whether the relationships differ among samples grouped by different thresholds and employ the panel threshold regression method of Hansen (1999) to search for multiple regimes. This model does not require any specified functional form of non-linearity; threshold numbers and locations are endogenously determined. Also, asymptotic theory can be used to construct appropriate confidence intervals. A bootstrap method is used to assess the statistical significance of the threshold effect; it is also possible to test the null hypothesis of a linear formulation rather than a threshold alternative (Chang et al. 2010). After allowing for fixed individual effects, the panel threshold model divides all observations into two or more regimes above and below the threshold level. The structural equation is:

where yit is a dependent variable, xit an explanatory variable, qit the threshold variable, and I(·) an indicator function. An alternative (intuitive) formulation of (5) is:

The observations are divided into two regimes, depending on whether the threshold variable qit is smaller or larger than the threshold γ. The regimes are distinguished by different regression slopes, β1 and β2. Sometimes, there may be multiple thresholds. Similar procedures can be extended in a straightforward manner to higher-order threshold models. This affords an advantage compared to the traditional approach, which allows of only a single threshold. For example, a double-threshold model is:

where γ1< γ2 (Hansen 2000).

5 Empirical results

5.1 The panel VAR model

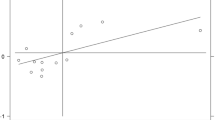

Because panel data were used, non-stationarity might be a problem, so panel unit root tests were performed. The results indicated that we should reject the null hypothesis that all panels contained a unit root (Table 2). We used Fisher-type test to verify the stationarity of the data, nevertheless, for comparison and as a robustness check, we made calculations based on both Levin-Lin-Chu test and Hadri LM test. The model lag length was set to 1, as suggested by the tests (Table 3). The Granger causality test indicated two-way causality between MU and IU at a significance level of 1% (Table 4). To check whether changes in one variable explained changes in other variables, we performed variance decomposition; does shocking of one variable explain fluctuations in other variables? Table 5 shows the variance decomposition analysis. Most MU and IU variances are attributable to their own shocks; the explanations exceed 68.5%. The contributions of own-shocks to forecast error decrease over time. The effect of IU on MU is stronger than the effect of MU on IU. Therefore, when developing the Chinese market economy, industrial upgrading should be prioritized. Figure 1 graphs the impulse-response functions and the 5% error bands generated via Monte Carlo simulations. Impulse responses show the effects of changes in one variable on changes in other variables. The effects are plausible. Similar to the above findings, the own-effects of MU and IU were the greatest; the impact period is about 20 years.

5.2 Coupling coordination degree model

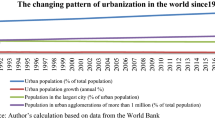

To reflect the extent of coupling co-ordination clearly between MU and IU, we use the uniformly distributed function method to define the interval and extent of coupling co-ordination (Table 6). Our comprehensive evaluation of MU and IU data and the extent of coupling co-ordination between the two systems are shown in Table 7 (the latest data are from 2017). We show that 0.443 ≤ D ≤ 0.611; the coupling co-ordination between MU and IU thus lies on the border between imbalance and primary coordination. Beijing exhibits primary co-ordination, Shanghai to Hubei little co-ordination, and Chongqing to Ningxia near-imbalances. By the different MU and IU, each level of coupling co-ordination can be further divided into three types: Type 1: MU < IU; lagged MU (Beijing, Shanghai, Heilongjiang, Hainan, Liaoning, and Jilin); Type 2: MU = IU; synchronous development of MU and industrial upgrading; Type 3: MU > IU, lagged industrial upgrading (Jiangsu, Guangdong, Zhenjiang, and 21 other provinces). High-level industrial upgrading is associated with high coupling co-ordination between MU and IU, but most provinces lack industrial support for MU. As shown by the panel VAR model, industrial upgrading should be prioritized. We use the average annual coupling co-ordination of the 30 provinces to derive an annual figure (Fig. 2). This increases over the years, from 0.378 in 2003 to 0.509 in 2017.

5.3 Panel threshold model

5.3.1 IU as the dependent and MU as the independent variable

The threshold results are shown in Table 8. REL, MF, and TP exhibited double-threshold effects; ME, HC, FDI and FS single-threshold effects; and DO no threshold effect; we subjected the data to regression analysis (Table 9). In general, MU promoted industrial upgrading. When REL was either low or high, MU markedly promoted IU. When REL was medium, MU still promoted IU, but less so. During regional economic development, MU strongly promoted IU initially, then less so, then strongly once more. This reflects the “middle-income trap”. At the macro level, MU and the regional economy are significantly (positively) correlated. During early economic development, many rural residents moved to small towns. In 1990, China began to strictly control movement to large cities. Recently, China has continued to support urbanization but regional imbalances have emerged, with marked effects on industrial upgrading. The thresholds show that Beijing, Shanghai, Tianjin, and Jiangsu exhibit high levels of economic development; Zhejiang, Fujian, and Guangdong medium levels; and the remaining provinces low levels. The latter provinces must urgently transition to higher economic growth.

When MF is low, MU positively affects IU with a regression coefficient of 0.219. When MF is medium, MU still promotes IU, but the regression coefficient falls to 0.078. When MF is high, MU greatly hinders IU development; the regression coefficient is significantly negative at the 1% level. Thus, as market vitality weakens, the impact of MU on industrial upgrading changes from positive to negative. The proportions of employees in state-owned enterprises of Xinjiang, Beijing, Shanxi, Heilongjiang, Inner Mongolia, and Liaoning were medium and the proportions in the remaining provinces low. All regions, especially the former provinces, should diversify employment; this would enhance market vitality.

When TP is low, MU has no significant effect on IU. As technological innovation improves, the positive effect gradually increases from 0.137 at an intermediate stage to 0.244 at a higher stage; agglomeration triggered by modern urbanization improves innovative capacity and, thus, industrial upgrading. In terms of the thresholds, Guangdong, Jiangsu, Zhejiang, Beijing, Shandong, Fujian, Shanghai, Sichuan and Anhui exhibit high levels but the remaining provinces (especially Ningxia, Qinghai, and Hainan) low levels; the latter provinces must increase financial support for technological research and development and urgently enhance their innovative capabilities.

When ME, HC, and FS do not attain their thresholds, MU does not greatly promote IU; when the thresholds are exceeded, promotion increases. In areas with higher ME, HC, and FS values, MU more obviously promotes industrial upgrading. The ME values of Hainan, Ningxia, and Qinghai are below the thresholds. With the exceptions of Beijing and Shanghai, the HC values are all below the thresholds. The FS values of Anhui, Hunan, Shanxi, Shanxi, Guangxi, Yunnan, Jiangxi, Inner Mongolia, Heilongjiang, Guizhou, Xinjiang, Gansu, Ningxia, Qinghai, and Hainan are below the thresholds. These provinces must invest more in education, enhance human capital, and improve financial systems. In regions with lower FDI values, the promotion effect of MU on IU is 0.205. In regions with higher values, the figure is 0.104. The effect of MU on industrial upgrading is thus both diminishing and marginal. In terms of threshold, Tianjin exhibits a higher FDI. Therefore, it is necessary to both diversify foreign capital utilization and seek national (Chinese) capital.

5.3.2 MU as the dependent and IU as the independent variable

The threshold effects of the variables are shown in Table 10. ME, HC, TP, and FS exhibit double- threshold effects, REL and MF single-threshold effects, and FDI and DO no effects. On regression analysis (Table 11), industrial upgrading generally fosters MU. When REL, ME, HC, and TP do not attain their thresholds, the pull effect of IU on MU is smaller, increasing when the thresholds are exceeded. When MF does not attain its threshold, the pull effect is relatively large, becoming less when the threshold is exceeded. The explanation is the same as that given above. Notably, when FS increases, the pull effect also increases. Thus, tertiary services and financial industries significantly promote MU, not only providing the necessary financial support for construction but also improving capital allocation efficiency and financial agglomeration effects; the role played by industrialization is weaker.

6 Conclusion and discussion

We analyze the relationship between Chinese MU and industrial upgrading using a panel VAR model, a coupling co-ordination model, and a panel threshold model; we input data collected in 30 provinces from 2003 to 2017. We derive strong evidence of a bidirectional relationship, but the effect of industrial upgrading is the greater. Overall coupling co-ordination increases annually, but there are large differences between regions. Provinces with high-level industrial upgrading exhibit high-level coupling co-ordination. Industrial upgrading should be prioritized. The relationship between urbanization and industrial structure in developing countries is complicated, being affected by regional economic level, material capital, the market environment, human capital, technological progress, foreign direct investment, financial support, and the extent of openness. These have implications for policies relating to China’s economic development in the new normal.

China also needs to continue its efforts in many aspects. Firstly, when adjusting industrial structure, rationalization and sophistication require equal attention; industries must exploit local comparative advantages and the developmental levels of modern cities, rather than overemphasize the proportion changes of three industries; modern industrial system driven by innovation should be established to enhance China’s position in the global value chain. Secondly, the urban layout must be people-friendly, with careful consideration of resources and environmental carrying capacity, and promote the coordinated development of large, medium, and small cities/towns. Finally, in order to achieve high-quality economic development, the threshold effects of influencing factors should be removed. In terms of economic development, China should actively develop high-tech industries, foster new sources of economic growth, continue to deepen supply-side structural reforms, improve the quality of products and services, and reduce market transaction costs. Also, China should use the Internet platform to develop e-commerce, analyze users’ preferences and purchase intentions based on big data, realize the matching between customers’ purchases and product sales, and promote consumer chain upgrading. In addition, China should give stronger protection to intellectual property rights, expand technical cooperation with foreign companies, and reduce the gap with developed country as soon as possible. Workers must use the digital economy to enhance learning and achieve diversity. Furthermore, the government must enhance market vitality and further optimize the business environment; education requires more investment, human capital must be fostered, and employees must receive on-the-job training to allow them to develop essential high-quality skills. Foreign investment must be used more diversely, the capacity for independent innovation and intellectual property protection improved, and the production-study-research chain enhanced to rapidly connect technological research to industrial upgrading. An inclusive and sustainable rural finance industry is very desirable.

Urbanization in developing and developed countries differ. Developing countries urbanize both by expanding natural resources and via traditional industrialization. Most provinces in China exhibit rapid urbanization, weak industrial upgrading, and a lack of industrial support. The coal resources of Shanxi facilitate resource-led urbanization. Our empirical results will allow of more detailed analyses of urbanization and the inter-provincial spillover effects of urbanization and industrial upgrading.

Notes

Step1: The original data is converted into proper dimensionless (Kuo and Liang 2011). If the expectancy is larger-the-better, then it can be expressed by: X *ij = (xij − mini xij)/(maxi xij − mini xij). If the expectancy is smaller-the-better, then it can be expressed by: X *ij = (maxi xij − xij)/(maxi xij − mini xij). Step 2: The set projection of the factor: Pij, it is a relative frequency, and \(P_{ij} = x_{ij} /\sqrt {\mathop \sum \nolimits_{i = 1}^{m} x_{ij}^{2} }\). Step 3: Entropy: the output entropy of the jth factor according to the information theory is the following equation: \(E_{j} = - k\mathop \sum \nolimits_{i = 1}^{m} P_{ij} { \ln }\left( {P_{ij} } \right)\), where k represents a constant: k = 1/lnm, which guarantees that 0 ≤ Ej ≤ 1. Step 4: Calculate the weight of entropy. The degree of diversification dj of the information provided by the factor j can be defined as following equation, and dj = 1 - Ej. Step 5: Then the weight of entropy of jth factor could be defined as: \(w_{j} = d_{j} /\mathop \sum \nolimits_{j = 1}^{n} d_{j}\) (Chang et al. 2009; Sun 2014).

\(TL = \mathop \sum \nolimits_{k = 1}^{3} (Y_{k} /Y)\ln \left( {\frac{{Y_{k} /L_{k} }}{Y/L}} \right)\), where L represents total employment, Y represents regional GDP, and k represents a specific industry.

References

Alkay, E., Hewings, G.J.D.: The determinants of agglomeration for the manufacturing sector in the Istanbul metropolitan area. Ann. Reg. Sci. 48(1), 225–245 (2012). https://doi.org/10.1007/s00168-010-0370-z

Arellano, M., Bover, O.: Another look at the instrumental variable estimation of error-components models. J. Econ. 68(1), 29–51 (1995). https://doi.org/10.1016/0304-4076(94)01642-d.

Barufi, A.M.B., Haddad, E.A., Nijkamp, P.: Industrial scope of agglomeration economies in Brazil. Ann. Reg. Sci. 56(3), 707–755 (2016). https://doi.org/10.1007/s00168-016-0768-3

Bertinelli, L., Black, D.: Urbanization and growth. J. Urban Econ. 56(1), 80–96 (2004). https://doi.org/10.1016/j.jue.2004.03.003

Black, D., Henderson, V.: Urban evolution in the USA. J. Econ. Geogr. 3, 343–372 (2003). https://doi.org/10.1093/jeg/lbg017

Boubtane, E., Coulibaly, D., Rault, C.: Immigration, growth and unemployment: panel VAR evidence from OECD countries. Work. Pap. 27(4), 399–420 (2013). https://doi.org/10.1111/labr.12017

Chang, C.L., Khamkaew, T., Mcaleer, M.: A panel threshold model of tourism specialization and economic development. Int. J. Intell. Technol. Appl. Stat. 3(2), 159–186 (2010). https://doi.org/10.2139/ssrn.1496324

Chang, Y.C., Chang, K.H., Liaw, C.S.: Innovative reliability allocation using the maximal entropy ordered weighted averaging method. Comput. Ind. Eng. 57(4), 1274–1281 (2009). https://doi.org/10.1016/j.cie.2009.06.007

Che, M.H., Deng, X.L., Chen, B.D.: Rationalization and improvements of industrial structure and economic growth: from the perspective of threshold effect. J. Manag. 32(4), 12–20 (2019). https://doi.org/10.19808/j.cnki.41-1408/f.2019.04.002

Chen, Z., Kohlhase, J.: Guest Editors’ introduction to “urbanization and spatial development of China”. Ann. Reg. Sci. 58(2), 271–274 (2017). https://doi.org/10.1007/s00168-017-0817-6

Cui, H., Jiang, Y., Geng, N.: An empirical study on the impact of new urbanization on the upgrading of forestry industrial structure: based on the state space model. J. Cent. South Univ. For. Technol. 38(8), 129–134 (2018). https://doi.org/10.14067/j.cnki.1673-923x.2018.08.020

Davis, J.C., Henderson, J.V.: Evidence on the political economy of the urbanization process. J. Urban Econ. 53(1), 98–125 (2004). https://doi.org/10.1016/S0094-1190(02)00504-1

Duranton, G.: Viewpoint: from cities to productivity and growth in developing countries. Can. J. Econ./Revue Can. d’Econ. 41(3), 689–736 (2008). https://doi.org/10.2307/25478300

Fan, C.C.: Kam Wing Chan with Fang Chai, Guanghua Wan and Man Wang: urbanization with Chinese characteristics: the Hukou system and migration. J. Hous. Built Environ. 34, 653–655 (2019). https://doi.org/10.1007/s10901-019-09649-z

Farhana, K.M., Rahman, S.A., Rahman, M.: Factors of migration in urban Bangladesh: an empirical study of poor migrants in Rajshahi city. Soc. Sci. Electron. Publ. 9, 105–117 (2012). https://doi.org/10.2139/ssrn.2517201

Gao, N., Ma, Y.F., Li, T.S., Bai, K.: Study on the coordinative development between tourism industry and urbanization based on coupling model: a case study of Xi’an. Tour. Tribune. 28(1), 62–68 (2013). https://doi.org/10.3969/j.issn.1002-5006.2013.01.007

Ge, J.T., Zhang, X.H.: The impact of new urbanization on the upgrading of China’s industrial structure. J. Univ. Jinan. 28(2), 32–38+157–158 (2018). https://doi.org/10.3969/j.issn.1671-3842.2018.02.005

Glaeser, E.L., Gottlieb, J.D.: The wealth of cities: agglomeration economies and spatial equilibrium in the United States. J. Econ. Lit. 47(4), 983–1028 (2009). https://doi.org/10.3386/w14806

Glaeser, E.L., Kallal, H.D., Scheinkman, J.A., Shleifer, A.: Growth in cities. J. Polit. Econ. 100(6), 1126–1152 (1992). https://doi.org/10.1086/261856

Gollin, D., Jedwab, R., Vollrath, D.: Urbanization with and without industrialization. J. Econ. Growth 21(1), 35–70 (2016). https://doi.org/10.1007/s10887-015-9121-4

Guo, X.C., Zhang, X.M., Cheng, G., Wang, Y.: The coordination relationship between new urbanization and industrial structure rationalization in Inner Mongolia. J. Inner Mong. Univ. 49(3), 279–288 (2018). https://doi.org/10.13484/j.nmgdxxbzk.20180309

Guo, Y.T., Wang, H.W., Nijkamp, P., Xu, J.G.: Space-time indicators in interdependent urban-environmental systems: a policy study on the Huai River Basin in China. Habitat Int. 45(2), 135–146 (2015). https://doi.org/10.1016/j.habitatint.2014.06.030

Halvorsen, T.: Size, location and agglomeration of inward foreign direct investment (FDI) in the United States. Reg. Stud. 46(5), 669–682 (2012). https://doi.org/10.1080/00343404.2010.506186

Hansen, B.E.: Sample splitting and threshold estimation. Econometrica 68(3), 575–603 (2000). https://doi.org/10.1111/1468-0262.00124

Hansen, B.E.: Threshold effects in non-dynamic panels: estimation, testing, and inference. J. Econ. 93(2), 345–368 (1999). https://doi.org/10.1016/S0304-4076(99)00025-1

He, J.F., Wu, H.: Do technological innovation and upgrading of industrial structure promote the development of new type urbanization. Modern Econ. Sci. 38(5), 59–68 + 126 (2016). https://doi.org/10.3969/j.issn.1002-2848.2016.05.007

Henderson, J.V.: Cities and development. J. Reg. Sci. 50(1), 515–540 (2010). https://doi.org/10.1111/j.1467-9787.2009.00636.x

Holmgren, J., Merkel, A.: Much ado about nothing? A meta-analysis of the relationship between infrastructure and economic growth. Res. Transp. Econ. 63, 13–26 (2017). https://doi.org/10.1016/j.retrec.2017.05.001

Hong, A., Cheng, C.C.: The study on affecting factors of regional marine industrial structure upgrading. Int. J. Syst. Assur. Eng. Manag. 7(2), 213–219 (2016). https://doi.org/10.1007/s13198-016-0440-4

Hope, K.R.: Urbanization and urban growth in Africa. J. Asian Afr. Stud. 33, 345–358 (1998). https://doi.org/10.1163/156852198X00104

Huang, C., Qiu, D.R.: Study on the interaction between urbanization and manufacture structure upgrade: based on crowd in-out effect. Econ. Theory Bus. Manag. 5, 102–112 (2017). https://doi.org/10.3969/j.issn.1000-596X.2017.05.008

Ian, M.: Kwinana industrial area: agglomeration economies and industrial symbiosis on Western Australia’s Cockburn Sound. Aust. Geogr. 44(4), 383–400 (2013). https://doi.org/10.1080/00049182.2013.852505

Kuo, M.S., Liang, G.S.: Combining VIKOR with GRA techniques to evaluate service quality of airports under fuzzy environment. Expert Syst. Appl. 38(3), 1304–1312 (2011). https://doi.org/10.1016/j.eswa.2010.07.003

Lan, Q.X., Chen, C.F.: Does new-type urbanization promote the upgrading of industrial structure? J. Financ. Econ. 39(12), 57–71 (2013). https://doi.org/10.16538/j.cnki.jfe.2013.12.001

Li, B.L., Hu, X.P.: Urbanization, factor endowments on urban industrial structure upgrade spatial econometric analysis from 345 Chinese Cities. J. Guizhou Univ. Financ. Econ. 3, 10–19 (2016). https://doi.org/10.3969/j.issn.1003-6636.2016.03.002

Li, S.F., Wang, W.C.: Research on the interaction mechanism between industrial structure evolution and new urbanization and its feedback mechanism. Urban Dev. Stud. 23(3), 1–4 (2016). https://doi.org/10.3969/j.issn.1006-3862.2016.03.018

Li, Y.F., Li, Y., Zhou, Y., Shi, Y., Zhu, X.D.: Investigation of a coupling model of coordination between urbanization and the environment. J. Environ. Manag. 98, 127–133 (2012). https://doi.org/10.1016/j.jenvman.2011.12.025

Li, Z., Ding, C., Niu, Y.: Industrial structure and urban agglomeration: evidence from Chinese cities. Ann. Reg. Sci. 63(1), 191–218 (2019). https://doi.org/10.1007/s00168-019-00932-z

Liu, Y.T., He, S.J., Wu, F.L., Webster, C.: Urban villages under China’s rapid urbanization: unregulated assets and transitional neighbourhoods. Habitat Int. 34(2), 135–144 (2010). https://doi.org/10.1016/j.habitatint.2009.08.003

Love, I., Zicchino, L.: Financial development and dynamic investment behavior: evidence from panel VAR. Q. Rev. Econ. Financ. 46(2), 190–210 (2006). https://doi.org/10.1016/j.qref.2005.11.007

Lu, H.L., Liu, G.F., Miao, C.H., Zhang, C.R.: Spatial pattern of residential carbon dioxide emissions in a rapidly urbanizing Chinese city and its mismatch effect. Sustainability 10(3), 1–19 (2018). https://doi.org/10.3390/su10030827

Michaels, G., Rauch, F., Redding, S.J.: Urbanization and structural transformation. Q. J. Econ. 127(2), 535–586 (2012). https://doi.org/10.2139/ssrn.1281691

Moir, H.: Relationships between urbanization levels and the industrial structure of the labor force. Econ. Dev. Cult. Change 25(1), 123–135 (1976). https://doi.org/10.1086/450932

Mori, T.: Evolution of the size and industrial structure of cities in Japan between 1980 and 2010: constant churning and persistent regularity. Asian Dev. Rev. 34(2), 86–113 (2017). https://doi.org/10.1162/adev_a_00096

Murakami, N.: Changes in Japanese industrial structure and urbanization: evidence from prefectural data. J. Asia Pac. Econ. 20(3), 385–403 (2015). https://doi.org/10.1080/13547860.2015.1054166

National Bureau of Statistics of China.: (2018) http://www.stats.gov.cn

Phelps, N.A., Ozawa, N.A.: Contrasts in agglomeration: proto-industrial, industrial and post-industrial forms compared. Prog. Hum. Geogr. 27(5), 583–604 (2003). https://doi.org/10.1191/0309132503ph449oa

Schafran, A., McDonald, C., Morales, E.L., Akyelken, N., Acuto, M.: Replacing the services sector and three-sector theory: urbanization and control as economic sectors. Reg. Stud. 52(12), 1708–1719 (2018). https://doi.org/10.1080/00343404.2018.1464136

Shen, Z.P.: Study on the interactive mechanism and its realization paths to optimize industrial structure and improve the quality of urbanization in China. Urban Dev. Stud. 20(5), 70–75 (2013). https://doi.org/10.3969/j.issn.1006-3862.2013.05.011

Sun, C.C.: Combining grey relation analysis and entropy model for evaluating the operational performance: an empirical study. Qual. Quant. 48(3), 1589–1600 (2014). https://doi.org/10.1007/s11135-013-9854-0

Sun, M.Y., Fang, D.C.: Research on the interaction between urbanization and industrial structure optimization. J. Shandong Inst. Bus. Technol. 29(5), 7–14 (2015). https://doi.org/10.3969/j.issn.1672-5956.2015.05.002

Sun, Y., Cui, Y.: Evaluating the coordinated development of economic, social and environmental benefits of urban public transportation infrastructure: case study of four chinese autonomous municipalities. Transp. Policy 66, 116–126 (2018). https://doi.org/10.1016/j.tranpol.2018.02.006

Sun, Y.F., Xia, Q., Zhou, M.: The economic growth effects of new urbanization development and industrial structure change. J. Quant. Tech. Econ. 33(11), 23–40 (2016). https://doi.org/10.13653/j.cnki.jqte.2016.11.002

Tang, Z.: An integrated approach to evaluating the coupling coordination between tourism and the environment. Tour. Manag. 46, 11–19 (2015). https://doi.org/10.1016/j.tourman.2014.06.001

Wang, F., Hu, L.J.: On the conduction effect of residents’ consumption structure in urbanization and industrial structure optimization. J. Zhongnan Univ. Econ. Law. 6, 33–43 + 159 (2018). https://doi.org/10.3969/j.issn.1003-5230.2018.06.004

Wang, J.F., Liu, X.H., Peng, L., Chen, H.Y., Driskell, L., Zheng, X.Y.: Cities evolution tree and applications to predicting urban growth. Popul. Environ. 33(2–3), 186–201 (2012). https://doi.org/10.1007/s11111-011-0142-4

Wang, L.X.: Economic growth, industrial structure and urbanization: an empirical research based on provincial panel data in China. Collect. Essays Financ. Econ. 4, 3–8 (2014). https://doi.org/10.3969/j.issn.1004-4892.2014.04.001

Wang, X.L., Dong, S.Z., Zhang, L., Zhao, X.C.: Research on the benign interactive development of industrial transformation and upgrading and new urbanization in Heilongjiang province. Macroecon. Manag. S1, 202–203 (2017). https://doi.org/10.19709/j.cnki.11-3199/f.2017.s1.102.

Wei, M., Hu, Z.H.: A review of the research on the coordinated development of urbanization evolution and industrial structure evolution. Inquiry Econ. Issues 8, 178–184 (2017).

Wetwitoo, J., Kato, H.: Inter-regional transportation and economic productivity: a case study of regional agglomeration economies in Japan. Ann. Reg. Sci. 59(2), 321–344 (2017). https://doi.org/10.1007/s00168-017-0833-6

Wong, C., Qiao, M., Zheng, W.: ‘Dispersing, regulating and upgrading’ urban villages in suburban Beijing. Town Plan. Rev. 89(6), 597–621 (2018). https://doi.org/10.3828/tpr.2018.41

Wu, F.L., Zhang, F.Z., Webster, C.: Informality and the development and demolition of urban villages in the Chinese peri-urban area. Urban Stud. 50(10), 1919–1934 (2013). https://doi.org/10.1177/0042098012466600

Wu, F.X., Shen, H.P.: New urbanization, infrastructure spatial spillover and upgrading of regional industrial structure: based on empirical analysis of 16 core cities of the Yangtze River Delta Urban Agglomeration. Financ. Econ. 7, 89–98 (2013). https://doi.org/10.3969/j.issn.1000-8306.2013.07.011

Wu, J.: Household consumption structure, industrial structure and economic growth. Inquiry Econ. Issues. 12, 18–22 + 180 (2017)

Wu, W.S., Zhao, K.: Dynamic interaction between foreign direct investment and the new urbanization in China. J. Hous. Built Environ. 34(4), 1107–1124 (2019). https://doi.org/10.1007/s10901-019-09666-y

Xie, T.T., Liu, J.H.: Financial agglomeration, industrial structure upgrading and new urbanization. Xinjiang State Farms Econ. 11, 52–62 + 71 (2018a)

Yang, L.X., Jiang, Z.M.: Matching and coordination between industrial structure and urbanization and its efficiency analysis. Inquiry Econ. Issues 10, 34–39 (2013). https://doi.org/10.3969/j.issn.1006-2912.2013.10.006

You, H.Y.: Quantifying the coordinated degree of urbanization in Shanghai, China. Qual. Quan. 50(3), 1273–1283 (2016). https://doi.org/10.1007/s11135-015-0204-2

Yuan, D.Q., Wang, F.X.: Study on coupling relationship between quality and speed of urbanization from the point of view of time and space in Shandong Province. Resour. Ind. 21(5), 37–43 (2019). https://doi.org/10.13776/j.cnki.resourcesindustries.20190905.001

Zhang, H.C., Wang, D.: The new type urbanization, the industrial structure adjustment and the rural labor “reemployment”. China Soft Sci. 6, 136–142 (2016). https://doi.org/10.3969/j.issn.1002-9753.2016.06.014

Zhang, Y.J., Liu, Z., Zhang, H., Tan, T.D.: The impact of economic growth, industrial structure and urbanization on carbon emission intensity in China. Nat. Hazards 73(2), 579–595 (2014). https://doi.org/10.1007/s11069-014-1091-x

Zhao, Y.P., Xu, Y.Z.: New urbanization, system changes and household consumption growth. J. Jiangxi Univ. Financ. Econ. 6, 3–13 (2015). https://doi.org/10.13676/j.cnki.cn36-1224/f.2015.06.001

Zheng, Y.G., Wei, L.H.: A research of urbanization process in China based on dual perspectives of industrialization and marketization. Asia-Pac. Econ. Rev. 1, 66–70 (2013). https://doi.org/10.16407/j.cnki.1000-6052.2013.01.005

Zirek, D., Celebi, F., Hassan, M.K.: The Islamic banking and economic growth nexus: a panel VAR analysis for organization of Islamic Cooperation (OIC) Countries. J. Econ. Cooper. Dev. 37(1), 69–100 (2016)

Xie, T.T., Liu, J.H.: Financial agglomeration, industrial structure upgrading and new urbanization. Xinjiang State Farms Econ. 11, 52–62 + T71 (2018b)

Acknowledgements

The research leading to this paper is financially supported by the Fundamental Research Funds for the Central Universities (Grant No. 2019YC20); the Key Project of Beijing Social Science Foundation (Grant No. 17GLA005); and the General Project Fund of the Ministry of Education Humanities and Social Sciences Research (Grant No. 13YJA790106). However, opinions expressed here do not reflect the funding agencies’ view. The authors thank the Editors and anonymous reviewers for their helpful comments and suggestions.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no known competing financial interests or personal relationships that could have appeared to influence the work reported in this paper.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Wang, F., Tian, MH. & Yin, ZH. Modern urbanization and industrial upgrading in China: evidence from panel data. Qual Quant 55, 661–681 (2021). https://doi.org/10.1007/s11135-020-01022-5

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11135-020-01022-5