Abstract

This study contributes to existing literature on the relationship between productivity and innovation through the knowledge spillover effects. To this end, we consider both a theoretical model and an empirical analysis in Russia. The investigation is based upon a dataset composed of 85 Russian regions for the period 2010–2014. In particular, the effect of R&D Spillovers are analysed through the use of spatial econometric techniques. In so doing, we have allowed the productivity of each region to be affected by the productivity of nearby regions. Results show that R&D significantly affects Russian regions productivity and that productivity spillover across regions matter.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

As recognized by economists and policy makers, research and development (R&D) investments are relevant to improve country’s productivity and then its standard of living over time. European Commission also increases attention to R&D activities. An important aspect of R&D activities in terms of policy implications is the diffusion of knowledge spillovers (Griliches 1979). Traditionally, we may distinguish two concepts of spillovers: knowledge versus rent spillovers. Knowledge spillovers derive from the imperfect appropriability of ideas. Indeed, the benefits of new knowledge accrue not only to the innovator, but “spill over” to other regions, thus enriching the pool of ideas upon which subsequent innovations can be based. Rent spillovers originate from the prices of intermediate inputs purchased from other economic agents and not fully adjusted for quality improvements. We consider pure knowledge Spillovers notion in our analysis, because it is not sensitive to price variations.

In this paper, we consider Russia country, which is investing in R&D activities more and more to favor its growth. We do not distinguish between public and private R&D investments. In particular, we apply spatial econometrics methods (Anselin 1988) to evaluate the spillovers effects in Russia regional units. As formulated by Tobler (1970): “Everything is related to every thing else, but near things are more related than distant things”.

Empirical findings show that spatial R&D spillover effects play a significant role for Russian regions’ productivity.

The paper is organized as follows. The literature review is discussed in Sect. 2. In Sect. 3, the theoretical framework is presented. Data used in the analysis are described in Sect. 4. Section 5 illustrates the empirical strategy and results are discussed in Sect. 6. Finally, the last section concludes and evidences some suggestions for further research.

2 Background literature

There are many papers that study innovations in Russia. Papers on national and regional-level innovation policy as well as papers on regional innovation clusters are produced in vast majority by Russian authors. We can see the “burst” of publication activity on innovation policy in 2011 when Strategy for socio-economic development of Russia up to 2020 (Strategy 2020) was launched by The Russian Government (see e.g. Dezhina 2011; Gokhberg and Kuznetsova 2011a, b as examples of such studies). These studies highlight the need for transition to innovation economy in Russia as a prerequisite for economic and technological development. Gokhberg and Kuznetsova (2011a, b) in this aspect state: “… is unlikely that there are any other sustainable strategies for the Russian economy in the long run than the transition to an innovation-based growth model with subsequent requirements for the substantial efficiency improvement in the national S&T infrastructure and overall innovation policies.” (Gokhberg and Kuznetsova 2011a, b, p.). Strong and weak sides of innovation policy in Russia are clearly synthesized in Dezihna (2011). Author highlights good practices of innovation policy in Russia as follows: “1. The Russian government’s commitment to innovation development and ability to mobilize resources for this purpose; 2. Growing financing from the federal budget to support R&D and innovations; 3. Development with the assistance of the government of various types of innovative infrastructure—both financial and technical; 4. Openness of the government to international expertise and best international practices and its willingness to study and adopt them.” (Cited from Dezhina 2011, p. 99). On the other hand key weaknesses of Russian innovation policy are: “1. Low demand for innovation within the country. 2. Low level of industry support for R&D. 3. Top-down approach in all government regulations and in many cases hands-on management. 4. Development institutions barely connected with each other Underdeveloped and incomplete technical regulations. 5. Immature and poorly working technological infrastructure” (cited from Dezhina 2011, p. 99).

Some studies on Russian innovation system show the strong path-dependence from Soviet era (Klochikhin 2012, 2013; Baburin and Zemtsov 2013). In this aspect “Russian innovation system inherited a lot of strong and weak features of the Soviet S&T system.” (see Klochikhin 2012, p.). Baburin and Kuznetsov (2013) in this vein state that: “After the collapse of the USSR, the single innovative space has broken up into a number of isolated and loosely connected centers, concentration in the key centers of the country has increased, the variety of functions has decreased, and a vast and “lifeless” periphery has been formed. These negative processes have not been overcome, despite the economic achievements of the 2000s” (Baburin and Kuznetsov 2013, p.).

On the regional level the main characteristics of Russian innovation system is strong centralisation and weak connections between regions (see e.g.). Key financial, human and infrastructural resources are concentrated in Moscow and Saint-Petersburg, there some big “points of development” (such as Tomsk, Novosibirk, Kazan, Hizhnii Novgorod among others) that are spread across the whole country and “and a vast and “lifeless” periphery” (as noted by Baburin and Zemtsov 2013). Theses authors also note that “For Russia as for the USSR, there is a high concentration of innovative potential in a limited number of centers. Moscow city and Moscow region and the surrounding areas of the Volga-Oka interfluve were, and probably will continue to act as Russia’s largest innovation area.” (Baburin and Zemtsov 2013, p.). Leydersdorf in this aspect notes: “Both KIS (knowledge intensive services, authors’ note) and high-tech manufacturing are heavily centralized in Moscow” (Leydersdorf et al. 2015, p. 1237). Studies on innovation policy highlight the need for measures on decentralization as key prerequisite for successful regional innovation policy (Gokhberg and Kuznetsova 2011a; Golova 2010.)

Within the literature on different aspects regional innovations in Russia we can detect the “stream” of papers on regional innovative clusters/innovative territories (see e.g. Kutsenko 2015; Untura 2013; Abashkin et al. 2012). This is related with the realization of initiatives on innovation clustersFootnote 1 within the framework of Russian innovation policy that actively takes place in early 2010s. Regional innovation clusters are seen as drivers of innovation development in regions. Kutsenko (2015) highlights the necessary conditions for sustainable cluster development: “… the quality of the urban environment, a critical mass of core companies, the dominance of private initiatives, internal competition and openness, and the existence of specialist independent administrative bodies and active working groups.” (Kutsenko 2015, p. 30). Meanwhile the system of regional innovation clusters currently is in process of formation: “… assessment of pilot clusters with the noted conditions showed that they all, to a greater or lesser extent, exhibit clear shortcomings. Therefore, their development strategy and the state support measures require some adjustment.” (as noted in Kutsenko 2015, p. 30).

There some examples of studies on the innovation development in Russia done by non-Russian researchers. These studies highlight that Russia lags behind in terms of innovation system development. E.g. Leydesdorff et al. (2015) state that “… Russian economy is not knowledge based. Synergies in the regions among existing technological and economic structures are disturbed instead of reinforced by medium-tech manufacturing and even more so by high-tech manufacturing” (Leydesdorff et al. 2015, p. 1237). Makkonen (2014) noted that “… for other countries of ECE (Eastern and central Europe—authors’ note) and Russia this kind of development (catching up with the global leaders—authors’ note) is not as evident (Makkonen 2014, p. 48). Table 4 in “Appendix” synthesizes the results of some selected, the most relevant studies on Russian innovation system and innovation policy both on national and regional level.

3 Theoretical framework

This section will offer a plain theoretic background on which our empirical model is built. Its structure is similar to other models in literature (Aldieri and Vinci 2017; Bretschger et al. 2017). We will consider an economy where production may follow two different output techniques; a first (h), with firms investing in R&D for process and product innovation, that combines a variety of technology classes, with physical, human and knowledge capital, and a second one where companies’ investments in R&D are quite irrelevant (N). The aggregate final output of the region considered, \(Y\) may be taken as:

where \(Y_{N} ,Y_{h} ,\) \(C_{N} ,C_{h} ,\) \(H_{N}\) and \(H_{h}\) stand respectively for production, physical and human capital according the two different output techniques; the innovation technology effects are captured by the knowledge capital levels denoted \(K_{h}\) and K N , patents denoted \(B_{h}\), depend on \(\chi\), a variable computing the results of different technological fields \(x_{i}\). At last \(B_{h}^{R} , \chi^{R}\) stand respectively for patents, and the variable catching the special effects of technological fields \(x_{j}^{R}\) from other regions. With simple substitution we may easily derive that the short run impacts of innovation respectively on \(Y\) may written as:

From inspection of Eq. (10), we can test for the following research hypothesis:

[H]

The effect on productivity of spillovers stemmed from neighbouring regions is positive.

The eventual absence of spillover effects might be interpreted as a signal of regions based on economies not linked and also this result would be relevant for policy makers because they should favour the technical interdependences between geographical areas to sustain higher growth.

4 Data sources

In our analysis we use regional data that are free available on the official portal of Russian Federal State Statistics Service (Rosstat http://www.gks.ru). In our analysis and model formation we use the following groups of indicators: Indicators of Research and development;Footnote 2 Indicators of national accounts; Macroeconomic indicators; Labour and population statistics.

In our panel data model we run the analysis for 2010–2014 for 85 Russian regions. Detailed statistical information on innovation activity in Russia (data reflecting innovation expenditure and output; co-operational linkages; factors hampering innovation; ecological innovation; innovative activities in the regions of the Russian Federation among other data) is also presented in “Indicators of Innovation in Russian Federation” data books issued on a yearly basis by HSE (Higher School of Economics) Institute for Statistical Studies and Economics of Knowledge (ISSEK).Footnote 3

Table 1 summarizes the indicators used for formation of our model.

In our calculations we also use the distances between Russian regions. Here we calculate distances between administrative centers of Russian regions (e.g. Oryol for Oryol region, Syktyvkar for Komi Republic, Makhachkala for Dagestan etc.). Here we use the haversine formula for a distance between two points on the sphere. In our case we apply the haversine formulas to calculate the difference in kilometers (d) between two points on the spherical Earth (11):

where R—is the radius of the Earth (we set this value as 6371 km); \(\varphi_{1}\)—latititue of point 1, \(\varphi_{2}\)—latitude of point 2, \(\lambda_{1}\)—altitude of point 1, \(\lambda_{2}\)—altitude of point 2.

5 Model and estimation method

The specification takes into account the relevant regressors in line with the literature. Thus, the model considered in this paper is the following:

where VAit represents the value added for region i (i = 1, 2, …85) at year t (T = 2010, 2011,…2014); L is the number of employees, C is the physical capital, K is the R&D capital stock, computed by the perpetual inventory method (Griliches 1979), with 15% depreciation rate and 5% initial growth rate.

Moreover, we test for the significance of spatial autocorrelation parameter of dependent variable and the effects of R&D Spillovers from neighboring regions, computed on the basis of spatial weight matrix, as explained in the methodological section. Finally, a set of dummy variables is also included: regional dummies to take into account heterogeneity stemmed from different regional context and time dummies to evaluate eventual temporal shocks. Finally, ε indicates error term. All variables are deflated at time 2010 and are expressed in logarithmic terms.

Since we are interested in the investigation of the dependence of innovation explanatory variable, R&D capital stock, then, we implement a Spatial Durbin Model (SDM) model, with endogenous feedback effects, and we verify the extent to which it is more informative than ordinary least squares (OLS), with exogenous feedback effects. In Table 2, we display the summary statistics of the variables used in the empirical analysis.

As emphasized by Schumpeter (1942), size assumes a relevant role in innovation. We have no expectations about the effect of labour force since large regions tend to be more innovative from one hand, but we can observe higher innovation in smaller regions, as suggested by Acs and Audretsch (1987) in case of firms.

Physical capital considers innovation embodied in capital goods implemented by suppliers. R&D activity leads to output production, but also to higher capacity to identify, assimilate and exploit external knowledge (Cohen and Levinthal 1990). For this reason, we can expect a positive impact of R&D capital stock on productivity.

In order to test for the spatial autocorrelation in the R&D capital stock variable, we perform Moran- I diagnostic test,Footnote 4 where the null hypothesis is represented by the absence of spatial autocorrelation.

In Fig. 1, we evidence the results of test and we visualize the Moran scatterplot, where R&D capital stock is measured on x-axis and spatially weighted R&D from neighbouring regions is measured on y-axis. As we may observe, we reject the null hypothesis and we can confirm the presence of spatial autocorrelation in our sample, as indicated also in the plot scheme.

However, we use caution in the interpretation of parameters, because of spatial lag of the dependent variable. In particular, we can compute direct, indirect and total effects, as suggested by LeSage and Pace (2009). The direct effect evaluates the impact of variations in the ith observation of the rth regressor, X ir , on y i , while the indirect effect measures the impact of X jr on y i .

The contribution of such econometric tool is to distinguish “the average total impact to an observation” and “the average total impact from an observation” (LeSage and Pace 2009). “The average impact to an observation” evaluates how region i is affected by changes in all regions. “The average total impact from an observation” measures how variations in region j affect all regions.

From an analytical perspective, the direct effect is the derivative of yi with respect to Xir: \(\frac{{\partial y_{i} }}{{\partial X_{ir} }} = S_{r} (W)_{ii}\) while the indirect effect is the derivative of yi to Xjr: \(\frac{{\partial y_{i} }}{{\partial X_{jr} }} = S_{r} (W)_{ij}\), dove S r (W) = (I − ρW)−1.

6 Estimation results

In Table 3, we show the empirical results of the analysis. In particular, we display the findings of the ordinary least squares (OLS) model, where there are exogenous feedback effects and Spatial Durbin Model (SDM), where we identify endogenous feedback effects.

In order to select the best model, we use Akaike Criterion test (AIC) and Bayesian Information Criterion Test (BIC). As we may observe, we can prefer SDM model, because of lower values.

The empirical findings reveal a significant positive externality R&D from neighboring regions, as we may identify also in the so-called indirect effects,Footnote 5 while the direct effects are not significant.

However, we can conclude that technology Spillovers across Russian regions matter.

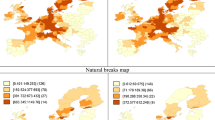

As far as the effects of other regressors are concerned, we find a negative impact of size on regional productivity and positive effect of physical capital investments, in line with our previous expectations. Figures 2, 3 and 4 visualize the regional distribution of the key variables of our model in Russia in 2014 (see regional values of this variables in Table 4 in “Appendix”). The highest values of gross regional product (GRP) (calculated as regional value added) (more than 1 trillion rubles in 20104 in constant 2010 prices) show such region as (Moscow, 9,1 trln—not shown on this map); Moscow Region, 2,1 trln, Saint Petersburg (2,0, not shown on the map), Khanty-Mansi Autonomous District—Yugra (KMAD), 1,9; Sverdlovsk Region 1,3; Krasnoyarsk Krai 1,2; Krasnodar Krai, 1,2; Republic of Tatarstan 1,2 (Fig. 2). The other regions with high level of GPR (form 0,75 to 1,0 trln rub.) are Yamalo-Nenets Autonomous District (YNAD); Republic of Bashkortostan; Samara Region; Rostov Region; Nizhny Novgorod Region. We can see interesting picture—the “richest” (in terms of GRP value) Moscow region (and Moscow city) and “rich” in the Central European part of Russia Nizhniy Novgorod region are surrounded by “poor” regions like Tver Region, Smolensk Region, Republic of Mordovia etc. KMADS, YNAD and Krasnoyarsk Krai—are the key mineral resource-reach in the Russia.

Figure 3 visualizes the regional distribution of spillovers in Russia in 2014. The explicit “cluster” of regions with very high level of spillovers : Khanty-Mansi Autonomous District; Sverdlovsk region; Tyumen Region; Republic of Bashkortostan, Omsk Region. WE should say that regions of Ural and Siberian Federal districts have high and very high level of Spillovers. Meanwhile the European part of Russia in terms of spillover values looks like patchwork quilt—regions with very high level of spillovers neighbors with very low level of spillovers. We can detect one “high spillover chain” Its starts from Belgorod Region, goes through Lipetsk and Kursk regions, takes Kaluga and Smolensk, further it goes through Moscow Region with very high spillover value, goes to Yaroslavl and Vologda region (with an “outlier” to the West to Novgorod Region); further to Kirov region and finally to Perm Krai and “through” perm Krai this chain is neighbors with a cluster of regions with very high spillover value in Ural and Western Siberia. In General Ural and Siberian Federal District are the strongest in terms of the level of spillovers due to their “central” geographical locations. Far Eastern part of the Russian Federation is also quite high differentiated be the level of spillover—poor spillover effect in the southern part of Far Eastern District (Amur region and Zabaikalye Krai) with high and very high spillover Effects in North-East regions of the Russian Federation (Chukotka Autonomous District and Magadan Region). If we take the regional distribution R&D capital we can see that the level of this indicator in Russia is high and very high (see Fig. 4). Only some regions have low and very low level of R&D.

Therefore Moscow and Saint Petersburg are key centers of Regional R&D spillover effects while Krasnoyarsk Krai is the “bridge” for translating spillover effects between European and Asian part of the Russian Federation.

7 Concluding remarks

The aim of this paper is to explore the role of knowledge Spillovers due to geographical proximity in Russian regions. To this end, the economic performance, measured by regional added value for the period 2010–2014 has been investigated. R&D Spillovers have been computed by considering geographical proximity, on the basis of Haversine formula and they have been analysed through spatial econometric techniques. Results show that R&D regional Spillovers are driven by geographical similarity. This finding seems to evidence the important role of space in Russian innovation process. Thus, the main policy implication is to favour geographical knowledge flows through the concentration process between regional units, because policy measures aimed at improving agglomeration seem be helpful in promoting economic growth.

However, our results should be interpreted with caution. First, more variables about Russian innovation, such as import/export activity volumes or Government subsidies, should be collected to confirm our results. Second, R&D Spillovers have been computed by using geographical coordinates between regions. We would need information about other data to investigate also the role of technological relatedness. In particular, also other channels of innovation diffusion process, such as employees’ mobility or patent data should be explored. Finally, we could compare our results, based on symmetric measure of proximity to those derived by applying an asymmetric measure, in such a way that we may distinguish horizontal spillovers and vertical ones.

Thus, further empirical analysis is required to overcome the previous limitations.

Notes

See more on these initiatives as well as on cluster policy on the portal of Russian Cluster Obsevatory (launched by Institute for Statistical Studies and Economics of Knowledge (ISSEK))—the leading Russia scientific, methodological, analytical and consulting centre specializing in research in the field of cluster policy. http://cluster.hse.ru/info/.

E.g. easily downloadable files with aggregated statistical data on R&D and Innovation activity in Russia are available for free here (in Russian Language interface): http://www.gks.ru/wps/wcm/connect/rosstat_main/rosstat/ru/statistics/science_and_innovations/science/#.

As mentioned on “HSE data books” portal https://www.hse.ru/en/primarydata/ “These data books present the results of statistical innovation surveys in the Russian Federation. They contain internationally compatible indicators characterizing the level of innovative activity in industry and services. These publication covers statistical data reflecting innovation expenditure and output, co-operational linkages, and factors hampering innovation. Specific chapters are devoted to ecological innovation and innovative activities in the regions of the Russian Federation. International comparisons with a wide range of innovation indicators are provided as well. These data book include information of the Federal Service for State Statistics, Organisation for Economic Co-operation and Development, European Commission, Eurostat, national statistical agencies, and results of own methodological and analytical studies of the HSE Institute for Statistical Studies and Economics of Knowledge”. Latest issue of “Indicators of Innovation in Russian Federation (2015)” in English can be downloaded here https://www.hse.ru/en/primarydata/innov2015. The latest Russian issue of “Indicators of Innovation in Russian Federation (2017)” can be downloaded here: https://issek.hse.ru/news/204006500.html.

From a statistical perspective, Moran’s I is a measure of spatial autocorrelation which is characterized by a correlation among locations in space. Spatial correlation is more relevant than one-dimensional autocorrelation since it is multidimensional. In particular, Moran’s I is defined as: \(I = \frac{z'Wz}{z'z}\), where z is an N—vector of standardized regions, W is an N × N row-standardized spatial weight matrix and N is the number of observations.

We use ‘xsmle’ STATA command (2017) for the estimation procedure.

References

Abashkin, V., Boyarov, A., Kutsenko, E.: Cluster policy in Russia: from theory to practice. Foresight Russ. 6(3), 16–27 (2012)

Acs, J.Z., Audretsch, D.B.: Innovation, market structure, and firm size. Rev. Econ. Stat. 69(4), 567–574 (1987)

Aganbegyan, A.G., Mikheeva, N.N., Fetisov, G.G.: Modernization of the real sector of the economy: spatial aspects. Reg. Res. Russ. 3(4), 309–323 (2013)

Akinfeeva, E.V., Abramov, V.I.: The role of science cities in the development of the national innovation system in Russia. Stud. Russ. Econ. Dev. 26(1), 91–99 (2015)

Aldieri, L., Vinci, C.P.: The role of technology spillovers in the process of water pollution abatement for large international firms. Sustainability 9, 868 (2017). https://doi.org/10.3390/su9050868

Andreeva, E.L., Simon, H., Karkh, D.A., Glukhikh, P.L.: Innovative entrepreneurship: a source of economic growth in the region. Econ. Reg. 12(3), 899–910 (2016)

Anselin, L.: Spatial Econometrics: Methods and Models. Kluwer Academic Publishers, Boston (1988)

Antonenko, I.: Innovation development sectoral trajectories of the South Russian regions. Reg. Sect. Econ. Stud. 14(2), 31–38 (2014)

Baburin, V.L., Zemtsov, S.P.: Geography of innovation processes in Russia. Vestnik Moskovskogo Universiteta, Seriya 5 Geografiya 5, 22–32 (2013)

Bakhtizin, A.R., Akinfeeva, E.V.: Comparative estimates of innovation potential of the regions of the Russian federation. Stud. Russ. Econ. Dev. 21(3), 275–281 (2010)

Bek, M.A., Bek, N.N., Sheresheva, M.Y., Johnston, W.J.: Perspectives of SME innovation clusters development in Russia. J. Bus. Ind. Mark. 28(3), 240–259 (2013)

Bretschger, L., Lechthaler, F., Rausch, S., Zhang, L.: Knowledge diffusion, endogenous growth, and the costs of global climate policy. Eur. Econ. Rev. 93, 47–72 (2017)

Cohen, W.M., Levinthal, D.A.: Absorptive capacity: a new perspective on learning and innovation. Adm. Sci. Q. 35(1), 128–152 (1990)

Crescenzi, R., Jaax, A.: Innovation in Russia: the territorial dimension. Econ. Geogr. 93, 66–88 (2017)

Dezhina, I.: Policy framework to stimulate technological innovations in Russia. J. East-West Bus. 17(2–3), 90–100 (2011)

Eferina, T., Kochkina, N., Lizunova, V., Prosyanyuk, D.: Systemic barriers to innovative business in Russia. Public Adm. Issues 2, 49–71 (2016)

Gokhberg, L., Kuznetsova, T.: S&T and innovation in Russia: key challenges of the post-crisis period. J. East-West Bus. 17(2–3), 73–89 (2011a)

Gokhberg, L., Kuznetsova, T.: Strategy 2020: new outlines of Russian innovation policy. Foresight Russ. 5(4), 8–30 (2011b)

Gokhberg, L., Roud, V.: Structural changes in the national innovation system: longitudinal study of innovation modes in the Russian industry. Econ. Change Restruct. 49(2–3), 269–288 (2016)

Golova, I.: Problems of regional innovation strategy forming. Econ. Reg. 1(3), 77–85 (2010)

Golova, I.: Building the effective innovation policy in the regions of the Russian Federation as a prerequisite for socio-economic growth. Econ. Reg. 1(2), 103–111 (2011)

Griliches, Z.: Issues in assessing the contribution of research and development to productivity growth. Bell J. Econ. 10, 92–116 (1979)

Indicators of Innovation in the Russian Federation: 2015: Data Book; Ditkovsky, K., Fridlyanova, S., Gokhberg, L., et al.: National Research University Higher School of Economics, p. 320. HSE, Moscow (2015)

Indicators of Innovation in the Russian Federation: 2017: Data Book; Gorodnikova, N., Gokhberg, L., Ditkovskiy, K., et al.: National Research University Higher School of Economics. HSE, Moscow (2017) [in Russian]

Ivanov, V.V.: Innovative territory as a basic element in the spatial structure of the national innovation system. Reg. Res. Russ. 6(1), 70–79 (2016)

Kaneva, M.A., Untura, G.A.: Diagnostics of innovative development of Siberia. Reg. Res. Russ. 4(2), 105–114 (2014)

Kazantsev, S.V.: Dynamics of innovative activity in Russian regions. Reg. Res. Russ. 3(1), 12–20 (2013)

Kihlgren, A.: Promotion of innovation activity in Russia through the creation of science parks: the case of St. Petersburg (1992–1998). Technovation 23(1), 65–76 (2003)

Klochikhin, E.A.: Russia’s innovation policy: stubborn path-dependencies and new approaches. Res. Policy 41(9), 1620–1630 (2012)

Klochikhin, E.A.: Innovation system in transition: opportunities for policy learning between China and Russia. Sci. Public Policy 40(5), 657–673 (2013)

Komkov, N.I., Selin, V.S., Tsukerman, V.A., Goryachevskaya, E.S.: Problems and perspectives of innovative development of the industrial system in Russian Arctic regions. Stud. Russ. Econ. Dev. 28(1), 31–38 (2017)

Kravchenko, N.A., Kuznetsov, A.V.: Problems in implementing scenarios of innovative development in Siberia. Reg. Res. Russ. 4(4), 355–363 (2014)

Kutsenko, E.: Pilot innovative territorial clusters in Russia: a sustainable development model. Foresight Russ. 9(1), 32–55 (2015)

Kuznetsov, S., Mezhevich, N., Lachininskii, S.: The spatial recourses and limitations of the Russian economy modernization: the example of the North-West macro region. Econ. Reg. 1(3), 25–38 (2015)

Lenchuk, E.B., Vlaskin, G.A.: A cluster-based strategy for Russia’s innovative development. Stud. Russ. Econ. Dev. 21(6), 603–611 (2010)

LeSage, J., Pace, R.K.: Introduction to Spatial Econometrics. Chapman & Hall/CRC Press, Boca Raton (2009)

Lesnik, A., Mingalyova, Z.: The development of innovation activities clusters in Russia and in the Czech Republic. Econ. Reg. 3, 190–197 (2013)

Leydesdorff, L., Perevodchikov, E., Uvarov, A.: Measuring triple-helix synergy in the Russian innovation systems at regional, provincial, and national levels. J. Assoc. Inf. Sci. Technol. 66(6), 1229–1238 (2015)

Makkonen, T.: National innovation system dynamics in East Central Europe, the Baltic countries and Russia. In: Geo-Regional Competitiveness in Central and Eastern Europe, the Baltic Countries, and Russia, pp. 32–56. IGIGlobal, Hershey (2014)

Mariyev, O., Savin, I.: Factors of innovative activity in Russian regions: modeling and empirical analysis. Econ. Reg. 1(3), 235–244 (2010)

Pelyasov, A.N., Kuritsyna-Korsoyskaya, E.N.: Geographic dimension of innovation activity. Izvestiya Akademii Nauk, Seriya Geograficheskaya 2, 8–16 (2009)

Petrov, A.P.: Regularities of formation regional cluster initiative. Econ. Reg. 1, 133–142 (2013)

Romanova, O.A., Grebenkin, A.V., Akberdina, V.V.: Effect produced by innovation dynamics on the development of regional economic system (case study of Sverdlovsk and Novosibirsk oblasts). Reg. Res. Russ. 2(3), 214–224 (2012)

Ryumkin, A.I.: Development of innovative clusters based on business-government partnership using the example of Tomsk. Stud. Russ. Econ. Dev. 20(4), 400–409 (2009)

Schumpeter, J.A.: Capitalism, Socialism and Democracy. Harper and Brothers, New York (1942)

Tkachenko, E., Bodrunov, S.: Development of the knowledge economy and regional innovation policy: Russian practice. In: European Conference on Knowledge Management, vol. 3, pp. 964–973. Academic Conferences International Limited, UK (2014)

Tobler, W.R.: A computer movie simulating urban growth in the Detroit region. Econ. Geogr. 46, 234–240 (1970)

Untura, G.A.: Strategic support of the Russian regions: problems of the assessment of the status of innovative territories. Reg. Res. Russ. 3(2), 153–161 (2013)

Acknowledgements

The article was prepared within the framework of the Basic Research Program at the National Research University Higher School of Economics (HSE) and supported within the framework of the subsidy granted to the HSE by the Government of the Russian Federation for the implementation of the Global Competitiveness Program. The authors are grateful to Editor and two anonymous reviewers whose comments greatly improved the quality of the paper. The results, conclusions, views or opinions expressed in this paper are only attributable to the authors.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

See Table 4.

Rights and permissions

About this article

Cite this article

Aldieri, L., Kotsemir, M.N. & Vinci, C.P. Knowledge spillover effects: empirical evidence from Russian regions. Qual Quant 52, 2111–2132 (2018). https://doi.org/10.1007/s11135-017-0624-2

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11135-017-0624-2