Abstract

We examine the effects of various motives to save money on the propensity of Italian households to allocate an unexpected inheritance towards consumption. To achieve this objective, we use microdata collected by the Bank of Italy in a structured questionnaire as part of the Italian Survey of Household Income and Wealth for 2012, which consists of a sample of 8151 Italian households. Among our results of interest, we found that families who are motivated to save money because they are planning to set up a new business, to invest in an existing business, to travel on holiday, or to make large purchases (such as automobiles, furniture, and so forth) are more likely to allocate an income shock towards consumption than families who are motivated by the need to save money to protect themselves (such as by providing for unexpected cash needs and/or retirement). We also found that such motivations have a non-linear (increasing/decreasing) effect on response behaviours to income shocks.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Economists and policymakers have long focused their attention on understanding the consumption behaviour of individuals and households across countries, taking both a macro- and a microeconomic perspective regarding changes in the composition of consumption over time (e.g., Adessi 2014), the role of liquidity constraints and time preferences (e.g., Trostel and Taylor 2001; Ozak 2014), consumer vulnerability (Berg 2015), the role of preferences for some types of consumption (e.g., Annunziata et al. 2015), the effects of the media (e.g., Bellotti and Panzone 2016), the influence of financial and environmental risks on consumption-savings choices (e.g., Baiardi et al. 2013), and the importance of re-distributive income policies (e.g., Johnson 1952), among other topics.

A relevant field of research has also focused on responses in terms of consumption when adverse or positive events (such as an income shock) affect the balance sheet of households and human decisions/behaviours. Studies on consumption as a response to permanent or transitory income shocks both from a theoretical and an empirical perspective are particularly interesting in this regard (e.g., Friedman 1957; Muth 1960). The main empirical evidence from these studies suggests that consumption is more sensitive to permanent than transitory income shocks. Focusing on Italy, Krueger and Perri (2011) examined households that did not own businesses or real estate and found that non-durable consumption increased by approximately 0.23 cents for each Euro increase in short-run labour income; for long-run income changes, the consumption response was stronger (0.47 cents). For households that owned real estate or that had a self-employed household head, the consumption response to income shocks was found to be smaller than for other households. Other studies on the relationship between the dynamics of household disposable income and consumption using Italian data were conducted by Jappelli and Pistaferri (2006), Jappelli and Pistaferri (2010). Their results rejected the consumption insurance model and noted that households tended to smooth income shocks to a lesser extent than suggested by the literature on permanent income. Notably, Padula (2004) found that durable and non-durable goods are complements and that the marginal propensity to allocate money to consumption based on permanent income shocks is less than one. Pistaferri (2001) also demonstrated how to combine income realisations with subjective expectations to separately detect permanent and transitory income shocks and to obtain an indicator of uncertainty.

The proposed micro-founded models do not explicitly account for individuals’ or households’ factors of preference, which are sometimes difficult to measure. It is generally acknowledged in the consumer science fields that individuals/households are heterogeneous in terms of lifestyle, aspiration levels, consumer preferences, and social comparison behaviour, among other aspects (Karlsson et al. 2004; Bryant and Zick 2006). Therefore, individual/household preferences, motivations and desires can play an important role in the econometric models that attempt to explain (at best) consumption responses to income shocks. These subjective factors include a number of motivations to save labour income.

In the presence of a transitory income shock (such as receiving an inheritance or winning the lottery), we assume that a household is likely to decide to spend of the extra income on anticipated spending events (such as taking an expensive trip) for which it was saving part of its labour income and/or that it may take the opportunity to increase its savings (e.g., to augment its pension fund). In this study, we aim to provide some initial evidence on the association between various motivations to save and a household’s decision process to allocate an unexpected inheritance towards consumption. Here, we have considered the following reasons to save: (a) important purchases planned in the future or postponed due to insufficient economic resources, such as the purchase of a home or other major item (e.g., vehicles, furniture), setting up a private business or investing in an existing business, travel/holidays, and education/support of children and grandchildren; (b) protection for the future, including provision for unexpected events, provision for retirement, and passing on wealth to children and grandchildren; and (c) paying off debts. To measure the effects and statistical significance (in terms of magnitude and sign) of a number of reasons to save money in relation to the proportion of an inheritance that households intend to allocate towards consumption is valuable information for a number of economic agents interested in consumer behaviours, including banks and insurance companies.

Obtaining observational data on consumption-savings decisions for a representative population of households exposed to an income shock such as an unexpected monetary inheritance can be very difficult. To conduct our analysis, we employed microdata from the 2012 Italian Survey of Household Income and Wealth (SHIW) conducted by the Bank of Italy. One section of the questionnaire was devoted to collecting information on households’ intentions to allocate an unexpected monetary inheritance to purchases that it otherwise would not have made or that it was waiting to make as opposed to that portion allocated towards savings or towards paying off debts early (if any).

The advantage of using microdata from a national sample survey is that we can explore the issue of interest based on a large number of households with a good trade-off between cost, time and the quality of data collection (sampling design). The disadvantage is based on the absence of a real cash transfer, as there might be a mismatch between intention and behaviour that we cannot control for with the available data. While recognising such limitations, to the best of our knowledge, this study is the first attempt to evaluate the consumption response to an (hypothetical) income shock based on information from households rather than from simulations in econometric models. Based on the available data, we investigate the relationship between the proportion of consumption (our outcome variable, measured in the range between 0 and 1, indicating 0 and 100 % of the hypothetical inheritance, respectively) and various motives for savings articulated by households during the interview, after having controlled for several socio-economic and demographic factors. The study of the relationships was undertaken by comparing some modelling frameworks proposed in the literature for response variables restricted to the standard unit interval (0,1). Specifically, we have assessed the results using beta regressions, fractional probit models, and fractional heteroskedastic probit regressions. We then explored possible differences in the effects of the motivations for saving that might be related to specific proportions of consumption as a response to an income shock. This analysis has been conducted using an ordered logit model.

This paper makes several contributions to the literature. First, we find that families who are driven to save money because they intend to set up a private business or finance investments in an existing business, to travel on holiday, or to make a major purchase (such as a vehicle or furniture) and so forth, are more likely to allocate an income shock towards consumption than households who are motivated by the need to protect themselves (such as by providing for unexpected events and/or for retirement). Specifically, we have noted from a descriptive analysis that a large proportion of households are motivated to save by the aim of ensuring financial stability in the future.

Second, we find that the motivations for saving money have non-linear (increasing/decreasing) effects on response behaviours to income shocks. These patterns were not captured using parametric modelling frameworks proposed in the literature for responses restricted to the standard unit interval (0,1).

Third, consistent with prior studies of responses to income shocks, we find that heads of households who are willing to allocate an inheritance towards consumption have expectations of income growth that is higher than price growth (that is, they have no expectations of a loss in purchasing power), have higher educational levels, and are impatient. Conversely, barriers to consumption include the presence of debt and being in arrears regarding financial commitments.

This article is organised as follows. Section 2 describes the data. Section 3 introduces the econometric models, and Sect. 4 presents the results of the empirical analysis. Section 5 concludes with a discussion of the main findings.

2 Data

This analysis is based on Italian microeconomic data collected by means of a structured questionnaire from the 2012 SHIW conducted during 2013 by the Bank of Italy. The survey consisted of a sample of 8151 Italian households and 20,022 individuals. The household questionnaire was addressed to the person of reference in the household (the household head), who responded on behalf of all members. The interviews were conducted mainly through computer-assisted personal interviewing. The survey aims to collect information on the socio-demographic characteristics of each member of the household, household wealth composition, income sources, and debt, among other topics. One issue with the SHIW microdata is that information is collected some months after the reference point (31 December 2012). As in Pistaferri (2010), for variables of a subjective nature, we must assume that individuals do not have to update their information (e.g., on expectations for the future) between the end of 2012 and the date of the interview.

2.1 Measuring the proportion of inheritance in consumption

One section of the questionnaire was devoted to investigating households’ intention in terms of how they would allocate an unexpected source of money obtained from an inheritance between consumption, savings and/or paying off debts (if any). The question submitted to each household head asks the following: Imagine receiving an unexpected inheritance equal to the amount that your family earns in a year. During the next 12 months, how would you intend to use this unexpected amount? Given 100 % of the inheritance, you must divide (in percentage terms) the amount received into the following three types of possible uses:

-

1.

Savings for future purchases or for paying off debts

-

2.

Purchases of durable goods and services (e.g., precious objects, vehicles, renovations, furnishing, dentistry) that the household would otherwise not have purchased or was waiting to buy

-

3.

Purchases of non-durable goods and services (e.g., food expenses, clothing, traveling on holiday) that the household would otherwise not have purchased or was waiting to buy

Based on the answer to this question, we define the proportion of inheritance that the household intends to allocate to consumption as the sum of points 2 and 3. Figure 1 presents a histogram and a box-plot of the proportion of consumption. We note that the distribution of observations in the 0–1 range (values rescaled from the 0–100 % range) is asymmetric with respect to the lower values of proportion. A visual inspection also highlights the presence of three peaks (at 0, 0.5, and 1) in the responses. The highest peak is observed at 0 (24.2 %), which suggests that approximately one quarter of the households intend to adopt fully conservative behaviour [including the intention to re-pay debts (if any)]. In other words, such households are not interested in allocating the resources from the inheritance to increase their consumption level. The median value of the proportion of inheritance destined to purchases is equal to 0.5, and the mean value is equal to 0.45. As a data constraint, we are not able to distinguish between the intention to save and that to repay debts.

2.2 Motivations for savings money

Households would like to have savings for several reasons. Whether the reasons are purchasing a car, purchasing a house, traveling on holiday, or preparing for an emergency, having money set aside can make a difference in our ability to satisfy our needs and/or achieve our dreams. During the interview, household heads were asked to indicate the main reasons that they saved money. The following options were considered:

To purchase or make an investment planned for the future or previously postponed due to insufficient economic resources, such as the following:

-

Purchase own home

-

Other major purchases (e.g., vehicles, furniture)

-

Set up a private business or invest in an existing business

-

Travels/holidays

-

Education/support of children and grandchildren

To protect the household’s future

-

Provision for unexpected events

-

Provision for retirement

-

Inheritance for children and grandchildren

To pay off debts

In the Appendix, we reported a detailed description of these variables (Appendix Table 3) and a descriptive analysis (Appendix Table 4).

2.3 Control variables

We selected a number of socio-economic and demographic variables that can explain the intention to allocate a monetary inheritance towards consumption. A description of these variables is reported in Appendix Table 3, and some descriptive statistics are reported in Appendix Table 4 (both Tables are found in the Appendix).

The region of residence is assumed to be an important predictor because it allows us to consider possible differences in outcome based on households’ geographical location (e.g., cultural and peer effects). Among the factors associated with household economic conditions, we considered equivalent income and the liquidity ratio as useful measures for drawing a picture of the standard of living. Specifically, equivalent income allows us to compare the income of different households (in terms of size and age composition), whereas the liquidity ratio is useful for measuring the number of months a household can meet its consumption needs after an income loss. For example, a liquidity ratio with a value of less than 0.25 indicates that a household can maintain the same standard of living, while covering its expenses for less than three months. Over-indebtedness (i.e., a debt-income ratio greater than 30 %), debts to friends and relatives, and being in arrears on the payment of commitments are likely be additional factors that affect the decision-making process when allocating a transitory source of money (such as an inheritance). We also assumed that the household head’s socio-demographic and behavioural characteristics such as age, educational level, marital status, expectation of household income growth in the next 12 months, and time preference might be additional factors affecting the decision-making process (see also Fernandez-Villaverde and Krueger 2011).

3 Econometric models

Given a sample of households exposed to an unexpected inheritance, we are interested in studying the following relationship:

where \(p_{i}\) is the proportion of inheritance that each household head intends to allocate to the purchase of durables and non-durables that otherwise would not have been purchased or that they were waiting to buy, \({\mathbf x} ^{T} _{i}=(1,x_{i1}, \ldots ,x_{ik})\) is the ith row vector that contains \(k+1\) explanatory variables such as the intercept, dummy, categorical and continuous variables (e.g., region of residence, equivalent income, liquidity ratio, time preference, and education, to name a few), and \({\varvec{\alpha }}\) is the corresponding parameter vector to be estimated. The specification and estimation of a classic linear model is widely employed to study the relationship between a response variable and a number of covariates. However, this approach is not appropriate for our case study because p represents a proportion that is expressed in the standard unit interval (0,1). As a methodological response, Ferrari and Cribari-Neto (2004) proposed a regression model that belongs to the class of generalised linear models and that assumes that the outcome p follows a beta distribution. Specifically, the beta density is expressed as follows:

and \(E(p)=\mu\) and \(Var(p)=\mu (1-\mu )/(1+\phi )\). \(\phi\) is the precision parameter, and \(\phi {-1}\) is the dispersion parameter. For a fixed \(\mu\), the larger the parameter \(\phi\) is, the smaller the variance of p (e.g., Ferrari and Cribari-Neto 2004). As demonstrated by Ferrari and Cribari-Neto (2004), the beta distribution is notable because it can assume a number of different shapes. From (1), the model can be written as follows:

where \(g(\cdot ):(0,1) \rightarrow {\mathrm IR}\) is a link function. The descriptive analysis has highlighted that some response values are exactly equal to 0 and 1. Such values are not admitted in the estimation of the beta regression. To overcome this limitation, it is common practice to apply the following transformation \((p \times (n-1) + 0.5)/n\) to the dependent variable before the model-fitting process (Smithson and Verkuilen 2006), as it transforms dependent variables with the values of 0 and 1 slightly inwards. In this way, we estimate a beta regression with a modified dependent variable (p). Because events 0 and 1 occur in the sample, we considered a fractional probit model and a fractional heteroskedastic probit model (e.g., Papke and Wooldridge 1996) as alternative approaches, which admit the events 0 and 1. Specifically, in estimating the fractional heteroskedastic probit model, we considered a measure of the liquidity ratio (see Appendix Table 3 in Appendix) as an independent variable to model the variance based on financial assets. This choice is supported by empirical evidence that show that consumption-savings decisions of households depend on the assets available to them (see Krueger and Perri 2011). In any event, the fractional models considered might not be the optimal solution when interest is on the variance rather than on the mean of the dependent variable, particularly in the presence of peaks of answer in specific points of the scale of response. Some scholars have considered a Tobit model as a regression technique to study proportional data that contain zero or one. However, this is not an appropriate choice for our analysis, as values outside of the (0,1) interval are not feasible.

3.1 Exploring the motivations for savings in relation to specific response behaviours to income shocks

It is likely that an interviewing is approximating when stating the proportion of monetary inheritance that a household intends to allocate towards consumption. This phenomenon is empirically supported by the presence of peaks in specific points of scale of response (see Fig. 1) and has raised interest in exploring possible differences in the effects of the various motivations for savings in relation to specific proportions of consumption allocated in response to income shock. Based on the evidence shown in Fig. 1, we classified the proportion of inheritance in consumption (P) into five groups (\(P^{*}\)) as follows:

and estimated an ordered logit model (e.g., Tutz 2012). This modelling framework is well-suited to studying the relationship between the ordinal categorical variables defined above and the various motivations for savings described in Sect. 2.2, after having considered a number of control variables listed in Sect. 2.3. Given the ordinal response \(P^{*}\) with S categories, the ordinal logit model is defined by a set of S-1 equations in which the cumulative probabilities \(g_{si}=Pr(P^{*}_{i} \le =p^{*}_{s}| {\mathbf x} _{i})\) are in relation to a linear predictor \({\varvec{\beta }}'{\varvec{x}}_{i}\) through the logit function:

where \(\alpha _{s}\) are the parameters of threshold (\(\alpha _{1}< \alpha _{2}< \cdots < \alpha _{S-1}\)), while \({\varvec{\beta }}\) is the vector of coefficients to be estimated and that are associated with explanatory variables. After estimating the models described above, the interpretation of the effects of the covariates on the outcome is based on the marginal effects (MEs) computed as the average change (increase or decrease) in the probability of the outcome given a change in the explanatory variable (for example, a one-unit change in the case of binary variables), holding the other covariates at their observed values. All computations were performed using STATA 14 (StataCorp 2015).

4 Results

The estimation of the effects of the motives for saving money on the propensity of Italian households to allocate an unexpected inheritance towards consumption was carried out using modelling frameworks proposed in the literature for response variables restricted to the standard unit interval (0,1). As described in Sect. 3, we considered a beta regression model with p modified (using a probit link function), a fractional probit model, and a fractional heteroskedastic probit model. Table 1 reports the MEs [including the associated confidence intervals (CIs)] of the variables included in the models. We prefer the fractional probit model or fractional heteroskedastic probit model because they admit the events 0 and 1. In any case, with the exception of certain explanatory variables, we observe non-significant differences in the MEs obtained from one model in comparison with the other two. This conclusion has been arrived at by comparing the MEs jointly with the CIs. For example, we note that the MEs associated with the time preferences of household heads obtained from one model fit with the CIs estimated for the other two models.

In presenting the results of the analysis, we will focus on the interpretation of the MEs (on the response scale 0–1) obtained from estimating the fractional probit model. We begin the discussion with the motivations for saving. We found that the need for protection is one of the main reasons motivating a family to save money. Our descriptive analysis (see Appendix Table 4) shows that a large percentage of households has indicated that they are motivated by the need to provide for unexpected events and retirement. This motivation for savings is common in Italy and is consistent with evidence from several behavioural economic studies showing that Italian families have negative attitudes towards risk (e.g., Zanin 2015a and references therein). Focusing on the results of the econometric analysis, we noted that households that save to provide for unexpected events and retirement are likely to reduce the proportion of unexpected income to be allocated to consumption by 0.030 (CI = −0.046;−0.015) and 0.020 (CI = −0.036;−0.004), respectively. This evidence should be of interest to both banks and insurance companies, as well as to policymakers. Banks and insurance companies should be interested in this information to craft products dedicated to the need for protection, while policymakers should be interested in improving knowledge about the decision-making processes of a family that is managing economic resources when facing an unexpected income shock.

Saving money to pay off debts is another factor that negatively affects our outcome of interest (ME = −0.036; CI = −0.062;−0.011). Two main reasons explain this finding. First, debt represents financial vulnerability to a household (particularly if a monthly instalment of debt repayment >30 % of monthly income). Second, the interest paid absorbs economic resources that could be used to meet other needs. Thus, a household with debt is likely to be motivated to use extra income to reduce or close debts.

We have observed that the intention to set up a private business or to finance investments in an existing business contribute to an increase of 0.099 (CI = 0.042;0.156) of the proportion of inheritance for consumption instead of savings. We found similar results when the goal was to travel on holiday (ME = 0.093; CI = 0.069;0.117). A minor effect is observed for other major purchases (e.g., vehicles, furniture—ME = 0.034; CI = 0.007;0.062). It is plausible to assume that an unexpected monetary inheritance can represent an opportunity to achieve some goals for which the household was saving. Finally, we found that saving money for the purchase of a family home, to pay for the education/support of children or grandchildren, and to pass on as an inheritance to children and grandchildren did not have a statistically significant impact on the decision to increase or decrease consumption following an income shock.

In terms of the control variables, we found that those households less motivated to allocate an unexpected inheritance towards consumption include those in arrears on the payment of commitments (e.g., bills, rent) and those that are renting—as opposed to owning—the family home. No statistically significant effect on outcome was observed for debts to friends and relatives. One possible explanation is that such a typology of debt might not be characterised by deadline constraints, as is the case for a debt owed to a bank.

The estimated effect of the household equivalent income on the outcome is found to follow an inverted U-shape. In other words, the household equivalent income has a positive (and increasing non-linear) effect on the outcome until a turning point that is estimated at 32,000 Euro (values obtained from a simulation using the estimated coefficients). After this threshold, the effect becomes negative and grows in magnitude as the household becomes richer. We also found that a higher liquidity ratio means that less of the inheritance is allocated to purchase durable and non-durable goods and services that otherwise the household would not have purchased or was waiting to purchase (ME = −0.006; CI = −0.012;−0.001).

Including variables on the socio-demographic characteristics of the head of the household in the model suggest that the higher the educational level achieved by the household head, the higher the proportion of inheritance that will be spent on consumption. However, a non-significant effect was observed for the age and gender of household heads. With respect to marital status, an interesting positive and statistically significant effect on outcome is observed for household heads who are divorced (ME = 0.032; CI = 0.004;0.061). The reasons for this result might involve the consequences of divorce in Italy. Mazzuco et al. (2009) noted a worsening of economic well-being for both Italian men (including among non-custodial fathers who live alone after separation) and Italian women after divorce. In this light, divorced individuals might gain the opportunity from a transitory income shock to purchase durables and non-durables that they might otherwise not have purchased with disposable income or that were postponed for other reasons. The presence of children aged 4–6 years old in the family was found to have a positive and statistically significant impact on the outcome (ME = 0.039; CI = 0.006;0.073). We also controlled for the effects of children below 4 years and above 6 years of age, but no significant evidence was found in this regard.

Among the variables of a more subjective nature (in addition to motivations for savings), our model considers the expectations of household income growth within the next 12 months and a proxy of the household head’s time preference. The main findings suggest that a stimulus for consumption is more effective for households that expect an increase in labour income that is higher than the trend in prices (ME = 0.123; CI = 0.096;0.150), i.e., when a household does not expect to lose purchasing power. This evidence concurs with studies on earnings uncertainty and precautionary savings (Guiso et al. 1992) and those on individual risk-taking behaviour in an environment of uncertainty (e.g., imperfect knowledge of the state space), including macroeconomic uncertainty (e.g., Malmendier and Nagel 2011; Mengel et al. 2016). From our descriptive analysis (see Appendix Table 4 in the Appendix), we observe that approximately 65 % of respondents expect that their income growth will be lower than price growth. Under this scenario, household heads might build their pessimistic vision for income growth based on past experience or as a response to bad economic news from the media, among other reasons. Garz (2013) observed that economic news from the media can create long-term attitudes in people’s economic expectations. It is therefore plausible that past negative experiences (e.g., unemployment and loss of purchasing power) together with the persistence of negative news regarding the general economic situation in Italy (the prolonged effects of the great recession) have contributed to curbing trust in the future and, as a result, have also curbed the optimism necessary to stimulate a household to plan purchases when there is extra (unanticipated) income (see, also, Clark et al. 2001; Knabe and Ratzel 2011; Garz 2014).

The time preference of individuals is another interesting factor that is useful for explaining the human decisions/behaviours behind the investigated scenario. According to the literature, we have found that a household head who is impatient has a higher propensity to allocate an unexpected source of money towards consumption than the counterpart of household heads who are patient (ME = 0.026; CI = 0.008;0.044). The positive and statistically significant effect of a high time preference on the outcome suggests that household heads are likely to have a greater interest in their present than on their future well-being. Impatient individuals are less sensitive to the negative effects of their choices, which can influence consumption decisions (e.g., Holden et al. 1998; Franken et al. 2008; Anderloni et al. 2012). Some empirical studies have provided evidence that an impatient household head is likely to live in a household characterised by economic inadequacy (e.g., Zanin 2015b).

4.1 Some evidence from the ordered logit model

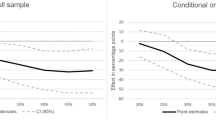

The descriptive analysis reported in Sect. 2.1 emphasises that approximately 50 % of household heads have declared a proportion of consumption that are concentrated in specific points of the scale of response: 0 % (24.2 % of individuals), 50 % (18.5 % of individuals), and 100 % (11.2 % of individuals). Given this evidence, we are interested in using an ordered logit model to explore the possible differences in the effects of several motivations for savings in relation to specific response behaviours. The MEs of the estimated model are reported in Table 2. The empirical findings support the existence of some differences in response behaviours. Specifically, we observe the presence of non-linear (increasing/decreasing) effects of covariates on the outcomes.

Focusing on the drivers of savings, households’ need to protect themselves from possible unexpected events and to provide for themselves in retirement have a non-linear decreasing effect on the proportion of an unexpected monetary inheritance allocated towards consumption. Conversely, a positive non-linear pattern on outcome is found for households that are motivated to save to set up a new business or to finance investments in an existing business, to plan travels/holidays, or to make other major purchases. For these last three categories of motivation, the probability that a household intends to allocate 100 % of an unexpected monetary inheritance towards consumption increases 5.3 (CI = 2.3;8.3), 4.9 (CI = 3.6;6.1) and 1.8 (CI = 0.4;3.1) percentage points, respectively.

Moving on to control variables of interest, we observe that the expectations of household income growth have a non-linear increasing effect on the proportion of inheritance allocated towards consumption. Specifically, consistent with evidence discussed in the previous section, the greatest effects on outcome are observable among households who have an expectation of income growth that is higher than price growth. In contrast with the results obtained from the fractional probit models, we found that the presence of at least one child 0–3 years old in the household has a statistically significant (non-linear decreasing) effect on outcome; a reverse pattern is found for the presence of children 4–6 years old. A non-significant statistical effect is confirmed for the presence of children greater than 6 years old. Regarding economic variables, we found that the household equivalent income follows an inverted U-shaped pattern for proportions of inheritance allocated towards consumption equal to or greater than 50 % of inheritance and that it follows a U-shaped pattern for values below this percentage.

5 Concluding remarks

The aim of the study is to explore both the statistical significance and the effects of a variety of motives for saving money on the propensity of Italian households to allocate an unexpected monetary inheritance towards consumption. The analysis has been conducted using microdata from a sample survey conducted by the Bank of Italy in 2012. The survey consisted of a sample of 8151 Italian households and represents the most important data source for analyses of the economic issues facing Italian households. One section of the questionnaire was devoted to collecting information regarding the response to a hypothetical inheritance. Specifically, each household head was asked to imagine receiving an unexpected monetary inheritance equal to the amount that his/her family earns annually and to indicate how he/she would allocate this amount between consumption, savings and paying off debts (if any). This information was then used to investigate the relationship between several motives for saving money and the propensity of Italian households to allocate an unexpected inheritance towards the consumption of durables and non-durables, after controlling for socio-economic, demographic and behavioural factors related to the household and its head.

The results suggest that households that are motivated to save money to set up a private business or to finance investments in an existing business, that intend to travel on holiday, or that intend to make a major purchase (such as a vehicle, furniture, and so forth) are more likely to allocate an income shock towards consumption than households that are motivated by the need to protect against financial instability (such as providing for unexpected events and/or retirement). Furthermore, we find non-linear (increasing/decreasing) effects in the relationship between the motivations for saving money and the response behaviours to an income shock.

An examination of the control variables included in the model reveals that the profile of households less motivated to allocate an unexpected inheritance towards consumption includes those that are renting their home, are in arrears with respect to the payment of commitments, or that have debt with financial institutions. Conversely, households that are motivated to allocate an unexpected monetary inheritance to consumption are characterised by a household head with a higher educational level, who is impatient and who has no expectations of incurring a loss in purchasing power.

In conclusion, it is likely that the decision-making processes of households vary with the dynamics of the business cycle and changes in the degree of perceived uncertainty/risk. In the present study, it was not possible to provide empirical evidence in this regard because of the lack of longitudinal data. However, future research can address this gap.

References

Adessi, W.: Preference shifts and the change of consumption composition. Econ. Lett. 125, 14–17 (2014)

Annunziata, A., Vecchio, R., Kraus, A.: Awareness and preference for functional foods: the perspective of older Italian consumers. Int. J. Consum. Stud. 39, 352–361 (2015)

Baiardi, D., Manera, M., Menegatti, M.: Consumption and precautionary saving: an empirical analysis under both financial and -environmental risks. Econ. Model. 30, 157–166 (2013)

Bellotti, E., Panzone, L.: Media effects on sustainable food consumption. How newspaper coverage relates to supermarket expenditures. Int. J. Consum. Stud. 40, 186–200 (2016)

Berg, L.: Consumer vulnerability: are older people more vulnerable as consumers than others? Int. J. Consum. Stud. 39, 284–293 (2015)

Bryant, W.K., Zick, C.D.: The Economic Organization of the Household. Cambridge University Press, New York (2006)

Clark, A., Georgellis, Y., Sanfey, P.: Scarring: the psychological impact of past unemployment. Economica 68, 221–241 (2001)

De Vaney, S.A.: The usefulness of financial ratios as predictors of household insolvency: two perspectives. Financ. Couns. Plan. 5, 5–26 (1994)

De Vos, K., Zaidi, M.A.: Equivalence scale sensitivity of poverty statistics for the member states of the European community. Rev. Income Wealth 43, 319–333 (1997)

Ferrari, S.L.P., Cribari-Neto, F.: Beta regression for modelling rates and proportions. J. Appl. Stat. 35, 799–815 (2004)

Ferrari, S.L.P., Zeileis, A.: Beta regression in R. J. Stat. Softw. 34, 1–24 (2010)

Fernandez-Villaverde, J., Krueger, D.: Consumption and saving over life cycle: how important are consumer durables? Macroecon. Dyn. 15, 725–770 (2011)

Franken, I.H., Van Strien, J.W., Nijs, I., Muris, P.: Impulsivity is associated with behavioral decision-making deficits. Psychiatry Res. 158, 155–163 (2008)

Friedman, M.: Theory of the Consumption Function. Princeton University Press, Princeton (1957)

Garz, M.: Unemployment expectations, excessive pessimism, and news coverage. J. Econ. Psychol. 34, 156–168 (2013)

Garz, M.: Consumption, labor income uncertainty, and economic news coverage. MPRA Working Paper N. 56076 (2014)

Guiso, L., Jappelli, T., Terlizzese, D.: Earnings uncertainty and precautionary saving. J. Monet. Econ. 30, 307–337 (1992)

Hagenaars, A.J.M., De Vos, K., Zaidi, M.A.: Poverty statistics in the late 1980s: research based on micro-data. Technical report, Office for Official Publications of the European Communities, Luxembourg (1994)

Holden, S.T., Shiferaw, B., Wik, M.: Poverty, market imperfections and time preferences: of relevance for environmental policy? Environ. Dev. Econ. 3, 105–130 (1998)

Jappelli, T., Pistaferri, L.: Intertemporal choice and consumption mobility. J. Eur. Econ. Assoc. 4, 75–115 (2006)

Jappelli, T., Pistaferri, L.: The consumption response to income changes. Annu. Rev. Econ. 2, 479–506 (2010)

Johnson, H.J.: The effects of income-redistribution on aggregate consumption with interdependence of consumers’ preferences. Economica 19, 131–147 (1952)

Karlsson, N., Dellgran, P., Klingander, B., Garling, T.: Household consumption: influences of aspiration level, social comparison, and money management. J. Econ. Psychol. 25, 753–769 (2004)

Knabe, A., Ratzel, S.: Scarring or scaring? The psychological impact of past unemployment and future unemployment risk. Economica 78, 283–293 (2011)

Krueger, D., Perri, F.: How do households respond to income shocks?. Working paper (2011)

Malmendier, U., Nagel, S.: Depression babies: do macroeconomic experiences affect risk taking? Q. J. Econ. 126, 373–416 (2011)

Mazzuco, S., Meggiolaro, S., Ongaro, F.: Economic consequences of union dissolution in Italy: findings from the European Community Household Panel. Eur. J. Popul. 25, 45–65 (2009)

Mengel, F., Tsakas, E., Vostroknutov, A.: Past experience of uncertainty affects risk aversion. Exp. Econ. 19, 151–176 (2016)

Muth, J.F.: Optimal properties of exponentially weighted forecasts. J. Am. Stat. Assoc. 55, 299–306 (1960)

Ozak, O.: Optimal consumption under uncertainty, liquidity constraints, and bounded rationality. J. Econ. Dyn. Control 39, 237–254 (2014)

Padula, M.: Consumer durables and the marginal propensity to consume out of permanent income shocks. Res. Econ. 58, 319–341 (2004)

Papke, L.E., Wooldridge, J.M.: Econometric methods for fractional response variables with an application to 401 (K) plan participation rates. J. Appl. Econ. 11, 619–632 (1996)

Pistaferri, L.: Superior information, income shocks and the permanent income hypothesis. Rev. Econ. Stat. 83, 465–476 (2001)

Smithson, M., Verkuilen, J.: A better lemon squeezer? Maximum-likelihood regression with beta-distributed dependent variables. Psychol. Methods 11, 54–71 (2006)

StataCorp.: Stata Statistical Software: Release 14. StataCorp LP, College Station (2015)

Trostel, P.A., Taylor, G.A.: A theory of time preference. Econ. Inq. 39, 379–395 (2001)

Tutz, G.: Regression for Categorical Data. Cambridge University Press, New York (2012)

Zanin, L.: Determinants of risk attitude using sample surveys: the implications of a high rate of nonresponse. J. Behav. Exp. Financ. 8, 44–53 (2015a)

Zanin, L.: On Italian households’ economic inadequacy using quali-quantitative measures. Soc. Indic. Res. (2015b). doi:10.1007/s11205-015-1019-1

Zanin, L., Marra, G.: A comparative study of the use of generalized additive models and generalized linear models in tourism research. Int. J. Tour. Res. 14, 451–468 (2012)

Acknowledgments

We would like to thank one anonymous reviewer for many suggestions that have helped to improve the presentation and quality of this article. The opinions expressed herein are those of the author and do not reflect those of the institution of affiliation.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Zanin, L. The effects of various motives to save money on the propensity of Italian households to allocate an unexpected inheritance towards consumption. Qual Quant 51, 1755–1775 (2017). https://doi.org/10.1007/s11135-016-0364-8

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11135-016-0364-8

Keywords

- Consumption

- Income shock

- Italian survey of household income and wealth

- Beta regression model

- Fractional probit model

- Ordered logit model