Abstract

This paper contributes in economic literature by investigating the impact of defense spending on income inequality in case of Iran using time series data over the period of 1971–2011. For this purpose, we have applied the ARDL bounds testing approach to cointegration for long run relationship in the presence of structural breaks arising in the series. The stationarity properties of the variables are tested using structural break unit root tests. The causal relationship between defense spending and income inequality is examined by employing the VECM Granger causality approach. Our findings validate the long run relationship between the series. The results indicate that defense spending improves income distribution in Iran. An inverted-U shaped relationship exists between defense spending and income inequality while economic growth reduces income inequality. The causality analysis reveals that defense spending Granger causes income inequality and feedback effect exists between income inequality and economic growth.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

This paper investigates the relationship between military spending and income inequality, which is ignored in the existing literature, focused on Iran. The existing defense economics literature on Iran provides some inconclusive evidence on military spending and income inequality nexus (Ali 2007). Meng et al. (2014) noted that the mechanism between defense spending and income inequality is quite complex. There are many factors that affect income inequality and we attempt to provide insights with regards to income inequality for Iran. The wages earned by labor employed in defense or defense related industries increases with an increase in defense spending. Wages will be increased during the inter-industry dispersion as rents paid by the industry to inelastic portion of personnel (working in defense industry) rises. On the contrary, if initial wages are high in defense or defense linked industries then relative wages will be low with the reduction in defense spending which leads to decline in income inequality. The efficiency wage theory asserts that workforce enjoys high wages in defense or defense related industries. This implies that defense spending and income inequality are endogenous variables (Ali and Galbraith 2003). Furthermore, Opportunity Cost Burden Effect Model (OCBM) reveals a trade-off between increased defense spending and reduced spending on development projects that tends to increase income inequality in the society (Chaitanya 2008). It is documented that income inequality in the society is associated with low social and human development and rise in military spending on the cost of diminishing returns on social sector’s development. The rapid increase in military expenditure leads to rise in total government spending also. In the long run, positive impact of government spending is nullified if productive resources of an economy are transferred for financial support of military spending. The downside to increase in military spending is that it forces the government to curtail spending on development projects (Chaitanya 2008). This shows that “cost of best alternative use (opportunity cost) is forgone by the country as it diverts development spending towards funding the defense sector growth requirement” (Chaitanya 2008, pp. 3).Footnote 1

Geographically, Iran is located in the Middle East and has neighboring borders with Afghanistan and Iraq, on the Eastern and Western sides. Both these counties are mired by political instability, civil war and hostile atmosphere over the last decade. On the other hand, Iran has unfriendly military relations with US and its allies. This background assigns high importance to the role of defense spending in Iran despite the economy experiencing negative economic growth and high inflation in recent years. At the same time, the government is trying to reduce income inequality and has reformed the subsidy plans by targeting subsidies on food and energy. In this context, any study related to income inequality is relevant and important. Our results illustrate that high defense spending could reduce income inequality. Based on our finding, it seems that the sanctioned and war threatened economies could reduce the income inequality through increase in defense spending.

The main objective of present study is to examine the effect of defense spending on income distribution over the period of 1971–2011 in case of Iran. This is a pioneering effort investigating the relationship between military spending and income inequality by incorporating economic growth in inequality function in case of Iran. We apply structural break unit root tests to test stationarity properties of the variablesFootnote 2 We also utilize the ARDL bounds testing approach to cointegration in the presence of structural breaks for long run relationship between the variables. The ordinary least square (OLS) and error correction model (ECM) are used to analyze long run and short run dynamics between the series. The direction of causality between the variables is examined by applying the VECM Granger causality framework. Our findings report that cointegration between the variables exists for long run relationship in case of Iran. Military spending reduces income inequality while inverted-U shaped hypothesis between military spending and income inequality is validated. Economic growth reduces income inequality and there is bidirectional causality between economic growth and income inequality and military spending Granger causes income inequality. The rest of the study is organized as following: Sect. 2 presents the review of literature, empirical model and estimations strategy is constructed in Sects. 3, and 4 deals with results and their discussion, conclusion and policy implications are drawn in Sect. 5.

2 Review of literature

There are many studies based on the association between military spending and economic growth,Footnote 3 however, there is still dearth in the field of military spending and income inequality. Gradstein et al. (2001) reported that democratization environment of political institutions causes to improve income distribution. Further, they concluded that strong correlation between smooth functioning of democratic institution and higher wage rate decline income inequality. These results are supported by Lipset et al. (1993); Diamond (1992) and Rodrik (1999). Dinardo et al. (1996) showed that de-unionization is an important factor to perk up wage inequality. There are numerous factors that affect wage structure in an economy like relative decentralization of wage-setting mechanism, institutional policies towards labour laws wage adjustment. Looney (1990) determined the interaction between military/civilian regime and socio-economic performance. The results indicated that LDCs have high defense burden because these nations have large proportion of budget spending on military needs. Similarly; Melman (1974) documented that high income inequality is the economic cost of permanent war. Income transfer programs and military spending on federal budget deficit has been discussed by Seiglie (1997) for US economy. Seiglie reported that defense spending and budget deficits are linked positively. Budget deficit is used to make income distribution more equal between black and white people.

Our interest is to explore the studies investigating the relationship between military spending and income inequality. For example, Chaitanya (2008) explored the relationship between military spending and income distribution using data of South Asia namely India, Pakistan, Sri Lanka and Bangladesh using model based on opportunity cost burden effect theory. His panel regression analysis supports the view that military spending, arms imports and armed forces deteriorate income inequality. However, in another study on military spending and income inequality Lin and Ali (2009) applied panel Granger non-causality test but did not find any causal relationship between said variables. Hirnissa et al. (2009) used the data of ASEAN countries to examine the impact of military spending on income inequality by applying the ARDL bounds testing approach to cointegration for long run relationship between the variables in the case of Malaysia, Indonesia, Singapore, Philippines, India and South Korea. Their results indicated that the variables are cointegrated for long run relationship. Military spending Granger causes income inequality in Malaysia, feedback effect is found between both variables in the case of Singapore and neutral relationship exists between military spending and income distribution in rest of the countries such as Indonesia, Singapore, Philippines, India and South Korea.

In single country studies, Abell (1994) explored the relationship between military spending and income inequality using data of United States by applying OLS regression. His finding unveiled that military spending worsens income inequality by controlling other macroeconomic variables such as economic growth, taxes, interest rates, non-military spending and inflation. After that, Ali and Galbraith (2003) used panel regression to investigate the impact of GDP growth, per capita income, size of armed forces and military spending on income distribution. Their results indicated that military spending increases income inequality. Comton (2005) noted a negative relationship between military spending and income inequality in United States. He unveiled that increase in military spending generates more jobs for unskilled workers and improves income distribution. Additionally, Henderson et al. (2008) illustrated that cut in military spending increases income inequality. They claimed that employing the people in productive sectors and less productive sectors proportionately contribute to income inequality in United States. In case of Turkey; Ozsoy (2008) noted that budget deficit is negatively correlated with transfer payments programs. The rise in military spending, education, health spending increases budget deficit and in turn, income inequality is increased. Later, Elveren (2012) confirmed the findings of Ozsoy (2008) by reporting that military spending Granger causes income inequality.

Ali (2012) used the data of Middle Eastern and North African (MENA) countries to examine the effect of defense spending on income distribution. Ali reported that military spending improves income distribution and income inequality and economic growth have negative effect on military spending. Kentor et al. (2012) introduced high-tech weaponry as “new” military and used the military expenditure per soldier as a proxy of military capital intensiveness for 82 developed and less developed countries. Their results pointed out that high-tech military spending exacerbates income inequality. Recently, Töngür and Elveren (2014) investigated the relationship between income inequality and military spending using data of 37 countries. They found the direct relationship between income inequality and defense spending. Meng et al. (2014) applied the pairwise Granger causality to test the causal relationship between income inequality and military spending using Chinese data over the period of 1989–2012. Their empirical evidence indicated that military spending Granger causes income inequality.

Recently, Töngür and Elveren (2015) used Turkish time series data (1963–2008) to examine the impact of military spending and income inequality on economic growth. They found that military spending has an insignificant effect on economic growth while income inequality stimulates economic growth. In Chinese economy, Meng et al. (2015) noted that income inequality is cause of defense spending in Granger sense i.e. shocks in defense spending deteriorate income distribution. Wolde-Rufael (2015) investigated the linkages between military spending and income inequality in Tiawan’s economy over the period of 1976–2011. The empirical evidence indicates that military spending is main driver of increasing income inequality. This study is the first effort to fill this gap regarding Iranian economy while investigating the relationship between military spending and income inequality.

3 Modeling, methodological framework and data collection

This study aims to investigate the linkage between defense spending and income inequality. Our model includes economic growth as an additional contributing factor towards income inequality and takes the following form:

where \( IE_{t} \) denotes income inequality, \( D_{t} \) shows defense spending and \( Y_{t} \) indicates economic growth. In order to curtail acuity in the data and achieve consistent and reliable results we have transformed the entire series into its log-linear specification using logarithm (Shahbaz 2010). The empirical model takes the following form:

where \( \ln IE_{t} \), is natural log of income inequality proxied by Gini-coefficient, \( \ln D_{t} \) is the natural log of defense spending per capita, \( \ln Y_{t} \) is natural log of economic growth proxied by real GDP per capita, and \( \varepsilon \) is residual term having zero mean and finite variance. In order to test for the nonlinear relationship, the squared term of defense spending is added to the model which is as following:

In Eq. 3, if: \( \theta_{33} < 0 \) and \( \theta_{44} = 0 \) then income inequality is decreasing, \( \theta_{33} = 0 \) and \( \theta_{44} > 0 \) then income inequality is increasing, \( \theta_{33} > 0 \) and \( \theta_{44} < 0 \) then inverted-U shaped hypothesis is confirmed, \( \theta_{33} < 0 \) and \( \theta_{44} > 0 \) U-shaped relationship is accepted.

Historically, in order to test stationarity properties of the variables, unit root tests such as ADF by Dickey and Fuller (1981), P–P by Phillips and Perron (1988), KPSS by Kwiatkowski et al. (1992), DF-GLS by Elliott et al. (1996) and Ng-Perron by Ng and Perron (2001) have been used. However, due to lack of information on structural break points, these tests produce unreliable results. To remove this anomaly, Zivot and Andrews (1992) suggested another model that allows us to accommodate single unknown structural break in the variables at level form, in the slope of trend component, and in the intercept and trend function. Zivot-Andrews unit root test fixes all points as potential for possible time break and does estimation through regression for all possible break points successively. Clemente et al. (1998) improved the methodology developed by Perron and Vogelsang (1992) to allow for two unknown structural breaks and better handles the problems due to structural breaks compared to Perron and Vogelsang (1992) and Zivot and Andrews (1992) unit root tests which can handle series with single unknown structural break.

Since traditional approaches to cointegration have certain demerits, we have used the autoregressive distributed lag model or the ARDL bounds testing approach to cointegration accommodating the structural break stemming in the series. The ARDL bounds testing approach to cointegration has certain merits like it is flexible regarding integrating order of the variables whether variables are found to be stationary at I(1) or I(0) or I(1)/I(0). In addition, Monte Carlo investigation confirms that this approach is better suited for small sample size (Pesaran and Shin 1999). Moreover, a dynamic unrestricted error correction model (UECM) can be derived from the ARDL bounds testing through a simple linear transformation. The UECM integrates the short run dynamics with the long run equilibrium without losing any information for the long run. The empirical equation of the ARDL bounds testing approach to cointegration is given below:

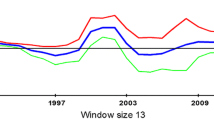

where \( \Delta \) denotes difference operator, \( \mu_{s} \) denotes residual terms, and \( DUM \) denotes dummy variable to capture the structural breaks arising in the series. The structural breaks are based on Clemente et al. (1998). F-statistics are computed to compare with upper and lower critical bounds generated by Pesaran et al. (2001) to test for existence of cointegration. The null hypothesis to examine the existence of long run relationship between the variables is \( H_{0} :\alpha_{IE} = \alpha_{D} = \alpha_{Y} = 0 \) against alternate hypothesis is \( H_{a} :\alpha_{IE} \ne \alpha_{D} \ne \alpha_{Y} \ne 0 \) of cointegration for Eq. 4. Using Pesaran et al. (2001) critical bounds, if computed F-statistic is more than upper critical bound (UCB) there is cointegration between the variables. If computed F-statistic does not exceed lower critical bound (LCB) the variables are not cointegrated for long run relationship. If computed F-statistic falls between lower and upper critical bounds then decision regarding cointegration between the variables is uncertain. However, since our sample size is small, critical bounds generated by Pesaran et al. (2001) may be inappropriate to take decision whether cointegration exists or not. Therefore, we use lower and upper critical bounds developed by Narayan (2005). The stability tests, to scrutinize the stability of ARDL bounds testing estimates, have been applied i.e. CUSUM and CUSUMSQ (Brown et al. 1975).

The ARDL bounds testing approach can be used to estimate long run relationships between the variables. For instance, if there is cointegration in Eq. 4 where income inequality (\( IE_{t} \)), defense spending (\( D_{t} \)) and economic growth (\( Y_{t} \)) are used as forcing variables then there is established long run relationship between the variables that can be molded in following equation given below:

where \( \theta_{0} = - \alpha_{1} /\alpha_{IE} ,\theta_{1} = - \alpha_{D} /\alpha_{1} ,\theta_{2} = - \alpha_{Y} /\alpha_{1} \) and \( \mu_{t} \) is the error term supposed to be normally distributed. These long run estimates are computed using the ARDL bounds testing approach to cointegration when income inequality (\( IE_{t} \)) treated dependent variables. This model can be further improved by including other dependent variables. On confirmation of long run relationship, it is important to find the direction of causality as below:

where \( (1 - L) \) denotes the difference operator and ECT t-1 denotes the lagged residual term generated from long run relationship, \( \varepsilon_{1t} ,\varepsilon_{2t} \, \) and \( \varepsilon_{3t} \) are error terms assumed to be normally distributed with mean zero and finite covariance matrix. The long run causality is indicated by the significance of t-statistic connecting to the coefficient of error correction term (\( ECT_{t - 1} \)) and statistical significance of F-statistic in first differences of the variables shows the evidence of short run causality between variables. Additionally, joint long-and-short runs causal relationship can be estimated by joint significance of both \( ECT_{t - 1} \) and the estimate of lagged independent variables. For instance, \( b_{12,i} \ne 0\forall_{i} \) shows that defense spending Granger-causes income inequality and causality is running from income inequality to defense spending indicated by \( b_{21,i} \ne 0\forall_{i} \).

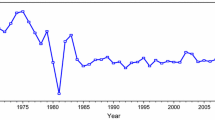

The study covers the period of 1971–2011. The data on real GDP per capita, real military spending per capita and Gini-coefficient (income inequality), has been sourced from world development indicators (CD-ROM 2012). For income inequality (Gini-coefficient) data, we used observations for 1986, 1990, 1994, 1998 and 2005. We have used extrapolation method to generate the time series data from 1971 to 2011 following Jamal (2006). The graphical presentation of three variables is shown in Fig. 1.

4 Results and their discussion

Descriptive statistics of income inequality (\( \ln IE_{t} \)), economic growth (\( \ln Y_{t} \)) and defense spending (\( \ln D_{t} \)) are presented in Table 1. While sample means of economic growth and defense spending are positive, it is negative when income inequality is considered. Skewness and kurtosis are measures of the shape of the distribution. Positive skewness illustrates that all the series are right-skewed. The value of kurtosis indicates that they are leptokurtic relative to a normal distribution. Jarque–Bera results show that the null hypothesis of normal distribution cannot be rejected implying that income inequality (\( \ln IE_{t} \)), economic growth (\( \ln Y_{t} \)) and defense spending (\( \ln D_{t} \)) have normal distributions with finite variance. The correlation analysis indicates that economic growth is positively correlated with income inequality. The negative correlation is found between defense spending and income distribution. There is a positive correlation between defense spending and economic growth.

The next step is to test the integrating properties of variables. In doing so, we have applied the ADF and PP unit root tests and results are reported in Table 2. Our results indicate that the unit root problem is found in the series of income inequality (\( \ln IE_{t} \)), defense spending (\( \ln D_{t} \)) and economic growth (\( \ln Y_{t} \)) with intercept and trend in level form. The variables are found to reject the hypothesis of non-stationarity with intercept and trend in their first differenced form. This shows that the variables are integrated at I(1). The main problem is that ADF and PP unit root tests have low explanatory power and null hypothesis is rejected when it is true and vice versa. Furthermore, these unit root tests do not accommodate information about break points in the series which may also be a cause of unit root problem in the series.

This issue is resolved by applying Zivot and Andrews (1992) structural break unit root test which accommodates information of single unknown break point in the series. The results are reported in Table 3 and we find that all the variables are non-stationary at level with intercept and trend in the presence of structural breaks in the series. These structural breaks are 1980, 1986 and 2004 in the series of income inequality, economic growth and defense spending. Over the selected period of time, Iranian government implemented many economic reforms to stimulate economic growth process. For example, Iran implemented the nationalization policy in 1979 after outbreak of Iran-Iraq war which affected economic activity and hence income inequality in 1980. In 1985, Economic Corporation Organization (ECO) was established to promote economic, technical and cultural corporation among Iran, Turkey and Pakistan. Local elections held in Iran in 2003 affected economic activity as well as defense spending in 2004. In first differenced form, all the variables are found to be stationary. This confirms that the variables have unique order of integration i.e. I(1).

The computation of the ARDL F-statistic is sensitive with lag order selection of the variables. So, it is necessary to choose appropriate lag order of the variables by applying unrestricted vector autoregressive (VAR). Our results reveal that lag order 1 is appropriate confirmed by sequential modified LR test statistic (LR), final prediction error (FPE), Akaike information criterion (AIC), Schwarz information criterion (SC) and Hannan-Quinn information criterion (HQ) method. Based on selected lag lengthFootnote 4 i.e. 1, we have applied the ARDL bounds testing approach to cointegration in the presence of structural breaks in the series. The structural break point in the series is indicated in 2nd row of Table 4. These break points are based on the findings of Zivot and Andrews (1992) unit root test.Footnote 5

The results of ARDL test are reported in the Table 4. We find that our computed F-statistics are 9.695 and 11.656 more than the upper bound at 5 and 1 % significance levels once we used income inequality (\( \ln IE_{t} \)) and economic growth (\( \ln Y_{t} \)) as dependent variables. We could not reject the hypothesis of no cointegration as we used defense spending (\( \ln D_{t} \)) as dependent variable. This confirms the presence of two cointegrating vectors which show that there is a long-run relationship among defense spending, economic growth and income inequality over the period of 1971–2011 in the case of Iran.

The long-run results are shown in Table 5. Our findings indicate that all coefficients are according to our expectations and statistically significant. Furthermore, a negative relationship between defense spending and income inequality is found. It is noted that all else same, a 1 % increase in defense spending will decline income inequality by 0.1167 per cent. This relationship is statistically significant at 1 % level of significance. These findings are contradictory with Abell (1994) for US; Ali and Galbraith (2003) for global data; Chaitanya (2008) for South Asia; Ozsoy (2008) for Turkey; Henderson et al. (2008); and Kentor et al. (2012) for 82 developed countries but consistent with Comton (2005) for US; Ali (2012) for MENA countries. The impact of economic growth on income inequality is positive and it is statistically significant at 1 percent level of significance. A 1 % increase in economic growth exacerbates income inequality by 0.2536 % keeping other things constant. These findings are consistent with Musai et al. (2011) and Keivani (2011) in the case of Iran.

Furthermore, we have included squared term of defense spending i.e. \( \ln D_{t}^{2} \) to examine non-linear relationship between defense spending and income inequality. Our empirical exercise shows that inverted U-shaped relationship between defense spending and income inequality is found in the case of Iran. It is noted that signs of linear and nonlinear terms are positive and negative respectively and statistically significant at 5 % level. This implies that a 1 % increase in defense spending increases income inequality by 4.7783 % (shown by linear term) while negative sign of squared term of defense spending (shown by nonlinear term) verifies the delinking point of income inequality and defense spending. Lastly, we have included dummy to capture the impact of nationalization policy on income inequality. We find that nationalization has negative impact on income inequality. This shows that implementation of the nationalization policy in 1979 improved income distribution in Iran. The lower segment of Table 5 reveals that residual term is normally distributed with constant variance and zero mean. There is no serial correlation between dependent variables and residual term and, same inference can be drawn for autoregressive conditional heteroskedasticity (ARCH). No evidence is found for the existence of white heteroskedasticity. Moreover, model is well specified confirmed by Ramsey reset test statistic.

The short-run dynamics are investigated by applying the error correction model (ECM). Table 6 illustrates the results of both linear and nonlinear models. The linear model shows that defense spending has positive impact on income inequality but it is statistically insignificant. The positive effect of economic growth is found on income inequality and significant at 5 %. This implies that by 1 % increase in economic growth deteriorates income distribution by 0.3681 %. The nonlinear model indicates that inverted-U shaped relationship between defense spending and income inequality exists but it is insignificant. The impact of nationalization policy on income inequality is negative and it is statistically significant at 5 % level. The coefficient of \( ECM_{t - 1} \) indicates short run deviations towards long run equilibrium path. The sign of lagged error term of linear and nonlinear models are significant at 5 % level. The coefficient of \( ECM_{t - 1} \) is 0.3958 for linear and 0.4182 for nonlinear model. This means that deviations in short run towards long run are corrected by 39.58 and 41.82 % per year for linear and nonlinear models respectively.

The lower segment of Table 7 reveals that short run models seem to pass all diagnostic tests. The results illustrate that error terms are normally distributed with constant variance and zero mean for both models. No serial correlation is found between dependent variables and residual term. There is no evidence about the existence of autoregressive conditional heteroskedasticity (ARCH) and white heteroskedasticity. Moreover, both models are well specified validated by Ramsey reset test statistic.

4.1 The VECM granger causality analysis

Casual relationship between income inequality, defense spending and growth is investigated by applying the VECM Granger approach. An appropriate knowledge about the direction of causality between the series can help policy makers in crafting an integrated defense and economic policy to improve income distribution for sustainable economic growth. Granger (1969) suggested if the series are first difference stationary and cointegrated then the VECM Granger is suitable to examine causality relationship between the variables. Our estimated \( ECM_{t - 1} \) coefficients are significant with negative sign for income inequality and economic growth equations. It reveals that the shock exposed by system converging to long run equilibrium path at a higher speed for income inequality (−0.5095) as compared to adjustment speed of economic growth (−0.1785).

The causality analysis reveals that in long run, defense spending Granger causes income inequality. These findings are consistent with existing literature such as Ozsoy (2008) and Elveren (2012) for Turkey; Hirnissa et al. (2009) for ASEAN countries. The feedback effect is found between economic growth and income inequality. This indicates that if economic growth deteriorates income inequality then in such situation income inequality retards economic growth via limiting access to resources and hence reducing investment in physical as well as human capital and vice versa (Shahbaz 2010). The unidirectional causality exists running from defense spending to economic growth. This empirical finding is consistent with Dunne and Vougas (1999) for South Africa; Kollias et al. (2007) for European Union; Karagol and Palaz (2004) and Karagianni and Pempetzoglu (2009) for Turkey; Shahbaz and Shabbir (2012) for Pakistan but contradictory with Tiwari and Shahbaz (2012) for India; Shahbaz et al. (2013) for Pakistan and Farzanegan (2012) for Iran.

The bidirectional causality exists between income inequality and defense spending in short run. In short run, unidirectional causal relationship is found running from income inequality to economic growth. Furthermore, our results validated the existence of inverted-U shaped relationship between defense spending and income inequality as both linear and nonlinear terms of defense spending Granger cause income inequality in short run as well as long run.

5 Conclusion and policy implications

This paper has assessed the relationship between defense spending and income inequality in Iran using annual data over the period of 1971–2011. In doing so, the ARDL bound testing approach to cointegration in the presence of structural break is applied after confirming integrating order of the variables by using structural break unit root test. Our cointegration analysis shows that there is a long run relationship between defense spending, economic growth and income inequality. Furthermore, defense spending improves income distribution in Iran. An inverted-U shaped relationship between defense spending and income inequality also exists. Economic growth increases income inequality. The causality analysis points out that military spending Granger causes income distribution. This confirmed the existence of an inverted-U shaped relationship between defense spending and income inequality. The feedback hypothesis is validated between economic growth and income inequality.

With the notice to the negative effects of defense spending on income inequality, it seems that in Iran defense sector is much more attractive for people belonging to low income groups in comparison with people in high income groups. The negative relationship between defense spending and income inequality in Iran can have multiple explanations. Ali (2012) suggests that “the military establishment in MENA (including Iran) countries is entrenched in all aspect of the society and it is complicated to parse-out the efficient from the inefficient allocations of the societal resources”. Other possible interpretation could be that the equity value of military industrialization more than offset the expense of inefficient allocation of resources hence the negative impact of military expenditure on income inequality. Also this negative relationship could be indicative of attempts by governments to consolidate their power by providing more subsidies and social programs while on the other hand they increase military expenditures. This study can be augmented by adding other factors of income inequality while investigating the impact of military spending on income inequality. These potential variables are welfare, political regimes, democracy, globalization, foreign direct investment etc. The state-level analysis between military spending and income inequality (state-level) is necessary to understand the dynamics of the relationship between both variables for designing a comprehensive defense and economic policy to achieve sustainable economic development in Iran.

Notes

Chaitanya (2008) has explained Opportunity Cost Burden Effect Model with help of diagram.

The results of all studies regarding unit root properties of the variables are biased. The traditional unit root tests do not have information regarding structural break stemming in the series.

Results are available upon request from authors.

We put dummy variable to capture the impact of structural breaks indicated by Zivot and Andrews (1992) unit root test.

References

Abell, J.D.: Military spending and inequality. J. Peace Res. 31, 35–43 (1994)

Ali, E.H.: Military expenditures and income inequality in the Middle East and North Africa: a panel analysis. Def Peace Econ 23(6), 575–589 (2012)

Ali, H.E.: Military expenditures and inequality: empirical evidence from global data. Def Peace Econ 18, 519–535 (2007)

Ali, H.E., Galbraith, J.: Military Expenditures and Inequality: Empirical Evidence from Global Data. The University of Texas at Austin UTIP Working Paper No. 24 (2003)

Brown, R.L., Durbin, J., Evans, J.M.: Techniques for testing the constancy of regression relations over time. J. Royal Stat. Soc. 37, 149–163 (1975)

Chaitanya, V. K.: Exploring the Relationship Between Military Spending & Income Inequality in South Asia. William Davidson Institute Working Paper Number 918, Feb 2008 (2008)

Clemente, J., Montanes, A., Reyes, M.: Testing for a unit root in variables with a double change in the mean. Econ. Lett. 59, 175–182 (1998)

Comton, C.: All men created unequal: tends and factors of inequality in the United States. Issues Political Econ. 13, 1–20 (2005)

Diamond, L.: Economic development and democracy reconsidered. In: Marks, G., Diamond, L. (eds.) Re-Examining Democracy: essays in Honor of Seymour Martin Lipset, pp. 93–139. Sage, Newbury Park (1992)

Dickey, D.A., Fuller, W.A.: Likelihood ratio statistics for autoregressive time series with a unit root. Econometrica 49, 1057–1079 (1981)

DiNardo, J., Fortin, N., Lemieux, T.: Labor market institutions and the distribution of wages, 1973–1993: a semi-parametric approach. Econometrica 64, 1001–1045 (1996)

Dunne, J.P., Vougas, D.: Military spending and economic growth in South Africa. J. Confl. Resolut. 43, 521–537 (1999)

Elliott, G.R., Thomas, J., Stock, J.H.: Efficient tests for an autoregressive unit root. Econometrica 64, 813–836 (1996)

Elveren, Y.A.: Military spending and income inequality: evidence on cointegration and causality for Turkey, 1963–2007. Def. Peace Econ. 23, 289–301 (2012)

Farzanegan, M.R.: Military spending and economic growth: the case of Iran. Def. Peace Econ. (2012). doi:10.1080/10242694.2012.723160

Gradstein, M., Milanovic, B., Ying, Y.: Democracy and Income Inequality: an Empirical Analysis. World Bank, Washington (2001)

Granger, C.W.J.: Investigating causal relations by econometric models and cross-spectral methods. Econometrica 37, 424–438 (1969)

Henderson, D.R., McNab, R.M., Rozsas, T.: Did inequality increase in transition: an analysis of the transition countries of Eastern Europe and Central Asia. East. Eur. Econ. 46, 28–49 (2008)

Hirnissa, M.T., Habibullah, M.S., Baharom, A.H.: Defense spending and income inequality: evidence from selected Asian Countries. Mod. Appl. Sci. 3, 96–111 (2009)

Jamal, H.: Does inequality matter for poverty reduction? Evidence from Pakistan’s poverty trends. Pak. Dev. Rev. 45(3), 439–459 (2006)

Karagianni, S., Pempetzoglu, M.: Defence spending and economic growth in Turkey: a linear and non-linear granger causality approach. Def. Peace Econ. 20, 139–148 (2009)

Karagol, E., Palaz, S.: Does defence expenditure deter economic growth in Turkey? A cointegration analysis. Def. Peace Econ. 15, 289–298 (2004)

Keivani, F.S.: Synchronization of Economic Growth and Income Distribution. 2011 International Conference on Sociality and Economics Development, pp. 7–11. IPEDR vol.10 (2011) © (2011) IACSIT Press, Singapore (2011)

Kentor, J., Jorgenson, A.K., Kick, E.: The ‘‘new’’ military and income inequality: a cross national analysis. Soc. Sci. Res. 41, 514–526 (2012)

Kollias, C., Mylonidis, N., Paleologou, M.S.: A panel data analysis of the nexus between defence spending and growth in the European Union. Def. Peace Econ. 18, 75–85 (2007)

Kwiatkowski, D., Phillips, P.C.B., Schmidt, P., Shin, Y.: Testing the null hypothesis of stationarity against the alternative of a unit root. J. Econ. 54, 159–178 (1992)

Lin, E.S., Ali, H.: Military spending and inequality: panel granger causality test. J. Peace Res. 49, 671–685 (2009)

Lipset, S.M., Seong, K.R., Torres, J.C.: A comparative analysis of the social requisites of democracy. Int. Soc. Sci. J. 45, 155–175 (1993)

Looney, R.: The policy relevance of recent research on the economics of third world military expenditures. J. Soc. Political Econ. Stud. 15, 213–223 (1990)

Melman, S.: The Permanent War Economy: American Economy in Decline. Simon & Schuster, New York (1974)

Meng, B., Lucyshyn, W., Li, X.: Defense expenditure and income inequality: evidence on co-integration and causality for China. Def. Peace Econ. (2014). doi:10.1080/10242694.2013.810026

Meng, B., Lucyshyn, W., Li, X.: Defense expenditure and income inequality: evidence on co-integration and causality for China. Def. Peace Econ. (2015). doi:10.1080/10242694.2013.810026

Musai, M., Abhari, M.F., Hemat, R.K.: Income distribution and economic growth in Iran. Eur. J. Soc. Sci. 20, 416–424 (2011)

Narayan, P.K.: The savings and investment nexus for China: evidence from Co-integration tests. Appl. Econ. 37, 1979–1990 (2005)

Ng, S., Perron, P.: Lag length selection and the construction of unit root test with good size and power. Econometrica 69, 1519–1554 (2001)

Ozsoy, O.: Defence spending and the macroeconomy: the case of Turkey. Def. Peace Econ. 19, 195–208 (2008)

Perron, P., Vogelsang, T.J.: Testing for a unit root in a time series with a changing mean: corrections and extensions. J. Bus. Econ. Stat. 10, 467–470 (1992)

Pesaran, M.H., Shin, Y.: An autoregressive distributed-led modeling approach to cointegration analysis. In: Strom, S. (ed.) Econometrics and Economic Theory in the 20th Century. The Ragnar Frisch Centennial Symposium. Cambridge University Press, Cambridge (1999)

Pesaran, M.H., Shin, Y., Smith, R.J.: Bounds testing approaches to the analysis of long run relationships. J. Appl. Econ. 16, 289–326 (2001)

Phillips, P.C.B., Perron, P.: Testing for a unit root in time series regressions. Biometrika 75, 335–346 (1988)

Rodrik, D.: Democracies pay higher wages. Quart. J. Econ. 114, 707–738 (1999)

Seiglie, C.: Deficits, defence, and income distribution. CATO J. 17, 11–18 (1997)

Shahbaz, M.: Income inequality-economic growth and non-linearity: a case of Pakistan. Int. J. Soc. Econ. 37, 613–636 (2010)

Shahbaz, M., Afza, T., Shabbir, M.S.: Does defence spending impede economic growth? Cointegration and causality analysis for Pakistan. Def. Peace Econ. 24(2), 105–120 (2013)

Shahbaz, M., Shabbir, M.S.: Military spending and economic growth in Pakistan: new evidence from rolling window approach. Econ. Res. 25, 144–159 (2012)

Tiwari, A.K., Shahbaz, M.: Does defence spending stimulate economic growth in India? A revisit. Def. Peace Econ. 24(4), 371–395 (2012). doi:10.1080/10242694.2012.710814

Töngür, Ü., Elveren, A.Y.: Military expenditures, income inequality, welfare and political regimes: a dynamic panel data analysis. Def. Peace Econ. (2014). doi:10.1080/10242694.2013.848577

Töngür, Ü., Elveren, A.Y.: The impact of military spending and income inequality on economic growth in Turkey. Def. Peace Econ. (2015). doi:10.1080/10242694.2014.925324

Wolde-Rufael, Y.: Defence spending and income inequality in Taiwan. Def. Peace Econ. (2015). doi:10.1080/10242694.2014.886436

Zivot, E., Andrews, D.: Further evidence of great crash, the oil price shock and unit root hypothesis. J. Bus. Econ. Stat. 10, 251–270 (1992)

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Shahbaz, M., Sherafatian-Jahromi, R., Malik, M.N. et al. Linkages between defense spending and income inequality in Iran. Qual Quant 50, 1317–1332 (2016). https://doi.org/10.1007/s11135-015-0207-z

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11135-015-0207-z