Abstract

This paper investigates the causal relationship between energy consumption, \(\hbox {CO}_{2}\) emissions and economic growth using dynamic simultaneous-equation panel data models for 58 countries over the period 1990–2012. We also estimate this relationship for three regional panels; namely, Europe and North Asia, Latin America and the Caribbean, and the Middle East, North Africa, and the sub-Sahara African region. Our results indicate that there is a bidirectional causality relationship between energy consumption and economic growth for the four panels, while our results significantly reject the neo-classical assumption that energy is neutral for growth. Similarly, the results support the occurrence of a bidirectional causality relationship between energy consumption and \(\hbox {CO}_{2}\) emissions for the four panels. A unidirectional causality running from \(\hbox {CO}_{2}\) emissions to economic growth for the Latin American and Caribbean, which implies that, the environment degradation has a negative impact on economic growth.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The issue of causality relationship among energy, \(\hbox {CO}_{2}\) emissions and economic growth has been an interesting topic concerning energy economists’ for the last few years. Energy is an important factor of production in economy, even though the value of its share relative to the value of other inputs’ share on the output is usually low 3.5 % (Akpan and Akpan 2012). The efficient exploitation of the development of a nation’s energy resources is thus of great importance for the progress and well-being of the consuming public and the overall economic growth.

In the last years, there have been three strands of research in the literatures on the relationship between economic growth, energy and environment. The first strand of research focused on the causal relationship between environmental pollutants and economic growth, which are closely related to testing the validity of Environmental Kuznets curve (EKC) hypothesis, which postulates an inverted U-shaped relationship between per capita income and the environment degradation in the long run. The second strand is related to the relationship between energy consumption and economic growth. The third strand of research is concerned with the relationship between \(\hbox {CO}_{2}\) emissions and energy consumption. Ozturk (2010) argues that higher energy consumption increases \(\hbox {CO}_{2}\) emissions; however, the use of efficient production technology might reduce these emissions over time (Chang 2010; Omri 2013).

A marriage of the three literatures in which the relationship between energy consumption, \(\hbox {CO}_{2}\) emissions, and economic growth are examined under a multivariate framework, has become a relatively new area of research. Most studies that have focused on this direction for both the developed countries (e.g. Ang 2007; Apergis and Payne 2009; Ozturk and Acaravci 2010a, b, etc) and developing countries (e.g. Jayanthakumaran et al. 2012; Menyah and Wolde-Rufael 2010a, b) have come out with conflicting and mixed results.

This paper used dynamic simultaneous equations based on structural modeling to study the causal relationship between energy consumption, \(\hbox {CO}_{2}\) emissions and economic growth for 58 countries, for the period 1990–2012. The model allows examining at the sometime the interrelationship between energy consumption, \(\hbox {CO}_{2}\) emissions and economic growth estimated by the generalized method of moments (GMM). This study is different from the literature identified below. We do not use panel unit root and panel co-integration approaches. While, we used an investigation technique, a dynamic panel data model which follows the spirit of the conventional ‘growth model’ framework. This approach ensures that there is a strong theoretical foundation for the empirical analysis (Sharma 2011). Our approach in this study is to estimate the short-run elasticities and not to estimate the long-run elasticity given our growth form modeling approach. There is a strong motivation for us to apply a growth form approach to analyzing the interrelationship between energy, \(\hbox {CO}_{2}\) emissions and economic growth. There is a strong motivation for us to apply a growth form approach to analyzing the interrelationship between energy, \(\hbox {CO}_{2}\) emissions and economic growth. We were motivated by the fact that there are no studies that model this interaction using growth form models. Finally, we use a dynamic simultaneous-equation model with panel data of 58 countries, which allows us to derive short-run elasticities.

The rest of the study is organized as follow: In the next section, we provide a brief literature review. In Sect. 3, we discuss the data and methodology used in the study. In Sect. 4, we discuss the results. The final section concludes the study and gives some policy implications.

2 Review literature

The question to know the causal relationship between energy consumption, \(\hbox {CO}_{2}\) emissions and economic growth of a country or a region has shaped an important query among economists in the literature for some time. Empirical studies on this regards, however, provided conflicting results so economists’ views on this issue have not been unanimous. Below, we will provide a brief review the studies that addressed the causal relationship between these three variables.

2.1 Economic growth and energy consumption

The relationship between energy consumption and economic growth has been one of the most investigated yet controversial issues in the energy economics literature since the seminal work of Kraft and Kraft (1978) with the application of a standard Granger causality test. They used the USA data for the period 1947–1974 and found that a unidirectional long run relationship running from GDP to energy consumption. For example, In the case of Malaysia, Ang (2008) found that pollution and energy use were positively related to the output in the long-run with strong support for causality running from economic growth to energy consumption, both in the short-run and long-run. Similarly, Akinlo (2008) examined the relationship between energy consumption and economic growth for 11 Sub-Sahara African countries. Using the autoregressive distributed lag (ARDL) bounds test, he found evidence of unidirectional causality running from economic growth to energy consumption in Sudan and Zimbabwe. Hye and Riaz (2008) have sought to determine the direction of causality between energy consumption (EC) and economic growth (EG), using annual data from 1971 to 2007. In our empirical analysis, we implement a bound testing approach to co-integration and an augmented form of the Granger causality test to identify the direction of the relationship between these variables both in the short and long run. Our findings suggest bidirectional causality between EG and EC in the short run; in the long run we find unidirectional causality from EG to EC.

In a recent study, Lee and Chang (2008) have applied the most recently developed panel unit root, heterogeneous panel cointegration and panel-based error correction models to re-investigate co-movement and the causal relationship between energy consumption and real GDP within a multivariate framework that includes capital stock and labor input for 16 Asian countries during the 1971–2002 period. The empirical results fully support a positive long-run cointegrating relationship between real GDP and energy consumption. It is found that although economic growth and energy consumption lack short-run causality, there is long-run unidirectional causality running from energy consumption to economic growth. This means that reducing energy consumption does not adversely affect GDP in the short-run but would in the long-run. For instance, Odhiambo (2009a) has examined the causal relationship between electricity consumption and economic growth in South Africa. The empirical results show that there is distinct bidirectional causality between electricity consumption and economic growth in South Africa. In addition, the results show that employment in South Africa Granger-causes economic growth. Ziramba (2009), as well, found a bi-directional causality between oil consumption and industrial production but for other forms of energy consumption. In addition, Ouédraogo (2010) empirically establishes the direction of causality between electricity consumption and economic growth in Burkina Faso for the period 1968–2003. Causality results indicate that there is no significant causal relationship between electricity consumption and investment. Estimates, however, detect in the long-run a bidirectional causal relationship between electricity use and real GDP. There is also evidence of a positive feedback causal relationship between GDP and capital formation. Tsani (2010) examined the causal relationship between energy consumption and economic growth for Greece for the period 1960–2006, and found that a unidirectional causality runs from energy consumption to economic growth.

The other study, Binh (2011) have investigated the energy consumption-growth nexus in Vietnam. The causal relationship between the logarithm of per capita energy consumption (LPCEC) and the logarithm of per capita GDP (LPC GDP) during the 1976–2010 periods is examined using the threshold cointegration and vector error correction models for Granger causality tests. The estimation results indicate that the LPCC and LPC GDP for Vietnam are cointegrated and that there is a strong uni-directional causality running from LPCGDP to LPCEC, but not vice versa. Similarly, Warr and Ayres (2010) found a one way causal relationship from energy consumption to economic growth in the USA, but no evidence of causal relationship from economic growth to energy consumption was found. Therefore, to sustain long run growth, it is important to increase either energy suppliers or the efficiency of energy usage. Bildirici (2012) used MS-Granger causality approach to examine the causal relationship between energy consumption and the real GDP in nine African countries. The results reported bidirectional Granger causality between energy consumption and economic growth for the nine analyzed countries. Farhani and Ben Rejeb (2012) have studied the relationship between economic growth (GDP) and energy consumption (EC) by using panel data for 95 countries from 1971 to 2008. The World Bank classification helps us to divide our 95 countries into four income groups of countries: low income group, lower-middle income group, upper-middle income group and high income group countries. The empirical results conclude that panel causality test results reveal that there is a long-run Granger causality running from GDP to EC for low and high income countries and bidirectional Granger causality between GDP and EC for the lower-middle and upper-middle income countries. Kwakwa (2012) has examined the causality between disaggregated energy consumption and overall growth, agricultural and manufacturing growth in Ghana’s economy over the period 1971–2007. By employing the Augmented Dickey Fuller test all variables were found to be integrated of the order one and the Johansen test showed the presence of cointegration between the variables. The granger causality test for the study indicated a unidirectional causality from overall growth to electricity and fossil consumption; a unidirectional causality from agriculture to electricity consumption both in the short and long run; and a feedback relationship between manufacturing and electricity consumption.

In Croatia, Jakovac (2013) has investigated the causal relationship between economic growth and energy consumption for the period 1952–2010. Therefore, has conducted our analysis on two sub-samples. The first one refers to the period 1952–1989 while the second one refers to the period 1993–2010. The years between 1990 and 1992 have been omitted from the analysis due to massive damage to the Croatian economy caused by the war at that time. The findings suggest that there is a bidirectional feedback in the short-run and that causality runs from energy consumption to economic growth in the long-run in the first sub-sample.

2.2 Economic growth and \(\hbox {CO}_{2}\) emissions

Over the past three decades, several studies have investigated the causal relationship between \(\hbox {CO}_{2}\) emissions and economic growth. For example, Richmond and Kaufmann (2006) found no significant causality between \(\hbox {CO}_{2}\) emissions and economic growth for 36 nations over the period 1973–1997, which validates the hypothesis neutrality. Dinda (2009) studied the causal link between \(\hbox {CO}_{2}\) emissions and economic growth for the OECD and non-OECD countries. He could that, for the OECD country group, \(\hbox {CO}_{2}\) emission is the cause of growth of income, where as for the non-OECD country group, the reverse is true. In contrast to the findings of Halicioglu (2009), Soyas and Sari (2009) found that there was a bi-directional Granger causality (both in short- and long-run) between carbon emissions and income in Turkey. In Nigeria and Venezuela, Soyas and Sari (2009) found a unidirectional causality running from economic growth to \(\hbox {CO}_{2}\). Similarly, Soyas and Sari (2009) investigated the long-run Granger causality relationship between energy consumption, \(\hbox {CO}_{2}\) emissions, and economic growth, in Turkey. They found no evidence of a long- run relationship between \(\hbox {CO}_{2}\) emissions and income.

On the other hand, Ghosh (2010) studies the causal link between carbon emissions and economic growth for India using ARDL bounds testing approach complemented by Johansen–Juselius maximum likelihood procedure in a multivariate framework by incorporating energy supply, investment and employment for time span 1971–2006. The results indicate that they exists a bi-directional short-run causality between the two. Hence, in the short-run, any effort to reduce carbon emissions could lead to a fall in the national income. Furthermore, also establishes unidirectional short-run causality running from economic growth to energy supply and energy supply to carbon emissions. In another study, Arouri et al. (2012) tried first to verify the existence of EKC in 12 MENA Countries over the period 1981–2005 and, second to characterize the turning points until which the development improves the environmental quality in these countries. Their results provide poor evidence in support of the EKC hypothesis the suggesting that all the MENA countries need to sacrifice economic growth to decrease their emission levels but they may achieve \(\hbox {CO}_{2}\) emissions reduction via energy conservation without negative long run effects on economic growth. Finally, and by using panel unit root tests and co-integration techniques, they found that energy consumption has a positive significant impact on the \(\hbox {CO}_{2}\) emissions in the long-run and that real the GDP shows a quadratic relationship with the \(\hbox {CO}_{2}\) emissions for the region as a whole. Odhiambo (2012) examined the causal relationship between \(\hbox {CO}_{2}\) emissions and economic growth in South Africa—using the newly developed ARDL-Bounds testing approach. The empirical results show that there is a distinct unidirectional causal flow from economic growth to carbon emissions in South Africa. It also finds that energy consumption Granger-causes both carbon emissions and economic growth.

In the case of Romania, Shahbaz et al. (2013) probed the existence of EKC hypothesis over the period of 1980–2010. They applied the ARDL bounds testing for long run and reported that relationship between economic growth and \(\hbox {CO}_{2}\) emissions is inverted U-shaped i.e. the EKC hypothesis is found. Furthermore, energy consumption contributes positively to \(\hbox {CO}_{2}\) emissions which have a negative impact on economic and financial policies.

2.3 Energy consumption, energy consumption, and \(\hbox {CO}_{2}\) emissions

In a multivariate causality study on China, Zhang and Cheng (2009) found a unidirectional Granger causality running from the GDP to energy consumption, and a unidirectional Granger causality running from energy consumption to carbon emissions in the long run, but neither carbon emissions nor energy consumption leads to economic growth. In contrast, Jalil and Mahmud (2009) examined the long-run relationship between carbon emissions and energy consumption, income and foreign trade in the case of China and found evidence of an EKC relationship. Their results also indicate that carbon emissions are mainly determined by income and energy consumption in the long-run, whereas trade has no impact on \(\hbox {CO}_{2}\) emissions. Concerning South Africa, there is no empirical evidence that investigates the relationship between output growth and \(\hbox {CO}_{2}\) emissions using modern advances in time series econometrics of co-integration and causality. However, there are few studies that linked economic growth to energy consumption.

Furthermore, Apergis and Payne (2010a, b), for a group of Commonwealth Independent States, found that both energy consumption and economic growth cause \(\hbox {CO}_{2}\) emissions in the short-run. In the long-run there appears to be a bi-directional causality between energy consumption and \(\hbox {CO}_{2}\) emissions. In addition, Lean and Smyth (2010) found a causal relationship running from electricity consumption and \(\hbox {CO}_{2}\) emission to economic output; and a bidirectional relationship between \(\hbox {CO}_{2}\) emissions and energy consumption in the ASEAN countries. Similarly, Ozturk and Acaravci (2010a, b) found similar results in Turkey where a short run and a long run causal relationship between energy consumption, \(\hbox {CO}_{2}\) emission and growth exist. Pao and Tsai (2010) examined the causal links between energy consumption and \(\hbox {CO}_{2}\) emissions for a panel of BRIC countries. The results from their Granger causality tests indicate the existence of strong bidirectional causality between these variables over the period 1992–2007. Niu et al. (2011) found a long run relationship between energy consumption, \(\hbox {CO}_{2}\) emission and economic growth in eight Asian economies. Although the \(\hbox {CO}_{2}\) emission per capita and energy efficiency of energy use in the developing countries are much lower than in the developed countries, the \(\hbox {CO}_{2}\) emission per unit of energy use is much higher than the developed countries. Tiwari (2011) examined the relationship between total primary energy consumption, \(\hbox {CO}_{2}\) emissions, and economic growth in India. He found a long run relationship among the series, and economic growth Granger causes energy consumption but neutral effect exists between economic growth and \(\hbox {CO}_{2}\) emissions while same is true for energy consumption and \(\hbox {CO}_{2}\) emissions.

Bloch et al. (2012) have investigated the relationship between coal consumption and income in China using both supply side and demand-side frameworks. Cointegration and vector error correction modeling show that there is a unidirectional causality running from coal consumption to output in both the short and long run under the supply-side analysis, while there is also a unidirectional causality running from income to coal consumption in the short and long run under the demand-side analysis. The results also reveal that there is bi-directional causality between coal consumption and pollutant emission both in the short and long run. Hossain (2012) has examined the dynamic causal relationship between carbon dioxide emissions, energy consumption, economic growth, foreign trade and urbanization in Japon using time series data for the period of 1960–2009. Short-run unidirectional causalities are found from energy consumption and trade openness to carbon dioxide emissions, from trade openness to energy consumption, from carbon dioxide emissions to economic growth, and from economic growth to trade openness. Yang et al. (2012) have analyzed the causal relationships between carbon emissions, energy consumption, and economic growth in Shanghai for the period of 1978–2010, adopting the co-integration and vector error correction methods. The empirical results showed, in the long-run equilibrium, are a positive relationship of a long-term equilibrium between carbon emission and energy consumption in Shanghai. However, between carbon emission and real GDP, there is a negative correlation. Besides, in the short-run equilibrium, energy consumption is the important impact on carbon emission. The causality results show that there is a bidirectional causality relationship between carbon emission, real GDP and energy consumption. More recently, Omri (2013) has examined the nexus between energy consumption, \(\hbox {CO}_{2}\) emissions, and economic growth using simultaneous-equation models with panel data of 14MENA countries over the period 1990–2011. His empirical results show that there is a bidirectional causal relationship between energy consumption and economic growth and a bidirectional causal relationship between economic growth and \(\hbox {CO}_{2}\) emissions for the region as a whole. Table 1 shows a summary of what has been previously mentioned regarding the results arrived at by the studies that deal with energy consumption, \(\hbox {CO}_{2}\) emission and GDP Growth.

3 Data and econometric procedure

3.1 Data source and descriptive statistics

The variables used in this study are the GDP per capita (constant 2005 US$), energy consumption (kg of oil per capita), \(\hbox {CO}_{2}\) emissions (metric tons per capita), capital stock (constant 2005 US$), foreign direct investment (% GDP), financial development (total credit to private sector as a ratio of GDP), total population (in thousands), trade openness (% of export and imports of GDP), and \(\hbox {GDP}^{2}\) the square of per capita GDP, and urbanization (% urban population of the total population). These variables come from the World Development Indicators (WDI 2011). The annual data selected cover the period from 1990 to 2012. Our study is about 58 countries selected on the basis of data availability. They include: (i) the European and North Asian countries, consisting of 22 countries, namely: Albania, Belgium, Bulgaria, Denmark, France, Germany, Greece, Hong Kong, Korea, Hungary, Iceland, Ireland, Italy, Japan, Luxembourg, the Netherlands, Norway, Portugal, Spain, Sweden, Switzerland, and the United Kingdom; (ii) the Latin American and Caribbean region, consisting of 15 countries, namely: Argentina, Bolivia, Brazil, Nicaragua, Chile, Costa Rica, Ecuador, Guatemala, Honduras, Mexico, Panama, Paraguay, Peru, Uruguay, and Venezuela; and (iii) the Middle Eastern, North African, and sub-Saharan region, consisting of 21 countries, namely: Algeria, Botswana, Cameroon, Congo, Cote D’Ivoire, Ethiopia, Gabon, Ghana, Egypt, Iran, Jordon, Kenya, Morocco, Mozambique, South Africa, Senegal, Sudan, Syrian Arab Republic, Togo, Tunisia, and Zambia. Table 2 presents’ descriptive statistics for all variables used in this study and discussions are provided accordingly.

The highest average of per capita GDP is obtained in the European and North Asian region, followed by the Latin American and Caribbean region, the Middle Eastern, North African, and sub-Saharan region with 31,342.48, 3,872.168, and 1,839.635, respectively. It has the highest coefficient of variation for the Middle Eastern, North African, and sub-Sahara region (0.960) as measured by the standard deviation-to-mean ratio, followed by the European and North Asian region and the Latin American and Caribbean region. Thereafter, Energy use is measured in the equivalent of kg of oil per capita. The mean of per capita energy use is the highest in Europe and North Asia (4,053.833) followed by Latin America and the Caribbean (1,041.055), and the Sub-Sahara/ North African and Middle Eastern regions (778.128), respectively. It is also noted that the Middle Eastern, North African, and sub-Saharan regions are the most volatile; their coefficient of variation is 7.966, which is the highest compared to other regions coefficient of variation. Finally, the highest level of per capita \(\hbox {CO}_{2}\) emissions is found for the European and North Asian region, followed by the Latin American and Caribbean region and the Middle Eastern, North African, and sub-Saharan region with 8.252, 2.332, and 1.765 metric tons, respectively. It has the highest coefficient of variation for the Middle Eastern, North African, and sub-Saharan region (1.273) measured by the standard deviation-to-mean ratio, followed by the Latin American and Caribbean region, and the European and North Asian region.

3.2 Econometric procedure

This study uses the Cobb–Douglas production function for examine the causal relationship between the energy consumption, \(\hbox {CO}_{2}\) emissions and economic growth, whereby the gross domestic product (GDP) depends on endogenous variables including energy consumption, \(\hbox {CO}_{2}\) emissions, foreign direct investment, capital stock, and labor force. This extended production function provides a meaningful framework in which to explore the three-way linkages between four variables.

Niu et al. (2011), Shahbaz et al. (2013), among others, include \(\hbox {CO}_{2}\) emissions and energy consumption variables in their empirical models to study the impact of these two variables on economic growth. While they generally find that FDI and \(\hbox {CO}_{2}\) emissions play important roles in explaining economic growth, in related studies, Vu et al. (2006), Ayanwale (2007) and Saboori et al. (2012), among others, show that FDI has a statistically significant influence on economic growth. The empirical model that we develop in this study is consistent with the broader literature on the determinants of economic growth and takes the following form:

Model (1) states that GDP per capita is based function of energy consumption per capita (ENC), \(\hbox {CO}_{2}\) emissions \((\hbox {CO}_{2})\), foreign direct investment inflows (FDI), labor force (L), and capital stock (K). We write Model (1) in the growth and panel data form as follows:

We can also divide both vides by population and get each series in per capita terms:

where i represents country (in our study, we have 58 countries); t represents time (our time frame is 1990–2012; \({\upvarepsilon }\) is the standard error term. \({\upalpha }_{1}, \, {\upalpha }_{2}, \, {\upalpha }_{3}\), and \({\upalpha }_{4}\), represent the long-run elasticity estimates of energy consumption, \(\hbox {CO}_{2}\) emissions, foreign direct investment, capital stock, respectively. gGDP represents the growth rate of per capita GDP, gENC represents the growth rate of per capita energy consumption, g\(\hbox {CO}_{2}\) the growth rate of per capita \(\hbox {CO}_{2}\) emissions, gK represents the growth rate of capital stock, and FDI the foreign direct investment.

By reformulating Model (3) into regression equations in order to treat energy consumption, \(\hbox {CO}_{2}\) emissions, and economic growth simultaneously as endogenous variables. Based on theoretical and empirical insights from the previous literature, the simultaneous-equation models that allow the investigation of the three-way linkages between these variables can be set out as follows:

Model (4) states that energy consumption, \(\hbox {CO}_{2}\) emissions, as well as the capital stock, and FDI can potentially determine economic growth (e.g. Ang 2008; Menyah and Wolde-Rufael 2010a, b; Saboori et al. 2012; Omri 2013).

Model (5) states that energy consumption (ENC) can be influenced by economic growth (GDP), \(\hbox {CO}_{2}\) emissions \((\hbox {CO}_{2})\), capital stock (K), and financial development level (FD) as measured by domestic credit to the private sector as share of GDP and the total population (POP) (e.g. Zhang and Cheng 2009; Sadorsky 2011).

Model (6), economic growth, economic growth square, energy consumption, the urbanization degree, and trade openness (TR), as measured by the ratio of (exports plus imports) to GDP, can potentially affect \(\hbox {CO}_{2}\) emissions (e.g. Apergis and Payne 2009; Halicioglu 2009).

3.3 Estimation technique

In our study we use a dynamic panel data models in a simultaneous-equations where lagged values of economic growth, energy consumption, and \(\hbox {CO}_{2}\) emissions are taken into account by using the Arellano and Bond (1991) GMM estimator. The GMM approach uses a set of instrumental variables to solve the endogeneity problem of the regressors. Accordingly, our empirical models to be estimated can be rewritten as follows:

where \(\hbox {gGDP}_\mathrm{i,t}, \, \hbox {gENC}_\mathrm{i,t}\), and \(\hbox {CO}_{2\mathrm{i,t}}\) represent, respectively, the growth rate of GDP, energy consumption and \(\hbox {CO}_{2}\) emissions of country i at time t. \({\upalpha }_{0}\) is the parameter to be estimated; Z is a vector of core explanatory variables used to model economic growth (foreign direct investment and capital stock), to model energy consumption (capital stock, total population, and financial development); and to model \(\hbox {CO}_{2}\) emissions (square GDP, trade openness, and urbanization), \({\upmu }\) is country-specific effects; and \({\upvarepsilon }\) is the error term. Finally, \(\upgamma \) and \({\updelta }\) captures the effect of energy consumption and \(\hbox {CO}_{2}\) emissions on economic growth; \({\updelta }\) and \(\upgamma \) captures the effects of economic growth and \(\hbox {CO}_{2}\) emissions on energy consumption; \({\upalpha }\) and \({\upbeta }\) captures the effects of economic growth and energy consumption on \(\hbox {CO}_{2}\) emissions.

Since the lagged dependant variable \((\hbox {gGDP}_\mathrm{i,t-1}, \, \hbox {gEC}_\mathrm{i,t-1}\), and \(\hbox {gCO}_{2\mathrm{i,t}-1})\) is correlated with the error term, the use of panel ordinary least squares (OLS) estimator (with fixed and random effects) is problematic. The Arellano and Bond (1991) approach solves this problem by first differentiating the above equation.

4 Empirical findings and discussion

After ascertaining the form in which variables would enter the empirical models, we proceed with the Arellano and Bond (AB, 1991) GMM estimator to find the causal relationship between energy consumption, \(\hbox {CO}_{2}\) emissions, and economic growth for all four panels. Each panel contains three different models (7)–(9) are simultaneously estimated. Tables 3, 4, 5 and 6 report the results for which diagnostic tests (the Sargan statistic for over-identification) provide good statistical performance.

The results of the global panel are reported in Table 3. Model 1 shows that energy consumption has a significant positive impact on economic growth at 1 % level. For the global panel, these results indicate when the power consumption increases by 1 % increases economic growth by around 0.149 %, which is consistent with the results achieved by (Shahbaz et al. 2013; Shahbaz and Lean 2012). Since energy is an important ingredient for economic growth, strong energy policies are required to attain sustained economic growth (Apergis and Payne 2010a, b). The \(\hbox {CO}_{2}\) emission has a negative impact and statistically significant on economic growth at 5 % level. Who suggest that a 1 % increase in \(\hbox {CO}_{2}\) emissions decreases economic growth by 0.0060 % is consistent with the findings of Jayanthakumaran et al. (2012) for China and India. Thereafter, the coefficient of capital is positive and significantly affects economic growth. The panel results of the regression equation with economic growth, as a dependent variable show, that the coefficient of K is positive and significant at 1 % level. These results are consistent with the findings of Shahbaz and Lean (2012). Who suggest that a 1 % increase in real capital increases economic growth by 0.067 %. This implies that capital is an important determinant of economic growth. Finally, FDI inflows have a positive and significant effect on economic growth at 1 % level. The results suggest that a 1 % increase in foreign direct investment raises the economic growth for the global panel by 0.033 %, which is consistent with the results achieved by Anwar and Nguyen (2010).

In Model (2), we conclude that the effects of economic growth and \(\hbox {CO}_{2}\) emissions on energy consumption are statistically significant at 1 % level. Economic growth and \(\hbox {CO}_{2}\) emissions have positive impacts on energy consumption. Accordingly, a 1 % increase in economic growth increased energy consumption for the global panel by 0.350 %, meaning that higher economic growth does send positive signals to energy consumption. This implies that economic growth tends to increase energy consumption. The results are consistent with the findings of Altinay and Karagol (2005) for Turkey; Oh and Lee (2004) for Korea; Ang (2008) for Malaysia; Belloumi (2009) for Tunisia, Halicioglu (2009) for Turkey; and Odhiambo (2009a, b) for Tanzania. On the other hand, a 1 % increases in \(\hbox {CO}_{2}\) emissions increases energy consumption per capita by around 0.138 %. Our results are in line with the findings of Menyah and Wolde-Rufael (2010a, b) for the United States and Wang et al. (2011) for China. Thereafter, the coefficient of capital variable has a positive but statistically insignificant impact on energy consumption. Our result is different with what stated in literature that more capital accumulation is expected to raise energy consumption (see Lorde et al. 2010). Similarly, the variable of financial development has a positive impact on energy consumption. This implies that an increase in the domestic credit to the private sector increases the energy consumption. The coefficient is 0.00066, indicating that energy consumption increases by 0.00066 % when there is a 1 % increase in the domestic credit to the private sector. Financial development promotes investment which raises energy demand due to economic growth. This implies that financial development promotes business activities and adds to demand for energy via cheaper credit. The findings are in line with those of Karanfil (2009), Sadorsky (2010, 2011), Shahbaz and Lean (2012), Islam et al. (2013), Shahbaz et al. (2013) and Wang et al. (2013). Finally, the variable of population has a negative but statistically insignificant impact on energy consumption.

In Model (3), economic growth per capita has a positive impact on the \(\hbox {CO}_{2}\) emissions. The coefficient is 0.027, indicating that \(\hbox {CO}_{2}\) emissions increase by 0.027 % when there is a 1 % increase in economic growth. This implies that an increase in economic growth tends to increase the environment degradation. The results are consistent with the findings of Halicioglu (2009) for Turkey; Fodha and Zaghdoud (2010) for Tunisia; Wang et al. (2011) for China; Arouri et al. (2012) for 12 MENA countries; Jayanthakumaran et al. (2012) for both China and India; Saboori et al. (2012) for Malaysia; and Lee (2013) for the G20 countries. The squared GDP has a negative and statistically significant impact on the \(\hbox {CO}_{2}\) emissions. The results are different with the findings of Coondoo and Dinda (2008), Dinda and Coondoo (2006), Akbostanci et al. (2009) and Lee and Lee (2009). Energy consumption has a significant positive impact on the \(\hbox {CO}_{2}\) emissions at the 1 % level. This indicates that a 1 % increase in energy consumption raises the \(\hbox {CO}_{2}\) emissions by 0.816 %, suggesting that energy consumption increase the environment degradation. Similar results are documented by Soytas et al. (2007); Pao and Tsai (2010) and Sharma (2011); Halicioglu (2009); Zhang and Cheng (2009) and Arouri et al. (2012). Similarly, the urbanization variable has a negative significant impact on the per capita \(\hbox {CO}_{2}\) emissions at the 5 % level. The coefficient value of urbanization reveals that a 1 % increase in urbanization reduces the \(\hbox {CO}_{2}\) emissions by 0.039 %. The variable openness variable has a negative but statistically insignificant impact on the \(\hbox {CO}_{2}\) emissions. This result is different with that of Khalil and Inam (2006), and Halicioglu (2009).

The results of the Europe and North Asia panels are reported in Table 4. Model 1 shows that, similar to the results of the global panel, economic growth is affected positively by energy consumption and negatively by \(\hbox {CO}_{2}\) emissions. The impact of other variables on economic growth is exactly the same as the results for the global panel. Thereafter, in Model 2, economic growth continues to affect energy consumption significantly at 1 % level. A 1 % increase in economic growth leads to a lower increase in the energy consumption (0.260 %) compared to the global panel (0.350 %). Another important finding is that \(\hbox {CO}_{2}\) emissions have significant impacts on energy consumption for the European and North Asian panel. Similarly, the capital stock has a negative but statistically insignificant impact on energy consumption. The variable of financial development has a positive but statistically insignificant impact on energy consumption. The variable of population has a positive and statistically significant on energy consumption at 5 % level. This indicates that a 1 % increase in the population raises energy consumption by 0.580 %. This is consistent with the findings of Batliwala and Reddy (1993), and Islam et al. (2013).

Finally, in Model (3), economic growth has a positive impact and statistically significant on the \(\hbox {CO}_{2}\) emissions, indicating that the latter increase by 0.140 % when there is a 1 % increase in economic growth per capita. The negative sign of the GDP confirms the link between of the \(\hbox {CO}_{2}\) emissions and the high level of economic growth. The findings validate the existence of the so-called Environmental Kuznets curve (EKC) which states that the \(\hbox {CO}_{2}\) emissions increase with economic growth at the initial stages and start to declines after stabilization as the economy achieves a sustainable level of economic growths. These results are different with those of Halicioglu (2009), Fodha and Zaghdoud (2010), Nasir and Rehman (2011). Indeed, the GDP squared has a positive but statistically insignificant impact on \(\hbox {CO}_{2}\) emissions. The energy consumption has a significant positive impact on the \(\hbox {CO}_{2}\) emissions at 1 % level. A 1 % increase in energy consumption raises the \(\hbox {CO}_{2}\) emissions by 0.960 %, suggesting that energy consumption increases the environment degradation. Besides, urbanization and trade openness have a statistically insignificant impact on the \(\hbox {CO}_{2}\) emissions.

Table 5 presents the estimated results for panels of Latin America and the Caribbean. According to Table 5, the results show that there is a positive impact of energy consumption and a negative impact of \(\hbox {CO}_{2}\) emissions on economic growth is smaller for the Latin American and Caribbean panel than for the global panel (0.095 and 0.0019 % or 0.149 and 0.0060 %, respectively). The capital stock and the FDI inflows have a positive and statistically significant effect on economic growth (Model 1). Thereafter, the Model 2 shows that economic growth, \(\hbox {CO}_{2}\) emissions have a positive and significant effect on the energy consumption per capita at 1 % level. A 1 % increase of \(\hbox {CO}_{2}\) emissions and economic growth increases energy consumption by 0.405, and 0.245 %. The impact of the financial development on energy consumption is positive and statistically significant at 5 % level. This means that a 1 % increase in financial development increase energy consumption by 0.0090 %. The coefficient of population has a positive but statistically insignificant impact on energy consumption. Finally, in Model 3, energy consumption has a positive and statistically significant effect on the \(\hbox {CO}_{2}\) emissions at 1 % level. Economic growth has a positive but statistically insignificant impact on \(\hbox {CO}_{2}\) emissions. The urbanization and trade openness variables are to reduce the level of emissions of \(\hbox {CO}_{2}\) but statistically insignificant impact on \(\hbox {CO}_{2}\) emissions.

Table 6 presents the estimated results of the Middle Eastern, North African, and sub-Sahara panel. The result from Model 1 shows that economic growth is affected positively by energy consumption and negatively by the \(\hbox {CO}_{2}\) emissions. The impact of the other variables on economic growth is exactly the same as the results for the global panel, in the European and Asian regions, and the Latin American and Caribbean regions. Thereafter, the result from Model 2 shows that economic growth continues to affect energy consumption significantly at 5 % level, but a 1 % increase in economic growth leads to a lower increase in energy consumption (0.162 %) compared to the global panel by (0.350 %). Another important finding is that the \(\hbox {CO}_{2}\) emissions have a positive significant impact on energy consumption at 1 % level for the Middle East, North Africa, and Sub-Saharan. It is exactly the same as the results for the global panel, in the European and North Asian, and Latin American and Caribbean regions. The population has a positive effect and significant on energy consumption at 1 % level. This implies an increase of 1 % of the population increases energy consumption by 1.002 %. Finally, in Model 3, economic growth causes changes in the per capita \(\hbox {CO}_{2}\) emissions. Effectively, a 1 % increase in economic growth decreases \(\hbox {CO}_{2}\) emissions by 5.797 %. This result is consistent with the findings by Pao and Tsai (2010), which provides evidence of an inverted U-shape for the growth–pollutant emissions nexus for a panel of the BRIC countries. Energy consumption per capita has a significant positive impact on \(\hbox {CO}_{2}\) emissions at 1 % level. A 1 % increase in energy consumption raises the \(\hbox {CO}_{2}\) emissions by 0.823 %, suggesting that energy consumption increases the environment degradation. The coefficient of urbanization is positive and trade openness is negative but statistically insignificant impact on the \(\hbox {CO}_{2}\) emissions.

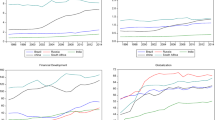

Finally, we have summarized the above results concerning the three-ways linkages between energy consumption, \(\hbox {CO}_{2}\) emissions, and economic growth for the four panels in Figs. 1, 2, 3 and 4 to make the comparison easier. The main findings can be summarized as follows. First, the effect of the per capita GDP on energy consumption in the four panels of countries is positive and statistically significant. This implies that, an increase in economic growth tends to raise energy consumption (Shahbaz and Lean 2012; Islam et al. 2013). The results are consistent with the findings of Aqeel and Butt (2001) for Pakistan, Ghosh (2002) and Paul and Bhattacharya (2004) for India, Morimoto and Hope (2004) for Sri Lanka, Ghali and El-Sakka (2004) for Canada, Oh and Lee (2004) for Korea, Altinay and Karagol (2005) for Turkey, Ang (2008) for Malaysia, Bowden and Payne (2009) for USA, Halicioglu (2007) for Turkey, Belloumi (2009), Odhiambo (2009a, b) for Tanzania, Shahbaz and Lean (2012) for Tunisia, and Omri (2013) for 14 MENA countries. On the other hand, the impact of the per capita GDP on the \(\hbox {CO}_{2}\) emissions is positive in the four panels, but not significant only of the Latin America and the Caribbean. This confirms the results showed by He (2008) for China, Song et al. (2008) for China, Halicioglu (2009) for Turkey, Jalil and Mahmud (2009) for China, Fodha and Zaghdoud (2010) for Tunisia, Lean and Smyth (2010) for ASEAN countries for Pakistan. Second, energy consumption has a statistically significant effect on economic growth in the four panels. This indicates that an increase in energy consumption tends to promote economic growth (Shahbaz and Lean 2012). Since energy is an important ingredient for economic growth, strong energy policies are required to realize sustained economic growth. This result is consistent with the findings of Apergis and Payne (2010a, b) and Omri (2013). Similarly, energy consumption has a statistically significant effect on the \(\hbox {CO}_{2}\) emissions in the four panels. The results reveal that increase in energy consumption will increase \(\hbox {CO}_{2}\) emissions. The findings are in line with the results showed by Hamilton and Turton (2002), Friedl and Getzner (2003), Liu (2005), Ang and Liu (2001), Say and Yucel (2006), Ang (2008), Halicioglu (2009), and Jalil and Mahmud (2009). Third, the \(\hbox {CO}_{2}\) emissions are found to have a statistically significant effect on the energy consumption per capita in the four panels. This is consistent with the findings of Menyah and Wolde-Rufael (2010a, b) for the United States and Wang et al. (2011) for china. However, the \(\hbox {CO}_{2}\)emissions have a negative effect on economic growth in the four panels. This result is consistent with the findings of Jayanthakumaran et al. (2012).

We have summarized these results in four figures. Table 4 reports the results for the European and North Asian region. The findings reveal that there is a bidirectional causal relationship between economic growth as well as energy consumption and between energy consumption and the \(\hbox {CO}_{2}\) emissions; and a bidirectional causal relationship between economic growth and \(\hbox {CO}_{2}\) emissions (Fig. 1). The results of the Latin American and Caribbean region are reported in Table 2. The findings reveal that there is a bi-directional causal relationship between economic growth and energy consumption as well as between energy consumption and \(\hbox {CO}_{2}\) emissions; and but a unidirectional causal relationship from \(\hbox {CO}_{2}\)emissions to the economic growth (Fig. 2). In addition, for the Middle Eastern, North African and Sub-Saharan regions, the findings reveal that there is a bidirectional causal relationship between economic growth and energy consumption as well as between energy consumption and \(\hbox {CO}_{2}\) emissions. Besides, is a bidirectional causal relationship between \(\hbox {CO}_{2}\) emissions and economic growth (see Fig. 3). For the global panel, the findings reveal that there is a bi-directional causal relationship between economic growth and energy consumption; \(\hbox {CO}_{2}\) emissions and energy consumption; and bidirectional causal relationship between economic growth and \(\hbox {CO}_{2}\) emissions (see Fig. 4).

5 Conclusion and policy implications

While the literature on energy—environment—GDP for individual countries and for panels of countries has increased over the last few years, there is no study that examines the interactions between the three variables using a growth framework. The major aim of this paper is to examine if there is causal relationships between economic growth, energy consumption and carbon emissions by using simultaneous-equation models that rely on a growth framework. We empirically tackle this issue for a global panel of 58 countries around the world as well as for three regional sub-panels, suchas Europe and North Asia, Latin America and the Caribbean, and the Middle East, North Africa, and sub-Sahara over the period 1990–2012. First, we found that there are bi-directional causal relationships between energy consumption and economic growth for the four panels. Our results significantly reject the neo-classical assumption that energy is neutral for growth. This pattern is similar to the findings of Oh and Lee (2004), Mahadevan and Asafu-Adjaye (2007), Ang (2008), Apergis and Payne (2009), Odhiambo (2009b), Pao et al. (2011), and Omri (2013). Consequently, we can say that energy is a determinant factor for the GDP growth, and, therefore, a high-level of economic growth leads to a high level of energy demand and vice versa. Second, for the four panels, the findings reveal that there is a bi-directional causal relationship between energy consumption and the \(\hbox {CO}_{2}\) emissions, but a uni-directional causal relationship running from the \(\hbox {CO}_{2}\) emissions to economic growth for the Latin American and Caribbean region. Thus implies that environment of degradation has a negative impact on economic growth, and a persistent decline in the environmental quality may exert a negative externality the economy by affecting human health, and thereby it may reduce productivity in the long run. The negative causality running from the \(\hbox {CO}_{2}\) emissions to economic growth for all the panels seems to suggest that policymakers should implement policies that encourage environmental energy production and utilization as well as green technologies in order to reduce carbon emissions and promote economic growth simultaneously. We can also conclude that air pollution tends to increase energy consumption. In addition, the three regions should make efforts to reduce the \(\hbox {CO}_{2}\) emissions and strengthen the management of energy and carbon in order to fight energy waste, attenuate the \(\hbox {CO}_{2}\) emissions and ensure safety sustainable development but without harming the economic development.

The main recommendation from our study is as follows. First, we find that there is a bi-directional causal relationship between energy consumption and economic growth only for the four panels. When energy consumption affects growth positively, it suggests that the benefit of energy use is greater than the externality cost of energy use. Conversely, if an increase in economic growth brings about an increase in energy consumption, the externality of the energy use will set back economic growth. Under this circumstance, a conservation policy is necessary. The findings of this study have important policy implications and show that this issue still deserves further attention in future researches. Second, high economic growth gives rise to environmental degrading. From these results the following points may be implemented to control the \(\hbox {CO}_{2}\) emissions. Countries need to embrace more energy conservation policies in order to reduce carbon dioxide emissions and should consider strict environmental and energy policies. Similarly, they have to strengthen the management of energy and carbon in order to fight energy waste, attenuate the \(\hbox {CO}_{2}\) emissions and ensure safety sustainable development but without harming the economic growth.

References

Akbostanci, E., Turut-Asik, S., Tunc, G.I.: The relationship between income and environment in Turkey: is there an environmental Kuznets curve. Energy Policy 37, 861–867 (2009)

Akinlo, A.E.: Energy consumption and economic growth: evidence from 11 SubSahara African countries. Energy Econ. 30(5), 2391–2400 (2008)

Akpan, E.G., Akpan, F.U.: Electricity consumption, carbon emissions and economic growth in Nigeria. Int. J. Energy Econ. Policy 4, 292–306 (2012)

Al-mulali, O.: Oil consumption, \(\text{ CO }_{2}\) emission and economic growth in MENA countries. Energy Policy 36, 6165–6171 (2011)

Al-mulali, O., Sab, C.N.B.C.: The impact of energy consumption and \(\text{ CO }_{2}\) emission on the economic growth and financial development in the Sub Saharan African countries. Energy 39, 180–186 (2012)

Altinay, G., Karagol, E.: Electricity consumption and economic growth: evidence from Turkey. Energy Econ. 27, 849–856 (2005)

Ang, B.W., Liu, F.L.: A new energy decomposition method: perfect in decomposition and consistent in aggregation. Energy 26, 537–548 (2001)

Ang, J.B.: Are saving and investment co-integrated. The case of Malaysia (1965–2003). Appl. Econ. 39, 2167–2174 (2007)

Ang, J.B.: Economic development, pollutant emissions and energy consumption in Malaysia. J. Policy Model. 30, 271–278 (2008)

Anwar, S., Nguyen, L.P.: Foreign direct investment and economic growth in Vietnam. Asia Pac. Bus. Rev. 16, 83–202 (2010)

Apergis, N., Payne, J.E.: Renewable energy consumption and economic growth: evidence from a panel of OECD countries. Energy Policy 38, 656–660 (2010)

Apergis, N., Payne, J.E.: \(\text{ CO }_{2}\) emissions, energy usage, and output in Central America. Energy Policy 37, 3282–3286 (2009)

Apergis, N., Payne, J.E.: The emissions, energy consumption and growth nexus: evidence from the commonwealth of independent states. Energy Policy 38, 650–655 (2010)

Aqeel, A., Butt, M.S.: The relationship between energy consumption and economic growth in Pakistan. Asia Pac. Dev. J. 8, 101–110 (2001)

Arellano, M., Bond, S.R.: Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. Rev. Econ. Stud. 58, 277–297 (1991)

Arouri, M.E., Youssef, A., M’henni, H., Rault, C.: Energy consumption, economic growth and \(\text{ CO }_2\) emissions in Middle East and North African countries. Energy Policy 45, 342–349 (2012)

Ayanwale, A.B.: FDI and economic growth: evidence from Nigeria. AERC Research Paper 165. African economic research consortium, Nairobi (2007)

Batliwala, S., Reddy, A.K.: Energy consumption and population, international energy initiative, Benson town, Bangalore, India pp 1–10 (1993)

Belloumi, M.: Energy consumption and GDP in Tunisia: co-integration and causality analysis. Energy Policy 37, 2745–2753 (2009)

Bildirici, M.: The relationship between economic growth and electricity consumption in Africa: MS-VAR and MS-Granger causality analysis. J. Energy Dev. 37, 179–207 (2012)

Binh, P.T.: Energy consumption and economic growth in Vietnam: threshold cointegration and causality analysis. Int. J. Energy Econ. Policy 1, 1–17 (2011)

Bloch, H., Rafiq, S., Salim, R.: Coal consumption, CO2 emission and economic growth in China: empirical evidence and policy responses. Energy Econ. 34, 518–528 (2012)

Bowden, N., Payne, J.E.: The causal relationship between US energy consumption and real output: a disaggregated analysis. J. Policy Model. 31, 180–188 (2009)

Chang, C.: A multivariate causality test of carbon dioxide emissions, energy consumption and economic growth in China. Appl. Energy 87, 3533–3537 (2010)

Coondoo, D., Dinda, S.: Carbon dioxide emission and income: a temporal analysis of cross-country distributional patterns. Ecol. Econ. 65, 375–385 (2008)

Dinda, S.: Climate change and human insecurity. Int. J. Global Environ. 9, 103–109 (2009)

Dinda, S., Coondoo, D.: Income and emission: a panel data-based cointegration analysis. Ecol. Econ. 57, 167–181 (2006)

Erdal, G., Erdal, H., Esengun K .: The causality between energy consumption and economic growth in Turkey. Energy Policy, 36(10), 3838–3842 (2008)

Farhani, S., Ben Rejeb, J.: Link between economic growth and energy consumption in over 90 countries. Interdiscip. J. Contemp. Res. Bus. 3(11), 282–297 (2012)

Fodha, M., Zaghdoud, O.: Economic growth and pollutant emissions in Tunisia: an empirical analysis of the environmental Kuznets curve. Energy Policy 38, 1150–1156 (2010)

Friedl, B., Getzner, M.: Determinants of \(\text{ CO }_{2}\) emissions in a small open economy. Ecol. Econ. 45, 133–148 (2003)

Ghali, K.H., El-Sakka, M.I.T.: Energy use and output growth in Canada: a multivariate co-integration analysis. Energy Econ. 26, 225–238 (2004)

Ghosh, S.: Electricity consumption and economic growth in Taiwan. Energy Policy 30, 125–129 (2002)

Ghosh, S.: Examining carbon emissions-economic growth nexus for India: a multivariate co-integration approach. Energy Policy 38, 2613–3130 (2010)

Halicioglu, F.: Residential electricity demand dynamics in Turkey. Energy Econ. 29, 199–210 (2007)

Halicioglu, F.: An econometric study of \(\text{ CO }_{2}\) emissions, energy consumption, income and foreign trade in Turkey. Energy Policy 37, 699–702 (2009)

Hamilton, C., Turton, H.: Determinants of emissions growth in OECD countries. Energy Policy 30, 63–71 (2002)

He, J.: China’s industrial SO2 emissions and its economic determinants: EKC’s reduced versus structural model and the role of international trade. Environ. Dev. Econ. 14, 227–262 (2008)

Hossain, S.: An econometric analysis for \(\text{ CO }_{2}\) emissions, energy consumption, economic growth, foreign trade and urbanization of Japan. Low Carbon Econ. 3, 92–105 (2012)

Huang, B.N., Hwang, M.J., Yang, C.W.: Causal relationship between energy consumption and GDP growth revisited: a dynamic panel data approach. Ecol. Econ. 67(1), 41–54 (2008)

Hye, Q.M.A., Riaz, S.: Causality between energy consumption and economic growth: the case of Pakistan. Lahore J. Econ. 13, 45–58 (2008)

Islam, F., Shahbaz, M., Ahmed, A.U., Alam, M.M.: Financial development and energy consumption nexus in Malaysia: a multivariate time series analysis. Econ. Model. 30, 435–441 (2013)

Jakovac, p: Empirical analysis on economic growth and energy consumption relationship in croatia. Ekonomska Istraživanja Econ. Res. 26, 21–42 (2013)

Jalil, A., Mahmud, S.F.: Environment Kuznets curve for \(\text{ CO }_{2}\) emissions: a co-integration analysis for China. Energy Policy 3, 5167–5172 (2009)

Jayanthakumaran, K., Verma, R., Liu, Y.: \(\text{ CO }_{2}\) emissions, energy consumption, trade and income: a comparative analysis of China and India. Energy Policy 42, 450–460 (2012)

Karanfil, F.: How many times again will we examine the energy–income nexus using a limited range of traditional econometric tools? Energy Policy 36, 3019–3025 (2009)

Khalil, S., Inam, Z.: Is trade good for environment? a unit root cointegration analysis? Pakistan Dev. Rev. 45, 1187–1196 (2006)

Kraft, J., Kraft, A.: On the relationship between energy and GNP. J. Energy Dev. 3(2), 401–403 (1978)

Kwakwa, P.A.: Disaggregated energy consumption and economic growth in Ghana. Int. J. Energy Econ. Policy 2, 34–40 (2012)

Lean, H., Smyth, R.: \(\text{ CO }_{2}\) emissions, electricity consumption and output in ASEAN. Appl. Energy 87, 1858–1864 (2010)

Lee, C.-C., Lee, J.-D.: Income and \(\text{ CO }_{2}\) emissions: evidence from panel unit root and co-integration tests. Energy Policy 37, 413–423 (2009)

Lee, ChCh.: Chang, ChP: Energy consumption and economic growth in Asian economies: a more comprehensive analysis using panel data. Res. Energy Econ. 30, 50–65 (2008)

Lee, W.J.: The contribution of foreign direct investment to clean energy use, carbon emissions and economic growth. Energy Policy 55, 483–489 (2013)

Liu, Q.: Impacts of oil price fluctuation to China economy. Quant. Tech. Econ. 3, 17–28 (2005)

Lorde, T., Waithe, K., Francis, B.: The importance of electrical energy for economic growth in Barbados. Energy Econ. 32, 1411–1420 (2010)

Mahadevan, R., Asafu-Adjaye, J.: Energy consumption, economic growth and prices: A reassessment using panel VECM for developed and developing countries. Energy Policy 35(4), 2481–2490 (2007)

Menyah, K., Wolde-Rufael, Y.: \(\text{ CO }_{2}\) emissions, nuclear energy, renewable energy and economic growth in the US. Energy Policy 38, 2911–2915 (2010)

Menyah, K., Wolde-Rufael, Y.: Energy consumption, pollutant emissions and economic growth in South Africa. Energy Econ. 32, 1374–1382 (2010)

Morimoto, R., Hope, C.: The impact of electricity supply on economic growth in Sri Lanka. Energy Econ. 26, 77–85 (2004)

Nasir, F., Rehman, M.: Environmental Kuznets curve for carbon emissions in Pakistan: an empirical investigation. Energy Policy 39, 1857–1864 (2011)

Odhiambo, N.M.: Economic growth and carbon emissions in South Africa: an empirical investigation. J. Appl. Bus. Res. 28(1), 37–46 (2012)

Niu, S., Ding, Y., Niu, Y., Li, Y., Luo, G.: Economic growth, energy conservation and emissions reduction: a comparative analysis based on panel data for 8 Asian-Pacific countries. Energy Policy 39, 2121–2131 (2011)

Odhiambo, N.M.: Electricity consumption and economic growth in South Africa: a trivariate causality test. Energy Econ. 31, 635–640 (2009)

Odhiambo, N.M.: Energy consumption and economic growth nexus in Tanzania: an ARDL bounds testing approach. Energy Policy 37, 617–622 (2009)

Oh, W., Lee, K.: Causal relationship between energy consumption and GDP: the case of Korea 1970–1999. Energy Econ. 26, 51–59 (2004)

Omri, O.: \(\text{ CO }_{2}\) emissions, energy consumption and economic growth nexus in MENA countries: evidence from simultaneous equations models. Energy Econ. 40, 657–664 (2013)

Ouédraogo, M.: Electricity consumption and economic growth in Burkina Faso: a co-integration analysis. Energy Econ. 3, 524–531 (2010)

Ozturk, I.: A literature survey on energy-growth nexus. Energy Policy 38, 340–349 (2010)

Ozturk, I., Acaravci, A.: \(\text{ CO }_{2}\)emissions, energy consumption and economic growth in Turkey. Renew. Sust. Energy Rev. 14, 32–205 (2010)

Ozturk, I., Acaravci, A.: The causal relationship between energy consumption and GDP in Albania, Bulgaria, Hungary and Romania: evidence from ARDL bound testing approach. Appl. Energy 6, 1938–1943 (2010)

Pao, H., Tsai, C.: \(\text{ CO }_{2}\) emissions, energy consumption and economic growth in BRIC countries. Energy Policy 38, 7850–7860 (2010)

Pao, H., Yu, H., Yang, Y.: Modeling the \(\text{ CO }_{2}\)emissions, energy use, and economic growth in Russia. Energy 36, 1–7 (2011)

Paul, S., Bhattacharya, R.N.: Causality between energy consumption and economic growth in India: a note on conflicting results. Energy Econ. 26, 977–983 (2004)

Richmond, A.K., Kaufmann, R.K.: Is there a turning point in the relationship between income and energy use and/or carbon emissions? Ecol. Econ. 56, 176–189 (2006)

Saboori, B., Sulaiman, J., Mohd, S.: Economic growth and \(\text{ CO }_{2}\) emissions in Malaysia: a cointegration analysis of the environmental Kuznets curve. Energy Policy 51, 184–191 (2012)

Sadorsky, P.: The impact of financial development on energy consumption in emerging economies. Energy Policy 38, 2528–2535 (2010)

Sadorsky, P.: Financial development and energy consumption in Central and Eastern European frontier economies. Energy Policy 39, 999–1006 (2011)

Say, N.P., Yucel, M.: Energy consumption and \(\text{ CO }_{2}\) emissions in Turkey: empirical analysis and future projection based on an economic growth. Energy Policy 34, 3870–3876 (2006)

Shahbaz, M., Lean, H.H.: Does financial development increase energy consumption? the role of industrialization and urbanization in Tunisia. Energy Policy 40, 473–479 (2012)

Shahbaz, M., Mutascu, M., Azim, P.: Environmental Kuznets curve in Romania and the role of energy consumption. Renew. Sust. Energy Rev. 18, 165–173 (2013)

Sharma, S.S.: Determinants of carbon dioxide emissions: empirical evidence from 69 countries. Appl. Energy 88, 376–382 (2011)

Song, T., Zheng, T., Tong, L.: An empirical test of the environmental Kuznets curve in China: a panel cointegration approach. China Econ. Rev. 19, 381–392 (2008)

Soyas, U., Sari, R.: Energy consumption, economic growth and carbon emissions: challenges faced by an EU candidate member. Ecol. Econ. 68, 1667–1675 (2009)

Soytas, U., Sari, R., Ewing, B.T.: Energy consumption, income, and carbon emissions in the United States. Ecol Econ. 62, 482–489 (2007)

Tiwari, A.K.: Primary energy consumption, \(\text{ CO }_{2}\) emissions and economic growth: evidence from India. South East Eur. J. Econ. Bus. 6, 99–117 (2011)

Toda, H.Y., Yamamoto, T.: Statistical inference in vector auto-regressions with possibly integrated processes. J. Econom. 66, 225–250 (1995)

Tsani, S.Z.: Energy consumption and economic growth: a causality analysis for Greece. Energy Econ. 32(3), 582–590 (2010)

Vu, T.B., Gangnes, B., Noy, I.: Is foreign direct investment good for growth? answers using sectoral data from China and Vietnam. Unpublished (2006)

Wang, R., Liu, M., Zhang, et al.: Decomposing the decoupling of energy-related \(\text{ CO }_{2}\) emissions and economic growth in Jiangsu province. Energy. Sustain. Dev. 17, 62–71 (2013)

Wang, S.S., Zhou, D.Q., Zhou, P., Wang, Q.W.: \(\text{ CO }_{2}\) emissions, energy consumption and economic growth in China: a panel data analysis. Energy Policy 39(9), 4870–4875 (2011)

Warr, B.S., Ayres, R.U.: Evidence of causality between the quantity and quality of energy consumption and economic growth. Energy 35, 1688–1693 (2010)

WDI.: World development indicators, world bank. Available: http://data.worldbank.org (2011)

Yang, G., Wang, H., Zhou, J., Liu, X.: Analyzing and predicting the economic growth, energy consumption and CO2 emissions in Shanghai. Energy Environ. Res. 2(2), 83 (2012)

Zhang, X.-P., Cheng, X.-M.: Energy consumption, carbon emissions, and economic growth in China. Ecol. Econ. 68, 2706–2712 (2009)

Ziramba, E.: The demand for residential electricity in South Africa. Energy Policy 36, 3460–3466 (2009)

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Saidi, K., Hammami, S. Economic growth, energy consumption and carbone dioxide emissions: recent evidence from panel data analysis for 58 countries. Qual Quant 50, 361–383 (2016). https://doi.org/10.1007/s11135-014-0153-1

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11135-014-0153-1