Abstract

This study examines how the structure of distribution channels may influence firms’ quality and price strategies and how they may in turn affect consumer welfare. It treats product quality as a decision variable so that the degree of product substitution becomes endogenous rather than exogenous as in previous studies. We find that, with vertically differentiated firms, the changes in channel structure have asymmetric effects depending on whether they occur in the high-quality channel or in the low-quality channel. The product quality of the high-quality channel decreases when it decentralizes unilaterally. However, product quality of the low-quality channel would increase when it decentralizes. The high-quality manufacturer and its channel suffer more from decentralization in comparison with their low-quality counterparts, and the low-quality manufacturer actually receives greater profits when both channels are decentralized. An important driver behind these asymmetries is the interaction between firms’ pricing incentives in integrated versus decentralized channels and what consumer segments they serve. Our analysis indicates that decentralization may reduce consumer welfare, but decentralization in the high-quality channel hurts consumers more than that in the low-quality channel. Therefore in a competitive environment where firms make both quality and price decisions, channel integration would have significant welfare enhancement effects through the elimination of double marginalization, especially if it happens in the high-quality channel. Moreover, we demonstrate that once quality is endogenized, integration is the only equilibrium of channel structure choices. This suggests that the private incentives of firms may actually benefit consumers but do not have to be in line with the general preference of industry regulation for decentralization.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Channel structure and how it may influence marketing strategies are of recurring interests to research and practice in distribution channels. The choice of vertical integration versus decentralization is influenced by a complex set of economic factors, such as the degree of product substitution (e.g., McGuire and Staelin 1983; Moorthy 1988a). Channel structure is also directly affected by industry regulation. Government agencies that oversee competition and antitrust issues, such as the Federal Trade Commission (FTC), are mostly concerned with anti-competitive effects that could arise due to channel structure changes. Examples that illustrate these policy considerations are abundant and often occur when the agencies act against vertical integration (Chen 2001; Riordan 2005). One of the historic cases occurred in the motion picture industry (Ornstein 2002). In 1938, the Department of Justice (DOJ) started to charge the eight largest studios with monopolizing the industry through the control of production, distribution and exhibition. The divestiture of theaters, the retail arm of the industry, was subsequently imposed through court orders. More recently, the DOJ challenged Lockheed Martin in 1998 in its proposed acquisition of Northrop Grumman, which supplies systems and subsystems used on various military platforms.

Regardless of whether a channel structure is chosen by firms or is imposed by regulation, firms must adopt appropriate marketing strategies in response to it. While they do so to maximize profits, these strategic choices will affect both competitors and consumers. A primary goal of this paper is thus to examine how distribution channel structures may influence firm strategies and how they in turn affect consumer welfare. We focus on product quality and pricing decisions. Product positioning as a response to channel structure, especially in a competitive environment, has not been systematically examined in the literature. Our model includes two manufacturers selling quality-differentiated products. Each manufacturer may use its own independent retailer or operates in a vertically integrated fashion. Following the approach of Economides (1999) and Villas-Boas (1998), we compare the firms’ quality and price strategies in four distinctive market scenarios: both channels are integrated, both channels are decentralized, the low-quality channel is integrated but the high-quality one is decentralized, and vice-versa.

A basic result from the model is that, regardless of the structure in the competing channel, the high-quality manufacturer would offer lower quality when it is decentralized rather than integrated. In contrast, the low-quality manufacturer would offer higher quality when decentralized rather than integrated. The intuition behind this asymmetry is as follows. Decentralization, through the well-known effect of double marginalization, induces the firm to raise price. Due to the strategic complementary pattern of price reaction, the competitor is motivated to raise price and thus leave some of its customers unserved. These customers become potential buyers for the firm that decentralizes. However, depending on whether decentralization occurs in the high-quality or the low-quality channel, the consumers left unserved (i.e., the potential switchers) belong to different segments—they have either a medium/high level or a low level of willingness-to-pay for quality. Whether and how to capture these newly available consumers result in different quality strategies in the channel that decentralizes. This strategic interaction subsequently leads to asymmetric results in demand and profit between the low-quality channel and the high-quality channel. We find that decentralization reduces consumer welfare, but unilateral decentralization in the high-quality channel does so to a greater degree than that in the low-quality channel.

Endogenizing the quality decision enables the manufacturer to cope with price competition in a more efficient way. Rather than resorting to decentralization at equilibrium (e.g., McGuire and Staelin 1983), they will stay integrated while choosing more differentiated quality levels. Since it is the integrated channel structures that provide greater consumer welfare, firms’ private incentives may benefit consumers. The implication of these results for regulation and antitrust policy is thus in favor of vertical integration.

Several streams of literature relate to our work. In a model of two competing manufacturers, McGuire and Staelin (1983) find that both integration and decentralization can be equilibria when the products are close substitutes. Moorthy (1988a) shows that the patterns of strategic reaction (i.e., strategic complementarity versus substitutability) also matter. Several other studies has further examined the relationship between channel structure and product substitutability (e.g., Coughlan 1985; Choi 1991; Gupta and Loulou 1998). An important feature of these studies is that the degree of product differentiation is assumed exogenous. This deprives the firms of an important strategic tool under different channel structures. In this paper, we endogenize quality together with pricing, thus making it possible to trace the origin of competition and scrutinize more closely the relationship between product strategies and channel structure.

Some recent research has made useful extensions to the channel structure and coordination literature (e.g., Bruce et al. 2005; Desai et al. 2004; Raju and Zhang 2005). For instance, Bruce et al. (2005) show that greater product durability induces higher demand for durable goods, causing a more severe double marginalization problem for a decentralized channel. As a result, firms selling more durable products offer deeper trade promotions. The studies by Economides (1999) and Villas-Boas (1998) are particularly relevant to our model. Economides (1999) looks at the quality and price of a composite good that is made up of two complementary components. He shows that if the production and sales of these two components are carried out by two independent firms, the quality of the composite good will be lower than in the case where both components are produced and sold by an integrated firm. An important feature of his model is that, since the two components are consumed jointly, their quality levels have to be identical at equilibrium. As a result, quality differentiation is not an issue. In another interesting study, Villas-Boas (1998) models a monopoly manufacturer’s product line decision when it sells through independent retailers. He compares the price and quality outcomes with the case where the manufacturer acquires the retail function. He finds that, in comparison with direct selling, the manufacturer increases the difference between the products. This happens since channel pricing distortion caused by independent retailers increases cannibalization within the product line.

Our model differs from Economides (1999) and Villas-Boas (1998) in several important ways. First, we allow competition at the manufacturer level to examine the effects of competition rather than cannibalization. Cannibalization and competition are important factors driving firm strategies (e.g., Desai 2001), and their effects can be very different (Moorthy 1988a). Second, quality differentiation allows us to show several distinctive asymmetric outcomes for the high-quality versus the low-quality firm when channel structures change. These effects have not been studied in earlier models. Third, we analyze the welfare implications (Tyagi 2004; Shugan 2004) of channel structure. These are of great concern to regulatory agencies who have the authority to prohibit channel integration altogether. Fourth, similar to McGuire and Staelin (1983) but different from Economides (1999) and Villas-Boas (1998), we allow firms to be solely responsible for channel structure decisions later in the paper. This allows us to examine equilibrium channel structures and if any consistency can exist between firm incentives and industry regulation.

2 Modeling framework

Each manufacturer (i = 1,2) produces a product at quality a i ( a i ≥ 0). The marginal cost of quality is c(a i ). Greater values of a i indicate higher quality that costs more to produce. Downstream are two exclusive retailers, each is either owned by the manufacturer (integrated, denoted by I) or operates independently (decentralized, denoted by D). II denotes when both channels are integrated, DD when both are decentralized, and ID and DI for mixed structures. Since there is only one manufacturer in each channel, i also identifies the channels and retailers. Retailer i purchases from manufacturer i at wholesale price w i before selling to consumers at retail price p i . The manufacturer in an integrated channel directly sets p i .

The sequence of the game is as follows. First, the manufacturers choose product qualities simultaneously. Second, they set w i , which is irrelevant for integrated channels. Third, the retailers simultaneously set p i (in the case of an integrated channel, the manufacturer sets retail price simultaneously with the competing channel). Without loss of generality, we label i = 2 as the higher quality channel (a 2 > a 1). Motta (1993) uses a similar setup of quality and price competition. He provides theoretical results that one firm offering higher quality than the other is indeed an equilibrium and that no firm benefits from leapfrogging the rival. It is convenient to ignore the case a 1 = a 2 because then Bertrand competition in the subsequent pricing game leads to zero profit for both channels. To avoid head-to-head competition, both firms have an incentive to differentiate their products, so we assume at least a minimum level of differentiation. The multistage game are analyzed using backward induction. Comparisons are made across different channel structures to show how channel structure may influence firm strategies and welfare. For exposition ease, we focus on the effects of decentralization in subsequent discussions. The implications for integration can be understood simply in the opposite direction. We endogenize the channel structure decision later in the paper based on based on the equilibrium profits of the manufacturers under each channel structures. The channel structure game can be regarded as an additional stage preceding the quality game.

Consumers differ in the willingness-to-pay for quality. Each consumer has a utility function U(t) = tu(a) − p. u(a) is the direct utility derived from quality a. u(a) is increasing and concave so that all consumers prefer higher quality to lower but the marginal utility diminishes. Consumer type t is willing to pay tu(a) for the product. Higher t indicates greater willingness-to-pay for quality. We take t as uniformly distributed in [0,1], which allows us to remove from the results the interference of non-uniformity of consumer distributions (Moorthy 1988b).

Demand for product i is λ i . Note that λ 1 + λ 2 is typically less than 1 as consumers with very low t will prefer not to purchase even the less expensive product. Consumers of type t ≥ t 1 = p 1/u(a 1) will participate, where U(t 1) = t 1 u(a 1) − p 1 = 0 . Consumers indifferent between the two products are located at t 2: t 2 u(a 1) − p 1 = t 2 u(a 2) − p 2. The demand functions are thus λ 1 = t 2 − t 1 = αp 2 − βp 1 and λ 2 = 1 − t 2 = 1 − α(p 2 − p 1), in which α = 1/[u(a 2) − u(a 1)] and β = 1/[u(a 2) − u(a 1)] + 1/u(a 1). Total demand is λ 1 + λ 2 = 1 − (β − α)p 1 = 1 − p 1/u(a 1). As our purpose is to examine the effects of channel structures under competition, we are interested in the case where the duopolists leave some market share to the substitute (Moorthy 1988b). To ensure that λ i > 0, two conditions need to hold: condition A: u(a 1)/p 1 > u(a 2)/p 2 and condition B : u(a 2) − u(a 1) > p 2 − p 1. Condition A requires that the utility per dollar provided by the low-quality product to be greater than that provided by the high-quality product. Otherwise the low-quality product cannot sell. It is also easily verified that the low-quality product needs to charge a lower price (p 2 > p 1). Condition B requires the incremental utility between the two products to be larger than the corresponding price difference. Otherwise the higher quality product has no sales.

\(p_{i}^{ID}\) and \(a_{i}^{ID}\) denote the retail price and quality of channel i under channel structure ID, and \(\pi _{Mi}^{ID}\), \(\pi _{Ri}^{ID}\) and \(\pi _{i}^{ID}\) denote profits of the manufacturer, the retailer, and the whole channel. Similar notations are used for other channel structures. The analyses in Section 3 and Theorem 1 in Section 4 are about the firms’ price and quality under different channel structures. We are able to carry out these analytically with general forms of u(a i ) and c(a i ), which are often simplified as u i = u(a i ) and c i = c(a i ). Later sections are equilibrium analyses that require the specifications of functional forms. There we adopt the family of power utility functions \( u(a_{i})=\sqrt[n]{a_{i}}\), which is commonly used in economics to study product differentiation as the constant elasticity of marginal utility function (the elasticity of marginal utility is 1/n − 1) or the constant relative risk averse (CRRA) utility function (the coefficient of relative risk aversion is 1 − 1/n). Two attractive features make the family of power utility functions very useful for our purpose. First, the values of n can be used to capture the importance of quality in its contribution to utility. A greater value of n generates greater utility for a given quality a. Second, the shape of the utility function changes significantly under different values of n (n = 2...9), enabling the model to cover a large range of utility patterns with a manageable set of parameter values.Footnote 1 Nevertheless, we are able to replicate the findings using another popular utility function, the exponential utility function u(a) = 1 − exp( − na).

3 Price competition with fixed quality levels

We first consider price competition with fixed quality levels. We solve the II case for illustration and leave DI, ID and DD to the Appendix, which contains all technical derivations. Under II, firms 1 and 2 set p 1 and p 2 to maximize their profits.

Both functions are strictly concave, and the best responses are linear with slopes given by implicit functions λ 1 − β(p 1 − c 1) = 0 and λ 2 − α(p 2 − c 2) = 0. So a unique pure-strategy Nash equilibrium exists (Fudenberg and Tirole 1991):

By replacing the prices into demand functions λ 1 and λ 2, and profit functions \(\pi _{1}^{II}=(p_{1}-c_{1})\lambda _{1}\) and \( \pi _{2}^{II}=(p_{2}-c_{2})\lambda _{2}\), we obtain the following results after simplification:

Note that conditions A and B are equivalent to [(2β − α)c 1 − 1]/α < c 2 < (2β + αβ c 1)/[(2β − α)α]. This can be further transformed into 2c 1/u 1 − 1 < (c 2 − c 1)/(u 2 − u 1) < 2 − c 2/u 2. These conditions guarantee positive demand for all the four channel structure cases. The pricing results of the four cases are summarized in Table 1 with the following simplifying terms: γ i =(β -α )+iβ, η =8β -3α, \(\rho _{1}=1+\frac{\beta \lambda _{2}^{II}}{2\gamma _{1}\lambda _{1}^{II}}\), \(\rho _{2}=1+\frac{\alpha \lambda _{1}^{II}}{ 2\gamma _{1}\lambda _{2}^{II}}\), τ = \(\frac{4\gamma _{1}^{2}}{4\gamma _{1}^{2}-\alpha \beta }\), \(\tau _{1}=\tau ^{2}\frac{\gamma _{2}}{2\gamma _{1} }\), \(\tau _{2}=\tau ^{2}\frac{\gamma _{3}}{4\gamma _{1}}\), \(\tau _{3}=\frac{ \tau ^{2}}{4}\), \(\delta _{1}=\frac{2\gamma _{2}\lambda _{2}^{II}+\eta \lambda _{1}^{II}}{4\gamma _{1}^{2}-\alpha \beta }\), and \(\delta _{2}=\frac{ 2\alpha \gamma _{2}\lambda _{1}^{II}+\beta \eta \lambda _{2}^{II}}{\alpha (4\gamma _{1}^{2}-\alpha \beta )}\).

Gupta and Loulou (1998) suggest that a firm’s decentralization, through pricing, has two effects on its demand in a competitive market: a negative effect due to the increase in own price and a positive effect due to the increase in the opponent’s price. The consequence of these two opposite forces can be quantified based on the results in Table 1. First, since \( \lambda _{1}^{DI}/\lambda _{1}^{II}=\lambda _{2}^{ID}/\lambda _{2}^{II}=50\%\) , a firm’s market share halves after unilateral decentralization, indicating that the negative effect is greater than the positive effect. Second, note that \((\lambda _{1}^{DI}-\lambda _{1}^{II})/(\lambda _{2}^{DI}-\lambda _{2}^{II})=-\gamma _{1}/\alpha \), \((\lambda _{2}^{ID}-\lambda _{2}^{II})/(\lambda _{1}^{ID}-\lambda _{1}^{II})=-\gamma _{1}/\beta \). Since γ 1/α and γ 1/β are bounded below by 1 and above by 2, demand reduction in the decentralized channel is greater than the demand increase in the competing channel. Total demand in the market is thus lower, reflecting the higher prices in both channels. If firms keep their quality levels fixed, these pricing results indicate that decentralization may harm consumers through higher prices and lower demand. From a public policy perspective, firms’ price reactions to channel decentralization may undermine the intention of regulatory agencies to protect consumers by imposing divestiture.

At this point, the pricing game with fixed quality can be compared with McGuire and Staelin (1983)’s model. Recall that they examine equilibrium channel structure with price competition and exogenous product substitutability. In Appendix 2, we show that in quality differentiated markets where channel structure is chosen by the manufacturers, II is always an equilibrium and DD is also an equilibrium when u(a 1) > 0.87u(a 2). Not only are the quality levels relevant, the form of utility function matters too. For example, even when the quality levels are very different, the condition for DD to be an equilibrium can still be satisfied for particular forms of u(a). Therefore, the price competition part of our model replicates the main results of McGuire and Staelin (1983), but extending them to quality differentiation and showing that product differentiation and consumer utility of quality, i.e., u(a), are both important for channel structure considerations.

4 Optimal quality and implications

Let \(r_{i}^{II}(a_{j})\) be the optimal quality response of channel i given a certain level of quality a j in channel j when both channels are integrated. Similarly \(r_{i}^{ID}(a_{j})\) is the optimal quality response of i when it is integrated but channel j is decentralized. Theorem 1 indicates that \( r_{1}^{DI}(a_{2})>r_{1}^{II}(a_{2})\) and \(r_{1}^{DD}(a_{2})>r_{1}^{ID}(a_{2}) \), and \(r_{2}^{ID}(a_{1})<r_{2}^{II}(a_{1})\) and \( r_{2}^{DD}(a_{1})<r_{2}^{DI}(a_{1})\) (see Appendix 3 for proof). This is a general result that holds for any utility or cost functions that lead to well-behaved objective functions, and it always holds when a pure-strategy Nash equilibrium exists and is unique.Footnote 2

Theorem 1

For any utility u(a) and cost functions that lead to well-behaved objective functions, and for any level of quality adopted by the competing channel, the low-quality channel will have a higher quality if it is decentralized rather than integrated. However, the high-quality channel will have a lower quality if it is decentralized rather than integrated.

Theorem 1 indicates that the interaction between quality and pricing plays critical roles in how channel structure may influence firms’ quality strategy. The influence is asymmetric and depends on whether decentralization occurs in the low-quality or the high-quality channel. The intuition can be explained as follows. Compared with low-quality firms, high-quality firms rely more on a higher margin for profits (Moorthy 1988b). If the low-quality channel is decentralized, its price increases due to double marginalization, which motivates the high-quality channel to charge a higher price for its quality a 2. By doing so, the high-quality channel focuses even more on the consumers with high willingness-to-pay for profit margin. This makes a segment of consumers who would have bought from the high-quality channel potential buyers for the low-quality channel. Note that these potential “switchers” have a medium level of willingness-to-pay that is higher than the typical consumers who buy from the low-quality channel. The low-quality channel has the incentive to capture these more profitable consumers. Compared with its high-quality competitor, the low-quality channel relies to a greater extent on the sales from the lower end segments. Since the low-quality channel has a higher price when decentralized, which could induce too much loss of sales from lower end consumers, it needs to improve quality in achieving optimal profits.

The situation is, however, different for a decentralized high-quality channel. The competing low-quality channel raises price for its quality a 1 and by doing so, drives away a segment of consumers who would have bought from it. However, different from the scenario of decentralization in the low-quality channel, this happens at the lowest end of the market—these consumers have low willingness-to-pay and they can no longer be served by either channel. Furthermore, consumers who still buy from the low-quality channel will receive lower utility. As a result of the higher price due to decentralization, the high-quality firm has two options—to increase quality to retain its customers and possibly acquire some consumers from the low-quality firm, or to reduce quality to ensure its margin does not fall too much. Since the consumers in the middle of the market, if acquired, will be the least profitable for the high-quality channel, the latter option is more profitable. By doing so, the high-quality channel incurs a lower cost for quality but focuses more on the high willingness-to-pay consumers.

We now build upon the optimal quality responses of Theorem 1 to examine quality equilibria. As discussed earlier, specific functional forms are needed to do so and we employ the power utility functions \(u(a_{i})=\sqrt[n]{ a_{i}}\) and cost function c(a i ) = a (n = 2...9) to find equilibrium quality 0 ≤ a 1 < a 2.Footnote 3 Take II as an example. The manufacturers choose quality to maximize profits (which equal total channel profits), \(\pi _{1}^{II\ast }=\underset{a_{1}}{\max }\) \(\pi _{1}^{II} \) and \(\pi _{2}^{II\ast }=\underset{a_{2}}{\max }\) \(\pi _{2}^{II}\) , where \(\pi _{1}^{II}\) and \(\pi _{2}^{II}\) are given by Eqs. 3 and 4. The isoprofit curves of \(\pi _{1}^{II}\) and \(\pi _{2}^{II}\) for 0 ≤ a 1 < a 2 generate the typical quality responses. The equilibrium point is interior, and we numerically solve equations \(\partial \pi _{1}^{II}/\partial a_{1}=0\) and \(\partial \pi _{2}^{II}/\partial a_{2}=0\) to obtain unique solutions (a 1,a 2) for all values of n (Table 2). The quality equilibrium shows several important properties. First, as n increases, the quality (and subsequently price) decreases for both channels. This is due to firms making a trade-off between consumers’ incremental utility of quality and the incremental cost of quality provision. Second, consistent with its positioning as a high-quality provider, channel 2 should benefit from a higher n as a result of greater consumer preference for quality. Table 2 shows this both in terms of market share and profit. Third, when a 1 and a 2 both decrease as a result of higher n, the degree of quality differentiation (a 2 − a 1) becomes smaller.

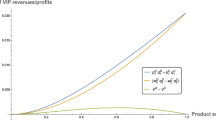

The quality equilibria for channel structures DI, ID and DD are derived similarly. As in the case of II, a unique pure-strategy Nash equilibrium is obtained for each value of n. The decreasing effect of n on equilibrium quality remains regardless of channel structures. The effect of n on equilibrium prices is, however, more complex. In the case of II and that of DI when n > 3, the prices of both the high-quality and the low-quality products decrease as n increases. In the case of DD and ID, both prices increase when n increases. Appendix 4 provides a plot illustrating these patterns using II and DD as the example. These imply that the structures of the high-quality and the low-quality channels have an asymmetric effect on equilibrium prices in the market. Specifically, the structure of the high-quality channel is the main driver of how the changes in n influence equilibrium prices.

5 Comparison across channel structures

Now we compare the quality and price equilibria across different channel structures. To aid the discussion, the main effects of decentralization are summarized for all values of n in Table 3. A symbol of “+” indicates a positive impact of decentralization on the variable(s) on the left, “−” indicates a negative impact, “+ / −” indicates that the impact is positive for smaller values of n but negative for greater values of n, and “− / +” indicates the reverse.

The equilibrium retail prices in both channels are higher if either channel is decentralized rather than integrated. More importantly, the asymmetric effects that we found earlier for quality responses continue to hold for the equilibrium results. First, comparisons between II and DI and between ID and DD suggest that when the low-quality channel is decentralized rather than integrated, it has a higher quality level and both its demand and the profit of the low-quality manufacturer are lower. The competing high-quality channel receives greater profit. Second, when the high-quality channel is decentralized (i.e., comparing II with ID, and DI with DD), it has a lower quality level and both its demand and the profit of the high-quality manufacturer are lower. Again, the competing low-quality channel receives greater profit. The effects on product differentiation depend on whether the decentralization occurs in the low-quality channel or the high-quality channel. If the high-quality channel is decentralized rather than integrated, the degree of product differentiation (i.e., a 2 − a 1) is less. If the low-quality channel is decentralized, product differentiation actually increases for greater values of n.

The comparison between the cases of II and DD is particularly interesting. As discussed earlier, divestiture imposed by industry regulation is one scenario where the shift from II and DD could happen. Table 3 shows product differentiation decreases when both channels are decentralized rather than integrated. Interestingly, the enforced divestiture results in higher total profit for both channels (\(\pi _{1}^{DD\ast }>\pi _{1}^{II\ast }\) and \(\pi _{2}^{DD\ast }>\pi _{2}^{II\ast } \)). Despite less-differentiated qualities, retail prices are higher in both channels so that the total profits in both channels increase despite lower demand. This result implies that when both channels are decentralized (DD), they can afford to have less-differentiated products without intensifying price competition. This intuition is consistent with the finding from McGuire and Staelin (1983). That is, decentralization helps buffer competition.Footnote 4

From the perspective of manufacturers, a channel structure of DD instead of II hurts the profit of the high-quality manufacturer (\(\pi _{M2}^{DD\ast }<\pi _{M2}^{II\ast }\)). However, the low-quality manufacturer actually benefits from it (\(\pi _{M1}^{DD\ast }>\pi _{M1}^{II\ast }\)). This is surprising given that the manufacturer receives only part of the channel profit in DD but the total channel profit in II. This result demonstrates the possibility of a profit enhancing effect of decentralization and contributes to the literature that is mostly built upon the premise that adding intermediaries causes channel inefficiencies. It is interesting to note that a similar result was reported by Desai et al. (2004) who, in studying durable goods, show that a manufacturer may receive higher profits by using a retailer if it can establish and commit to a two-part fee schedule. Bonanno and Vickers (1988) also show that decentralization could be profitable for a manufacturer if it induces some collusion from the rival, such as when the manufacturer can charge a franchising fee to extract retailers’ surplus. Compared with these two studies, our model demonstrates a very different mechanism through which the benefit of decentralization occurs. That is, as an important competitive strategy, product positioning enables some (but not all) manufacturers to benefit from decentralization and the impact on the high-quality versus low-quality manufacturers could be very different.

Overall, the effects of decentralization, whether it is unilateral or in both channels, tend to be asymmetric on the high-quality versus the low-quality manufacturer. The industry as a whole, however, benefits from decentralization. That is, \(\pi _{1}^{DI\ast }+\pi _{2}^{DI\ast }>\pi _{1}^{II\ast }+\pi _{2}^{II\ast }\), \(\pi _{1}^{DD\ast }+\pi _{2}^{DD\ast }>\pi _{1}^{ID\ast }+\pi _{2}^{ID\ast }\), \(\pi _{1}^{ID\ast }+\pi _{2}^{ID\ast }>\pi _{1}^{II\ast }+\pi _{2}^{II\ast }\), \(\pi _{1}^{DD\ast }+\pi _{2}^{DD\ast }>\pi _{1}^{DI\ast }+\pi _{2}^{DI\ast }\), and \(\pi _{1}^{DD\ast }+\pi _{2}^{DD\ast }>\pi _{1}^{II\ast }+\pi _{2}^{II\ast }\).

To measure the net effects of price and quality reactions on consumer welfare, we calculate consumer surplus for each channel structure. As a policy benchmark, we also obtain quality solutions via maximizing total surplus for efficient product positioning. We find that the product provided by the high-quality channel is either positioned above the efficient level or very close to it. However, the quality of the low-quality product is lower than the efficient level, especially if n is relatively large. The combination of these two patterns lead to that, for almost all the values of n, product differentiation (i.e., a 2 − a 1) is larger than what a social planner would choose in all four channel structures. This echoes a result obtained by Moorthy (1988b) who, in the absence of the channel issue, finds that product differentiation between duopolists is greater than that in the efficient solution. Our model extends this result to more general channel structures and shows that profit maximization in competitive markets often results in firms focusing on more distinct consumer segments than what a social planner would choose.

We find that decentralization, whether it is unilateral or in both channels, leads to lower consumer welfare. Higher prices in both channels as a result of decentralization reduces consumer surplus, even in the cases of higher quality. Therefore, in a competitive environment with firms making both quality and price decisions, vertical integration would have a significant welfare enhancement effect through the elimination of double marginalization. It is important to note that this occurs in the absence of any cost efficiencies that might have resulted from vertical integration.

6 Endogenous channel structure

The profit and welfare results appear to undermine the intention of regulatory agencies when they impose divestiture orders on the industry to preserve competition and enhance welfare. If decentralization has the potential to hurt consumers through the combination of pricing and quality consequences, industry regulation needs to be more sensitive to firms’ strategic response to channel structure changes. A critical question, then, is whether there can be any consistency between the general preference of industry regulation for decentralization and the firms’ private incentives in choosing channel structures. If such consistency exists, an enforced divestiture may be easier to implement since it is in line with the interest of firms (although it does not necessarily benefit consumers). Otherwise industry regulation needs to be cautious since an enforced divestiture may work against the interests of both the firms and the consumers.

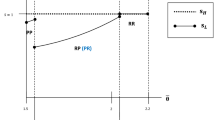

Such consistency exists in the study of McGuire and Staelin (1983). They show while II is always an equilibrium, DD can be an equilibrium too if the degree of product substitution is high. When DD is an equilibrium, it Pareto dominates II in terms of manufacturer profit. What happens if product differentiation is endogenous? Can both II and DD still be equilibrium? To examine this issue, we compare the equilibrium profits of the manufacturers under different channel structures. Table 4 illustrates the channel structure game using n = 9 as the example.

We find that endogenizing product positioning removes decentralization as a channel structure equilibrium. Regardless of the values of n, II remains an equilibrium but DD does not. The intuition of this finding is suggested by the previous analysis of firms’ optimal price and quality decisions. That is, in addition to the possibility of using decentralization to counter price competition (McGuire and Staelin 1983), firms can now reposition their products to achieve similar effects. As we show earlier, decentralization by the low-quality firm will increase its quality, and that by the high-quality firm will reduce its quality. This means that staying integrated by the low-quality firm would lead to a lower quality than the case of decentralization, and staying integrated by the high-quality firm would result in an even higher quality. Together with the consequence on pricing, the benefit of making one’s product more differentiated from that of the competitor (and staying integrated) is greater than adopting a decentralized channel. Proposition 1 highlights the equilibrium channel structure result.

Proposition 1

When the product positioning decision is endogenized and if industry regulation does not interfere, the only channel structure equilibrium in quality-differentiated market is integration in both channels.

This analysis extends the findings of McGuire and Staelin (1983) to the case where product positioning is endogenous. It suggests that the private incentive of manufacturers is mostly in favor of integration. This is consistent with the common belief that firms have the tendency to integrate, but it stems from reasons other than cost efficiencies or gaining market power. Instead, firms may prefer integration if their ability to strategically adjust the degree of product differentiation enables them to reduce the impact of price competition. It turns out that, net of the impact from price and quality, consumers may also benefit from integrated sellers. For regulatory agencies, these findings highlight the strategic role of product positioning that has not received much attention in antitrust cases involving distribution channels. Although enforced divestiture reduces the market power of firms, it creates an additional layer of pricing that may push up prices sufficiently high to offset any potential gain in quality so that consumers are hurt. Due to the same reason, divestiture may have the unintended effect of enhancing the profitability of the firms.

7 Conclusions

The main results in this study can be summarized in four aspects. First, in a market where firms differentiate in quality, a change in channel structure can produce asymmetric effects depending on whether it occurs in the high-quality or low-quality channel. These happen as a result of firms targeting different consumer segments when they make price and quality decisions. Second, enforced decentralization by industry regulation results in less differentiated products, higher retail prices, and higher total profits for both channels. It hurts the profitability of the high-quality manufacturer, but benefits the low-quality one. Third, decentralization, whether it is unilateral or bilateral, has the tendency to reduce consumer welfare. In an environment where channels competing in both price and quality, vertical integration have a significant welfare enhancement effect. Lastly, the seminal work by McGuire and Staelin (1983) points out that decentralization is not always damaging and the inefficiency introduced by double marginalization may be offset by less price competition. Our model unpacks the “black box” of product substitution by endogenizing the quality decision. It shows that, different from the case where product substitution is exogenous, integrated channels are the unique equilibrium.

Several limitations and research opportunities should be noted. First, some of the results are derived for very general cases while others need to be solved from specific functional forms. Although the power utility functions are commonly used in analytical and empirical work and cover a large range of utility patterns, it is useful to examine other utility functions. To do so, we examined another popular utility function, the exponential utility function, which has the form of u(a) = 1 − exp( − na) (Blanchard and Fischer 1993). The results on the effects of channel structures and the endogenous channel decisions remain unchanged. Thus our main findings hold at least for these commonly-used utility functions and the strategic forces illustrated appear to be quite general. Second, we have focused on the typical pricing structure used in the literature: manufacturers charge a per unit wholesale price to retailers who charge a per unit retail price to consumers. It is useful to consider alternative sales mechanisms such as non-linear pricing contracts (Bonanno and Vickers 1988; Desai et al. 2004) and advance selling (Xie and Shugan 2001). Third, our focus of product differentiation is quality. While this is consistent with a well-established research stream in economics and marketing (e.g., Economides 1999; McGuire and Staelin 1983; Moorthy 1988b; Villas-Boas 1998), and arguably captures an important aspect of differentiated product markets (Blattberg and Wisniewski 1989), it is interesting to extend the model to horizontal differentiations (Neven and Thisse 1990). One may speculate that being able to differentiate on an additional dimension could enable the firms to favor integrated channels even more. Finally, to focus on the effects of channel structures on positioning and pricing, we have assumed that the distribution of consumer preference is uniform. We acknowledge that there could be markets where other distributions such as bimodal or unimodal are more suitable (e.g., Blattberg and Wisniewski 1989). Extensions to different consumer distributions will be challenging but useful.

Notes

The case of n = 1 is not interesting and the cases of n > 9 do not provide extra observations.

Existence requires minimal conditions such as continuity. Uniqueness requires well-behaved objective functions that defy simple conditions on u and c (e.g., strictly quasi-concave or unimodal and contraction mappings), and is evident in all computational work subsequently reported in the paper.

A technical requirement for compactness of the strategy sets, such as 0 ≤ a 1 ≤ a 2 − ε and \(a_{1}+\epsilon \leq a_{2}\leq a^{\max }\), where ε is a small number, is needed.

Moreover, as we show below, the lower-quality manufacturer, which has less a problem of double marginalization, benefits more from decentralization. We thank an anonymous reviewer for this observation.

References

Blanchard, O., & Fischer, S. (1993). Lectures on macroeconomics. Cambridge: MIT.

Blattberg, R., & Wisniewski, K. (1989). Price-induced patterns of competition. Marketing Science, 8(4), 291–309.

Bonanno, G., & Vickers, J. (1988). Vertical separation. Journal of Industrial Economics, 36(3), 257–265.

Bruce, N., Desai, P., & Staelin, R. (2005). The better they are, the more they give: Trade promotions of consumer durables. Journal of Marketing Research, XLII, 54–66.

Chen, Y. (2001). On vertical mergers and their competitive effects. The Rand Journal of Economics, 32(4), 667–685.

Choi, C. (1991). Price competition in a channel structure with a common retailer. Marketing Science, 10, 271–296.

Coughlan, A. (1985). Competition and cooperation in marketing channel choice: Theory and application. Marketing Science, 4, 110–129.

Desai, P. (2001). Quality segmentation in spatial markets: When does cannibalization affect product line design. Marketing Science, 20(3), 265–283.

Desai, P., Koenigsberg, O., & Purohit, D. (2004). Strategic decentralization and channel coordination. Quantitative Marketing and Economics, 2, 5–22.

Economides, N. (1999). Quality choice and vertical integration. International Journal of Industrial Organization, 17, 903–914.

Fudenberg, D., & Tirole, J. (1991). Game theory (pp. 67–105, 144–200). Cambridge: MIT.

Gupta, S., & Loulou, R. (1998). Process innovation, product differentiation, and channel structure: Strategic incentives in a duopoly. Marketing Science, 17, 301–316.

McGuire, T., & Staelin, R. (1983). An industry equilibrium analysis of downstream vertical integration. Marketing Science, 2, 161–191.

Moorthy, S. (1988a). Strategic decentralization in channels. Marketing Science, 7, 335–355.

Moorthy, S. (1988b). Product and price competition in a duopoly. Marketing Science, 7, 141–168.

Motta, M. (1993). Endogenous quality choice: Price vs. quantity competition. Journal of Industrial Economics, 2, 113–131.

Neven, D., & Thisse, J.-F. (1990). On quality and variety competition. In Economic decision making: Games, econometrics and optimization (pp. 175–199). Amsterdam: North-Holland.

Ornstein, S. (2002). Motion pictures: Competition, distribution, and efficiencies. In Duetsch, L. (Ed.), Industry studies (pp. 263–288). Armonk: M. E. Sharpe.

Raju, J., & Zhang, Z. J. (2005). Channel coordination in the presence of a dominant retailer. Marketing Science, 24(2), 254–262.

Riordan, M. (2005). Competitive effects of vertical integration. Mimeo: Columbia University.

Shugan, S. (2004). Finance, operations, and marketing conflicts in service firms. Journal of Marketing, 68, 24–26.

Tyagi, R. (2004). Technological advances, transaction costs, and consumer welfare. Marketing Science, 23(3), 335–344.

Villas-Boas, J. M. (1998). Product line design for a distribution channel. Marketing Science, 17, 156–169.

Xie, J., & Shugan, S. (2001). Electronic tickets, smart cards, and online prepayments: When and how to advance sell. Marketing Science, 20(3), 219–243.

Acknowledgements

Dr. Xuan Zhao thanks the support by the Natural Sciences and Engineering Research Council of Canada, No. 312572-05. Yong Liu gratefully acknowledges research support from the Joseph W. Newman Memorial Fund at the Department of Marketing, Eller College of Management, University of Arizona.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix 1. Proof of results in the pricing game (Table 1)

The case of II

The first order conditions are αp 2 − βp 1 − β(p 1 − c 1) = λ 1 − β(p 1 − c 1) = 0 and 1 − α(p 2 − p 1) − α(p 2 − c 2) = λ 2 − α(p 2 − c 2) = 0. The second order conditions are \(\partial ^{2}\pi _{1}^{II}/\partial p_{1}^{2}=-2\beta ,\) \(\partial ^{2}\pi _{2}^{II}/\partial p_{2}^{2}=-2\alpha ,\) which satisfy the requirement for concavity and guarantee that a pure-strategy Nash equilibrium exists. The required results can be obtained by first solving prices from the implicit functions and then substituting them into λ and π.

The case of DI

The game becomes

in which the retailer in the decentralized channel and the manufacturer in the integrated channel simultaneously set retail prices. The equilibrium solutions are as follows:

and \(\lambda _{1}^{DI}=\lambda _{1}^{II}-\frac{\beta (2\beta -\alpha )(w_{1}-c_{1})}{4\beta -\alpha },\lambda _{2}^{DI}=\lambda _{2}^{II}+\frac{ \alpha \beta (w_{1}-c_{1})}{4\beta -\alpha }\). Then the manufacturer’s problem in the decentralized channel is to set wholesale price, which is irrelevant for the integrated channel:

Substituting \(w_{1}^{DI}\) into Eqs. 5 and 6, then into the demand and profit functions, we obtain the required results. The ID case is similar.

The case of DD

Under channel structure DD, we have the following profit functions:

The equilibrium prices and demands are

Then the suppliers’ wholesale price game is \(\pi _{M1}^{DD}=(w_{1}-c_{1})\lambda _{1}^{DD},\) \(\pi _{M2}^{DD}=(w_{2}-c_{2})\lambda _{2}^{DD}.\)

Both of these functions are strictly concave, and this results in a unique Nash wholesale price equilibrium:

Substituting the wholesale prices into the demand functions, resulting in

The profit functions then become

Similarly, we can derive the results for channel 2.

The wholesale prices in Eq. 9 can be written as

Solving the two equations in Eq. 14, we can obtain the required results for equilibrium wholesale prices in Table 1,

and then obtain \(p_{1}^{DD},\) \(p_{2}^{DD}\) by substituting Eq. 15 into Eqs. 7 and 9.

Substituting Eq. 15 into the demand functions results in

The profit functions in Table 1 are finally obtained by substituting \( \lambda _{1}^{ID}|_{w_{2}=w_{2}^{DD}}=\tau \lambda _{1}^{II}\rho _{1}\) into functions (11) to (13). Similarly, we can derive the results for channel 2.

Appendix 2. Equilibrium channel structure with fixed quality levels

The strategic form of the channel structure game is presented below in Table 5. As the manufacturers make channel structure decisions with fixed quality levels, II is always an equilibrium, and DD is also an equilibrium when u(a 1) > 0.87u(a 2). When DD is an equilibrium, it Pareto dominates II. These results mirror those of McGuire and Staelin (1983) except that the conditions are now in terms of primitive consumer utility rather than the (exogenous) degree of substitutability.

Proof

Since γ 3/4γ 1 < 1, we have \(\pi _{M1}^{DI}<\pi _{1}^{II}\) and \(\pi _{M2}^{ID}<\pi _{2}^{II}\); II is always an equilibrium. \(\pi _{M1}^{DD}>\pi _{1}^{ID}\) or \(\pi _{M2}^{DD}>\pi _{2}^{DI}\) if τ 2 > 1. The inequality is equivalent to − 128 + 320x − 273x 2 + 96x 3 − 12x 4 > 0, where x = u 1/u 2 and x = 0.87 (approximately) solves the corresponding equality. So, u(a 1) > 0.87u(a 2) implies \(\pi _{M1}^{DD}>\pi _{1}^{ID},\pi _{M2}^{DD}>\pi _{2}^{DI},\) and DD is a Nash equilibrium. If \( \min \{\rho _{1}^{2},\) \(\rho _{2}^{2}\}>1/\tau _{2}\) (which is always true if τ 2 > 1, and it can be true even if τ 2 > 1 is violated), then \(\pi _{i}^{DD}>\pi _{i}^{II}\). Thus the equilibrium channel structure is a function of both consumer preferences and quality choices. The condition u(a 1) > 0.87u(a 2) concerns not only the quality levels, but also the form of utility that consumers derive from quality. □

Appendix 3. Proof of Theorem 1

Proof

Take the cases of DI and II as an example. The other proofs are similar. Under the DI structure, from Table 1,

The response functions come from the following first-order conditions:

Recall \(r_{1}^{II}(a_{2})\) is the optimal quality level of channel 1 under II given a certain level of a 2. As \(\pi _{1}^{II}|_{r_{1}^{II}(a_{2}),a_{2}}>0\) and \(u_{1}^{\prime }>0\), it holds that \(\dfrac{\partial \pi _{M1}^{DI}}{\partial a_{1}} |_{r_{1}^{II}(a_{2}),a_{2}}=\pi _{1}^{II}\dfrac{2u_{2}u_{1}^{\prime }}{ 4(2u_{2}-u_{1})^{2}}|_{r_{1}^{II}(a_{2}),a_{2}}>0.\) So \( r_{1}^{DI}(a_{2})>r_{1}^{II}(a_{2})\). □

Appendix 4. Asymmetric patterns of price changes with n

Rights and permissions

About this article

Cite this article

Zhao, X., Atkins, D. & Liu, Y. Effects of distribution channel structure in markets with vertically differentiated products. Quant Mark Econ 7, 377–397 (2009). https://doi.org/10.1007/s11129-009-9075-y

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11129-009-9075-y

Keywords

- Distribution channel

- Vertical differentiation

- Product positioning

- Anti-trust

- Competition

- Heterogeneity

- Pricing

- Quality