Abstract

Rents and political motives are present in many aspects of public policy. This article considers the role of rents, rent seeking, and the political choice of environmental policy. Rents are introduced into the political choice of price and quantity regulation under conditions of uncertainty. The model shows how political-economy aspects affect the choice between price and quantity regulation. The contesting of rents associated with different policies affects the regulatory structure and influences the political choice of an environmental policy target. The primary conclusion is that the political choice of environmental policy depends on the interaction between the efficiency of rent transfer and the size of rent-seeking groups within the economy.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Pollution regulation can take the form of price controls (emissions taxes) or quantity controls (cap-and-trade markets). In the mainstream environmental economics literature, the objective of regulation has been specified as the maximization of social welfare. Consequently, price regulation has been regarded as optimal on the grounds that quantity regulation encourages a culture of rent seeking and corruption. Nordhaus (2007, p. 39), for example, states that “[q]uantity-type systems are much more susceptible to corruption than price-type regimes. An emissions-trading system creates valuable assets in the form of tradable emissions permits” whereas “a price approach gives less room for corruption because it does not create artificial scarcities, monopolies, or rents.... [t]here is no new rent seeking opportunity”.Footnote 1 Rents indeed arise from the use of quantity instruments. However, rents in the form of potentially contestable public funds are also created through price regulation. A comparison of political-economy aspects of regulation through prices and quantities therefore requires investigating contestable rents created through both types of regulation and the potential implications for instrument choice and policy targets.

Instrument choice for environmental policy has been investigated under uncertainty. Weitzman (1974), Adar and Griffin (1976), Fishelson (1976) and Roberts and Spence (1976) studied expected costs and benefits of reducing pollution using price and quantity regulation, again with a social welfare objective. This traditional perspective shows that price regulation is socially preferred when the slope of the expected marginal cost function is steeper than the slope of the expected marginal benefit function (and vice versa). Intuitively, a quantity policy will fix a level of pollution but allow price (the level of marginal abatement costs) to vary whereas under price regulation the price of pollution control is fixed but the level of pollution can vary. When expected marginal costs are relatively steep, price regulation is preferred as the distortion associated with changing pollution level is less severe that the distortion generated in price (marginal costs) caused by implementing quantity regulation.

Although these past studies provide a comparative analysis of alternative environmental policies, they are limited to cases where the regulator’s objective is to maximize social welfare. Thus this literature has limited capacity to explain how and why political decision makers decide on environmental policies. This paper investigates instrument choice for environmental policy in a political-economy setting, allowing for the presence of contestable rents from both price and quantity regulation. A two-stage model is set out in which, in the first stage, under uncertainty, a politician sets a pollution target using either price or quantity regulation as considered by Weitzman (1974). In the second stage, the rent created by regulation is contested, with the regulating politician benefiting from rent extraction (Appelbaum and Katz 1987; Gradstein and Konrad 1999). The political objective trades off the public interest against the political benefit from rent creation (see Peltzman 1976; Hillman 1982).

In comparing price and quantity regulation, I distinguish whether or not regulation provides revenue. Three important cases exist: freely allocated pollution permits (quantity regulation), auctioned permits (quantity regulation), and emissions taxes (price regulation). When pollution permits are freely allocated, no revenue is generated. Rents are then created through a fixed supply of tradable permits (the realized rents are associated with either selling the permits or reducing marginal pollution control costs). In practice, in such cases, the distribution of permits is usually only contested by regulated entities. In contrast, revenue is provided through emissions taxes and the auctioning of pollution permits, and rent seeking for this revenue is open, in principle, to all players in the economy.

The efficiency of rent transfers depends on the form of regulation. For rents created through freely allocated pollution permits, rent transfers can be costless: these pollution permits are created and distributed through the bureaucratic system. For revenue-raising instruments, however, revenue collection can be subject to ‘leakage’ within the regulatory system, with consequent revenue (rent) loss. Contestable rents are also reduced if part of the revenue is earmarked a priori for specific purposes. Further, revenue can also be used to finance productive investments (such as infrastructure or energy efficiency projects, which are frequently observed uses for permit auction revenue).

Against this background, I investigate why particular quantity allocation mechanisms are chosen within cap-and-trade markets. Under the conventional social-welfare maximizing approach (Weitzman 1974), the regulator is indifferent between freely-allocated and auctioned permits because both are quantity mechanisms. In a more realistic setting, I show how rent seeking affects the regulatory policy choice when there is political rent extraction. When pollution permits are auctioned, there are more potential rent seekers than when permits are freely allocated (which increases rent-seeking effort for auctioned permits). There is also a greater potential of rent losses under auctioned permits due to revenue ‘leakage’ or earmarking of revenues (this therefore decreases rent-seeking efforts for auctioned permits). This tradeoff determines total rent-seeking effort and thereby whether freely allocated or auctioned permits are politically preferred.Footnote 2 I show that freely allocated permits are politically preferred to auctioned permits when the former yields higher contestable rents: this occurs when the proportion of rent transfer loss from auctioned permits is smaller than the ratio between rent seekers from regulation entities and the wider economy.

Rent seeking over freely allocated permits is commonplace in the Acid Rain Program (Ellerman et al. 2000) as well as the European Union’s Emission Trading Scheme (EU-ETS) (Zapfel 2007). Ellerman et al. (2000) provide clear evidence that rent seeking occurred over the distribution of pollution permits under Title IV of the 1990 Clean Air Act Amendments. The political process was distributional through legislation. Under Sect. 403(a) of that law, a ‘ratchet’ provision was adopted ensuring that any political lobbying over the legislation would not affect the aggregate level of emissions.

Evidence of rent seeking for public funds also appears commonplace. Aidt (2010) provides details of how revenue from ‘green’ taxes has been appropriated by special interests. Within the Regional Greenhouse Gas Initiative (RGGI)—a cap-and-trade scheme regulating most Northeastern US states—some states have diverted auction revenues away from intended recipients. For example, since 2009 New York State has diverted revenue away from energy efficiency projects towards reducing its budget deficit, the so-called ‘Deficit Reduction Plan (DRP) Transfer’.Footnote 3

The present study is related to three fields of literature: the political economy of environmental policy, price versus quantity regulation under uncertainty, and the political economy of quotas and tariffs. The literature on the political economy of environmental policy is vast (see Oates and Portney 2003) and has taken two main modeling approaches. The first type of model focuses on the endogenous determination of environmental policy (e.g., Fredriksson 1997; Aidt 1998, 2010; Aidt and Dutta 2004; Lai 2007). Most of these models use the political rent-extraction model of Grossman and Helpman (1994, 2002).Footnote 4 Lobbyists provide a menu of contributions for the rent-extracting politician’s policy decisions. The politician then selects policy based on the weighted sum of social welfare and political contributions (which is equivalent to the trade-off in the political-support models). The second modeling approach focuses on the distributional conflict within environmental policy (e.g., Buchanan and Tullock 1975; Appelbaum and Katz 1987; Dijkstra 1998; Malueg and Yates 2006; Dijkstra 2007; Hanley and MacKenzie 2010; MacKenzie and Ohndorf 2012). This literature views environmental policy in the context of contest theory (see Tullock 1980; Hillman and Riley 1989; Long 2013). In applications to environmental policy, however, the contest literature has not accounted for uncertainty.Footnote 5

The second field of literature includes uncertainty into the comparison of price and quantity regulation (Schöb 1996; Stavins 1996; Hoel and Karp 2001, 2002; Montero 2002; Pizer 2002; Williams 2002; Newell and Pizer 2003; Quirion 2004; Krysiak 2008; Fell et al. 2012; Rohling and Ohndorf 2012; Wirl 2012; Storrøsten 2014; D’Amato and Dijkstra 2015).Footnote 6 This vast literature confirms—in different ways—the core result that instrument choice depends on the relative slopes of the expected marginal cost and benefit functions. This literature abstracts from political objectives and the quest for political influence; yet without investigating how political objectives and political influence affect a regulator’s instrument choice, little can be said about the reality of price versus quantity regulation.

A third relevant field of literature investigates the choice between quotas and tariffs in international trade (e.g., Cassing and Hillman 1985; Lake and Linask 2015; Cassing and Hillman 2016 and references therein). Although parallels exist between this literature and environmental regulation, there are a number of key differences. First, emission permits are tradable whereas import quotas are usually not. The existence of trade alters the value of contestable rents and the associated rent seeking. Second, the size of the emissions permit rent is endogenously determined by the marginal costs of pollution reduction (permit demand) and the politically determined supply of the permits. Thus, unlike in the conventional trade quota model, rent seeking can be influenced by the marginal costs of all participants in the emissions market. Third, there are numerous methods used to initially allocate pollution permits, such as auctions or free allocation based on past emissions. The use of alternative initial allocation methods has important implications for the creation of contestable rents and the ability of players to rent seek, which is absent in the analysis of import quotas.

My contribution is to show—using a political-economy setting that departs from the standard social-welfare maximizing model—how rents and rent seeking influence choice between price and quantity environmental regulation. The results show that taking political objectives and political influence into account is central to understanding the choice of environmental regulatory policy. In particular, a positive analysis is outlined to explain why political decision makers choose specific environmental policy instruments. The article also provides insights into the stringency of pollution targets. A perhaps surprising result is that when the political decision maker is modeled as a politician that maximizes the gains from rent extraction, the pollution target may be more stringent than the level chosen by a conventional social welfare maximizing regulator. The political decision maker may increase the stringency of the pollution target to maximize rent-seeking efforts from which he or she gains a private payoff through rent extraction. Overall, the article highlights the importance of rents and rent seeking in explaining the choice of environmental policy instruments and associated pollution targets.

This article is organized as follows. Section 2 describes the basic model. Section 3 describes the contests for rents. Section 4 derives the politically preferred policy choice. Section 5 compares price regulation with revenue- and non-revenue-raising quantity regulation. Section 6 provides concluding remarks.

2 The economic environment

Consider an economy with a set of players \(\Psi =\{1,2,\ldots ,m\}\).Footnote 7 Within this population, pollution is generated by a subset of players \(\Phi =\{1,2,\ldots ,n\}\subseteq \Psi \). Group \(\Phi \) can reduce pollution at a cost of \(C(q,\theta )\), where \(q \ge 0\) is the choice of pollution abatement and \(\theta \) is a random variable with \({\mathbb {E}}[\theta ]=0\) and \({\mathbb {E}}[\theta ^{2}]=\sigma ^{2}\). It is assumed that \(C^{'}(q,\theta )>0\), \(C^{''}(q,\theta )>0\), and the (marginal) cost is increasing in the level of the random variable \(\theta \). The choice of pollution abatement q provides benefits to the general population \(\Psi \setminus \Phi \).Footnote 8 We denote these aggregate benefits as B(q), where \(B^{'}(q)>0\) and \(B^{''}(q)<0\). To ensure the existence of a single-crossing property between the marginal benefit and marginal cost curves, we assume \(B^{'}(0)>C^{'}(0,\theta )\) and \(B^{'}(q)<C^{'}(q,\theta )\) for a sufficiently large q. Finally, denote \({\bar{q}}>0\) as the level of initial emissions prior to any adoption of regulation. It follows that \(q\in [0,{\bar{q}}]\) and \({\bar{q}}-q\) is the post-abatement emissions level.

The focus of this article is to investigate how rent seeking—the use of resources to capture rents generated from the regulatory system—alters the political choice of price and quantity regulation. To highlight the fundamental differences, this environment is modeled as a two-stage game. In the first stage, a politician selects a level of pollution regulation under the presence of uncertainty: either a price level p or quantity restriction q is chosen. In the second stage, players compete for the rents generated by the adoption of pollution regulation. Uncertainty over the level of (marginal) costs is resolved after stage one, but prior to stage two.Footnote 9

To present players’ rent-capturing activities, the model follows the contest literature (e.g., Tullock 1980). In a contest, players invest in sunk effort that determines their probability of winning the rent. Formally, the probability of player \(i\in \Psi \) obtaining the rent is given by:

where \(\kappa _{i}\) is the level of player i’s effort used to appropriate the rent and \(\kappa _{-i}\equiv \sum _{j\ne i}^{m}{\kappa _j}\) denotes the sum of efforts from all players excluding player i.Footnote 10 From (1), player i’s probability of winning the rent is the ratio of their sunk effort relative to total outlays. Thus player i’s probability of winning the rent (weakly) increases in their own effort and (weakly) decreases in rivals’ efforts. We can interpret (1) as player i winning the entire rent with probability \(\rho _{i}(\kappa _{i}, \kappa _{-i})\), or, perhaps more realistically, the share of rent attributed to player i.

The model is solved using the Subgame Perfect Nash equilibrium solution concept, and thus the analysis begins with stage two.

3 Stage two: distributional rent seeking

3.1 Price regulation

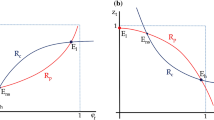

Let \({\tilde{p}}\) denote the per-unit tax on pollution emissions determined in stage one. For a realization of the random variable, \(\theta ^{0}\), let us denote the level of aggregate pollution abatement by \(h({\tilde{p}},\theta ^0)\), which is derived from players setting their marginal abatement costs equal to the tax, \(C^{'}(h({\tilde{p}},\theta ^0),\theta ^{0})={\tilde{p}}\). Thus the level of emissions is given by \(\left( {\bar{q}}-h({\tilde{p}},\theta ^0)\right) \). Therefore the total tax revenue raised from an emissions tax is given by \({\tilde{p}}\times \left( {\bar{q}}-h({\tilde{p}},\theta ^0)\right) \). Figure 1 provides an illustrative example in which the tax per-unit of emissions is set to equate the marginal benefits and expected marginal costs; therefore, the resulting tax revenue for \(\theta ^{0}\) is indicated by the hatched area.

A key argument within this article is that the tax revenue generated may be contested by rent seekers: players within the economy may invest resources to capture this revenue. As such, we define the rents generated from price regulation (tax revenue) by:

The parameter \(\delta \) is introduced in order to reflect the efficiency of transfers within the economy. If \(\delta \in [0,1)\) then there is a loss of rent within the economy. For example this could represent inefficiencies within the bureaucratic system, where revenue is being appropriated within the regulatory system. Further, it could also be interpreted as a situation where a proportion \((1-\delta )\) of the revenue is earmarked for a specific use and the remainder \(\delta \) is a contestable component.Footnote 11 Alternatively, if \(\delta >1\) then the generation of this rent has the potential to be used to provide advantages to some members of the economy over-and-above the size of the revenue. That is, the rent can be transferred to respective players as an investment with positive returns. For example, tax and auction revenue could be used to provide investments in club goods, such as infrastructure investments, reductions in distortionary taxation, or investments in technology. There exists anecdotal evidence of this occurring: within the U.S. Regional Greenhouse Gas Initiative (RGGI) cap-and-trade market, the majority of auction revenue is transferred to specific players in order to invest in energy efficiency projects that will, over time, provide positive returns for those respective players.Footnote 12 From (2), note that the rent (tax revenue) is likely to be contestable to the whole population \(\Psi \) because all players can invest in rent-capturing resources to obtain the rent from the politician.Footnote 13 Note, however, that the framework presented here can also consider cases where the revenue is recycled back to the population of regulated players \(\Phi \) for \(\delta \in [0,\infty )\) (Gersbach and Requate 2004).

Using (1) and (2), player i’s objective function is given by:

This game has a pure-strategy Nash equilibrium. Thus the equilibrium appropriation effort of player i, is given by:

Aggregating over the population \(\Psi \), total appropriation effort is given by:

where subscript T denotes the tax case. Equation (5) shows that aggregate appropriation activity is increasing in the population \(\Psi \), the value of the rent \(\delta {\tilde{p}}\times \left( {\bar{q}}-h({\tilde{p}},\theta ^0)\right) \), as well as the level of transfer efficiency \(\delta \).

3.2 Quantity regulation

Let \({\tilde{q}}\) denote the level of regulation on pollution emissions derived in stage one, where the politician sets a limit on emissions within a cap-and-trade market. In particular, an aggregate pollution cap is chosen and the regulator initially allocates the corresponding permits to regulated players. The permits are freely tradable and, consequently, the market clearing price for permits is established. For a realization of the random variable, \(\theta ^{0}\), the level of marginal cost (equilibrium permit price) associated with a specific level of pollution abatement target \({\tilde{q}}\) is given by \(C^{'}({\tilde{q}},\theta ^{0})\), and the level of total emissions within the cap-and-trade market is given by \({\bar{q}}-{\tilde{q}}\). As the regulator issues tradable permits to regulated players for each unit of emissions, the total value of these permits is given by:

This is observed as the hatched area in Fig. 2, where, as an illustrative example, the quantity regulation is determined by equating marginal benefits and expected marginal costs.

At this point we have to differentiate between quantity mechanisms that generate revenue (e.g., permit auctions) and those that do not generate revenue (e.g., freely allocated pollution permits). Note that, for cap-and-trade markets with auctioned permits, players receive the total \(({\bar{q}}-{\tilde{q}})\) permits, but have to pay \(C^{'}({\tilde{q}},\theta ^{0})\times \left( {\bar{q}}-{\tilde{q}}\right) \) to the politician. Thus the hatched area in Fig. 2 illustrates the revenue raised by the regulator under a cap-and-trade scheme with a permit auction. Contrast this with freely allocated pollution permits. The hatched area in Fig. 2 now illustrates the total value of freely allocated permits and the potential rent available to the regulated players. Under a system of free permit allocation, players can realize the value of a permit by polluting more (i.e., using the permit and reducing abatement costs) or selling the permit at the clearing price to another regulated player. The free allocation of permits provides an economic rent to the players and, therefore, an incentive exists to invest in rent-seeking activities in order to capture the pollution permits.

Due to these separate initial allocation processes, there exist two major distinctions. First, the revenue generated from auctioned permits has the potential to be contested by the entire population \(\Psi \). Revenue generated from a permit auction is usually treated like any other government revenue, such as the tax revenue previously described. Thus the entire population has the ability to obtain this generated revenue. In contrast, it is frequently the case that freely allocated pollution permits are contested only by the population of regulated players \(\Phi \). Indeed quantity regulation in this case only provides a rent to the regulated players.Footnote 14 Second, the rents generated from permit auctions may also be affected by the efficiency of government transfer. As both auction and tax revenues are transferred to the government, the transfer efficiency is likely to be the same, we focus on the case where \(\delta \) is identical for a price mechanism and revenue-raising quantity mechanism.Footnote 15 In contrast, for freely allocated permits, the creation of a finite amount of permits is transferred directly to regulated entities, thus \(\delta =1\).

3.2.1 Revenue-raising quantities

For revenue-raising quantity mechanisms, then, the rent is contestable by the whole population \(\Psi \). Using (1) and (6), player \(i\in \Psi \) has the expected payoff:

The equilibrium appropriation effort of player i, is given by:

Aggregating over all the population, total appropriation effort is thus:

where subscript A denotes the auctioning of pollution permits. Again we can see that aggregate appropriation effort is increasing in population, rent, and the efficiency of transfer.

3.2.2 Non-revenue-raising quantities

For non-revenue-raising quantity regulation, it is likely that only the regulated population expend resources in order to capture the pollution permit rent. Restricting \(\rho _{i}(\kappa _{i}, \kappa _{-i})\) in (1) to the regulated population \(\Phi \), the expected payoff for player \(i\in \Phi \) is therefore:

Not only is there a lower level of population incentivized to contest the rent but also \(\delta =1\), i.e., there is a direct transfer of permits without efficiency loss. The pure-strategy Nash equilibrium appropriation effort of player i is given by:

Aggregating over all the population, total appropriation effort is given by:

where G denotes the free allocation (grandfathering) of pollution permits within a cap-and-trade market.

Table 1 provides a summary of the components for all instruments. It is likely that for revenue-raising instruments \(\delta \in [0,\infty )\), whereas for non-revenue-raising quantities \(\delta =1\). A clear separation exists over the composition of rent when either a price or quantity instrument is chosen. The other remaining difference is the number of players that contest the rent, which is higher for revenue-raising instruments, \(m\ge n\). Throughout the remainder of this article, our focus is on the institutional values presented in Table 1. Note, however, that additional analysis can be achieved by considering alternative parameter values.

4 Stage one: politician’s choice of policy level

In stage one the politician decides on the level of regulation. As the main objective of this article is to investigate how rent-seeking efforts alter the comparison of price regulation versus quantity regulation, it is paramount to identify potential institutional rent-seeking environments. There are four main scenarios of importance. First, a politician may be solely committed to maximizing social welfare and perceive rent-seeking efforts as a loss. The most likely interpretation is where the rents offered to the politician are illegal and the acceptance of such rents generates a negative expected gain due to the (high) probability of being found guilty of corruption. Second, the politician may still be committed to the maximization of social welfare but may perceive rent seeking as a transfer between players in the economy and thus not of inherent social loss. Third, the politician may continue to view the maximization of social welfare as an objective, but also receives a benefit associated with players’ rent-seeking efforts. In this case, for example, the politician may place equal weight on the maximization of social welfare and the gains associated with rent extraction. Fourth, the politician may have a sole objective to maximize the gains associated with the creation and extraction of rents and simply disregard social welfare. The assumption that requires the politician to maximize social welfare is unrealistic, yet it does provide a direct link to the established environmental economics literature as well as providing a comparison to more realistic scenarios, where the politician aims to maximize the gains from rent extraction.

Generating this spectrum of environments can easily be achieved by creation of an institutional parameter \(\mu \in [0,1]\). The politician places weights on the importance of social welfare and rent-seeking activity: the politician will place a weight of \(\mu \) on social welfare and a weight of \((1-2\mu )\) on rent-seeking activities. Note that the weight \((1-2\mu )\) is used to reflect the scenario that the politician can either have positive \((\mu\,<\,1/2)\) or negative \((\mu >1/2)\) payoffs from rent-seeking activity.Footnote 16

Using (5) the politician’s objective function under price regulation is given by

Using (9), under a revenue-raising quantity mechanism we have:

and finally, using (12), for a non-revenue-raising mechanism, the objective function is given by:

In all types of regulation, if \(\mu =0\) this details a case where the politician’s sole focus is on maximizing the gains associated with rent extraction. If \(\mu =1/3\), there is equal weight between social welfare and the gains associated with rent-seeking efforts. If \(\mu =1/2\), the politician cares about social welfare but also views rent seeking only as a transfer without any loss to society. If \(\mu =1\), the politician not only cares about social welfare they also view rent-seeking efforts as socially wasteful.Footnote 17 For the sake of brevity we focus on the cases where the politician receives positive payoffs from rent-seeking effort (\(\mu \le 1/2\)) and relegate the analysis of a general model to the “Appendix”.Footnote 18

5 Price regulation versus quantity regulation

In this section, price and quantity regulation are compared under alternative institutional settings. For each institutional setting, we start by investigating how distributional rent seeking affects the politician’s choice of policy level under alternative mechanisms. Then the focus moves to the primary goal: to provide a positive analysis that assists in explaining why certain policies may be chosen over others. More precisely, pairwise comparisons are provided that detail the politician’s expected payoffs for taxes as well as revenue- and non-revenue-raising quantity mechanisms. To start, we denote \(\Delta _{TA}\) as the relative expected payoff difference between a tax and a permit auction. Similarly we denote \(\Delta _{TG}\) as the relative expected payoff difference between a tax and grandfathered (freely allocated) permits. Finally, let us denote \(\Delta _{AG}\) as the relative expected payoff difference between auctioned permits and grandfathered (freely allocated) permits.

Following the literature on price regulation versus quantity regulation, costs are detailed as

where \(c>0\) is a parameter. The benefits obtained by abatement level q are given by

where \(a,b>0\) are parameters such that \(a\,>\,\theta \) and \(q\,<\,\frac{a}{b}\) that ensures a single-crossing property as well as positive marginal benefits. Thus this holds for a sufficiently large a.

5.1 Benchmark

As a starting point—and to provide a benchmark—consider a scenario similar to Weitzman (1974) in which the politician’s objective is to maximize expected social welfare. Within the framework presented here, this requires an additional assumption that any rent seeking is non-wasteful and simply ignored by the politician. Formally, this is modeled by setting \(\mu =1/2\). Beginning with price regulation, substitute \(\mu =1/2\), (16), and (17) into (13). The equilibrium level of price regulation is then:

Thus given the equilibrium price regulation, the level of expected quantity is

Substituting (18) into (13) yields the expected net benefit of price regulation:

Now consider a quantity mechanism. As \(\mu =1/2\), it is trivial to show that that there is no distinction needed between revenue-raising and non-revenue-raising quantities. Thus using (16) and (17), optimization over (14) and (15) with respect to q and solving yields

To focus on interior solutions we assume throughout that the initial level of emissions is sufficiently large such that \({\bar{q}}>\frac{a}{b+c}\).Footnote 19 Comparison of (19) and (21) provides the following proposition.

Proposition 1

Let rent seeking be non-wasteful. If the politician maximizes expected social welfare then:

Similar to Weitzman (1974), the expected regulation levels are identical. For use later in the article, let us denote this level of benchmark quantity by \(q^W\). Substituting (21) into (14) (and 15) yields the expected net benefit from quantity regulation:

Subtracting (23) from (20) and taking expectations yields Proposition 2.

Proposition 2

(Weitzman 1974) Let rent seeking be non-wasteful. If the politician maximizes expected social welfare then:

Proposition 2 shows a comparative result to Weitzman (1974): if rent seeking has no bearing on the politician’s preferred type of regulation, the politician’s relative payoff differences perfectly align with social welfare.Footnote 20 Note that social welfare \((B(q)-C(q,\theta ))\) is concave in q and, as such, the politician will prefer a known policy level over an expected policy level. As can be observed from Proposition 2, the relative payoff difference between price and quantity regulation depends on the variance of the error term and the relative slopes of the marginal benefit and cost functions. In particular, when the slope of the marginal abatement cost function is steeper than the slope of the marginal benefit function then prices are preferred to quantities (and vice versa). Intuitively, setting a quantity restriction when the marginal cost function is relatively steep will result in a significant distortion in the level of marginal costs when the random variable is realized. Yet if a tax is introduced, this places a limit on the level of marginal abatement costs: players can then emit pollution by simply paying the tax for every unit of emissions. Conversely, when the marginal cost function is relatively flat, the implementation of a tax will result in substantial distortions in the equilibrium pollution abatement q, once the random variable is realized. In this case, then, setting a quantity regulation will reduce these distortions by fixing q and improving expected social welfare. Proposition 2 also shows that there is no relative difference between revenue and non-revenue-raising quantity mechanisms—something implicit within Weitzman (1974). As will be shown later in the article, however, this result does not hold for alternative—and arguably more realistic—institutional settings.

5.2 Rent-maximizing politician

It is possible that the politician ignores the costs and benefits of regulation entirely and, instead, sets regulation solely to maximize the gains from rent extraction. Substituting \(\mu =0\) into (13), (14), and (15) yields objective functions that aim to maximize the gains associated with rent seeking. Let us begin with the price mechanism. Optimization of (13) yields the following expected price regulation

thus we obtain

Substituting into (13) yields the politician’s expected payoff:

Next consider the two cases for quantity regulation. Under revenue-raising quantity regulation the optimal policy level is given by

which yields the politician’s expected payoff:

For non-revenue-raising quantity regulation, the optimal policy level is identical to (29). The politician’s expected payoff is therefore:

Comparison of (27) and (29) reveals \({\mathbb {E}}[q(p^{*},\theta )]=q^{*}_{A}= q^{*}_{G} \), where the equilibrium level of q chosen by the politician is exactly half of the initial emissions level.Footnote 21 Note that even though the politician aims to maximize the gains associated with rent-seeking efforts, it chooses a non-zero policy level for all possible regulatory instruments. Pairwise comparison of (21) with (27) and (29) shows that there exists ambiguity over whether the rent-maximizing politician’s target is more or less stringent compared to the Weitzman (1974) benchmark determined in Proposition 1. Two possible cases exist: (i) \({\bar{q}}>\frac{{\bar{q}}}{2}>\frac{a}{b+c}=q^W\), where a rent-maximizing politician selects a more stringent target and (ii) \({\bar{q}}>\frac{a}{b+c}=q^W>\frac{{\bar{q}}}{2}\), where the Weitzman benchmark results in a more stringent target. It is clear that if the initial emissions \({\bar{q}}\) are relatively large then the rent-maximizing politician will generate stricter externality controls. Intuitively, this can be explained by use of Figs. 1 and 2. For the benchmark model, the policy level is independent of \({\bar{q}}\): from Figs. 1 and 2, an increase in \({\bar{q}}\) does not alter the intersection of expected marginal costs and marginal benefits and thus the policy level remains unchanged. Contrast this result to a case where there exists a rent-maximizing politician. Figures 1 and 2 show that as \({\bar{q}}\) increases, the rent (denoted by the hatched area) increases in size, for a given level of regulation. This, in turn, generates an incentive for the politician to impose stricter regulation (thus also increasing the height of the hatched rent area). This is surprising: one may expect that a politician who focuses on maximizing social welfare may have an incentive to choose a more stringent target, but this need not be the case. Relating this to carbon dioxide regulation suggests that if \({\bar{q}}\) is sufficiently large then a rent-maximizing politician may introduce an emissions tax or cap-and-trade scheme that would be more stringent than if the rent-seeking efforts were ignored.

Pairwise comparisons of (28), (30), and (31), yields the following proposition.

Proposition 3

If the politician maximizes the gains associated with rent-seeking effort then:

Proposition 3 shows that \(\Delta _{TA}=0\), i.e., the politician is indifferent between taxes and permit auctions and is not affected by the relative slopes of the benefit and cost functions: a clear contrast to Weitzman (1974). Thus, independent of the benefits and costs associated with externality control, the politician is indifferent between taxes and permit auctions. The relative payoff difference between freely allocated permits and the remaining mechanisms is ambiguous, which is illustrated within the following corollary.

Corollary 1

Corollary 1 shows that the politician’s preference over a revenue-raising versus non-revenue-raising instrument is dependent on the revenue transfer efficiency \(\delta \) and the size of rent-seeking groups \(\frac{m}{(m-1)}\frac{(n-1)}{n}\). First, recall that aggregate rent seeking increases with the size of the group contesting the rents. Thus larger groups will result in increased aggregate rent seeking. Second, note that aggregate rent seeking decreases as the rent size decreases. Using these two findings, Corollary 1 is relatively intuitive. Let us first set \(\delta =1\) so that there exists no influence from changes in the size of the rent. In such a case it is clear that \(\frac{m}{(m-1)}\frac{(n-1)}{n} \le 1\), and, given the group size is larger for revenue-raising regulation, it follows that auctions and taxes generate larger levels of rent-seeking effort and are, therefore, preferred over grandfathered permits. But as the efficiency of rent transfer starts to decrease (i.e., \(\delta \) decreases below 1) the group-size effect becomes less relevant. For a sufficiently inefficient rent transfer such that \(\frac{m}{(m-1)}\frac{(n-1)}{n} > \delta \), the large rent-seeking group is actually contesting a relatively smaller rent. In this case, then, the optimal policy is to choose grandfathered permits as this generates larger gains associated with rent-seeking effort. Thus in contrast to the conventional regulator in Weitzman (1974), a clear distinction arises over the ability of regulatory instruments to raise revenue (or not).

5.3 Equal weight between social welfare and rent-seeking efforts

Let us now analyze a more general institutional environment, where a politician not only cares about social welfare but also cares about receiving gains from rent creation and extraction. To showcase how the introduction of rent-seeking efforts alters the comparison of alternative regulation types, let us assume that the politician places an equal weight on social welfare and the gains associated with rent-seeking efforts. In such a case \(\mu =1/3\). Let us begin with price regulation. Substituting \(\mu =1/3\) into (13) and optimizing yields:

which yields

where \(q^{W}\) is the benchmark target level determined in (19). For permit auctions, optimization of (14) yields:

and for the freely allocated permits it follows that:

First note that, observing (36), (37), and (38), we see that the equilibrium target is a composite of both the benchmark target \(q^W\) and the level determined under a rent-maximizing politician \(\frac{{\bar{q}}}{2}\). Thus the relative positions of these two extreme policy levels will determine how a politician selects their policy. Second, under taxes and permit auctions, the policy level chosen is now dependent on the efficiency of rent transfer \(\delta \). As the politician is maximizing a weighted sum of both expected social welfare and gains from rent extraction, \(\delta \) acts as a scaling factor that changes the relative impact of rent-seeking efforts on the politician’s expected payoff; thus, the efficiency of rent transfer now has a direct impact on the politician’s choice of policy level. Third, equilibrium policy levels are now asymmetric such that \({\mathbb {E}}[q(p^{*},\theta )]=q^{*}_{A}\ne q^{*}_{G}\). By comparing the benchmark quantity level \(q^W\) in (21) with (36), (37), and (38), we can observe how the existence of rent seeking alters the politician’s chosen equilibrium policy levels.

Proposition 4

Let the politician have equal weight between social welfare and the gains associated with rent-seeking efforts.

-

If \(\frac{{\bar{q}}}{2}\,\lessgtr\,q^{W}\) then \( q^{*}_{A}= {\mathbb {E}}[q(p^{*},\theta )]\,\lessgtr\,q^{W} \) and \( q^{*}_{G} \lessgtr q^{W}\).

-

\(q^{*}_{G} -q^{*}_{A}=\frac{c (m (-\delta n+n-1)+\delta n) ({\bar{q}} (b+c)-2 a)}{(b n+c (3 n-2)) (m (b+c)+2 c \delta (m-1))} = q^{*}_{G}-{\mathbb {E}}[q(p^{*},\theta )]\).

The first component of Proposition 4 shows that the policy levels chosen by the politician—when there exists a rent-seeking influence—are distinct from the conventional Weitzman (1974) result. Indeed, it is clear that if there exists a difference between \(q^W\) and \(\frac{{\bar{q}}}{2}\) then the politician will choose a policy level that will not maximize expected social welfare. If \(\frac{{\bar{q}}}{2} > q^W\), Proposition 4 shows that the expected policy level chosen by the politician is, in fact, more stringent than that proposed under Weitzman (1974). This is a direct result of the influence of rent seeking, which pulls the stringency level above that of the benchmark model. From Subsection 5.2, where the politician focuses only on maximizing the rent, it was observed that for a sufficiently large \({\bar{q}}\) the policy level is more stringent. The same occurs here: for cases where the initial level of emissions is relatively large (i.e., large \({\bar{q}}\)), a politician will choose a relatively more stringent policy compared to one that only maximizes expected social welfare. For cases where \(\frac{{\bar{q}}}{2}\,<\,q^W\), the rent-seeking components have a lower level of stringency and the politician’s choice of policy level is reduced.

The second component of Proposition 4 compares the relative policy level for the three alternative instruments. Note that there exists a difference between revenue- and non-revenue-raising instruments. Crucially there are two influences on this outcome: (i) the difference between \(q^W\) and \(\frac{{\bar{q}}}{2}\), and (ii) \(\delta\,\lessgtr\,\frac{m}{(m-1)}\frac{(n-1)}{n}\), the relationship between the revenue transfer efficiency and the size of rent-seeking groups within the economy. Suppose \(\frac{{\bar{q}}}{2} > q^W\). If \(\delta <(>)\,\frac{m}{(m-1)}\frac{(n-1)}{n}\) then it is clear that free permit allocation generates a more (less) stringent target than auctioned permits and taxes. For the case \(\frac{{\bar{q}}}{2}\,<\,q^W\), the results are reversed.

We now consider the expected differences in the politician’s payoff under alternative regulatory instruments. Substituting (35), (37) and (38) into (13), (14), and (15), respectively, yields:

Proposition 5

If the politician has an equal weight between social welfare and the gains associated with rent-seeking efforts then:

where

Proposition 5 combines the key components from Proposition 2 and 3. Note that \(\frac{(c-b)}{6c^{2}}\sigma ^{2}\) reflects the relative difference in expected social welfare and \(\Lambda \) represents a rent-seeking effect. It is clear to see that if \(c>b\) and \(\Lambda >0\) then the politician’s preferred regulatory instrument is a tax. Similarly, if \(c<b\) and \(\Lambda <0\) then freely allocated permits would be the most preferred regulatory instrument. We now take a closer look at these relative pairwise comparisons.

The term \(\Delta _{TA}\), which compares taxes and auctions, is only influenced by differences in the relative expected social welfare, similar to Weitzman (1974). The term \(\Delta _{TG}\) is composed of two effects: the difference in relative expected social welfare and the influence from rent seeking, \(\Lambda \). Both effects can either be complementary or result in opposing effects. To see this, observe that the term \(\Lambda \) has ambiguous sign but is monotonically increasing in \(\delta \). Rearranging \(\Lambda \) shows all terms are positive except the ambiguous term \(\left( m(1+n(\delta -1))-n\delta \right) \).Footnote 22 Using this we can then find a similar result to that of Corollary 1, where if the politician now has an equal weight between social welfare and the gains from rent-seeking efforts, then

Thus when there exists sufficiently large rent transfer inefficiencies, there will be a rent-seeking effect such that \(\Lambda <0\) that results in a negative impact on \(\Delta _{TG}\).

Finally, \(\Delta _{AG}\) is solely influenced by the rent-seeking environment \(\Lambda \). In other words, the sign of \(\Delta _{AG}\) is completely independent of uncertainty: although uncertainty continues to play a role in differences between price regulation and quantity regulation, it is no longer important when we compare two alternative quantity mechanisms. As can be seen from (43), whether auctions are preferred over free allocation, \(\Delta _{AG}\), depends crucially on \(\delta \): the degree of transfer efficiency with the economy. The politician’s choice between quantity mechanisms depends on which one generates the largest rent: auctions if \(\delta \) is sufficiently large, or grandfathered permits if \(\delta \) is sufficiently small. This may provide an additional theoretical explanation as to why we observe mainly non-revenue-raising quantity regulation, especially at the implementation stage of regulation. Once the politician is modeled realistically—in that there is a private payoff from rent seeking and sufficiently large transfer inefficiencies exist—then it is clear that a preference may be directed towards freely allocated permits.

6 Concluding remarks

This article has investigated price regulation versus quantity regulation when environmental regulation gives rise to contestable rents. A two-stage process is described whereby, in the first stage, a politician selects a policy level for either a price or quantity, as in Weitzman (1974). In the second stage, players invest in rent-capturing activities in order to obtain the rents. The objective has been to provide a tractable positive analysis of how and why a politician selects environmental regulatory instruments under political influence and to compare this with the traditional (normative) approach.

A key distinction between the different types of regulation is the way in which rents diffuse within the economy. First, non-revenue-raising quantity mechanisms—such as freely allocated permits—give rise to rents that are usually only contested by the regulated entities. In contrast, rents deriving from revenue-raising mechanisms (both price and quantity regulation) are usually collected by the government and rent seeking can occur from the whole economy. Second, for instruments that give rise to revenues there may exist transfer inefficiencies, such as bureaucratic friction or a priori earmarking, where the size of rents are reduced. Additionally, the revenue may, through an investment process, result in rents that generate value over-and-above the initial revenue raised.

I have provided pairwise comparisons between price regulation and quantity regulation. This has been achieved under a number of institutional environments that reflect realistic bureaucratic scenarios. For example, one such scenario occurs where the politician’s preferences equally weigh social welfare and the gains from rent extraction. Alternatively, and more realistically, other cases exist where the politician maximizes rent-creation and extracting activities and entirely neglects social welfare. It has been observed—independently of the institutional environment analyzed—that a distinction exists between price regulation, revenue-raising quantity regulation, and non-revenue-raising quantity regulation. I have shown that a politician’s preference for a specific environmental policy instrument will vary depending on (i) the efficiency of rent transfer, (ii) the size of rent-seeking groups within the economy, and (iii) the relative slopes of the marginal cost and benefit functions.

In general, we would expect efficiency losses to occur from transferring rents, which diminishes the size of the potential rent and the associated rent seeking. The size of rent-seeking groups within the economy may also be pivotal. As can be seen from the analysis, the population of rent seekers may influence both the equilibrium level of policy as well as the politician’s preference ranking. Importantly, it is the relative difference in the number of rent seekers between the industry and the wider economy that plays a role within many of the institutional environments that are analyzed here. The analysis also shows that the relative slopes of the marginal cost and benefit curves continue to play an important role as long as the politician has a preference for social welfare; otherwise, the traditional analysis on price regulation versus quantity regulation breaks down and the politician’s preference depends solely on the efficiency of rent transfer and size of rent-seeking groups.

Notes

For similar arguments see, for example, Stavins (1998), Cramton and Kerr (2002), and Hepburn et al. (2006). Another argument extends this perspective by suggesting that the only politically feasible instrument is a non-revenue-raising quantity mechanism—such as freely allocated permits—as this reduces the financial burden on regulated entities (e.g., Goulder and Parry 2008).

Indeed a common argument for the non-revenue-raising instruments being so frequently used is that it is the ‘path of least resistance’ as the regulated entities try to persuade the regulator to avoid raising revenue (Buchanan and Tullock 1975). In the framework of Buchanan and Tullock (1975) firms prefer direct control over taxes because this provides a form of monopoly rent whereas society prefers the tax due to the revenue-raising capabilities. It is argued, then, that direct control occurs as the firms are more organized in lobbying the government than society.

Finkelshtain and Kislev (1997) use the model of Grossman and Helpman (1994) to compare tax and quota regimes. They find that the relative difference between taxes and quotas depends on the elasticity of the demand, supply of the product, and the number of politically organized firms. Their approach, however, is not concerned with uncertainty of control costs nor the revenue-raising capabilities of regulatory regimes, which is central to the argument about regulatory instrument choice presented in this article. See also Miyamoto (2014). Lake and Linask (2015) analyze tariffs versus quotas within a Grossman and Helpman (1994) framework but they abstract from differences in the size of rent-seeking groups as well as the level of efficiency loss from rent transfer: the key elements of this article.

Very few articles focus on the revenue generation component within this setting (Schöb 1996; Quirion 2004). Quirion (2004) shows that analyzing price regulation versus quantity regulation in a world of distortonary taxation strengthens the comparative advantage of revenue-raising instruments and then argues that there is no rationale for implementing non-revenue raising instruments. In contrast, however, the analysis presented here provides a positive analysis of the regulatory process, where it is shown that it is entirely possible for a regulator to prefer non-revenue-raising instruments: the key determinants are the efficiency of rent transfer and the population of rent seekers.

Players can be interpreted as individuals or special-interest groups.

This benefit can also be experienced over the population \(\Psi \) without any difference in results.

This assumption is easily relaxed: if uncertainty is realized after players invest in capturing the rents, players will rent seek over the expected rents rather than the realized value.

Under the interpretation of earmarked revenues, it is possible that the process of earmarking incurs additional rent seeking. This is compatible with the analysis presented here because the important link is the interaction between players and the politician. In such a case, the politician’s rent being diminished due to earmarking can be interpreted as additional regulatory or legislative checks and balances. It is unlikely that a politician has full control over the entire revenue raised, thus, in such a case, we would expect \(\delta <1\).

For a full report on how auction revenue is used as an investment, see https://www.rggi.org/docs/ProceedsReport/RGGI_Proceeds_Report_2014.pdf.

Throughout this article players non-cooperatively invest in rent-capturing activities. The framework can easily be extended to include groups. Either one can interpret each player as a specific lobbying group or one can enhance the model by allowing for an additional stage where inter-group rent seeking occurs followed by intra-group rent seeking or sharing of the rent (see, for example, MacKenzie and Ohndorf 2012).

It is, of course, feasible that non-regulated entities rent seek for quantities, e.g., environmental groups, but this appears not to be the case. To include such aspects in the analysis, one simply needs to incorporate a further subgroup of the entire population \(\Psi \) into the game.

Throughout this analysis administration costs are assumed to be comparable for all mechanisms. Inclusion of these costs does not alter the results of this article. Note that when \(\delta\,<\,1\) under price and revenue-raising quantity regulation, this reflects inherent bureaucratic inefficiencies over and above any administration costs. Another possible interpretation is that \((1-\delta )\) of the rent is earmarked for use and thus non-contestable. Thus \(\delta\,<\,1\) of the rent is contestable.

The cost and benefits detailed here are associated only with abatement activity and all other costs are directed to the net rent-seeking function. The objective function can also be rewritten to balance social welfare (inclusive of rent-seeking costs) and the advantages to the politician of rent-seeking efforts. Under price regulation, for example, the objective function can be rewritten as \(\max _{p}{\mathbb {E}}\left[ \mu \left( B(q(p,\theta ))- C(q(p,\theta ),\theta ) -K^{*}_{T}(p,\theta )\right) +(1-\mu )K^{*}_{T}(p,\theta )\right] \).

As already discussed, \(\delta \) can represent the revenue-recycling effect. To take into account a tax interaction effect this analysis can follow Quirion (2004) and allow a parameter to alter the slope of the marginal cost function. In the current context this would simply result in a redefinition of the cost function, without any significant difference to the results. The approach followed here is similar to the ‘weak double dividend’ (e.g., Goulder 1995; Parry 1995; Goulder et al. 1999).

If the politician receives negative payoffs from rent-seeking efforts similar (but opposite) results are found. To ensure the existence of a Nash equilibrium, the marginal benefits of pollution reduction are required to be sufficiently large.

For an analysis of corner solutions see Goodkind and Coggins (2015).

Note that relative difference is half of the Weitzman (1974) result due to \(\mu =1/2\).

As can be observed, the equilibrium policy level is independent of \(\delta \) as the politician’s objective is to maximize the gains associated with rent creation and extraction for a given \(\delta \). A variation in \(\delta \) will simply alter the level of rent seeking but not affect the optimal policy level that maximizes the gains associated with rent-seeking efforts. As we will show in the next subsection, \(\delta \) does become influential in determining the policy level when a politician aims to maximize both social welfare and the gains associated with rent creation and extraction. A choice of policy level will simultaneously alter rent-seeking efforts and social welfare: \(\delta \) has a scaling effect on the relative impact of rent-seeking effort and, therefore, the politician’s choice of policy level is now dependent on \(\delta \).

In particular, \(\Lambda \) can be arranged so that:

$$\begin{aligned} \Lambda =\frac{c\left( m(1+n(\delta -1))-n\delta \right) \left( 2amn({\bar{q}}(b+c)-a)+{\bar{q}}^{2}c\left( m(n-1)(b+c)+(m-1)(bn+(3n-2)c)\delta \right) \right) }{6mn(bn+(3n-2)c)\left( m(b+c)+2(m-1)c\delta \right) }. \end{aligned}$$.

References

Adar, Z., & Griffin, J. M. (1976). Uncertainty and the choice of pollution control instruments. Journal of Environmental Economics and Management, 3(3), 178–188.

Aidt, T. S. (1998). Political internalization of economic externalities and environmental policy. Journal of Public Economics, 1, 1–16.

Aidt, T. S. (2010). Green taxes: Refunding rules and lobbying. Journal of Environmental Economics and Management, 1, 31–43.

Aidt, T. S., & Dutta, J. (2004). Transitional politics: Emerging incentive-based instruments in environmental regulation. Journal of Environmental Economics and Management, 47(3), 458–479.

Appelbaum, E., & Katz, E. (1987). Seeking rents by setting rents: The political economy of rent seeking. The Economic Journal, 97(387), 685–699.

Buchanan, J. M., & Tullock, G. (1975). Polluters’ profits and political response: Direct controls versus taxes. The American Economic Review, 65(1), 139–147.

Cassing, J. H., & Hillman, A. (2016). The political choice between tariffs and quotas. European Journal of Political Economy (forthcoming).

Cassing, J. H., & Hillman, A. L. (1985). Political influence motives and the choice between tariffs and quotas. Journal of International Economics, 19(3–4), 279–290.

Cramton, P., & Kerr, S. (2002). Tradeable carbon permit auctions: How and why to auction not grandfather. Energy Policy, 30(4), 333–345.

D’Amato, A., & Dijkstra, B. R. (2015). Technology choice and environmental regulation under asymmetric information. Resource and Energy Economics, 41, 224–247.

Dijkstra, B. R. (1998). A two-stage rent-seeking contest for instrument choice and revenue division, applied to environmental policy. European Journal of Political Economy, 14(2), 281–301.

Dijkstra, B. R. (2007). An investment contest to influence environmental policy. Resource and Energy Economics, 29(4), 300–324.

Ellerman, A . D., Joskow, P . L., Schmalensee, R., Montero, J.-P., & Bailey, E . M. (2000). Markets for clean air: The US acid rain program. New York: Cambridge University Press.

Fell, H., MacKenzie, I. A., & Pizer, W. A. (2012). Prices versus quantities versus bankable quantities. Resource and Energy Economics, 34(4), 607–623.

Finkelshtain, I., & Kislev, Y. (1997). Prices versus quantities: The political perspective. Journal of Political Economy, 105(1), 83–100.

Fishelson, G. (1976). Emission control policies under uncertainty. Journal of Environmental Economics and Management, 3(3), 189–197.

Fredriksson, P. G. (1997). The political economy of pollution taxes in a small open economy. Journal of Environmental Economics and Management, 33(1), 44–58.

Gersbach, H., & Requate, T. (2004). Emission taxes and optimal refunding schemes. Journal of Public Economics, 88, 713–725.

Goodkind, A. L., & Coggins, J. S. (2015). The weitzman price corner. Journal of Environmental Economics and Management, 73, 1–12.

Goulder, L. H. (1995). Effects of carbon taxes in an economy with prior tax distortions: An intertemporal general equilibrium analysis. Journal of Environmental Economics and Management, 29(3), 271–297.

Goulder, L. H., & Parry, I. W. H. (2008). Instrument choice in environmental policy. Review of Environmental Economics and Policy, 2(2), 152–174.

Goulder, L. H., Parry, I., Williams lii, R. C. W., & Burtraw, D. (1999). The cost-effectiveness of alternative instruments for environmental protection in a second-best setting. Journal of Public Economics, 72(3), 329–360.

Gradstein, M., & Konrad, K. A. (1999). Orchestrating rent seeking contests. The Economic Journal, 109(458), 536–545.

Grossman, G. M., & Helpman, E. (1994). Protection for sale. The American Economic Review, 84(4), 833–850.

Grossman, G. M., & Helpman, E. (2002). Special interest politics. Cambridge MA: The MIT Press.

Hanley, N., & MacKenzie, I. A. (2010). The effects of rent seeking over tradable pollution permits. The B.E. Journal of Economic Analysis & Policy, 10(1), 56.

Hepburn, C., Grubb, M., Neuhoff, K., Matthes, F., & Tse, M. (2006). Auctioning of eu ets phase ii allowances: How and why? Climate Policy, 6(1), 137–160.

Hillman, A. L. (1982). Declining industries and political-support protectionist motives. The American Economic Review, 72(5), 1180–1187.

Hillman, A. L., & Riley, J. G. (1989). Politically contestable rents and transfers. Economics and Politics, 1(1), 17–39.

Hillman, A. L., & Samet, D. (1987). Dissipation of contestable rents by small numbers of contenders. Public Choice, 54(1), 63–82.

Hoel, M., & Karp, L. (2001). Taxes and quotas for a stock pollutant with multiplicative uncertainty. Journal of Public Economics, 82(1), 91–114.

Hoel, M., & Karp, L. (2002). Taxes versus quotas for a stock pollutant. Resource and Energy Economics, 24(4), 367–384.

Krysiak, F. C. (2008). Prices vs. quantities: The effects on technology choice. Journal of Public Economics, 92, 1275–1287.

Lai, Y.-B. (2007). The optimal distribution of pollution rights in the presence of political distortions. Environmental and Resource Economics, 36(3), 367–388.

Lake, J., & Linask, M. K. (2015). Costly distribution and the non-equivalence of tariffs and quotas. Public Choice, 165(3), 211–238.

Long, N. V. (2013). The theory of contests: A unified model and review of the literature. European Journal of Political Economy, 32, 161–181.

MacKenzie, I. A., & Ohndorf, M. (2012). Cap-and-trade, taxes, and distributional conflict. Journal of Environmental Economics and Management, 63(1), 51–65.

Malueg, D. A., & Yates, A. J. (2006). Citizen participation in pollution permit markets. Journal of Environmental Economics and Management, 51(2), 205–217.

Miyamoto, T. (2014). Taxes versus quotas in lobbying by a polluting industry with private information on abatement costs. Resource and Energy Economics, 38, 141–167.

Montero, J.-P. (2002). Prices versus quantities with incomplete enforcement. Journal of Public Economics, 85(3), 435–454.

Newell, R. G., & Pizer, W. A. (2003). Regulating stock externalities under uncertainty. Journal of Environmental Economics and Management., 45(2 Supplement), 416–432.

Nordhaus, W. D. (2007). To tax or not to tax: Alternative approaches to slowing global warming. Review of Environmental Economics and Policy, 1(1), 26–44.

Oates, W. E., & Portney, P. R. (2003). The political economy of environmental policy. In K.-G. Mäler & J. Vincent (Eds.), Handbook of environmental economics (Vol. 1, pp. 325–354). Amsterdam: Elsevier.

Parry, I. W. (1995). Pollution taxes and revenue recycling. Journal of Environmental Economics and Management, 29(3), S64–S77.

Peltzman, S. (1976). Toward a more general theory of regulation. The Journal of Law and Economics., 19(2), 211–240. doi:10.1086/466865.

Pizer, W. A. (2002). Combining price and quantity controls to mitigate global climate change. Journal of Public Economics, 85(3), 409–434.

Quirion, P. (2004). Prices versus quantities in a second-best setting. Environmental and Resource Economics, 29(3), 337–360.

Roberts, M. J., & Spence, M. (1976). Effluent charges and licenses under uncertainty. Journal of Public Economics, 5, 193–208.

Rohling, M., & Ohndorf, M. (2012). Prices vs. quantities with fiscal cushioning. Resource and Energy Economics, 34(2), 169–187.

Schöb, R. (1996). Choosing the right instrument. Environmental and Resource Economics, 8(4), 399–416.

Stavins, R. N. (1996). Correlated uncertainty and policy instrument choice. Journal of Environmental Economics and Management, 30(2), 218–232.

Stavins, R. N. (1998). What can we learn from the grand policy experiment? Lessons from so2 allowance trading. The Journal of Economic Perspectives, 12(3), 69–88.

Storrøsten, H. B. (2014). Prices versus quantities: Technology choice, uncertainty and welfare. Environmental and Resource Economics, 59(2), 275–293.

Tullock, G. (1980). Efficient rent seeking. In J. M. Buchanan, R. D. Tollison, & G. Tullock (Eds.), Toward a theory of the rent-seeking society. College Station: Texas A&M University Press.

Weitzman, M . L. (1974). Prices vs. quantities. The Review of Economic Studies, 41(4), 477–491.

Williams III, R. (2002). Prices vs. quantities vs. tradable quantities, Working Paper 9283, National Bureau of Economic Research.

Wirl, F. (2012). Global warming: Prices versus quantities from a strategic point of view. Journal of Environmental Economics and Management, 64(2), 217–229.

Zapfel, P. (2007). A brief but lively chapter in EU climate policy: The commission’s perspective. In A . D. Ellerman, B . K. Buchner, & C. Carraro (Eds.), Allocation in the European emissions trading scheme: Rights, rent and fairness (pp. 13–38). Cambridge: Cambridge University Press. Chapter 2.

Acknowledgements

The author is grateful to an anonymous reviewer and the Editor for helpful comments and suggestions that improved this article. We would also like to thank Lana Friesen, Arye Hillman, Randall Walsh, as well as seminar participants at the Australasian Public Choice Conference (2015) and the University of Tasmania. All errors and shortcomings are my own.

Author information

Authors and Affiliations

Corresponding author

Appendix: a generalized model

Appendix: a generalized model

Let \(\mu \in [0,1/2]\). Substituting \(\mu \) into (13), (14), and (15) yields the following policy targets:

Using these policy targets and providing pairwise comparisons between regulatory instruments yields the following comparisons:

where \(\Gamma =\frac{(a \mu m+c \delta {\bar{q}}(1-2\mu )(m-1))^2}{2 m ( \mu mb+c (2 \delta (1-2\mu )(m-1)+\mu m))}+\frac{(a \mu n+c {\bar{q}} (1-2\mu )(n-1))^2}{2 n (c (2(1-2 \mu ) +(3 \mu -2) n)- \mu nb)}\). This shows that the differences between quantity mechanisms continues to depend on the number of rent seekers and the level of efficiency transfer loss.

Rights and permissions

About this article

Cite this article

MacKenzie, I.A. Rent creation and rent seeking in environmental policy. Public Choice 171, 145–166 (2017). https://doi.org/10.1007/s11127-017-0401-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11127-017-0401-8