Abstract

The paper asks whether members of central bank decision-making committees should communicate with the public in a collegial manner, by conveying the consensus or majority view of the committee, or in an individualistic way, by providing the diversity of views among the committee members. It finds that more active as well as more consistent communication by committee members improves the predictability of monetary policy decisions significantly. This effect is sizeable as communication dispersion across committee members accounts on average for one third to one half of the market’s prediction errors of FOMC policy decisions. Moreover, more active and more consistent communication are found to also reduce the degree of uncertainty about the future path of interest rates. These findings suggest that a collegial communication which stresses the consensus view on policy inclinations can enhance the effectiveness of central bank communication.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Communication plays a central role in monetary policy making. Central banks have direct control only over a single interest rate, usually the overnight rate, while their success in achieving their mandate—whether the focus is on price stability or on economic activity—requires that they are able to influence asset prices and interest rates at all maturities. Effective communication as much as credible policy actions are thus of fundamental importance for achieving these objectives.

But how should central banks communicate? The aim of this paper is to shed light on the proper design of a central bank communication strategy primarily in one dimension: monetary policy decisions are typically taken by committees rather than by individuals, and while a number of announcements are issued by the committee as such, there are several others (such as speeches, interviews, or in some countries also testimony before parliamentary bodies) through which the individual committee members communicate with the public. A major question therefore is the extent to which such communications should reflect the consensus view of the committee, or whether there is value in providing the public with information about the dispersion of opinions on the committee. The paper starts from the conjecture that central bank communication intends to enable the public better to understand the goals and strategies of the central bank as well as its assessment of the current economic situation and its policy stance. In turn, this should allow financial markets to anticipate better the policy decisions as well as the future path of monetary policy. Accordingly, the paper tests whether the degree of dispersion in communications by committee members affects the predictability of upcoming monetary policy decisions and the future path of interest rates more generally.

These tests relate to two strands of the literature. One deals with the limits to transparency, where a number of theoretical contributions have shown that more communication need not always be beneficial, in particular if more communication endangers clarity. One argument in this direction is provided by Morris and Shin (2002). In their model, agents use public information as a co-ordination device, and therefore possibly put too much weight on signals provided by the central bank than would be justified by their precision. Geraats (2007) finds that it is optimal for a central bank to provide clarity about the inflation target, whereas it should communicate information about the output target and supply shocks with perceived ambiguity. In a similar vein, Dale et al. (2011) show that the central bank should disclose pieces of information about which it is certain (like its inflation target), whereas the communication of uncertain information might trigger a deterioration of private sector expectations. In the spirit of these models, van der Cruijsen et al. (2010) stress that there might be an optimal level of transparency, beyond which the accuracy of private sector expectations starts to worsen. The results of these models have not been uncontroversial. Svensson (2006), for instance, has argued that the result of Morris and Shin (2002) is valid theoretically, whereas for empirically plausible parameter values, more public information is always desirable. Accordingly, there is a need to shed empirical light on this theoretical debate, which is the aim of the current paper.

A second strand of the literature studies the nature of monetary policy decision making in the Federal Reserve and other central banks, distinguishing the decision-making process in committees on the one hand, and modeling the special role of central banks as bureaucratic institutions on the other hand. With regard to decision-making in committees, individual committee members might have incentives to disagree with the committee view in the public debate, either because of private objectives (Grüner 1997), or because they might want to build reputations of, for instance, being inflationary hawks (Sibert 2003). However, it is important to understand whether a central bank should encourage such behavior, or rather attempt to ensure communication along the consensus view. Such a decision should be taken against an assessment as to how different communication styles affect the conduct of monetary policy. This issue continues to be highly controversial. Some policy-makers have argued that it is important to communicate the diversity of views because it helps markets understand the risks surrounding policy decisions and anticipate monetary policy decisions (e.g., Bernanke 2004). By contrast, others have argued that such a communication strategy may not necessarily provide greater clarity and common understanding among market participants and, thus, that it may be important for central banks to communicate “with one voice” (e.g., Issing 1999, 2005). In addition, this paper closely relates to the analysis of the role of the chairman in setting monetary policy. The Federal Reserve’s Federal Open Market Committee (FOMC) has often been described as a committee where the chairman exerts a disproportionate influence on the outcome of monetary policy decisions (Chappell et al. 2004). Gerlach-Kristen (2008) has shown how this role originates from three different sources, namely the chairman’s “economic” and “moderating” abilities, and in certain institutional setups also his position per se. At the same time, Riboni and Ruge-Murcia (2010) have shown that for a large number of central banks, including the Federal Reserve, policy decisions are best modeled as the outcome of a consensus model rather than an agenda-setting or a dictator model.

With regard to decision-making of central banks as bureaucratic institutions, there is a long-standing literature that analyzes the incentives of the FOMC members in a public choice setting. Toma (1982) argues that the independence of the Federal Reserve from the parliamentary budget process generates an inflationary bias. Shughart and Tollison (1983) find a positive correlation between the monetary base and the number of Federal Reserve employees, which is taken as evidence that bureaucratic incentives play a role in the formulation of monetary policy. In a similar vein, Belongia (2007) and McGregor (2007) assess the changes in the Federal Reserve’s transparency over time in the context of a public choice framework, arguing that transparency levels are the outcome of politicians’ incentives, on the one hand, and the central bank’s bureaucratic objectives on the other.

This paper intends to contribute to these strands of the literature, not by adding to the already rather rich existing theory, but rather by providing empirical tests that can shed light on the established theories. For this purpose, we analyze the communication strategies pursued by the Federal Reserve since February 1994. We exploit a database of real-time newswire reporting that contains statements by the individual FOMC members, such as speeches and interviews in the inter-meeting period. The paper’s primary objective is to analyze the effect of communication dispersion, i.e., the degree of disagreement among committee members about the future path of monetary policy. In particular we ask whether communication dispersion affects the predictability of monetary policy decisions and the uncertainty surrounding them. At the same time, we also analyze whether the frequency of communication affects the predictability of monetary policy. Moreover, we control for the effects of several other factors, such as the degree of uncertainty created by the release of macroeconomic data and other sources of uncertainty.

The empirical results show that more dispersed communication among committee members about policy inclinations worsens the ability of financial markets to anticipate future monetary policy decisions. Importantly, the effect is economically large, as the dispersion among FOMC members’ communications accounts for about one-third to one-half of the errors that markets made in predicting FOMC monetary policy decisions since 1994. The second key result is that more active communication (controlling for its dispersion) improves markets’ anticipation of future monetary policy decisions significantly. This evidence suggests that markets may take some time to fully incorporate information and communication by central banks, such that frequent statements may enable markets to better anticipate policy decisions.

Third and finally, we find that lower dispersion and higher frequency of communication not only improve the predictability of monetary policy decisions, but also significantly reduce the uncertainty surrounding the future path of monetary policy.

These findings have a number of policy implications. First, they imply that communication plays a central role in helping markets anticipate monetary policy decisions and in lessening market uncertainty. However, it is important for central banks to provide a consistent message to markets, as the communication of dispersed points of view undermines predictability, both in the short run and in the long run.

Our analysis builds on the premise that central banks are generally credible, i.e. that financial markets consider announcements and communications by policy-makers as credible indications of future actions or of available information and beliefs. When such credibility is not present, financial markets may counteract policy announcements and thus render them ineffective, detrimental or achieving an outcome different from that intended by policy makers. However, in the case of our analysis, we investigate communications about the central bank’s standard policy tool, namely about interest rate setting. Moreover, our analysis focuses on central banks that have enjoyed a considerable degree of credibility by financial markets.

The paper is organized in the following way. Section 2 offers a brief review of the related literature on central bank communication and decision-making. Section 3 outlines the data and the methodology for the empirical analysis. Section 4 then provides the empirical analysis of the effects and effectiveness of communication, as well as several extensions and robustness tests. Section 5 offers conclusions and draws some policy implications.

2 Central bank communication and decision-making

Central bank communication typically occurs via two channels: by the policy-making committee itself, on the one hand, and by its individual members on the other hand. Committee communications often include statements about monetary policy decisions following committee meetings, but also publications in the inter-meeting period such as minutes of past meetings or inflation reports. Communication by individual committee members, in contrast, mostly takes the form of speeches, interviews and, at times, official testimony. This type of communication is usually more flexible in its timing and content than the statements of the committee itself, and may therefore provide more detailed information, in particular about the diversity of views and the discussions in the committee.

This study encompasses a strand of the literature that has analyzed the role of committees in the decision-making process. There is a broad consensus that decision-making in committees has improved the overall quality of the decisions, partly because it allows for learning and pooling of information (Blinder and Morgan 2005; Lombardelli et al. 2005) and partly because it enhances the flexibility of policy in responding to shocks of different magnitude and nature (Sibert 2003; Mihov and Sibert 2006). Blinder (2007) provides a basic framework for analyzing the compositions and functioning of different central bank committees, distinguishing between collegial and individualistic committees and central banks where decisions are taken by individuals, such as e.g., the Reserve Bank of New Zealand.

The decisions of the FOMC in particular have been scrutinized by Chappell et al. (2005). Based on individual voting records, they could for instance identify the time-varying influence of the FOMC chairman on interest rate decisions. Furthermore, it has been investigated whether policy makers might have different voting practices depending on whether they are internal members working in the central bank, or external members (e.g., Besley et al. 2008), depending on their educational and occupational backgrounds (e.g., Göhlmann and Vaubel 2007), their experience on the committee (e.g., Allen et al. 1997), or depending on their regional origins (e.g., Meade 2006). Furthermore, it has been shown that the voting record of committees, if released to the public, can provide useful information about future monetary policy decisions (Gerlach-Kristen 2004).

Given the key roles of individuals in shaping monetary policy decisions, it is important whether the individual views are provided to the public. Salient background on this question is provided by the literature on possible limits to transparency in central banking. Amato et al. (2002), based on the conceptual work in Morris and Shin (2002), suggest that central bank communication may at times lead markets away from equilibrium, though Svensson (2006) argues that the validity of this argument is based on rather strong assumptions regarding the signal-to-noise ratio of central bank communication, and Roca (2010) shows that the results might not hold under monopolistic competition and imperfect common knowledge. Others (e.g., Winkler 2002) underline that more information, in particular if it reveals diversity in committee members’ views, may be undesirable if it reduces the degree of clarity and common understanding among market participants. Moreover, there is a limit to how much information individuals can digest (e.g., Kahneman 2003). Thus, communication, and the underlying transparency of central banks, may not be an end itself, but merely a means that allows the central bank to fulfill its mandate more effectively (Mishkin 2004). In fact, Walsh (2007) provides a broad array of arguments in favor as well as against transparency of central banks in their decision-making process. Eijffinger and Geraats (2006) propose an original measure of central bank transparency by categorizing the institutional features of central banks’ disclosure practices.

On the empirical side, a number of recent studies have analyzed the effect of communication on asset prices. Kohn and Sack (2004) investigate the impacts of statements by Federal Reserve Chairman Greenspan on the volatility of various asset prices and find that they have had a sizeable effect overall. Reinhart and Sack (2006) analyze different types of communication by the FOMC and find that it is primarily the committee-wide communications that affect markets. Ehrmann and Fratzscher (2007) take a broader perspective by analyzing and comparing the effects of communication on monetary policy inclinations and the economic outlook between the Federal Reserve, the Bank of England and the European Central Bank (ECB). The paper finds that communications about the monetary policy inclinations of committee members exert substantial effects on financial markets for all three central banks, but that markets react significantly to statements about the economic outlook only by the FOMC. Moreover, the paper compares the degree of communication dispersion and relates it to the voting behavior and the predictability of decisions by the three central banks. Other papers focusing on the content and dispersion of communication include Jansen and de Haan (2006), who find that the degree of dispersion in the ECB’s communication about the outlook for monetary policy was greater in the initial period after is start in 1999 and has declined over time.

Despite these various strands of the literature on central bank communication and decision-making, to our knowledge no paper has so far attempted to provide a systematic assessment of the effectiveness of dispersed communication by committee members. In particular, understanding how communication affects the predictability of policy decisions remains highly controversial among policy-makers, but is crucial for assessing the overall effectiveness and success of central bank communication strategies. This is the objective of the remainder of the paper and its intended contribution to the literature.

3 Data and methodology

This section discusses the data definitions and sources used, separately for our measures of predictability at short and medium horizons (Sect. 3.1), for the explanatory variables (Sects. 3.2 and 3.3.), and then outlines the empirical methodology (Sect. 3.3).

3.1 Dependent variables: measuring predictability at short and medium horizons

If central bank communication succeeds in reaching the central bank’s intended goal of conveying information about its strategy, financial markets should be able to anticipate well the future path of monetary policy, and there should be little uncertainty surrounding these expectations. Of course, it may be necessary at times to surprise markets with policy decisions, but in principle a high degree of predictability and a low degree of uncertainty are important elements for the credibility and effectiveness of monetary policy.

An open question relates to the relevant horizon at which predictability is desirable. Predictability at short horizons can be relevant for financial markets, as surprising monetary policy decisions necessitate a repositioning of market positions. In contrast, this short-term predictability should be less relevant for the real economy, where, for instance, investment decisions will have to take into account the entire future path of interest rates over an investor’s planning horizon. For that reason, we will attempt to analyze predictability at both horizons.

At the short horizon, measures of predictability are easily obtained. We make use of a survey based measure, but test whether results are robust to using market-based measures. The survey we employ is conducted by Reuters a few days before each FOMC decision. A large number of market participants and Fed observers are asked about their expectations regarding the upcoming decision. Let us denote the expectation of an individual respondent i for a decision at time t as e i,t . We measure the surprise component contained in an upcoming interest rate decision as the difference between the actual decision (a t ) and the mean of the survey expectations (\(\bar{e}_{i,t}\)), and take the absolute value of this difference. This survey-based measure has been shown to be an efficient and unbiased proxy for the surprise component of monetary policy decisions (e.g., Ehrmann and Fratzscher 2005). To obtain a measure of predictability, we multiply the surprise measure by minus one so that a smaller (more negative) value implies less predictability, i.e., our measure is equal to

Obtaining measures of monetary policy predictability at longer horizons is much more difficult. Measures analogous to (1) are complicated by the fact that large forecast errors can arise either due to poor central bank communication (which is the part we would like to measure) or, alternatively, because in between the survey and the monetary policy decision, new information arrives that warrants a different monetary policy decision than anticipated initially. The longer the horizon, the more important become the second part. As we are not able to disentangle these two alternatives, we need to find an alternative measure of predictability.

We will use the heterogeneity of policy monetary policy forecasts across financial market participants as our proxy for the medium-term predictability of FOMC policy. The underlying reasoning is based on Faust and Svensson (2001), namely that if a central bank is transparent and has managed to make itself understood to market participants, this should lead to a harmonious understanding of the likely future path of monetary policy (conditional on expectations about future macroeconomic variables). Our measure is also derived from the Reuters surveys mentioned above, which also include expectations about the key interest rate set by the central bank at the end of the current year. We construct a measure of uncertainty within each survey, which is the standard deviation of the responses across individual forecasters. As before, we multiply this uncertainty measure by minus one in order to obtain a measure of predictability, i.e.,

It is important to note that the forecast horizon for this survey differs over time (at the beginning of the year, it asks for expectations in a year’s time, towards the end of the year, the forecast horizon is much shorter; on average, it amounts to two quarters). In our empirical analysis, we will therefore control for the length of the forecast horizon in each survey. Of course, it will also be important to control for the degree of macroeconomic uncertainty prevailing at the time of the survey, as greater uncertainty about the evolution of the macroeconomy in general will likely be reflected in more uncertainty about the future path of interest rates. Only once we have conditioned for this, we will be able to understand the extent to which central bank communication can affect uncertainty among financial market participants about later monetary policy decisions.

Table 1 provides summary statistics for both measures of predictability. The availability of these survey data defines our sample frequency: surveys are conducted prior to each FOMC meeting. Accordingly, we have eight observations each year, bringing us to a total of 80 observations for our sample period February 1994–May 2004 for short-term predictability. Data for medium-term predictions are available to us starting May 1999, amounting to 44 observations in total. The relatively small sample size clearly implies an important caveat that needs to be borne in mind when interpreting our results.

Another important issue to note is that both predictability measures are censored to lie at or above zero. In fact, in a number of cases policy decisions are predicted perfectly, or the survey reports no degree of uncertainty about later decisions, so that a number of observations are at the distribution’s lower limit of zero. This will have to be reflected in the econometric model, as we will discuss below.

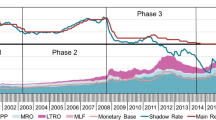

3.2 Independent variables: measuring central bank communication

What explains the predictability of monetary policy decisions, or the uncertainty around them? There are several factors that may have an influence. The main variables of interest to us here are the ones related to central bank communication. For that purpose, we employ the data developed and described in detail in Ehrmann and Fratzscher (2007). This dataset collects all communications by FOMC members in the inter-meeting periods that contain some reference to monetary policy inclinations, using the newswire service Reuters News. Each individual statement has been classified as to whether it indicates an inclination towards monetary policy tightening, towards easing, or is neutral. Table 1 provides an overview of the communication data in this database.

The key element for our analysis is the degree of dispersion in the communications by FOMC members. We employ a dispersion measure used in Jansen and de Haan (2006) and Ehrmann and Fratzscher (2007), which is defined as follows:

with N as the number of statements in the inter-meeting period t, C MP the statements on monetary policy inclinations classified as {−1,0,+1}, and a dummy D with D=0 if N is an even number and D=1 if it is odd. This normalization allows us to obtain a dispersion measure that lies strictly between zero and one, with Ω t =0 if no dispersion is present (i.e., all committee members share the same inclination about monetary policy) and Ω t =1 if there is a maximum of degree of dispersion across statements within an inter-meeting period t (for instance a case of two statements, one expressing a tightening inclination and the other an easing inclination).Footnote 1

In addition to the dispersion, we also control for the frequency of communication and the size of communication effects. The frequency is measured as the number of statements by FOMC members in a given inter-meeting period, while for the size variable we measure the reaction of three-month treasury bills on the day of each statement (controlling for the effects of macroeconomic announcements) and cumulate the absolute reactions over the inter-meeting period. The reasoning for including these variables is that it may not only be the dispersion of communication, but also the number of statements and their relevance that influence the predictability of decisions.

Finally, our last characteristic of communication in the inter-meeting period is based on the fact that the FOMC has a self-imposed blackout (or purdah) period during which committee members agree not to communicate with the public. For the FOMC, the purdah appears to be in place seven days before and three days after FOMC meetings (Federal Reserve 1995). The underlying reasoning is that statements just prior to policy-setting meetings are undesirable as they risk unsettling markets and possibly limit the options of the committee (Bank of England 2000; Federal Reserve 1995). As a matter of fact, it has been shown that communication during the purdah period creates excessive volatility in financial markets (Ehrmann and Fratzscher 2009). This suggests that statements during the purdah period might be of a special nature in affecting predictability. We use the fact that there are occasional instances of communication during the purdah period—be it intentionally to communicate important new information, by mistake, or because the media may hold back reporting on statements until the purdah period—to test whether such communication affects predictability.

3.3 Independent variables: other controls

Of course communication is only one factor determining the predictability of monetary policy decisions. Policy decisions may be hardest to predict when there is a high degree of underlying economic uncertainty. We proxy for such uncertainty in several ways. First, by measuring the heterogeneity across in forecasts for CPI inflation and for GDP growth over the coming year by market participants. The source of this data is the Blue Chip Economic Indicators data, which conducts monthly surveys of about 30 market participants. For each of these two forecasts, we use the cross-sectional standard deviation of the last survey before an FOMC meeting.Footnote 2

As a second type of proxy for the underlying uncertainty, we use the volatility of short-term (3-month) interest rates. More interest rate volatility is likely to partly reflect greater uncertainty. In order to avoid a potential endogeneity problem (whereby communication causes interest rate volatility), we measure interest rate volatility as the standard deviation of daily interest rate changes during the pre-event window, i.e., before communication takes place in each inter-meeting period.

Third, we control for the dispersion among ten of the most relevant macroeconomic news releases for to the United States in the same way as we constructed the dispersion measure for communication.Footnote 3 Moreover, again following the methodology for the constructing our communication variables, we use the cumulated impact of macroeconomic news on short-term interest rates in each inter-meeting period as another proxy for the information content inherent in macroeconomic announcements.

Finally, we also include dummy variables indicating whether the FOMC had changed interest rates or had included a statement of bias toward subsequent tightening or easing of policy in its release of monetary policy decisions at the previous FOMC meeting, as these may help markets better anticipate future decisions.

3.4 Methodology

As mentioned above, our dependent variables, the predictability of monetary policy at short and medium horizons, are censored at or above zero, and a number of observations are indeed at this lower limit of the distribution. This requires estimating a censored regression or tobit model, which is formulated as follows:

where

with y ∗ as the latent, i.e., unobservable variable, y t the observable variable measuring the surprise component of monetary policy decisions, x t the vector of independent variables, and t as the time dimension of the inter-meeting periods. The marginal effect of a change in x t with respect to the observable variable y t is

under the condition that the disturbance ε t ∼N(0,σ 2), and with β as the marginal effect of x t on the latent variable y ∗. All results shown below refer to this marginal effect of x t . The model is estimated via maximum likelihood estimation of the log-likelihood function for the censored regression at y t =0:

which is a mixture of a continuous distribution—for the linear regression of the non-limit observations, and a discrete distribution—for the limit observations at y t =0, again under the condition that ε t is normally distributed.

4 The effectiveness of communication and its dispersion

We now turn to the results of the empirical analysis. The central objective is to assess the effect of communication, and in particular its dispersion, on the predictability of the subsequent policy decision as well as about the future path of interest rates (Sect. 4.1). We subject our findings to a number of robustness tests and extensions in Sect. 4.2.

4.1 The predictability of monetary policy

How does the communication by FOMC members, and in particular its dispersion, affect the predictability of monetary policy? Table 2 shows the estimates for the short-term predictability of subsequent FOMC decisions, using three specifications starting from a simple model (1) that includes only the communication variables, and leading to a more extensive model (3) that includes all sets of variables discussed above.

The key result is that dispersed communication among FOMC members lowers the predictability of policy decisions significantly. The size of this effect is quite large. A high degree of communication dispersion in an inter-meeting period, i.e., when this dispersion variable is one as opposed to zero, raises the surprise of the FOMC decision by about five basis points.Footnote 4 Given that the average absolute surprise component contained in FOMC decisions, as calculated from our Reuters poll dataset, is around 3.4 basis points, this implies that dispersion among committee members about policy inclinations has a substantial overall effect on the predictability of monetary policy. The average degree of communication dispersion on policy inclination is 0.252, as indicated in Table 1, which suggests that communication dispersion has accounted for about one-third to one-half of the market’s prediction errors of FOMC monetary policy decisions since 1994.

Also the frequency of communication shows some systematic impact on policy predictability. The empirical finding is interesting, as it suggests that each additional statement by committee members—on average and controlling for the dispersion of the statements—improves the predictability of decisions by around one or more basis points. This stresses that information transmitted frequently to markets through central bank communication is indeed beneficial.

The other communication variables appear to be less influential. Neither the magnitude of the market response to FOMC communications nor communication during the purdah period have a robust effect on predictability. The latter seems to reduce the short-term predictability of FOMC decisions, but the effects are only weakly statistically significant.

As to macroeconomic uncertainty, more forecast heterogeneity about GDP growth appears to lower the predictability of FOMC decisions, as does the size of the effect of macroeconomic news on financial markets. This implies that when a lot of new and unexpected macroeconomic information comes to the market, it may induce market participants to become more uncertain about how the FOMC may react to it in the next meeting, thus making it more difficult for markets to anticipate decisions. Beyond this, there seems to be little role for macroeconomic news and uncertainty in influencing the predictability of FOMC decisions.

We now turn to study the predictability of FOMC decisions at a medium term. This is an interesting extension to Table 2, because communication frequently has a much longer time horizon by conveying views of policy-makers not only for the next monetary policy decision, but about the path of future monetary policy. Table 3 shows that also in the medium term, a higher frequency of statements increases, but communication dispersion lessens, predictability.

However, there are also some interesting differences between the impact of communication on the short- and the medium-term predictability of US monetary policy. Communication in the purdah period lowers predictability only at the short horizon, but has no effect on the uncertainty surrounding the medium-term policy path. This result seems intuitive and sensible given the specific characteristics of this type of communication. Finally, interest rate changes at the previous FOMC meeting appear to influence only the predictability of decisions at the subsequent meeting, but not beyond.

In summary, we find that communication exerts a statistically and economically significant effect on the predictability of US monetary policy, both at the short and the medium-term. More frequent communication appears to be beneficial in helping markets settle and better anticipate future decisions. By contrast, communication dispersion and the timing of statements close to meetings during the purdah period seem to be detrimental.

4.2 Extensions and robustness

As the next step, we conduct several sensitivity tests to check for the robustness of our results. Two key issues are the possibility of an omitted variable bias for our results and the potential endogeneity of communication dispersion. The reasoning goes as follows: the fact that we find a significant effect of communication dispersion on predictability in Tables 2 and 3 may simply reflect the possibility that communication dispersion is influenced and determined by other factors that are not included in the model. For instance, a great deal of communication dispersion may merely reflect the large degree of macroeconomic uncertainty caused by conflicting or unclear signals coming from macroeconomic or other news, which, in turn, lead to lower predictability of policy decisions (omitted variable bias). Alternatively, policy decisions may be more difficult to predict when interest rates are changed, which, in turn, may raise the degree of disagreement and thus communication dispersion in the inter-meeting period (endogeneity bias).

We deal with possibility of an omitted variable bias in two separate ways. First, we include as broad a set of control variables as possible in our model. Hence our preferred specification is the one shown in columns (3) in Table 2, as there we can control for several other factors. However, comparing the various specifications – ranging from a more minimalist specification (1) to a more extensive one in (3) – shows that the results with regard to communication are robust, both in terms of statistical and economic significance.

Second, we also tested for other definitions of the various variables. These results are reported in Table 4. First, rather than using the survey based measure of short-term predictability, we employ a market-based measure, anchored on the reaction of Fed funds futures to the monetary policy decisions in the 30 minutes following their release (taken from Gürkaynak et al. 2005). The idea here is that more dramatic market reactions reflect bigger surprise components. Accordingly, we use the absolute market reaction, and multiply this by minus one in order to get a measure of predictability. While we had used survey data for the benchmark results in order to be consistent with the predictability measure at the longer horizon, it is comforting to know also that the market-based measure delivers robust results: predictability is negatively affected by dispersed communication (see column (1) of Table 4).

In addition, we also checked the extent to which our results are driven by the fact that the sample includes some inter-meeting periods where we did not observe any communications by FOMC members. In the absence of communications, our measure for the dispersion of communication is equal to zero, just as in cases when there are multiple, but consistent communications that cancel each other out. To distinguish these cases, we have dropped all inter-meeting periods without any communications from our sample. Of course, this reduces the number of observations, to 67 in the case of short-term predictability, and to 39 for our predictability measure at the medium horizon. Importantly, however, our key result remains unaffected: more dispersion reduces predictability (see columns (2) and (6) of Table 4). Another robustness test relates to our classification of the communication variables. As described above, the benchmark models employ the categories reported in Ehrmann and Fratzscher (2007), which are based on the authors’ reading and coding of the statements. As an alternative, it is possible to code statements as relatively hawkish (dovish) if they led to an increase (decrease) in market rates on their release date. Based on this classification, we recalculated our dispersion measure, and find our key result to be robust (see columns (3) and (7) of Table 4).

Endogeneity could also be an issue. For instance, communication might intensify if the outlook for monetary policy is more uncertain—or, alternatively, FOMC members might want to communicate less if the outlook is uncertain. If anything, we are inclined to think that the former possibility is more likely, given that in uncertain times, FOMC communication is bound to be more valuable, and therefore sought after more intensively by the media. If this was the case, more communication during uncertain times would tend to bias our coefficient estimates downward, such that our results would actually be understated. Endogeneity could also arise with regard to the accuracy of private sector forecasts. For instance, in situations when future policy is difficult to predict, forecasters might be willing to gather relatively more accurate information, given that this carries larger benefits. With regard to the degree of dispersion, we believe that an endogeneity bias is even less relevant in our analysis. Most importantly, as shown in Ehrmann and Fratzscher (2007), communication dispersion across committee members is largely a variable of choice, which reflects the philosophy of central bank committees as to what information they want to provide. After all, in most cases (with a few exceptions, such as testimony) committee members can abstain from discussing monetary policy, or may choose to communicate the consensus view of the committee.

Nonetheless, we estimate an instrumental variable tobit model, instrumenting communication diversity by various factors that might affect dispersion, while not affecting the predictability of monetary policy decisions. Finding valid instruments is not an easy task in this application; we use (i) a dummy variable indicating whether the balance of views expressed by the committee is in line with the balance of views expressed by the head of the committee, (ii) a variable that captures different degrees of policy activism by summing the number of times interest rates had been changed at the last 10 meetings prior to the current meeting, and (iii) a variable capturing the dispersion of votes in the preceding meeting.

According to the Hausman specification test, communication dispersion is indeed endogenous in the model of short-term predictability (with a p-value of 0.005), whereas endogeneity is clearly rejected for the case of medium-term predictability (with a p-value of 0.49). These results are furthermore confirmed by Wald tests of exogeneity (which rejects endogeneity in the medium-term predictability model with a p-value of 0.48, and does not reject it for the short-term model with a p-value of 0.009). In line with these results, we estimate an IV model only for the subsequent monetary policy decision.

Column (4) in Table 4 shows that our previous findings are robust and confirmed by this approach using instrumented variables (of course with weaker statistical significance). More dispersion leads to less predictability; by contrast, more communication enhances the predictability of decisions.

For a final robustness test, we have estimated simple OLS models rather than the benchmark tobit models, to see whether the censoring of our dependent variables is responsible for the results. As can be seen in columns (5) and (8) of Table 4, this is not the case.

In summary, the results suggest that communication dispersion among committee members is an important determinant of the predictability of monetary policy decisions. The findings indicate that it explains on average around one-third to one-half of the unexpected component of monetary policy decisions of the FOMC since 1994. Moreover, we find that more communication, i.e., more frequent statements by committee members in the inter-meeting period, also induces a significant improvement in the predictability of decisions. These findings hold up in several robustness tests, including an instrumental-variable approach for communication dispersion and a market-based procedure to classify the content of communication.

We have also tested several extensions of the current model. We began by isolating the effect of the FOMC chairman’s communication from those of the other members in three different ways. First, by entering a dummy variable that measures whether or not the FOMC chairman has made a communication in the inter-meeting period; second, by means of a variable that counts the number of inter-meeting communications by the chairman, and third by entering a dispersion measure for the communication by the FOMC chairman (where it has to be noted that this dispersion is generally very low). None of these measures turns out to be important (results are not reported for brevity), which constitutes an interesting difference when compared with the literature on communication effects on market interest rate expectations, where the chairman is typically found to receive heavier weight than the other FOMC members (e.g., Ehrmann and Fratzscher 2007). At the same time, this might not be very surprising, given that much of the dispersion does not arise from the chairman, but rather from the other committee members. A fruitful extension of the current paper could be a comparison of the chairman’s influence during the tenure of Alan Greenspan with the tenure of Ben Bernanke, given their different leadership styles. This is beyond the scope of the current paper, and unfortunately not possible with the existing dataset.

A logical next step is to investigate whether there is a distinction between the Governors of the Federal Reserve Board and the presidents of the regional Federal Reserve Banks. Table 5 reports the corresponding results, and shows that it is primarily dispersed communication by the regional Fed presidents that determines the predictability of monetary policy, whereas dispersion among the Federal Reserve Board’s governors does not enter in a statistically significant fashion. It has to be noted, however, that the dispersion among the regional Fed presidents is substantially larger than the dispersion among the Board Governors.

Another extension relates to whether market participants give more weight to messages about the price stability part of the Fed’s mandate than to the full employment part. Our dataset does distinguish between communications that contain the keyword “inflation” and others with the keywords “economy” or “economic outlook”. Accordingly, we have calculated separate dispersion measures, and find that the dispersion about the economic outlook is not statistically significant, whereas the one about inflation is (results not reported for brevity).

As a final step in the empirical analysis, we are interested to learn whether there is some state dependence in the effects of dispersed communication on predictability. Dispersion might be particularly disturbing if economic agents have a rather clear signal of the economy, i.e., when uncertainty is low. In this case, we would expect that dispersion lessens predictability in situations of low macroeconomic uncertainty. Alternatively, economic agents might be particularly interested in clear guidance from the central bank in times when their own uncertainty is great, such that the opposite hypothesis should result. Which effect dominates is therefore an empirical question. To test this, we define times of high and low uncertainty in three different ways. Using the forecast heterogeneity about CPI inflation and GDP growth as well as the pre-event interest rate volatility in each inter-meeting period, we define uncertainty as large for the upper half of the distribution, and as low for the lower half of the distribution. Subsequently, we interact the communication dispersion variable with the two regime dummies. In addition, all other variables of the benchmark model are included in the regression.Footnote 5

Table 6 shows the results for the effect of communication on the short-term predictability of FOMC decisions in the upper panel, and for the longer horizon in the lower panel. For brevity, all other estimated coefficients are not included in the table. The columns labeled “sig.” provide p-values for a t-test of the hypothesis that the effects of communication dispersion differ across the uncertainty regimes.

There is clear evidence that the effect of communication dispersion on policy predictability indeed depends on the prevailing uncertainty. In particular, communication dispersion is more detrimental when uncertainty is relatively low. This difference is statistically significant in four out of the six cases we study. This suggests that the effectiveness of communication is dependent on the market environment in which it takes place, and that dispersed communication in an environment with relatively low uncertainty disturbs the predictability of monetary policy.

5 Conclusions

How central banks should communicate remains controversial and intensely debated both in the academic literature as well as among policy-makers. While an increase in transparency over the past decade has helped improve the effectiveness of monetary policy, it is unclear what precisely constitutes an optimal communication strategy. In particular, providing the public and market participants with clarity about the future path of monetary policy is an important public good mandated to central banks. There is an ongoing debate on the limits to central bank transparency, and on whether central banks should communicate in a collegial manner, by conveying the consensus or majority view of the committee, or in an individualistic way, by stressing and providing the diversity of views among the committee members.

The objective of this paper has been to test these issues empirically for the Federal Reserve since 1994. The paper has employed two benchmarks for this purpose: the effect of communication on the short-term predictability of subsequent FOMC decisions and on the extent of uncertainty about the medium-term path of monetary policy. With these, we capture several, but not all goals of central bank communication, as also the improvement of the market’s understanding of the policy strategy and the reaction of a central bank to shocks are important communication objectives (Woodford 2005). However, evaluating communication strategies with regard to the latter objectives is beyond the scope of this paper.

A first key result of the paper is that communication that is dispersed and conveys not a single committee view but a variety of views on monetary policy inclinations lessens the predictability of decisions, and worsens the ability of market participants to understand the future path of monetary policy. This finding explains a substantial part of the magnitude of prediction errors of monetary policy decisions: A high degree of communication dispersion lessens the predictability of an FOMC decision by as much as four to five basis points. This implies that dispersed communication among FOMC members has accounted for about one-third to one-half of the market’s prediction errors of FOMC monetary policy decisions since 1994.

A second key result is that more communication (always controlling for the amount of dispersion involved) tends to improve the market’s understanding of monetary policy along both dimensions we have analyzed. A potential caveat is that omitted variables might induce a high degree of dispersion and also make it harder to predict monetary policy decisions. We have included various sets of controls—in particular capturing other sources of economic and market uncertainty—and used instrumental-variable approaches to avoid such a bias. These tests show that our results are robust to a broad set of alternative specifications.

The findings of the paper provide a clear policy message. Overall, it is the collegiality of views on policy inclinations that appear to enhance the effectiveness of central bank communication. Communicating the diversity of views lowers the market’s ability to predict the subsequent policy decision as well as its ability to anticipate the path of future interest rates. Moreover, it appears beneficial to communicate with the markets in the preparation of a decision, as a more communication seems to lower the degree of market uncertainty and improves the predictability of policy decisions.

Notes

As the inter-meeting period spans around six to seven weeks, it could be that dispersion in communications stems not from different views across FOMC members, but rather from an evolution of views over time. However, it seems that indeed most of the dispersion reflects differences in opinion: First, dispersion measures for individual FOMC members are close to zero; second, dispersion measures for shorter time spans, such as for the two weeks prior to an FOMC meeting, lead to basically unchanged results.

Cukierman and Wachtel (1979, 1982) show that the cross-sectional variance of survey expectations data provides a proxy for macroeconomic uncertainty. We are grateful to Tao Zha for kindly sharing these data series with us. Note that the survey asks its participants to provide expectations through the end of the subsequent year. We use standard deviation measures of expectations that are seasonally adjusted, using a regression of the series on monthly dummies, in order to control for different time lengths of forecast horizons.

The set of macro news comprises advance GDP, consumer confidence, the CPI, industrial production, the Institute for Supply Management survey, nonfarm payrolls, producer prices, retail sales, the trade balance and unemployment. We use the surprise component within each macroeconomic announcement, by subtracting a survey-based expectation measure (obtained from MMS International) from the actually released figure. The macro dispersion measure follows that for communication, using the direction of the surprise of macro announcements to classify them as containing positive or negative news about the economy. Higher than expected inflation releases are counted as “positive” surprises, as they would point towards higher interest rates in the same fashion as “positive” real developments.

Note that the point estimates shown in the tables are marginal effects evaluated at the respective means of the independent variables, and thus one cannot easily evaluate the effect of any change on the dependent variable. However, evaluating the model at a dispersion measure of zero and then comparing it to the predicted value with the dispersion measure at one shows that the overall effect of such a change is very similar, in most cases only slightly larger than the marginal effects shown in the tables. For instance, for column (3) in Table 2, a change of dispersion from zero to one raises the prediction error by 5.4 basis points as compared to a marginal effect of 5.3 basis points in the table.

We use these discrete versions of high and low uncertainty regimes rather than directly interacting the uncertainty measures with communication dispersion, for two reasons. First, they sharpen the empirical analysis (results show more statistical significance), and second, the coefficients are much easier to interpret.

References

Allen, S. D., Bray, J., & Seaks, T. G. (1997). A multinominal logit analysis of the influence of policy variables and board experience on FOMC voting behavior. Public Choice, 92, 27–39.

Amato, J. D., Morris, S., & Shin, H. S. (2002). Communication and monetary policy. Oxford Review of Economic Policy, 18, 495–503.

Bank of England (2000). Monetary policy framework speaking restrictions. Available at http://www.bankofengland.co.uk/monetarypolicy/restrictions.htm.

Belongia, M. T. (2007). Opaque rather than transparent: why the public cannot monitor monetary policy. Public Choice, 133, 259–267.

Bernanke, B. (2004). Fedspeak. Remarks at the meetings of the American Economic Association, San Diego, California, January 3, 2004. Available at http://www.federalreserve.govboarddocs/speeches/2004/200401032/default.htm.

Besley, T., Meads, N., & Surico, P. (2008). Insiders versus outsiders in monetary policymaking. American Economic Review, 98, 218–223.

Blinder, A. (2007). Monetary policy by committee: why and how? European Journal of Political Economy, 23, 106–123.

Blinder, A., & Morgan, J. (2005). Are two heads better than one? Monetary policy by committee. Journal of Money, Credit and Banking, 37, 798–811.

Chappell, H. W., McGregor, R. R., & Vermilyea, T. A. (2004). Majority rule, consensus building, and the power of the chairman: Arthur Burns and the FOMC. Journal of Money, Credit and Banking, 36, 407–422.

Chappell, H. W., McGregor, R. R., & Vermilyea, T. A. (2005). Committee decisions on monetary policy: evidence from historical records of the Federal Open Market Committee. Cambridge: MIT Press.

van der Cruijsen, C., Eijffinger, S., & Hoogduin, L. (2010). Optimal central bank transparency. Journal of International Money and Finance, 29, 1482–1507.

Cukierman, A., & Wachtel, P. (1979). Differential inflationary expectations and the variability of the rate of inflation: theory and evidence. American Economic Review, 69, 595–609.

Cukierman, A., & Wachtel, P. (1982). Inflationary expectations: reply and further thoughts on inflation uncertainty. American Economic Review, 72, 508–512.

Dale, S., Orphanides, A., & Österholm, P. (2011). Imperfect central bank communication: information versus distraction. International Journal of Central Banking, 7, 3–40.

Ehrmann, M., & Fratzscher, M. (2005). Equal size, equal role? Interest rate interdependence between the euro area and the United States. Economic Journal, 115, 930–950.

Ehrmann, M., & Fratzscher, M. (2007). Communication and decision-making by central bank committees: different strategies, same effectiveness? Journal of Money, Credit and Banking, 39, 509–541.

Ehrmann, M., & Fratzscher, M. (2009). Purdah—on the rationale for central bank silence around policy meetings. Journal of Money, Credit and Banking, 41, 517–528.

Eijffinger, S., & Geraats, P. (2006). How transparent are central banks? European Journal of Political Economy, 22, 1–21.

Faust, J., & Svensson, J. (2001). Transparency and credibility: monetary policy with unobservable goals. International Economic Review, 42, 369–397.

Federal Reserve (1995). Transcript of the meeting of the Federal Open Market Committee, January 31–February 1, 1995. Available at http://www.federalreserve.gov/FOMC/transcripts/1995/950201Meeting.pdf.

Geraats, P. (2007). The mystique of central bank speak. International Journal of Central Banking, 3, 37–80.

Gerlach-Kristen, P. (2004). Is the MPC’s voting record informative about future UK monetary policy? Scandinavian Journal of Economics, 106, 299–313.

Gerlach-Kristen, P. (2008). The role of the chairman in setting monetary policy: individualistic vs. autocratically collegial MPCs. International Journal of Central Banking, 4, 119–143.

Göhlmann, S. & Vaubel, R. (2007). The educational and occupational background of central bankers and its effect on inflation: an empirical analysis. European Economic Review, 51, 925–941.

Grüner, H. P. (1997). A comparison of three institutions for monetary policy when central bankers have private objectives. Public Choice, 92, 127–143.

Gürkaynak, R., Sack, B., & Swanson, E. (2005). Do actions speak louder than words? The response of asset prices to monetary policy actions and statements. International Journal of Central Banking, 1, 55–94.

Issing, O. (1999). The Eurosystem: transparent and accountable, or “Willem in Euroland”. Journal of Common Market Studies, 37, 503–519.

Issing, O. (2005). Communication, transparency, accountability—monetary policy in the twenty-first century. Federal Reserve Bank of St. Louis Review, 87, 65–83.

Jansen, D.-J., & de Haan, J. (2006). Look who’s talking: ECB communication during the first years of EMU. International Journal of Finance and Economics, 11, 219–228.

Kahneman, D. (2003). Maps of bounded rationality: psychology for behavioral economics. American Economic Review, 93, 1449–1475.

Kohn, D. L., & Sack, B. P. (2004). Central bank talk: does it matter and why. In Bank of Canada (Ed.), Macroeconomics, Monetary Policy, and Financial Stability (pp. 175–206). Ottawa: Bank of Canada.

Lombardelli, C., Proudman, J., & Talbot, J. (2005). Committees versus individuals: an experimental analysis of monetary policy decision-making. International Journal of Central Banking, 1, 181–205.

McGregor, R. R. (2007). The more things change, the more they stay the same? Public Choice, 133, 269–273.

Meade, E. (2006). Dissents and disagreement on the Fed’s FOMC: understanding regional affiliations and limits to transparency. De Nederlandsche Bank Working Paper No. 94.

Mihov, I., & Sibert, A. (2006). Credibility and flexibility with independent monetary policy committees. Journal of Money, Credit and Banking, 38, 23–46.

Mishkin, F. (2004). Can central bank transparency go too far. In C. Kent & S. Guttmann (Eds.), The Future of inflation targeting (pp. 48–65). Sydney: Reserve Bank of Australia.

Morris, S., & Shin, H. S. (2002). Social value of public information. American Economic Review, 92, 1521–1534.

Reinhart, V., & Sack, B. (2006). Grading the Federal Open Market Ccommittee’s communication. Mimeo. Federal Reserve Board of Governors, January 2006.

Riboni, A., & Ruge-Murcia, F. J. (2010). Monetary policy by committee: consensus, chairman dominance, or simple majority? Quarterly Journal of Economics, 125, 363–416.

Roca, M. (2010). Transparency and monetary policy with imperfect common knowledge. IMF Working Paper No. 10/91.

Shughart, W. F. II, & Tollison, R. D. (1983). Preliminary evidence on the use of inputs by the Federal Reserve System. American Economic Review, 73, 291–304.

Sibert, A. (2003). Monetary policy committees: individual and collective reputations. Review of Economic Studies, 70, 649–666.

Svensson, L. (2006). Social value of public information: Morris and Shin (2002) is actually pro transparency, not con. American Economic Review, 96, 448–451.

Toma, M. (1982). Inflationary bias of the Federal Reserve System. A bureaucratic perspective. Journal of Monetary Economics, 10, 163–190.

Walsh, C. (2007). Optimal economic transparency. International Journal of Central Banking, 3, 5–36.

Winkler, B. (2002). Which kind of transparency? On the need for clarity in monetary-policy making. Ifo Studien, 48, 401–427.

Woodford, M. (2005). Central-bank communication and policy effectiveness. In The Greenspan era: Lessons for the future (pp. 399–474) Kansas City: Federal Reserve Bank of Kansas City.

Acknowledgements

We would like to thank Terhi Jokipii for excellent research assistance, and Tao Zha, as well as Reuters and Standard and Poor’s for sharing some of the data series. We are grateful for comments to three anonymous referees, Peter Kurrild-Klitgaard, William F. Shughart II, Christopher Crowe, Alex Cukierman, Petra Geraats, Athanasios Orphanides, and participants at the NBER Summer Institute’s Workshop on Monetary Economics, the 2008 Annual Meetings of the American Economic Association, the Benomics workshop on Optimal Monetary Policy and Central Bank Communication, the Norges Bank workshop on Monetary Policy Committees, the Banca d’Italia Conference on Monetary Policy Design and Communication, and a seminar at Tilburg University. We have benefited substantially from and would like to thank, without implicating them, a number of central banking colleagues at the Federal Reserve, the Bank of England and the ECB and the Eurosystem for numerous discussions, insights and suggestions. This paper presents the authors’ personal opinions and does not necessarily reflect the views of the European Central Bank.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Ehrmann, M., Fratzscher, M. Dispersed communication by central bank committees and the predictability of monetary policy decisions. Public Choice 157, 223–244 (2013). https://doi.org/10.1007/s11127-012-9941-0

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11127-012-9941-0