Abstract

The analysis of efficiency and productivity in banking has received a great deal of attention for almost three decades now. However, most of the existing literature to date has not explicitly accounted for risk when measuring efficiency. We propose an analysis of profit efficiency taking into account how the inclusion of a variety of bank risk measures might bias efficiency scores. Our measures of risk are partly inspired by the literature on earnings management and earnings quality, considering that loan loss provisions, as a generally accepted proxy for risk, can be adjusted to manage earnings and regulatory capital. We also consider some variants of traditional models of profit efficiency where different regimes are stipulated so that financial institutions can be evaluated in different dimensions—i.e. prices, quantities, or prices and quantities simultaneously. We perform this analysis on the Spanish banking industry, whose institutions are deeply affected by the current international financial crisis, and where re-regulation is taking place. Our results can be explored in multiple dimensions but, in general, they indicate that the impact of earnings management on profit efficiency is of less magnitude than what might, a priori, be expected, and that the performance of savings banks has been generally worse than that of commercial banks. However, savings banks are adapting to the new regulatory scenario and rapidly catching up with commercial banks, especially in some dimensions of performance.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The evaluation of bank efficiency and productivity has expanded dramatically over the last three decades, and new contributions are still being added to this relevant field of knowledge. The number of studies is high enough to have merited two surveys already (Berger and Humphrey 1997; Fethi and Pasiouras 2010). Since the last of these surveys was published, further empirical evidence has been made available, partly because following the start of the international financial crisis in 2007 the banking industries in several Western economies have been substantially reshaped. Considering also the new challenges faced by the banking industry such as the increasingly prominent role of digital banking, FinTech, or the low interest rates prevailing in several financial markets, one may naturally inquire about how banks’ efficiency is affected.

However, despite the extent of this relevant literature, some issues have not been fully addressed. For instance, some already classic studies in the field such as Hughes and Mester (1993) or Mester (1996) and, in more recent years, Hughes and Mester (2009) pointed out that bank efficiency studies have generally disregarded the impact of risk and, consequently, they miscalculate the banks’ levels of inefficiency. This is important for many reasons, one of them being that among the most fundamental causes of the international financial crisis lies the issue of bank risk mismanagement. During the last twenty years, due to the importance and growing relevance of this issue, although the number of bank efficiency analyzes disregarding risk increased notably, some papers did actually take it into account, including Färe et al. (2004), Koetter (2008), Altunbaş et al. (2007) or, more recently, Fiordelisi et al. (2011) and Epure and Lafuente (2015), among others.

Many of the contributions in this particular field have considered different proxies for risk, among which the most widespread approach has been to include loan loss provisions. Alternatively, some authors such as Berger and DeYoung (1997) argue that non-performing loans might be a better option to measure bank risk, since loan loss provisions can be more easily manipulated. However, this decision hinges crucially on the availability of data, and it is usually the case that data on non-performing loans simply cannot be obtained. In addition, since many non-performing loans are finally repaid, to write-off the whole amount of non-performing loans as an expenditure might lead to overestimations of the effects of risk. However, as indicated by Ahmed et al. (1999), although the purpose of loan loss provisions is to adjust banks’ loan loss reserves to reflect expected future losses on their portfolios, bank managers may also have incentives to use them to manage earnings and regulatory capital. As Pérez et al. (2008) note, in the case of banks the accrual of loan loss provisions is left to bank managers’ discretion (Beatty et al. 1995). Analysis of this industry takes on even greater importance due to inter-country differences in accounting and capital adequacy regulations (Laeven and Majnoni 2003), or the regulatory changes in individual countries.

This and related issues have been considered by the earnings management and earnings quality literatures (Dechow et al. 2010; Louis et al. 2013) but, despite its magnitude and importance, it has rarely been barely contemplated when risk is explored in bank efficiency studies. However, the literature on earnings management and earnings quality is not conclusive as to the links between loan loss provisions and earnings; for instance, while Collins et al. (1995) find evidence of a positive relationship between these two variables (which is consistent with smoothing earnings via loan loss provisions), Beatty et al. (1995) did not find evidence of earnings smoothing (Ahmed et al. 1999).

The joint consideration of the literature on bank efficiency (controlling for risk) and earnings management and earnings quality has additional implications. Whereas most contributions in the bank efficiency literature have analyzed either cost or (input) technical efficiency, far fewer studies have analyzed either revenue (or output technical efficiency) or profit efficiency. However, the magnitude and heterogeneity of the differences among financial institutions when examining profit efficiency—which implies evaluating cost and revenue efficiency simultaneously—are much higher. In addition, in our particular case, in which we are concerned with analyzing the links between earnings management and performance, it is clear we must adopt an approach that takes earnings (and, therefore, earnings management and earnings quality) into account—i.e. a profit efficiency approach.

Our analysis extends the existing literature in three main directions. First, we use several variables to measure credit risk. On this point, despite the advantages of non-performing loans over loan loss provisions referred to by Berger and DeYoung (1997), the frequent unavailability of the non-performing loans measure, and the ease with which loan loss provisions can be manipulated led us to pursue consider an alternative strategy. Specifically, we consider some accounting modifications to control provisions which add a discretional component to the use of loan loss provisions—i.e. we will consider two additional proxies for credit risk that give us some intuition about whether banks did actually manipulate this information during the analyzed period. Therefore, our profit frontier approach explicitly takes into account the quality of the variables which affect the measurement of bank profits. This approach, as far as we know, has never been used in the literature measuring bank efficiency—regardless of whether we control for risk or not. However, an accurate profit frontier evaluation will hinge on the quality of the components of profits. The literature on earnings quality and earnings management (Roychowdhury 2006; Dechow et al. 2010), as indicated, deals precisely with this. In our setting, both the choices on when transactions occur (timeliness and timely loss recognition) and the choices made to (perhaps) manipulating the profits to be disclosed are particularly relevant because of their impact on profits (Beaver and Engel 1996). This has been widely recognized in the literature, since the expected future losses cannot be estimated with certainty and, therefore, bank managers’ discretion when when setting loan loss provisions (LLPs) is relatively substantial.

Although, in theory, discretion is exercised to provide the best estimates of their portfolios’ expected losses, in practice, managers might have considerable incentives to manipulate LLPs. These incentives include, for instance, helping to reduce earnings volatility, enhancing managers’ compensation, or avoiding capital adequacy regulation. Several contributions have acknowledged this reality (see, for instance Ahmed et al. 1999; Kim and Kross 1998; Collins et al. 1995), and much of the literature, especially studies focusing on the U.S., has extensively analyzed the determinants of LLP decisions. Our model controls for this aspect by including loan loss provisions as an expenditure in the profit function and, in a subsequent step, to offset the effects of their manipulation we will consider expected as opposed to realized LLPs, for which we will follow the recent proposals by Nichols et al. (2009). Specifically, in contrast to other contributions that adopt a static approach, Nichols et al. (2009) suggest estimating LLPs by taking into account not only present but also past and future non-performing loans. Therefore, we will ultimately estimate three earnings management models, depending on whether we allow bank managers to “manipulate” the LLPs, or whether we estimate these provisions considering both a time series and a cross-sectional approach.

Our second contribution lies in proposing three variants of our profit frontier model. We estimate a non-convex short-run profit frontier model in the spirit of Prior (2003), taking as a starting point the contributions of Färe et al. (1994) and Primont (1993). However, in contrast to previous studies we go beyond a model in which output and input prices are kept constant—implying that market power might not exist, an assumption that recent literature (Salas and Saurina 2003; Maudos and Fernández de Guevara 2007) suggests could be implausible. We extend this basic model in two main directions. In the first banks will be allowed to influence quantities only, being price-acceptant, whereas in the second, banks will be able to influence prices. We will refer to these three models as the unconstrained profit model, the price-constrained profit model and the quantity-constrained profit model, respectively. For all three profit frontier models we will consider three variants depending on the degree to which LLPs are manipulable—i.e. one model subject to manipulation, and two models in which the estimation of LLPs are plugged in.

Finally, we apply the analysis to the Spanish banking system, for which there is compelling evidence on its performance (see, for instance Grifell-Tatjé and Lovell 1999). However, only a very few contributions deal explicitly with risk. Likewise, studies that adopt a profit frontier approach are also very scarce. We consider this to be a relevant context, especially taking into account the difficulties that many Spanish commercial and savings banks are experiencing after the crash of the housing market, and the threat that this represents for the entire European banking industry. In addition, the Spanish banking system is undergoing a profound regulatory change whose impact on the industry is yet to be examined. Our strategy to estimate LLPs is also particularly well suited to the Spanish banking system, due to the dynamic LLP scheme introduced by the Bank of Spain in 2000.

Results can be summarized from a multiplicity of angles. Our combination of profit frontier models (unconstrained, price-constrained, and quantity-constrained) and proxies for risk yields a total of nine models. Although there are several differences depending on the profit frontier model considered, the heterogeneity found when comparing results yielded by models with varying degrees of LLP discretion is very low, suggesting that the likely impact of LLP manipulation on profit efficiency is limited. This result is robust across profit frontier models, time (pre-crisis or crisis years) and types of firms (commercial or savings banks). The differences, however, are quite large and significant when considering the context—time or type of firms. During the pre-crisis years, commercial banks performed better than savings banks, regardless of the model considered. In the 2008–2010 period, savings banks caught up with banks and, for some models, their efficiency is higher, suggesting that they are adapting rapidly to the new regulatory scenario.

One of these threats is represented by the drop of profits before provisions are made, which may be strongly influenced by the efficiency with which banking firms operate. More specifically, as pointed by Martín-Oliver et al. (2013), “the level of efficiency when performing banking intermediation activities is a key factor in economic development” (Buera et al. 2009; Diamond and Rajan 2009; Mehra et al. 2011). Moreover, they add that “changes in the costs of intermediation have important macroeconomic consequences for investment and growth” (Christiano and Ikeda 2011; Hall 2011). In general, as shown by the well-established field of research on the finance-growth nexus (Demirgüç-Kunt and Levine 2001; Levine 1997), the evidence shows that some countries, such as Germany or Japan, whose economies and financial systems are more bank-oriented, have also higher growth rates and, therefore, an efficient banking system may ultimately have positive effects on economic growth.Footnote 1

The article is organized as follows. After this introduction, the next section presents an overview of the Spanish banking sector and recent changes (Section 2). The model considered to measure profit efficiency taking into account risk preferences is introduced in Section 3, and the data are described in Section 4. Some interpretations of the results from our analytical proposal are provided in Section 5, and concluding remarks are made in Section 6.

2 Overview of the Spanish banking system: an unusual long journey

The Spanish banking system consists of three main types of institutions: commercial banks, savings banks and credit unions. After a particularly intense deregulatory process during the 1980s, all three institution types were subject to similar credit risk, accounting standards and taxation regulations. However, their differences in terms of ownership, governance structure and organizational form remained, and were actually modified after the crisis, as we will see below.Footnote 2

Due to their role in fueling and accommodating the housing and construction bubble, many Spanish banks (especially savings banks) came under severe stress, as well as deeper scrutiny from both domestic and, particularly, international financial markets. Their large accumulated stocks of potentially problematic (generally real estate related) assets, as well as the relatively low capitalization of some banks (savings banks in particular) raised concerns. Given the relevance of banks’ economic functions in providing liquidity and allowing funds to transfer from savers to investors and their importance for facilitating economic growth (Hellwig 1991), and to rule out the possibility that these institutions could lead Spain deeper into the crisis, a profound restructuration and recapitalization took place in the sector, although the challenges facing Spanish banks remain. Specifically, in order to deal more effectively with banks’ impaired real estate assets and, in general, to restore the viability of the sector, external assistance was needed in order to provide a sufficiently large and credible backstop.

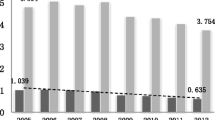

The restructuring and recapitalization of the sector resulted in a profound reshaping of the banking system from an industrial organization perspective. The changes led to a decline in the sector’s excess capacity, including a sharp fall in the number of bank branches (more than 10,500 branches were closed between the 2008 peak and 2013, representing a 22% decrease, and the trend continues) and the total number of employees (more than 41,800 from the 2008 peak until 2012, representing a 15% decrease). Although, in general, many indicators are improving (e.g., solvency ratios), several challenges still exist (for instance, total volume of non-performing loans, sluggish growth of bank lending, or slow de-leveraging).

2.1 A look at the recent changes in the Spanish banking sector

Table 1 provides summary statistics on the market shares of commercial banks, savings banks, and credit unions for both loans (and credits) and deposits, for the private and public sectors. A sharp change in tendencies is apparent after 2008, generally to the detriment of savings banks. In contrast, savings banks showed the most rapidly increasing growth rates from 1988 onwards. For instance, as reported in Table 2, between 1998 and 2008 the volume of loans granted by savings banks increased annually by a remarkable 16.25%—although the increase was also noteworthy for commercial banks (12.60%) and, more importantly, credit unions (15.90%). In contrast, the volume of deposits raised by each type of banking firm during the same period (1998–2008) increased at more moderate (and similar) rates (approximately 10%).

The discrepancy observed between the deposits raised and loans issued by savings banks indicates that the geographic expansion policies—triggered by the deregulation process implemented in Spain in the late eighties—were successful in terms of loans issued, but less so in terms of deposits raised. This is further corroborated by the decrease in the number of commercial bank branches since the late 1990s. Credit unions followed a similar pattern to that of savings banks, although their geographic expansion policies were more conservative. When we extend the analysis to the crisis years (2008–2010), as reported in Table 2, different patterns are also observed for the three firm types. Although commercial banks and credit unions managed to grow in terms of loans, credits and deposits (at least in nominal terms), the situation is very different for savings banks, whose volume of loans issued and deposits raised actually fell between 2008 and 2010.

Taking into account the total number of branches for any of the three aggregates (commercial banks, savings banks or credit unions), it is apparent that lifting the restrictions on branching for savings banks and credit unions led them to follow very different strategies to those of commercial banks. Indeed, the evolution of the aggregate (see Table 3) was the result of very disparate trends for the three types of institutions. In the case of savings banks, the number of branches increased from 12,252 in 1988 to 22,649 by 2010, representing an average increase of 2.62% per year. The increase was even higher for the 1988–2008 period (an increase of 3.43%). This also led savings banks to increase their share of branches, as indicated in Table 3 (from 38.32% to 52.80% between 1988 and 2010 although, again, the peak of 54.90% was reached in 2009). The number of credit union branches rose notably from 3,029 to 5,018, representing a 2.66% annual increase.Footnote 3

The trends for commercial banks went in the opposite direction. As shown in Table 3, the number of branches actually fell from 16,691 to 15,227 between 1988 and 2010, representing a 0.43% annual decline. Most of this decline occurred in the first half of the sample period (between 1988 and 2001) coinciding with the period when savings banks expanded more aggressively. By contrast, in the second half of the period, the total number of branches actually increased slightly, although the rise would have been higher had we excluded years 2009 and 2010. Therefore, although commercial banks and savings banks operate under the same regulatory system (the remaining differences are almost entirely restricted to their type of ownership), the opposing branching strategies could suggest that differences are stronger than might a priori be expected.

2.2 Bank recapitalization and restructuration

Although the Spanish financial system consists of commercial banks, savings banks and credit unions, savings banks were, by and large, the most severely affected by the financial crisis. As indicated above, these financial institutions have a particular type of ownership which, in practical terms, implies they have no owners—neither shareholders nor formal owners; instead they have a general assembly and a board. The board is composed of four groups: founding entities, depositors, employees and public authorities; the public authorities are represented by regional authorities that may have incentives to control savings banks in order to finance their adjustment policies. These regional authorities may weigh too heavily on certain commercial decisions or could lead to excessive risk-taking (Illueca et al. 2014). Although savings banks date back to the XIXth century, their geographic expansions, as indicated above, did not take off until the beginning of the 1990s. Apart from this, they underwent several legislative changes over the years that allowed them to compete on equal terms with commercial banks, accounting (according to the Bank of Spain) for almost half of the credit market during the decade of 2000–2010. However, following the financial crisis the legislative reforms carried out in Spain in the last three years almost led to their demise (see Fig. 1).

In fact, the Spanish banking industry restructuring process in the last few years has focused mainly on savings banks. There were basically four reasons for this: (i) corporate governance model limitations; (ii) powerful business expansion; (iii) heavy reliance on wholesale funding; and (iv) easing of credit standards. Specifically, the organizational system of savings banks, with an absence of corporate structure, created problems in raising capital, and their system of corporate government was not competitive in the current market for corporate control. This was not a significant problem for many years, since savings banks operated within the boundaries of their traditional activities—mostly related to retail banking and with strong links to their home regions.

However, from the end of the 1990s to the start of the crisis (2007–2008) there was a strong credit expansion and a growing exposure to real estate development and construction (see Fig. 2), in which savings banks had a leading role. This brought about, on the one hand, a substantial increase in structural costs (see Table 3, which shows the rapid growth in the number of savings bank branches, and Fig. 3, which reports the increase in the number of employees). On the other hand, it led to a clear risk exposure concentrated on a cyclical industry and the flexibility to grant credits. Finally, to fund this intensive business growth, the use of wholesale funding increased, including mortgage securitizations, as traditional funding sources were not sufficient to feed the growing housing bubble. The burst of the Spanish property bubble, along with the international economic turmoil, prompted a complete overhaul of this component of the banking industry. Figure 4 shows the increase in the default rate following the financial crisis.

Focusing on the case of the Spanish banking industry is also relevant due to its relative size and importance. Specifically, the Spanish financial system and the Spanish economy are crucial for the viability of the Euro zone; Spain’s economic size is larger than that of Greece, Ireland or Portugal, and although some of its macroeconomic indicators are slightly better (although others are worse), the size of the Spanish economy represents a bigger threat to the viability of the Euro (after Germany, France and Italy, Spain is the fourth economy of the Euro area in terms of Gross Domestic Product, representing 11% of the total Euro area GDP in 2012).

3 The analytical framework

3.1 Measuring profits and the literature on earnings quality

The first step in our analytical framework is to define those components that make up the profits of a banking firm, namely, revenues, operating costs, and loan loss provisions, as well as how they relate to each other:

The left-hand side in Eq. (1) represents the bank’s profits, whereas in the right-hand side the operating costs and loan loss provisions have to be subtracted from total revenues. Total revenues are the result of multiplying the prices (rm) and quantities (um) corresponding to each m output, for m = 1, …, M. As expected, the operating costs resulting from multiplying input prices (pn) by input quantities (xn), for inputs n = 1, …, N. Finally, we must also factor in the possibility of unpaid loans and, therefore, loan loss provisions are also subtracted from the revenues. If we attempt to measure this magnitude accurately, in the same way as for revenues and operating costs, the corresponding prices and quantities must also be defined. In this case, for each non-performing loan or asset o (o = 1, …, O), the latter would correspond to the percentage of write-offs or estimated price (po) for the non-performing loan, whereas the former would simply correspond to its monetary value (nplo). The complexity of measuring the different components in the r.h.s. of Eq. (1) has spawned a well-established branch of research in the accounting literature, namely the earnings quality literature, the aims of which include assessing the quality of those variables which make up firms’ profits (Dechow et al. 2010).

According to this literature, several scenarios may emerge concerning the measurement of the variables related to loan loss provisions. On the one hand, if prices (both pn and po) are determined internally, some opportunistic behaviors could emerge in the form of “manipulating” (or “making-up”) the amount of profits to be disclosed. Accoring to Beaver and Engel (1996), in the particular case of banking, manipulating profits is generally associated with problems related to credit risk (such as bad loans). On the other hand, there are various possibilities to consider the exact moment when transactions take place or, as Roychowdhury (2006) notes, incentives to manipulate real operations, in which case the quantities (um, xn, nplo) would be affected. In addition to these two main scenarios, from another perspective some banks might have incentives to decrease earnings in years with unexpectedly strong performance in order to reduce volatility and to increase earnings in weak performance years. A smoother stream of earnings would result from this behavior, helping to reduce the information asymmetries between outside investors and managers.Footnote 4 In this regard, there is substantial evidence for managers smoothing earnings via loan loss provision and recognizing security gains and losses, suggesting that these should be the variables to account for when measuring earnings quality.

In this context, some authors such as Dechow and Dichev (2002) have considered higher profit quality exists when earnings and cash flows follow the same pace. They document that earnings quality is poorer for smaller firms, which experience losses and greater volatility in sales and cash flows. The presence of some of these characteristics in the Spanish banking system provides a rationale for our research objectives.

3.2 Estimating loan loss provisions

Different approaches can be considered to incorporate banks’ risk-taking behavior in the estimation of efficiency indicators. Following previous literature, non-performing loans can be incorporated into the production function of banks as a bad output (or, in terms of the profit function, an expense that reduces total profits). According to the Spanish accounting standards, banks must classify a loan as non-performing when either interest or principal payments are more than 90 days overdue. In addition, all loans granted to borrowers in default are also considered as non-performing, irrespective of whether or not they are overdue. However, a large share of bad loans are ultimately repaid, implying that we might overestimate the effects of risk on profits if the whole amount of npl is written-off as expenditures. Alternatively, we consider a different approach by including loan loss provisions (LLP), defined in Eq. (1) (\(LLP = \mathop {\sum}\nolimits_{o = 1}^O {p_o} npl_o\)), as an expenditure in the profit function.

According to Spanish banking regulations, loan loss provisions are estimated by bank managers following strict Bank of Spain guidelines (which depend on time overdue). However, there is considerable room for discretion, since Bank of Spain’s rules determine only the minimum amount of losses to recognize after classifying a loan as non-performing—although authors such as Pérez et al. (2008) do not entirely agree, considering that the Bank of Spain enforces strict regulations on the accrual of loan loss provisions, by imposing a priori considerable restrictions on banks’ ability to use managerial discretion.

In order to mitigate the effects of this potential manipulation of loan loss provisions, rather than using realized loan loss provisions, we advocate using expected loan loss provisions as an expenditure. Accordingly, it will be possible to disentangle whether banks’ loan loss provision decisions to manage earnings or capital are being successful or not.Footnote 5 If banks were “successful” in this regard, the implication would be that loan loss provision regulations might be irrelevant.

We follow Nichols et al. (2009), who propose estimating expected (or “non-manipulated”) loan loss provisions at the bank level by regressing them on both a backward-looking and a forward-looking component. The former would consist of the increase in non-performing loans on both the two previous years (t − 1, t − 2) as well as the current year (t), whereas the latter would be the increase in non-performing loans (npl) in t + 1 (this component would also allow us to control for accounting conservatism). The model to be estimated would respond to the following equation:

To carry out the estimation (for each bank for the sample period) we consider two different specifications, one static (cross-section) and the other dynamic (time series). The dynamic specification is considered due to the relevance of the “statistical provision” promulgated by the Bank of Spain in 2000, according to which banks had to use their own reserves to cover realized losses (ultimately helping banks to maintain provisions for incurred losses embedded in the credit portfolios created in expansion years).Footnote 6 Due to the strong impact of the dynamic provisioning system on the relationship between non-performing loans and loan loss provisions, we run a second set of regressions excluding the dynamic (or time series) loan loss provisions from the dependent variable, yielding the static (cross-section) specification for LLP.

Table 4 summarizes the main results of the loan loss provision models estimated to disentangle the normal and discretionary components of loan loss provisions at the bank level. Δnpl and LLP refer to the increase in non-performing loansand total loan loss provisions, both deflated by lagged total loans. Subscripts i and t denote bank i and year t, respectively. The first three columns correspond to the average coefficients and respective t-statistics and p-values of year regressions using the cross-section approach, whereas the last three columns report analogous information for bank regressions using the time series approach.Footnote 7

3.3 The profit frontier model

We follow the contributions of Färe et al. (1994) in order to estimate a non-convex short run profit frontier model.Footnote 8 This must be tuned to our particular scenario, classifying the inputs into fixed (xf) and variable (xv) and, in the case of the bad output, considering the realized loan loss provisions. Our variable profit maximization will therefore correspond to the following expression:

In linear programming problem (3) the vector of output prices for bank j is defined by \(r_{jm} \in {\Bbb R}_ + ^M\) (rjm ≥ 0), and the variable input prices are defined by \(p_{jv} \in {\Bbb R}_ + ^V\), v = 1, …, V. The output quantities for j are represented by \(u_j \in {\Bbb R}_ + ^M\), \(x_{jv} \in {\Bbb R}_ + ^V\) are the variable netputs for bank j and \(x_{jf} \in {\Bbb R}_ + ^F\) are the fixed netputs for the same bank.

We tune linear programming model (3) to adapt the contributions by Primont (1993) and Färe et al. (1994) to our specific scenario in which risk enters the model via loan loss provisions. This leads to the inclusion of additional variables, namely, \(npl_j \in {\Bbb R}_ + ^O\), which is the amount of non-performing loans for bank j, o = 1, …, O, and their corresponding prices, \(p_{jo} \in {\Bbb R}_ + ^O\). In addition, in the second step we re-run linear programming model (3) but including the variables subject to “manipulation” by their estimated values, which in practical terms implies considering an additional linear program:

According to the rationale presented in the preceding paragraphs, \({\Pi}^{{\mathrm{not}}\:{\mathrm{manip}}}\left( {r_jm,p_{jv},\tilde p_{jo}} \right)\) will provide a more objective profit target for each bank, since the profits yielded by the (likely) “manipulation” of earnings will be controlled for in this second program.

The problem of programs (3) and (4) is that potential outputs and inputs are estimated in order to maximize profits for the unit under analysis, keeping constant the corresponding output and input prices. This assumption is equivalent to considering that prices are determined in competitive markets, so that firms cannot implement any strategy to influence market prices, or that local markets can absorb any level of output without any change in output prices. This assumption can be strong in the Spanish banking industry, where recent studies have analyzed the existence of market power (see, for instance Maudos and Pérez 2003; Maudos and Fernández de Guevara 2007; Salas and Saurina 2003). From the theoretical point of view, the efficiency literature also contains contributions indicating the problems caused by setting prices in non-fully competitive settings (Camanho and Dyson 2006; Portela and Thanassoulis 2014; Portela 2014; Tone 2002; Tone and Tsutsui 2007).

As a way of using our data to confirm the extent to which banks are oriented towards the maximization of profits in an imperfect competition setting, we followed the Monopolist Axiom of Profits Maximization (proposed by Varian 1984) and, more specifically, the condition of downward sloping demand function:

After estimating expression (5) for all possible combinations of output quantities and prices for each unit/year, the results indicated that the condition was not met for more than 89% of the possible comparisons—i.e. the sign was negative. This might constitute evidence supporting the existence of market power, as previously found by Maudos and Pérez (2003). This would imply that we cannot artificially deal separately with quantities and prices, implying that the two previous programs to estimate of the profit frontier are not applicable.

One way to overcome this limitation is by making the profit function dependent on the total revenues minus costs, as in the following expression:

where Rm = rmum, VCv = pvxv and LLPo = ponplo.

This serves to define a profit frontier program depending on the revenues and the costs, by combining feasible amounts of quantities and prices.

First we will consider model 0, also referred to as the unconstrained variable profit model, which is defined as follows:

From the optimal solution of this program, we can obtain the optimal revenues (\(R_m^ \ast\) and subsequently the optimal values of output prices \(r_m^ \ast = \mathop {\sum}\nolimits_{j = 1}^J {z_j^ \ast } r_{jm}\) and physical outputs \(u_m^ \ast = \mathop {\sum}\nolimits_{j = 1}^J {z_j^ \ast } u_{jm}\)), the optimal values of variable costs (\(VC_v^ \ast\) and subsequently the optimal values of variable input prices \(p_v^ \ast = \mathop {\sum}\nolimits_{j = 1}^J {z_j^ \ast } p_{jv}\) and physical variable inputs \(x_v^ \ast = \mathop {\sum}\nolimits_{j = 1}^J {z_j^ \ast } x_{jv}\)), and the optimal values for the loan loss provisions (\(LLP_o^ \ast\) and subsequently the optimal values of loss recognition \(p_o^ \ast = \mathop {\sum}\nolimits_{j = 1}^J {z_j^ \ast } p_{jo}\)).

In the second stage, we consider the constrained model 1. Compared with the unconstrained model 0, in model 1 banking firms can influence quantities only, as they are price-takers. We will refer to this as the price-constrained variable profit model, according to which we will have:

Finally, we also have model 2, which we will term the quantity-constrained variable profit model, assuming that banks can influence output and input prices but not quantities, according to which:

As a way to synthesize the characteristics of the proposed evaluation process, in Fig. 5 we illustrate the three models defined above. Note that model 0 (unconstrained profit model) tries to maximize profits by estimating the optimal level of revenues and operating costs, constrained not to have more fixed inputs than observed values. This means that inefficient banks should try to introduce modifications on both the outputs and operating inputs side, as well as in the output and the operating input prices in order to rectify the inefficiencies found. Model 1 assumes that output and input prices are negotiated in competitive markets, thus reducing the available options, and estimates the profit inefficiency due to sub-optimal levels on the outputs and the operating inputs, keeping constant the respective prices. By definition, this will produce a lower level of inefficiency than model 0 or, put the other way round, differences between models 0 and 1 are due to the rigidity on the prices side. One can compare model 1 (price-constrained profit model) with the standard programs of technical efficiency because, at the end of the day, both programs orient their assessment to the consideration of quantities. Given this fact, model 1 will always have a better impact on profits than standard DEA models, as the radial increase (decrease) in outputs (inputs) does not mean that their movement should mechanically improve the level of potential profits. In contrast, our proposed model 1 allows change in the output and input mixes in order to improve profits.

From a third perspective, model 2 (quantity-constrained profit model) estimates the profit frontier by trying to optimize the corresponding output and operating input prices, given the observed levels of outputs and operating inputs. This is the case when, for instance, local markets restrict levels of activity once a certain limit is reached. In these circumstances, managers should orient their strategy to find the optimal levels of output and input prices (and the optimal level of financial risk) that allow the bank to improve its net profits. As a result, differences between model 0 and model 2 are due to the rigidity in the level of activity; in these circumstances, when the activity level is not a controlled variable, the consideration of prices and the risk assumed can drive increased levels of profitability.

4 Data and variables

In this section we provide detailed information on the different magnitudes that constitute banks’ profits, corresponding to total costs, total revenues and loan loss provisions. In the first two cases, these magnitudes are obtained by multiplying the different bank inputs and outputs by their respective prices. This choice is not trivial, as documented in the literature cited below, although as we will see, it is often constrained by data availability. Regarding loan loss provisions, however, although the procedure is a priori analogous, we are not actually dealing with either inputs or outputs but rather with what could be referred to as bad outputs, and defining their corresponding prices is particularly intricate, and one of the aims of our study.

4.1 Inputs, outputs and their associated prices

Defining outputs is a complex issue and somewhat controversial, due to the different choices made in different studies. These difficulties are also related to the distinction between how to measure bank outputs, and how to define what it is that banks produce.Footnote 9 Regarding the latter, the most widely used approaches to define bank outputs are user cost, value added and the asset approach (Berger and Humphrey 1992), and scholars have generally tended to prefer the latter two because of restrictions on the available data (see also Tortosa-Ausina 2002, 2003; Colangelo and Inklaar 2012).

One of these restrictions concerns the need to use the accounting information to attach a specific revenue to each output category, which implies that our choice must be restricted to two outputs only: loans (representing banks’ traditional lending activities, y1), and other operating income (which refers to non-lending activities, y2). In practical terms, this implies we are using a combination of the asset approach and the value added approach. Each of these outputs yields a different type of revenue, namely, interest income (interest income from loans and other interest income, R1), and other operating income (R2). The prices corresponding to each output category are obtained by dividing the corresponding revenues by their associated outputs (i.e., r1 = R1/y1, r2 = R2/y2).

In the case of costs, the three specified categories correspond to the cost of funds (total interest expenses, VC1), the cost of labor (personnel expenses, VC2), and other operating expenses (FC1). These three cost categories, however, differ in several characteristics such as whether they are variable or fixed, which is why we use a different notation (VC refers to variable costs, FC to fixed costs). Therefore, their corresponding inputs are variable (loanable funds, xv1, and number of employees, xv2), and fixed (physical capital, xf1). The input prices (wv1, wv2 and wv3) are obtained by dividing each cost category by the corresponding output (wv1 = VC1/xv1, wv2 = VC2 and wv3 = VC3). All this information is reported in Table 5, where detailed definitions of outputs, inputs, and their correspondence prices are provided.

4.2 Loan loss provisions

In this study there is an additional difficulty related to the integration of banks’ risk-taking behavior when measuring efficiency. As mentioned above, non-performing loans (NPL) enter the model as bad outputs. Two types of loans are classified as non-performing: those whose interest or principal payments are more than 90 days overdue, and those granted to borrowers in default (regardless of whether they are overdue or not). As indicated in Section 3.2, we consider not only a relatively standard model in which non-performing loans are the bad output and loan loss provisions the costs it generates, but also two additional models in which two expected loan loss provision models are also studied.

Therefore, as reported in Table 6, which provides definitions for the loan loss provisions, non-performing loans and their associated prices, we are considering three models of the role of loan loss provisions: (i) “manipulated” earnings model (with npl as bad output and LLP as an expenditure, and the corresponding price wl1 = LLP/npl); (ii) “non-manipulated” short-run model (with npl as bad output and LLP + llp1(predicted) as an expenditure, and the corresponding price wl3 = (LLP + llp1(predicted))/npl); and (iii) “non-manipulated” long-run model (with npl as bad output and LLP + llp2 as an expenditure, and the corresponding price \(wl_3^\prime = (LLP + llp_2{\mathrm{(predicted)}})/npl\)).

We selected Spanish banking firms for the 1997–2010 period. Our sample includes both commercial and savings banks. Inputs and outputs data to estimate efficiency came from the Fitch-IBCA Bankscope database and from each firm?s balance sheets and profit and loss account except for number of employees, which was obtained from the AEB (Asociación Española de Banca) for commercial banks and the CECA (Confederación Española de Cajas de Ahorro) for savings banks; credit risk variables data were taken from each institution’s yearbook.Footnote 10Footnote 11 All monetary variables are expressed in thousands of euros. After removing some unreliable data such as zero employees, we have a total of 646 observations for consolidated firms and for all sample years.Footnote 12 A summary of the different variables (inputs, outputs, revenues, costs, loan loss provisions and non-performing loans) used in the study is reported in Table 5, and summary statistics for all variables are reported in Table 7.

4.3 Loan loss provisions and earnings management

The empirical evidence on whether banks are using LLPs for earnings management is mixed.Footnote 13 We find support for this claim in the literature for the US case. For instance, Greenawalt and Sinkey Jr. (1988), in a study of regional banks and money-centered banks, find the latter to be more likely to use LLPs for earnings management, whereas for the former the probability is lower (see also Collins et al. 1995; Ma 1988). A relatively similar result is obtained by Bhat (1996), who found evidence that the use of LLPs for earnings management was higher for smaller banks. Evidence also exists for other contexts such as Australia (Anandarajan et al. 2007), or the Spanish banking industry analyzed here, for which Pérez et al. (2011) obtain empirical evidence on the use of loan loss provisions to smooth earnings—although they do not find evidence of the practice of capital management.

However, other studies such as Scheiner (1981) and Wetmore and Brick (1994), among many others, find no evidence for this relationship. Some studies take a broader focus, by including several countries in the sample. This is the case of, for instance, Fonseca and González (2008), who compare the management of loan loss provisions for banks of 40 different countries, finding a positive link between more developed financial systems and earnings management. The cross-country study by Bouvatier and Lepetit (2008) focused on European banks only, concluding that non-discretionary LLPs increased credit fluctuations, whereas discretionary LLPs—motivated by management objectives—had no impact on credit fluctuations.

Other studies have dealt more explicitly with the issue of International Financial Reporting Standards (IFRS) implementation. This include, for instance, Leventis et al. (2011) and Curcio and Hasan (2015), who found evidence that the practice of using LLPs for earnings management fell significantly after 2005 as a result of IFRS implementation. Before 2005, when all listed companies in the European Union (EU) were required to comply with IFRS, the public information disclosed by Spanish commercial and savings banks (balance sheet and profit and loss account) was structured very differently to that reported after 2005. This information was taken from CECA and AEB, which therefore report different balance sheets and profit and loss accounts for years before and after 2005. In contrast, Bankscope-Fitch provides a homogeneous balance sheet and profit and loss account to make comparisons easier, even if this comes at the cost of less detailed information. All these different balance sheet and profit and loss accounts differ remarkably from the information these institutions report to the Bank of Spain, which is obviously much more detailed (to the point that there is information for each loan Jiménez et al. 2014). This is therefore confidential information that all commercial banks and savings banks must disclose to the Bank of Spain, and which is the same for all of them, regardless of whether they are listed or not.

Unfortunately, no studies have dealt specifically with IFRS/GAAP (Generally Accepted Accounting Principles) in Spanish banking. Some authors have examined the issue of IFRS/GAAP for EU listed banks (Curcio and Hasan 2015; Leventis et al. 2011), whereas others look at the specific case of Spain for listed firms (Callao et al. 2007). However, in the studies on the Spanish case, financial institutions were explicitly excluded from the analysis (Callao et al. 2007). More research is therefore needed and welcome in this specific field.

5 Results

Results can be explored from multiple perspectives. Taking into account the rationale presented in the preceding sections, we will consider four of them: (i) results for the manipulated and non-manipulated model (either static or dynamic); (ii) results for the different types of banks considered (commercial banks, savings banks, or all banks); (iii) results for all years, pre-crisis and crisis years; (iv) and results for efficient vs. inefficient banks. All these results are reported in Tables 8–10, which include both summary statistics (mean and standard deviation) for all banking firms and also specific results for the inefficient firms only (as well as the percentage of inefficient banks).

Each Tables 8–10 refers to the three periods and sub-periods considered (all, pre-crisis, and crisis years). The different rows in each panel report results according to either manipulated or non-manipulated models, as well as considering the different types of firms—all banks, commercial banks, and savings banks. Finally, the columns in each table report results for both efficient and inefficient units, as well as the percentage of efficient firms.

According to the market prices, we are trying to improve profits through the changes in the quantities of inputs and outputs. Our case differs from existing standard models (Färe et al. 1994) in that prices appear in the restrictions but they are not considered in the alternative definition, and efforts therefore focus on the physical quantities in order to maximize profits. In other words, the standard proposal (Färe et al. 1994) is appropriate when competitive markets exist, driving banking firms to be price-takers. When imperfect markets exist, though (as in the Spanish banking sector), our proposed models (unconstrained, price-constrained, and quantity-constrained) contribute to disentangle the extent to which profit inefficiencies are caused by imperfect amounts of quantities or by sub-optimal output and input prices. However, we stick to the unconstrained model to simplify the presentation of results.

If we consider the decomposition by bank type (commercial banks or savings banks) according to their behavior as reported in the different rows in each table, remarkable differences are observed. This result is robust across all the models and sub-periods considered, although in some cases the differences are particularly noteworthy.

There may be multiple explanations for this result; the bank ownership and efficiency literature (Altunbaş et al. 2001), as well as the broader literature on bank ownership (La Porta et al. 2002) have forcefully argued the potential relevance of ownership for banks’ performance. In the case of Spanish banking, and in the particular case of savings banks, Illueca et al. (2013) contend that the political ties of certain board members might have affected the decision-making process in those firms (see also Crespí et al. 2004). More specifically, the likely sources for initial inquiry into savings banks’ efforts to maximize profits include the political motives of boards with strong political ties, the inefficiencies derived from an absence of market for corporate control, social corporate responsibility issues, or the cost of the geographic expansions carried out by these firms over more than 15 years.

The mix of these different but related effects (particularly the last one) might have had quite a strong effect on the ability of savings banks to optimize their profits, driving their comparatively lower performance shown in Table 8. Before savings banks began to expand outside their home regions (starting in 1989), their business model consisted of trading relatively simple banking products and services, and expanding moderately, which was enough to generate equity via profits. Once the territorial expansions started, traditional banking business models were insufficient to deal with the increased operating costs brought about by a much denser branching network (the number of savings bank branches more than doubled between 1988 and 2008, see Table 3). In addition to this, expanding into new markets sometimes also implied increased exposure to loan default, because of new customers with a lower record of repeated interaction (Ongena and Smith 2000), as well as concentration in a limited number of sectors.

These and related issues have been analyzed in detail in Crespí et al. (2004), García-Cestona and Surroca (2008), Prior and Surroca (2006), Surroca and García-Cestona (2006), Illueca et al. (2009) and Illueca et al. (2013), among others. Further insights, although from a more general perspective, can be found in the report published by the Bank of Spain (Banco de España 2017), which offers a thorough analysis of how the 2007/08 international financial crisis affected the Spanish banking industry, and the subsequent regulatory, supervisory and control measures adopted during the 2008–2014 period.

Tables 9 and 10 extend the analysis in Table 8 to the two sub-periods considered, i.e. pre-crisis (1997–2007) and crisis years (2008–2010), respectively. It is apparent that regardless of the model considered (manipulated or non-manipulated earnings model, short-run model or long-run model), the differences between commercial banks and savings banks are robust to the period considered. In fact, during the crisis years period analyzed (Table 10), the gap between the two types of banking firms widened.

However, this is an average result that might have been driven by the behavior of the most inefficient banking firms since, as shown in columns 3 and 4 in Table 10, not only did their performance worsen substantially, but when commercial and savings banks are compared the gap widens considerably. This trend holds for all three models considered (none of them takes prices into account), and might be multiple, but could be largely related to the critical impact of the 2007/08 crisis on some institutions, particularly the most vulnerable, and the ensuing bank restructuring process.

5.1 Manipulated vs. non-manipulated models

As indicated above, Tables 8–10 also provide information split according to the way we control for risk, i.e. the manipulated earnings and the non-manipulated model—either short- or long-run. Several features emerge, notably that the differences among the three models are, in general, modest. Although specific statistical tests were conducted to analyze whether these differences are significant or not, the magnitude of the differences across the three types of models according to the way risk is controlled for is relatively limited compared with the differences found across types of institutions or time periods.

These differences are, on average, particularly low when considering the entire period (Table 8) and the pre-crisis years (Table 9). The trend holds, in general, when considering all banks, commercial banks and savings banks. It is particularly notable for savings banks during the pre-crisis period (Table 9), whose means are 1.9153, 1.9002 and 1.9113 for the manipulated earnings, non-manipulated short-run, and non-manipulated long-run model, respectively. In the case of commercial banks, and considering all banking firms jointly, the magnitude of the discrepancies is also moderate.

The differences are only found to be slightly higher in the crisis period (Table 10). This trend is basically driven by savings banks which, contrary to what one might expect, are actually more inefficient in the case of the manipulated earnings model—the average is 2.2634 compared to 2.0766 and 2.0877 in the case of the short- and long-run non-manipulated models. In the case of commercial banks, results are very similar for the different models regarding the period considered, although some subtle differences emerge. For instance, when examining the behavior of inefficient banks only, discrepancies are found to be larger when the short-run and the long-run non-manipulated models are compared (1.2983 and 1.1617, respectively, see Table 10). However, differences from the manipulated earnings model are modest in all cases.

Therefore, in these estimations the manipulation of the accounting variables (both short-run and long-run models) does not change the overall picture. This outcome might be the result of two very different scenarios. First, on average, the manipulation of the accounting variables has a limited impact on the levels of profit efficiency. This does not imply that the worst performers would probably have incentives to manipulate their accounts, but this behavior does not have significant results on the averages corresponding to the entire sector. Second, it could be the case that when manipulation of the accounting information is notable, we do not perceive any bias on the part of the “manipulators”, as similar procedures are being considered by both the efficient and inefficient institutions. More work will be needed in the near future to disentangle this issue, taking into account the results yielded by the different models presented in Section 3, as well as more recent data—if possible.

5.2 Analyzing the significance of the differences found

We can also formally test the statistical significance of differences between the results reported in Tables 8–10. The results in these tables provide summary statistics on the results for the different profit models under consideration. In some cases (especially when comparing commercial banks with savings banks, or results for different time periods) the differences were noteworthy. In others (especially when comparing the different ways to control for risk) the differences were negligible. We did not formally test for those differences in either case, however.

We could follow authors such as Li (1996, 1999) or Fan and Ullah (1999), who proposed nonparametric tests to compare two unknown distributions that we may refer to as f(x) and g(x). Thus, we would be testing the null hypothesis that H0:f(⋅) = g(⋅) against the alternative H1:f(x) ≠ g(x). In our particular case, these f(x) vs. g(x) comparisons would refer to the variety of models and contexts present inin Tables 8–10. Specifically, we consider two types of comparisons of distributions, namely, contextual and across models. In the former we refer to f(x) and g(x) distinguishing between commercial banks and savings banks, or between pre-crisis and crisis years. In the latter, we refer to f(x) and g(x) distinguishing between the range of models considered.

Tables 11 and 12 show the results for the contextual and across models comparisons, respectively. One of the main advantages of the proposals by Li (1996, 1999), or Fan and Ullah (1999), is that they do not actually test for differences between some summary statistics of the distributions of interest but for the entire distributions themselves, using kernel methods. The shape of these distributions is depicted in Figs. 6 and 7. The results on the differences observed among the different densities depicted in the two figures are reported in Tables 11 and 12.

In general, the results in Tables 11 and 12 generally corroborate the findings presented in the preceding subsections. When comparing results for commercial banks vs. savings banks (upper panel in Table 11) the differences are statistically significant when considering both the entire period and the pre-crisis years. However, the differences are only significant during the crisis years at the 5% significance level—with the exception of the non-manipulated short-run model, for which they are also significant at the 1% level. In the lower panel of Table 11, results indicate whether the differences are significant when comparing the results for the pre-crisis and crisis years. These results are strongly significant, but not for commercial banks, implying that the significance is driven exclusively by savings banks’ behavior. This result is robust across all the models considered.

Table 12 provides results on formal testing for the differences across models. Results indicate that the differences are never significant when comparing the different ways to control or, more properly, when comparing the manipulated earnings model with the non-manipulated earnings model—either short- or long-run. The bivariate kernel density functions, in which the different variables considered are the results for the different models, strongly corroborate this finding, as probability mass concentrates tightly along the 45-degree main diagonal (see Fig. 8).Footnote 14 Both Table 12 and Fig. 8 provide statistical support for the comments made in the preceding subsection.

6 Conclusions

For more than three decades now the analysis of the efficiency and productivity of financial institutions has received a great deal of attention. The number and relevance of the contributions in the field have grown steadily, yielding a huge literature in which studies are not always easy to compare due to the use of different methodologies, models to measure bank activities, samples and contexts.

The magnitude and length of the international financial crisis and the challenges faced by the banking industry (such as the increasing relevance of digital banking, FinTech, or the low interest rates in major financial markets) have granted a new perspective on the available evidence, providing different weightings to the aspects dealt with by this relevant literature. Among these aspects, a significant hindrance to progress in the field has been the difficulties of bank production and intermediation models, as well as definitions of inputs and outputs (and their associated prices) to measure banks’ activities—in particular, when taking credit risk into account.

Some relatively recent contributions shown a deep interest on defining with care banks inputs and, more importantly (due to the difficulties in their measurement), outputs, among which we may highlight those by Basu et al. (2011), Colangelo and Inklaar (2012) or Diewert et al. (2012). In this article, we extend this relevant literature, although with more modest aims due to data limitations, to the specific analysis of how controlling for risk may influence the analysis of financial institutions’ performance.

Controlling for risk is actually a strong limitation shown by most studies of financial institutions performance, mostly due to lack of data, and we try to fill this gap in the literature providing a painstaking comparison of the results yielded by different earnings management models, namely, a naive model in which bank managers can “manipulate” the results to those provided by two accounting models in which loan loss provisions are estimated in the first stage and then, in the second stage, plugged-in into the profit model. In this respect, a more modest contribution of the paper has been to consider a profit model in which banks can set prices non-competitively.

The context of analysis is the Spanish banking industry, which we consider particularly interesting for a variety of reasons, including its size in the European context, how it was affected by the 2007/08 financial crisis (in particular savings banks), and the ensuing restructuring process which is not over yet in some aspects (such as mergers or re-sizing of the branching network). It is also an attractive setting due to the Bank of Spain anticyclical provisioning regime (put into place in July 2000), which we have partly attempted to model in our study.

Results are explored from several perspectives. In general, they indicate that results for the models in which managers can “manipulate” more easily vs. those earnings model in which this practice is not contemplated do not show substantial differences—following some nonparametric tests, the differences found were never statistically significant. In contrast, these differences were strong when comparing commercial banks and savings banks, or when comparing results for either the pre-crisis or crisis years.

Reasons explaining this behavior may be multiple, but they could be partly related to the restructuring which has strongly reshaped the Spanish banking industry since most savings banks have ultimately been transformed into proper commercial banks—including the type of ownership. Other important issues such as the geographic contraction policies in which most savings banks are now engaged, as well as the renewed membership of savings banks’ boards of directors (with fewer political affiliations) might have also contributed to boosting convergence between commercial banks and savings banks.

Notes

In contrast to Spanish commercial banks, savings banks are private foundations with no formal owners. Their profits had either to be retained or partially invested in social/community/cultural programs—they were even known as “social dividends”. The main goals of these institutions were: (i) provision of universal access to financial services; (ii) profit maximization; (iii) competition; (iv) enhancement and avoidance of monopoly abuse; (iv) contribution to regional development; and (v) wealth redistribution. See Crespí et al. (2004).

The information reported does not include the latest available years, since the analysis carried out in the paper and presented in the next sections ends in 2010.

This would ultimately imply that over- or under-provisioning assets, or misclassifying them, would circumvent strict accounting rules.

This rule ultimately enforced a counter-cyclical loan loss provision that resulted in income smoothing practices by banks (Pérez et al., 2008, p. 425).

p-values are computed using Fama-McBeth standard errors.

For a short-run cost frontier definition see also Primont (1993).

AEB and CECA compile information on commercial banks and savings banks, respectively, not only balance sheets and profit and loss accounts but also number of branches, employees, etc. The information is publicly available on their respective web pages (https://www.aebanca.es/ and http://www.ceca.es/).

The sample represents more than 90% of the commercial and savings banks’ total assets. However, in terms of firms, the sample is smaller because information on nonperforming loans is not publicly available and had to be compiled manually from the institutions yearbooks, which were not available for all banks and all years.

Commercial and savings banks prepared the same public balance sheet before 2005. Since 2005, when IFRS rules were introduced, the new public balance sheets are also the same for both types of institutions.

We thank one of the anonymous referees for this observation.

If results differed across models probability mass would shift clockwise.

References

Ahmed AS, Takeda C, Thomas S (1999) Bank loan loss provisions: a reexamination of capital management, earnings management and signaling effects. J Account Econ 28(1):1–25

Allen F, Gale D (1997) Financial markets, intermediaries, and intertemporal smoothing. J Political Econ 105(3):523–546

Altunbaş Y, Carbó S, Gardener E, Molyneux P (2007) Examining the relationships between capital, risk and efficiency in European banking. Eur Financ Manag 13(1):49–70

Altunbaş Y, Evans L, Molyneux P (2001) Bank ownership and efficiency. J Money, Credit Bank 33(4):926–954

Anandarajan A, Hasan I, McCarthy C (2007) Use of loan loss provisions for capital, earnings management and signalling by Australian banks. Account Finance 47:357–379

Banco de España (2017). Informe sobre la crisis financiera y bancaria en España, 2008–2014. Other publications, Banco de España, Madrid

Basu S, Inklaar R, Wang JC (2011) The value of risk: measuring the service output of US commercial banks. Econ Inq 49(1):226–245

Beatty A, Chamberlain SL, Magliolo J (1995) Managing financial reports of commercial banks: The influence of taxes, regulatory capital, and earnings. J Account Res 33(2):231–261

Beatty A, Harris DG (1999) The effects of taxes, agency costs and information asymmetry on earnings management: A comparison of public and private firms. Rev Account Stud 4(3):299–326

Beatty AL, Ke B, Petroni KR (2002) Earnings management to avoid earnings declines across publicly and privately held banks. Account Rev 77(3):547–570

Beaver WH, Engel EE (1996) Discretionary behavior with respect to allowances for loan losses and the behavior of security prices. J Account Econ 22(1):177–206

Berger AN, DeYoung R (1997) Problem loans and cost efficiency in commercial banks. J Bank Finance 21(6):849–870

Berger AN, Humphrey, DB (1992) Measurement and efficiency issues in commercial banking. In: Griliches, Z (ed.) Output measurement in the service sectors, NBER studies in income and wealth. The University of Chicago Press, Chicago, pp 245–300

Berger AN, Humphrey DB (1997) Efficiency of financial institutions: International survey and directions for future research. Eur J Oper Res 98:175–212

Bhat V (1996) Banks and income smoothing: An empirical analysis. Appl Financial Econ 6(6):505–510

Bouvatier V, Lepetit L (2008) Banks’ procyclical behavior: Does provisioning matter? J Int Financial Markets, Institutions Money 18(5):513–526

Buera FJ, Kaboski J, Shin, Y (2009) Finance and development: A tale of two sectors. Working Paper 14914, National Bureau of Economic Research

Callao S, Jarne JI, Laínez JA (2007) Adoption of IFRS in Spain: Effect on the comparability and relevance of financial reporting. J Int Account Auditing Tax 16:148–178

Camanho AS, Dyson RG (2006) Data Envelopment Analysis and Malmquist indices for measuring group performance. J Prod Anal 26(1):35–49

Christiano L, Ikeda, D (2011) Government policy, credit markets and economic activity. Working Paper w17142, National Bureau of Economic Research

Colangelo A, Inklaar R (2012) Bank output measurement in the euro area: a modified approach. Rev Income Wealth 58(1):142–165

Collins JH, Shackelford DA, Wahlen JM (1995) Bank differences in the coordination of regulatory capital, earnings, and taxes. J Account Res 33(2):263–291

Crespí R, García-Cestona MA, Salas V (2004) Governance mechanisms in Spanish banks. Does ownership matter? J Bank Finance 28(10):2311–2330

Curcio D, Hasan I (2015) Earnings and capital management and signaling: the use of loan-loss provisions by European banks. Eur J Finance 21(1):26–50

Dechow PM, Dichev ID (2002) The quality of accruals and earnings: the role of accrual estimation errors. Account Rev 77:35–59

Dechow PM, Ge W, Schrand C (2010) Understanding earnings quality: a review of the proxies, their determinants and their consequences. J Account Econ 50(2):344–401

Demirgüç-Kunt A, Levine R (2001) Financial Structure and Economic Growth: A Cross-Country Comparison of Banks, Markets, and Development. MIT Press, Cambridge and London

Diamond DW, Rajan RG (2009) The credit crisis: conjectures about causes and remedies. Am Econ Rev 99(2):606–610

Diewert E, Fixler D, Zieschang, K (2012) Problems with the measurement of banking services in a national account framework. Discussion Paper 12-03, Department of Economics, University of British Columbia, Vancouver, B.C.

Epure M, Lafuente E (2015) Monitoring bank performance in the presence of risk. J Prod Anal 44(3):265–281

Fan Y, Ullah A (1999) On goodness-of-fit tests for weekly dependent processes using kernel method. J Nonparametric Stat 11:337–360

Färe R, Grosskopf S, Lovell CAK (1994) Production frontiers. Cambridge University Press, Cambridge

Färe R, Grosskopf S, Weber WL (2004) The effect of risk-based capital requirements on profit efficiency in banking. Appl Econ 36(15):1731–1744

Fethi MD, Pasiouras F (2010) Assessing bank efficiency and performance with operational research and artificial intelligence techniques: A survey. Eur J Oper Res 204(2):189–198

Fiordelisi F, Marqués-Ibáñez D, Molyneux P (2011) Efficiency and risk in European banking. J Bank Finance 35(5):1315–1326

Fixler DJ, Zieschang KD (1992) User costs, shadow prices, and the real output of banks. In: Griliches Z (ed.) Output measurement in the service sectors. The University of Chicago Press, Chicago, pp 219–243

Fonseca AR, González F (2008) Cross-country determinants of bank income smoothing by managing loan-loss provisions. J Bank Finance 32(2):217–228

Freixas X, Rochet J-C (1997) Microeconomics of Banking. MIT Press, Cambridge, MA

García-Cestona MA, Surroca J (2008) Multiple goals and ownership structure: effects on the performance of Spanish savings banks. Eur J Oper Res 187(2):582–599

Greenawalt M, Sinkey Jr. J (1988) Bank loan loss provisions and the income smoothing hypothesis: an empirical analysis. J Financial Services Res 1(4):301–318

Grifell-Tatjé E, Lovell CAK (1999) Profits and productivity. Manag Sci 45(9):1177–1193

Hall RE (2011) The high sensitivity of economic activity to financial frictions. Econ J 121(552):351–378

Hellwig M (1991) Banking, financial intermediation and corporate finance. In: Giovannini A, Mayer C (eds) European financial integration, chapter 3. Cambridge University Press, Cambridge, pp 35–63

Hughes JP, Mester LJ (1993) A quality and risk-adjusted cost function for banks: evidence on the “too-big-to-fail” doctrine. J Prod Anal 4:293–315

Hughes JP, Mester LJ (2009) Efficiency in banking: Theory, practice, and evidence. In: Berger AN, Molyneux P, Wilson J (eds) The Oxford handbook of banking, Oxford handbooks in finance, chapter 18. Oxford University Press, Oxford

Illueca M, Norden L, Udell GF (2014) Liberalization and risk-taking: evidence from government-controlled banks. Rev Finance 18(4):1217–1257

Illueca M, Pastor JM, Tortosa-Ausina E (2009) The effects of geographic expansion on the productivity of Spanish savings banks. J Prod Anal 32(2):119–143

Jiménez G, Ongena S, Peydró JL, Saurina J (2014) Hazardous times for monetary policy: what do twenty-three million bank loans say about the effects of monetary policy on credit risk-taking? Econometrica 82(2):463–505

Kim M, Kross W (1998) The impact of the 1989 change in bank capital standards on loan loss provisions and loan write-offs. J Account Econ 25(1):69–100

Koetter M (2008) The stability of bank efficiency rankings when risk preferences and objectives are different. Eur J Finance 14(2):115–135

La Porta R, López-de-Silanes F, Shleifer A (2002) Government ownership of banks. J Finance 57(1):265–301

Laeven L, Majnoni G (2003) Loan loss provisioning and economic slowdowns: too much, too late? J Financial Intermediation 12(2):178–197

Leventis S, Dimitropoulos PE, Anandarajan A (2011) Loan loss provisions, earning management and capital management under IFRS: the case of EU commercial banks. J Financial Services Res 40(1–2):103–122

Levine R (1997) Financial development and economic growth: views and agenda. J Econ Literature 35(2):688–726

Li Q (1996) Nonparametric testing of closeness between two unknown distribution functions. Econometric Rev 15:261–274

Li Q (1999) Nonparametric testing the similarity of two unknown density functions: local power and bootstrap analysis. J Nonparametric Statistics 11(1):189–213

Liu CC, Ryan SG (2006) Income smoothing over the business cycle: changes in banks’ coordinated management of provisions for loan losses and loan charge-offs from the pre-1990 bust to the 1990s boom. Account Rev 81(2):421–441

Louis H, Sun AX, Urcan O (2013) Do analysts sacrifice forecast accuracy for informativeness? Manag Sci 59(7):1688–1708

Ma CK (1988) Loan loss reserve and income smoothing: the experience in the US banking industry. J Bus Finance Account 15(4):487–497

Martín-Oliver A, Ruano S, Salas-Fumás V (2013) Why high productivity growth of banks preceded the financial crisis. J Financial Intermediation 22(4):688–712

Maudos J, Fernández de Guevara J (2007) The cost of market power in banking: social welfare loss vs. cost inefficiency. J Bank Finance 31(7):2103–2125

Maudos J, Pérez F (2003) Competencia vs. poder de monopolio en la banca española. Moneda y Crédito 0(217):139–166

Mayer C (1988) New issues in corporate finance. Eur Econ Rev 32(5):1167–1183

Mehra R, Piguillem F, Prescott EC (2011) Costly financial intermediation in neoclassical growth theory. Quantitative Econ 2(1):1–36

Mester LJ (1996) A study of bank efficiency taking into account risk-preferences. J Bank Finance 20:1025–1045

Nichols DC, Wahlen JM, Wieland MM (2009) Publicly traded versus privately held: implications for conditional conservatism in bank accounting. Rev Account Stud 14(1):88–122

Ongena S, Smith DC (2000) Bank relationships: a review. In: Harker PT, Zenios SA (eds) Performance of financial institutions. Efficiency, innovation, regulation, chapter 7. Cambridge University Press, Cambridge, pp 221–258.

Pérez D, Salas-Fumás V, Saurina J (2008) Earnings and capital management in alternative loan loss provision regulatory regimes. Eur Account Rev 17(3):423–445

Portela MCAS (2014) Value and quantity data in economic and technical efficiency measurement. Econ Lett 124:108–112

Portela MCAS, Thanassoulis E (2014) Economic efficiency when prices are not fixed: disentangling quantity and price efficiency. Omega 47:36–44

Primont D (1993) Efficiency measures and input aggregation. In: Diewert WE, Spremann K, Stehling, F (eds) Mathematical modelling in economics. Essays in honor of Wolfgang Eichhorn. Springer, Berlin, pp 288–294

Prior D (2003) Long- and short-run non-parametric cost frontier efficiency: an application to Spanish savings banks. J Bank Finance 27:655–671

Prior D, Surroca J (2006) Strategic groups based on marginal rates: an application to the Spanish banking industry. Eur J Oper Res 170(1):293–314

Pérez D, Salas-Fumás V, Saurina J (2011) Earnings and capital management in alternative loan loss provision regulatory regimes. Eur Account Rev 17(3):423–445

Roychowdhury S (2006) Earnings management through real activities manipulation. J Account Econ 42(3):335–370

Salas V, Saurina J (2003) Deregulation, market power and risk behaviour in Spanish banks. Eur Econ Rev 47:1061–1075

Scheiner JH (1981) Income smoothing: an analysis in the banking industry. J Bank Res 12:19–23

Surroca J, García-Cestona MA (2006) Evaluación de la eficiencia con múltiples fines: una aplicación a las cajas de ahorro. Revista de Economía Aplicada 14(40):67–90

Tone K (2002) A strange case of the cost and allocative efficiencies in DEA. J Oper Res Soc 53(11):1225–1231