Abstract

This paper presents a novel approach to measure efficiency and productivity decomposition in the banking systems of emerging economies with a special focus on the role of equity capital. We model the requirement to hold levels of a fixed input, i.e. equity, above the long run equilibrium level or, alternatively, to achieve a target equity-asset ratio. To capture the effect of this under-leveraging, we allow the banking system to operate in an uneconomic region of the technology. Productivity decomposition is developed to include exogenous factors such as policy constraints. We use a panel data set of banks in emerging economies during the financial upheaval period of 2005–2008 to analyse these ideas. Results indicate the importance of the capital constraint in the decomposition of productivity.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

When a banking system has undergone a financial shock, there are important lessons to learn from how it reacts, adapts and recovers. These lessons had particularly strong policy implications when most of the developed world was recovering from the financial crisis of 2007–2008. Many emerging economies, however, experienced a number of shocks before this and some began to recover ahead of the developed economies. As a consequence, considerable lessons can be learned from the emerging economies during the last decade about financial liberalization, banking system recapitalization and financial crises.

Banking system recapitalization, that is, a greater reliance on equity capital rather than short-term borrowing as a means of providing full loss absorbing capacity for problem loans is a major preoccupation of policymakers around the world. It is widely believed that a well-capitalized banking system is expected to be less vulnerable to financial crises, whereas an inadequately capitalized banking system is more susceptible to financial shocks (Koutsomanoli-Filippaki et al. 2009). Major recapitalization of the banking systems mandated by regulators’ requirements, could, however, impose a resource cost both on the wider economy and on the banking system in particular (Daniel and Jones 2007).Footnote 1

Our paper attempts to measure this cost and its impact on the banking system. One focus of the research, therefore, will be on measuring the shadow return on equity associated with regulatory capital constraints on the bank balance sheets.Footnote 2 A related question is how has the upheaval in financial markets affected the efficiency and productivity change of banking systems during this period? This paper fills a gap in the literature by departing from the traditional analysis of efficiency and productivity by incorporating regulatory constraints into the cost function. We argue that the regulatory capital constraint is a critical aspect to be considered when modelling a banking system’s cost-minimizing behaviour in order to measure productivity. These ideas are soundly established in the theoretical literature but we wish to develop this theoretical framework into an empirical application. In particular, we aim to measure the productivity cost of changes in the regulatory capital requirements of banks and to relate this to the empirical measurement of the shadow price of equity capital over time and amongst groups of emerging economies.

There is a vast amount of literature on bank efficiency and productivity that examines a number of aspects such as investigating the determinants of efficiency (Canhoto and Dermine 2003; Casu and Molyneux 2003); ownership (Havrylchyk 2006; Sturm and Williams 2004); stock returns and efficiency (Beccalli et al. 2006; Erdem and Erdem 2008); corporate events and efficiency (Avkiran 1999; Sherman and Rupert 2006); regulatory reform, liberalization and efficiency (Brissimis et al. 2008; Fethi et al. 2011; Isik and Hassan 2003; Tsionas et al. 2003); consolidation and its impact on banks’ efficiency (Cuesta and Orea 2002; Lozano-Vivas et al. 2011); and comparison of different frontier techniques (Delis et al. 2009).Footnote 3 However, to our knowledge, there is an insufficient number of studies that formally consider the relationship between banks’ regulated capital and productivity (Fethi et al. 2012).

Our paper provides a new direction in the efficiency and productivity literature by exploiting a theoretical feature long overlooked empirically in this strand. The novelty of this paper is owed to constructing a modelling framework that accounts for the impact of the regulatory capital constraint on banking production costs. We relax the underlying assumption of the long run cost function by exploiting the envelopment theory and introducing a proxy of capital that is subject to short-run adjustment into the cost function. Our proposed approach is then utilized to obtain the efficiency and productivity decomposition in the banking systems of emerging economies. We further extend the analysis by reflecting our proposed model on the specification of composed error stochastic frontier analysis to derive a productivity decomposition for a panel data set of emerging economy banking systems, where the decomposition includes the impact of the capital constraint.

The paper is organized as follows: Sect. 2 discusses the theoretical background and the proposed model whilst Sect. 3 introduces the model specification and data. Section 4 provides analytical discussions on the empirical findings; and the final section concludes.

2 Alternative modelling for the technology and relative efficiency

In this section, we develop a model of banking system activity that takes account of the equity capital requirements. In particular, we look at how the increased capital requirements (compulsory by regulators) may impose additional costs on the efficient allocation of resources. We begin with the parametric frontier dual-cost function, which is based on K variable inputs: x = (x 1,…,x k ) with input prices: w = (w 1,…,w k ) and R outputs: y = (y 1,…,y R ), and an additional input. This input may be either fixed in the short run, or required in a fixed ratio to output, but is variable in the long run. To further clarify, we symbolize this particular input as z 0, with input price w 0. We argue that the interpretation of this fixed input will be critical in a banking industry paradigm; hence it captures the importance of the equity capital level.

We formalize our hypothesis based on the arguments introduced by Braeutigam and Daughety (1983) and Hughes et al. (2001), and we write the long run cost function, with all inputs including z 0 treated as variable, in the form:

The efficient boundary of the technology set is represented by a transformation function: \(F\left( {{\mathbf{x}},z_{0} ,{\mathbf{y}},t} \right) = 0\). Assuming weak disposability of the technology implies that the first derivatives, \(F_{k} \equiv \partial F/ \partial x_{k}\), \(F_{r} \equiv \partial F/ \partial y_{r}\), are not restricted in sign. This will allow the model to accommodate both positive and negative shadow prices in the dual-cost function. In that vein, for a banking industry the regulated short run cost function can be modelled in two ways: either by specifying a fixed level of the critical input equity capital, z 0 is fixed; or alternatively, by specifying a fixed ratio of the critical input equity capital to a single dimension of output measured as total assets, \(r_{0} = {{z_{0} } \mathord{\left/ {\vphantom {{z_{0} } {{\mathbf{i^{\prime}y}} = }}} \right. \kern-0pt} {{\mathbf{i^{\prime}y}} = }}{{z_{0} } \mathord{\left/ {\vphantom {{z_{0} } y}} \right. \kern-0pt} y}\). Most of the literature tends to perceive this feature of the envelope theorem application to banking costs through the short run cost function with a fixed equity level. However, we opt to show the relationship between the long run total cost and the short run total cost expressed in regulated equity-asset ratio form. In this case, where the equity capital input z 0 must be held in a regulated or target ratio with output measured as total assets, r 0, the short run cost function is:

The envelope theorem confirms that long run total cost defines the envelope of short run total cost:

Consequently, the following derivative result holds in the neighbourhood of the optimal ratio of the fixed input, z 0 = r 0 y:

Rearranging this last result and expressing it in elasticity form gives the critical interpretation of the shadow price of the target equity capital ratio:

In other words, the negative log derivative of the short run cost function expresses the shadow share of equity costs to total expenses.Footnote 4

There are two particularly important implications in the analysis of banking systems, and these concern the measurement of the shadow price away from equilibrium and the measurement of returns to scale. These implications depend on the nature or choice of the fixed input, either the level of equity capital or equity capital expressed as a ratio to total assets (equity-asset). In the first case when equity level is involved, we interpret that the negative of the derivative of short run total cost with respect to the equity level is the shadow cost of equity. The second case is when the model involves the equity-asset ratio. In that case we interpret the negative of the derivative of short run total cost with respect to the equity-asset ratio as the shadow ratio of equity expenses to total expenses.

In our case, the inclusion of the equity-asset or capital ratio as an explanatory variable in the cost function enables us to examine three possible outcomes that will consequently affect the cost in our model. First, “Over Leverage”: banks that are over-leveraged or reliant on debt and under-use equity capital can be expected to show a relatively low ratio of equity expenses to total expenses [but with a negative sign on the measured elasticity in the cost function—see Eq. (5) above]. These banks might be engaged in capitalizing themselves, however, with insignificant proportions or relatively very low rates either due to high competition, lucrative opportunities in the loans market, or simply weak accessibility to equity capital. Second, “Active-Capitalizer” banks that are engaged in active recapitalization will show a relatively high ratio of equity expenses to total expenses, but still with a negative sign in (5). (These types of banks tend to constantly adjust their equity levels to meet the regulatory requirements.) Third, “Excessive-Capitalizer” banks that are far from long run cost minimizing equilibrium, for example because they are undergoing major recapitalization with current equity capital levels well above the long run equilibrium and may be expected to show a significant rise in the ratio of equity expenses to total expenses compared with the long run average when the fitted cost function includes the equity-asset ratio. In the third case, for instance where the fitted cost function is conditioned on the level of equity capital instead of the equity-asset ratio, we will observe a very low possibly severely negative shadow return on equity in the recovery phase from financial crisis. Negative values of the shadow input price or return on the fixed input equity level (corresponding to above average ratio of equity to total expenses) would arise if, for example, the firm was operating in the uneconomic region of the production function. Such “Excessive-Capitalizer” banks most often appear when the banking system is mandated to re-capitalize following a financial crisisFootnote 5—a classic example of this regulatory imposition of re-capitalization was the IMF-mandated re-organization of the Turkish banking system after 2001 when the regulatory capital requirement was set at 25 % of total assets, at a time when many European banks were operating with <3 % equity-assets ratios, see Fethi et al. (2012).

The sign and magnitude of the shadow return for the equity-asset ratio indeed have an implication on the measurement of returns to scale. Panzar and Willig (1977) derive the following result concerning the inverse of the elasticity of cost with respect to output:

Then \(E_{{c{\mathbf{y}}}}^{ - 1} < 1\) implies diseconomies of scale (decreasing returns), \(E_{{c{\mathbf{y}}}}^{ - 1} = 1\) implies constant returns to scale and \(E_{{c{\mathbf{y}}}}^{ - 1} > 1\) implies economies of scale (increasing returns). The definition of cost used here, however, is the long run total cost: \(c\left( {{\mathbf{y,w}},w_{0} ,t} \right)\), but as Braeutigam and Daughety (1983) demonstrate, close to the optimum level of the fixed input, the short run total cost can be used instead. The elasticity of scale is measured by adjusting the long run Panzar–Willig estimate by the shadow ratio of equity expenses to total expenses:

This measures returns to scale at the observed suboptimal level of the fixed input, which may be more appropriate if the industry is expected to remain at a suboptimal allocation of inputs.

We therefore have two possible specifications of the short run total cost function, one using the equity-asset ratio and one using the equity level. We proceed at this point using the equity-asset ratio, but both forms are fitted in the estimation results. The actual cost experienced by the firm is by definition: C t ≡ w ′ x + α 0 where α 0 is expenditure on the fixed input. Consequently, cost efficiency at time t is:

Using \(\exp \left( { - u} \right), u \ge 0\) to transform the measure of cost efficiency from the interval (0, 1) into a non-negative random variable with support on the non-negative real line [0, +∞) yields:

This function should be homogeneous of degree +1 and concave in input prices. An econometric approach may be adopted by replacing the deterministic kernel of (13) with a fully flexible functional form such as the translog function with an additive idiosyncratic error term v to capture sampling, measurement and specification error. We impose homogeneity by dividing through by one of the input prices, for example w K , expressing the variables in vector form as:

and writing the translog approximation with additive error term as \(TL\left( {\mathbf{y},{\tilde{\mathbf{w}}},r_{0} ,t} \right) + v\). In the equity-asset ratio specification, these steps give us the following result:

The vectors of elasticity functions (equivalent in the case of the input prices to the share equations by Shephard’s lemma) are derived by differentiating the translog quadratic form:

This matrix derivative of the translog short run cost function can be used to generate a total factor productivity decomposition.

2.1 Productivity growth decomposition

We derive the total factor productivity index and its decomposition as follows (see Bauer 1990; Orea 2002). Differentiating both sides of the cost Eq. (10) with respect to t and rearranging the result, we obtain:

In this expression, E −1 is the elasticity of scale; \({\varvec{\upvarepsilon}}_{y}\) is the vector of cost elasticity functions with respect to the outputs, with typical element: \(\varepsilon_{yr} = \partial \ln c\left( {{\mathbf{y}}, {\mathbf{w}}, r_{0} , t} \right)/ \partial \ln y_{r}\); \({\varvec{\upvarepsilon}}_{w}\) is the vector of cost elasticity functions with respect to the input prices, with typical element: \(\varepsilon_{wk} = \partial \ln c\left( {{\mathbf{y}}, {\mathbf{w}}, r_{0} , t} \right)/ \partial \ln w_{k}\); ɛ t is the cost elasticity function with respect to the time-based index of technological progress: \(\varepsilon_{t} = \partial \ln c\left( {{\mathbf{y}}, {\mathbf{w}}, r_{0} , t} \right)/ \partial t;\,\,\left( {du/dt} \right)\) is the rate of change of inefficiency; and finally, ɛ r0 is the cost elasticity with respect to the target equity-asset ratio constraint. The left-hand side of this expression is by definition a measure of total factor productivity change with weights that sum to unity, that is, by construction in the case of outputs and by linear homogeneity in the case of inputs. Hence, the right-hand side is a complete decomposition of the total factor productivity index.

The five components of the total factor productivity change on the right-hand side of the equation can therefore be interpreted as follows:

-

(a)

\(\left( {{{1 - E} \mathord{\left/ {\vphantom {{1 - E} E}} \right. \kern-0pt} E}} \right){\mathbf{\varepsilon^{\prime}}}_{y} {\dot{\mathbf{y}}}\): scale efficiency change; if E = 1 i.e. CRS, there is zero scale efficiency change in the total factor productivity change, TFPC, decomposition.

-

(b)

\(\left( {{\mathbf{s}} - {\varvec{\upvarepsilon}}_{w} } \right)^{\prime } {\dot{\mathbf{w}}}\): allocative efficiency change; if actual input cost shares and optimal input cost shares are equal, there is no potential for allocative efficiency change s − ɛ w = 0.

-

(c)

−ɛ t : technological change; if the elasticity of cost with respect to time as a proxy for the technological change is negative, ɛ t < 0, then this term will raise productivity.

-

(d)

−(du/dt): cost efficiency change; if this term, including the sign, is positive then productivity is enhanced by improvements in the technology.

-

(e)

\(\varepsilon_{r0} \dot{r}_{0}\): regulated equity-asset ratio productivity change; if this term, including the sign, is positive then productivity is enhanced by relaxation of the equity-asset ratio constraint, and conversely productivity is reduced when the constraint becomes more strongly binding, for example in a recapitalization phase.

It is the last component that allows us to compute the first order cost of recapitalizing the banking system. If the shadow price or rate of return on equity is positive, then holding higher levels of equity capital or a higher target equity-asset ratio will move the banking system towards a long run equilibrium and will generate a positive impact on productivity growth.

However, if the shadow price or rate of return on equity is negative (i.e. the equity level has a positive coefficient in the fitted cost function), or there is a requirement to hold higher than equilibrium levels of equity capital relative to assets, then this will impose a negative component on productivity growth. The negative shadow rate of return on equity capital is the first order indicator that the bank is an excessive captalizer in the term introduced earlier. This allows us to measure the cost impact of recapitalization by the contribution (negative or positive) of the changes in the equity level or the equity-asset ratio to the measured total factor productivity growth. There is a further potential second order effect in that the imposition of policy determined additional equity capital requirements may have a knock-on effect on the alloative efficiency component. Even where positive allocative efficiency is achieved this may be mitigated by the additional regulatory requirements.

The components of total factor productivity change, \(T\dot{F}P\), are shown in total differential form; however, we can use them in index number form, as follows:

-

(a)

\(\tfrac{1}{2}\sum\nolimits_{r} {\left[ {\left( {{{\left( {1 - E^{t + 1} } \right)\varepsilon_{yrt + 1} } \mathord{\left/ {\vphantom {{\left( {1 - E^{t + 1} } \right)\varepsilon_{yrt + 1} } {E^{t + 1} }}} \right. \kern-0pt} {E^{t + 1} }}} \right) + \left( {{{\left( {1 - E^{t} } \right)\varepsilon_{yrt} } \mathord{\left/ {\vphantom {{\left( {1 - E^{t} } \right)\varepsilon_{yrt} } {E^{t} }}} \right. \kern-0pt} {E^{t} }}} \right)} \right]\left( {\ln y_{rt + 1} - \ln y_{rt} } \right)}\) is the effect of scale efficiency change.

-

(b)

\(\tfrac{1}{2}\sum\nolimits_{k} {\left[ {\left( {s_{kt + 1} - \varepsilon_{wkt + 1} } \right) + \left( {s_{kt} - \varepsilon_{wkt} } \right)} \right]\left( {\ln w_{kt + 1} - \ln w_{kt} } \right)}\) is the effect of the bias in using actual cost share weights instead of optimal cost shares based on shadow prices, i.e. allocative efficiency change.

-

(c)

\(- \tfrac{1}{2}\left[ {\left( {{{\partial \ln c\left( {{\mathbf{y}},{\mathbf{w}},z_{0} ,t + 1} \right)} \mathord{\left/ {\vphantom {{\partial \ln c\left( {{\mathbf{y}},{\mathbf{w}},z_{0} ,t + 1} \right)} {\partial t}}} \right. \kern-0pt} {\partial t}}} \right) + \left( {{{\partial \ln c\left( {{\mathbf{y}},{\mathbf{w}},z_{0} t} \right)} \mathord{\left/ {\vphantom {{\partial \ln c\left( {{\mathbf{y}},{\mathbf{w}},z_{0} t} \right)} {\partial t}}} \right. \kern-0pt} {\partial t}}} \right)} \right]\) is the effect of cost reducing technical progress.

-

(d)

\(\left[ {CE_{t + 1} - CE_{t} } \right]\) is cost efficiency change.

-

(e)

\(- \tfrac{1}{2}\left[ {\varepsilon_{r0t + 1} + \varepsilon_{r0t} } \right]\left( {\ln r_{0t + 1} - \ln r_{0t} } \right)\) is the effect on productivity change of variation in the equity-asset ratio constraint.

3 Methodology and data

The stochastic frontier analysis regression to be estimated, with the error components v representing idiosyncratic error and u representing inefficiency, can be expressed succinctly as follows:

Here \({\mathbf{x^{\prime}}}_{it}\) is a (K + R + 2) vector of explanatory variables representing the input prices, outputs, time and the level of the fixed input equity capital including second order direct and cross product translog expressions. The range of panel data stochastic frontier analysis models reflects different assumptions about the nature of the composed error terms. Because experience suggests that parameter values can be sensitive to the form of the stochastic frontier analysis model that is fitted, we shall use a number of different types of these models. The literature here is immense but we can summarize it briefly as follows.

Within the strict panel data structure, many researchers have followed Schmidt and Sickles (1984) and Pitt and Lee (1981) in adopting a time-invariant model of inefficiency with a short panel; therefore the composed error term is written as: ɛ it = v it + u i . The model can be estimated by standard fixed effects using dummy variables (FE-LSDV), standard random effects with generalized least squares (RE-GLS), or by random effects maximum likelihood estimation (RE-MLE), as suggested by Pitt and Lee, if specific distributional assumptions are made, for example the truncated-normal distribution for the inefficiency term.

The RE-GLS and RE-MLE models usually provide very similar results. To incorporate the more general assumption of time-varying inefficiency, two broad approaches are possible. The inefficiency component can be made an explicit function of time: u it = u i h(t). Battese and Coelli (1992) use an exponential function which is the same across all producers and can be estimated by maximum likelihood with the appropriate distributional assumptions. These methods retain an explicit panel structure.

Firm specific heterogeneity may be incorporated through additional conditioning variables, and a pooled estimation technique based on some form of modified least squares could also be adopted. For example, by making use of the seemingly unrelated regression estimator based on generalized least squares SURE-GLS, we can obtain estimators which are relatively efficient and permit the error terms in the cost share equations to be related to the overall cost equation. This is a generalization which standard stochastic frontier analysis estimators are unable to provide (see Kumbhakar and Lovell 2000: 156–158).

Finally, Reifschneider and Stevenson (1991), and Battese and Coelli (1995) amongst others, suggested the strategy of making specific parameters of the inefficiency density function for u it conditional on time-varying exogenous variables (i.e. conditional mean or conditional heteroscedasticity). Numerous other models in the literature develop variants of these general procedures; for example, the “thick frontier” approach of Berger and Humphrey (1991) splits the sample into quantiles of the dependent variable and estimates average regressions for each quantile; the distribution-free approach of Berger (1993), which is similar in concept to RE-GLS, uses seemingly unrelated regression with generalized least squares (SURE-GLS) applied to each time period separately. Reflecting this discussion, the empirical results in this paper are derived from five broad categories of model. These are summarized in the “Appendix” as Table 7 of composed error specifications.

3.1 Data

The data are gathered from several major sources: Bankscope by Bureau van Dijk (2010), the Organisation for Economic Co-operation and Development (OECD) and World Bank databases. The bank data have been reported in $US millions at current prices and market exchange rates. We convert to constant price (year 2000) values by deflating the $US denominated data converted at market exchange rates by the US GDP deflator. Table 1 reports the range of countries and regions used in the sample, while summary statistics for our sample of 485 banks over the period 2005–2008 are reported in Table 2; these indicate the within sample variability of the pre-filtered raw data. Prior to data filtering we selected a balanced panel comprising the largest commercial banks within each country so that no country has fewer than six observations per year of the sample.

The definitions of the key variables in the cost function are standard in the current literature on bank performance (e.g., Bikker and Bos 2008). They are calculated from the constant price data as follows. Cost, C, is the total cost, that is, the sum of interest expenses, salaries and employee benefits and other operating costs. Outputs are: loans, y 1, securities investments, y 2, and off balance sheet total business volume, y 3. The loans variable used is net loans after allocating reserves for non-performing loans (NPLs). Equity capital (z 0) is reported separately in the Bankscope data base. On average, banks in the sample held equity capital ratios of about 11 % of total assets at this time—this not only met Basel requirements but also exceeded ratios typically held in the EU and other developed economies in the lead up to the financial crisis. The first two outputs, loans, y 1, securities investments, y 2, together account for total assets, (z 1). Input price indices are: the price of labour, w 1 , computed as salaries and employee benefits relative to total assets, the price of physical capital, computed as other operating expenses divided by fixed assets, w 2 , and the price of funds, computed as interest expenses relative to deposits and short term funding, w 3 . All of these industry variables are sourced from Bureau van Dijk (2010) for each bank and period in the sample, and all have been deflated as above. In addition to these key variables, banking system variables are used along with macroeconomic variables to condition the individual bank cost functions.

Macroeconomic variables are collected from the OECD and World Bank databases and vary through time but are constant across banks. They are measured as percentage rates of change. In this way the banking market is conditioned at the level of the macroeconomy before the beginning of the sample period; then the relative changes in the macroeconomic environment are treated as exogenous shocks. They are measured in differenced form to avoid the spurious correlation problem of entering macroeconomic trending variables in the cost regression. The macroeconomic environmental shocks used in the analysis are as follows:

-

(a)

Change in gross domestic product (GDP) at 2000 market prices;

-

(b)

Change in GDP at 2000 market prices per head of population.

These reflect the cyclical response to government macroeconomic policy as well as the impact of exogenous shocks from the external economy.

The banking system variables that can be derived from Bankscope for the emerging banks in the sample include: Loan loss reserve/Gross loans, Net interest margin, Return on assets, Return on equity, Cost to income ratio, Net loans/Total assets, Net loans/Customer and short term, Funding reserves for impaired loans/NPLs, Non-interest income/Gross revenues, Non-interest expense/Gross expenses, NPL/Gross loans, Reserves for NPL/Gross loans, Reserves for NPL/NPL, and Interbank assets/Interbank liabilities.

All of the data in the fitted regressions are log-mean-corrected, that is, expressed as deviations from the sample means after having been transformed to natural logarithms. This has three advantages: it ensures that the translog function which is an approximation to an arbitrary second order function has the point of approximation at the sample mean; it allows us to check the properties of the fitted translog function at the sample mean by examining the first order estimated coefficients; and it enables computation of the variance of linear functions of the estimated coefficients around the sample mean from the variance–covariance matrix of the regression coefficients. Finally, prior to estimation of the models, the data were filtered using the financial ratio rules suggested by Bikker and Bos (2008) together with the addition of a statistical criterion in which we estimated a simple pooled ordinary least squares (OLS) translog model for the whole sample and dropped observations with a standardized OLS residual exceeding 2 in absolute value. This statistical rule of thumb is approximately equivalent to capturing outliers in the data by an instrumental dummy variable at the 5 % level of significance. We refer the reader to Bikker and Bos (2008: 61–62, Table 9.2) for a full discussion of data-filtering rules using international banking data. The purpose of the rule-based filtering is to eliminate banks operating in special circumstances or with obviously erroneous data and with abnormal ratios between key variables.Footnote 6 These rule based and regression based filters resulted in reducing the sample from 1940 observations to 1786 observations so that 8 % of the initial balanced sample was filtered out by the combination of the rules and the standardized residual test.Footnote 7

After the filtering, all of the original countries remain in the sample in every year of the panel, and all of the geographical regions are represented in more or less the same proportions, although the data for South America are reduced slightly more than the others because of the impact on Brazil. Therefore we can confirm the stability of the sampled data set in terms of selected banks. In each country except one the filtering rules left at least 87 % of the sample remaining after applying the filtering tests. The exception is Brazil for which the tests deselected 44 % of the initial balanced sample; nevertheless, even after filtering, Brazil remains the second largest contributor to the sample accounting for 6 % of the observations.

4 Empirical results: parameter estimates and the shadow price of the equity-asset ratio

Regression results for the first order coefficients in the cost function fitted under different models are shown in Table 3, which presents: (1) the monotonicity effects, that is, elasticity function estimates at the sample mean, and (2) measures of the presence of inefficiency as a component of the error term and whether the inefficiency is time varying.

The regression coefficients on the first order terms,Footnote 8 that is, the cost function elasticities at the sample mean, are relatively consistent across the different econometric specifications. The models all fit well and there are no strong reasons to favour one over another. However, the SURE-GLS model which pools the data without a panel structure finds a negative effect from securities investment while at the same time suggesting that the shadow price of the equity-asset ratio constraint is higher than for other models and therefore we drop this model from the reported results. The four stochastic frontier analysis models all find a very consistent and statistically significant negative cost elasticity of −4.1 to −4.9 % on the capital constraint at the sample mean. Using the envelope theorem result in Eq. (5) above, this elasticity estimate is the negative of the shadow price of capital consequently we can see that the regulatory requirement to hold equity capital as a proportion of total assets is a strongly binding constraint at the sample mean. Applying matrix Eq. (11) to the whole sample makes it possible to determine the impact of this constraint at every sample point, and this is what emerges from the subsequent productivity change decomposition. At some sample points this elasticity function in the last row of matrix Eq. (11) turns positive indicating that we have identified an “Excessive Capitalizer” operating in the uneconomic region of the banking production function because it is having to achieve a much higher equity capital to assets ratio. It is at these sample points where the capital constraint will have a negative impact on productivity change, and they are identified in the subsequent analysis of the productivity change decomposition.

Amongst the four stochastic frontier analysis models the Reifschneider and Stevenson (1991) results indicate the significance of all of the output variables and have significant and theoretically correct first order elasticity estimates at the sample mean.

Each of the final banking system variables is statistically significant in at least one of the estimated models. The reported results indicate that the significant banking system variables fall into three types: loans relative to measures of scale with a higher ratio having negative cost elasticity, liquidity ratio again with negative elasticity and non-performing loans ratios relative to the average for the country.

The Panzar–Willig estimate of the elasticity of scale at the sample mean and the scale elasticity evaluated out of equilibrium, after adjusting for the regulated equity-assets ratio, are shown in Table 4; they indicate a small degree of increasing returns suggesting scope for some consolidation amongst the banking systems in emerging economies.

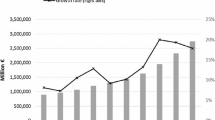

4.1 Empirical results: productivity measurement

In this section of the paper, we use the discrete index number calculation to decompose productivity change during the period encompassing the financial crisis. We could illustrate the impact by using any of the four composed error stochastic frontier analysis models since their coefficients are relatively stable across different approaches. For a number of reasons described above, the Reifschneider–Stevenson model seems to generate the most sensible results and we focus on that model to calculate the productivity decomposition. It is important to distinguish the interpretation of the productivity change components from that of the regression coefficients. As we see from Table 3, the models are all well-determined and the coefficients estimated with high precision; these strongly significant coefficients are then used through matrix Eq. (11) to generate the productivity components, but it is not possible to attach statistical significance to the numerically derived productivity change components in Tables 5 and 6 below. The essential point is that the productivity change estimates are derived from a regression model estimated with a high degree of precision and statistical significance, but the productivity change components are numerically derived by the application of matrix Eq. (11) and do not have corresponding standard errors. The numerical impacts are expressed as decimal fractions so that for example an impact of −0.006 is equivalent to a decline of more than half of 1 % in the rate of annual productivity change, which by conventional measures is a substantial impact.

Table 5 reports the productivity estimates and the component factors for this model; the decomposition covers scale efficiency change, technical change, efficiency change, allocative efficiency change, and constraint relaxation change. The last component illustrates how an enhanced regulatory requirement to build up a stronger equity-asset ratio during recapitalization may enhance or offset total factor productivity change over the period.

In Table 5 we see that total factor productivity change in emerging economy banking systems averaged over the sample period has been very slightly negative. The forces driving total factor productivity up have originated in scale efficiency change and allocative efficiency change. Regressive factors have been an apparent loss of technological progress and the impact of the equity-asset constraint. In other words, the need to maintain a certain level of capital has offset the positive forces on total factor productivity change during this critical period. Consistently over the period allocative and scale efficiency change have contributed positively to the performance of banking systems in transition economies. Efficiency change has improved after an initial negative start. Consequently the emerging economies’ banking systems have shown signs of resilience while the international financial system has been coping with its recent problems. However, cost performance has been weakened by a failure to take advantage of technological progress and by the need to maintain acceptable equity capital ratios. The capital adequacy constraint has contributed to the weak overall productivity performance.

These results can be seen in more detail when we disaggregate by country groupings in Table 6 to obtain the average productivity change components over time.

The impact of the capital constraint has been particularly strong for the Middle East (ME) and South East Asia (SEA). The deleveraging implied by a more strongly binding capital constraint and the consequent fact that the shadow return on equity turned negative for these regions has meant that the impact on total factor productivity has been regressive (the growth factor is below one). This allows us to say that this modelling approach provides a direct estimate of the productivity cost of constrained deleveraging activity arising from policy decisions. A key to understanding this effect is that it is regulatory requirements that conventionally drive re-capitalization activity, and therefore there is an interaction with the ability to generate productivity change through allocative efficiency gains so that enhanced regulatory requirements may have a second order indirect effect in mitigating the achievement of allocative efficiency improvement.Footnote 9

5 Conclusions and policy lessons

We have carried out an empirical analysis of the banking systems of a large number of emerging economies during a critical period for the international financial system. In doing this we focused on three aspects of the modelling problem. First, we chose to construct short run regulatory constrained total cost functions for the emerging economy banks. The regulatory constraint arises from equity-capital requirements imposed on the balance sheet. Second, we applied stochastic frontier analysis to these in order to identify sources of variability in economic performance. Third, we were able to derive from the estimated cost functions a decomposition of total factor productivity into: scale efficiency change, allocative efficiency change, technical change, efficiency change and the impact of the equity capital constraint.

We discovered that a variety of time-invariant and time-varying stochastic frontier analysis models produced consistent results for this sample period, but we were able to show that a time varying conditional heteroscedasticity model fitted the data particularly well. Amongst the empirical results that we were able to uncover, we confirm the importance of the regulated equity capital ratio as a constraint on cost minimizing behaviour. This has important policy implications. In the current state of worldwide recovery from the financial crisis, the issue of the recapitalization of the banking system is dominating the policy debate. This has a long run dimension, which is expressed in the question of whether greater reliance on equity capital will raise the long run funding costs of the banks. Policymakers seem relatively optimistic on this issue. However, the equity capital ratio also has a short run dimension: what are the adjustment costs that arise when a banking system recapitalizes? As we indicated at the beginning of the paper, this is an important and unresolved policy problem. This paper has suggested a way of measuring these adjustment costs by examining the role of the equity capital constraint in the determination of total factor productivity of the banking system. Our results suggest that there is a positive adjustment cost. However, it may be relatively small enough not to offset the recognized benefits of moving to a more securely based banking system that uses higher levels of equity capital.

Notes

In the aftermath of the 2007–2008 financial crisis, this issue has preoccupied regulators; a member of the US Senate Banking Committee asks: “What is the true cost to national economies of higher capital requirements for banks?” Senator Kay Hargan, letter to The Economist, June 4, 2010.

This shadow return is calculated from the negative of the elasticity of a bank’s cost function with respect to the level of equity capital, as shown later in the paper.

In the case where a fixed level of input is the constraint, the corresponding result is that the negative of the derivative of the variable cost function with respect to this fixed input is the input’s shadow price.

We are grateful to a reviewer for emphasizing the distinction between regulatory capital requirements and real balance sheet constraints.

We made an exception to the Bikker and Bos filtering rules. We adjusted the permitted upper bound of the equity asset ratio to 90 % if the observation simultaneously passed the regression standardised residual test—we did so because this variable is a key aspect of our analysis. This resulted in keeping in the sample 14 observations (0.8 % of the sample), chiefly of banks in South America, that the rule based criterion would have deselected.

The statistical standardised residual test has more impact on the sample selected than the rule based approach.

There are multiple second order and interaction coefficients too numerous to report here.

We acknowledge the suggestion of a reviewer in this comment.

References

Avkiran NK (1999) The evidence on efficiency gains: the role of mergers and the benefits to the public. J Bank Finance 23:991–1013

Battese GE, Coelli TJ (1992) Frontier production functions, technical efficiency and panel data: with application to paddy farmers in India. J Prod Anal 3:153–169

Battese GE, Coelli TJ (1995) A model for technical inefficiency effects in a stochastic frontier production function for panel data. Empir Econ 20:325–332

Bauer PW (1990) Decomposing TFP growth in the presence of cost inefficiency, nonconstant returns to scale, and technological progress. J Prod Anal 1:287–299

Beccalli E, Casu B, Girardone C (2006) Efficiency and stock performance in European banking. J Bus Finance Account 33:245–262

Berger AN (1993) Distribution-free estimates of efficiency in the US banking industry and tests of standard distributional assumptions. J Prod Anal 4(3):261–292

Berger AN, Humphrey DB (1991) The dominance of inefficiencies over scale and product mix economies in banking. J Monet Econ 28:117–148

Berger AN, Humphrey DB (1997) Efficiency of financial institutions: international survey and directions for future research. Eur J Oper Res 98:175–212

Bikker JA, Bos JWB (2008) Bank performance: a theoretical and empirical framework for the analysis of profitability, competition and efficiency. Routledge, London

Braeutigam RR, Daughety AF (1983) On the estimation of returns to scale using variable cost functions. Econ Lett 11:25–31

Brissimis SN, Delis MD, Papanikolaou NI (2008) Exploring the nexus between banking sector reform and performance: evidence from newly acceded EU countries. J Bank Finance 32:2674–2683

Bureau van Dijk (2010) Bankscope database. http://www.bvdinfo.com/Home.aspx. Accessed 3 Nov 2012

Canhoto A, Dermine J (2003) A note on banking efficiency in Portugal: new vs old banks. J Bank Finance 27:2087–2098

Casu B, Molyneux P (2003) A comparative study of efficiency in European banking. Appl Econ 35:1865–1876

Cuesta RA, Orea L (2002) Merger and technical efficiency in Spanish savings banks: a stochastic distance function approach. J Bank Finance 26:2231–2247

Daniel BC, Jones JB (2007) Financial liberalization and banking crises in emerging economies. J Int Econ 72:202–221

Delis MD, Koutsomanoli-Fillipaki A, Staikouras CK, Gerogiannaki K (2009) Evaluating cost and profit efficiency: a comparison of parametric and nonparametric methodologies. Appl Financ Econ 19:191–202

Erdem C, Erdem MS (2008) Turkish banking efficiency and its relation to stock performance. Appl Econ Lett 15:207–211

Fethi M Duygun, Pasiouras F (2010) Assessing bank efficiency and performance with operational research and artificial intelligence techniques: a survey. Eur J Oper Res 204(2):189–198

Fethi M Duygun, Shaban M, Weyman-Jones T (2011) Liberalization, privatization and the productivity of Egyptian banks: a non-parametric approach. Serv Ind J 31:1143–1163

Fethi M Duygun, Shaban M, Weyman-Jones T (2012) Turkish banking re-capitalization and the financial crisis: an efficiency and productivity analysis. Emerg Mark Finance Trade 48(5):76–90

Havrylchyk O (2006) Efficiency of the Polish banking industry: foreign versus domestic banks. J Bank Finance 30:1975–1996

Hughes JP, Mester LJ, Moon C-G (2001) Are scale economies in banking elusive or illusive? Evidence obtained by incorporating capital structure and risk taking into models of bank production. J Bank Finance 25:2169–2208

Isik I, Hassan MK (2003) Financial deregulation and total factor productivity change: an empirical study of Turkish commercial banks. J Bank Finance 27:1455–1485

Koutsomanoli-Filippaki A, Margaritis D, Staikouras C (2009) Efficiency and productivity growth in the banking industry of central and Eastern Europe. J Bank Finance 33:557–567

Kumbhakar S, Lovell CAK (2000) Stochastic frontier analysis. Cambridge University Press, Cambridge

Lozano-Vivas A, Kumbhakar SC, Fethi MD, Shaban M (2011) Consolidation in the European banking industry: How effective is it? J Prod Anal 36:247–261

Orea L (2002) A generalised parametric Malmquist productivity index. J Prod Anal 18:5–22

Panzar J, Willig R (1977) Economies of scale in multi-output production. Q J Econ 8(August):48l–493

Pitt MM, Lee L-F (1981) Measurement and sources of technical inefficiency in the Indonesian weaving industry. J Dev Econ 9:43–64

Reifschneider D, Stevenson R (1991) Systematic departures from the frontier: a framework for the analysis of firm efficiency. Int Econ Rev 32(3):715–723

Schmidt P, Sickles RC (1984) Production frontiers and panel data. J Bus Econ Stat 2:367–374

Sherman HD, Rupert TJ (2006) Do bank mergers have hidden or foregone value? Realized and unrealized operating synergies in one bank merger. Eur J Oper Res 168:253–268

Sturm J-E, Williams B (2004) Foreign bank entry, deregulation and bank efficiency: lessons from the Australian experience. J Bank Finance 28:1775–1799

Tsionas EG, Lolos SEG, Christopoulos DK (2003) The performance of the Greek banking system in view of the EMU: results from a non-parametric approach. Econ Model 20:571–592

Acknowledgments

We would like to thank the anonymous referees and the participants of the VI Seminar on Risk, Financial Stability and Banking of the Banco Central do Brasil in São Paulo and our paper’s discussant, Emanuel Kohlscheen, for valuable comments and helpful suggestions.

Author information

Authors and Affiliations

Corresponding author

Appendix

Rights and permissions

About this article

Cite this article

Duygun, M., Shaban, M., Sickles, R.C. et al. How a regulatory capital requirement affects banks’ productivity: an application to emerging economies. J Prod Anal 44, 237–248 (2015). https://doi.org/10.1007/s11123-015-0451-1

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11123-015-0451-1

Keywords

- Banking

- Efficiency and productivity analysis

- Shadow price

- Cost function

- Regulated capital

- Bank capitalization