Abstract

We develop a method for eco-efficiency analysis of consumer durables that is based on Data Envelopment Analysis (DEA). In contrast to previous product efficiency studies, we consider the measurement problem from the policy perspective. The innovation of the paper is to measure efficiency in terms of absolute shadow prices that are optimized endogenously within the model to maximize efficiency of the good. Thus, the efficiency measure has a direct economic interpretation as a monetary loss due to inefficiency, expressed in some currency unit. The advantages as well as technical differences between the proposed approach and the traditional production-side methods are discussed in detail. We illustrate the approach by an application to eco-efficiency evaluation of Sport Utility Vehicles.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The use of consumer durables such as automobiles or washing machines generates multiple economic benefits and costs to consumers. In addition to the economic impacts, consumer durables also cause pressures on the ecosystem. Eco-efficiency of a consumer durable refers to the capability to produce net economic benefit by polluting the environment and using natural resources as little as possible. The more economic benefits or services a certain product can produce for given economic and environmental costs, the more eco-efficient it is and the more value it provides. Environmental pressures occur throughout the product’s life-cycle, including the production, use, and disposal phases. For most consumer durables, the use phase creates the main environmental burden. In practice, it is very difficult to attribute the environmental burden from production and disposal stages to a specific product. Footnote 1

To assess the performance or eco-efficiency of consumer durables, it is natural to consider a consumer durable as a production unit that demands inputs (such as energy, water, and other resources) to produce outputs (desirable services and undesirable environmental effects). Footnote 2 Adopting this perspective enables us to apply the traditional production theory and the sophisticated quantitative methods of efficiency analysis developed therein. In particular, we draw insights from the activity analysis (Koopmans 1951) and Data Envelopment Analysis (DEA: Farrell 1957; Charnes et al. 1978) approaches, which are widely used nonparametric methods, particularly developed for comparative performance assessment. These approaches do not require arbitrary prior specification of weights and can also take different kinds of economic impacts into consideration.

Activity analysis and DEA have been applied to the measurement of environmental efficiency or eco-efficiency in numerous studies (see e.g., Färe et al. 1989; Tyteca 1996; Kuosmanen and Kortelainen 2005; and references therein). However, these studies focus exclusively on the production phase, assessing eco-efficiency at the level of firms and production units. Indeed, eco-efficiency of the final products (i.e., outputs of the production process) has been neglected in this literature so far. On the other hand, a number of authors have used DEA for the evaluation of consumer durables. These studies tend to assess product characteristics from an engineering or marketing perspective, paying little, if any, attention to environmental sustainability (see e.g., Doyle and Green 1991, 1994; Odeck and Hjalmarsson 1996; Fernandez-Castro and Smith 2002; Staat et al. 2002). In these studies, products are usually regarded as production units that use some inputs (costs) to produce some outputs (services), while their burden on the ecosystem has been left aside.

In this paper, we consider a combination of these two approaches: we develop a general method for analyzing eco-efficiency of consumer durables during their use phase. While we acknowledge the importance of the production and disposal phases on environmental sustainability, we believe these phases are best addressed in separate eco-efficiency assessments at the firm or plant level (see e.g., Kuosmanen and Kortelainen 2005). Therefore, we hereafter limit attention on eco-efficiency in the use phase.

While we draw influence from earlier activity analysis and DEA approaches, our approach diverges from them in many important respects. The main difference is that we take a policy maker perspective to the measurement problem, while preserving the production theoretic view of the consumer durable as a production unit that produces services for the consumer. This view leads us to explore new technical solutions (which will be discussed in more detail in Sects. 3 and 4). Perhaps the most important innovation of this paper is to measure eco-efficiency in terms of absolute rather than relative prices. By absolute prices we mean prices that are expressed in terms of some well-defined unit of measurement (e.g., €/kg), whereas relative prices refer to normalized prices or weights that are not anchored in any currency. It should be emphasized that, in our analysis, the prices are not given a priori but are endogenously determined within our model, like the usual shadow prices in DEA. To our knowledge, only Womer et al. (2003) have earlier considered a DEA model with absolute-scale shadow prices; yet the rationale behind their method is very different from that of the present paper. Footnote 3 One advantage of using absolute rather than relative prices is that our efficiency measure has a direct economic interpretation as a monetary loss due to inefficiency, expressed in the chosen currency (e.g., €). Also the interpretation of shadow prices becomes more obvious, as one can link them to prices observed in the real markets. This also makes it easier to impose restrictions on the feasible range of prices. To show how the approach can be used in practice, we apply it to eco-efficiency assessment of automobiles.

The remainder of this paper unfolds as follows. Section 2 presents the general setting for evaluation of consumer durables. Section 3 presents the absolute shadow price method for eco-efficiency measurement. Section 4 presents the dual problem and compares the technical differences between the proposed approach and the traditional production-side methods. Section 5 considers certain extensions and modifications to absolute shadow price approach. After this, Section 6 applies the presented methodology to the measurement of eco-efficiency of Sport Utility Vehicles (SUVs). Finally, Sect. 7 presents the concluding remarks.

2 Setting

2.1 Environmental pressures versus undesirable outputs

This section presents the general setting for efficiency analysis of consumer durables. We avoid unnecessary formalism and focus on verbal explanation. Some formal notation will be introduced for the purposes of the subsequent sections. Before presenting the main ideas, the notion of “environmental pressure” requires more detailed explanation.

One important difference to the earlier environmental performance studies in the productive efficiency literature is that we focus on environmental pressures rather than specific undesirable outputs (or pollutants) per se. Undesirable outputs usually refer to different kinds of undesirable side-products and side-effects of production, which include, for example, the generation of (non-recycled) solid waste, emission of substances to air and water and non-material side-effects such as noise. Each undesirable output includes only one individual pollutant or emission (such as CO2 or SO2), whereas environmental pressure refers to a broader environmental theme that is influenced by multiple pollutants contributing to the same environmental problem. For example, production (or product) could generate two different undesirable outputs: carbon-dioxide (CO2) and methane (CH4), which contribute to the same environmental problem, the greenhouse effect. Numerous studies have investigated the effects of different greenhouse gases, and scientifically sound conversion factors are available for translating the amounts of different greenhouse gases into carbon-dioxide equivalents. Besides greenhouse gases it is often possible and meaningful to aggregate individual pollutants that contribute to the same environmental theme in a single overall measure for a specific environmental pressure using conversion factors from environmental impact assessment studies. See Kuosmanen and Kortelainen (2005) for further discussion about aggregation possibilities.

Table 1 illustrates the relationship between undesirable outputs and environmental pressures in the context of automobiles (see Sect. 6 for further discussion). The first column of Table 1 lists the main undesirable outputs emitted to the environment while driving a car. The second column indicates the environmental pressures caused by the specific group of outputs. Some environmental pressures (e.g., smog formation) are caused by a single undesirable output, while climate change and acidification are influenced by several alternative pollutants. Some harmful substances may even contribute to several environmental pressures, although this is not the case in Table 1. Footnote 4 To assess a given environmental theme, different pollutants affecting the same environmental pressure can usually be aggregated based on their relative damage impact, as discussed above. By contrast, there is no unambiguous way to summarize all the different pressures into a single overall environmental damage index. For example, we cannot simply add greenhouse gases measured in CO2 equivalents to particle emissions measured in tons of TPM. While this example pertains to the case of road transportation, which in industrialized countries is one of the main sources of air emissions, the similar type of aggregation possibilities and problems are faced equally well in other industries and at all levels of aggregation.

2.2 Theoretical setting

Suppose there are N alternative (comparable) models of the consumer durable available. Use of consumer durables typically offers private economic benefits and costs for the consumer and external environmental costs for the society. As a consequence, it is sensible to consider the measurement problem from the perspective of a policy maker who evaluates consumer durables for regulatory purposes, but also takes the private net benefits into account. However, the specific definition of the policy maker, or the distinction between private and social net benefits, will be immaterial for the purposes of our DEA approach.

To assess eco-efficiency of a product, we need to account for both private net economic benefits and external social costs that arise during the use phase of the product’s life-cycle. However, since the duration of the use phase is difficult to predict, we find it most meaningful to analyze the economic benefits and costs and the environmental pressures associated with a single run or performance of a consumer durable. For example, in the case of washing machines, it would be reasonable to measure environmental pressures and economic benefits and costs per one washing time.

Suppose the use of these N consumer durables generates L different desirable services to consumers, as well as M environmental pressures to the environment. Since economic costs are usually easy to calculate, we assume that the total marginal cost per one performance, denoted by C k (k = 1,...,N), is known. We also assume that both services and environmental pressures can be quantified unambiguously. The services provided by consumer durable k in a single performance are represented numerically by vector \({\mathbf{Y}_k =\left({Y_{k1}\ldots Y_{kL}} \right)^{\prime}}\) and the associated environmental pressures by vector \({\mathbf{Z}_{k} =\left({Z_{k1}\ldots Z_{kM}} \right)^{\prime}}\) , respectively.

We propose to approach the policy maker’s evaluation problem from the perspective of Pareto efficiency, asking whether the use of a particular consumer durable is Pareto efficient from the social point of view. Suppose the external environmental effects could be “internalized”, for example by creating markets for transferable emission permits, so that the consumer who uses the good has to pay the social cost of environmental damage in addition to the use cost. In such a hypothetical case, the free markets offer an effective mechanism for pricing the services Y and the environmental pressures Z, taking into account both consumer preferences and the firms’ production possibilities, resulting in a Pareto efficient allocation. This result is known as the first fundamental theorem of welfare economics. Conversely, if any allocation is Pareto efficient, irrespective of how efficiency is achieved, then there must exists a set of prices, called “efficiency prices” by Koopmans (1951), at which no consumer or firm is willing to trade goods in the market. This result is known as the second fundamental theorem of welfare economics. Note that the efficiency prices need not result as an outcome of perfectly competitive markets, but the efficiency prices might be equally well determined by a social planner (consider e.g., an emission tax). Moreover, note that the prices of the attributes Y and Z need not be explicitly listed on the market place, but may be implicitly represented in the price of the non-homogenous goods. If individual’s utility is a function of the attributes Y and Z, as in Lancaster’s (1966) theory of consumer choice, then Pareto efficiency requires existence of efficiency prices for the attributes. Indeed, there exists a vast literature on hedonic estimation that focuses on recovering such attribute prices from the empirical market data.

Suppose for a moment that a unique set of efficiency prices exist, which are represented by vector \({\mathbf{P}=\left({P_1 \ldots P_L} \right)^{\prime }}\) for services Y and by vector \({\mathbf{U}=\left({U_1 \ldots U_M}\right)^{\prime}}\) for the environmental pressures, respectively. The social value added created by a single performance of consumer durable k can now be measured by

where the first term \({\mathbf{P}^{\mathbf{\prime}}\mathbf{Y}_k }\) represents the gross economic value of one performance of consumer durable k, the second term represents the economic cost, and the last term represents the social cost of the environmental pressures expressed in money, respectively. Since all efficiency prices are in monetary units, the total VA k is also measured in money.

In this study we do not try to impose or estimate any efficiency prices. Efficiency prices would depend on the initial allocation of resources and emission permits in the free market, or the social planner’s perception of what is good for the society (i.e., the social welfare function). In the spirit of Pareto and Koopmans, we call a consumer durable efficient if there exists a set of non-negative efficiency prices at which the evaluated good would be adopted in use. In other words, we test if any society, irrespective of individuals’ preferences, would find it Pareto optimal to use the evaluated good. For transparency, we shall refer to the “true” efficiency prices by capital letters P, U, and reserve the lower case \({\mathbf{p}_{k}}\) and \({\mathbf{u}_{k}}\) for the model variables that show the performance of good k in the most favorable light.

3 DEA approach using absolute shadow prices

The previous section presented the theoretical setting and showed how value added scores can be calculated with the help of efficiency prices. We next present our approach for eco-efficiency analysis of consumer durables based on Data Envelopment Analysis (DEA). We consider DEA as the most suitable tool for this problem, because in addition to efficiency scores it can give us optimal shadow prices that present every consumer durable in the most favorable light compared to other products. Further, as prices are optimized endogenously within the DEA model, one does not need any a priori arbitrary assumption as on how to set these prices. In this context this property is very important, because we do not typically have any information about the prices of environmental pressures.

The key idea of our approach is to test whether there are any nonnegative prices at which consumer durable k is efficient. In order to be efficient, product k needs to fulfill the following two conditions.

-

(1)

Inactivity condition: the value added of the consumer durable has to be nonnegative at the optimal prices. Formally, there must exist prices \({\mathbf{p}_k,\mathbf{u}_k \ge \mathbf{0}}\) such that \({\mathbf{p}_k \mathbf{Y}_k -C_k -\mathbf{u}_k \mathbf{Z}_k \ge 0.}\)

-

(2)

Optimality: the consumer durable must be the optimal choice at some prices. Formally, there must exist prices \({\mathbf{p}_k ,\mathbf{u}_k \ge \mathbf{0}}\) such that the inequality

$$ (\mathbf{p}_k \mathbf{Y}_k -C_k -\mathbf{u}_k \mathbf{Z}_k )-(\mathbf{p}_k \mathbf{Y}_n -C_n -\mathbf{u}_k \mathbf{Z}_n)\ge 0, $$(2)is satisfied for all n∈1,..., N.

The rationale of the inactivity condition is to ensure that no consumption occurs if the costs outweigh the benefits; this condition implies that the vector \({(\mathbf{y},c,\mathbf{z})=(\mathbf{0},0,\mathbf{0})}\) is feasible. To test these two conditions simultaneously, we propose to impose the inactivity condition as a price constraint, and maximize the minimum value of differences (2) of the optimality condition. That is, we impose the inactivity constraint for all testable goods (i.e., for both inefficient and efficient products) as a necessary but not sufficient condition, whereas the optimality condition only holds for the subset of efficient goods. Focusing on consumer durable k, we solve the following linear programming problem

The first N linear constraints in (3) compare in pair-wise fashion the value added of good k relative to all goods in the sample, calculated using the shadow prices. The constraint is binding only for the best product in the reference group. Thus, efficiency score EE k can be interpreted as a difference between value added score of consumer durable k and the score of the best product in the reference group at the given prices. The solution of (3) gives both shadow prices \({\mathbf{p}_{\rm k}^{\ast},\mathbf{u}_{\rm k}^{\ast}}\) and the optimal efficiency score EE k * for consumer durable k. Further, since the efficiency score is calculated by using the most favorable prices, we may interpret efficiency score EE * k as an upper bound for the true efficiency in a single performance of the evaluated good.

Practically, efficiency score EE * k indicates the minimum monetary loss that the use of one service of consumer durable k can offer compared to the best alternative. Note that if the best product in the reference group at the given prices is the evaluated consumer durable itself, then that product is given efficiency score of zero and is qualified as efficient. If the optimal solution EE * k to problem (3) is negative, this means that product k cannot be socially optimal at any non-negative prices for outputs and environmental pressures. Whatever the true efficiency prices might be, there exists another good—or a combination thereof—that yields a higher social value added. Hence, consumer goods with negative efficiency scores can be regarded as inefficient.

To classify a good as eco-efficient, we also require that the shadow price of at least one environmental pressure must be positive. Using the efficiency measures and the shadow prices, we may classify the goods in following categories:

-

1.

Efficient goods

-

1a.

Eco-efficient goods: EE * k = 0 such that \({\exists\mathbf{u}_k^{\ast} \ne\mathbf{0}}.\)

-

1b.

Weakly efficient, economical goods: EE * k = 0 only for \({\mathbf{u}_k^{\ast} =\mathbf{0}}.\)

-

1a.

-

2.

Inefficient goods

-

2a.

Inefficient, environmentally less harmful goods: EE * k < 0 and \({\mathbf{u}_k^{\ast} \ne \mathbf{0}}.\)

-

2b.

Inefficient, environmentally harmful goods: EE * k < 0 and \({\mathbf{u}_k^{\ast} = \mathbf{0}}.\)

-

2a.

Group 1 includes commodities that can be efficient in use. The group 1a consists of eco-efficient goods, while goods in group 1b are efficient only because of their relatively low operating costs. Note that the optimal shadow prices \({\mathbf{p}_{k}^{\ast},\mathbf{u}_{k}^{\ast}}\) obtained from (3) for an efficient good (group 1) are usually not unique. Therefore, one should test for the uniqueness of the shadow prices when EE * k = 0 and \({\mathbf{u}_k^{\ast} =\mathbf{0}}\) (see e.g., Kuosmanen et al. 2006, for a description of a uniqueness test). If the evaluated product is efficient only when \({\mathbf{u}_k^{\ast} = \mathbf{0}}\), it belongs to group 1b (i.e., weakly efficient goods). Instead, if the evaluated product is efficient both when \({\mathbf{u}_k^{\ast} = \mathbf{0}}\) and for some \({\mathbf{u}_k^{\ast} \ne \mathbf{0}}\), the product is classified to group 1a. Note that within this group, we could further separate the products that are efficient only under \({\mathbf{u}_k^{\ast} \ne\mathbf{0}}\) from the products that can be efficient both under positive and zero environmental prices. A more detailed classification of group 1a could also take into account the environmental themes in which the good has positive shadow price. Environmental policy measures (e.g., green taxes or subsidies) could be implemented to increase the market share of group 1a relative to group 1b.

Group 2 consists of goods that are inefficient in use from the social point of view. These goods may appeal to consumers with a low retail price. By green taxes or subsidies, the government may discourage the consumption of goods in group 2b. Supporting consumption of goods in group 2a with direct policy measures is inefficient from social point of view. However, indirect policy measures that influence the use costs C could help to upgrade some goods from group 2a to 1a.

We will illustrate the efficiency classification by a simple numerical example in Sect. 4. But to gain more insight, let us first consider the dual problem of (3).

4 Dual formulation

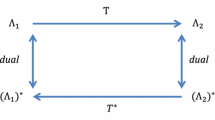

Our value added based efficiency measure was formulated in the difference form, with money as the unit of measurement, analogous to Nerlove’s (1965) profit efficiency measure. This observation presents an immediate link to the directional distance function frequently used in the environmental performance analysis: the directional distance function has a dual formulation as profit efficiency at the normalized prices (Chambers et al. 1998).

The dual problem of (3) further clarifies the relationship between the absolute shadow price approach and the directional distance function. Introducing vector \({\mathbf{C}=(C_1 \ldots C_N )^{\prime}}\), and matrices \({\vec {\mathbf{Y}}=(\mathbf{Y}_1 \ldots \mathbf{Y}_N)^{\prime}}\) and \({\vec {\mathbf{Z}}=(\mathbf{Z}_1 \ldots \mathbf{Z}_N)^{\prime}}\), we can write the dual as:Footnote 5

Variable θ represents the shadow price of the inactivity constraint \({\mathbf{p}_k\mathbf{Y}_k-\mathbf{C}_k-\mathbf{u}_k\mathbf{Z}_k \ge 0}\) of the primal problem (3). This variable enables upward scaling of the values of the evaluated commodity k. As far as the reference technology is concerned, an upward scaling of the evaluated commodity is equivalent to a downward scaling of the intensity weights \({\varvec{\lambda}}\). Therefore, an efficient commodity must lie on the boundary of the non-increasing returns to scale (NIRS) reference technology. However, the scaling also influences the efficiency measure. Therefore, problem (4) is not merely a special case of the NIRS DEA model, as we will show next.

Note first that excluding the inactivity constraint from the primal would correspond to setting θ = 0, in which case the dual problem would simplify to

This expression can be interpreted as the directional distance function, with direction vector \({(g_C,\mathbf{g}_\mathbf{Y}, \mathbf{g}_\mathbf{Z})=(1,\mathbf{0, 0})}\) , evaluated with respect to a variable returns to scale DEA technology. Comparison of problems (4) and (5) reveals the unique character of the inactivity constraint. To gain further intuition, we can re-express (4) in the directional distance function form. Let us normalize the intensity weights by denoting \({\varvec{\kappa= \lambda}/(1+\theta)}\) . This allows us to write (4) as

which resembles the directional distance function with the direction vector \({(g_C,\mathbf{g}_Y,\mathbf{g}_Z)=(\varvec{\kappa 1, 0, 0})}\) , evaluated with respect to a constant returns to scale DEA technology. However, the difficulty of this interpretation is that the direction vector is not an ex ante given constant: the norm of the direction vector depends on the sum of the intensity weights. Thus, we conclude that our approach does not reduce to a special case of the directional distance function or any other formulation proposed in the literature.

Let us now illustrate the geometrical interpretation of our model and the efficiency classification by a simple numerical example involving five goods and a single output, a single environmental pressure and total cost variable. Table 2 reports both the data for these products and efficiency scores and shadow prices given by the model. The example is further illustrated graphically by means of an isoquant map in Fig. 1. The vertical axis represents the quantity of environmental pressure and the horizontal axis the total costs. Points A–E indicate the costs and environmental pressure of the corresponding good. Triangles OAB and ABC represent the efficient frontier of the NIRS reference technology, as seen from above from the bird perspective. The isoquant lines (i.e., the broken lines) indicate all environmental pressure—total cost combinations that can produce the indicated output quantity.

Since points A, B, and C lie on the isoquants corresponding to the output level of the goods, all three goods are classified as efficient. For each of these points, there exist positive prices for environmental pressures at which these points will yield the maximum value added. Thus all three points are classified as eco-efficient (and hence belong to group 1a). Hypothetical goods of group 1b would be located on the vertical parts of the isoquants.

Next, consider the classification of observations D and E. Both these observations lie in the interior of the level set for Y = 4, and are therefore classified as inefficient. The arrows indicate the direction in which these points will be projected to the frontier; however, the reference points suggested by the diagram are not fully accurate due to the effect of the scaling variable θ (i.e., the shadow price of the inactivity constraint). For good D, the shadow price of the environmental pressure is positive, and thus, good D is classified as inefficient but environmentally less harmful product. For good E, the shadow price of the environmental pressure will be zero; good E is classified as inefficient, environmentally harmful good.

More generally, let us consider a hypothetical inefficient observation whose output level is 4. We can see from Fig. 1 that the shadow price of the environmental pressure will be positive if the environmental pressure falls within range [1.333, 6]. If the environmental pressure is higher than 6, its shadow price will be set equal to zero.

5 Extensions and modifications

Thus far we have assumed that the total operating costs C are known, and we have normalized the “shadow price” of cost C k as one. This is a natural choice since costs are measured in money, and data about the operating costs are often available. By contrast, the economic prices of the services Y and environmental pressures Z are typically unknown. Our choice of cost C k as the numeraire has been guided by the data availability in typical applications.

Of course, if the price of some specific input or output (or even the price of certain environmental pressure) is known, we could choose it as the numeraire instead of the operating cost. The practical implementation of such alternative normalizations in problem (3) is rather straightforward, and will not be discussed in more detail here. On the other hand, even if all prices (and costs) are unknown (which is sometimes the case), it may be useful to select one output or input as a numeraire commodity, and express all prices in terms of this numeraire. The absolute interpretation of the eco-efficiency is then conditional upon the specific price value for that selected commodity.Footnote 6

In the proposed method, the only restriction for prices of outputs and environmental pressures is that they have to be nonnegative. As a consequence, the primal problem (3) allows for rather extreme pricing scenarios. For example, a certain product can be considered eco-efficient, although its output prices may become unrealistically high by virtue of optimization. Therefore, if we have some a priori information concerning true prices, in some situations it can be reasonable to impose price or domain restrictions on the admissible prices, as in the weight-restricted DEA approaches.Footnote 7

Price restrictions can usually be set either on objective or subjective grounds. It is worth emphasizing that the absolute shadow prices suggested above also enable us to impose absolute price restrictions of the form α m ≤ u m ≤ β m , which restricts the price of environmental pressure m to the closed interval [ α m ,β m ]. We note that this contrasts with the usual DEA practice, which typically do not employ absolute weight restrictions (see Dyson et al. 2001, for discussion). From the perspective of policy maker the absolute restrictions are usually more accessible and transparent than relative restrictions, since lower and upper bounds have a more meaningful interpretation. Furthermore, it is rather easy to include absolute weight restrictions to the presented framework. Although absolute price restrictions are more meaningful, conventional relative price restrictions can also be used as well.

One alternative modification to the presented approach is to change the reference group in (3) so that the evaluated good cannot be compared with itself. Such adjustment would be directly analogous with the super-efficiency approach by Andersen and Petersen (1993). In the super-efficiency approach, the eco-efficiency measure indicates how well consumer durable k performs relative to its best competitor (i.e., the best other product). The value is positive, if product k performs better than its best competitor at the given optimal prices. The value is negative, if its value added is lower than that of any other product. The advantages of this approach include the following: 1) it is possible to measure the comparative advantage of the efficient products and 2) it is possible to find unique shadow prices also for the efficient products. On the other hand, the important problem related to super-efficiency approach is that in the primal problem prices can go up to infinity such that the solution of the primal problem is also infinite. This problem results from the form of the model: since the comparison product is not included in the reference group, it is possible that the linear programming problem cannot be solved. However, if the super-efficiency approach has a finite optimal solution, its shadow prices can in some situations provide further complementary information.

6 Eco-efficiency of sport utility vehicles

6.1 Setting

In this section we demonstrate how the presented approach can be applied to the real-world case of eco-efficiency assessment of car models. Generally, automobiles are extremely differentiated products, since many characteristics vary considerably among different brands and models. Therefore, it is not meaningful to compare cars that differ heavily with respect to their technology and product characteristics. To guarantee sufficient homogeneity we will focus on evaluating eco-efficiency of Sport Utility Vehicles (SUVs) that can generally be considered as fairly homogeneous products.

A number of earlier studies have applied DEA for performance evaluation of products, and some of these studies have assessed efficiency of cars (e.g., Papahristodoulou 1997; Fernandez-Castro and Smith 2002; Staat et al. 2002). To our knowledge, however, earlier DEA product evaluation studies have not paid attention to the environmental burden generated by the products. This is quite surprising given that private automobiles are major contributors to the global greenhouse effect, transboundary acidification problem, particle emissions, and smog formation. Besides pollutants and emissions, car traffic also creates other notable side-effects such as noise. Together, all these different environmental effects present a great challenge for the evaluation of environmental pressures and further, eco-efficiency.

The main purpose of this application is to demonstrate how the presented approach can be used for eco-efficiency evaluation in practice. From an environmental point of view, one of the most interesting issues is whether the gasoline and diesel engine vehicles differ with respect to their environmental performance. Hence, we examine the effect of engine type on the eco-efficiency of SUVs. A second important aim is to compare our approach to more traditional DEA models based on relative shadow prices. For this purpose, we use the environmental efficiency DEA approach where emissions are modeled as negative outputs. This approach has been suggested by many authors (e.g., Scheel 2001; Korhonen and Luptacik 2004) and used in many environmental efficiency applications. From various specifications presented in literature, this approach comes closest to our method. This comparison helps to understand the differences between absolute shadow price approach and traditional DEA in greater depth.

6.2 Data

In accordance with our theoretical framework, the application focuses on the use phase. Thus we have to take into account environmental pressures, economic outputs (or services) and costs that the use of automobiles generates. It is reasonable to focus on the marginal costs and environmental pressures associated with a 1 km drive with the vehicle.

Our data set is based on the database of the Finnish Vehicle Administration (AKE) and it includes the total of 88 different models from 8 different manufacturers (Chevrolet, Hyundai, Jeep, Land Rover, Mitsubishi, Nissan, Suzuki and Toyota). From these, 49 are gasoline engine and 39 diesel engine vehicles. The data are based on the technical inspections carried out by AKE before a model is approved a sales license in Finland (every approved model must meet certain criteria related to safety and emissions). Although the database covers the most important economic and environmental variables, many important characteristics related to safety and comfort are not available.

To a large extent, the economic value of safety and comfort features depends on motorists’ subjective perceptions, which are difficult to quantify and evaluate objectively. Here, we do not cover indicators for immaterial benefits associated with owning and driving a car, but focus exclusively on its primary transportation function. For comparison, we assume that all SUV models are driven at the same speed to transport the same (unspecified) load of passengers and cargo, which is less than the maximum capacity of any of the vehicles. As a consequence, our analysis includes only one output, the mileage, which has the same value (1 km) for all vehicles. The value of all the benefits per 1 km of transportation service is represented by the output price p, which is treated as an unknown variable. Since all vehicles are assumed to produce a homogenous service, the true price is the same across all vehicles. Still, the shadow prices of output will differ across the vehicles due to the uncertainty regarding the true price.

To calculate absolute efficiency scores and absolute shadow prices, we have to fix a certain price or total costs. In this application, it is natural to measure efficiency with respect to costs (i.e., fix the price of total economic costs), because information about costs or input prices is readily available. Given our focus on the transportation function, the total economic cost will in this case consist of the fuel costs.Footnote 8 Since we compare efficiency of the gasoline and diesel engine vehicles from the social point of view, we use tax-free prices for both gasoline and diesel fuels. After all, the retail prices of fuels already include taxes that are (at least partly) motivated by environmental policy arguments. Thus, the fuel costs were calculated by multiplying the average fuel consumption (l/km) by the price of 0.52 Euro per liter for gasoline vehicles and by 0.54 Euro per liter for diesel vehicles; the prevailing tax-free fuel prices in Finland at the time of the analysis.

We accounted for five different environmental pressure categories: climate change, acidification, smog formation, dispersion of particles and noise. From various greenhouse gases, the data include carbon monoxide (CO) and carbon dioxide (CO2) emissions, which form the climate change category. Other environmental pressures, on the other hand, are only represented by one emission or burden: nitrogen oxides NO x (g/km) for acidification, hydrocarbons HC (g/km) for smog formation, total particulate matter TPM for dispersion of particles and the noise level (dB) in the speed of 50 km/h for the noise variable. Descriptive statistics of environmental pressures and total costs are provided in Table 3.

Before proceeding to the results, we note that the sample of SUV models and their associated data represent the situation in Finland. The fuel prices differ across countries, and also the vehicles themselves are adapted to the technical requirements of the market area. For these reasons, the results that follow do not directly apply to SUV markets in other countries.

6.3 Results and discussion

We calculated efficiency scores for all 88 different models by using absolute shadow price approach. For comparison, we also estimated efficiency scores with the standard input-oriented DEA model where the environmental pressures were treated as negative outputs; thus the relative efficiency measure is of form \({\frac{\mathbf{p}_k \mathbf{Y}_k -\mathbf{u}_k \mathbf{Z}_{k}} {C_k }}\). With the NIRS reference technology, this DEA model comes very close to our method (see Sect. 4): the key difference is the absolute versus relative scale of the measurement units.

The proportion of eco-efficient models is relatively high: 28 SUV models in our sample proved efficient in terms of both models. According to presented methodology and the classification of goods proposed in Sect. 3, all these 28 efficient vehicles were also eco-efficient, i.e., belonged to group 1a. Thus, in this case there were no weakly efficient products (group 1b). A total of 60 models were classified as inefficient. Moreover, 44 models could be classified as inefficient, but environmentally less harmful (group 2a) as they had at least one positive environmental shadow price. Further, 16 models were classified both inefficient and environmentally harmful (group 2b) as these models received zero shadow prices for all environmental pressures.

Table 4 reports the efficiency scores for the 10 least efficient SUVs and the arithmetic averages of all models. For these 10 models, the rank correlation of the absolute and relative DEA efficiency measures is equal to one, and for all models the correlation is 0.982. Interestingly, for certain brands all models proved to be inefficient. For example, all 6 different models of Chevrolet Tahoe are inefficient, and even among the ten most inefficient models as seen also from Table 4. Other examples of inefficient models are Jeep Wrangler and Jeep Grand Cherokee.

Consider the efficiency score of the most inefficient model in our analysis (i.e., Range Rover 4.4 V8 Vogue A). The value of −4.57 means that this model has at least 4.57 Euros higher costs per 100 km than the efficient reference model. This inefficiency premium sounds surprisingly high, given that it only represents an upper bound (or the most optimistic estimate) for true efficiency. The results of the DEA are parallel to those of the absolute shadow price model, although the interpretation of the efficiency measure is different. According to the traditional DEA, the most inefficient models have reduction potential over 50% in costs, achievable through efficiency improvements while keeping the mileage and environmental pressures at the present levels. Of course, our analysis does not take into account capital costs or immaterial benefits of car ownership (such as the prestige value of owning a V8-engine SUV). Nonetheless, these results clearly indicate that there are remarkable differences between different SUV models as far as eco-efficiency in their primary transportation function is concerned.

We also considered two alternative treatments of environmental variables known in the DEA literature (e.g., Korhonen and Luptacik 2004): modeling environmental pressures as inputs (efficiency measure of type \({\frac{\mathbf{p}_k \mathbf{Y}_{k}}{C_k +\mathbf{u}_k \mathbf{Z}_k })}\), and modeling environmental pressures as inputs and costs as negative outputs (type \({\frac{\mathbf{p}_k \mathbf{Y}_k -C_k }{\mathbf{u}_k \mathbf{Z}_k })}\). For comparability, we focused on input-oriented DEA models with the NIRS reference technology. These two specifications gave very high efficiency scores; the mean efficiency was 0.989 for the former and 0.988 for the latter model. As many as 61 SUVs had efficiency score of 1 in both models. The high efficiency scores are explained by a large number of weakly efficient products (i.e., products with positive slacks); no less than 33 products were weakly efficient in these two models. Note the effect of dimensionality: while the first two models decrease a single variable (cost), the latter two models simultaneously decrease 6 and 5 variables, respectively. Nevertheless, the subset of (strongly) eco-efficient products was the same in all models. This supports the result of Korhonen and Luptacik (2004) who showed that the set of eco-efficient units in DEA does not depend on the orientation of the efficiency measure.

Returning to Table 4, we note that the ten most inefficient vehicles all had gasoline engines. We next examine if there are systematic differences in environmental performance of gasoline and diesel vehicles. To eliminate other possible effects (such as the safety and comfort features), we consider the subset SUV models which are available with either gasoline or diesel engine. Our data set includes 18 pairs of models with identical features, except for the engine type. For both these groups, we use the full sample of 88 models as the reference group. The efficiency measures of these 36 models are reported in Table 5.

From the 18 pairs presented in Table 5, only in one case gasoline vehicle proved out to be more efficient than the corresponding diesel engine vehicle. Yet more interesting are the remarkable differences in certain pairs. For example, the three Toyota Land Cruisers are efficient for diesel models, whereas corresponding gasoline vehicles produce 2.75 Euros higher costs per 100 km than their efficient reference models. The average difference between gasoline and diesel vehicles is also quite high: the gasoline vehicles generate about 1.1 Euros higher costs per 100 km than their diesel engine counterparts. Although these results are merely suggestive, they seem to indicate that diesel engine SUVs are more environmental friendly than the gasoline engine SUVs. Definitive conclusions would yet require a more detailed analysis concerning the economic benefits and costs. In any case, this kind of analysis could be used for assessing whether the use of diesel vehicles should be encouraged by the government, and for designing efficient policy instruments.

Thus far we have only considered the efficiency scores and the effect of the engine type on the scores. However, it is also important to investigate the absolute shadow prices in more detail. Table 6 reports descriptive statistics for the optimal shadow prices of environmental pressures and output concerning all vehicles. Interestingly, the shadow prices of climate change are zero for all but one model. By contrast, prices for smog formation and noise are positive for over half of the SUV models.

To understand how these shadow prices are determined, it is illustrative to consider the evaluation from the perspective of strategic competition between alternative models. Since assigning a positive price on an environmental pressure will always decrease the economic net benefit of the evaluated model, models that perform poorly on environmental criteria will assign zero prices for those criteria. Only those models that perform well (in relative terms) on some environmental criterion assign a positive price for an environmental pressure, because this will give them a comparative advantage relative to competing models. For example, all 11 Land Rover Freelander models with a diesel engine assign a positive price for smog formation. A closer inspection of the data shows that these models indeed have notably lower hydrocarbon emissions compared to other models. Similarly, five (out of 6) Nissan models and seven (out of 10) Toyota models have a positive price for noise. These models have lower noise levels than their competitors. In conclusion, if a model assigns a high shadow price for an environmental pressure, it must perform relatively well in this criterion compared to its competitors.

It should be emphasized that although zero shadow price are possible in our method, the same issue concerns other DEA and activity analysis approaches presented in literature. To estimate more realistic absolute prices in this context, additional price constraints could be included into primal problem (3), as discussed in Sect. 5.

To conclude, this application illustrated how the proposed approach for eco-efficiency analysis of consumer durables can be employed in practice. We found that the efficiency measure has a compelling economic interpretation, and that absolute prices enable its direct assessment. Eco-efficiency analysis of automobiles is a fascinating topic that certainly warrants further empirical analysis. A more systematic empirical study could try to quantify the economic benefits and costs more precisely, accounting for capital costs and possibly certain subjective factors such as safety and comfort and some immaterial benefits such as the prestige value of a car.

7 Conclusions

We have presented a new approach for analyzing eco-efficiency of consumer durables. Conceptually, our setting is most closely related to the product evaluation approaches of DEA literature. In contrast to the earlier studies, however, we considered the measurement problem from the policy maker’s point of view taking into account environmental pressures generated by products. From a technical perspective, an important difference to previous studies was our solution to measure efficiency in absolute monetary terms using prices expressed in absolute units of measurement. In the presented method, the efficiency score indicates the minimum monetary loss that the usage of one service of the evaluated consumer durable can offer compared to the best product in the reference group.

The proposed approach was applied to the eco-efficiency evaluation of Sport Utility Vehicles, with the main purpose of demonstrating the application of the method in practice. We calculated the efficiency scores by using the presented approach and more traditional DEA models and compared the results given by these approaches. In addition, we examined the differences in eco-efficiency between gasoline and diesel engine vehicles. We conclude that a full-scale empirical eco-efficiency analysis of automobiles would provide a fascinating area of future research.

We believe that measuring efficiency in terms of absolute scale shadow prices is a useful innovation in general, and this paper is one of the first studies to explore that route. In another research, we have applied the ideas of absolute shadow prices to profit efficiency measurement (Kuosmanen et al. 2005) and environmental cost-benefit analysis (Kuosmanen and Kortelainen 2007). Although these may be among the most intuitive application areas, one can use absolute shadow price approach in many other contexts equally well.

Notes

Production phase typically requires a vast number of different material inputs, energy, machinery and tools, as well as transportation services, which all cause environmental pressures that are difficult (or even impossible) to attribute to a specific output unit. Likewise, it is difficult to attribute the environmental pressures from waste treatment (e.g., land filling or incineration) to a single product: it is hard to anticipate how completely the product is disposed after use and to what extent recycling possibilities are utilized.

Life-cycle analysis (LCA) is the most standard method for assessing environmental performance of products. Despite its popularity, LCA has some major weaknesses. Firstly, it does not account for economic benefits and costs. Secondly, there is no general methodology within the LCA that would allow one to aggregate different environmental pressures into a single damage index.

Färe et al. (1990) presented the idea of absolute shadow price in the context of price efficiency, but did not utilize it for efficiency measurement.

Toxic pesticide applied in agriculture is an example of such a substance that can cause different types of pressures and risks for farm-workers, consumers, and to the eco-system. As a consequence, substances of this kind should be accounted for in several pressure indicators.

The proof of the dual expression is available from the authors by request.

See Kuosmanen et al. (2005) for further discussion about the normalization.

As we focus on the use phase of the vehicle, we only consider the marginal costs of the primary transportation function of the vehicle, and exclude the capital costs as sunk cost. Consumer-oriented analysis could take into account the capital costs as well as immaterial benefits such as the prestige value of a car.

References

Allen R, Athanassopoulos AD, Dyson RG, Thanassoulis E (1997) Weight restrictions and value judgements in DEA: evolution, development and future directions. Ann Oper Res 73:13–34

Andersen P, Petersen NC (1993) A procedure for ranking efficient units in DEA. Manage Sci 39(10):1261–1264

Chambers RG, Chung Y, Färe R (1998) Profit, directional distance functions and nerlovian efficiency. J Optimiz Theory Appl 98(2):351–364

Charnes A, Cooper WW, Rhodes E (1978) Measuring the efficiency of decision-making units. Eur J Oper Res 2:429–444

Doyle JR, Green RH (1991) Comparing products using data envelopment analysis. Omega 19(6):631–638

Doyle JR, Green RH (1994) Strategic choice and data envelopment analysis: comparing computers across many attributes. J Inform Technol 9(1):61–69

Dyson RG, Allen R, Camanho AS, Podinovski VV, Sarrico CS, Shale EA (2001) Pitfalls and protocols in DEA. Eur J Oper Res 132(2):245–259

Farrell MJ (1957) The measurement of productive efficiency. J Stat Soc Ser A Gen 120(3):253–281

Fernandez-Castro AS, Smith PS (2002) Lancaster’s characteristics approach revisited: product selection using non-parametric methods. Manage Decis Econ 23(2):83–91

Färe R, Grosskopf S, Lovell CAK, Pasurka C (1989) Multilateral productivity comparisons when some outputs are undesirable: a non-parametric approach. Rev Econ Stat 71:90–98

Färe R, Grosskopf S, Nelson J (1990) On price efficiency. Int Econ Rev 31:709–720

Koopmans TC (1951) An analysis of production as an efficient combination of activities. In: Koopmans TC (ed) Activity analysis of production and allocation. Cowles Commission for Research in Economics, Monograph No. 13. Wiley, New York

Korhonen P, Luptacik M (2004) Eco-efficiency analysis of power plants: an extension of data envelopment analysis. Eur J Oper Res 154(2):437–446

Kuosmanen T, Cherchye L, Sipiläinen T (2006) The law of one price in data envelopment analysis: restricting weight flexibility across firms. Eur J Oper Res 170(3):735–757

Kuosmanen T, Kortelainen M (2005) Measuring eco-efficiency of production with data envelopment analysis. J Ind Ecol 9(4):59–72

Kuosmanen T, Kortelainen M (2007) Valuing environmental factors in cost-benefit analysis using data envelopment analysis. Ecol Econ 62(1):56–65

Kuosmanen T, Kortelainen M, Sipiläinen T, Cherchye L (2005) Firm and industry level profit efficiency analysis under incomplete price data: a nonparametric approach based on absolute and uniform shadow prices. Discussion Paper 31, Economics and Business Administration, University of Joensuu

Lancaster K (1966) A new approach to consumer theory. J Polit Econ 74:132–157

Nerlove M (1965) Estimation and identification of Cobb-Douglas production functions. Chicago/Amsterdam, Rand McNally/North Holland

Odeck J, Hjalmarsson L (1996) The performance of trucks—an evaluation using data envelopment analysis. Trans Plan Tech 20(1):49–66

Papahristodoulou C (1997) A DEA model to evaluate car efficiency. Appl Econ 29:1493–1508

Pedraja-Chaparro F, Salinas-Jimenez J, Smith P (1997) On the role of weight restrictions in data envelopment analysis. J Prod Anal 8:215–230

Scheel H (2001) Undesirable outputs in efficiency evaluations. Eur J Oper Res 132:400–410

Staat M, Bauer HH, Hammerschmidt M (2002) Structuring product-markets: an approach based on customer value. Market Theory Appl 13(1):205–212

Tyteca D (1996) On the measurement of the environmental performance of firms—a literature review and a productive efficiency perspective. J Environ Manage 46:281–308

Womer NK, Shroff HFE, Gulledge TR, Haynes KE (2003) Measuring efficiency with linear economic model. Appl Econ 35:1459–1467

Acknowledgements

We thank three anonymous referees and Victor Podinovski, the co-editor of this special issue, for valuable comments. An earlier version of this paper was presented at the North American Productivity Workshop 2004, Toronto, Canada; the 4th International DEA Symposium, Birmingham, UK, 2004; and the INFORMS 2005, San Francisco. We thank the participants of these events, and in particular, Rolf Färe, Ludwig Lauwers, Hervé Leleu, David Saal, and Matthias Staat, for critical and helpful comments and stimulating discussions. The first author gratefully acknowledges the financial support from the Finnish Doctoral Programme in Economics.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Kortelainen, M., Kuosmanen, T. Eco-efficiency analysis of consumer durables using absolute shadow prices. J Prod Anal 28, 57–69 (2007). https://doi.org/10.1007/s11123-007-0046-6

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11123-007-0046-6