Abstract

Profitability analyses of site-specific nitrogen (N) management strategies have often failed to provide satisfying reasons for adoption of precision farming technologies. However, effects of precision farming on product quality and price premiums, as well as on downside risk mitigation, are generally not taken into account. This study aimed to evaluate the comparative advantages of site-specific N management over uniform N management considering N supply on grain quality, and accordingly price premiums for wheat from a downside risk point of view. A virtual field was modelled with two subfields representing two distinctive yield zones to investigate how consideration of grain quality affects the economic potential of site-specific N management under temporally varying N mineralization and changing price patterns of wheat. Moreover, the extent was investigated to which site-specific N management can have a risk-reducing effect on economic shortfalls compared to uniform N management. Two site-specific N management options were assessed: variable N rate application using yield mapping and N sensor for real-time proximal sensing. Results indicated that even though crop yields were only slightly higher, higher expected protein contents of grains could be achieved with site-specific N management options compared to uniform N management. Baking wheat quality was secured to a greater extent with site-specific N management options. Higher average grain quality improved the economic benefits due to price premiums. A risk-reducing effect was observed with the site-specific N management by maintaining the baking wheat quality with a higher probability. Higher economic returns mostly compensated the additional costs for the precision farming technologies in the lower tail of the probability distribution and, thus, site-specific N management did not show any substantial disadvantage on downside risk as compared to uniform N management.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Since the early stages of precision farming (PF), variable rate application of nitrogen (N) fertilizer to crops has been addressed. The obvious reason for this is that N is the crop nutrient needed in the highest amount among all crop nutrients. While this reason is intuitive, profitability of site-specific N application technologies has been under discussion. Consequently, worldwide adoption of these technologies has been slower than initially expected (Griffin and Lowenberg-DeBoer 2005), as widespread technology adoption is considered to be a sound indicator of economic benefits (Lowenberg-DeBoer 2019). Profitability analyses of PF technologies have often been conducted based on short-term field trials or simulations, whereas data on long-term response to site-specific farming are becoming available (e.g., Yost et al. 2017, 2019). Economic assessment of PF has been facing various obstacles. For example, the economic advantage of PF technologies has been found to be highly dependent on the reference system to which it is compared, and the associated costs that are considered (Gandorfer and Meyer-Aurich 2017). Bullock et al. (2002) proposed using site-specific yield functions for the economic assessment of site-specific nutrient management, which has been commonly used since then in the profitability analyses. They found a net economic benefit of around 7$ ha−1 for using site-specific N application compared to uniform N management, while Lawes and Robertson (2011) calculated about 11€ ha−1 net return after the additional costs for PF were deducted. Schneider and Wagner (2008) reported 16€ ha−1 of economic return with an N sensor approach where the costs for the sensor technology were not included. Based on a long-term field trial, Yost et al. (2019) concluded that PF system did not significantly change profitability and spatial variation of profit for wheat compared to the conventional system, whereas it reduced the temporal variation of profit. Various profitability analyses of site-specific N fertilization strategies often showed that investments in PF technologies do not cover their costs or result in low economic return (OECD 2016; Gandorfer and Meyer-Aurich 2017). In a recent review, Colaço and Bramley (2018) reported a wide range of sensor-based N application’s profitability from 30$ ha−1 loss to 70$ ha−1 benefit. Such broad ranges of economic returns might have failed to prove the usefulness of PF technologies to farmers; whereas perceived usefulness is considered as a main factor for adoption (Colaço and Bramley 2018).

Some argue that investments in variable rate application technologies may not be paid off, when yield response to N does not vary strongly within a field (Anselin et al. 2004; Liu et al. 2006). Others argue that profit functions are generally flat, thus, limit the economic potential of site-specific input management (Pannell 2006, 2017). However, the situation of low profitability of site-specific N fertilization may change, if such PF technologies do not only affect crop quantity but also crop quality, for example baking quality of cereals. It has been shown that site-specific N fertilization can help to achieve specific baking quality thresholds (Fiez et al. 1994; Long et al. 2000; Stewart et al. 2002; Morari et al. 2018). For instance, based on a two-year field trial, Long et al. (2000) observed higher protein concentrations of wheat, and lower within-field variability in protein levels with variable N rate application, while there was no significant yield change. The profitability of site-specific N fertilization can be improved, when its effect on grain quality is taken into account (Bongiovanni et al. 2007; Gandorfer and Rajsic 2008; Meyer-Aurich et al. 2010a, b). Bongiovanni et al. (2007) concluded that grain protein levels can be optimized by site-specific N application considering spatial variability of subfields, based on yield maps, soil moisture, and protein content, which in turn can lead to higher economic returns. Gandorfer and Rajsic (2008) and Meyer-Aurich et al. (2010b) depicted the economic relationship of protein concentration indicating shifts in the profit function linked to quality premiums for wheat.

Several studies have been conducted on grain yield and quality effects of PF technologies from agronomic and nutrient efficiency point of view, whereas few studies assessed the profitability of PF technologies considering the effects of site-specific N management on grain quality. Moreover, there is still lack of research investigating the impacts of PF technologies on risk-effectiveness together with the grain quality aspect considering temporal variability in N mineralization and changing wheat prices. Crop yield and protein response may vary according to weather conditions, and uncertainties in weather challenge optimum management of zones for variable rate N application (Morari et al. 2018). Year to year variance of soil N mineralization and unforeseeable price patterns practically make it impossible to fertilize for the profit peak. Pannell (2017) emphasized that instead of recommending a single N rate, identifying a range of N rates within a certain percentage change of maximum profits would be of more interest and relevance to farmers.

Farmers do not only aim at profit maximization but also at minimization of production risks in order to secure a certain income level (Finger 2013). Risk can be defined as the uncertainty of outcomes (Berg and Starp 2006) and main risk factors with respect to PF practices can be categorized as production risk, price/market risk, legal risk (site-specific documentation), personal risk (job safety), financial risk (investment payoff) (Griffin et al. 2018), human risk (learning new skills), and technology risk (compatibility with new gadgets/software) (Lowenberg-DeBoer 1999). Production, price/market, and financial risks are directly related to profitability of PF technologies, thus, have been given attention and analyzed to a larger extent over the years. Different risk factors can pose trade-offs among each other. While PF technologies may reduce production risks (Gandorfer and Meyer-Aurich 2017), costs of PF investments may increase the financial risk (Lowenberg-DeBoer 1999). Tozer (2009) made a risk assessment of PF and compared the standard net present value analysis with a real-options approach focusing on whether an investment in PF can be more profitable if made now or in future. The author found that in all cases the PF system generated greater net present value than the conventional system calculated by a real-options model. Whelan and McBratney (2000) reported that site-specific crop management does not necessarily show advantages over uniform management in terms of risk, if there is a strong temporal variability. However, most of the studies do not consider the impact of PF technologies in terms of utility with respect to risk attitudes of farmers. While the possibilities to consider site-specific variability in the field may be attractive for risk-averse decision makers because sources of risk from heterogeneity of fields can be better addressed, the investments in PF technologies themselves imply specific risks, which need to be traded off. Risk aversion often faces the challenge aiming at reducing the probability of low profit which, in turn, usually reduces the maximum achievable profit (Marchant et al. 2013). In this context, PF technologies show a potential to increase profit while reducing production risks (Dillon et al. 2007).

Risk assessment can be performed employing different risk measures. The most straightforward measures are computed based on probability distribution of possible outcomes (i.e., yield, profit margins, or net return). These include calculating the expected utility and its variance, as well as skewness and kurtosis of the outcome distribution. These approaches are commonly used as risk measures by economists where higher variance of an option would make it less attractive for adoption/application from the risk aversion point of view (Hardaker et al. 2015; Pannell 2017). Furthermore, the certainty equivalent with different attitudes based on a specific level of risk aversion is often used to specify the utility of production alternatives (Monjardino et al. 2013). The certainty equivalent is a monetary measure of farmers’ welfare under risk. It can be calculated based on variance and mean of expected net returns (Monjardino et al. 2015). Hardaker et al. (2004) proposed an approach to calculate the certainty equivalent of production alternatives based on a number of discrete outcomes.

Even though there are few analytical studies that investigated the impact of PF with respect to farmers’ risk aversion, many studies have analyzed the impact of technologies or inputs with respect to risk aversion. For instance, Finger (2013) evaluated irrigation in a combination with N fertilizer as a risk-reducing strategy with a downside risk approach assessing the impact on the lower tail of the distributions of possible outcomes. Monjardino et al. (2015) assessed the implication of farmers’ attitude to risk on N fertilizer application using the certainty equivalent approach. Gandorfer et al. (2011) analyzed the effects of risk aversion on tillage and N fertilizer intensity using the expected utility and certainty equivalent approach.

Expected utility and certainty equivalent approaches are not easy to comprehend by decision makers, thus, downside risk assessment approaches have been given attention and widely used (Berg and Starp 2006). In the same vein, although variance is generally a useful statistic to depict variability of an outcome, it provides a limited perspective on the downside risk which concerns farmers more than the upside variation, i.e., higher profits (Lowenberg-DeBoer 1999). Downside risk assessment does not require assumptions on utility functions or risk aversion coefficients, whereas it considers the lower tail of an outcome distribution specifying the probability of bad outcomes falling below a certain threshold or a target return. Two common downside risk measures are value at risk (VaR) and conditional value at risk (CVaR). VaR indicates the scale of a potential large loss in its expected value at a specific confidence level (e.g., 95%) (Manfredo and Leuthold 1999). Similar to VaR, CVaR indicates a potential loss within a particular confidence level, though not as a single value at a certain level as in VaR, but as an average of values within the worst/lowest percentage of cases (e.g., in the worst 5%). CVaR offers some advantages over VaR. Webby et al. (2007) reported that when a loss distribution (lower tail of the probability distribution) has discontinuities, VaR shows drawbacks, since VaR values can vary greatly with a slight increase in probability level, whereas CVaR shows rather more stability in such cases. Therefore, the CVaR approach offers benefits by indicating risk implications not for a single point over an outcome distribution (i.e., minimum value or any other single value at a certain probability level) but for a range of outcomes. Looking at a single value of the outcome distribution may lead to misinterpretation of risk implications, since it reflects only one out of many probabilities of occurrence whose effect may be smoothed by preceding or subsequent values. As a logical consequence, the average of probable outcomes within a downside range can be more meaningful for decision makers than a single outcome in the lower bound of the probability distribution.

It is possible to assess profitability of PF technologies considering their risk related implications on the basis of empirical data. Nevertheless, long-term data on yield response to PF reflecting the variability of the response are scarce and could be confounded by the experimental design in which they were surveyed. By means of simulation, all possible combinations regarding variable N mineralization affecting yield and protein response, as well as change in price patterns can be analyzed, which may, however, not be observable looking at individual years based on empirical data. Especially in the case of downside risk assessment, simulation is a powerful tool to picture the worst case scenarios enabling the worst combinations (e.g., lowest N mineralization with lowest wheat price) which might not have been empirically observed yet, but have probability to occur. Therefore, in this study simulation based on modelled yield and protein response was opted using its advantages to detect abovementioned systematic effects, which are important for the economic and risk assessment of site-specific N management.

This study aimed at assessing site-specific N management with respect to grain quality from economic and risk implications point of view. It investigated, first, if price premiums for a certain grain quality contribute to higher economic potentials of site-specific N management under temporally varying N mineralization and changing price patterns; and secondly whether site-specific N management can reduce the production risk in terms of meeting a specific grain quality, thus securing the quality premium. In this context, the hypotheses tested in this study were that: (i) site-specific N management generates higher economic returns, when grain quality is considered under uncertain N supply from soil pool and wheat prices and (ii) site-specific N management reduces the risk of economic shortfalls by coping with temporally varying N mineralization and changing price patterns in a more cost-efficient way than uniform management. A conceptual framework was developed modelling yield and protein response to N on a virtual field with two subfields. These represent sites with high and low yield potentials. Considering the costs of PF investments, downside risk can be a meaningful indicator for farmers’ decision on technology adoption. The conceptual framework enables to evaluate uniform and site-specific N management options for temporal effects of varying N mineralization on crop yield and protein content, and changing price patterns, and to simulate a stepwise production function and consequently calculate the expected net return and the CVaR for the downside risk analysis.

Materials and methods

Research concept

Research concept was developed to evaluate profitability and risk mitigation potential of site-specific N management with respect to grain quality based on simulation. It contains an approach for estimating site-specific yield response functions based on transformation of yield and protein response data to N supply from a long-term field experiment to a virtual model field. Empirical yield response data were used to build yield response functions to simulate the implications of N fertilization on economic returns for the model field that consists of subfields with different yield zones based on a model approach (normalization method) following Karatay and Meyer-Aurich (2018). For the yield response transformation, information on input–output relations for N fertilizer supply and crop yields for different yield zones in the federal state of Brandenburg (Germany) were employed in order to generate specific yield response functions for the respective yield zones, which were then incorporated as subfields in the present model.

In comparison to uniform N management, two site-specific N management options were assessed: variable N rate application using yield mapping (monitoring) and the other using N sensor conducting real-time proximal sensing. Partial budgeting was performed regarding N fertilization for winter wheat considering two grain quality levels on a virtual field with two subfields representing a high and a low yield zone. For the downside risk assessment, simulation is essential in the present study, since there is not enough site-specific data covering temporal uncertainties on yield and protein, in order to directly estimate associated outcome distributions. Therefore, Monte Carlo simulations were used to depict uncertainties on N mineralization and price patterns for the risk analysis conducted in this study. Furthermore, sensitivity analyses were executed to investigate the effects of assumptions made on the results in this study. The workflow of the methodological concept is shown in Fig. 1.

Bold lines in the workflow (Fig. 1) separate working steps as: the first part for the estimation of yield and protein response functions, the second for different N management options and their yield and protein responses to N fertilizer, the third for the economic return analysis based on the partial budgeting approach, the forth for the downside risk assessment on the basis of Monte Carlo simulations, and the last part for the sensitivity analyses.

Site-specific yield and protein response functions to nitrogen supply

Data

In order to assess the economics of N fertilizer use for wheat production, there is a need to model yield and protein response of wheat to N fertilizer. Crop yield response data from a field experiment (1986–1999) in Dahlem, Berlin were used for winter wheat (Triticum aestivum L.) (Köhn et al. 2000). Protein response data were taken from the same experiment (1996–1998; 2004) (Ellmer et al. 2001; Erekul et al. 2005) (Table 1).

N fertilizer and yield relations considering the yield zone specific context, as reported in Hanff and Lau (2016), were used from two yield zones (Table 2). These yield zone specific input–output patterns were set as reference points for modelling the site-specific production functions with the aid of a normalization (scaling) approach. This method enables transferring yield response function from sites with empirical data to other sites lacking that information by adjusting the yield response to N fertilizer to a dimensionless ratio (Karatay and Meyer-Aurich 2018). This is needed in order to enable the transfer of the rescaled response and estimate the site-specific yield response functions. In this study, the empirical data on yield response to N fertilizer from Köhn et al. (2000) were employed together with the yield-N fertilizer patterns given in Hanff and Lau (2016) for the normalization approach to estimate site-specific yield response functions for the two subfields.

It is commonly known that PF technologies regarding N fertilizer application can be adopted, in case there are two or more yield zones in the field requiring different fertilizer managements. The larger the difference is among the yield zones, the larger the economic benefit is achievable by the PF adoption (Robertson et al. 2008; Bachmaier and Gandorfer 2009). Therefore, in the analysis of this study, yield-zone I and yield-zone III were chosen representing a typical high and a low yield zone for winter wheat production in Brandenburg (Table 2).

Estimation of site-specific yield and protein response functions

Yield response was estimated with a quadratic univariate yield response function to N fertilizer by using ordinary least square method as follows:

where ƒ(N) is yield (kg ha−1) as a function of N—nitrogen fertilizer rate (kg N ha−1), a is the quadratic coefficient, b is the linear coefficient, and c is a constant.

The response functions for each subfield can be written as:

where i denotes the subfield. Site-specific yield response functions (Table 3) were taken from Karatay and Meyer-Aurich (2018), which were estimated using the normalization approach. The main purpose of the approach is based on the assumption that an empirically determined relationship of N fertilizer and yield, modelled as a quadratic production function, can be transferred -under certain conditions- to other sites lacking yield response data. The method converts the absolute yield response function into a relative function (rescaled between 0 and 1) upon a certain reference point (i.e., profit or yield maximizing N fertilizer rate) so that it can be transferred to another site where comparable on-site reference points are given. The detailed approach to the methodology was reported in the aforementioned reference.

Protein response functions g(N) were assumed to be indifferent in both subfields as a linear function of N empirically estimated from the Dahlem experiment based on the average protein response from Ellmer et al. (2001) and Erekul et al. (2005):

Crop yield and protein content of the whole field were considered as the average values of outcomes of two subfields. Yield was averaged simply as arithmetic mean, whereas protein content was calculated as weighted arithmetic mean; multiplying each weight (yield) by the corresponding value (protein content), summing the values up, and dividing them by the sum of weights (yields).

Profitability calculation

Partial budgeting was performed for net return calculation over N fertilizer applied. This approach has been found as an appropriate method to evaluate profitability of PF technologies showing the cost-effectiveness of PF adoption (Marchant et al. 2013). Net return over fertilizer cost was found as revenue due to crop sales minus N fertilizer costs (Eq. 4). In the case of site-specific N management options, annual costs of the investment for equipment and operational costs of the PF technology for information gathering and processing, and variable N application were taken into account. Assuming a cropping area of 500 ha, the costs for a yield mapping system and an N sensor system were considered as 8.02 and 10.69€ ha−1 a−1, respectively (OECD 2016). The cost-estimations for the PF technologies were made according to the annuity method, for which 6 years as depreciation time with 6% interest rate were assumed. Additional costs for the PF technologies contain hardware/software expenditure 14,800€ and 22,350€, and service provider fee 2€ ha−1 a−1 and 800€ a−1 for the yield mapping system and the sensor system, respectively.

Net return over N applied (€ ha−1) was calculated as:

NR—net return, PW—price of wheat (€ kg−1) depending on protein content g(N), f(N)—yield (kg ha−1) as a function of N—nitrogen fertilizer rate (kg N ha−1), PN—price of N fertilizer (€ kg−1 N), i—subfield, λ—share of subfield in the total area as percentage, and KPF—investment and operational costs of PF technologies (€ ha−1).

The reference optimum N rates were calculated according to respective yield and protein response functions with the average price for baking (B) quality wheat (Table 4). In order to simulate different possible economic outcomes due to varying price premiums, two crop prices were considered for winter wheat according to the protein content as a proxy for grain quality. In the case where protein content was achieved above 13%, the price for B-quality wheat was used in the calculation; otherwise the price for feed (F) quality was used. Table 4 shows varying price patterns of wheat reported by the Bavarian State Research Center for Agriculture (Landesanstalt für Landwirtschaft, LfL 2018) over a period of 10 years.

Nitrogen fertilizer management systems

With uniform management, a predetermined reference N fertilizer rate was assumed to be applied homogenously across the field which consists of two subfields of equal size with different yield responses to N. The reference uniform N rate is the net return maximizing N rate of the average yield response function which is calculated as the average of high and low yield functions according to Table 3.

Predetermined reference N fertilizer rates with the site-specific N management (SSNMYM) were assumed to be estimated using the yield mapping approach. N rates were applied according to each subfield’s yield response to N using the production functions in Table 3. In other words, this management system maximizes the net return of the whole field by applying individual economically optimal N rates in both subfields of equal size.

As a further management option, site-specific N management system with an N sensor (SSNMNS) was considered. N sensor uses crop specific canopy reflectance sensing linked to chlorophyll content of leaves to determine the N status of the crop, which in turn depends on available N in soil due to earlier N fertilization and N mineralization (Diacono et al. 2013). In this study, the N sensor was assumed to provide an indirect estimation of N mineralization in the soil by employing wheat plant optical real-time sensing, so that the respective optimal N rate can be adjusted on-the-go, in addition to the predetermined optimal variable N rates of the reference based on the estimated site-specific yield response functions in Table 3.

For both uniform and site-specific N management options, the expected wheat quality type was assumed to be baking quality. Therefore, the reference optimal N fertilizer applications were ensured reaching baking quality (minimum 13% of protein content).

Uncertainty and risk analyses

In order to provide an array of possible net returns resulting from the analyzed management practices (uniform, SSNMYM and SSNMNS), Monte Carlo simulations (10 000 iterations) were run considering uncertainties with wheat prices depending on the grain quality (Table 4), and N mineralization in the soil which, in turn, causes yield uncertainty (Fig. 2). Yield uncertainty can occur, for instance, due to variability in disease, insect and weed pressure, and/or weather conditions and its related effects on N availability in soil for plant growth. N availability in the soil depends on total N input as a result of N fertilizer application, and N supply from the soil pool (N mineralization) which can be considered as the intersection of the yield function to the ordinate (x-axis) (Berg 2003). For simplification reasons, it was assumed that the temporal variability in yield could be explained—among other factors—by the variability in N mineralization at the temporal scales, if N fertilizer is held unchanged. Therefore, a random effect was included for N supply shifting the yield response function vertically, in order to depict year-over-year changing N mineralization. A similar approach estimating variation in yield and N mineralization was employed for a linear yield response model to N with a stochastic plateau in Berg (2003) and Tembo et al. (2008).

Estimation of the N mineralization range for the uncertainty analysis based on the data (Köhn et al. 2000) from Dahlem (1986–1999) at N fertilizer rate 110 kg N ha−1

Based on the yield response functions for every year for the same N fertilizer rate (110 kg N ha−1 from the Dahlem experiment), the deviation was calculated in every year comparing the observed yield for the respective year with the estimated yield using the average yield response function. The curvature of the yield response function was then adjusted shifting up and downwards reflecting the variability in N mineralization, by adjusting the constant (c) in Eq. 1 according to the deviation for every year while keeping the shape of the curvature unchanged. For this transformation, it was assumed that the shape of the curvature would remain the same, if all N inputs and other production factors were controllable and held constant. Afterwards, it was calculated where each curvature intersects the x-axis (N fertilizer rate) and defined it as N supply due to mineralization (Nminer) for the respective year and shifted the intercept across the years calculated as in Eq. 5 derived from Eq. 1.

In other words, Eq. 5 was derived from solving the quadratic equation (Eq. 1) at “f(N) = 0” (zero yield). This is based on the assumption that in the absence of any fertilizer applied, there would still be yield observable, where the required N for the plant growth should come from the N pool in the soil. Based on the response function, the amount of N mineralization required for that yield level can be estimated by running the response curve in the negative quadrant back from zero fertilizer N (intersection of the yield function at the y-axis) to zero yield (intersection of the yield function at the x-axis).

The average of the Nminer terms from all years was used as the expected N mineralization and defined it as a reference point Nminer_ref. For the uncertainty analysis, every Nminer as an uncertainty input was modelled with the same probability of occurrence reflecting the temporal effects on N mineralization and accordingly on total N supply (Ntotal) resulting in different yield and protein content levels which may eventually change the profitability of management systems (Eq. 6).

The estimated range of variability in N mineralization was adopted based on the data from Dahlem experiment and applied it to the production functions of modelled subfields in Eq. 2 assuming the range of N mineralization being indifferent among them. N mineralization rates were estimated on the basis of the measured yield variability employing the empirical data at the N fertilizer rate of 110 kg ha−1. In Fig. 2, different curves represent the adjusted course of yield response functions of different years. This indicates the assumed relationship between temporal variability in yield and temporal variability in N mineralization.

In the case of SSNM option with N sensor (SSNMNS), it was assumed that economic optimal Nfertilizer can be adjusted by anticipating the current N mineralization to some extent using wheat plant optical real-time sensing. In other words, N sensor was assumed to be able to partially mitigate the temporal weather impact on yield which was modelled in this study using variability in N mineralization as a proxy. Estimation of yield variability based on variability in N mineralization was a simplification made to ceteris paribus focus on N related production risks assuming other factors causing uncertainties on yield remain constant over the time. Three scenarios were run for different levels of simultaneous N mineralization forecast: 25, 50 and 75% of detection rate in percentage DRNminer(%):

Abovementioned uncertainties represent production risks (yield and protein) and price risks in the model. All input parameters for the uncertainty analysis were modelled with a discrete uniform distribution RiskDUniform using the risk assessment tool “@Risk” (Palisade Corporation Software, Ithaca NY, USA).

Based on the simulation results, expected values were calculated for yield, protein content and net return, conditional value at risk (CVaR), and probability of maintaining B-quality for wheat. The expected value is the average of the simulation results of respective output (yield, protein content, and net return) considering uncertain N rates due to varying N mineralization, and changing price patterns of wheat. CVaR describes the expected value of an economic mean shortfall at a certain confidence level associated with a decision (Rockafellar and Uryasev 2002) and offers comparability to a reference whether the expected economic loss is minimized at the specified interval in the lower bound of the probability distribution (e.g., 5%). In this study, CVaR was calculated (Eq. 8) as a measure for downside risk assessment illustrating the effect of changing total N supply and price structure on profitability.

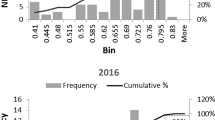

where CVaRa is the conditional value at risk at the a % level and F(NR) is the cumulative distribution function of the net return NR. The cumulative distribution function is truncated to a range chosen and the outcomes within that range are averaged. For instance, CVaR(90) of net return indicates the mean value of possible outcomes from 0 to 10% of the lower bound of the probability distribution function of net return (see Fig. 3).

By means of “@Risk”, CVaR(a) was calculated using the function RiskMean(NR) to obtain the average outcome of the net return (NR) by truncating the cumulative distribution function of NR from “0” to “100−a” deploying the function RiskTruncateP(0, 100−a).

CVaR does not require assumptions on the utility function and risk aversion coefficients, and it focusses on the lower partial moments of the distributions of possible outcomes (Meyer-Aurich et al. 2016). The main benefit of CVaR approach is that it implies risk based on an average for a number of values instead of a single point over the outcome distribution. A single value at a probability level (e.g., minimum) can be misleading, since their implications may be under- or overestimated when preceding or subsequent values are considered.

CVaR in this study was used as an indicator, whether SSNM poses a risk-reducing effect compared to uniform N management in a worst-case scenario. Following values were calculated to capture the abovementioned uncertainties: the mean of the lowest (worst) 5, 10 and 15% of the expected value (mean) of net return (CVaR 95, 90, 85, respectively) for each management system.

Sensitivity analyses

Farm size can have an impact on economic advantage of SSNM due to relatively lower costs of investing in PF technologies. For this purpose, a smaller and a larger cropping area was considered in the sensitivity analysis, and its effect on the SSNM profitability was analyzed. Annual costs of a yield mapping system for variable rate N application were accounted for a smaller (250 ha) and a larger cropping area (1000 ha) as 14.04€ ha−1 to 5.01€ ha−1, respectively, and for a sensor system as 21.38€ ha−1 and 5.35€ ha−1, respectively.

Furthermore, a sensitivity analysis was carried out on the reference N fertilizer rate of uniform N management. N fertilizer rates were determined as net return maximizing rates according to the estimated yield response functions as defined in the “Profitability calculation” subsection. SSNM systems were assumed to consider the subfield-specific yield response to N fertilizer, whereas for uniform N management, the average yield response function of the entire field determined the reference N rate, which was found slightly less than the average reference N rate of the SSNM systems. In order to investigate how the outcomes would change if the reference uniform rate was the exact rate as of the reference SSNM average, the Monte Carlo simulations were re-run with the N rate for uniform management at the same rate as the average N rate of SSNM systems.

Results and discussion

Results in this study were reported in two groups: (i) outcomes as default, when parameters for yield, protein, and net return were calculated based on the respective reference N rates (following average values both for B-quality wheat price and for N mineralization) and (ii) outcomes based on the Monte Carlo simulations, when uncertainties on N mineralization and price patterns were considered.

Yield, protein and economic response

Similar default yields were found with uniform and site-specific N management options (Table 5) applying the respective reference optimal N rates that were calculated for the average B-quality wheat price and the average N mineralization. In the case of the uniform approach, both subfields received 137 kg N ha−1 homogenously derived from the production function of the average yield zone, whereas in the case of site-specific measures, the subfields received differentiated optimal N rates according to each subfield’s yield response, at the rate of 173 kg N ha−1 and 113 kg N ha−1 for high and low yielding zones, respectively.

Results from the Monte Carlo simulations show that compared to the uniform N management, both site-specific N management options improved the expected crop yield (mean) slightly, whereas the one with N sensor (SSNMNS) reduced the variance of yield with higher rates of N mineralization detection (Table 5). Slight yield changes with SSNM found in this study are in line with earlier reports published in Diacono et al. (2013). For instance, Boyer et al. (2011) found no significant yield change comparing conventional N management with uniform and variable N rate applications using optical reflectance measurements. Liang et al. (2005) reported that variable rate N application reduced the yield variance but did not increase the yield significantly. Yost et al. (2017) reported a similar picture from a long-term experiment comparing PF systems with conventional management systems across time. Other statistical values regarding the crop yield were found similar among the N management options in the present study.

Site-specific N applications resulted in slightly higher expected value (mean) of protein content compared to uniform fertilization (Table 6). Nevertheless, higher values of minimum protein content were achieved with the SSNM and it also showed advantages over uniform N management to maintain B-quality level to a larger extent. For the SSNM with yield mapping, 79% of the simulations, B-quality was achievable, and 93% to 100% for the SSNM with N sensor, while it was 64% for the uniform N management. Thus, especially the SSNM with N sensor reduced the probability of missing that critical quality level considerably compared to uniform N management. Uniform N management hardly met the threshold for the expected value (mean) for protein content (13%), whereas both site-specific N management options resulted in higher expected values for protein contents. As expected, higher detection of N mineralization via the N sensor yielded in lower risk of not achieving the quality threshold. The options SSNMNS(50%) and SSNMNS(75%) met the required quality for B-quality wheat in almost all possible combinations of simulations. The enhanced potential for meeting a certain grain quality with PF technologies was notified in earlier studies evaluating not only the impacts on crop quantity but also the crop quality (e.g., Long et al. 2000; Stewart et al. 2002; Bongiovanni et al. 2007; Meyer-Aurich et al. 2010b; Morari et al. 2018).

SSNM options showed advantages for default net returns (6 to 9€ ha−1) for which uncertainties were not considered (Table 7). This effect was due to the assumption that site-specific optimal N application maximized the economic return in each subfield, whereas uniform management did not exploit the maximum potential of achievable net return applying a uniform reference N rate over the whole field. Expected value (mean) of net return was improved by more than 17€ ha−1 with the SSNM using yield mapping compared to the uniform N management (Table 7). The SSNM measures with N sensor led to a further increase in the expected net return compared to the SSNM with yield mapping. The SSNMNS(25%) increased the expected net return by almost 8€ ha−1 further compared to the SSNMYM by keeping the protein content above the threshold in more cases. While there was only a slight further increase with the SSNMNS(50%) on top, the SSNMNS(75%) resulted in additional 6€ ha−1 compared to the SSNMNS(25%) due to adjusting economic optimal variable N rates more efficiently and, thus, reducing the costs of a potential N over-application on average. The minimum net return for the PF options were found lower compared to the uniform management due to additional costs implemented for the PF investment, except for the SSNMNS(75%). In this management option, the minimum net return was found approximately 200€ ha−1 greater than all other management options. The reason is that the SSNMNS(75%) held the protein content in all possible combinations of the simulation above the critical threshold of 13% (see Table 6). Therefore, even the lowest value (minimum) for net return was calculated with the price for B-quality wheat, whereas other options did not reach B-quality in their lowest value for protein.

In summary, yields were found only slightly higher with the site-specific N management options, therefore, higher yields could not justify the relatively high potential for profitability of SSNM alone. The economic advantage was achievable through higher protein content and associated higher product prices in the first place. This is consistent with previous studies. For instance, Meyer-Aurich et al. (2010a) reported that assuring protein content for baking quality was decisive to obtain the highest economic benefit based on an on-farm experiment in Germany. The Monte Carlo simulations of the present study showed that in the cases of larger difference between baking and feed quality price, high opportunity costs of not adopting site-specific N management options could arise (> 200€ ha−1), when baking quality was reachable only by the SSNM options. Furthermore, the SSNM with N sensor improved the profitability by reducing the negative temporal effects of N mineralization on protein content and also avoided costs of over-fertilizing. The economic benefit found in this study is higher than the benefits calculated for wheat in other studies on the SSNM, where no premiums for product quality were taken into account (Griffin 2005; Gandorfer and Meyer-Aurich 2017; Colaço and Bramley 2018).

Risk implications

Apart from increase in profitability, farmers can have other objectives such as risk reduction (Pannell 2017). Some might trade off profit against risk, and some would do vice versa. As expected, the lowest observed values of net return were lower with the SSNM options, except with the SSNMNS(75%), due to investment and operational costs for the PF technologies. The SSNMNS(75%) completely mitigated the risk of falling below the baking threshold of protein content, thus, secured the B-quality wheat price in the entire simulation. The minimum value was lower for the other SSNM option with N sensor because of higher associated costs for the sensor technology compared to the SSNM approach with yield mapping. However, this is not surprising when only the extreme lower tail of the probability distribution is observed, since it is expectable that investments in PF technologies would not pay off in the worst case scenario. Nevertheless, the SSNM options reduced the probability of low net returns substantially, and indicated lower downside risks compared to the uniform N management. Considerably higher conditional value at risk values (CVaR) were achievable with the SSNM measures. The SSNM options reduced the probability of too low protein contents and associated losses in net return occurring, therefore, reduced the downside risk. The advantages in CVaR showed a similar pattern as for the expected net return; SSNMNS(25%) increased all three CVaR values further (6 to 17€ ha−1) compared to the SSNMYM which showed higher CVaR values (18, 10 and 19€ ha−1 higher for CVaR 95, 90 and 85, respectively) compared to the uniform N management. This indicates a positive impact of the SSNM options with respect to downside risk. With the SSNM measures, 18 to 20€ ha−1 higher maximum values for net return were achievable. Compared to the uniform management, the variance of net return of SSNM was slightly higher. A minor effect of SSNM was observed on skewness and kurtosis of net return which shows no change in downside risk from this point of view given the distribution of the net returns.

In order to give another comparative measure on economic benefits of site-specific N management, net profit can be considered for which all the associated costs are deducted from earnings from crop sales. For instance, Meyer-Aurich and Karatay (2019) estimated all other farming costs except for N fertilizer management at 909€ ha−1 for an average wheat grower in Germany. When these costs are considered in the present analysis, the expected net profits would range between 49 and 64€ ha−1 for the site-specific management options, and 32€ ha−1 for the uniform management. In the lowest value (minimum) of net profit scenarios, the costs would not be covered by the earnings for any of the management options investigated in this study, leading to 552€ ha−1 loss for the uniform management and 360 to 559€ ha−1 loss for the site-specific options. Nonetheless, SSNMNS(75%) resulted in considerably less economic shortfall for the minimum compared to other measures, due to its advantage to maintain the protein above the threshold also for the lowest value for the protein content. This comparatively high advantage of SSNMNS(75%), however, relatively diminished for the mitigation of economic loss looking at the CVaR (95, 90 and 85) values, since within the lower tails (5, 10 and 15%) of the outcome distribution, other management options also reached B-quality in some scenarios.

The downside risk analysis does not consider the whole distribution of possible outcomes as could have been done with other risk measures, for instance with a certainty equivalent analysis. However, since the lower partial moments were clearly higher in the PF scenarios in this study, it can be expected that the certainty equivalent based on the discrete outcomes (e.g., Hardaker et al. 2004) would also show higher values than the certainty equivalent of the reference. A simplified calculation of the certainty equivalent based on the variance and the mean can be misleading, since the probabilities of higher outcomes, which are given with the PF technology, also increase the variance.

Cumulative probability of protein contents indicates that the SSNM resulted in higher protein contents -or at least equal- in all of the simulation combinations and, thus, shows stochastic dominance over the uniform management (Fig. 4). In the lowest 10% bound of the probability distribution on protein content, B-quality could not be reached by the uniform N management. Within the same bound, the SSNMYM option resulted in an improved protein content, yet remained below the 13% threshold, while the SSNMNS systems assured B-quality at this probability rate. In the upper bounds, the advantage of all SSNM systems was maintained in comparison to uniform management.

Modelling uncertainties

Modelling of varying N mineralization had impacts on crop yield, protein content and, thus, net return in the Monte Carlo simulations. Change in N mineralization and change in net return followed a similar pattern (Fig. 5). Higher negative deviations from the reference N mineralization led to lower net returns. Results show the applicability of the approach estimating the range of temporal variability in N mineralization based on the temporal variability in yield—as described in “Uncertainty and risk analyses” section—assessing its impact on net return. Comparable conclusions on applicability were drawn by Berg (2003) and Tembo et al. (2008) that employed a similar approach. In their analyses, they included a random effect of variability in yield and a random effect of variability in N mineralization for a linear response production function with a stochastic plateau, and did not consider the effects on crop quality. This study considered the estimation of variability in N mineralization for a quadratic polynomial production function, and implemented the quality price differential as a stochastic variable depending on protein content which in turn was affected by N mineralization.

In addition to higher economic potential with SSNM, another aspect for PF adoption could be farmers’ objective for simplification of complex farm management, which was not considered in this study. Integrating a new practice into farm management often requires considerable time and efforts and can, thus, make the management even more complicated than before. It can also lead to human risk of PF technologies, if high skills and knowledge are required, and if it is necessary to train or hire a person (i.e., producer, consultant) to operate the equipment, interpret the data, and make decisions, the farm can be vulnerable in the absence of that person (Lowenberg-DeBoer 1999). In this sense, one SSNM option can show advantages over another alternative. For instance, Meyer-Aurich et al. (2008) concluded that a sensor-based approach demands less additional knowledge and skills to acquire and, thus, requires less change in farm management. Therefore, it is likely to be easier to implement it compared to a mapping-based approach from this applicability point of view. Nevertheless, since benefits of sensor-based systems depend on the systems they are compared to, information gathering and processing, and development of site-specific algorithms to determine N fertilizer recommendation may be of more importance than the sensor device itself (Colaço and Bramley 2018). Consequently, some PF options would not only improve the farm profitability but may also reduce the complexity of farm management—depending on the farmers’ previous knowledge and the PF technology chosen. Furthermore, Marra et al. (2003) reported that there is also a possibility of over-adoption of some PF technologies by farmers, if the complexity of evaluating the information and correctly applying PF techniques are perceived only from a simple perspective.

Sensitivity analyses

It is anticipated that when the farm size is bigger and/or the heterogeneity of the field is greater, the economic advantage of SSNM could be higher. Hurley et al. (2004) reported that variable N rate application offers a significant potential to increase economic returns, while the returns decrease with the decrease in the farm size. Tozer (2009) reported that the PF system performed better in terms of net return than the conventional system by managing low productive land more efficiently, and the economic benefit diminished, when the relative proportion of high productivity land was increased. The present study assumed a cropping area of 500 ha with two subfields of equal size with different yield potentials. The sensitivity analysis on farm size showed that if annual costs of a yield mapping system for variable rate N application were accounted for a smaller or a larger cropping area (250 ha or 1000 ha), the net economic benefit would range from 11€ ha−1 to 20€ ha−1. If annual costs for a sensor system were assumed for a smaller (250 ha) or a larger cropping area (500 ha), the net economic benefit of the SSNMNS options would vary between 15€ ha−1 and 37€ ha−1 compared to the uniform N management. Furthermore, ownership of the PF technologies was assumed for the profitability and risk assessment in this study. However, contractors providing PF services may reduce the additional costs for the PF management depending on farm characteristics and site-specific conditions.

In the sensitivity analysis on setting the N rates, the reference N fertilizer rate for uniform management was raised from 137 to 143 kg ha−1 as it was the amount of average N fertilizer rate assumed for the SSNM systems. Default values of the outcomes remained similar by the slight increase in N rate. While there was a slight increase in default yield and protein levels, the default net return was reduced due to the fact that the elevated rate was beyond the economic optimum of estimated average response function. In the Monte Carlo simulations, as anticipated, there was no remarkable change in yield levels. However, the increase in N fertilizer rate for the uniform management system led to an increase of 0.15% in the expected protein content on average and, thus, improved the expected net return by approximately 9€ ha−1 considering the uncertainties on N mineralization and price patterns. It also yielded in lower downside risk for uniform management, where CVaR (95, 90, 85) values were found 18, 6, 21€ ha−1 higher accordingly, compared to the status quo of the uniform management system. The sensitivity analysis indicated that higher N rates in the reference uniform management resulted in a lower advantage of SSNM in terms of expected net returns and downside risk mitigation. In conclusion, slight adjustments in the reference N rates had no considerable economic impact on the default economic outcomes, due to relatively flat economic returns, as also suggested by Pannell (2006). However, comparing two management options of N fertilizer in a probabilistic analysis, such as the Monte Carlo method, the level of reference N rates should be chosen according to an explicit assumption (i.e., same total N rate or profit maximizing N rate of the average response function) and interpreted accordingly, as they could have an impact on the probability distribution of economic returns. Meyer-Aurich and Karatay (2019) found expected profit maximizing N rates considerably higher than economic optimal N rates for average yield and protein response based on the experimental data. Even though N fertilizer is commonly considered as a risk-increasing production factor (Monjardino et al. 2013), incentives for higher grain protein content can mitigate the risk of economic loss due to over-supply of N fertilizer (Meyer-Aurich and Karatay 2019). This can give some insight why ex-post calculated economic optima are often found lower than conventional N rates applied by farmers, since -as in the case of price premiums for wheat- higher N rates can be applied without significantly increasing risk which may however -in turn- cause environmental harms.

Conclusions

Under temporally varying N mineralization and changing price patterns of wheat, the potential of higher economic returns with SSNM options was outlined, when their impact on product quality -in addition to quantity- was considered. The findings of this study suggest that SSNM can reduce probability of low net returns in the lower tail of the distribution by meeting the critical threshold for protein content to a greater extent. For a risk-averse decision maker, the additional economic benefit of SSNM has to be traded off against the higher variance of net returns and mostly the lower minimum value for net returns due to the additional costs for PF technologies. Considerably higher conditional values at risk indicate a risk-reducing effect of the SSNM systems on the downside risk. The magnitude of comparative economic advantage of SSNM options depends on the reference N rates assumed for. Higher N rates with uniform management reduce the advantage of SSNM, probably at the cost of the environment, which deserves further research.

In the present study, simulation of yield and protein response to N fertilizer were conducted based on modelled response functions, whereas in this approach not all variability affecting yield and protein could be captured. If long-term and site-specific observed data become more available, risk mitigation potential of site-specific N management can empirically be investigated in a more detailed manner from various perspectives. These include considering other factors affecting yield and protein risks, while in this study yield and protein risk was modelled solely via changes in N mineralization. Furthermore, this study considered two modelled subfields with different yield potential. Two differentiated subfields are assumed to cover the economic response of site-specific N management, since including more subfields is not expected to greatly change its comparative advantage over uniform N application from economic point of view. However, it can be further investigated in future studies to what extent heterogeneity, as well as number of subfields would have an influence on the conclusions of this work.

References

Anselin, L., Bongiovanni, R., & Lowenberg-DeBoer, J. (2004). A spatial econometric approach to the economics of site-specific nitrogen management in corn production. American Journal of Agricultural Economics,86(3), 675–687. https://doi.org/10.1111/j.0002-9092.2004.00610.x.

Bachmaier, M., & Gandorfer, M. (2009). A conceptual framework for judging the precision agriculture hypothesis with regard to site-specific nitrogen application. Precision Agriculture,10(2), 95–110.

Berg, E. (2003). Modelling the impacts of uncertainty and attitudes towards risk on production decisions in arable farming. In Paper presented at the 25th International Conference of IAAE. Retrieved March 24, 2018 from http://www.ilr.uni-bonn.de/pe/publication/Publikationen/IAAE2003_BE.pdf.

Berg, E., & Starp, M. (2006). Farm level risk assessment using downside risk measures. In Contributed paper prepared for presentation at the 26th International Conference of the IAAE.

Bongiovanni, R. G., Robledo, C. W., & Lambert, D. M. (2007). Economics of site-specific nitrogen management for protein content in wheat. Computers and Electronics in Agriculture,58(1), 13–24. https://doi.org/10.1016/j.compag.2007.01.018.

Boyer, C. N., Wade Brorsen, B., Solie, J. B., & Raun, W. R. (2011). Profitability of variable rate nitrogen application in wheat production. Precision Agriculture,12, 473–487.

Bullock, D. S., Lowenberg-DeBoer, J., & Swinton, S. M. (2002). Adding value to spatially managed inputs by understanding site-specific yield response. Agricultural Economics,27(3), 233–245. https://doi.org/10.1016/S0169-5150(02)00078-6.

Colaço, A. F., & Bramley, R. G. V. (2018). Do crop sensors promote improved nitrogen management in grain crops? Field Crops Research,218, 126–140.

Diacono, M., Rubino, P., & Montemurro, F. (2013). Precision nitrogen management of wheat. A review. Agronomy for Sustainable Development,33, 219–241.

Dillon, C. R., Stombaugh, T. S., Kayrouz, B. M., Salim, J., & Koostra, B. K. (2007). An educational workshop on the use of precision agriculture as a risk management tool. In Stafford, J.V. (ed.), Precision Agriculture ‘07, The 6th European Conference on Precision Agriculture. Wageningen Academic Publishers, 861–867.

Ellmer, F., Erekul, O., & Köhn, W. (2001). Einfluss langjährig differenzierter organisch-mineralischer düngung auf den ertrag, die Ertragsstruktur und die Backqualität von Winterweizen. Archives of Agronomy and Soil Science,47(5–6), 423–444. https://doi.org/10.1080/03650340109366226.

Erekul, O., Ellmer, F., Köhn, W., & Öncan, F. (2005). Einfluss differenzierter Stickstoffdüngung auf Kornertrag und Backqualität von Winterweizen. Archives of Agronomy and Soil Science,51(5), 523–540.

Fiez, T. E., Miller, B. C., & Pan, W. L. (1994). Winter wheat yield and grain protein across varied landscape positions. Agronomy Journal,86(6), 1026–1032.

Finger, R. (2013). Expanding risk consideration in integrated models—the role of downside risk aversion in irrigation decisions. Environmental Modelling & Software,43, 169–172.

Gandorfer, M., & Meyer-Aurich, A. (2017). Economic potential of site-specific fertiliser application and harvest management. In S. M. Pedersen & K. M. Lind (Eds.), Precision Agriculture: Technology and Economic Perspectives (pp. 79–92). Cham: Springer International Publishing.

Gandorfer, M., Pannell, D. J., & Meyer-Aurich, A. (2011). Analyzing the effects of risk and uncertainty on optimal tillage and nitrogen fertilizer intensity for field crops in Germany. Agricultural Systems,104(8), 615–622.

Gandorfer, M., & Rajsic, P. (2008). Modeling economic optimum nitrogen rates for winter wheat when inputs affect yield and output-price. Agricultural Economics Review,9(2), 54.

Griffin, T., & Lowenberg-DeBoer, J. (2005). Worldwide adoption and profitability of precision agriculture: Implications for Brazil. Revista de Política Agrícola,4(4), 20–37.

Griffin, T. W., Shockley, J. M., & Mark, T. B. (2018). Economics of precision farming. In D. K. Shannon, D. E. Clay, & N. R. Kitchen (Eds.), Precision agriculture basics (pp. 221–230). Madison: American Society of Agronomy, Crop Science Society of America, and Soil Science Society of America.

Hanff, H., & Lau, H. (2016). Datensammlung für die betriebswirtschaftliche Bewertung landwirtschaftlicher Produktionsverfahren im Land Brandenburg. Schriftenreihe des Landesamtes Ländliche Entwicklung, Landwirtschaft und Flurneuordnung, Frankfurt (Oder), 7(1).

Hardaker, J. B., Lien, G., Anderson, J. R., & Huirne, R. (2015). Coping with Risk in Agriculture, 3rd edition: Applied Decision Analysis. Wallingford, UK: CABI Publishing.

Hardaker, J. B., Richardson, J. W., Lien, G., & Schumann, K. D. (2004). Stochastic efficiency analysis with risk aversion bounds: A simplified approach. The Australian Journal of Agricultural and Resource Economics,48, 253–270.

Hurley, T. M., Malzer, G. L., & Kilian, B. (2004). Estimating site-specific nitrogen crop response functions. Agronomy Journal,96, 1331–1343.

Karatay, Y. N., & Meyer-Aurich, A. (2018). A model approach for yield-zone-specific cost estimation of greenhouse gas mitigation by nitrogen fertilizer reduction. Sustainability,10(3), 710.

Köhn, W., Ellmer, F., Peschke, H., Chmielewski, F., & Erekul, O. (2000). Dauerdüngungsversuch (IOSDV) Berlin-Dahlem Deutschland. In Körschens M. (2000) IOSDV Internationale organische Stickstoffdauerdüngeversuche. Bericht der Internationalen Arbeitsgemeinschaft Bodenfruchtbarkeit in der Internationalen Bodenkundlichen Union. UFZ Bericht 15/2000, 25–35.

Landesanstalt für Landwirtschaft (LfL) (2018) Deckungsbeiträge und Kalkulationsdaten. Bayerische Landesanstalt für Landwirtschaft. München. Retrieved March 24, 2018, from, https://www.stmelf.bayern.de/idb.

Lawes, R. A., & Robertson, M. J. (2011). Whole farm implications on the application of variable rate technology to every cropped field. Field Crops Research,124(2), 142–148. https://doi.org/10.1016/j.fcr.2011.01.002.

Liang, H., Zhao, C., Huang, W., Liu, L., Wang, J., & Ma, Y. (2005). Variable-rate nitrogen application algorithm based on canopy reflected spectrum and its influence on wheat. In Proceedings of Fourth International Asia-Pacific Environmental Remote Sensing Symposium 2004: Remote Sensing of the Atmosphere, Ocean, Environment, and Space. SPIE, p. 9.

Liu, Y., Swinton, S. M., & Miller, N. R. (2006). Is site-specific yield response consistent over time? Does it pay? American Journal of Agricultural Economics,88(2), 471–483.

Long, D. S., Engel, R. E., & Carlson, G. R. (2000). Method for precision nitrogen management in spring wheat: II. Implementation. Precision Agriculture,2(1), 25–38.

Lowenberg-DeBoer, J. (1999). Risk management potential of precision farming technologies. Journal of Agricultural and Applied Economics,31(2), 275–285.

Lowenberg-DeBoer, J. (2019). The economics of precision agriculture. In J. Stafford (Ed.), Precision agriculture for sustainability. Cambridge: Springer. https://doi.org/10.19103/AS.2017.0032.19.

Manfredo, M. R., & Leuthold, R. M. (1999). Value-at-risk analysis: A review and the potential for agricultural applications. Review of Agricultural Economics,21, 99–111.

Marchant, B. P., Oliver, M. A., Bishop, T. F. A., & Whelan, B. M. (2013). The economics of precision agriculture. In M. A. Oliver, T. F. A. Bishop, & B. P. Marchant (Eds.), Precision Agriculture for Sustainability (pp. 191–204). Abingdon: Routledge.

Marra, M., Pannell, D. J., & Abadi Ghadim, A. (2003). The economics of risk, uncertainty and learning in the adoption of new agricultural technologies: Where are we on the learning curve? Agricultural Systems,75, 215–234.

Meyer-Aurich, A., Gandorfer, M., & Heißenhuber, A. (2008). Economic analysis of precision farming technologies at the farm level: Two german case studies. In O. W. Castalonge (Ed.), Agricultural systems: economics, technology, and diversity (pp. 67–76). Haupage, NY (USA): Nova Science Publishers.

Meyer-Aurich, A., Gandorfer, M., Trost, B., Ellmer, F., & Baumecker, M. (2016). Risk efficiency of irrigation to cereals in northeast Germany with respect to nitrogen fertilizer. Agricultural Systems,149 132–138.

Meyer-Aurich, A., Griffin, T. W., Herbst, R., Giebel, A., & Muhammad, N. (2010a). Spatial econometric analysis of a field-scale site-specific nitrogen fertilizer experiment on wheat (Triticum aestuvum L.) yield and quality. Computers and Electronics in Agriculture,74(1), 73–79.

Meyer-Aurich, A., & Karatay, Y. N. (2019). Effects of uncertainty and farmers’ risk aversion on optimal N fertilizer supply in wheat production in Germany. Agricultural Systems,173, 130–139.

Meyer-Aurich, A., Weersink, A., Gandorfer, M., & Wagner, P. (2010b). Optimal site-specific fertilization and harvesting strategies with respect to crop yield and quality response to nitrogen. Agricultural Systems,103(7), 478–485. https://doi.org/10.1016/j.agsy.2010.05.001.

Monjardino, M., McBeath, T. M., Brennan, L., & Llewellyn, R. S. (2013). Are farmers in low-rainfall cropping regions under-fertilising with nitrogen? A risk analysis. Agricultural Systems,116, 37–51.

Monjardino, M., McBeath, T., Ouzman, J., Llewellyn, R., & Jones, B. (2015). Farmer risk-aversion limits closure of yield and profit gaps: A study of nitrogen management in the southern Australian wheatbelt. Agricultural Systems,137, 108–118.

Morari, F., Zanella, V., Sartori, L., Visioli, G., Berzaghi, P., & Mosca, G. (2018). Optimising durum wheat cultivation in North Italy: Understanding the effects of site-specific fertilization on yield and protein content. Precision Agriculture,19(2), 257–277. https://doi.org/10.1007/s11119-017-9515-8.

OECD. (2016). Farm management practices to foster green growth. Paris: OECD Publishing.

Pannell, D. J. (2006). Flat earth economics: The far-reaching consequences of flat payoff functions in economic decision making. Review of Agricultural Economics,28(4), 553–566. https://doi.org/10.1111/j.1467-9353.2006.00322.x.

Pannell, D. J. (2017). Economic perspectives on nitrogen in farming systems: Managing trade-offs between production, risk and the environment. Soil Research,55, 473–478.

Robertson, M. J., Lyle, G., & Bowden, J. W. (2008). Within-field variability of wheat yield and economic implications for spatially variable nutrient management. Field Crops Research,105, 211–220.

Rockafellar, R. T., & Uryasev, S. (2002). Conditional value-at-risk for general loss distributions. Journal of Banking & Finance,26, 1443–1471.

Schneider, M., & Wagner, P. (2008). Ökonomische Effekte der teilflächenspezifischen Bewirtschaftung auf betrieblicher Ebene. In: Werner A, Dreger F, Schwarz J. Informationsgeleitete Pflanzenproduktion mit Precision Farming als zentrale inhaltliche und technische Voraussetzung für eine nachhaltige Entwicklung der landwirtschaftlichen Landnutzung—preagro II. Retrieved August 8, 2016, from http://preagro.auf.uni-rostock.de/Veroeff/preagro_Abschlussbericht_2008.pdf.

Stewart, C. M., McBratney, A. B., & Skerritt, J. H. (2002). Site-specific durum wheat quality and its relationship to soil properties in a single field in northern New South Wales. Precision Agriculture,3(2), 155–168.

Tembo, G., Brorsen, B. W., Epplin, F. M., & Tostão, E. (2008). Crop input response functions with stochastic plateaus. American Journal of Agricultural Economics,90, 424–434.

Tozer, P. R. (2009). Uncertainty and investment in precision agriculture—Is it worth the money? Agricultural Systems,100(1), 80–87. https://doi.org/10.1016/j.agsy.2009.02.001.

Webby, R. B., Adamson, P. T., Boland, J., Howlett, P. G., Metcalfe, A. V., & Piantadosi, J. (2007). The Mekong—applications of value at risk (VaR) and conditional value at risk (CVaR) simulation to the benefits, costs and consequences of water resources development in a large river basin. Ecological Modelling,201, 89–96.

Whelan, B. M., & McBratney, A. B. (2000). The “Null Hypothesis” of precision agriculture management. Precision Agriculture,2(3), 265–279. https://doi.org/10.1023/a:1011838806489.

Yost, M. A., Kitchen, N. R., Sudduth, K. A., Massey, R. E., Sadler, E. J., Drummond, S. T., et al. (2019). A long-term precision agriculture system sustains grain profitability. Precision Agriculture. https://doi.org/10.1007/s11119-019-09649-7.

Yost, M. A., Kitchen, N. R., Sudduth, K. A., Sadler, E. J., Drummond, S. T., & Volkmann, M. R. (2017). Long-term impact of a precision agriculture system on grain crop production. Precision Agriculture,18(5), 823–842. https://doi.org/10.1007/s11119-016-9490-5.

Acknowledgments

The authors gratefully acknowledge the financial support by the Senate Competition Committee (SAW) within the Joint Initiative for Research and Innovation of the Leibniz Association (Grant Number: SAW-2013-ATB-4).

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Karatay, Y.N., Meyer-Aurich, A. Profitability and downside risk implications of site-specific nitrogen management with respect to wheat grain quality. Precision Agric 21, 449–472 (2020). https://doi.org/10.1007/s11119-019-09677-3

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11119-019-09677-3