Abstract

The City of Munich, in cooperation with the local public transport provider MVG, is testing a pilot project of a “Mobility Station”, which is a multimodal mobility hub connecting public transport (PT) and new shared mobility services. The project’s goal is to provide sustainable mobility options that allow citizens to be mobile without owning a car. To evaluate the acceptance of the Mobility Station, as well as short and long term effects on mobility behavior, we developed an online user survey in close cooperation with the stakeholders and experts in the field of shared mobility. The results provide insights on the awareness and perception of the Mobility Station among users, their mobility patterns, current degree of multimodality, as well as actual and potential changes on mobility behavior and travel preferences due to the multimodal mobility service. Most users are young, male, and highly educated individuals with access to multiple mobility options. PT plays a central role for daily mobility together with the services they were identified to be customers of. The high share of users that use different mobility services at least once a month indicates some degree of multimodality. Actual and potential changes in mobility behavior towards multimodality were revealed. Some users declared to use other mobility services more often. They appreciate the availability of different mobility options and show interest in other services and intermodal connections indicating that there is still potential to increase multimodal behavior.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

In recent years, with the advances of Information and Communication Technologies (ICT) as well as innovations in vehicle technology, new mobility services such as carsharing, bikesharing and ridesourcing, among others, have emerged (Shaheen et al. 2015). Furthermore, a gradual change in the consumption culture towards more using and less owning, as well as the sharing economy supported by internet platforms and smartphone applications enable easy access to multiple options for daily mobility, especially in urban environments.

An efficient integration of multiple mobility services has the potential to compete against the flexibility and convenience of private cars by enabling comfortable, cost and time-effective door-to-door travel (Van Nes 2002). Thus, an integrated multimodal mobility service which combines the advantages of different mobility options has the potential to reduce car trips and the associated negative impacts of car-based mobility such as congestion, pollution, noise and accidents, among others.Footnote 1

Multimodal mobility hubs, commonly known as ‘Mobility Stations’ in Germany, are multimodal transport nodes that facilitate intermodal transfers by providing different mobility options in close proximity. Here public transport (PT) plays a central role usually in connection with an additional shared mobility service. Beyond the concept of Bike and Ride (B + R) or Park and Ride (P + R), the multimodal mobility service at Mobility Stations is integrated either through information (multimodal trip planners), marketing, tariffs (mobility packages) and/or access (multimodal smart cards) (Bundesinstitut für Bau-, Stadt- und Raumforschung 2015).Footnote 2

The City of Munich, in cooperation with the local PT operator (MVG), is testing a pilot Mobility Station since November 2014. In order to decide whether or not to invest in additional Mobility Stations, and if so in which form, the main stakeholders are seeking to understand the public perception and acceptance of the pilot project as well as its impacts on mobility behavior and car ownership.

The Chair of Urban Structure and Transport Planning at the Technical University of Munich is carrying out the evaluation of this Mobility Station on behalf of the Department of Public Order (DPO) of the City of Munich. In this paper, we present the results of a user survey conducted in June and July 2016 which forms an essential part of the evaluation.

Background

The City of Munich with 1.4 million inhabitants is the third largest, and the most densely populated city in Germany with more than 4400 inhabitants per square kilometer (Wulfhorst et al. 2013). The urban PT network consists of 95 km of subway, 75 km of tramway and 456 km of bus lines. In addition, 442 km of commuter train lines connect the city with the metropolitan region. Car ownership within the city is relatively low (432 vehicles/1000 inhabitants) compared to the national average (Wulfhorst et al. 2013). While other cities in Germany are witnessing a shrinking population, the city of Munich has seen a significant growth in population in the last decade (15.1% between 2004 and 2014).Footnote 3 This places a high pressure on the real estate market and on the transport network (Wulfhorst et al. 2013; see footnote 4).

Over the last few decades, a number of measures have been implemented to restrict car traffic (i.e. parking management scheme and environmental zone) and to promote using other modes (i.e. mobility management, cycling campaign, and investments in PT). According to mobility surveys, the mode share of cycling trips increased from 10% in 2002 to almost 14% in 2008, and that of car trips reduced from 41% in 2002 to 37% in 2008 (Follmer et al. 2010).Footnote 4 Further, the evaluation carried out by the city’s cycling campaign in 2011 reported a share of 18% of cycling trips and 33% of trips by car.Footnote 5

Shared mobility services

Carsharing started in Munich in 1992 in the form of Station Based Carsharing (SBCS). Today there are seven SBCS providers, of which the following two are the most important: STATTAUTO with a fleet of approximately 450 vehicles distributed across 115 stations and Flinkster with 135 vehicles available in 63 parking zones within the city.Footnote 6,Footnote 7,Footnote 8,Footnote 9,Footnote 10 With the roll out of DriveNow and car2go in 2011 and 2013 respectively, free-floating carsharing (FFCS) services were introduced. In contrast to SBCS, FFCS vehicles are not station-bound, allowing for a greater flexibility for one-way trips within the service area. Both the city’s FFCS providers have similar business models and share similar service areas (extended downtown area and Munich airport) with about 680 and 500 vehicles respectively.Footnote 11,Footnote 12,Footnote 13,Footnote 14 In addition there are three private (peer-to-peer) carsharing platforms (see footnote 7) and one scooter sharing provider with a less significant market.Footnote 15

Two bikesharing systems operate in Munich: Call a Bike is a free-floating service offered by Deutsche Bahn (German Railways) and has been operating since 2000 with 1200 bikes (Völklein 2015).Footnote 16 MVG Rad is a hybrid service (free-floating and 125 docking stations within a service area) with 1200 bikes provided by MVG since October 2015. MVG Rad users can unlock a bike from a docking station or anywhere within the service area. The MVG Rad bikes can also be returned anywhere within the service area or at a docking station. In the last case, users are rewarded with 10 min of credit in their bikesharing accounts.Footnote 17,Footnote 18

Impacts of carsharing in Munich

A recent survey among carsharing users in Munich revealed that 12% relinquished a car in their households, 40% abstained from buying a car and 27% considered giving up a car in the upcoming year. About half of the respondents indicated that carsharing played an important role in these decisions. It is estimated that the total vehicle kilometers traveled by the households that relinquished a car is on average 50% lower than those households that did not (team red 2015).

The most prominent reasons for the use of carsharing as revealed by the respondents include cost savings, affordability, flexibility in combining with PT, and the perception that it is a modern and environmentally friendly service. Another attitudinal observation is that owning a car is no longer considered a status symbol (team red 2015). Approximately 80% of the respondents were men, almost half of them were between 26 and 35 years old, and a further 25% were between 36 and 45 years old (team red 2015).

The Mobility Station

The first Mobility Station in Munich is a pilot project led by the City of Munich in cooperation with Munich City Utilities (SWM) and MVG. The goal of this pilot project is to offer sustainable mobility options to the citizens “from a single source” so that they can abstain from their private cars. The technical, legal and operational aspects of the pilot station are being tested and further stations are planned if the model proves successful.Footnote 19

Location and context

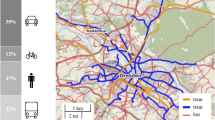

The Mobility Station at Münchner Freiheit is located in “Schwabing” a densely populated district (12,800 inhabitants/km2) of Munich.Footnote 20 This is a wealthy, young and dynamic urban area with attractive residential locations and jobs as well as multiple cultural, shopping and recreational destinations. The immediate surroundings of the Mobility Station are characterized by a mixed land-use with housing, business, retail, and leisure activities. Around 18,000 persons live in a walking distance of 10 min from the Mobility Station. This area is well served by PT services and lies within the service area of free-floating carsharing and bikesharing services (Fig. 1).

In addition to free-floating carsharing and bikesharing vehicles, which are usually available in this area, a STATTAUTO carsharing station with 10 vehicles is about 300 m away from the Mobility Station, while the next MVG Rad station is beyond the 10-min walking distance.

Components of the Mobility Station

The PT station “Münchner Freiheit“consists of subway, tram, and bus services, as well as a taxi stand and private bike parking facilities. Since November 2014 six parking places are reserved for carsharing vehicles of three different providers. Since October 2015, there is an MVG Rad bikesharing station with 20 docks. Since then, the Mobility Station is in “full operation” (Fig. 2).

Beyond the physical multimodal integration, an on-site interactive screen provides real-time information on the availability of the different alternatives such as the location of carsharing vehicles and departure times of PT services at the Mobility Station. The smartphone application, MVG More, provides the same information at the city level as well as the location of other PT stations and MVG Rad bikes. A multimodal trip planner is however not included.

A partial tariff integration exists for PT subscribers who are entitled to reduced rates for MVG Rad, free registrations with one-time free credit for FFCS and a reduced deposit for SBCS services. However, tariff integration between carsharing and MVG Rad is missing. FFCS and MVG Rad can be used with or without prior booking (allowed up to 15 min in advance) via the apps of the respective providers. STATTAUTO vehicles can be booked months in advance or for instant use.

Stakeholders

Both public and private actors are involved in the implementation, development, operation and evaluation of this pilot project. The awarding authority is the City of Munich while MVG constructs and operates the Mobility Station. MVG is at the same time the PT operator and provider of the bikesharing system MVG Rad. SWM (Munich City Utilities) provides the charging station for the electric carsharing vehicles.

The participating carsharing providers are DriveNow, car2go and STATTAUTO. Their role is to ensure that vehicles are regularly available at the station and to inform their clients about the service at the Mobility Station. Park and Ride GmbH is the organization responsible for the maintenance and control of the reserved parking places.

Initial response

The Mobility Station has registered an increasing use since its roll-out in November 2014. FFCS trips starting and ending at the station increased steadily from 164 to over 500 per month between November 2014 and June 2016. Bikesharing trips also increased from 265 to over 800 per month between October 2015 and June 2016, only showing a slight decrease during the winter months when only 186 trips were registered. The only SBCS vehicle provided at the Mobility Station is used on average six times per month. The company attributes this low use rate to the availability of ten vehicles at the other STATTAUTO station nearby.

Methodology

To evaluate the immediate and potential effects of the first Mobility Station on urban mobility we employ several methods. First, we carried out interviews with the main stakeholders of the Mobility Station to consider their goals and interests as well as their experiences as providers of the respective services. Based on findings from the interviews and in agreement with the stakeholders we designed two surveys.

The first survey aims to find out about the perception, acceptance and experiences when using the Mobility Station as well as actual and potential changes in travel behavior among users. The second survey focuses on those PT users that have never used the additional mobility services at the Mobility Station. Its aim is to learn the reasons for not using the service and factors that may persuade them. Finally, by means of focus groups we aim to examine further the findings of both surveys. This paper focuses on the design, implementation and results of the first survey, hereinafter referred to as the “user survey”.

Target group

Users are defined as customers of the new shared mobility services who have rented or returned a carsharing vehicle or an MVG Rad bike at least once at the Mobility Station.

Main aspects to be investigated

In agreement with the stakeholders, we identified two main aspects to be investigated by means of the user survey.

-

1.

Awareness and perception: Does the physical presence of the Mobility Station play a role in attracting new customers to the individual mobility services and increasing its use?

-

2.

Users’ mobility patterns and degree of multimodality: Which mobility services are most used and for what purposes? Does the Mobility Station support multimodal behavior and offer added value for mobility? Which components and which intermodal connections are more important for the users? Does the Mobility Station influence mobility behaviour in the short and long term?

Design of user survey

The user questionnaire was built upon a questionnaire previously used to evaluate the impacts of carsharing in Munich (team red 2015). The original questionnaire was adapted in order to address the above-mentioned questions related to the multimodal character of the Mobility Station and explore specific aspects interesting for the stakeholders.

The online questionnaire consisted of three main parts:

-

1.

General questions aimed to give insights on the main aspects mentioned above (acceptance, awareness, perception, adaptation of mobility behaviour, travel preferences).

-

2.

Questions about the last trip that started or ended at the Mobility Station aimed to identify important reasons for using the station, trip characteristics, the mode of transport replaced by the shared service, and the mode of transport used

-

a.

to reach the mobility station before renting a vehicle or bike;

-

b.

to reach their destination after returning a vehicle or bike.

-

a.

-

3.

Questions about the user such as age, gender, and education as well as access to and use of different modes of transport.

We created three versions of the same questionnaire with slight differences for users of the three different mobility services (MVG Rad, FFCS and SBCS).

Contact approach

Based on booking data, the providers identified those clients that used the Mobility Station during one week and invited them via e-mail to participate in the survey. The providers chose an on-line survey as the most convenient way to contact their clients since they are already used to this way of communication. We decided to contact users within the period of one week to facilitate recollection of the last trip. To avoid duplication, users were contacted only once regardless of frequency of use.

Literature suggests a response rate of 10–20% without incentives for such surveys (team red 2015; Theobald et al. 2003). However, this rate seemed optimistic considering that Munich’s carsharing users have been overwhelmed with questionnaires due to recurring studies in the past years (team red 2015; Kopp et al. 2016).Footnote 21 To ensure a reasonable response rate, the City of Munich offered an unusual incentive of 10 euro per completed questionnaire. Typically, such surveys in Germany offer monetary incentives in the form of draws (see footnote 22).Footnote 22,Footnote 23 It was not necessary to send reminders because the response rate was higher than expected (above 60%). We believe that this has to do with the incentive that the respondents received in form of credit (2 free hours for MVG Rad users and 30 free minutes for FFCS users).

Results and analysis

The user survey took place in June and July 2016. Users of three types of mobility services participated in this questionnaire. We concentrate our analysis on the two most represented groups: MVG Rad (BS) users (69%) and FFCS users (29%). By means of focus groups in a later stage, we aim to examine further the findings of the user’s survey, including those related to the underrepresented SBCS users’ group.

About 87% of FFCS users and 96% of BS users remembered their last trip by which they rented or returned a vehicle or bike at the Mobility Station. This is likely due to the short time period between using the shared service and receiving an invitation email to the online survey. For both services, rentals (70%) were more common than returns (30%).

Understanding the demand for the Mobility Station

To understand the demand for the Mobility Station, we analyze the demographic characteristics of the users including their access to different mobility options, as well as the frequency and the purpose of using them at this node.

We explore the acceptance and perception of the multimodal service by looking into their awareness of the Mobility Station as well as the reasons for using the services there instead of somewhere else. In order to derive recommendations for the design of further stations, we asked which modes are used to access and egress the Mobility Station and how important the different components and intermodal connections are to the users.

User profile

Highly educated, young males make up the big majority of respondents from both BS users and FFCS users. About 60% of FFCS users and 71% of BS users have some kind of PT subscription (weekly, monthly or yearly pass) and most of them have at least one bicycle in their households. Respondents of both groups reported to know and have used other shared services in addition to those they were identified to be customers of (Table 1).

The share of MVG Rad users that use FFCS is higher than the share of FFCS users that use MVG Rad. This is in part because MVG Rad has been on the market for a shorter period (less than 1 year) than FFCS services have been (3–5 years). The demographic characteristics of the sample are very similar to those of the 2015 survey of carsharing users in Munich (team red 2015) which in part validates our sample.

Frequency of use and purpose

A significant majority of respondents use PT at least once a week at the Mobility Station, showing that PT plays a central role for mobility among both BS and FFCS users. The high share of BS and FFCS users that use different mobility services more than once a month indicates some degree of multimodality (Fig. 3).

We asked users who declared to use a mobility service at least once a month for what different purposes they do so. The different mobility services are used for a variety of purposes (Fig. 4).

There are no significant differences between the responses of the two user groups except for the use of STATTAUTO and Taxi where small differences can be seen.

Awareness

About 60% of the users indicated that they were aware that the “Mobility Station offers bundled and easy to combine alternatives to private cars”. About half of these users learnt about the Mobility Station by chance while walking past. This highlights the importance of the physical presence of the multimodal service in public space.

Other equally important sources of information, are advertisement from stakeholders (24%), smartphone and internet (24%), as well as the on-site information screen (20%).

Reasons to use the Mobility Station

Among other reasons, 73% of FFCS users and 58% of BS users decided to rent from the Mobility Station because it offered the closest available vehicle. Another important reason is that the station is conveniently located on their way. Accessibility by PT and the high probability to find a bike was important for 34 and 22% of BS users respectively. Other reasons include the availability of electric carsharing cars, which was a decisive factor for 23% of FFCS users.

Users who ended their rental at the station report that the proximity to their final destination was the most common reason to use the Mobility Station (75% of FFCS users and 56% of BS users). BS users appreciate the direct connection to PT (45%) and the 10-min incentive for returning the bike at the station (49%). FFCS users also appreciate the availability of an electric charging point (28%) and the high chance of availability of a parking space (28%).

The possibility to rent electric vehicles and charge them at the Mobility Station seem to offer an added value to FFCS users. We know from the interviews with stakeholders that electric vehicles are more popular than conventional ones among their clients.

Connecting mode to and from the Mobility Station

FFCS users use PT (38%) or walk (55%) to rent a vehicle at the Mobility Station (Fig. 5a). This differs from shares reported for accessing a randomly located FFCS vehicle (80% walk and less than 10% use PT) (team red 2015), indicating that the Mobility Station encourages intermodal transfers. BS users use PT (60%) and walk (38%) to access bikesharing at the Mobility Station. These results show that walking and Public Transport are the two main modes to access the Mobility Station.

After returning a bike, BS users either walked or took PT to continue their trips. Most of FFCS users walked and only few took PT to their destinations. Intermodal connections that combine BS and FFCS do not seem to play an important role yet. However, 6% of FFCS users continue their trip with a shared bicycle after returning a vehicle (Fig. 5b).

Importance of intermodal connections

One of the most important features of the Mobility Station for both BS and FFCS users is the connection with PT. BS users rated the connection of PT and MVG Rad as very important (75%) or important (19%); and FFCS users rated the connection of PT and FFCS as very important (45%) or important (33%).

Other intermodal connections are also important to both FFCS and BS users. About a third of FFCS users rate the intermodal connections of PT and MVG Rad as well as FFCS and MVG Rad as important. About 30% of BS users rate the intermodal connections of PT and FFCS as well as FFCS and MVG Rad as important.

Importance of individual components

More than 83% of FFCS users and more than 93% of BS users confirm the importance of the connection to PT. As expected, a big majority of FFCS users rated components related to the use of carsharing—availability of carsharing vehicles (96%), reserved parking places (86%) and the possibility to use electric carsharing (65%)—as important. Similarly, BS users rate components related to the use of MVG Rad—availability of bikes (98%) and parking spaces for MVG Rad (84%)—as important. However, an important amount of BS users (35%) rated components related to the use of carsharing as important. A smaller, but significant share of FFCS users (25%) rated components related to the use of MVG Rad as important.

The on-site information screen is important only for 10% of FFCS and 17% of BS users. This might be due to the fact that most users of shared mobility services already have access to the same information provided on the on-site screen through a smartphone.

Demand for more Mobility Stations

The majority of users (70%) wants more Mobility Stations in Munich and only 2.5% disagree (the rest are undecided). The preferable locations for more Mobility Stations suggested by the users can be classified in the following three categories:

-

Central places in the city center,

-

Public transport nodes along high-capacity public transport axes, and

-

Residential areas, both in central districts and in the suburbs.

Impacts of the Mobility Station on mobility behavior and travel preferences

Important questions about the use of integrated multimodal services are if and how they influence mobility behavior in the short and long term. We asked users which mode of transport would they have used for their last trip starting or ending at the Mobility Station with a carsharing vehicle or MVG Rad in case the service were not available. Further, we explored potential changes in mobility behavior by asking users how the multimodal service influences their perception and use of different mobility services.

Modes replaced by the use of shared mobility services

We asked users which mode of transport they would probably have used for their last trip instead of carsharing or MVG Rad. Around 70% of FFCS and BS users would have used PT. FFCS users would have used Taxi (11%) or their own car (9%) and BS users would have walked (13%) or used their own bike (8%).

It is important to note that these responses refer only to one specific trip and do not necessarily suggest an actual replacement of transport modes for daily mobility. Based on the responses from the users regarding their last trip on the connecting mode to and from the Mobility Station we could argue that that shared mobility services complement other services, especially public transport, instead of completely replacing them. However, additional surveys are necessary to have better answers to this matter.

Impacts on mobility behavior

Using the Mobility Station contributes to changes in mobility behavior towards more multimodality. Respondents indicated that, since they use the Mobility Station they also use other mobility services more often:

-

26% of MVG Rad users and 20% of FFCS users travel more often by PT;

-

12% of FFCS users indicated that they use MVG Rad more often, and 18% of MVG Rad users indicated that they use carsharing more often.

The Mobility Station increases awareness and patronage of shared mobility services. Because of the Mobility Station—

-

18% of FFCS users and about 31% of MVG Rad joined the respective service;

-

9% FFCS users joined MVG Rad; and

-

36% of FFCS and 21% of BS users are considering joining another/a carsharing provider.

Long term effects on travel preferences can be expected. Based on previous findings on the impacts of carsharing in Munich (team red 2015) we know that carsharing contributes to reduce car ownership and total vehicle kilometers traveled. About 80% of respondents of both user groups agree that by means of the Mobility Station, they can always find the right mode of transport for them and about 75% think that it contributes to make private cars unnecessary.

Conclusions

In order to understand the impacts on mobility behavior in the short and long term of the Mobility Station in Munich, as well as it acceptance and perception we carried out a survey among users of the shared mobility services added to public transport (PT) at this node. The big majority of users are highly educated young men with access to different modes of transport and experience in using shared mobility services.

Public Transport plays a central role for more than 75% of users. Most users might still be using only the mobility service that they were identified to be customers of (in addition to PT) with a weekly frequency. However, the high share of bikesharing and FFCS users that use different mobility services more than once a month indicates some degree of multimodality among the users.

The share of bikesharing users that rate intermodal connections with carsharing and carsharing components as important, is higher than the share of bikesharing users that currently use carsharing. Similarly, the share of carsharing users that rate intermodal connections with bikesharing and bikesharing components as important, is higher than the share of carsharing users that currently use bikesharing. These findings indicate potential for future changes in mobility behavior towards more multimodality.

Actual changes in mobility behavior and travel preferences were also revealed. Users of the shared mobility services indicated that they joined and/or used other mobility services more often because of the Mobility Station.

About a third of the respondents learnt about the Mobility Station by chance while walking past. Walking is also one of the most frequently used modes to access and egress the station. This highlights the importance of the physical presence of a multimodal mobility service in public space and the quality of the urban environment. Our findings indicate a higher use of PT to access FFCS vehicles at the Mobility Station in comparison to those randomly located within the service area. This indicates that the Mobility Station encourages intermodal connections between PT and FFCS. The high share of PT use in combination with bikesharing underlines the relevance of bikesharing for first- and last mile trips.

The on-site information screen is one of the least used services and the least rated as important. Nevertheless about half of respondents indicated it to be the source of information by which they became aware of the Mobility Station. This indicates that this component is an important eye-catcher but the information provided is not very relevant for the use of mobility services. This might be because most users of shared mobility services already have access to the same information through a smartphone. Although the MVG More smartphone application provides information on the location and availability of the different mobility services, further tariff integration in the form of mobility packages and marketing might be necessary to further promote multimodality.

The majority of respondents show interest in having more mobility stations at other PT nodes, and in residential areas. The possibility to use alternative fueled vehicles (electric carsharing), seems to be an important factor for the users and should be included in other mobility stations.

The user survey was developed in close cooperation with the stakeholders and experts in the field of shared mobility. The results obtained so far are providing important insights on the awareness and perception of the Mobility Station as well as actual and potential changes of mobility behavior towards multimodality. These insights can be useful in the design of further Mobility Stations in Munich.

Nevertheless, our findings are limited due to the unique and small sample of users and the fact that only one user survey was carried out so far. More user surveys or panel studies would be necessary to better understand the impacts of a multimodal mobility service on mobility behavior in the short and long term as well as its implications for urban and transport planning.

Also the particular context where this pilot project is located with a high population density, mixed land-used and high availability of different types of (shared) mobility services must be taken in account as well as the implications for upscaling the multimodal mobility service in other parts of the city with different transport supply and land-use characteristics.

Further investigation on these aspects by means of face-to-face interviews with non-users and focus groups of both users and non-users is being done as part of the evaluation of this project. In a later stage, the results of the overall evaluation shall provide more robust conclusions.

Notes

References

Bundesinstitut für Bau-, Stadt- und Raumforschung. Neue Mobilitätsformen, Mobilitätsstationen und Stadgestalt. Kommunale Handlungsansätze zur Unterstützung neuer Mobilitätsformen durch die Berücksichtigung gestalterischer Aspekte, March, 2015. http://www.bbsr.bund.de/BBSR/DE/Veroeffentlichungen/Sonderveroeffentlichungen/2016/Mobilitaetsformen-DL.pdf. Accessed 13 Jan 2016

Call a Bike. LinkFang.de. http://www.linkfang.de/wiki/Call_a_Bike. Accessed 26 July 2016

Carsharing-Experten.de. http://www.carsharing-experten.de/carsharing-muenchen. Accessed 25 July 2016

Carsharing München. car2go München. http://carsharing-muenchen.org/car2go-muenchen/. Accessed 26 July 2016

Carsharing München. carsharing-news.de. http://www.carsharing-news.de/carsharing-muenchen/. Accessed 25 July 2016

Carsharing News. carsharing-news.de. car2go startet in München. http://www.carsharing-news.de/car2go-startet-in-munchen/. Accessed 26 July 2016

Deutsche Bahn AG. Flinkster Standorte. https://www.flinkster.de/kundenbuchung/process.php?proc=stadt&. Accessed 25 July 2016

DriveNow Carsharing München. DriveNow GmbH & Co. KG. https://de.drive-now.com/#!/carsharing/muenchen. Accessed 26 July 2016

Eggers, W.D.: Helsinki Wants To Eliminate The Need For Car Ownership By 2025. http://www.fastcoexist.com/3061108/helsinki-wants-eliminate-car-ownership-by-2025. Accessed 25 July 2016

Elias, N.: PRESSEMITTEILUNG. http://www.esa-bic.de/pdf/pm_rollout_scoo%20me_frankfurt.pdf. Accessed 26 July 2016

Fischer, M.: DriveNow startet innovatives Car Sharing in München. https://de.drive-now.com/fileadmin/sys/files/presse/2011.06.09-Launch-DriveNow_01.pdf. Accessed 26 July 2016

infas and DIW (Institut für angewandte Sozialwissenschaft GmbH; Deutsches Institut für Wirtschaftsforschung (DIW): Follmer, R., Kunert, U., Kloas, J., Kuhfeld, H.: Mobilität in Deutschland, April 2004. http://www.mobilitaet-in-deutschland.de/pdf/ergebnisbericht_mid_ende_144_punkte.pdf. Accessed 20 July 2016

infas and DLR (infas Institut für angewandte Sozialwissenschaft GmbH; Deutsches Zentrum für Luft- und Raumfahrt e.V. Institut für Verkehrsforschung): Follmer, R., Gruschwitz, D., Jesske, B., Quandt, S., Lenz, B., Nobis, C., Köhler, K., Mehlin, M.: Mobilität in Deutschland 2008. Ergebnisbericht Struktur—Aufkommen—Emissionen—Trends, February 2010

innoZ. Innovationszentrum für Mobilität und gesellschaftlichen Wandel. Aufruf: Zweite Erhebungsphase im Projekt RadSpurenLeser gestartet. innoZ. https://www.innoz.de/de/aufruf-zweite-erhebungsphase-im-projekt-radspurenleser-gestartet. Accessed 10 Nov 2016

Kopp, J., Gerike, R., Axhausen, K.W.: Status quo and perspectives for CarSharing systems: the example of DriveNow. In: Gerike, R., Hülsmann, F., Roller, K. (eds.) Strategies for Sustainable Mobilities. Opportunities and Challenges, pp. 207–226. Routledge, London (2016)

Landeshauptstadt München. Indikatorenatlas München. http://www.mstatistik-muenchen.de/indikatorenatlas/atlas.html. Accessed 10 November 2016

Mobilitätsakademie. 28.01.2016—Im Dialog: Mobilitätsstationen—Eine Idee für Berlin? http://www.mobilitaets-akademie.de/index.php?id=449. Accessed July 20, 2016

Münchner Verkehrsgesellschaft mbH (MVG). Die Mobilitätsstation an der Münchner Freiheit. The mobility station at Münchner Freiheit, September 2015. https://www.mvg.de/dam/mvg/services/mobile-services/mobilitaetsstation/flyer-mobilitaetsstation-muenchner-freiheit.pdf. Accessed 26 July 2016

Münchner Verkehrsgesellschaft mbH (MVG). Ganz einfach mobil mit dem MVG Rad, August 2015. https://www.mvg.de/dam/mvg/services/mobile-services/mvg-rad/folder-mvg-rad.pdf. Accessed 26 July 2016

Münchner Verkehrsgesellschaft mbH (MVG). Münchens CarSharing-Angebot im Überblick. https://www.mvg.de/services/mobile-services/carsharing.html. Accessed 25 July 2016

Munich Annual Economic Report 2015, City of Munich—Department of Labor and Economic Development, 2015. http://www.wirtschaft-muenchen.de/publikationen/pdfs/aer15_summary.pdf. Accessed 20 July 2016

nextbike GmbH. Fahrräder mieten in München. http://www.nextbike.de/en/muenchen/. Accessed 26 July 2016

Raumkom Institut für Raumentwicklung und Kommunikation & Wuppertal Institut für Klima, Umwelt und Energie GmbH, November 2011. Evaluationsbericht der Fahrradmarketingkampagne, Radlhauptstadt München. https://www.ris-muenchen.de/RII/RII/DOK/SITZUNGSVORLAGE/2497925.pdf. Accessed 20 July 2016

RWTH Aachen. Verlosungsbedingungen für das Gewinnspiel im Rahmen zur Umfrage “Mobilität und Erreichbarkeit der RWTH Aachen“. http://www1.isb.rwth-aachen.de/umfrageemail/Verlosungsbedingungen.pdf. Accessed 10 Nov 2016

Shaheen, S., Chan, N., Bansal, A., Cohen, A.: Shared Mobility—A Sustainability and Technologies Workshop. Definitions, Industry Developments, and Early Understanding (2015)

team red Deutschland GmbH. Collaborators: Schreier, H., Becker, U., Heller, J.: Evaluation CarSharing (EVA-CS). Landeshauptstadt München, 05/04/2015

Theobald, A., Dreyer, M., Starsetzki, T.: Online-Marktforschung. Theoretische Grundlagen und praktische Erfahrungen. Springer Fachmedien, Wiesbaden (2003)

STATTAUTO München CarSharing. Über uns. https://www.stattauto-muenchen.de/ueber-uns/. Accessed 25 July 2016

Van Nes, R.: Design of multimodal transport networks. A hierarchical approach, TRAIL-Thesis Series T2002/5, The Netherlands TRAIL Research School. Delft University Press (2002)

Völklein, M.: Call a Bike bekommt Konkurrenz. Süddeutsche Zeitung, SZ.de, 04/07/2015

Wirkung von E-Car Sharing Systemen auf Mobilität und Umwelt in urbanen Räumen. Laufzeit: 01.09.2012–31.10.2015, Bundesministerium für Umwelt, Naturschutz, Bau und Reaktorsicherheit, April 2016. http://www.erneuerbar-mobil.de/projekte/wimobil

Wulfhorst, G., Priester, R., Miramontes, M.: What Cities Want. How Cities Plan Future Mobility. MAN Group, London (2013)

Acknowledgements

We are grateful to the City of Munich and the mobility services providers (MVG, DriveNow, STATTAUTO and car2go) for their support in carrying out this evaluation. We are also grateful to all the anonymous reviewers that helped to improve the quality of our paper.

Author information

Authors and Affiliations

Contributions

MM: Questionnaire design, analysis and interpretation of results, manuscript writing. MP: Questionnaire design, analysis and interpretation of results, manuscript writing. HSR: Literature research, analysis of results, manuscript writing. MS: Questionnaire design, interpretation of results. GW: Questionnaire design, interpretation of results.

Corresponding author

Ethics declarations

Conflict of interest

On behalf of all authors, the corresponding author states that there is no conflict of interest.

Rights and permissions

About this article

Cite this article

Miramontes, M., Pfertner, M., Rayaprolu, H.S. et al. Impacts of a multimodal mobility service on travel behavior and preferences: user insights from Munich’s first Mobility Station. Transportation 44, 1325–1342 (2017). https://doi.org/10.1007/s11116-017-9806-y

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11116-017-9806-y