Abstract

Using China’s province-level panel data from 1987 to 2010, this study explores the optimal level of transport infrastructure accumulation maximizing the growth rate. We investigate under what circumstances can additional transportation infrastructure capacity positively affect economic growth, based on panel threshold regression models. Our empirical findings suggest that there is a non-monotonic relationship between the stock of transport infrastructure and the long-run growth rate. The magnitude of transport-led economic growth effect significantly depends on the level of the existing transport network. The empirical results identify two endogenous cut-off points of efficiency of transport-led economic growth effect. When the highway network density is lower than 0.17 km/km2, an insignificant positive relationship between highway infrastructure accumulation and economic growth was found. When the highway density is estimated between 0.17 and 0.38 km/km2 or higher than 0.38 km/km2, expanding the highway network has a significant positive effect on economic growth, but the magnitude of the impact is weaker in the latter, with the estimated coefficients equal to 0.23 and 0.09 respectively. Although China still enjoys a positive economic growth effect led by building more large-scale highway infrastructure, the magnitude of the effects of most provinces in China has already passed the saturation point and continuously expanding the highway network is not very productive.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Over the years, there has been a lasting interest in exploring the role of public infrastructure investment in the nation’s economic growth in the literature. Transport infrastructure investment, which takes a considerable share in public expenditure, becomes a focus of this economic phenomenon. Significant positive effects on economic growth led by transport infrastructure investment have been widely reported, such as Aschauer (1990), Moomaw and Williams (1991), Garcia-Millà and McGuire (1992), Pereira (2000), Démurger (2001), Cantos et al. (2005), Berechman et al. (2006), Hong et al. (2011). However, Evans and Karras (1994), Chandra and Thompson (2000) find little evidence to support a transport-led economic growth hypothesis, which thus reveals the uncertainty of continuous infrastructure investment. Canning and Pedroni (2008) and Crafts (2009) explain that there are associated costs for governments investing in transport infrastructure. Theoretically, the net gain from transport investment theoretically could be positive, zero or negative.

More recent research, however, has emphasized that the contribution of additional transportation infrastructure capacity to economic growth significantly depends on the level of infrastructure accumulation. The network nature of the transport infrastructure stock is observed to be responsible for this economic phenomenon. As Fernald (1999) notes, building a transport network may have been very productive, but building a second one may have a very low marginal return. Agénor (2010) indicates that the degree of efficiency of public infrastructure may be subject to threshold effects, due to the existence of network effects. Banister (2012) argues that a reasonable quality and density of the transport network has positive effects for local economic growth. However, above a certain level, an additional transport investment is likely to have less impact on the economy, as accessibility enhancement benefits become less. More specifically, the contribution of transport infrastructure provision to economic activity may depend on the level of existing infrastructure accumulation. These results raise an important policy question: What is the optimal level of transport infrastructure accumulation maximizing the growth rate? That is, in relation to expanding transport network, under what circumstances can additional transport infrastructure capacity positively affect economic growth?

Despite some mixed evidence, the majority of previous studies demonstrate significant positive effects on economic growth resulting from transport infrastructure investment (Berechman et al. 2006; Hong et al. 2011). Further, numerous researchers have presented theoretical arguments suggesting that there should exist a non-linear relationship between transport infrastructure provision and economic growth (Fernald 1999; Canning and Pedroni 2008; Crafts 2009; Agénor 2010; Banister 2012). However, this relationship has not been empirically confirmed yet. To the best of our knowledge, the cut-off points of efficiency of transport-led economic growth effect remain within the theoretical domain.

Unlike existing studies, which focus on the output elasticity of transport infrastructure, this paper explores the optimal level of transport infrastructure accumulation maximizing the growth rate, based on panel threshold regression models. The paper contributes to the literature on the transport-led economic growth hypothesis in two important directions. Firstly, it constitutes the first attempt using panel threshold regression models to empirically investigate possible threshold effects of transport infrastructure accumulation on economic growth. Secondly, it provides a research framework for decision makers to identify regions being under or over invested regards to transport resource allocation.

In this paper, we empirically confirm a non-monotonic relationship between the stock of transport infrastructure and the long-run growth rate. The empirical results identify two endogenous cut-off points of efficiency of transport-led economic growth effect. Although transport infrastructure investment can promote economic growth, the magnitude of the measured effect changes depend on the existing transport network. Below or above a certain level, the growth effect caused by expanding the transport network tends to be small. In the Chinese case, the two endogenous cut-off points (highway density) of efficiency of highway infrastructure provision on economic growth are estimated at 0.17 and 0.38 km/km2, with the estimated coefficients equal to 0.23 and 0.09 respectively. Although China still enjoys positive economic growth effects led by building more large-scale highway infrastructure, the magnitude of the effects of most provinces in China has already passed the saturation point and continuously expanding highway network is not very productive.

The rest of the paper is structured as follows. “Literature review” reviews the related literature. “The development of China’s transport network” describes the development of China’s transport network. “Model specifications and data” describes the data and model specification. “Empirical results and discussions” presents the results from the panel threshold regression and discusses limitations of the transport-led economic growth hypothesis. “Conclusions and policy implications” draws conclusions and makes some policy recommendations for promoting transport infrastructure investment as a viable development strategy.

Literature review

Transport infrastructure and economic growth

The contribution of transport infrastructure provision (including mainly highways, railways, public transit, ports and airports) to economic growth has received great attention during recent years. It is generally believed that transport infrastructure affects overall economic performance by reducing transport costs and increasing accessibility, which will directly lower the cost of input factors, increase private investment, stimulate trade, create jobs and indirectly enhance labour productivity and improve education and health outcomes.Footnote 1 In addition, transport improvements can have an even larger effect on economic activity that goes beyond the effect of the capital stock, because of agglomeration economies. The travel time reduction from transport investments can make areas more attractive to firms and households, consequently making cities, downtowns and industrial clusters become dense, and thereby increase external agglomeration economies (Chatman and Noland 2011). In reality, lack of roads and poor quality of roads obviously always act as a significant constraint on labour migration, material handling and market expansion, which are generally considered as a key obstacle for local economic development.

However, inevitably there are associated costs for governments investing in transport infrastructure. Crafts (2009) indicates that transport infrastructure investment comes at the expense of increased tax. Canning and Pedroni (2008) suggest that infrastructure investment comes at the cost of reduced investment in other types of capital, thus there may exist a growth-maximizing infrastructure level. When the existing infrastructure accumulation is lower than the growth-maximizing infrastructure level, infrastructure investment can positively affect output; above the optimal level, an additional investment tends to reduce the output elasticity.

A number of empirical studies have been conducted to examine the impact of transport infrastructure on economic growth. For example, Berechman et al. (2006) examined the relationships between the geographical scale of analysis (at the US state, county and municipality levels) and the output elasticity of highway investment. Highway capital was found to have positive impacts on output at the state and county levels from 1990 to 2000. The output elasticity with respect to highway capital was found to decline significantly, as the geographical scale gets smaller. In spite of the wide range of output elasticities observed, those studies generally support the contention that transport infrastructure is an important contributor to economic growth. Nevertheless, contradictory evidence has been found by some researchers who have found little evidence to support the transport-led economic growth hypothesis, which may cast doubt on government policies leading to continuous infrastructure investment (Evans and Karras 1994; Chandra and Thompson 2000). Chandra and Thompson (2000) for example examined specifically the impact of the interstate highway on economic growth in non-metropolitan counties in the continental US Chandra and Thompson (2000) found evidence that highway investments only increase earnings in countries that they pass directly through but not for adjacent counties. Although the findings of Chandra and Thompson (2000) suggest that the interstate highways do not increase the net economic effect in non-metropolitan countries, empirical studies at the US state level suggest that highway investment increases the output of state economies as a whole. It is interesting to note, however, Fernald (1999) suggests that construction of the interstate highway network offers a one-time increase rather than a continuing growth effect, despite that transport investment is productive. Given the possible contradictory evidence that exists within the literature, the current study seeks to examine possible reasons as to why transport infrastructure investment may not always act as an engine for regional economic growth.

Transport infrastructure and economic growth: the case of China

Over the last three decades, China has made huge investments in transport network expansion. There is a growing body of research examining China’s investment policies of transport infrastructure and examining how transport infrastructure affects China’s economic growth at the national, provincial and city levels, shown in Table 2.

These studies focus on the output elasticity of transport infrastructure investment on economic growth. They generally employ a production function or endogenous growth approach to investigate the growth effect of transport investment. While the range of the measured economic growth effects varies among empirical studies, depending on the type of transport infrastructure, research period, specification and estimation method, all studies reviewed concerning China’s transport network (in Table 2) have reported a positive contribution of transport infrastructure investment to economic performance. The estimated elasticity of transport infrastructure on economic growth is 0.05–0.245.

The literatures reviewed above demonstrate that transport investment can affect economic growth, however, their relationship should not be simply considered as a linear one. More specifically, the contribution of transport infrastructure may depend on the level of transport infrastructure accumulation. Despite both central and local governments in China investing considerable resources in transport infrastructure, however, relatively little is known about whether providing more transport infrastructure would continuously boost regional economic growth. Since it is argued that infrastructure investment has substantial payoffs in the literature, does it imply that an additional increased infrastructure provision will guarantee higher economic performance? In some developed regions like Beijing and Shanghai, where the transport network is already very dense, does a further expansion of highway network continuously stimulate economic growth? Has the transport-led economic growth effect reached a peak in China?

Although Fernald (1999), Canning and Pedroni (2008), Crafts (2009), Agénor (2010), Banister (2012) argue that the relationship between transport infrastructure endowment and economic growth is non-linear, the cut-off points of this relationship have never been empirically investigated. This paper fills this gap in the literature by investigating the non-linear relationship between transport infrastructure provision and economic growth in the worlds fastest-growing country, in which transport investment has been considered as an ‘engine’ for economic growth. Using a panel threshold regression approach, this paper explores the optimal level of transport infrastructure accumulation maximizing the economic growth of China’s provincial economies, and answers the question of whether China’s transport infrastructure accumulation has reached a peak.

The development of China’s transport network

Over the last three decades, there has been an exponential growth of investments in China’s transport network. Consequently, China’s transport infrastructure, including highway, railway, waterway and airway, all has experienced major growth and expansion during the past three decades. Among different types of transport infrastructure, highway network is evidently a basic and the most important type of transport infrastructure for China’s economic development. As indicated in Figs. 1 and 2, highway network carries the highest passenger traffic and freight during the whole period (1985–2010), which reveals the significance of the highway sector in the nation’s economic development.Footnote 2

From 1978 to 2010, the total investment in highway construction and maintenance increased from 0.94 billion RMB to 1,158.9 billion RMB, an annual growth rate of 13.64 % (deflated). Figure 3 illustrates the evolution of aggregate investment in the highway sector in China from 1978 to 2010 in relation to real GDP. Accompanying with the nation’s rapid economic growth, the highway sector has attracted an even greater level of growth in investment since the early 1990s. Consequently, China’s highway network has experienced a dramatic increase.

As a whole, the progress of China’s highway network can be divided into three periods, with the government forces playing a significant role.

-

1.

During the pre-reform period, construction of transport infrastructure was determined at the central level. Investment in transport infrastructure was given priority to regions where heavy industries were located but not with the emphasis on provincial self-sufficiency (Démurger 2001). Consequently, public transport infrastructure in most parts of China’s territory was very poor and that became a bottleneck to economic development.

-

2.

When the market-oriented economic reform started in 1978, the demand for modern transport infrastructure and construction of new transport facilities soared. Some transport projects were completed to satisfy basic needs and solve transport ‘bottle-necks’ in China.

-

3.

The early 1990s to the present represent a period of major development in the highway network. Since fiscal decentralization started in 1990s, local governments have prioritized transport projects to support economic growth and job creation. Both central and local governments have invested heavily in the construction of various types of transport infrastructure, especially the highway network. From 1978 to 2010, the total length of the highway has increased from 0.89 million km to 4.01 million km, an annual growth rate of 4.82 %.Footnote 3

Model specifications and data

The growth model

As indicated in Tables 1, 2, the most frequently used models are Cobb-Douglas production function and the growth model. In this paper, we estimate how transport infrastructure accumulation affects provincial economic growth in a Barro-type growth model, after adjusting for other regional factors that influence the level of local economic activity. Based on the principles behind the growth model by Barro (1990), the panel specification of the growth model used for this study takes the following form.

where, the subscript i and t refer to region and time, respectively, GDP i,t is the growth rate of real GDP per capita at time t, PGDP i,t-1 is the lagged values of log per capita GDP at time t-1, RDD i,t is the ratio of total length of highway to provincial area (km/km2), GOV i,t is the ratio of government consumption expenditure to GDP at time t, INV i,t is the ratio of fixed-asset investments to GDP at time t, FDI i,t is the ratio of the foreign direct investment (FDI) to GDP at time t, used as a measure of openness of the economy, EDU i,t is the educational attainment, indicated by the college student enrollment per 10000 population (person), Year 2006 is the dummy variable for the year 2006Footnote 4 (before 2006 = 0, otherwise = 1), V i,t is the error term.

Our interest here is to examine the impact of transport infrastructure accumulation on economic growth. We use the physical measure of transport infrastructure accumulation, the density of a province’s highway network, rather than the monetary investment in infrastructure.Footnote 5 In previous studies conducted by Mody and Wang (1997), Démurger (2001), Hong et al. (2011), highway density is also used as a proxy for the transport infrastructure accumulation.

Panel threshold model

We use the panel threshold model developed by Hansen (1999) to estimate the structural break of the threshold value. Considering fixed individual effects in the model, the observations are divided into multiple regimes, depending on whether the observation is above, below or between threshold levels. These regimes are distinguished by differing regression slopes. In this endogenous threshold regression model, the number and location of thresholds are endogenously determined by the data, and the bootstrap method could be used to assess the statistical significance of the threshold effect. A single threshold model takes the following form:

where, the subscript i and t refer to region and time, respectively, G i,t is the growth rate of real GDP per capita, θs the coefficient of control variables, X i,t is a vector of control variables that may affect economic growth, q i,t is the explanatory variable and also the threshold variable (highway network density), γ is the threshold value, β 1 is the threshold coefficient when the threshold value is lower than γ, β 2 is the threshold coefficient when the threshold value is higher than γ, μ i is the fixed effects, e i,t is assumed to be independently and identically distributed with mean zero and finite variance σ.

We hypothesize that there is a threshold effect (that is a nonlinear relationship) between transport infrastructure accumulation and economic growth. The null hypothesis is set as H 0 :β 1 = β 2; the alternative hypothesis is set as H 1 :β 1 ≠ β 2. If the null hypothesis holds, the coefficient β 1 = β 2 represents that the threshold effect between transport infrastructure accumulation and economic growth does not exist. Otherwise, it implies that the threshold effect does exist. It should be noted that the specification of Eq. (2) is extendable for the multiple thresholds case. It the next section, firstly, we test for the existence of thresholds against the linear hypothesis. Secondly, we determine the number of thresholds. Lastly, we calculate the confidence intervals and slope coefficients for the threshold parameters.

Data sources

The annual data for 30 provincesFootnote 6 in mainland China covering the period 1987–2010 were collected from the Compilation of Transportation Statistical Materials for New China for 50 Years, Yearbook of China Transportation and Communications, China Provincial Statistical Yearbooks and Compilation of Statistical Materials for New China for 60 Years. The descriptive statistics on the variables used in this study are summarized in Table 3.

Empirical results and discussions

Descriptive evidence

We start with a simple scatter plot depiction (Fig. 4), illustrating the relationship between highway network density and economic growth for 30 provinces in China from 1987 to 2010. Figure 4 indicates that highway provision is positively related to economic growth.

For further examination, we divide the 24-years period into eight 3-years periods, in which the average value of variables has been taken. Figure 5 reveals that the relationship between highway network density and economic growth does not maintain a uniform pattern during the eight periods that were analyzed. Following the timeline, it seems that the measured marginal effect declines over the years. From the scatter plots, we can see that the relationship between highway network density and economic growth changes overtime.

Tests of threshold effect

We firstly tested the existence of a threshold effect between transport infrastructure accumulation and economic growth for 30 provinces. We estimated the number of thresholds, allowing for zero, one, two and three thresholds. The bootstrap method was used to obtain an approximation of the F-statistics and then calculate the p values. For each of the three bootstrap tests, 300 bootstrap replications were used. Table 4 shows the results of test statistics along with their bootstrap value for a single threshold, double thresholds and triple thresholds effects.

As indicated in Table 4, the test for a single threshold F 1 is highly significant with a bootstrap p value of 0.000 and a double threshold F 2 is highly significant with a bootstrap p value of 0.010, which strongly rejects the linear model. The test statistic for a triple threshold is insignificant. Thus, we prefer to conclude there is very strong evidence that there are two thresholds in the relationship between highway network density and provincial economic growth. That is, the sample (30 provinces) can be divided into three regimes, according to the highway network density, to present different impacts on economic growth.

Table 5 shows the point estimates of the thresholds and their confidence intervals. Thus, the observations can be grouped into three regimes for further analysis, based on the threshold levels: RDD = 0.17 km/km2 and RDD = 0.38 km/km2.

The whole sample (30 provinces) is divided into three regimes: regime 1 (low regime), RDD ≤ 0.17, regime 2 (medium regime), 0.17 < RDD ≤ 0.38 and regime 3 (high regime), RDD > 0.38.

Panel threshold regression estimates

Table 6 presents the estimated coefficients of threshold variable and five control variables.

All five control variables have shown significant and expected effects on economic growth. The lagged values of log per-capita GDP has a negative effect on economic growth, implying the existence of conditional convergence in China’s economic growth process. Fixed-assets investments positively affect economic growth, while government consumption expenditure negatively affects economic growth, due to crowding out effects on private spending. Both FDI and human capital have a positive role to play in regional economic growth.

Turning to the variable of interest to us, the density of highway network, we observe that its parameter estimate is positive and highly significant at the 1 % level, when 0.17 < RDD ≤ 0.38Footnote 7 (medium regime, RDD_2) and RDD > 0.38 (high regime, RDD_3), with the higher impact being found in the medium regime. Nevertheless, when RDD ≤ 0.17 (low regime, RDD_1), an insignificant positive relationship between transport infrastructure accumulation and economic growth was confirmed in the regression analysis. This result may not be surprising. When the level of highway network density is very low, transport infrastructure does not show a significant positive impact on regional economic growth. After the level of the highway network exceeds the minimum threshold (RDD = 0.17 km/km2 in this case), continuously expanding highway network density can positvely affect economic growth, with the estimated coefficient equals 0.23. After the level of the highway network reaches the second threshold (RDD = 0.38 km/km2 in this case), the magnitude of the effect of highway infrastructure accumulation on economic growth shows a declining trend, with the coefficient equal to 0.09.

Figure 6 shows changes at the level of transport infrastructure accumulation in regimes from 1987 to 2010. Highway network in all provinces has experienced major expansion during the past three decades, thus the number of regions in the low regime and medium regime has been decreasing, while the number of regions in the high regime has been increasing gradually.

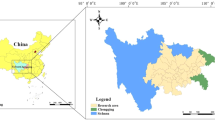

Figure 7 illustrates the distribution of provinces in different regimes in 2010, which indicates the estimated impacts of further highway infrastructure provision on economic growth. For Inner Mongolia, Qinghai and Xinjiang provinces in the low regime, since a basic highway network has not been completed yet, it seems that the current highway infrastructure does not act as an engine of regional economic growth. For Heilongjiang, Gansu and Ningxia provinces in the medium regime, providing more highway infrastructure can significantly boost regional economic growth. For other provinces, although expanding highway network can still stimulate regional economic growth; the magnitude of the transport-led growth effect has already passed a saturation point and continuously expanding highway network is not very productive.

The distribution of provinces in different regimes in 2010, *regime 1 (low regime), RDD ≤ 0.17, indicated in blue colour, regime 2 (medium regime), 0.17 < RDD ≤ 0.38, indicated in orange colour, regime 3 (high regime), RDD > 0.38, indicated in yellow colour, **Tibet is excluded in the sample due to lack of continuous statistics. (Color figure online)

Re-considering the transport-led economic growth hypothesis

In an endogenous growth model proposed by Barro (1990), government capital is included in the aggregate production function and that clearly implies the importance of infrastructure as a determinant of economic growth. Among various types of public capital, transport infrastructure certainly can raise economic growth. However, there may exist two types of costs (monetary costs and opportunity costs) for public infrastructure investment. The former one is, as noted by Crafts (2009), that public infrastructure needs tax to fund. The growth effect will be partly offset by the increased taxation required to finance public investment. This, as argued by Crafts (2009), suggests that infrastructure investment comes at the cost of reduced investment in other types of capital. Since the two opposing forces tend to lead to a non-monotonic relationship between infrastructure accumulation and economic growth, theoretically, the net gain from transport investment may be positive, zero or negative.

Empirical results of this study confirm a non-monotonic relationship between the stock of transport infrastructure and the long-run growth rate. This is consistent with network arguments by Fernald (1999), Démurger (2001), Agénor (2010), Banister (2012): the relationship between transport endowment and economic growth is positive, but subject to diminishing returns effect of the highway network. Studies of US interstate highway network by Fernald (1999) suggest that although the interstate network is highly productive, this productivity growth effect decreases (after 1970s) once the main network was completed.

These findings point out the complex phenomenon of transport infrastructure investment; that is, the transport-led economic growth hypothesis is valid only when transport infrastructure accumulation meets some specific requirements. The effect of transport infrastructure investment on economic growth depends on the development stage of the transport network. Banister (2012) suggests that there may exist at least one threshold for the magnitude of the elasticity of transport infrastructure provision. Investment in transport infrastructure can positively affect economic growth when the existing infrastructure accumulation is lower than the threshold level. Above the threshold level, the magnitude of economic growth effect declines. Agénor (2010) suggest that there may exist at least two thresholds. Using China’s province-level panel data from 1987 to 2010, we have empirically identified two turning points of efficiency of transport infrastructure provision on regional economic growth. When the highway network density is below a certain level (the first threshold), highway investment may not generate significant positive benefits to the local economy. After the basic part of the network is completed, building more large-scale highway network can significantly spur economic growth. However, beyond a saturation point (the second threshold), the growth effects caused by expanding developed networks tend to become small.

Conclusions and policy implications

The theoretical and empirical literature tends to demonstrate fairly strong positive links between transport infrastructure investment and economic growth. This research has empirically examined the impacts of transport infrastructure accumulation on economic growth in China. Unlike existing studies, which focus on the output elasticity of transport infrastructure, this study explores the optimal level of transport infrastructure provision maximizing the growth rate based on panel threshold regression models.

Focusing on highways, the largest component of transport infrastructure, our results support the contention that transport infrastructure is an important contributor to economic growth. However, results of this study confirm a non-monotonic relationship between the stock of highway provision and the long-run growth rate. The magnitude of transport-led economic growth effect depends on the level of the existing transport network. With strong evidence, we have identified two turning points of efficiency of transport-led economic growth effect by using a threshold regression approach. When the highway network density is lower than 0.17 km/km2, an insignificant positive relationship between transport infrastructure accumulation and economic growth was found. When the highway network density is between 0.17 and 0.38 km/km2, or higher than 0.38 km/km2, continuously expanding highway network has a significantly positive impact on economic growth, but the magnitude of the impact is weaker in the latter, with the estimated coefficients equal to 0.23 and 0.09 respectively.

The results suggests that although transport infrastructure investment can promote economic growth, the magnitude of effect changes depend on the scale of the existing transport network. There exists an optimal level of transport infrastructure provision for regional economic growth. Before the basic part of a transport network is completed, transport investment may not act as an engine for the local economy. Above the certain level, the productivity gains caused by additional investments tend to slow down. The results raise some policy implications for further transport investments. At the time when Chinese cities are experiencing rapid industrialization and urbanization, significant investments have been made to construct a highway network, largely based on the hypothesized causal link between transport infrastructure provision and economic growth. Indeed, China still enjoys a significant positive economic growth effect led by building large-scale highway networks. And it is expected that the positive effects of investment in the highway network will continue to outweigh its costs in the foreseeable future. However, as noted in Fig. 7, the highway network density in most provinces has reached a relatively high level (in the high regime), indicating that the transport-led economic growth effects in most regions in China have already passed the saturation point and continuously expanding highway network is no longer very productive in these cases. Increasing transport infrastructure stocks may not be a sustained path of future economic growth.

Transport infrastructure accumulation matters for the marginal productivity of additional transport investment. The optimal level of transport infrastructure accumulation maximizing the growth rate is a key concern for policymakers in determining the allocation of investment in transport infrastructure across regions. The research framework may be generalized to other countries to identify regions being under or over-invested.

Notes

See Agénor and Neanidis (2011) for a more detailed discussion of how infrastructure investments affect education and health outcome and thus indirectly affect economic growth.

Highway is a basic and the most important type of transport infrastructure. In China, the highway carries 75.5 % of the country's freight traffic and 93.4 % of the country's passenger traffic in 2010. Thus, in the following parts, we focus on the highway sector. Certainly, investment in other modes of transport, including railway, waterways, ports, civil aviation and pipelines, may influence productivity and economic growth.

A number of factors contribute to the fast development of China`s transport infrastructure. Among them, FDI-driven competition among local governments and governance level largely explain the rapid increase in infrastructure provision. (See Zhang et al. 2007 for more details).

Beginning in 2006, Ministry of Transportation in China implemented a specific project, named "five-year 100 billion", aiming to substantially improve the quality of rural roads. The year 2006 was a momentous one for the Chinese rural road construction; it witnessed a rapid, large-scale development of rural roads in the history. Thus, we use Year 2006 as a dummy variable to control the possible change.

We prefer to use the physical measure of transport infrastructure accumulation rather than the monetary investment in infrastructure for three reasons

1. Transport infrastructure facilitates economy through a networked delivery system. Since there is a lag between the times when the transport investments are made and when the economic benefits transpire, existing road supply on the year can better reflect the functioning transport network.

2. The construction cost for a road differs significantly between provinces, largely due to substantially different geological environment, such as Beijing-Tibet expressway. Thus, the monetary investment in transport infrastructure is not capable of reflecting the road kilometer that it can build.

3. In the published China Statistical Yearbook, the detailed investment specifically for the transport sector is not well documented. In some studies, the total investment in transport, storage and post was used as a proxy to aggregate transport investment, for which we believe may bias the results.

The provincial-level data include 22 provinces, 4 provincial level municipalities and 4 autonomous regions over the period from 1987 to 2010. Tibet is excluded in the sample due to lack of continuous statistics.

In the regression, both sides of equation were multiplied by 100 to reduce volatility. Thus, in the interpretation of final results, the estimated threshold of highway density should be divided by 100.

References

Agénor, P.R.: A theory of infrastructure-led development. J. Econ. Dyn. Control 34, 932–950 (2010)

Agénor, P.R., Neanidis, K.C.: The allocation of public expenditure and economic growth. Manch. Sch. 79(4), 899–931 (2011)

Aschauer, D.A.: Highway capacity and economic growth. Econ. Perspect. 14(55), 4–24 (1990)

Banister, D.: Transport and economic development: reviewing the evidence. Transp. Rev. 32(1), 1–2 (2012)

Barro, R.J.: Government spending in a simple model of endogenous growth. J. Polit. Econ. 98(5), 103–125 (1990)

Berechman, J., Ozmen, D., Ozbay, K.: Empirical analysis of transportation investment and economic development at state, county and municipality levels. Transportation 33, 537–551 (2006)

Bougheas, S., Demetriades, P.O., Mamuneas, T.P.: Infrastructure, specialization, and economic growth. Can. J. Econ. 33, 506–522 (2000)

Canning, D., Pedroni, P.: Infrastructure, long-run economic growth and causality tests for cointegrated panels. Manch. Sch. Spec. Issue 76(5), 504–527 (2008)

Cantos, P., Gumbau-Albert, M., Maudos, J.: Transport infrastructures, spillover effects and regional growth: evidence of the Spanish case. Trans. Rev. 25(1), 25–50 (2005)

Chandra, A., Thompson, E.: Does public infrastructure affect economic activity? Evidence from the rural interstate highway system. Reg. Sci. Urban Econ. 30, 457–490 (2000)

Chatman, D.G., Noland, R.B.: Do public transport improvements increase agglomeration economies? A review of literature and an agenda for research. Transp. Rev. 31(6), 725–742 (2011)

Cohen, J.P., Paul, C.J.M.: Public infrastructure investment, inter-state spatial spillovers, and manufacturing costs. Rev. Econ. Stat. 86(2), 551–560 (2004)

Crafts, N.: Transport infrastructure investment: implications for growth and productivity. Oxf. Rev. Econ. Policy 25(3), 327–343 (2009)

Démurger, S.: Infrastructure development and economic growth: an explanation for regional disparities in China? J. Comp. Econ. 29, 95–117 (2001)

Evans, P., Karras, G.: Are government activities productive? Evidence from a panel of U.S. states. Rev. Econ. Stat. 76(1), 1–11 (1994)

Fernald, J.G.: Roads to prosperity? Assessing the link between public capital and productivity. Am. Econ. Rev. 89(3), 619–638 (1999)

Garcia-Millà, T., McGuire, T.J.: The contribution of publicly provided inputs to States’ economies. Region. Sci. Urban Econ. 22, 229–241 (1992)

Garcia-Milà, T., McGuire, T.J., Porter, R.H.: The effect of public capital in state-level production functions reconsidered. Rev. Econ. Stat. 78(1), 177–180 (1996)

Hansen, B.: Threshold effects in non-dynamic panels: estimation, testing, and inference. J. Econ. 93, 345–368 (1999)

Hong, J.J., Chu, Z.F., Wang, Q.: Transport infrastructure and regional economic growth: evidence from China. Transportation 38, 737–752 (2011)

Jacoby, H.G., Minten, B.: On measuring the benefits of lower transport costs. J. Dev. Econ. 89, 28–38 (2009)

Jiwattanakulpaisarn, P., Noland, R.B., Graham, D.J.: Marginal productivity of expanding highway capacity. J. Transp. Econ. Policy 46(3), 333–347 (2012)

Liu, B.L., Wu, P., Liu, Y.H.: Transportation infrastructure and the increase in TFP in China—spatial econometric analysis on provincial panel data. China Ind. Econ. 3, 54–64 (2010). (in Chinese)

Liu, S.L., Hu, A.G.: Transport infrastructure and economic growth: perspective from China’s regional disparities. China Ind. Econ. 4, 14–23 (2010). (in Chinese)

Mody, A., Wang, F.Y.: Explaining industrial growth in coastal China: economic reforms…and what else? World Bank Econ. Rev. 11(2), 293–325 (1997)

Moomaw, R.L., Williams, M.: Total factor productivity growth in manufacturing: further evidence from the States. J. Region. Sci. 31(1), 17–34 (1991)

Munnell, A.H.: How does public infrastructure affect regional economic performance? N. Engl. Econ. Rev. 11–32 Sept./Oct. (1990)

Man, J.Y.: Transportation infrastructure and regional economic development in China. Int. J. Public Adm. 21(9), 1307–1321 (1998)

Pereira, A.M.: Is all public capital created equal? Rev. Econ. Stat. 82(3), 513–518 (2000)

Roberts, M., Deichmann, U., Fingleton, B., Shi, T.: Evaluating China’s road to prosperity: a new economic geography approach. Region. Sci. Urban Econ. 42(4), 580–594 (2012)

Zhang, X.L.: Has transport infrastructure promoted economic growth? With an analysis of the spatial effects of transport infrastructure. Soc. Sci. China 3, 60–77 (2012). (in Chinese)

Zhang, X.L.: Regional comparative analysis on the relationship between transport infrastructure and economic growth in China. J. Financ. Econ. 33(8), 51–63 (2007). (in Chinese)

Zhang, J., Gao, Y., Fu, Y., Zhang, H.: Why does China enjoy so much better physical infrastructure? Econ. Res. J. 3, 4–19 (2007). (in Chinese)

Zou, W., Zhang, F., Zhuang, Z.Y., Song, H.R.: Transport infrastructure, growth, and poverty alleviation: empirical analysis of China. Ann. Econ. Financ. 9(2), 345–371 (2008)

Acknowledgments

The authors acknowledge the financial support provided by the National Natural Science Foundation of China (Nos. 41201102, 71373153) and Leading Academic Discipline Program, 211 Project for Shanghai University of Finance and Economics (the 4th phase). This research was also supported by “Shu Guang” project grant from Shanghai Municipal Education Commission and Shanghai Education Development Foundation to Xueliang Zhang.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Deng, T., Shao, S., Yang, L. et al. Has the transport-led economic growth effect reached a peak in China? A panel threshold regression approach. Transportation 41, 567–587 (2014). https://doi.org/10.1007/s11116-013-9503-4

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11116-013-9503-4