Abstract

The financial crisis has shown that the liquidity creation function of banks is critical for the economy. In this paper, we empirically investigate whether bank liquidity creation fosters economic growth in a large emerging market, Russia. We follow the methodology of Berger and Bouwman, Rev Financ Stud 22:3779–3837, (2009) to measure bank liquidity creation using a rich and exhaustive dataset of Russian banks. We perform fixed effects and GMM estimations to examine the relation of liquidity creation with economic growth for Russian regions for the period 2004–2012. Our results suggest that bank liquidity creation strengthens economic growth. This effect was not halted by the financial crisis. Our conclusion thus supports a positive impact of financial development on economic growth in Russia.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The aim of our research is to investigate the impact of bank liquidity creation on economic growth by examining this question in one large emerging country, Russia. Our study builds on the finance-growth literature and our goal is to investigate a critical channel through which finance might contribute to economic growth.

Following the seminal paper by King and Levine (1993), the question of how financial development affects growth has received great attention among researchers. Levine and Zervos (1998) document that stock market liquidity and banking development are both positively and robustly correlated with future economic growth, capital accumulation and productivity growth. Rajan and Zingales (1995, 1998) find that in countries with more developed financial markets the provision of external finance to industrial sectors allows them to develop disproportionately faster. Beck et al. (2000) find that financial development boosts economic growth primarily by improving resource allocation and accelerating total factor productivity growth, and that banks promote economic growth by reducing the cost of external finance of firms.

Overall, the papers in the finance-growth nexus literature confirm that financial sector development positively associates with economic growth. Further, several channels explain why some countries have well-developed growth-enhancing financial systems, including stock market liquidity, financial sector and bank development, as well as bank lending and credit extension.

However, the impact of bank liquidity creation that represents a comprehensive measure of bank output on economic growth has not been assessed. As explained by Berger and Bouwman (2009), banks create liquidity by financing relatively illiquid assets with relatively liquid liabilities. The liquidity-creating role of banks is fundamental in the economy.

We propose to investigate whether bank liquidity creation is growth-enhancing. In his survey of this literature, Levine (2005) observes that the channels through which financial development positively impacts growth all rest on the fact that the financial system emerges to ease information, enforcement, and transactions costs in financing decisions and transactions. More importantly, financial systems reduce costs to ease the exchange of goods and services. Indeed, financial development contributes to develop media of exchange that consequently facilitate the exchange of goods and services. This function of the financial system is directly related to the liquidity creation role of banks in the economy. Therefore, by examining the role of liquidity creation on enhancing growth, we provide new evidence concerning one specific aspect of financial development.

Our research contributes to the recent literature on bank liquidity creation, while placing it in a broader macroeconomic context. The recent financial crisis has confirmed that the liquidity creation function of banks is critical for the economy. A few recent studies provide evidence on the volume of bank liquidity creation in some countries as well as the determinants of liquidity creation (Berger et al. 2010; Fungáčová and Weill 2012; Horvath et al. 2014). However, whereas there is commonly accepted view that bank liquidity creation contributes to improvement in the financing conditions in the economy and facilitates transactions between economic agents, empirical evidence confirming its macroeconomic impact is still missing. Our study thus contributes to filling this gap in the literature.

We aim to provide new evidence on the liquidity creation channel which we expect will lead to an increase in the volume of credit, better financial sector development, and, consequently, higher levels of economic growth. Our fieldwork is Russia, which is a large bank-based emerging economy. The ratio of banking credit to GDP is below 50 % which resembles many other emerging markets. State-controlled banks and large banks create the core of the banking sectorFootnote 1 and these banks are the ones which also contribute the most to the bank liquidity creation. Russia provides a good opportunity to investigate whether bank liquidity creation is growth enhancing for three reasons. First, the “finance-growth nexus” issues are of particular interest in the context of emerging countries, and especially given that the recent financial crisis has shown that such countries have a great role to play in restoring global financial output. Second, the measurement of bank liquidity creation requires very detailed data at the bank level, which is available for Russia on a quarterly basis from the Central Bank of Russia. This rich panel dataset on all banks in Russia allows us to measure liquidity creation following the methodology of Berger and Bouwman (2009), which requires the classification of all bank assets and liabilities as either liquid, semi-liquid, or illiquid. Third, all estimations will be performed at the regional level. The availability of information on the number of branches by bank and by region enables us to proxy liquidity creation for each bank in each region, thus obtaining regional measures of bank liquidity creation that we link to data on economic growth for these regions. We employ both fixed effects panel estimations as well as the generalized method of moments methodology for dynamic panel data estimations (Arellano and Bond 1991; Arellano and Bover 1995; Blundell and Bond 1998) to control for potential endogeneity in our key variables.

The results of our analysis represent significant contribution to the literature on the “finance-growth nexus” and bank liquidity creation as they help better understand the mechanisms through which financial development influences economic growth. Moreover, they also contribute to a better understanding of the relation between financial development and economic growth in Russia, as a limited number of papers have examined this issue. Eller et al. (2013) show that financial variables do not determine the output volatility in Russia. Berkowitz and DeJong (2010) provide an analysis of the determinants of growth in Russia during the transition in which they show that the emergence of bank-issued credit has contributed to favor growth since 2000. Berkowitz et al. (2014) use the natural experiment of the creation of specialized banks in the last years of the Soviet Union to investigate whether banking development contributes to growth. They find that while privatized banking increased lending significantly, it did not increase economic growth except when bank retained fewer political connections and when regional property rights were better protected.

These mixed results can be related to the findings that the effect of financial development is dependent of the level of economic development (Rioja and Valev 2004; Arcand et al. 2012). The relation between financial development and growth would be the strongest for middle-income countries and could even turn negative for high-income countries.

The rest of the article is structured as follows. Section 2 discusses the data. Section 3 presents the methodology used to measure liquidity creation and to perform estimations. Section 4 displays the findings, and section 5 concludes.

2 Data

We employ several sources of data to construct a unique dataset for our estimations. Macroeconomic data concerning Russian regions come from the Russian Federation Federal State Statistics Service, Rosstat. Out of 83 Russian regions we exclude some because they are significant outliers, war regions or autonomous regionsFootnote 2 below oblast level. The aggregate data on bank loans at regional level come from the Central Bank of the Russia (CBR). In some cases we use the data that are collected from these original sources and stored in the CEIC Russia Premium Database.

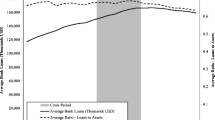

Our annual panel data set covers the period from 2004 to 2012. This time period is based on the availability of data for economic growth at the regional level as well as the data for the measures of bank liquidity creation. We calculate these measures by employing the bank-level financial statement data for Russian banks from Interfax, a financial information agency that collects and organizes data from the CBR.Footnote 3 This dataset contains data on all banks in Russia and has the detailed financial information necessary for the calculation of liquidity creation measures. The breakdown of loan portfolios enables us distinguish between corporate, household, and government loans; deposits are classified by type; securities portfolios are reported by asset classes; and there is detailed information on the maturity of all liabilities. The data is cleaned so that we drop the observations for which the ratio of total loans to total assets is lower than 5 % and the observations for which the sum of all deposits equals to 0 as these institutions are clearly not involved in standard banking activities. To calculate liquidity creation measures we thus benefit from over 27,000 bank-quarter observations for more than 1100 Russian banks. We also hand-collect data on the location of the banks and their branches from the CBR website. We use this information to allocate the liquidity created calculated for individual banks to regions.

Taking all the restrictions set by different data sources into account we end up with the dataset that contains over 576 observations for 64 regions available for the estimations. The descriptive statistics of the main variables as well as their correlations are displayed in Tables 1 and 2.

3 Methodology

3.1 Liquidity Creation Measures

The liquidity creation measures are calculated using the approach developed by Berger and Bouwman (2009). In the three-step procedure they suggest to start by classifying the bank balance sheet items as liquid, semi-liquid or illiquid. This classification is based on the ease, cost, and time necessary for banks (customers) to turn their obligations into liquid funds (withdraw funds). We also take Russian-specific factors, e.g. active trading in certain securities, into account.

In the second step the weights are assigned to all the items. In line with financial intermediation theory that banks create liquidity by transforming illiquid assets to liquid liabilities, positive weights are assigned to these two balance sheet categories. We apply negative weights to liquid assets, illiquid liabilities, and capital, since bank liquidity creation is destroyed if illiquid liabilities are used to finance liquid assets.

Equation (1) defines liquidity creation calculated in the third step,

We consider two measures of bank liquidity creation. They differ in the definitions of the right-hand side terms of Eq. (1). The first liquidity creation measure is based on a category classification of balance sheet items. The second measure is a liquidity creation measure that relies on a maturity classification of bank balance sheet items. Table 3 provides a detailed description of balance sheet items used to calculate both liquidity creation measures, their classification according to categories and maturities, and the weights assigned to each grouping.

The liquid assets category for the category definition consists of cash holdings, correspondent accounts with other banks (i.e. central bank, commercial resident and nonresident banks), investments in promissory notes, investments in debt securities (firms, governments and banks), and investments in stocks. When classifying loans we follow the literature in that corporate loans are considered illiquid assets since banks generally lack the option of selling them to meet liquidity needs. All the other types of loans, including loans to households, loans to government including foreign government and interbank loans, are classified as semi-liquid assets. As mortgage lending is relatively recent phenomenon in Russia, the majority of loans to households are still short-term loans to buy consumer goods. We view loans to households as semi-liquid following the idea that items with shorter maturity tend to be more liquid than longer-term items, notwithstanding rare loan securitization in Russia. Other loans together with intangible assets, fixed assets and other assets are included in the category of illiquid items.

Turning to the liability side, we first define liquid liabilities. Settlement accounts of banks, firms, households and government are considered liquid because customers can easily withdraw these funds without penalty. Also, securities issued by banks (bonds and promissory notes) for which liquid market exits in Russia are classified as liquid. Unlike these, deposit and savings certificates have only emerged in recent years and they are included in the semi-liquid category. This category also contains term and other deposits because it may be costly to withdraw them immediately. Other liabilities are included in the illiquid category. The same holds true for the equity.

The second liquidity creation measure is based on the maturity classification of balance sheet items. Indeed, maturity-based information provides us with important additional information to define liquidity creation in a more precise and objective manner. On the asset side the most important item are the loans. Our dataset contains the detailed information concerning the maturity of all the loans. We use this data to classify the loans with maturity less than 1 year as semi-liquid and the loans with longer maturities as liquid. All the other categories correspond to the classification used for the first liquidity creation measure.

Following similar logic as adopted on the asset side, deposits stand out as the most significant item at the liability side. Our data enables us to distinguish term deposits with the maturity lower than 1 year which we classify as semi-liquid and term deposits with longer maturity considered as illiquid. Since the maturity classification of the other liability items can be well proxied by the nature of these items, we classify them in the same way as with the first liquidity creation measure.

The above described calculation provides us with liquidity creation measures for individual banks at different points in time. In order to be able to merge this data with the dataset of regional variables we need to calculate liquidity creation in each of the regions. We use the distribution of bank branches as a proxy for banking output in a given region. Following this logic we use the number of bank branches as weights to allocate the corresponding part of liquidity created by a bank to a given region. We then sum the liquidity creation by regions and by time. This way we get a proxy for liquidity created by banks in a given region. This procedure is applied to both liquidity creation category measure and liquidity creation maturity measure.

3.2 Methodology

Given a relatively low number of regions with complete data, we cannot estimate cross-section models even if they are often used to document the preliminary stylized facts in the literature. We should also keep in mind that Russian data are more volatile than the growth data for OECD countries or selected emerging economies analyzed in the previous research.

Therefore, we rely on the estimation of a fixed effects model between 2004 and 2012 as the starting point of the empirical analysis. Our benchmark regression equation is specified as

where the subscript i stands for region index and t is a time index; \( {\dot{y}}_{it} \) is annual growth rate of gross regional product (GRP) in percent, lc it is one of the two measures of liquidity creation by the banks described in the previous subsection, and X it is a matrix of additional control variables. Variable lc it is the ratio of bank liquidity creation to GRP which we use to measure the level of financial intermediation. We use two alternative measures one based on the category and the other on the maturity classification of balance sheet items.

The set of control variables employed in our estimations includes the variables traditionally used in the finance-growth literature. We control for human capital by employing the variable education which is the proportion of employees with higher education. The degree of openness of a region (openness) is defined as the proportion of exports and imports in GRP. We also consider government size proxied by government expenditure as a proportion of GRP and inflation in the estimations. Time effects are included as well.

However, fixed effects estimations do not take into account the dynamic properties of the analyzed time series. Moreover, we need to consider possible reverse causality and endogeneity problems. Liquidity creation may be endogenous in our estimations, e.g. due to reverse causality, as the bank can extend financial means especially in the growing regions. In similar empirical settings, several authors accounted for the potential endogeneity problems by applying instrumental variable estimation techniques. Yet another important concern is that economic shocks are often highly persistent and affect economic developments for several years. Therefore, we control for dynamic properties of our data by estimating a dynamic panel model:

where ρ are autoregressive parameters for P lags of output growth and all other variables are defined as above.

The OLS estimate may be significantly biased when number of time periods is small (Baltagi 2008) because the lagged values of the dependent variable, y it-p , are correlated with the fixed effects, α i . Therefore, Arellano and Bond (1991) propose a GMM estimator which removes fixed effects by difference transformation (difference GMM). However, the difference transformation leads to the so called weak instrument problem when the dynamic terms are close to unity. Arellano and Bover (1995) and Blundell and Bond (1998) builds a system of two equations (system GMM) in levels and in first differences.

In the estimation of (3) we compare the one-step difference and system GMM estimators, which enables us also to tackle the problem of endogeneity. We use two lags of the dependent variable (annual growth rate of GRP). As far as we have longer time series for regional output growth, the inclusion of its lagged values does not result in any loss of observations. We instrument all control variables because they can be endogenous. As this approach results in a high number of internal instruments, we use collapse option as proposed by Roodman (2009) for the difference GMM specifications. Similarly, we use only one lag of each of the endogenous variables for the system GMM estimations. Time effects are included as exogenous instruments.

4 Results

This section presents our results for the impact of liquidity creation on economic growth.

4.1 Main Estimations

Table 4 sets out the main results. We present the results obtained with fixed effects and with GMM by considering alternatively liquidity creation based on maturity and on category.

We obtain overall the same results with fixed effects and with difference or system GMM. This reflects that the autoregressive coefficients are relatively small but significant. Given this property, difference GMM can be taken as our preferred method of estimation.

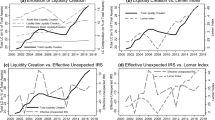

We can see somewhat mixed results concerning bank liquidity creation. On the one hand, we observe a positive and significant coefficient for the maturity version of liquidity creation measure in all specifications. On the other hand, in case of the liquidity creation measure based on the category classification, the coefficient is positive but not always significant. The maturity-based liquidity creation measure is however our preferred measure of bank liquidity creation. It is based on the maturity of different balance sheet items that is provided in our data and thus can be considered a more objective than the category based measure. Taking into account this fact we interpret our results as providing a sound support for the positive relation between bank liquidity creation and economic growth.

Our results tend to confirm that the liquidity creation role of banks is positive for the economy. From a broad perspective, they contribute to the literature on the finance-growth nexus by providing evidence on the impact of a broad measure of bank output, liquidity creation. From a Russian perspective, they provide some support for the impact of financial development on economic growth in this country. By doing so, they are not at odds with the scarce studies on this issue, including Berkowitz and DeJong (2010) who show the beneficial impact of banking development on Russian growth in the 2000s.

They can also be connected to the studies that investigate the influence of the level of economic development on the link between financial development and growth (e.g. Rioja and Valev 2004). Russia would rather be in the situation of a country for which greater bank liquidity creation enhances growth.

We now turn to the analysis of the control variables. We observe that government size is negative and significant in most estimations, which suggests that a greater influence of the government in the economy hampers economic growth. Education is not significant in the vast majority of estimations, which might be a result of the fact that there are small differences across regions. Moreover, the time period that we consider is from this point of view rather short and education level can be covered already be the regional fixed effects. Openness is positive in all estimations and significant in about a half of them including our preferred difference GMM specification with the maturity version of bank liquidity creation. This accords with the view that greater openness to trade contributes to economic growth. Finally, inflation exhibits a positive and significant impact on economic growth.

4.2 Robustness Checks

Overall, our main estimations confirm that bank liquidity creation has a positive relation with economic growth. We can nonetheless wonder if this impact is influenced by the economic cycle. Namely, financial development can improve growth performance in normal times, but can amplify output drops in recessions. Finance can be susceptible to shocks and hence can be a factor of fragility which contributes to deterioration of economic performance in troubled times (Kroszner et al. 2007; Dell’Ariccia et al. 2008).

Russia has been particularly affected by economic downturns in the last two decades. Moreover the dependence of this country on the oil and gas markets makes it particularly sensitive to macroeconomic cycles. To examine this issue, we redo the estimations by adding an interaction term between liquidity creation and a dummy variable (Crisis) equal to one if the year is 2009 or 2010. A significant interaction term would mean that the impact of liquidity creation on economic growth is different in normal years and in crisis years. Table 5 reports the results. We observe the same results for liquidity creation variables: they are positive and significant when using the measure based on maturity. Moreover, difference GMM yields also a positive and significant result for the category version of liquidity creation. Thus, the weak overall results for the category measure seem to be influenced largely by the financial crisis. This finding is further supported by our results showing that liquidity creation had a negative albeit insignificant impact on growth during the financial crisis in nearly all specifications for both versions of liquidity creation.

In the second robustness check we perform the estimations without considering regions of Moscow and Saint Petersburg. Both of these regions are very specific in the sense that they enjoy a much higher financial development than the average Russian region. Therefore we can reasonably wonder if their inclusion does not influence our main results. Table 6 displays the estimations. We confirm the positive and significant impact of bank liquidity creation on economic growth, which is only significant when using the liquidity creation measure based on maturity. Thus, the inclusion of the regions of both largest Russian cities does not affect our main findings.

5 Conclusion

In this study, we investigate the impact of bank liquidity creation on economic growth in Russia. To investigate our hypothesis we compute two measures of bank liquidity creation for Russian regions following Berger and Bouwman (2009) and link them to growth measures at the regional level.

We find some evidence that the liquidity creation role of banks is beneficial for economic growth. Liquidity creation is positively associated with growth, even if this link is only significant when we compute liquidity creation based on maturity classification. We also show that this effect was not halted by the financial crisis.

Our findings have two implications. First, they contribute to the literature on the finance-growth nexus by showing the influence of bank liquidity creation on the economy. While several studies have looked at the determinants and the measures of bank liquidity creation, our work is the first showing the major consequences of greater bank liquidity creation. Second, our results provide more insights concerning the impact of financial development on economic growth in Russia. Bank liquidity creation is a comprehensive measure of bank output which can be considered a proxy for financial development. As such, our results tend to show that financial development contributes to growth in Russia.

In any case, to deepen our understanding of the relation between liquidity creation and growth, this topic needs to be explored more within the research agenda for the finance-growth nexus.

Notes

For more details concerning the development and stability of the Russian banking system see e.g. Fungáčová and Jakubik (2013).

We neither include autonomous regions nor several Caucasus regions that are affected by military conflicts (Chechnya, Ingushetia, Ossetia, and Dagestan). We also exclude Kalmykia, Chukotka and Vologda because these regions are either characterized by insufficient data quality or are outliers.

For a more detailed description of the dataset, see Karas and Schoors (2005).

References

Arcand JL, Berkes E, Panizza U (2012) Too much finance? IMF Working Paper WP12/161

Arellano M, Bond S (1991) Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. Rev Econ Stud 58:277–297

Arellano M, Bover O (1995) Another look at the instrumental-variable estimation of error-components. J Econ 68:29–52

Baltagi B (2008) Econometric analysis of panel data. Wiley, Chichester

Beck T, Levine R, Loayza N (2000) Finance and the sources of growth. J Financ Econ 58(1–2):261–300

Berger A, Bouwman C (2009) Bank liquidity creation. Rev Financ Stud 22:3779–3837

Berger A, Bouwman C, Kick T, Schaeck K (2010) Bank risk-taking and liquidity creation following regulatory interventions and capital support. Deutsche Bundesbank Discussion Paper 05/2010

Berkowitz D, DeJong D (2010) Growth in post-soviet Russia: a tale of two transitions? J Econ Behav Organ 79:133–143

Berkowitz D, Hoekstra M, Schoors K (2014) Bank privatization, finance, and growth. J Dev Econ 110:93–106

Blundell R, Bond S (1998) Initial conditions and moment restrictions in dynamic panel data models. J Econ 87(1):115–143

Dell’Ariccia G, Detragiache E, Rajan R (2008) The real effect of banking crises. J Financ Intermed 17:89–112

Eller M, Fidrmuc J, Fungáčová Z (2013) Fiscal policy and regional output volatility: evidence from Russia. BOFIT Discussion Papers 13/2013, Bank of Finland, Helsinki

Fungáčová Z, Jakubik P (2013) Bank stress tests as an information device for emerging markets: the case of Russia. Czech J Econ Financ 63(1):87–105

Fungáčová Z, Weill L (2012) Bank liquidity creation in Russia. Eur Geogr Econ 53(2):285–299

Horvath R, Seidler J, Weill L (2014) Bank capital and liquidity creation: granger causality evidence. J Financ Serv Res 45(3):341–361

Karas A, Schoors K (2005) Heracles or Sisyphus? Finding, cleaning and reconstructing a database of Russian banks. Ghent University Working Paper 05/327

King R, Levine R (1993) Finance and growth: Schumpeter might be right. Q J Econ 108(3):717–737

Kroszner R, Laeven L, Klingebiel D (2007) Banking crises, financial dependence and growth. J Financ Econ 84:187–228

Levine R (2005) Finance and growth. In: Aghion P, Durlauf S (eds.), Handbook of economic growth. Elsevier

Levine R, Zervos S (1998) Stock markets, banks and economic growth. Am Econ Rev 88:537–558

Rajan R, Zingales L (1995) Financial systems, industrial structure and growth. Oxf Rev Econ Policy 17(4):467–482

Rajan R, Zingales L (1998) Financial dependence and growth. Am Econ Rev 88:559–586

Rioja F, Valev N (2004) Does one size fit all? A reexamination of the finance and growth relationship. J Dev Econ 74:429–447

Roodman D (2009) How to do xtabond2: An introduction to difference and system GMM in Stata. Stata J 9:86–136

Acknowledgments

We would like to thank Roman Horváth, Peter Gerstmann, Sven-Erik Jacobsen, and participants of the INFER Workshop on Banking in Europe in Prague in September 2014 and of the XV April International Academic Conference on Economic and Social Development of Higher School of Economics in Moscow in April 2014 for helpful comments and discussions.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Fidrmuc, J., Fungáčová, Z. & Weill, L. Does Bank Liquidity Creation Contribute to Economic Growth? Evidence from Russia. Open Econ Rev 26, 479–496 (2015). https://doi.org/10.1007/s11079-015-9352-1

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11079-015-9352-1