Abstract

We assess the transmission of monetary policy and the impact of fluctuations in commodity prices on the real economy for the five biggest and fastest growing emerging market economies: Brazil, Russia, India, China and South Africa (BRICS). Using modern econometric techniques, we show that a monetary policy contraction has a negative effect on output, suggesting that it can lean against unexpected macroeconomic shocks even when the financial markets are not well-developed in this group of countries. We also uncover the importance of commodity price shocks, which lead to a rise in inflation and demand an aggressive behaviour from central banks towards inflation stabilisation.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The most recent financial crisis initially did not seem to affect emerging financial markets much. However, as the collapse of Lehman Brothers in September 2008 unleashed a full-blown systemic crisis with global risk aversion dramatically increasing, even emerging market economies with sound macroeconomic and financial conditions were strongly affected. This comes as no surprise, given the importance of the trade links and the capital flows and also if one takes into account that oil and other commodity prices reached historically high levels at the onset of the global turmoil. On the one hand, the collapse of financial markets quickly morphed into real sector problems while, on the other hand, the strong correction in commodity prices brought additional macroeconomic volatility, in particularly, for commodity-producing countries.

Consequently, the severity of the Great Recession forced central banks to act quickly and to implement measures to stimulate the economy, thereby raising the need to assess whether monetary policy can be an influential stabilisation tool. Similarly, it renewed an interest in understanding the challenges that fluctuations in commodity prices pose to economic policy, in particular, for emerging market economies. For net commodity-exporting countries, higher commodity prices can have a positive impact on output, while for net commodity-importers it could have a negative impact on the economy.

Is there a scope for monetary authority in reviving output in these emerging markets? How effective is it in controlling inflation? What is the impact of central bank decisions on equity markets? How challenging does the conduct of monetary policy become in the context of sharp variation in commodity prices? These are relevant questions that we aim at answering in the current paper.

From an empirical perspective, some authors have tried to quantify the response of a set of macroeconomic variables to unexpected variation in monetary policy or to shocks in commodity prices in emerging markets. For instance, Taylor (2002) highlights the role of the monetary authority in managing agents’ expectations, in particular, when financial markets are less developed.Footnote 1 Ahmed (2003) uses a Panel Vector Auto-Regression (PVAR) framework to assess the determinants of economic fluctuations in Latin American countries. Calvo and Mishkin (2003) suggest that central banks should be subject to “constrained discretion” through inflation targeting and suggest that financial crises are strongly determined by weak institutional credibility.Footnote 2 Morón and Winkelried (2005) find that large external shocks, abrupt swings in the real exchange rate and sudden capital outflows are particularly important in this regard. Devereux et al. (2006) argue that financial frictions magnify volatility, while Batini et al. (2007) contend that they raise the costs of a fixed exchange rate regime. Wang and Handa (2007) uncover, for China, an interest rate rule targeting inflation and output smoothing, and Burdekin and Siklos (2008) show that external pressures also explain the behaviour of the monetary authority. For South Africa, du Plessis (2006) find evidence supporting the idea that monetary policy is used to dampen economic cycles. More recently, Vasicek (2010) assesses the interest rate setting followed by central banks of 12 new EU members and concludes that inflation targeting is superior to exchange rate peg. IMF (2011) reports that food price shocks have a large effect on inflation, in particular, in countries with high share of food price in CPI. In addition, the impact on medium-term inflation expectations is larger in emerging markets due to their poor anchoring.Footnote 3

In this paper, we start by evaluating the real effect of monetary policy shocks in the five key emerging countries, namely, Brazil, Russia, India, China and South Africa, i.e. the so called BRICS. We try to improve the existing literature in following directions. First, we look not only at the impact of monetary policy on output and inflation, but also on money growth, the real effective exchange rate and the stock price. Second, we assess the impact of unexpected variation in commodity prices in these large emerging market economies. Third, from a methodological perspective, we emphasize the importance of the identification of the commodity price and monetary policy shocks via modern econometric strategies (i.e. a Bayesian Structural Vector Auto-Regression (B-SVAR), a Sign-Restrictions VAR and a Panel VAR (PVAR)). Finally, we use quarterly data and for a longer time period (namely, 1990:1–2012:1), in order to be able to obtain more precise estimates for these emerging economies.

We find that a positive shock to the interest rate: (a) has a contractionary impact on real GDP growth; (b) brings a strong fall in commodity price inflation, despite the persistence of overall inflation; (c) leads to a large (albeit temporary) correction of equity markets; (d) generally tightens the liquidity market conditions; and (e) contributes to an appreciation of domestic currency. Then, we assess the impact of a positive shock to the commodity price index. Our findings reveal that such type of macroeconomic shock typically has a positive effect on overall inflation and demand a strong response from the central bank. Moreover, it boosts short- and medium-term activity in net oil-exporting countries, improves optimism of investors as reflected in the behaviour of equity markets and delivers a domestic currency appreciation.

The rest of the paper is organized as follows. Section 2 presents the econometric methodologies. Section 3 describes the data and discusses the empirical results. Finally, Section 4 concludes with the main findings of the paper and the policy implications.

2 Econometric Methodology

2.1 B-SVAR

We start by considering the following Structural Vector Auto-Regression (SVAR)

where Γ(L) is a matrix polynomial in positive powers of the lag operator L, n is the number of variables in the system, ε t are the fundamental economic shocks, \( {v_t} = \Gamma_0^{{ - 1}}{\varepsilon_{\mathrm{t}}}{ } \), and v t is the VAR innovation.

We adopt a partial recursive identification scheme, where the variables in X t can be separated into 3 groups: (a) a subset of n 1 variables, X 1t , that respond to the monetary policy shock with a lag; (b) a subset of n 2 variables, X 2t , that adjust contemporaneously to it; and (c) the policy instrument, i.e. the nominal Central Bank rate, i t . In accordance with the studies by Christiano et al. (2005) and Sousa (2010), we include the GDP deflator and the real GDP among the set of variables belonging to X 1t and the growth rate of M 2 to the set of variables in X 2t . Moreover, we add the commodity price index to X 1t and the real effective exchange rate and the equity price index to X 2t .

Finally, we use a Monte Carlo Markov-Chain (MCMC) algorithm to assess uncertainty about the impulse-response functions and construct probability intervals by drawing from a Normal Inverse-Wishart distribution. The selected optimal lag length is 1 (Russia) and 2 (Brazil, China, India and South Africa), in accordance with the standard likelihood ratio tests.

2.2 Sign Restrictions VAR

Unlike the traditional VAR approach, Uhlig (2005) proposes imposing sign restrictions on the impulse-response functions. In this case, the identification approach consists of representing the one-step ahead prediction errors into economically meaningful shocks, so that there are n fundamental shocks that are mutually orthogonal.

We randomly draw the variance covariance matrix of the error term from the posterior distribution of the reduced-form VAR coefficients. The sign-restriction approach amounts to simultaneously estimating these coefficients and the impulse vector, thereby, searching over the space of possible impulse vectors and finding those that are in accordance with the economic theory. The goal is to identify an impulse vector, a, with \( a \in {\Re^n} \), such that there is a matrix A that satisfies \( AA\prime = \Sigma \), where \( A = \left[ {{a_1}, \ldots, {a_n}} \right] \) and Σ is the variance covariance matrix of the fundamental shocks. Finally, the impulse-response function is computed as \( {\varepsilon_a}(k) = \sum\limits_{{i = 1}}^n {{\alpha_i}{\varepsilon_i}(k)} \), where α is an impulse vector of dimension n and unit length, and \( {\varepsilon_i}(k) \in {\Re^n} \) is the vector response at horizon k to the ith shock in a Cholesky decomposition of Σ.

2.3 Panel VAR

We also use a Panel-data Vector Auto-Regression PVAR, which: (a) relies on the standard VAR approach, and, therefore, treats all variables in the system as endogenous; (b) combines it with the panel-data framework, thereby, allowing for unobserved individual heterogeneity; and (c) increases the efficiency of statistical inference, consequently, avoiding the potential bias that is due to the small number of degrees of freedom.

We formulate the following first-order PVAR model

where Y i,t is a vector of endogenous variables, Γ0 is a vector of constants, Γ(L) is a matrix polynomial in the lag operator, ν i is a matrix of country-specific fixed effects, and ε i,t is a vector of error terms.

Given that the mean-differencing procedure leads to biased coefficients when there is correlation between the fixed effects and the regressors as a result of the lags of the dependent variables (Holtz-Eakin et al. 1988), we use a two-stage procedure in which we: 1) forward mean-difference the data (the ‘Helmert procedure’), thereby removing only the mean of all future observations available for each country-year; and 2) estimate a system-GMM using the lags of the regressors as instruments (Blundell and Bond 1998).Footnote 4

3 Data and Empirical Results

3.1 Data

We set up a Vector Auto-Regressive (VAR) model with seven key macroeconomic variables, namely: the commodity price index, the GDP deflator and the real GDP, the central bank rate, the monetary aggregate, the real effective exchange rate and the equity price index. The quarterly data refers to the BRICS (i.e. Brazil, Russia, India, China and South Africa) and is compiled from Datastream. The sample covers the period 1990:1–2012:1. The variables included in the econometric analysis are as follows:

-

Commodity price index: used as a forward looking variable that helps eradicate the price puzzle and proxies for changes in global demand, as well as accounts for the effects of a country being a commodity importer (as in the case of China and India) or a commodity exporter (as for Russia and, to a lesser extent, Brazil and South Africa).

-

Inflation rate, which is computed from country-specific CPIs.Footnote 5

-

Real GDP (i.e. GDP at constant prices).

-

Nominal central bank rate, which is used as the monetary policy instrument.

-

Broad money supply, M2, which captures the broad concerns of central banks towards the dynamics of money markets as well as credit conditions (Mallick 2006), is used as a monetary aggregate alongside the cost of money.

-

Real effective exchange rate, which tracks variation in the foreign exchange market and in the balance of payments.Footnote 6

-

Stock price index, which allows us to quantify the response of financial markets to monetary and macroeconomic developments.

All variables are expressed in logs of first-differences and measured at constant prices with the obvious exception of the price variables and policy instrument, which is expressed in levels and measured in nominal terms.

3.2 B-SVAR

We start by analyzing the impact of changes in the interest rate in Brazil, which are plotted in Fig. 1a. The solid line of the impulse-response functions (IRFs) corresponds to the point estimate, the red line represents the median response, and the dashed lines are the 68 % posterior confidence intervals based on 10,000 draws. We find that a monetary policy contraction lead to a fall in real GDP growth for about six, despite a small price puzzle. The shock also reduces liquidity over the next 8 quarters, while equity prices fall by close to 6 %.

We also assess, in Fig. 1b, the portion of fluctuations in the data that is caused by a monetary policy shock, i.e. we display the forecast-error variance decomposition. Policy shocks account for a reasonable fraction of the variation in inflation (6 %), the price of raw materials (8 %), the real GDP and the equity price (10 %) 12 quarters ahead.

As for Russia, Fig. 2a plots the impulse-response functions to a positive shock to the interest rate.Footnote 7 They uncover: (a) a pronounced reduction in output growth over almost eight quarters; (b) a sharp fall in the commodity price inflation; (c) some tightening of liquidity conditions; (d) a short-lived appreciation of the domestic currency; and (e) a very sharp (i.e. close to 15 %) correction of stock markets.

Figure 2b corroborates these findings in that it suggests that the monetary policy shock is responsible for a substantial fraction of the variation in the stock price index (10 %), the real GDP (25 %), the real effective exchange rate (35 %) and the monetary aggregate (50 %) over the next 12 quarters.

In Fig. 3a, we plot the impulse-response functions to a positive shock to the interest rate in India. It can be seen that output growth falls in a gradual and persistent manner for almost 10 quarters, with a trough of −0.15 % at around six quarters. It also has a strong and negative impact on inflation, although the effect is of shorter duration. As for the commodity price inflation, it falls but with a substantial lag, largely reflecting a narrower exposure of the country to the behaviour of raw materials. In line with Kubo (2009), the growth rate of M2 rises, but this pattern is reverted after six quarters. Financial markets fall on impact by 4 % (i.e. less than in the case of Brazil and Russia) and the real effective exchange rate increases only temporarily as the central bank regularly intervenes in order to stabilize the foreign exchange market.

Figure 3b also reveals the important role that monetary policy has on the real economic activity, the inflation rate and the dynamics of stock markets, as it explains around 5 % of the variation of those variables at the 12quarters ahead forecasting horizon.

In the case of China, our findings, displayed in Fig. 4a, also show: (a) a slowdown of real GDP; (b) a persistent reduction in the commodity price inflation and in overall inflation, which highlights the effectiveness of monetary policy regarding the stabilization of inflation (Zhang 2009); (c) a fall (of 4 %) and relatively long-lived fall in the stock price; (d) a contraction in the growth rate of M2; and (e) a temporary appreciation of the domestic currency. Figure 4b suggests that the interest rate shock is particularly relevant at explaining the variation in the real effective exchange rate.

Finally, the impulse-response functions to a positive shock to the interest rate in South Africa, plotted in Fig. 5a, corroborate the existence of a negative impact on real output growth, in line with the results found for the other BRICS economies. The strong fall in the commodity price inflation that is observed four quarters after the shock helps explain the reduction in overall inflation, and is in accordance with the improvements in interest rate and inflation forecasts, the increase in transparency of monetary policy and the effectiveness of inflation targeting regime (Aaron and Muellbauer 2007). The growth rate of the monetary aggregate falls in a gradual and persistent manner, while the domestic currency temporarily depreciates. The stock price index suffers a downfall of 4 % at four quarters-ahead, after which the effect starts eroding.

Figure 5b displays the variance decomposition, and shows that the policy shock accounts for close to 10 % of the variation in the real GDP and the stock price index and more than 15 % of the variation in inflation 12 quarters after the shock.

3.3 Sign Restrictions VAR

In this Section, we assess the effects of an interest rate shock—i.e. an increase in the central bank’s nominal rate, a reduction in inflation, and a fall in money growth—and a commodity price shock—i.e. an increase in the commodity price index, a rise in inflation and an increase in the central bank’s nominal rate. A summary of the identifying restrictions can be found in Table 1.

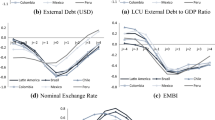

Figures 6a, 7a, 8a, 9a and 10a plot the impulse-response functions for a commodity price shock, while Figs. 6b, 7b, 8b, 9b and 10b display the responses to an interest rate shock. The thick line of the impulse-response functions (IRFs) corresponds to the median estimate and the dotted lines represent the 68 % error bands based on 10,000 draws.

The main results can be summarized in the following way:

-

1)

Russia seems to have experienced the largest fall in real output following a contractionary monetary policy shock, followed by Brazil, India, China and then South Africa. All countries seem to demonstrate monetary neutrality in the long-run.

-

2)

Inflation declines in all five countries reacting almost immediately to a monetary policy shock, but the effect seems smallest and mostly short-lived, as it quickly goes back to its initial level.

-

3)

Money growth falls in all five countries in response to a contractionary monetary shock, but the impact dies out quickly given the high rate of money growth in these emerging markets, except India where there has been higher degree of macroeconomic stability in the recent years compared to other countries. This illustrates that there is a ‘liquidity effect’ at work, following a contractionary monetary shock.

-

4)

Interest rates rise in all countries, slowly receding back to zero in all five cases. Inflation gets reduced, but at the cost of reduction in output.

-

5)

Also we find that a commodity price shock leads to appreciation in the real effective exchange rates in all countries except India where UIRP appears to hold as there is regular central bank intervention in the foreign exchange market.

-

6)

The commodity price shock contributes to higher inflationary pressures in most countries, while monetary policy helps stabilise inflation as reflected in the response of interest rate to commodity price shocks.

-

7)

While commodity price shock has a positive impact on output in the case of Russia and Brazil, such impact in case of other countries is muted as they are not net commodity exporters.

3.4 Panel VAR

We also report the results from the estimation of the PVAR. We start by analysing the impact of a positive shock to the interest rate (Fig. 11). In Fig. 12, we investigate the effects of a positive shock to the commodity price index. Figure 11 shows that a tightening of monetary policy leads to: (a) a negative effect on real GDP growth with a trough that is reached after three to four quarters; (b) a quick and large fall in the commodity price inflation; (c) a smaller (albeit negative) impact on overall inflation; (d) a negative liquidity effect that erodes after six quarters; and (e) a negative impact (of close to 3 %) on the equity price, which remains at a lower level for about five quarters.

As for the commodity price shock (displayed in Fig. 12), it generates: (a) an immediate increase in overall inflation, which persists for almost five quarters; (b) a positive (although temporary) impact on real GDP, suggesting the role played by commodities in countries that are net exporters; (c) a strong rise in the equity price of almost 12 %, in accordance with the improved economic prospects; and (d) an increase in money growth that is, eventually, boosted by money demand.

Additionally, we assess the extent to which the previous results are sensitive to the occurrence of economic, financial and/or currency crises. Therefore, we define a dummy variable, \( D_{{i,t}}^{{CRISIS}} \), that takes the value 1 if either the change (year-on-year) of real GDP or equity price index is more than two times the country-specific standard deviation of the variable, and 0, otherwise. The quarters before and after the peak of crisis are also marked with 1, and all other periods (normal periods) are marked with 0. We also consider the 2008–2009 global financial turmoil. Another dummy variable, \( D_{{i,t}}^{{NO\,CRISIS}} \), is constructed, and takes the value 1 in case of absence of episodes of crises, and 0, otherwise. Then, we estimate the following dummy variable augmented PVAR model:

Figure 13 displays the impulse-response functions in the absence of crises. The results suggest that, in “normal” periods, monetary policy has a negative effect on real GDP growth, leads to a fall in commodity price inflation, tightens the liquidity conditions and negatively impacts on stock markets.

4 Conclusion

This paper provides time-series and panel evidence on the transmission of monetary policy and on the impact of fluctuations in commodity prices for five key emerging market economies (Brazil, Russia, India, China, and South Africa, i.e. the so-called BRICS). We use modern econometric methods—namely, a Bayesian Structural Vector Auto-Regression (B-SVAR), a Sign-Restrictions VAR and a Panel VAR (PVAR)—and quarterly data for the period 1990:1–2012:1.

We uncover a strong and negative impact of monetary policy on real GDP growth and a relatively small and negative effect on inflation. A large fall in the price of commodities and a sharp correction in the stock price are also associated with a restrictive monetary policy.

All in all, these finding highlight that central banks in emerging market economies address a panoply of objectives (Singh and Kalirajan 2006), despite the focus on inflation stabilisation. Indeed, it might be partly due to inflation persistence in these economies, which is largely driven by supply shocks (such as weather-related jumps in food prices). This seems to be corroborated by the analysis of the effects of a positive shock to the commodity price, which leads to a rise in overall inflation, boosts economic activity and pushes for a monetary tightening.

While providing interesting evidence about the macroeconomic determinants of business cycle fluctuations in the BRICS, the current work opens new directions for further research. In this context, it would be important to estimate monetary policy reaction functions, i.e. the systematic response of the central bank to major economic developments. In light of the asymmetric preferences and policy switches driven by changes in financial stress conditions in emerging markets, nonlinear methods may prove successful at accurately assessing such reaction (Martin and Milas 2004; Vasicek 2011b).

Notes

Taylor (2001) also emphasizes that exchange rate stabilization can help promoting output stabilization and bringing down inflation to a targeted level.

Interestingly, Vasicek (2011a) shows that the degree of inflation persistence is higher for new EU member states than for developed economies.

The variance-covariance matrix of the residuals is decomposed using a triangular Choleski identification.

We use CPI inflation in each country as an indicator of the dynamics of inflation in all countries except India, where WPI-based inflation is used as an indicator of consumer prices.

Interestingly, Milas and Otero (2003) use a non-linear approach to model official and parallel exchange rates in a Latin American emerging market economy (Colombia). For China, Kubo (2009) investigates the role of quantity and price measures to achieve the equilibrium of the balance of payments and the stability of the financial system.

In accordance with Esanov et al. (2005), who highlight the role of monetary aggregates as policy instruments, we also compute the impulse-response functions under this set up. They are both quantitatively and qualitatively similar to the ones displayed in Fig. 2a and are available upon request. For a review of the changes in the conduct of monetary policy in Russia, see Granville and Mallick (2010). For an interesting assessment of the bank lending channel in Russia, see Vinhas de Souza (2006).

References

Aaron J, Muellbauer J (2007) Review of monetary policy in South Africa since 1994. J Afr Econ 16(5):705–744

Ahmed S (2003) Sources of economic fluctuations in Latin America and implications for choice of exchange rate regimes. J Dev Econ 72(1):181–202

Batini N, Levine P, Pearlman J (2007) Monetary rules in emerging economies with financial market imperfections. In: Galí J, Gertler M (eds) International Dimensions of Monetary Policy, NBER Conference Volume, Chapter 5, 251–311: The University of Chicago Press

Blundell R, Bond S (1998) Initial conditions and moment restrictions in dynamic panel data models. J Econ 87(1):115–143

Burdekin RCK, Siklos PL (2008) What has driven Chinese monetary policy since 1990? Investigating the People’s bank’s policy rule. J Int Money Finance 27(5):847–859

Calvo GA, Mishkin FS (2003) The mirage of exchange rate regimes for emerging market economies. J Econ Perspect 17(4):99–118

Castro V, Sousa RM (2012) How do central banks react to wealth composition and asset prices? Econ Model 29(3):641–653

Christiano LJ, Eichenbaum M, Evans CL (2005) Nominal rigidities and the dynamic effects of a shock to monetary policy. J Polit Econ 113(1):1–45

Devereux MB, Lane PR, Xu J (2006) Exchange rates and monetary policy in emerging market economies. Econ J 116(511):478–506

Du Plessis S (2006) Reconsidering the business cycle and stabilisation policies in South Africa. Econ Model 23(5):761–774

Esanov A, Merkl C, Vinhas de Souza L (2005) Monetary policy rules for Russia. J Comp Econ 33(3):484–499

Granville B, Mallick SK (2009) Monetary and financial stability in the euro area: pro-cyclicality versus trade-off. J Int Financ Mark Inst Money 19:662–674

Granville B, Mallick SK (2010) Monetary policy in Russia: identifying exchange rate shocks. Econ Model 27:432–444

Holtz-Eakin D, Newey W, Rosen HS (1988) Estimating vector autoregressions with panel data. Econometrica 56(6):1371–1395

IMF (2011) World Economic outlook. International Monetary Fund, Washington

Kubo A (2009) The effects of a monetary policy shock: evidence from India. Econ Bull 29(3):1530–1541

Mallick SK (2006) Policy instruments to avoid output collapse: an optimal control model for India. Appl Financ Econ 16(10):761–776

Martin C, Milas C (2004) Modelling monetary policy: Inflation targeting in practice. Economica 71(282):209–221

Martin C, Milas C (2010) Financial stability and monetary policy. University of Bath, Department of Economics, Working Paper No. 5

Milas C, Otero JG (2003) Modelling official and parallel exchange rates in Colombia under alternative regimes: a non-linear approach. Econ Model 20(1):165–179

Morón E, Winkelried D (2005) Monetary policy rules for financially vulnerable economies. J Dev Econ 76(1):23–51

Singh K, Kalirajan K (2006) Monetary policy in India: objectives, reaction function and policy effectiveness. Rev Appl Econ 2(2):181–199

Sousa RM (2010) Housing wealth, financial wealth, money demand and policy rule: evidence from the euro area. North Am J Econ Financ 21(1):88–105

Sousa RM (2012) Wealth, asset portfolio, money demand and policy rule. Bull Econ Res, forthcoming

Taylor JB (2001) The role of the exchange rate in monetary policy rules. Am Econ Rev Pap Proc 91:263–267

Taylor JB (2002) Using monetary policy rules in emerging market economies. Stabilisation and Monetary Policy, Banco de Mexico, 441–457

Uhlig H (2005) What are the effects of monetary policy on output? Results from an agnostic identification procedure. J Monet Econ 52(2):381–419

Vasicek B (2010) The monetary policy rules and the inflation process in open emerging economies: evidence for 12 new EU members. East Eur Econ 48(4):37–58

Vasicek B (2011a) Inflation dynamics and the New Keynesian Phillips curve in four Central European countries. Emerg Mark Financ Trade, forthcoming

Vasicek B (2011b) Is monetary policy in new EU member states asymmetric? Czech National Bank, Working Paper No. 5

Vinhas de Souza L (2006) Estimating the bank lending channel in Russia. Bank Credit 9:3–13

Wang S, Handa J (2007) Monetary policy rules under a fixed exchange rate regime: empirical evidence from China. Appl Financ Econ 17(12):941–950

Zhang W (2009) China’s monetary policy: quantity versus price rules. J Macroecon 31(3):473–484

Author information

Authors and Affiliations

Corresponding author

Additional information

We gratefully acknowledge the constructive comments made by the Editor-in-chief, George S. Tavlas, and two anonymous referees of this journal.

Rights and permissions

About this article

Cite this article

Mallick, S.K., Sousa, R.M. Commodity Prices, Inflationary Pressures, and Monetary Policy: Evidence from BRICS Economies. Open Econ Rev 24, 677–694 (2013). https://doi.org/10.1007/s11079-012-9261-5

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11079-012-9261-5