Abstract

Theoretical models on trade balance adjustment make a distinction between adjustment led by relative quantities (expenditure reduction) and adjustment led by relative prices (expenditure switching). Using cluster analysis on a set of over 70 current account adjustment episodes, we confirm the empirical relevance of this theoretical distinction, as quantity and price-driven adjustment cases can be distinguished in a statistically meaningful sense. We also identify a group of mixed cases, where both quantities and prices played a significant role in adjustment. Multinomial logit results suggest that economic fundamentals and business cycle positions prior to the adjustment have predictive power over the type of adjustment, i.e. whether the adjustment is quantity– or price-driven. The exchange rate regime and the level of economic development (emerging market versus advanced status) do not have significant predictive power.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Over the past years, widening current account imbalances in major economies have triggered a discussion as to whether and how these imbalances will adjust. The adjustment could involve different combinations of demand rebalancing between surplus and deficit countries, changes in real effective exchange rates between surplus and deficit countries, and underlying structural changes in the main surplus and deficit countries.

International macroeconomic theory offers many insights into the mechanics of current account adjustment. Current account adjustment is typically based on a combination of adjustment to quantities — in particular to domestic absorption — and adjustment to prices — typically to nominal or real exchange rates. The standard elasticities, absorption and monetary approaches to the balance of payments emphasise various combinations and drivers of quantity-based and price-based adjustment. Recent models emphasise the role of price-based adjustment, arguing that a relatively large depreciation in the deficit country will in all circumstances be needed to enable relative price shifts between tradables and non-tradables (see for instance Obstfeld and Rogoff 2005 and Rogoff 2006) or to promote a switch in international portfolio allocations (Blanchard et al. 2005).

Empirical regularities from the past offer a natural benchmark to test whether the conceptual distinction between quantity-based and price-based adjustment can be found in practice. The empirical literature on current account adjustment, however, tends to throw all adjustment cases in one basket. Empirical reviews of current account adjustment, for instance, typically estimate the average size of exchange rate adjustment during a current account rebalancing, and tend to conclude from this that an exchange rate adjustment is to be expected in all circumstances.

In our view, inference from past episodes can be enhanced by classifying episodes. To do so, we introduce a cluster analysis, allowing to form groups on the basis of numerical optimisation techniques. Each group is characterised by different adjustment patterns. Once the groups are established, we validate them by checking whether economic developments differ significantly during and before the adjustment. To this purpose, and differently from the existing literature, we fit a multinomial logit model that estimates the likelihood of a particular adjustment scenario.

The paper provides several contributions to the literature. It explicitly examines diversity across adjustment episodes and proposes a classification that is statistically robust and economically meaningful. While we are not the first to flag diversity between adjustment cases,Footnote 1 a systematic analysis has so far not been undertaken. A further novelty of the paper relates to the use of a discrete choice model with multiple outcomes instead of a standard binomial outcome analysis. As another contribution, we devote considerable attention to the selection of adjustment episodes and examine the sensitivity of the selection to changes in the underlying criteria.

The remainder of the paper is organised as follows. Section 2 briefly reviews the related literature and presents the empirical methodology. Section 3 discusses the selection of episodes and classifies the adjustments in different scenarios, using cluster analysis. Section 4 discusses the characteristics of adjustment under the different scenarios. Section 5 concludes.

2 Literature and methodology

This paper is inspired by two strands of the literature. First, a long-standing literature on the theoretical determinants and mechanics of current account adjustment. According to international trade theory, a current account deficit can be reverted via exchange rate depreciation or via domestic macroeconomic rebalancing. Price-led adjustment via exchange rate depreciation assumes that relative price adjustments cause an “expenditure switching” effect captured by the IS curve in the variation of the traditional Mundell-Fleming model (Friedman 1953; Mundell 1960). This expenditure switching mechanism retains its validity in the Obstfeld and Rogoff redux model (1995) provided that nominal prices are fixed in the producer country and the exchange rate pass-through is complete. Furthermore, this casual link is central in the analysis of the theory of optimum currency areas. Quantity-led adjustment via domestic macroeconomic rebalancing rests on the fact that external imbalances reflect country-wise domestic imbalances coming from the national income accounting identity \( \begin{gathered} {\text{GDP}} = {\text{C}} + {\text{I}} + {\text{G}} + \left( {{\text{X}} - {\text{M}}} \right) \hfill \\ \hfill \\ \end{gathered} \). In other terms, the current account balance is a summary statistic of the developments in the macro-economy and reflects the presence of imbalances in the domestic economy (Debelle and Galati 2007). The current account can be regarded as a by-product of other macroeconomic outcomes and thus the timing of reversal is driven by the factors that are contributing to those macro outcomes. Such external adjustments tend to occur through marked changes in the overall volume of expenditure, or expenditure reduction, rather than expenditure switching (IMF 2005, 2006).

Second, a more recent empirical literature on the determinants and consequences of current account adjustment. Various authors examined episodes of current account adjustment in low- and middle-income countries (Milesi-Ferretti and Razin 2000) or in industrial countries (Freund 2005). Based on a review of adjustment episodes during the 1980s and 1990s, the authors typically find that sharp corrections of current account deficit are, on average, accompanied by slowing income growth and a real exchange rate depreciation. Subsequent work, summarised in Table 1, has largely confirmed these findings. The literature has also identified leading indicators of current account adjustment, including large current account deficits, low real GDP growth in the local economy, and low real GDP growth globally.

The central contribution of this paper is to cross-check the findings of the first strand of the literature — which emphasises the theoretical role of various alternative adjustment channels — and the second strand — which examines average empirical regularities from adjustment episodes. So far, the distinction between adjustment scenarios has hardly received attention in the empirical literature. Only a few authors have explicitly differentiated adjustment scenarios, including Croke et al. (2005) and IMF (2007), who distinguish top and bottom performers in terms of real GDP growth, Guidotti et al. (2003), who investigate differences in export and import performance, and Edwards (2005b), who distinguishes adjustment episodes by country size.

To examine current account adjustment, we first identify episodes in 23 industrial and 22 emerging market economies over the period 1973–2006.Footnote 2 Broadly in line with the existing literature, we define adjustments in terms of the initial balance (the current account records a deficit before the adjustment),Footnote 3 the size of the current account improvement (one standard deviation of the country’s current account to GDP ratio),Footnote 4 the timeframe of adjustment (the adjustment should take place within 4 years), and the sustainability of adjustment (the current account improvement to be sustained over a period of 5 years).

In a second step, we classify the adjustment episodes according to developments in real exchange rates and real GDP growth, in line with the theoretical distinction between price-led and quantity-led adjustment. Rather than cutting the sample arbitrarily, for instance between high and low-growth cases as in Croke et al. (2005) and IMF (2007) or between small and large economies as in Edwards (2005b), we use cluster analysis, a numerical optimisation tool that maximises similarity within groups and minimises similarity across groups (Romesburg 2004; Everitt et al. 2001; Jain et al. 1999). Cluster analysis has clear advantages over an ad-hoc approach, as it does not require any random decisions on cut-off values between groups.

Finally, we examine carefully macroeconomic developments during and before the adjustment across each of the groups so as to uncover whether the adjustments scenarios differ in terms of overall macroeconomic dynamics, drivers, and early warning signals.Footnote 5

3 Selection and classification of adjustment episodes

Within the sample of 23 industrial and 22 emerging market economies, we find a total of 71 current account adjustment episodes, using the criteria mentioned above. Most adjustments took place in the 1980s and 1990s (26 and 28 episodes, respectively), and a majority of them occurred in industrial countries (Table 2).Footnote 6

Macroeconomic and financial developments differ strongly between the 71 adjustment episodes. To see that, Table 11 in the Appendix compares for each of episode the average post-adjustment and the average pre-adjustment levels of real GDP growth and the real exchange rate.Footnote 7 In a majority of the 71 episodes, real GDP growth declined and the real effective exchange rate depreciated, in line with the findings of the literature. However, in about one-third of the episodes, developments went against this average trend, as growth accelerated in 25 cases and the exchange rate appreciated in another 25 cases.

This casual evidence suggests that simple averages may mask important differences across episodes and that it is meaningful to classify adjustment episodes in groups on the basis of common economic characteristics. We perform such a classification using cluster analysis, identifying the groups through an optimisation process. The analysis is based on a distance measure between two episodes α and β with underlying characteristics α 1 and β 1 and α 2 and β 2 (i.e. the change in GDP growth and in the real exchange rate)Footnote 8 on the basis of the following Euclidean metric:Footnote 9

Under this iterative technique, which starts from a random grouping, individual observations are reclassified on the basis of the distance of each individual observation to the means of the various groups, until a stable solution is found whereby observations do not change groups (Romesburg 2004; Everitt et al. 2001).

As we have no priors on the number of groups, we identify the optimal number of groups by comparing statistical differences between groups. Concretely, starting with two groups, k = 2, we test whether the mean differences between groups are significantly different, and then increase the number of groups k until the group means are no longer significantly different. The optimal number of groups k* is defined as the highest number for which we find a significant difference between all groups.Footnote 10

Using real GDP growth and real effective exchange rate changes as underlying characteristics,Footnote 11 we explore classifications with two, three and four groups (k = 2, 3 and 4). We then check the significance of pairwise differences between groups, using the non-parametric Wilcoxon-Mann-Whitney test with null hypothesis of equal medians. This non-parametric test does not rest on the normality assumption and is valid also for small samples.Footnote 12 For a discussion of the advantages of this test, we refer to Detken and Smets (2004) and Adalid and Detken (2007), who apply it to episodes of asset price boom and bust cycles.

For two groups (k = 2), the test suggests that changes in real GDP growth and in the real effective exchange rate are significantly different between the groups. Also for three groups (k = 3), pairwise differences are significant. For four groups (k = 4), however, exchange rate changes are no longer significantly different, in particular for groups 2 and 4 (Table 3). We conclude that the optimal number of groups is three, k* = 3.

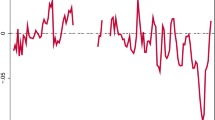

The main characteristics of the three groups, or three adjustment scenarios, are visualised in Fig. 1, which presents median developments in the current account balance, the real effective exchange rate and real GDP growth over a window of 8 years (32 quarters) before and after the adjustment. While the current account behaviour is broadly similar in the three groups, there are notable differences for the exchange rate and for real GDP growth. The real effective exchange rate records a steep depreciation in two groups, while it appreciates slightly in a third group. Real GDP growth falls sharply in two of the groups, while it accelerates in the third group.

In accordance with these broad characteristics, we name the three adjustment scenarios internal (quantity-led), external (price-led) and mixed adjustment. Internal adjustment is accompanied by a fall in economic growth without much adjustment in the real effective exchange rate. In the external adjustment group, the real effective exchange rate depreciates sharply while real GDP growth remains unchanged or even accelerates. Mixed adjustment embodies a combination of an economic slowdown and a currency depreciation.Footnote 13

4 The characteristics of current account adjustment

In this Section, we examine the characteristics, drivers, and early warning signals across the three adjustment scenarios. As a starting point, it should be emphasised that a number of potentially plausible explanations, such as the level of economic development, the exchange rate regime, the degree of openness, or the dependence on oil imports, do not seem to play a predominant role in determining the adjustment scenario. This can be seen in Table 4, which presents a simple count of the number of adjustments according to various characteristics.

-

Level of development. The three adjustment scenarios are relatively evenly spread between industrial and emerging market economies, both when the level of development is measured with recent data and when it is measured at the time of adjustment (e.g. cases of Portugal or Greece, which are nowadays classified as industrialised by the IMF but can be classified as emerging at the time of their adjustment episodes in the 1970s and 1980s).

-

Exchange rate regime. The adjustment scenarios also broadly spread over different exchange rate regimes, in particular when a distinction is made between pegs/crawling pegs and floating regimes.Footnote 14 This seems to rule out exchange rate regime choices as an explanation of adjustment typologies.

-

Degree of openness and oil dependence. The adjustment scenarios are evenly spread across open and closed economies, as well as across oil importers and exporters.

These indicative results suggest that the typology of current account adjustment cannot be brought down to general country characteristics, and instead has to reflect more deeply-rooted mechanics of adjustment. To deepen the understanding of such mechanics, and using a more thorough approach, we test whether changes in a range of macroeconomic and financial variables (from their pre– to their post-adjustment levels) are significantly different from zero and significantly different between groups.Footnote 15 We use non-parametric tests on the median of the distributions given the higher power of such tests for small samples and for variables that are not normally distributed, as is likely to be the case with several of the variables considered here. The left-hand columns of Table 5 report the results of the Wilcoxon rank sign test for the null hypothesis that the median of each group is zero, while the right-hand columns present the results of the Wilcoxon-Man-Whitney test of the null hypothesis that two groups have the same median.Footnote 16

The results presented in Table 5 allow to establish the following typology of current account adjustment:

-

Internal adjustment. In terms of current account composition, internal adjustment takes place predominantly through a compression of imports. The fall in imports mirrors a significant contraction in domestic demand, by 2.9 percentage points on average, reflecting a slowdown in private consumption growth and an even more pronounced correction in fixed private investment growth. This suggests that internal adjustment may be a (regular or sharp) manifestation of a conjunctural downturn, taking place in the context of an overheating economy reaching or exceeding its capacity limits, as also evidenced by the statistically significant decline in consumer price inflation and in housing prices during the adjustment.

-

External adjustment. In the case of exchange rate-led external adjustment, the improvement in the current account is exclusively attributable to an increase in exports, which more than offsets an improvement in imports. Changes in domestic demand growth are much smaller than in the internal adjustment case, and have the opposite sign, as domestic demand growth records a strengthening of around 0.7 percentage points. This is in line with the idea that the correction of the trade balance is mainly situated on the export side, with additional demand for exported goods fuelling a pick-up of domestic consumption and investment growth. Presumably, such external adjustment cases may take place in economies with excess capacity, where a real exchange rate depreciation triggers additional foreign demand for goods, which are met by an increase in overall production of the economy. At the same time, the observed increase in unemployment could be seen as shedding doubt on such a hypothesis of an economy with excess capacity. One other salient feature of external adjustments is that they tend to coincide with periods of an acceleration in global economic activity. The result is intuitive and suggests that, whereas internal and mixed adjustments are mainly internal phenomena, external adjustments based on higher export growth are facilitated by stronger global growth.

-

Mixed adjustment. The mixed adjustment cases are characterised by a large real effective exchange rate depreciation (almost 20%) and a collapse in real GDP growth by 3 percentage points. Domestic demand growth contracts significantly, by 4.8 percentage points, driven mainly by a very sharp correction in fixed private investment growth. Differently from the external adjustment cases, the exchange rate depreciation is not expansionary, and the mixed adjustment cases therefore appear to reflect the crisis-driven adjustment scenario where a strong external adjustment need is addressed through a simultaneous shift in relative prices and in domestic absorption. The mixed adjustment cases are also the only ones where government balances change in a statistically significant way, with a negative sign, suggesting a fiscal consolidation that is part of the drivers of adjustment.

To enhance the rigour of analysis and to check this broad description of the three adjustment typologies, it is useful to see whether specific country characteristics or macroeconomic variables help to predict the adjustment scenario. A number of authors have estimated the likelihood of a current account adjustment using discrete choice models,Footnote 17 but they have not distinguished across potentially different adjustment scenarios. These existing results are insightful but have in our view a serious shortcoming as they rely on the assumption that a single equation can signal all current account adjustments. This assumption seems restrictive as one would expect the significance and possibly even the sign of some variables to differ between adjustment scenarios. An internal adjustment, for instance, is more likely to be signalled by indicators of overheating, while an external adjustment is more likely to be signalled by an overvalued exchange rate.

We first replicate the results of the literature in a first specification, using a binomial logit with a dependent variable that takes value S = 0 during tranquil times and S = 1 before a current account adjustment.Footnote 18 We then add a new model, using a multinomial setting that differentiates between adjustment scenarios (S = 0 during tranquil times, S = 1 for internal adjustment, S = 2 for external adjustment, and S = 3 for mixed adjustment). This specification allows to estimate the specific likelihood of each of adjustment scenario.Footnote 19

The choice of explanatory variables in our baseline specification is motivated by existing studies, as well as by the significance of the variables and the goodness of fit. The specification includes six variables: (i) the current account balance in percent of GDP; (ii) an import expansion variable, measured as the difference between the current level of imports to GDP and its average over the past 10 years; (iii) exchange rate overvaluation, measured as the difference between the current level of the real effective exchange rate and its average over the past 10 years;Footnote 20 (iv) the output gap in percent of potential GDP; (v) a credit expansion variable, measured as the difference between the current level of the credit to GDP ratio and its average over the past 10 years; and (vi) the oil price in real terms, for countries that are net oil importers (this variable is muted, taking value 0, for net oil exporters), so as to capture one of the potential exogenous shocks that may trigger a current account adjustment.Footnote 21

Estimation results, based on observations between 1973 Q1 (the start of our sample) and 2003 Q4 (the latest point at which we identify the start of an adjustment), are reported in Table 6. The column “without adjustment scenarios” reports the coefficients of the first specification, the traditional binomial model as adopted in the literature. This specification apparently delivers good results, as most variables are significant and enter the model with the expected signs. A larger current account deficit, an import expansion, overvaluation, a higher output gap, and an increase in oil prices for oil importers all increase the likelihood of adjustment.

Allowing for a distinction between the three adjustment scenarios, however, most coefficients change size, significance, and sometimes even sign. The multinomial logit results are reported in the right-hand side of Table 6. The statistical tests confirm that most coefficients are statistically significantly different. This result also holds for all coefficients jointly, as reported in the joint test for equality of coefficients in the last row.Footnote 22 All in all, these results clearly confirm that each adjustment scenario is signalled by different economic developments. This provides a further validation of the classification and confirms that one single equation cannot predict different adjustment scenarios.

The results for the individual variables have a meaningful economic interpretation:

-

the import expansion variable is significant and positive in the internal and mixed adjustment cases. This can be explained by the fact that current account deficits resulting from very rapid import growth require a correction on the import side through lower domestic demand growth, and hence involve some form of internal adjustment. By contrast, rapid import expansion makes an external adjustment less likely, suggesting that instead sluggish export performance is a leading indicator of external adjustment;

-

overvaluation makes an external or mixed adjustment more likely, but has no significance as a leading indicator of internal adjustment. This is in line with the intuition that external and mixed adjustments tend to occur in countries with an overvalued exchange rate;

-

a positive output gap is a relevant signal for internal or mixed adjustment, suggesting that these adjustment scenarios mainly occur at an advanced stage of the cycle. The output gap has the opposite sign in case of external adjustment, in line with the idea that external adjustment primarily occurs in countries with low economic growth, possibly due to competitiveness problems.

-

credit expansion is significant and positive variable in the external adjustment case. Bearing in mind that this case involves significant currency depreciation, this result is consistent with the early warning literature on currency crises. Specifically, strong credit growth is typically found to be a leading indicator of currency crashes (see e.g. Bussière and Fratzscher 2006).

-

for net-oil importing countries, increasing oil prices are significant as a trigger for all three adjustment scenarios.

We apply a number of tests to assess the robustness and quality of our model.

-

Goodness of fit. We asses the two types of errors of the early-warning model, namely adjustments that are not signalled by the model (type 1-error) and signals of adjustment that turn out to be false (type 2-error). The model is said to produce a signal if the estimated probability of adjustment exceeds a user-defined threshold, which we set at 0.25 so as to broadly balance the two types of errors.Footnote 23 Such errors are not commonly reported in the current account adjustment literature, with the exception of Milesi-Ferretti and Razin (2000) and Benhima and Havrylchyk (2006). Yet, they are important to gauge the model’s quality for policy purposes. In the second specification, we find a type 1-error of 40.6% and a type 2-error of 58.3% (Table 7).

-

Prediction of adjustment scenario. Another important aspect is whether the model signals the correct adjustment scenario. The model is said to predict an adjustment of a certain scenario if the estimated likelihood of that scenario is above the estimated likelihood of the two other scenarios. The type 1-error is lowest, at 17%, for internal adjustments, and reaches 39% for mixed adjustments and 44% for external adjustments (Table 8). This suggests a comparatively better performance of the model in signalling internal adjustment.

-

Independence of irrelevant alternatives (IIA). The multinomial model is valid only if the relative probabilities between two states are independent from all other states. We test this IIA assumption using the Hausman and McFadden (1984) test and Small and Hsiao’s (1985) likelihood-ratio test.Footnote 24 Both tests confirm the IIA assumption for our specification (Table 9).Footnote 25

-

Outliers. We detect potential outliers by computing Cook’s distance, which summarises the effect of removing individual observations from the sample (Long and Freese 2006, p. 151). We detect considerable outliers in our original sample for several observations of Singapore and Venezuela. These two countries have therefore been excluded completely from the estimation results reported above.

As a final check of the assumptions underlying the different adjustment scenarios, we estimate a number of alternative specifications, which estimate not the timing of current account adjustments per se, but do explain which type of adjustment occurs, conditional on adjustment taking place. Concretely, we rerun the multinomial logit model, lapsed to only three states (S = 1 for internal adjustment, S = 2 for external adjustment, and S = 3 for mixed adjustment) for specifications that test for the exchange rate environment, the external environment, and the cyclical position of the economy. The estimation results, presented in Table 10, indicate the impact of individual variables on the probability of a particular adjustment scenario occurring, conditional on adjustment taking place.

The results for the exchange rate specification suggest that the exchange rate level, captured by a simple measure of overvaluation (see definition above) significantly increases the likelihood of ending an exchange rate-led adjustment, i.e. an external or a mixed adjustment case, while the prevailing exchange rate regime (peg or no peg) has no significant impact on the type of adjustment. This is in line with the preliminary results that can be drawn from Table 4 above, suggesting that the three different adjustment scenarios are relatively equally spread across adjustment regimes. Also exchange rate developments in the immediate run-up to the adjustment, captured by the variable “appreciation”, do not significantly impact the probability of a particular type of adjustment.

It was suggested, in the statistical results above (Table 5), that external adjustment, which is essentially based on higher export growth, may be facilitated by a favourable global environment. Results for the external environment specification confirm this result. Specifically, higher global growth, as captured by average real GDP growth in the OECD economies, significantly increases the relative likelihood of an external adjustment.

Finally, the specification on the cyclical position of the economy, with real GDP growth and the output gap as explanatory variables, confirms the importance of the position in the business cycle as a determinant of adjustment scenarios. A starting position at a low point in the business cycle, as evidence by low real GDP growth and a negative output gap, increase, ceteris paribus, the likelihood of an external adjustment. This finding corroborates a central thesis of the paper, and of the analysis above, that expansionary price-led current account adjustment is comparatively more likely in the event of an economy with remaining excess capacity, while a contractionary quantity-led adjustment is more likely to occur in economies characterised by overheating, an advanced stage of the business cycle, and high capacity utilisation rates.

5 Conclusions

This paper has examined past experience with the adjustment of current account deficits in industrial and systemically important emerging market economies. It looked at episodes where individual countries recorded an improvement in their current account position that was relatively rapid (within 4 years), substantial (exceeding a predefined, country-specific threshold) and sustained (no subsequent deterioration). Using these criteria, 71 episodes have been identified since the mid-1970s.

We have also highlighted that these 71 episodes mask a surprisingly large degree of variation. In roughly one-third of the cases, economic growth accelerated, rather than decelerating, and also in one-third of the cases, the real effective exchange rate appreciated, rather than depreciating. Classifying the episodes, on the basis of cluster analysis, we identified three groups of adjustment, which we find to be robust and to exhibit significantly different macroeconomic and financial trends. The grouping is corroborated through an event-study analysis and a statistical analysis of adjustment dynamics as well as through a multinomial model that predicts the likelihood of adjustment.

A first group, constituting the majority of episodes, experienced a growth slowdown but not much change in the real exchange rate (even on average a slight appreciation). This group is labelled “internal adjustment”, given that the current account correction essentially comes through a slowdown in domestic demand growth, translating into reduced demand for foreign goods and therefore lower import growth. This type of adjustment seems to be typical when the deficit widening resulted from buoyant domestic demand growth. The multinomial logit model suggests that the likelihood of such an adjustment increases as economies reach an advanced stage of the business cycle, as indicated by a positive and widening output gap. On balance, this adjustment scenario therefore appears to be of a largely cyclical nature. Asset price movements seem to play some role in this group, as the internal adjustment is on average accompanied by a statistically significant deceleration of asset price inflation (e.g. house prices) following a period of rapid increase.

A second group, constituting half of the remaining cases, is characterised by a depreciating real exchange rate without much movement in real GDP growth (even on average a slight increase in growth). It is labelled “external adjustment”, and is characterised by a real exchange rate depreciation that induces an improvement in the country’s competitiveness, favouring an increase in net exports. The pick-up in net exports provides a positive impetus to economic growth and explains the absence of an economic slowdown in this group. According to the logit model, this adjustment pattern is more likely when the widening current account deficit reflects sluggish export growth performance and when the exchange rate is overvalued. Differently from internal adjustment, which is common among high-growth countries, external adjustment seems to be preceded by sluggish economic growth, possibly reflecting competitiveness problems of the economies concerned.

A third and final group is characterised by a combination of slower economic growth and a depreciating exchange rate. Accordingly, the group is labelled “mixed adjustment”. Developments in this group are more pronounced than in the two other groups. The slowdown is, on average, deeper than in the internal adjustment cases and the depreciation is, on average, larger than in the external adjustment cases. This points to the crisis-like character of mixed adjustment episodes. Mixed adjustments, in fact, are characterized by a mix of expenditure reduction and expenditure switching policies. This type of adjustment, for instance, may take place when a currency depreciation is coupled with tight fiscal policies that curb domestic demand. In terms of leading indicators, the logit model suggests that mixed adjustments are typically signalled by a combination of an overvalued exchange rate — pointing to the need for correction on the external side — and indications of potential overheating — pointing to the need for correction on the internal side.

An important finding is also that the type of adjustment cannot be “predicted” by rule-of-thumb macroeconomic characteristics, such the level of development of an economy, its openness, or its exchange rate regime. Instead, the logit results confirm that adjustment patterns are primarily explained by underlying economic conditions and business cycle positions in the deficit country.

Notes

The list of countries is provided in the Appendix. It includes individual euro area countries until 1998 and the euro area as a whole since 1999. The focus on developments after 1973 corresponds with the intention to focus on adjustment in the post-Bretton-Woods era.

Most authors use a tougher criterion in terms of initial balance and require the current account balance to record a deficit of at least 2 percent or 3 percent of GDP before the adjustment. Our criterion allows to include also cases where the current account improved from just below balance. An advantage of this approach, which is also adopted by IMF (2007), is that it allows to significantly increase the sample size. A potential drawback could be that adjustment dynamics of small and large deficits may be different. However, average dynamics turn out to be very similar when the sample is restricted to large deficit cases.

We consider a fixed threshold across countries not to be very meaningful. In an open economy subject to large terms of trade shocks (e.g. an oil exporter such as Norway), a current account fluctuation of, say 2% of GDP, may occur relatively frequently. For a less open economy, by contrast, such a fluctuation may be a rather rare event. It seems preferable to select a threshold that accounts for the country-specific degree of variation in the current account. In particular, we select as threshold one standard deviation of the country’s current account to GDP ratio. This threshold is lowest in the euro area (0.7% of GDP) and highest in Norway (7.2%).

The macroeconomic and financial time series include the current account balance, export and import volumes and prices, real GDP growth and its main components, consumer prices, interest rates, house prices, share prices, government balances, and external variables (real GDP growth in the OECD as a proxy for global growth conditions, the real short-term interest rate in the United States as a proxy for global monetary conditions, and oil prices). The series are mainly from the OECD’s Economic Outlook and Main Economic Indicators, complemented with data from the Bank for International Settlements, the International Monetary Fund and the European Central Bank. Compatibility of the series has been checked across databases, in particular with the annual series published in the IMF World Economic Outlook. Data with statistical breaks are eliminated or corrected. Series exhibiting seasonal patterns are seasonally adjusted using the census X-12 additive method.

An important feature of our dataset is the inclusion of 14 episodes in G7 economies, far above the number of G7 cases covered in the literature. This results from the design of the selection criteria, in particular the consideration of a country-specific threshold for the size of the adjustment, which tends to be lower for the relatively more closed G7 countries. This important novelty helps improve the relevance of our findings for large economies and hence also for the case of the United States.

The pre- and post-adjustment levels are computed as the average over the second and third year before and the second and third year after the start of the adjustment. Similar results hold for other reference periods.

In our analysis, we standardise all variables before measuring the distance in order to avoid that the outcome of the analysis depends on the scale of data. Such standardisation prevents that variables with large values skew the distance measure and thereby ensures that each of the economic variables has the same weight in the analysis.

Cluster analysis can also be based on non-Euclidean distance measures, such as the square Euclidean distance, the Manhattan distance, the Chebychev distance and the power distance. These alternative distance measures are useful for specific types of data (e.g. ordinal data) but not relevant for our analysis.

This is known as the k-means cluster analysis.

For these two variables, we compare the average post-adjustment level (second and third year after adjustment) with the average pre-adjustment level (second and third year before the adjustment). We compute the simple difference for real GDP growth and the difference in logs for the real effective exchange rate, an approximation of the percentage change. Other reference periods are explored under the discussion of robustness.

We also apply a parametric t-test, which rests on the normality assumption, yielding broadly similar results (not reported).

We have checked the outcome of the cluster analysis to the choice of underlying variables (real GDP growth and the real effective exchange rate) and the reference period over which changes in these variables are computed (two to three years pre- and post-adjustment). It turns out that most of the 71 episodes remain within the same group under various alternative choices of underlying variables or reference periods, so that we can conclude that the baseline cluster analysis is fairly robust. There are also around 10-15 borderline cases that switch groups for some of the alternative criteria. While one could remove such borderline cases from the sample, this would unduly reduce the sample size and artificially change the results as we would no longer consider the full spectrum of past cases. Detailed results of this robustness analysis are presented in Appendix E to Algieri and Bracke (2007).

We use the same timeframe as in the cluster analysis, comparing the average over the second and third year after adjustment with the average over the second and third year prior to adjustment. The results are broadly similar when we use other horizons.

Parametric t-tests yield similar results (not reported).

As shown in Table 1, all authors find the current account itself to be statistically significant in signalling an adjustment, while the significance of other variables (e.g. real GDP growth, exchange rate, foreign exchange reserves, terms of trade, global growth) differs across papers. See, for instance, Adalet and Eichengreen, 2006; Benhima and Havrylchyk, 2006; de Haan et al, 2006; Debelle and Galati, 2007; Edwards, 2005b; Freund, 2005; Milesi-Ferretti and Razin, 2000.

The timing of the independent variable is important. In our specification, we assign a non-zero value to our independent variable not only in the exact quarter where the adjustment starts, but also in the eight quarters before. The approach is appealing from a policy viewpoint, as it allows to signal adjustments not just in the current quarter but over a horizon of two years, and from an econometric viewpoint, as it allows to avoid the use of lagged independent variables (see Bussière and Fratzscher (2006) for an application of a similar technique in a context of early warning systems for currency crises). In line with the literature, observations immediately after the start of adjustment (2 years) are excluded from our estimations so as to avoid any potential bias that may arise when the model does not distinguish post-adjustment times from tranquil times.

Differently from the current account reversal literature, which mostly relies on probit models, we use a logit model. This allows to capture potential non-linear effects that are commonly found to be important in early-warning contexts. As a robustness check, we also fit an ordered probit model, which yields very similar estimated coefficients and predicted probabilities (not reported).

We lag the measure of overvaluation by 2 years, to account for the fact that, on average, the exchange rate starts to correct already two years prior to the adjustment.

The real oil price is proxied by dividing the nominal oil price by the US consumer price index. This real oil price is then multiplied by a dummy with value 1 if the country is a net oil-importer. For net oil-exporters, the dummy takes value 0 and the variable hence does not enter the specification. The dummy is based on the sign of the oil trade balance of the IMF World Economic Outlook. The dummy is allowed to change over time (for instance, Canada changed from a net oil-importer to a net oil exporter in 1983).

We use a likelihood ratio test. It is also a test whether two or more states can be combined, known as test for combining dependent categories (Long and Freese, 2006). The fact that coefficients are significantly different suggests that the four states are significantly different.

The estimated probability of adjustment is given by the estimated probability of being in state S 1 = 1 for the first specification and by the estimated probability of being in either state S 2 = 1, S 2 = 2 or S 2 = 3 for the second specification.

The choice of the threshold implies a trade-off between the two types of errors. A lower threshold will increase the number of alarms, thereby reducing the number of type 1-errors, but will at the same time increase the number of type 2-errors. Using other thresholds changes the numerical but not the qualitative aspects of our results.

The tests are computed with stata modules produced by Long and Freese (2006), as available under http://www.indiana.edu/~jslsoc/.

References

Adalet M, Eichengreen B (2006) Current Account Reversals: Always a Problem? In: Clarida R (ed) G7 Current Account Imbalances: Sustainability and Adjustment. University of Chicago Press, Chicago

Adalid, R., Detken, C., (2007) Liquidity shocks and asset price boom/bust cycles. ECB Working Paper Series 732

Algieri, B., Bracke, T., (2007) Patterns of current account adjustment — Insights from past experience. ECB Working Paper Series 762

Benhima, K., Havrylchyk, O., (2006) Current Account Reversals and Long Term Imbalances: Application to the Central and Eastern European Countries. CEPII Working Papers 27

Blanchard, O., Giavazzi, F., Sa, F., (2005) The U.S. Current Account and the Dollar. NBER Working Paper Series 11137

Bussière M, Fratzscher M (2006) Towards a new early warning system of financial crises. Journal of International Money and Finance 25(6):953–973

Croke, H., Kamin, S., and Leduc, S., (2005) Financial Market Developments and Economic Activity during Current Account Adjustments in Industrial Countries. International Finance Discussion Papers 827. Board of Governors of the Federal Reserve System, Washington D.C

Debelle G, Galati G (2007) Current account adjustment and capital flows. Review of International Economics 15(5):989–1013

de Haan L, Schokker H, Tcherneva A (2006) What do current account reversals in OECD countries tell us about the US case. DNB Working Paper Series III, De Nederlandsche Bank, Amsterdam

Detken C, Smets F (2004) Asset price booms and monetary policy. In: Siebert H (ed) Macroeconomic Policies in the World Economy. Springer, Berlin

Edwards, S., (2005a) Is the U.S. Current Account Deficit Sustainable? If Not, How Costly Is Adjustment Likely to Be?. Brookings Papers on Economic-Activity, 211–271

Edwards, S., (2005b) The End of Large Current Account Deficits, 1970–2002: Are There Lessons for the United States?” In The Greenspan Era: Lessons for the Future, The Federal Reserve Bank of Kansas City, pp. 205–268

Edwards S (2006) On Current Account Surpluses and the Correction of Global Imbalances. Paper presented at Tenth Annual Conference of the Central Bank of Chile on Current Account and External Financing, Central Bank of Chile

Everitt B, Landau S, Leese M (2001) Cluster Analysis, 4th edn. Edward Arnold Publisher, London

Freund C (2005) Current Account Adjustment in Industrialized Countries. Journal of International Money and Finance 24(8):1278–1298

Freund C, Warnock F (2006) Current Account Deficits in Industrial Countries: The Bigger They Are, The Harder They Fall? In: Clarida R (ed) G7 Current Account Imbalances: Sustainability and Adjustment. University of Chicago Press, Chicago

Friedman M (1953) Essays in Positive Economics. Chicago Press, Chicago

Guidotti P, Sturzenegger F, Villar A (2003) Aftermaths of current account reversals: Exports growth or import compression. Presented at the 8th LACEA Meeting, Puebla-Mexico, October, 2003

Hausman J, McFadden D (1984) Specification Tests for the Multinomial Logit Model. Econometrica 52(5):1219–1240

IMF (2005) IMF World Economic Outlook (September). Washington, D.C

IMF (2006) IMF World Economic Outlook (April). Washington, D.C

IMF, (2007) Large External Imbalances in the Past: An Event Analysis. In World Economic Outlook (April), Washington, D.C

Jain AK, Murty MN, Flynn PJ (1999) Data Clustering: A Review. ACM Computing Surveys 31(3):264–323

Komárek, L., Komárková, Z., Melecký, M., (2005) Current Account Reversals and Growth: The Direct Effect Eastern Europe 1923–2000. Warwick Economic Research Papers 736

Komárek, L., Melecký, M., (2005) Currency Crises, Current Account Reversals and Growth: The Compounded Effect for Emerging Markets. Warwick Economic Research Papers 735

Long JC, Freese J (2006) Regression Models for Categorical Dependent Variables Using Stata, 2nd edn. Stata Press Publication, College Station, Texas

Milesi-Ferretti GM, Razin A (2000) Current Account Reversals and Currency Crises: Empirical Regularities. In: Krugman P (ed) Currency Crises. University of Chicago Press, Chicago, pp 285–326

Mundell RA (1960) The Monetary Dynamics of International Adjustment under Fixed and Flexible Exchange Rates. Quarterly Journal of Economics 84, no. 2:227–257

Obstfeld M, Rogoff K (2005) The Unsustainable US Current Account Position Revisited. Proceedings, Federal Reserve Bank of San Francisco

Reinhart C, Rogoff K (2004) The Modern History of Exchange Rate Arrangements: A Reinterpretation. The Quarterly Journal of Economics 119(1):1–48

Rogoff K (2006) Global imbalances and exchange rate adjustment. Journal of Policy Modeling 28(6):695–699

Romesburg, C., (2004) Cluster Analysis for Researchers, Lulu Press

Small KA, Hsiao C (1985) Multinomial Logit Specification Tests. International Economic Review 26(3):619–627

Acknowledgements

The authors are grateful to Luca Dedola, Carsten Detken, Gabriel Fagan, Marcel Fratzscher, Arnaud Mehl, Frank Moss, Frank Smets, Christian Thimann, anonymous referee of the ECB Working Paper Series and the Open Economies Review for insightful suggestions and comments. We received useful comments from seminar participants at the CESifo Area Conference on the Global Economy (Munich, 13–14 April 2007), the AISSEC national conference (Parma, 21–23 June), the Open Macroeconomics and Development conference (Aix-en-Provence, 2–3 July 2007), the European Economic Association (Budapest, 27–31 August 2007), and an internal ECB seminar. We are grateful to Alexander Droste-Haars for assistance with the data collection. All remaining errors are ours.

Author information

Authors and Affiliations

Corresponding author

Additional information

The views expressed in this paper are those of the authors and do not necessarily reflect those of the European Central Bank.

Appendix

Appendix

Rights and permissions

About this article

Cite this article

Algieri, B., Bracke, T. Patterns of Current Account Adjustment—Insights from Past Experience. Open Econ Rev 22, 401–425 (2011). https://doi.org/10.1007/s11079-009-9126-8

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11079-009-9126-8

Keywords

- External imbalances

- Current account adjustment

- Cluster analysis

- Multinomial logit

- Expenditure switching

- Expenditure reduction