Abstract

Extreme weather events lead to significant physical, economic and social impacts with short- and long-term consequences for affected regions. The methodologies used to assess the impacts often focus on the insured losses associated with private capital and public infrastructure. However, these estimates do not reflect the losses, monetary and non-monetary, associated with damage to uninsured assets. In addition, in the absence of systematic methods for measuring and recording impacts experienced by the informal sector—both households and small businesses—losses experienced by these segments are not reported, particularly in the developing world. This paper uses primary data collected from a survey of households and small businesses to estimate the uninsured losses due to a major flood event in the city of Mumbai, India. A detailed characterization of the losses is attempted, by disaggregating losses into monetary damage to property, physical capital, assets, equipment and inventory as well as loss of income, investment and disruption of essential services. Aggregate estimates of losses at the city level are computed and compared with the insured private and public losses traditionally reported in the literature. Our results indicate that the uninsured private losses suffered by individuals and small businesses significantly exceed the damage to public infrastructure. In the absence of insurance or government assistance, these costs represent a significant out-of-pocket expenses for the households and businesses. These findings have significant policy implications in terms of highlighting the vulnerability of the informal sector to extreme weather events in cities of the developing world.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

It is now widely accepted that the impacts of future climate change will often be observed through changes in the magnitude and frequency of existing climate-related hazards. The exposure to such hazards is increasing on a global scale with population growth, urbanization and increased income and wealth. Climate-related hazards have huge physical, economic and social impacts and can have long-term negative consequences for development and poverty alleviation. Assessing and measuring these impacts are essential for the formulation of need-based adaptation and disaster risk management policies. Most impact assessment studies generally focus on economic impacts measured either through insured losses associated with private capital or through insured and uninsured losses associated with public infrastructure. Such methods, however, fail to reflect the losses suffered by the informal sector including households and small commercial establishments as they are mostly uninsured, and detailed information on impacts is either unavailable or difficult to obtain. However, such losses are likely to be very significant in developing countries, particularly given the limited penetration of formal insurance.

As per the insurance industry figures, the number of meteorological, hydrological and climatological loss events (disasters) between 1980 and 2013 has gone up from an annual average of 250–800, and the overall estimated losses have increased steadily from US$ 70 billion in 1980 to US$ 400 billion in 2011 (Munich Re 2014). These losses have been calculated at 2013 values and have been adjusted to inflation based on the consumer price index for each country. What is significant about the overall losses from the disasters between 1980 and 2012 worldwide is that a significantly large share of them (about 75 % or US$ 310 billion) is uninsured (Munich Re 2014). Further, in the poor and inadequately insured economies, based on the calculations from the Munich Re database, only 7 % of the overall losses (US$ 13.8 billion) were insured in 1980–2009 at 2012 values (Munich Re 2013). Therefore, there is a significant insurance deficit among poor and developing economies that imposes almost the entire burden of the impacts of weather events on their people.

In the developing world, a major part of the local economy is in the informal sector. World Development Report 2013 suggests that the percentage of informal non-agricultural employment is around 83.5 % in India (as per 2005 figures), 42.3 % in Thailand, 68.2 % in Vietnam, 62 % in Sri Lanka and 70 % in Philippines. With the prevalence of a large informal economy, the penetration of insurance for life and non-life products including that for physical assets is minimal or non-existent. For instance, the share of the developing countries in the world’s non-life insurance market was only 10 %. Further, insurance density of OECD countries in 2007 was $2517 as against South Asia with the density of $67.8 (UNCTAD 2007). In India, the insurance density for non-life segment was $10.5 in 2012 and insurance penetration was 0.78 in 2012 (IRDA 2013).Footnote 1 This suggests that the absence of or inadequacy of insurance coverage turns most of the losses related to weather events or disasters into out-of-pocket expenses for the citizens in the developing world.

The damage assessment methods usually capture the insured losses and extrapolate them using the insurance density of the affected region to arrive at the overall damage estimate (Munich Re 2011). However, such methods do not capture the uninsured losses suffered by households and businesses in the absence of adequate data. Yet the uninsured losses, especially in the developing world, need to be assessed as they form the largest part of the total losses in case of weather events (Munich Re 2013). It is quite critical to assess the losses suffered by the largely uninsured communities in the developing world to understand the full implications of the extreme weather events for them, understand their vulnerability and help devise suitable adaptation strategies that would minimize such losses in future.

One such impact assessment study carried out in Mumbai, India, to capture the uninsured losses suffered by the households and small businesses resulting from the extreme precipitation event on 26 July 2005 has been discussed in this paper. The study uses primary data collected from a random sample of households and small businesses and secondary data collected from government institutions to measure the economic impacts of the unprecedented floods. The impacts include damage to property and infrastructure, physical assets and equipments as well as loss of income, investment and inventory. The study seeks to understand the policy implications of the findings for informal sector vulnerability, adaptation efforts, development planning and poverty alleviation for the city.

The outline of the paper is as follows: the next section creates the context for the study by describing the city profile and the catastrophic event of July 2005, which caused unprecedented rainfall and flooding. Section Three outlines the methodology and data sources used in the study to identify and measure the impacts of this event on households and small commercial and industrial establishments. The results of the study are discussed in Section Four. Section Five summarizes the overall findings and their policy implications.

2 Context

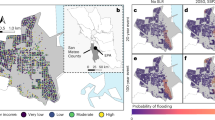

Mumbai (formerly known as Bombay) is a large megacity supporting more than 11.9 million people on 437.71 km2 of landmass with population density of 27,209 per km2 (MCGM 2013). The city is the financial capital of India with a large commercial and trading base. It is also an important international sea port and strategic for the country from defence perspective. The city map, with administrative zones known as wards, can be seen in Fig. 1 below. Coastal location of Mumbai, however, makes it acutely vulnerable to the risks of heavy precipitation, flooding, high winds, cyclones, sea-level rise and coastal erosion. Most parts of the city are built on reclaimed land. It is estimated that about half of the island city and one-fifth to one-fourth of the suburban area have been reclaimed from the sea to build the present day city (MCGM 2006). Also, parts of the city are barely 6–10 m above sea level, for instance the international airport area, which is only 6 m above mean sea level (Government of Maharashtra 2007; MCGM 2006). Major commercial and residential areas such as Bandra Kurla Complex, Wadala and Worli are low lying and barely above the mean sea level. In addition, 55.67 % population lives in informal housing known as slums, which are often located in dangerous zones such as hill slopes, coastal or creek-side locations, low-lying areas, marshy zones, along footpaths and so on (MCGM 2009). About 40 % of dwellings in slums are semi-permanent or temporary structures made from low-quality material and hence more vulnerable in case of extreme weather events (Government of Maharashtra 2007).

Distribution of rainfall on 26–27 July 2005 (in mm). Source: http://www.mcgm.gov.in

Every year, the city experiences average rainfall of more than 2100 mm during the monsoon season between June and September (MCGM 2003), often causing flash floods. Many low-lying, reclaimed areas and areas in the river flood plains are prone to flooding. Floods during the monsoon are believed to be dependent on the intensity and duration of rainfall per hour, timing of high tide, topography of the area compared to mean sea level and percentage of run-off and carrying capacity of storm water drainage (SWD) system (MCGM 2006, 2010). With rapid urban development and encroachment on natural water ways, the carrying capacity of the SWD system has reduced substantially and the run-off has increased considerably. Therefore, the city has been getting flooded frequently. On average, per year, there have been 77 recorded instances of flooding in the island city, 58 in eastern suburbs and 130 in western suburbs between 2001 and 2008 (MCGM 2010).

2.1 Extreme rainfall on 26 July 2005

On 26 July 2005, Mumbai experienced extreme precipitation that led to unprecedented floods, massive damages, loss of life and property and affected the economic and social services adversely. India Meteorological Department (IMD) weather station located in the western suburb recorded 944 mm rainfall (45 % of the annual average rainfall in Mumbai) between 8.30 a.m. on July 26 and 8.30 a.m. on July 27, with the highest precipitation for a few hours between 2.30 p.m. and 7.30 p.m. as can be seen in Fig. 2 below. This also coincided with the high tides at 2.30 p.m. and 8.30 p.m. on July 26. The IMD forecast had issued a warning of heavy to very heavy rainfall for the day. Normally, ‘heavy’ rainfall forecast is issued for precipitation of 65 mm or more during the day, and ‘very heavy’ rainfall is for precipitation of more than 135 mm during the day. Very high rainfall greater than 200 mm per day is also not uncommon during the onset phase of monsoon (MCGM 2006). However, rainfall on 26 July 2005 was an extreme precipitation event by all standards. The previous recorded instance of heavy rainfall in Mumbai was 570 mm rainfall on 5 July 1974 in the island city. There have been other instances of very heavy rainfall ranging from 540 to 800 mm in the surrounding region of Konkan between 1882 and 1989 (MCGM 2006). The magnitude of the July 2005 event in Mumbai was so huge that the administration had no guidance or prior experience to react to such a situation (MCGM 2006). The unprecedented rainfall coinciding with the high tide brought the city to a complete standstill.

Distribution of rainfall on 26–27 July 2005 (in mm). Source: Based on the report of the Fact Finding Committee on Mumbai floods (MCGM 2006)

The impacts of the event have been documented by the subsequent government reports (Government of Maharashtra 2005; MCGM 2006). Figure 3 shows the extent of flooding across different administrative wards of Mumbai. Excluding the hilly areas of forest and lakes, 22 % of the city land was submerged in rainwater on 26–27 July 2005. Around 2 million people were stranded in transit or took shelter in different transportation modes. Another 2.5 million people were exposed to floods for hours in different parts of the city, with half of them being the poor from the slums of Dharavi, Sion, Kurla, etc. (MCGM 2006). Civic amenities such as electricity, water supply, transportation and communication networks were completely shutdown. The air traffic had to be suspended for 2 days due to submergence of the airport. It took 1–4 weeks for the train and bus services to start normal functioning. Road and train services to other areas within and outside the state were also disrupted for 3–10 days (MCGM 2006).

Extent of flooding in Mumbai on 26 July 2005. Source: Based on the report of the Fact Finding Committee on Mumbai floods (MCGM 2006)

A number of estimates have been put forward in the aftermath of the floods to understand the extent of damage. Municipal Corporation of Greater Mumbai (MCGM) undertook damage assessment in the immediate aftermath of the floods to seek financial assistance from the central government under the Central Relief Fund (CRF). As per this assessment, 445 people lost their lives in the city and 50,000 residential and 40,000 commercial buildings were partially damaged. The cost of damage to municipal infrastructure including municipal buildings, water supply systems, roads and storm water drains was estimated at Indian Rupees (INR) 2475 million or US$ 55 million (exchange rate US$ 1 = INR 45, the prevailing rate at the time of the study in 2010–2011) under the CRF (MCGM 2005). In addition to this, 1318 cases of gastroenteritis, 194 cases of hepatitis, 406 malaria cases and 197 cases of leptospirosis were admitted in the public hospitals from 29 July till 5 August 2005 (MCGM 2005). However, the MCGM estimates did not actually measure the monetary losses in the city due to inadequate data and absence of measurable variable such as insurance coverage. The unofficial figure quoted by the Indian Merchants Chamber (IMC) put the losses at INR 50 billion or US$ 1.1 billion (Government of Maharashtra 2005). Munich Re, using the standard methodology of insurance density, population density, nature of the region affected and extrapolation, estimated the total losses of US$ 5 billion (including insured losses of US$ 770 million) for the Mumbai floods (Jha et al. 2011; Munich Re 2011). Ranger et al. (2011) carried out a detailed exercise of estimating the total direct damages of 2005 floods. For estimating the damages, distribution of residential, commercial and industrial property types was derived from satellite images, and total insured value (TIV) for each property type was assigned based on the RMS Earthquake Model. Combining the TIV estimates for different property types with the average mean damage ratios, the simulated direct losses, including infrastructure, were estimated in the range of US$ 690–1910 million.

The estimates of the total losses from the July 2005 flood event, thus, range from US$ 1.1 billion to US$ 5 billion using different methodologies and different sets of assumptions. However, none of the damage assessments have covered the extent of vulnerability and impacts on the large informal sector comprising households and small commercial establishments. They suffer the most direct impacts of floods and have the least capacity to bear the burden of the losses in the absence of insurance coverage or an official compensation mechanism. This study, thus, focuses exclusively on the informal sector and seeks to understand and characterize the nature of losses by disaggregating them into damage to property, assets, inventory and loss of income, investment and disruption of essential services.

3 Methods and data

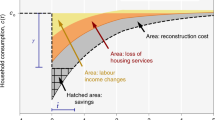

In order to bring into focus the damage assessment for the informal sector and understand the extent and nature of impacts, this study analyses the impacts of the extreme precipitation in Mumbai on households and small commercial and industrial establishments. From the perspective of impacts, an extreme weather event (often termed as a natural disaster) implies a combination of losses in physical, financial and human capital and reduction in economic activities of investment, consumption, production and employment (World Bank 2004). Most of the existing natural hazards and impacts literature focuses on short-term and immediate damage to human, built and natural capital, as measured by indicators such as mortality and damage to private and public property and infrastructure. These direct losses are often calculated by the insurance industry. For instance, in the developed world, damage assessment methods mostly use the insured exposure analysis since the insurance coverage for property is quite high (Hallegatte et al. 2011). In the developing world, however, the population does not have the means to insure themselves against weather hazards, although they are often the most vulnerable sections to such hazards (Herweijer et al. 2009). Therefore, the estimated impacts of the weather events do not reflect the true losses in their entirety in such countries.

A number of empirical studies have been carried out to assess the damage from floods. Messner et al. (2007) have defined flood damage as all varieties of harm caused by floods on humans, their health, belongings (buildings, assets, infrastructure, inventory, etc.), production and competitive strength of the economy. They have also described the typology of flood damages as direct or indirect and tangible or intangible. The review of flood-related economic damage assessment studies done by Merz et al. (2010) suggests that most studies are carried out at the macro- or meso-level where spatial aggregation of the affected assets is done over the whole administrative area using land-use and hazard exposure maps and census data. Further, only direct and tangible damages are included in most damage assessment studies (Hammond and Chen 2014). Direct tangible damage is defined as the harm caused due to direct contact with flood waters and can be measured in monetary terms as damage to stock values (Messner et al. 2007). Indirect and intangible damages such as health effects and damage to ecological goods and services cannot be measured in monetary terms, and methods used to monetize intangibles or non-market goods are not widely accepted by the practitioners (Merz et al. 2010). Hence, such studies are very few. Further, very few studies focus on capturing losses at micro-level (looking at single elements of risks like houses, infrastructure objects) due to unavailability of data (Merz et al. 2010). Indirect or secondary impacts such as the effect on provision of goods and services, provision of public utilities like water and electricity, transportation and so on are typically not measured due to practical difficulties arising out of data availability and absence of measurable variables (World Bank 2004). Indirect impacts in the form of disruptions in availability of goods and services, altered migration flows, relocation of houses or industries have not been estimated except for Hallegate (2008) who looked at the indirect losses of Hurricane Katrina.

There are few studies that assess the damage on single elements at risk such as houses or other infrastructure objects, as they require detailed local input data (Merz et al. 2010). Table 1 below lists selected studies that have used household surveys at the micro-level to assess damage from floods. The table also describes the methodology used by each study to arrive at the monetary estimates of the damage.

As seen in Table 1, studies carried out in Japan (Dutta et al. 2003) and Australia (Blong 2003) have estimated unit economic values for the elements at risk. Studies in Limpopo Province, South Africa (Khandlhela and May 2006) and Bangladesh (Brouwer et al. 2007) have used household interviews to assess the vulnerability and impacts from floods. Questionnaires have been used to capture issues such as impacts of flooding on life and livelihood, health impacts and damage costs at the household level. Further, Adger (1999) in coastal Vietnam, Sales (2009) in coastal Philippines and Munji et al. (2013) in Cameroon mangrove forest have analysed vulnerability to floods and adaptive capacity through household/individual interviews. We have also reviewed studies that have captured loss and damage from climate change impacts, sea-level rise, coastal erosion, salinity, etc., through household surveys (Warner and van der Geest 2013; Rabbani et al. 2013; Monnereau and Abraham 2013).

Besides the above-mentioned studies that have estimated flood damages at the micro-level using households as single units of analysis, studies estimating the damage from Saxony floods in 2002 (Meyer and Messner 2005) and summer floods in England in 2007 (Chatterton et al. 2008) provide guidance on what should be focused on for the direct and tangible damages. The important categories to be considered in damage assessment at micro-scale are residential and non-residential buildings and inventories (Messner et al. 2007). For the residential properties, households, building structures and household goods or assets have been considered for estimating the damages. For non-residential or commercial properties, building structures, machinery and equipment, inventory and disruptions have been considered.

The present study has used the guidance offered by all the above-mentioned empirical studies to build on the methodology for the survey carried out for flood damage assessment in Mumbai. We have focused on single units of analysis, households and small businesses and conducted detailed surveys to capture direct and tangible damages. The focus of this study is on estimating the damages to physical assets including property, appliances, equipment and products as well as income loss, disruption of activities and other impacts. The primary survey was carried out for this purpose in randomly selected households, retail businesses and small-scale industrial establishments in six administrative wards of Mumbai. The selected wards—K East, H East, F North, F South, L Ward and P North—are the most flood-prone areas in the city and have many chronic flooding spots identified in the Greater Mumbai Disaster Management Action Plan (Government of Maharashtra 2007). These wards experienced massive flooding in the July 2005 extreme precipitation event. The description of the chosen wards including population, the number of flooding spots, average depth of flooding and the number of households and businesses selected in each ward for the survey is given in Table 2.

We selected wards belonging to three categories—river flood plain, low-lying and reclaimed areas—as these geophysical characteristics are one of the main determinants of vulnerability to flash floods. There are other features that add to their physical and socio-economic vulnerability. For instance, international airport is on the fringes of H East Ward. K East has major flooding spots near busy suburban railway stations. Mithi River, which contributed to the massive floods on 26 July 2005, flows through this area. There are also interconnecting subways, which experience heavy traffic flow. In L Ward, F North, F South and P North, there are many landslide spots that make the situation worse during heavy rainfall. F South experiences the worst flooding even during normal monsoon due to the low-lying topography and leads to disruption of the north–south traffic flow. Further, the major flooding spots in L Ward are close to large slum pockets. For the above reasons, we selected these wards for the present study.

We administered detailed questionnaires to randomly selected 1168 households and 792 small businesses. The sample was chosen around the areas surrounding the chronic flooding spots in each of the wards. The households and businesses were mostly located on the ground or first floor of the buildings with direct contact with the flood waters. This deliberate bias was introduced in the sample selection as the houses located on the ground and first floor are the worst affected with floods and suffer direct losses due to damages to property, assets and equipment. Further, the retail shops and small industrial establishments are invariably located along the busy and congested roads in Mumbai and are the first ones to get affected with rising flood waters. The survey questionnaires focused on identifying and measuring the impacts of 26 July 2005 floods on the respondents and response from the civic authority. The respondents could vividly recall the extent of damage during this extreme precipitation event. The questions were divided into five parts: (a) socio-economic characteristics, (b) physical characteristics of the dwellings or establishments, (c) flood-specific impacts and costs of repairs/replacements, (d) experiences regarding the response from civic administration and (e) insurance and other government assistance. The following section discusses the results and findings based on the data collected through this survey.

4 Results and discussion

As mentioned above, the survey covered 1168 households and 792 small businesses across six wards of Mumbai. The important characteristics of the surveyed units are described in Tables 3 and 4 below. Among the surveyed households, as given in Table 3, we have identified different income categories ranging from less than INR 5000 to INR 45,000 per month and above. Less than INR 5000 (US$ 111) is the category of households below poverty line (BPL) as per the poverty line estimates published by Government of India (2013a). Households with incomes between INR 5000 and 15,000 are the low-income group (LIG) and those with incomes between INR 15,000–30,000 are middle-income group (MIG) as per the Ministry of Housing and Urban Poverty Alleviation (MHUPA) (Government of India 2013a, b). We have termed households with monthly incomes of more than INR 30,000 and above as higher MIG. Majority of the surveyed households in this study belong to the lower-income group (LIG) and a sizable number are below poverty line, as seen in Table 3. This distribution of households conforms to the overall pattern of income distribution in Mumbai (Annez et al. 2010). Apart from the household income, the survey has also tried to capture the expenditure pattern of the households. The extensive household surveys in India, such as the National Sample Survey (NSS), include questions on expenditures on different categories such as groceries, water, electricity and cooking fuel (NSS 2011, 2013). We have used similar expenditure categories here. The average expenditures show the lower socio-economic strata of the surveyed households. Further, the types of dwellings have also been classified based on the standard classification of kutcha, semi-pucca and pucca housesFootnote 2 for slums and single and multi-storey buildings for other dwellers (NSS 2010, 2013). We find that among the surveyed families, majority live in pucca houses in slums and others are in the single-storey buildings, known as chawlsFootnote 3 in Mumbai. The type of construction material is mostly reinforced concrete and bricks, but quite a few households have reported using wood and aluminium sheets for construction. These construction materials are mostly used in slums.

As regards the commercial establishments, the sample has covered all types of retail establishments located on the city roads and small industrial units located in the residential and commercial areas. Since Mumbai has a mixed land use, there is no clear demarcation for residential, commercial and industrial zones, and all types of activities are found across all the wards. As seen in Table 4, the survey has covered retail activities such as shops, IT centres and jewellery shops, and industrial units such as service centres, warehouses, manufacturing units and other small businesses including workshops. Their locations are mainly ground and first floor where they come in direct contact with flood waters. The physical characteristics of their establishment are similar to households like kutcha or pucca dwellings or single- and multi-storey buildings. Unlike households, we could not obtain data from the commercial establishments on their total turnover or monthly revenues as they were unwilling to share this information.

Based on the data obtained from households, during the July 2005 floods, the average depth of flooding in the residential areas was 5 feet (ft.) and the houses remained flooded for an average of 3 days. Fifty-nine percentage respondents said that the effect of floods on their families was high. On an average, the income loss for households due to floods in 2005 was INR 5000 (84 % respondents), and amount spent on repair/rebuilding of house was INR 15,000 (86 % respondents). Further, it took around 8 days to complete the repair/reconstruction of the damaged houses. It must be noted here that only 6.8 % of households claimed to have some form of insurance including life insurance. Further, only 3.5 % claimed insurance for damage due to floods. Similarly, for the commercial establishments, the average depth of flooding reported by them was 4 ft. However, 30 % reported the depth of 5–8 ft. The average time taken by them to get back to normal business was 3.5 working days. However, 15 % reported spending 1–2 weeks before the business operations could resume. Further, only 7 % of businesses had insurance of any type. In the absence of insurance coverage, these establishments had to bear the entire burden of repairs and/or replacements for different physical assets damaged/destroyed during the floods. In addition, they also had to spend on account of clean-up, loss of income, operating costs and other emergency expenses when flood waters entered their establishments.

4.1 Monetary estimates of damage borne by households and businesses

Table 5 shows the average estimated losses for flood-affected households in each ward considered in the study. The numbers here depict the average estimates of losses of a single household, and the figures in bracket are the percentages of estimated losses compared to the average monthly incomes of the houses in each ward. The estimated losses have been classified into different damage categories as given in Messner et al. (2007) and flood damage model guidelines developed in Hammond and Chen (2014) for measuring direct and tangible damage. We have estimated average losses on account of damage to building structure, damage to appliances, damage to household assets and damage to vehicles. Similarly, the total estimated losses are calculated in the last row for a single household in each ward to indicate the extent of burden borne by individual households on account of floods. The numbers in Table 5 reveal that the most prominent loss has been on account of damage to the house structure, which is the most important asset of the families. There are other sizable losses on account of damage to household appliances and assets. Majority of the households in the sample across the wards belong to the LIG with monthly incomes of INR 5000–15,000. Hence, the figures in bracket assume great importance. Some of the losses reported here are much greater than the monthly income of majority households. For instance, average amount spent on house repairs is more than 150 % of monthly incomes in H East and F North and more than 200 % in F South. When the losses across different categories are added, these entail substantial losses for individual houses. The average losses in different wards are 3.5–4.5 times the average incomes of the family, as seen in the last row of the table.

We have further analysed the average losses suffered by households belonging to the given income categories. The analysis suggests that the poor and low-income households suffered relatively far greater magnitude of losses compared to those belonging to middle-income groups. For instance, the BPL households with monthly incomes less than INR 5000 suffered losses of average INR 37,000, which is more than 6 times their monthly income. Similarly, for the LIG families with incomes of INR 5000–15,000, average losses were 4–5 times their monthly income. For the middle-income households, losses were about thrice the monthly income, and for the higher middle-income group, they are twice their income. Hence, the poor and low-income households with limited or no ability to bear the losses suffered the most during the extreme floods.

Among the surveyed households, only 3.5 % claimed insurance for flood losses. Thirty-three percentage surveyed families took loans after the floods for house repairs or replacing household appliances and assets. The average amount of loans was INR 25,000, which is greater than the monthly average income of most households. Majority of them had to use their savings to repair and rebuild the damaged assets and appliances. Forty percentage of the respondents reported relief measures offered by the government, in the form of food and clothing during floods and disability assistance in some cases. About 47 % families received the maximum of INR 5000 for the damages from government agencies under the Gratuitous Relief Assistance (GRA). The GRA is supposed to take care of only the immediate requirements of food, clothing and utensils. Therefore, the monetary assistance has no correlation with the actual amount of losses suffered by the families. We find the correlation coefficient of −0.18 between the extent of losses suffered by the surveyed households and compensation offered by the government as GRA. Further, the government assistance was sufficient to cover only up to 13.5 % of the losses suffered by the BPL families and 10.4 % of losses of LIG households. This highlights the clear inadequacy of the relief and compensation measures commonly used by the government agencies to help the poor households. These findings have very important implications for the vulnerability of such poor and low-income households from the recurrent threat of floods.

For the commercial establishments covered under this study, Tables 6 and 7 show the costs of repairs/replacement and other flood-related expenses. The individual costs have been combined under three categories, as used in Messner et al. (2007) and Kreibich et al. (2010)—damage to premises, equipment and materials. Average costs under each category head have been calculated for each ward. Since the businesses did not report the monthly revenues or annual turnover, the losses could not be compared with their earnings. However, given the nature of the business activities covered under the survey, the losses are substantial. For businesses, costs were also incurred on disinfecting premises and clearing debris as well as losses due to suspended operations and higher operating costs. Depending on the nature of businesses surveyed in each wards, there are differences in the average costs of repairs/replacements as well as losses due to suspended production or emergency expenditure. For instance, we have covered many manufacturing units as well as offices and IT centres in P North. Their losses are reflected in the greater costs on account of loss of business, suspended production or emergency spending. F South has mostly retail shops, workshops and other business units, which do not rely on equipment such as machine tools. Hence, the costs reported from this ward reflect this. As majority (93 % of the sample) of the small businesses did not have insurance coverage, the costs are out-of-pocket expenses for them. Only 2 % claimed insurance for the losses from floods, with the average amount of insurance being INR 35,000.

Besides the damages to physical assets and economic losses, there are disruptions of essential services that households and businesses suffered from during the floods. The survey questionnaire tried to capture some of these disruptions as given in Table 8 below. In the absence of measurable variables, we were not able to calculate the monetary costs associated with them. Some of the major problems faced by both households and commercial and industrial establishments were flood waters entering the premises, non-availability of local transportation, disruption of electricity and supply of clean drinking water. Seventy-seven percentage of households reported that on an average, during the 2 days of floods, drinking water was available for about 15 h. Forty-three percentage further reported that on average water supply was discontinued for 3 days, while electricity supply was discontinued for 5 days after the floods.

4.2 Estimation of aggregate uninsured losses

When economic damage estimation for floods is aggregated, spatial aggregations are done on the basis of land use, such as total number of residential or commercial buildings, or for administrative units, e.g. wards. However, such aggregations require reliable land-use data. Study carried out in Germany (Grunthal et al. 2006) has used gross stock of physical assets combined with the land-use data to estimate the total monetary damage to the commercial sector. For residential buildings, for the same study, the number of buildings has been multiplied by their insurance value. Such aggregation is possible only when the insurance coverage is prevalent and the units for estimation, i.e. the residential buildings are homogenous. In another study, Scawthorn et al. (2006) have used building replacement costs for building structures associated with different types of activities and aggregated them over the census blocks. In case of Mumbai, aggregation at the ward level or the municipal level is not possible as the land-use data available for different wards is not reliable and accurate. The types of buildings and their usage for residential and commercial purposes are also not uniform over smaller administrative areas. Most wards in Mumbai are densely populated and have a mix land use of residential and commercial activities in varying proportions. Therefore, extrapolation exercise undertaken by us in the present study to estimate aggregate uninsured losses of households and small businesses uses a number of assumptions.

The costs associated with direct impacts estimated in the earlier section have been extrapolated for Mumbai using a set of assumptions. The databases used for the extrapolation are Census 2001 and ward-wise records with the MCGM for registered shops and commercial establishments. For the purpose of extrapolation, we have considered individual costs as indicated in Table 9 and not the combined average costs for different damage categories as shown earlier. 2001 census data show the total population of 8.5 million in eastern and western suburbs of Mumbai. Assuming the average of 4 members per family, this translates to about 2.1 million households. We assume that 20 % of these households (about 420,000) were directly affected due to floods in July 2005 given the extent of flooding in suburbs as seen in the flood map in Fig. 3 earlier. It must be noted here that we are considering households who are located at the ground and first storey of residential buildings. Hence, 20 % seems a reasonable estimate for directly affected households. The extrapolation exercise shows the burden of US$ 267 million on the Mumbai households on account of direct damages during the extreme event.

Similarly, for the small businesses, costs of repairs/replacements and costs incurred on account of floods have been extrapolated by using certain assumptions. As seen in Tables 10 and 11, individual costs were considered for extrapolation and not the combined average costs for different damage categories discussed earlier. MCGM records of registered shops and business establishments show that there were around 400,000 registered retail shops and other commercial establishments in the city out of which 60 % (240,000) were located in the suburbs. We assume that 40 % of these establishments were affected during the July 2005 floods given the extent of flooding and given the location of such establishments along the roadsides. The costs of the direct damage suffered by these establishments have been extrapolated using this assumption. These costs are to the tune of US$ 90 million on account of damages to premises, equipment and materials and US$ 59 million due to losses in the business operations and clean-up costs.

4.3 Discussion

The findings in the preceding section indicate the magnitude of losses from the extreme event for households and small businesses in Mumbai. For the households, the losses are due to the damage to structure, appliances, assets and vehicles besides the income loss on account of floods. The estimated losses from these damages are 3.5–4.5 times the monthly incomes of the poor and middle-income households surveyed by us in the six flood-affected wards. The magnitude of losses also suggests relatively greater burden on the households who are poor or below poverty line compared to those who are better off than them. For instance, the BPL households suffered losses, which were more than 6 times their monthly income. Similarly, average losses for the LIG families were 4–5 times their monthly income. For the middle-income households, losses were about thrice the monthly income and for the higher middle-income group, they are twice their income. When the average costs of repairs or replacements for the damaged structures, appliances and assets were extrapolated for the flood-affected households across the city using certain assumptions, the estimated costs have been to the tune of US$ 267 million. It must be mentioned here that these costs of damages borne by the households are out-of-pocket expenses in the absence of insurance, social security or adequate compensation mechanism.

For the small businesses in the city, we have similarly captured the losses on account of damage to structure or premises, equipment such as machine tools and heating systems and materials such as inventory and raw material. The average losses are different across the wards depending on the predominant nature of businesses located there. Apart from these losses, we have also estimated the average costs incurred on disinfecting premises, clearing debris and losses due to business interruption and increased operating costs. These costs are much bigger than the losses due to damages. Using suitable assumptions, the average costs of repairs or replacements due to damage to structure, equipment and materials have been extrapolated for the small businesses across the city to the tune of US$ 90 million. Added to these are the extrapolated average costs due to disruptions in business operations which work out to about US$ 59 million.

The extrapolated losses for households and small businesses, as calculated in this study, can be added to the estimates of damage to municipal infrastructure and insurance claims by the large private sector businesses to give the total estimated losses for the city due to the extreme weather event of July 26 and resultant massive floods. We compare our estimates with the estimated losses from other sources as given in Table 12 below. The total damage to municipal infrastructure has been estimated at US$ 55 million, followed by the insurance claims of US$ 770 million on account of damage to infrastructure and business losses of large private sector undertakings. Our results estimate the losses of US$ 267 million for households and US$ 149 million for the small businesses. The total estimated losses from the direct and tangible damages on account of the extreme floods are thus US$ 1.241 billion.

The total losses calculated by using official damage and insurance estimates and the estimates obtained through this study compare well with other estimates for the Mumbai floods. The unofficial estimates of the Indian Merchants Chamber put the losses to US$ 1.1 billion (Government of Maharashtra 2005), whereas Munich re-estimated the total losses (insured and non-insured) at US$ 5 billion ((Jha et al. 2011; Munich Re 2011). Ranger et al. (2011) have estimated the total losses of US$ 1.7 billion using the insurance data and mean damage ratios. Similarly, Ranger et al. (2011) have also used the TIV for each property type and simulated the July 2005 losses in the range of US$ 690–1910 million. The total losses calculated by Munich Re and Ranger et al. (2011) are based on exposure maps and assumptions about population and insurance density. There is no information on the nature and magnitude of losses of households and small businesses in these estimates. Our study, thus, adds value in terms of detailed understanding of the nature and magnitude of household and small business losses. Primary data collected through surveys have been used for this estimation. These estimates also throw light on the vulnerability of these sections of the population who do not have insurance and social security and have very limited means to bear the burden of the losses resulting from floods.

Other comparable empirical studies with detailed estimation of losses for households are undertaken after German Federal State of Saxony floods (Meyer and Messner 2005) and London floods (Chatterton et al. 2008). In both studies, similar categories of damages have been used, namely buildings and housing goods (appliances and assets). These studies have found that the percentage of household losses in the total estimated losses from floods are 33 % in Saxony and 38 % in London. For the Mumbai households, their losses are about 22 % as per our estimates. This is not surprising, given the fact that majority of households in Mumbai are either poor, low-income or middle-income families with limited assets that would get exposed to floods. However, unlike households in Germany or UK, households in Mumbai have limited ability to bear the burden of the losses since there is no insurance cover.

In case of small businesses, the categories of damages used in this study are similar to the ones used in the studies carried out for Saxony (Meyer and Messner 2005) and London (Chatterton et al. 2008). These studies have also estimated losses for non-residential properties for damage to buildings, machinery and equipment, stocks or inventory and business disruptions. But the estimated losses are for all types of businesses and cannot be compared directly with small businesses in Mumbai who do not have insurance coverage. Our findings of the losses of small businesses, however, correspond with the findings of the study carried out after Northridge earthquake to study business disruptions, preparedness and recovery (Tierney and Dahlhamer 1997). The study covered more than 1000 businesses who were affected by the earthquake and found widespread direct physical damage to more than half the structures. More than half the businesses also had to shutdown their operations for a period of at least 2 days. The main reasons for business disruption in this case are very similar to the Mumbai study, such as cleaning up the damage, loss of electricity and communication, employees not getting to work and decline in number of consumers post the disaster. Another similarity with the Mumbai study is the fact that small businesses were more vulnerable to business interruption than the larger ones. In case of Mumbai, not only are the small businesses more vulnerable but also have limited resources to bear the burden of losses and also do not have insurance support or other compensation mechanisms.

As mentioned earlier, this study has tried to estimate the losses associated with direct and tangible damages to buildings, appliances, equipment, assets and inventory. However, it must be noted that the extrapolations undertaken in this study are indicative estimates for the costs of damage faced by the households and largely informal private sector in Mumbai. The actual costs may be much higher as our assumptions are quite moderate. Further, there are a number of indirect impacts of floods, such as price rise and non-availability of transportation, disruption of electricity and water supply, which also involve monetary losses. But they have not been measured in this study in the absence of measurable variables or reliable proxies. Ranger et al. (2011) have estimated the indirect losses for the household and commercial sector in terms of reduced production and consumption by using the adaptive regional input–output model (ARIO), local input–output model and loss distribution per sector in a simulation exercise. The simulated model estimates the indirect loss in terms of loss of value added (VA) in commercial and industrial sector at US$ 395 million. This shows that the losses estimated by the present Mumbai study are lower-bound estimates and would increase in magnitude if we are able to capture the indirect losses and their monetary burden on the households and commercial sector. However, the extrapolated costs estimated in our study are important to understand how the informal sector losses form a substantial part of the overall costs of an extreme weather event and in particular, how this sector ends up bearing the entire burden of such losses.

5 Conclusion and policy implications

To summarize, the study carried out for Mumbai assesses the impacts of the 26 July 2005 catastrophic flood event in Mumbai. Unlike the usual impact assessment methods which focus on insured losses to property and infrastructure, this study has estimated the essentially uninsured losses on account of damage to structures and assets suffered by the informal sector, namely households and small business establishments. The catastrophic event of July 2005 with unprecedented heavy rainfall of 944 mm in a single day disrupted the life in the city completely with millions affected due to flood waters entering their houses or offices and damaging the assets owned by them and near shutdown of electricity, water supply, transportation and communication services. There was massive damage to public and private assets and infrastructure. The total losses suffered by the informal sector significantly exceeded the damage to public infrastructure, as evident by the findings of our study. Most importantly, the losses of the citizens were uninsured, out-of-pocket expenses that had to be met with through their savings and loans secured against their meagre incomes. The costs borne by individual families and businesses, when extrapolated, turned into huge losses that the city residents had to bear on account of massive floods.

The findings of this study have significant implications for the informal sector vulnerability in a city like Mumbai. As seen in the preceding section, the poor and low-income households and small businesses have borne the brunt of the extreme event and have very limited ability to cope with the resultant losses. For instance, our analysis shows how poorer households bear far greater burden of the losses resulting from damages to structures and assets in comparison with their incomes. The losses of poor and low-income families are 4–5 times their monthly incomes, whereas the losses of middle-income households are twice their monthly incomes. In absolute terms, the losses suffered by relatively better-off households might be greater, but in relative terms, the poor households have suffered more due to the floods. Similarly, in case of small businesses, they suffer much more than their larger counterparts due to nature and scale of business and absence of insurance coverage. Such businesses have had to rebuild their damaged assets and restart business operations on their own without help from an external agency.

In case of affected households, since they have no insurance cover or social security net, they have had to rely on the compensation offered by the government in the aftermath of floods or have taken loans from family, friends, moneylenders and other sources to rebuild the assets destroyed or damaged. The compensation offered by the government as per the rules is far smaller compared to the losses of individual families. For instance, for the poor families, the money offered as compensation by the government was barely enough to take care of 10–14 % of their total loss. Further, the compensation amount had no correlation with the actual losses for each family. This clearly brings out the fact that the poor households belonging to the informal sector in the city are acutely vulnerable to losses resulting from hazards such as floods.

Another important point to be noted here is the fact that when the households and small businesses are affected by floods and other hazards, their asset base is destroyed or depleted. Typically, the families and small businesses invest in assets, such as building structures and appliances or equipment. This asset base is threatened and is acutely vulnerable to hazards. Mumbai is acutely vulnerable to future climate-related hazards due to the proximity to sea, flood-prone topography and large-scale reclamation done for development. In case of future hazards, the informal sector will, thus, be at greater risk due to exposure of their critical assets and may not have any support to rebuild their lives. Added to this is the issue of more than 50 % population staying and working in informal settlements or slums with limited access to basic civic services and provisions. Such settlements, where most poor households live and small retail businesses operate from, will be acutely vulnerable to future climate risks.

Therefore, cities such as Mumbai need well-directed efforts to address the vulnerability of the informal sector and protect their lives and assets from future risks. It means that future adaptation planning and programmes need to identify the physical, economic and social vulnerability of the areas with informal settlements and activities and help the informal sector cope with the hazards. What is urgently required is setting up of a programme to provide insurance cover to the poor households and small businesses and also develop a meaningful compensation mechanism. Our study highlights the need to mainstream adaptation into larger developmental goals to benefit the informal sectors who form a significant part of the local economy. The developmental and most importantly, the poverty alleviation goals should be linked closely with the adaptation strategies for Mumbai and similar cities in the developing world.

The findings of this study bring out the extent and nature of vulnerability of the informal sector to extreme weather events, particularly in the absence of insurance coverage or any other compensation mechanism. This in a way also highlights the costs of inaction that poor citizens would bear in future if very little is done to enhance the coping capacity for future weather events and climate risks in general. Mumbai is currently in the process of drafting the new development plan that is expected to be implemented in the near future. The findings of this study put forth a convincing argument that adaptation strategies need to become a part of mainstream planning while devising strategies of developing infrastructure, housing, transport network and other facilities and services in the city. Although adaptation is costly, the costs of inaction can prove to be costlier. Hence, there is a need for integrated and coordinated efforts from all agencies including local government, planners, public utilities and community at large to work towards greater resilience to future weather risks for the city.

Notes

Insurance density and penetration are the two indicators of the extent of insurance coverage in any country. Insurance density is the total premium income per person in a country’s population (UNCTAD 2007), and insurance penetration is the ratio of premium underwritten a given year to the Gross Domestic Product (GDP) (IRDA 2013).

Kutcha structure has walls and roof made of materials such as unburnt bricks, bamboo, mud and grass. A pucca structure has walls and roof made of concrete, cement, bricks, stone blocks, metal sheets, corrugated iron, poly vinyl chloride (PVC) material and so on. Semi-pucca structures are a combination of the two structures, kutcha and pucca (NSS 2010).

Chawls are long (and mostly single-storey) buildings divided into many separate and often single-room rental tenements offering cheap and basic accommodation. Such buildings were constructed in Mumbai decades ago to provide housing to textile mill workers and other labourers who migrated into the city. Many of these buildings are in poor and dilapidated conditions now.

References

Adger W (1999) Social vulnerability to climate change and extremes in coastal Vietnam. World Dev 27(2):249–269

Annez P, Bertaud A, Patel B, Phatak V (2010) Working with the market: approach to reducing urban slums in India. Policy Research Working Paper No. 5475. The World Bank, Washington, DC

Blong R (2003) A new damage index. Nat Hazards 30(1):1–23

Brouwer R, Akter S, Brander L, Haque E (2007) Socioeconomic vulnerability and adaptation to environmental risk: a case study of climate change and flooding in Bangladesh. Risk Anal 27(2):313–326

Chatterton J, Viavattene C, Morris J, Penning-Rowell E, Tapsell S (2008) Delivering benefits through evidence: the costs of the summer 2007 floods in England. Environment Agency, Government of UK. https://www.gov.uk/government/uploads/…/scho1109brja-e-e.pdf. Accessed 4 April 2015

Dutta D, Herath S, Musiake K (2003) A mathematical model for flood loss estimation. J Hydrol 277:24–49

Government of India (2013a) Model state affordable housing policy for urban areas. Draft for Comments. Ministry of Housing and Urban Poverty Alleviation, Government of India

Government of India (2013b) Press note on poverty estimates 2011–2012. Planning Commission, Government of India. http://planningcommission.nic.in/news/pre_pov2307.pdf. Accessed 30 March 2015

Government of Maharashtra (2005) Maharashtra floods 2005. Relief and Rehabilitation Department

Government of Maharashtra (2007) Greater Mumbai disaster management action plan. Maharashtra Emergency Earthquake Management Programme

Grunthal G, Thieken A, Schwarz J, Radtke K, Smolka A, Merz B (2006) Comparative risk assessments for the city of Cologne: storms, floods, earthquakes. Nat Hazards 38(1–2):21–44

Hallegate S (2008) An adaptive regional input–output model and its application to the assessment of the economic cost of Katrina. Risk Anal 28(3):779–799

Hallegatte S, Ranger N, Mestre O, Dumas P, Corfee-Morlot J, Herweijer C, Wood R (2011) Assessing climate change impacts, sea level rise and storm surge risk in port cities: a case study on Copenhagen. Clim Change 104:113–137

Hammond M, Chen A (2014) Flood damage model guidelines. CORFU, FP7 Collaborative research on flood resilience in urban areas. http://www.corfu7.eu. Accessed 9 April 2015

Herweijer C, Ranger N, Ward R (2009) Adaptation to climate change: threats and opportunities for the insurance industry. The Geneva Papers 34:360-380. The International Association for the Study of Insurance Economics, Palgrave

IRDA (2013) Annual report 2012–2013. Insurance Regulatory and Development Authority India

Jha A, Lamond J, Bloch R, Bhattacharya N, Lopez A, Papachristodoulou N, Bird A, Proverbs D, Davies J, Barker R (2011) Five feet high and rising: cities and flooding in the 21st century. Policy Research Working Paper No. 5648. East Asia and Pacific Region. Transport, Energy and Urban Sustainable Development Unit, The World Bank

Khandlhela M, May J (2006) Poverty, vulnerability and the impact of flooding in the Limpopo Province, South Africa. Nat Hazards 39:275–287

Kreibich H, Seifert I, Merz B, Thieken A (2010) Development of FLEMOcs: a new model for the estimation of flood losses in the commercial sector. Hydrol Sci J 55(8):1302–1314. doi:10.1080/02626667.2010.529815

MCGM (2003) Environment status report 2002–2003. Municipal Corporation of Greater Mumbai

MCGM (2005) Report on relief measures and damage assessment due to heavy rains on 26th July 2005. Municipal Corporation of Greater Mumbai

MCGM (2006) Fact finding committee on Mumbai floods: final report volume I. Municipal Corporation of Greater Mumbai

MCGM (2009) Mumbai human development report 2009. Municipal Corporation of Greater Mumbai. Oxford University Press, Oxford

MCGM (2010) Flood preparedness guidelines 2010. Municipal Corporation of Greater Mumbai

MCGM (2013) Statistics on Mumbai. http://mcgm.gov.in. Accessed 20 July, 2013

Merz B, Kreibich H, Schwarze R, Thieken A (2010) Assessment of economic flood damage. Nat Hazards Earth Syst Sci 10:1697–1724

Messner F, Penning-Rowsell E, Green C, Meyer V, Tunstall S, van der Veen A (2007) Evaluating flood damages: guidance and recommendations on principles and methods. Report no. T09-06-01. FLOODsite. http://www.floodsite.net. Accessed 9 April 2015

Meyer V, Messner F (2005) National flood damage evaluation methods: a review of applied methods in England, the Netherlands, the Czech Republic and Germany. UFZ Discussion Papers 21

Monnereau I, Abraham S (2013) Limits to autonomous adaptation in response to coastal erosion in Kosrae, Micronesia. Int J Glob Warm 5(4):416–432

Munich Re (2011) Natural catastrophe know-how for risk management and research. NatCatSERVICE. Munich Reinsurance Group, Munich

Munich Re (2013) Topic natural hazards: NatCatSERVICE. Munich Reinsurance Group, Munich

Munich Re (2014) Loss events worldwide 1980–2013: NatCatSERVICE. Munich Reinsurance Group, Munich

Munji C, Bele M, Nkwatoh A, Idinoba M, Somorin O, Sonwa D (2013) Vulnerability to coastal flooding and response strategies: the case of settlements in Cameroon mangrove forests. Environ Dev 5:54–72

NSS (2010) Housing condition and amenities in India 2008–2009. NSS 65th Round. National Sample Survey Office. Ministry of Statistics and Programme Implementation, Government of India

NSS (2011) Key indicators of household consumption expenditure in India 2009–2010. NSS 66th Round. National Statistical Organisation. National Sample Survey Office. Ministry of Statistics and Programme Implementation, Government of India

NSS (2013) Key Indicators of drinking water, sanitation, hygiene and housing condition in India. NSS 69th Round. National Sample Survey Office. Ministry of Statistics and Programme Implementation, Government of India

Rabbani G, Rahman A, Mainuddin K (2013) Salinity-induced loss and damage to farming households in coastal Bangladesh. Int J Glob Warm 5(4):400–415

Ranger N, Hallegate S, Bhattacharya S, Bachu M, Priya S, Dhore K, Rafique F, Mathur P, Naville N, Henriet F, Herweijer C, Pohit S, Corfee-Morlot J (2011) An assessment of the potential impact of climate change on flood risk in Mumbai. Clim Change 104:139–167

Sales R (2009) Vulnerability and adaptation of coastal communities to climate variability and sea-level rise: their implications for integrated coastal management in Cavite City, Philippines. Ocean Coast Manag 52(7):395–404

Scawthorn C, Flores P, Blais N, Seligson H, Tate E, Chang S, Mifflin E, Thomas W, Murphy J, Jones C, Lawrence M (2006) HAZUS-MH Flood loss estimation methodology—II: damage and loss assessment. Nat Hazards Rev 7(2):72–81

Tierney K, Dahlhamer J (1997) Business disruption, preparedness and recovery: lessons from the Northridge earthquake. Preliminary paper 257. Disaster Research Centre, University of Delaware

UNCTAD (2007) Trade and development aspects of insurance services and regulatory frameworks. United Nations, New York and Geneva

Warner K, van der Geest K (2013) Loss and damage from climate change: local-level evidence from nine vulnerable countries. Int J Glob Warm 5(4):367–386

World Bank (2004) Understanding the economic and financial impacts of natural disasters. Disaster Risk Management Series No. 4. The World Bank, Washington, DC

Acknowledgments

This empirical study was part of the research project funded by the Asia Pacific Network for Global Change Research (APN) under the ARCP 2010. The project was funded for three cities—Mumbai, Bangkok and Manila. The authors acknowledge the support and funding received from the APN for this study and also appreciate the valuable inputs of the collaborators.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Patankar, A., Patwardhan, A. Estimating the uninsured losses due to extreme weather events and implications for informal sector vulnerability: a case study of Mumbai, India. Nat Hazards 80, 285–310 (2016). https://doi.org/10.1007/s11069-015-1968-3

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11069-015-1968-3