Abstract

The recent economic downturn has intensified the need for cooperation among carriers in the container shipping industry. Indeed, carriers join inter-firm networks for several reasons such as achieving economies of scale, scope, and the search for new markets. In this paper we apply network analysis and construct the Cooperative Container Network in order to study how shipping companies integrate and coordinate their activities and to investigate the topology and hierarchical structure of inter-carrier relationships. Our data set is comprised of 65 carriers that provide 603 container services. The results indicate that the Cooperative Container Network (CCN) belongs to the family of small world networks. This finding suggests that the most cooperative companies are small-to-medium-size carriers that engage in commercial agreements in order to reduce costs and, when in partnership with larger carriers, these cooperative companies are able to compete, especially against the largest carriers. However shipping companies with high capacity engage in cooperation with other carriers by merely looking for local partners in order to increase their local and specialized market penetration.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction and Background

Cooperative agreements have long attracted the interest of scholars for their “great efficiency in moving information, innovation, routine experience, and resources that enable firms to increase their organization learning, adaptation and competitive advantage” (Baum et al. 2003). Inter-firm cooperation has been addressed widely in the industrial literature, particularly in the automotive industry (Hüttenrauch et al. 2008), the high technology industry (Gomes-Casseres 1996; Patibandla and Petersen 2002; Roijakkers 2003), iron and steel production (Rosegger 1992), research and development (Staropoli 1998; Grønhaug 1989), and cooperative advertising (Li et al. 2002). However, as observed by Chen and Yahalom (2013), although cooperative agreements and alliances are main trends in the shipping industry, scant analyses have focussed on this topical industrial strategy.

The shipping industry, which is noted for its freight rate instability, imbalanced cargo flows and high degree of required financial commitment (i.e. significant capital investments in assets) is thus a volatile and risky sector with strong competition among carriers (Graham 1998; Stopford 2009; Notteboom et al. 2010; Satta et al. 2013); for instance, only five major ocean carriers (Maersk, MSC, CMA-CGM, Evergreen Line, and APL) operate nearly 50 % of the cellular fleet in the world. Carriers have therefore used various cooperative agreements to gain competitive advantage, share investment risk, and reduce costs. In the late 19th century carriers started to negotiate agreements in order to stabilize the supply chain and assure steady services on different maritime routes (Stopford 2009). Furthermore, consortia were introduced in the 1960s with the aim to lower costs and achieve efficiency in the production cycle due to the introduction of new typologies of vessels such as the deployment of mega-vessels (Drewry Shipping Consultants 2005; Imai et al. 2006). From the 1990s onward, cooperative agreements in shipping have had the twin goals of sharing risk and widening carriers’ markets in order to develop economies of scale and scope (Brooks et al. 1993; Alix et al. 1999), strengthen global, vertical (Soppé et al. 2009) and/or horizontal integration (Midoro and Pitto 2000; Panayides and Cullinane 2002; Ferrari et al. 2008; Lam and van de Voorde 2011) and sometimes test if there are sufficient economic conditions for mergers (Gardellin et al. 2011).

Within this framework, the container shipping industry is particularly interesting because in the last twenty years it has experienced tremendous growth rates triggered by the delocalization of manufacturing activities and the expansion of the world seaborne trade of components and finished products (UNCTAD 2012). To keep pace with market demand and decrease risks through diversification across the different business segments (liquid bulk, dry bulk, container, general cargo, etc.), as well as defend their market share, container companies have begun to follow aggressive corporate growth strategies. Whereas if traditionally, shipping companies have entered into the market largely alone, more recently this trend has been overturned by more and more cooperative agreements (Rimmer 1998; Alix et al. 1999; Lorange 2001). The container shipping industry has thus increasingly introduced cooperative strategies into its organization, resulting in a growing market concentration (Lorange 2001). Several types of cooperative strategies, from informal consortia to formal strategic alliances, are present in the container maritime market. Strategic alliances are agreements where carriers manage several joint shipping services worldwide, and by doing so, alliance members also share the investment risks. Two major strategic alliances currently operate in the market: G6 Alliance (derived from the merger between Grand Alliance and New World Alliance) and CKYH Alliance; it is noteworthy that these two alliances involve many of the world’s leading carriers. In June 2013 (Financial Times 2013) a new agreement known as P3, among Maersk, MSC and CMA-CGM concerning the Far East-Europe shipping route, was announced. Since the agreement involves the “big three” shipping companies in the world, it will be subject to the approval of the antitrust agencies of Asia, Europe and the US. Whatever the final decision turns out to be, this trend clearly shows how shipping cooperative agreements will play a crucial role in the growth and development of the maritime industry. And indeed, as observed by various scholars, the economic and financial crisis started in 2008 has determined a significant decrease in freight rates as well as chronic overcapacity, but has also resulted in an increase in cooperation among container shipping carriers (Hoffmann 2010; Panayides and Wiedmer 2011; Notteboom and Rodrigue 2012).

In the present paper we focus on the container industry, and in particular on the cooperative agreements based on the sharing of on-board slots: which may be either slot-charter (S-C) or vessel-sharing (V-S). Slot-charter agreements are those in which a shipping companyFootnote 1 books a certain number of slots on vessels operated by a partner without deploying any (owned) ship (Panayides and Wiedmer 2011); this type of agreement is implemented in order to streamline operational costs. Whereas in a vessel-sharing (V-S) agreement, each carrier deploys its own fleet and allows other partners to place a number of slots at their own disposal.

Against this background, in this study we apply network analysis and construct the Cooperative Container Network in order to study how shipping companies integrate and coordinate their activities. In constructing our network, we assume that, as discussed previously, carriers join inter-firm networks for several reasons, including the achievement of economies of scale (supply of services) and scope (joint utilization of equipment and know-how) and in order to enter into new markets (Caves and Porter 1977; Goerzen and Beamish 2005; Hoetker and Mellewigt 2009). The contribution of this study is therefore given by the fact that network applications in the maritime literature—particularly of analyses relating to container shipping—are relatively few. Some studies have applied network analysis to worldwide movements of cargo disaggregated at port level (Bergantino and Veenstra 2002; Koluza et al. 2010; Ducruet and Notteboom 2012; Parola et al. 2013); other studies investigate port choice behaviour (Tang et al. 2011), but most contributions focus on port efficiency, global cargo networks and maritime freight rates (Barros 2005; Cisic et al. 2007; Ducruet et al. 2010; Márquez-Ramos et al. 2011). In our network analysis application we aim to demonstrate that the cooperative container network has a small world structure, i.e. a network where firms cluster into dense cliques that foster communication and cooperation (Phelps and Schilling 2005). Through a stepwise analysis we reach different interesting results that support our idea that network analysis is an important tool for understanding and mapping specific patterns of cooperative agreements in the container shipping industry.

The paper is organized as follows. Section 2 addresses a literature review on inter-firm networks. Section 3 describes the dataset and network modelling applied to construct the cooperative container network (CCN). Sections 4 and 5 present the network analysis. In Section 6 we discuss the results of our study, set out the main implications for the container industry, and propose future research developments.

2 Literature Review on Inter-firm Networks

Network analysis provides a solid background to study the impact of agreements on firms, and scholars have often applied network analysis in order to disentangle the mechanisms at the centre of complex economic and financial cooperative interdependence among firms (Grandori and Soda 1995). Network theory is an effective paradigm for analyzing cooperative agreements between firms (nodes in the network) connected by links which may, for example, be franchising agreements, joint ventures, sub-contracts, and interlocking directorates. Network analysis has allowed scholars to scrutinize the strategic behaviours and partnering of firms that are involved in inter-firm agreements.

Network theory has its roots in the work of Euler in the first half of the 18th century, Solomonov (1951) and Erdos and Renyi (1960). Their work with the development of the network paradigm represents the first successful attempts to understand and study real world phenomena through the lens of the network (Newman et al. 2003). Another important advance is the introduction by Watts and Strogatz (1998) of a new network class known as small world. Small world networks are characterized by a high local connectivity (i.e. clustering coefficient C) and by a small topological distance (i.e. shortest path l) between each pair of nodes in the network, whereas regular networks have a high C and a high l, and random networks have a low C and a low l. Soon after the seminal contribution of Watts and Strogatz, Barabasi and Albert (1999) proposed a model for the growth of networks based on the notion that “the rich get richer.” In this formulation, networks grow according to power laws and are known as scale free. Networks such as the Internet, the WWW, airline networks, cross-collaboration in science, and many others all belong to the class of scale free networks (Albert and Barabási 2002; Newman 2003; Boccaletti et al. 2006).

In its focus on inter-firm cooperation studies, network analysis has been carried out mainly in accordance with two approaches. The first approach examines the formation, evolution and adaptation of firm networks in order to calculate the levels of performance and allocative efficiency due to economies of scale and scope (Sydow and Windeler 1998; Koza and Lewin 1999). For instance, Gimeno (2004) has argued that competitive strategies evident in network analysis can explain how a firm decides to cooperate and build an alliance with a third party. But the literature is not consistent in its results. Network formation in inter-firm cooperation does not always add competitive advantage to the industrial relationship; sometimes very diverse firms involved in an agreement, as well as their national or corporate culture, can impact negatively on the economic performance of the alliance (Brown et al. 1989; Biggart and Guillen 1999; Goerzen and Beamish 2005). The second approach applies network analysis to the characterization of the structure of firm relationships (Stuart et al. 1999; Dittrich et al. 2007); in this approach one examines the inter-firm network topology so as to understand firm behaviour in the choice of partners and impacts of the strategies of firms on alliance networks (Ahuja 2000; Goerzen and Beamish 2005; Zaheer and Bell 2005; Dittrich et al. 2007).

From our perspective of analysis it is interesting to observe how in the literature the level of interconnectedness of a firm’s partners can influence a firm partnering strategy. According to Rowley et al. (2000), highly interconnected firms can generate local clusters that may force a firm to cooperate in order to avoid being excluded from commercial agreements. Firms may therefore use existing cooperative agreements to connect to a third party (i.e. indirect links) in order to maximize inter-firm network benefits such as an increase in innovation, output and maintenance costs (Ahuja 2000). Furthermore, firms may also gain competitive advantage from their position within a network; a firm acts as a conduit to connect disjointed clusters and exploit strategic information from both sides (Zaheer and Bell 2005). Various authors have also extended this analysis by examining the global interconnectedness of inter-firm networks and the influence on firms’ commercial strategies. Garcia-Pont and Nohria (2002) have argued that there is no evidence to confirm whether the global interconnectedness of a network can impact on individual firm behaviour; this means that each firm acts according to its own commercial advantage without considering the effect of its commercial cooperative strategy on other firms.

However, an interesting element of network inter-firm cooperation is that it can be identified as a small world network (Watts and Strogatz 1998) because small world networks often encapsulate the many characteristics of industrial cooperation. Small world networks are sparsely connected networks with high local connectivity, and therefore firms identified as small world networks are more likely to disseminate information and implement best practice among them (Watts and Strogatz 1998). Following these findings, our approach will examine container shipping companies as firms that cooperate and which are also identified as small world networks. In so doing, we are in line with several scholars (Goerzen and Beamish 2005; Hoetker and Mellewigt 2009; Sullivan and Tang 2012) who have verified that small world networks are best able to capture inter-firm cooperation. Baum et al. (2003) in particular have evaluated the origin and evolution of small world networks in inter-firm alliances in order to bring to light the factors underlying the formation of these network structures. They argue that in the case of firm alliances, the evolution of a network is neither random nor due to coordinated behaviours, but is instead driven by chance partnering and strategic manoeuvring (insurgent and control partnering), and this is key to our analysis as well. Thus, the small world network structure is none other than the result of local interactions among firms that generate complex non-local cooperative behaviours. In the next section we discuss the data set we have exploited to investigate cooperation in the container industry and present the cooperative container network (CNN).

3 Modelling and Data Description

We select 24 major ocean carriers (that cooperate with 41 other carriers) on the basis of total fleet capacity, and construct the network of all the cooperative agreements for the given set of carriers (65 in total). Information has been collected through the Containerisation International Journal and refers to January 2010. In this way we provide a picture of a specific moment in time and avoid any bias, since there is commonly variability in the supply of shipping services. In order to design the Cooperative Container Network, we calculate the Weekly Container Transport Capacity (WCTC) deployed by each carrier of the selected set per container service, as defined by Frémont and Soppé (2004). In addition, the data set includes for each container service: frequency, fleet capacity (Twenty-Foot Equivalent Units—TEUs) deployed by one or more carriers on the same service, and existence of vessel-sharing (V-S) or slot-charter (S-C) agreements. As mentioned above, container carriers cooperate in accordance with either vessel-sharing (V-S) or slot-charter (S-C) agreements. Figure 1 shows a simplified representation of container cooperation schemes, where carriers α, ß, and γ operate container service S among ports A, B, C, D, E, F, and G with a Weekly Container Transport Capacity (WCTC). Let us notice in the figure that one slot-charter, carrier δ, does not use its fleet to provide the service but instead rents container slots from carriers α, ß, and γ (vessel-sharing). The complete data set is thus comprised by a subset of 603 container services split into two categories: services managed by single carriers (205) and services managed by multiple carriers (398).

The Cooperative Container Network (CCN) is represented by an indirect graph G (N, L) composed of two sets: N is the set of nodes, N ≡ {n1, n2, … nN} and L is the set of links, L ≡ {l1, l2, … ln}. We use a mathematical representation for the CCN composed of a NxN adjacency matrix A, whose off-diagonal entries aij are equal to 1 when we have one or more shared service between companies i and j (i ≠ j or j ≠ i), and 0 otherwise. Diagonal elements aii are set to 0 because there is no intra-firm relationship in our modelling. Since we have constructed an indirect graph, the adjacency matrix A is symmetrical. We extend the topological representation provided by the adjacency matrix by constructing the weighted adjacency matrix W, whose off-diagonal elements wij are the sum of service capacity Q S WCTC shared by carriers i and j. The weighted matrix W provides us with a richer description of the CCN because it considers the topology in addition to quantitative information on the market share between pairs of carriers. The two fundamental types of agreements (V-S and S-C) yield the mutual interactions between pairs of carriers in our network modelling. Each node in the network corresponds to a carrier and the links represent cooperation between carriers. Total vessel capacity available for each service is thus represented by tvc.

In our depiction of five cooperative and fleet characteristics of the major carriers of our data set shown in Table 1, two main patterns emerge: all of the carriers in our set provide liner services through cooperative agreements, but in varying degrees, and only the MSC operates more services independently than in cooperation with other carriers. A second pattern is apparent when we observe the number of independently operated services; after the sixth major carrier (Cosco Container Lines), the number of digits of services operated independently drops off by one unit. Data shows that cooperative agreements are the preferred organizational and logistics solutions of minor carriers, whereas mega-carriers such as the MSC still operate a number of services independently due to the global services they have built up over the years.

In Table 2 we rank the ten most frequent cooperative agreements in our data set. The Asian players clearly dominate the ranking and are the most likely to cooperate with other carriers through strategic alliances.

Figure 2 displays the complete CCN composed of N = 65 carriers (nodes) and L = 287 cooperative agreements (links). The colour of each node is drawn as a function of the number of connections from red (high number of connections) to light yellow (low number of connections); the size of each node (i.e. carrier) is proportional to the number of TEU operated in January 2010; and the width of each link is proportional to the level of cooperation between nodes i and j.

From a network perspective, our CCN is sparse because its density is equal to 0.086,Footnote 2 but it has a relatively small average shortest path (2.2),Footnote 3 given that the value of maximum shortest path to connect the most remote nodes in the graph is five links. The analysis of shortest path shows us that, on average, nodes are close to each other; in other words, having obtained an average shortest path equal to 2.2 means that the cooperative container network is a tight network based on cooperative agreements among shipping companies. In the next sections we examine the CCN in greater detail in order to characterize the topological structure of the container shipping industry.

4 Analysis of the Cooperative Container Network (CCN)

In this section we examine the characteristics of the Cooperative Container Network (CCN); in doing so, we identify the carriers (nodes) that play a relevant role in terms of cooperation. Our aim in this section is to verify if highly connected carriers play leading roles in the organization of strategic container agreements and the management of services. Our first step is to calculate for each carrier i the level of connectivity, that is, the degree k (or number of cooperative partners in our specific case study) in the following expression:

where ϑ(i) is the set of topological neighbours of carrier i, i.e. the carriers (nodes) directly connected to i, and aij is the element of the adjacency matrix A. The value of degree k in our set ranges between 1 and 31, and the average degree k is equal to 8.8.

Let us now estimate the cumulative probability distribution of degree k, which can give us an idea about the interactions among shipping carriers. The degree distribution in our analysis (Fig. 3) points to two different regimes: a power law in the first part and an exponential regime in the final part of the tail of the distribution. The black dots in Fig. 3 depict the log-log scatter plot. The first regime is well-approximated by a power law with an exponent of −0.58 (adjusted R2 = 0.845 for the complete distribution). Moreover, the cumulative probability distribution has a cut-off point at approximately degree k = 20 and p < 0.2. We can conclude that in our sample we have a higher probability of carriers with less than 20 cooperative partners, and that the CCN does not belong to the family of random networks. Cooperation is therefore not uniformly distributed among carriers. Nonetheless, we also need to emphasize that this conclusion may be influenced by the limited number of observations in our data set (65 nodes). Some authors have suggested that x-axis of a power law distribution should range over more than three orders of magnitude (Farmer and Geanakoplos 2008; Clauset et al. 2009). In the CCN the total number of nodes influences the variance of degree k (maximum possible degree k is 64).

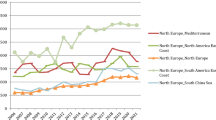

When we analyze the relationship between the network connectivity and the commercial capacity of each carrier, the linear regression in Fig. 4 shows a significant correlation between degree k (i.e. number of cooperative partners) and total fleet capacity. In our set the carriers with a small operated fleet capacity (TEUs) have limited cooperation (k < 10); the majority of these carriers cluster together in the low-k and low-TEU region of Fig. 4. Carriers with higher carrying capacity than in the previous case are more scattered and clearly do not cluster. In this case we can infer that carriers use cooperation as an industrial strategy to establish their leadership roles in the market. Two cases are worthy of mention: the mega-carriers MSC with k = 9 and Maersk Line with k = 17. MSC, for instance, follows an industrial strategy characterized by a large total fleet capacity (i.e. high level of market share), which allows this company to behave as an independent operator. Carriers such as MSC and Maersk can operate independently due to the large portfolio of clients they have accumulated over time.

At this point in the analysis we may ask, do carriers select their commercial partners on the basis of similar industrial strategy (i.e. cooperation or independence)? To answer this question we estimate what is known as network assortativity. This measure provides information on the tendency of nodes/carriers to connect to other nodes/carriers with a similar level of connectivity (Newman 2003). The assortativity coefficient ranges between 1 (the highest value) to −1 (the lowest value). The assortativity coefficient r is defined as follows:

where e is the vector of entries from the network mixing matrix aij, Tr(e) is the trace of the matrix A and ||e 2|| is the sum of the squared entries.

In the CCN we obtain a small assortativity coefficient (r = −0.16), and when we consider the top ten most connected carriers, we find a similar assortativity value (r = −0.14). These results demonstrate that container shipping companies do not select their partners on the basis of similar industrial strategies; in fact, with a value of assortativity at −0.14, the carriers which are the most connected do not necessarily consider connectivity as a determinant factor for entering into partnerships with other carriers.

In the next section we will compare these results with the capability of carriers to topologically cluster together, in other words, we will verify if our network is a small world network.

5 Cooperative Clusters in the CCN

We have shown that degree k represents local connectivity of the CCN from the viewpoint of a single node, but we do not yet know how the partners of this node link together. Therefore, at this stage of the analysis we need to calculate inter-local connectivity, i.e. the clustering coefficient. The clustering coefficient for carrier/node i is defined as the number of closed paths of length two, normalized by the maximum possible number of paths of length two.Footnote 4 Although the literature identifies at least four different mathematical expressions for the clustering coefficient (Saramäki et al. 2007), in this study we adopt the topological formulation of the clustering coefficient as proposed by Watts and Strogatz (1998) in their seminal work on small world networks, which yields the following definition:

where E(i) is the number of the nearest paths of node/carrier i and k i (k i - 1)/2 is the maximum number of possible links among the neighbours of node/carrier i. Clustering coefficient C in this formulation ranges between 0 and 1.

For our Cooperative Container Network we obtain values of clustering coefficient close to 1 for carrier i when its first neighbours (i.e. carriers with direct cooperation in the CCN) show a mutually higher number of links; otherwise we have values close to 0. Figure 5 shows values of degree k, versus clustering coefficient C, for each carrier. The trend is approximated by a linear decay law (correlation coefficient of 0.81). The regression excludes carriers with a clustering coefficient of zero.

The results obtained relating to degree k with clustering coefficient C are in line with our findings in the previous sections. In this case we observe a main cluster in the data. The cluster includes carriers with low values of degree k and high clustering coefficient C (regional carriers), implying that carriers with only a few cooperative links and low levels of operated fleet capacity generally tend to link together. In other words, cooperative agreements are more easily established among regional players that tend to be specialized in local markets.

In Fig. 6 we depict the sub-networks of a sample of four cooperative carriers. We can observe that, as the clustering coefficient increases (from bottom to top), the links are more equally distributed among the carriers.

After having carried out our stepwise analysis, we can now verify that the CCN is a small world network with an average shortest path (2.2) that scales as the logarithm of the number of nodes in the network (65); the CCN shortest path has the same order of a random graph with the same number of nodes/carriers, while the average clustering coefficient is equal to < C(i) > = 0.55, a very high value, higher than the case of a random graph with the same number of nodes/carriers (<Crand (i) > = 0.1). The result shows that, as a small world network, medium and small companies in the CCN are the most cooperative players. Small world networks are locally clustered networks with short path lengths connecting different clusters, meaning that apparently disconnected carriers (as in the case of small and medium carriers) may easily be indirectly connected through a few intermediary companies. In the case of the container industry we can confirm that the most cooperative companies are small-to-medium-size carriers that engage in commercial agreements in order to reduce costs (hedge risk and increase scale and scope economies), and also when in partnership with larger carriers, these cooperative companies are able to compete, especially against the three largest carriers which absorb around 40 % of the total fleet capacity (Table 1).

The reader is invited to peruse the Appendix, where we have developed a community detection analysis over the CCN so as to provide a detailed picture of the membership of families of carriers (clusters) created by cooperative agreements in the container industry. Although it is interesting as a descriptive tool, due to the low values of modularity Q provided by six different methods (Table 3), the community detection analysis does not allow us to reach conclusive results. For example, we had expected to detect clusters of carriers involved in the two major alliances active at the time of observation; this has happened in a few cases (Table 5). However, it is interesting to note that the three major ocean carriers have recently created the P3 alliance (mid-2013) and are coincidentally members of the same cluster. This situation could be the result of long-term cooperative agreements (sharing of on-board slots) between Maersk, MSC and CMA-CGM, which set the stage for the launch of the P3 alliance.

In conclusion, the various findings of our analysis have provided empirical evidence to indicate that small world cooperative networks have a positive impact on the container shipping industry. This organizational strategy has strong positive effects, particularly on small and medium size shipping companies that are now able to reduce financial risks and increase economies of scale and scope. But above all, through partnerships with global shipping companies, small and medium companies gain access to larger portfolios of clients that the international companies have built up over time in different parts of the globe.

6 Conclusion

The dramatic economic downturn occurring in 2008 has prompted carriers to increasingly seek cooperative schemes for their operations. In the mature and highly-competitive container shipping market, cooperation has strategic value because it allows for the reduction of investment in assets and the increase of load factor aggregating demand flows. In this work we have examined a sample of 603 container services distributed worldwide involving 65 carriers; we have then constructed a network of cooperative agreements of container services of our sample which we have labelled Cooperative Container Network (CCN). By applying network analysis, we have demonstrated that CCN belongs to the class of small world networks with high levels of local interconnectivity. We have shown that no random patterns emerge from cooperation among container carriers, thereby implying that they abide by rules in their cooperative relationships.

As a small world network, in the CCN we observe that carriers with small and medium total fleet capacity have cooperative links with other carriers sharing similar characteristics. However, when fleet capacity increases, the clustering coefficient decreases linearly. Interestingly from this point of view, is that a carrier with high capacity engages in cooperation with other carriers by merely looking for local carriers in order to increase its local and specialized market penetration. This result suggests how cooperative agreements among shipping carriers can indeed lead to greater diffusion of knowledge and information across the market and facilitate operational services, for example, in specific regional markets. However, when container carriers reach significant levels of total fleet capacity, they tend to achieve a level of connection that allows them to exert dominance in the market. The mega-carriers (MSC and Maersk) still operate a number of services independently due to the global services they have developed over many years. MSC and Maersk operate around 32 % of the container fleet deployed by top shipping firms (Table 1). From this perspective, on the one hand small and medium carriers use cooperative agreements as a way to reduce risk and reach economies of scale and scope. But when they are in partnership with international companies, small and medium carriers can use cooperative agreements as a means of achieving greater market scope and geographical coverage. On the other hand, large carriers tend to establish agreements with small carriers in order to penetrate the more specialized local markets.

Beneficial future research would be to evaluate cooperative attitudes among different shipping companies by examining the impacts of the maritime network structure in terms of hub-and-spoke solutions and geographical diversity. We suggest that it would then be possible to measure the level of investment risk that may affect cooperation agreements in the container shipping industry. The present paper has analyzed cooperative agreements from the carrier’s point of view; an extension of this work could apply network analysis to a study of container services.

Notes

In this paper the terms “company” and “firm” are used interchangeably.

The density is calculated as the ratio between number of links and maximum number of links for the case of a complete graph with the same number of nodes.

The shortest path is the minimum distance (number of links) that separates two nodes.

A path (also known as a cycle) is a walk that connects two or more nodes. The path is closed if the start and end node of a walk both coincide.

References

Ahuja G (2000) Collaboration networks, structural holes, and innovation: a longitudinal study. Adm Sci Q 45(3):425–455

Albert R, Barabási AL (2002) Statistical mechanics of complex networks. Rev Mod Phys 74:47–97

Alix Y, Slack B, Comtois C (1999) Alliance or acquisition? Strategies for growth in the container shipping industry, the case of CP ships. J Transp Geogr 7:203–208

Barabasi AL, Albert R (1999) Emergence of scaling in random networks. Science 286:509–512

Barros CP (2005) Decomposing growth in Portuguese seaports: a frontier cost approach. Marit Econ Logist 7:297–315

Baum JAC, Shipilov AV, Rowley TJ (2003) Where do small worlds come from? Ind Corp Chang 12(4):697–725

Bergantino AS, Veenstra AW (2002) Interconnection and co-ordination: an application of network theory to liner shipping. Int J Marit Econ 4:231–248

Biggart N, Guillen M (1999) Developing difference: social organization and the rise of the auto industries of South Korea, Taiwan, Spain and Argentina. Am Sociol Rev 64:722–747

Blondel VD, Guillaume J, Lambiotte R, Lefebvre E (2008) Fast unfolding of communities in large networks. J Stat Mech Theory Exp 10:1742–5468

Boccaletti S, Latora V, Moreno Y, Chavez M, Hwang DU (2006) Complex networks: structure and dynamics. Phys Rep 424:175–308

Brooks MR, Blunden RG, Bidgood CI (1993) Strategic alliances in the global container transport industry. In: Rerck R (ed) Multinational strategic alliances. International Business Press, London, pp 221–250

Brown L, Rugman A, Verbeke A (1989) Japanese joint ventures with western multinationals: synthesizing the economic and cultural explanations of failure. Asia Pac J Manag 6:225–242

Caves R, Porter ME (1977) From entry barriers to mobility barriers: conjectured decisions and contrived deterrence to new competition. Q J Econ 91:241–267

Chen J, Yahalom S (2013) Container slot co-allocation planning with joint fleet agreement in a round voyage for liner shipping. J Navig 66(4):589–603

Cisic D, Komadina P, Hlaca B (2007) Network analysis applied to Mediterranean liner transport system. In: Proceedings of the International Association of Maritime Economists Conference, Athens

Clauset A, Newman MEJ, Moore C (2004) Finding community structure in very large networks. Phys Rev E 70:066111–066117

Clauset A, Shalizi CR, Newman MEJ (2009) Power-law distributions in empirical data. SIAM Rev 51(4):661–703

Dittrich K, Duysters G, de Man AP (2007) Strategic repositioning by means of alliance networks: the case of IBM. Res Policy 36(10):1496–1511

Drewry Shipping Consultants (2005) Ship operating costs. Annual market review and forecast, London

Ducruet C, Notteboom T (2012) The worldwide maritime network of container shipping: spatial structure and regional dynamics. Glob Networks 12(3):395–423

Ducruet C, Lee SW, Ng AKY (2010) Centrality and vulnerability in liner shipping networks: revisiting the Northeast Asian port hierarchy. Marit Policy Manag 37(1):17–36

Erdos P, Renyi A (1960) On the evolution of random graphs. Publ Math Inst Hung Acad Sci 12:17–61

Farmer JD, Geanakoplos J (2008) The virtues and vices of equilibrium and the future of financial economics. arXiv:0803.2996

Ferrari C, Parola F, Benacchio M (2008) Network economies in liner shipping: the role of the home markets. Marit Policy Manag 35(2):127–143

Financial Times (2013) ‘Big three’ container shipping groups plan alliance, 18 June

Frémont A, Soppé M (2004) Les stratégies des armateurs de lignes régulières en matière de dessertes maritimes. Belgéo 4:391–406

Garcia-Pont C, Nohria N (2002) Local versus global mimetism: the dynamics of alliance formation in the automobile industry. Strateg Manag J 23:307–321

Gardellin V, Das SK, Lenzini (2011) Cooperative vs. non-cooperative: self-coexistence among selfish cognitive devices. In: World of Wireless, Mobile and Multimedia Networks (WoWMoM), 2011 I.E. International Symposium on a (pp. 1–3). IEEE

Gimeno J (2004) Competition within and between networks: the contingent effect of competitive embeddedness on alliance formation. Acad Manag J 47(6):820–842

Goerzen A, Beamish PW (2005) The effect of alliance network diversity on multinational enterprise performance. Strateg Manag J 26(4):333–354

Gomes-Casseres B (1996) The alliance revolution: the new shape of business rivalry. Harvard University Press, Cambridge

Graham MG (1998) Stability and competition in intermodal container shipping: finding a balance. Marit Policy Manag 25:129–147

Grandori A, Soda G (1995) Inter-firm networks: antecedents, mechanisms and forms. Organ Stud 16(2):183–214

Grønhaug K (1989) Knowledge transfer: the case of the Norwegian technology agreements. OMEGA Int J Manag Sci 17(3):273–279

Hoetker G, Mellewigt T (2009) Choice and performance of governance mechanisms: matching alliance governance to asset type. Strateg Manag J 30(10):1025–1044

Hoffmann J (2010) Shipping out of the economic crisis. Brown J World Aff 16(2):121–130

Hubert L, Arabie P (1985) Comparing partitions. J Classif 2:193–218

Hüttenrauch M, Baum M, Vielfalt E (2008) Die dritte Revolution in der Automobilindustrie. Springer, Berlin

Imai A, Nishimura E, Papadimitriou S, Liu M (2006) The economic viability of container mega-ships. Transp Res E 42:21–41

Koluza P, Kolzsch A, Gastner MT, Blasius B (2010) The complex network of global cargo ship movements. J R Soc Interface 7:1093–1103

Koza MP, Lewin AY (1999) The coevolution of network alliances: a longitudinal analysis of an international professional service network. Organ Sci 10(5):638–653

Lam JSL, van de Voorde E (2011) Scenario analysis for supply chain integration in container shipping. Marit Policy Manag 38(7):705–725

Li SX, Huang Z, Zhu J, Chau PYK (2002) Cooperative advertising, game theory and manufacturer–retailer supply chains. OMEGA Int J Manag Sci 30:347–357

Lorange P (2001) Strategic re-thinking in shipping companies. Marit Policy Manag 28(1):23–32

Márquez-Ramos L, Márquez-Ramos I, Pérez-García E, Wilmsmeier G (2011) Maritime networks, services structure and maritime trade. Netw Spat Econ 11:555–576

Midoro R, Pitto A (2000) A critical evaluation of strategic alliances in liner shipping. Marit Policy Manag 27(1):31–40

Newman MEJ (2003) Mixing patterns in networks. Phys Rev E 67:026126–026139

Newman MEJ (2006) Finding community structure in networks using the eigenvectors of matrices, arXiv:physics/0605087v3

Newman MEJ, Girvan M (2004) Finding and evaluating community structure in networks. Phys Rev E 69:026113–026128

Newman MEJ, Strogatz SH, Watts DJ (2003) Random graphs with arbitrary degree distributions and their applications. Phys Rev E 64:026118 (1–17)

Notteboom T, Rodrigue JP (2012) The corporate geography of global container terminal operators. Marit Policy Manag 39(3):249–279

Notteboom T, Rodrigue JP, De Monie G (2010) The organizational and geographical ramifications of the 2008–09 financial crisis on the maritime shipping and port industries. In: Hall PV, McCalla B, Comtois C, Slack B (eds) Integrating seaports and trade corridors. Ashgate, Surrey

Panayides PM, Cullinane K (2002) Competitive advantage in liner shipping: a review and research agenda. Int J Marit Econ 4:189–209

Panayides PM, Wiedmer R (2011) Strategic alliances in container liner shipping. Res Transp Econ 32:25–38

Parola F, Satta G, Caschili S (2013) Unveiling cooperative networks and ‘hidden families’ in the container port industry. Marit Policy Manag 40. doi:10.1080/03088839.2013.782442

Patibandla M, Petersen B (2002) Role of transnational corporations in the evolution of a high-tech industry: the case of India’s software industry. World Dev 30(9):1561–1577

Phelps C, Schilling MA (2005) Interfirm collaboration networks: the impact of small world connectivity on firm innovation. Academy of Management Proceedings 2005 (1). Academy of Management

Pons P, Latapy M (2006) Computing communities in large networks using random walks. J Graph Algorithm Appl 10(2):191–218

Reichardt J, Bornholdt S (2006) Statistical mechanics of community detection. Phys Rev E 74:016110–016124

Rimmer PJ (1998) Ocean liner shipping services: corporate restructuring and port selection/competition. Asia Pac Viewpoint 39(2):193–208

Roijakkers N (2003) Inter-firm cooperation in high-tech industries: a study of R&D partnerships in pharmaceutical biotechnology. PhD thesis, Maastricht University, Maastricht

Rosegger G (1992) Cooperative strategies in iron and steel: motives and results. OMEGA Int J Manag Sci 20(4):417–430

Rowley T, Behrens D, Krackhardt D (2000) Redundant governance structures: an analysis of structural and relational embeddedness in the steel and semiconductor industries. Strateg Manag J 21:369–386

Saramäki J, Kivelä M, Onnela JP, Kaski K, Kertész J (2007) Generalizations of the clustering coefficient to weighted complex networks. Phys Rev E 75:027105–027109

Satta G, Parola F, Ferrari C, Persico L (2013) Linking growth to performance: insights from shipping line groups. Marit Econ Logist 15(3):349–373

Solomonov R (1951) Rapport A: connectivity of random nets. Bull Math Biophys 13:107–117

Soppé M, Parola F, Frémont A (2009) Emerging inter-industry partnerships between shipping lines and stevedores: from rivalry to cooperation? J Transp Geogr 17(1):10–20

Staropoli C (1998) Cooperation in R&D in the pharmaceutical industry—the network as an organizational innovation governing technological innovation. Technovation 18(1):13–23

Stopford M (2009) Maritime economics, 3rd edn. Routledge, London

Stuart TE, Hoang H, Hybels R (1999) Interorganizational endorsements and the performance of entrepreneurial ventures. Adm Sci Q 44:315–349

Sullivan BN, Tang Y (2012) Small-world networks, absorptive capacity and firm performance: evidence from the US venture capital industry. Int J Strateg Chang Manag 4(2):149–175

Sydow J, Windeler A (1998) Organizing and evaluating interfirm networks: a structurationist perspective on network processes and effectiveness. Organ Sci 9(3):265–284

Tang LC, Low JMW, Lam SW (2011) Understanding port choice behavior—a network perspective. Netw Spat Econ 11(1):65–82

UNCTAD (2012) Review of maritime transport 2012. United Nations Publication, Geneva

Watts D, Strogatz SH (1998) Collective dynamics of ‘small-world’ networks. Nature 393:440–442

Zaheer A, Bell GG (2005) Benefiting from network position: firm capabilities, structural holes, and performance. Strateg Manag J 26(9):809–826

Acknowledgments

S.C. and F.M. acknowledge the financial support of the Engineering and Physical Sciences Research Council (EPSRC) under the grant ENFOLD-ing: Explaining, Modelling and Forecasting Global Dynamics, reference EP/H02185X/1.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

We propose the application of a network community detection analysis in order to identify how carriers cluster together in the container shipping industry.

In this study we present the results of the application of the Spinglass method (Reichardt and Bornholdt 2006). We also test a number of other methods (Table 3), but we propose the partition provided by the Spinglass algorithm because it offers the highest value of modularity Q (Newman and Girvan 2004) among the methods tested. The modularity Q provides a measure to discern if a partition is valid to unfold the community structure in a network.

The six methods tested provide us with partitions of similar values of modularity Q, unless the number of clusters provided by each method ranges between 4 and 9. In order to evaluate how similar these partitions look, we propose the application of a quantitative index, the Adjusted Rand Index (ARI) proposed by Hubert and Arabie (1985). The ARI compares two partitions T and W of the same data set. The first partition T is used as a reference partition. Classes in partition W are in turn evaluated according to the following formulation:

Where:

- a :

-

is number of pairs of elements belonging to the same class both in T and W.

- b :

-

is number of pairs of elements belonging to the same class in T and to different clusters in W.

- c :

-

is number of pairs of elements belonging to different classes in T and to the same cluster in W.

- d :

-

is number of pairs of elements belonging to different classes both in T and W.

- n :

-

is number of elements of the partitions.

The ARI ranges between 0 and 1 (perfect similarity). Table 4 shows the level of similarity of the partitions provided by the six methods of community detection. We order the table to have a comparative analysis from the best method (as proved by the modularity function Q) to the lower value. A high level of agreement can be detected among all the partitions (Table 4), thus confirming that apart from small variations, the partition provided by the Spinglass method is reliable.

By comparing the Spinglass partitioning (Table 5) with the results proposed in Table 4, as well as the composition of official alliances, we can see that community 2 comprises all members of the CKYH alliance. The membership of this cluster appears to be quite heterogeneous, as it is composed of 17 carriers with an average degree k of 11 (standard deviation of 7.9). The other carriers are minor companies, as they do not belong to the first 15 companies in terms of shipped freight volumes. The members of the other official alliance, i.e. G6, are spread over the other clusters.

In order to clarify the relationships between the network structure and the cluster organization of carriers, Table 6 shows some statistics on the average degree and standard deviation of the carriers belonging to each cluster, and the list of the three leading carriers in terms of network connections. Most clusters show similar values of average degree k and standard deviation. There are a few leaders in each group (dominant carriers) while weakly connected carriers compose the remainder of the clusters’ population (high values of standard deviation). Finally, Fig. 7 depicts the cluster membership of the carriers in our sample as provided by the Community Spinglass method. The size of each node is drawn as a function of the number of connections, while the colours correspond to node membership in the five clusters.

Rights and permissions

About this article

Cite this article

Caschili, S., Medda, F., Parola, F. et al. An Analysis of Shipping Agreements: The Cooperative Container Network. Netw Spat Econ 14, 357–377 (2014). https://doi.org/10.1007/s11067-014-9230-1

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11067-014-9230-1