Abstract

The paper discusses the theoretical and empirical evidence on the subject and concludes that freight mode choice can be best understood as the outcome of interactions between shippers and carriers, and that mode choice depends to a large extent on the shipment size that results from shipper-carrier interactions. These conclusions are supported by economic experiments designed to test the hypothesis of cooperative behavior. This was accomplished by conducting two sets of experiments (ones with the shipper playing the lead role in selecting the shipment size; and others in which the shipment size decision was left to the carriers), and by comparing their results to the ones obtained numerically under the assumption of perfect cooperation. The comparison of results indicated that the experiments converged to the perfect cooperation case. This is in line with the conclusion from game theory that indicates that under typical market conditions the shipper and carrier would cooperate. These results also imply that it really does not matter who “makes” the decision about the shipment size and mode to be used at a given time period, as over time the shipper—that is the customer—ends up selecting the bids more consistent with its own interest. In other words, these results do not support the assumption that freight mode choice is solely made by the carriers.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Freight demand is the result of complex interactions among numerous economic agents, including: producers, shippers, freight forwarders, warehouse operators, carriers, receivers, regulatory agencies, to name a few. This fact provides ample evidence of the derived nature of transportation demand. From the standpoint of freight demand modeling, however, three agents stand out in terms of importance: shippers, carriers, and receivers. The “shipper” refers to the economic agent(s) associated with the production and the shipping of goods. The “carrier” represents the companies (e.g., transportation companies, third party logistics service providers) that are in charge of physically transporting the goods. The final group, i.e., “receivers,” represents the consignees of the cargoes. Although a useful construct to classify the key agents, it is important to highlight that each of these groups is a highly heterogeneous collection of individual companies with vastly different sizes, operational styles and patterns, and company structures. As a result of this, the companies in each group may exhibit significantly different behaviors.

It seems obvious that the interactions between these agents must affect freight demand, though not much is known about how to effectively consider these interactions in the context of the freight demand models. This presents a major obstacle to transportation planners because these agents and their interactions are at the heart of two of the most important decision processes in transportation policy making: freight mode choice, and freight road pricing. A solid knowledge of freight mode choice is required to define policies aimed at reducing the dependence on trucking; while a thorough understanding of the freight industry response to road pricing is needed for the definition of efficient policies to shift truck deliveries to the off-hours. Since the main focus of this paper is on freight mode choice, the reader interested in discussions on the carrier-receiver interactions that determine the behavioral responses to freight road pricing, is referred elsewhere (Holguín-Veras et al. 2007; Holguín-Veras 2008; Holguín-Veras et al. 2008).

Regarding the freight mode choice process, there seems to be no agreement about the role of shipper decisions on mode choice. The literature is divided in three groups. The first one postulates, with support from econometric modeling and game theory, that two-way interactions between shippers and carriers determine mode choice. This line of thinking is based on the assumption that shippers, after experimenting with various shipment sizes and receiving feedback signals (e.g., prices, level of service, damage rates) from the carriers, finally settle down on what they consider the optimal shipment size, which in turn influences mode choice (Samuelson 1977; Holguín-Veras 2002). In this context, the shipper decisions pertaining to shipment size influence mode choice; while the performance of the carrier may alter shippers’ decisions. Needless to say, this point of view is implicitly taken in the Economic-Order-Quantity model used in logistics to compute optimal shipment size and delivery frequency. These interactions have been studied using optimization (Hall 1985), and econometric formulations. The majority of these econometric formulations (McFadden et al. 1986; Abdelwahab and Sargious 1991; Abdelwahab and Sargious 1992; Abdelwahab 1998; Abdelwahab and Sayed 1999; Holguín-Veras 2002) consider freight and vehicle choices as part of a discrete-continuous choice problem in which the shipment size is the continuous variable and mode (or vehicle in the case considered in Holguín-Veras 2002) is the discrete variable. However, a subset of publications treat shipment size as another discrete variable with shipment size classes (Chiang et al. 1980; De Jong 2007).

A smaller group of papers assumes that the shipment size is exogenously determined. This enables to consider shipment size as a demand characteristic that could be entered directly in the utility functions of the different modes (Wilson et al. 1986; Jiang et al. 1999; Norojono and Young 2003; Arunotayanun and Polak 2007a,b). This is equivalent to assuming a one-way interaction from the shipper to the carrier, as the shipment size impacts the mode choice while the converse is not true.

A final group of papers (McGinnis et al. 1981; Nam 1997; Golias and Yannis 1998; Catalani 2001; Kim 2002; Train and Wilson 2006) do not consider shipment size at all. This implies that shipper-carrier interactions play no role in mode choice, which is assumed to depend exclusively on the attributes of the modes (e.g., travel time, cost, reliability, inventory and stockout costs, product differentiation, capability and accessibility, and security).

All of this means that there are three different assumptions about the role of shipper-carrier interactions in mode choice. However, the important question of which these assumptions can be expected to emerge in a competitive market still remains. This paper seeks to answer this question with the use of economic experiments. As the reader shall see later in the paper, the main focus is on the interactions between shippers and carriers, assuming that the receiver only specifies the total demand during a time period, which then acts as a constraint for the shipper-carrier interaction. The focus on a competitive market is worthy of highlighting as the paper does not consider cases in which one of the economic agents could unilaterally impose its will on the other.

The paper is comprised of five additional sections. Section 2 discusses the modalities of shipper-carrier interactions considered in the paper. In section 3, the experimental setup is described. Section 4 introduces the mathematical formulations underlying the experiments. The experimental results are presented and analyzed in Section 5. Finally, the key findings of the research are summarized in the conclusion section (Section 6).

2 Modalities of shipper-carrier interactions

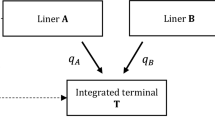

As mentioned in the introduction, shippers and carriers could engage each other in different ways. They could participate in either two-way, or one-way interactions, or have no interactions at all. The most complex one assumes two-way interactions in which the shipper decisions influence the carrier, and the performance of the carrier influences the shipper. The second perspective assumes that the shipper influences the carrier decisions, though not the other way around. The third one simply assumes no interaction at all, in fact implying that the mode choice is solely the carrier’s decision. These three modalities are referred to, in this paper, as: cooperative, sequential, and independent, as shown in Fig. 1. Obviously, these interactions could take place over time as part of a dynamic decision making process, which is what one would expect to take place in real life.

Theoretically, there is a strong case arguing that shipper-carrier interactions jointly determine freight mode choice. As stated by Samuelson (1977): “…the relevant transportation choice which a shipper makes is not simply a choice between modes, but a joint choice of mode and shipment size. In most cases, the shipment size is practically mode determining….” (Samuelson 1977). The reason why can be appreciated by constructing the corresponding payoff matrix (see Table 1) that shows the anticipated payoffs to each player for cooperating or not cooperating with the other agent. The resulting four quadrants are labeled by the superscripted numbers I, II, III and IV. The payoffs are indicated as a duplet with two signs, where a positive sign indicates a net benefit and a negative sign a net loss. The first sign in the duplet represents the payoff to the shipper, while the second sign in the duplet represents the payoff to the carrier. As shown in Table 1, the quadrants involving some degree of non-cooperation between shippers and carriers (i.e., II, III and IV) have negative payoffs for both agents. This is because under typical market conditions: (1) the non-cooperative carrier of quadrants II and IV would sooner or later be replaced because its customers will not be satisfied with its non-cooperative behavior; and, (2) the non-cooperative shipper of quadrants III and IV by not choosing a shipment size convenient to its carrier is likely to experience higher costs or lower quality of service. If both agents choose to cooperate with the other, as shown in quadrant I, both of them are likely to be better off as an adequate shipment size is likely to bring about lower transportation costs and better level of service, while it would enable the carrier to take advantage of its technological strengths. As a result, since cooperation is the only logical alternative, this is a cooperative game.

A sequential decision making process only considers the impact that the shipment size decision has on mode choice. This is equivalent to a Stackelberg game in which the shipper plays the lead role. As a result, this assumption does not take into account how changes in carrier performance could influence shipper choices. Examples could be: situations in which the shipper is sending indivisible loads, in which the shipment size is constrained by the nature of the product being transported; and, high priority shipments that must be sent as soon as possible at any cost. In all these cases, one could argue that the shipper is inelastic to any feedback signals emanating from the carrier as the shipper’s ability to change shipment size is very limited or nonexistent.

Finally, not considering the impact of shipment size on mode choice is equivalent to assuming independent decision making processes. An example may be a situation in which the carrier enjoys monopoly power that enables it to simply disregard shipper’s input. Another may be in the transport of bulk materials—where the shippers produce and store a highly divisible commodity, that is then picked up and transported to the corresponding destinations by carriers. Another example could be a situation in which inventory costs are negligible. In such a situation, the carrier’s decision about shipment size and mode would have no impact on the shipper, other than the transportation cost.

The preceding discussion highlights that the different modalities of interactions are associated with which agent makes the shipment size decision. At one end of the spectrum, in the case of cooperative behavior has a shipper deciding on shipment size and reacting to the feedback signals from the carrier. At the other end, corresponding to the independent decision making, one finds a carrier deciding on the shipment size, in complete independence from the shipper. Elucidating what modality of interaction is the one that may be expected in a competitive environment is a key objective of this paper. The experimental setup used to achieve this is described in the next section.

3 Description of experimental setup

Experimental economic techniques have been used to tackle a wide variety of problems, for the most part focusing on: (a) testing theories of individual choice behavior; (b) testing game theoretic formulations; (c) analyzing alternative industrial/market organizations to support policy analyses; and/or, (d) studying the effects of variables about which very little is known (Davis and Holt 1993). The ability of experimental economics to provide sound conclusions and insight hinges on the experiment’s ability to provide an environment in which the fundamental decision process under study could emerge in a laboratory setting. In general terms, this depends upon: (a) an appropriate definition of the level of specification of the experiment; (b) a proper use of Induced Value Theory; and, (c) the definition of a controlled environment with pre-specified rules governing the interaction among the economic agents (Friedman and Sunder 1994). These features make experimental economics particularly well suited to test game theoretic formulations. In transportation research, there are very few applications of experimental economics (De Jong 2005). These applications have focused on the study the formation of truck tours under spatial price equilibrium (Holguín-Veras et al. 2004), the allocation of rail track capacity to competing operators (Isacsson and Nilsson 2003), and procurement for road markings in Sweden (Lunander and Nilsson 2004).

Of fundamental importance to experimental economics is Induced Value Theory. A fundamental tenet of this theory is that appropriate use of a reward medium allows an experimenter to induce pre-specified characteristics on experimental subjects, while the subjects’ innate characteristics become irrelevant. As a result of this, volunteers playing the role of economic agents will tend to behave as these agents, as long as the reward structure resembles the agents’. This has been corroborated by a number of research projects (Davis and Holt 1993; Friedman and Sunder 1994). Furthermore, even in cases where the volunteers are not domain-experts on the subject of the experiment, induced value theory predicts that after a period of familiarization they would behave as the actual agents. This suggests caution when interpreting the results of the initial iterations of economic experiments.

In the context of this paper, experimental economic techniques are used to determine the modality of shipper-carrier interaction that is likely to emerge in a competitive market. In the experiments, volunteers played the role of profit maximizing agents (either shippers or carriers) and were given rewards based on the profits they obtained at the end of the experiment, in accordance with Induced Value Theory (Davis and Holt 1993). It was assumed that the demand and market price for the commodity were constant, that shipper profits depend on transportation and inventory costs, and that carrier profits depend on the profit margin it is able to get for its services (and obviously gross revenues and total costs).

Basically, the same experiments were carried out in the United States (US), the United Kingdom (UK) and The Netherlands. The volunteers (players) in the US and The Netherlands were students (3rd and 4th year) without much experience in logistics. The players in the UK were staff members of the Institute for Transport Studies of the University of Leeds that can be considered to have domain expertise. As will be shown below, the outcomes for all three countries were quite similar (though for the UK the number of observations is low). So cultural differences and the amount of experience do not seem to play a key role in determining the outcomes of these experiments. In all three countries the players were highly motivated to make the highest possible profit and win the game.

Two different assumptions were made regarding which agent plays the leading role. In some of the experiments, it was assumed that the shipper decides on the shipment size that maximizes its profits. In other experiments, the decision on the shipment size was left to the carriers. The former case is referred to in the paper as leading shipper, and the latter as leading carrier. Since independent shipper and carrier operations were assumed, all agents were trying to independently maximize their profits. In all cases, the carriers submit bids to compete for the transportation of the cargoes.

The results from the experimental setup described above were compared to the ones obtained from assuming perfect cooperation between shipper and carrier. “Perfect cooperation” refers to the situation in which the individual agents are only concerned with the performance of entire operation (as opposed to being concerned with their own individual performance). This unselfish behavior on the part of shippers and carriers is equivalent to having a super-decision maker deciding on the shipment size that maximizes the combined profits of shipper and carrier. Should the experimental and perfect cooperation setups lead to similar results, it would confirm the assumption of cooperative behavior. The optimal shipment sizes for the perfect cooperation scenarios were obtained using a numerical solver.

Similarly, the comparison of the results for the leading shipper and the leading carrier cases will provide evidence about the reasonableness of the assumptions of cooperative and independent behavior. In this context, should the experimental results indicate that the leading carrier cases have a different solution than the ones with leading shippers, one would conclude that there may be cases where the assumption of independence is appropriate. On the other hand, should the results converge to either solution, it would clearly indicate that the other assumption is not valid.

In addition to having a different agent in charge of the shipment size decision, a change was introduced in the market conditions surrounding the experiment. In the first setup, each carrier has three different modes at its disposal (van, truck, and combined rail/truck). This leads to a situation in which there is inter and intramodal competition in the market place. In contrast, the second setup considers carriers with access to only one mode, different for each carrier. This means that there is only intermodal competition, as the element of intramodal competition has been removed. These setups enable to study the modalities of interaction likely to emerge, and at the same time, to gain insight into the role of market competition into the allocation of profits among shipper and carriers.

The authors did consider a full factorial design comprised of the different combinations of leading agent (shipper, carrier) intramodal competition (with, without). However, the results clearly indicated that such design was not needed. Each experiment was conducted at least twice, with a different volunteer playing the role of the shipper. Having two independent instances of the same experiment enables to identify cases where the volunteer playing the role of the shipper—either because of inattentiveness or distraction—failed to reach the solution that maximizes shipper profits. These cases are highlighted in the analysis. The experimental setup is summarized in Fig. 2.

-

1.

Leading shipper/three-mode carriers

The shipper was given a target value of market demand to fulfill in terms of a number of units of demand per week, assuming seven days a week operations. This assumption removes receiver behavior from the experiment as the receiver’s requirements act as a constraint for the shipper-carrier experiments. Based on the target value of demand, the shipper had to decide on a given production level, and shipment size. However, since it is generally more advantageous to maintain a constant production level—equal to one seventh of the weekly demand—the key decision is the one about shipment size because of its impacts on transportation and inventory costs. Obviously, the shipper tries to minimize the sum of its inventory and transportation costs. After deciding on the shipment size, the shipper announced this to all carriers, which used this information to prepare and submit their bids to the shipper.

Each carrier has three modes at their disposal: van, truck, or combined road/rail. The same modes were assumed to have the same cost structure for each of the carriers. Upon receiving the shipper’s request specifying a given shipment size, the carriers had to decide what is the optimal mode for the job, compute their costs, decide on the profit margin, and submit bids for the job. The bid (a shipping rate quote), was confidentially submitted to the shipper on a form sheet. Figure 3 shows the experiment structure. For each experiment, one player played the role as shipper, and the other three players played the roles of competing carriers.

After receiving all the bids, the shipper—assumed to be a price taker—selected the lowest one, recorded it on the form sheet whether the bid had won or lost, and returned the sheets to the carriers. Based on the resulting total logistic costs (inventory plus transportation costs), the shipper had the opportunity to change the shipment size, or to keep the current values if it believed they are optimal. This means that for each experiment a number of iterations are needed to reach a equilibrium. At each iteration the shipper first had to assume the transport cost when setting the shipment size, and later received feedback from the carriers in the form of shipping rate quotes, which he could use to compute the actual transport cost and his profit. This iterative process was repeated until the shipper was convinced to have found the optimal shipment size that maximizes its profits.

Each of the carriers had access to a personal computer with spreadsheets to carry out calculations to prepare their bids. The shipper also had access to a personal computer with spreadsheets to assist in the determination of the shipment size/delivery frequency. The cost functions for the shipper and the carriers operations were coded into the spreadsheets.

-

2.

Leading carrier/single-mode carriers

In this setup, the shipper only specifies the total amount of cargo to be transported per week (as in the previous setup, demand and market prices were held constant), leaving the shipment size decision to the carriers. Each carrier then selects a combination of shipment size and profit margin to maximize profits. At this point, the shipper selected the carrier whose offer maximizes its own (shipper) profit. It should be noted that the chosen offer does not have to be the offer with the lowest shipping rate, as what really matters is the total logistic costs for the shipper, which is determined by both transportation and inventory costs. Each carrier in this second set-up could only use a single mode: one has only vans, another has only trucks, and a third only does combined road-rail transport (as shown in Fig. 4). This set-up represents the case in which the shippers do not play the dominant role in the shipment size decision. The process of submitting the bids followed the outline described in the previous section.

4 Mathematical formulations

Before delving into the analysis of the experiment results, it is important to define and explain the underlying mathematical formulations. Below is a list of the key variables.

- Q :

-

Quantity produced per day, assuming seven days per week

- N :

-

Number of deliveries (shipments) per week

- S S :

-

Shipment size

- C P :

-

Shipper’s production cost per week

- C S :

-

Shipper’s inventory cost per week

- C T :

-

Shipper’s transportation cost per week

- I t :

-

Shipper’s daily inventory level, t = 1,…, 7

- c s :

-

Shipper’s unit inventory cost per day, assumed to be $1

- c v :

-

Carrier’s operating cost per vehicle

- M:

-

Number of vehicles needed for a single shipment

- C C :

-

Carrier’s total operating cost

- c :

-

Carrier’s unit shipping cost

- S R :

-

Agreed shipping rate

- P A :

-

Agreed upon price of commodity Y, set as $60 per unit

- \( \alpha \) :

-

Carrier’s profit margin

- \( \pi_S \) :

-

Shipper’s profits

- \( \pi_C \) :

-

Carrier’s profits

It was assumed that shippers produce a generic commodity and accrue the production and inventory costs. Since the market price was assumed to be constant, the shipper maximizes profits by minimizing its total logistic costs. The carriers were assumed to incur in the costs associated with delivering the goods to their destinations, which include the empty running. The carrier profits are determined by their direct costs, and the profit margin the select. A minimum value of the profit margin of 5% was assumed as the opportunity cost of the capital.

Each mode has a set capacity and cost of operation. The costs were assumed to depend exclusively on the transportation technology (mode) being used, and be the same across carriers, i.e., same modes have the same costs across carriers. To replicate real life conditions, the cost functions were set such that the larger modes are more efficient than the smaller ones for long distances and/or for the transport of large amounts of commodities (Table 2).

The carrier’s vehicle operation cost per week is equal to the unit cost per trip (c V ) times the number of trips per week (which are determined by the vehicle capacity constraint):

Thus, carrier’s unit shipping cost is:

Assuming a profit margin α, the shipping rate becomes:

The carrier profits—which depend on the shipment size selected by the shipper—are equal to its gross revenues minus the transportation costs:

Shipper’s weekly production cost (C P ) depends on daily production (Q). The cost structure used in the experiments is shown in Table 3. As shown, it exhibits scale economies for Q ≤ 80, and diseconomies for Q > 80.

The shipper’s daily inventory cost could be estimated as the product of inventory level at the end of the day multiplied by the unit inventory cost. Daily inventory level could be obtained from:

The weekly inventory cost C S could then be estimated as:

Obviously, the shipper’s transportation cost is determined by the carrier’s operating cost and profit margin. The shipper’s weekly transportation cost could then be estimated as:

The shipper’s profits are equal to the gross revenues minus the summation of production, inventory, and transportation costs, as follows:

The following section discusses the numerical results produced by the experiments.

5 Descriptive analysis of results

This section provides an overview of the key results obtained from the economic experiments. Both set-ups (leading shipper and leading carrier) were piloted in the UK in January/February 2007. The main survey was carried out in the US. It was repeated, on a smaller scale, in The Netherlands in April 2008. The discussion focuses on convergence to equilibrium solutions, profits obtained by carriers and shippers, and a comparative analyses of the solutions obtained from the experiments conducted. The reader shall be aware that, since the market price at which the shipper sells its products was artificially set, there are a handful of cases in which the shipper incurs in losses. This tended to happen in the experiments with low demand levels as the gross revenues could not cover the production and transportation costs. This probably suggests that the market price should have been set a bit higher to prevent this from happening. In any case, having losses does not invalidate the results as the corresponding strategies are still optimal for the shipper.

-

1.

Results for Leading Shippers/Three-mode carriers

For this case, eighteen experiments were conducted in the US from January to February of 2007. The experimental variables were weekly demand level, and delivery distance. Table 4 shows the breakdown of experiments by weekly demand level and delivery distance. As shown, weekly demand levels vary from 140 to 1,400 units. Experiments focused on long distance deliveries with the majority having 1,000 units of distance. As mentioned before two experiments were carried out for each combination of demand and distance, with a different player playing the role of shipper. These experiments are labeled “A” and “B.”

The experiments indicated that the shippers are able to find the optimal solution of shipment size relatively quickly. Table 5 shows the number of iterations needed for the experiments to converge, i.e., number of iterations of each game until the shipper was convinced to have found the optimal delivery frequency/shipment size. Most experiments required around ten iterations.

Figures 5, 6, 7, 8 show the number of deliveries, agreed shipping rates and shipper’s profits for two typical experiments. In each experiment, as explained before the shipper changed shipment size to find the best shipping strategy and maximize profits. As shown in Fig. 5, the shipper reached the highest profits at the 6th iteration selecting two deliveries a week, but still tried different values to see if that leads to higher profits, and eventually moved back to the shipment size found at the 6th iteration. A similar pattern is shown in Fig. 7. In all cases and as expected, the shipper profits tend to decrease with shipping rates.

Table 6 shows a summary of the key performance measures resulting from the experiments in the three countries for cases when shippers led experiments. As shown in the table, most carriers chose the minimum profit margin (5%) in order to win the bid, which is what economic theory would predict in a competitive market, i.e., rates set at marginal costs. The experiments show that the winning carrier’s profits increase with demand level. However, shipper profits first increase with demand, reach the optimum at medium demand level (560 units), and then drop as demand increases, reflecting the scale diseconomies of production.

As shown in Table 6, as expected, for low demand levels, the modes with smaller capacity tend to be better because they provide a better match to the amount of cargo to transport. In general, when the demand level is equal to 140 units, trucking is the best alternative; when demand level increases to 280, van became the best mode. This is because although truck has twice the capacity of van, it leads to higher inventory costs. For medium demand levels (420 and 560), truck is the best. For high demand levels (700 and 1,400), the mode with largest capacity (combined road-rail) outperforms the other two. However, truck is the best mode for demand level of 1,400 with seven deliveries a week, because the daily production is equal to the truck capacity, which allows for a very efficient utilization of the trucks without incurring in inventory costs. These results are interesting because they indicate that increasing demand levels lead to optimal modes of increasing capacity does not always hold. As shown in Table 6, the optimal mode when the demand is 140 units is the truck, while when the demand increases to 280 units, the optimal mode is the smaller van.

-

2.

Results for leading carrier/single-mode carriers

The experiments discussed in this section consider the case in which the carriers determine shipment size/delivery frequency. Eighteen experiments were conducted in the US from September to October of 2007, the breakdown of experiments by demand level and distance following those for the leading shipper (see Table 4). Table 7 shows the number of iterations needed for the experiments to converge. As shown, the majority of experiments required around ten iterations though some needed more iterations to converge. This is because when either the demand level is low (or high) one mode has a competitive advantage over the two, so experiments converged relatively quickly. However, for the mid range of demand, there is usually more competition among the different modes, and as a result the experiments need more iterations to converge.

Table 8 shows a summary of the key performance measures from the experiments. Unlike the experiments that shippers led, here each carrier was in charge of only one mode. As expected, carriers charged higher profit margins since in most situations, one mode typically had a comparative advantage over the others (as opposed to the previous case in which all carriers had access to all modes), the carrier could increase profit margin up to the point its bid was jut lower than the competition. The results show a pattern similar to cases when shipper led: winning carriers’ profits increase with demand level, while shipper’s profits first increase with demand, reach the optimum at demand level of 560 units, and then decrease with demand, indicating the scale diseconomies. Also, as before, modes with smaller capacity competed really well for lower demand levels, while modes with larger capacity tended to be better for higher demand levels (with the exception of the already discussed case of the demand level of 280 units).

-

3.

Comparison of results: shipper led vs. carrier led experiments

It is important at this point to compare the results from the two experimental setups discussed in the previous section to gain insight into the nature of the underlying decision making process. Table 9 shows a summary of the key results from the different experiments conducted. Probably, the most striking feature of Table 9 is that the optimal shipment size from the shipper’s point of view was reached in almost all instances, regardless of who made the decision. This undoubtedly reflects the working of a competitive market in which the carriers are obliged to be responsive to the needs of their customers. As shown, there are no differences between the leading shipper and leading carrier cases as they converge to the same solutions. Similarly, the number of iterations to converge was found to be statistically the same in both set-ups.

The second finding, not entirely unexpected, is that the degree of market competition determines the split of the value added by the production process between the shipper and the carriers. As shown, in the three-mode carrier case the carrier’s profit margins tended to their opportunity cost of the capital (assumed to be 5%), while in the one mode case, they were much higher due to the lack of intramodal competition.

-

4.

Comparison of results: experimental vs. perfect cooperation

The results discussed in the previous section indicate that, in terms of shipment size, there is no difference about which agent makes the decision as shipment sizes tend to the same values. Furthermore, the modes selected are also usually the same for the leading shipper and leading carrier set-ups. However, it is important to determine if the convergence is to the cooperative or to the independent case. This question could be answered by comparing the outcome of the experiments described in the previous section—in which both sides are trying non-cooperatively to maximize their own profits—to the ones obtained assuming perfect cooperation, i.e., when the individual agents are concerned with the performance of entire operation. In this context, if the experimental results coincide with the ones for perfect cooperation, it would imply that the assumption of cooperative behavior—which is what game theory predicts (Holguín-Veras 2002)—is correct. The optimal shipment sizes for the scenarios of perfect cooperation were obtained using a numerical solver.

As shown in Table 10, when the shipper led the experiments, sixteen out of nineteen experiments yielded the same mode and shipment size as the optimal solution, and approximately the same combined profits, with minor differences due to rounding errors. Only three cases did not yield the same solution in terms of shipment size, leading to profits that were very different from the perfect cooperation case. This outcome may be just the result of a distraction of the volunteer playing the role of the shipper. This point of view is supported by the fact that, in all cases where a player failed to reach the optimal, the second player always did (meaning that there was no structural obstacle that prevented reaching the optimal). When carriers led the experiments, fourteen out of eighteen experiments yielded the same mode and shipment size as the optimal solution, and roughly the same values for the combined profits. This happens because, although the carriers select the shipment size, the shipper will select the carrier whose shipment size is most convenient for its own operations. Over many iterations, carriers learn to fine tune their operational decisions to suit the needs of its customers, which is what they need to do to survive in the market place.

These results imply that the assumption of cooperation between shipper and carriers is correct. As shown in Tables 10 and 11, the vast majority of experiments led to the same values of shipment size and profits (no experiments were conducted in The Netherlands for these cases). The fact that this results holds—even for cases in which the carrier played the lead role in the shipment size choice—clearly indicates the robustness of the result. All of this leads the authors to believe that assuming independence between shipper and carriers is fundamentally incorrect. The same could be said about a sequential decision making process as the experiments clearly demonstrated that the shippers do take into account the feedback signals (prices, quality of service, inventory costs, etc.) emanating from the carrier’s decision about shipment size.

6 Conclusions

The paper discusses the theoretical and empirical evidence on the subject and concludes that freight mode choice can be best understood as the outcome of interactions between shippers and carriers, and that mode choice depends to a large extent on the shipment size that results from these interactions. These conclusions are supported by economic experiments designed to test the hypothesis of cooperative behavior. This was accomplished by: (1) conducting two sets of experiments (some with the shipper playing the lead role in selecting the shipment size; and others in which the shipment size decision was left to the carriers); and, (2) comparing their results to the ones obtained numerically under the assumption of perfect cooperation, i.e., the condition in which the participating companies are only concerned with the performance of the entire operation.

The results clearly indicated that, in competitive markets, shipper and carriers are likely to cooperate in the selection of the shipment size and mode. This is a direct implication of the fact that the results of the economic experiments converged to the ones for perfect cooperation, which is what game theory predicts. The results also show that it really does not matter who “makes” the decision about the shipment size and mode to be used at a given time period, as over time the shipper—that is the customer—ends up selecting the bids more consistent with its own interest. These findings imply that assuming a sequential or an independent decision process is not correct. In other words, these results do not support the assumption that freight mode choice is solely made by the carriers. This has important implications for freight mode choice as the assumption of independence has been frequently used.

Taken together, the paper has shed light into the nature of the likely interaction between shippers and carriers. In spite of this, a lot of work remains to be done as the cases considered here are among the simplest ones. Other aspects that clearly deserve further research involve the use of computer simulations of shipper-carrier considering stochasticity and uncertainty in shipment orders, and the role of volume-price contracts, among many other possibilities. One might also consider experiments that involve the behavior of the receivers. At this stage, it is clear to the authors that the work done here is only scratching the surface of a very complex problem.

References

Abdelwahab WM (1998) Elasticities of Mode Choice Probabilities and Market Elasticities of Demand: Evidence from a Simultaneous Mode Choice/Shipment Size Freight Transport Models. Transp Res Part E Logist Trans Rev 34(4):257–266. doi:10.1016/S1366-5545(98)00014-3

Abdelwahab WM, Sargious MA (1991) A Simultaneous Decision-Making Approach to Model the Demand for Freight Transportation. Can J Civ Eng 18(3):515–520

Abdelwahab WM, Sargious MA (1992) Modelling the Demand for Freight Transport. Can J Civ Eng 26(1):49–70

Abdelwahab WM, Sayed T (1999) Freight Mode Choice Models Using Artificial Neural Networks. Civ Eng Environ Syst 16:267–286. doi:10.1080/02630259908970267

Arunotayanun K, Polak J (2007a) Taste heterogeneity in freight shippers' mode choice behaviour. Annual Meeting of the Transportation Research Board, Washington, DC, Transportation Research Board

Arunotayanun K, Polak J (2007b) Unobserved heterogeneity in freight shippers' mode choice behaviour. World Conference on Transport Research, Berkeley, CA

Catalani M (2001) A Model of Shipper Behaviour Choice in a Domestic Freight Transport System. 9th World Conference on Transport Research, Seoul

Chiang Y, Roberts PO, Akiva MB (1980) Development of a Policy Sensitive Model for Forecasting Freight Demand. Massachusetts, Center for Transportation Studies, Cambridge

Davis D, Holt C (1993) Experimental economics. Princeton University Press, Princeton New Jersey

De Jong G (2005) Experimental economics, transport and logistics. European Transport Conference, Strasbourg, France

De Jong G (2007) A model of mode and shipment size choice on the Swedish commodity flow survey. Universities' Transport Study Group, Leeds

Friedman D, Sunder S (1994) Experimental methods. Cambridge University Press, Cambridge, Massachusetts, A Primer for Economists

Golias J, Yannis G (1998) Determinants of combined transport's market share. Transport Logistics 1(4):251–264. doi:10.1163/156857098300155250

Hall R (1985) Dependence between Shipment Size and Mode in Freight Transportation. Transp Sci 19(4):436–444. doi:10.1287/trsc.19.4.436

Holguín-Veras J (2002) Revealed Preference Analysis of the Commercial Vehicle Choice Process. J Transp Eng 128(4):336–346. doi:10.1061/(ASCE)0733-947X(2002)128:4(336)

Holguín-Veras J (2008) Necessary Conditions for Off-Hour Deliveries and the Effectiveness of Urban Freight Road Pricing and Alternative Financial Policies. Transp Res Part A policy Pract 42A(2):392–413. doi:10.1016/j.tra.2007.10.008

Holguín-Veras J, Silas M, Polimeni J, Cruz B (2007) An Investigation on the Effectiveness of Joint Receiver-Carrier Policies to Increase Truck Traffic in the Off-Peak Hours. Part I: The Behavior of Receivers. NETS 7(3):277–295. doi:10.1007/s11067-006-9002-7

Holguín-Veras J, Silas M, Polimeni J, Cruz B (2008) An Investigation on the Effectiveness of Joint Receiver-Carrier Policies to Increase Truck Traffic in the Off-Peak Hours. Part II: The Behavior of Carriers. NETS 8:327–354. doi:10.1007/s11067-006-9011-6

Holguín-Veras J, Thorson E, Ozbay K (2004) Preliminary Results of an Experimental Economics Application to Urban Goods Modeling Research. Transp Res Rec 1873:9–16. doi:10.3141/1873-02

Isacsson G, Nilsson J-E (2003) An experimental comparison of allocation mechanisms in the railway industry. J Transp Econ Policy 37(3):353–382

Jiang F, Johnson P, Calzada C (1999) Freight Demand Characteristics and Mode Choice: An Analysis of the Results of Modeling with Disaggregate Revealed Preference Data. J Transp Stat 2(2):149–158

Kim K-S (2002) Inherent Random Heterogeneity Logit Model for Stated Preference Freight Mode Choice. J Korean Stud 20(3):1–10

Lunander A, Nilsson J-E (2004) Experimental Tests of Alternative Mechanisms to Procure Multiple Contracts. J Korean Stud 25(1):39–58. doi:10.1023/B:REGE.0000008654.68169.08

McFadden D, Winston C, Boersch-Supan A (1986) Joint Estimation of Freight Transportation Decisions under Non-Random Sampling. Analytical Studies in Transport Economics. A. Daugherty, Cambridge University Press: 137–157

McGinnis MA, Corsi TM, Roberts MJ (1981) A Multiple Criteria Analysis of Modal Choice. J Bus Logist 2(2):48–68

Nam KC (1997) A study on the estimation and aggregation of disaggregate models of mode choice for freight transport. Transp Res Part E Logist Trans Rev 33(3):223–231. doi:10.1016/S1366-5545(97)00011-2

Norojono O, Young W (2003) A stated preference freight mode choice model. Transp Plan Technol 26:2

Samuelson RD (1977) Modeling the freight rate structure. Center for Transportation Studies, Massachusetts Institute of Technology, Cambridge MA

Train K, Wilson W (2006) Spatial Demand Decisions in the Pacific Northwest: Mode Choices and Market Areas. Transportation Research Record, in press

Wilson FR, Bisson BG, Kobia KB (1986) Factors that determine mode choice in the transportation of general freight. Transp Res Rec 1061:26–31

Acknowledgements

The research reported in this paper was supported by the National Science Foundation’s grants CMS-0324380. This support is both acknowledged and appreciated. The authors want to recognize the input provided by anonymous reviewers that helped improve the paper.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Holguín-Veras, J., Xu, N., de Jong, G. et al. An Experimental Economics Investigation of Shipper-carrier Interactions in the Choice of Mode and Shipment Size in Freight Transport. Netw Spat Econ 11, 509–532 (2011). https://doi.org/10.1007/s11067-009-9107-x

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11067-009-9107-x