Abstract

In order to restrict global warming to no more than 2 ∘C, more efforts are needed. Thus, how to attract as more as possible countries to international environment agreements (IEAs) and realize the maximum reduction targets are meaningful. The motivation of this paper is exploring a set of method of designing IEA proposals. The paper built a chance-constrained two-stage cartel formation game model, which can explore whether a country signs an agreement in the first stage and discusses how the countries joining the coalition can make the best emission commitments in the second stage. Based on the model, the real emission data of 45 countries was collected for numerical experiments, which almost completely depict the current global emissions of different countries. A numerical experiment has also been carried out in the paper. Then some interesting results emerge as follows: risk averse, high cost, high emission reduction duty, and external stability impede large coalition formation; transfer scheme and high perceived benefits stimulate countries to join IEAs and make a good commitment; the most influential countries for coalition structure and commitment are those low-cost and low-emission entities. The results also demonstrate that the design of IEA proposals should not only pay attention to those economically developed and high-emission “big” countries, but also attach importance to those low-emission “small” countries.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

In order to mitigate climate change, various forms of international environmental agreements (IEAs) have been proposed, with the purpose of gathering global efforts to tackle emission reduction (Hoel 1992; Chander and Tulkens 1997; Tingley and Tomz 2014; Alston 2015). Kyoto Protocol is one of the classic IEAs, which has attracted 189 countries to sign until 2009. According to the agreement, 37 developed countries have submitted the intended nationally determined contributions (INDC), committing to reduce greenhouse gas emissions by a certain percentage at 1990 levels. However, with the Kyoto Protocol, there is some controversy. Developed countries have assumed their obligation to reduce their carbon emissions since 2005, while developing countries have been obligated to reduce emissions since 2012. This caused the dissatisfaction of developed countries. Simultaneously, some developed countries also worry emission reduction action will affect the domestic economic. These controversies related to abatement responsibilities led to the withdraw of countries like the United States of America (USA) and United Nations Framework Convention on Climate Change Kyoto Protocol. The Paris Climate Agreement reached in 2015 after many rounds of negotiations is another landmark IEA. This agreement fully reflects the aspirations of all parties under the framework of the United Nations and is a very balanced agreement, attracting 175 countries to sign in 2016. These signatures also face the same problem of how to make a commitment to reduce emissions, with the fact that some countries have actively submitted INDC, some countries hesitate, and even some countries have chosen to withdraw like the USA.

The above two agreements also demonstrate that IEAs are able to guide as many countries as possible to participate in reducing emissions, but how much responsibility these signatories should take on and how to make the best reduction commitment become the key issue for IEAs going on (Victor 2006). Therefore, to keep IEAs going, this paper focuses on the design of IEA proposal, a reference program that aims not only to attract as many countries as possible but also to assist signatories in setting emission reduction commitments. The proposed proposal has a very important influence on the governments’ final decisions, including whether to accept the IEA and promise to meet the assigned emission target within the stipulated time frame or not to accept it and commit to a self-enforcing reduction target. Eyckmans and Finus (2006) had ever studied the problem of IEA proposals’ design and analyzed how different designs affect the success of environment agreements. A good proposal for IEA usually proposed by the sponsor of climate negotiation is conducive to resolve the controversy by suggesting feasible emission targets to the governments involved in the talks on the basis of their own situation and the economic development. As self-enforcing agreements and a multilateral negotiation problem, IEAs can not require all states to have a signature, but they can get as many states as possible to participate through effective and reasonable proposals (Hoel and Schneider 1997).

In order to design a good proposal for IEAs to realize the maximize reduction of the global emissions, a chance-constrained cartel formation game model is developed in this paper. The cartel formation game modeled as a two-stage open membership single coalition game problem was first introduced to solve price-leadership model, and it is demonstrated that it is always possible to find a stable cartel within a finite number of firms (d’Aspremont et al. 1983). On the basis of the cartel formation model, the standard two-stage game theoretic model on self-enforcing IEA problem was first proposed by Barrett (1994), which has been applied widely in the literature (e.g., Rubio and Ulph 2006; Kolstada 2007). Using the cartel formation game, authors put the focus on the emergence of international cooperation in climate change and underlying incentives. There are two points included in the cartel formation model: the definition of player’s profit function and the measurement of a stable coalition structure. Petrakis and Xepapadeas (1996) presented a net benefit function for each country that includes a strictly concave benefit function of its own emissions and a deduction item of damage functions caused by global emissions. He employed a concept of marginal damage to construct the damage function and examined the conditions under which countries can hold as environmentally conscious (ENCCs) or as less environmentally conscious (LENCCs). Finus et al. (2006) showed that stable coalitions could emerge only if benefits from global abatement were sufficiently high or if an appropriate transfer scheme was introduced. By introducing the transferable utilities, Chou and Sylla (2008) proposed a two-stage exclusive cartel formation game. Finus and Rbbelke (2013) detected if ancillary benefits increase participation in international climate agreements through including them in the payoff function. The result showed that although ancillary benefits provide additional incentives to protect the climate, they will not raise the likelihood of an efficient global agreement on climate change to come about. Further, the role of uncertainty and learning for the success of international climate agreements attracted Finus and Pintassilgo (2013), who paid attention to the uncertain nature of benefit-cost parameters and explored their influences on the success of IEA by constructing a cartel formation game model, assuming three types of the uncertainty and eventually concluding why and under which conditions the veil of uncertainty can be conductive to the success of international environmental cooperation. For IEA problem, in addition to cartel formation game model, a policy network analysis using a questionnaire survey was conducted (Acuto 2013). With this method, the authors attempted to identify the main climate policy actors in IEA and examined how the states can form alliances and come into conflict over major issues (Yun et al. 2014).

The chance-constrained game model states three characteristics. First, it is derived from a two-stage cartel formation game model, which is formulated on the principal that the majority of IEAs are self-enforcing with no supranational jurisdiction which can force adhesion or compliance of individual countries to IEAs and has been widely used to solve such IEA problems (McEvoy 2013). Second, the aims of the model are to answer in what condition the government will sign the agreement as a member of climate alliance and what factors will influence the emission decision. Hence, two constraints to ensure the stability of the alliance are involved in the model. Moreover, considering the uncertainty of the unit benefit and cost to cut emissions (Kolstad CD and Ulph A 2011; Kunreuther et al. 2013), the two constrains are measured with probability functions, turning to chance constraints with acceptable risk levels. Third, in order to embody fairness that the more emission countries should assume more responsibility in IEA and avoiding the free-riding incentive (McGinty et al. 2012; Bollino and Micheli 2014), a duty factor which is derived from the country’s emissions in previous years is introduced into the model and the player’s revenue is closely related to the amount of the emissions as well as the duty factor. The other aim of this paper is to investigate if the optimal emission target calculated by this model is directly proportional to the duty factor.

Despite all this, it should be notified that the existing literature using cartel formation game model has only put emphasis on the paths to enlarge the coalition structure by exploring under what conditions countries will affirm to take part in IEA, but have not focused on the solutions to determine the optimal reduction commitments. However, since the reduction commitments have always been the key issues in the climate negotiation, the fact stimulates us to keep a watchful eye on this point. In addition, the uncertainty of parameters has a significant impact on the government’s decisions to abatement, as described by Kolstad and Ulph (2008) and Finus and Pintassilgo (2013), which attract us to lay emphasis on it. Considering the uncertainty of parameters and the aim of finding optimal decisions, the methodology of stochastic programming exerts an appropriate method to realize the goal. Inspired by the work mentioned above, this paper designs a new cartel formation game model discussed below.

2 Formation of risk averse two-stage stochastic climate coalition problem

In this section, a climate negotiation involving n countries is considered, whose main purpose is to get as many countries as possible to reach a consensus on IEA. In order to achieve this purpose, a new cartel formation game model is construed for the design of a good IEA proposal. The game model is a risk averse two-stage stochastic model, where the first stage solves the problem of whether the country signs the agreement and the second stage puts emphasis on how to determine emission reduction commitments after signing. The following notations are adopted to describe our problem.

- ᅟ:

-

Indices: i: index of countries, i ∈ Nj: index of countries, j ∈ Nℓ: index of countries, ℓ ∈ N

- ᅟ:

-

Parameters: N = {1,2,…,n}: the set of countries in the climate negotiation C: the set of signatory countries, C ⊂ N, where if i ∈ C, xi = 1Ω: the set of possible scenarios ω: a scenario of Ωei: carbon emission load of i in the baseline year λi: duty factor, a parameter to evaluate country i’s responsibility for global climate change bi: environmental benefit of i from unit global emission reduction ci: cost for i to reduce emissions by one percentage point πi(C): the payoff of country i when i ∈ Cφ: a predetermined minimum allowance risk level

- ᅟ:

-

Decision variables: xi: 1 if country i is signatory, and 0 otherwise x: a decision vector (xi) in {0,1}n with n being the number of countries in the negotiation qi: the reduction target (a percentage point) promised by country i

All the countries that signed the agreement are considered as a climate coalition. The stability of climate coalition is related to game revenues of those n countries after negotiations. The game revenues are also related to historical emissions, reduction responsibility, and reduction cost and benefits. Hence, a detailed description of the game’s revenues is displayed firstly.

2.1 The game’s revenues in the climate negotiation

Each country’s environment revenue collected from own emissions and aggregate emissions is given by

The first term represents the revenues for country i benefiting from global emission reduction. The first term can be written as \(b_{i}E \times 1\%\left (\sum \limits _{\ell = 1}^{n}\frac {e_{\ell }}{E}q_{\ell }\right )\), where \(E=\sum \limits _{\ell = 1}^{n}e_{i}\). Let \(\tilde {b_{i}}=b_{i}E \times 1\%\), and then it can be interpreted as the environment benefit of i when the global emissions decline 1%. Let \(\lambda _{i}=e_{i}/\sum \limits _{\ell = 1}^{n}e_{\ell }\) the ratio of country i’s emissions to the global emissions in the baseline year with a given name Duty factor, implying his duty to the global climate change. Given \(E=\sum \limits _{i = 1}^{n}e_{i}\), the first term equals to \(b_{i}E*\left (\sum \limits _{\ell = 1}^{n}e_{\ell }q_{\ell }/E\right )\), denoted by \(\tilde {b_{i}}\left (\sum \limits _{\ell = 1}^{n}\lambda _{\ell }q_{\ell }\right )\), where \(\sum \limits _{\ell = 1}^{n}\lambda _{\ell }q_{\ell }\) is the global reduction level compared to emissions in the baseline year and \(\tilde {b_{i}}\) is the marginal environment benefits of i only if the global emissions are reduced by 1%. The second term shows the cost for i to reduce emissions by qi percentage points. The assumption of a quadratic cost function is in accordance with the practical fact, which has been used in et al., and implies increasing marginal cost of abatement. The environment revenue of Eq. 1 is rewritten as

For better describing the payoff, we modify Eq. 2 with the benefit-cost ratio \(\gamma _{i}=\widetilde {b}_{i}/c_{i}\) as

that is \(\pi _{i}=c_{i}*\widetilde {\pi }_{i}\). Obviously, the optimal solution derived from \(\{\widetilde {\pi }_{i},i\in N\}\) equals to it from {πi,i ∈ N}. In the following, we use \(\widetilde {\pi }_{i}\) to substitute for πi.

2.2 The optimal reduction commitments for IEAs

Modeling from the second stage is a traditional modeling approach in a two-stage problem. Therefore, given that some coalition C has formed and the benefit-cost ratio \(\{{\gamma _{i}^{N}}\}\) is known, then the reduction commitments {qi}N can be decided through the following process.

We assume that the equilibrium strategy vector {qi}N substantially constitutes a Nash equilibrium between coalition S and those singletons when the coalition acts as a single or meta player. In this way, the policy level of each country belonging to C is optimized by maximizing the aggregate payoff of all signatories

where qC = {qi|xi = 1,i ∈ N}. According to the first-order conditions (FOCs) in Eq. 4, we can obtain equilibrium policy level \(q^{*}_{i\in C}=\lambda _{i}\sum \limits _{\ell = 1}^{n}x_{\ell }\gamma _{\ell }\) and the optimal payoff for country in the coalition

While for the country not belong to C, its policy level is assumed to be determined by maximizing the payoff itself, that is

which is a classical Nash equilibrium in membership strategies. By FOCs, we obtain \(q_{j\not \in C}^{*}=\lambda _{j}\gamma _{j}\) and

2.3 The probability constraints for stable climate coalition

In the first stage, players in the negotiation need to decide to sign IEA or not without having any knowledge of benefit-cost parameters. The stable coalition is constrained by invoking the concept of internal and external stability (Finus and Pintassilgo 2013).

According to Eq. 8, no signatory should have an incentive to leave coalition C, while no non-signatory should have an incentive to join coalition C as described in Eq. 9.

Since the unknown information exists, the optimal payoff for each country cannot be measured exactly. In such a coalition formation problem, we assume that the unknown parameters follow probability distributions. Thus, the event that the coalition is internal or external stable can be measured from the view of probability theory. Further assuming players are risk averse, the concept of potential stability of coalition is invoked by the following Eqs. 10 and 11.

We refer to the constraints (10) as potential internal stability. That is, for each country i ∈ C, the probability that the payoff of country i as a signatory is no less than it as a non-signatory should not be lower than α, where α denotes the biggest tolerant risk level for internal stability breaking. By the same token, we introduce another tolerable level β to check potential external stability of the coalition in Eq. 11, namely the probability that each non-signatory’s payoff greater than it as a signatory to join the coalition is no less than β. In this paper, α and β are real numbers close to 1.

2.4 The two-stage stochastic coalition formation game model

From Section 2.2, we know that the optimal policy level \(q^{*}_{i}\) is actually dependent on the negotiation result x and random variables γi, mapping a scenario ω in Ω to a real number. In this way, we substitute qi(x,ω) for qi to reveal the uncertainty of optimal policy levels. Since there can be at most one non-trivial coalition (i.e., all players that do not belong to C are singletons with a non-trivial coalition being a coalition of at least two players), we would like to detect the optimal coalition that maximizes the total expectation abatement levels from all countries in the negotiation. Thus, the first-stage objective function reads

and as a consequence, the first-stage programming problem can be summarized as

Combing (4), (6), and (14), we can formally build a risk averse two-stage stochastic coalition formation game model as follows:

where qi(x,ω) is optimal value of the following Nash equilibrium problem:

3 Analysis of the model

3.1 The single-stage stochastic programming problem for IEAs

Following the instructions of how signatories choose their equilibrium abatement levels as stated in Eq. (4) and non-signatories as stated in Eq. 6 and inserting Eqs. 5 and 7, we obtain the difference between a country being a signatory and being not a signatory (see A):

In this way, the original two-stage coalition formation game problem (14) and (15) can be changed into a single-stage stochastic programming problem, that is

We consider the uncertainty nature of those benefit parameters and suppose that they are following random distributions. In the next section, we will describe the random variables and make future analysis of the optimization problem based on the random assumptions.

3.2 Transforming into approximate equivalent model by SAA

We use the vector of random variables Γ = (Γ1,…,Γn) to represent the benefit parameters. We consider a more general case that the random vector follows a joint uniform distribution, whose one-dimensional marginal distribution is uniform on some interval T. Let \(\xi _{i}=\widetilde {\pi }^{*}_{i}(C)-\widetilde {\pi }^{*}_{i}(C\setminus \{i\})\). Then ξi includes the accumulation term of all benefit parameters in the coalition, so it is difficult to describe its distribution if Γ1,…,Γn are not independently and identically distributed. Also noticing that the probability constraints need to measure the probabilities that multiple random variables like ξi are not lower than 0 simultaneously, it is typically impossible to receive the results by integration directly. To solve this problem, we apply the sample approximation approach (SAA) based on Monte Carlo simulation to go for the next transformation. The process can be described as follows.

Let \(\widehat {{\Gamma }}^{1},\ldots ,\widehat {{\Gamma }}^{K}\) be an independently and identically distributed (iid) random sample of K realizations of the random vector Γ. Then, for each scenario \(\widehat {{\Gamma }}^{k}=(\widehat {{\Gamma }}_{1}^{k},\ldots ,\widehat {{\Gamma }}_{n}^{k})\) and a given coalition structure C, we need to check whether the events ξi ≥ 0, for any i ∈ S, occur. In the similar way, we also need to check whether ζj ≥ 0, for any j∉S, occurs, where \(\zeta _{j}={\Pi }_{j\not \in S}^{*}(C)-{\Pi }_{j\not \in C}^{*}(C\cup \{j\})\). An auxiliary variable εk,k = 1,…,K is introduced and the probability that potential internal stability holds can be approximated by

where M is a large enough constant to confirm that εk takes values 0 when potential internal stability holds and 1 otherwise.

We can now compute the probability constraint of the potential external stability using SAA method. Introducing a binary variable 𝜖k which takes value 0 if the potential external stability holds and 1 otherwise. The the second probability constraint can be turned into the following form:

Now we use (19) and (20) to approximate probability constraints. We get an approximate equivalent form of model (21) as follows:

4 A transfer scheme for cartel formation game

In addition to the uncertainty of major parameters that affect the countries’ decision for IEA, the multilateral negotiation itself increases complexity of agreeing on the agreement as each country has its own considerations. Actually, the international cooperation between the IEA signatories is always allowed and gets great support, which helps to break the deadlock of multilateral negotiation and turn to multilateral cooperation. Thus, here, we consider one model of cooperation named a transfer scheme, that is, the revenues can be transferred between a few signatories so that the surplus from some signatories can be transmitted to cover the deficit of the other signatories. The concept is based on an almost ideal transfer scheme (AITS) proposed by Eyckmans and Finus (2009).

According to the above statement, one necessary condition for internal stability in this case is redescribed as that the sum of payoffs in the coalition exceeds the sum of free-rider payoffs when leaving the coalition

By the same token, a necessary condition for external stability is that the sum of non-members’ payoffs exceeds the sum of payoffs when joining the coalition

Considering the uncertainty of benefit parameters, we use probability functions to measure the stable conditions with AITS. Hence, we have

According to Eq. 3, the stable constraints with AITS of Eqs. 24 and 25 could be changed into

We make the same assumption that the vector of benefit parameters Γ = (Γ1,…,Γn) follows a joint uniform distribution. Using the SAA method based on Monte Carlo simulation, we derive Eq. 26 into

and Eq. 27 into

Therefore, the optimization problem with AITS can be converted into the following approximate programming model, whose convergence can be proved by the law of large numbers or according to the analysis of Shapiro (2008).

5 Numerical experiments

The purpose of numerical experiments is to study the impacts of model parameters on the coalition’s expected abatement, the scale of stable coalition, and the policy level of each country. This study complements our analytical results and gives us additional managerial insights and interpretations.

5.1 Classification assumption

In these numerical experiments, we classify multitudinous carbon countries in the world into different categories so that each category is defined as one economic entity to represent decision result of everyone in this category. The advantage of doing so is that it not only eases the difficulty of solution finding for problems (21) and (30) but also provides a new negotiation style that the crux of climate talks is to explore what proposals can promote cooperation between those heterogeneous countries rather than homogeneous entities based on the assumption that those countries with similar attributes are easy to come to an agreement after few number of conversation. The method to make classification is focused on two aspects, emissions and economic incomes.

First, we classify those countries according to their emissions. In fact, according to the data from world bank group, we select 45 countries who are emitting more carbon than others in the world for analysis and their total emissions can account for more than 89% of all whether in year 1990, 2000, or 2010. And due to some missing data in year 1990, we here describe merely carbon dioxide emissions of the 45 countries in year 2000 and year 2010, as displayed in Fig. 1.

From Fig. 1, we can clearly see that USA, CHN, RUS, IND, JPN, and ARB are part of the largest contributors to past emissions, especially USA and CHN who have discharged over 10,000,000 kilotons of carbon dioxide during the two years. Relatively, the other 30 countries have obvious gap with the main contributors in the value of emissions. In order to make a clear analysis of them, we draw another figure to show their emission levels in terms of percentage, see Fig. 2.

In Fig. 2, the less emission countries are reclassified. DEU, GBR, and CAN are the higher emitters with a portion above 2% in 2000 and 1% in 2010; ITA, KOR, IRN, MEX, FRA, BRA, AUS, UKR, POL, ESP, and IDN are the second higher emitters since their emissions have been fluctuating between 1 and 2% in the two years; the remaining countries can be expected as the very few emission countries with a value no more than 1% in any given year. Combining the analysis of the two figures, we can make a specific classification of the 45 countries and the results are shown in a world map (see Fig. 3) by using a cartographic application software, named Dituhui.

Because the scale of emissions in Fig. 3 is distinguished by percentage, i.e., duty factor defined in Section 2, this figure could be considered as the burden sharing distribution for the global climate change.

Second, however, this is not possible for those countries to make an abatement decision going by the burden sharing. On the contrary, the level of economic development restricts their capacity on the carbon reduction. Therefore, we make repeated analysis on them in terms of economic aspects. According to world bank group, all countries around the world have been divided into five categories in terms of the economic income level, that is, high-income OECD country, high-income non-OECD country, upper-middle-income country, low-middle-income country, and low-income country. We present this kind of classification using Dituhui once again, shown in Fig. 4.

In this figure, we also mark out the classification result in terms of emissions by using the numbers between 1 and 5 to signify the corresponding emission scale. One point should be noted that in the 45 countries, RUS is the only one non-OECD high-income country and PRK is the only one low-income country. Thus, we group RUS into high-income country and PRK into the low-middle-income country.

Finally, integrating the two kinds of categories, we deduce a new classification mode considering both emission and economic situation. The final result is displayed in Table 1.

In this table, the first point to note is that the symbol “\(\checkmark \)” denotes the adjective “low,” “\(\checkmark \checkmark \)” denotes “middle,” and “\(\checkmark \checkmark \checkmark \)” denotes “high.” Hence, we can see the first category country is high-emission and high-income while the last category is a low-emission and low-income one and so on, for the attributes of other countries. The emission index is computed with data in 2010.

By the accumulated value, each category plays an obvious role in air pollution, even for the low-emission countries since their total emissions account for 10.17% and a higher value 16.34%. In other words, in spite of the low emission level with merely 0.73% and 0.74% in average for categories 4 and 5, their effects can not be ignored. If all of them act together to reduce emissions or continue to emit as always, the effects on the climate would be huge and significant. On this score, it is worth involving the low-emission countries into the negotiation.

By the average value, we can clearly see that the typical developed and developing countries are high-emission and the developing countries emit more in recent times. Thus, the income level will imply different answers on IEA, including how much the reduction goal will be made and in what ways to finish this goal. Similarly, categories 4 and 5 may take an entirely different attitude on CO2 mitigation since one are rich economies and the other are poorer ones. Category 3 countries emit much less than the former two and a little bigger than the latter two, so they share moderate burden on reduction. But they have the ability to achieve a bigger reduction goal with adequate financial support. Therefore, the final decision of category 3 is supposed to be diverse.

The correlation between the former classification is 0.16712, being non-obvious. Nevertheless, the correlation between classifications 1 and 3 is 0.86442 and the one between 2 and 3 is 0.45096. The result shows the last classification has obvious correlation with the former two, especially the first one, which proves reasonable to make a classification like 3 since it has done more justice to combine the reduction burden and the economy factor.

5.2 The unit abatement cost assumption

McKinsey & Company has reported that some 70% of the possible abatements could be achieved at a cost below or equal to 40 euros a ton, by employing little technology (for example those in forestry or agriculture) or relying primarily on mature technologies, such as nuclear power, small-scale hydropower, and energy-efficient lighting (Per-Anders et al. 2007). By this research, we limit the cost of per unit abatement in an interval [0,40] for numerical computing.

Generally, advanced technology can reduce abatement cost by improving energy efficiency. However, the developed countries may not bare a lower cost in emission reduction since they are bound by emission limitation and their marginal abatement cost is inversely increased to implement additional reductions in pollution. For the developing countries, the capital investment and technical transfer from advanced countries have reduced cost to some extent to promise as large abatement target as possible. At last, despite the lack of ability, those poorest countries can adopt some cheap abatement measures like tree planting to protect the environment and in most cases they can receive external sources of funds or free technical support to mitigate financial strain. Hence, the cost for the low-income country to reduce one ton CO2 may be the cheapest.

Based on the above analysis, we set the expected reduction cost of the five entities as 40€, 30€, 35€, 35€, and 25€, respectively.

5.3 The unit abatement benefit assumption

At present, n = 5 has been determined as the number of abatement entities that will participate in negotiations on climate change. For the convenience of calculation, the emission level ei is computed as the average emissions of category i in 2010, that is rounded to e1 = 2,781,516,e2 = 3,965,612,e3 = 579,342,e4 = 217,231, and e5 = 222,120 kilotons, while the duty factor λi takes value of the average emission index, as λ1 = 0.0930,λ2 = 0.1326,λ3 = 0.00194,λ4 = 0.0073, and λ5 = 0.0074.

For discussing the application of SAA and insuring the computation accuracy, we define the n-dimensional random vector Γ = (Γ1,…,Γn) as an expression associated with two mutually independent random variables ζ and η. Take ζ to denote the random benefit of emitting one ton of global emissions, and η to denote the unit random cost, which is estimated around the average cost displayed in Table 1 regardless of the measures to reduce emissions. In this way, the benefit parameter Γi is represented with the formation of \({\Gamma }_{i}=\frac {E*1\%*{\omega ^{b}_{i}}\zeta }{e_{i}*1\%*{\omega ^{c}_{i}}\eta }=\frac {{\omega ^{b}_{i}}\zeta }{\lambda _{i}{\omega ^{c}_{i}}\eta }\), where \({\omega ^{b}_{i}}\) and \({\omega ^{c}_{i}}\) are prescribed, implying the differences on benefit and cost between the five countries. Therefore, the K samples of random vector can be derived from K scenarios of ζ and η.

For each player i, assume its unit environment benefit and unit cost for reduction follow uniform distribution. Considering the case that the vector of benefit parameters follows uniform distribution, we generate K = 1000 samples by assuming ζ ∼ U[0.4,0.6] and η ∼ U[20,40]. The scenarios of η is on average 60 times than those of ζ. That implies the current cost for reduction is greater than the benefits, and if not, entities would have the initiative to reduce emissions.

Let \(\omega ^{b}=\{{\omega _{1}^{b}},{\omega _{2}^{b}} , {\omega _{3}^{b}}, {\omega _{4}^{b}}, {\omega _{5}^{b}}\}\). \({\omega _{i}^{b}},i = 1,\ldots ,5\) can be identical or be diverse. When taking the same values, it implies every country is enjoying the same benefits by 1% decline in global emissions. When taking different values, it means different countries perceive dissimilarity about climate change mitigation. In reality, it seems very idealistic to assume the same benefit parameter, because the evaluation to climate change varies from country to country. As an example, the atoll nations care about rising seas due to global warming that threaten to force whole populations off their land, and then they will give higher marks for the overall emissions. A further example, in certain areas with heavy air pollution like China and India, governments seem more sensitive to domestic environment improvement such as hazy days are gradually reduced, rather than global climate change; therefore, this category of country possibly makes a medium score for it. In the next section, we will consider different values about ωb to compute optimal results and further analyze the impact of ωb to coalition structure as well as reduction target.

Moreover, let \(\omega ^{c}=\{\frac {4}{3}, 1, \frac {7}{6}, \frac {7}{6}, \frac {5}{6}\}\). \({\omega _{i}^{c}},i = 1,\ldots ,5\) is given to describe variability of cost in different attribute countries. The value corresponds to the expected cost prescribed in Section 5.2. For instance, \({\omega _{1}^{c}}=\frac {4}{3}\). Since the expected value of η is 30, the real expected cost of category 1 is \({\omega _{1}^{c}}*30 = 40\), which is homologous to the assumption. In the similar way, we can check the expected cost for categories 2,3,4, and 5.

This method to generate samples of Γ complies with independent identical distribution by no means. Actually, the benefit parameter is assumed as a general continuous random vector. Each component in it is a general continuous random variable and any two components are not necessarily independent. The samples generated by SAA obey the assumption.

5.4 Results and discussion

In this section, we perform some numerical experiments to demonstrate the effectiveness of the chance-constrained cartel formation game model. The numerical experiments are carried out by the classical optimization software Lingo 11.0 and on a personal computer (Lenovo with Intel Pentium(R) Core i5-5200U CPU 2.20 GHZ and RAM 8.00 GB) using the Microsoft Windows 10 operating system.

5.4.1 Optimal policy level with identical benefit parameter

When benefit parameters \({\omega _{i}^{b}},i\ldots ,5\) have a common value, set as 10 in this section, optimal policy level including coalition structure C and reduction level Q = {q1,…,q5} will be influenced by cost parameter \({\omega _{i}^{c}}\) and duty factor λi.

Table 2 presents optimal results by computing IEA without transfer scheme problem (21). K in the first column is the number of sample size, taking values from 3000 to 6000; α(β) in the second column represents minimum allowance risk aversion parameter, where α = β = {0.2,0.6,0.9}.

From Table 2, with the increase of K, when α(β) takes 0.2, coalition structure C gradually stabilizes as {1,1,1,1,1} and the corresponding objective value is gradually increasing to 4.60024 × 105 Kt; when α(β) takes 0.6, the optimal C is stabilized in {0,1,1,1,1} with maximum objective value 3.03680 × 105 Kt; when α(β) takes 0.9, category 2 drops out of C following category 1 and the final objective value is 7947 Kt.

The results imply following several conclusions: the effectiveness of model (21) and convergence of SAA have been verified, since optimal policy level becomes more and more stable with the increase of sample points; when α(β) becomes bigger, the number of countries in C becomes less; it proves that the factor of risk averse reduces entities willing to abatement; no matter what α(β) is (0.2, 0.6, 0.9), categories 3, 4, and 5 always stay in the coalition, which means low cost and low duty factor can encourage entities to take part in IEA; compared with duty factor λi, cost parameter \({\omega _{i}^{c}}\) plays more important role in making entity leave coalition with the fact that countries like the USA drop out prior to countries like China when α becomes bigger.

Table 3 presents optimal results of IEA with transfer scheme problem (30). This group of experiments is executed four rounds by taking K = 5000,6000,7000, and 8000. For each round, we consider four risk adverse scenes, that is low-internal and low-external (α = 0.2,β = 0.2), low-internal and high-external (α = 0.2,β = 0.9), high-internal and low-external (α = 0.9,β = 0.2), and high-internal and high-external (α = 0.9,β = 0.9). The results reveal that no matter the internal risk adverse parameter α is low or high, in most cases, coalition C seems being optimized by the change of external risk adverse parameter β, except for the case K = 8000. It implies external stability plays a more important part on the structure of coalition. In other words, once the external stability is realized, it is hard for C to attract new country to join. In this sense, breaking external stability is an effective mentality of designing for IEA proposers to improve their agreement proposes. In addition, from the former two group experiments with K = 5000 and K = 6000, we find more countries join C as well as obtaining greater objective value, comparing the results under the same conditions in Table 2, which verifies transfers can really expedite high-emission and high-cost countries to take part in IEA.

5.4.2 Optimal policy level with diverse benefit parameter

To verify the impact of ωb to the optimal policy level, we perform experiments by taking various benefit parameters and by computing model (30) which consumes lower computational cost than model (21), as shown above.

In Table 3, when K = 7000 and α = β = 0.9, stable coalition C is x = {1,0,1,1,0}, showing category 2 and category 5 out of C. In order to find effective paths to make all countries agree to IEA, we conduct experiments by changing benefit parameters of different abatement entities. The computation results obtained are summarized in Table 4.

The first column is entity order to be changed. The second column shows the increment in every \({\omega _{i}^{b}}\). The following three columns display the corresponding results.

Categories 2 and 5 are firstly selected, because we want to explore how many increment in their growth can impact themselves. According to columns 2 to 5, category 2 itself and category 5 take part in IEA only if \({\Delta } {\omega _{1}^{b}}\) increases to 5, whereas to achieve the same result, it is only one unit amount needed for \({\Delta } {\omega _{5}^{b}}\). This part of the results indicates high perceived benefits have positive effects on expanding climate coalition and for every one unit increment in benefit parameter, category 5 receives more emission reduction revenues than category 2, implying that the positive effect played by the low-cost and low-emission entity is larger than by the high-cost and high-emission one. We change \({\omega _{1}^{b}},{\omega _{3}^{b}},{\omega _{4}^{b}}\) to explore how transfer scheme impacts the final climate coalition. The rest results reveal that it is true that transfers are in favor of the emergence of all entities’ cooperation after \({\Delta } {\omega _{1}^{b}}= 1,{\Delta } {\omega _{3}^{b}}= 4,{\Delta } {\omega _{4}^{b}}= 2\), implying the order of positive effects is 4, 3, 1. Though categories 3 and 4 have same marginal cost, it seems category 4 plays a more powerful role as the result of his lower duty factor than category 3.

5.4.3 Discussion

From the results, it has been found that the optimal climate policy levels were influenced by more than one factor and the design of proposal should base on principals from several aspects as follows.

-

(1)

Major factors of influencing climate coalition structure stability.

According to the results obtained in Sections 5.4.1 and 5.4.2, we summarized those factors which have influenced optimal coalition structure. One, factors of risk averse reduce entities willing to abatement; two, low cost and low duty factor encourage entities to join IEA; three, cost plays more important role in making entity leaves coalition than duty factor; four, external stability impedes large coalition; five, transfer scheme expedites high-cost and high-emission to take part in IEA; six, high perceived benefits have positive effects on expanding C, and the order is 5, 4, 3, 1, 2. As a consequence, in order to attract more countries to join IEA, the agreement should include some of the mechanisms to mitigate uncertain risk by information sharing in climate conferences, to reduce emission costs like current CDM which reduces costs for developed countries, to break external stability by paths to reduce total revenues of external entities of climate coalition, and to emphasize the importance of transfer scheme to all the nations. Moreover, these low-emission countries also could not be neglected since their total emissions have accounted for high proportion as well as the truth that they are playing more important role than big countries like the USA and China in climate negotiation.

-

(2)

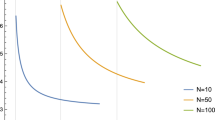

Influence power analysis of different category entities on reduction commitment. With the purpose of revealing the impact of different entities on emission target commitment, we take \({\omega _{i}^{b}}= 25\) for any i, to compute model (30) and solve the expect emission target qi. For the reason that category 2 is the last entity to join C if and only if \({\omega _{3}^{b}}= 23\) from Table 4, the optimal coalition C is always {1,1,1,1,1} in this part. The results are described in Fig. 5. It is evident that category 5 generates maximum values for any entity. The maximum values respectively are 9.19, 13.11, 1.92, 0.72, and 0.73, reflecting that the greater the emissions, the greater the responsibility. It also verifies the effectiveness of our proposed models to give rich conclusions corresponding to social reality and o be adopted by policy makers. The suboptimal results are successively followed by category 4, category 3, category 1, and category 2, which once again prove that the order of influence power is 5, 4, 3, 1, 2.

6 Conclusions

The paper explored the design of IEA proposals, based on a chance-constrained cartel formation game model. Considering the uncertainty characteristics of abatement benefits and costs, two chance constraints are introduced to measure the stability of climate coalition, a classical measurement in probability theory that was first applied in IEA problems. According to the experimental results, several interesting conclusions emerged.

Risk averse, high cost, high emission reduction duty, and external stability impede large coalition formation, where cost plays more important role in making entity leaves coalition than duty factor; the optimal emission reduction commitment calculated by this model is directly proportional to the duty factor; transfer scheme and high perceived benefits stimulate countries to join IEA and make a good commitment. As a consequence, in order to attract more countries to join IEA, the agreement should include some of the mechanisms to mitigate uncertain risk by information sharing in climate conferences, to reduce emission costs like current CDM which reduces costs for developed countries, to break external stability by paths to reduce total revenues of external entities of climate coalition, and to emphasize the importance of transfer scheme to all the nations.

The low-cost and low-emission countries play more positive roles in attracting countries to join climate coalition and make a higher commitment to reducing emissions. This seems to be not conforming to the reality, since high-emission and economically developed countries have been dominating the entire global emission reduction in the current climate meetings. Almost all countries are focusing on emission reduction strategies of these big countries. However, we think it reasonable instead, for the reason that big power countries still dominate the global emissions, but transform the dominant way.

Countries like PER, BLR, and COL are given low costs by the assumption that they enjoy fringe benefits of free technology transfer from big countries. Otherwise, the marginal cost of these countries will be high such that it is impossible for them to make a promise. And that is why these countries make greater efforts to abatement when perceived benefits increase. Meanwhile, the increased revenues for these countries are transferred to big power countries through transfer scheme, to compensate their costs of commitments and thereby contribute to common reductions.

Therefore, we emphasize that the designer of climate proposal should attach importance to transfer scheme and call on big countries like USA, JAP, and RUS as well as economically developed countries like CAN, GBR, DEU,NOR, and FIN to provide free techniques, which is definitely a feasible and effective way to reduce the overall cost of emission reduction.

Previous literatures put more attention on binary climate negotiation countries from a local point of view. The reduction target was certainly decided depending on benefits of these two countries, which was not necessarily effective for global climate change. As a supplement, our paper studied this problem from an overall perspective. We discussed multi-party negotiation with general target restrictions, so that most of countries were considered and their reduction targets coincided with duty factors. The final proposal in our paper desired to attract more countries to fight against pollution in a more fair way.

References

Acuto M (2013) The new climate leaders? Rev Int Stud 39(4):835–857

Alston M (2015) Social work, climate change and global cooperation. Int Soc Work 58(3):355–363

Barrett S (1994) The biodiversity supergame. Environ Resour Econ 4(1):111–122

Bollino C A, Micheli S (2014) Cooperation and free riding in EU environmental agreements. Int Adv Econ Res 20(2):247–248

Chander P, Tulkens H (1997) The core of an economy with multilateral environmental externalities. International Journal of Game Theory 26(3):379–401

Chou P B, Sylla C (2008) The formation of an international environmental agreement as a two-stage exclusive cartel formation game with transferable utilities. Int Environ Agreements 8(4):317–341

d’Aspremont C, Jacquemin A, Gabszewicz J J et al (1983) On the stability of collusive price leadership. Can J Econ 16(1):17–25

Eyckmans J, Finus M (2006) Coalition formation in a global warming game: how the design of protocols affects the success of environmental treaty-making. Nutural Resource Modeling 19(3):323–358

Eyckmans J, Finus M (2009) An almost ideal sharing scheme for coalition games with externalities. Stirling Discussion Paper Series 2009–10. University of Stirling

Finus M, Ierland E V, Dellink R (2006) Stability of climate coalitions in a cartel formation game. Econ Gov 7(3):271–291

Finus M, Pintassilgo P (2013) The role of uncertainty and learning for the success of international climate agreements. J Public Econ 103:29–43

Finus M, Rbbelke D T G (2013) Public good provision and ancillary benefits: the case of climate agreements. Environ Resour Econ 56(2):211–226

Hoel M (1992) International environment conventions: the case of uniform reductions of emissions. Environ Resour Econ 2(2):141–159

Hoel M, Schneider K (1997) Incentives to participate in an international environmental agreement. Environ Resour Econ 9(2):153–170

Kolstada KD (2007) Systematic uncertainty in self-enforcing international environmental agreements. J Environ Econ Manag 53(1):68–79

Kolstad C, Ulph A (2008) Learning and international environmental agreements. Clim Chang 89(1–2):125–141

Kolstad CD, Ulph A (2011) Uncertainty, learning and heterogeneity in international environmental agreements. Environ Resour Econ 50(3):389–403

Kunreuther H, Heal G, Allen M et al (2013) Risk management and climate change. Nat Clim Chang 3(5):447–450

McEvoy D M (2013) Enforcing compliance with international environmental agreements using a deposit-refund system. Int Environ Agreements 13(4):481–496

McGinty M, Milam G, Gelves A (2012) Coalition stability in public goods provision: testing an optimal allocation rule. Environ Resour Econ 52(3):327–345

Petrakis E, Xepapadeas A (1996) Environmental consciousness and moral hazard in international agreements to protect the environment. J Public Econ 60(1):95–110

Per-Anders E, Tomas N, Jerker R (2007) A cost curve for greenhouse gas reduction. McKinsey Quarterly 1(6):48–51

Rubio S J, Ulph A (2006) Self-enforcing international environmental agreements revisited. Oxf Econ Pap 58(2):233

Shapiro A (2008) Stochastic programming approach to optimization under uncertainty. Math Program 112(1):183–220

Tingley D, Tomz M (2014) Conditional cooperation and climate change. Comparative Political Studies 47(3):344–268

Victor D G (2006) Toward effective international cooperation on climate change: numbers, interests and institutions. Global Environmental Politics 6(3):90–103

Yun SJ, Ku DW, Han JY (2014) Climate policy networks in South Korea: alliances and conflicts. Climate Policy (Earthscan) 14(2):283–301

Funding

This research is supported by the National Natural Science Foundation of China (71373173), the National Social Science Foundation of China (2014B1-0130), and the Doctoral Fund of Ministry of Education of China (2014D0-0024).

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

-

1.

The difference of payoff between a country being a signatory or not.

Using equilibrium abatement payoffs in Eqs. 5 and 7 gives the following payoffs:

-

(1)

If country i is a member of coalition C, then the payoff when i leaves the coalition is

$$ \begin{array}{lll} \widetilde{\pi}^{*}_{i}(C\setminus\{i\})&=&\gamma_{i}\left[\left( \sum\limits_{\ell= 1}^{n}x_{\ell}\lambda_{\ell}^{2}-{\lambda_{i}^{2}}\right) *\left( \sum\limits_{\hbar= 1}^{n}x_{\hbar}\gamma_{\hbar}-\gamma_{i}\right)\right.\\ &&\left.+\sum\limits_{k = 1}^{n}(1-x_{k}){\lambda_{k}^{2}}\gamma_{k} +{\lambda_{i}^{2}}\gamma_{i}\right] -\frac{1}{2}(\lambda_{i}\gamma_{i})^{2}\\ &=&\gamma_{i}\left( \sum\limits_{\ell= 1}^{n}x_{\ell}\lambda_{\ell}^{2}\sum\limits_{\hbar= 1}^{n}x_{\hbar}\gamma_{\hbar} -{\lambda_{i}^{2}}\sum\limits_{\hbar= 1}^{n}x_{\hbar}\gamma_{\hbar}-\gamma_{i}\sum\limits_{\ell= 1}^{n}x_{\ell}\lambda_{\ell}^{2}\right.\\ &&\left.+{\lambda_{i}^{2}}\gamma_{i}+\sum\limits_{k = 1}^{n}(1-x_{k}){\lambda_{k}^{2}}\gamma_{k}+{\lambda_{i}^{2}}\gamma_{i}\right)-\frac{1}{2}(\lambda_{i}\gamma_{i})^{2}\\ &=&\gamma_{i}\left( \sum\limits_{\ell= 1}^{n}x_{\ell}\lambda_{\ell}^{2}\sum\limits_{\hbar= 1}^{n}x_{\hbar}\gamma_{\hbar}+\sum\limits_{k = 1}^{n}(1-x_{k}){\lambda_{k}^{2}}\gamma_{k}\right)\\ &&-{\lambda_{i}^{2}}\gamma_{i}\sum\limits_{\hbar= 1}^{n}x_{\hbar}\gamma_{\hbar}-{\gamma_{i}^{2}}\sum\limits_{\ell= 1}^{n}x_{\ell}\lambda_{\ell}^{2}+\frac{3}{2}(\lambda_{i}\gamma_{i})^{2}, \forall i\in C. \end{array} $$(31)Putting Eq. (5) into Eq. (31), we have

$$ \begin{array}{lll} \widetilde{\pi}^{*}_{i}(C\setminus\{i\})&\,=\,&\widetilde{\pi}^{*}_{i}(C) +\frac{1}{2}{\lambda_{i}^{2}}\left( \sum\limits_{\hbar= 1}^{n}x_{\hbar}\gamma_{\hbar}\right)^{2} \,-\,{\lambda_{i}^{2}}\gamma_{i}\sum\limits_{\hbar= 1}^{n}x_{\hbar}\gamma_{\hbar} \,-\,{\gamma_{i}^{2}}\sum\limits_{\ell= 1}^{n}x_{\ell}\lambda_{\ell}^{2}\,+\,\frac{3}{2}(\lambda_{i}\gamma_{i})^{2}\\ &\,=\,&\widetilde{\pi}^{*}_{i}(C)+\frac{1}{2}{\lambda_{i}^{2}}\left( \sum\limits_{\hbar= 1}^{n}x_{\hbar}\gamma_{\hbar}\,-\,\gamma_{i}\right)^{2}\,-\,{\gamma_{i}^{2}}\left( \sum\limits_{\ell= 1}^{n}x_{\ell}\lambda_{\ell}^{2}-{\lambda_{i}^{2}}\right), \end{array} $$(32)which equals to

$$ \widetilde{\pi}^{*}_{i}(C)-\widetilde{\pi}^{*}_{i}(C\setminus\{i\})={\gamma_{i}^{2}}\left( \sum\limits_{\ell= 1}^{n}x_{\ell}\lambda_{\ell}^{2}-{\lambda_{i}^{2}}\right) -\frac{1}{2}{\lambda_{i}^{2}}\left( \sum\limits_{\hbar= 1}^{n}x_{\hbar}\gamma_{\hbar}-\gamma_{i}\right)^{2}, \forall i\in C. $$(33) -

(2)

If country j is not a member of coalition C, then the payoff when j joins the coalition is

$$ \begin{array}{lll} \widetilde{\pi}^{*}_{j}(C\cup \{j\})&=&\gamma_{j}\left[\left( \sum\limits_{\ell= 1}^{n}x_{\ell}\lambda_{\ell}^{2}+{\lambda_{j}^{2}}\right) *\left( \sum\limits_{\hbar= 1}^{n}x_{\hbar}\gamma_{\hbar}+\gamma_{j}\right)\right.\\ &&\left.+\sum\limits_{k = 1}^{n}(1-x_{k}){\lambda_{k}^{2}}\gamma_{k} -{\lambda_{j}^{2}}\gamma_{j}\right] -\frac{1}{2}{\lambda_{j}^{2}}\left( \sum\limits_{\hbar= 1}^{n} x_{\hbar}\gamma_{\hbar}+\gamma_{j}\right)^{2}\\ &=&\gamma_{j}\left( \sum\limits_{\ell= 1}^{n}x_{\ell}\lambda_{\ell}^{2}\sum\limits_{\hbar= 1}^{n}x_{\hbar}\gamma_{\hbar} +{\lambda_{j}^{2}}\sum\limits_{\hbar= 1}^{n}x_{\hbar}\gamma_{\hbar}+\gamma_{j}\sum\limits_{\ell= 1}^{n}x_{\ell}\lambda_{\ell}^{2}\right.\\ &&\left.+{\lambda_{j}^{2}}\gamma_{j}+\sum\limits_{k = 1}^{n}(1-x_{k}){\lambda_{k}^{2}}\gamma_{k}-{\lambda_{j}^{2}}\gamma_{j}\right)-\frac{1}{2}{\lambda_{j}^{2}}\left( \sum\limits_{\hbar= 1}^{n} x_{\hbar}\gamma_{\hbar}+\gamma_{j}\right)^{2}\\ &=&\gamma_{j}\left( \sum\limits_{\ell= 1}^{n}x_{\ell}\lambda_{\ell}^{2}\sum\limits_{\hbar= 1}^{n}x_{\hbar}\gamma_{\hbar}+\sum\limits_{k = 1}^{n}(1-x_{k}){\lambda_{k}^{2}}\gamma_{k}\right)\\ &&+{\lambda_{j}^{2}}\gamma_{j}\sum\limits_{\hbar= 1}^{n}x_{\hbar}\gamma_{\hbar}+{\gamma_{j}^{2}}\sum\limits_{\ell= 1}^{n}x_{\ell}\lambda_{\ell}^{2}-\frac{1}{2}{\lambda_{j}^{2}}\left( \sum\limits_{\hbar= 1}^{n} x_{\hbar}\gamma_{\hbar}+\gamma_{j}\right)^{2}, \forall j\not\in C. \end{array} $$(34)Inserting Eq. (7) into Eq. (34), we obtain

$$ \begin{array}{lll} \widetilde{\pi}^{*}_{j}(C\cup\{j\})&=&\widetilde{\pi}^{*}_{j}(C) +\frac{1}{2}(\lambda_{j}\gamma_{j})^{2} +{\lambda_{j}^{2}}\gamma_{j}\sum\limits_{\hbar= 1}^{n}x_{\hbar}\gamma_{\hbar}+{\gamma_{j}^{2}}\sum\limits_{\ell= 1}^{n}x_{\ell}\lambda_{\ell}^{2}\\ &&-\frac{1}{2}{\lambda_{j}^{2}}\left( \sum\limits_{\hbar= 1}^{n} x_{\hbar}\gamma_{\hbar}+\gamma_{j}\right)^{2}\\ &=&\widetilde{\pi}^{*}_{j}(C)+{\gamma_{j}^{2}}(\sum\limits_{\ell= 1}^{n}x_{\ell}\lambda_{\ell}^{2})-\frac{1}{2}{\lambda_{j}^{2}}(\sum\limits_{\hbar= 1}^{n}x_{\hbar}\gamma_{\hbar})^{2}, \end{array} $$(35)which equals to

$$ \widetilde{\pi}^{*}_{j}(C)-\widetilde{\pi}^{*}_{j}(C\cup\{j\})= \frac{1}{2}{\lambda_{j}^{2}}\left( \sum\limits_{\hbar= 1}^{n}x_{\hbar}\gamma_{\hbar}\right)^{2}-{\gamma_{j}^{2}}\left( \sum\limits_{\ell= 1}^{n}x_{\ell}\lambda_{\ell}^{2}\right), \forall j\not\in C. $$(36)

Rights and permissions

About this article

Cite this article

Chen, W., Zang, W., Fan, W. et al. Optimize emission reduction commitments for international environmental agreements. Mitig Adapt Strateg Glob Change 23, 1367–1389 (2018). https://doi.org/10.1007/s11027-018-9788-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11027-018-9788-x