Abstract

This paper examines the effects of consumer preferences, firms’ costs, and advertising efficiencies on firms’ pricing and persuasive advertising strategies. We show that as the firms’ horizontal differentiation increases, the firm with a lower value-added product tends to increase persuasive advertising, whereas its competitor tends to reduce advertising. Second, the firm receiving a favorable shock in product valuation will complement the favorable change with additional persuasive advertising rather than reduce advertising spending. Third, an equal improvement in advertising efficiency in the industry will lower the profits for both firms, whereas a decrease in advertising efficiency in the industry can benefit both firms. Fourth, a larger shock that improves a firm’s product valuation or unit cost is more likely to induce higher advertising spending in the industry. Lastly, an exogenous increase in the separation between firms’ product valuations or perceived qualities may actually reduce the price dispersion in the industry.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Many demand-side and supply-side factors can lead to shocks in consumers’ preferences, firms’ production costs, or advertising efficiency. For example, surveys reveal that consumers are willing to pay at least 20 % more for service products with a five-star rating than those with a four-star rating (comScore and The Kelsey Group 2007). The consumer’s valuation for a firm’s product or service may increase if its online reviews are overwhelmingly positive or if the product is endorsed by third parties such as Consumer Reports. The availability of price shocks in complementary products can also influence the consumer’s valuations for the firm’s product. Even actions by non-profit organizations or governments can generate significant shocks to the consumer’s valuation; for example, if the governments or other organizations create campaigns to promote green causes and car efficiency, the consumers’ valuation for electric or hybrid vehicles may become higher because of the consumers’ increased positive image associated with living sustainably and environmental conscientiousness. Similarly, a firm’s production cost may change due to many exogenous factors such as shocks in labor costs, production input prices, and new government subsidies or tax regulations. This paper examines the effects of such shocks on firm’s strategies and profits. Note that oftentimes, even a seemingly common exogenous shock may affect different firms to a different degree; for example, a 10 % drop in metal prices may reduce the unit cost for an SUV much more than that for a compact car. We develop a parsimonious game-theoretic framework to study the effects of both symmetric and asymmetric shocks in the market. We will examine how changes in consumers’ preferences, firms’ production costs, and advertising efficiencies will affect firms’ pricing and persuasive advertising strategies.

Our research contributes to the stream of the literature on persuasive advertising and product differentiation. We focus on examining competitive strategies of persuasive advertising rather than informative advertising (e.g., Amaldoss and He 2010; Grossman and Shapiro 1984; Iyer et al. 2005). Bloch and Manceau (1999) study persuasive advertising in a Hotelling model of product differentiation and assume that advertising will shift the distribution of consumer tastes towards the advertised product. They show that there exist some mathematical distributions of consumers before and after advertising such that advertising may lead to a decrease in the price of the advertised product. Their model assumes that only one firm can advertise, and hence, the model does not allow them to analyze the firm’s choice of advertising levels or study any strategic effects of advertising by both firms. Another related paper by von der Fehr and Stevik (1998) shows that, when persuasive advertising increases the consumer’s willingness to pay, both firms will advertise in equilibrium and the amount of advertising does not depend on the degree of product differentiation.Footnote 1 Their models do not consider any asymmetry between the firms’ product valuations nor between their marginal costs or costs of advertising. In contrast, we explicitly allow for asymmetry between competing firms and we obtain qualitatively different results and insights.

We highlight our main findings. First, the strength of consumers’ taste preferences or the degree of product differentiation affects firms’ advertising decisions. Firms’ optimal advertising responses to an increase in the degree of product differentiation are qualitatively different: one firm will increase persuasive advertising expenditure, whereas the other will reduce it. As product differentiation becomes larger, the firm with a lower value-added product tends to increase advertising, whereas its competitor tends to reduce advertising. This result directly contrasts von der Fehr and Stevik (1998), which shows that, if advertising increases the consumer’s willingness to pay, the degree of product differentiation has no effect on the firms’ equilibrium advertising levels—a result of that paper’s restrictive focus on symmetric firms and outcomes.

Second, one may intuit that the firm with an exogenous shock that increases its product valuation will reduce its advertising, but we show in the competitive market that a firm will complement an exogenous increase in its product valuation with additional persuasive advertising, due to an increase in its marginal benefit for advertising. Third, if the exogenous shock increases the symmetric firms’ advertising efficiency to an equal extent, both firms will make lower profits. In essence, this seemingly favorable shock in the industry creates a worsening prisoners’ dilemma—both firms have incentives to increase their expenditure on persuasive advertising, but because of more intense price competition, neither can reap any benefit. The flip side of this story is that a negative shock in efficiency in the industry may benefit both firms. Fourth, the larger the shock that improves a firm’s product valuation or unit cost, the more likely the total advertising spending in the industry will increase. Lastly, because of strategic persuasive advertising decisions, an exogenous shock that increases the separation between the firms’ product valuations or perceived qualities may actually reduce the price dispersion in the industry.

Our main results and intuition are robust to alternative game structure, heterogeneity in consumer responses or exposure to advertising, nonlinearity of horizontal preferences, and alternative functional forms for advertising costs. Instead of the persuasive advertising, our model can also be interpreted in other settings such as strategic product/service quality improvements in high-tech product markets, where improvements in software or application services typically involve high fixed costs, but little marginal costs.

2 Model

Consider a duopoly with each firm offering one product. Each consumer will buy at most one product. The firms’ products are both horizontally and vertically differentiated. Firm i sells product i with marginal cost c i . Consumers are heterogeneous with respect to their horizontal preferences (x) and are uniformly distributed on the line segment between zero and one: x ∼ uniform[0, 1]. We assume that firm 1’s product is located at zero and firm 2’s product at one. The consumer’s disutility from non-exactly matched taste preference is td i , where d i is the distance between the consumer’s ideal location (x) and product i’s location, and t represents the strength of consumers’ taste preferences. So, the consumer’s valuation for product i is V i − td i , where V i is the consumer’s valuation for an ideally matched product. Without loss of generality, we normalize the total number of consumers to 1.

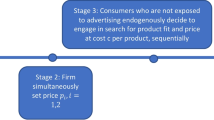

Each firm i maximizes its own profit by choosing the level of advertising (a i ) and price (p i ). In the first stage of the game, the firms simultaneously decide their advertising levels, and in the second stage, they simultaneously choose prices. Lastly, consumers make purchase decisions. We model the advertising and pricing decisions sequentially since, in reality, fixed-cost decisions such as advertising tend to be made earlier, whereas prices may be more easily changed. As in the study of Adams and Yellen (1977), we assume that firm i’s advertising can increase consumers’ willingness to pay for its product by some amount, which we denote as a i . This assumption is also consistent with the persuasive view of advertising—advertising alters consumers’ preferences and creates brand loyalty—and the complementary view of advertising—well-conducted advertising provides additional utility to consumers such as creating a feeling of greater social prestige (Bagwell 2007). Let g i (a i ) denotes firm i’s fixed cost required for its advertising level a i . To facilitate closed-form analytical solutions, we adopt quadratic cost functions for advertising (e.g., Tirole 1988; Bagwell 2007): g i (a i ) = k i a i 2, i ∈ {1, 2}. For the existence of a stable, competitive equilibrium, advertising cannot be too effective at increasing consumers’ valuations (i.e., k i is not too small).Footnote 2

In summary, given firms’ advertising and price decisions, a consumer of type x will derive a net utility of U i = V i + a i − td i − p i from product i, where d i = x for i = 1 and d i = 1 − x for i = 2. The consumers have zero utility from the outside option and will thus buy the product that yields a higher non-negative utility.

Note that, if the product valuations (V i + a i ) are too low, both firms will be localized monopolies and the market will not be covered in equilibrium. Further, if the difference in the two products’ valuations is too large, one firm will profitably squeeze the other out of the market and become a monopoly. We focus on the more interesting case of a competitive market and will implicitly assume that the product valuations are not too low and that the difference in the two products’ valuations is not too large. This assumption is equivalent to assuming that the strength (t) of consumers’ horizontal preference is not too small and not too large. We use standard backwards induction to solve for the pure-strategy subgame perfect Nash equilibrium.

Let x in be the consumer who is indifferent between the two products (i.e., U 1 = U 2)

We easily find that \( {x}_{in}=\frac{V_1+{a}_1-{V}_2-{a}_2+t-{p}_1+{p}_2}{2t} \).

Consumers with x ≤ x in prefer to buy product 1, and those with x > x in prefer product 2. Thus, firm i’s profit is expressed as

In the second stage, firms simultaneously choose prices given their advertising levels to maximize their respective profits. Solving the first-order conditions simultaneously \( \left(\frac{\partial {\Pi}_{\mathrm{i}}}{\partial {p}_i}=0\ \mathrm{f}\mathrm{o}\mathrm{r}\ i\in \left\{1,\ 2\right\}\right) \), we obtain the interior solutions for the firms’ optimal prices.

Substituting (2) and (1), we simplify the firms’ profits to

Next, we analyze the first stage of the game, in which firms simultaneously choose their advertising levels (a i ) to maximize their respective profits. Solving the first-order conditions from (3), we get

The equilibrium price can thus be simplified to

Firm i’s equilibrium profit is given by

Note that in the subgame perfect Nash equilibrium, both firms choose positive levels of advertising and make positive profits. This is consistent with the study of von der Fehr and Stevik (1998), which shows that when persuasive advertising increases the consumer’s willingness to pay, competitive firms will advertise at symmetric equilibrium. These authors do not consider any asymmetry between firms. In contrast, we explicitly model the asymmetry between the two competing firms and show qualitatively different results.

Proposition 1

As consumers’ taste preference becomes stronger (i.e., as t increases), one firm will increase advertising, whereas the other will reduce advertising. The firm with the lower value added, V i –c i , is more likely to increase advertising as t increases.

Proposition 1 directly contrasts von der Fehr and Stevik (1998), which shows that, if advertising increases the consumer’s willingness to pay, the degree of horizontal product differentiation has no effect on firms’ equilibrium advertising levels. We show that generally, t, the strength of consumers’ taste preferences (i.e., the degree of product differentiation), has opposite effects on firms’ advertising decisions. A larger t has two effects. First, it reduces consumers’ willingness to pay because their horizontal preferences are not exactly matched. Second, a larger t implies that firms’ products are more differentiated, and hence, price competition between the firms tends to be alleviated, a fact that is manifested in (2). Since a larger t tends to lower both the consumer’s product valuations and price competition, one might expect that both firms should have incentives to increase their persuasive advertising to raise consumers’ valuations. Proposition 1 shows a surprising result—firms’ optimal advertising responses to an increase in t are qualitatively different: one firm will increase advertising, whereas the other will reduce it. As t becomes larger, the firm with the lower value-added product tends to increase advertising, whereas its competitor tends to reduce advertising. For example, if both firms are equally effective at advertising (k i = k j ), the firm with a lower V i = c j will have a higher marginal incentive to increase advertising when t becomes larger. As a result, the firm with the higher value-added product will find it optimal to reduce advertising rather than to engage in an advertising war.

Now, we examine how exogenous changes in consumers’ valuations (V i ) or firms’ costs (c i ) will influence their advertising and pricing strategies. Many exogenous factors can lead to changes in consumers’ product valuations or firms’ costs. For example, the consumer’s valuation or willingness to pay for a firm’s product may be influenced by product reviews or changing trends in consumer preferences, price shocks in complements, or even actions by third parties such as non-profit organizations or governments. Similarly, a firm’s production cost may also change due to many exogenous factors such as changes in labor costs, input prices, and government subsidies or tax law/regulations. Let us take electric cars as an example. Tax credits to consumers who purchase such environmentally friendly cars will reduce costs of ownership and hence increase consumers’ willingness to pay for such vehicles. If environmental agencies run public campaigns promoting green causes and praising eco-friendly firms, consumers may increase their valuations for green brands/products such as electric cars (relative to conventional gasoline cars) because by using such products consumers may project a desirable self-image in public. Of course, if gasoline prices rise, then consumers will also have an increased valuation for an electric car because of its lowered relative cost of operation. Similarly, exogenous factors in the supply chain may increase (or decrease) one firm’s cost more than the cost its competitor. Even when unit labor costs or input prices change by the same amount for different firms, the effect of such changes on the unit production cost may differ across firms. This is because firms may use different amounts of input or labor for each unit of their product; for example, each electric car requires fewer metal parts (e.g., no engine needed) than a conventional car; hence, an increase in metal prices will raise the unit cost of conventional cars much more than that of electric cars.

It is ex ante unclear how firms should adjust their advertising and pricing strategies to respond to these exogenous changes that influence their costs or the consumer’s valuations. If external factors have raised the consumer’s valuation for a firm’s product or reduced the firm’s cost relative to its competitor, should the firm increase its advertising or price? Should the firm’s competitor increase advertising or reduce its price to compensate for its exogenously lowered competitiveness?

Note that how an exogenous change in consumers’ valuations or firms’ unit costs will affect firms’ advertising and profits depends only on the relative change between the two firms. For example, if exogenous factors increase both firms’ valuations (or unit costs) by the same amount, neither firm will change its advertising; mathematically, \( \frac{\partial {a}_i^{*}}{\partial {V}_i}=\frac{\partial {a}_i^{*}}{\partial \left({V}_i-{V}_j\right)} \). Thus, for brevity, we will list the comparative statics with respect to V i and c i only rather than also for the relative changes. Proposition 2 sheds light on how exogenous changes in consumers’ valuation and firms’ production costs may affect their advertising strategies.

Proposition 2

Firms’ advertising responses to an exogenous relative change in consumers’ valuations or firms’ unit production costs are opposite—one firm increases advertising, whereas the other decreases it. The firm with an exogenous increase in its product valuation or a decrease in its unit cost will increase advertising.

Note that an exogenous increase in consumers’ valuation for a firm’s product has a similar direct effect to the firm’s advertising, which also increases consumers’ willingness to pay. One may thus intuit that the firm with an exogenous shock that increases its product valuation will reduce its advertising, especially when advertising is very costly or inefficient (i.e., when k i is large). Our analysis shows that this naïve intuition turns out to be incorrect. If advertising is inefficient, the firm will in fact consider advertising as a complement to the exogenous increase in its product valuation, i.e., the firm will increase its advertising. The intuition comes from the competitive effect. Let firm 1 be the firm with the exogenous increase in product valuation. When advertising is costly, firm 2 (firm 1’s competitor) will find it inefficient to increase its advertising to compensate for the unfavorable exogenous change in product valuation; its best response is mainly to reduce its price to make its product offer more attractive. In fact, in equilibrium, firm 2 will marginally reduce its advertising level. This competitive advertising response makes firm 1’s marginal benefit of advertising higher than its marginal cost, inducing firm 1 to increase rather than decrease its advertising (and raise its price as well). That is, in a competitive market, a firm complements an exogenous increase in its product valuation with additional advertising, especially when advertising is costly and inefficient. The intuition is similar with respect to an exogenous change in unit production cost.

In practice, a firm’s advertising efficiency may improve because of, for example, favorable third-party reviews or endorsement/recommendations, which may make the firm’s advertising more convincing or persuasive. By examining the comparative statics with respect to k i , we find unsurprisingly that other things are being equal; if firm i’s advertising efficiency improves (i.e., k i decreases), firm i’s profit will increase, while firm j’s profit will decrease. What if the exogenous shock improves the advertising efficiencies of both firms, say, to the same degree? Note that from our earlier analysis, the firms will see no changes in their profits when there is an industry level shock that improves the firms’ production costs (c i ) or the consumer’s valuations (V i ) to the same degree. This phenomenon is referred to as Bertrand trap, where because of price competition, firms’ equilibrium profits remain constant despite seemingly positive exogenous changes such as reduced costs (Hermalin 1993). Note that, if firms do not adjust their prices to such exogenous changes, then all firms will make higher profits. The underlying cause for the Bertrand trap is that, if all firms’ marginal costs are reduced by the same amount, no firm will be able to profit from such a favorable change in the industry because each firm has an equal incentive to reduce prices, hence benefiting only the consumers. In our setting, will the improvement in advertising efficiency in the industry also wash out for symmetric firms because of competition? Or can both firms benefit from the favorable shock?

Proposition 3

Suppose that firms are ex ante symmetric (i.e., V 1 = V 2, c 1 = c 2, k 1 = k 2 ). When the exogenous shock improves firms’ advertising efficiencies equally, both firms become worse off.

Proposition 3 shows that symmetric firms (with V 1 = V 2, c 1 = c 2, k 1 = k 2) will become worse off if their advertising efficiencies increase equally (i.e., k 1 = k 2 and both decrease by the same amount). One can easily show that when the symmetric firms both improve their advertising efficiencies, both firms will increase their advertising expenditure equally, and neither can profitably raise their prices because of competition.Footnote 3 This seemingly favorable shock in the industry essentially creates a worsening prisoners’ dilemma for both firms. Each firm ends up investing more on persuasive advertising, and yet because of competition, neither is able to reap any benefit, leading to lower profits for both firms. The flip side of the story is that if an exogenous shock makes both firms’ advertising less efficient, both firms will actually become better off because they would both reduce advertising expenditure, leaving their relative competitiveness unchanged.

We now examine how shocks to firms’ product valuations or unit costs affect the total advertising expenditure and the price dispersion in the industry. The total advertising expenditure in the industry is given by T≡∑g i (a * i ) = ∑k i a * i 2. We know from (4) that firms’ advertising decisions are affected by an exogenous shock in the consumer’s product valuations or the firms’ unit costs only to the extent that the two firms’ valuations or costs are changed by a different amount. A relative increase in a firm’s product valuation has the same effect on advertising and profit as a relative decrease of the same amount in the firm’s unit cost. Without loss of generality, let firm i be the firm that has an exogenous increase in its product valuation or a decrease in its unit cost relative to its competitor (j). One may also think of V i − V j as the relative separation between the firms’ quality levels perceived by the consumer. If the exogenous shock increases the separation between consumers’ valuations (or perceived qualities), will it necessarily increase the price difference between the two firms? How will the exogenous shock affect the advertising spending in the industry? The following propositions shed light these questions.

Proposition 4

The larger the exogenous shock in the relative product valuation or unit cost between the two firms, the more likely the total advertising expenditure in the industry will increase.

Proposition 5

An exogenous shock that increases (decreases) the separation between the consumer’s valuations for the firms’ products can reduce (increase) the difference between firms’ equilibrium prices.

According to Proposition 4, the larger the shock in firm i’s product valuation or the larger the reduction in its production cost (relative to its competitor, firm j), the more likely the advertising expenditure in the industry will increase. The exogenous shock essentially reduces firm j’s competitiveness. Our analysis reveals that the favorable exogenous shock increases firm i’s marginal benefit for advertising and will induce it to raise its advertising level. Firm i’s advertising response and the exogenous shock actually reduce firm j’s marginal benefit for advertising, leading to a small decrease in firm j’s advertising. The larger the favorable shock to firm i, the more likely firm i’s increase in advertising expenditure will be more than firm j’s reduction in advertising, resulting in an increase in advertising spending in the industry.

One may intuit that, if the exogenous shock increases the difference between consumers’ valuations for the firms’ products, the price difference between the firms will increase as well and vice versa. Proposition 5 shows that this may not necessarily be the case. The exogenous shock may have opposite effects on firms’ valuation separation and their price dispersion. The main insight here comes from the competitive advertising responses to the exogenous shock. In essence, when the shock increases the separation between the firms’ product valuations, the difference between firms’ marginal incentives to do persuasive advertising may help counter that increased separation and can, under some circumstances, yield higher rather than lower competitive pressure on prices leading to smaller price dispersion in the industry.

3 Robustness checks and reinterpretation of the model

Our results are robust to several modeling alternatives. First, we have assumed that firms simultaneously decide their advertising levels and then their prices. If firms do not observe the other firm’s advertising decision before making pricing decisions, the game will be static (advertising and pricing decisions are made simultaneously in one stage). The analysis of such a static game shows that our results remain qualitatively the same. Second, we have also considered nonlinear (quadratic) horizontal preferences and alternative functions for advertising cost, g i (a i ) = k i a n i with n > 2 and found that our results are qualitatively the same. Lastly, we have examined a model in which consumers may perceive advertising differently or have different exposures to advertising. Our analysis shows that our results are also robust to such a model extension.

Instead of persuasive advertising, we can interpret a i as the firm’s product improvement that requires the firm to make a fixed cost. For example, in a technology market, V i can be seen as the baseline quality of firm i’s product, which has a marginal cost c i , whereas a i can be considered as the level of quality improvement of the product’s software or service component, which has a negligible marginal cost, but a significant fixed cost g i (a i ). Such software or service quality improvement decisions correspond to the persuasive advertising decisions (a i ) in our original model interpretation. Our previous analyses imply, for example, that when the consumer’s taste preferences get stronger, one firm will increase its spending on improving its software or service quality, whereas its competitor will reduce spending. Exogenous shocks to the firms’ product valuations or costs will also induce opposite incentives for the firms to improve their software or service quality. Furthermore, an equal increase in efficiency to improve software or service quality in the industry can make both firms worse off.

4 Conclusion

This paper examines the effects of demand-side and supply-side shocks on firm strategies and profits. Our analysis shows that an increase in the degree of product differentiation tends to induce the firm with a lower value-added product to increase advertising and its competitor to reduce advertising. A firm will also complement an exogenous increase in its product valuation (e.g., due to favorable consumer reviews) with additional persuasive advertising due to an increase in its marginal benefit for advertising. We find that an equal improvement in advertising efficiency in the industry will lower both firms’ profits giving rise to a worsening prisoners’ dilemma—with both firms investing more on persuasive advertising and yet neither will be able to reap any benefit. A large exogenous improvement in a firm’s product valuation or unit cost tends to raise the total advertising spending in the industry. Lastly, an exogenous increase in the separation between the firms’ valuations or perceived qualities may actually reduce the price dispersion in the industry.

Notes

The authors also study two alternative models of advertising; one assumes that advertising changes the ideal product variety, and the other assumes that advertising increases perceived product differences. To provide direct comparison in marketing implications, we focus on their case that assumes advertising raises the consumer’s willingness to pay since this is consistent with our model.

The parameter region of interest is k i > k (c) i for i ∈ {1, 2}, where \( {k}_i^{(c)}\equiv \frac{1}{3\left[3t-{V}_i+{V}_j+{c}_i-{c}_j\right]} \) for i ≠ j. In this paper, when the subscripts i and j appear in the same expression, it is always assumed that i ≠ j.

This relates to the Bertrand supertrap result by Cabral and Villas-Boas (2005), which shows that, in the presence of intra-firm product interactions, a positive shock in the industry (e.g., an increased degree of economies of scope or demand synergies) may lower equilibrium profits for all firms that compete on prices. Our result shows that a Bertrand supertrap is also possible for single-product firms that strategically compete on both prices and advertising.

References

Adams, W. J., & Yellen, J. (1977). What makes advertising profitable? The Economic Journal, 87, 427–449.

Amaldoss, W., & He, C. (2010). Product variety, informative advertising and price competition. Journal of Marketing Research, 47, 146–156.

Bagwell, K. (2007). The economic analysis of advertising. M. Armstrong, R. Porter (eds). Handbook of industrial organization, Vol. 3, Chapter 28. North-Holland, Amsterdam.

Bloch, F., & Manceau, D. (1999). Persuasive advertising in Hotelling’s model of product differentiation. International Journal of Industrial Organization, 17, 557–574.

Cabral, L., & Villas-Boas, M. (2005). Bertrand supertraps. Management Science, 51, 599–613.

comScore. (2007). The Kelsey Group. “Online consumer-generated reviews have significant impact on offline purchase behavior.” comScore Press Release.

Grossman, G., & Shapiro, C. (1984). Informative advertising with differentiated products. Review of Economic Studies, 51, 63–81.

Hermalin, B. (1993). Notes on microeconomics. Berkeley: University of California.

Iyer, G., Soberman, D., & Villas-Boas, J. M. (2005). The targeting of advertising. Marketing Science, 24, 461–476.

Tirole, J. (1988). The theory of industrial organization. Cambridge: MIT.

von der Fehr, N. H., & Stevik, K. (1998). Persuasive advertising and product differentiation. Southern Economic Journal, 65, 113–126.

Author information

Authors and Affiliations

Corresponding authors

Electronic supplementary material

Below is the link to the electronic supplementary material.

ESM 1

(DOCX 45 kb)

Rights and permissions

About this article

Cite this article

Jiang, B., Srinivasan, K. Pricing and persuasive advertising in a differentiated market. Mark Lett 27, 579–588 (2016). https://doi.org/10.1007/s11002-015-9370-1

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11002-015-9370-1