Abstract

Consumer behavior research has a long history indicating that preferences are influenced by the relative positions of members of a choice set. The realism of this work, however, is somewhat limited because alternatives are typically labeled with letters rather than with real brand names. We investigate the boundaries of prior research by testing whether preferences for alternatives in compromise and superior positions generalize to a more realistic market scenario that includes choices between real brands. In particular, we conduct two studies that examine if preferences for brands in a choice set are moderated by the inclusion of more or less familiar brand names. We find that consumers prefer extreme brands when compromise brands are relatively less familiar and compromise brands when they are relatively more familiar. In this scenario brand familiarity and not the position of the alternatives determine choice. In situations where a choice alternative is superior, we find no moderation due to brand familiarity.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

A great deal of marketing research documents that consumers’ judgments and choices are affected by choice context (e.g., Huber et al. 1982; Pan and Lehmann 1993; Simonson 1989; Simonson and Tversky 1992). More specifically, researchers have found that consumers’ preferences are influenced by the relative position of alternatives in a choice set and that they are more likely to prefer alternatives that are in superior or compromise positions (e.g., Huber et al. 1982; Simonson 1989; Simonson and Tversky 1992). A superior position occurs when an alternative dominates others on one or more product attributes. A compromise position occurs when alternatives are positioned between other non-dominated alternatives (Simonson 1989).

Studies in this area typically fall under the rubric of “context effects” because when consumers judge an alternative, they often consider not only that option’s features but the features of other options in the set (e.g., Chernev 2004; Drolet et al. 2000). Context effects have provocative implications for choice research, as they often violate several established choice axioms. Moreover, these effects have numerous strategic implications on marketers’ decisions about positioning, line extensions, and assessments of a brand’s vulnerability to the entry or repositioning of competitors (e.g., Drolet et al. 2000; Sen 1998; Ratneshwar et al. 1987).

While the robustness of these effects across studies has been noted (e.g., Kivetz et al. 2004), several studies report on factors that moderate context effects. The moderators investigated reflect scenarios that consumers actually face in the marketplace, such as time pressure (e.g., Dhar et al. 2000), product category knowledge (e.g., Ratneshwar et al. 1987), attribute importance (e.g., Malaviya and Sivakumar 1998), and mode of information presentation (e.g., Sen 1998).

Consistent with a call for realism, Houghton et al. (1999) argue that it is important to understand how “consumers typically operate (in real life)” (p. 108). Ironically, a closer examination of the choice alternatives they present to consumers include brands denoted by letters (i.e., Option A, Option B, etc.) rather than by brand names that consumers would confront in the marketplace. The failure to use real brand names is, in fact, typical of most of the research on context effects (e.g., Drolet et al. 2000; Houghton et al. 1999; Huber et al. 1982; Huber and Puto 1983; Sheng et al. 2005) and may place serious boundaries on the entire set of findings in this research stream. We are not the first to note this important omission (e.g., Broniarczyk and Alba 1994) and agree that if researchers are trying to disentangle brand effects from other contextual cues (e.g., product category effects) then fictitious or disguised brands are required. If, however, the call for realism is heeded and researchers wish to affect managerial decision making, then real brands must be considered in the design.Footnote 1

So, while context effects might be swamped by other moderators at certain times, the use of brand names is a constant in the marketplace and is the focus of our research. It is rarely, if ever, the case that options in a choice set would be introduced as Brand X or Y, rather than with real brand names. In situations where alternatives are unbranded, it is not surprising that consumer choice is driven by the comparison of attribute levels associated with each alternative in the choice set. However, brands play an important role and are often the major determinant of choice (e.g., Erdem and Swait 2004; Erdem et al. 2006; Heilman et al. 2000; Hoyer and Brown 1990). In today’s marketplace, consumers typically can choose from a variety of increasingly similar offerings. What often differentiates product offerings is the brand. Brands vary with respect to a myriad of dimensions such as familiarity, liking, and image associations. In fact, prior research demonstrates that consumers often use their familiarity and associations with a brand as a risk-reducing cue in determining value (e.g., Erdem and Swait 2004; Erdem et al. 2006; Keller 1993; Smith and Park 1992).

Thus, investigating the influence of brands on context effects is important because the “brand” is a variable that is always part of consumers’ decision environments. Furthermore, brands strongly influence consumers’ valuations and choices of product offerings. The objective of this research is to explicate the conditions under which compromise and superiority effects occur and to examine the boundaries of prior research by testing these effects in a scenario that includes choices between real brands. To understand the impact of real brands on context effects, we begin our investigation by varying the level of brand familiarity among the alternatives in the choice set. We chose brand familiarity as a starting point in this stream of research for several reasons. First, the equity or value that a brand represents to consumers depends both on their “familiarity” with the brand and on the “favorability, strength and uniqueness” of brand associations (Keller 1993). However, when consumers are unfamiliar with a brand they are unlikely to have many, if any, brand associations. In other words, consumers’ familiarity with or awareness of a brand precedes their development of brand associations. Second, there is compelling evidence that brand familiarity is an important cue influencing consumer choice (e.g., Heilman et al. 2000; Hoyer and Brown 1990). Therefore, as a first step in examining the brand as a moderator of context effects, we conduct two studies that examine if preferences for brands in a choice set are moderated by the inclusion of more or less familiar brand names. We conclude by addressing the implications of our findings as they relate to the boundaries and ecological validity of earlier studies.

Hypothesis development

Risk is an important construct in consumer research with a rich history illustrating that consumers’ perceptions of risk are central to their evaluations, choices, and behaviors. Importantly, perceived purchase risk produces wariness or risk aversion and often leads to a variety of risk-handling activities meant to reduce uncertainty about the choices presented (e.g., Campbell and Goodstein 2001; Dowling and Staelin 1994). Choosing compromise brands appears to be one such strategy as a compromise alternative tends to be a safer option, especially for risk averse consumers (Huber and Puto 1983). Researchers suggest that the principle underlying why consumers consider a compromise alternative to be safer is extremeness aversion (Simonson and Tversky 1992). Extremeness aversion suggests that all else being equal, an option with more extreme attribute values tends to be viewed as more risky than those with more moderate attribute values (e.g., Chernev 2004; Simonson and Tversky 1992).

In choice scenarios where alternatives consist only of product attributes without real brand names and no option is dominated by another, relative position may be an influential cue to reduce risk. We propose that when alternatives are presented with real brand names, the brand provides an additional cue to reduce risk (e.g., Erdem et al. 2006; Keller 1993; Miyazaki et al. 2005). One brand cue known to reduce purchase risk is its familiarity relative to other brands in the product category. For example, a dominant choice strategy for inexperienced buyers in a product category is to choose the most familiar brand (Hoyer and Brown 1990). Heilman et al. (2000) find that consumers new to a market tend to choose well-known, national brands rather than lesser-known national or store brands because consumers’ familiarity with a well-known brand name reduces perceived risk.

The question that arises then is whether consumers’ reliance on the position cue to reduce risk will be affected by the inclusion of a brand cue, in particular brand familiarity. Diagnosticity theory predicts that additional cues decrease the predictive validity of a single cue (e.g., Miyazaki et al. 2005; Purohit and Srivastava 2001). Brand names and their related associations are more likely to allow consumers to form more and varied inferences about a new product than does its relative position. In fact, prior research indicates that consumers’ familiarity and associations with a brand name is an extremely powerful cue in inferences about product performance (e.g., Erdem et al. 2006; Smith and Park 1992). Thus, we expect that the addition of the brand name cue reduce consumers’ reliance on relative position to reduce risk and that this cue is more diagnostic of product performance. This could lead to a violation of the compromise effect when the compromise brand is relatively less familiar than its extreme competitor (given that all brands have positive associations). We therefore hypothesize:

-

H1:

Compromise brands that are more familiar than extreme brands are more preferred, whereas, compromise brands that are less familiar than extreme brands are less preferred.

Study 1

Experimental design and sample

Study 1used a 2 × 2 × 3 between-subjects design and included a control condition to check our manipulations. The three factors are parent brand of the product entrant, relative brand familiarity, and entrant positioning. The parent brand factor was included as a replicate in the study for generalization purposes. Relative brand familiarity represents situations in which competitor brands are relatively less (more) familiar than the entrant brand in the choice set. With respect to the positioning factor, the choice set contained three non-dominated alternatives (two established competitors and one new entrant). The entrants were extensions of the two parent brands and were positioned either in the extreme position above the high quality competitor (HQC), in a compromise position close to the HQC, or in a compromise position equidistant from the two competitors (see Fig. 1). Respondents were 333 business students (288 in experimental conditions and 45 in the control condition) who completed a paper-and-pencil questionnaire administered during their class time.

Stimuli

Based on pretests, the two entrant brands chosen were Nikon and Minolta. On seven-point scales (1 = low, 7 = high), they both proved to be familiar (M Nikon = 5.72, M Minolta = 5.08, t 44 = 2.37, p < 0.05), well-liked (M Nikon = 5.76, M Minolta = 4.84; t 44 = 4.40 , p < 0.01), and differentiated in terms of quality (M Nikon = 6.24, M Minolta = 4.36; t 44 = 5.91, p < 0.001). The competitor brands and product categories chosen to represent the two levels of relative competitor familiarity were, the less familiar binocular brands, Bushnell and Tasco, (M Bushnell = 1.12 and M Tasco = 1.88) and the more familiar scanner brands, Hewlett-Packard (HP) and Epson (M HP = 6.04 and M Epson = 5.08; t 44 = 8.90, p < 0.001). Additionally, the familiar scanner brands were evaluated positively (M HP = 6.20, M Epson = 5.12; t 44 = 4.69, p < 0.0001). Note that no attitude measures for the unfamiliar brands were obtained as it is difficult for respondents to reliably assess them. Finally, Nikon and Minolta fit both extension categories equally well (Scanners: M Nikon = 4.32, M Minolta = 4.32; t 44 < 1, n.s.; Binoculars: (M Nikon = 4.20, M Minolta = 4.36; t 44 < 1, n.s.).

Procedure

Participants were instructed to imagine that they needed to buy a scanner or binoculars, and in a local store they found three brands from which to choose. For each alternative, participants were provided with the brand name and price (obtained from the market) and asked to choose a brand (see Appendix 1). In the control condition, participants rated on seven-point scales (1 = low, 7 = high) their familiarity, quality beliefs, and attitudes toward Nikon and Minolta, their familiarity with the competitor brands (HP, Epson, Bushnell and Tasco), and their attitudes toward the familiar competitor brands (HP and Epson). Finally, participants indicated how well Nikon and Minolta fit with the extended-to-product categories.

Results

Manipulation checks

All of our manipulations worked as expected. Participants were equally familiar with both parent brands (M Nikon = 4.26, M Minolta = 4.04, t < 1, n.s.) and were significantly more familiar with the competitor scanner brands, HP (M HP = 5.93) and Epson (M Epson = 5.84), than with the binoculars brands, Bushnell (M Bushnell = 1.35) and Tasco (M Tasco = 1.17, t 45 = 9.686, p < 0.001). The levels of familiarity within each instantiation of higher and lower familiarity did not differ within product categories (all t’s < 1, n.s.). Further, respondents had positive attitudes toward both parent brands (M Nikon = 4.71, M Minolta = 4.53, t < 1, n.s.) and the familiar competitor brands (M HP = 5.18, M Epson = 5.54, t < 1, n.s.). Nikon and Minolta also had essentially equal ratings (M Nikon = 5.13 and M Minolta = 4.88; t < 1, n.s.). Finally, both Nikon and Minolta had acceptable and similar levels of fit with the extension categories (Scanners: M Nikon/scanners = 4.86, M Minolta/scanners = 4.73, t < 1, n.s.; Binoculars: M Nikon/binoculars = 4.28, M Minolta//binoculars = 4.50, t < 1, n.s.).

Hypothesis test

To test H1, choice data of the brand extension entrant and the high quality competitor (HQC) were subjected to a binary log linear model.Footnote 2 Study 1 presented two distinct circumstances that result in compromise brands: When the entrant was positioned in the high end/extreme, the HQC becomes the compromise alternative and when the entrant was positioned in a compromise position (either similar to the HQC or equidistant between the two competitors). Therefore, for analysis purposes, we consider as compromise alternatives both the compromise brand extension entrant (competitor is in this case in the extreme position) or the compromise HQC (the entrant is in the extreme position). Analogously, we consider as extreme alternatives both the extreme HQC (entrant is in the compromise position) and the extreme entrant (the HQC becomes the compromise alternative).

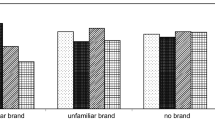

H1 predicts that compromise brands that are relatively more familiar than extreme brands are more preferred, whereas, compromise brands that are relatively less familiar than extreme brands are less preferred. Both compromise entrant brands (equidistant and similar) were analyzed together since there was no difference in responses to the two compromise positions (β = −.0780, W 1 = 0.384, p > 0.1). As expected, a positive effect on choice for compromise brands was encountered when they were relatively more familiar (Compromisemore fam = 86%; Extremeless fam = 14%). However, when the compromise alternative was less familiar it was less preferred (22%) than the extreme, more familiar alternative (78%, X 2 (2) = 98.11, p < 0.001, see Fig. 2). Choice shares for all three alternatives are presented in Appendix 2.

Discussion

In Study 1, we moderate the compromise effect by manipulating the relative familiarity of competitive brands in the choice set. We did so utilizing a simple scenario where only brands and prices were provided and there was no possibility of making tradeoffs between attributes. When the compromise brand is relatively more familiar than extreme brands it is preferred. When it is relatively less familiar than the extreme brand it is less preferred.

While in many situations consumers choose an alternative based on limited information such as price and brand, in other circumstances consumers consider multiple attributes in their choices (e.g., Miyazaki et al. 2005). The question that logically arises then is whether the boundaries for the compromise effect found in this study are generalizable to situations where more information is provided. Further as we noted earlier, context effects also pertain to superior (inferior) positions in a choice set and Study 1 examined choice sets where no alternative dominated or was dominated by another. Study 2 addresses these issues.

Replication and extension

Hypotheses

The first question Study 2 addresses is whether the results of Study 1 replicate when consumers are provided with more information about choice alternatives. Research shows that consumers’ reliance on cues to form preferences is diminished when product information is available and more diagnostic than extrinsic cues (e.g., Shimp and Bearden 1982). However, in the case where the information indicates that no alternative dominates or is dominated by another, consumers may still look for cues to reduce decision risk. Therefore, when no alternative is clearly better on attributes, brand familiarity will likely be a more powerful cue to reduce risk than will positioning. Thus, we expect that in this scenario the results found in H1 will generalize.

The second question Study 2 examines is whether similar effects of brand familiarity will be obtained when the product information indicates that an alternative in the choice set is superior or inferior. Consumers will consider an alternative as superior when attribute tradeoffs are favorable to that alternative, and, therefore, they will be more inclined to choose it (e.g., Simonson and Tversky 1992). The principle underlying consumer preferences for superior brands is known as “tradeoff contrast,” whereby products appear more attractive when compared to less attractive alternatives and less attractive when compared to more attractive options (Simonson and Tversky 1992). We propose that when an alternative is clearly superior the effect of relative brand familiarity will be diminished.

Our logic is that when product information is available, consumers’ reliance on cues to make inferences and form preferences is diminished (e.g., Shimp and Bearden 1982). That is, intrinsic attribute information may dominate extrinsic cues in forming preferences when it is more diagnostic than are the cues (e.g., Purohit and Srivastava 2001) and when consumers are motivated to process it (e.g., Miyazaki et al. 2005). For instance, Heilman et al. (2000) found that as consumers gather more information about a product category and become more knowledgeable, perceived risks for lesser-known or store brands diminish and their willingness to purchase one increases. Thus, when product attributes clearly indicate that one alternative is superior (or inferior) to others in a set and consumers use that information to form their judgments, the effect of brand familiarity on choice should be diminished.

We acknowledge that there may be situations where the familiarity cue may still influence the choice decision, such that an inferior alternative is chosen even when another alternative possesses superior attributes. For example, suppose a new or little known brand is positioned at a lower price and equivalent quality level as a well-established familiar brand, such as Sony. It would not be surprising for Sony to be chosen even though the new brand is superior with respect to the attribute tradeoffs. A familiar brand may evoke other important associations that the consumer values, such as after-sales service or prestige. In fact, consumers’ willingness to pay more for a brand with similar or equivalent levels of product attributes could be a reflection of differences in brand equities, which are based in part on familiarity, among the choice alternatives (Keller 1993). However, in general, based on the reasoning articulated earlier we expect:

-

H2:

The effects of brand familiarity will be diminished when an alternative in a choice set is clearly superior (inferior) to the other alternatives.

Study 2

Experimental design and sample

Study 2 used a 2 × 4 between-subjects factorial design with a control condition to check our manipulations. The two factors are relative brand familiarity (less/more familiar) and entrant position (extreme/similar compromise/superior/inferior). The extreme and similar (assimilated) compromise positions are the same, non-dominated, positions used in Study 1 and the relatively superior entrant position dominates the HQC and the relatively inferior entrant position is dominated by the HQC (see Fig. 3). As our earlier results reveal no parent brand differences, Study 2 used one parent brand with good fit with the extended-to product category. Participants were provided with brand, price, quality and additional attribute information to allow them to assess superior and inferior alternatives (see Appendix 2). Respondents were 232 business students (185 in experimental conditions and 47 in the control condition) who completed a paper-and-pencil questionnaire administered during their class time.

Stimuli and procedure

Based on Study 1 pretests, Nikon was chosen as the parent brand and scanners and binoculars were chosen as the extended-to-product categories, with HP and Epson as the competitive scanner brands and Bushnell and Tasco as the competitive binoculars brands. The same procedure as in Study 1 is followed except that for each choice alternative, participants were provided with expanded information from a “Consumer Reports” type rating about a brand extension (entrant) and two competing brands. The information included brand, price, quality and two other attributes taken from actual market conditions (see Appendix 3). After reviewing this information, participants were asked to choose one of the alternatives. In the control condition, the manipulation checks were identical to those in Study 1.

Results

Our manipulations proved successful as Nikon was rated as familiar (M Nikon = 4.50), good quality (M Nikon = 5.94), well-liked (M Nikon = 5.66), and as fitting well with both the extended-to-product categories, scanners and binoculars (M Nikon/scanners = 4.58, M Nikon/binoculars = 4.97, p > 0.1). Further, HP and Epson were well-liked (M HP = 6.31, M Epson = 5.86, t 46 = 3.05, p < 0.01) and were rated as significantly more familiar (M HP = 6.03, M Epson = 5.66) than Bushnell and Tasco (M Bushnell = 1.32, M Tasco = 1.84, t 46 = 8.77, p < 0.001).

H1 was again tested using choice data for the brand extension and the HQC competitor in a binary log linear model. Supporting H1, choice shares for the less familiar compromise brands were significantly lower than the more familiar extreme brands. (M compromise/lessfam = 34%, M extreme/more fam = 66%, p < .001, see Fig. 4). However, under this scenario choice shares were only marginally higher for the more familiar compromise brands than for the extreme, less familiar brands (M compromise/more fam = 56%, M extreme/less fam = 44%, X 2 (2) = 4.63, p < 0.10, see Fig. 4).

For H2, the two cases of relative superiority were analyzed together. The analysis revealed strong support for the strength of the superiority effect under both brand familiarity conditions, such that when the superior brand is more familiar, it is preferred to the inferior alternative (M superior/fam = 67%, M inferior/less fam = 33%) and when the superior alternative is less familiar, it is still preferred to the inferior option (M superior/less fam = 71%, M inferior/fam = 29%, X 2 (2) = 13.65, p = 0.001, see Fig. 5). These results support H2, in that brand familiarity effects were diminished.

General discussion

The purpose of this research was to examine whether compromise and superiority effects generalize to marketplace scenarios that include brand names. We conducted two experiments using real brands and multiple positioning strategies and our results indicate boundaries for the compromise effect due to the relative brand familiarity of the choice alternatives. Specifically, the compromise effect seems to generalize to situations where the compromise brand is relatively more familiar than the extreme brands but not to situations where the compromise brand is relatively less familiar than the extreme brands. These results suggest that the compromise effect may occur only when the brand options are unfamiliar or perhaps equally familiar. Specifically, when all the brands in a choice set are unfamiliar, such as with fictitious or unknown brands, or when the brand alternatives are equally familiar, such as with line extensions, the position of the alternatives strongly influences choice. Alternately when some brand options are more familiar than others, consumers’ choices are based on familiarity rather than the position of alternatives in the set.

We find no real support for the compromise effect when real brands are considered and their level of familiarity varies. This indicates that although both position and brand familiarity are cues that reduce risk, it appears that brand name familiarity is the more diagnostic of the two. This finding not only sets boundary conditions on the compromise effect, it also questions the ecological validity of earlier work (cf. Klink and Smith 2001). This is a real limitation for both researchers and practitioners because consumers’ consideration sets rarely consist of unbranded products.

The results of Study 2 indicate that when one alternative is superior to another, the diagnosticity and reliance on cues, such as brand name familiarity, is diminished. These findings are consistent with diagnosticity theory (e.g., Miyazaki et al. 2005; Purohit and Srivastava 2001) and suggest that superiority effects are more robust to brand familiarity cues. Importantly, there may be boundaries on the superiority effect due to the variability of factors such as the levels of familiarity and strength of the brands in the choice set, the degree of superiority of an alternative, the particular attribute an alternative is superior (inferior) on, and the diagnosticity of the attribute information. For example, while Nikon was relatively more familiar than the competitive brands, the absolute level of familiarity is only in the moderate range (M = 4.50, see manipulation check Study 2) and thus it is possible consumers have somewhat limited knowledge and associations with Nikon. In this case the product information seems to be more diagnostic. However, if a brand name evokes a rich set of relevant associations that consumers value, it should increase the relative attractiveness of that alternative. Therefore, it is quite possible that the superiority effect will be moderated by factors not tested in this research.Footnote 3

While our research tests the boundaries and validity of compromise and superiority effects on choice, there are limitations that need to be addressed. First, to explicate the effects of brands on choice and to generalize our findings, many more entrant and competitors’ brands, product categories, and attributes (not just price/quality tradeoffs) need to be analyzed. Second, it may be useful to directly compare context effects under both the no brand and brand scenarios in a single experiment. Researchers should also explore brand characteristics other than familiarity that may moderate or challenge the ecological validity of context effects on choice. While in the marketplace familiarity among brands often differs, there are situations where consumers choose among alternatives where all are highly familiar. When this occurs, brand familiarity is unlikely to determine choice though brands are likely to differ with respect to a number of other characteristics such as attitudes, country-of-origin, or image. Therefore, an important next step would be to investigate how such characteristics affect choice. More generally, the question is when are consumer choices driven more by brand characteristics than by a comparison of the relative attribute positions of each alternative (i.e., when do brands matter)? Ours is a first step in addressing this issue. Given the vast amount of firms’ resources dedicated to creating and building brand equity and the considerable body of research dedicated to understanding consumer choice, we believe that continuing this line of research will have important implications for both practitioners and academics.

Notes

Simonson and Tversky (1992) did include brand names in some of their tests, however, all alternatives had the same brand name (line extensions) and thus, the differential effects of brands cannot be assessed.

Since we position the extreme entrant above the HQC the standard quality competitor (SQC) is never a compromise alternative, therefore it is not considered. Further, as the similar compromise entrant is situated closer to the HQC than the SQC, it is more relevant to compare it to the HQC (Pan and Lehmann 1993). Finally, Glazer et al. (1991) explain that a lone alternative (the standard quality competitor in this case) is less likely to be chosen possibly because buyers infer desirability from the distribution of the available alternatives.

We thank an anonymous reviewer for pointing out this possibility.

References

Broniarczyk, S. M., & Alba, J. W. (1994). The importance of brand in brand extension. Journal of Marketing Research, 31, 214–228, (May).

Campbell, M. C., & Goodstein, R. C. (2001). The moderating effect of perceived risk on consumers’ evaluations of product incongruity: Preference for the norm. Journal of Consumer Research, 28, 439–449 (December).

Chernev, A. (2004). Extremeness aversion and attribute-balance effects in choice. Journal of Consumer Research, 31, 249–263 (September).

Dhar, R., Nowlis, S. M., & Sherman, S. J. (2000). Trying hard or hardly trying: An analysis of context effects in choice. Journal of Consumer Psychology, 9(4), 189–200.

Dowling, G. R., & Staelin, R. (1994). A model of perceived risk and intended risk-handling activity. Journal of Consumer Research, 21, 119–134 (June).

Drolet, A., Simonson, I., & Tversky, A. (2000). Indifference curves that travel with the choice set. Marketing Letters, 11(3), 199–209.

Erdem, T., & Swait, J. (2004). Brand credibility, brand consideration, and choice. Journal of Consumer Research, 31(1), 191–198.

Erdem, T., & Swait, J., & Valenzuela, A. (2006). Brands as signal: A cross-country validation study. Journal of Marketing, 70(1), 34–49.

Glazer, R., Kahn, B. E., & Moore, W. L. (1991). The influences of external constraints on brand choice: The lone-alternative effect. Journal of Consumer Research, 18, 119–125 (June).

Heilman, C. M., Bowman, D., & Wright, G. P. (2000). The evolution of brand preferences and choice behaviors of consumers new to a market. Journal of Marketing Research, 37, 139–155 (May).

Houghton, D. C., Kardes, F. R., Mathieu, A., & Simonson, I. (1999). Correction processes in consumer choice. Marketing Letters, 10(2), 107–112.

Hoyer, W. D., & Brown, S. P. (1990). Effects of brand awareness on choice for a common, repeat-purchase product. Journal of Consumer Research, 17, 141–148 (September).

Huber, J., Payne, J. W., & Puto, C. (1982). Adding asymmetrically dominated alternatives: Violations of regularity and the similarity hypothesis. Journal of Consumer Research, 9, 90–98 (June).

Huber, J., & Puto, C. (1983). Market boundaries and product choice: Illustrating attraction and substitution effects. Journal of Consumer Research, 10, 31–44 (June).

Kivetz, R., Netzer, O., & Srinivasan, V. (2004). Alternative models for capturing the compromise effect. Journal of Marketing Research, 41, 237–257 (August).

Keller, K. L. (1993). Conceptualizing, measuring, and managing customer-based brand equity. Journal of Marketing, 57, 1–22 (January).

Klink, R., & Smith, D. C. (2001). Threats to the external validity of brand extension research. Journal of Marketing Research, 38, 326–335 (August).

Malaviya, P., & Sivakumar, K. (1998). The moderating effect of product category knowledge and attribute importance on the attraction effect. Marketing Letters, 9(1), 93–106.

Miyazaki, A. D., Grewal, D., & Goodstein, R. C. (2005). The effect of multiple extrinsic cues on quality perceptions: A matter of consistency. Journal of Consumer Research, 32, 146–153 (June).

Pan, Y., & Lehmann, D. R. (1993). The influence of new brand entry on subjective brand judgments. Journal of Consumer Research, 20, 76–86 (June).

Purohit, D., & Srivastava, J. (2001). Effects of manufacturer reputation, retailer reputation, and product warranty on consumer judgments of product quality: A cue diagnosticity framework. Journal of Consumer Psychology, 10(3), 123–134.

Ratneshwar, S., Shocker, A. D., & Stewart, D. W. (1987). Toward understanding the attraction effect: The implications of product stimulus meaningfulness and familiarity. Journal of Consumer Research, 13, 520–533 (March).

Sen, S. (1998). Knowledge, information mode, and the attraction effect. Journal of Consumer Research, 16, 158–174 (September).

Sheng, S., Parker, A. M., & Nakamoto, K. (2005). Understanding the mechanism and determinants of compromise effects. Psychology and Marketing, 22(7), 591–609.

Shimp, T. A., & Bearden, W. O. (1982). Warranty and other extrinsic cue effects on consumers’ risk perceptions. Journal of Consumer Research, 9, 38–46 (June).

Simonson, I. (1989). Choice based on reasons: The case of attraction and compromise effects. Journal of Consumer Research, 16, 158–175 (September).

Simonson, I., & Tversky, A. (1992). Choice in context: Tradeoff contrast and extremeness aversion. Journal of Marketing Research, 29, 281–295 (August).

Smith, D., & Park, C. W. (1992). The effects of brand extensions on market share and advertising efficiency. Journal of Marketing Research, 29, 296–313 (August).

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix 1

Appendix 2

Appendix 3

Appendix 4

Rights and permissions

About this article

Cite this article

Sinn, F., Milberg, S.J., Epstein, L.D. et al. Compromising the compromise effect: Brands matter. Market Lett 18, 223–236 (2007). https://doi.org/10.1007/s11002-007-9019-9

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11002-007-9019-9