Abstract

The objective of the paper is to examine the influence of innovation measures on the export intensity of Italian high technology small and medium firms. In fact, despite a growing number of empirical studies attempting to guide the approximation of the value of innovation and its relative impact on the export intensity, a distinction between innovation input and output indicators, both internal and external to the firms has not been clearly established. Drawing on the innovation and export management literature, we used a sample of Italian firms operating in the high tech settings within the manufacturing industry (HTSMEs). Applying a 3 years lag time approach, we ran various Tobit regression models. Our empirical results revealed that: (1) R&D employees do positively and significantly impact the export intensity of HTSMEs, whereas R&D expenditures do not; (2) the use of ‘Universities’ as external R&D partners has a positive influence on the export intensity of HTSMEs; (3) ‘Product innovations’ and the ‘Turnover derived from innovative activities’ positively and significantly affect the export intensity of firms in our sample.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The advent of information, communication and technological advances, the falling barriers to international trade and the emergence of homogenous global preferences have changed the worldwide economy, characterized the firms’ business behaviour and influenced current research frameworks (Bird and Stevens 2003). Previous studies have shown that the traditional conception of larger firms being the leaders in innovation and internationalisation has become outdated when taking into account the increasing share of smaller firms (Acs and Audretsch 1990; Audretsch 2002). Previous research has revealed that bigger firms are often locked in their organizational routines (Abernathy and Thushman 1978; Anderson and Thushman 1990) and bureaucratic constraints (Link and Bozeman 1991) that produce inertia regarding the undertaking approach of innovative activities (Scherer 1991). Whereas, smaller firms with fewer routines and less bureaucratic resistance have the ability to adapt to environmental changes more easily which makes them more prone to provide innovations compared to their larger counterparts (Foster 1986; Christensen and Rosenbloom 1995; Scherer 1991; Tether 1998). In the recent years, we have also witnessed an increasing presence of small firms on the international scene as a result of their ability to respond to market forces more rapidly thanks to their flexibility (Miesenbock 1988). The advent of the rapid internationalisation phenomenon (Oviatt and McDougall 1994) has, furthermore, confirmed that small and medium firms (SMEs) are able to overcome resource constraints and the liabilities of smallness, newness and foreignness (Zahra and George 2002). In other words, SMEs are not only able to manage situations of great complexity such as innovation and internationalisation, but also to interpret them efficiently despite the difficulties inherent to their reduced dimension. Our research focuses on a specific type of SMEs, i.e. those operating in high technology sectors. High-tech firms play a major role in industrialized economies since they strongly contribute to economic growth and social development (OECD 2005). However, when studying efforts related to innovation and internationalisation, their relevance has often been neglected by previous studies (Bernardino and Jones 2008). Buckley and Casson (1998) argued that innovation is a crucial factor in a firm’s product mobility across national boundaries. According to Ruzzier et al. (2006, p. 476), SMEs that operate in high technology sectors “can not act in the marketplace without taking into account the risks and opportunities presented by international competition”. In these firms, innovation is the raison d’etre and constitutes the basis for their competitive advantage not only in the domestic market, but also in foreign markets (Jones 1999, 2001; Guan and Ma 2003). Innovation can confer competitive advantage focus on costs, via the development of new and more efficient productive process, and/or based on differentiation by means of product innovations, allowing firms to tailor their products to customer requirements, or develop products of a higher quality (Lopez Rodriguez and Garcia Rodriguez 2005). Examining, therefore, whether innovation would increase the export intensity of high technology small and medium firms (HTSMEs) represents a topic of secure interest not only for managers but also for policy makers and scholars occupied with export issues.

Innovation, as in the Oslo Manual (OECD 2005), is defined as the implementation of a new or significantly improved product (good or service), process or business function such as marketing methods and organization changes or external relations. This description not only encompasses the entrepreneurial venture endeavours of Schumpeterian origin (1934), but it also emphasises the fact that the actual implementation of innovations in the form of products, services, organization and marketing processes derives from the enterprises sector (European Commission 2002). Moreover, the above definition underlines the importance of collaborations with external partners within an open innovation framework, which has found increasing consensus in business and management literature (Amara and Landry 2005; Chesbrough 2005; Lacetera 2001; Lechner and Dowling 1999; Lorenzoni and Lipparini 1999; Nooteboom 2000; Onetti and Zucchella 2008; Onetti et al. 2010; Powell 1990, 1998; Veugelers and Cassiman 2005). Innovation is a complex and multidimensional phenomenon (Adams et al. 2006). A plethora of indicators has been proposed in literature to accomplish the goal of measuring a firm’s innovative effort. The measures of innovation proposed by ENRS (2002) distinguish between innovation input indicators, innovation throughput indicators and innovation output indicators. In their attempts to guide the approximation of the value of innovation, previous studies have often reduced the issue to either single or aggregate measures of the innovative activities that take place within firms. Yet these studies lack a distinction between innovation input and output indicators, both internal and external to the firms. The purpose of this research is to target this gap while examining which type of innovation measures is the most effective in determining the export intensity of high-tech small and medium firms (HTSMEs). For this purpose a population of 689 Italian manufacturing firms is used as a sample. In this research, we hope to make two important contributions to SMEs export literature. First, by considering SMEs that operate in the high-tech sectors within the Italian manufacturing industry, we believe to provide more useful, precise and comparable empirical evidences to exporting scholars, policy makers and corporate managers. Second, by disaggregating inputs and outputs measures of innovation into different types and measuring each independently, we hope to fully capture the magnitude of a firm’s innovative effort and evaluate its effectiveness in determining the export intensity of high-tech SMEs.

The paper is organised as follows. In Sect. 2, we draw the theoretical elements of the research along with the formulation of the working hypotheses. In Sect. 3, we present the data used in this study and the methodology selected for the statistical analysis. In Sect. 4, we summarize the main research findings and report the discussion of the most significant empirical evidence. In Sect. 5, we outline conclusions, limitations and possible suggestions for future research.

2 Literature review and hypothesis development

When studying the relation between export intensity, which has largely been considered as a typical measure of the degree of internationalisation of SMEs (Leonidou and Katsikeas 1996; Majocchi and Zucchella 2003; Ramaswamy et al. 1996; Young et al. 1989), and innovation related issues, not only the dimension of the firm, but also the sectors and countries in which firms operate may present marked differences and have different implications. Although, the lack of firm-level data has hampered investigation on the topic concerning the relation between innovation and export intensity (Wignaraja 2007), the research conducted on these issues has reserved considerable attention to smaller firms (Lefebvre et al. 1998; Nassimbeni 2001; Sterlacchini 1999). However, earlier empirical studies of export intensity in SMEs research did not specifically deal with high-tech sectors (Lefebvre et al. 1998). Studies using Italian samples of SME (Sterlacchini 1999, 2001; Nassimbeni 2001) estimated the effect of a number of non-R&D related indicators of innovative activities on exports. Traditionally, export research has tended to examine SMEs homogeneously without distinguishing among business sectors (Sousa et al. 2008; Wheeler et al. 2008). However, Bell et al. (2003) showed that high-tech firms tend to have different internationalisation pathways from low-tech firms. Moreover, to fully understand aspects of export behavior of firms, the consideration of the geopolitical, social and economical context seem to be necessary (Wheeler et al. 2008). Previous research supported that export intensity “is strongly influenced by background variables from the local business environment” (Stottinger and Holzmuller 2001, p. 23).

Contrasting results on the impact of internal inputs of innovation on the export intensity of firms have been reported in literature (Harris and Li 2009; Hirsch and Bijaoui 1985; Ito and Pucik 1993; Kumar and Siddharthan 1994; Lefebvre et al. 1998; Lopez Rodriguez and Garcia Rodriguez 2005; Nassimbeni 2001; Roper and Love 2002; Sterlacchini 1999; Wakelin 1998; Wignaraja 2007; Willmore 1992; Zhao and Li 1997, among others). Hirsch and Bijaoui (1985), in their study of 111 Israeli firms, found out that internal innovation inputs have a positive and significant effect on their export growth. Conversely, Willmore (1992) found no innovation effect on exports of Brazilian multinational firms. Ito and Pucik (1993) also found no evidence of the significant effect of internal innovation inputs on the export intensity of Japanese manufacturing firms. However, they concluded that innovation was a significant determinant of export intensity when the size indicator was excluded from the equation. Kumar and Siddharthan (1994) considered 640 Indian firms and concluded that internal innovation inputs were significant determinants for technology industries. Zhao and Li (1997) used data from Chinese firms and found that internal innovation activities were positively associated with export growth. Kalafsky and MacPherson (2001) examined the export characteristics of US companies in the machine tool industry and found that export intensity correlates strongly with applied internal innovation activities. Roper and Love (2002) studied the differences between the determinants of export intensity among the UK and German manufacturing plants and reported that internal innovation inputs influence export intensity. Hasan and Raturi (2003) used data for Indian manufacturing firms and showed that the role played by internal innovation activities does have a positive influence on the entry mode of firm, but only limited influence on the export volume. In his study, Rasiah (2003) found that the internal innovation inputs have a positive effect on the export intensity of electronic firms in Malaysia and Thailand. Ozcelik and Taymar (2004) confirmed the positive effect of internal innovation inputs on the export intensity of Turkish firms working in the manufacturing industries. In their study, Gourlay and Seaton (2004) concluded that firm export intensity is positively influenced by internal innovation activities. More recently, Lopez Rodriguez and Garcia Rodriguez (2005) found that internal innovation inputs were significant in affecting export intensity. In their study for the UK, Harris and Li (2009) reported that internal innovation inputs play an important role for firms to overcome barriers to internationalisation, but they do not increase export intensity. In studies specifically dealing with SMEs, Lefebvre et al. (1998) found no evidence with respect to the contribution of internal innovation inputs to the export dynamics of 101 Canadian small firms. The same results were found by Sterlacchini (1999) and Nassimbeni (2001) on Italian samples of small firms. In line with the majority of the studies reported above, we hypothesise that:

H1

There is a positive relationship between internal innovation inputs and export intensity of Italian HTSMEs.

However, limitations in using only internal innovation measures to approximate the firm’s innovative profile do exist. Previous studies suggested that the presence of risky sunk expenditures connected to the innovative process makes the relative activities more risky to smaller firms (Veugelers 1997). For this reason, SMEs often do not organise a formal internal department devoted to innovation (Brouwer and Kleinknecht 1996). As Bayona et al. (2000) noted, the complexity of technology and its costs and uncertainty motivate firms to reach cooperative innovation agreements. Previous research revealed that research partnerships and cooperative agreements act as important mechanisms for firms to share costs and reduce risks connected to innovation (Veugelers and Cassiman 2005). After all, innovation is not possible in isolation (Lachenmaier and Wossmann 2006). The ability to exploit collaboration has frequently been reflected in previous studies by means of a scale that comprises the various forms of innovative co-operations with universities, firms and other organizations (e.g. Lefebvre et al. 1998; Nassimbeni 2001). However, insufficient attention has been paid to the role that different forms of cooperation with external innovation partners play for the success of small firms in international markets (Guan and Ma 2003; Nassimbeni 2001). The collaboration with universities should provide a means of developing technological knowledge (Lee et al. 2001) and opportunities for growth due to their increasing commercialization effort to exploit academic knowledge and generate revenues (Shane and Stuart 2002; Grimaldi 2005). However, empirical findings reported that the cooperation and knowledge exchange between high-tech firms, the small ones in particular, and universities remains underdeveloped (European Commission 2002). Strategic collaborations with other companies and/or organizations should assist firms with complementary resources (Cohen and Levinthal 1990). According to Gulati et al. (2000), firm alliances and strategic networks potentially provide a firm with access to information, resources, markets and technologies. Technology-based firms generally seek technical, managerial and financial resources through alliances so as to enhance legitimacy and increase the chance of harvesting investments in the firms (Lee et al. 2001). Stuart et al. (2007) positioned high-tech firms as intermediaries along a tripartite value chain which entails upstream alliances with universities and downstream deals with established firms. They argued that high-tech firms prefer vertical collaborations, rather than horizontal linkages among firms engaged in similar activities in order to exploit complementary assets in terms of expertises in different fields of knowledge from their own. Generally, collaborations have been considered particularly important, not only for their role in helping to overcome resource constraints providing additional competences (Mort and Weerawardena 2006), but also in term of additional information enabling identification of new market trends and exploitation of entrepreneurial opportunities (Dimitratos and Jones 2005). For international firms, collaborations represented the principal source of external physical, organisation, technical and reputation resources (Chetty and Wilson 2003). According to Lu and Beamish (2001), alliances and cooperative agreements can improve the international performance of small firms by providing resources and mitigating the uncertainty of the internationalisation process. Empirical evidence in export literature, to which this study belongs, reveals that collaborations with external partners is quite common among high-tech companies as it enables firms to accelerate their international growth (Coviello and Munro 1997; Keeble et al. 1998). Hence, we hypothesise that:

H2

There is a positive relationship between external innovation inputs and export intensity of Italian HTSMEs.

Partnerships and inter-organizational collaborations usually act as a source of information for innovation (Amara and Landry 2005) and as an active integration mechanism of knowledge (Sobrero 2000), since innovation increasingly derives from networking interactions (Veugelers and Cassiman 2005). Firms are linked to a diversified set of agents through networks of collaboration and exchange of information. This represents a system of open innovation where intense interactions between firms and external sources of information increase the benefits in terms of new knowledge and knowledge sharing (Chesbrough 2005; Lorenzoni and Lipparini 1999; Lundvall 1993; Nooteboom 2000; Powel 1990, 1998; Rothwell 1992). This helps to reduce uncertainty in innovation processes, time frame, knowledge gaps and financial constrains of the firms (Pyka and Kuppers 2002). Basile (2001) argued that small firms innovate through acquiring knowledge embodied in external sources and external collaborations. However, the presence of internal innovation abilities remains essential to optimize the benefits from external cooperation (Veugelers and Cassiman 2005). Besides those internal and external innovation inputs, some authors argued that innovative inputs only weakly represent the amount of innovative activity actually realized at firm level (Van Dijk 2002; Lachenmaier and Wossmann 2006). Other authors (Lefebvre et al. 1998; Lopez Rodriguez and Garcia Rodriguez 2005) suggested to take into account innovation outputs in order to avoid reflecting only a partial aspect of the innovative profile of the firms. Empirical evidence has shown that accounting standards lack the ability to accurately reflect innovative activities of firms when these are related to innovative inputs (Canibano et al. 2000). Hoffman et al. (1998) invited researchers to study both innovative inputs and innovative outputs in order to fully capture the amount derived from their innovative effort. Previous research using both large and small firms’ samples (Basile 2001; Ozcelik and Taymar 2004; Lopez Rodriguez and Garcia Rodriguez 2005; Sterlacchini 2001; Roper and Love 2002) found that innovation outputs are significant determinants of the export intensity. In line with previous research, we hypothesise that:

H3

There is a positive relationship between innovation outputs and export intensity of Italian HTSMEs.

3 Data and methodology

3.1 The sample

The present study is based on secondary data of Italian firms operating in the manufacturing industry collected through a National Survey carried out by the research department of Capitalia (now Unicredit) at the end of 2003. The database accounted 3,452 observations with a large set of variables including both questionnaire data and balance sheet information. A more detailed description of the dataset is provided in the appendix. Moving from the original dataset and following the EU Recommendation (2003), we selected SMEs only according to their number of employees (>10 and <250) and total turnover (<50 million euro). The decision to concentrate on SMEs resides in the fact that they represent almost 99% of all enterprises in the EU, providing around 100 million jobs or 67% of the total employment in Europe (European Commission 2003a, b). Italy is the European country with the greatest number of SMEs per inhabitants (65 SMEs per 1,000 inhabitants). Thus, the relative importance of SMEs for the Italian economy exceeds by far the EU average (Eurostat 2008). Having restricted our unit of analysis to small firms only, we used the classification adopted by EU Commission (European Commission 2002) to further reduce our unit of analysis to small firms operating in the high technology sectors. Although, a broadly accepted definition for high-tech SMEs does not exist in literature, the use of an EU classification should allow comparison with other studies on high-tech SMEs from other European countries. This approach is in line with Storey and Tether’s (1998) recommendation.

However, when applying the two digit statistical classification of economic activities provided by the EU Commission (Table 1), ‘Computers and related activities’ and ‘Research and Development’ are considered service activities. Data collected in the Capitalia Survey did not report information about the service activities. In accordance with previous scholars (Bernardino and Jones 2008), we concentrated the analysis on the remaining six high-tech sectors which belong to the manufacturing industry. For our empirical analysis, the adjustments described above lead us to have 2,749 small firms, of which 689 belong to the high-tech sectors.

3.2 The dependent variable

Exporting is the most common entry strategy adopted by SMEs to internationalise their activity (Wolff and Pett 2000). According to Zucchella et al. (2007), three dimensions of export are reported in the literature. The first dimension measures the geographic scope of the exporting activities in terms of number of countries to which the firm exports. Another measure is represented by the precocity and speed of foreign sales. The third dimension, defined export intensity, is represented by the ratio/percentage of export sales over total sales. Leonidou et al. (2002) identified that export proportion of sales, export sales growth, export profit level, export sales volume, export market share, and export profit contribution were the most used measures of export intensity. According to Katsikeas et al. (2000), none of the individual measures of export can be considered inherently superior to others. However, it has often been argued that the percentage of export sales to total sales better represents the performance of SME which extended their business activities internationally (Cavusgil 1980; Ramaswamy et al. 1996). This measure has also been applied in recent studies performed in Italy (Majocchi et al. 2005). Recent figures released by the Eurobarometer (2007) showed a low performance of Italian SMEs on exporting sales. This underperformance justifies our interest in the use of the percentage of export sales to total sales (EXP INT) as the dependent variable to investigate.

3.3 Independent variables

Measuring innovation is a complex operation because of its multi-dimensional nature (Adams et al. 2006). Not commonly agreed measures exist representing exhaustively all the manifestation of innovation. The measures of innovation proposed by ENRS (2002) distinguish between innovation input indicators (e.g. R&D expenditure, R&D personnel, etc.), innovation throughput indicators (e.g. Patents, Trademarks, etc.) and innovation output indicators (e.g. number of innovation, type of innovation, turnover attributable to innovation, etc.). The majority of these indicators have been used in this study for the purpose of distinguishing input and output innovation measures, internal and external to the firms.

3.3.1 Measures of innovation inputs

In line with previous studies, we used the total R&D internal expenditure to total sales (R&D INT) and the R&D employees to total employees (R&D EMP) as proxies to measure the inputs in the firms’ innovative process. However, Adams et al. (2006, p. 26) state: “R&D is only one of several inputs into the innovation process”. The role of the external R&D partnership and inter-organizational collaboration is considerably important to measure the firm’s innovative effort (Nassimbeni 2001). In our analysis, we considered several measures to represent a diversified set of agents through which R&D collaborations occur. We used a measure (R&D EXT) that looks at the total R&D external expenditure to total sales. Moreover, we also employed external R&D by three sub-groups of R&D partners (‘Universities R&D’, ‘Other companies R&D’ and ‘Other organizations R&D’) as percentage of sales. Table 2 summarizes the variables included in the empirical analysis.

3.3.2 Measures of innovation outputs

Besides those internal and external R&D input measures, other innovation measures must be taken into account in order to avoid coverage of only a partial aspect of the innovative profile of the firms (Lefebvre et al. 1998; Lopez Rodriguez and Garcia Rodriguez 2005). With this in mind, we also included two measures of innovation outputs: one variable measuring whether the firms have undertaken product innovations (PROD) and another measuring whether the firms have undertaken process innovations (PROC). Previous research (Basile 2001; Ozcelik and Taymar 2004; Lopez Rodrıguez and Garcıa Rodrıguez 2005) found that both product and/or process innovations are significant determinants of the export intensity. Furthermore, we considered another variable reflecting the output side of the innovation process such as the percentage of turnover derived from a firm’s innovative activities (TURINNO). We believe that this variable will allow us to widen the range of measures of innovation outputs employed in previous studies. We also believe it will help to capture not only the magnitude of the technological profile (Lopez Rodrıguez and Garcıa Rodrıguez 2005) of Italian high-tech SMEs, but also the amount derived from firms’ innovative effort and its relative effect on their export intensity.

3.3.3 Control variables

The innovative profile of firms and their R&D resource capacity can be related to firms’ characteristics. Following Lopez Rodriguez and Garcia Rodriguez (2005), we included four control variables that previous research has demonstrated can affect the firm’s export intensity. Such variables are: firm size, firm age, home location industrial environment and economic sectors. The first two variables are internal to the firms. Although progress has been made in understanding the effect of a firm’s internal resources on export intensity, knowledge of the internal determinants is still contradictory (Pla-Barber and Alegre 2007). The most contradictory results in the literature have been reported for the analysis of the relationship between firm size and export intensity. According to Zou and Stan (1998), empirical findings have produced mixed results detecting several inconsistencies in the current knowledge base. Some scholars report a positive relationship between the two variables (Dhanaraj and Beamish 2003; Majocchi et al. 2005; Reid 1982; Wagner 1995), while others report a negative relationship (Wolff and Pett 2000). Some authors found no relationship (Bonaccorsi 1992) or a medium positive effect (Chetty and Hamilton 1993). According to Baldauf et al. (2000) these inconsistencies may be grounded in the use of non-uniform measures. Zou and Stan (1998) stated that the most common hypothesis is a positive relationship, based on the Reid’s concept (1982) of size advantage. However, Kaynak and Kuan (1993) found out that when size is measured by number of employees negative effects especially on export profit are more frequent. This negative effect has been well explained by Harris and Li (2009) who argued that as firms grow bigger they may prefer an alternative foreign entry mode such as FDI because more convenient than export. In line with other studies (Dhanaraj and Beamish 2003; Mittelstaedt et al. 2003), the number of total employees (EMP) as a proxy for the firm size will be used in our research in order to control the effects of firm’s size on the export intensity of high-tech SMEs.

The relationship between firms’ age and export intensity has also been studied widely in recent years. Firm’s age, expressed as number of years in business, has been previously used as a proxy of business experience in other internationalisation studies (Chen and Martin 2001; Majocchi et al. 2005). Some research has shown that experience is a key factor in international development, reporting a positive and robust relationship (Majocchi et al. 2005); other studies considered experience an unimportant variable for internationalisation (Oviatt and McDougall 1994). Zou and Stan (1998) stated that, among others, firm’s age, expressed as number of years in business, have only limited explanatory power in explaining export intensity and the relationship between a firm’s age had either a negative effect (Zou and Stan 1998; Baldauf et al. 2000; Brouthers and Nakos 2005; Sousa et al. 2008) or an insignificant effect. In this study we include a variable to control for firm’s age, defined as the number of years since foundation (AGE). Where the company is placed and its surrounding industrial environments have been scarcely investigated in previous research (Aaby and Slater 1989; Zou and Stan 1998). Miesenbock (1988, p. 44) stated that “the home country of the firm also determines the performed export behaviour”. Infrastructures, legal systems and government support are all measures of the domestic geographic environment (Leonidou and Katsikeas 1996). According to Dunning (1997), the location advantage which includes knowledge-based assets, infrastructure and technology, shapes the firms competitiveness. Robertson and Chetty (2000) suggested that firms generally perform better when they face a benign domestic environment. Differences about the North, Centre and South of Italy have been reported in terms of infrastructure endowments, public expenditures, corruption and economic growth (Del Monte and Papagni 2003). Hence, we decided to control for the home country location effect introducing three dummy variables (see Table 2). Finally, we included five dummy variables for the six high-tech sectors discussed above. Previous studies revealed that the intensity of export activities may vary considerably across industries (Cavusgil and Zou 1994; Harris and Li 2009) and that firms in more complex and technologically oriented industries may have a better export intensity (Zou and Stan 1998). However, as noted by Basile (2001), studies at industry level abstract the variations among firms. Within the high-tech industry there are different sectors with different type of firms which might have different export intensity. We controlled for the ‘firm’s sector effect’ on the export intensity.

3.4 Descriptive statistics

Tables 3 and 4 show the sectoral and geographical breakdown of the sample of firms together with the average export intensity. These data give a preliminary indication of the extent of exporting among high-tech SMEs in Italian manufacturing industry.

In particular, Table 3 shows that Italian high-tech SMEs have an higher propensity towards exporting (84.2% in average) except those operating in the ‘office machines and computers’ sector (33.3%). Data show that high-tech SMEs operating in the ‘machinery and equipment’ sector, which are the most frequent in our sample (52%), also present the highest export propensity (89.4%) followed by firms operating in ‘electrical machinery’ and ‘medical, precision and optical instruments’ sectors, which respectively reported 88.2 and 77.1%. The Chi-squared statistics (p < .001) shows evidence of a relationship between the export propensity and sectors high-tech firms belong to Table 3 also shows differences in export intensity between the different groups of high-tech SMEs. The Levene’s test for the homogeneity of variance was statistically significant (p < 0.05), therefore after having rejected the null hypothesis of equal variances, we run the Welsh and Brown-Forsythe’s tests which were both statistically significant (p < 0.01). Therefore, we could reject the null hypothesis that the mean values of export intensity are equal for the six groups of high-tech firms in our sample. The Tamhane’s post-hoc test showed that the statistically significant differences (p < 0.01) between the six groups of high-tech firms for our dependent variable (export intensity) hold only for firms in the ‘chemicals, chemical products and fibres’, ‘medical, precision and optical instruments’, ‘machinery and equipment’, ‘radio, television and communication equipments’ sectors. Therefore, we can safely conclude at 95% confidence level that the export intensity of firms operating in the ‘medical, precision and optical instruments’ (50.18) and ‘machinery and equipment’ (49.76) sectors is greater than that of firms in the ‘chemicals, chemical products and fibres’ (34.37) and ‘radio, television and communication equipments’ (30.10) sectors.

Table 4 shows that high-tech SMEs located in the North West of Italy, which are the most frequent in our sample (44.4%), also present the highest export propensity (87.9%) followed by firms located in the North East of Italy (85.8%). The Chi-squared statistics (p < .001) showed evidence of a relationship between the propensity of exporting and the geographic location of high-tech SMEs. Table 4 also shows differences in export intensity between the high-tech SMEs located in the different geographical areas. The Levene’s test for the homogeneity of variance was not statistically significant (p > 0.05), therefore we failed to reject the null hypothesis of equal variances. The F-statistics (3.567) in the ANOVA test was statistically significant (p < 0.05), therefore differences in the export intensity between high-tech SMEs located in different areas exist. However, the difference was statistically significant only for firms located in the North East part of Italy (44.70) and those located in the South and Islands (35.97). We can conclude at 95% confidence level that high-tech SMEs located in the North East part of Italy have an higher export intensity than those located in the South and Islands.

Table 5 shows that 90% of high-tech SMEs that have undertaken product innovations exports compared to 77% of high-tech SMEs that did not undertake product innovations. More than 57% of high-tech exporting SMEs have undertaken product innovations. The Chi-squared statistics (p < .001) suggested that high-tech SMEs that have undertaken product innovations have an higher export propensity. Table 5 also shows differences in export intensity between the two groups of high-tech SMEs. The Levene’s test for the homogeneity of variance was not statistically significant (p > 0.05), therefore we could not reject the null hypothesis of equal variances for the two independent samples. The consequent Student’s t test for equal variances was statistically significant (p < 0.05). Therefore, we can conclude at 95% confidence level that high-tech SMEs occupied with product innovations have an higher level of export intensity (47.87 in average) suggesting that a positive relationship between the export intensity and undertaking product innovations does exist.

Table 6 shows that 76.5% of high-tech SMEs occupied with process innovations export, whereas 85.4% of high-tech SMEs that did not undertake process innovations export. More than 87% of high-tech exporting SMEs have not undertaken process innovations. The Chi-squared statistics (p < .025) suggested evidence of a negative relationship between the propensity of exporting and undertaking process innovations. Table 6 also shows differences in export intensity between the two groups of high-tech SMEs. The Levene’s test for the homogeneity of variance was not statistically significant (p > 0.05); therefore, we could not reject the null hypothesis of equal variances for the two independent samples. The consequent Student’s t test for equal variance was not statistically significant (p > 0.05). Therefore, although raw data shows that high-tech SMEs that did not undertake process innovations seem to have an higher level of export intensity, a negative relationship between the export intensity and undertaking process innovations can not be assumed at 95% confidence level.

To recap, the descriptive statistics discussed above show that sectors and geographical locations in which high-tech SMEs operate are important aspects influencing their export behavior (Stottinger and Holzmuller 2001). Moreover, having undertaken product innovations rather than process innovations seem to positively influence the extent of exporting (propensity and intensity) among high-tech SMEs in Italian manufacturing industry.

3.5 Methodology

Our research focuses on examining whether innovation would increase the export intensity of high technology small and medium firms (HTSMEs). To study the relation between innovation and export intensity, methodological problems may arise due to the contemporaneous effect of innovation and export. Two main trade and economic growth theories exist to explain the relationship between innovation and export. The first approach, which goes back to the technology-gap theory (Posner 1961) and the life-cycle approach (Vernon 1966), sustains the innovation-led exports argument which claims that innovating firms have incentives to expand their activities into other markets so they can earn higher returns from their investments (Teece 1996). In this context, the direction of causality runs from undertaking innovation activities to internationalisation (Harris and Li 2009). The second approach is anchored in international growth models and recognizes the learn by exporting effect (Aghion and Howitt 1998; Alvarez and Lopez 2005; Grossman and Helpman 1991). This effect stresses the endogenous nature of innovation; i.e. innovation is not the cause, but the effect of the internationalisation process (Harris and Li 2009; Lachenmaier and Wossmann 2006). Exporting should allow firms to acquire new and diverse knowledge from acting in foreign markets (Lachenmaier and Wossmann 2006). In other words, exporting firms enhance their competency base through the learning process occurring when dealing with international markets. Taking advantage of these factors, they can foster innovation within firms (Harris and Li 2009). In this context, the direction of causality runs from internationalisation to undertaking innovation activities. As already said, from a methodological perspective, the mutual causation of innovation and exports represents an important issue predicted by trade and economic growth theories which may raise problems for empirical analysis (Lachenmaier and Wossmann 2006). However, Nassimbeni (2001) noted that a bi-directional relationship exists not only between the measures of innovation and export, but also between the firm’s export intensity and other firm’s characteristics. Therefore, he concluded that “given the twofold valence of many of the factors which can be hypothesised to be both a cause and an effect of the export choice, the model [to] verify is not a causal model, that is, it does not explain the export (intensity) of small units. It simply identifies which factors best characterise their export activity” (Nassimbeni 2001, p. 249). This is in line with our research aim of examining which type of innovation measures is the most effective in determining the export intensity of high-tech SMEs. In order to deal with the problems of causality due to the possible endogenous nature of the variables, the use of lagged rather than contemporaneous variables represents a strategy that allows to alleviate the possibility that independent variables and the dependent variable are jointly determined (Spanos et al. 2004). The data collected through the Capitalia Survey (2003) allowed us to measure the independent variables concerning the firm’s innovation effort with a lag time period of 3 years compared to our target variable. More precisely, the dependent variable (export intensity) is considered at the end of 2003, whereas the independent variables are taken at the end of 2001.Footnote 1 Recent studies on export intensity (Lopez Rodriguez and Garcia Rodriguez 2005) applied this approach in order to overcome the causal effect problem. However, the data allowed them to apply only a one year lag time period. The data Capitalia (2003) provided us with more information which made possible the use of a lag time period of 3 years, in line with the OECD (2005) suggestion which recommends to take into account a 3 years period since innovation is a path dependent process which may take some time to manifest its effects on the firms’ activities. This should allow us to realize a more realistic analysis of the influence of innovation measures on the export intensity of high-tech SMEs.

4 Empirical analysis and results

Before conducting our empirical investigation, we handled missing data by employing the expectation–maximization (EM) approach. According to Little and Rubin (1987), when data are not missing completely at random, mean estimates from the EM (expectation–maximization) method are unbiased and closest to the parameter values. Therefore, mean estimates from the EM represent the best option for estimating missing values.

A correlation matrix for all the continuous independent variables and our dependent variable is presented in Table 7. Results show several positive and statistically significant correlations between export intensity of HTSMEs and some of the determinants chosen for our regression model. Data also reveal a positive correlation between the internal and external innovation input measures as well as correlations between the input and output measures. Given that correlations between predictor variables could lead to unreliable regression estimates (Hair et al. 2006), examining the significance of correlation coefficients allows checking for multicollinearity problems. The Table 7 shows that the correlations are quite low, thereby suggesting that multicollinearity is not a problem. Other diagnostic tests for multicollinearity such as the Tolerance test and the Variance Inflation Factor have been executed and no multicollinearity problems were found. To model the relative contribution of innovation measures to export intensity of Italian of high-tech SMEs (HTSMEs), we relied on Tobit regression. This type of regression was chosen in preference to the more common linear regression techniques (OLS) because of the nature of our dependent variable. It is a percentage variable (percentage of export over total sales), whose minimum value is 1 and whose maximum is 100, or 100% of sales. As previously noted, in our sample out of the 689 HTSMEs, 580 (84.2%) were exporters, while 109 (15.8%) were non-exporters. We can observe how, considering only exporting companies in the sample, all the values of our dependent variable are all non-zero. Moreover, the variable has a right censored point because its maximum value cannot exceed 100%. So, OLS assumptions of linearity and normality may be violated and, therefore its estimations would thus give rise to biased and inconsistent estimates (Maddala 1983). One of the main problems in estimating the determinants of our dependent variable is that there may be selectivity bias if we would have included only firms with positive exports. However, the Tobit model enables us to include also those firms with zero exports. This allowed us to accommodate censoring in the dependent variable and to overcome the bias associated with assuming a linear functional form in the presence of such censoring. Moreover, the Tobit model enables us to analyse both the decision whether or not to export, and the level of export, in a single model (Nassimbeni 2001). The Tobit model is expressed by the following equation:

where N is the number of observations, Y t is the dependent variable, x t is a vector of independent variables, β is a vector of unknown coefficients, and u t is an independently distributed error term assumed to be normal with zero mean and constant variance. Thus, the model assumes that there is an underlying, stochastic index equal to x t β + u t which is observed only when it is positive, and hence qualifies as an unobserved, latent variable.

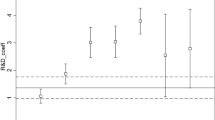

Table 8 reports the results of various Tobit regression models identifying the factors that explain export intensity of HTSMEs. For all the models, the likelihood ratio statistic (LR chi2) tests that at least one of the regression coefficient is not equal to zero. The p-value associated is <0.0001 in all of them. So the specified models are statistically correct and we can assume validity of results. The various pseudo R2 reported in Table 8 evaluate the goodness-of-fit of our models. Several pseudo R2 measures exist. A detailed discussion on these measures is offered in Maddala (1983, p. 38–41). In the first model we included only control variables to have a benchmark against which to test the effects of input and output innovation measures. The pseudo R2 (16.8%) in model 1 is considered acceptable for a cross section model (Wignaraja 2007). Of the ten control variables, seven are significant (mostly at the 1% level). In the second model we added the two internal innovation measures. The pseudo R2 (19%) in model 2 is higher than that in model 1 and the likelihood ratio statistic (LR chi2) remains significant at the 1% level. Model 2 seems to explain the variation in export performance of HTSMEs better than model 1. On the basis of our model 2, we only found partial evidence to support a positive relationship between internal innovation measures and export intensity of HTSMEs (hypothesis 1). We did not find evidence to support a positive relationship between R&D internal expenditure and export intensity of HTSMEs in our sample. However, we found that R&D employees positively and significantly impact on the export intensity of HTSMEs. Investing in R&D employees represents the R&D orientation of firms which has often been interpreted as an important driver to export intensity (Hirsch and Bijaoui 1985). Our model 3a shows that R&D external expenditure does not impact on the export intensity of HTSMEs. However, when we differentiated in model 3b the R&D external expenditure in the three sub-groups of R&D partners (i.e. ‘Universities R&D’, ‘Other companies R&D’ and ‘Other organizations R&D’), our results show that the use of ‘Universities’ as external R&D partners has a positive influence on the export intensity of HTSMEs. This result is in line with previous research (Shane and Stuart 2002; Grimaldi 2005) which claimed that the increasing effort of universities in commercialization of academic knowledge might bring spill over effects to the growth opportunities of firms collaborating with the universities. Furthermore, we argue that the prestige of universities may act as a sign of recognition of the quality of the products offered by the firms. This may represent an incentive for consumers to buy, at both national and international level. This also is in line with the view that assigns to a system of open innovation the benefits in terms of knowledge sharing, uncertainty reduction, technological complexity, time frame and financial constrains (Amara and Landry 2005; Chesbrough 2005; Lorenzoni and Lipparini 1999; Lundvall 1993; Nooteboom 2000; Powell 1990, 1998; Pyka and Kuppers 2002; Rothwell 1992) that allow firms to accelerate their international growth in foreign markets (Coviello and Munro 1997; Dimitratos and Jones 2005; Mort and Weerawardena 2006; Onetti and Zucchella 2008). On the basis of our model 3a and 3b, we found evidence to support a positive relationship between external R&D expenditure and export intensity of HTSMEs (hypothesis 2) only when external R&D is carried out by universities. The fact that both internal and external R&D sourcing have a role in predicting export intensity of HTSMEs recalls the choice problem between internal and external R&D sourcing which is associated with uncertainty, asset specificity, transaction costs, opportunism and appropriability. Transaction Cost Theory (TC) provides a useful approach to understand why firms choose to cooperate in R&D. Partnerships, cooperative agreements and alliances represent a hybrid form of organisation (governance structure) between hierarchical (firm) and arm’s-length transactions (market place). As technology is specific, uncertain and tacit in nature, the risk of opportunism and appropriability increase. This determines high transaction costs which make the choice of hierarchical (firm based) governance structure more appropriate. However, the internal development of technology, i.e. within the firm’s boundary, although it reduces the transaction costs, it does not allow access to specialist know-how available externally. Collaboration allows access to this specialised know-how, and the reciprocity exchange of the relationships between complementary partners should minimize the risk of opportunism. R&D cooperation between universities and industry is characterized by high uncertainty, high information asymmetries between partners, high transaction costs. However, since universities are not direct competitors in the output markets of the collaborating firm, they are not able to appropriate the benefits from the new know-how generated (Veugelers and Cassiman 2005). This finding confirms previous research that claimed that the collaboration with universities provides a mean of developing new technological knowledge (Lee et al. 2001). This finding also provides support to the literature which argues that, developing in-house R&D, firms acquire the necessary in-house capability to effectively exploit external know-how coming from external R&D sources (Veugelers and Cassiman 2005). This finding does not support previous empirical research that reported that the cooperation and knowledge exchange between the small high-tech firms and universities is underdeveloped (European Commission 2002). Moreover, it provides support for the literature (Stuart et al. 2007) which positioned high-tech firms as intermediaries between upstream alliances with universities and downstream deals with established firms. The preference for vertical collaborations with universities, in our case, supports previous evidence that high-tech firms are more prone to engage in dissimilar activities in order to exploit the complementary assets in terms of different expertises, rather than the horizontal collaborations with a similar set of knowledge. Our hypothesis 3 predicted a positive relationship between the innovation output measures (i.e. product, process innovations and the level of turnover derived from innovative activities) and small high-tech export firms’ returns. Our models 4a and 4b seem to confirm this positive relationships. We found that ‘Product Innovations’ is a significant determinant of export intensity of HTSMEs. Therefore, the competitive advantages of HTSMEs when dealing with international markets via exporting is based on product differentiation whose technology is one of the main driver (Lopez Rodriguez and Garcia Rodriguez 2005; Teece 1996). Thus, technology drives product innovations and HTSMEs differentiation which has been found in international markets the area of exploitation from which derive higher economic performance (Onetti and Zucchella 2008). We did not find evidence to support that ‘Process Innovations’ is a significant determinant of export intensity of HTSMEs in our sample. In model 4b, we also found that the level of ‘Turnover derived from innovative activities’ is a significant determinant of export intensity of HTSMEs.

As far as the control variables are concerned, firm size, home country location and economic sectors seem to significantly affect the export intensity of exporting HTSMEs across all the different models. The positive relationship between firm size and the degree of internationalisation of HTSMEs measured in terms of total turnover exported is consistent with the Reid’s concept (1982 of size advantage and economies of scale to overcome the perception of risk in dealing with foreign markets. Our finding is in line with the majority of the studies in the export literature (Zou and Stan 1998). In an age of information and communication technologies, geographic and industrial setting location should be less a constraint, especially for exporters. However, our results show that the surrounding industrial environments and the domestic geographic location of firms are still important determinants of export intensity. This result confirms previous research which underlined the importance of location assets in determining firm competitiveness (Dunning 1997; Leonidou and Katsikeas 1996; Robertson and Chetty 2000). The existence of differences between the North, Centre and South of Italy in the term of infrastructure endowment, public expenditure, corruption and economic growth (Del Monte and Papagni 2003) seem to negatively affect the export intensity of Italian HTSMEs. With regards to the performing a specific economic activity within the technology-intensive sectors, the results indicate that the effect is negative and significant on the export intensity. This might suggest that some firms performing specific economic activities might lack capacity to compete in foreign markets although belonging to the technology-intensive sector. The intensity of exporting activity vary considerably not only across industries (Cavusgil and Zou 1994; Harris and Li 2009), but also across sectors and within sectors. Our result show that differences in export intensity exist between firms performing different economic activities within the same sector. Finally, the limited explanatory power of the variable age in explaining export intensity of HTSMEs reported in our study is in line with previous research which argued that experience is an unimportant variable for internationalisation (Oviatt and McDougall 1994; Zou and Stan 1998).

5 Conclusions

In this article we have tried to examine which type of innovation measures is the most effective in determining the export intensity of high-tech small and medium firms (HTSMEs), using a sample of 689 Italian manufacturing firms. Drawing on the innovation and export management literature, this study presents important implications for SMEs export scholars, managers and policy makers. By distinguishing among innovation input indicators both internal to the firms (such as R&D expenditure, R&D employment) and external (R&D collaborations), as well as innovation output indicators (types of innovation and turnover attributable to innovation), we have tried to capture the magnitude of the firm’s innovative effort and its effectiveness in characterising the export intensity of high-tech SMEs. Applying a lag time period of 3 years, we have also comprehensively distinguished innovative inputs to innovative outputs while exploring whether innovative efforts have had a measurable effect on the export intensity of high-tech SMEs. This allowed us to expand the traditional innovation measures used in the literature and to provide more accurate and precise results. R&D expenses and R&D employees are essential indicators of R&D orientation and innovation. However, no evidence is found with respect to the contribution of internal R&D expenses to the export intensity of our firms. Our analysis suggests that R&D employees seem to positively and significantly impact the export intensity of HTSMEs. This underlines the limitations in using only input measures of innovations to account for the innovative activity realized at small firm level. The positive influence of external R&D on the export intensity of Italian HTSMEs and, in particular, that one of ‘Universities’ as R&D partners supports the existence of cooperation development and knowledge exchange between the small high-tech firms and universities. The exploitation of complementary innovation assets not only make it possible for core innovation resources to operate effectively, but they also become relevant for achieving success in foreign markets. Therefore, Italian HTSMEs and their managers should consider other complementary innovation assets along with their technological resources to enhance their export competitiveness. ‘Universities’, in our case, seem to provide positive spill-over effects on exporting HTSMEs that present R&D orientation. They seem to be able to absorb know-how coming from external R&D sources and to exploit it in export markets. Policy makers should foster the cooperation between universities and small firms operating in high-tech sectors as this may generate higher returns for firms in terms of sales at international level. Moreover, the cooperation between universities and small firms could also facilitate the link between the academic knowledge and the productive world. Many countries have launched a variety of public promotion programmes supporting especially collaborative research between industry and public science institutions, and we hope that the Italian government will follow. Our analysis suggest that high technology SMEs and their managers should direct their innovative effort towards product innovations rather than process innovations if they want to perform in international markets. Product innovations represent the materialization of the technological resources of high technology SMEs which allows them to focus on product differentiation to achieve a competitive advantage on export markets (Lopez Rodriguez and Garcia Rodriguez 2005). As for future studies in this area of research, export scholars are called to expand the scope of this study by focussing on other measures of innovation which may influence the internationalisation of high technology SMEs such as organizational innovations. The empirical analysis has also shown that, while the age of the firms does not account for significant differences, the size, geographic home location and economic sectors of the firms act as important control variables. An heterogenic perspective has emerged when attempting to explain the influence of innovation measures on the export intensity of HTSMEs. With regards to economic activities, our results suggest that dissimilar firms performing diverse economic activities within the high-tech sectors differ in terms of their export intensity questioning whether studying SMEs heterogeneously rather than homogeneously could offer a more insight into the firms’ dynamics. In this regard, future studies dealing with high-tech sectors should examine firms carrying out a precise economic activity in order to achieve a deeper understanding of their intenationalisation behaviour. At the policy level, policy makers should pay more attention to the economic activities of the firms when they implement public policies to foster exports. With regards to the existence of export performance differences between firms located in the North, Centre and South of Italy, managers should pay due attention to where they locate their investments; whereas policy makers should focus their public interventions in reducing the gaps that exist between the North and the South of the country not only in terms of infrastructure endowment (Del Monte and Papagni 2003), but also in terms of availability of high skilled human capital which can allow firms located in the South of the country to better perform in foreign markets. Last but not least, policy makers should implement policies to encourage firms to increase their size in order to achieve economies of scale to overcome the perception of risk in dealing with foreign markets.

This study would not be complete without mentioning several limitations, followed by possible avenues for future research. There are several weaknesses concerning the results of this study that have to be stressed. First, previous studies pointed out that the findings of research concerning the internationalisation of firms are mainly country-specific (Lu and Beamish 2001). We are aware that the application of EU classification (European Commission 2002) to define our sample of HTSMEs and the use of data from the Italian manufacturing setting makes the empirical evidence comparable at European level. However, this approach represents a limitation as the generalizability of the findings is questionable to other countries outside Europe. Thus, studies with comparative samples are called to extend the generalizability of the results of this study. Second, although the use of a lag time period of 3 years allowed us to provide more accurate results while measuring the influence of innovation measures on the export intensity of HTSMEs, this study has been constructed within a cross-sectional design. The Tobit regression used it has been helpful to analyse the relationship between a single dependent variable and several independent (predictor) variables (Hair et al. 2006). However, it would be interesting to investigate all dependence relationships of innovation measures along with export intensity at the same time. A structural equations approach (SEM) would allow us to test the entire model simultaneously. SEM is a multivariate technique suitable for estimating causal models with multiple independent and dependent constructs, i.e. when dependent variables become independent variables in subsequent dependence relationships (Hair et al. 2006). Finally, the research has been limited to export intensity as the only measure of the degree of internationalisation. It has been argued that relying only on export intensity leaves out the multiplicity of factors connected to international expansion of a firm. Therefore, analysis should adopt multiple indicators which are not limited only to the internationalisation in terms of export sales. To test a model in which the dependent variable is export propensity could represent an extension of this study. Another idea for further research concerns the possibility of studying the contribution of innovation towards the propensity of firms to expand internationally by analysing the differences among entry modes: exports, inter-firm equity and non-equity agreements and foreign direct investment.

Notes

The data from the Capitalia Survey (2003) did not allow us to prove the opposite direction, i.e. whether internationalisation [export] causes innovation as we did not have data for firms exports in the period 2001–2003, but only for 2003.

References

Aaby, N., & Slater, S. F. (1989). Management influences of export performance: A review of the empirical literature 1978–1988. International Marketing Review, 6(4), 7–26.

Abernathy, W. J., & Tushman, J. H. (1978). Patterns of innovation in technology. Technology Review, 80(7), 40–47.

Acs, Z. J., & Audretsch, D. B. (1990). Innovation and small firms. Cambridge: MIT Press.

Adams, R., Bessant, J., & Phelps, R. (2006). Innovation management measurement: A review. International Journal of Management Reviews, 8(1), 21–47.

Aghion, P., & Howitt, P. (1998). Endogenous growth theory. Cambridge: MIT Press.

Alvarez, R., & Lopez, R. A. (2005). Exporting and performance: Evidence from Chilean plants. Canadian Journal of Economics, 38(4), 1384–1400.

Amara, N., & Landry, R. (2005). Souce of information as determinants of novelty of innovation in manufacturing firms: Evidence from the 1999 statistics Canada innovation survey. Technovation, 25(3), 245–259.

Anderson, P., & Tushman, M. L. (1990). Technological discontinuities and dominant designs: A cyclical model of technological change. Administrative Science Quarterly, 35(4), 604–633.

Audretsch, D. B. (2002). Entrepreneurship: A survey of the literature prepared for the European Commission, Enterprise Directorate General. http://ec.europa.eu/enterprise/entrepreneurship/green_paper/literature_survey_2002.pdf.

Baldauf, A., Cravens, D. W., & Wagner, U. (2000). Examining determinants of export performance in small open economies. Journal of Word Business, 35(1), 61–79.

Basile, R. (2001). Export behaviour of Italian manufacturing firms over the nineties: The role of innovation. Research Policy, 30(8), 1185–1201.

Bayona, C., Garcia-Marco, T., & Huerta, E. (2000). Firms’ motivations for cooperative R&D: An empirical analysis of Spanish firms. Research Policy, 30(8), 1289–1307.

Bell, J., McNaughton, R., Young, S., & Crick, D. (2003). Towards an integrative model of small firms internalisation. Journal of International Entrepreneurship, 1(4), 339–362.

Bernardino, L., & Jones, M. V. (2008). Internationalisation and performance. An empirical study of high-tech SMEs in Portugal. Booknomics, May 2008; ISBN 978-989-8184-02-03.

Bird, A., & Stevens, M. J. (2003). Toward an emergent global culture and the effects of globalization on obsolescing national cultures. Journal of International Management, 9(4), 395–407.

Bonaccorsi, A. (1992). On the relationship between firm size and export intensity. Journal of International Business Studies, 23(4), 605–635.

Brouthers, L. E., & Nakos, G. (2005). The role of systematic international market selection on small firms’ export performance. Journal of Small Business Management, 43(4), 363–381.

Brouwer, E., & Kleinknecht, A. (1996). Firm size, small business presence and sales of innovative products: A micro-econometric analysis. Small Business Economics, 3(8), 189–201.

Buckley, P. J., & Casson, M. C. (1998). Analyzing foreign market entry strategies: Extending the internalization approach. Journal of International Business Studies, 29(3), 539–561.

Canibano, L., Garcia-Ayouso, M., & Sanchez, M. P. (2000). Shortcomings in the measurement of innovation: Implications for accounting standard setting. Journal of Management and Governance, 4(4), 319–342.

Capitalia Survey (2003). XI survey of manufacturing enterprises. 2003. http://www.unicredit-capitalia.eu/DOC/jsp/navigationDayOne/index.jsp.

Cavusgil, S. T. (1980). On the internationalisation process of firms. European Research, 8(6), 273–281.

Cavusgil, S. T., & Zou, S. (1994). Marketing strategy-performance relationship: An investigation of the empirical link in export market ventures. Journal of Marketing, 58(1), 1–21.

Chen, R., & Martin, J. M. (2001). Foreign expansion of small firms: The impact of domestic alternatives and prior foreign business involvement. Journal of Business Venturing, 16(6), 557–574.

Chesbrough, H. W. (2005). Open innovation: The new imperative for creating and profiting from technology. Boston: Harvard Business School Press.

Chetty, S. K., & Hamilton, R. K. (1993). Firm level determinants of export performance: A meta-analysis. International Marketing Review, 10(3), 26–34.

Chetty, S. K., & Wilson, H. I. M. (2003). Collaborating with competitors to acquire resources. International Business Review, 12(1), 61–81.

Christensen, C. M., & Rosenbloom, R. S. (1995). Explaining the attacker’s advantage: Technological paradigms, organizational dynamics and the value network. Research Policy, 24(2), 233–257.

Cohen, W. M., & Levinthal, D. A. (1990). Absorptive capacity: A new perspective on learning and innovation. Administrative Science Quarterly, 35(1), 128–152.

Coviello, N. E., & Munro, H. (1997). Network relationships and internationalisation process of SME software firms. International Business Review, 6(4), 361–386.

Del Monte, A., & Papagni, E. (2003). R&D and the growth of firms: Empirical analysis of a panel of Italian firms. Research Policy, 32(6), 1003–1014.

Dhanaraj, C., & Beamish, P. W. (2003). A resource-based approach to the study of export performance. Journal of Small Business Management, 41(3), 242–261.

Dimitratos, P., & Jones, M. V. (2005). Future directions for international entrepreneurship research. International Business Review, 14(2), 119–128.

Dunning, J. H. (1997). Location and the multinational enterprise: A neglected factor? Journal of International Business Studies, 29(1), 45–66.

Eurobarometer (2007). Eurobarometer flash 196—observatory of European SMEs. Analytical report. Fieldwork: November 2006–January 2007. European Commission. http://www.cieslik.edu.pl/index.php/ida/27/?getFile=227:0.

European Commission (2002). High technology SMEs in Europe. The observatory of European SME’s, No.6, Luxemburg: European Communities. http://ec.europa.eu/enterprise/policies/sme/files/analysis/doc/smes_observatory_2002_report6_en.pdf.

European Commission (2003a). SMEs in Europe 2003. The observatory of European SMEs, No.7, Luxemburg: European Communities. http://ec.europa.eu/enterprise/policies/sme/files/analysis/doc/smes_observatory_2003_report7_en.pdf.

European Commission (2003b). Recommendation 2003/361/EC, Bruxeles: European Communities. http://ec.europa.eu/enterprise/enterprise_policy/sme_definition/decision_sme_en.pdf.

Eurostat (2008). European Commission. Entreprise and industry. Facts Sheet: Italy (2008). http://ec.europa.eu/enterprise/entrepreneurship/spr08_fact_sheet_it.pdf.

Foster, R. N. (1986). Innovation: The attacker’s advantage. New York: Summit Books.

Gourlay, A., & Seaton, J. (2004). Explaining the decision to export: Evidence from UK firms. Applied Economics Letters, 11(3), 153–158.

Grimaldi, R. (2005). Are universities entrepreneurial? Journal of Management and Governance, 9(3), 315–319.

Grossman, G. M., & Helpman, E. (1991). Innovation and growth in the global economy. Cambridge: MIT Press.

Guan, J., & Ma, N. (2003). Innovative capability and export performance of Chinese firms. Research Policy, 36(6), 880–886.

Gulati, R., Nohria, N., & Zaheer, A. (2000). Strategic networks. Strategic Management Journal, 21(3), 203–215.

Hair, J. F., Black, B., Babin, B., Anderson, R. E., & Tatham, R. L. (2006). Multivariate data analysis (6th ed.). New Jersey: Pearson Publications.

Harris, R., & Li, Q. C. (2009). Exporting, R&D, and absorptive capacity in UK establishments. Oxford Economic Papers, 61(1), 74–103.

Hasan, R., & Raturi, M. (2003). Does investing in technology affect exports? Evidence from Indian firms. Review of Development Economics, 7(2), 279–293.

Hirsch, S., & Bijaoui, I. (1985). R&D intensity and export performance: A micro view. Review of World Business, 121(2), 238–251.

Hoffman, K., Parejo, M., Bessant, J., & Perren, L. (1998). Small firms, R&D, technology and innovation in the UK: A literature review. Technovation, 18(1), 39–55.

Ito, K., & Pucik, V. (1993). R&D spending, domestic competition, and export performance of Japanese manufacturing firms. Strategic Management Journal, 14(1), 61–75.

Jones, M. V. (1999). The internationalisation of small high technology firms. Journal of International Marketing, 7(4), 15–41.

Jones, M. V. (2001). First steps in internationalisation concepts and evidence from a sample of small high technology firms. Journal of International Management, 7(3), 191–210.

Kalafsky, R. V., & MacPherson, A. D. (2001). Recent trends in the export performance of US machine tool companies. Technovation, 21(11), 709–717.

Katsikeas, C. S., Leonidou, L. C., & Morgan, N. A. (2000). Firm-level export performance assessment: Review, evaluation and development. Journal of the Academy of Marketing Science, 28(4), 493–511.

Kaynak, E., & Kuan, W. K. (1993). Environment, strategy, structure, and performance in the context of export activity: An empirical study of Taiwanese manufacturing firms. Journal of Business Research, 27(1), 33–49.

Keeble, D., Lawson, C., Lawton Smith, H., Moore, B., & Wilkinson, F. (1998). Internationalisation processes, networking and local embeddedness in technology-intensive small firms. Small Business Economics, 11(4), 327–342.

Kumar, N., & Siddharthan, N. S. (1994). Technology, firm size and export behavior in developing countries: The case of Indian firm. Journal of Development Studies, 32(2), 288–309.

Lacetera, N. (2001). Corporate governance and the governance of innovation: The case of pharmaceutical industry. Journal of Management and Governance, 5(1), 29–59.

Lachenmaier, S., & Wossmann, L. (2006). Does innovation cause exports? Evidence from exogenous innovation impulses and obstacles using german micro data. Oxford Economic Papers, 58(2), 317–350.

Lechner, C., & Dowling, M. (1999). The evolution of industrial districts and regional networks: The case of the biotechnology region Munich/Martinsried. Journal of Management and Governance, 3(4), 309–338.

Lee, C., Lee, K., & Pennings, J. M. (2001). Internal capabilities, external networks and performance: A study on technology-based ventures. Strategic Management Journal, 22(6–7), 615–640.

Lefebvre, E., Lefebvre, L. A., & Bourgault, M. (1998). R&D-related capabilities as determinants of export performance. Small Business Economics, 10(4), 365–377.

Leonidou, L. C., & Katsikeas, C. S. (1996). The export development process: An integrative review of empirical models. Journal of International Business Studies, 27(3), 517–551.

Leonidou, L. C., Katsikeas, C. S., & Samieec, S. (2002). Marketing strategy determinants of export performance: A meta-analysis. Journal of Business Research, 55(1), 51–67.

Link, A. N., & Bozeman, B. (1991). Innovative behaviour in small-sized firms. Small Business Economics, 3(3), 179–184.

Little, R. J. A., & Rubin, D. B. (1987). Statistical analysis with missing data. New York: Wiley.

Lopez Rodriguez, J., & Garcia Rodriguez, R. M. (2005). Technology and export behaviour: A resource-based view approach. International Business Review, 14(5), 539–557.

Lorenzoni, G., & Lipparini, A. (1999). The leveraging of interfirm relationships as a distinctive organizational capability: A longitudinal study. Strategic Management Journal, 20(4), 317–338.

Lu, J. W., & Beamish, P. W. (2001). The internationalisation and performance of SMEs. Strategic Management Journal, 22(6–7), 565–586.

Lundvall, B. A. (1993). Explaining interfirm cooperation and innovation. Limits of the transaction-cost approach in the embedded firm. In G. Grabher (Ed.), Socioeconomics of industrial networks (pp. 52–64). London: Routledge.

Maddala, G. S. (1983). Limited-dependent and qualitative variables in econometrics. Cambridge: University Press.

Majocchi, A., Bacchiocchi, E., & Mayrhofer, U. (2005). Firm size, business experience and export intensity in SMEs: A longitudinal approach to complex relationships. International Business Review, 14(6), 719–738.

Majocchi, A., & Zucchella, A. (2003). Internationalisation and performance, findings from a set of Italian SMEs. International Small Business Journal, 21(3), 249–268.

Miesenbock, K. J. (1988). Small business and exporting: A literature review. International Small Business Journal, 6(2), 42–61.

Mittelstaedt, J. D., Harben, N. G., & Ward, W. A. (2003). How small is too small? Firm size as a barrier to exporting from the United States. Journal of Small Business Management, 41(1), 68–84.

Mort, G. S., & Weerawardena, J. (2006). Networking capability and international entrepreneurship. How network function in Australian born global firms. International Marketing Review, 23(5), 549–572.

Nassimbeni, G. (2001). Technology, innovation capacity, and the export attitude of small manufacturing firms: A logit/tobit model. Research Policy, 30(2), 245–262.

Nooteboom, B. (2000). Learning by interaction: Absorptive capacity, cognitive distance and governance. Journal of Management and Governance, 4(1–2), 69–92.

OECD (2005). The measurement of scientific activities. Proposed guideline for collecting and interpreting technological innovation data. Oslo Manual, 2005. http://www.oecd.org/dataoecd/35/61/2367580.pdf.

Onetti, A., & Zucchella, A. (2008). Imprenditorialità, Internazionalizzazione e Innovazione. I Business Model delle Imprese Bio-tech. Roma: Carocci Editore.

Onetti, A., Zucchella, A., Jones, M. V., & McDougall-Covin, P. P. (2010). Internationalization, innovation and entrepreneurship: Business models for new technology-based firms. Journal of Management and Governance (in press).

Oviatt, B. M., & McDougall, P. P. (1994). Toward a theory of international new ventures. Journal of International Business Studies, 25(10), 45–64.

Ozcelik, E., & Taymar, E. (2004). Does innovativeness matter for international competitiveness in developing countries. Research Policy, 33(3), 409–424.

Pla-Barber, J., & Alegre, J. (2007). Analysing the link between export intensity, innovation and firm size in a science-based industry. International Business Review, 16(3), 275–293.

Posner, M. (1961). International trade and technical change. Oxford Economic Papers, 13(3), 323–341.

Powell, W. W. (1990). Neither market nor hierarchy: Network forms of organisation. Research in Organizational Behaviour, 12, 295–336.

Powell, W. W. (1998). Learning from collaborations: Knowledge networks in the biotechnology and pharmaceutical industries. California Management Review, 40(3), 228–240.

Pyka, A., & Kuppers, G. (2002). Innovation networks: Theory and practice. New horizons in the economics of innovation series. Cheltenham: Edward Elgar.

Ramaswamy, K., Kroeck, K. G., & Renforth, W. (1996). Measuring the degree of internationalisation of a firm: A comment. Journal of International Business Studies, 27(1), 167–177.

Rasiah, R. (2003). Foreign ownership, technology and electronics exports from Malaysia and Thailand. Journal of Asian Economics, 14(5), 785–811.

Reid, S. D. (1982). The impact of size on export behaviour in small firms. In M. R. Czinkota & G. Tesar (Eds.), Export management: An international context. New York: Fraeger Publishers.

Robertson, C., & Chetty, S. K. (2000). A contingency-based approach to understanding export performance. International Business Review, 9(2), 211–235.

Roper, S., & Love, J. H. (2002). Innovation and export Performance: Evidence from the UK and German manufacturing plants. Research Policy, 31(7), 1087–1102.

Rothwell, R. (1992). Successful industrial innovation: Critical factors for the 1990s. R&D Management, 22(3), 221–239.

Ruzzier, M., Hisrich, R. D., & Antoncic, B. (2006). SME internationalisation research: Past, present, and future. Journal of Small Business and Enterprise Development, 13(4), 476–497.

Scherer, F. M. (1991). Changing perspectives on the firm size problem. In Z. J. Acs & D. B. Audretsch (Eds.), Innovation and technological change: An international comparison (pp. 24–38). Ann Arbor: University of Michigan Press.

Schumpeter, J. A. (1934). The theory of economic development. Boston: Harvard University Press.

Shane, S., & Stuart, T. (2002). Organizational endowments and the performance of university start-ups. Management Science, 48(1), 154–170.

Sobrero, M. (2000). Structural constraints, strategic interactions and innovative processes: Measuring network effects in new product development projects. Journal of Management and Governance, 4(3), 239–263.