Abstract

This paper presents the economic and exergoeconomic analysis of the 660 MW coal-fired supercritical unit. The economic analysis is carried out using present worth method. The lifetime cost in terms of fuel, maintenance, insurance, labor, pumping, revenue generated, operating expenses, total capital investment and net present value is studied varying plant life, plant load and interest rate. In addition to economic analysis, exergoeconomic analysis is performed with specific exergy costing method. The payback period for supercritical power plant is evaluated to 4.5 years for 9% of interest rate and plant life of 30 years. The relative cost difference and exergoeconomic factor are studied for various components available in plant. This study reveals that steam generator exhibits maximum exergy destruction rate and capital cost. The present study also investigates the capital cost of the turbine can be reduced in the expense of exergetic efficiency. The exergoeconomic analysis reveals that performance of high-pressure heater 1 can be improved by reducing significant decrease in exergy destruction rate. The components with work as a input parameters show higher relative cost difference. The analysis is performed using the MATLAB programming environment. The outcomes of this study will help the researcher to develop the optimize economic analysis model of the upcoming power plants.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

The initial capital investment is the deciding factor for the long term feasibility of any thermal power plant. The various uncertainties in the case of thermal power plant-related expected returns and cost factors decide whether to invest in the project or think of alternative generation setup [1]. The increasing supply from end-users leads us to think about cash flow involved in thermal power systems from site preparation to working final installation. As 70% to 80% cost of the thermal power system setup is involved in plant mechanical equipment, electrical systems, civil work, etc., cost components of each subsystem plays vital role. Because of this, the formulation for cost analysis of thermal power plant, construction of objective function by integrating availability analysis module and thermal analysis module with constraints on redundancies on various components/subsystems had been worked out [2, 3]. Many researchers had attempted different approaches to reduce the cost function for some crucial areas in the power sector considering the current status of the economics of the country. Some approaches based on the literature are discussed in this section. Some researchers optimized condenser design parameters by taking into account condenser cost, energy generation cost and developed numerical approach in fluent code [4]. Few technologists developed real structural optimization procedures and use it for large-scale thermal power plant by taking into account the objective of minimization of total operating cost flow during installation [5]. Others compared the existing supercritical plant with an economically design plant, which suggested that the cost of electricity can be lowered by 2% to 4% by considering temperature at various stages. In comparison, efficiency can be increased by 2% [6]. Also, some researchers suggested a multi-objective multi-constraint nonlinear programming approach to study the exergoeconomic parameters considering heat, mass and pressure as parameters [7]. The results were validated by the MATLAB code. Some of the researchers modified and developed a globally accepted relation between thermodynamic losses and capital cost for newly installed coal-fired power plant [8]. The cost-effective analysis is the other key factor in the installation of coal-fired power plants. The investigation on the impact of various factors that directly affect a subcritical coal-fired power plant was performed [9]. The investigator also planned out an idea about the need for optimum burning of fuel, which could be monitor and figured out during the installation of the project itself [10]. The thermodynamic and exergoeconomic modeling indicates that maximum exergy destruction occurs at a fuel-burning chamber followed by steam carrying pipes. The study was enriched by optimization by developing a hybrid genetic teaching learning-based optimization algorithm considering the fuel cost as a minimization objective [11]. The discussion on various thermo-economic analysis from which modified productive structure and specific exergy costing was taken into account for exergetic and thermo-economic along with the cost of electricity prediction [12,13,14,15]. The specific cost of the product and the fuel found to be evaluating parameters in exergoeconomics analysis of various systems [16]. Ahmadi et al. reviewed economic analysis of different fuel thermal power plants and identified that economical optimization is complicated for coal-fired power plant [17]. The analysis of the coal-fired power plant was performed in terms of economic, environmental and exergoeconomic to increase the feasibility of thermal power plant in the future [18] [19]. The harmony Search optimization technique was used by taking into account economic, and emission as a minimization objective function, and result was compared with the PSO algorithm on the basis of minimum parameters, less computational steps and easiness of implementation [20]. The integration of exergetic principles with economic concepts determined the cost related to thermodynamic inefficiencies of an energy system. The 4 E analyses were done using city gas station to ensure vapor generator as key parameters the responsible components for exergy destructor. The unit cost and CO2 emission cost were estimated involved in the production plant of hydrogen [21]. In hydrogen liquefaction plant, exergoeconomic analysis was performed to check the feasibility of components from economic perspectives [22]. The exergoeconomic analysis also found popularity in evaluation of specific cost of blended diesel fueled direction injection engine system [23]. The SPECO approach was also seen to carry out exergoenvironmental analysis of traditional sugarcane bagasses cogeneration plant [24]. The investigator studied reduction in the exergy destruction by implementing low-pressure economizer concept in supercritical CO2 power plant and optimized thermodynamically using optimization techniques. From the economic point of view, low-pressure economizer found a favorable way for heat recovery. The payback period was estimated by performing economic analysis of the waste recovery system involved in coal-fired power plant [25]. Hofman et al. performed a comparative study of exergoeconomic and proposed a idea about secondary Rankine cycle that helped to reduce fuel dependency, reduction in emission and reduction in the cost of electricity to end-users [26]. The effect of coal cost and initial investment on the referenced cost of electricity were analyzed by comparing binary and conventional power generating coal-fired power plant. Presently, no thermal system works alone to produce the power; it is always associated with subsystems of multidisciplinary areas. Some literatures have been studied in multidisciplinary directions and is also included in the following section. The multi-objective optimization was carried out considering generation cost produced from the desalination unit integrated with the thermal power unit [27]. The economic analysis was carried out to evaluate the capital cost involved in proposing a power plant operating with natural gas as a fuel [28]. The price of electricity generated from the combined cycle power plant was taking into account as an objective function to carry out an economic analysis of power generating plant [29, 30]. The incremental variation of air temperature found significantly increasing impact on specific cost rate of steam and electricity produced from natural gas-fired cogeneration system [31]. The product cost ratio was taken into account as a minimization objective to find out suitable working fluid in case of an organic ranking cycle for thermal recovery from low-grade geothermal water [32, 33]. The modern thermal power plant operating above a critical point of water was analyzed economically on the basis of fuel tax and biomass combustion. The feasibility of plant was cross-verified by evaluating Net Present Value (NPV), the benefit to cost ratio and internal rate of return (IRR) [34]. The financial hurdles of carbon capture technology involving initial investment and penalty charges were analyzed, and incentive-based approach was proposed by some of the researchers in the literature [35, 36]. The exergoeconomic analysis was performed on 660 MW coal-fired subcritical power plant to reveal the effect of the flue gas temperature on payback period of plant. The resulted payback period was 5.02 years. The research also evaluated the exergoeconomic factor and relative cost difference for the collective system components of subcritical power plant [37]. From the literature review, it is concluded that limited work was found on economic analysis of supercritical coal-fired plant, and it is hard to manage different cash flow by any relevant empirical relations. The present study deals with economic analysis of supercritical power plant of capacity 660 MW in the form of capital cost, present worth value and net present value over a span of 30 years of project life. To accomplish the work, equipment cost and other costing data were directly taken from the actual working plant situated in western India. The semi-empirical module of economic analysis was constructed in MATLAB package. The study was extended to reveal the exergoeconomic variables for 660 MW supercritical power plant by SPECO analysis [38].

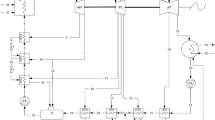

Layout and description of 660 MW supercritical coal-fired power plant

The supercritical coal-fired thermal power plant of 660 MW capacity situated in western India has been chosen for economic analysis. The schematic diagram of the 660 MW supercritical power plant is shown in Fig. 1. It consists of high-pressure, intermediate-pressure and low-pressure turbine set operating at 247 bar, 50.5292 bar and 5.8221 bar, respectively. The steam bled is extracted from each turbine section and allowed to pass through series of high-pressure and low-pressure heaters, as shown in Fig. 1B1 to B6 and C1 to C6 represents the loss occurred during the expansion of steam in turbine set. These losses are collected and allowed to pass through the condenser section. The increase in temperature from 335.6 °C to 593 °C observed in the re-heater placed between high and intermediate-pressure turbines. The wet steam coming out from a low-pressure turbine is pass through the condenser at a pressure of 0.1047 bar. The fluid coming out from the condenser is pumped through a series of the arrangement of low-pressure heaters, deaerator and high-pressure heaters before entering the once-through steam generator section. A pump drive turbine is used to drive the boiler feed pump. The values of specific enthalpy and specific entropy were formulated as per the IAPWS IF97 standard [39] and tabulated in Table 1.

Economic analysis

In the present work, an economic analysis is performed in terms of Net present value (NPV) of coal-fired plant. The net present value of the coal-fired plant is evaluated in terms of entire capital investment and total operating cost. The entire capital investment involves the overall direct and indirect costs related to the plant. The cost of each component like steam generator island, turbine island etc. as well as auxiliary components collectively as BOP mechanical is categorized under total direct cost. The other costs like civil work, ash handling unit, coal handing unit, piping work along with site preparation are added with equipment cost. The installation cost of plant and initial expenditure is categorized under indirect cost. The latest cost of components are taken into consideration to reduce complexity occur in analysis [9, 13, 34, 40]. The total direct plant cost is expressed as

The cost of equipment, CEqp, can be expressed as

Here, ‘Ni’ represents the number of spare units of pumps. The available literature indicates that cost of components in terms of total load using power law [40] and is given by

where i represent equipment involved plant.

Indirect cost is calculated as follows

Here, \(\xi\) is a factor which considers engineering and plant start-up expenses.

Total capital investment is expressed as

The present worth method converts all cash flow to a single sum equivalent at time zero by assuming an interest rate (i). Cost of fuel and Lifetime cost can be obtained in terms of present worth factor as follows

The cost data of steam generator island, turbine generator island, BOP (Balance of Plant) mechanical, BOP electrical packing, civil works, coal handling unit, ash handling unit, pipe costing are evaluated by curve fitting actual data obtained from the plant with 660 MW capacity and a varying number of unit (n) as shown in Figs. 2–9. The number of capacity unit varies from 1 to 4. The fuel cost is evaluated with respect to changing calorific value of fuel [41]. The cost involved in economic analysis are taken in Indian Rupees (Rs).1$(American Dollar) = 74.555Rs (Indian Rupees). The constants a and b are tabulated in Table 2. The linear regression-curve fitting is shown in Figs. 2–9. The steam generator BOP electrical packing, coal handling unit, ash handling unit and ash handling unit shows linear relationship with variation in plant load from 660 to 2640 MW. The BOP mechanical and Turbine generator island shows power function with variation in plant load. The civil works show exponential rise with variation in plant load.

The escalation rate value for fuel cost (F), maintenance cost (M), labor cost (L), insurance cost (I), pumping cost (P), number of labor and their salary component are taken from the literature [3, 43, 44].

Fuel Cost

Maintenance Cost

Labor Cost

Insurance Cost

Pumping Cost

Lifetime Cost

Revenue over Life span

The sum of all the present values is known as the net present value. This is done by equating each future cash flow to its current value. Net present value is calculated as follow

Exergoeconomic analysis

The specific exergy costing method (SPECO) approach is used to perform exergoeconomic analysis [38]. The first step in exergoeconomic analysis is to evaluate the exergy of the stream. The reference condition for exergy analysis is T0 = 298.15 K and P0 = 101.325 kPa [45]. The individual equipment is classified with the summation of input stream exergy (Fuel) and output stream exergy (Product). Table 3 represents the exergy stream of the fuel and product side.

The next step of exergoeconomic starts with the calculation of purchased equipment cost (PEC) for each component. The PECs for boiler, heat exchanger, turbine, condenser, deaerator and generator have been calculated with relation available in the literature [46]. The capital investment cost (CC) is determined from purchased equipment cost.

The cost balance of a productive component k is expressed as

where the term Caux, dc,k indicates the cost rate of additional working fluids, Cdiff, dc,k are charged to the cost of final product.

The specific cost of exergy loss is expressed as

The thermo-economic variables, i.e., average unit costs of the fuel CF,k and the product CP,k, the cost rate of exergy destruction CD,k, the summation (CD + Z)k, the relative cost difference rk and the exergoeconomic factor fk, are calculated. Table 4 represents the formulation of main exergoeconomic and auxiliary equation to the evaluate cost flow of each stream.

The relative cost difference rk and exergoeconomic factor fk are the exergoeconomic variables.

The relative cost difference is expressed in terms of cost per exergy for fuel and product side of components. The exergoeconomic factor fk is expressed in terms of nonexergy-related costs and exergy destruction.

The MATLAB package is used to simulate economic and exergoeconomic analysis. Figure 10 represents the flowcharts of the methodology for economic and exergoeconomic analysis. The economic and exergoeconomic analysis is carried out by using present worth method and SPECO approach.

Results and discussion

Economic analysis

The economic analysis of 660 MW Plant is carried out to reveal the behavior of the lifetime cost of necessary components. The plant life of 30 years and present interest rate of 9% is taken into account for this analysis [3]. The lifetime cost increases with plant life as, shown in Fig. 11. The cost related to pumping and labor shows the least increment as compared with other lifetime costs. The fuel cost increases from 1171.6 crores to 5169.26 crores with 30 years of life span.

The previous similar study was conducted on subcritical power plant of 250 MW capacity, which results in a payback period of 10 years [3]. The current research of supercritical proved to be more feasible as payback period reduces to 4.5 years, as shown in Fig. 12. Total revenue increases up to 31,640 INR crores over a span of 30 years. The total capital cost remains nearly steady as compared with operating costs. The supercritical plant generates revenue and gives the profit after 4.5 years of commencement.

The economic study was extended to lifetime cost plotted with respect to varying plant load from 198 to 660 MW. The situation occurs where plant need to run under capacity for long-duration depends upon the demand requirement. It is necessary to study the behavior of the lifetime cost of the supercritical plant with varying loads. Figure 13 shows that, except labor and pumping cost, all other costs improve with plant load varying from 198 MW to 660 MW. Figure 14 represents revenue goes on increasing as the plant operates to its maximum capacity. The revenue generated varying plant load increased from 8736.54 crores to 29,121.8 crores. The revenue generated is 2.92 times greater for supercritical power plant than the subcritical power plant of capacity 210 MW [40].

The prediction of lifetime cost with respect to the varying interest rate is performed in the present study. The increase in interest rate causes a decrease in lifetime cost specifically for fuel cost and maintenance cost. The other cost shows the least decrement for varying interest rate. The annual interest rate from 9 to 15% is considered for the study, as shown in Fig. 15. Also, the revenue generated from the plant shows the decrement curve for an increase in the interest rate, as shown in Fig. 16.

The payback period obtained in this study of 660 MW supercritical unit can be compared with results from other power generation systems, as presented in Table 5. The supercritical power plant remains dominant over subcritical power plant with respect to the payback period. Lesser the payback period, more will be the revenue generated throughout plant life.

Exergoeconomic analysis

The present study also includes exergoeconomic analysis of 660 MW supercritical power plant. The purchased equipment cost evaluated during the economic analysis was considered as the external attributes. The square matrix of [41] was constructed by considering the main and auxiliary equations in order to find the cost flow at the various streams of the plant. The fuel and product side cost flow was computed for major equipment present in the 660 MW Plant. The first step involved in exergoeconomic analysis is to evaluate the exergy of fuel and product side of each equipment present in the plant. Table 6 represents the exergy of the fuel and product side of components. Table 7 gives the values of the cost of equipment per unit exergy for the product, fuel flows and respective cost of destruction of components. The steam generator contributes to major cost destructive component followed by generator.

The purchased equipment cost (PEC) of components are evaluated from the available literature relations [46, 51]. Table 8 represents the PEC of the various components. The capital recovery factor of 0.09733 has been evaluated by considering the interest rate of 9% and the number of years as 30. Assuming 6900 annual plant operating hours and a factor αq = 1.06 is considered in the account of maintenance cost for each plant component [52], the cost rate has been evaluated as, shown in Table 8. The cost rate of all set of turbines contributes to be maximum as compared with other components. The largest capital cost rate is observed in intermediate-pressure turbine (1530$ H−1) followed by high (1310.09$ H−1) and low (1293.21$ H−1) pressure turbine.

The relative cost difference and exergoeconomic factor are presented in Figs. 17,18. The maximum relative cost difference in boiler (124.4%) followed by condenser (84.8%) and dearator (42.4%). The steam generator contributes to maximum exergy destruction and lower capital cost rate while the high-pressure heater and turbine contribute lower exergy destruction but high capital cost rate. The trend of relative cost difference decreases as it moves from boiler to high-pressure heaters. The component having work as the product shows lower relative cost difference ranging from 3.5 to 6.5%. The component having work as the fuel shows higher relative cost difference as compared with turbines ranging from 12 to 27%. The exergoeconomic factor signifies the performance of components. The exergoeconomic factor for turbines (above 90%), condenser (64%) and high-pressure heater 1(71%) is maximum, which implies to decrease investment cost of these components at the expense of exergetic efficiency. A high exergoeconomic factor (71%) and lower relative cost difference (1.5%) indicates that performance of high-pressure heater 1 can be improved by reducing exergy destruction rate. The components such as boiler feed pump (50%), condensate extraction pump (54%) exhibit lower exergoeconomic factor which indicates that cost saving of the overall plant can be achieved by reducing their exergy destruction rate. The remaining components, such as a steam generator, low-pressure heaters, dearator, and generator, have exergoeconomic factors within the permissible range.

Conclusions

In this paper, the economic and exergoeconomic semi-empirical model of a 660 MW coal-fired power plant was established. The economic analysis reveals that the lifetime cost of decreases with an increase in annual interest rate. The revenue generated from the 660 MW supercritical coal-fired power plant is 2.92 times higher than the subcritical coal-fired power plant of capacity 210 MW. The fuel cost is found to be one of the independent variable which gets affected by the grade of coal used. The economic analysis indicates the payback period for a supercritical power plant is 4.5 years. The specific exergy costing method is used to perform exergoeconomic analysis of the 660 MW power plant. The relative cost difference for the steam generator evaluated to be 124%, which implies that the maximum exergy destruction rate and capital cost rate occur in the steam generator. Following conclusions have been drawn from exergoeconomic analysis

-

The capital cost of the components such as turbine set and condenser set can be decrease in expense of exergetic efficiency.

-

The higher exergoeconomic factor and lower relative cost difference indicates that high-pressure heater 1 performance can be increase by reducing exergy destruction rate.

-

The condensate extraction pump and boiler feed boiler having work as fuel shows significant higher relative cost difference.

The results of the economic and exergoeconomic analysis can be implemented as input for overall economical optimization of supercritical power plant.

Abbreviations

- HPTur.:

-

High-pressure turbine

- IPTur.:

-

Intermediate-pressure turbine

- LPTur.:

-

Low-pressure turbine

- Gen.:

-

Generator

- Cond.:

-

Condenser

- CEPump:

-

Condensate extraction pump

- BFPump:

-

Boiler feed pump

- LPHe:

-

Low-pressure heater

- Dear.:

-

Dearator

- PDTur.:

-

Pump drive turbine

- DC:

-

Drain cooler

- SG:

-

Steam generator

- RH:

-

Reheater

- LCA:

-

Life cycle assessment

- SPECO:

-

Specific exergy costing

- F and P :

-

Fuel and product

- IAPWS:

-

International association for the properties of water and steam

- W revhpt, W revipt, W revlpt :

-

Work output from high, intermediate and low-pressure turbine

- BOP:

-

Balance of plant

- C :

-

Cost

- h :

-

Specific enthalpy (kJ kg−1)

- s :

-

Specific entropy (kJ kg−1 K−1)

- E x :

-

Exergy flow of stream

- r k :

-

Relative cost difference

- f k :

-

Exergoeconomic factor

- ξ :

-

Engineering and plant start-up expenses

- NPV:

-

Net present value

- PWF:

-

Present worth factor

- PEC:

-

Purchased equipment cost

- C x :

-

Specific cost of exergy

- Z x :

-

Levelized cost rates

References

Kumar R, Ojha K, Ahmadi MH, Raj R, Aliehyaei M, Ahmadi A, et al. A review status on alternative arrangements of power generation energy resources and reserve in India. Int J Low-Carbon Technol. 2019;15:1–17.

Kumar R, Jilte R, Ahmadi MH, Kaushal R. A simulation model for thermal performance prediction of a coal-fired power plant. Int J Low-Carbon Technol. 2019;14:122–34.

Kumar R, Ahmadi MH, Rajak DK. The economic viability of a thermal power plant: a case study. J Therm Anal Calorim. 2020. https://doi.org/10.1007/s10973-020-09828-z.

Bekdemir Ş, Öztürk R, Yumurtac Z. Condenser optimization in steam power plant. J Therm Sci. 2003;12:176–8.

Seyyedi SM, Ajam H, Farahat S. A new approach for optimization of thermal power plant based on the exergoeconomic analysis and structural optimization method: application to the CGAM problem. Energy Convers Manag. 2010;51:2202–11.

Tang Y, Tu S, Du Y, Wang C, Wang H. Economic analysis of a 660 MW supercritical turbine for steam initial parameters. Adv Mater Res. 2014;961:1550–3.

Wu L, Wang L, Wang Y, Hu X, Dong C. Component and process based exergy evaluation of a 600 MW. Energy Proc. 2014;61:2097–100. https://doi.org/10.1016/j.egypro.2014.12.084.

Manesh MHK, Navid P, Baghestani M, Abadi SK, Rosen MA, Blanco AM, et al. Exergoeconomic and exergoenvironmental evaluation of the coupling of a gas fired steam power plant with a total site utility system. Energy Convers Manag. 2014;77:469–83. https://doi.org/10.1016/j.enconman.2013.09.053.

Kumar R, Sharma AK, Tewari PC. Thermal performance and economic analysis of 210 MWe coal-fired power plant. J Termodyn. 2014. https://doi.org/10.1155/2014/520183.

Bolatturk A, Coskun A, Geredelioglu C. Thermodynamic and exergoeconomic analysis of Çayirhan thermal power plant. Energy Convers Manag. 2015;101:371–8. https://doi.org/10.1016/j.enconman.2015.05.072.

Güçyetmez M, Çam E. A new hybrid algorithm with genetic-teaching learning optimization (G-TLBO) technique for optimizing of power flow in wind-thermal power systems. Electr Eng. 2016;98:145–57.

Park SH, Kim JY, Yoon MK, Rhim DR, Yeom CS. Thermodynamic and economic investigation of coal-fired power plant combined with various supercritical CO2 Brayton power cycle. Appl Therm Eng. 2018;130:611–23. https://doi.org/10.1016/j.applthermaleng.2017.10.145.

Kumar R. A critical review on energy, exergy, exergoeconomic and economic (4-E) analysis of thermal power plants. Eng Sci Technol Int J. 2017;20:283–92. https://doi.org/10.1016/j.jestch.2016.08.018.

Javadi MA, Ahmadi MH, Khalaji M. Exergetic, economic, and environmental analyses of combined cooling and power plants with parabolic solar collector. Environ Prog Sustain Energy. 2019. https://doi.org/10.1002/ep.13322

Marquesd A da S, Carvalho M, Lourenço AB, dos Santos CAC. Energy, exergy, and exergoeconomic evaluations of a micro-trigeneration system. J Braz Soc Mech Sci Eng. 2020. https://doi.org/10.1007/s40430-020-02399-y.

Souza RJ, Dos Santos CAC, Ochoa AAV, Marques AS, Neto J, Michima PSA. Proposal and 3E (energy, exergy, and exergoeconomic) assessment of a cogeneration system using an organic Rankine cycle and an absorption refrigeration system in the Northeast Brazil: thermodynamic investigation of a facility case study. Energy Convers Manag. 2020;217:113002. https://doi.org/10.1016/j.enconman.2020.113002.

Ahmadi MH, Alhuyi Nazari M, Sadeghzadeh M, Pourfayaz F, Ghazvini M, Ming T, et al. Thermodynamic and economic analysis of performance evaluation of all the thermal power plants: a review. Energy Sci Eng. 2019;7:30–65.

Uysal C, Kurt H, Kwak HY. Exergetic and thermoeconomic analyses of a coal-fired power plant. Int J Therm Sci. 2017;117:106–20. https://doi.org/10.1016/j.ijthermalsci.2017.03.010.

Chen C, Zhou Z, Bollas GM. Dynamic modeling, simulation and optimization of a subcritical steam power plant. Part I: Plant model and regulatory control. Energy Convers Manag. 2017;145:324–34. https://doi.org/10.1016/j.enconman.2017.04.078.

Damodaran SK, Kumar TKS. Economic and emission generation scheduling of thermal power plant incorporating wind energy. In: IEEE Reg 10 annual international conference on proceedings/TENCON. 2017;2017-Dec 1487–92.

Ghaebi H, Farhang B, Rostamzadeh H, Parikhani T. Energy, exergy, economic and environmental (4E) analysis of using city gate station (CGS) heater waste for power and hydrogen production: a comparative study. Int J Hydrog Energy. 2018;43:1855–74. https://doi.org/10.1016/j.ijhydene.2017.11.093.

Ansarinasab H, Mehrpooya M, Sadeghzadeh M. An exergy-based investigation on hydrogen liquefaction plant-exergy, exergoeconomic, and exergoenvironmental analyses. J Clean Prod. 2019;210:530–41.

Cavalcanti EJC, Carvalho M, Ochoa AAV. Exergoeconomic and exergoenvironmental comparison of diesel-biodiesel blends in a direct injection engine at variable loads. Energy Convers Manag. 2019;183:450–61. https://doi.org/10.1016/j.enconman.2018.12.113.

Cavalcanti EJC, Carvalho M, da Silva DRS. Energy, exergy and exergoenvironmental analyses of a sugarcane bagasse power cogeneration system. Energy Convers Manag. 2020;222:113232. https://doi.org/10.1016/j.enconman.2020.113232.

Liu M, Zhang X, Ma Y, Yan J. Thermo-economic analyses on a new conceptual system of waste heat recovery integrated with an S-CO2 cycle for coal-fired power plants. Energy Convers Manag. 2018;161:243–53. https://doi.org/10.1016/j.enconman.2018.01.049.

Hofmann M, Tsatsaronis G. Comparative exergoeconomic assessment of coal-fired power plants—binary rankine cycle versus conventional steam cycle. Energy. 2018;142:168–79. https://doi.org/10.1016/j.energy.2017.09.117.

Fathia H, Tahar K, Yahia B, Brahim B. Exergoeconomic optimization of a double effect desalination unit used in an industrial steam power plant. Desalination. 2018;438:63–82.

Farooqui A, Bose A, Ferrero D, Llorca J, Santarelli M. Techno-economic and exergetic assessment of an oxy-fuel power plant fueled by syngas produced by chemical looping CO2 and H2O dissociation. J CO2 Util. 2018;27:500–17. https://doi.org/10.1016/j.jcou.2018.09.001.

Ameri M, Mokhtari H, Mostafavi Sani M. 4E analyses and multi-objective optimization of different fuels application for a large combined cycle power plant. Energy. 2018. https://doi.org/10.1016/j.energy.2018.05.039.

Mohammadi A, Vandani K, Bidi M, Ahmadi MH. Energy, exergy and environmental analyses of a combined cycle power plant under part-load conditions. Mech Ind. 2016;17:1–14.

Cavalcanti EJC, De Souza GF, Lima MSR. Evaluation of cogeneration plant with steam and electricity production based on thermoeconomic and exergoenvironmental analyses. Int J Exergy. 2018;25:203–23.

Noroozian A, Naeimi A, Bidi M. Exergoeconomic comparison and optimization of organic Rankine cycle, trilateral Rankine cycle and transcritical carbon dioxide cycle for heat recovery of low-temperature geothermal water. J Power Energy. 2019;0:1–17.

Chahartaghi M, Kalami M, Ahmadi MH, Kumar R, Jilte R. Energy and exergy analyses and thermoeconomic optimization of geothermal heat pump for domestic water heating. Int J Low-Carbon Technol. 2019;14:108–21.

Hoon S, Hee T, Mun S, Min J. Economic analysis of a 600 mwe ultra supercritical circulating fluidized bed power plant based on coal tax and biomass co-combustion plans. Renew Energy. 2019;138:121–7. https://doi.org/10.1016/j.renene.2019.01.074.

Kumar R, Jilte R, Nikam K. Status of carbon capture and storage in India’ s coal fired power plants : a critical review. Environ Technol Innov. 2019;13:94–103. https://doi.org/10.1016/j.eti.2018.10.013.

Kumar R, Ahmadi MH, Rajak DK, Nazari MA. A study on CO2 absorption using hybrid solvents in packed columns. Int J Low-Carbon Technol. 2019;14:561–7.

Tontu M, Sahin B, Bilgili M. An exergoeconomic–environmental analysis of an organic Rankine cycle system integrated with a 660 MW steam power plant in terms of waste heat power generation. Energy Sour Part A Recover Util Environ Eff. 2020;0:1–22. https://doi.org/10.1080/15567036.2020.1795305.

Lazzaretto A, Tsatsaronis G. SPECO: a systematic and general methodology for calculating efficiencies and costs in thermal systems. Energy. 2006;31:1257–89.

Wagner WKH. IAPWS industrial formulation 1997 for the thermodynamic properties of water and steam. In: International Steam Tables. Springer, Berlin; 2008. p. 7–150.

Kumar R, Sharma AK, Tewari PC. Cost analysis of a coal-fired power plant using the NPV method. J Ind Eng Int. 2015;11:495–504.

Tongia R, Gross S. Coal in India: adjusting to transition [Internet]. 2019. Available from: https://www.brookings.edu/wp-content/uploads/2019/03/Tongia_and_Gross_2019_Coal_In_India_Adjusting_To_Transition.pdf.

Dincer I, Rosen MA. Exergoeconomic analysis of thermal systems. Exergy. 2013;393–422. https://doi.org/10.1016/B978-0-08-097089-9.00020-6.

Yan L, Wang Z, Cao Y, He B. Comparative evaluation of two biomass direct-fired power plants with carbon capture and sequestration. Renew Energy. 2020;147:1188–98. https://doi.org/10.1016/j.renene.2019.09.047.

Yan L, Cao Y, He B. Energy, exergy and economic analyses of a novel biomass fueled power plant with carbon capture and sequestration. Sci Total Environ. 2019;690:812–20. https://doi.org/10.1016/j.scitotenv.2019.07.015.

Kumar A, Nikam KC. An exergy analysis of a 250 MW thermal power plant. Renew Energy Res Appl. 2020;1:197–204.

Wang L, Yang Y, Dong C, Morosuk T, Tsatsaronis G. Multi-objective optimization of coal-fired power plants using differential evolution. Appl Energy. 2014;115:254–64. https://doi.org/10.1016/j.apenergy.2013.11.005.

Mehrpooya M, Taromi M, Ghorbani B. Thermo-economic assessment and retrofitting of an existing electrical power plant with solar energy under different operational modes and part load conditions. Energy Rep. 2019;5:1137–50. https://doi.org/10.1016/j.egyr.2019.07.014.

Vu TT, Lim YI, Song D, Mun TY, Moon JH, Sun D, et al. Techno-economic analysis of ultra-supercritical power plants using air- and oxy-combustion circulating fluidized bed with and without CO2 capture. Energy. 2020;194:116855. https://doi.org/10.1016/j.energy.2019.116855.

Liu Y, Li Q, Duan X, Zhang Y, Yang Z, Che D. Thermodynamic analysis of a modified system for a 1000 MW single reheat ultra-supercritical thermal power plant. Energy. 2018;145:25–37. https://doi.org/10.1016/j.energy.2017.12.060.

Gai S, Yu J, Yu H, Eagle J, Zhao H, Lucas J, et al. Process simulation of a near-zero-carbon-emission power plant using CO2 as the renewable energy storage medium. Int J Greenh Gas Control. 2016;47:240–9. https://doi.org/10.1016/j.ijggc.2016.02.001.

Fu P, Wang N, Wang L, Morosuk T, Yang Y, Tsatsaronis G. Performance degradation diagnosis of thermal power plants: a method based on advanced exergy analysis. Energy Convers Manag. 2016;130:219–29. https://doi.org/10.1016/j.enconman.2016.10.054.

Singh OK, Kaushik SC. Exergoeconomic analysis of a Kalina cycle coupled coal-fired steam power plant. Int J Exergy. 2014;14:38–59.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Nikam, K.C., Kumar, R. & Jilte, R. Economic and exergoeconomic investigation of 660 MW coal-fired power plant. J Therm Anal Calorim 145, 1121–1135 (2021). https://doi.org/10.1007/s10973-020-10213-z

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10973-020-10213-z