Abstract

Labor flows are important channels for knowledge spillovers between firms; yet competing arguments provide different explanations for this mechanism. Firstly, productivity differences between the source and recipient firms have been found to drive these spillovers; secondly, previous evidence suggests that labor flows from multinational enterprises provide productivity gains for firms; and thirdly, industry relatedness across firms have been found important, because industry-specific skills have an impact on organizational learning and production. In this paper, we aim to disentangle the effects of productivity gap, multinational experience and industry relatedness in a common framework. Hungarian employee–employer linked panel data from 2003–2011 imply that the incoming labor from more productive firms is associated with increasing future productivity. The impact of multinational spillovers cannot be confirmed, once productivity differences between the firms are taken into account. Furthermore, we find that flows from related industries outperform the effect of flows from same and unrelated industries even if we control for the effects of productivity gap and multinational spillovers.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Following Arrow (1962), worker mobility has long been considered a major source of knowledge flow across firms: the hiring firm benefits from the embodied knowledge and skills of incoming labor, which has a positive effect on wages and productivity in the recipient company (Almeida and Kogut 1999; Zucker et al. 2002; Palomeras and Melero 2010; Stoyanov and Zubanov 2014). It is widely accepted that skills gained at the source firm matters for the productivity gains of the recipient firm; and the knowledge spillover conveyed by labor flows and its impact on firm’s productivity is affected by individual, firm-level, and environmental attributes (Mawdsley and Somaya 2016). Here we focus on three complementary factors of firm-level attributes that have been found critical in facilitating or constraining the impact of inter-firm knowledge transfer through labor mobility.

First, Stoyanov and Zubanov (2012) argue that the experience gained from efficient production is important and claim that the influence of new workers is stronger if they arrive from more productive firms. Second, scholars argue that labor mobility from foreign-owned or multinational enterprises (MNEs) to domestic companies is an efficient channel for productivity spillovers, because the experience of previous MNE workers regarding production technologies, marketing and management processes provide extra gains for the domestic firms that hire them (Balsvik 2011; Gorg and Strobl 2005; Poole2013). Third, the degree of technological relatedness of skills between the source and recipient firms have been found important and empirical results suggest that those new skills provide the most benefits that are related but not identical to the existing skills of the recipient firm (Boschma et al. 2009; Timmermans and Boschma 2014).

Despite the well-developed literature shortly summarized above, the effects and the interactions of relative productivity, multinational spillovers and relatedness of skills have not been looked at in a common framework. The aim of our paper is to test these mechanisms together. To do this, we analyze a matched employer-employee dataset that covers the 2003–2011 period and the full horizon of Hungarian firms.

In addition to verifying all the above arguments separately, we contribute to the literature in two ways. First, our analysis reveals that the effect of multinational spillovers disappears when productivity differences are introduced into the model. This finding implies that labor flows from MNEs do not boost local economy per se and labor mobility matters only from those MNEs that are more productive than their host economy. Second, we found that the similarities of knowledge base of the source and recipient firms exert an additional positive effect on productivity. The effect of related labor flows remain positive and significant even if the productivity gap and multinational spillovers are controlled for.

The structure of the paper is as follows. In the following section we summarize the conceptual framework and theoretical background of our research. The structure of the data and the main patterns of labor flows are presented in Sect. 3. The baseline empirical model focusing on productivity differences is introduced and implemented in Sect. 4, which is extended by multinational spillovers in Sect. 5. The measurement for relatedness of skills across industries is introduced in Sect. 6, where we further extend the empirical model and discuss results regarding industry-specific skills. The main conclusions are drawn in Sect. 7.

2 Conceptual framework and related literature

Mawdsley and Somaya (2016) suggest an integrative conceptual framework of employee mobility research. According to this, the content transferred by labor mobility between firms is a central element. Mobile employees convey their human capital when they move between firms, which includes their knowledge, skills, competencies and expertness they gained through formal education and experiential learning. Therefore, the most rewarding for firms is hiring high performers: talents, star employees and executives or inventors (Groysberg et al. 2008; Palomeras and Melero 2010; Teece 2003), who may bring outstanding managerial, professional or occupational human capital and thus can extensively improve the new firm’s performance. However, Campbell et al. (2012) and Carnahan et al. (2012) revealed that if employees with extreme high performance leave a firm, they are more likely to create new ventures instead of joining another firm, and that an appropriate compensation schedule can minimize the hazard of employee entrepreneurship of high performing employees. Nonetheless, not only star employees and executives are valuable for firms; the experience, skills, tacit knowledge of specialized practices, processes, and technologies the mobile employees gain at the source firm all add to the capabilities of the recipient firm (Dokko et al. 2009; Song et al. 2003).

Mawdsley and Somaya (2016) highlight that the labor mobility and its impact on organizational outcomes are conditioned by three contextual layers: the individual attributes of the mobile employees, the attributes of the source and destination firms, and the features of the broader environment. In this paper we focus on the attributes of the source and destination firms and reflect on three complementary theories on how the capabilities gained at the sending firm are conveyed through labor mobility and are integrated into the processes of value production of the recipient firm. In the remainder of this section, we provide an overview of the “Productivity gap”, “Multinational spillover” and “Industry relatedness” approaches and introduce the hypotheses accordingly.

2.1 Productivity gap

Stoyanov and Zubanov (2012) shows that incoming workers have positive influence on the productivity of the recipient company if hired away from a more productive firm, because their experience of efficient production might be implemented in the production process or can diffuse in the recipient firm and increase the productivity of incumbent employees as well.

However, according to the extant literature, it is far from trivial that the productivity gap effect is universally present regardless from the structure of the labor market. One counter-example is Germany where Stockinger and Wolf (2016) found no evidence for the productivity gap effect. Therefore, it is important to test the theory in an economy with different level of development and historical context from Denmark where the original model was developed (Stoyanov and Zubanov 2012). Our case refers to Hungary that, like other countries in Central and Eastern Europe, went through a rapid skill-biased technological change and an intense influx of MNEs in the 90 and 2000 s, before joining the EU.

Our first hypothesis refers to the positive impact of hiring workers from more productive firms:

H1

Incoming employees with similar levels of human capital increase the productivity of the recipient firm to a greater extent if they have been hired away from more productive firms.

2.2 Multinational spillovers

Labor mobility is frequently used to illustrate the presence of productivity spillovers from foreign-owned or multinational enterprises (MNEs) to domestic companies (Fosfuri et al. 2001). This mechanism is especially important in developing and catching-up economies, where several policy instruments are used to attract and retain multinationals (Blomström and Kokko1998). Multinational companies spend more on R&D, utilize more intangible assets such as patents and new technologies; are much more involved in international trade than domestic ones, and outperform them in productivity as well (Arnold and Javorcik 2009). Theoretical models suggest three channels that contribute to productivity spillovers from multinationals: demonstration effects, when domestic companies develop by imitating multinationals, competition effects and knowledge transfer through labor mobility (Djankov and Hoekman 2000; Gorg and Strobl 2005). Previous research in Hungary found spillover effects from MNEs to domestic companies by looking at the productivity dynamics of co-locating companies (Halpern and Muraközy 2007); however, only highly productive domestic firms enjoy these positive externalities (Békés et al. 2009).

Considering the mechanisms of spillovers through employee mobility, Görg & Strobl (2005) show that the domestic firms whose owners worked for MNEs in the same industry are more productive than other domestic firms, however, receiving training in the multinational environment was not found to have additional effect. Mion and Opromolla (2014) show that export experience of managers acquired at the source firm influences the export performance of the recipient firm. Maliranta et al. (2009) finds that the mobility of R&D personnel has positive effect on the recipient firm’s productivity, if they are employed in non-R&D jobs. Balsvik (2011) finds that the private reward of moving from MNEs to non-multinational firms is far less than the productivity premium they cause at the hiring non-multinational firm. Poole (2013) identifies an increase in incumbent domestic workers’ wages after hiring employees with some experience at a multinational establishment as evidence of knowledge transfers from multinationals to domestic firms.

However, mechanisms, such as training, R&D activity, or successful export activity condense in labor productivity; thus, it is not clear how multinational spillovers add to the effect of productivity gap. Therefore, we aim to test how these two mechanisms prevail together and based on the previous literature, propose that the multinational spillover effects sustain.

H2

Incoming employees from MNEs have higher impact on the productivity of recipient firms than employees from coming from domestic firms, even if the productivity gap between the source and recipient firms is controlled for.

2.3 Industry relatedness

Following Becker (1964), the human capital theory claims the human capital transferred by mobile employees consist of general and firm-specific components. Accordingly, labor is not homogeneous but specific to the firm (Becker 1962, 1964; Mincer 1974; Jovanovic 1979a, b; Flinn 1986; Topel and Ward 1992), to the occupation (Kambourov and Manovskii 2009a, b) or both to the firm and occupation (McCall 1990; Miller 1984; Neal 1999; Pavan 2011) to the tasks performed (Poletaev and Robinson 2008; Gathman and Schoenberg 2010; Nedelkoska and Neffke 2010). However, according to some studies, human capital proved being industry-specific rather than firm-specific (Neal 1995; Parent 2000; Sullivan 2010).

In this paper, we will take the industry-specific human capital approach (Neal 1995; Parent 2000; Sullivan 2010) by arguing that similarity across industries in terms of dominant knowledge and skills matters for productivity spillovers transmitted by labor mobility. The rationale behind the expectation is that workers moving across industries use some of their previous experience in their new firm in a new industry, which might be more efficient if the knowledge and skills of the mobile employee are similar to the ones needed at the company (Neffke et al. 2016). Further, industry-specific human capital and the opportunity costs of jobs switching—due to the imperfect utilization of skills in the new workplace—might also constrain inter-industry labor movements. On this base, we posit that highly qualified workers are more likely to move to technologically related industries then low-skill workers because their opportunity cost is higher. Thus, human capital of mobile workers and technological relatedness of industries are interdependent factors and drive the impact of labor flows jointly. In the matter of organizational impacts of labor mobility, a certain degree of similarity is useful between the technological knowledge environment in the receiving company and the new knowledge and skills conveyed by the incoming labor flow. This is because new employees might understand and accomplish tasks more easily when they have developed related skills previously and also because incumbent workers might absorb the new knowledge more easily if the new knowledge is related to their extant knowledge (Boschma et al. 2009; Timmermans and Boschma 2014). There is a trade-off between learning new routines, practices, processes, insights from the incoming employees and ease of integration of them. On the one hand, new knowledge and novel thinking yields new valuable capabilities for the hiring firm, but on the other hand, similarities across firms in terms of demanded knowledge and skills might facilitate the adoption and spread of new knowledge (Herstad et al. 2015; Maliranta et al. 2009; Tzabbar et al. 2013, 2015).

Empirical findings suggest that the incoming workforce has to bring a certain amount of novelty to the firm as well in order to obtain productivity gains (Boschma 2005); for example, innovating firms need to hire new inventors who possess expertise that is new to the firm (Rosenkopf and Almeida 2003; Song et al. 2003). However, too high knowledge overlap between the source and destination firms leads to redundant knowledge which might reduce the positive impact of productivity gap between the source and destination firms (Maliranta et al. 2009), while the heterogeneous technological knowledge might intensify the positive effect of knowledge spillover (Rosenkopf and Almeida 2003; Song et al. 2003). Therefore, previous results suggest that the recipient firm benefits the most when the incoming workers arrive from related but not the same industries (Boschma et al. 2009; Timmermans and Boschma 2014). A remaining puzzle is if these findings hold when the productivity gap and multinational spillovers are also considered.

H3

Incoming employees from related industries have higher impact on the productivity of recipient firms than employees from the same and unrelated industries, even if the productivity gap between the source and recipient firms and multinational spillovers are controlled for.

3 Data

We have access to the Hungarian administrative data integration database, which is an anonymized employer-employee linked panel dataset created by matching five administrative data sources, for the years 2003–2011, developed by the databank of HAS CERS. The database contains a 50% random sample of the population aged 15–74 living in Hungary in 2003 and the involved employees are traced over the period. The most important demographic features of the employees (gender, age, place of residence in the year of entry), and information about their employment spells (months worked, ISCO-88 occupation code, monthly wage) as well as company characteristics (4-digit industry code according to the NACE’08 classification, number of employees, and specific rows of their balance sheets and financial statements including tangible assets, equity owned by private domestic, private foreign, and state owners, sales, pre-tax profits, material-type costs, personnel expenditures, the wage bill) are known. All monetary variables are deflated by yearly industry-level producer price indices to calculate their real 2011 value.

The data is managed by the Databank of the Institute of Economics of the Hungarian Academy of Sciences and can be accessed for scientific research upon individual request. For more details consult http://adatbank.krtk.mta.hu/adatbazisok_allamigazgatasi_adatok.

Data manipulation included two steps. First, we created yearly matrices from the monthly intercompany movements of employees. Details of the first step can be found in the “Appendix”. Second, we excluded those worker movements where spin-offs, mergers and acquisitions or reorganizations were suspected to be the reason for the change in company ID instead of real labor movements. Following Neffke et al. (2016), we identified these spurious labor flows when (1) all employees of a firm with 5 or less employees moved to another firm with identical ID; (2) at least 80% of the employees of a firm with more than 5 employees moved to another firm with identical ID; (3) at least 100 employees “moved” between two firms within 1 year. Furthermore, we excluded firms with less than 2 employees, firms with extremely high productivityFootnote 1, and firms that did not receive incoming workers from the private sector. This procedure resulted in 652,289 individual job switches and 70,771 firm-year combinations during the observed period (Table 1).

4 The productivity gap effect

4.1 Baseline model

We measure firm productivity by the natural logarithm of value added per worker, standardized with industry-year averages. To quantify productivity spillovers, we use the productivity gap between source and recipient firms according to the formulation of Stoyanov and Zubanov (2012). Thus we calculate the average difference between the source firms’ and recipient firm’s productivity, weighted by the number of incoming workers from source firm i; and multiply this number by the share of new workers within the total number of employees at the recipient firm:

where \( A_{i,t} \) and \( A_{j,t} \) denote the logarithm of labor productivity standardized with industry-year averages of the source firm i and the recipient firm j at time t, respectively, \( H_{j,t + 1} \) is the number of new workers in the recipient firm j, and \( N_{j,t + 1} \) is the total number of employees in the recipient firm j. Note that in Eq. (1) we calculate productivity differences between the source and the recipient firms in time t (before the mobility happened), and take the average of these for the newly arrived workers at the recipient firm after the mobility (time t + 1).

Figure 1 illustrates the connections between the yearly changes in productivity of the recipient firm on the basis of the average productivity difference between the recipient firm and the source firms in a bivariate analysis. The average productivity difference has been transformed with the formula ex–1, so that labor inflows arriving from at least 65% more productive firms take the value of 0.5 on the horizontal axis. Productivity growth is also transformed in a similar way. Subfigures are separated by the share of new workers within the employees of the recipient firm. One can observe that a higher productivity difference is associated with higher productivity growth, which suggests that workers arriving from a more productive firm have a higher positive effect on the productivity of the recipient firm. When labor inflows constitute a greater share of the workforce of the recipient firm, the effect of the productivity difference is bigger. In the extreme case when labor inflows reach at least 30% of the number of employees in the recipient firm, a positive productivity difference of at least 65% is associated with a 50–55% increase in the productivity of the recipient firm. The connection is also significant for the negative productivity difference, but the effect seems to be smaller.

When exploring how different labor flows affect the productivity of firms, we have to consider several alternative explanations. The first problem arises when a firm alters the combination of inputs, for example invests into more efficient production facilities without changing the labor force, which automatically increases the labor productivity of the firm. Therefore, the quantity of capital must be controlled for together with labor inflow and outflow. The second problem is the effect of exogenous demand and industry-specific shocks on value added per worker, because a positive demand shock may increase the value added per capita even if a firm does not employ new workers simply because sales are growing. To control for this effect, we will use industry-region-year fixed effects in the pooled OLS regression models. The third problem is the self-selection of workers, because the human capital of incoming workers might be correlated with the productivity of the source firm, which might confound our estimates on the effect of the productivity gap between the source and recipient firms. We may also assume an endogenous connection between productivity growth and the quality of incoming workers, if a priori expectations on future firm productivity attract more productive workers to firms with better growth potential (e.g. a new project a firm just landed is not yet visible in productivity but may be already known for aspiring workers), which may result in a reverse causality between the quality of new hires and the future productivity of the recipient firm.

In order to remedy the problem of worker self-selection and to control for the objectionable correlations of the human capital of the moving workforce with the productivity levels of firms, we include the average human capital of the recipient firms for years t and t + 1 in the productivity growth estimation. In calculating human capital, we follow the idea of Abowd et al. (1999), which we found the most readily applicable to our data. Since we do not know the exact locations of establishments, the dynamics in the geographical mobility of employees and their acquisition of new skills, we consider problematic to model individual worker assortativeness to establishments based on expected wage level (Card et al. 2013). Deploying the method of Abowd et al. (1999), our results also remain comparable with those of Stoyanov and Zubanov (2012).

The corresponding wage equation is specified as

where wm,j,t denotes the natural logarithm of the wage of worker m working for firm j at time t, \( z_{m,t} \) stands for the vectors of worker m’s time-variant attributes (age, age-squared, 1-digit occupation code) at time t, \( \theta_{m } \) represent their time-invariant personal characteristics, and \( \varphi_{j } \) is the firm fixed effect. The wage equation is estimated using a panel regression with employee and employer fixed effects, with Correia (2016)’s multi-dimensional fixed-effects approach and the Stata command reghdfe.

Using this approach, the human capital of workers is calculated from the predicted values of worker-specific component of Eq. (2):

for each worker. This way we are able to include the average wage gain due to the observable attributes of the workers (such as age, included in the term \( z_{m,t} \beta ) \), together with their unobserved human capital characteristics, \( \theta_{m } \). In fact this \( \theta_{m } \) worker-level fixed-effect in the wage equation estimates the bonus that employees receive in wage compared to their co-workers with similar observable characteristics (as they are controlled for in the equation) at the same workplace (as firm fixed effects are included). Following the above mentioned literature, we assume that this bonus is due to the worker’s unobserved human capital. Worker-specific human capital is then averaged for each firm j:

where \( N_{j,t + 1} \) is the total number of employees in the recipient firm j, and \( \widehat{HC}_{m,t} \) stands for the human capital of each employee at firm j measured at time t. For the results of the wage equation estimation and a more detailed description of the calculation of human capital, see the “Appendix”.

We estimate the level of productivity of firm j at t + 1 if the firm receives labor inflow at t using the following equation, and include the lagged productivity of firm j to control for autocorrelation:

where \( A_{j,t + 1} \) and \( A_{j,t} \) denote the natural logarithm of the productivity of firm j standardized with the industry average in the recipient firm at t + 1 and t, respectively; To control for the change of average human capital of the workforce, we included the current and lagged estimate of the workforce’s human capitalFootnote 2. \( \varvec{X}_{j,t} \) includes the characteristics of the recipient firm at t (firm size, total assets, share of outflows, employee fluctuation, share of workers without a job in the previous year), and D denotes the combined industry-region-year fixed effects.

Pooled OLS estimations with industry-region-year fixed effects confirm Hypothesis 1, that incoming employees with similar average human capital will increase the recipient firm’s productivity more if they have been hired from a firm with higher productivity. We find a positive and significant effect of the productivity gap on the subsequent productivity of the recipient firm (Table 2 Columns A–B). The coefficient of 0.162 means that a firm hiring 10% of its employees from 10% more productive firms at year t gains a productivity increase of 0.1 × 0.1 × 0.162 = 0.16% at t + 1.

Following Stoyanov and Zubanov (2012), the productivity gap can be decomposed into positive and negative productivity gap indicators when only those movements are taken into account that originate from more or less productive firms compared to the recipient one:

where \( D_{i,t} = 1 \) if \( A_{i,t} > A_{j,t} \), and zero otherwise. All other notations are identical with the ones in Eq. 1. The above differentiation is useful if we assume that knowledge spillovers occur primarily when the incoming labor arrives from more productive firms. Equation 5 can be reformulated by decomposing the productivity gap into a positive and a negative gap:

where notations are identical with notations in Eq. 5.

Our findings reveal the importance of the positive productivity gap. Results are reported in Table 2 Columns C–D. They show that hires from firms with higher productivity increase the subsequent productivity of the firm by 0.31% (Column D). Although we found a significant effect for the negative productivity gap in the bivariate analysis (see Fig. 1), hires from firms with lower productivity do not have a significant influence on subsequent productivity in the multivariate specification.

Equation 5 is estimated on different groups of firms to check the robustness of the estimated effects. Results are reported in Table 3. First, we relax the condition of having new hires, and include all firm-years in the model (Column A). Then we separate these by size (Columns B–C). Finally, we return to the original sample of firms with non-zero incoming workers, and analyze them by size (Columns D–E). The effect of the productivity gap becomes larger in big firms (0.32% in Column C, 0.35% in Column E). Possible explanations for this last phenomenon may lie in the effective HR processes and training in large firms; alternatively, a few incoming worker may spread new knowledge to more colleagues in large firms. This might set a new agenda for knowledge spillover studies.

4.2 Alternative mechanisms

To verify the robustness of the productivity gap as the baseline mechanism of knowledge spillovers through labor flows, we test a variety of alternative explanations. It is possible that the decision of the management to hire many workers (or to hire new workers at all) indicates an expected increase in productivity (Acemoglu 1997). Therefore the hiring decision may be endogenous to the expected productivity increase. To check this reversed causality issue, we first decompose the productivity gap variable into its two elements: the share of new hires and the average productivity of their sending firm.

so that the productivity gap is the interaction of these two terms:

In case if our results were only due to this endogeneity, we would expect that only the share of new workers remains significant, and the productivity difference loses significance. Another way to deal with this issue of endogeneity is to consider the decision of the firm on hiring new employees or not, instead of measuring the quantity of new hires. Therefore we need to control for the estimated probability of hiring new employees. We use a logit model (“Appendix”: Table 10) to predict the probability of employing new labor for period t + 1 based on firm characteristics already known in period t, and include the predicted probabilities in the productivity regression.

In addition, geography might matter for productivity spillovers through labor flows because skills of workers from another region might be different (Boschma et al. 2009), labor flows might be motivated by amenities and other advantages for individuals (Florida et al. 2008) and large cities provide productivity advantages for firms (Combes et al. 2012). To control for spatial mechanisms, we include the settlement type combination of the recipient and source firm, and a same settlement dummy in our model.

The robustness of productivity gap against these alternative mechanisms is evaluated with the following model:

where \( Pr\_\widehat{hiring}_{j,t + 1} \) stands for the predicted probability of hiring at firm j at time t + 1, and \( \varvec{G}_{j,t + 1} \) for the set of geography controls, that is the share of new hires arriving from various settlement types and the exact same settlement at firm j at time t + 1.Footnote 3

In Table 4, we test these proposed alternative mechanisms empirically by constructing the augmented model seen in Eq. 12 in a stepwise manner. First, we only include the share of new hires in the baseline model without human capital (Column A). Next, we go on with adding human capital and its lag (Column B), the average productivity difference and productivity gap separately (Column C and D), and finally we also test how much the inclusion of the predicted probability of hiring and detailed geography controls (Column E and F) alters the coefficients of our model.

The share of new hires has a significant effect on subsequent productivity (Column A) even when controlled for human capital (Column B) and for the average productivity difference (Column C). In Column D productivity gap and the average productivity difference offset each other, and their joint effect show that the superior productivity of the source firm enhances productivity only if a sufficient number of new workers (7.4%) arrives to the firm.Footnote 4 In Column E, we find that the predicted probability of hiring is indeed significant, and the coefficient of the share of new hires loses its significance in explaining subsequent productivity; but most importantly, it does not alter the coefficient of our main explanatory variable, the productivity gap. Therefore we can conclude that the share of new hires, or alternatively, the probability of hiring new employees predicts subsequent productivity growth, however, the impact of superior productivity of the source firms remains positive after these controls.

The geography controls (Column F), that is the settlement type of the source and recipient firm and the same settlement dummy also prove to have a significant effect on productivity. Similarly to the previous control, the geography controls do not change the coefficient of the productivity gap substantially.

4.3 Dynamics

Knowledge of the new workers may not only affect the recipient firm’s productivity immediately after arrival, but the new employees may have an adjustment period, and they can also have a longer term impact. This was confirmed by Stoyanov and Zubanov (2012). They advocate for the method of local projections (Jordá 2005) to measure the own dynamics of the effect of productivity gap. We estimate the proposed forecast equation:

In Eq. 13, the autoregressive terms are recursively substituted with their respective values n years back, the coefficient \( \theta_{n} \) measures the response of the recipient firms’ productivity in year t + n to the productivity gap in t, via the channels of autoregression and own dynamics. Average productivity of source firms from year t + 1 to year t+n–1 ensure to control for the effects of hiring in these years: \( av\_prod_{j,t} \) denotes the natural logarithm of the average productivity of all source firms from where firm j hired a new worker in year t, weighted by the share of new workers in the total workforce of the recipient firm.

where the notations are identical with notations in Eq. 1. All the other notations in Eq. 13 are identical with those in Eq. 5.

Table 5 contains results of the estimation on the sample of firms with at least one new hire in the starting year, i.e. in year t. We estimated the dynamics up to five years following the arrival of the workers in a step-wise manner; however, the inclusion of productivity in 4 and 5 years as a dependent variable caused a critical drop in the common number of observations. Therefore, we only present results for the subsequent three years.

Coefficients of the positive productivity gap indicate that if the firm keeps hiring 10% of its workforce for two consecutive years from firms which are 10% more productive, the cumulative productivity gain in the third year is 0.1 × 0.1 × (0.343 + 0.089 + 0.185) = 0.62 percent over the productivity of a similar firm which did not hire during the same period.

In sum, our analysis in Hungary provides further evidence that the productivity gap between the source and recipient firm is crucial for knowledge spillovers; we can verify Hypothesis 1. In the remainder of the paper, the productivity gap models presented in Sect. 4 will be used as a base model to test the additional effects of multinational spillovers and industry relatedness.

5 Is there an additional foreign-domestic spillover effect?

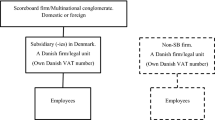

We define a company as foreign-owned or multinational if at least 50% of its registered capital belongs to foreign private owners, the company is state-owned if at least 50% of the registered capital belongs to public entities, and the company is private domestic if at least 50% of the registered capital belongs to private domestic owners. Figure 2 illustrates that similarity between the source and the recipient firm in terms of ownership increases the probability of job switch. The probability that an employee will go to a foreign-owned company is almost two times higher when the source firm is foreign-owned as compared to other types of source firms. Also, a higher share of workers from private domestic firms will go to private domestic firms as compared to the moves from other firm categories. Finally, employees leaving state-owned companies are more likely to move to state-owned companies than employees leaving other types of firms. However, the majority of employees leaving firms from all ownership categories will end up in private domestic companies, because most of the firms are in this category.

Labor flows from foreign-owned firms or MNEs are usually considered a major source of knowledge spillovers, and we aim to see whether there are any additional effects of foreign spillovers besides the effect of the productivity gap because MNEs are typically more productive than domestic firms. In order to observe these in the data, we calculate the share of workers arriving from private domestic and foreign-owned companies, and analyze their effects in the regression models, first without, and then with the productivity gap:

where \( H_{j,t + 1}^{PD} \) denotes the number of new arrivals to firm j from private domestic companies at time t + 1, \( H_{j,t + 1}^{F} \) denotes the number of hires coming from foreign-owned companies at time t + 1. \( \widehat{HC}_{j,t + 1} \) stands for the average human capital of the employees of firm j at time t + 1 including new hires at time t + 1, and \( \widehat{HC}_{j,t} \) denotes the same notion at time t, \( \varvec{X}_{j,t} \) for the characteristics of the recipient firm at t (firm size, total assets, general labor mobility measures), and D for the combined industry-region-year fixed-effects.

Table 6 illustrates the effect of the ownership of the source firms. In the first step, only the ownership variables are entered (Column A) in the baseline model without human capital controls. To test if the coefficients of new hires from domestic firms and those from multinational firms are different, we conducted a Wald test as a postestimation. We see significant differences between the reference category, private domestic companies and foreign-owned ones. The results are consistent with the idea of knowledge transfer from foreign to local companies, since the point estimate of the foreign effect is significantly higher than the point estimate of the domestic effect. In the next model, human capital controls are included (Column B), which decreases the difference between foreign and domestic point estimates, and the difference is no longer significant. Third, the estimated probability of hiring is included in the model, which does not alter the difference between the parameter estimates of the ownership of the source firms (Column C). Finally, the productivity gap and the ownership of the source firms are considered jointly (Column D) and the difference between local private companies and foreign owned ones diminishes even more: the point estimate of the effect of new hires from domestic firms becomes higher than those from of MNEs, and the difference stays insignificant. These results suggests that the knowledge transfer from foreign companies to private domestic ones is partly explained by the higher human capital of the employees coming from foreign-owned firms, and by the superior productivity of these firms; and we do not see substantial additional effect of the multinational ownership.

Based on these findings, we cannot verify Hypothesis 2. Notwithstanding the falsified hypothesis, the results are reasonable because multinational companies are generally more productive than domestic companies, and employ more skilled workers. However, the discovery we presented in this section is original because it implies that the mechanisms that are frequently observed in connection with MNEs (e.g. training, experience with international business) already embody in the productivity of the firm. The results also imply that we can expect knowledge spillovers only from those foreign-owned firms that are more productive than the host economy.

6 Industry relatedness and the effect of inter-industry labor flows

Scholars quantify inter-industry relatedness by using both output-based approaches and input-based approaches. The input-based approaches assume industries are related if they use the same inputs in their production process, such as patents (Engelsman and van Raan 1991; Breschi et al. 2003) value-chain linkages retrieved from input-output tables (Fan and Lang 2000), or similarities of human capital by looking at the occupational profiles of industries (Farjoun 1994, 1999; Chang 1996; Chang and Singh 1999). A specific case among the input-based measures is the skill-relatedness measure (Neffke and Henning 2013), as it measures similarities between inputs: skills applied in industries—but indirectly: from labor mobility, by comparing the extent of moving workers across industries to expected values in case of random movements.

In output-based analyses the relatedness is measured by the co-occurring products that are produced in the single economic entities. The approach is based on the coherence measure of Teece et al. 1994, in analyzing corporate diversification. According to them, “a firm exhibits coherence, when its lines of business are related, in the sense that there are certain technological and market characteristics common to each. A firm’s coherence increases as the number of common technological and market characteristics found in each product line increases” (Teece et al. 1994:4) They constructed the measure of industry relatedness by comparing the joint occurrences of industries in diversified firms’ portfolio compared to random diversification of corporations. The following studies of Lien and Klein 2008; and Bryce and Winter 2009 added slight modifications to the measure, and analyzed empirically its effect entry behavior of firms.

A further development of this method is the revealed relatedness index of Neffke et al. (2011); the relatedness network of industries based on this measure is commonly referred to as industry space. This, instead of comparing actual co-occurrences of industries within the firm portfolios to ones expected under random diversification, estimate the expected value using regression analysis, explicitly taking into account the characteristics of source and recipient industries, such as profitability, size, and total revenue. We choose this method for measuring relatedness, as we consider the “common technological and market characteristics” to be good proxies of the necessary skills in the production. We opt for this measure in contrast to the more evident skill-relatedness measure because of the endogeneity concerns about skill-relatedness: we would infer the impact of related skills through a measure which infers relatedness from the direct consequence of related skills, mobility. In addition to the co-occurrence of products within firms, we will test the results using the product space measure of Hidalgo et al. (2007). This measures similarity between the necessary resources for manufacturing products by the co-occurrences of products within countries’ export portfolios.

Since the revealed relatedness is the conditional probability of co-occurrence of products in industries i and j, where most of the potential pairs of industries do not co-occur with each other in the same firm, i.e. there is a large number of zeros, we follow Neffke et al. (2011) and use zero-inflated negative binomial regression for estimation. From the predicted values of the regression, we could get our revealed relatedness measure:

where ^ indicates fitted value and k is a normalizing constant to normalize the RR values to the [0,1] interval (see “Appendix 4” for a detailed description of the methodology. The network data of the Hungarian industry space is available at http://www.mtakti.hu/relatedness/).

In Fig. 3, the industry space network of four-digit industries is plotted using a spring algorithm, which brings related industries close to each other. It is visible from the network that there is a correlation between the official NACE classification and revealed relatedness, because industries in similar sectors tend to group together. However, one can observe a much more complex structure of industry relatedness than one can deduce from industry classification.

Industry space network in Hungary, 2003–2012. Notes: Nodes are industries defined by 4-digit NACE codes and color-codes refer to sectors of 2-digit NACE codes. We included edges with weights \( \overline{R}_{ij} > 0 \). The natural logarithm of employment is used to depict the size of the industry, which is reflected by the size of the nodes. The position of the nodes is determined by the Force Atlas 2 algorithm in Gephi

The distribution of labor mobility across related, unrelated and same industries varies by the skill-level of occupation categories (Table 7). Most of the moves occur across unrelated industries (RR = 0), and this rate grows as the skill-level of workers decreases. The likelihood of moving to a related industry increases with the workers skills which might be due to the opportunity cost of job-switching and thus the barriers of employee mobility. Furthermore, managers have the highest chance to move within the same industry. This suggests that low-skilled occupations are less industry-specific and the costs of changing industry are low. Meanwhile the costs of an industry switch are the highest for managers, which implies that management techniques might differ across industries and managers have to have a deep knowledge of their field to know how to set up firm structure, organize the activities, and allocate tasks within the firm.

In order to include technological proximity into the estimation framework, we add two new variables to the equation: the number of workers arriving from the above RR categories and the interaction of industry relatedness with the productivity gap. The final regression equation is specified by

where \( H_{j,t + 1}^{RRk} \) represents the number of new arrivals from firms with the respective technological distance: RR1 indicates proximity below the median level, and RR2 above the median. \( H_{j,t + 1}^{SAME} \) is the number of new workers at firm j who did not change industry, and RR = 0 is the reference category. HCj,t denotes human capital of firm j at time t. \( \varvec{X}_{j,t} \) stands for the characteristics of the recipient firm at t (total assets, firm size, ownership, general labor mobility measures), and D for the industry-region-year dummies. The variable \( prodgap_{j,t}^{RRk} \) denotes the productivity gap for the workers arriving from firms with the specific technological proximity category specified above:

where \( D_{i,t} \) equals 1 if \( RR\left( {i,j} \right) \) corresponds to the above specified ranges (RR1: RR below median, RR2: RR above the median) and zero otherwise.

Table 8 contains the results of the estimation specified in Eq. 12 in a step-wise manner. Each specification includes industry-region-year fixed effects, the characteristics of the recipient firm, average characteristics of source firms, the human capital of the new hires, and general inflow-outflow measures. First, only the share of incoming workers from different industry relatedness categories are examined (Column A). The findings suggest that a higher share of inflows from related industries to the firm increases productivity more. Interestingly, workers arriving from the same industry do not have such impact. Next, the productivity gap is added, together with its interaction with the industry relatedness measures (Column B). We find that the effect of the productivity gap is positive, and its effect does not differ by industry relatedness, furthermore, the positive effect of new workers arriving from a related industry remains stable. Finally, the models are completed with ownership variables (Column C); the effects of the industry relatedness and the productivity remain similar, and multinational spillovers do not have an additional significant effect when one compares them to labor flows from domestic firms of the same productivity. These findings support Hypothesis 3 and we can verify that workers arriving from firms that apply related technologies boost the productivity of the recipient firm more than workers from the same or from unrelated industries. This finding imply that workers from related industries implement their experience more easily than those from unrelated ones, and also suggest that workers from related industries bring more novelty than workers from the same industry and consequently, some difference in the incoming knowledge is beneficial for the subsequent productivity.

7 Conclusion

The aim of this paper was to investigate the impact of knowledge spillover conveyed by labor flows across firms on firm’s productivity and the factors that can facilitate or constrain this knowledge transfer. We examined three attributes of companies involved in the mobility process in a common framework: their relative productivity, their ownership, and their industry relatedness. We found evidence that knowledge spillovers transmitted by labor flows across companies are determined by productivity gap across the source and recipient companies. When we examined positive and negative productivity gap separately, we have shown that hiring workers from more productive companies is beneficial, however, hiring from less productive one in not harmful, which is consistent with the idea that employees apply the knowledge of better operations. These results are consistent with previous finding of Stoyanov and Zubanov (2012) and contradicts Stockinger and Wolf (2016). One can also note that our measure of productivity gap is composed of two parts: the magnitude of incoming workers, and the superiority of the firm they are coming from in terms of productivity. When including both terms in the regression, we see that the interaction of these two is the actually significant term, that is work experience at a more productive firm has a higher impact on productivity with the increasing share of new workers.

The fact that hiring workers from more productive firms is associated with subsequent productivity gain does not imply causality itself. First, hiring decisions of firms may indicate future productivity increases. When including these factors to our models, we found that the decision of hiring new workers (or alternatively, the magnitude of the new hires) can be an indicator of subsequent productivity growth; however, the effect of productivity gap between the source and recipient firms is still present after controlling for this endogeneity.

Further endogeneity issues may arise, because the fact that companies introducing new technologies, and expecting productivity gains can attract employees with better skills, who tend to work with more productive companies. We applied a human capital control for controlling this endogeneity, which indeed decreased the estimates of the productivity difference parameters indicating the presence of this endogeneity, but additional productivity effects remained. We acknowledge however, that including the average human capital of firms may not tackle the endogeneity of labor movements entirely, thus we do not intend to imply causality design.

We also find that the above productivity gap overshadows the effect of foreign spillovers. Our results show that foreign spillovers in Hungary disappear after controlling for the human capital of workers and the productivity difference of firms, so that flows from foreign firms are effective only if the foreign firm is more productive than the domestic firm. This clears up the outcomes of some former studies on a positive productivity effect of labor flows from multinational firms to domestic firms (Balsvik 2011; Poole 2013). These results are also consistent with the economic operation of (multinational) companies. Significant additional effect would indicate an investment of MNEs’ employees’ transferable human capital, which does not return in the terms of productivity. Furthermore, we show that technological proximity across industries matters: hiring workers from related, but not similar industries is associated with an additional increase in subsequent productivity. This result is similar to the findings of Boschma et al. (2009), even though our study adds several additional controls, most importantly by using panel methods and industry fixed-effects, and the control for productivity differences. Our results are also valid across measures of relatedness commonly used in economic geography, as the technological proximity of Neffke et al. (2011) and the product space of Hidalgo et al. (2007).

Our results have important implications for strategic decisions at the firm level and for policy makers as well. A clear message for firms is that it is worth to hire new employees from more productive firms because productivity spillovers manifest in these labor flows. Furthermore, a firm might expect productivity gains not only when hiring from the same industry but also when new employees come from technologically related industries because the skills developed in these industries can be also quickly fit to the firm’s production processes. Consequently, firms might also benefit from considering the technological proximity to other firms in the local environment in various types of further strategic decisions such as site selection.

We can also argue that the use of labor flow data allows us to re-evaluate our policy-related knowledge about productivity spillovers from foreign-owned or multinational enterprises to domestic companies and thus can provide better recommendations. To that end, the support of FDI per se may not be the most rewarding policy, if the productivity growth of the local economy is an important aim. Instead, regional and national policies should focus on those foreign investments that are more productive than domestic firms, which can lead to productivity spillovers through labor flows and thus to economic growth. Additionally, policies should pay more attention to attract those new industries that are related to the incumbent industries in local environment because skill-relatedness increases the chance of inter-firm learning, which favors growth. National and regional governments can also improve the quality of their intervention in the accumulation of local skill base by mapping the technological proximity of present industries. By doing this, they might better plan and design local training and re-training programs and help early-career or dismissed employees to obtain those skills that are related to the local demand and thus increase the chance of career progress.

Further research might go into more detail on where exactly the productivity differences lie, which really matter for spillovers through labor mobility. For example, is the training the multinationals or more productive firms provide to their employees important for knowledge spillovers? One might expect that the knowledge gained over longer periods of working at more productive firms matters more than narrowly defined training. Another underexplored but connected question concerns the role of organizational structure. New employees might exploit their skills better in an environment they are already used to and might perform better in a new organization with similar routines to what they are already familiar with.

Notes

The threshold was set to labor productivity of HUF 50 million per worker. 0.8% of the cases were dropped due to this rule.

Note in Eq. (4) that for calculating \( \widehat{HC}_{t + 1} \) at company j, the wage equation at the previous year is used, so that in case of a newly arriving worker at company j, human capital measures come from a wage equation in the employee’s previous workplace in order to overcome the endogenous connection between the employee’s new wage and the new productivity of the recipient firm.

Beyond the settlement type combination of the recipient and source firm, and the same settlement dummy, we also used alternative measures of geography controls, such as two different divisions of settlement types, same region dummy, and the settlement type of the residential address. These specifications earned very similar results.

The joint effect of average productivity difference and productivity gap turns positive at 0.014/0.188 = 7.4% share of new workers.

Available at http://atlas.media.mit.edu/en/resources/data/.

References

Abowd, K. M., Kramarz, F., & Margolis, D. N. (1999). High wage workers and high wage firms. Econometrica,67(2), 251–333.

Acemoglu, D. (1997). Training and innovation in an imperfect labour market. Review of Econoimcs and Statistics,64(3), 445–464.

Almeida, P., & Kogut, B. (1999). Localization of knowledge and the mobility of engineers in Regional networks. Management Science,45(7), 905–917.

Arnold, J., & Javorcik, B. (2009). Gifted kids or pushy parents? Foreign direct investment and plant productivity in Indonesia. Journal of International Economics,79(1), 42–53.

Arrow, K. (1962). Economic welfare and the allocation of resources for invention. In R. R. Nelson (Ed.), The rate and direction of inventive activity: economic and social factors (pp. 609–626). Princeton: Princeton University Press.

Balsvik, R. (2011). Is labor mobility a channel for spillovers from multinationals? evidence from Norwegian manufacturing. The Review of Economics and Statistics,93(1), 285–297.

Becker, G. S. (1962). Investment in human capital: A theoretical analysis. The Journal of Political Economy,70(5), 9–49.

Becker, G. S. (1964). Human capital: A theoretical and empirical analysis, with special reference to schooling. New York: Columbia University Press.

Békés, G., Kleinert, J., & Toubal, F. (2009). Spillovers from multinationals to heterogeneous domestic firms: Evidence from Hungary. The World Economy,32(10), 1408–1433.

Blomström, M., & Kokko, A. (1998). Multinational corporations and spillovers. Journal of Economic Surveys,12(3), 247–277.

Boschma, R. (2005). Proximity and innovation: a critical assessment. Regional Studies,39, 61–74.

Boschma, R., Eriksson, R., & Lindgren, U. (2009). How does labour mobility affect the performance of plants? the importance of relatedness and geographical proximity. Journal of Economic Geography,9(2009), 169–190.

Boschma, R., Minondo, A., & Navarro, M. (2013). The emergence of new industries at the regional level in Spain: A proximity approach based on product relatedness. Economic Geography,89(1), 29–51.

Breschi, S., Lissoni, F., & Malerba, F. (2003). Knowledge-relatedness in firm technological diversification. Research Policy,32(1), 69–87.

Bryce, D. J., & Winter, S. G. (2009). A general interindustry Relatedness Index. Management Science,55(9), 1570–1585.

Campbell, B. A., Ganco, M., Franco, A. M., & Agarwal, R. (2012). Who leaves, where to, and why worry? employee mobility, entrepreneurship and effects on source firm performance. Strategic Management Journal,33(1), 65–87.

Card, D., Heining, J., & Kline, P. (2013). Workplace heterogeneity and the rise of west German wage inequality. The Quarterly Journal of Economics,128(3), 967–1015.

Carnahan, S., Agarwal, R., & Campbell, B. A. (2012). Heterogeneity in turnover: The effect of relative compensation dispersion of firms on the mobility and entrepreneurship of extreme performers. Strategic Management Journal,33(12), 1411–1430.

Chang, S. J. (1996). an evolutionary perspective on diversification and corporate restructuring: Entry, Exit, and economic performance during 1981–1989. Strategic Management Journal,17, 587–611.

Chang, S. J., & Singh, H. (1999). The impact of modes of entry and resource fit on modes of exit by multibusiness firms. Strategic Management Journal,20, 1019–1035.

Combes, P.-P., Duranton, G., Gobillon, L., Puga, D., & Roux, S. (2012). The productivity advantages of large cities: Distinguishing agglomeration from firm selection. Econometrica,80(6), 2543–2594.

Correia, S. (2016). REGHDFE: Stata module to perform linear or instrumental-variable regression absorbing any number of high-dimensional fixed effects. Statistical Software Components. Boston College Department of Economics.

Djankov, S., & Hoekman, B. (2000). Foreign investment and productivity growth in Czech Enterprises. World Bank Economic Review,14(1), 49–64.

Dokko, G., Wilk, S. L., & Rothbard, N. P. (2009). Unpacking prior experience: How career history affects job performance. Organization Science,20(1), 51–68.

Engelsman, E. C., & van Raan, A. (1991). Mapping of technology: A first exploration of knowledge diffusion amongst fields of technology. Leiden: Centre for Science and Technology Studies, University of Leiden.

Fan, J. P. H., & Lang, L. H. P. (2000). The measurement of relatedness: An application to corporate diversification. The Journal of Business,73(4), 629–660.

Farjoun, M. (1994). Beyond industry boundaries: Human expertise, diversification and resource-related industry groups. Organization Science,5(2), 185–199.

Farjoun, M. (1999). The independent and joint effects of the skill and physical bases of relatedness in diversification. Strategic Management Journal,19, 611–630.

Flinn, C. J. (1986). Wages and job mobility of young workers. The Journal of Political Economy,94(3, Part 2), S88–S110.

Florida, R., Mellander, Ch., & Stolarick, K. (2008). Inside the black boxs of regional development: Human capital, the creative class and tolerance. Journal of Economic Geography,8(5), 615–649.

Fosfuri, A., Motta, M., & Ronde, T. (2001). Foreign direct investment and spillovers through workers’ mobility. Journal of International Economics,53(1), 205–222.

Gathmann, C., & Schönberg, U. (2010). How general is human capital? a task-based approach. Journal of Labor Economics,28(1), 1–49.

Gorg, H., & Strobl, E. (2005). Spillovers from foreign firms through worker mobility: An empirical investigation. Scandinavian Journal of Economics,107(4), 693–709.

Groysberg, B., Lee, L., & Nanda, A. (2008). Can they take it with them? the portability of star knowledge workers’ performance. Management Science,54(5), 1213–1230.

Halpern, L., & Muraközy, B. (2007). Does distance matter in spillover? Economics of Transition,15(4), 781–805.

Herstad, S. J., Sandven, T., & Ebersberger, B. (2015). Recruitment, knowledge integration and modes of innovation. Research Policy,44(1), 138–153.

Hidalgo, C. A., Klinger, B., Barabási, A.-L., & Hausmann, R. (2007). The product space conditions the development of nations. Science,317, 482–487.

Jovanovic, B. (1979a). Firm specific capital and turnover. Journal of Political Economy,87(6), 1246–1260.

Jovanovic, B. (1979b). Job matching and the theory of turnover. Journal of Political Economy,87(5), 972–990.

Kambourov, G., & Manovskii, I. (2009a). Occupational specificity of human capital. International Economic Review,50(1), 63–115.

Kambourov, G., & Manovskii, I. (2009b). Occupational mobility and wage inequality. Review of Economic Studies,76(2), 731–759.

Lien, L. B., & Klein, P. G. (2008). Using competition to measure relatedness. Journal of Management,35(4), 1078–1107.

Maliranta, M., Mohnen, P., & Rouvinen, P. (2009). Is inter-firm labor mobility a channel of knowledge spillovers? evidence from a linked employer-employee panel. Industrial and Corporate Change,18(6), 1161–1191.

Mawdsley, J. K., & Somaya, D. (2016). Employee mobility and organizational outcomes: an integrative conceptual framework and research agenda. Journal of Management,42(1), 85–113.

McCall, B. P. (1990). Occupational matching: A test of sorts. Journal of Political Economy,98(1), 45–69.

Miller, R. A. (1984). Job matching and occupational choice. The Journal of Political Economy,92(6), 1086–1120.

Mincer, J. (1974). Schooling, experience, and earnings (p. 2). Institutions No: Human Behavior and Social.

Mion, G., & Opromolla, L. D. (2014). Managers’ mobility, trade performance, and wages. Journal of International Economics,94(1), 85–101.

Neal, D. (1995). Industry-specific human capital: Evidence from displaced workers. Journal of Labor Economics,13(4), 653–677.

Neal, D. (1999). The complexity of job mobility among young men. Journal of Labour Economics,17(2), 237–261.

Nedelkoska, L., & Neffke, F. (2010). Human capital mismatches along the career path. Jena Economic Research Papers 2010-051. Friedrich-Schiller-University Jena.

Neffke, F., & Henning, M. (2013). Skill relatedness and firm diversification. Strategic Management Journal,34(3), 297–316.

Neffke, F., Henning, M., & Boschma, R. (2011). How do regions diversify over time? industry relatedness and the development of new growth paths in regions. Economic Geography,87(3), 237–265.

Neffke, F., Henning, M., & Boschma, R. (2012). The impact of ageing and technological relatedness on agglomeration externalities: A survival analysis. Journal of Economic Geography,12(2), 485–517.

Neffke, F., Otto, A., & Hidalgo, C. (2016). The mobility of displaced workers: How the local industry mix affects job search strategies. Section of Economic Geography: Utrecht University.

Palomeras, N., & Melero, E. (2010). Markets for inventors: Learning-by-hiring as a driver of mobility. Management Science,56(5), 881–895.

Parent, D. (2000). Industry-specific capital and the wage profile: Evidence from the national longitudinal study of income dynamics. Journal of Labor Economics,18(2), 306–323.

Pavan, R. (2011). Career choice and wage growth. Journal of Labor Economics,29(3), 549–587.

Poletaev, M., & Robinson, C. (2008). Human capital specificity: Evidence from the dictionary of occupational titles and displaced worker surveys, 1984–2000. Journal of Labor Economics,26(3), 387–420.

Poole, J. P. (2013). Knowledge transfers from multinational to domestic firms: Evidence from worker mobility. Review of Economics and Statistics,95(2), 393–406.

Rosenkopf, L., & Almedia, P. (2003). Overcoming local search through alliances and mobility. Management Science,49(6), 751–766.

Song, J., Almeida, P., & Wu, G. (2003). Learning-by-hiring: When is mobility more likely to facilitate inter-firm knowledge transfer? Management Science,49(4), 351–365.

Stockinger, B., & Wolf, K. (2016). The productivity effects of worker mobility between heterogeneous firms. IAB Discussion Paper 7

Stoyanov, A., & Zubanov, N. (2012). Productivity spillovers across firms through worker mobility. American Economic Journal: Applied Economics,4(April), 168–198.

Stoyanov, A., & Zubanov, N. (2014). The distribution of the gains from spillovers through worker mobility between workers and firms. European Economic Review,70, 17–35.

Sullivan, P. (2010). Empirical evidence on occupation and industry specific human capital. Labor Economics,17(3), 567–580.

Teece, D. J. (2003). Expert talent and the design of (professional services) firms. Industrial and Corporate Change,12(4), 895–916.

Teece, D. J., Rumelt, R., Dosi, G., & Winter, S. (1994). Understanding corporate coherence: Theory and Evidence. Journal of Economic Behaviour and Organization,23(1), 1–30.

Timmermans, B., & Boschma, R. (2014). The effect of intra- and inter-regional labour mobility on plant performance in Denmark: The significance of related labour inflows. Journal of Economic Geography,14(2), 289–311.

Topel, R. H., & Ward, M. P. (1992). Job mobility and the careers of young men. The Quarterly Journal of Economics,107(2), 439–479.

Tzabbar, D., Aharonson, B. S., & Amburgey, L. T. (2013). When does tapping external sources of knowledge result in knowledge integration? Research Policy,42(2), 481–494.

Tzabbar, D., Silverman, B. S., & Aharonson, B. S. (2015). Learning by hiring or hiring to avoid learning. Journal of Managerial Psychology,30(5), 550–564.

Zucker, L. G., Darby, R. M., & Torero, M. (2002). Labor mobility from academe to commerce. Journal of Labor Economics,20(3), 629–660.

Acknowledgements

The research project was financed by the Hungarian Scientific Research Fund (K112330). Data was developed and access was provided by the Databank of the Center for Economic and Regional Studies, Hungarian Academy of Sciences. The paper also uses the Hungarian Prodcom database matched to the firm-level balance sheet panel data, available at the Central Statistical Office of Hungary; calculations and conclusions drawn therefrom are intellectual products of the authors. We are thankful for the help of Zoltán Elekes for providing the product space matrices on the SITC level. Comments by Gábor Békés, Rikard Eriksson, César Hidalgo, János Köllő, Balázs Muraközy, Frank Neffke, Victor López Pérez and two anonymous reviewers are gratefully acknowledged. The authors received further suggestions at the 35th SUNBELT Conference of INSNA in Brighton 2015, the Finance and Economics Conference of LUPCON in Frankfurt 2015, the 2nd EEGinCEE workshop in Szeged 2015, the 2nd Skill-relatedness workshop in Gothenburg 2015, the 9th Conference of the Society for Hungarian Economists in Budapest 2015, the 81st International Atlantic Economic Conference in Lisbon 2016, the 32nd Annual Congress of the European Economic Association in Lisbon 2017 and during seminar sessions at the Hungarian Academy of Sciences, the MIT Media Lab and Northeastern University.

Author information

Authors and Affiliations

Corresponding author

Appendix 1: Detailed description of data management

Appendix 1: Detailed description of data management

We have access to the Hungarian administrative data integration database, which is an anonymized employer-employee linked panel dataset created by the matching of five administrative data sources, for the years 2003–2011, developed by the databank of HAS CERS. The database contains a 50% random sample of the population aged 15–74 living in Hungary in 2003 and the involved employees are traced over the period. The most important demographic features of employees (gender, age, place of residence in the year of entry), and information about their employment spells (months worked, ISCO-88 occupation code, monthly wage) as well as company characteristics (4-digit industry code according to the NACE Rev. 2 classification, number of employees, and specific rows of their balance sheets and financial statements including tangible assets, equity owned by private domestic, private foreign, and state owners, sales, pre-tax profits, material-type costs, personnel expenditures, wage bill) are known. All monetary variables are deflated by yearly industry-level producer price indices to calculate their real 2011 value.

The data is managed by the Databank of the Institute of Economics of the Hungarian Academy of Sciences and can be accessed for scientific research upon individual request. For more details consult http://adatbank.krtk.mta.hu/adatbazisok_allamigazgatasi_adatok.

The raw data contains employee-employer links on a monthly basis. We defined the main employer for every worker and for every year as the workplace where the worker spent the highest number of months in the given year, and created yearly matrices of intercompany movements between these main employers. In particular, if an employee switches firm in the second half of year t or first half of year t + 1, the recipient firm will be her employer in year t + 1 and the source firm will be her employer in year t.

However, our models assess the effect of labor mobility on firms’ productivity on a yearly basis, which can lead to an endogenous connection between labor flows and productivity change (not discussed in the main text). The problem is illustrated in Fig. 4; productivity shocks (e.g. purchasing a machine) happening in the first half of year t + 1 can affect the number of new hires in the first half of year t + 1.

The potential of reverse causality shortly summarized above might distort our analysis. In order to exclude the possibility of such endogeneity, we conduct the analysis only for those new hires that were observed in year t or in January in year t + 1 at the latest, and exclude all the cases of labor mobility that happened between February and June.

A certain time period has to pass for the new employee to exert a significant effect on firm productivity. With new employees working for a short period and not controlling for months worked at the recipient firm, we would underestimate the effect of new hires on yearly productivity growth. Therefore, in the productivity spillover analysis, only those workers were considered as new hires that stayed for at least 6 months with their new employer.

1.1 Appendix 2: Calculation of human capital

As described in the main text, the human capital of each worker is calculated for each year spent in the private sector. The gaps in private sector employment of at most 3 years are filled by linear interpolation. In case of gaps of at least 4 years, or when the worker only worked in the public sector before getting a job in the private sector, human capital is calculated by a wage regression on the subsample of public sector workers. In addition to the multi-dimensional fixed-effects approach, as a robustness check, we also estimated a pooled OLS regression with age, age-squared, gender and skill-levels of workers. Results are presented in Table 9.

Figure 5 shows the distribution of human capital calculated without and with employee fixed effects. Version 1 explains 69% of the variation of the log value of wage, whereas version 2 has an R-squared of 84%. The correlation between the two versions of human capital is 0.74. Since fixed effects can control for more individual-specific characteristics, version 2 is a better approximation of the worker’s true human capital. Its closer-to-normal distribution also makes it more desirable for further analysis, therefore we continue with this measure.

Figures 6 and 7 show the distributions of human capital with employee fixed effects by gender and skill level. Looking at the curves, we can infer that there is no significant difference between the value of the work-related abilities of men and women, although the variation is higher in the case of women. There is a clear difference between the distributions of human capital by skill level, particularly to the advantage of highly skilled workers. These descriptive findings confirm our decision to use human capital calculated with worker fixed effects.

High-skilled: worked at least once in an occupation requiring tertiary education; Mid-skilled: worked at least once in an occupation requiring secondary education; Low-skilled: everybody else.

1.2 Appendix 3: Estimating the probability of hiring

Since the hiring decision of the firm might be correlated with productivity, we should control for this endogeneity. We do so by estimating the probability of hiring and including it in the productivity regression. We estimate logit regressions to predict the probability of hiring for period t + 1 based on firm characteristics already known in period t for the whole population of firms.

1.3 Appendix 4: Calculation of the revealed relatedness distances between industries

To construct the revealed relatedness distances between industries in Hungary, we used the Hungarian Prodcom database matched to the firm-level balance sheet panel data from the National Tax and Customs Administration, available at the Central Statistical Office of Hungary for years 2002–2012. Because the Prodcom database covers industrial activities only, we had to restrict this step of the analysis to the mining, manufacturing and energy sectors (NACE Rev 2: 05-35).

The Hungarian Prodcom database, available at Central Statistical Office (CSO) of Hungary has data on the production of manufactured goods in Hungary for years 1996–2012.

The Prodcom survey requires all qualifying firms to record their production activities at the 8-digit Prodcom (PC8) product level. In the first step of data procession, the primary sector of each company was identified. Each company the (4 digit) industry code was assigned, which corresponded in the Prodcom classification to its most important product in sales volume. Second, a directed link from industry A to industry B was created, if a company had the highest sales volume in sector A, but also produced products, which belong to sector B according to the Prodcom classification. By summing the links over the industries we got the co-occurrence network of industries, where each node corresponds to a (4 digit) industry, and each edge weight corresponds to number of the companies producing in both industries. Note, that we have obtained a directed and weighted network this way for each year.

To calculate the expected number of these co-occurrences between the industries, we used a zero-inflated negative binomial regression, following Neffke et al. (2012). This models the dependent variable by a regime selection process, which determines the probability if the outcome is an excess zero or not, and a count data part, which determines the count outcome in case it is not an excess zero, assuming negative binomial distribution:

where \( \delta_{i} \) and \( \delta_{j} \) represent the characteristics of the source and recipient industries respectively, specifically the number of firms, the total revenue, profits, number of employees, and value added. These variables are available in the firm-level balance sheet panel data from the National Tax and Customs Administration (NTCA), which was available at the CSO and was merged to the Prodcom database using the anonymized company identifier.

From the predicted values of the regression, we were able to calculate our revealed relatedness measure:

where ^ indicates fitted value and k is a normalizing constant.

1.4 Appendix 5: The effect of relatedness using the product space measure

The product space concept is based on the idea that different productive factors are behind the production of each product. These include labor, land, capital, technological sophistication and institutions (Hidalgo et al. 2007). However, the products are not only different by the necessary level of these factors, but specializing on a product needs specific skills, infrastructure, or institutions: “making cotton shirts does not require more or less skills than making chocolate, but different skills”. The similarity of these factors will increase the likelihood that these products are produced in similar countries, therefore a pair of products will appear in a country’s export portfolio more often, if they require similar production factors. Consequently, the relative co-appearance of the products in the countries’ export portfolios can be used to proxy the similarity of the necessary production factors.

The product space is calculated using the conditional probabilities of being effective exporters of products:

where \( RCAx_{i,t} \) =1 if a country is an effective exporter of product i in year t, and zero otherwise.