Abstract

The paper investigates the relationship between organizational ambidexterity and firm performance in knowledge-intensive firms. In particular, using a quantitative methodology involving a structural equation model, the research investigates whether external knowledge sourcing enhances the impact of ambidexterity on firm performance. The results show that organizational ambidexterity in knowledge-intensive firms does not, in fact, have a significant impact on firm performance, but it does have a positive and significant mediating effect considering external knowledge sourcing. The findings are presented along with interesting and significant implications for both theory and practice, largely stemming from the still much neglected relationship between organizational ambidexterity and external knowledge sourcing in the open innovation context.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

In an incessantly changing and ever demanding business environment, managers across the globe are correspondingly, proportionately and inexorably obliged to reconsider the very fundamentals of their business approaches and constantly to renew, redefine and reinvent their organizations with the aim of achieving sustainable competitiveness within a dynamic environment (Danneels 2002; Vrontis et al. 2012). This challenge is prominent in the current business context, which is characterized by the shifting behavior of customers, deeply and widely impacting technologies and fierce competition (Bresciani and Ferraris 2014; Thrassou et al. 2014), requiring the building and expansion of significant and relevant knowledge over time. In fact, knowledge is considered to be the most valuable global commodity, which can give a firm an advantage over its competitors (Gorman 2002).

The importance of both current and new knowledge, resources and competencies thus dictates that innovative firms have to maintain their adaptiveness by exploiting their existing knowledge and exploring new knowledge (Levinthal and March 1993; Floyd and Lane 2000; Chesbrough et al. 2006). In this context, the concept of organizational ambidexterity has attracted growing attention in both organizational (Adler et al. 1999; Raisch and Birkinshaw 2008; Chebbi et al. 2015) and strategic (Ghemawat and Costa 1993; Porter 1996) theories.

An ambidextrous firm is one that is capable of both exploiting existing competencies and exploring new opportunities, and achieving ambidexterity enables a firm to enhance its competitiveness and performance (Lubatkin et al. 2006; Carayannis and Rakhmatullin 2014). Although the literature substantially investigates the concept of organizational ambidexterity, highlighting the complementarities, contingencies and limitations of exploitation and exploration, few studies consider the strategic role of external knowledge in enhancing ambidexterity and firm performance. This relationship is even less studied in the context of knowledge-intensive firms (KIFs). In fact, to cope with the increasing technological complexity and market uncertainty (Thrassou 2007), KIFs must increasingly involve external sources of knowledge within their innovation process (Enkel et al. 2009), based on the extent of the ambidextrous strategy adopted. KIFs are those “having a high added value of scientific knowledge embedded in both product and process” (Coviello 1994), such as firms operating in information and communication technologies (ICT) and in high-technology manufacturing sectors such as electronics (Bell et al. 2004). This knowledge-based embedded added value also constitutes a primary reason for this research’s natural focus on KIFs.

This research fills the above-identified gap in knowledge. In particular, we build on the organization context (March 1991; Ghoshal and Bartlett 1994) and on the open innovation literature (Chesbrough et al. 2006; Laursen and Salter 2006) to suggest that external knowledge sourcing mediates the relationship between organizational ambidexterity and firm performance, in terms of exploitation and exploration, for KIFs. Moreover, we employ a quantitative methodology using a structural equation model to test and investigate the hypotheses, developing the constructs according to the relevant literature. Thus, the article contributes to the existing organizational ambidexterity literature, furthering our understanding of the factors leveraging the ambidexterity–performance relationship. The article is structured as follows: first, we provide a literature review on organizational ambidexterity and external knowledge sourcing to identify the gap; the research method is subsequently delineated and the findings of the empirical research are presented and discussed; finally, the conclusions and implications of the study are set out, along with the limitations of the research.

2 Theoretical framework

2.1 Organizational ambidexterity

For many sectors, innovation constitutes a key strategy in the search for and development of lasting competitive advantages (Cooper and Kleinschmidt 1993; Bresciani 2010), especially in the contemporary business context, which is characterized by globalization, hyper-competition, technological advancement and ever-shifting consumer behaviors (Vrontis and Thrassou 2013). Innovative firms build and maintain a competitive advantage by developing products, processes and services (Tidd et al. 2000) that achieve a sustainable position in internationally competitive markets with increasing customer demands (Santoro et al. 2016). Consequently, adopting faster, more efficient and less risky innovation processes has become the main driver for competitive companies (Drucker 2014).

Towards this aim, organizational theories recognize that firms have to develop both exploitative and exploratory innovation (Tushman and O’Reilly 1996). These two concepts explain well the notion of organizational ambidexterity, according to which firms are able simultaneously to exploit their current capabilities while exploring new competencies and knowledge (Duncan 1976; Levinthal and March 1993; Gibson and Birkinshaw 2004; He and Wong 2004; O’Reilly and Tushman 2004; Lubatkin et al. 2006). More specifically, organizational ambidexterity is defined as the ability of a firm to pursue both exploitative (incremental) and explorative (radical) innovation (O’Reilly and Tushman 2004). On the one hand, exploitation is intended to extend the current knowledge, seeking greater efficiency and improvements to enable incremental innovation (Atuahene-Gima 2005). On the other hand, exploration involves the development of new knowledge, seeking the variation and novelty needed for more radical innovation (Atuahene-Gima 2005). As Taylor and Greve (2006) suggest, both strategies require the combination of knowledge: the first employing existing knowledge in well-understood ways and the second leveraging varied and dispersed knowledge in new ways. Similarly, exploitation demands efficiency and convergent thinking to harness the current capabilities and expand product innovation continuously, while exploration, in contrast, entails search and experimentation efforts to generate novel knowledge recombination (Wadhwa and Kotha 2006) in the search for new business territory (Chebbi et al. 2013).

March (1991) assumes that firms must choose between structures that facilitate exploitation (the use of existing knowledge) and those that facilitate exploration (the search for new knowledge). In line with this, Ghemawat and Costa (1993) argue that firms must choose between a strategy of dynamic effectiveness with flexibility and internal efficiency through more rigid discipline, while Vrontis et al. (2012) put forward the notion of strategic reflexivity, emphasizing the need for strategic deployment to become an inherent reflex action of firms seeking fast adaptability to changing external conditions. As many authors point out, pursuing both goals simultaneously would thus involve mixing organizational elements appropriately for each strategy and thus losing the benefit of the complementarities typically obtained between the various elements of each type of organization (Ghemawat and Costa 1993; Porter 1996). This shows organizational ambidexterity from a trade-off perspective. On the one hand, too much effort exerted on the exploitation of current knowledge and competencies can lead to path dependency, which prevents firms from adapting to the dynamic environment (Smith and Tushman 2005; Simsek et al. 2009). On the other hand, too much focus on exploration can starve firms of core competencies (Andriopoulos and Lewis 2009) or lead to underdeveloped new ideas (Levinthal and March 1993). As a result, some authors suggest that a balance must be found between explorative and exploitative activities (Volberda et al. 2001; Cao et al. 2009).

2.2 External knowledge sourcing and organizational ambidexterity

As new technological advances have permeated international markets, increased attention has been paid to the involvement of external knowledge sources within firm innovation processes (Chesbrough 2003). Indeed, the innovation management literature strongly agrees that firms are increasingly having to use both internal and external sources of knowledge to accelerate innovation (Cassiman and Veugelers 2006; Chesbrough 2006). This is because joining collaborations and innovation networks enable firms to access external knowledge, and combining different types of knowledge can enhance innovation (Rosenzweig 2016). In addition, intra- and inter-organizational innovation results from the capacity to share, combine and create new knowledge in order to act dynamically and perceive new opportunity in the current competitive environment (Teece 2007; Audretsch et al. 2016). In this way, a strategically balanced mix of internal and external sources of knowledge can not only prevent over- or under-investment in R&D but also exploit business opportunities efficiently (Cohen and Levinthal 1990; Narula 2001). This is in line with the open innovation paradigm, according to which much of the knowledge that is useful for developing new products and services lies outside the boundaries of the company (Gassmann and Enkel 2004). Therefore, innovation strategies exploiting external flows of knowledge represent a new source of competitive advantage for companies (Gassmann et al. 2010; Del Giudice et al. 2013). This is further both facilitated and enhanced through the accelerating global dispersion of knowledge (Bresciani et al. 2015). Thus, firms increasingly need to collaborate with other actors to enhance their innovativeness and sustain their international market competitiveness. This “openness” helps firms to access ideas, knowledge, skills and technologies from their external environment. In particular, the knowledge and technology transfer is fostered by certain kinds of collaboration, co-creation processes and ecosystem development within an environment that is commonly called the quadruple helix (Carayannis and Rakhmatullin 2014). The stakeholders involved in these ecosystems can be actors such as companies, universities, public and private research centers and citizens, sharing complementary resources, infrastructures, knowledge and technologies (Ferraris and Santoro 2014; Carayannis et al. 2015).

Nevertheless, there is a scarcity of empirical studies assessing the relationship between external knowledge adoption in response to an ambidextrous strategy. A rare exception is the study by Rothaermel and Alexandre (2009), which develops a theoretical model linking ambidexterity in technology sourcing to firm performance. Specifically, the authors find an inverted U-shaped relationship between a firm’s technology sourcing mix and its performance, emphasizing that pursuing ambidexterity in technology sourcing enhances firm performance. From a theoretical point of view, a balanced opening to external sources of knowledge can enhance the competitiveness of firms both in terms of internal efficiency (exploitation) and in terms of their ability to recognize opportunities and technological trajectories (exploration) (Rothaermel and Alexandre 2009). The economics literature, along with the research on knowledge spillovers, suggests that growth opportunities can emerge from the joint effort of internal exploitation and external knowledge sourcing (Nelson and Winter 1982; Cassiman and Veugelers 2002). Superimposing this view on the previous literature section, we verify that organizational ambidexterity can be considered to be the ability of a firm to pursue both exploitative (incremental) and explorative (radical) innovation (O’Reilly and Tushman 2004). Again, exploitation involves the use of explicit knowledge, such that by internalization and combination, incremental refinements to existing technological or marketing trajectories can be made (Nonaka 1994). Essentially, the intention of exploitation is to respond to the current environmental conditions by adapting the existing knowledge and technologies and thus to meet the needs of the existing customers further (Harry and Schroeder 2000). In contrast, exploration involves the use of tacit knowledge bases, such that, by externalizing and combining them, new technological or marketing trajectories are developed (Nonaka 1994).

3 Hypothesis development

Despite early studies’ description of ambidexterity as a trade-off, recent empirical research on the field underlines ambidexterity as an important factor in enhancing the overall firm performance (Junni et al. 2013). In addition, other scholars show that ambidexterity, in terms of exploitation and exploration, is positively associated with innovation performance, specifically with both incremental and radical innovation (Sheremata 2000; Raisch et al. 2009). Moreover, the literature finds that exploitation and exploration are both positively associated with firm sales growth (He and Wong 2004). Finally, Gibson and Birkinshaw (2004) indicate that achieving ambidexterity through contextual support is positively associated with performance. Following this review, we can predict that firms involved in both exploitation and exploration are more likely to achieve better performance. Hence, our first hypothesis is as follows:

HP 1

Organizational ambidexterity is positively associated with firm performance.

Although the literature provides different definitions of exploitation and exploration, according to several studies they are both associated with learning and innovation (Baum et al. 2000; Benner and Tushman 2002; He and Wong 2004), and an expanded knowledge domain base is required. Thus, both exploitation and exploration involve accessing different knowledge-based sources and establishing different kinds of partnership (Shortell and Zajac 1990; Del Giudice and Maggioni 2014). In addition, we expect that KIFs with strong internal capabilities that facilitate the combination of exploitation and exploration activities are likely to seek external knowledge. In turn, the open innovation paradigm points out that involving external knowledge sources enhances learning, innovation and firm performance. For instance, Laursen and Salter (2006) indicate that external search depth is associated with radical innovation while external search breadth is associated with incremental innovation. Hung and Chou (2013) find that external knowledge sourcing is positively associated with the ratio of a firm’s market value to the replacement cost of its assets (Tobin’s q index).

For these reasons, we can predict that external knowledge is positively associated with organizational ambidexterity and that external knowledge sourcing enhances the effects of organizational ambidexterity on firm performance. Hence, our second and third hypotheses are as follows:

HP 2

External knowledge sourcing is positively associated with organizational ambidexterity.

HP 3

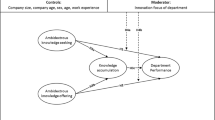

External knowledge sourcing mediates the relationship between organizational ambidexterity and firm performance (Fig. 1).

4 Methodology

4.1 Sample and data collection

This paper aims to analyze the relationship between organizational ambidexterity, external knowledge sourcing and firm performance. To test the hypotheses, we collected data through a semi-structured questionnaire that was sent to the CEO and CTO of each firm, after having explained the purpose of the research. We used multiple respondents, in line with Cao et al. (2009). The CEO was deemed appropriate to provide details of the firm’s performance measures, while the CTO was particularly relevant to information on the firm’s innovation strategy.

The questionnaire itself investigated: (a) general information about the firm, such as industry, firm values, strategy, age and number of employees; (b) economic/financial data, such as profit growth, revenues, R&D expenses and share of income from new products; and (c) innovation process orientation, with a particular emphasis on exploitation, exploration and external knowledge sourcing.

In the first phase, a sample of 500 Italian knowledge-intensive firms was selected from the Italian database AIDA of Bureau Van Dijk; 189 Italian KIFs answered the questionnaire successfully and satisfactorily (response rate of 37.8 %). In line with other studies in this field, we analyzed organizational ambidexterity and external knowledge sourcing at the firm level (Laursen and Salter 2006; Lubatkin et al. 2006; Cao et al. 2009). The firms in the sample are considered to be knowledge intensive, and global KIFs are considered to be the major producers of technological knowledge in the new knowledge economy (Blackler 1995; Keller 2004; Del Giudice and Straub 2011). The concept of knowledge-intensive firms (KIFs) has found widespread usage and acceptance in the organizational science literature, despite the literature recognizing that it is empirically impossible to establish which firms can be considered to be “knowledge intensive” (Alvesson 2011). For these reasons, the concept of KIFs has received substantial attention from researchers. Alvesson defines a KIF as a company in which the majority of employees are well qualified, while Bontis (1998) sees the quality of human capital as a source of innovation and strategic renewal, both essentially denoting employee skills as central to the creation of a competitive advantage and, indeed, to the survival of the organization under harsh market conditions.

For the above reasons, we adopted a perspective that reflects traditional industrial classification schemes, whereby organizations are grouped into industries according to their outputs. To avoid any ambiguity issues, we selected companies from the ICT and electronics sectors, consistent with Swart and Kinnie (2003) and Bell et al. (2004), and the definition of Coviello (1994), as provided in the introduction (Table 1).

4.2 Measurement of constructs

All the latent variables were tested and measured using multiple items based on previous studies (Cao et al. 2009; Laursen and Salter 2006; Aloini et al. 2015). We measured firm performance in line with Gupta and Govindarajan (1986) and Cao et al. (2009), asking the CEO of each firm to rate, on a 1–7 Likert scale, the firm performance for the year 2014 in terms of profit growth, sales growth and market share growth.

We developed a 7-point Likert scale for the organizational ambidexterity second-order construct on the basis of the recommendations by He and Wong (2004), Lubatkin et al. (2006) and Cao et al. (2009), which proved to have high reliability. This also ensured content validity. The construct was measured through two first-order indicators following the literature on organizational ambidexterity, namely exploitation and exploration (March 1991; Adler et al. 1999). In line with these studies, we collected data for these measures by asking the CTO to indicate, on a 1–7 Likert scale (1 = strongly disagree; 7 = strongly agree), the extent to which 8 different statements were true regarding product development in their firm, over the past 3 years. With regard to firm “exploration,” we asked for an evaluation of statements regarding: “introduction of new generations of products”; “extension of product range”; “opening up of new markets”; and “entering new technological fields.” Concerning “exploitation,” we asked for an evaluation of statements regarding: “improvement of existing products”; “improvement of product flexibility”; “reduction of production cost”; and “enhancement of existing markets.” With these questions, the construct thus reflects the extent of the ambidextrous strategy of the firm.

The main purpose of the paper is to evaluate the mediating effect of external knowledge sourcing on the relationship between organizational ambidexterity and firm performance. To measure the external knowledge-sourcing construct, following Aloini et al. (2015), we employed two first-order measures, namely “sources of knowledge” and the “innovation funnel phase.” For the sources of knowledge, we asked the respondents to assign a value of importance (on a 7-point Likert scale) of using 6 external sources according to Laursen and Salter’s classification (customers, suppliers, competitors, consultants, universities and research centers). For the innovation funnel phase, we asked the respondents to assign a value of importance of using external sources in each innovation funnel phase, namely research, development, manufacturing and marketing (Chesbrough and Bogers 2014).

Finally, R&D intensity (a firm’s expenditures on its research and development divided by its revenue) was included as a control variable, since it is recognized as measuring absorptive capacity (Cohen and Levinthal 1990; Tsai 2001; West and Bogers 2014). Here, internal R&D represents a main source of knowledge creation and absorption, allowing firms also to manage the relationship with other internal and external departments better, improving the innovation outcomes and firm performance.

5 Analysis and results

5.1 The measurement model

The model is represented by two second-order constructs, specifically “organizational ambidexterity” and “external knowledge sourcing.” Organizational ambidexterity consists of two first-order factors (exploitation and exploration). Likewise, external knowledge sourcing consists of two first-order factors (sources of knowledge and the innovation funnel phase). We began the data analysis with the use of descriptive statistics to make the data clearer. The measurement scales were assessed according to accepted practices (Gerbing and Anderson 1988). The measurement model shows high reliability and validity of the scales. The reliability was examined using composite reliabilities that show appropriate values (Table 2) and Cronbach’s alpha, which is above 0.70 for each construct (Cronbach 1951; Hair et al. 2001). The content validity is assumed to be appropriate since the scales were developed according to the literature. Overall, the measurement model shows an acceptable fit, with a non-significant χ2 (p > 0.05), CFI, NFI and NNFI above the threshold of 0.90 and RMSEA below the threshold of 0.08.

5.2 The structural model

Following previous studies, we used the structural equation model to test our hypotheses (Aloini et al. 2015). The structural equation model offers the advantage of flexibility in matching the theoretical model with the data and allows the description of unobservable latent variables (Shah and Goldstein 2006). Table 3 shows the acceptable fit of the model. Because of the satisfactory fit of the model, the hypotheses were evaluated by examining the robust estimated structural path coefficients. For the sake of brevity, only the main construct (second-order factors) is presented in the model.

The findings presented in Table 3 show that organizational ambidexterity is not directly associated with firm performance (p > 0.05); thus, hypothesis 1 does not receive support. Conversely, the indirect effect of organizational ambidexterity through the mediation of external knowledge sourcing is significant (β = 0.412; p < 0.01). Thus, hypothesis 3 is strongly supported by our results. Furthermore, hypothesis 2 is supported, since organizational ambidexterity is positively associated with external knowledge sourcing (β = 0.686; p < 0.01). Consistent with previous studies on the open innovation–performance relationship, external knowledge sourcing is positively associated with firm performance (β = 0.592; p < 0.01). Finally, R&D is significantly related to firm performance (β = 0.18; p < 0.05).

6 Discussion and conclusions

This research examined the relationship between organizational ambidexterity and firm performance, hypothesizing a mediating effect of external knowledge sourcing. Two out of three of the hypotheses are supported by the empirical analysis. The results show no evidence of a direct effect of organizational ambidexterity on firm performance. This result is inconsistent with some of the previous empirical studies on organizational ambidexterity (Gibson and Birkinshaw 2004; He and Wong 2004; Junni et al. 2013). One possible explanation is that the previous studies analyze ambidexterity performance in different industries and different contexts (Sidhu et al. 2007) and employ different statistical methods. Rather, our results seem similar to those of Venkatraman et al. (2007), who find no significant relationship between organizational ambidexterity and performance.

The findings, however, do outline the key role of external knowledge sourcing for KIFs and a positive effect on firm performance, consistent with open innovation studies (Laursen and Salter 2006; Van de Vrande et al. 2009; Ahn et al. 2015). In fact, thise specific type of firms (KIFs) gains competitive advantage by converting the existing knowledge and skills into new intellectual capital through explorative activities; because they usually follow a growth strategy which forces them to steadily develop new ideas and to look for new business opportunities. Here, external knowledge sourcing is found not only to be an important driver of KIF performance but also to be a mediator of the relationship between organizational ambidexterity and firm performance. As a consequence, with higher investment in external knowledge, the effects of pursuing both exploitation and exploration on KIF performance are greater.

From a managerial point of view, our results suggest that open innovation should be integrated with the firm strategy. An ambidextrous KIF, which constantly manages and balances exploitation and exploration activities, performs better when exploring external sources of knowledge that are incorporated into the various phases of the innovation funnel. Therefore, a KIF that aims at jointly exploiting existing knowledge and exploring new knowledge should adopt an open approach, considering ideas and knowledge from customers, suppliers, competitors, consultants, universities and research centers and evaluating potential partnerships (Del Giudice and Straub 2011). In this context, as several studies emphasize, openness towards external sources helps in reducing the risks associated with the innovation process and the exploration of new opportunities (Gassmann and Enkel 2004).

In addition, the control variable of R&D intensity is positively related to firm performance. One reason could be that, with more capable R&D employees, KIFs are better able to recognize and integrate external information with internally developed knowledge and technologies. In the given contemporary dynamic and competitive environment, firms have to recognize the complementary role of internally developed knowledge with external knowledge, overcoming the not-invented-here (NIH) syndrome (Katz and Allen 1982). Furthermore, the power of internal R&D enhances firms’ capacity to predict more accurately the nature and commercial potential of new technologies and to choose the right external paths to sources and markets (Chesbrough 2006).

Our study substantially contributes to both external knowledge sourcing and organizational ambidexterity knowledge. First, although the construct of organizational ambidexterity has been widely investigated, and despite many different interpretations of the exploitation and exploration concepts having been provided, actual empirical studies on the ambidexterity–performance relationship remain scarce and show mixed results. Our research thus provides new and valuable empirical evidence on a subject that demands it more than ever, in both the scholarly and the managerial context, and it does so through the employment of a powerful quantitative method within a specific industry context, namely KIFs. In addition, the existing literature does not deeply (or satisfactorily) investigate the contingent factors regulating the ambidexterity–performance relationship (Raisch and Birkinshaw 2008); this research fills part of this gap as well. Moreover, though the open innovation literature thoroughly investigates the effects of firms’ external knowledge-sourcing strategy on their financial and innovation performance, it rarely addresses this relationship within several organizational situations and strategic decisions. Accordingly, we find that firms with higher levels of incorporated external knowledge obtain greater benefits from ambidexterity. This is because external knowledge helps in finding knowledge that is useful to enhance internal efficiency and new knowledge to develop new technological opportunities (Chesbrough 2006; Terwiesch and Xu 2008). One explanation could be that external knowledge helps in managing the internal tension deriving from joint efforts in exploitation and exploration activities (March 1991).

Our work, nonetheless, also presents some limitations. First, we employ the Cao et al. (2009) ambidexterity perspective, which is not in line with some other ambidexterity views. Second, the sample used in this study is represented by firms of different sizes and may not fully represent the population. Third, though we find that openness leads to higher firm performance, our model does not consider the costs of acquiring external knowledge. In fact, the open innovation literature posits that over-searching can lead to negative firm performance due to the increasing transaction costs or the organizational/human resources needed to manage and integrate knowledge coming from several sources (Mintzberg 1983; Williamson 1985; Laursen and Salter 2006; Berchicci 2013). In the above contexts, further research is called for to deploy differing ambidexterity perspectives, further and different sampling techniques and cost factors to enhance and/or validate this research’s findings. Naturally, the academic and industrial relative weight of this research’s findings also demand further research into the wider subject through multiple perspectives and industry contexts towards refinement and practicable adoption.

References

Adler, P. S., Goldoftas, B., & Levine, D. I. (1999). Flexibility versus efficiency? A case study of model changeovers in the Toyota production system. Organization Science, 10(1), 43–68.

Ahn, J. M., Minshall, T., & Mortara, L. (2015). Open innovation: A new classification and its impact on firm performance in innovative SMEs. Journal of Innovation Management, 3(2), 33–54.

Aloini, D., Pellegrini, L., Lazzarotti, V., & Manzini, R. (2015). Technological strategy, open innovation and innovation performance: Evidences on the basis of a structural-equation-model approach. Measuring Business Excellence, 19(3), 22–41.

Alvesson, M. (2011). De-essentializing the knowledge intensive firm: Reflections on sceptical research going against the mainstream. Journal of Management Studies, 48(7), 1640–1661.

Andriopoulos, C., & Lewis, M. W. (2009). Exploitation-exploration tensions and organizational ambidexterity: Managing paradoxes of innovation. Organization Science, 20(4), 696–717.

Atuahene-Gima, K. (2005). Resolving the capability—rigidity paradox in new product innovation. Journal of Marketing, 69(4), 61–83.

Audretsch, D. B., Kuratko, D. F., & Link, A. N. (2016). Dynamic entrepreneurship and technology-based innovation. Journal of Evolutionary Economics, 26(3), 603–620. doi:10.1007/s00191-016-0458-4.

Baum, J. A., Calabrese, T., & Silverman, B. S. (2000). Don’t go it alone: Alliance network composition and startups’ performance in Canadian biotechnology. Strategic Management Journal, 21(3), 267–294.

Bell, J., Crick, D., & Young, S. (2004). Small firm internationalization and business strategy an exploratory study of ‘knowledge-intensive’ and ‘traditional’ manufacturing firms in the UK. International Small Business Journal, 22(1), 23–56.

Benner, M. J., & Tushman, M. (2002). Process management and technological innovation: A longitudinal study of the photography and paint industries. Administrative Science Quarterly, 47(4), 676–707.

Berchicci, L. (2013). Towards an open R&D system: Internal R&D investment, external knowledge acquisition and innovative performance. Research Policy, 42(1), 117–127.

Blackler, F. (1995). Knowledge, knowledge work and organizations: An overview and interpretation. Organization Studies, 16(6), 1021–1046.

Bontis, N. (1998). Intellectual capital: An exploratory study that develops measures and models. Management Decision, 36(2), 63–76.

Bresciani, S. (2010). Innovation within firms: A survey in the Piedmont area. International Journal of Quality and Innovation, 1(2), 138–152.

Bresciani, S., & Ferraris, A. (2014). The localization choice of multinational firms’ R&D Centers: A survey in the Piedmont area. Journal of Promotion Management, 20(4), 481–499.

Bresciani, S., Thrassou, A., & Vrontis, D. (2015). Strategic R&D internationalisation in developing Asian countries—the Italian experience. World Review of Entrepreneurship, Management and Sustainable Development, 11(2–3), 200–216.

Cao, Q., Gedajlovic, E., & Zhang, H. (2009). Unpacking organizational ambidexterity: Dimensions, contingencies, and synergistic effects. Organization Science, 20(4), 781–796.

Carayannis, E. G., & Rakhmatullin, R. (2014). The quadruple/quintuple innovation helixes and smart specialisation strategies for sustainable and inclusive growth in Europe and beyond. Journal of the Knowledge Economy, 5(2), 212–239.

Carayannis, E. G., Sindakis, S., & Walter, C. (2015). Business model innovation as lever of organizational sustainability. The Journal of Technology Transfer, 40(1), 85–104.

Cassiman, B., & Veugelers, R. (2002). R&D cooperation and spillovers: Some empirical evidence from Belgium. The American Economic Review, 92(4), 1169–1184.

Cassiman, B., & Veugelers, R. (2006). In search of complementarity in innovation strategy: Internal R&D and external knowledge acquisition. Management Science, 52(1), 68–82.

Chebbi, H., Yahiaoui, D., Thrassou, A., & Vrontis, D. (2013). The exploration activity’s added value into the innovation process. Global Business and Economics Review, 15(2–3), 265–278.

Chebbi, H., Yahiaoui, D., Vrontis, D., & Thrassou, A. (2015). Building multiunit ambidextrous organizations: A transformative framework. Human Resource Management, Special Issue on Ambidexterity of Human Resource Management. doi:10.1002/hrm.21662.

Chesbrough, H. (2003). The logic of open innovation: Managing intellectual property. California Management Review, 45(3), 33–58.

Chesbrough, H. W. (2006). The era of open innovation. Managing Innovation and Change, 127(3), 34–41.

Chesbrough, H., & Bogers, M. (2014). Explicating open innovation: Clarifying an emerging paradigm for understanding innovation. In H. Chesbrough, W. Vanhaverbeke, & J. West (Eds.), New Frontiers in open innovation (pp. 3–28).

Chesbrough, H., Vanhaverbeke, W., & West, J. (Eds.). (2006). Open innovation: Researching a new paradigm. Oxford: OUP Oxford.

Cohen, W. M., & Levinthal, D. A. (1990). Absorptive capacity: A new perspective on learning and innovation. Administrative Science Quarterly, 35, 128–152.

Cooper, R. G., & Kleinschmidt, E. J. (1993). Major new products: What distinguishes the winners in the chemical industry? Journal of Product Innovation Management, 10(2), 90–111.

Coviello, N. E. (1994). Internationalizing the entrepreneurial high technology, knowledge-intensive firm, Ph.D. thesis, Department of Marketing, University of Auckland, New Zealand.

Cronbach, L. J. (1951). Coefficient alpha and the internal structure of tests. Psychometrika, 16(3), 297–334.

Danneels, E. (2002). The dynamics of product innovation and firm competences. Strategic Management Journal, 23(12), 1095–1121.

Del Giudice, M., Della Peruta, M. R., & Maggioni, V. (2013). Collective knowledge and organizational routines within academic communities of practice: an empirical research on science–entrepreneurs. Journal of the Knowledge Economy, 4(3), 260–278.

Del Giudice, M., & Maggioni, V. (2014). Managerial practices and operative directions of knowledge management within inter-firm networks: A global view. Journal of Knowledge Management, 18(5), 841–846.

Del Giudice, M., & Straub, D. (2011). Editor’s comments: IT and entrepreneurism: An on-again, off-again love affair or a marriage? MIS Quarterly, 35(4), iii–viii.

Drucker, P. (2014). Innovation and entrepreneurship. Abingdon-on-Thames: Routledge.

Duncan, R. B. (1976). The ambidextrous organization: Designing dual structures for innovation. The Management of Organization, 1, 167–188.

Enkel, E., Gassmann, O., & Chesbrough, H. (2009). Open R&D and open innovation: Exploring the phenomenon. R&D Management, 39(4), 311–316.

Ferraris, A., & Santoro, G. (2014). Come dovrebbero essere sviluppati i progetti di social innovation nelle smart city? Un’analisi comparativa. Impresa Progetto-Electronic Journal of Management, 4, 1–15.

Floyd, S. W., & Lane, P. J. (2000). Strategizing throughout the organization: Managing role conflict in strategic renewal. Academy of Management Review, 25(1), 154–177.

Gassmann, O., & Enkel, E. (2004). Towards a theory of open innovation: Three core process archetypes. In R&D management conference (Vol. 6, No. 0, pp. 1–18).

Gassmann, O., Enkel, E., & Chesbrough, H. (2010). The future of open innovation. R&D Management, 40(3), 213–221.

Gerbing, D. W., & Anderson, J. C. (1988). An updated paradigm for scale development incorporating unidimensionality and its assessment. Journal of Marketing Research, 25, 186–192.

Ghemawat, P., & Ricart Costa, J. E. (1993). The organizational tension between static and dynamic efficiency. Strategic Management Journal, 14(S2), 59–73.

Ghoshal, S., & Bartlett, C. A. (1994). Linking organizational context and managerial action: The dimensions of quality of management. Strategic Management Journal, 15(S2), 91–112.

Gibson, C. B., & Birkinshaw, J. (2004). The antecedents, consequences, and mediating role of organizational ambidexterity. Academy of Management Journal, 47(2), 209–226.

Gorman, M. E. (2002). Types of knowledge and their roles in technology transfer. The Journal of Technology Transfer, 27(3), 219–231.

Gupta, A. K., & Govindarajan, V. (1986). Resource sharing among SBUs: Strategic antecedents and administrative implications. Academy of Management Journal, 29(4), 695–714.

Hair, J., Anderson, R., Tatham, R., & Black, W. (2001). Análisis multivariante (5a ed.). Madrid: Prentice Hall.

Harry, M., & Schroeder, R. (2000). Six sigma: The breakthrough management strategy revolutionizing the world’s top corporations. New York: Currency.

He, Z. L., & Wong, P. K. (2004). Exploration versus exploitation: An empirical test of the ambidexterity hypothesis. Organization Science, 15(4), 481–494.

Hung, K. P., & Chou, C. (2013). The impact of open innovation on firm performance: The moderating effects of internal R&D and environmental turbulence. Technovation, 33(10), 368–380.

Junni, P., Sarala, R. M., Taras, V., & Tarba, S. Y. (2013). Organizational ambidexterity and performance: A meta-analysis. The Academy of Management Perspectives, 27(4), 299–312.

Katz, R., & Allen, T. J. (1982). Investigating the not invented here (NIH) syndrome: A look at the performance, tenure, and communication patterns of 50 R&D Project Groups. R&D Management, 12(1), 7–20.

Keller, W. (2004). International technology diffusion. Journal of Economic Literature, 42(3), 752–782.

Laursen, K., & Salter, A. (2006). Open for innovation: The role of openness in explaining innovation performance among UK manufacturing firms. Strategic Management Journal, 27(2), 131–150.

Levinthal, D. A., & March, J. G. (1993). The myopia of learning. Strategic Management Journal, 14(S2), 95–112.

Lubatkin, M. H., Simsek, Z., Ling, Y., & Veiga, J. F. (2006). Ambidexterity and performance in small-to medium-sized firms: The pivotal role of top management team behavioral integration. Journal of Management, 32(5), 646–672.

March, J. G. (1991). Exploration and exploitation in organizational learning. Organization Science, 2(1), 71–87.

Mintzberg, H. (1983). Structures in fives. Engelwood-Cliffs, CA: Prentice-Hall.

Narula, R. (2001). Choosing between internal and non-internal R&D activities: Some technological and economic factors. Technology Analysis & Strategic Management, 13(3), 365–387.

Nelson, R. R., & Winter, S. G. (1982). The schumpeterian tradeoff revisited. The American Economic Review, 72(1), 114–132.

Nonaka, I. (1994). A dynamic theory of organizational knowledge creation. Organization Science, 5(1), 14–37.

O Reilly, C. A., & Tushman, M. L. (2004). The ambidextrous organization. Harvard Business Review, 82(4), 74–83.

Porter, M. E. (1996). What is strategy? Harvard Business Review, 74(6), 61–81.

Raisch, S., & Birkinshaw, J. (2008). Organizational ambidexterity: Antecedents, outcomes, and moderators. Journal of Management, 34(3), 375–409.

Raisch, S., Birkinshaw, J., Probst, G., & Tushman, M. L. (2009). Organizational ambidexterity: Balancing exploitation and exploration for sustained performance. Organization Science, 20(4), 685–695.

Rosenzweig, S. (2016). The effects of diversified technology and country knowledge on the impact of technological innovation. The Journal of Technology Transfer. doi:10.1007/s10961-016-9492-5.

Rothaermel, F. T., & Alexandre, M. T. (2009). Ambidexterity in technology sourcing: The moderating role of absorptive capacity. Organization Science, 20(4), 759–780.

Santoro, G., Ferraris, A., Giacosa, E., & Giovando, G. (2016). How SMEs engage in open innovation: A survey. Journal of the Knowledge Economy. doi:10.1007/s13132-015-0350-8.

Shah, R., & Goldstein, S. M. (2006). Use of structural equation modeling in operations management research: Looking back and forward. Journal of Operations Management, 24(2), 148–169.

Sheremata, W. A. (2000). Centrifugal and centripetal forces in radical new product development under time pressure. Academy of Management Review, 25(2), 389–408.

Shortell, S. M., & Zajac, E. J. (1990). Perceptual and archival measures of Miles and Snow’s strategic types: A comprehensive assessment of reliability and validity. Academy of Management Journal, 33(4), 817–832.

Sidhu, J., Commandeur, H. R., & Volberda, H. W. (2007). The multifaceted nature of exploration and exploitation: Value of supply, demand, and spatial search for innovation. Organization Science, 18, 20–38.

Simsek, Z., Heavey, C., Veiga, J. F., & Souder, D. (2009). A typology for aligning organizational ambidexterity’s conceptualizations, antecedents, and outcomes. Journal of Management Studies, 46(5), 864–894.

Smith, W. K., & Tushman, M. L. (2005). Managing strategic contradictions: A top management model for managing innovation streams. Organization Science, 16(5), 522–536.

Swart, J., & Kinnie, N. (2003). Knowledge-intensive firms: The influence of the client on HR systems. Human Resource Management Journal, 13(3), 37–55.

Taylor, A., & Greve, H. R. (2006). Superman or the fantastic four? Knowledge combination and experience in innovative teams. Academy of Management Journal, 49(4), 723–740.

Teece, D. J. (2007). Explicating dynamic capabilities: The nature and microfoundations of (sustainable) enterprise performance. Strategic Management Journal, 28(13), 1319–1350.

Terwiesch, C., & Xu, Y. (2008). Innovation contests, open innovation, and multiagent problem solving. Management Science, 54(9), 1529–1543.

Thrassou, A. (2007). Doing business in the industrialised countries, Chapter 13. In M. Katsioloudes & S. Hadjidakis (Eds.), International business—a global perspective. Oxford: Butterworth-Heinemann. ISBN 978-0-7506-7983-1.

Thrassou, A., Vrontis, D., & Bresciani, S. (2014). Strategic reflexivity in the hotel industry—a value-based analysis. World Review of Entrepreneurship, Management and Sustainable Development, 10(1–2), 352–371.

Tidd, J., Bessant, J., & Pavitt, K. L. R. (2000). Managing innovation: Integrating technological, market and organizational change (2nd ed.). Wiley: Chichester.

Tsai, W. (2001). Knowledge transfer in intraorganizational networks: Effects of network position and absorptive capacity on business unit innovation and performance. Academy of Management Journal, 44(5), 996–1004.

Tushman, M. L., & O’Reilly, C. A. (1996). The ambidextrous organizations: Managing evolutionary and revolutionary change. California Management Review, 38(4), 8–30.

Van de Vrande, V., De Jong, J. P., Vanhaverbeke, W., & De Rochemont, M. (2009). Open innovation in SMEs: Trends, motives and management challenges. Technovation, 29(6), 423–437.

Venkatraman, N., Lee, C. H., & Iyer, B. (2007). Strategic ambidexterity and sales growth: A longitudinal test in the software sector. In Unpublished manuscript (earlier version presented at the Academy of Management Meetings, 2005).

Volberda, H., Baden-Fuller, C., & Van den Bosch, F. A. J. (2001). Mastering strategic renewal: Mobilizing renewal journeys in multi-unit fi rms. Long Range Planning, 34, 159–178.

Vrontis, D., & Thrassou, A. (Eds.). (2013). Innovative business practices: Prevailing a Turbulent Era. Cambridge: Cambridge Scholars Publishing.

Vrontis, D., Thrassou, A., Chebbi, H., & Yahiaoui, D. (2012). Transcending innovativeness towards strategic reflexivity. Qualitative Market Research: An International Journal, 15(4), 420–437. doi:10.1108/13522751211257097.

Wadhwa, A., & Kotha, S. (2006). Knowledge creation through external venturing: Evidence from the telecommunications equipment manufacturing industry. Academy of Management Journal, 49(4), 819–835.

West, J., & Bogers, M. (2014). Leveraging external sources of innovation: A review of research on open innovation. Journal of Product Innovation Management, 31(4), 814–831.

Williamson, O. E. (1985). The economic intstitutions of capitalism. NewYork: Simon and Schuster.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no competing interests.

Research involving human participants

The authors declare that the surveyed have been correctly informed about the purpose of this study. The authors also declare that data have been collected in an anonymous way and in aggregated form.

Rights and permissions

About this article

Cite this article

Vrontis, D., Thrassou, A., Santoro, G. et al. Ambidexterity, external knowledge and performance in knowledge-intensive firms. J Technol Transf 42, 374–388 (2017). https://doi.org/10.1007/s10961-016-9502-7

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10961-016-9502-7