Abstract

Academic entrepreneurship, the establishment of new companies based on technologies derived from university research, is a well-recognized driver of regional and national economic development. For more than a decade, scholars have conceptualized individual university faculty as the primary agents of academic entrepreneurship. Recent research suggests that graduate students also play a critical role in the establishment and early development of university spinoff companies, but the nature of their involvement through the entrepreneurial process is not yet fully understood. Employing a case study approach, this paper investigates the role of graduate students in early-stage university spinoff companies from the Massachusetts Institute of Technology. We find that graduate students play role similar to that of individual faculty entrepreneurs in university spinoffs, both in terms of making the initial establishment decision and in reconfiguring the organization for marketable technology development. We also find that student entrepreneurs face unique challenges involving conflicts with faculty advisors and other students.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

Larry Page and Sergey Brin developed the underlying technology for the now-multi-billion dollar corporation Google while graduate students at Stanford University. Beyond their spectacular commercial success, the efforts of Messrs. Page and Brin are representative of the entrepreneurial potential of students as ‘knowledge agents’ important for the dissemination and commercialization of university knowledge, a critical ingredient for regional economic development (Roberts 1991; Roberts and Eesley 2009; Romer 1990; Stephan 2009). In the words of Massachusetts of Technology president, L. Rafael Reif:

A powerful way that MIT graduates drive progress is by starting companies that deliver new ideas to the world…MIT alumni have launched more than 30,000 active companies, creating 4.6 million jobs, and generating roughly $1.9 trillion in annual revenue (2015).

Despite the perceptible link between students and the economic impact of their companies, scholars have largely overlooked the specific entrepreneurial role of students. Part of this oversight may be explained by an early focus by researchers on the firm—in the case of a university, a spinoff company—as the primary unit of analysis. A firm-level focus neglects the role of individual entrepreneurs such as faculty and students, a challenge observed within the broader entrepreneurship literature (Acs et al. 2009; Bradley et al. 2013a; Braunerhjelm et al. 2010; Link et al. 2014). For example, early studies of the entrepreneurial activities of universities focus primarily on the relative number of spinoffs established, not necessarily entrepreneur-specific or intra-firm factors responsible for spinoff performance and, thus, their economic impact (Hayter 2015b; Phan and Siegel 2006).

Recent studies have emphasized the role of individual ‘academic entrepreneurs’: faculty, technicians, postdoctoral fellows, or students who act as the primary entrepreneurial agent for the dissemination and commercialization of new knowledge generated in universities (Hayter 2013, 2015b). Although early work contained a broad conceptualization of the academic entrepreneur (e.g. Doutriaux 1987), more recent and influential scholarship focused on the role of individual university faculty. For example, in his investigation of the emergence and contributions of university spinoffs (specifically from MIT),Footnote 1 Shane (2004) posits that academic entrepreneurship is the establishment of new spinoff companies by university faculty. Other studies have similarly adopted a faculty-as-entrepreneur approach given their role as principal investigators on sponsored research projects, relatively uniform intellectual property guidelines for faculty who conduct federally-funded research,Footnote 2 as well as their academic rank and technical knowledge, factors important for the establishment of new spinoff companies (Bradley et al. 2013a; Link et al. 2007). Indeed, studies show that the individual academic entrepreneur, their entrepreneurial motivations and growth ambitions (Hayter 2011, 2015a; Lam 2011) social networks (Hayter 2013, 2016a; Rasmussen et al. 2015), backgrounds (O’Gorman et al. 2008), and access to resources (Wright et al. 2007) are critical factors in the function and long-term success of university spinoffs.

Recent research questions this narrow emphasis on faculty in the extant literature; graduate students also play a catalytic role in academic entrepreneurship (Boh et al. 2016; Hayter 2016a; Lubynsky 2012). However, beyond a few exceptions (reviewed in Sect. 2 below), scholars have largely eschewed knowledge-based investigations of the role of students, especially graduate students, in the establishment and early-stage development of university spinoff companies. For example, to what extent are student entrepreneurs engaging in similar activities as faculty entrepreneurs? Does their engagement ebb and flow through the life cycle of the spinoff? To what extent does their status as students create unique difficulties and challenges? Without a better understanding of the roles and challenges faced by student entrepreneurs, scholars, and policymakers seeking to accelerate the development and economic impact of university spinoffs run the risk of targeting related programs and policies incorrectly.

Our investigation seeks to address this conspicuous gap in the literature by investigating the role and factors associated with graduate students in the early-stage development of university spinoffs. The reminder of the paper is organized as follows. Section 2 reviews the modest but emergent literature that examines to role of graduate students in university spinoffs. Section 3 discusses the methodological approach taken in the present study while Sect. 4 presents the findings of the investigation. Finally, we discuss the implications of the paper for policy as well as future research in Sect. 5.

2 Literature review

2.1 Student entrepreneurship

Early empirical research related to student entrepreneurship focused primarily on the emergence of entrepreneurship education programs: The response of higher education institutions to growing student demands for entrepreneurship courses and programs along with growing recognition that entrepreneurship is important. The growth of university entrepreneurship education offerings has been extraordinary (Hébert and Link 2009; Morris 2015); according to Katz (2003, 2004), the number of entrepreneurship education programs established within universities has grown exponentially since the early 1980s driven by student interest and the emergent economic development missions of universities. Further, Pittaway and Cope (2007) posit that a critical mass of related empirical research exists relating to entrepreneurship education programs, including course pedagogy and entrepreneurial management training, as well as the establishment of student-based ventures.

Research shows that university culture and entrepreneurship programs can positively impact the entrepreneurial motivations and attitudes of students (Boh et al. 2016; Pittaway and Cope 2007). How students are initially exposed to entrepreneurship matters: While most education programs focus on teaching entrepreneurship in a classroom setting, learning-by-doing and building relevant social networks are far more effective for spurring entrepreneurial behavior (Rasmussen and Sorheim 2006; Shah and Pahnke 2014). Similarly, Bailetti (2011) and Barr et al. (2009) compare traditional lecture format with hands-on entrepreneurial education and find the latter is critical for enabling entrepreneurial skills important to success. Facilitated student interactions with entrepreneurs and small business owners provide students with role models, practical skills, and expanded networks (Brindley and Ritchie 2000; Fukugawa 2005; Ridder and Van der Sijde 2003; Wani et al. 2004). Similarly, Bramwell and Wolfe (2008) describe the cooperative education (‘co-op’) program at Waterloo University that places students into companies to work on tangible problem-solving projects and thus provides valuable experience that may be useful to future entrepreneurial efforts.

Limited evidence shows that entrepreneurship programs do not necessarily increase the likelihood that a student will establish a new company. Oehler et al. (2015), for example, examine the entrepreneurial attitudes and skills among German undergraduate students taking entrepreneurship courses and find that, though their entrepreneurial intentions are strong, most are unsure of the efficacy of what they know or need to know to be a successful entrepreneur. Oosterbeek et al. (2010) find that entrepreneurship programs can moderate entrepreneurial intentions by providing students with a more realistic perspective on the lifestyle and skills needed for successful entrepreneurship. Further, Berggren and Dahlstrand (2009) find that regional policies and networks may have a disproportionate impact on entrepreneurial motivations and success among students and faculty compared to internal university factors.

Though empirical investigations of the economic impact of student entrepreneurship are rare, scholars have shown that students establish new companies more often than faculty. Åstebro et al. (2012), for example, find that recent university graduates are, in general, more likely to start new businesses than university faculty by a factor of 24.3 to 1. Further, the propensity among students to establish companies likely translates initially into life-long entrepreneurial behavior important to regional economic growth. Roberts (1991) and Roberts and Eesley (2009, 2011) discuss, for example, the impact students and alumni from the Massachusetts Institute of Technology (MIT) and their impact on the Boston metropolitan region. Roberts (1991) found that entrepreneurs within the Boston Metropolitan area were most likely to establish their first company in their late 1920s or early 1930s. However, more recent analyses of MIT students, faculty, and alumni find that first time academic entrepreneurs are not only younger, early exposure to entrepreneurial ideas and networks help form long-lasting entrepreneurial perspectives (Hsu et al. 2007; Roberts and Eesley 2009, 2011; Roberts et al. 2015).

2.2 Graduate students and postdocs

Despite the considerable body of research that focuses on student entrepreneurship education, little attention has been given to the role of students in the establishment and development of university spinoff companies, though a few exceptions exist. Boh et al. (2016), for example, find that among 47 university spinoffs in their sample, graduate students and postdocs were involved in 36 (77 %), with at least 11 spinoffs established with no faculty involvement (i.e. solely established by graduate students and/or postdocs). The authors find that both faculty and students are heavily involved in early phases of the spinoff but that the role of faculty (where applicable) diminishes over time whereas student involvement is sustained over the course of the study. Further, students from different disciplines may aid spinoff success: Business school students may possess management, accounting, and fundraising capabilities complementary to the scientific and technical skills of science and engineering students and faculty.

Hayter (2016a) examines the composition, contributions, and evolution of social networks among faculty entrepreneurs and similarly finds that graduate students play a critical role in the early stages of spinoff development. Specifically, out of 366 business contacts reported by faculty entrepreneurs as critical to the establishment and growth of their spinoff, 51 (14 %) were graduate students. The author found that the primary contribution of graduate students is their role as catalysts, convincing faculty to establish their spinoff company and then providing the time and leadership needed to do just that. In several cases, faculty reported that their spinoff would not exist without the efforts of their graduate students who assumed roles as co-founder or CEO. The second primary contribution of graduate students was their technical expertise related to relatively fundamental scientific problems. Graduate students are typically involved in the academic research of faculty and work on research within a spinoff context similar to their role within a university laboratory. Hayter (2016a) also finds that students unfortunately do not generally possess the knowledge or networks necessary to accelerate spinoff development.

Beyond these recent contributions, however, scholars have overlooked the entrepreneurial role of graduate students choosing instead to conceptualize the ‘academic entrepreneur’ as individual university faculty. This study seeks to address this oversight by investigating the role and factors associated with students in the early-stage development of university spinoffs. The next section discusses our methodological approach.

3 Methodology

3.1 Study approach

This paper empirically investigates the role of graduate students in the establishment and development of university spinoff companies. A spinoff is defined as a company established by a researcher (faculty, staff or student) based on technologies stemming from university research. Following Link and Ruhm (2009), we frame spinoff success in terms of technology commercialization, the sale of derivative products or services.

Studies of new entrepreneurship phenomena are criticized for their reliance on structured surveys, predefined measures, and working assumptions that exclude more inductive responses (e.g. Cliff 1998; Brush 1992; Shane et al. 2003). Deductive approaches are problematic for areas—such as graduate students entrepreneurship—where little empirical research exists and theory is thus non-existent. In these cases, inductive, qualitative approaches are recommended in order to contribute to the scholarship and inform future theory-building efforts (Cooper 2003; Patton 2002; Phan and Siegel 2006; Shane 2004).

For the purposes of our study, we thus articulate three broad, inductive research questions to guide our investigation:

-

Q 1 What is the role of graduate students within university spinoffs?

-

Q 2 What are their specific contributions to spinoff establishment and development?

-

Q 3 What are challenges associated with graduate student involvement in university spinoffs?

To address these questions, we accordingly adopt a case study approach (Eisenhardt 1989). A case study approach allows researchers to ask questions of how, why, and what. Further, case studies permits replication logic treating each case as an independent experiment to confirm or disconfirm the inferences drawn from other cases (Yin 2003).

3.2 Data collection

Given the paucity of empirical data on the topic, we investigate the role of graduate students among a relevant sample of university spinoffs from MIT. A sample framing strategy was crafted following procedures outlined by Miles and Huberman (1994). Eight MIT spinoffs were selected in order to investigate the role, contributions, and challenges of graduate student involvement therein. Spinoffs were identified based on their potential to represent various stages of spinoff development—from pre-spinoff idea formulation to older firms that had achieved commercialization as well as those that had not.Footnote 3

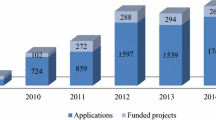

All spinoffs in the sample had received assistance from MIT’s Venture Mentoring Service (VMS) within the period of 2002–2012. Data were collected through a variety of mechanisms, including (1) semi-structured interviews with multiple spinoff personnel, (2) other personnel such as advisors, mentors, investors and other observers involved in the establishment of the spinoffs, (3) archival data collected by VMS relating to spinoff performance, and (4) other documents and materials provided by spinoff companies themselves.

Eight spinoffs were observed through various stages of development over varying lengths of time, from 6 months to 10 years (See Table 1), thus providing insights on graduate student involvement within different entrepreneurial contexts. Specifically data were collected from over 3400 documents from the VMS archives as well as 22 individuals associated with the ideation, establishment, and subsequent development of the spinoffs. Data were collected in person or over the phone; periodic interviews ranged in length from 90 min to 2 h. Follow-on inquiries for clarification purposes were undertaken as needed.

Table 1 presents the eight spinoffs selected for our study. Given that information disclosed during the study is potentially sensitive, each spinoff has been given a pseudonym and the year of spinoff establishment has not been disclosed. The second column in Table 1 presents spinoff industry while the third column presents the associated academic discipline. The fourth and fifth columns list the number and position of spinoff founders at the time of the study. The ‘Development Status’ column indicates the growth stage achieved by the spinoff at time of observation. The final column shows the outcome achieved since the time of the study, including in progress (i.e. pursuing commercialization); commercialization, acquisition, or failure. The next section summarizes our findings.

4 Findings

Our empirical inquiry yields three principal findings. First, graduate students, not faculty, played the lead role in the initial establishment of all spinoffs in the sample. Second, graduate students played a critical role in the subsequent development of the spinoff company, including acquiring and managing resources for growth and reconfiguring the spinoff for commercialization. Finally, we find that graduate students often faced multiple conflicts with faculty and other students associated with tension between their academic and entrepreneurial responsibilities. We discuss each of these findings in more detail below.

4.1 Students, not faculty, launched most ventures

The literature holds that faculty are primarily responsible for the launch of new university spinoff companies. For all eight spinoffs in the sample, however, graduate students served as the primary entrepreneurial agent for company establishment and development. Additionally, in six of the eight startups, fundamental spinoff technologies were derived from the PhD thesis research of individual graduate students, and another from a separate (non-thesis related) research stream originated by the student.

An important early activity for the student entrepreneur was to define the relationship between the venture and their faculty advisor. All graduate students in the study acknowledged the credibility that the relationship with their advisors could bring to their spinoff, including their social networks and scientific and technical expertise. Graduate students also (initially) viewed relationships with their advisor as symbiotic, allowing them to provide scientific feedback and resources back to the professor and his or her lab. What many graduate students found, however, is that their advisors did not have the time or interest to devote to intensive management or research tasks not related to their primary responsibilities as a university faculty member.

Consequently, faculty roles within spinoffs in our sample varied substantially. As illustrated in Table 2, faculty were formally involved in three spinoff companies, one as co-founder (Lamda Magnetics) and two as scientific advisor board (SAB) member (Gamma Materials and Delta Pharma). In all three cases, the technological focus on the spinoff company was directly related to the primary research focus of the faculty member at that time. In the case of Beta Bio, the graduate student advisor was involved in early spinoff-related discussions though, discussed in Sect. 4.3 below, the faculty researcher decided to pursue their own, separate entrepreneurial venture. In the case of Alpha Chips, the faculty researcher played an informal role in the development of the core spinoff technology but chose not to participate because “I’ve got too many shares in too many start-ups that never went anywhere” (Alpha Chips).

For the three other spinoff companies, graduate students asked their advisors to—at a minimum—participate in their respective venture’s scientific advisory board. In all three cases, advisors declined to take a more active role because the core spinoffs were not, according to student entrepreneurs, well-connected to their research interests or had “moved his research in other directions” (Alpha Chips). Thus, while faculty roles ranged from co-founder, to scientific advisory board (SAB) member, to no role, graduate students were primarily responsible for the establishment and early development of university spinoff companies within our sample.

4.2 Student role in resource reconfiguration

A number of empirical studies frame university spinoff success in terms of their ability to achieve various developmental milestones. Vohora et al. (2004), for example, view spinoff success as iterative and nonlinear, where spinoffs acquire and reconfigure necessary resources, capabilities, and network ties necessary to pass through a series of milestones that they term critical junctures. Spinoff success is defined as forward progression though each critical juncture, with the eventual goal of achieving enterprise sustainability. Though the findings are limited to faculty entrepreneurs, Hayter (2013) shows that the post-establishment credibility phase, whereby academic entrepreneurs obtain and reconfigure myriad resources important to venture success, is a critical crossroads for university spinoffs. In the present case, graduate students are critical for obtaining and reconfiguring critical resources; the sections below describe when and how.

4.2.1 Opportunity investigation and vetting

Each of the eight ventures in the study drew upon informal (or network) and formal resources from MIT as well as the Boston Metropolitan region to inform their startup decision. All graduate student founders spoke with their classmates in order to find possible venture partners and solicit advice from those with prior experience launching companies.

Six of eight spinoff companies participated in at least one formal business plan competition. Business plan competitions were particularly important for guiding spinoffs toward the development of specific products and services; as one founder put it, business plan competitions were a way to “pressure test” venture ideas. In addition to formal competition processes, business plan competitions included mixers and other networking events that proved valuable for graduate students to interact with others outside their respective disciplines, especially business school students. Further, investors and attorneys were involved within the competitions, providing valuable guidance and advice for nascent entrepreneurs to refine their business plan. According to the founder of Gamma Materials, competitions are an important tool for refining the venture and building confidence:

In doing the competition, I found enough to convince myself that this could be, yeah, that there’s definitely, this is something that’s very commercially feasible. I was the first to commit to this. I decided probably about half way through the competition that I’m gonna start a company with this no matter what (Student Founder, Gamma Materials, July 11, 2012).

The competition is but one component of a wide range of entrepreneurship support programs and networks—an entrepreneurship ecosystem—within and around MIT. Many of these resources were unknown to graduate students during their time as students as well as the early phases of spinoff development. However, the business competition and their participation in MIT VMS programs often led to a greater understanding of the entrepreneurship support programs at their disposal, as did informal interactions with students and faculty with entrepreneurial experience or interest. It was through these multiple and iterative interactions that students were able to gain visibility and introductions to many other resources and individuals. Perhaps most importantly, these venues often included relevant individuals from the Boston Metropolitan region, including attorneys, investors, entrepreneurs, and other entrepreneurship support programs with whom graduate students could work in order to improve their technologies, products, and business ideas.

4.2.2 Acquiring and managing resources

All spinoffs in the sample believed they possessed a promising technology at the time they exited the university and devoted full time effort to the new venture. All founders eventually came to the realization that an early-stage technology developed within an academic context is far from a commercial product and that further development requires substantial time and resources. Pursuing a variety of fund-raising activities, founders responded by collectively attracting more than $70 million in funding during their early years while focusing on further technology development. Over 80 % of this funding initially came from research grants given to their new spinoffs such as Small Business Innovation Research (SBIR) awards and other public research funding. The grants were supplemented with limited personal resources such as savings and small amounts of prize monies from the business plan competitions. They also obtained small amounts of equity-type funding from individuals who were very close to the founders such as family members and friends. For example, one spinoff was surprised to receive an unsolicited check from their faculty advisor after they had graduated. In the post-graduation stages of the spinoff, any equity investments tended to come from angel investors closely connected with the primary contacts of the founder and were motivated to invest beyond purely financial factors.

The majority of this funding went to support additional technology development through the hiring of talented researchers and engineers. For example, Epsilon built up to 40 researchers, half of them PhDs. Alpha grew to 20 researchers, Delta Pharma had 12 and Zeta Web had a research development staff of 12. Thus, graduate student entrepreneurs had to quickly become effective leaders and managers who can motivate technical teams to help meet the technical goals of the spinoff company:

Well I think the biggest maybe like thing that I couldn’t have anticipated was people. So like learning to manage people and deal with the people aspects of an organization. That’s still a learning experience for me and something I didn’t realize I was going to be doing. I just figured it’ll just be like MIT, like you get smart people who make stuff, like they’ll be awesome, I’ll be awesome, we’ll all just show up for work in our sneakers. It’ll be fine, we’ll make some stuff, it’ll be awesome. But then you’ve got to figure how to build them into a team. (Student Founder, Alpha Chips, June 20, 2012)

All founders described their transition from graduate student to that of an entrepreneur as extremely challenging. While students felt they possessed the capability to deal with technology development issues, they struggled with organizational leadership and management and often sought advice on these issues. Specifically, they received guidance from investors, advisors and mentors, often on an ad-hoc basis. They also turned to other student entrepreneurs who had faced similar challenges. More developed spinoffs were able to bring on experienced entrepreneurs, initially on a part-time basis, to help direct operations.

4.2.3 Reconfiguring for commercialization

Six ventures had developed to a point where they recognized the need to develop a product or service to drive future sales. For student entrepreneurs, this realization grew from the aggregation of various spinoff experiences, including business plan competitions, interactions with successful entrepreneurs, or organically during the long process of technology development. Four of the six ventures were able to transition from their nearly singular focus on technology development to successfully commercialize a product.

Student entrepreneurs described two key challenges to this transition. The first challenge related to managing the composition of their staff and management. All spoke about the need to find and hire qualified individuals in product-focused and customer-facing roles, while placing relatively importance on scientific research. The comments on one student founder illustrated this transition:

We’ve largely proven out the technology. We’ve developed what we think has a lot of value and we’re starting to scale that up. And so this is the first year we’re out in external trials, we’re lining up big commercial partners. . . . It’s becoming more industrial as we pivot from discovery into development and commercialization. Before that though, when we were in the discovery phase, it was you know, I wouldn’t say it was academic but it was much more open and collaborative. . . . So we’re starting to hire fewer PhD-level people. . . . We’ll be hiring more sort of downstream field-type people. We’ll probably hire some more engineering people. . . . We’ll retask some of the PhDs for where you need a high level of technical sophistication. . . . We’ll probably hire a few more executives. So we’re going to have to expand the management team for sure. (Student Founder, Epsilon Energy, July 25, 2012)

The second challenge for graduate student entrepreneurs was managing the transition to different funding sources. While all ventures in the study benefited from research grants and early-stage angel investments, it became necessary to approach professional investors as the spinoff developed; larger levels of financing were required to fund the organizational shift to commercialization and, thus, new hires and capital expenditures. During the study period, four of the eight spinoffs raised significant equity investment (totaling over $50 million) from professional venture capital firms. Both Zeta Web and Epsilon Energy took large rounds of venture financing from professional venture capital firms.

To manage this transition, the student founders needed to expand their understanding of venture financing options and tradeoffs associated with different options. They did seek out and receive significant support from the local entrepreneurial ecosystem. For example, they received coaching and “pitch scrubs” from the mentors at VMS. However, this transition from research development to presenting a viable product-focused business model was a new experience for founders who wrestled with difficult and stressful processes.

I’d say the darkest things were usually around fundraising. Like, are we going to be able to raise funds to sustain the company, are we going to have to cut staff? We have lots of families that depend on us . . . to keep things going. That keeps me awake. . . . We’re actually raising money right now and that is largely to get things into commercial development, to start the regulatory process . . . to the point where we can start selling things. (Student Founder, Epsilon Energy, July 25, 2012)

I was pretty confident that it would work out, even though we didn’t have money at many points in the process…. The transition points is where it gets very difficult sometimes … like every round you can feel the tension between the investors…. This last round there’s some, I didn’t like it too much, the way it happened, because of the tensions from investors. (Student Founder 1, Zeta Web, July 24, 2012)

Alternatively, Alpha Chips and Delta Pharma explored venture capital financing but, in the process, decided that the best path was to move their product to the brink of commercialization and seek an acquisition from a strategic buyer with the deep pockets and resources needed to scale and grow. At this point, both spinoffs were still led by the founding researcher as CEO and neither had taken professional venture capital, with all equity funding coming strictly from angel investors.

In both cases, the decision was the result of a thorough analysis of the remaining technical and market risks involving consultation with their various advisors, mentors and angel investors. Both spinoffs were successfully sold to industry leaders at substantial valuations. The founders explained:

With a huge additional risk and a lot more time invested and also trying to raise the money just when a lot of VCs were pulling out of these types of investments. The way our finances and our market worked out this was a good path for us (Student Founder, Alpha Chips, June 20, 2012).

We needed to step down as much of the risk associated with that product as possible to the point where we could license that to a pharma . . . by bringing it to the point of being ready for human clinical trials (Student Founder, Delta Pharmaceuticals, July 18, 2012).

4.3 Conflict associated with student entrepreneurship

The student founders of four of the eight spinoffs in the study described encountering two types of significant conflict within the early years of venture establishment. The first set of issues related to students encountering conflicts with faculty advisors. The second group arose during business plan competitions with newly recruited team members.

4.3.1 Conflicts with faculty

Three graduate students who launched spinoff companies before they graduated experienced conflict with their faculty advisors. For example, the founder of Beta Bio founder was a few months away from graduation when he decided to enter a business plan competition based on technologies stemming from his PhD research. He had previously discussed the idea of establishing a spinoff company with his faculty advisor and believed that the advisor would serve as scientific advisor. After a series of “confusing conversations”, the graduate student realized that he and his advisor had different expectations about the formation of the new company.

The graduate student founder of Beta Bio later discovered that his advisor had decided to establish a separate venture based on similar technologies with himself as CEO. The graduate student confronted his advisor and, from that point on, their relationship rapidly deteriorated, to the point where the college’s administration moved the graduate student to another advisor so that he might complete his thesis and graduate. Further, the conflict extended to intellectual property ownership issues. Initial discussions with MIT’s technology transfer office included both faculty and student. However, even though the graduate student was intimately involved in the development of the core spinoff technology, university rules favor faculty. Thus the advisor’s spinoff received the option to license the core technology, requiring the student and his spinoff team to create a new technology.

While Beta Bio may represent an extreme example of conflict, is it illustrative of the broader conflict between the academic responsibilities of graduate students and the operational responsibilities of establishing and developing a university spinoff. In an effort to mitigate conflict of interest and maintain academic integrity MIT implemented strict policies to govern the advisor-student relationship. However, numerous opportunities for conflict exist and faculty and students may not know or understand these regulations. Further, regulations cannot anticipate every scenario.

In at least two other spinoffs (Gamma Materials and Delta Pharma) faculty were deeply involved in the establishment of student spinoffs. Thus, both student and advisors were faced with scenarios and decisions that might have also resulted in serious conflict, especially relating the student’s academic responsibilities.

For example, the student founder of Gamma Materials began his PhD with the intent of pursuing an academic career. However, during the course of his experience in a business plan competition he became convinced that launching and leading a company as soon as possible was the best way to advance the technology. It became clear that he would not be able to continue as a student and launch his company at the same time as conversations with his advisor resulted in the realization that there would be a conflict of interest with both of them involved as active founders. After careful consideration, the student decided to withdraw from his PhD program to launch a venture and provide full time attention to it.

The founder of Delta Pharma encountered a similar issue with his faculty advisor while still a PhD student and deciding to launch a venture. In this case, the advisor was not expecting to be deeply involved as a founder, but would have an affiliation as a scientific advisor. The key issue in this case was the conflict of interest of an advisor receiving spinoff equity before a student had graduated. In this case the outcomes were safely achieved, but the potential for a serious problem was present. As the founder of Delta Pharma described:

I think at the time there weren’t as many safeguards or rules in place or if there were I wasn’t aware of them and certainly my advisor didn’t indicate she was aware of any. So I mean we were kind of, you know I was still finishing up my PhD and we’re kind of haggling on how to split up this company… But it took a while for me to work out an arrangement. (Student Founder, Delta Pharmaceuticals, July 18, 2012)

4.3.2 Conflicts with other students

As mentioned, the business plan competition was one of the first times that graduate student entrepreneurs were required to focus on how their spinoff would provide value. In the course of doing this, three spinoffs—Epsilon Energy, Gamma Materials, and Delta Pharma—recruited additional teams members to aid the founding entrepreneur often leading to conflict. The codification of spinoff ownership seemed to be a source of conflict among the three spinoffs. Spinoff companies are in the very early stages of development yet business plan competition team members may want to know “who owns what.” While all three spinoffs experienced some level of conflict, the founders of Epsilon Energy and Gamma Materials recommended that these discussions be postponed until spinoffs are further developed.

I’d say even though…they tell you to make a founder’s agreement and everything in the competition. I don’t think that’s a good idea because I think you don’t know anything at that point. You know absolutely nothing with regards to what your team needs to be later, and how an equity split would be, and what are reasonable expectations, and what people’s time commitments should be, and what are things that could go wrong. You know nothing at that point and just doing a founder’s agreement at that point, all that does is set expectations that should’ve never been set (Student Founder, Gamma Materials, July 11, 2012).

In both cases, the teams resolved their discussions but, at Delta Pharma, the resulting conflict was more serious. While preparing for the business plan competition, the founder of Delta Pharma partnered with four business school students. The four students asked for major equity positions in a future spinoff (one had yet to be established) during the competition but the founder told them there was as of yet no practical role for them as he continued developing the technology.

When he established the spinoff, the graduate student founder offered the business school students small equity shares in the company and three out of the four agreed. The fourth student, however, refused the small stake and asked for 20 % of the company. When the founder refused, the business school student sued:

About a week before I was going to defend my thesis, a knock comes on our apartment door. My wife answers and it’s the constable delivering essentially a notice of I’m being sued and the company’s being sued. And not only that but he’s filed for a preliminary injunction on the company, which meant if I don’t show up in court in the next 10 days or whatever I basically, it shuts down the whole thing. . . . I had no money in the company, I had not even gotten my PhD yet, I had no prospects of money. . . . But I knew I had to defend. (Student Founder, Delta Pharmaceuticals, July 18, 2012)

The founder decided to fight the lawsuit and, while expensive and time consuming, after about 7 years a judge eventually found for Delta Pharma and found the lawsuit to be frivolous, awarding the company sanctions.

5 Discussion

By examining a small but rich sample of cases from a well-established entrepreneurship support program at MIT, this paper is among the first to carefully investigate the role of graduate students in the establishment and development of university spinoffs. While great care should be taken in extending our findings to other contexts, including those that examine the role of graduate students in spinoffs not affiliated with the university (e.g. Hayter 2016a; Boh et al. 2016), or to generalizing about the behavior of other universities, our study provides a better and more nuanced understanding of role of students in university spinoffs and thus sets the stage for broader studies with more generalizable samples. Our findings (1) confirm and expand upon existing work that graduate students play an important role in university spinoff companies, and (2) introduce previously unrealized challenges faced by these students.

The entrepreneurial role of the graduate students begins with knowledge production; six of the eight spinoffs in our sample were established based on the individual research projects of students. Following Hayter (2016a), graduate students also serve as the catalyst for spinoff establishment by formulating initial spinoff ideas and investigating mechanics associated with firm establishment. Once the commitment to establish a spinoff is made, graduate students undertake a lengthy process—what we term resource reconfiguration (Vohora 2004)—of idea refinement, technology development, and resource acquisition that, if successful, enables spinoffs to transition from an enterprise focused primarily on academic research to a company focused on the development and commercialization of products and services.

The difficulty of reconfiguring resources within university spinoffs is well-established in the literature and largely attributed to the limited, homophilous social networks of academic entrepreneurs (Hayter 2015a, 2016; Rasmussen et al. 2015; Vohora 2004). Student entrepreneurs in our sample attend a well-regarded research university known for its entrepreneurial history and culture; indeed, many students came to MIT because of its entrepreneurial culture. Thus, student entrepreneurs in our sample are surrounded by relatively entrepreneurial students and faculty—and often draw on these individuals in support of their spinoff endeavors.

Graduate students also have access to business plan competitions, the Venture Mentoring Service, the Deshpande Center for Technological Innovation, and numerous other formal entrepreneurship support programs at MIT. While prior studies provide operational detail relating to these entrepreneurship support mechanisms (e.g. Bradley et al. 2013b; Audretsch et al. 2015; Swamidass 2013), we find that these programs not only provide formal structures and incentives for entrepreneurship, they also serve as mechanisms to connect graduate students to individuals outside the university with access to resources critical to spinoff success, an important factor in academic entrepreneurship (Hayter 2016b). In other words, the development and success of student-run spinoffs are intimately linked to the availability of and connections to relevant contacts and their resources in the surrounding region.

For example, the National Science Foundation (NSF) established it’s highly regarded I-Corps Program in 2011 to indoctrinate university researchers (faculty, postdoctoral fellows, and graduate students) to entrepreneurial thinking and practices while building connections with such contacts and resources (Reich 2011). In so doing, the NSF recognized the important entrepreneurial role of the students and postdocs in the establishment and development of new university spinoffs that might later be eligible for other support programs such as SBIR awards. The program assumes that the graduate student or postdoc will undertake full-time responsibility for the new company while faculty remain in their academic positions (Blank and Engel 2016). Future research might focus on the efficacy of university entrepreneurship support programs specifically tailored to the roles and needs of graduate students, among others.

In addition to elaborating on the activities of students in university spinoffs, we also unearthed unique conflicts that arise during the entrepreneurial experience of graduate students thus far only elucidated in the popular press (e.g. McMurtrie 2015). While conflicts over ownership shares and functional roles among co-founders and employees are common in the general entrepreneurship literature, graduate students are enrolled in academic programs the primary goal of which is conferring an advanced degree. The establishment and development of a spinoff company—a component of the emergent economic development mission of research universities—may conflict with these academic aims, however. Specifically, the academic responsibilities and entrepreneurial ambitions of graduate students often conflict with students frequently prioritizing the latter.

Perhaps more serious are scenarios whereby student entrepreneurial activities create conflict with faculty advisors. Faculty advisors have enormous authority relating to the academic progress and standing of graduate students. While most advisors remained agnostic, if not supportive of student entrepreneurship (so long as students fulfill their academic responsibilities), myriad conflicts could arise relating to IP, grades/academic credit, and spinoff ownership. The most serious conflict within our study related to varying views of IP ownership and competition between a student-initiated spinoff and the entrepreneurial efforts of their faculty advisor. While these conflicts may (or may not) be rare, they pose serious risks to university operations and should be investigated further.

To be clear, this finding in no way implies that universities should deemphasize student entrepreneurship; the activity is vital for knowledge dissemination and commercialization. It is to say, however, that research universities should be aware of and anticipate these conflicts—and consequently create mechanisms and policies to manage and resolve them, ideally identifying and addressing them early before they escalate. Future research might investigate the nature of conflict associated with student entrepreneurship and promising approaches taken to manage conflict. Further, how does graduate student entrepreneurship differ within other universities, especially those not located within large metropolitan regions? Left unexplored in this paper, future research might also examine the role of university IP policy in graduate student entrepreneurship. To what extent do university IP policies promote (or discourage) student entrepreneurship and subsequent spinoff success?

Finally, researchers might build on our findings by exploring additional elements of success associated with graduate student entrepreneurship. A further focus on undergraduates and postdocs is also welcome as well as greater depth related to student-advisor interaction. What our study illuminates, however, is that academic entrepreneurship research—and perhaps more importantly entrepreneurship support policies and programs—can no longer focus primarily on faculty. Instead a more encompassing view of entrepreneurial actors within a university context is required, one that includes their identification, interaction, and specific organizational, regional, and policy-related factors that enable academic and entrepreneurial success.

Notes

As of January 1, 2016, Google Scholar shows that lists Shane’s (2004) book Academic Entrepreneurship with 1366 citations.

See Bradley et al. (2013a) for a detailed discussion of the emergence of the patent-centric, linear model of technology transfer among most research universities within the United States. In practical terms, this means that most university faculty are subject to similar technology disclosure and management processes, typically articulated within their employment contracts. This also helps explains the emphasis on licensed technologies, a characteristic that is relatively easy to capture as opposed to other forms of entrepreneurship (e.g. Fini et al. 2010).

Theoretical sampling introduces deductive thinking into the study (Eisenhardt 1989). Decisions about which data should be collected next were determined by the insights revealed in the present case; collected data guided the selection of the next case in order to maximize empirical heterogeneity, an important consideration for early theory-building efforts (Creswell 2003).

References

Acs, Z., Braunerhjelm, J. P., Audretsch, D. B., & Carlsson, B. (2009). The knowledge spillover theory of entrepreneurship. Small Business Economics, 32(1), 15–30.

Åstebro, T., Bazzazian, N., & Braguinsky, S. (2012). Startups by recent university graduates and their faculty: Implications for university entrepreneurship policy. Research Policy, 41(4), 663–677.

Audretsch, D. B., Hayter, C. S., & Link, A. N. (Eds.). (2015). Concise guide to entrepreneurship, technology and innovation. Northampton, MA: Edward Elgar.

Bailetti, T. (2011). Fostering student entrepreneurship and university spinoff companies. Technology Innovation Management Review, 1, 7–12.

Barr, S., Baker, T., Markham, S., & Kingon, A. (2009). Bridging the valley of death: Lessons learned from 14 years of commercialization of technology education. Academy of Management Learning & Education, 8(3), 370–388.

Berggren, E., & Dahlstrand, Å. L. (2009). Creating an entrepreneurial region: Two waves of academic spin-offs from Halmstad University. European Planning Studies, 17(8), 1171–1189.

Blank, S., & Engel, J. (2016). The National Science Foundation I-Corps Teaching Handbook. https://venturewell.org/wp-content/uploads/I-Corps-Teaching-Handbook-Jan16.pdf. Accessed 26 Jan 2016.

Boh, W. F., De-Haan, U., & Strom, R. (2016). University technology transfer through entrepreneurship: Faculty and students in spinoffs. Journal of Technology Transfer (forthcoming).

Bradley, S., Hayter, C. S., & Link, A. N. (2013a). Methods and models of university technology transfer. Foundations and Trends in Entrepreneurship, 9(6), 571–650.

Bradley, S., Hayter, C. S., & Link, A. N. (2013b). Proof of concept centers in the United States: An exploratory look. Journal of Technology Transfer, 38, 349–381.

Bramwell, A., & Wolfe, D. A. (2008). Universities and regional economic development: The entrepreneurial University of Waterloo. Research Policy, 37, 1175–1187.

Braunerhjelm, P., Ács, Z. J., Audretsch, D. B., & Carlsson, B. (2010). The missing link: Knowledge diffusion and entrepreneurship in endogenous growth. Small Business Economics, 34(2), 105–125.

Brindley, C., & Ritchie, B. (2000). Undergraduates and small and medium-sized enterprises: Opportunities for a symbiotic partnership? Education & Training, 42(9), 509–517.

Brush, C. (1992). Research on Women business owners: Past trends, a new perspective, and future directions. Entrepreneurship Theory and Practice, Summer, 12, 27–35.

Cliff, J. (1998). Does one size fit all? Exploring the relationships between attitudes towards growth, gender, and business size. Journal of Business Venturing, 13, 523–542.

Cooper, A. (2003). Entrepreneurship: The past, the present, the future. In Z. Acs & D. Audretsch (Eds.), Handbook of entrepreneurship (pp. 21–36). The Netherlands: Kluwer.

Creswell, J. W. (2003). Research design: Qualitative, quantitative, and mixed methods approaches (2nd ed.). New York: Sage.

Doutriaux, J. (1987). Growth patter of academic entrepreneurial firms. Journal of Business Venturing, 2, 285–297.

Eisenhardt, K. M. (1989). Building theories from case study research. Academy of Management Review, 14, 532–550.

Fini, R., Lacetera, N., & Shane, S. (2010). Inside or outside the IP system? Business creation in academia. Research Policy, 39, 1060–1069.

Fukugawa, N. (2005). Characteristics of knowledge interactions between universities and small firms in Japan. International Small Business Journal, 23(4), 379–401.

Hayter, C. S. (2011). In search of the profit-maximizing actor: Motivations and definitions of success from nascent academic entrepreneurs. Journal of Technology Transfer, 36, 340–352.

Hayter, C. S. (2013). Harnessing university entrepreneurship for economic growth: Factors of success among university spin-offs. Economic Development Quarterly, 27(1), 17–27.

Hayter, C. S. (2015a). Public or private entrepreneurship? Revisiting motivations and definitions of success among academic entrepreneurs. Journal of Technology Transfer, 40, 1003–1015.

Hayter, C. S. (2015b). Social networks and the success of university spinoffs: Toward an agenda for regional growth. Economic Development Quarterly, 29, 3–13.

Hayter, C. S. (2016a). Constraining entrepreneurial development: A knowledge-based view of social networks among academic entrepreneurs. Research Policy, 45, 475–490.

Hayter, C. S. (2016b). A trajectory of early-stage spinoff success: The role of knowledge intermediaries within an entrepreneurial university ecosystem. Arizona State University Working Paper.

Hébert, R. F., & Link, A. N. (2009). A history of entrepreneurship. London: Routledge.

Hsu, D. H., Roberts, E. B., & Eesley, C. E. (2007). Entrepreneurs from technology-based universities: Evidence from MIT. Research Policy, 36, 768–788.

Katz, J. (2003). The chronology and intellectual trajectory of American entrepreneurship education. Journal of Business Venturing, 18(2), 283–300.

Katz, J. (2004). Survey of endowed positions in entrepreneurship and related fields in the United States. Available at SSRN 1234582.

Lam, A. (2011). What motivates academic scientists to engage in research commercialization: ‘Gold’, ‘ribbon’ or ‘puzzle’? Research Policy, 40, 1354–1368.

Link, A. N., & Ruhm, C. (2009). Bringing science to market: Commercializing from NIH SBIR awards. Economics of Innovation and New Technology, 4, 381–402.

Link, A. N., Siegel, D. S., & Bozeman, B. (2007). An empirical analysis of the propensity of academics to engage in informal university technology transfer. Industrial and Corporate Change, 16(4), 641–655.

Link, A. N., Siegel, D. S., & Wright, M. (Eds.). (2014). The Chicago handbook of university technology transfer and academic entrepreneurship. Chicago, IL: University of Chicago Press.

Lubynsky, R. (2012). Critical challenges to nascent academic entrepreneurs: From lab bench to innovation, University of Maryland, unpublished dissertation.

McMurtrie, B. (2015). Inside startup U: How Stanford develops entrepreneurial students. The Chronicle of Higher Education. http://chronicle.com/article/Inside-Startup-U-How/233899. Accessed 01 Nov 2015.

Miles, M. B., & Huberman, A. M. (1994). Qualitative data analysis: An expanded sourcebook (2nd ed.). Thousand Oaks, CA: Sage.

Morris, M. H. (2015). Entrepreneurship, education and the unreasonable. In D. B. Audretsch, C. S. Hayter, & A. N. Link (Eds.), Concise guide to entrepreneurship, technology and innovation. Northampton, MA: Edward Elgar.

O’Gorman, C., Byrne, O., & Pandya, D. (2008). How scientists commercialise new knowledge via entrepreneurship. Journal of Technology Transfer, 33, 23–43.

Oehler, A., Hofer, A., & Schalkowski, H. (2015). Entrepreneurial education and knowledge: Empirical evidence on a sample of German undergraduate students. Journal of Technology Transfer, 40, 536–557.

Oosterbeek, H., van Praag, M., & Ijsselstein, A. (2010). The impact of entrepreneurship education on entrepreneurship skills and motivation. European Economic Review, 54(3), 442–454.

Patton, M. (2002). Qualitative research and evaluation methods (3rd ed.). Thousand Oaks, CA: Sage.

Phan, P., & Siegel, D. (2006). The effectiveness of university technology transfer: Lessons learned. Foundations and Trends in Entrepreneurship, 2(2), 77–144.

Pittaway, L., & Cope, J. (2007). Entrepreneurship education: A systematic review of the evidence. International Small Business Journal, 25(5), 479–510.

Rasmussen, E., Mosey, S., & Wright, M. (2015). The transformation of network ties to develop entrepreneurial competencies for spin-offs. Entrepreneurship and Regional Development, 27(7–8), 430–457.

Rasmussen, E., & Sorheim, R. (2006). Action-based entrepreneurship education. Technovation, 26, 185–194.

Reich, E. S. (2011). Scientists, meet capitalists. Nature, 480(7375), 15.

Reif, L. R. (2015). Personal communication with author, December 10.

Ridder, A., & van der Sijde, P. (2003). Raising awareness of entrepreneurship and e-commerce: A case study on student-entrepreneurship. International Journal of Entrepreneurship and Innovation Management, 3(5), 609–620.

Roberts, E. (1991). Entrepreneurs in high technology. New York: Oxford University Press.

Roberts, E. B., & Eesley, C. (2009). Entrepreneurial impact: The role of MIT. Ewing Marion Kauffman Foundation.

Roberts, E. B., & Eesley, C. (2011). Entrepreneurial impact: The role of MIT—an updated report. Foundations and Trends in Entrepreneurship, 7(1–2), 1–149.

Roberts, E. B., Murray, F., & Kim, J. D. (2015). Entrepreneurship and Innovation at MIT: Continuing global growth and impact. Technical Report: http://web.mit.edu/innovate/entrepreneurship2015.pdf. Accessed January 9, 2016.

Romer, P. M. (1990). Endogenous technological change. Journal of Political Economy, 98, 71–102.

Shah, S. K., & Pahnke, E. C. (2014). Parting the ivory curtain: Understanding how universities support a diverse set of startups. Journal of Technology Transfer, 39, 780–792.

Shane, S. A. (2004). Academic entrepreneurship: University spinoffs and wealth creation. Northampton, MA: Edward Elgar.

Shane, S., Locke, E., & Collins, C. (2003). Entrepreneurial motivation. Human Resource Management Review, 13, 257–279.

Stephan, P. (2009). Tracking the placement of students as a measure of technology transfer. In G. Libecap (Ed.), Measuring the social value of innovation: A link in the university technology transfer and entrepreneurship equation (Advances in the Study of Entrepreneurship, Innovation & Economic Growth, Volume 19) (pp. 113–140). Bingley: Emerald Group Publishing Limited.

Swamidass, P. (2013). University startups as a commercializing alternative: Lessons from three contrasting case studies. Journal of Technology Transfer, 38, 788–808.

Vohora, A., Wright, M., & Lockett, A. (2004). Critical junctures in the development of university high-tech spin-out companies. Research Policy, 33, 147–175.

Wani, V., Garg, T., & Sharma, S. (2004). Effective industry/institute interaction for developing entrepreneurial vision amongst engineers for the sustainable development of SMEs in India. International Journal of Technology Transfer and Commercialization, 3(1), 38–55.

Wright, M., Clarysse, B., Mustar, P., & Lockett, A. (2007). Academic entrepreneurship in Europe. Northampton, MA: Edward Elgar.

Yin, R. (2003). Case study research: Design and methods (3rd ed.). Beverly Hills, CA: Sage.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Hayter, C.S., Lubynsky, R. & Maroulis, S. Who is the academic entrepreneur? The role of graduate students in the development of university spinoffs. J Technol Transf 42, 1237–1254 (2017). https://doi.org/10.1007/s10961-016-9470-y

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10961-016-9470-y