Abstract

In this study, we explore the extent to which diversity of educational levels among research scientists and engineers (RSEs) in the context of a firm’s level of technological diversity influences innovation performance. We used data from the 2004–2008 National R&D Survey in Singapore. The results from 366 firms across different industries indicate that when a firm’s technological domains are heterogeneous, those firms with an RSE workforce comprising similar educational levels have positive innovation performance, measured as the number of patent applications, while those comprising diverse educational levels have negative innovation performance. Our further exploration of the positive interaction between technological domain heterogeneity and similarity of educational levels suggests that firms that had a high ratio of RSEs with lower educational levels had more positive patent outcomes compared to those that had a high ratio of RSEs with higher educational levels. The results show that there are limits to the strength of technological diversity in a firm’s absorptive capacity as explained by organizational demography.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

An innovation is characterized by an invention that either has new practical insights or a new useful combination from existing inventions. The role played by technological diversification to achieve innovations has been fraught with paradox. On the one hand, the resource-based view of the firm argues that firms should build their core competencies by focusing on one domain or a body of homogeneous technological domain to generate incremental innovation more quickly and reliably (Barney 1991; Prahalad and Hamel 1990; Quintana-García and Benavides-Velasco 2008). On the other hand, other research argues for the importance of having multiple strands of theoretical and experiential knowledge for innovation to overcome competence traps, familiar thought patterns, and organizational inertia (Amabile 1988; Leonard-Barton 1992).

Since firms achieve innovations through their human capital (Becker 1964), herein lies a second paradox. While some studies found that diversity in a firm’s human capital improves its absorptive capacity and problem solving capacities (Page 2007; van der Vegt and Janssen 2003), other studies found that such diversity has led to greater dysfunctional conflicts, distrust, miscommunication, and social disintegration for the firm (Cabrales et al. 2008). A review of 50 years of social science research on diversity demonstrates that the diversity-performance link is not clear-cut, suggesting that the performance benefits from diversity may be realized only under very narrow conditions (Jackson et al. 2003; Milliken and Martins 1996). Disentangling the inconsistent findings on diversity requires a careful consideration of the contextual factors that may either pose opportunities or challenges for the firm (Mannix and Neale 2005). In this study, we aim to take a finer-grained examination of technological diversity and human capital diversity on innovation performance by exploring the interdependencies between these two factors.

Human capital is an important feedstock for innovation (Becker 1964). Past studies have explored the relationship between the diversity of educational backgrounds and functional competencies on innovation performance (Bercovitz and Feldman 2011; Vinding 2006). However, little is understood about the role that educational level, another measure of human capital, plays in innovation performance. We argue that since individuals with different educational levels play different roles from support to the conceptualization of ideas in the innovation process, we seek to explore the extent to which diversity of educational levels among research scientists and engineers (RSEs) in the context of a firm’s level of technological diversity influences innovation performance. Consequently, we seek to explore the interdependencies between the heterogeneity of a firm’s technological domains as a proxy for technological diversity and the diversity of their RSE’s educational levels on innovation performance, as measured by patent applications. We hope that the results from this focused approach will extend the literature that explores the relationship between human capital and innovation performance as well as begin a conversation in the future for a different approach to considering how technological diversity and human capital diversity affect innovation performance.

We chose Singapore as the context for our study because it has a National Innovation Policy aimed at boosting the country’s technological capabilities. The government invests heavily in tertiary education in science, engineering, and information technology, and creates public sector research institutes (RIs) to foster applied research. Through these RIs, the government supplies technology-intensive firms with RSEs of different educational levels to match their R&D activities. A policy implication from this study would suggest how governments can supply the private sector with appropriate levels of R&D skills through their universities, while a managerial implication would suggest how firms can best utilize their RSEs’ educational levels to foster technological innovation based on the firms’ technological diversity.

The rest of this paper is organized as follows. First, we review the extant literature on the relationships between R&D activities and educational levels on innovation performance using absorptive capacity and human capital theories. Next, we describe the methods, data, and estimation model that we utilize to test the model. Finally, we report the results and discuss the implications of the findings.

2 Literature review and research hypotheses

2.1 The paradox of technological diversity on innovation performance

Firms introduce new technologies into their existing products and systems as a means to diversify and add variety in their knowledge system for several reasons. Firstly, a broader range of technical and multidisciplinary areas are needed for innovation because repeated applications within the same technological domain eventually exhaust the set of potential combinations (Dosi 1982; Granstrand and Oskarsson 1994; Nelson 1959). Moreover, the convergence of products, technologies, and markets makes it necessary for a firm to engage in a business that produces multi-technological products (Subramaniam and Youndt 2005). Technological diversity serves as an insurance against the uncertainty of market demands and represents a way for firms to hedge their technological bets (van der Bergh 2008). A firm attenuates its systematic risk from a changing technological landscape by moving into diverse fields (Levinthal 1997). Thus, technological diversity helps firms avoid obsolescence, lock-in, imitation, or other such vulnerabilities related to asset irreversibility or irrevocability (Amabile 1988; Leonard-Barton 1992).

Secondly, technological diversity increases a firm’s absorptive capacity to assimilate external knowledge to create new knowledge (Cohen and Levinthal 1989, 1990; Zahra and George 2002). Having multiple strands of theoretical and experiential knowledge increase the pathways for learning (Grandstrand 1998; Rosenkopf and Nerkar 2001; Suzuki and Kodama 2004). Firms that are more technologically diversified have greater flexibility for cross-fertilization of different technological domains, which fosters novel associations to achieve radical innovations (Abernathy and Clark 1985). The resulting recombinant, cross-over, and spillover effects from increased absorptive capacity are the creation of new opportunities that did not exist previously (Henderson and Clark 1990). Hence, the result of technological diversity and increased absorptive capacity is enhanced innovation as the firm obtains spillovers from other related technological fields (van der Bergh 2008).

Consequently, Wang and Chen (2010) found that under high environmental dynamism, firms increase the diversity of their knowledge composition to mitigate the risk of value erosion from being in a narrow domain. Kim et al. (2009) also found that technological diversification increases a firm’s technological marginal productivity and the speed of its diffusion. García-Vega’s (2006) study of a panel of European R&D firms showed that the number of patents increased when a firm engaged in technological diversification. Similarly, Fernández-Ribas and Shapira (2009) found that technological diversity in nanotechnology firms increased the number of patents. These studies suggest that firms with heterogeneous technological bases have improved innovation performance (Quintana-García and Benavides-Velasco 2008).

However, the resource-based view of the firm argues that firms should build their core competencies by focusing on a homogeneous technological domain (Barney 1991; Prahalad and Hamel 1990). By being focused, a firm can generate incremental innovation more quickly and reliably from its core expertise (Quintana-García and Benavides-Velasco 2008). Lin et al. (2006) demonstrated that it is better for technology firms to concentrate its R&D on specific fields and develop a portfolio with a clear technological focus. Thus, McGill and Santoro (2009) found that firms with focused portfolios have higher patent outputs. Likewise, Ejermo (2005) found that technological specialization improves patenting productivity. Other studies have also found that when firms concentrate on a few core and narrowly-defined technological areas as a means to accumulate intellectual property, they utilize their limited R&D resources more effectively (Granstrand et al. 1997; Gambardella and Torrisi 1998).

Although these opposing views on the impact of technological diversity on innovation are the dominant ones in the literature, other views also exist. For example, Huang and Chen (2010) found an inverse U-shaped relationship between technological diversity and innovation performance, while Nicholls-Nixon and Woo (2003) found no significant relationship between the breadth of technological knowledge and the number of patents. The lack of clear findings suggests that other factors are at work and further research is needed to disentangle these relationships. Since innovation activities are conducted among RSEs involving tacit knowledge, exchanges that are difficult to transfer without close interaction among the members. We posit that the composition of the RSEs’ human capital may provide a contingency explanation to resolve these mixed findings.

2.2 The paradox of educational level diversity on innovation performance

To turn ideas into innovations, individuals must acquire human capital (knowledge, education and training, skills, experience, and attitudes). A firm’s knowledge management capability depends on the stock of human capital held by its members while the composition of a firm’s RSE workforce affects the production of new knowledge (Berliant and Fujita 2011; Grant 1996). The expertise embodied in human capital is largely due to the level of formal training and the knowledge domain that each individual brings to the scientific tasks (Becker 1964; Zahra and George 2002). In particular, the amount of knowledge held by a firm’s RSE determines the firm’s absorptive capacity and its level of R&D productivity because the firm’s ability to absorb external knowledge is determined by the skill and the depth of knowledge of its R&D workforce (Castellacci 2011; Cohen and Levinthal 1994; Keller 1996). Consequently, Leiponen (2005) found that when employees do not have sufficient or the requisite capabilities, innovation productivity suffers.

While human capital has a positive influence on innovation performance, the literature on the advantages of having a workforce with diverse human capital has been mixed. On the one hand are clear advantages of human capital diversity. Specifically, diversity in a firm’s human capital enhances cross-functional learning and increases the chances for new combinations of knowledge and, consequently, innovation performance (van der Vegt and Janssen 2003). Also, the literature from social network theory suggests that individuals from diverse backgrounds bring new sources of novel information, resources, and social ties to the firm that enhance firm performance (Burt 1992; Granovetter 1973; Higgins 2000). By tapping into multiple social groups, this ‘bridging capital’ (Bourdieu 1986) provides the firm access and exposure to a greater variety of experiences, perspectives, and ideas that enhances firm performance. Consequently, as the firm’s environmental scanning and critical thinking processes are enhanced, better quality and more novel decisions can be expected (Henderson and Cockburn 1996).

On the other hand, the literature from organizational demography provides a pessimistic view on the costs of diversity and argues for the value of workforce similarity (Pfeffer 1983; Tsui, Egan, and O’Reilly 1992). According to this view, individuals from diverse backgrounds are predicted to have more difficulties in teaming because they do not necessarily share a common social identity and so experience communication difficulties due to different norms of behavior (Alderfer 1987; Bunderson and Sutcliffe 2002; Tajfel and Turner 1986; Zenger and Lawrence 1989). In this literature, workforce diversity arguably produces in-group and out-group dynamics, which damages cohesiveness and lowers individuals’ psychological attachment to the firm. Thus, diversity within a firm can be a source of dysfunctional conflict and distrust, miscommunication, and social disintegration. Such discord and distrust would be detrimental to innovation activities that require individuals to work cooperatively and share ideas with each other in teams. As a result, Cabrales et al. (2008) found that team diversity is often at risk of increased conflicts, reduced cohesion, complicated internal communication, and hampered coordination within the team, which hinders innovation.

2.3 Reconciling the paradoxes by considering their interdependencies

We seek to explore these two paradoxes by examining the technological diversity of the firms in which the RSEs do their work. We focused on the composition of RSEs’ educational levels within firms as the measure of human capital because Jacobsson et al. (1996) found that the educational level of a firm’s workforce is related to the nature and diversity of its technological competence. Note that the functional diversity of RSEs within firms is outside the scope of this study because much of past research has already examined the impact of functional backgrounds and competencies on innovation (Bercovitz and Feldman 2011; Vinding 2006). Instead, we seek to extend the literature on the influence of human capital on innovation by exploring the interdependencies between educational level diversity and technological diversity on innovation performance.

The extant literature on the relationship between educational level and innovation performance is very sparse. The literature merely suggests that having high levels of education or a terminal degree is insufficient to ensure high levels of patenting outcomes. For example, Morgan et al. (2001) found that in the US, the largest single contributor to patenting activity was RSEs with bachelor’s degrees at 40.1 %, followed by those with doctorate degrees at 33.7 %. Similarly, Kaasa (2009) found that 44.6 % of RSEs who had patents had bachelor’s degrees while 26.2 % had master’s degrees. Since much of the R&D activities are performed by RSEs working in teams (Leonard and Sensiper 1998) and diversity among a group of problem solvers affects innovation performance more than individual excellence (Page 2007), we consider the educational levels of the RSE workforce as the unit of analysis in this study, as suggested by Østergaard et al. (2011), rather than focus on the educational levels of individual RSEs.

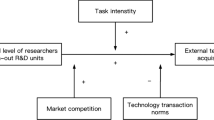

We draw from the extant literature on functional diversity to derive conjectures of the impact of educational level workforce diversity. Specifically, when individuals from diverse functional backgrounds work together, performance improves (Bercovitz and Feldman 2011; Page 2007; Vinding 2006). Sun and Anderson (2008) argue that when individuals share their diverse knowledge together, novel and frame-breaking insights are created from their dialogues. Page (2007) reported that cognitive diversity in a group improves innovation performance over individuals working alone because when individuals share information and receive feedback, they increase their accuracy in understanding the problems to solve and reduce potential errors by verifying with others. Thus, we posit that when a firm is focused on a narrow core of highly related and homogeneous technological domain, an RSE workforce that has diverse knowledge would inject positive dissonance, novelty, and critical thinking to question deep-seated assumptions about the status quo and to think ‘outside the box’. A diverse pool of employees can bring different perspectives to evaluate critical issues creatively to prevent the firm from developing core rigidities, reduce groupthink, and improve its problem solving processes (Amabile 1988; Janis 1972). We draw from the literature on the benefits of functional diversity to examine whether an RSE workforce with diverse educational levels would obtain positive outcomes since educational level is another dimension of human capital (Becker 1964). Accordingly, we hypothesize that when a firm operates within a highly related and homogeneous technological domain, its ability to innovate is greater if the RSE workforce is diverse with respect to their educational levels and vice versa as shown in left column of Fig. 1.

H1

When a firm’s technological domains are homogeneous, an RSE workforce with diverse educational levels will influence innovation performance positively and vice versa.

Organizational demography argues for better organizational outcomes when the demographic characteristics of its members are similar (Tsui et al. 1992). Since organizations are fundamentally relational entities, people who share similar experiences are more likely to develop common bonds and attractions for each other (Alderfer 1987; Lawler and Yoon 1996). This ‘bonding capital’ enables an individual to obtain help from others because of high levels of closeness and intimacy, reciprocal obligations, and personal commitments (Bourdieu 1986). Problem solving during interdependent tasks is also enhanced because of stronger identification and increased frequency of communication (Tajfel and Turner 1986). Moreover, an individual who receives emotional support and friendship from strong peer relationships is also more effective at meeting challenges and overcoming personal setbacks (Higgins 2000), which are commonly encountered during innovation activities. These positive social relationships from greater goodwill and trust among individuals highly influence their willingness to learn, share, and create knowledge together (Collins and Smith 2006). Consequently, Bercovitz and Feldman (2011) found that firms were more successful at generating patents, licenses, and royalties when organizational members shared similar experiences.

In an environment of heterogeneous technological domains, an RSE workforce that is similar may be more connected and this positive affect may increase the likelihood that individuals work together successfully. Since the recombination process that generates breakthrough ideas is extremely uncertain (Fleming 2001), the development of close relationships from similar educational levels may strengthen information channels and improve information bandwidths, thereby enhancing the efficient transfer of tacit knowledge in diverse R&D domains. Thus, we posit that when a firm operates in heterogeneous technological domains, an RSE workforce that has similar educational levels may improve communication and the sharing of knowledge necessary to enhance innovation performance.

Conversely, when the firm’s technological domains are heterogeneous, communication among the RSEs with different levels of education may be hindered by variations in the level of knowledge, different vocabularies, and norms of behaviors (Bunderson and Sutcliffe 2002; Zenger and Lawrence 1989). Hence, the opportunity to capitalize on synergies by having people work together may be compromised and limited. Such difficulties and conflicts are exacerbated when individuals with different backgrounds work together on projects involving heterogeneous technological domains (Ancona and Caldwell 1992). Since diversity in educational levels requires greater coordination and increases the costs of integration in an already heterogeneous technological environment, individuals with different levels of education who work together may experience greater difficulties in building a shared mental model of understanding needed to productively integrate disparate chunks of information (Dahlin et al. 2005). Thus, when technological domains are heterogeneous within a firm, we hypothesize that diverse educational levels among RSEs will create dissonance, which hinders innovation performance, but similarity in educational levels will enhance it, as shown in the right column of Fig. 1.

H2

When a firm’s technological domains are heterogeneous, an RSE workforce with similar educational levels will influence innovation performance positively and vice versa.

If having similar educational levels among its RSE workforce is advantageous to a firm operating in heterogeneous technological domains; then it begs the question as to whether the RSEs should be similar in having lower educational levels or whether they should be similar in having higher educational levels. The literature on absorptive capacity suggests that firms that rely on a large number of individuals with basic degrees to conduct R&D work benefit from economies of scale in the common activities that span multiple technological domains as individuals transfer their knowledge through experiential learning by doing (Vinding 2006). At the other end of the educational level spectrum, individuals with terminal (doctorate) degrees are skilled in conceptual thinking and conduct their research in highly specialized areas. The value that doctorate degree holders bring to knowledge work stems from their focused specialization. Consequently, an RSE workforce that comprises predominantly doctorate degree holders can be expected to be less willing to dilute their core specialization to move into other specialized areas (Vega-Jurado et al. 2008). Hence, we predict that the firms involved in heterogeneous technological domains will report higher levels of innovation performance if a larger proportion of their RSE workforce has basic degrees because such individuals have more portable knowledge and skills that can be transferred to different domains. Conversely, when the firms are involved in heterogeneous technological domains, we predict that those firms with a larger proportion of their RSE workforce with doctorate degrees will have lower levels of innovation performance because such individuals who are specialized to perform basic research in specified domains may not be willing to dilute or deviate from their core domain to bridge their human capital into other technological domains. This argument is depicted in the bottom right quadrant of Fig. 1. Our research model that shows how each type of diversity is related to each other is also shown in Fig. 2.

H3

When a firm’s technological domains are heterogeneous, an RSE workforce that is similar at lower levels of education will influence innovation performance more positively than an RSE workforce that is similar at higher levels of education.

3 Methods

3.1 Sample and data

We chose Singapore as the context for our study because it has no natural resources and the government has historically considered human capital as the only means to compete in a global economy. Therefore, it has taken an aggressively proactive stance in developing talent through education, training, and labor relations. To foster innovation, the government established a National Innovation Policy to invest in tertiary education in the science, engineering, and information technology disciplines as well as establish research institutes (RIs) to transfer the country’s technological human capital to domestic science-based firms. The Agency for Science, Technology, and Research (A*STAR) was established to be the nation’s supplier of scientific, engineering, and technology talent to commercial enterprises by offering scholarships to individuals to enroll in science and engineering-based disciplines. When these individuals graduate from the universities, they either work in the RIs or Singapore-based technological firms. By centralizing the country’s research activities, A*STAR hopes to enhance intellectual capital and increase national R&D intensity through manpower transfer programs to create knowledge spillovers from the RIs to Singapore-based firms to accelerate technology commercialization.

To test our research model, we utilize the questionnaire survey that was implemented by A*STARFootnote 1 to 1439 Singapore organizations in a mandatory 2004–2008 National R&D Survey. The population of firms included for-profit organizations, educational institutes, and RIs. The survey was conducted in line with the standard OECD methodology for R&D statistics as prescribed in the Frascati Manual.Footnote 2 Educational levels of RSEs are particularly salient in the Singapore context since A*STAR sponsors scholarship programs to educate individuals at different educational levels to supply talent to technology-based firms.

Of the 1439 organizations surveyed, we utilize data from 366 for-profit organizations since for-profit firms have a higher propensity to apply for intellectual property protection (Dasgupta 1994). However, some firms did not participate every year that the survey was implemented. Hence, our panel of data included 720 observations, with an average of about 2 observations reported per firm during the survey period.

In addition to collecting information on R&D expenditure and the nature of R&D activities, the survey captures information on the composition of the R&D workforce. In 2008, the number of research scientists and engineers (RSEs) per 10,000 employees in the labor force was 87.6. The male to female ratio was 2.8. 68 % of RSEs are Singapore citizens or permanent residents and the rest are foreign nationals. 33 % of RSEs are under 35 years of age and 73 % were under 45 years of age. 20 % of RSEs had doctorate degrees, 23 % had master’s degrees, and 56 % had bachelor’s degree or a technical associate’s degree. The following section describes the operationalization of the constructs we used to test our research model.

3.2 Variables

3.2.1 Dependent variable: innovation performance (t)

Raw patent count is the generally accepted indicator of a firm’s innovation performance (Acs and Audretsch 1988; Hagedoorn and Cloodt 2003; Patel and Pavitt 1995). Thus, we obtained the number of patent applications for our sample of firms between 2004 and 2008 as our measure of Innovation Performance (t). Each company reported the number of patent applications that resulted from its R&D activities in Singapore. This included applications filed with the Intellectual Property Office of Singapore (IPOS) and other patent offices, including the United States Patent and Trademark Office and the European Patent Office. Only the first filing of a specific patent was counted even if the same invention was filed in other countries to ensure that the sample of patent applications was not counted more than once.

3.2.2 Independent variables

Technological Diversity (t − 1)

Firms provided information on their R&D expenditure across 21 different domains.Footnote 3 We calculated a technological diversity index for the year prior to the patent application using the formula \( 1 - \sum_{i = 1}^{n} T_{i}^{2} \) (one minus the Herfindahl concentration index), where Ti is the proportion of R&D expenditure in each category of technological domain at time t − 1, with n = 21. This measure ranges from 0 to 1 where the higher the value, the greater the R&D expenditure across the different domains. The median value of this technological diversity index was used to divide the sample into subgroups comprising firms with high [Heterogeneous Technological Domains (t − 1)] and low [Homogeneous Technological Domains (t − 1)] levels of technological diversity respectively (Carpenter 2002). The reason we divided technological diversity into high and low levels is because of the mixed findings from past research that we reviewed earlier, where technological diversity was measured as a continuous variable. Since the purpose of this study is to seek to isolate a finer-grained analysis of the specific effects from high and low levels of technological diversity on innovation performance, we split the sample accordingly.

Educational Level Diversity (t − 1)

The diversity in educational levels among the RSEs for the year prior to the patent application was also measured using a Herfindahl index according to previous studies (Østergaard et al. 2011). Since firms provided information on the number of R&D employees categorized by their highest educational qualification at the Ph.D., master’s, bachelor’s, and associate’s degree levels, an educational level diversity index was calculated using the formula \( 1 - \sum_{i = 1}^{n} E_{i}^{2} \) (one minus the Herfindahl concentration index), where Ei is the proportion of employees in each category of educational qualification at time t − 1, with n = 4. This measure ranges from 0 to 1 where the higher the number, the greater the educational level diversity in the organization’s RSE workforce. The median value of this index was used to divide the sample into two subgroups comprising firms with high [Diverse Educational Levels (t − 1)] and low [Similar Educational Levels (t − 1)] levels of RSE workforce diversity in educational levels respectively. As above, the reason we divided the educational level diversity into high and low levels is because of the mixed findings on performance in past research where workforce diversity was measured as a continuous variable. Since the purpose of this study is to seek to isolate a finer-grained analysis of the specific effects from high and low levels of educational level diversity on innovation performance, we split the sample into two subgroups accordingly.

Types of Educational Level Similarity

To test Hypothesis 3, which seeks to explore whether RSE workforce similarity at the lower or higher levels of education had a more positive influence on innovation performance, we measured three categories of educational level similarity. The first category comprises firms with a high ratio of RSEs with bachelor’s and associate’s degrees, representing an RSE workforce that is similar at lower educational levels with basic degrees. The second category comprises firms with a high ratio of RSEs with terminal degrees, i.e. Ph.Ds. The third category comprises firms with a high ratio of RSEs with advanced degrees, i.e. both master’s degrees and Ph.Ds. Firms in the latter two categories represent an RSE workforce that is similar at higher educational levels. These subgroups are categorized according to the mean values of RSEs with the respective degrees.

3.2.3 Control variables

Other diversity measures for workforce composition, specifically nationality and gender, were included as control variables in the data analysis. Gender diversity in the year prior to the patent application [Gender Diversity (t − 1)] was measured with a Herfindahl index of male and female R&D employees using the formula \( 1 - \sum_{i = 1}^{n} G_{i}^{2} \) (one minus the Herfindahl concentration index), where Gi is the proportion of employees based on gender in year t − 1, with n = 2. Similarly, the nationality diversity of each firm’s workforce in the year prior to the patent application [Nationality Diversity (t − 1)] was measured with a Herfindahl index from the number of R&D employees categorized by nine categories of nationality comprising Singapore (including permanent residents), India, China and Hong Kong, Malaysia, other parts of Asia, Australia and New Zealand, Western and Eastern Europe, North and South America, and other countries. Thus, Nationality Diversity (t − 1) was measured using the formula \( 1 - \sum_{i = 1}^{n} N_{i}^{2} \) (one minus the Herfindahl concentration index), where Ni is the proportion of employees in each category of nationality in year t − 1, with n = 8. Moreover, since past research suggests that the propensity of firms to innovate varies by resource differences (Cohen and Levinthal 1990), we included R&D intensity, firm size, and the availability of financial resources in the year prior to the patent application as control variables. For example, Arvanitis and Woerter (2009) argue that the adequacy of knowledge for technology transfer is dependent on a firm’s existing knowledge profile, which affects its subsequent ability to enlarge and enrich its existing knowledge base. Mohnen and Hoareau (2003) found that firm size is positively correlated with the probability that a firm cooperates with RIs to obtain government support for its innovation activities and the propensity for patenting. R&D Intensity (t − 1) is measured as R&D expenditure divided by total assets in the year prior to the patent application. Firm Size (t − 1) is measured as the log value of total assets in the year prior to the patent application. The availability of financial resources is measured as the log value of the amount of government funding provided to the firm in the year prior to the patent application [Government R&D Funding (t − 1)]. Finally, we included each firm’s patent applications in the previous year, Innovation Performance (t − 1), as a control variable for unobserved firm heterogeneity (Cameron and Trivedi 1998).

The independent and control variables were lagged by 1 year to account for their impact on patent applications at time t. Although causality is not the focus of this study, lagging these variables by one year minimizes some limitations of cross-sectional data. As the propensity to apply for patents varies across industries, we controlled for this effect using the average number of industry patent applications at time t, Industry Innovation Performance (t), in the industry classification of the focal firm.

The descriptive statistics and inter-correlations among the variables are reported in Table 1. The number of patent applications in the previous year, firm size, and government supported R&D funding are positively correlated with the number of patent applications, but industry patent applications are not significantly correlated with patent applications made by firms at p < 0.05. Technological diversity and educational level diversity are positively correlated with patent applications at p < 0.05.

3.2.4 Statistical analysis

We test our hypotheses with an unbalanced panel of 720 observations (132, 145, 146, 151 and 146 observations in 2004, 2005, 2006, 2007, and 2008 respectively) from 366 firms. The dependent variable is a count variable, which ranges from zero to a positive number. Since a non-negative dependent variable violates the assumptions of a linear regression model and the patent data exhibits an over-dispersion in the distribution, we used the negative binomial model in our hierarchical piecewise panel regression analyses (Cameron and Trivedi 1998). The results from both the random- and fixed-effects models yield similar findings. Thus, we report the results from the former model as more observations were included in the analyses.

4 Results

Model 1 in Table 2 shows the relationships between the control variables and innovation performance. Similar to the correlation results, the regression results indicate that government supported R&D funding, the firm’s innovation performance in the previous year, and the industry’s innovation performance are significantly related to the firm’s innovation performance. Firm size, R&D intensity, and the diversity of the firm’s workforce with respect to gender and nationality did not have any significant associations with innovation performance at p < 0.05.

Model 2 in Table 2 shows that firms have positive innovation performance at p < 0.05 when their technological domains are heterogeneous. This regression result is similar to the correlation results. However, when the control variables are considered, the regression results indicate that firms with a workforce of RSEs with either diverse educational levels or similar educational levels have significantly positively innovation performance at p < 0.05. This result illustrates the existence of the paradox regarding the value for both similarity as well as diversity in human capital as seen in the extant literature. We tease out this paradox by considering the diversity of technological domains under which the RSEs work so that the interdependencies between educational level diversity and technological diversity are taken into account simultaneously as seen in Models 3–6 in Table 2.

Hypothesis 1 predicts that when a firm’s technological domains are homogeneous, an RSE workforce with diverse educational levels will influence innovation performance positively. Conversely in such context, similarity in educational levels will have a negative influence on innovation performance. Model 3 in Table 2 shows that when a firm’s technological domains are homogeneous, diversity in educational levels was not significantly related to innovation performance at p < 0.05. Model 4 in Table 2 shows that when a firm’s technological domains are homogeneous, similarity in educational levels was not significantly related to innovation performance at p < 0.05. Thus, Hypothesis 1 is not supported by our results. Both Models 3 and 4 in Table 2 suggest that when firms focus on one core technological domain, the educational levels of their RSE workforce did not have a significant influence on innovation performance.

Hypothesis 2 predicts that when a firm’s technological domains are heterogeneous, an RSE workforce with similar educational levels will influence innovation performance positively. Conversely in such context, diversity in educational levels will have a negative influence on innovation performance. Model 5 in Table 2 shows that when firms’ have heterogeneous technological domains, they have significantly positive innovation performance at p < 0.01 when their RSEs have similar educational levels. Conversely, Model 6 in Table 2 shows that such firms have significantly negative innovation performance at p < 0.01 when their RSEs have diverse educational levels. Thus, our data provides strong support for Hypothesis 2.

Hypothesis 3 predicts that when a firm’s technological domains are heterogeneous, an RSE workforce that is similar at lower levels of education will influence innovation performance more positively than an RSE workforce that is similar at higher levels of education. Table 3 shows the type of educational level similarity that will have a positive influence on innovation performance for firms with heterogeneous technological domains. The results in Table 3 show that only the interdependency in Model 1 is positive and significant at p < 0.01. The data implies that for firms with heterogeneous technological domains, only those firms with an RSE workforce that is highly similar with basic degrees have significant improvements in innovation performance. Conversely, Models 2 and 3 in Table 3 show that when firms have heterogeneous technological domains, those firms with an RSE workforce that is highly similar with advanced degrees did not report significant improvements in innovation performance. Thus, our data provides strong support for Hypothesis 3.

5 Discussion

The resource-based view suggests that firms benefit from building a technological focus from a core competence (Barney 1991; Prahalad and Hamel 1990). However, other research suggests that technological diversity enhances innovation because of increased probability of knowledge recombination (Amabile 1988). The mixed results indicate an unresolved paradox on the value of technological diversity. Likewise, research on human capital diversity show mixed findings. On the one hand, some studies on human capital diversity show a positive effect arising from multiple perspectives (Bercovitz and Feldman 2011; Vinding 2006) but studies from organizational demography indicate increased conflicts and misunderstandings when individuals of diverse backgrounds work together (Lawler and Yoon 1996; Tsui et al. 1992), which limit the value of diversity. In order to explain these two paradoxes, we seek to consider the interdependencies between technological diversity in the context of the firms’ RSE workforce diversity to provide a much richer understanding of the effects.

Our results show that, although technological heterogeneity can be advantageous to innovation performance, its effects must be understood in light of educational level diversity among the firm’s RSE workforce. The data shows that when R&D projects are based on heterogeneous technological domains, firms can optimize their innovation performance by choosing knowledge workers with similar levels of human capital. Conversely, when the workforce of the RSEs is diverse in educational levels, innovation performance is dampened, perhaps because of communication difficulties and status differences. Our results indicate that when firms are engaged in R&D projects derived from heterogeneous technological domains, RSEs with similar educational levels are better able to optimize the level of productivity in exploitation (recombination) activities as explained by organizational demography. Our results imply that in such a context, improving relational cohesions and group relations by increasing similarity among the RSEs may enhance the knowledge exchange and interpersonal relationships, which are necessary for innovation.

A deeper examination on the type of similarity in educational levels is needed to explain the results. We learned from five interviews with R&D directors of the sample firms to further understand this phenomenon. They explained that while RSEs with advanced degrees are critical, their training often makes them more ideological in outlook. They tend to prefer working in silos with a focus on their technological domain. These characteristics are not conducive for a firm exploring multiple domains to innovate. RSEs with basic degrees are less ideological and more malleable. To venture into multiple domains, firms need to cross-fertilize ideas, which is achieved more effectively with a workforce of RSEs with basic degrees.

We hope that our results provide some insights and discussions to address calls from the academic community to explain variances in innovation performance (Hess and Rothaermel 2011; Link et al. 2014) by considering the interdependencies between technological and human capital diversities. Two managerial implications derived from this study are one, firms need to weigh the costs and benefits of workforce diversity by taking into consideration the nature of their R&D activities because synergies may be limited if there is minimal commonality between the diverse skills for the diverse R&D activities. And two, although attracting highly qualified professionals is important to innovation success, firms also need to value their R&D staff with basic skills because such skills provide the foundation in and the flexibilities needed for innovation activities. Hence, a better understanding of the role of R&D workforce composition can help managers utilize their scarce scientific talent more efficiently by configuring their R&D teams accordingly.

The results from our study also serve as a case study for governments who are aiming to improve their national innovativeness. One national innovation policy implication is that by partnering with the private sector to understand their R&D activities and trajectory needs, governments can establish a national framework and system for the investment and deployment of scientific resources through an educational infrastructure to supply the private sector with the appropriate R&D skills for their research activities. Specifically, governments can supply R&D personnel with specific educational levels to the private sector through educational grants and scholarship programs in the country’s universities to provide appropriate levels of R&D skills to fulfill the firms’ R&D objectives. This creative leveraging of talent is one way for small countries to compete in a knowledge-based global economy. Specifically, for emerging economies whose domestic firms tend to be small, resource-poor, and lack the ability to attract and develop R&D employees, the results of this study may inform policy makers on the mix of educational levels best needed to foster patent productivity. By serving as a supplier of RSEs to firms in different R&D domains, governments can shorten the cycle time in knowledge creation at the national level.

5.1 Limitations and future research

Due to data limitations, we were not able to obtain details on the nature and types of the patents reported by the companies. More fine-grained firm-level data would have allowed us to further explore the optimal mix of human capital levels needed for each firm’s mix of technological domains. Specifically, if access to the types of patents achieved was available, the results from such a study would enable firms to select or train RSEs with specific educational levels to achieve scientific patents that are highly commercializable given the mix of technological domains in the firm.

We were also not able to determine from the data how organizational culture or organizational structure plays a role in how the R&D workforce is organized at the team level. Data was not available on team culture if hierarchical or status barriers exist among RSEs with different educational levels or across technological domains within the firms. Neither was information available on the job assignments or job rotation practices of the firms to help us understand whether RSEs worked exclusively in specific products or technological domains, the extent to which they were rotated among different technological domains, which educational groups were more likely to be rotated into different R&D projects utilizing different technological domains, the frequency of rotation, or the length of time spent in each R&D project at the team level of analysis. Such information may be important because, for instance, the length of time that individuals spend in each team could affect team cohesiveness or organizational commitment, which affects innovation performance. Additionally, the profile for each RSE, such as age or work experience, was not available. Therefore, individual differences, team dynamics, and organizational culture, which other studies have found to be important for innovation outcomes (Barney 1986; Becker 1964; Page 2007), could not be included as control variables in our study. These limitations set a constraint on the degree to which we could speculate on the influence of the levels of RSEs’ human capital on patent productivity. If access to organizational culture, team- and person-level data was available, we could examine the extent to which firms could generate synergies by utilizing the human capital of their RSEs more efficiently through career paths via job rotation and project assignments or by pacing the length of time that the RSEs spend in each R&D project domain. The findings from such data could help firms minimize the costs and maximize the benefits of diversity (Page 2007).

Finally, the generalizability of our results is constrained by a single country study. While the investigation of Singapore RSEs offers a point of reference for future studies, future research in different national contexts, including other small countries such as Israel, Finland, and Ireland as well as larger countries, would confirm the external validity of our results and give better insights into how organizations can improve innovation performance by managing diversity both in their technological domains and from their RSEs’ educational levels. In particular, a multi-level research design bridging technological domains and RSEs’ psychological attributes such as creativity (Mumford and Gustafson 1988) and ideology (Bunderson 2001) could be juxtaposed in future research. A study that utilizes hierarchical linear modeling could potentially integrate country, firm-, team- and individual-level data to unpack the phenomena for a richer understanding of the dynamics that explain the success of country-, firm-, team-, and individual-level attainments of patent outcomes with minimum risk to double-counting the patent outcomes reported by individuals and teams for the organization.

6 Conclusion

In this study, we seek to have a deeper understanding for the mixed findings on two major streams of research related to technological diversity and human capital diversity. We attempt to solve these two paradoxes by looking at their interdependencies with each other to understand the context under which the RSE workforce of a firm could play a supportive or a detrimental role under different levels of technological diversity. This finer-grained examination shows that firms with heterogeneous technological domains have positive innovation performance when their RSE workforce had similar educational levels with basic degrees. The results show how theories that support both similarity and diversity could work simultaneously within a firm because of different contexts at play at the same time. We hope that by teasing out the dimensions within these two factors in finer grain, we can promote more dialogue to explore the confounding results on the relationships between diversity and innovation (Link et al. 2014). The results of this study suggest that innovation performance depends on the strategic choices that firms make in managing the interplay between technological and human capital when implementing innovation strategy.

Notes

The domains include the chemical sciences, aeronautical engineering, electronic and electrical engineering, computer sciences, biomedical engineering, info-communication and media technology, earth and related environmental sciences, civil engineering and architecture, marine engineering, physical sciences and mathematics, computer engineering, materials science and chemical engineering, mechanical engineering, basic medicine, pharmaceutical sciences and manufacturing, metallurgy and metal engineering, biological sciences, health sciences, agriculture and food sciences, clinical medicine, and other biomedical sciences.

References

Abernathy, W. J., & Clark, K. B. (1985). Innovation: Mapping the winds of creative destruction. Research Policy, 14(1), 3–22.

Acs, Z. J., & Audretsch, D. B. (1988). Innovation in large and small firms: An empirical analysis. American Economic Review, 78(4), 678–690.

Alderfer, C. P. (1987). An intergroup perspective on group dynamics. In J. W. Lorsch (Ed.), Handbook of Organizational Behavior (pp. 90–222). Englewood Cliffs, NJ: Prentice-Hall.

Amabile, T. M. (1988). A model of innovation and creativity in organizations. Research in Organizational Behavior, 10, 123–167.

Ancona, D., & Caldwell, D. (1992). Demography and design: Predictors of new product team performance. Organization Science, 3(3), 231–241.

Arvanitis, S., & Woerter, M. (2009). Firms’ transfer strategies with universities and the relationship with firms’ innovation performance. Industrial and Corporate Change, 18(6), 1067–1106.

Barney, J. (1986). Organizational culture: Can it be a source of sustained competitive advantage? Academy of Management Review, 11(3), 656–665.

Barney, J. (1991). Firm resources and sustained competitive advantage. Journal of Management, 17(1), 99–120.

Becker, G. S. (1964). Human capital. New York: National Bureau for Economic Research.

Bercovitz, J., & Feldman, M. (2011). The mechanisms of collaboration in inventive teams: Composition, social networks, and geography. Research Policy, 40(1), 81–93.

Berliant, M., & Fujita, M. (2011). The dynamics of knowledge diversity and economic growth. Southern Economic Journal, 77(4), 856–884.

Bourdieu, P. (1986). The forms of capital. In J. G. Richardson (Ed.), Handbook of theory and research for the sociology of education (pp. 241–258). New York: Greenwood.

Bunderson, J. S. (2001). How work ideologies shape the psychological contracts of professional employees: Doctors’ responses to perceived breach. Journal of Organizational Behavior, 22(7), 717–741.

Bunderson, J. S., & Sutcliffe, K. M. (2002). Comparing alternative conceptualizations of functional diversity in management teams: Process and performance effects. Academy of Management Journal, 45(5), 875–893.

Burt, R. (1992). Structural holes: The social structure of competition. Cambridge, MA: Harvard University Press.

Cabrales, A. L., Medina, C. C., Lavado, A. C., & Cabrera, R. V. (2008). Managing functional diversity, risk taking and incentives for teams to achieve radical innovations. R&D Management, 38(1), 35–50.

Cameron, C., & Trivedi, P. K. (1998). Regression analysis of count data. Econometric Society Monograph No. 30. Cambridge: Cambridge University Press.

Carpenter, M. A. (2002). The implications of strategy and social context for the relationship between top management team heterogeneity and firm performance. Strategic Management Journal, 23(3), 275–284.

Castellacci, F. (2011). Closing the technology gap? Review of Development Economics, 15(1), 180–197.

Cohen, W. M., & Levinthal, D. A. (1989). Innovation and learning: The two faces of R&D. Economic Journal, 99, 569–596.

Cohen, W. M., & Levinthal, D. A. (1990). Absorptive capacity: A new perspective of learning and innovation. Administrative Science Quarterly, 35(1), 128–152.

Cohen, W. M., & Levinthal, D. A. (1994). Fortune favors the prepared firm. Management Science, 40(2), 227–251.

Collins, C. J., & Smith, K. G. (2006). Knowledge exchange and combination: The role of human resource practices in the performance of high-technology firms. Academy of Management Journal, 49(3), 544–560.

Dahlin, K., Weingart, L., & Hinds, P. (2005). Team diversity and information use. Academy of Management Journal, 48(6), 1107–1123.

Dasgupta, P. (1994). Toward a new economics of science. Research Policy, 23(5), 487–521.

Dosi, G. (1982). Technological paradigms and technological trajectories: A suggested interpretation of the determinants and directions of technical change. Research Policy, 11(3), 147–162.

Ejermo, O. (2005). Technological diversity and Jacobs’ externality hypothesis revisited. Growth and Change, 36(2), 167–195.

Fernández-Ribas, A., & Shapira, P. (2009). Technological diversity, scientific excellence and the location of inventive activities abroad: The case of nanotechnology. Journal of Technology Transfer, 34(3), 286–303.

Fleming, L. (2001). Recombinant uncertainty in technological search. Management Science, 47(1), 117–132.

Gambardella, A., & Torrisi, S. (1998). Does technological convergence imply convergence in markets? Evidence from the electronics industry. Research Policy, 27(5), 445–463.

García-Vega, M. (2006). Does technological diversification promote innovation? An empirical analysis for European firms. Research Policy, 35(2), 230–246.

Grandstrand, O. (1998). Towards a theory of the technology-based firm. Research Policy, 27(5), 465–489.

Granovetter, M. (1973). The strength of weak ties. American Journal of Sociology, 78(6), 1360–1380.

Granstrand, O., & Oskarsson, C. (1994). Technological diversification in MUL-TECH corporations. IEEE Transactions on Engineering Management, 41(4), 355–364.

Granstrand, O., Patel, P., & Pavitt, K. (1997). Multi-technology corporations: Why they have “distributed” rather than “distinctive core” competencies. California Management Review, 39(4), 8–25.

Grant, R. M. (1996). Towards a knowledge-based theory of the firm. Strategic Management Journal, 17(2), 102–122.

Hagedoorn, J., & Cloodt, M. (2003). Measuring innovative performance: Is there an advantage in using multiple indicators? Research Policy, 32(8), 1365–1379.

Henderson, R. M., & Clark, K. B. (1990). Architectural innovation: The reconfiguration of existing product technologies and the failure of established firms. Administrative Science Quarterly, 35(1), 9–30.

Henderson, R., & Cockburn, I. (1996). Scale, scope, and spillovers: The determinants of research productivity in drug discovery. RAND Journal of Economics, 27(1), 32–59.

Hess, A. M., & Rothaermel, F. T. (2011). When are assets complementary? Star scientists, strategic alliances and innovation in the pharmaceutical industry. Strategic Management Journal, 32(8), 895–909.

Higgins, M. C. (2000). The more, the merrier? Multiple developmental relationships and work satisfaction. Journal of Management Development, 19(4), 277–296.

Huang, Y. F., & Chen, C. J. (2010). The impact of technological diversity and organizational slack on innovation. Technovation, 30(7), 420–428.

Jackson, S., Joshi, A., & Erhardt, N. (2003). Recent research on team and organizational diversity: SWOT analysis and implications. Journal of Management, 29(6), 801–830.

Jacobsson, S., Oskarsson, C., & Philipson, J. (1996). Indicators of technological activities—comparing educational, patent and R&D statistics in the case of Sweden. Research Policy, 25(4), 573–585.

Janis, I. L. (1972). Victims of groupthink. Boston, MA: Houghton Mifflin.

Kaasa, A. (2009). Effects of different dimensions of social capital on innovative activity: Evidence from Europe at the regional level. Technovation, 29(3), 218–233.

Keller, W. (1996). Absorptive capacity: On the creation and acquisition of technology in development. Journal of Development Economics, 49(1), 199–227.

Kim, H., Lim, H., & Park, Y. (2009). How should firms carry out technological diversification to improve their performance? An analysis of patenting of Korean firms. Economics of Innovation and New Technology, 18(8), 757–770.

Lawler, E. J., & Yoon, J. (1996). Commitment in exchange relations: Test of a theory of relational cohesion. American Sociological Review, 61(1), 89–108.

Leiponen, A. (2005). Skills and innovation. International Journal of Industrial Organization, 23(1), 303–323.

Leonard, D., & Sensiper, S. (1998). The role of tacit knowledge in group innovation. California Management Review, 40(3), 112–132.

Leonard-Barton, D. (1992). Core capabilities and core rigidities: A paradox in managing new product development. Strategic Management Journal, 13(Summer), 111–126.

Levinthal, D. A. (1997). Adaptation on rugged landscapes. Management Science, 43(7), 934–950.

Lin, B. W., Chen, C. J., & Wu, H. L. (2006). Patent portfolio diversity, technology strategy, and firm value. IEEE Transactions on Engineering Management, 53(1), 17–26.

Link, A. N., Siegel, D. S., & Wright, M. (2014). The Chicago handbook of university technology transfer and academic entrepreneurship. Chicago, IL: University of Chicago Press.

Mannix, E., & Neale, M. A. (2005). What differences make a difference? American Psychological Society, 6(2), 31–55.

McGill, J. P., & Santoro, M. D. (2009). Alliance portfolios and patent outputs: the case of biotechnology alliances. IEEE Transactions on Engineering Management, 56(3), 388–401.

Milliken, F. J., & Martins, L. L. (1996). Searching for common threads: Understanding the multiple effects of diversity in organizational groups. Academy of Management Review, 21(2), 402–433.

Mohnen, P., & Hoareau, C. (2003). What type of enterprises forges close links with universities and government labs? Managerial Decision Economics, 24(2–3), 133–145.

Morgan, R. P., Kruytbosch, C., & Kannankutty, N. (2001). Patenting and invention activity of U.S. scientists and engineers in the academic sector: Comparisons with industry. Journal of Technology Transfer, 26(1), 173–183.

Mumford, M. D., & Gustafson, S. B. (1988). Creativity syndrome: Integration, application, and innovation. Psychological Bulletin, 103(1), 27–43.

Nelson, R. (1959). The simple economics of basic scientific research. Journal of Political Economy, 67(3), 297–306.

Nicholls-Nixon, C. L., & Woo, C. Y. (2003). Technology sourcing and the output of established firms in a regime of encompassing technological change. Strategic Management Journal, 24(7), 651–666.

Østergaard, C. R., Timmermans, B., & Kristinsson, K. (2011). Does a different view create something new? The effect of employee diversity on innovation. Research Policy, 40(3), 500–509.

Page, S. E. (2007). The difference: How the power of diversity creates better groups, firms, schools, and societies. Princeton, NJ: Princeton University Press.

Patel, P., & Pavitt, K. (1995). Patterns of technological activity: Their measurement and interpretation. In P. Stoneman (Ed.), Handbook of the economics of innovation and technological change (pp. 14–51). Cambridge, MA: Blackwell.

Pfeffer, J. (1983). Organizational demography. In B. Staw & L. Cummings (Eds.), Research in organizational behavior (pp. 299–357). Greenwich, CT: JAI Press.

Prahalad, C. K., & Hamel, G. (1990). The core competence and the corporation. Harvard Business Review, 68(3), 71–91.

Quintana-García, C., & Benavides-Velasco, C. A. (2008). Innovative competence, exploration and exploitation: The influence of technological diversification. Research Policy, 37(3), 492–507.

Rosenkopf, L., & Nerkar, A. (2001). Beyond local search: Boundary-spanning, exploration, and impact in the optical disk industry. Strategic Management Journal, 22(4), 287–306.

Subramaniam, M., & Youndt, M. A. (2005). The influence of intellectual capital on the types of innovative capabilities. Academy of Management Journal, 48(3), 450–463.

Sun, P. Y. T., & Anderson, M. H. (2008). An examination of the relationship between ACAP and OL, and a proposed integration. International Journal of Management Reviews, 12(2), 130–150.

Suzuki, J., & Kodama, F. (2004). Technological diversity of persistent innovators in Japan: Two case studies of large Japanese firms. Research Policy, 33(3), 531–549.

Tajfel, H., & Turner, J. C. (1986). The social identity theory of intergroup behavior. In S. Worchel & W. G. Austin (Eds.), The Psychology of intergroup relations (pp. 7–24). Chicago: Nelson-Hall.

Tsui, A. S., Egan, T. D., & O’Reilly, C. A. (1992). Being different: Relational demography and organizational attachment. Administrative Science Quarterly, 37(4), 549–579.

van der Bergh, J. C. (2008). Optimal diversity: Increasing returns versus recombinant innovation. Journal of Economic Behavior and Organization, 68(3–4), 565–580.

van der Vegt, G., & Janssen, O. (2003). Joint impact of interdependence and group diversity on innovation. Journal of Management, 29(5), 729–751.

Vega-Jurado, J., Gutierrez-Gracia, A., & Fernandez-de-Lucio, I. (2008). Analyzing the determinants of firm’s absorptive capacity: Beyond R&D. R&D Management Journal, 38(4), 392–405.

Vinding, A. L. (2006). Absorptive capacity and innovative performance: A human capital approach. Economic Innovation of New Technology, 15(4–5), 507–517.

Wang, H., & Chen, W. R. (2010). Is firm-specific innovation associated with greater value appropriation? The roles of environmental dynamism and technological diversity. Research Policy, 39(1), 141–154.

Zahra, S. A., & George, G. (2002). Absorptive capacity: A review, reconceptualization, and extension. Academy of Management Review, 27(2), 185–203.

Zenger, T., & Lawrence, B. (1989). Organizational demography: The differential effects of age and tenure distributions on technical communications. Academy of Management Journal, 32(2), 353–376.

Acknowledgments

We would like to thank the participants of the Technology Transfer Society Conference 2014 for their helpful feedback. We are grateful to NUS (R-535-000-006-133) for their grant support. Errors remain our own.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Subramanian, A.M., Choi, Y.R., Lee, SH. et al. Linking technological and educational level diversities to innovation performance. J Technol Transf 41, 182–204 (2016). https://doi.org/10.1007/s10961-015-9413-z

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10961-015-9413-z